Key Support Levels: 1.3200, 1.3000, 1.2800

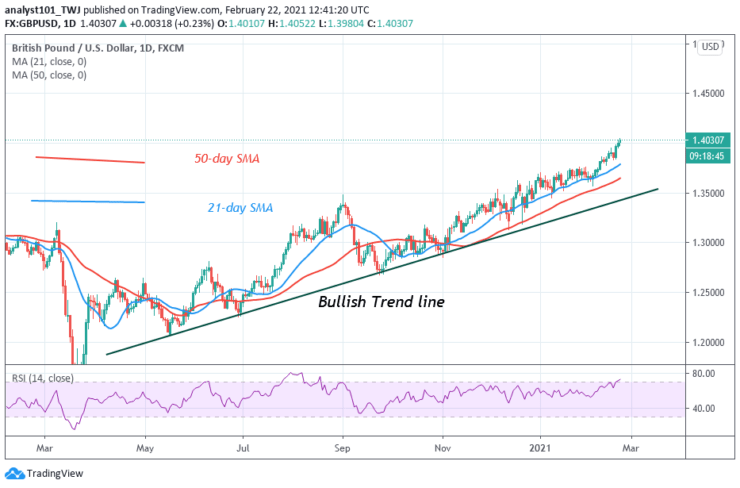

GBP/USD Price Long-term Trend: Bullish

GBP/USD had been in an uptrend since September 2020. The price has been making a series of higher highs and higher lows. Today, the pair is trading at level 1.4025 at the time of writing. The RSI has indicated that price has reached an overbought region of the market. Therefore, the upward move is doubtful in the interim.

Daily Chart Indicators Reading:

The 21-day SMA and the 50-day SMA are sloping upward indicating the upward move. The pair has risen to level 72 of the Relative Strength Index period 14. This indicates that the Yen is in the uptrend zone and above the centerline 50.

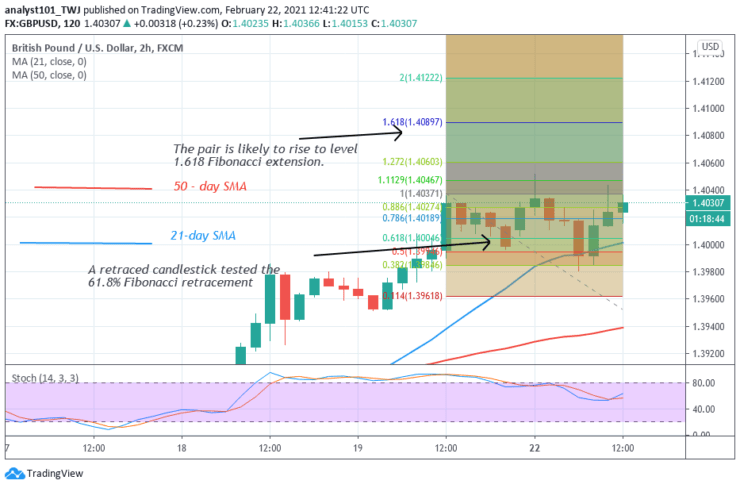

GBP/USD Medium-term Trend: Bullish

On the 4-hour chart, the pair has been in an upward move. On February 19 uptrend; a retraced candle body tested the 61.8% Fibonacci retracement level. The Yen is likely to rise to level 1.618 Fibonacci extensions or the high of level 1.4089.

4-hour Chart Indicators Reading

The GBP/USD pair is currently above the 40% range of the daily stochastic. It indicates that the pair is in a bullish momentum. . The SMAs are sloping upward indicating the uptrend.

General Outlook for GBP/USD

The GBP/USD is in an uptrend. The price has been consistently rising on the upside. According to the Fibonacci tool analysis, the market will rise to level 1.618 Fibonacci retracement level.

Source: https://learn2.trade

Hot Features

Hot Features