We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Metalla Royalty and Streaming Ltd | TSXV:MTA | TSX Venture | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.02 | 0.54% | 3.70 | 3.60 | 4.10 | 3.79 | 3.63 | 3.63 | 23,936 | 21:21:24 |

(All dollar amounts are in Canadian dollars unless otherwise indicated)

TSXV: MTA

OTCQB: MTAFF

VANCOUVER, Oct. 24, 2019 /CNW/ - Metalla Royalty & Streaming Ltd. ("Metalla" or the "Company") (TSXV: MTA) (OTCQB: MTAFF) announces its operating and financial results for the first quarter ended August 31, 2019. For complete details of the consolidated financial statements and accompanying management's discussion and analysis for the quarter ended August 31, 2019, please see the Company's filings on SEDAR (www.sedar.com) or on EDGAR (www.sec.gov). Shareholders are encouraged to visit the Company's website at http://www.metallaroyalty.com/.

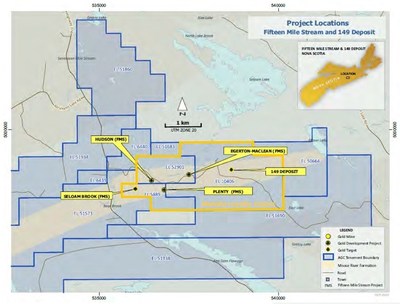

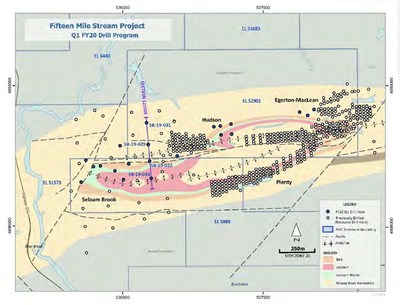

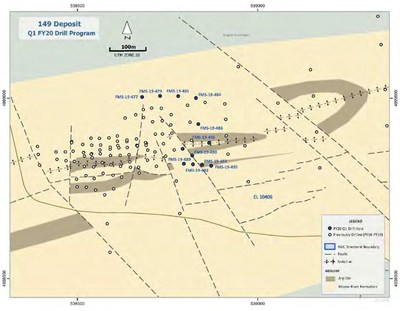

"In fiscal Q1, we added a key royalty on Fifteen Mile Stream ("FMS") that expands our coverage over the entire project with additional ground along strike to the southwest of the resource base," commented Brett Heath, President and Chief Executive Officer of Metalla. "Additionally, we already see very positive drill results with the discovery at Seloam Brook, which is on the newly acquired royalty claims. Further, confirmatory drill results at the 149 zone and between Hudson and Egerton continues to show the potential of significant resource growth at FMS over the next year."

"Production at Endeavor was in line with the revised schedule from CBH Resources for the quarter, but concentrate shipments were pushed into Q2 due to a planned bulk shipment in October which resulted in Q1 revenue from the mine to be realized in Q2. Exploration success at Agnico Eagle's Santa Gertrudis and El Realito deposits continue to expand the resource base with further drilling and expected updated resource estimate in February 2020."

FINANCIAL HIGHLIGHTS

During the three months ended August 31, 2019, the Company:

UPDATES ON ROYALTIES AND STREAMS

Fifteen Mile Stream 1.0% and 3.0% NSRs

St. Barbara disclosed by news release on October 21, 2019 that it continued drilling at FMS, which was focused on expanding the resource base to the east and west. Mineralization was extended west of the resource base within the Seloam Brook prospect. Significant intercepts from five holes included 6 m at 2.22 g/t gold and 4m at 9.73 g/t gold, assays are pending for the remaining eight holes.

Drilling at the 149 deposit to the east of the resource base is ongoing, with a plan of twelve diamond drill holes focused on resource expansion. To date, assays are pending for drill holes on the 149 deposit, but core logging has visually indicated that the target zones have been intercepted. At the main resource base, eight exploration holes focused on the resource expansion between the planned Hudson and Egerton-Maclean open pits. Assays are pending however; initial visual inspection and core logging supports the potential extension of gold mineralization approximately 100m northwest of the Egerton-Maclean pit and 200m east of the Hudson pit.

For more information please see St Barbara Limited press release dated October 21, 2019 and Q1 Report.

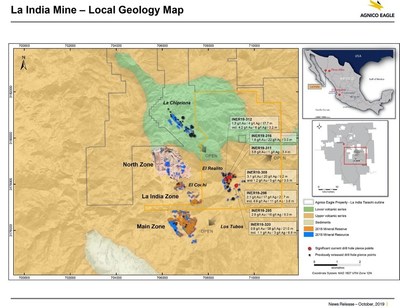

El Realito 2.0% NSR

On October 23, 2019, Agnico Eagle Mines Limited ("Agnico Eagle") reported by news release they continued to have exploration success at El Realito which is part of operating La India mine. Drilling within the main corridor confirmed that the mineralized structures are steeply dipping to the northwest, suggesting the possibility of a lower strip ratio with increased resources within the current pit design. Drilling within the main corridor indicated the possibility of increasing mineral reserves below the current pit plan with intercepts of 1.3 g/t gold and 4 g/t silver over 17.7 m and 3.1 g/t gold and 20 g/t silver over 9.2 m.

To the southeast at the El Realito east corridor, the structural continuity of the mineralization has been extended with significant intercepts of 2.1 g/t gold and 17 g/t silver over 22.7 m and 2.8 g/t gold and 16 g/t silver over 8 m.

Agnico Eagle is currently undergoing an exploration program to further test the extension of the mineralized system in order to expand the mineral resources, which they expect will increase in the annual updated resource estimate scheduled for February 2020. Located 1.5km east of the operating North and La India zones, El Realito continues to have the potential to extend the current mine life at La India.

For more information please see Agnico Eagle press release date October 23, 2019.

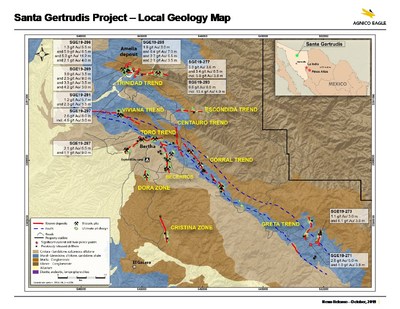

Santa Gertrudis 2.0% NSR

On October 23, 2019, Agnico Eagle reported by news release continued exploration success at its Santa Gertrudis project, particularly at Amelia where over 15,000m have been drilled at the end of the third quarter. Drilling at the Amelia discovery continued to extend the deposit to the east. Significant intercepts to the north of Amelia include 3.9 g/t gold over 3.5 m and 5.9 g/t gold over 8.5 m, 70 metres to the northeast. The deepest hole to date at Santa Gertrudis, intercepted 2.1g/t gold over 4 m at 439 m depth and 150 m to the northeast a hole intersected 6.4 g/t gold over 7 m. In the eastern extension of the Amelia deposit, drilling continued to expand the resource envelope with intercepts such as 9.6 g/t gold over 6 m, 5.8 g/t gold over 3.8 m and 2.6 g/t gold over 8 m.

Further south of the Trinidad zone, the Toro zone was extended to the northwest with holes intersecting 2.1 g/t gold over 6.5 m and 1.1 g/t gold over 9 m. Agnico Eagle disclosed by news release that it believes that Santa Gertrudis has the potential to eventually be a similar size operation to La India.

For more information please see Agnico Eagle press release date October 23, 2019.

Endeavor 100% Silver Stream

Production at Endeavor for the quarter of 56,844 oz Ag was in line with the revised schedule from CBH Resources ("CBH"), but concentrate shipments were pushed into Q2 due to a planned bulk shipment in October of an estimated 107,221 oz Ag which resulted in Q1 revenue from the mine to be realized in Q2. CBH announced on July 17, 2019 that it will scale back production from 25,000 to 17,000 tonnes per month and staff for the remainder of calendar year 2019 while focusing on infill drilling of the new Deep Zinc Lode Resource to better appraise its future viability. A production decision on the Deep Zinc Lode is expected by the end of calendar year 2019 with the potential to add 3 to 5 years of production. Metalla will continue to monitor production at the Endeavor mine.

Metalla has the right to buy 100% of the silver production up to 20.0 million ounces (7.2 million ounces have been delivered to date) from the Endeavor Mine for an operating cost contribution of US$1.00 per ounce of payable silver, indexed annually for inflation, and a further increment of 50% of the amount by which silver price exceeds US$7.00 per ounce.

Joaquin 2% and COSE 1.5% NSRs

Pan American Silver Corp. has disclosed they will report its third quarter results on November 6, 2019. Metalla expects a production update on both of its COSE and Joaquin royalties at that time.

QUALIFIED PERSON

The technical information contained in this news release has been reviewed and approved by Charles Beaudry, geologist M.Sc., member of the Association of Professional Geoscientists of Ontario and the Ordre des Géologues du Québec and a consultant to Metalla. Mr. Beaudry is a Qualified Person as defined in "National Instrument 43-101 Standards of disclosure for mineral projects".

ABOUT METALLA

Metalla is a precious metals royalty and streaming company. Metalla provides shareholders with leveraged precious metal exposure through a diversified and growing portfolio of royalties and streams. Our strong foundation of current and future cash-generating asset base, combined with an experienced team gives Metalla a path to become one of the leading gold and silver companies for the next commodities cycle.

For further information, please visit our website at www.metallaroyalty.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accept responsibility for the adequacy or accuracy of this release.

Non-IFRS Financial Measures

Certain marked information are alternative performance measures and readers should refer to non-international financial reporting standards ("IFRS") financial measures in the Company's Management's Discussion and Analysis for the three months ended August 31, 2019 as filed on SEDAR and on EDGAR and as available on the Company's website for further details. Metalla has included certain performance measures in this press release that do not have any standardized meaning prescribed by IFRS including average cash cost per ounce of attributable silver, average realized price per ounce of attributable silver, and cash margin. Average cost per ounce of attributable silver is calculated by dividing the cash cost of sales, plus applicable selling charges, by the attributable ounces sold. In the precious metals mining industry, this is a common performance measure but does not have any standardized meaning. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance and ability to generate cash flow. Cash margin is calculated by subtracting the average cash cost per ounce of attributable silver from the average realized price per ounce of attributable silver. The Company presents cash margin as it believes that certain investors use this information to evaluate the Company's performance in comparison to other companies in the precious metals mining industry who present results on a similar basis. The presentation of these non-IFRS measures is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Other companies may calculate these non-IFRS measures differently.

Technical and Third Party Information

Metalla has limited, if any, access to the properties on which Metalla holds a royalty, stream or other interest. Metalla is dependent on, (i) the operators of the mines or properties and their qualified persons to provide technical or other information to Metalla, or (ii) on publicly available information to prepare disclosure pertaining to properties and operations on the mines or properties on which Metalla holds a royalty, stream or other interest, and generally has limited or no ability to independently verify such information. Although Metalla does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some information publicly reported by operators may relate to a larger property than the area covered by Metalla's royalty, stream or other interest. Metalla's royalty, stream or other interests often cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, resources and production of a property.

The disclosure was prepared in accordance with Canadian National Instrument 43-101 ("NI 43-101"), which differs significantly from the current requirements of the U.S. Securities and Exchange Commission (the "SEC") set out in Industry Guide 7. Accordingly, such disclosure may not be comparable to similar information made public by companies that report in accordance with Industry Guide 7. In particular, this news release may refer to "mineral resources", "measured mineral resources", "indicated mineral resources" or "inferred mineral resources". While these categories of mineralization are recognized and required by Canadian securities laws, they are not recognized by Industry Guide 7 and are not normally permitted to be disclosed in SEC filings by U.S. companies that are subject to Industry Guide 7. U.S. investors are cautioned not to assume that any part of a "mineral resource", "measured mineral resource", "indicated mineral resource", or "inferred mineral resource" will ever be converted into a "reserve." In addition, "reserves" reported by the Company under Canadian standards may not qualify as reserves under Industry Guide 7. Under Industry Guide 7, mineralization may not be classified as a "reserve" unless the mineralization can be economically and legally extracted or produced at the time the "reserve" determination is made. Accordingly, information contained or referenced in this news release containing descriptions of mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of Industry Guide 7.

"Inferred mineral resources" have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Further, while NI 43-101 permits companies to disclose economic projections contained in preliminary economic assessments and pre-feasibility studies, which are not based on "reserves", U.S. companies have not generally been permitted under Industry Guide 7 to disclose economic projections for a mineral property in their SEC filings prior to the establishment of "reserves". Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian reporting standards; however, Industry Guide 7 normally only permits issuers to report mineralization that does not constitute "reserves" by Industry Guide 7 standards as in-place tonnage and grade without reference to unit measures. Historical results or feasibility models presented herein are not guarantees or expectations of future performance.

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and U.S. securities legislation. The forward-looking statements herein are made as of the date of this press release only, and the Company does not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information in this press release includes, but is not limited to, statements with respect to future events or future performance of Metalla, disclosure regarding the precious metal purchase agreements and royalty payments to be paid to Metalla by property owners or operators of mining projects pursuant to net smelter returns and other royalty agreements of Metalla, continued ramp-up at the Endeavor Mine, management's expectations regarding Metalla's growth, results of operations, estimated future revenues, potential expansion of reserves and mineralization carrying value of assets, future dividends, and requirements for additional capital, production estimates, production costs and revenue, future demand for and prices of commodities, expected mining sequences, business prospects, and opportunities. Such forward-looking statements reflect management's current beliefs and are based on information currently available to management.

Forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. The forward-looking statements contained in this press release are based on reasonable assumptions that have been made by management as at the date of such information and is subject to unknown risks, uncertainties and other factors that may cause the actual actions, events or results to be materially different from those expressed or implied by such forward-looking information, including, without limitation: the impact of general business and economic conditions; the ongoing operation of the properties in which the Company holds a royalty, stream, or other production-based interest by the owners or operators of such properties in a manner consistent with past practice; absence of control over mining operations; the accuracy of public statements and disclosures made by the owners or operators of such underlying properties; no material adverse change in the market price of the commodities that underlie the asset portfolio; and other risks and uncertainties disclosed under the heading "Risk Factors" in the Management's Discussion and Analysis and the Annual Information Form of the Company both dated September 26, 2019 and filed with the Canadian securities regulatory authorities on the SEDAR website at www.sedar.com and with the SEC on the EDGAR website at https://www.sec.gov/.

Although Metalla has attempted to identify important factors that could cause actual actions, events or results to differ materially from those contained in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Investors are cautioned that forward-looking statements are not guarantees of future performance. The Company cannot assure investors that actual results will be consistent with these forward-looking statements. Accordingly, investors should not place undue reliance on forward-looking statements or information.

Readers are cautioned that forward-looking statements are not guarantees of future performance. All of the forward-looking statements made in this press release are qualified by these cautionary statements.

SOURCE Metalla Royalty and Streaming Ltd.

Copyright 2019 Canada NewsWire

1 Year Metalla Royalty and Stre... Chart |

1 Month Metalla Royalty and Stre... Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions