Asset tokenization is transforming how we own and trade valuable assets by using blockchain and smart contracts to represent ownership as digital tokens. While commonly associated with tokenized stocks or gold, its potential extends to nearly any asset with monetary value, positioning it as a game-changer in finance. However, tokenization faces challenges, particularly the oracle problem, as off-chain asset data must be securely integrated on-chain. Reliable oracles are essential for ensuring accurate minting, trading, and management. This article explores the mechanics, potential, and challenges of asset tokenization and its impact on the financial landscape.

What is Asset tokenization?

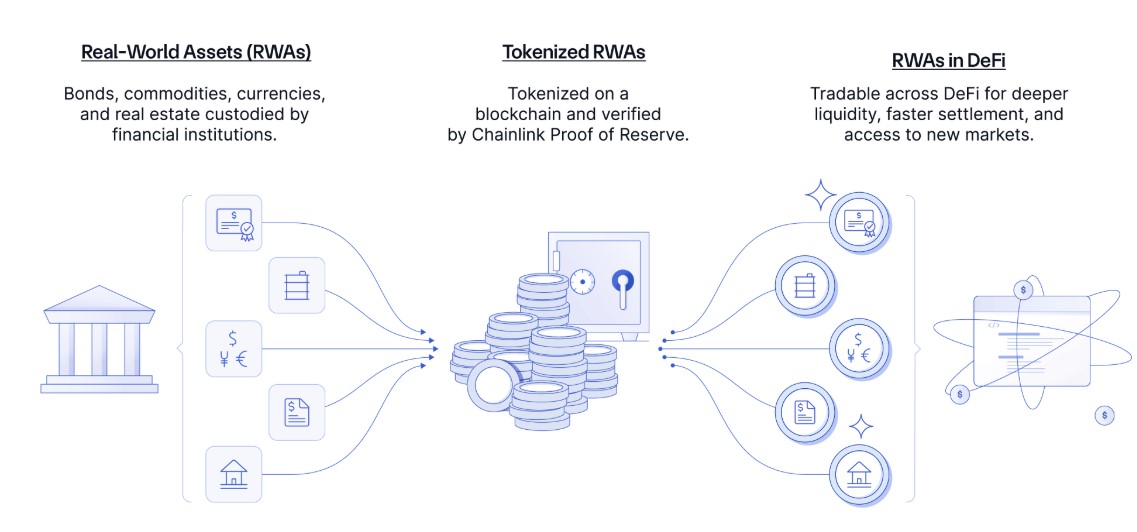

Asset tokenization is the process of converting real-world assets—such as real estate, stocks, commodities, or intellectual property—into digital tokens on a blockchain. These tokens represent ownership or a share of the asset and can be traded, transferred, or stored digitally.

How Asset Tokenization Works

Asset tokenization follows a structured process to convert real-world assets into digital tokens that can be securely traded and managed on a blockchain. Below is a detailed breakdown of each stage:

1. Asset Selection

Before tokenization begins, the first step is selecting a suitable asset. This could be a physical asset (e.g., real estate, gold, artwork) or a financial asset (e.g., stocks, bonds, intellectual property rights). The asset must have clear ownership rights and a defined market value to ensure a smooth tokenization process.

For example:

• A real estate developer may tokenize a commercial building to allow multiple investors to own fractional shares.

• A fine art collector could tokenize a rare painting, enabling investors to buy partial ownership through digital tokens.

Choosing the right asset is crucial, as not all assets are easily tokenizable due to legal, regulatory, or market liquidity concerns.

2. Legal & Regulatory Compliance

Since tokenization involves financial transactions and asset ownership, legal and regulatory frameworks must be considered. The asset must be structured to allow fractional ownership and comply with financial regulations in the jurisdiction where it is issued.

Key aspects of compliance include:

• Regulatory Classification: The token must be classified correctly (e.g., as a security, utility, or governance token).

• Investor Eligibility: Some tokenized assets may be restricted to accredited investors based on local securities laws.

• KYC (Know Your Customer) & AML (Anti-Money Laundering) Requirements: To prevent fraud, tokenized platforms require identity verification for investors.

For example, in the U.S., the Securities and Exchange Commission (SEC) regulates tokenized securities to ensure compliance with financial laws.

3. Token Creation

Once legal matters are settled, the next step is the creation of digital tokens on a blockchain. This process involves:

• Selecting a Blockchain: Popular choices include Ethereum (ERC-20, ERC-1400), Binance Smart Chain (BEP-20), Polygon, or Solana, each offering different benefits in terms of security, speed, and cost.

• Developing a Smart Contract: A smart contract is coded to manage token distribution, transfers, and investor rights automatically.

• Determining Token Supply & Value: The asset is divided into a fixed number of tokens, each representing a share of the asset’s total value.

For instance, if a $1 million property is tokenized into 1 million tokens, each token would be worth $1, allowing fractional ownership.

4. Trading & Transfer

Once tokens are created, they can be traded or transferred on decentralized (DEX) or centralized exchanges (CEX), giving investors easy access to buy and sell their shares.

• Liquidity: Unlike traditional assets that may take weeks or months to sell, tokenized assets can be traded instantly on exchanges.

• Global Accessibility: Investors worldwide can participate in ownership without geographical restrictions.

• 24/7 Market: Unlike stock markets that operate on fixed hours, tokenized assets can be traded around the clock.

For example, platforms like Securitize, tZERO, and OpenSea allow tokenized securities, real estate, and NFTs to be bought and sold with ease.

Source: chain.link/education/asset-tokenization

5. Ownership & Settlement

A major benefit of tokenization is transparent and secure ownership recording on a blockchain. This ensures:

• Immutability: Every transaction is permanently recorded, preventing fraud or manipulation.

• Proof of Ownership: Investors can verify their holdings without intermediaries like banks or brokers.

• Automatic Dividends & Revenue Sharing: Some tokenized assets allow smart contracts to automatically distribute rental income, dividends, or profit shares to token holders.

For instance, if a tokenized real estate property generates monthly rent, token holders can receive their proportional share directly to their crypto wallets without any manual intervention.

Key Players in Asset Tokenization

Asset tokenization is reshaping finance by enhancing liquidity, transparency, and efficiency. Several major players are driving this transformation:

• BlackRock’s BUIDL – A tokenized fund offering yields in U.S. dollars through Securitize Markets, investing in cash, U.S. Treasury bills, and repurchase agreements, with daily dividends and enhanced liquidity.

• Goldman Sachs’ GS DAP™ – A digital asset platform using the Canton Network to streamline tokenized asset issuance, registration, settlement, and custody.

• Ondo Finance – Democratizing institutional-grade financial products via blockchain, ensuring transparency, regulatory compliance, and broader access.

• Centrifuge – Providing infrastructure for real-world asset tokenization, enabling users to tokenize, manage, and invest in assets through collateralized pools and a DAO governance model.

Conclusion

Asset tokenization stands poised to revolutionize the financial landscape. While challenges remain, the potential benefits—increased liquidity, fractional ownership, and enhanced efficiency—are undeniable. As technology matures and regulatory frameworks adapt, we can expect to see even greater innovation and wider adoption of this transformative technology, ushering in a new era of finance.

Learn from market wizards: Books to take your trading to the next level