Yield farming has been described as the DeFi ecosystem’s lifeblood or rocket fuel. During a time when traditional banks were offering exceptionally low loan rates, yield farming produced substantial yields. Over the next two years, yield farming drew more than $150 billion into DeFi protocols, solidifying it as the “next big thing” in crypto. According to Nansen, the field grew by more than 6,900% between 2020 and 2022.

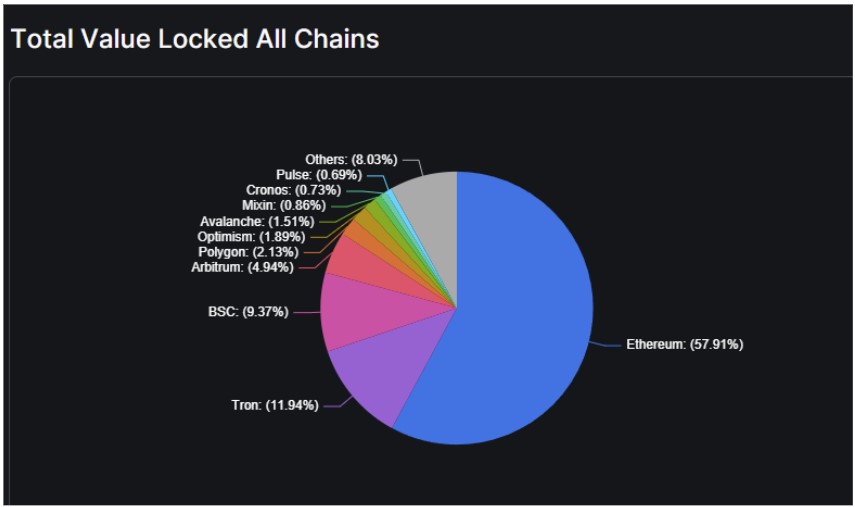

Despite a 76% reduction in DeFi protocols since 2022, the sector is still worth $47.3 billion in TVL. The Ethereum blockchain is home to more than 57% of all DeFi yield farming activity, with Tron (11.94%) and Binance Smart Chain (9.37%) following close behind.

Top 5 Yield Farming Investments in 2023

Despite a 76% reduction in DeFi protocols since 2022, the sector is still worth $47.3 billion in TVL. The Ethereum blockchain is home to more than 57% of all DeFi yield farming activity, with Tron (11.94%) and Binance Smart Chain (9.37%) following close behind.

Stablecoins are still playing important roles in the advancement of DeFi and yield farming. Coins like USDC and USDT have developed into attractive farming and staking choices due to their low volatility. Many DeFi protocols are in the process of releasing native stablecoins to capitalize on this trend. With the issue of crvUSD on the Ethereum mainnet in May 2023, Curve Finance was the first to reach this milestone.

Uniswap is a well-known decentralized exchange on the Ethereum blockchain. Hayden Adams founded and launched the DEX in 2018, and it has received funding from Paradigm, USV, and Andreessen Horowitz (a16z).

Uniswap

Uniswap is intended for the trading and exchange of ERC-20 tokens as well as decentralized loans. No buying or selling is going on. Holders of the UNI token are in charge of protocol governance. Uniswap compensates LPs with a portion of the platform’s trading fees. Uniswap is a particularly appealing platform for yield farming because it is one of the largest DEX platforms, with a TVL of $4 billion. It’s difficult to argue against Uniswap’s long-term potential based on its sheer size, median APY, and market position.

Aave

Aave is a decentralized marketplace for crypto lending and borrowing. While Aave was initially established on the Ethereum blockchain, it has since expanded to other blockchains like Avalanche and Harmony.

Stani Kulechov, a Finnish law student, founded the Aave project in 2017 under the moniker ETHLend. It was renamed Aave, which means “ghost” in Finnish, in 2018. The LPs, in this case, are lenders who receive interest income in the form of “aTokens.”

The protocol also includes a native governance token known as AAVE. To mitigate default risk, Aave loans are overcollateralized. Borrowers must pledge other crypto assets worth more than the loan sum to obtain a loan.

However, this type of activity has limited application outside of the DeFi realm, and, as with all other DeFi projects, there is a significant risk of regulatory action due to the protocol’s decentralized structure.

Synthetix

Synthetix is a non-custodial trading system based on Optimism, Ethereum’s layer-2 scaling solution. Kain Warwick, an Australian cryptophile, launched the DeFi protocol in 2016. Before renaming itself the Synthetix Network in 2018, it was known as Havven.

Synthetix is a cutting-edge DeFi platform that operates similarly to a derivatives market in traditional finance. Users can trade in a variety of commodities, coins, and fiat currencies without possessing them directly.

On the network, these derivatives are known as Synths. They monitor the underlying asset’s value (which might be gold, US dollars, or even bitcoin). Oracles are the protocols that track this pricing. The platform’s native coin is known as SNX.

The Synthetix Network has a lot of staying power in the crypto derivatives space because it was the first to market. Its key attraction is its capacity to provide exposure to fresh assets without requiring ownership.

Curve

Curve Finance, behind Uniswap, is the second-largest DEX platform by volume. Curve, founded by Michael Egorov in 2020, is a non-custodial exchange technology that focuses largely on stablecoin liquidity pools.

The protocol debuted on the Ethereum blockchain at a time when stablecoins such as Tether and USDC were gaining traction. Curve quickly attracted LPs with its promise of minimal fees, a reduced chance of slippage, and efficient stablecoin trading opportunities. Aside from stablecoins, Curve’s liquidity pools are based on wrapped versions of prominent cryptos. This combination enables Curve to outperform other DEXs in terms of fees and efficiency while also lowering the risk of volatility.

PancakeSwap

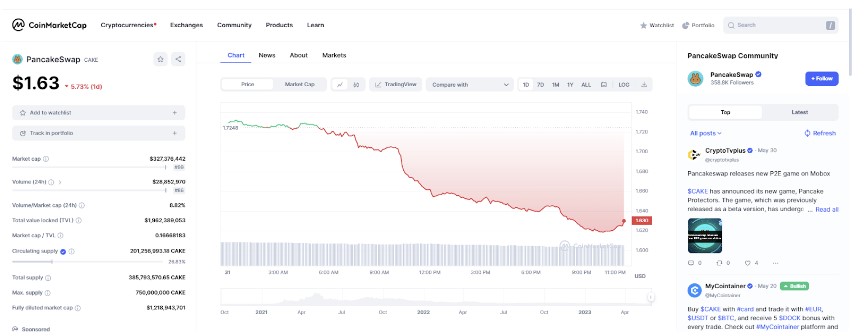

PancakeSwap is a decentralized exchange that is genetically related to Uniswap. The new protocol, which was originally a fork of Uniswap, was adopted and deployed on the Binance Smart Chain (BSC). Despite being a Uniswap branch, PancakeSwap exists on the BSC independently.

The development team chose Binance due to the high gas fees and delayed transactions that plagued the old Ethereum network in 2020. PancakeSwap was able to attract more users as a result of its efficient and cost-effective solutions.

The platform’s native token is known as CAKE. PancakeSwap is a simple DEX where LPs gain incentives for staking and yield farming. The protocol compensates LPs in CAKE with a share of trading fees. The sole significant constraint on PancakeSwap is its absence from prominent blockchains such as Ethereum. Being on the BSC has some significant drawbacks, including the inability to trade in any tokens other than BEP-20.

Conclusion

The yield farming space has lost some of its luster as a result of the 2022 crypto market meltdown, but it’s not all doom and gloom. The demise of centralized exchanges such as FTX, as well as continuing SEC proceedings against Binance and Coinbase, may make DeFi more appealing to investors globally.

However, due to the approaching advent of new laws, there is still ambiguity in the DeFi space. Regulators are scrutinizing the whole crypto economy, from the EU to North America, and DeFi could be next.

With so much fluctuation and uncertainty in the system, we encourage all newbies to proceed with care and due diligence. As a general guideline, focus your investment considerations on the token(s) with the most users and the highest TVL.

Learn from market wizards: Books to take your trading to the next level.