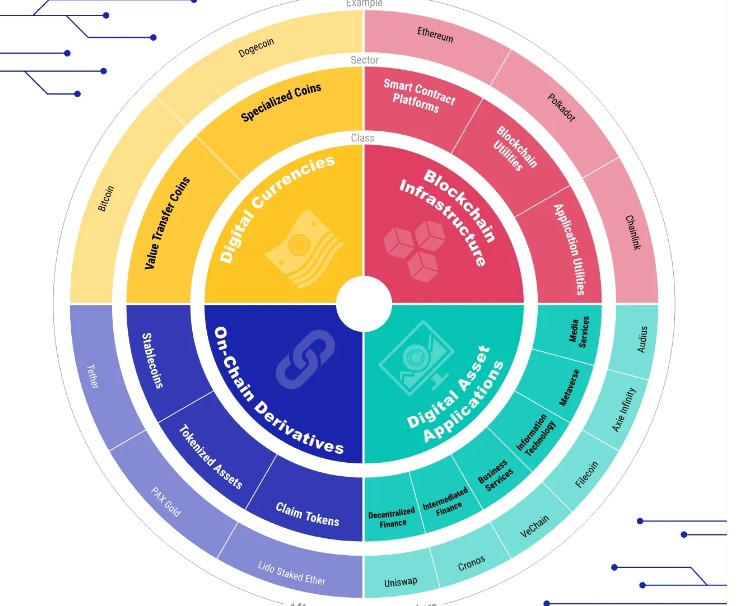

The crypto universe has undergone a remarkable transformation since the inception of Bitcoin in 2009. From a single asset, the market has expanded into a vast ecosystem encompassing 4 asset classes, 14 sectors, and 41 subsectors, as defined by datonomy™.

Today, the aggregate market capitalization of assets within the datonomy™ universe exceeds $2 trillion, a significant increase from a year ago. By combining on-chain metrics with datonomy’s insights, we can gain valuable understanding into the interplay between fundamental value drivers and sector returns. Notably, the On-Chain Derivatives asset class, including stablecoins and tokenized assets, constitutes a substantial portion of trusted spot volume across all sectors, representing 50% of the total.

From Bitcoin to a Blockchain Universe

In 2008, the world was introduced to Bitcoin, a revolutionary decentralized digital currency. This breakthrough paved the way for a wave of altcoins, each offering unique features and capabilities. Litecoin, Dogecoin, and Ripple were among the early entrants, each inspired by Bitcoin’s foundation but with distinct characteristics.

While these early cryptocurrencies laid the groundwork, a significant limitation remained: the inability to support more complex and programmable transactions. Ethereum, a groundbreaking platform, addressed this challenge by introducing smart contracts and decentralized applications. This innovation spurred the development of numerous other Layer-1 blockchains, each with its own strengths and tradeoffs.

Today, the crypto ecosystem has exploded with a diverse range of use cases and tokens. From tokenized assets and Layer-2 scalability solutions to governance tokens and decentralized applications, the possibilities are endless. What began as a single concept has evolved into a vast and intricate universe.

Navigating this rapidly evolving landscape can be daunting. In this edition of Coin Metrics’ State of the Network, we offer a comprehensive update on crypto-asset valuations, sector performance, and volumes, utilizing datonomy™, a robust classification system for the digital asset ecosystem.

Source: Coin Metric

Datonomy: A Framework for Navigating the Crypto Landscape

The rapidly evolving crypto ecosystem can be overwhelming, with its constant introduction of new assets and technologies. To simplify this complexity and provide a clearer understanding of the market, datonomy™ was developed. This classification system categorizes digital assets into four distinct classes, fourteen sectors, and forty-one subsectors, based on their economic use cases. This granularity enables investors to differentiate between “Smart Contract Platforms” and “Digital Currencies,” as well as “Tokenized Assets” and “Decentralized Finance,” offering a transparent framework for portfolio construction, risk management, and market trend analysis.

By dividing the digital asset universe into four primary asset classes, datonomy™ provides valuable insights into the relative market size of each category and its historical evolution. Digital Currencies, one of the earliest use cases, continue to dominate the market, accounting for 57% of the total market capitalization. Blockchain Infrastructure, which includes smart contract platforms and essential utilities like scalability and interoperability solutions, has been steadily gaining traction, currently holding a 31% market share. Digital Asset Applications, while still relatively small at approximately 4%, represent a promising area for future growth, driven by the underlying infrastructure and tokenized assets.

In aggregate, the market capitalization of assets covered by datonomy™ has experienced substantial growth, reaching $2 trillion as of September 2023. This represents a 100% increase from the previous year, highlighting the continued expansion and maturation of the crypto ecosystem.

Sector Performance and the Crypto Landscape

Understanding sector performance within the cryptocurrency market helps investors spot trends, optimize portfolios, and manage risk. By comparing sectors like Decentralized Finance (DeFi) to the broader market, investors gain insights into market dynamics and prevailing narratives, allowing for more informed strategies.

Long-Term Sector Performance

Despite fluctuations, the Coin Metrics Total Market Index (CMBITM) has seen a 690% cumulative gain. Notably, Intermediated Finance (+1948%), Business Services (+1734%), and Information Technology (+1681%) have significantly outperformed the market. The Metaverse sector surged in 2021 but faced limited adoption and challenges in monetization.

Short-Term Trends

In the short term, the Specialized Coins sector was the quickest to recover after the August 5th market crash, with a year-to-date gain of 6%. The Metaverse sector saw a brief 15% rise before declining again.

On-Chain Metrics and Sector Returns

On-chain metrics, like Layer-1 (L1) network fees and decentralized exchange (DEX) volumes, can provide insights into sector returns. For example, the correlation between L1 fees and Smart Contract Platform returns shows that rising fees may reflect higher demand for transactions, aligning with price increases. DEX volume, especially during periods of stress, impacts DeFi sector returns, with correlation patterns shifting based on market conditions.

Volume by Asset Class and Sector

Spot trading volume has shifted from Digital Currencies toward Blockchain Infrastructure and Digital Asset Applications, which now account for 20% and 40% of total volume, respectively. The On-Chain Derivatives sector, led by Stablecoins, has grown to 50% of spot volume. Despite recent declines, volumes remain above summer 2023 levels.

Conclusion

The crypto ecosystem has expanded beyond a single application, encompassing smart contracts, on-chain finance, and more. As the industry evolves, frameworks like datonomy™ will become essential for navigating its growing complexity.

Learn from market wizards: Books to take your trading to the next level