Smart investors are looking past the stock market and spreading their investments to manage risk. Keep reading to discover how private equity and venture capital fill the void.

In today’s fast-moving financial world, investors are no longer satisfied with just buying shares and hoping for the best. Market volatility, fast corrections, and unpredictable global events have pushed many people to look beyond the traditional stock market. That’s where private equity and venture capital funds come in.

These investment routes offer something different. This includes access to private companies, high-growth startups, and long-term strategies that aren’t tied to daily market swings. Just like savvy players look for the best deals from casinos to maximise their chances, they carefully evaluate each option before playing. Smart investors, following this approach, seek out alternative investment funds that offer more potential value than the middle market and with less financial risk.

For investors who want more control and potentially higher rewards, private equity firms and venture capital have become alternative investments. According to Bain, global private equity investments are expected to increase by 37% in 2025. In this article, we will explore how PE fund managers and VC firms are helping investors to balance their portfolios.

Why Investors Are Looking for Alternative Assets Instead of Stocks

The stock market has been a bit of a rollercoaster lately. From global conflicts to shifting tech valuations, it has become increasingly difficult to predict what comes next. One week, the S&P 500 rises, and the next, it tumbles due to concerns about inflation or policy changes.

However, PE/VC focuses on long-term value creation and growth equity rather than short-term speculation. As such, it has become common among private investors and hedge funds to commit their alternative investment funds to VC firms and their asset managers.

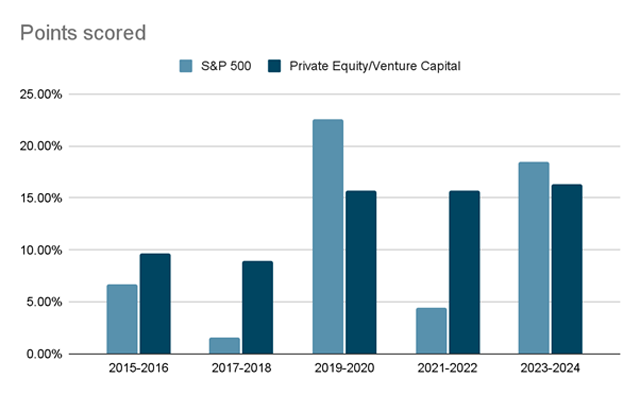

Even many institutional investors and accredited investors are increasing their allocations to private markets and mature companies after conducting due diligence on investment performance. The chart below reveals the average returns on investment capital of stock indices vs PE and VC over the past 10 years:

What Is Private Equity Investment

Private equity is basically about investing in companies that aren’t publicly traded on the stock market. Private equity investors invest their money in private companies or acquire public companies, and then sell them at a profit.

Types of Private Equity Funds

Private equity isn’t just one type of investment. There are different types depending on the investment strategy and stage of business. The table below reveals the types of funds for private equity:

| Type of Private Equity Funds | What It Focuses On |

| Buyout Funds | These are funds that purchase established companies and enhance their operations to sell them for a profit later. |

| Growth Equity Funds | These funds invest in fast-growing, revenue-generating companies that need extra capital to expand into new markets. |

| Distressed Asset Funds | These private equity funds step in when companies are struggling and buy them at a discount to turn them around. |

| Secondary Funds | These are funds that buy existing stakes in other PE funds from investors who want their money back before the fund matures. |

How It Works:

A PE firm raises money from investors, known as limited partners, to invest in private companies or buyout companies with private debt in the public market. These investors can be pension funds, portfolio companies, investment banks, and private credit from wealthy individuals. Here is how it works:

- Fundraising: The private equity firms collect money commitments from investors.

- Investment Period: After raising the needed capital, the fund follows a fund structure and invests the money into carefully chosen private markets.

- Management and Value Building: The private equity firm actively helps these companies improve in efficiency, operations, or even enter new markets.

- Exit: Then, after several years, the firm sells its stake. Most times, they sell through an IPO, merger, or secondary sale and return the profits to investors.

Generally speaking, private equity firms are just like hedge funds, but with long-term value creation. And with big names like Blackstone and Carlyle, the private equity industry reached a record high of $10.8 trillion at the end of 2024, with some sources predicting continued growth to over $17 trillion by 2030.

What Is Venture Capital

While private equity often invests in mature companies, venture capital focuses on transforming early-stage startups into growth-stage companies. VC firms raise money through limited partnerships and invest it in new businesses with potential.

Types of Venture Capital Funds

When it comes to private capital markets, such as venture capital, the operation of the fund depends on what the venture capital firm specialises in. Below are the types of VC funds:

| Type of VC Fund | What It Focuses On |

| Early-Stage | These are funds that invest in brand-new startups without revenue. |

| Growth-Stage Funds | These funds invest in companies that already have traction and need direct or indirect investment to scale up quickly. |

| Corporate VC | These are venture capitalist parts of big companies like Google that invest in startups that align with their industry. |

| Sector-Focused Funds | These funds specialise in niches with different financial engineering – for example, AI-only funds and biotech funds. |

How It Works:

A venture capital firm like Sequoia Capital raises money from investors, including general partners, investment banks, and others. Then they invest in companies with vision. Below is the process it follows:

- Fundraising: Raise capital from partners and investors.

- Investment Period: Seed funding and running the series A to D rounds of growing the company to a global scale.

- Support and Exit: The firm mentors these companies till it eventually exits via IPO or acquisition.

The good news is, there are big success stories like Airbnb, Stripe, and investors with diversified portfolios that grew with the help of venture capital firms. Moreover, as of mid-2025, the total value of the global VC investment market is estimated at approximately $364.19 billion.

Advantages of Private Capital Markets, Like Private Equity and Venture Capital

Private market asset classes like PE/VC have taken over the public markets and other alternative asset classes. Many investors now allocate a portion of their investments to private equity to manage risk. Below are the advantages of PE/ VC:

- Higher potential returns than public markets.

- Longer investment horizons.

- Access to innovation and private market growth.

- Portfolio diversification beyond traditional equities and bonds.

- PE/VC firms often influence company strategy and governance.

- Protection from market volatility.

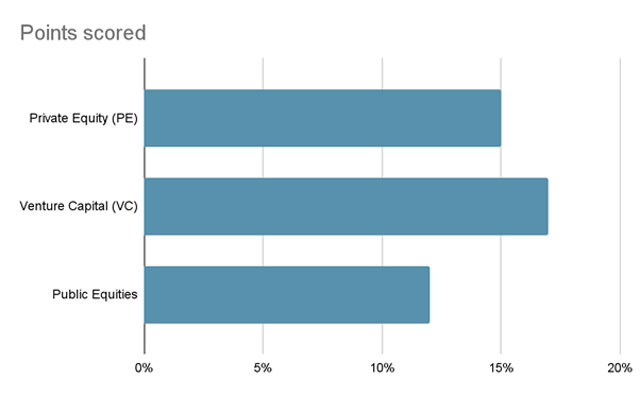

Comparison Chart of the Average Annual Return of Private Equity vs Venture Capital vs Public Market

Risk and Limitations

Everything good in business has its risks. As such, investing in asset class private equity and venture capital also has its downsides. Below are the key considerations and high investment minimums to know:

- Long lock-up periods that can span 7 to 12 years.

- High entry thresholds.

- Valuation transparency issues.

- Operational and execution risk — not all funds outperform.

- Economic downturns can delay exits or reduce multiples.

- More than 75% of startups fail to return capital to VC investors.

The Changing Landscape of VC and PE Firms

Until recently, PE/VC were only reserved for large institutions and the ultra-wealthy. Small investors didn’t stand a chance. However, it’s different today. There are new trends like tokenisation and digital funds. The reality now is no longer just about accessibility. It is more about private equity vs venture capital, and the one that offers above-average returns.

Moreover, secondary markets for PE/VC shares are getting popular. No wonder the Securities and Exchange Commissions and other top regulatory bodies are evolving in major regions like the EU and the US to enact the Exchange Act. Nowadays, you can even access PE/VC through platforms or feeder funds. No wonder retail investors now represent 10-15% inflows into private markets.

Conclusion

Private equity and venture capital are changing the way people think about investing. As public markets remain unpredictable, Private Equity and Venture Capital may define the next decade of global wealth creation.

Note that PE/VC are not substitutes, but complements to the stock markets. At the end of the day, it’s about making smarter choices, spreading your risk, and putting your money in places that align with the future — not just the fluctuations of the moment.