Euro Dollar Exchange Rate – EURUSD is expected to trade at 1.22 and higher in 2021 by the end of this quarter. After COVID-19 disrupted financial markets and the global economy in 2020, the US dollar as a whole has weakened. Participants in the European foreign exchange market hope to see a return to economic growth by mid-2021.

Key Levels

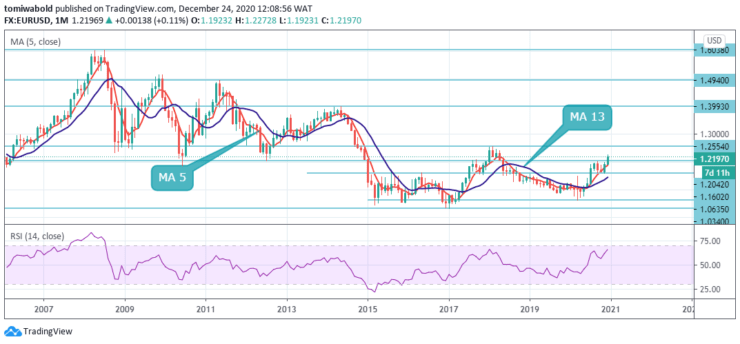

Resistance Levels: 1.4940, 1.3993, 1.2554

Support Levels: 1.1602, 1.0635, 1.0340

EURUSD Monthly Chart: Ranging

EURUSD Monthly Chart: Ranging

EURUSD has maintained its bearish trend since it touched the barrier at 1.2554. Since then, the pair has traded lower and the pair reached a multi-year low at 1.0635. After recovering, the pair gained enough momentum to confirm a bullish breakout.

The next logical target is at 1.2554, and additional gains beyond that level would signal a long-term bullish continuation. If the bulls manage to push the pair over the barrier, the next in line will be the 1.2750 price zone, as the pair has several monthly lows around it.

EURUSD Weekly Chart: Bullish

EURUSD Weekly Chart: Bullish

The uptrend of EURUSD has reached the level of 1.2272. The further rally should be considered to 61.8% of the 1.0635 forecasts by 1.2011 from 1.1602 to 1.2452 further. On the other hand, a break of 1.2058 support is needed to mark a short-term peak. From a technical point of view, the pair has so far managed to defend the support on the weekly chart, which is now in the 1.2175-70 region.

Starting in 2021, the gain from 1.0635 is seen as the third phase of the trend from 1.0339 (low). Further rally can be seen towards cluster resistance at 1.2555, mostly in early 2021 (38.2% retracement from 1.6039 to 1.0339 at 1.2516). This may remain the preferred scenario as long as the 1.1602 support remains.

Conclusion

EURUSD is recovering, but it could still be a corrective rally towards 1.3000. The idea is to see limited upside potential in 2021, however, the near-term situation supports the outlook for an extension of recent appreciation. Meanwhile, sentiment also continues to be fueled by expectations of a deal to boost the U.S. economy and the availability of a coronavirus vaccine.

Source: https://learn2.trade

Hot Features

Hot Features