Staking has become a popular avenue for crypto investors to earn passive income. By locking up your Proof-of-Stake (PoS) coins for a specific period, you can earn rewards akin to interest on a savings account. But with countless PoS coins available, choosing the right one can be overwhelming.

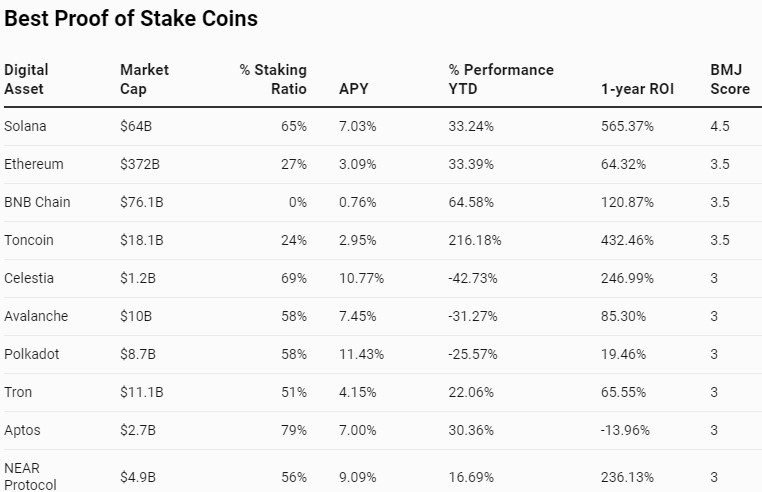

When selecting a PoS coin, factors like minimum staking requirements, market capitalization, trading volume, setup complexity, staking yield, and return on investment (ROI) are crucial. Remember, while high Annual Percentage Yields (APYs) might be tempting, prioritizing trusted tokens is essential.

Understanding the Basics of Staking

Staking is essentially a way for cryptocurrency holders to earn rewards by contributing to the security and validation of a blockchain network. Unlike traditional investments, staking doesn’t require you to relinquish ownership of your assets. Instead, you lock up your coins for a specific period, and in return, you receive a share of the network’s rewards.

Staking: Double Your Crypto Gains

Staking isn’t just about earning rewards; it’s a dual-pronged investment strategy. Picture it as a savings account on steroids. Not only do you earn interest-like rewards on your crypto, but you also retain ownership and exposure to its potential price appreciation.

Unlike traditional savings, where your principal remains static, staking allows your investment to potentially grow in two ways: through staking rewards and through the asset’s price increase. It’s like earning interest while also owning a stock that could skyrocket. Of course, the crypto market is volatile, and both your principal and rewards can fluctuate.

Essentially, staking offers a unique opportunity to amplify your crypto investment, combining the stability of passive income with the thrill of potential capital gains.

Source: bitcoinmarketjournal.com

Solana

Solana has quickly established itself as a leading blockchain platform, known for its lightning-fast transaction speeds and low fees. Positioned as a potential Ethereum rival, Solana attracts a thriving ecosystem of DeFi protocols, NFT marketplaces, and Web3 applications.

Despite a sharp correction after the FTX collapse, the SOL token has rebounded, driven by improved network stability, increased on-chain activity, and growth in the DeFi and NFT sectors. The possibility of a Solana spot ETF could further boost its value. However, the network’s history of outages raises concerns about long-term reliability.

Key Strengths:

• Unparalleled Speed: High transaction throughput sets Solana apart.

• Thriving Ecosystem: A wide range of DeFi and NFT projects.

• Low Fees: Affordable transactions enhance the user experience.

Challenges:

• Network Stability: Addressing frequent outages is crucial for sustained growth.

Ethereum

Ethereum remains a dominant force in the blockchain world, boasting a thriving ecosystem of decentralized applications (dApps) and a strong developer community. The shift to Proof-of-Stake was a game-changer, unlocking new opportunities and attracting billions in staked ETH. The Shapella upgrade further boosted liquidity, enhancing the network’s appeal.

Despite price fluctuations, Ethereum’s fundamentals are strong, with the potential approval of spot ETFs likely to drive further growth. While solo staking offers high rewards, its high entry barrier has led to the rise of staking pools like Lido and Rocket Pool, making staking more accessible.

Strengths:

• Pioneering Smart Contract Platform: The foundation of DeFi and Web3.

• Strong Network Effects: A vast, growing ecosystem.

• Institutional Adoption: Increasing interest from traditional finance.

Challenges:

• Scalability Issues: Despite improvements, congestion persists.

• High Staking Threshold: Solo staking remains out of reach for many.

BNB

Originally an Ethereum-based token, Binance Coin (BNB) has become essential to the Binance ecosystem. Initially used for trading fee discounts, BNB now plays a key role in Binance’s growing blockchain infrastructure, supported by the Proof-of-Staked Authority (PoSA) consensus on the BNB Beacon Chain.

As the flagship token of the world’s largest cryptocurrency exchange, BNB’s performance often reflects Binance’s overall success. Despite a strong rise, BNB faces challenges from regulatory scrutiny and market volatility. However, its fundamentals remain solid, with its unique token burn mechanism and central role in Binance positioning it as a strong investment. Navigating regulatory challenges will be crucial for BNB’s continued success.

Strengths:

• Central Role in the Binance Ecosystem: Integral to the leading exchange.

• Token Burn Mechanism: Gradually reduces supply.

• Proven Utility: Extends beyond fee discounts.

Challenges:

• Regulatory Uncertainty: Potential risks from global regulators.

• Market Volatility: Affected by broader market fluctuations.

Toncoin: A High-Speed Blockchain Challenger

Toncoin powers The Open Network (TON), a Layer-1 blockchain designed for exceptional speed and scalability with minimal fees, thanks to its advanced sharding architecture and Proof-of-Stake consensus. Since its relaunch, Toncoin has outpaced market trends, driven by its growing utility in the expanding TON ecosystem, particularly in DeFi, staking, and liquidity provision.

While Toncoin’s potential is significant, it faces challenges from regulatory risks and limited exchange availability, which must be addressed for it to fully succeed.

Strengths:

- High Performance: Fast transaction speeds and low fees.

- Growing Ecosystem: Expanding DeFi hub and utility.

- Innovative Technology: Scalable sharding architecture.

Challenges:

- Regulatory Risks: Potential regulatory obstacles.

- Limited Exchange Listings: Less accessible to investors.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features