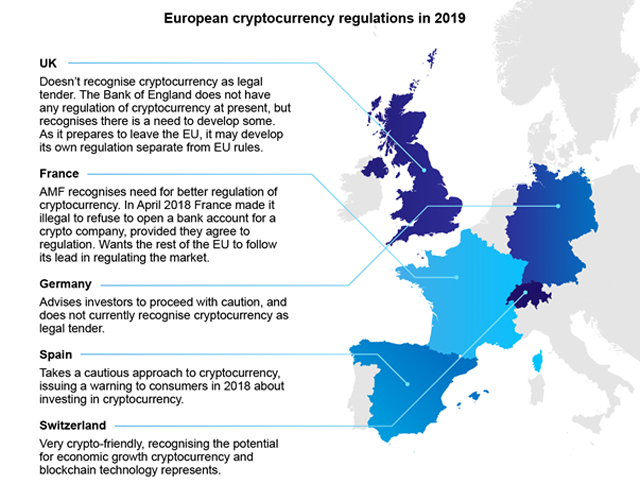

As the market for cryptocurrencies and blockchain technology grows, many European countries are starting to take more notice of the opportunities and threats it represents. With huge technology giants like Facebook looking to launch its own cryptocurrency, the Libra Coin, cryptocurrency looks to be moving from niche to mainstream, bringing it into sharp focus for governments and regulators. Some forward-thinking countries such as Switzerland are keen to harness the new developments in fintech that cryptocurrencies and blockchain bring, while others such as Spain and Germany raise grave concerns around whether cryptocurrency investments can be used to facilitate criminal activity.

Whichever camp you are in, it seems cryptocurrency is here to stay, and it is interesting to see how countries differ in their approaches to it, particularly as Brexit looms large. One question that remains to be answered is what approach will the UK take regarding cryptocurrency once it breaks away from the EU? Will it mirror the EU’s collective stance once this is agreed, or will the UK develop its own independent strategy for regulation of cryptocurrencies and blockchain use? At present the UK has no cryptocurrency regulation in place, although the Bank of England recognises the need to develop some as the market expands.

Once upon a time, around a decade ago, Bitcoin dominated the cryptocurrency market, but with so many other cryptocurrencies such as Ripple, Neo and Litecoin also attracting investment, it is by no means monopolising the market today. There are literally thousands of cryptocurrencies now, and more being developed all the time. Bitcoin’s value in 2019 saw some significant fluctuations, meaning investors have had a rocky ride, but this is to be expected as the value of cryptocurrency is notoriously volatile.

The market for 2020 will see Bitcoin halving in May, although some experts are predicting this won’t have a big impact on price. In terms of developments for cryptocurrency use, 2020 is likely to see adoption of it as a means of payment broadening now that big brands such as Wholefoods and Starbucks have started accepting them. Facebook will also aim to launch its own Libra Coin cryptocurrency as a means of transacting globally, described as a cross between PayPal and Bitcoin. It is currently facing some teething issues though, as regulators voice concerns over the credibility of Facebook as a financial services provider on a potentially global scale, with all the responsibility that brings.

Attitudes to regulation of cryptocurrency vary enormously by country. In France, the AMF has acknowledged a need for greater regulation of the market and is launching its new voluntary code of practice framework. It will address capital requirements, consumer protection and tax mandates. In April, France made it illegal to refuse to open a bank account for cryptocurrency and blockchain companies, provided they agree to sign up to the new regulation. France is now pushing for the rest of the EU member states to adopt its model. With the UK set to leave the EU imminently, it is unclear as to whether it will also adopt the same approach.

Currently, the UK doesn’t class cryptocurrency as legal tender. It does however have a registration process for the platforms that trade crypto. There are no laws around cryptocurrency at present, and Mark Carney, the Governor of the Bank of England, has stated that any launch of cryptocurrency on a wide scale, such as Facebook’s Libracoin, will be subject to intense scrutiny from the IM, the Bank of International Settlements, and the Financial Stability Board.

Spain takes a cautious approach to cryptocurrency, yet at the same time recognises blockchain’s potential for technological advancements. In 2018, Spain issued a warning to consumers about investing in cryptocurrency.

Germany also advises investors to proceed with caution, as Finance Minister Olaf Scholz expressed his concerns about private companies such as Facebook owning currency. Germany doesn’t recognise cryptocurrency as legal tender, and its regulators, BaFin, has warned the public about cryptocurrency marketing.

Some non-EU countries such as Switzerland take a radically different standpoint, raising the question; when the UK breaks away from the EU, will it follow suit? Switzerland is very crypto-friendly compared to its EU neighbours, and is one of a handful of countries to have already established regulation of the market, making it a market leader in cryptocurrency and blockchain technology. Clearly the Swiss government has recognised the economic growth potential that cryptocurrency presents.

With the House of Commons voting down Boris Johnson’s Brexit deal, the Institute for Government think tank is predicting a no-deal Brexit as the most likely scenario now. This means investors are possibly seeking safe-havens to protect their assets from the current uncertainty regarding trade which is playing havoc with stocks and shares. Commodities such as gold and other precious metals have traditionally proven to do well in such circumstances, but could Bitcoin, dubbed ‘digital gold’ also prove to hold its value and ride out the Brexit storm? Some experts predict there may be a slight increase in demand for Bitcoin and other cryptocurrencies following Brexit, as the anticipated dip in value of the pound takes hold.

Some online trading platforms, such as eToro, could provide investors with an opportunity to continue to trade in cryptocurrencies as well as other investment types. This means investors are able to spread their risk across several investments as a means of shoring themselves up against the continuing uncertainty. eToro is one of the leading social trading networks which offer millions of users the possibility to trade cryptocurrencies through innovative trading and investments tools.

With the UK general election taking place, it may be some time before the outlook on Brexit is clear, but the freedom to create its own rules and regulations around cryptocurrency, free from EU constraints, could be an opportunity for the UK to embrace the economic growth potential that cryptocurrency and blockchain technology represents.

Hot Features

Hot Features