We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Aldebaran Resources Inc | TSXV:ALDE | TSX Venture | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.05 | 2.86% | 1.80 | 1.76 | 1.80 | 1.80 | 1.75 | 1.77 | 12,300 | 16:52:19 |

Aldebaran Intercepts 14.9 m of 19.08 g/t Au in Discovery of New High-grade Gold Zone at

the Altar Copper-Gold Project, San Juan, Argentina

February 24, 2022 (Vancouver, BC) - InvestorsHub NewsWire -- Aldebaran Resources Inc. ("Aldebaran" or the "Company") (TSXV: ALDE) (OTCQX: ADBRF) is pleased to report the discovery of a new high-grade gold zone at the Altar copper gold project located in San Juan, Argentina. The Company made the discovery in hole QDM-22-45 (assays partially reported in Tables 1 and 2), which is targeting the North extension of the Radio Porphyry copper-gold target and was drilled beneath the current resource for the QDM Gold deposit (See Table 3). QDM-22-45 is still in progress.

Highlights

Dr. Kevin B. Heather, Chief Geological Officer of Aldebaran, commented as follows: "This is by far the highest-grade, gold-dominated intercept we have encountered at the Altar project to date. The epithermal style of this mineralization and associated alteration, along with its spatial relationship to the QDM Gold deposit, suggests that it may be a high-grade "feeder-structure" to the larger, lower-grade, disseminated QDM Gold style mineralization currently reported in the resource. Clearly this intercept, which is made up of multiple multi-gram assay intervals, warrants additional follow-up drilling to determine its potential size and geometry, and opens up the possibility of finding additional higher-grade feeder structures."

John Black, Chief Executive Officer of Aldebaran, commented as follows: "We normally don't report partial results from a drill hole, however due to the high-grades associated with this interval we felt it appropriate to do so. We know that the Altar project has the potential to host high-grade copper and copper-gold mineralization, however this is the first time we've observed this type of high-grade gold mineralization. More drilling is required to better understand the controls on this new gold zone. This adds an exciting new aspect to the Altar and QDM/Radio story."

Discussion of Results:

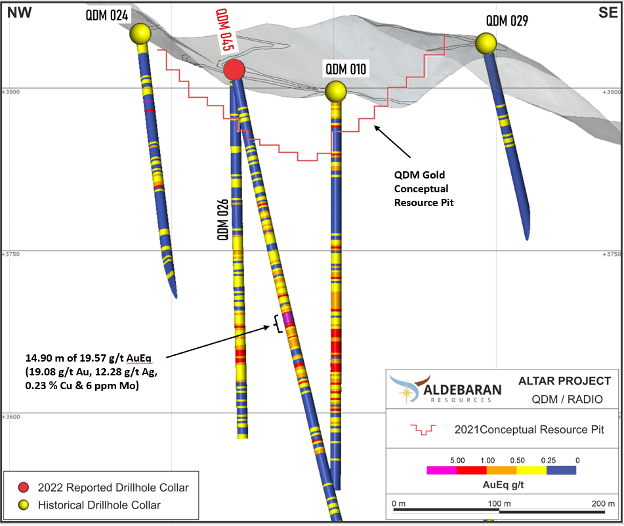

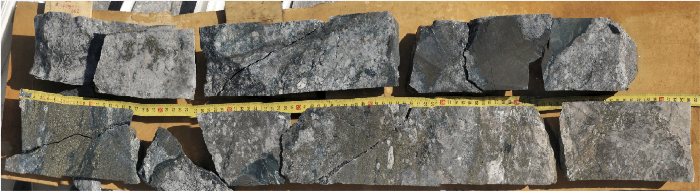

Drill Hole QDM-22-45 is currently being drilled at an azimuth of 133 degrees and dip of -70 degrees. The hole was designed to explore for the northern extension of known porphyry mineralization at the Radio Porphyry target. Currently the Company has received assays for the first 457 metres of hole QDM-22-45. The top 240 m of the hole intersected an intrusion breccia consisting of dacite porphyry matrix with andesite fragments. At approximately 240 m depth the hole intersected the contact between this dacite intrusion breccia, and the andesite wall rocks. Immediately after the contact, a hydrothermal breccia containing up to 10% sulphides (primarily pyrite) and fine chalcedonic quartz hosts the high-grade gold mineralization (Photo 1). The hydrothermal breccia is bounded downhole by a dacite porphyry dyke which is also well mineralized. Andesite host rocks continue down to the 457 m mark. From 330 m to 358 m a broad fault zone was intersected. Beneath this fault, an abrupt change is observed with alteration and veining increasing in intensity as the hole gets deeper and copper values increasing. There are no reportable copper intervals in the first 457 m of the hole, which was expected, as the Radio Porphyry target in this area is known to be deeper.

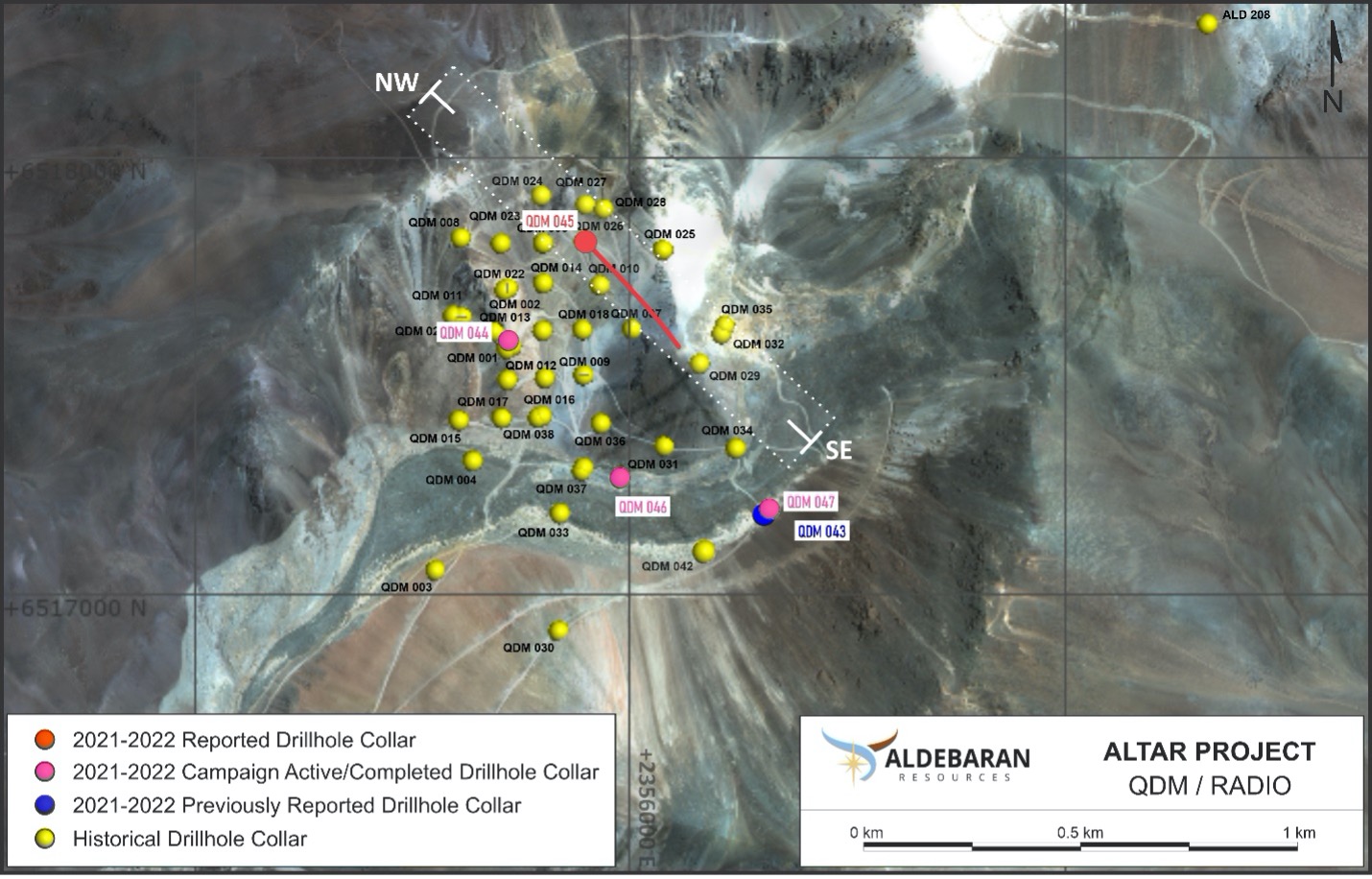

Table 1 below provides more detail on the mineralized intercepts encountered in the first 457 m of drill hole QDM-22-45. The location of the reported drill hole is indicated in Figure 1 and Figure 2. Figure 3 displays a cross section of QDM-22-45.

|

Table 1 – 2022 Altar Drill Hole Results |

||||||||||

|

Au (g/t) |

From |

To |

Interval |

Au |

Ag |

Cu |

Mo |

As |

AuEq |

|

|

QDM-22-045 |

||||||||||

|

0.3 |

|

197.00 |

240.10 |

43.10 |

0.39 |

0.60 |

0.07 |

2 |

137 |

0.50 |

|

1.0 |

|

240.10 |

255.00 |

14.90 |

19.08 |

12.28 |

0.23 |

6 |

363 |

19.57 |

|

5.0 |

incl. |

241.20 |

250.65 |

9.45 |

27.84 |

18.46 |

0.24 |

6 |

338 |

28.43 |

|

25.0 |

incl. |

249.00 |

250.65 |

1.65 |

98.70 |

19.40 |

0.27 |

15 |

453 |

99.36 |

|

0.3 |

|

255.00 |

297.40 |

42.40 |

0.56 |

0.42 |

0.08 |

1 |

124 |

0.69 |

|

The grades are uncut. AuEq values were calculated using copper, gold, silver and molybdenum. Metal prices utilized for the calculations are Cu = US$3.00/lb, Au = US$1,400/oz, Ag = US$18/oz, and Mo = US$10/lb. No adjustments were made for recovery as the project is an early-stage exploration project and metallurgical data to allow for estimation of recoveries is not yet available. True width cannot be determined at this time due to limited drilling. The formulas utilized to calculate equivalent values is AuEq g/t = Au g/t + Ag g/t / 77.7778 + Cu % * 1.4694 + Mo ppm / 2041.7092. |

||||||||||

|

Table 2 - Detailed Assay Results for the High-grade Gold Intercept in Hole QDM-22-045 |

||||||

|

From |

To |

Length |

Au |

Ag |

Cu |

Mo |

|

240.10 |

241.20 |

1.10 |

2.11 |

1.50 |

0.31 |

4 |

|

241.20 |

243.00 |

1.80 |

13.50 |

17.90 |

0.16 |

6 |

|

243.00 |

245.00 |

2.00 |

11.10 |

8.80 |

0.38 |

6 |

|

245.00 |

247.00 |

2.00 |

6.97 |

9.10 |

0.15 |

4 |

|

247.00 |

249.00 |

2.00 |

19.90 |

37.20 |

0.22 |

8 |

|

249.00 |

250.65 |

1.65 |

98.70 |

19.40 |

0.27 |

15 |

|

250.65 |

251.65 |

1.00 |

1.39 |

0.70 |

0.10 |

2 |

|

251.65 |

253.00 |

1.35 |

11.40 |

3.60 |

0.44 |

2 |

|

253.00 |

255.00 |

2.00 |

1.04 |

0.70 |

0.07 |

2 |

QDM Gold Deposit

The QDM gold deposit is primarily a gold-silver deposit with minor associated copper. It consists of dominantly sulphide mineralization with minor oxide (~10%) mineralization. The resource estimate for QDM Gold is constrained using a conceptual open pit (the northern margin of the conceptual pit is seen in Figure 3). Mineralization at QDM Gold is primarily hosted in a dacite intrusion. The majority of drilling completed at the QDM gold deposit was done by Stillwater Mining in 2012 with relatively shallow holes.

|

Table 3 - QDM Gold - Open Pit Mineral Resource |

||||||||

|

|

|

Average Grade |

Contained Metal |

|||||

|

|

Tonnes |

Au |

Ag |

Cu |

As |

Au (M Oz) |

Ag (M Oz) |

Cu (M lbs) |

|

Measured |

15.8 |

0.81 |

3.59 |

0.06 |

168 |

0.41 |

1.83 |

21 |

|

Indicated |

4.2 |

0.68 |

3.74 |

0.06 |

164 |

0.09 |

0.50 |

5 |

|

Total M&I |

20.0 |

0.78 |

3.62 |

0.06 |

167 |

0.50 |

2.33 |

26 |

|

Inferred |

1.2 |

0.58 |

5.34 |

0.03 |

153 |

0.02 |

0.21 |

1 |

|

QDM Gold utilizes a 0.33 AuEq (US$13.17 NSR/t) cut-off grade for sulphide mineralization and a 0.7 AuEq (US$13.17 NSR/t) cut-off grade for oxide mineralization. |

||||||||

Results Webinar, March 3 at 11:00 am ET

Join Aldebaran on Thursday March 3, 11:00 am ET for a live 6ix summit to review the promising initial drill results from Altar's 2022 drill campaign. The summit will include a presentation from Chief Geological Officer, Dr. Kevin B. Heather and CEO, John Black, will join for a live Q&A. Register for the webinar here: https://my.6ix.com/j8uDby9O.

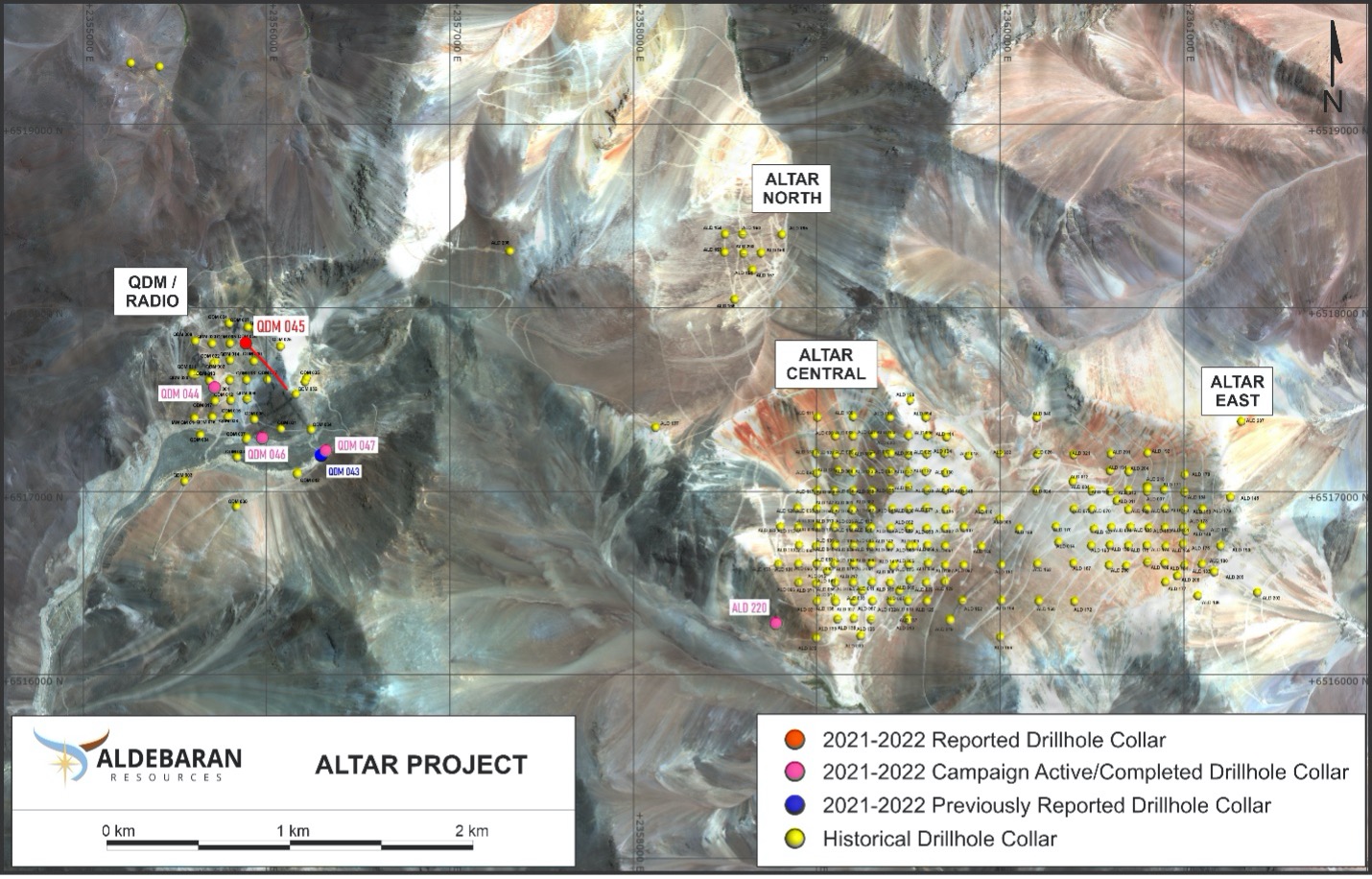

Project Update

The Company is currently drilling with four drill rigs on the Altar project. Three are currently at the QDM/Radio area, while the other is at Altar Central (See Figure 1). The Company recently completed QDM-21-44 (total depth of 1,440.70 m) in the QDM/Radio area, and samples have now been sent to the assay lab with results for the complete hole anticipated by the end of March. QDM-21-44 encountered multiple challenges while in progress, and deviated significantly from its original trajectory, ultimately missing the intended target. QDM-22-45, QDM-22-46, QDM-22-47 and ALD-22-220 are respectively 932.50 m, 997.90 m, 172.05 m, and 299.80 m deep at the time of this release. None of the active holes (other than QDM-22-45) are testing the newly discovered gold zone. The Company is evaluating options to follow up on the new discovery and test the extents of mineralization.

Qualified Person

The scientific and technical data contained in this news release has been reviewed and approved by Dr. Kevin B. Heather, B.Sc. (Hons), M.Sc, Ph.D, FAusIMM, FGS, Chief Geological Officer and director of Aldebaran, who serves as the qualified person (QP) under the definitions of National Instrument 43-101.

For further information, please consult our website at www.aldebaranresources.com or contact:

Laura Brangwin

Investor Relations Manager

Phone: +1 646 583-1404

Email: laura.brangwin@aldebaranresources.com

About Aldebaran Resources Inc.

Aldebaran is a mineral exploration company that was spun out of Regulus Resources Inc. in 2018 and has the same core management team. Aldebaran acquired the Rio Grande copper-gold project located in Salta Province, Argentina from Regulus along with several other early-stage projects in Argentina. Aldebaran also has the right to earn up to an 80% interest in the Altar copper-gold project in San Juan Province, Argentina from Sibanye Stillwater Limited. The Altar project hosts multiple porphyry copper-gold deposits with potential for additional discoveries. Altar forms part of a cluster of world-class porphyry copper deposits which includes Los Pelambres (Antofagasta Minerals), El Pachón (Glencore), and Los Azules (McEwen Copper). In March 2021 the Company announced an updated mineral resource estimate for Altar, prepared by Independent Mining Consultants Inc. and based on the drilling completed up to and including 2020. Aldebaran's primary focus is the Altar project with a view to discovering new zones with higher-grade mineralization.

Sampling and Analytical Procedures

Altar follows systematic and rigorous sampling and analytical protocols which meet and exceed industry standards. These protocols are summarized below and are available on the Aldebaran website at www.aldebaranresources.com.

All drill holes are diamond core holes with PQ, HQ or NQ core diameters. Drill core is collected at the drill site where recovery and RQD (Rock Quality Designation) measurements are taken before the core is boxed and transported to the Altar camp facilities, a short distance away, where the whole core is photographed under more optimum lighting conditions and geological quick log is produced. The whole-core is then marked and sampled into geological defined, systematic 1- to 2-metre sample intervals, unless the geologist determines the presence of an important geological contact, which should not be crossed. The whole-core is then cut-in-half with a diamond saw blade, with half the sample retained in the core box for future reference and the other half placed into a pre-labelled plastic bag, sealed with a two plastic security zip ties, and labeled with a unique sample number. The bagged samples are then placed into larger plastic sacks and those sacks are sealed with another plastic security zip tie and labelled for shipment. The sacks are then placed onto wooden pallets and wrapped in plastic shrink-wrap and stored in a secure area pending shipment to a certified ALS laboratory sample preparation facility located in Mendoza, Argentina, where the samples are dried, crushed, and pulverized. The resulting sample pulps are sent by batch to the ALS laboratory in Lima for geochemical assay analysis, including a 30g fire assay with an atomic absorption (AA) finish analysis for gold and a full multi-acid digestion (4-acid) with ICP-AES analysis for other elements. Samples with results that exceed maximum detection values for gold are re-analyzed by fire assay with a gravimetric finish and other elements of interest are re-analyzed using precise ore-grade ICP analytical techniques. Aldebaran independently inserts certified control standards (Super Certified Reference Materials (SCRM's), coarse field blanks, and duplicates into the sample stream to monitor data quality. These standards are inserted "blindly" to the laboratory in the sample sequence prior to departure from the Aldebaran facilities.

Forward-Looking Statements

Certain statements regarding Aldebaran, including management's assessment of future-plans and operations, may constitute forward-looking statements under applicable securities laws and necessarily involve known and unknown risks and uncertainties, most of which are beyond Aldebaran's control. Often, but not always, forward-looking statements or information can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate" or "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved.

Specifically, and without limitation, all statements included in this press release that address activities, events or developments that Aldebaran expects or anticipates will or may occur in the future, including the proposed exploration and development of the Altar project described herein, and management's assessment of future plans and operations and statements with respect to the completion of the anticipated exploration and development programs, may constitute forward-looking statements under applicable securities laws and necessarily involve known and unknown risks and uncertainties, most of which are beyond Aldebaran's control. These risks may cause actual financial and operating results, performance, levels of activity and achievements to differ materially from those expressed in, or implied by, such forward-looking statements. Although Aldebaran believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. The forward-looking statements contained in this press release are made as of the date hereof and Aldebaran does not undertake any obligation to publicly update or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Figure 1 – Plan map showing drill collar locations.

Figure 2 – QDM/Radio plan map with section line location.

Figure 3 - QDM-22-45 Cross Section - Oblique Northeast View.

Photo 1 - A selection of representative samples showing the style of mineralization and alteration associated with the 14.9 m high-grade gold intercept report in drill hole QDM-22-45.

1 Year Aldebaran Resources Chart |

1 Month Aldebaran Resources Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions