B2TRADER, the renowned multi-asset, multi-market trading platform, has just been upgraded to B2TRADER 2.2, introducing new features and functionalities that improve trading efficiency and provide more control.

The upgrade’s pivotal element is the C-Book order routing, which improves pricing flexibility. Additionally, admins can now configure multiple liquidity providers for a single asset type. The update also improved the risk management tools and iOS/Android mobile app, ensuring a smoother and better user experience. Let’s explore these features in more detail.

C-Book Routing: Better & More Flexible Order Execution

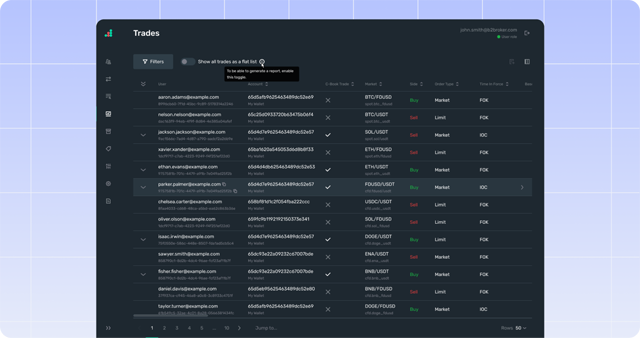

The B2TRADER 2.2 features C-Book, a new protocol that complements the existing A-Book and B-Book models. The C-Book provides CFD and crypto brokers with better control over order processing and improves risk management capabilities.

From now on, brokers can specify how much of each order is processed using external liquidity providers and how much is managed internally using B-Book. Additionally, the admin interface provides more in-depth reports on all orders, whether executed internally or externally.

The C-Book gives brokers better risk management tools, improves financial performance, and reduces the costs of using liquidity providers.

“At B2BROKER, we aim to stay ahead of the curve and empower brokers with innovative solutions that align with the rapidly evolving market needs. With B2TRADER 2.2, we remain committed to enabling our clients to thrive in a competitive environment while reflecting where the market is headed—towards greater customisation, advanced risk management, and unparalleled accessibility.

We are proud to continue driving innovation that helps our clients succeed in an increasingly complex trading environment.”

Mark Speare, Chief Client Officer at B2BROKER

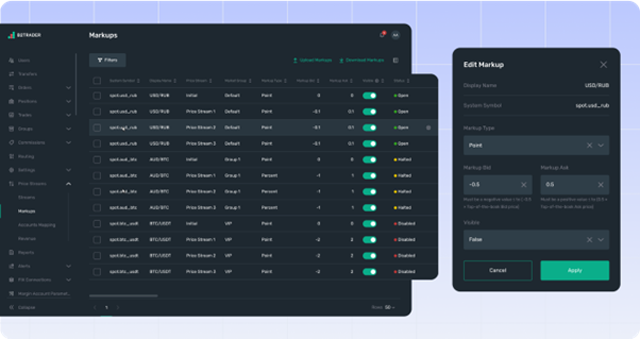

Enhanced Pricing Flexibility with Customisable Markups

The B2TRADER 2.2 expanded its functionality with customisable markups, allowing brokers to set their own commissions, markups, or both, catering to different pricing plans. This allows for more personalised pricing strategies to meet diverse client needs and business models.

Additionally, flexible price streams allow brokers to manage market access for selected traders or groups, providing greater control over the configuration of market proposals.

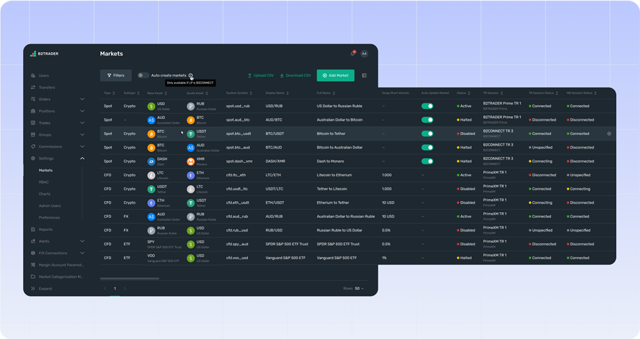

Multiple Liquidity Providers for Better Risk Management

Brokerages can now choose from a selection of liquidity providers for price quotes and order placement. Accessing multiple providers ensures more competitive pricing, better market depth, and faster execution.

Moreover, this feature highlights risk diversification. As such, if issues occur with one provider, connections with other liquidity sources remain stable, guaranteeing consistent trading operations across the board.

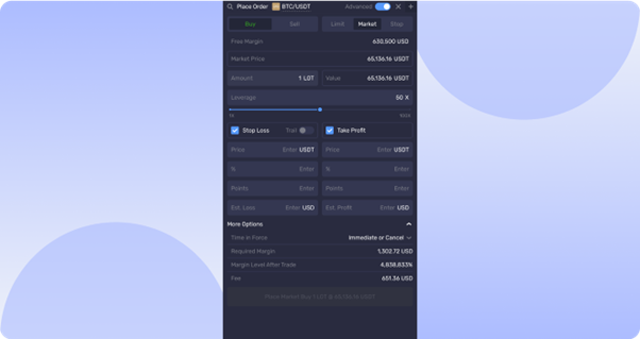

More Trading Options: Take Profit, Stop Loss, and Trailing Stops

With the newest B2TRADER version, the platform supports popular condition order types, such as Take-Profit, Stop-Loss, and Trailing Stops. These orders let traders set their exit strategies, choose profit and loss limits, and handle risks more accurately, even without closely watching the markets. More importantly, they are easy to use for traders of any skill level and work well with multiple trading strategies.

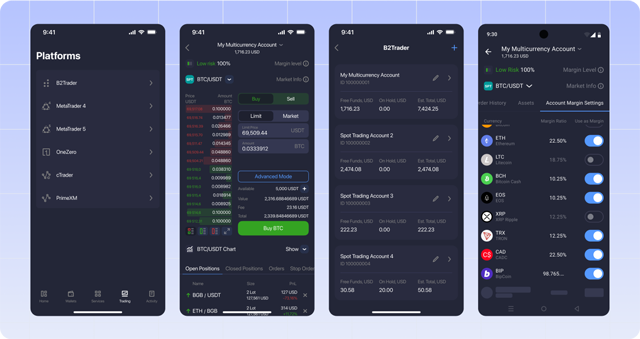

Thoughtful Mobile App Design

More significant improvements involved mobile app accessibility, allowing traders to manage their accounts, monitor positions, and execute traders easily from iOS and Android devices. This flexibility ensures users never miss an opportunity, no matter where they are. This update involves the following:

Intuitive UI

Designed to replicate the desktop version’s experience, the mobile app has all essential functionalities and boosts user satisfaction.

Flexible Trading Anytime, Anywhere

Within the mobile app, traders can control their portfolios from any location and check their orders at any time, with all the capabilities they enjoy on the desktop version.

The Ultimate Mobile Solution

The B2TRADER mobile app supports various trading activities, allowing traders to perform complex operations, control stop settings, view live markets, and track performance effortlessly from their mobile devices.

Explore B2TRADER 2.2 Trading Platform

In the B2TRADER 2.2 release, the platform introduced C-Book order routing, enhanced pricing flexibility, expanded access to diverse liquidity providers, upgraded risk management tools, and improved user experience on iOS and Android mobile apps.

With a commitment to providing the best technology solutions, B2BROKER keeps upgrading the ultimate multi-asset and multi-market trading platform. The plans are to introduce perpetual futures trading soon, complementing existing offerings in CRYPTO SPOT, Forex, and CFDs.

Get B2TRADER and lead the market.

Hot Features

Hot Features