We could not find any results for:

Make sure your spelling is correct or try broadening your search.

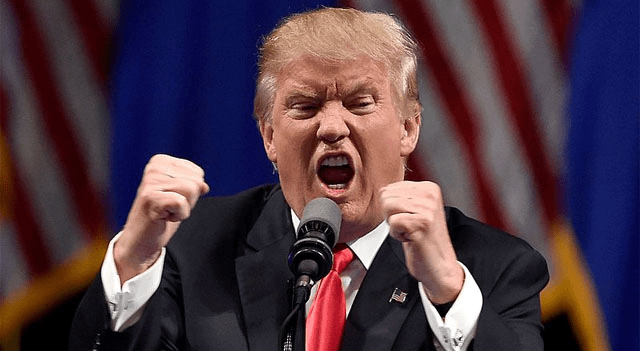

This Wednesday, July 9, was supposed to end the 90-day grace period Donald Trump had set for countries to reach trade agreements with the U.S., or face steep tariffs. As such, markets tightened again, especially after Trump announced 25% tariffs on Japan and South Korea, which will take effect on August 1. To top it off, he also sent a new wave of warning letters to Malaysia, Kazakhstan, Laos, and Myanmar, among others.

Subsequently, the major U.S. indices fell, including the S&P 500 and the Nasdaq. However, the situation had improved slightly by the end of the session. In a now familiar move, Trump backtracked on his tariff threats, signing an executive order postponing “reciprocal” tariffs until August 1, as opposed to the July 9 initially set. Thus, the markets breathed a sigh of relief, but the issue remains on the table, and it is big.

So far, trade agreements have only been reached with the United Kingdom, Vietnam, and China. The European Union also appears close to reaching a trade agreement with the United States. There is also progress in talks with India, and, finally, negotiations with Canada and Mexico are ongoing. In short, progress is being made slowly, and it is not yet clear how substantial the final agreements will be.

Beyond the uncertainty, the risk of this whole trade war saga is that it prevents the Fed from resuming the easing cycle. In a speech last week, Jerome Powell reemphasized that the Fed is in no rush to cut rates, in large part because of the current trade-related uncertainty. If Trump were to replace Powell with someone more accommodative, it could undermine confidence in the Fed’s independence, which would only worsen matters.

And what if no major deals are made?

That would be the worst-case scenario. A collapse in negotiations could trigger capital flight from U.S. assets, impacting not just the dollar and Treasuries, but also equities. Global investors could rotate into safer or alternative assets like the euro (EURUSD), yuan (USDJPY), or gold (XAUUSD). The U.S. stock market would not be immune and could take a significant hit. Still, the White House will likely do everything possible to avoid this cliff-edge scenario.

This article was written by the editorial team at InvestorsHub/ADVFN and is provided for informational purposes only. In some cases, editorial staff may use artificial intelligence–based tools to assist in the research, drafting, or editing of content, under human review and oversight. This article does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. The views expressed are based on publicly available information believed to be reliable at the time of publication, but accuracy or completeness is not guaranteed. Readers should conduct their own independent research and consult a qualified financial professional before making any investment decisions.

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions