The last few weeks have been very interesting.

After the giant rally of the summer, there was a small correction.

Corrections are always nasty periods because – in line with great rallies – there never seems to be a clear cut reason for them, beyond the barely credible narrative of the media, that is.

Mainly random markets will behave just so, yet ultimately following the “skew” of long term returns you are working for.

This means the market will jiggle around strangely but, over all, your profit will appear as a result of the days of random rallies and slumps.

Now, suddenly the portfolio is storming ahead again and at new highs. This looks very positive.

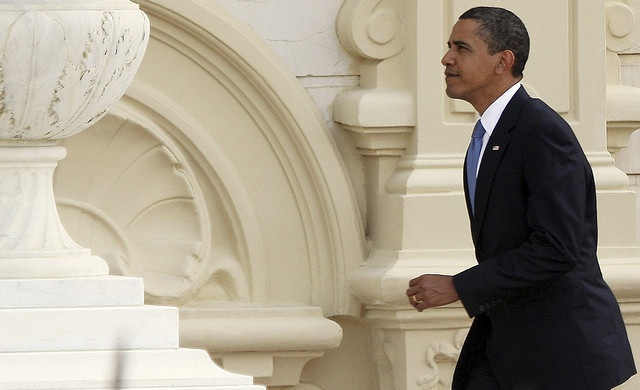

In my model, a second Obama term looks amazing for equities. This is not necessarily good economic news however, as I think it will come via galloping inflation. Nonetheless, here we are.

Meanwhile, my ‘crazy punting’ account is at all -time highs and may have even broken out into new territory. It pains me that this account may just end up ‘serious’ at this rate, but it’s a high class problem to have.

Findel is now over 100% up, so a nice winner. I would normally sell but there looks to be much upside remaining, so I will sit it out along with the other ‘doubler’, Enterprise Inns.

This is not a strategy I’m truly comfortable with, but these stocks have such good upside and my appetite for new stocks is so low that Im prepared to hold on and run the profits, rather than bag them now.