Bitcoin credit card and crypto credit card are words often used interchangeably. They don’t have much difference from typical credit cards, and they are the future of credit cards.

Bitcoin credit cards are usually issued by banks and other financial organizations that grant you credit lines. As an alternative, you may link your credit limit to your cryptocurrency balance.

Some of the main benefits of using a crypto or Bitcoin credit card are that you can easily purchase goods and services directly out of your crypto account balance. You can also make easy fiat currency withdrawals from ATMs without having to convert the crypto first.

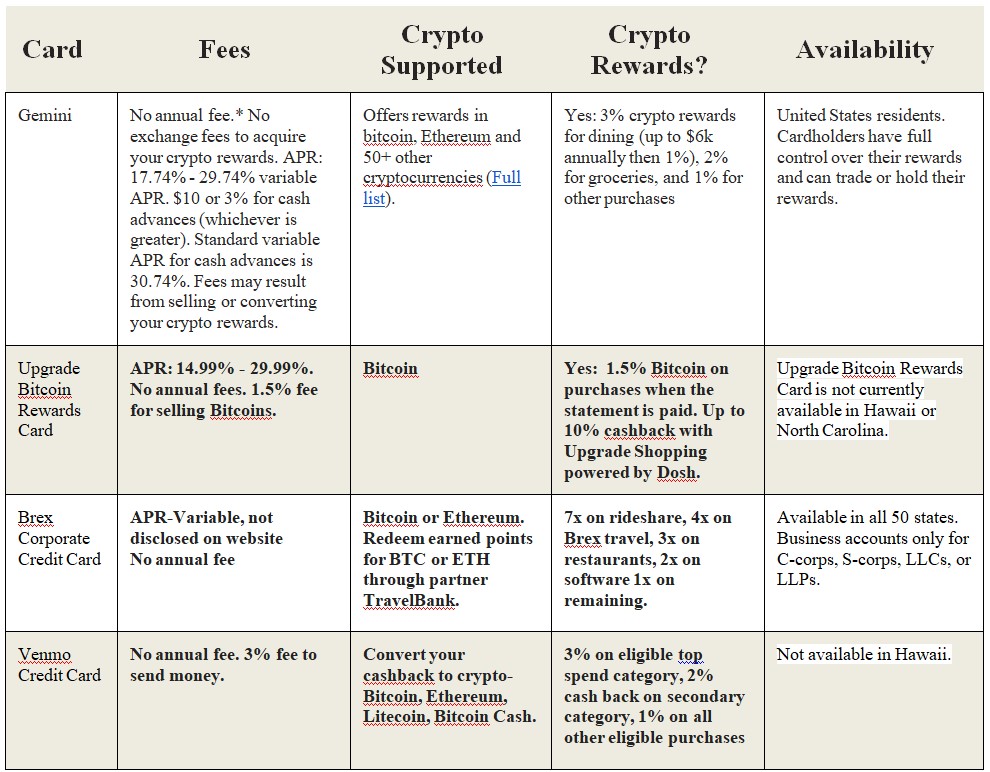

The following are rated and reviewed as the top cryptocurrency credit card services on the market:

Gemini Credit Card

Gemini is a crypto exchange platform that also offers Bitcoin credit services to customers. The company makes it possible for customers to spend digital money anywhere around the globe. Gemini accepts deposits and facilitates transactions in more than 50 different cryptocurrency types.

Gemini gives account holders instant rewards, and their crypto cards do not require extra fees for purchases or ATM withdrawals. Gemini also offers users cashback incentives on dining, groceries, and other purchases. The downside is that Gemini is only available in the United States of America, but the crypto card can be used anywhere in the world.

Upgrade Your Bitcoin Reward Card

This type of Bitcoin credit card makes it possible for the holders to earn rewards in BTC when they make purchases with the card.

In exchange for a set interest rate, you can pay off your balance in equal monthly installments, which makes budgeting simpler.

With this card, you have the opportunity to utilize the Visa card to get a personal loan that is paid immediately into your account.

Users can put the BTC reward they earn to more profitable use. They can let the balance grow. The NYDIG platform will keep your funds. The BTC that you sell is then used as statement credits. There is a 90-day holding period for your Bitcoin rewards. Users can also send money to their bank accounts or use their cryptocurrency at merchants that accept Visa. On the downside, the card cannot be used to withdraw from ATMs, but it can be used for purchases from retailers and e-commerce platforms.

Brex Corporate Credit Card

This crypto credit card is designed to be well-suited for business owners. Exclusive benefits are provided to cardholders to help their businesses. Additionally, through Brex’s partner TravelBank, cardholders can exchange their points for either Bitcoin or Ethereum.

Additionally, a Brex-only tier provides cardholders with the greatest cashback multipliers on the market. It’s a terrific option for company owners who wish to simplify their spending and get the benefits of cryptocurrencies.

This crypto card service is only available in the US. What may be considered the downside of this card is that it is exclusively designed for business owners.

Venmo Credit Card

Venmo is a Fintech Company based on mobile payment services. They started operations in 2009, but in 2021, they began to offer a service that allows users to buy and sell cryptocurrencies. They now provide a credit card that enables users to convert cashback rewards into cryptocurrency. For those who already have a Venmo account, the card is an excellent option. It also gives beginners a brief introduction to cryptocurrency. Before choosing to make more significant transactions in digital currency, cardholders can benefit from rebates in the form of cryptocurrency.

Venmo supports Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. They charge no transaction fee when users purchase crypto with cashback rewards. Venmo is more suited for customers that find mobile payment convenient; it also introduced them to crypto in a low-pressure way.

Why Consider Bitcoin Credit Card?

For most investors, it sounds good to have a credit card that lets you pay down your monthly debt in dollars while also providing you cashback incentives in Bitcoin.

You achieve the best of both worlds in this manner. It functions just like a typical credit card but with the extra benefit of generating cryptocurrency, which has produced astounding profits over time.

However, if you don’t pay off your balance each month as you should, crypto credit cards are like ordinary credit cards; they will charge interest. Your credit report may be impacted by this. There may also be monthly fees, annual fees, and charges for ATM withdrawals. It is, therefore, advisable to pay up your balance each month and settle all fees.

Learn from market wizards: Books to take your trading to the next level.

Hot Features

Hot Features