In this exclusive article Clem Chambers, Forbes columnist and author of the Amazon No.1 investing bestseller 101 Ways to Pick Stock Market Winners, discusses the five golden rules to help you start trading successfully.

After you register for free, ADVFN provides the essential tools and information to make the right investment decisions.

Here are FIVE rules, ALL available for free on ADVFN, to stock market and investing success!

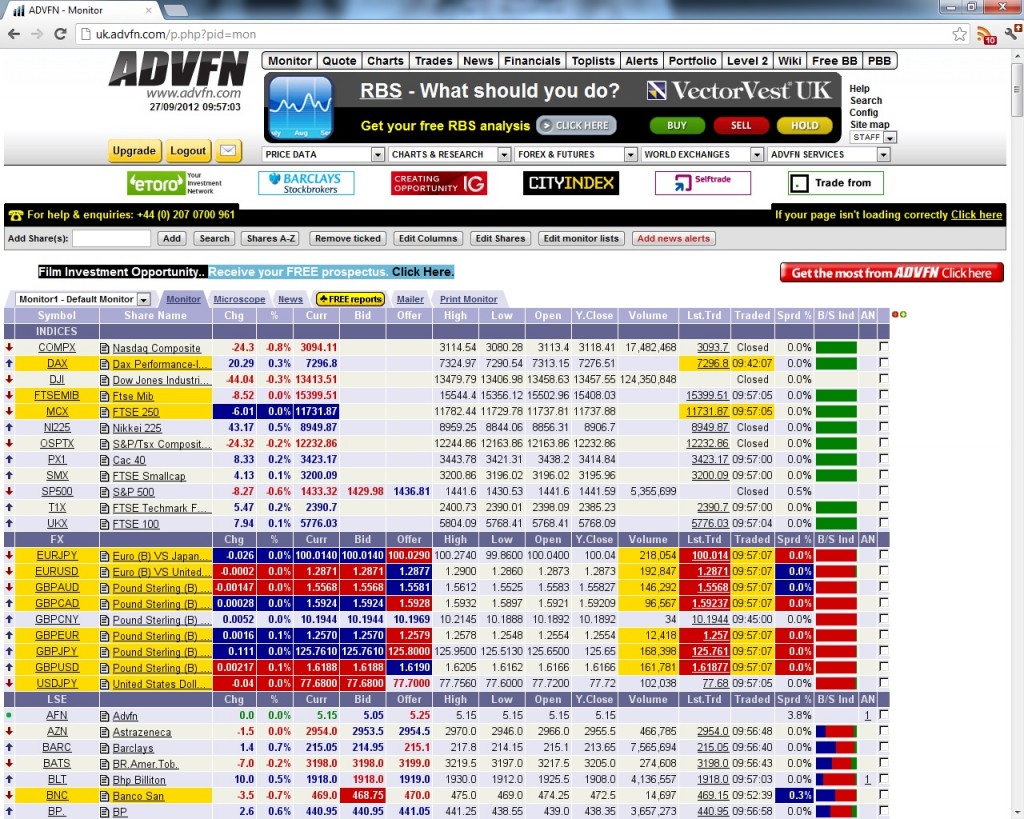

- Rule 1: Real time share prices

Follow the market live.

In a fast paced market investors need live and direct information on their stocks current price – finding out late that your investments are falling or booming can cost you a small fortune. Whilst other websites may only provide prices after a 15 minute delay, a free ADVFN account allows users to watch them in real time and see what trades are being made. This knowledge is absoutely essential.

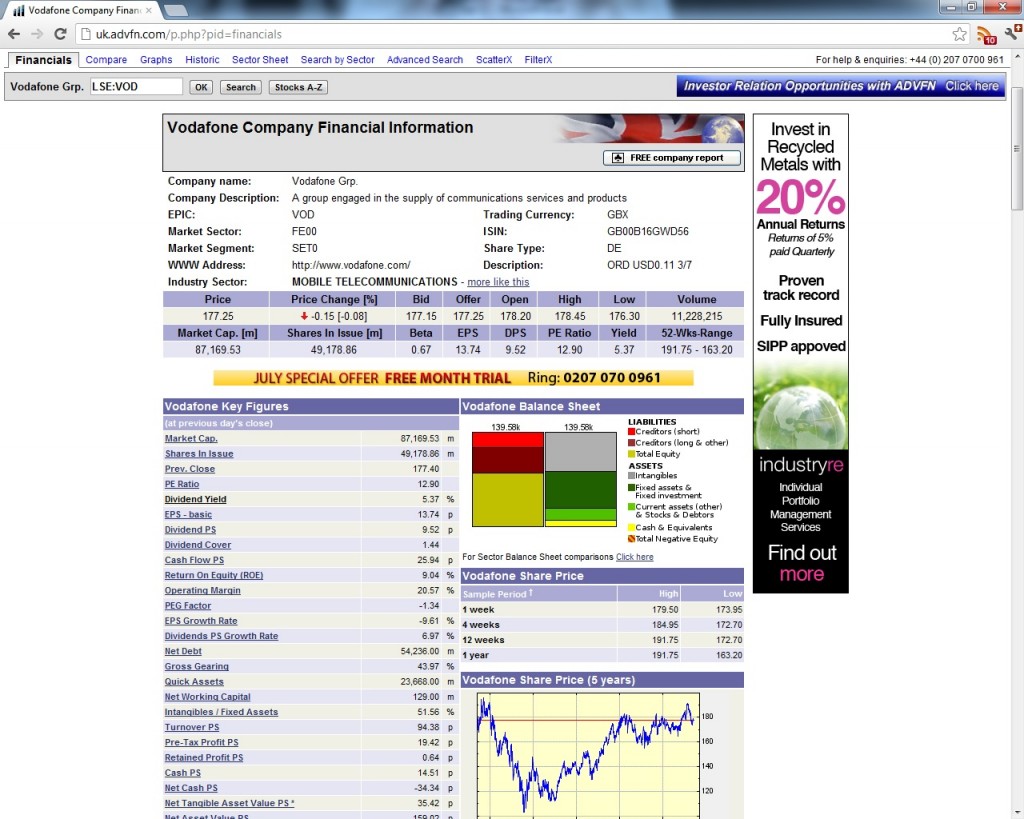

- Rule 2: Fundamental information

Know the figures.

A smart investor will not make an investment without conducting company background research. Company annual results, along with key fundamental figures will give guidance to determining the long term trends and progression of a company. ADVFN offers key financial information in the UK markets, US, Europe, Japan and many more over the past 10 years.

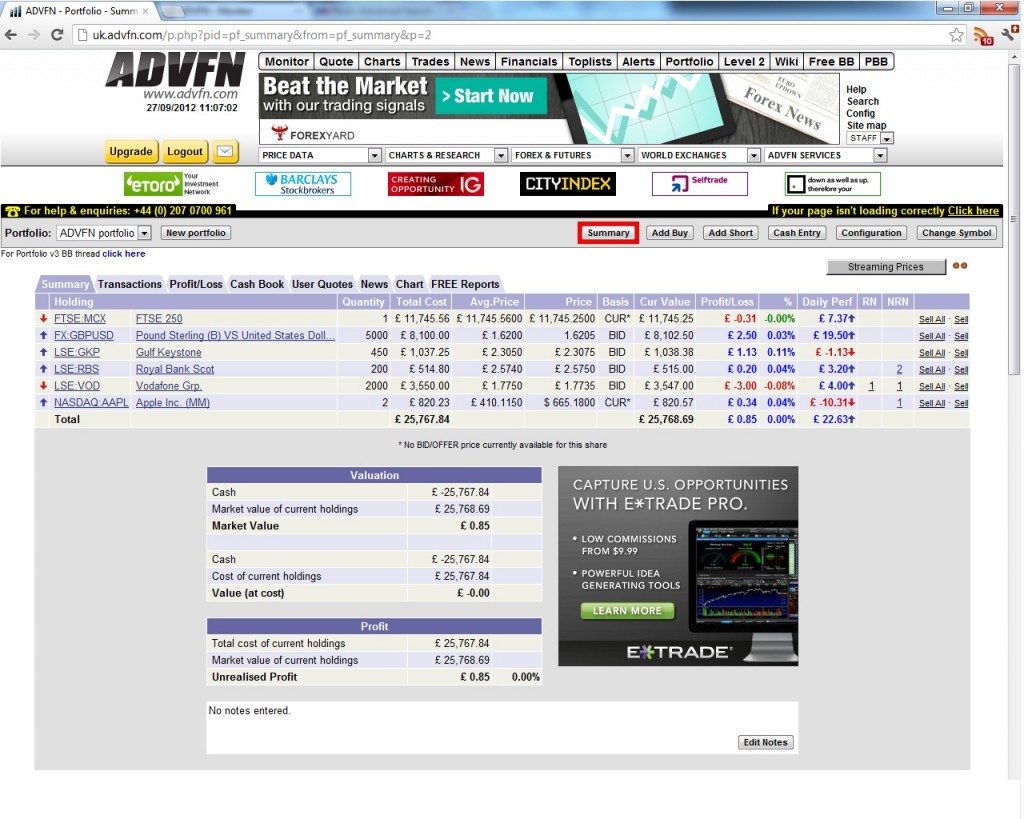

- Rule 3: Portfolio tracking

Be organised.

Building a portfolio is a key strategy for invesment success. Being able to track your stocks in one easy to access and use platform allows you to see how they are performing, the overall value of your investments and assess whether they are providing you the returns you desire. An easy-to-manage portfolio is an essential role for market success and a free ADVFN account lets you do just that.

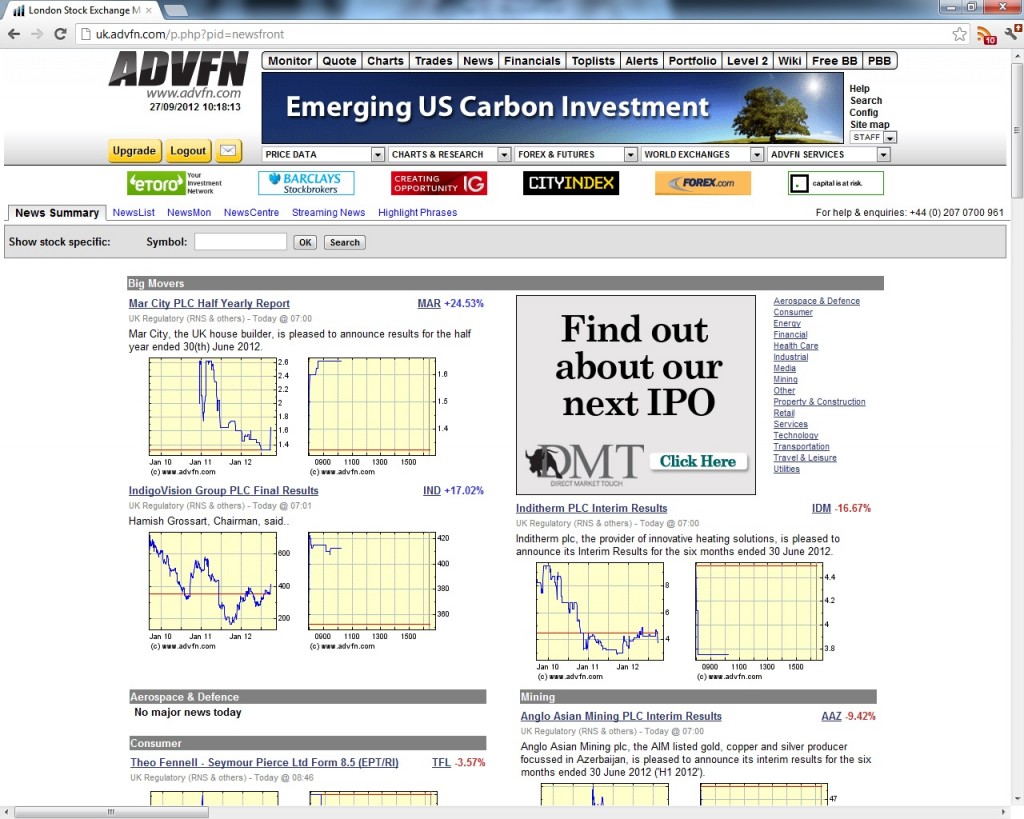

- Rule 4: News

Be informed.

Informed decesions are the best decisions, when it comes to investing this means you need up-to-date knowledge of what’s going on globally. What happens in the US will effect you in the UK and what happens in China will affect the US. ADVFN News is desgined with this and the investor in mind by providing breaking market news and expert blogs from respected financial authors.

- Rule 5: Opinion

Listen to others.

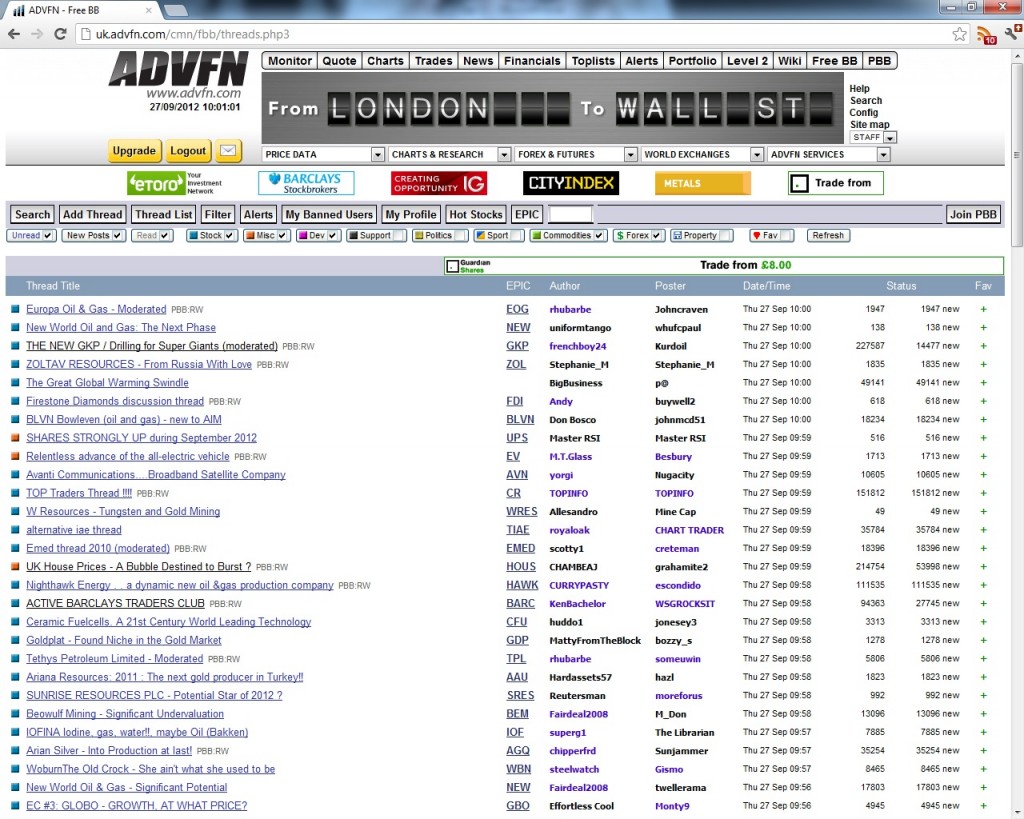

Bulletin boards are a great place to pick up new investing tips, gauge opinion and gain insight into the world of investing. With thousands of posts a day ADVFN’s free bulletin boards are the ideal place to talk with other investors and discuss your opinion about the current state of the market.

I would like to learn about market and investment, Thanka

Read your classics!! These are more the five golden rules for a bad investment experience. Follow these rules and you will lose money for sure! @Tron: read Common Sence on Mutual Funds from John Boggle.

Why go to Vegas to lose your retirement account?

Start trading online. It’s fun!

Never, EVER forget that trading accounts automatically assume liquidity.

It’s pretty easy to make 50 grand in a practise account when you can sell short successfully over and over again.

In real life…its pretty hard to sell shares in a stock that’s crashing.

Reply to Jeff: What an attitude…!! If you think Stock market is like Casinos, you just have not understood the basics of finance management.

It is such mis informed people that bring bad feelings to those young people who have time on their side to make a lot of money. Steady as she goes. It is NOT gambling.

this is just a shameless advertisement plug designed as an article. fucking bs.

Read the ‘Intelligent Investor’ by Ben Graham especially the parts about how to value a company and market price fluctuations. The read Buffett’s writings from the annual reports of http://www.berkshirehathawy.com

Nothing else is needed.

This is HORRIBLE horrible investment advice.

Actually, to be honest… investing is gambling to an extent. But the more of the basics you know and understand it migrates more from gambling to understanding and sound investing. I made an excellent return last year with my investments due to the fact that I put the time into reading and understanding the system. I have lost too. But in the end the lost times was part of my education. My suggestion with investing would be: Start slow, diversify, study, and become proficient. Understanding more of how the system works will provide you with the basic tools that will give you a solid foundation later in life. I’m 35, been investing for years. You must understand I started with a fake portfolio and worked my way into it. Now, I am pleased with the results…even when I invested thru the roughest investment period of my life, just a few years ago. So get your feet wet…and learn the system. I’m still learning!

What about annuities? Less taxes about 17% less. More income.

Yes, I agree. It is a cheap way of advertising. Screw you ADVFN. I did not learn anything important.

Here is a proper set of ‘rules’: http://www.ft.com/cms/s/0/a955c74a-76a3-11e2-8569-00144feabdc0.html#axzz2LxDX7Apy

Compromise to and for the issue

ONE TIME INVESTMENT…

INVEST AND FORGET FOR EVER

How do one get started

I am interested to know more about what type of business I should tacle to be successful.

ADVFN covers all things stock market but failed to cover The 5 Golden Rules of Investing.Maybe advfv should have brought 5 trusted Portfolio people ,instead of halfa$$ing the topic . Here are The 5 Golden Rules of Investing :

1. Don’t put all your eggs in one basket

2. Look at it from the social being view point not the human being pov.

3. Read what Investors read

4. …

5. …

For more follow me of Face book ; #Ceemeeluv Akbr (.my id.)

Medy– find something that you can do for others in a different and better way than it is done currently, which you will enjoy doing — make that your business. —- otherwise you will fail.. +++ learn the business around it before going on your own.

As for the OP — REAL BAD ADVICE….. stay clear of people providing such advice, also stay clear of mutual funds etc in a declining period …. They sell based on bull performances, not bear.

this seems to be one sided, if i were to get any advice it would be from folks like http://www.binary360.com who offers online tuts…

“News” is what you pass off as a rule? “Opinion” is a rule? These are not rules. Read something by Bogle, or Lynch, or Buffett… won’t give you a complete formula, but steps toward that.

I am 40 years old and have been investing in stocks, bonds, annuities, real estate, commodities, etc and fundamentals are not all you must worry about when picking an investment vehicle. Companies with great bottom lines get beat up on a whim, greed, fear, or because another company has become the “darling or favorite” of the year but watching fundamentals and being diversified is important, that and keeping abreast of current events and technological trends.