In recent times, the Decentralized Finance (DeFi) sector on the Solana blockchain has encountered various challenges, including hacks, FTX crashes, reduced liquidity, and network interruptions. However, surprisingly, Solana has shown resilience and strength amidst these difficulties. The credit goes to the dedicated efforts of the Solana team and developers, who have worked tirelessly to overcome these obstacles and bolster the ecosystem.

A Beginner’s Guide to Solana DeFi in 2023

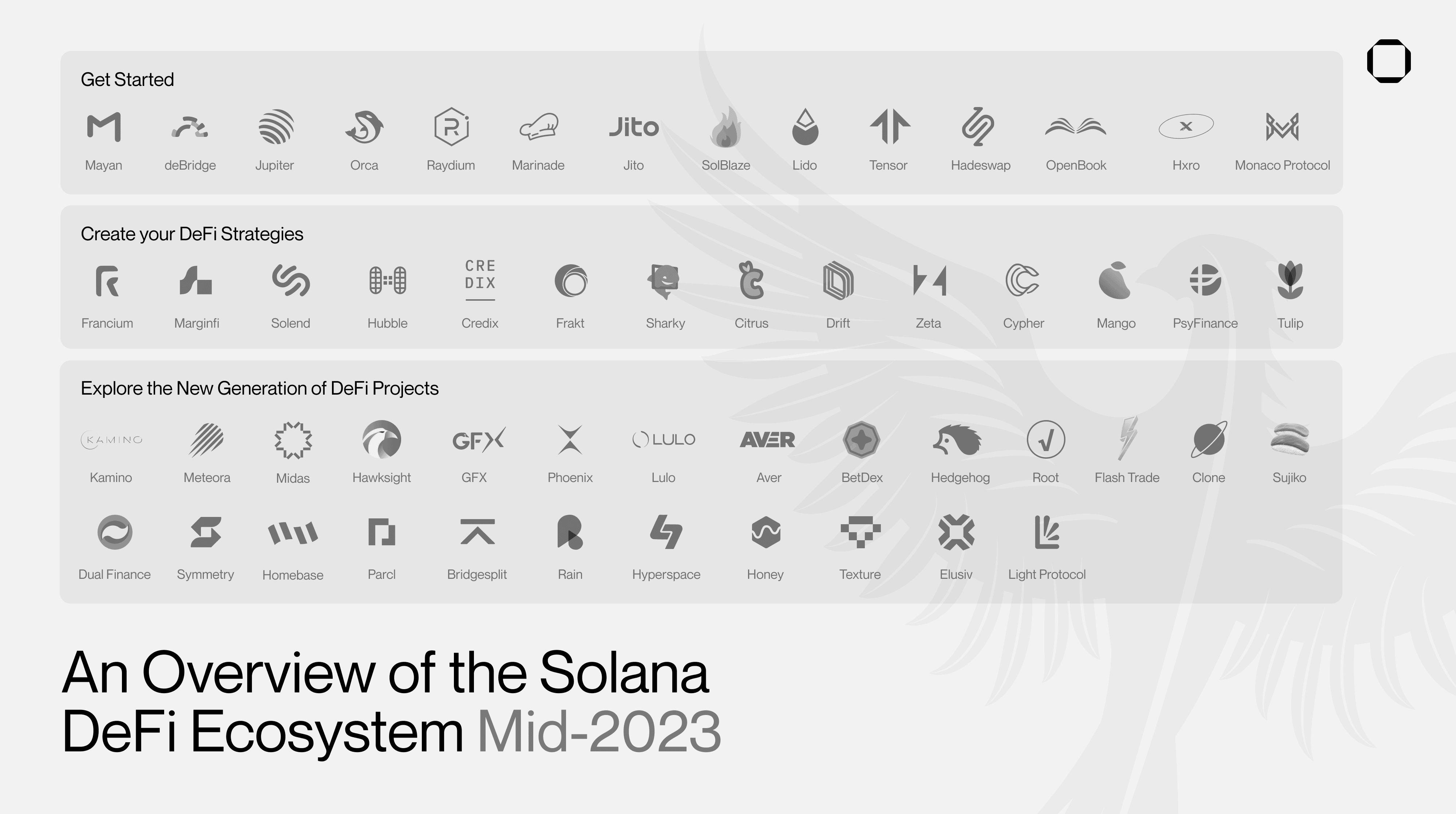

If you have funds on another blockchain, such as Ethereum or EVM, the most straightforward method to transfer them to Solana is through centralized exchanges like Coinbase or Kraken. Alternatively, you can explore decentralized cross-chain solutions like Mayan Finance (powered by Wormhole) or deBridge, which enable the receipt of native tokens instead of wrapped assets.

How to Buy Tokens on Solana

After your funds are on-chain, the next step is to exchange them for SOL, USDC, or any other token you’re interested in. Unlike Ethereum, where most people trade directly with an AMM, Solana users prefer using Jupiter, the leading DEX aggregator. Jupiter sources liquidity from various AMMs like Orca and Raydium, as well as order books such as OpenBook and Phoenix. Jupiter not only offers the best swap rates but also allows users to create on-chain limit orders for any token. Additionally, an on-chain DCA feature is in the pipeline and coming soon.

Staking Opportunities on Solana

Now that you have some SOL and SPL tokens in your wallet, you are well-prepared to explore the various yield options available on Solana. One straightforward approach is to stake SOL to receive incentives. Fortunately, reputable companies like Marinade, Jito, SolBlaze, and Lido offer liquid staking services.

JitoSOL (Jito) stands out as a cutting-edge liquid staking solution, offering a higher yield compared to conventional staking methods. Stakers not only receive emissions but also benefit from MEV payouts generated by Jito validators.

Marinade currently holds the largest stake, with over $150 million in assets. It provides the most significant staking solutions in the ecosystem. Additionally, Marinade offers a unique feature called “Directed Stake,” allowing users to delegate their tokens to a validator of their choice.

SolBlaze, on the other hand, offers an automatic staking feature that distributes Solana tokens among various validators based on their delegation strategy. This functionality contributes to the decentralization of the ecosystem.

With these options at your disposal, you can now explore and maximize your yield opportunities on Solana.

Liquidity Provisioning

In Solana, concentrated liquidity has become the standard for AMMs, with prominent decentralized exchanges like Raydium and Orca mainly offering concentrated liquidity market-making (CLMM) pools. These pools are more capital-efficient, providing increased liquidity for users and higher fees for traders. For instance, if you have staked your SOL into mSOL or JitoSOL, you can support users looking to swap these tokens by providing liquidity on these exchanges for pairs like SOL or USDC. This allows you to earn yields from trading fees and potentially receive additional rewards through liquidity mining programs, as seen with Marinade’s MNDE for mSOL pools.

In addition to AMMs for traditional assets, major NFT protocols on Solana have integrated AMMs to improve NFT trading. Hadeswap has been at the forefront of democratizing this for major collections, followed by Tensor and Magic Eden. Just as you would provide liquidity for a SOL-USDC pair, you can do the same for NFT collections, earning fees on these marketplaces from people trading the liquidity you’ve provided.

More experienced users can explore additional protocols on Solana to provide liquidity and earn trading fees. OpenBook, derived from Serum by the Solana community after FTX’s collapse, serves as an on-chain order book frequently used by traders for on-chain limit orders and is integrated into protocols like Raydium and perpetual exchanges. Users can also access products built on top of Hxro, a liquidity layer for derivatives trading and betting applications. Additionally, the Monaco Protocol powers numerous betting applications on Solana, such as BetDex.

Explore Solana’s Decentralized Finance

Solana offers a variety of lending and borrowing protocols for DeFi strategies. Marginfi and Solend are prominent lending platforms, while Francium and Hubble cater to specific needs such as LP position leveraging and fixed-rate borrowing. Credix allows Real-World Asset (RWA) loans, while NFT traders can explore options like Frakt, Sharky, or Citrus to leverage their NFTs for lucrative opportunities.

Exploring Airdrops: What You Need to Know

Airdrops have significantly contributed to the success of Ethereum protocols, and even Layer 2 solutions have leveraged them to build communities and boost liquidity. BONK showcased successful airdrops on Solana earlier this year, setting a precedent for other projects. While some projects on Solana haven’t introduced their tokens yet, many have recently teased the possibility of future airdrops for their user base.

Cypher introduced a Liquidity Incentive Program with a fixed yield for liquidity providers, locking tokens for 6 months, and compensating with $CYPHER tokens. Marginfi implemented gamification using points to engage traders and bootstrap liquidity, offering potential rewards or perks like token airdrop eligibility. LSTs are gaining popularity on Solana, with SolBlaze planning an airdrop for bSOL holders. Solana’s ecosystem is witnessing continuous growth, with valuable products to explore, supported by solutions like Cubik for early project funding. Squads provide support to Solana teams, enabling control over on-chain assets and secure operations through multisig security for DeFi protocols.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features