The USD/JPY became clearly bearish last week, with further bearish movement on Friday. This has resulted in a Bearish Confirmation Pattern in the market, and the demand level at 111.50 could be tested. However, there would be a rally before the end of this week, which may threaten the bearish bias.

EUR/USD: This pair went upwards last week, gaining 200 pips and testing the resistance line at 1.1850. Price has retraced a bit, but it could go upwards again to test that resistance line (possibly breaching it to the upside). There are support lines at 1.1700 and 1.1650, which would try to impede any bearish attempts along the way.

USD/CHF: This currency trading instrument dropped this week. It tried to go upwards on Thursday, but it came down again on Friday, thus emphasizing the bearish bias on the market. This week, further bearish movements may enable price to reach the support levels at 0.9850 and 0.9800.

GBP/USD: The Cable is essentially neutral and that has been going on for about 4 weeks. For the neutrality to end, price would need to go above the distribution territory at 1.3300; or go below the accumulation territory at 1.3050. As long as price hovers between the two aforementioned boundaries, the bias on the market would remain neutral.

USD/JPY: The USD/JPY became clearly bearish last week, with further bearish movement on Friday. This has resulted in a Bearish Confirmation Pattern in the market, and the demand level at 111.50 could be tested. However, there would be a rally before the end of this week, which may threaten the bearish bias.

EUR/JPY: This cross went upwards last week, moving briefly above the supply zone at 133.50. Had price been able to stay above the supply zone, things would have remained bullish. But price moved downwards by 160 pips from the high of last week (133.87), and closed at 132.15. Further bearish movement is possible before price makes a U-turn this week.

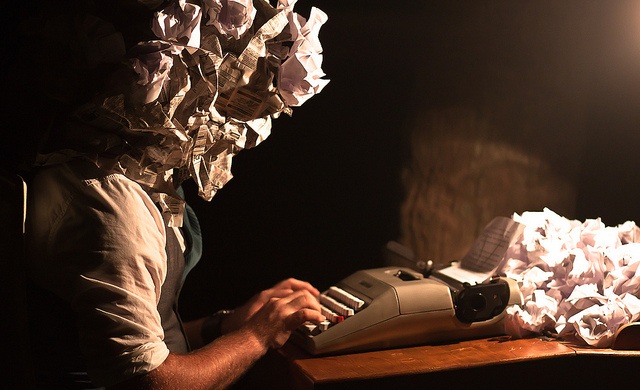

Traders’ Mindset: http://www.advfnbooks.com/books/insights/index.html