Since 2021, the BNB chain has been making waves in the decentralized finance (DeFi) sector. It currently holds almost 9% of the market share. It is also now becoming a formidable competitor with some of the top DeFi platforms, such as Ethereum and Tron. BNB is an appealing alternative to Ethereum due to its user-friendly interface, interoperability with the Ethereum virtual machine, and lower transaction costs.

Currently, BNB has over 500 DeFi applications running on it.

BNB could be likened to the operating system on your computer; as applications run on operating systems, so do DeFi apps. BNB is still attracting more investors. However, the recent legal action taken by the United States Securities and Exchange Commission has impacted the BNB token, which is the native token of the Binance platform.

The BNB Chain

The BNB chain provides quick block times and minimal fees. It relies on the consensus known as the Proof of Staked Authority (PoSA), which is supported by 50 validators. Block production is ensured by the most bonded validators, ensuring chain finality, stability, and security. BNB Chain enables cross-chain transfers and communications and is compatible with the Ethereum virtual machine (EVM).

Through the selected validators, the BNB offers security and safety. In order to provide quicker finality and lower transaction fees, it leverages Ethereum technology. The native token, BNB, is employed for staking and the execution of smart contracts. It also has a market value of over $47 billion, making it the fourth-largest cryptocurrency.

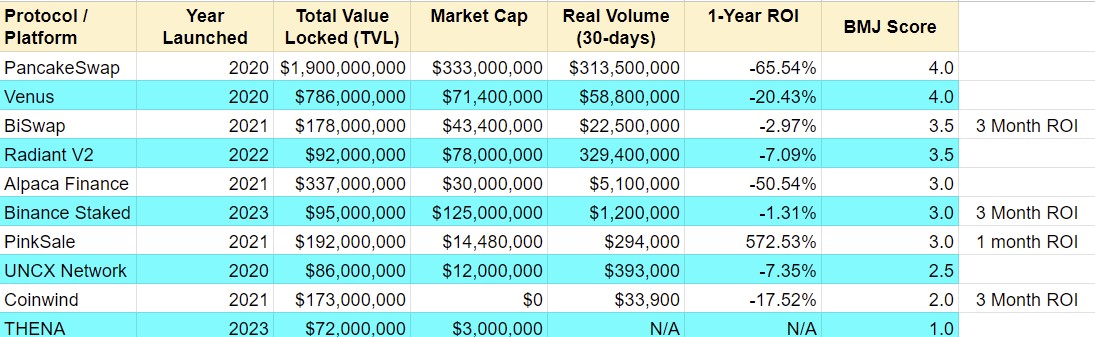

The Best Protocols on the BNB Chain by Total Value Locked

PancakeSwap

PancakeSwap is an exchange platform built on the BNB blockchain. It facilitates the easy swapping of Binance’s BEP-20 token. It has some elements borrowed from Uniswap and SushiSwap. A centralized order book or facilitator is not required thanks to PancakeSwap’s automated market maker (AMM) solution. This means that rather than trading directly with counterparties, users trade against liquidity pools sponsored by other users.

Aside from just trading, PancakeSwap investors can engage in lotteries, yield farming, becoming liquidity providers, earning a percentage of transaction fees, and trading in addition to trading. Additionally, it facilitates the exchange and staking of non-fungible tokens (NFTs).

Of the total value locked (TVL), the BNB blockchain has about 44% of it. For this reason, it is regarded as topping the list.

Venus

On the BNB network, Venus’ specialty is decentralized lending and borrowing. Everyone is welcome to access the algorithm-based financial market as long as they have a compatible wallet such as MetaMask.

Through Venus’ native token, XVS, users can lend or borrow supported digital assets, earn token rewards, and take part in governance. The protocol combines MakerDAO and Compound capabilities, allowing users to mint, lend, and borrow stablecoins within a unified ecosystem.

Venus has a total value locked (TVL) of $800 million, which has earned it the second position on the list.

Biswap

This platform was launched on the BNB chain in May 2021. It is a decentralized exchange platform that offers token switching on BSC with trade fees as low as 0.1%. Biswap offers an innovative three-type referral network that rewards users for their referees’ activity in farming, launch polls, and swaps, in addition to providing a platform for trading, farming, and staking.

NFT games and marketing are also available on Biswap. It offers quick transactions while preserving user control over funds by employing an AMM paradigm. Its native token (BSW) makes platform-wide incentives possible. Binance Labs’ strategic investment enables Biswap to improve its cutting-edge DEX services.

Radiant V2

This platform is an omni-chain money market protocol that is native to Arbitrum. It attempts to make cross-chain borrowing and the deposit of large assets easier.

With Radiant Version 2, some of the issues of Version 1 have been resolved.

The LayerZero Omnifungible Token (OFT) has been implemented, along with improved tokenomics, higher usefulness, cross-chain capability integration, and debuts on numerous new EVM networks. Radiant is positioned as a leading, revenue-generating protocol in DeFi thanks to V2, which is also intended to build up fair value for the DAO. The upgrade’s strong security foundation was confirmed by thorough security audits conducted by Peckshield, Zokyo, and BlockSec.

Conclusion

Since 2021, BNB blockchain has demonstrated impressive growth, and it is gaining more and more acceptance in the DeFi ecosystem, grabbing about 10% of the overall market as it effectively competes with Tron. But currently, investors’ confidence in this platform has fallen due to the ongoing SEC lawsuit against Binance. For now, investors should be cautious about investing in this space.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features