XAGUSD Price Analysis – October 9

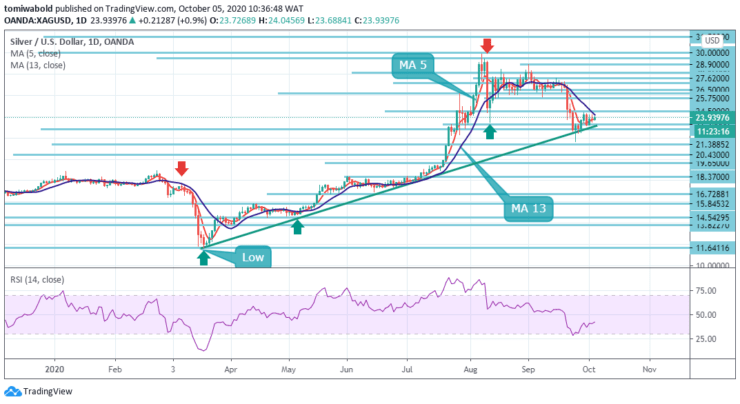

Silver (XAGUSD) price prints a $24.04 intraday high level with 0.50% gains during Monday’s session. Buyers may re-attempt the prior week’s high at $24.40 level for new entries. Traders also resumed accumulating Silver on price correction as safe-haven demand reemerged amidst the second wave of coronavirus outbreak in Europe, and political uncertainty in the US.

Key Levels

Resistance Levels: $28.90, $26.50, $24.50

Support Levels: $23.50, $21.38, $19.65

XAGUSD Long term Trend: Ranging

XAGUSD Long term Trend: Ranging

Silver (XAGUSD) has staged a dramatic decline to $21.66 low level and rebounded to trade at $24.40 level prior week high but still failed to close above the daily moving average 13. The failure to close beyond the MA 13 could increase that level’s importance as resistance going forward.

Although the overall daily market trend is currently in a near-term downtrend, this might just be a correction, as both the medium and long-term trends are still bullish. Buying could accelerate should prices move above the close-by swing high at 24.50 level where further buy stops might get triggered.

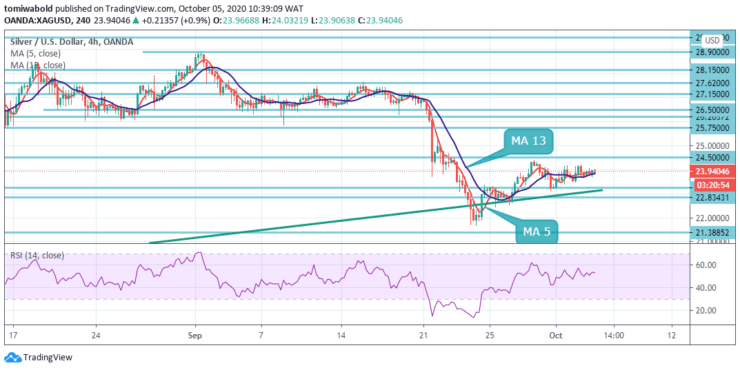

XAGUSD Short term Trend: Ranging

XAGUSD Short term Trend: Ranging

The momentum indicators are painting an optimistic short-term picture as well. The RSI has extended its rally into the positive area, while the moving average 5 and 13 are forcefully stretching towards the continuation of the rebound.

Should the $23.50 level give way, the bears may need to remove the $22.83 support level to pick up steam towards the $21.38 key area. In brief, silver may remain under consolidation control in the short-term if it fails to break past the $24.50 level, with the sell-off expected to gain fresh momentum beneath the $23.50-21.83 region.

Source: https://learn2.trade

Hot Features

Hot Features