The charts in Forex trading are key to understanding the market. They show you where low prices or high trades might be expected, which can give you an edge when trying your luck with some fast-paced moves in this game known as currency exchange rates.

Many beginners think it’s too difficult to read charts and just give up on the idea. But don’t worry. Forex chart reading isn’t as hard or complicated as it seems.

If you wish, you can use the services of brokers to read charts. In this case, the main thing is a choice of a trusted and competent broker. Check out VT Markets review as an example of a reliable broker.

Anyways, we will try to introduce you to ways to read it like a professional trader. But first, let’s understand what a chart is.

What is a Forex chart?

The Forex chart is a trader’s best friend. With it, you can monitor any price fluctuations and view historical exchange rates that may help in making trades on the fly with just seconds to spare. Forex charts are especially common for day trading strategies when the trading period does not exceed a minute.

The Price and Time Axis

Forex charts are built on two coordinates: price and time. As a rule, the vertical axis is for the price and the horizontal one is for time. Based on these two axises the different types of Forex charts are made.

The 3 types of Forex charts

Usually, traders come across 3 types of Forex charts:

Line charts are one of the most basic and important types in trading. They show you how prices have changed over time for an asset or pair, which can be handy when looking to short-sell a currency that has gone down too much against your expectations.

Bar charts are perfect for those who want more information than just an opening and closing price. They show both highs and lows, as well the overall range of trading over time in one chart format that’s easy to understand.

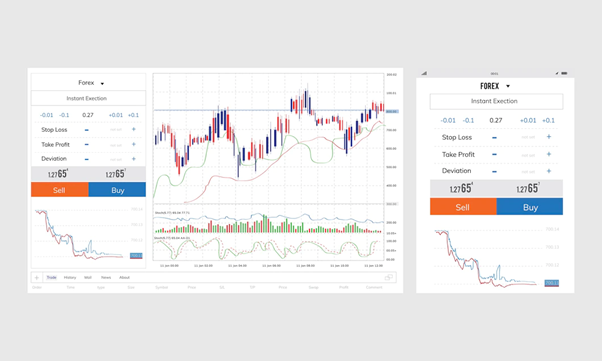

Candlestick charts are being used by traders worldwide. According to Forex traders, candlesticks are the most popular types of charts. They provide information about the market’s maximum and minimum prices, as well as the range between prices opening and closing. This type of chart also enables traders to be aware of major events in the market.

How to read a line chart

The appearance of line charts is made by connecting points with a straight line. So the whole information is displayed with the points and lines.

Reading this type of chart is the simplest. The chart is drawn from one closing price to another. They show you how prices fluctuated over time, with an individual line representing each day’s closing price for that currency pairing.

How to read a bar chart

The main thing you should know is that at the bottom of the vertical bar, the lowest trading price for a certain period is formed, and at the top – is the highest.

And on the horizontal line on the left and right sides, the opening and closing prices are displayed.

How to read candlesticks

On this chart, you’ll find the same sets of data as on the previous Forex charts: the vertical axis shows prices while time moves along horizontally. If a currency pair closes at less than it opens then that block will be colored red (for example); if they close out more expensively – green.

Conclusion

Reading charts is an essential part of Forex trading. If a beginner does not take the time to understand how different types of charts are read, he is unlikely to ever succeed in doing things.

The article discussed the main types of forex charts, as well as how to read each of them. Having understood this, you will take one step in the Forex trading industry and make profitable deals.

Combining the knowledge of reading charts and choosing a reliable day trading broker will make the trading process easier than ever. Check the Islamic account forex brokers in case of trading in Islamic countries.