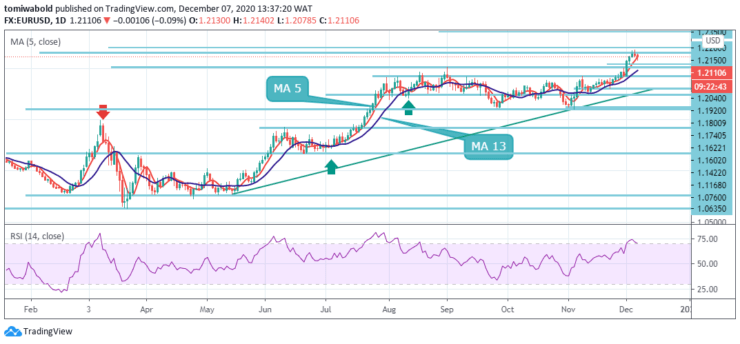

The major European currency adds to prior session corrective downside and takes EURUSD to fresh lows in the sub-1.2100 area. EURUSD appears to be fading after its upside run halts under barrier 1.2150 level. The pair is off its highs could extend its downward correction.

Key Levels

Resistance Levels: 1.2350, 1.2200, 1.2150

Support Levels: 1.2040, 1.1920, 1.1800

EURUSD Long term Trend: Bullish

EURUSD Long term Trend: Bullish

The upside traction in EURUSD eased in the proximity of the 1.2200 resistance level in prior sessions. At the moment, the pair is losing 0.12% at the 1.2110 level and confronts the next support at 1.2040 level seconded by 1.2011 level and finally 1.1920 level.

On the other hand, a breakout of 1.2150 level would target 1.2177 level (high Dec 4) en route to 1.2200 resistance level. The alternative scenario sees the loss of the 1.20 zone as an initial bearish signal, which would be boosted on a breach beneath last week’s low at the 1.1922 level.

EURUSD Short term Trend: Ranging

EURUSD Short term Trend: Ranging

The intraday bias in EURUSD stays neutral for some range trading beneath the 1.2177 temporary high level. Meanwhile, the downside of the retreat should be contained by the 1.2011 support level to bring another increase.

On the upside, breach of 1.2177 level may aim for 61.8% forecast of 1.0635 to 1.2011 levels from 1.1602 at 1.2200 level next. The pair is currently signaling a short-term downside correction towards 1.2040 levels. Any more losses could lead the pair towards the 1.2011 support zone.

Source: https://learn2.trade

Hot Features

Hot Features