Companies finance themselves using a mix of bonds & equity. Popular belief is that most of the financial world lives within the stock market, yet the global debt market — standing at $169trn (McKinsey & Company, 2017), is almost double the size of the stock market.

WiseAlpha has opened the corporate bond market to you, the retail investor, for the first time. With many of our users having prior experience of stocks but being new to the bond market, this post will outline the differences between investing in a company’s stocks & its bonds.

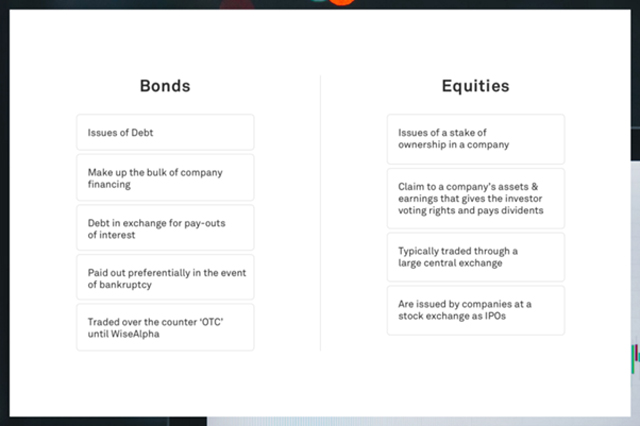

Equities & Bonds, a quick recap:

Stocks & shares (equities) are ownership shares of a business, while corporate bonds are a form of debt. A company’s shareholders are its owners while a company’s bondholders are people it has borrowed money from.

Are bonds also subject to price changes?

Both bonds and equities are subject to market risk — the risk that the security may rise or fall in price based on supply and demand.

However, bondholders are insulated from market risk. Imagine that you buy a bond trading at 100 pence on the pound. If the price of that bond falls to 95 pence on the pound, you can protect yourself from this paper loss by holding the investment until maturity, where you are entitled to 100 pence on the pound back. As bondholders are aware of this the price of bonds ‘pulls to par’ — approaches 100 as a bond approaches maturity, this gives bondholders reassurance over market price fluctuations.

Of course, this is subject to the risk of a company defaulting. Although this is uncommon for large corporate borrowers, a useful gauge of a company’s risk of default is its credit rating, presented as a grade score (Aaa-C). You can read more about credit ratings here.

The effect of company performance

One of the main reasons why the price of a stock goes up or down are expectations about the profitability, or lack thereof, of the company whose stock you own. If the company is expected to perform well, then its share price generally appreciates. On the other hand, if the company is expected to perform poorly, it’s stock price also performs poorly.

Performance matters less to bondholders. Bondholders receive an interest payment at specified intervals, regardless of how the company is doing (as long as the company does not go bankrupt). The downside here, of course, is that if the company has a great year from a profits standpoint, you will not earn any additional interest either.

Concisely, equity investors care about both upside and downside performance, while bondholders only have to worry about downside performance (in the extreme) as they have the assurance of a stated return.

Seniority

When a company fails, it’s assets are liquidated and are used to pay off bond(debt)holders and it’s shareholders. Bondholders are paid out before shareholders. Stockholders being last in the line makes stocks riskier:

Within bonds, there are rankings determining in which order bondholders will be paid out in the event of bankruptcy. Senior bonds are paid out before subordinated bonds. Also, some bonds are ‘secured’ — they are backed by assets which are used to pay back the bond if the company fails. Senior secured bonds combine these assurances, protecting investors against large losses in worst case scenarios. Subordinated, hybrid and perpetual bonds are only senior to shareholders — who are the first to lose out in the event of bankruptcy.

Risks unique to bonds

Due to bondholders being entitled to their principal at maturity, the greater degree of certainty in interest payments over dividend payments and assurances against bankruptcy, corporate bonds are less risky than equities. However, the ‘wonderful world of corporate bonds’ is rather more colourful.

The three unique risk factors to corporate bonds are:

- Duration risk — the longer the maturity of a bond the greater the price volatility from changes in central bank rates.

- Credit quality, this is the concern over a company’s ability to service its debt (going bankrupt). If a company uses high leverage (i.e a large portion of debt versus the value of the company) it may become risky to lend to. Bondholders benefit less from extreme upsides than equity holders, so a company taking on high levels of debt and hence risk is typically less attractive to bondholders.

- Liquidity risk,bonds are in general less liquid than equities and so for people looking to exit quickly, this can present an additional risk.

Where can I invest?

How to buy an equity:

Equities typically trade on large, well known central stock exchanges. Notable names include the NYSE (New York Stock Exchange), the NASDAQ, the LSE (London Stock Exchange) and the JPX (Japan Exchange). Stock exchanges are open to retail investors.

How to buy a corporate bond:

The bond market is much more opaque. Deals are typically done directly ‘OTC’ — over the counter, between the dealer and the investor. Deals begin in denominations of £100,000, so most investors cannot gain access to this elusive asset class. As such, WiseAlpha was set up to broaden access.

So, should I invest in Bonds or Equities?

The answer is typically a combination of both. How you decide to allocate your portfolio depends on your appetite for risk. As you become older you should move towards less risky investments such as bonds. Investors are told ‘OYAIB’ (Own Your Age In Bonds), but this is just a rule of thumb. That said, the bond market is incredibly diverse and we are just beginning to explore the range of opportunities available to retail investors. For example, investors with higher risk appetites also have access to the High Yield Market, (Junk bond) where returns (and risks) are much higher.

However you decide to allocate your capital it’s important to understand the decisions you are making. As such, we hope this article has given some light on the differences between investing in a company’s bonds and in its equity.

Please remember that bonds are investments not savings or deposit protected products and your capital and interest is at risk.

Find out more about investing in Corporate Bonds with WiseAlpha.