Ethereum staking has been gaining more and more popularity after the successful merger and elimination of lock-up periods. However, on the downside, staking deprives the market of liquidity. But platforms that can provide Liquid Staking Derivatives (LSD) tokens give users the ability to draw benefits from both sides. They will be able to trade and, at the same time, invest staked ETH on decentralized exchange platforms and decentralized finance platforms while also receiving passive income from staking rewards.

Liquid Staking Tokens (or LSD tokens) are of different types. There are about four different types. We have the rebasing token, the non-rebasing token, the single token, and the dual token. Investors need to learn about the pros and cons of these different LSD token types so that they can make wise choices as they choose the one that suits their long-term goals, risk tolerance, and liquidity needs.

The Idea of Liquid Staking Derivatives

The idea of liquid staking derivatives started in 2020. Liquid staking derivatives facilitate the flexibility and liquidity of the staked assets on a particular blockchain. The staked assets are used to secure the particular blockchain, and for this, the investors earn rewards. But with the liquid staking derivatives, stakeholders are allowed to unlock their assets and use them on other DEX and DeFi platforms, thereby getting extra utility from staked assets.

Liquid Staking Derivatives, or LSD tokens, are similar to other cryptocurrencies. Their value is equivalent to the underlying tokens, and their primary goal is to circumvent the constraints of conventional staking.

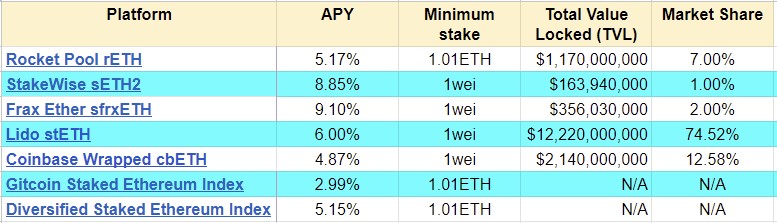

Best Liquid Staking Derivative Rates

Rocket Pool

This is one of the first Ethereum staking projects. It was introduced in 2016 while the Ethereum community was still debating whether to switch to a proof-of-stake consensus method for the blockchain.

Even though Rocket Pool has been overtaken by others, such as Lido and the more recent Coinbase liquid staking protocol, it is still the third-largest liquid staking project for ETH. It has a devoted following among crypto enthusiasts because it places a strong emphasis on decentralization.

The platform’s token is RPL. Investors get the rETH LSD token in return for staking ETH. A Rocket Pool staking node can be easily created by anyone with 16 ETH and 1.6 ETH worth of RPL.

Other ETH holders who want to take part in liquid staking through permissionless staking contribute the remaining 16 ETH. Only 0.01 ETH, or around $20 at the current exchange rate, is needed as the minimum stake.

Node operators earn between 5% and 20% of staking rewards. The returns provided by Rocket Pool are rather low, at about 5.17%. The only source of revenue for the protocol is the release of RPL tokens.

StakeWise sETH2

This platform is part of the many protocols that emerged after the introduction of Beacon Chain for the Ethereum Merge in December 2020. For each of the stakeholders on the platform, the LSD token awarded to them is known as sETH2.

In addition to sETH2, the protocol contains a separate coin called rETH2 that is intended only for staking rewards and should not be confused with rETH from Rocket Pool. After depositing their ETH, holders of Stakewise LSD tokens will begin receiving rETH2 incentives within 24 hours.

Anyone can apply to become a node operator in StakeWise’s decentralized network. Qualification is not guaranteed, though, as there is a strict vetting procedure and candidates must win the support of protocol DAO members.

The simplicity and promise of quick payouts are StakeWise sETH2’s primary selling points for regular ETH stakers. The minimum stake accepted by the service is 1 wei, which is the smallest fraction of ETH.

Frax Ether (sfrxETH)

Frax Finance is the brain behind the Frax Ether token. They are also the brains behind the first fractional reserve stablecoin to be linked to the US dollar, FRAX. A soft community launch took place in October 2022, and an official launch took place in January 2023; this makes it new in the market.

Similar to StakeWise, Frax Ether’s liquid staking service uses separate tokens for liquidity (frxETH) and staking incentives (sfrxETH). Holders of ETH can enter their tokens into the Frax ETH Minter smart contract to participate.

Key Takeaways for Investors

This market is rapidly developing. There are already a large number of LSD tokens available to investors, each with its strengths and limitations.

Lido is without a doubt the best option for investors looking for the token with the most market share. However, there are worries that it could pose a long-term threat to the Ethereum network’s decentralization.

In terms of high annual percentage yield (APY) among popular coins, Frax and StakeWise are the best options if big profits are a priority to you as an investor.

Rocket Pool is perhaps the best choice for investors worried about over-centralization in the Ethereum ecosystem.

Learn from market wizards: Books to take your trading to the next level.