Cryptocurrency was built on the promise of decentralization—a world where no single company or authority controls the flow of data, value, or computation. Yet despite this ideal, the backbone that powers most blockchain networks still depends heavily on a surprisingly centralized foundation: the world’s major cloud providers.

As demand for computing power grows across industries like AI, gaming, and finance, the limits of centralized cloud infrastructure are becoming more visible. Outages, capacity constraints, and pricing pressures are forcing both blockchain builders and traditional tech companies to rethink how and where they run their systems. This shift is opening the door for distributed alternatives that more closely align with crypto’s foundational philosophy.

Centralized Clouds Still Run the Crypto World

Despite promoting decentralization, many blockchain applications are built on top of Amazon Web Services (AWS), Microsoft Azure, or Google Cloud—the so-called “Big Three.” Together, these companies command a majority of the global cloud market, making them the default choice for startups and established firms alike.

This efficiency comes with a trade-off. When one of these platforms experiences disruptions, a wave of industries can be affected simultaneously. Over the past year, several high-profile cloud outages temporarily knocked major apps offline—from entertainment platforms to financial services. Even crypto exchanges and blockchain validators felt the ripple effects, revealing how vulnerable the ecosystem still is to centralized points of failure.

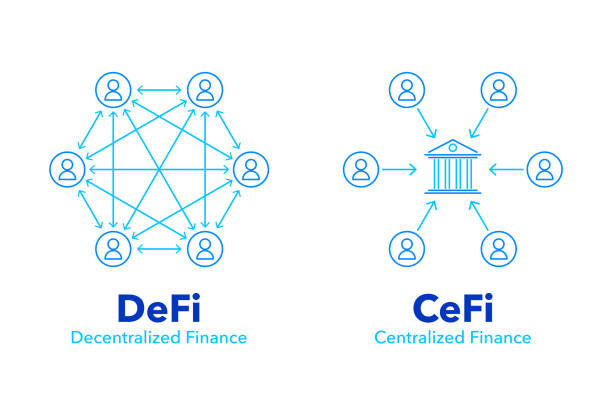

The Decentralization Paradox

Blockchains were designed to distribute trust across thousands of independent nodes. But in reality, many of those nodes operate on centralized servers. For example, large portions of validator networks on major proof-of-stake blockchains run on commercial cloud platforms. Operators choose these services because of their reliability, ease of deployment, and predictable performance—benefits difficult to replicate when running hardware independently.

The downside appears when centralized services falter. During a recent AWS outage, crypto users experienced login failures, trade delays, and withdrawal issues. Events like these highlight how deeply blockchain infrastructure depends on systems outside its decentralized ethos.

A Rising Push Toward Distributed Alternatives

As centralized clouds face increasing strain—partly due to skyrocketing demand from AI and other compute-heavy sectors—new distributed models are gaining momentum. These systems aim to spread computing, storage, and bandwidth across smaller, independent nodes instead of relying on a single massive provider.

Some emerging networks tap into unconventional resources, such as unused GPU power from gaming PCs or excess internet bandwidth from local operators. This creates a more geographically distributed infrastructure that reduces the risk of a single point of failure.

Other projects focus on modularity, allowing blockchain teams to gradually migrate critical components—such as data storage or compute tasks—away from centralized clouds. Rather than competing directly with AWS or Google Cloud, these distributed networks complement them by offering resilient alternatives where they matter most.

The Future: Hybrid, Not Extreme

Industry experts increasingly agree that the future of Web3 infrastructure will be neither entirely decentralized nor fully centralized. Instead, a hybrid model is emerging. In this setup, hyperscale cloud providers remain valuable for their elasticity and reliability, while distributed networks offer diversity, resilience, and cost flexibility.

This approach allows developers to run parts of their stack on centralized clouds while outsourcing other components to smaller data centers, edge networks, or decentralized platforms. When one system encounters downtime, workloads can automatically shift elsewhere—reducing disruption without demanding a complete infrastructure overhaul.

Conclusion

Crypto’s infrastructure still hasn’t caught up with its decentralized ideals, but the gap is beginning to narrow. As the limitations of centralized clouds become clearer, distributed models are gaining relevance, not as replacements but as essential complements.

The long-term vision isn’t to abandon the Big Three cloud providers. It’s to create a richer, more resilient ecosystem where workloads can flow across centralized and decentralized networks seamlessly. In a world where computing demand continues to surge, diversification could be the key to achieving true resilience—and bringing blockchain closer to the ideals it was founded on.

Learn from market wizards: Books to take your trading to the next level