We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Metalla Royalty and Streaming Ltd | TSXV:MTA | TSX Venture | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.08 | 2.17% | 3.76 | 3.75 | 3.78 | 3.78 | 3.63 | 3.63 | 9,121 | 16:51:46 |

TSXV: MTA

NYSE American: MTA

Unless otherwise specified, all references to dollars set forth herein shall mean United States dollars.

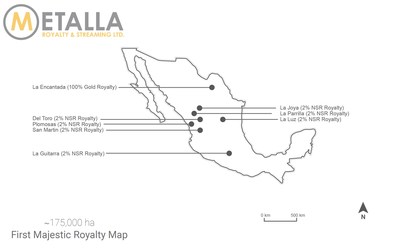

VANCOUVER, BC, Nov. 28, 2022 /CNW/ - Metalla Royalty & Streaming Ltd. ("Metalla" or the "Company") (TSXV: MTA) (NYSE American: MTA) is pleased to announce that on November 26, 2022 it signed a royalty purchase agreement with First Majestic Silver Corp. ("First Majestic") (NYSE: AG) (TSX: FR), pursuant to which Metalla will acquire eight royalties for $20 million of common shares of Metalla (the "Transaction"). First Majestic holds and will originate a portfolio of royalties in Mexico as described below.

Brett Heath, President, and CEO of Metalla, commented, "This transaction marks another important milestone in our continued growth at Metalla. It provides shareholders with eight new royalties that have a significant amount of exposure and leverage to silver. It adds immediate cash flow from one producing royalty, bolsters our near-term development pipeline with four development royalties, and three advanced exploration royalties. It also adds a significant amount of exploration upside with over 175,000 hectares of royalty coverage across the most prolific silver trends in Mexico. We want to thank First Majestic for entrusting the Metalla team with unlocking additional value from their royalty assets and welcome them to our registry."

The aggregate consideration payable by Metalla for the purchase of the royalties will be satisfied by Metalla issuing $20 million of common shares based on the 25-day volume-weighted average price of shares traded on the NYSE American LLC ("NYSE") prior to this announcement at a price of US$4.7984 (representing an aggregate of 4,168,056 common shares of Metalla) to be issued upon closing. The Transaction is subject to customary closing conditions and exchange approvals and is expected to close in Q1 2023.

The portfolio comprises of a total of eight royalties, including one producing gold royalty, four development silver royalties, and three advanced exploration silver royalties. The royalties cover 100% of all the concessions on the eight properties.

PORTFOLIO OVERVIEW

Asset | Operator | State | Stage | Terms |

La Encantada | First Majestic | Coahuila | Production | 100% Au GVR |

Del Toro | First Majestic | Zacatecas | Development | 2% NSR |

La Guitarra | Sierra Madre* | Mexico State | Development | 2% NSR |

Plomosas | GR Silver | Sinaloa | Advanced Exploration | 2% NSR |

San Martin | First Majestic | Jalisco | Development | 2% NSR |

La Parrilla | First Majestic | Durango | Development | 2% NSR |

La Joya | Silver Dollar | Durango | Advanced Exploration | 2% NSR |

La Luz | First Majestic | San Luis Potosi | Advanced Exploration | 2% NSR |

*Assuming completion of sale by First Majestic to Sierra Madre |

The producing La Encantada Silver Mine in Coahuila, Mexico is 100% owned by First Majestic and has become one of the First Majestic's largest producing silver mines with 2021 production of 3.2 Moz of silver and 460 ounces of gold over its 4,076 ha land package. The underground silver mine has been in production under First Majestic's tenure since 2006, and through various improvements, the processing plant was upgraded to 4,000 tons per day ("tpd") and includes a roasting circuit to further enhance recoveries and recover tailings. In the first three quarters of 2022, La Encantada produced 305 ounces of gold. In late 2021, First Majestic announced the successful completion of a land surface agreement on the 4,076 ha property package which opened up a significant amount of near mine exploration opportunities. First Majestic expects to complete 19,000 meters of exploration on the mine in 2022 and expects 2022 production guidance to be in the range of 2.9 – 3.2 Moz silver.

Metalla will be granted a 100% gross value royalty on the gold produced at the La Encantada mine limited to 1,000 ounces annually.

Reserve & Resource Estimate | |||

Tonnes | Ag-Equivalent | ||

(000's) | (g/t) | (Koz) | |

Probable Reserves | 2,260 | 170 | 12,350 |

Proven & Probable Reserves | 2,260 | 170 | 12,350 |

Indicated Resources | 4,308 | 169 | 23,410 |

Indicated Resources (Tailings) | 2,459 | 119 | 9,410 |

Measured & Indicated | 6,767 | 151 | 32,820 |

Inferred Resources | 3,470 | 170 | 18,930 |

Inferred Resources (Tailings) | 428 | 118 | 1,620 |

Del Toro is an underground silver mine and processing facility located in Zacatecas, Mexico, which was operated by First Majestic from 2013 until 2020 when it was placed on temporary suspension subject to further exploration in order to improve overall operating cash flows and profit margins. Exploration at Del Toro has been primarily focused on the investigation of two areas: the San Juan and Perseverancia areas within the project's holdings. Both the San Juan and Perseverancia were historic mines; Perseverancia was mined for high grade silver rich sulphide ore and San Juan is believed to be the oldest mine in the district, possibly dating back 500 years. More recently, the San Nicolas and Dolores areas that consist of breccia chimney and vein deposits have been receiving attention.

In 2018, silver equivalent production totaled 1.4 Moz silver, meanwhile 2017 silver equivalent production totaled 2.2 Moz. The operation is in close vicinity and similar in nature to Pan American Silver Corp.'s (NASDAQ: PAAS) La Colorada mine. The mine infrastructure includes a 2,000 tpd flotation circuit, as well as a 2,000 tpd cyanidation circuit with a 3,815 ha property package.

Reserve & Resource Estimate | |||

Tonnes | Ag-Equivalent | ||

(000's) | (g/t) | (Koz) | |

Indicated Resources | 440 | 414 | 5,850 |

Indicated Resources | 153 | 351 | 1,720 |

Measured & Indicated | 592 | 398 | 7,570 |

Inferred Resources | 496 | 322 | 5,130 |

Inferred Resources (Transitional) | 690 | 273 | 6,050 |

Total Inferred | 1,186 | 293 | 11,180 |

San Martin is an underground silver mine and 1,300 tpd cyanidation processing facility in Jalisco State, Mexico with a 38,512-ha property package. The 1,300 tpd mill and processing plant consists of crushing, grinding and conventional cyanidation by agitation in tanks and a Merrill-Crowe doré production system. At full capacity of 1,300 tpd, San Martin's annual silver production has reached over 2 million ounces of silver in the form of doré bars. In 2018, First Majestic produced 2.2 Moz AgEq from the mine and in 2017, produced 2.3 Moz AgEq. First Majestic operated the mine from 2006 until 2019 when it was place on temporary suspension. First Majestic continues to work with government authorities to secure the mine site for a potential reopening. Drilling has been focused on deeper ore shoots of the Rosario vein for continuation of mineralization. Since the acquisition of the mine, First Majestic completed 195,628 meters in 1,125 diamond drill-holes on the property.

Reserve & Resource Estimate | |||

Tonnes | Ag-Equivalent | ||

(000's) | (g/t) | (Koz) | |

Measured Resources | 70 | 255 | 580 |

Indicated Resources | 958 | 321 | 9,890 |

Measured & Indicated | 1,028 | 317 | 10,470 |

Inferred Resources | 2,533 | 256 | 20,870 |

La Parrilla is an underground mine complex owned by First Majestic consisting of multiple inter-connected mines within a 69,478-ha land package. The property has known mineralization throughout, with a complex of five underground mines surrounding the mill including Los Rosarios, La Rosa, San Jose, Quebradillas and San Marcos. Full production from the mine for 2018 totaled 2.3 Moz AgEq meanwhile 2017 production totaled 2.5 Moz AgEq. The mine was placed on care and maintenance in 2019 to complete exploration and development work. The mine has a 2,000 tpd processing plant and all associated infrastructure. In 2021, First Majestic completed discussions to continue the long-term land use agreement at La Parrilla and expected to complete a 19,000-meter drill program to test near mine, brownfield, and greenfield targets.

Reserve & Resource Estimate | |||

Tonnes | Ag-Equivalent | ||

(000's) | (g/t) | (Koz) | |

Measured Resources | 15 | 250 | 120 |

Indicated Resources (Sulphides) | 1,028 | 277 | 9,160 |

Indicated Resources (Oxides) | 76 | 278 | 680 |

Measured & Indicated | 1,119 | 277 | 9,960 |

Inferred Resources | 393 | 207 | 2,610 |

Inferred Resources (Sulphides) | 1,028 | 299 | 9,890 |

Total Inferred | 1,421 | 274 | 12,500 |

La Joya is a large silver-copper-gold advanced exploration project in Durango, Mexico currently operated by Silver Dollar (CSE: SLV) near Grupo Mexico's (BMV: GMEXICOB) San Martin Mine. In 2013, a Preliminary Economic Assessment on the first stage of the project proposed a low strip, open pit mine with an initial nine-year life of mine plan with a 5,000 tpd conventional mine and flotation plant producing an average of 3.9 Moz AgEq per year with an IRR of 30.5%. Since assuming ownership of the project, Silver Dollar announced the discovery of the Brazo Zone, ~1 km west of the bulk of the historical resource. Significant intercepts from the discovery include 2,369 g/t AgEq over 1.01 meters and 815 g/t AgEq over 5 meters.

Historical Reserve & Resource Estimate | |||

Tonnes | Ag-Equivalent | ||

(000's) | (g/t) | (Koz) | |

Inferred Resources | 71,204 | 70 | 159,750 |

Plomosas is a permitted, advanced exploration stage silver project in Sinaloa, Mexico owned and operated by GR Silver (TSXV: GRSL). After assuming ownership of the project, GR Silver announced an updated resource estimate at the Plomosas mine and began an infill drill program to add new zones into the resource model. GR Silver is targeting an updated resource estimate in Q1 2023. Significant results from the infill drilling program at Plomosas include 518 g/t AgEq over 44.5 meters, 1,146 g/t AgEq over 12.5 meters and 471 g/t AgEq over 24.9 meters.

The Plomosas royalty is subject to a 1% buyback for $1 million.

Reserve & Resource Estimate | |||

Tonnes | Ag-Equivalent | ||

(000's) | (g/t) | (Koz) | |

Indicated Resources (OP) | 300 | 114 | 1,300 |

Indicated Resources | 2,100 | 136 | 9,100 |

Measured & Indicated Resources | 2,400 | 133 | 10,300 |

Inferred Resources (OP) | 1,400 | 103 | 4,800 |

Inferred Resources (Underground) | 4,400 | 116 | 16,200 |

Total Inferred | 5,800 | 113 | 21,000 |

La Guitarra is a fully permitted underground silver mine in Temascaltepec, Mexico, 100% owned by First Majestic and subject to a binding purchase agreement with Sierra Madre (TSXV: SM). The mine was in production in 2018 where production averaged between 1 million to 1.5 million AgEq ounces annually between 2015 and 2018. Sierra Madre has announced a fast-track restart strategy for the mine whereby a district-scale exploration and mine development program will be initiated, thereafter a resource report is planned with mine restart studies and finally, reprocessing the tailings. The potential target for tailings at La Guitarra is 2-2.5 Mt at 0.4-0.6 g/t gold and 35 – 40 g/t silver where initial metallurgical tests show 80% gold recovery and 70% silver recovery.

La Guitarra is subject to a 1% buyback for $2 million.

Historical Reserve & Resource Estimate | |||

Tonnes | Ag-Equivalent | ||

(000's) | (g/t) | (Koz) | |

Measured Resources | 57 | 347 | 640 |

Indicated Resources | 644 | 328 | 6,800 |

Measured & Indicated | 701 | 330 | 7,440 |

Inferred Resources | 1,044 | 299 | 10,030 |

La Luz is a silver advanced exploration project owned by First Majestic in San Luis Potosi, Mexico. The project is located within Real de Catorce, a historically significant mining district with an estimate historical production of 230 Moz of silver between 1773 and 1990.

Historical Resource Estimate (Including Tailings) | |||

Tonnes | Ag-Equivalent | ||

(000's) | (g/t) | (Koz) | |

Inferred Resources | 5,005 | 204 | 32,008 |

Pursuant to the Transaction, First Majestic and Metalla will enter into the Security Holder Rights and Obligations Agreement in respect of the common shares of Metalla being issued to First Majestic, which will include certain transfer restrictions, a customary shareholder lockup and voting rights.

DLA Piper (Canada) LLP acted as legal counsel to Metalla, and Bennett Jones LLP acted as legal counsel to First Majestic for the Transaction.

No finder's fee or other commission is payable by Metalla in connection with the Transaction.

The technical information contained in this news release has been reviewed and approved by Charles Beaudry, geologist M.Sc., member of the Association of Professional Geoscientists of Ontario and the Ordre des Géologues du Québec and a consultant to Metalla. Mr. Beaudry is a Qualified Person as defined in National Instrument 43-101, Standards of Disclosure for Mineral Projects ("NI 43‑101").

Metalla is a precious metals royalty and streaming company. Metalla provides shareholders with leveraged precious metal exposure through a diversified and growing portfolio of royalties and streams. Our strong foundation of current and future cash-generating asset base, combined with an experienced team gives Metalla a path to become one of the leading gold and silver companies for the next commodities cycle. For further information, please visit our website at www.metallaroyalty.com.

ON BEHALF OF METALLA ROYALTY & STREAMING LTD.

(signed) "Brett Heath"

President and CEO

Website: www.metallaroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Notes: | |

(1) | For details please refer to First Majestic's Annual Information Forms dated March 31, 2022 and March 31, 2021 or First Majestic's 2021 and 2020 Annual Reports and asset specific First Majestic Silver Website Landing Pages. |

(2) | For details on the estimation of mineral resources and reserves, including the key assumptions, parameters and methods used to estimate the Mineral Resources and Mineral Reserves, investors should refer to the most recent NI 43-101 Technical Reports for the La Encantada, Del Toro, San Martin, La Parilla, La Joya, Plomosas and La Luz on file at www.sedar.com. |

(3) | See Silver Dollar's Q3 MD&A dated May 31, 2022, First Majestic La Joya Website Landing Page, Based on a historical estimate for La Joya prepared for Silvercrest Mines, a previous owner of the property, in a report titled "Preliminary Economic Assessment for The La Joya Property, Durango, Mexico" dated 5 December 2013, While Metalla considers these historical estimates to be relevant to investors as it may indicate the presence of mineralization, a qualified person for Metalla has not done sufficient work to classify the historical estimates as current mineral resources as defined by NI 43-101 and Metalla is not treating these historical estimates as a current mineral resource. |

(4) | See GR Silver's Q3 MD&A Dated August 29, 2022, GR Silver's Presentation dated November 2022 and GR Silver's Press Release Dated October 31, 2022. |

(5) | See Sierra Madre's Corporate Presentation dated November 2022 and Sierra Madre's Press Release dated May 25, 2022. Based on a historical estimate for La Guitarra prepared by First Majestic, a previous owner of the property, in a report titled "First Majestic 2021 Annual Information Form" dated 31 March 2022. While Metalla considers these historical estimates to be relevant to investors as it may indicate the presence of mineralization, a qualified person for Metalla has not done sufficient work to classify the historical estimates as current mineral resources as defined by NI 43-101 and Metalla is not treating these historical estimates as a current mineral resource. |

(6) | See First Majestic La Luz Website Landing Page. Based on a historical estimate for La Luz prepared by Normabec Mining Resources, a previous owner of the property, in a report titled "Updated NI 43-101 Technical Report And Mineral Resource Estimate For The Real De Catorce Property" dated July 25, 2008. While Metalla considers these historical estimates to be relevant to investors as it may indicate the presence of mineralization, a qualified person for Metalla has not done sufficient work to classify the historical estimates as current mineral resources as defined by NI 43-101 and Metalla is not treating these historical estimates as a current mineral resource. |

(7) | Numbers may not add due to rounding. |

(8) | Mineral resources which are not mineral reserves do not have demonstrated economic viability. |

(9) | Including historical resources. |

Information contained on any website or document referred to or hyperlinked in this press release shall not be deemed to be a part of this press release.

TECHNICAL AND THIRD-PARTY INFORMATION

Except where otherwise stated, the disclosure in this press release relating to La Encantada, Del Toro, La Guitarra, Plomosas, San Martin, La Parrilla, Ja Joya and La Luz are based on information publicly disclosed by the current or former owners or operators of the respective properties and information/data available in the public domain as at the date hereof and none of this information has been independently verified by Metalla. Specifically, as a royalty holder, Metalla has limited, if any, access to the property subject to the royalties. Although Metalla does not have any knowledge that such information may not be accurate, there can be no assurance that such third party information is complete or accurate. Some information publicly reported by the operators may relate to larger properties than the areas covered by Metalla's royalty interests. Similarly, Metalla's royalty interests often cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, mineral resources and production of a property.

The disclosure was prepared in accordance with NI 43-101 of the Canadian Securities Administrators, which differs significantly from the current requirements of the U.S. Securities and Exchange Commission (the "SEC") applicable to U.S. domestic issuers. Unless otherwise indicated, the technical and scientific disclosure contained or referenced in this press release, including any references to mineral resources or mineral reserves, was prepared in accordance with Canadian National Instrument 43-101 ("NI 43-101"), which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the "SEC") applicable to U.S. domestic issuers. Accordingly, the scientific and technical information contained or referenced in this press release may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

"Inferred mineral resources" have a great amount of uncertainty as to their geological existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Historical results or feasibility models presented herein are not guarantees or expectations of future performance.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements and information include, but are not limited to, statements with respect to: the completion of the conditions required for the closing of the Transaction; the closing of the Transaction; the authorization by the TSX Venture Exchange and NYSE of the issuance of common shares in connection with the Transaction; commencement of an exploration program at La Encantada; the potential reopening of San Martin; the completion of the drill program at La Parilla; the potential target for tailings at La Guitarra; future high-grade discoveries, development, production, recoveries, cash flow, and other anticipated or possible future developments at La Encantada, Del Toro, La Guitarra, Plomosas, San Martin, La Parrilla, Ja Joya and La Luz and the properties on which the Company currently holds royalty and stream interests or relating to the companies owning or operating such properties; and current and potential future estimates of mineral reserves and resources. Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Metalla to control or predict, that may cause actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: the risk that the parties may be unable to satisfy the closing conditions for the Transaction or that the Transaction may not be completed; risks associated with the impact of general business and economic conditions; the absence of control over mining operations from which Metalla will purchase precious metals or from which it will receive stream or royalty payments and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; regulatory, political or economic developments in any of the countries where properties in which Metalla holds a royalty, stream or other interest are located or through which they are held; risks related to the operators of the properties in which Metalla holds a royalty or stream or other interest, including changes in the ownership and control of such operators; risks related to global pandemics, including the current novel coronavirus (COVID-19) global health pandemic, and the spread of other viruses or pathogens; influence of macroeconomic developments; business opportunities that become available to, or are pursued by Metalla; reduced access to debt and equity capital; litigation; title, permit or license disputes related to interests on any of the properties in which Metalla holds a royalty, stream or other interest; the volatility of the stock market; competition; future sales or issuances of debt or equity securities; use of proceeds; dividend policy and future payment of dividends; liquidity; market for securities; enforcement of civil judgments; and risks relating to Metalla potentially being a passive foreign investment company within the meaning of U.S. federal tax laws; and the other risks and uncertainties disclosed under the heading "Risk Factors" in the Company's most recent annual information form, annual report on Form 40-F and other documents filed with or submitted to the Canadian securities regulatory authorities on the SEDAR website at www.sedar.com and the U.S. Securities and Exchange Commission on the EDGAR website at www.sec.gov. Although Metalla has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Metalla undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management's best judgment based on information currently available. No forward-looking statement can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/metalla-to-acquire-strategic-silver-focused-royalty-portfolio-from-first-majestic-silver-301687646.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/metalla-to-acquire-strategic-silver-focused-royalty-portfolio-from-first-majestic-silver-301687646.html

SOURCE Metalla Royalty and Streaming Ltd.

Copyright 2022 Canada NewsWire

1 Year Metalla Royalty and Stre... Chart |

1 Month Metalla Royalty and Stre... Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions