We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| ATHA Energy Corp | TG:X5U | Tradegate | Ordinary Share |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 0.248 | 0.244 | 0.256 | 0.248 | 0.236 | 0.236 | 91 | 19:22:16 |

HIGHLIGHTS

VANCOUVER, British Columbia, Nov. 25, 2024 (GLOBE NEWSWIRE) -- ATHA Energy Corp. (TSX.V: SASK) (FRA: X5U) (OTCQB: SASKF) (“ATHA” or the “Company”), holder of the largest uranium exploration portfolio in two of the highest-grade uranium districts in the world, is pleased to announce conclusions from its updated 2024 Technical Report (effective date November 25, 2024) on its 100%-owned Angilak Uranium Project in Nunavut.

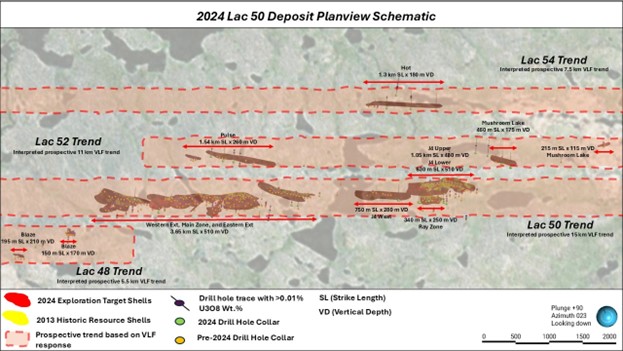

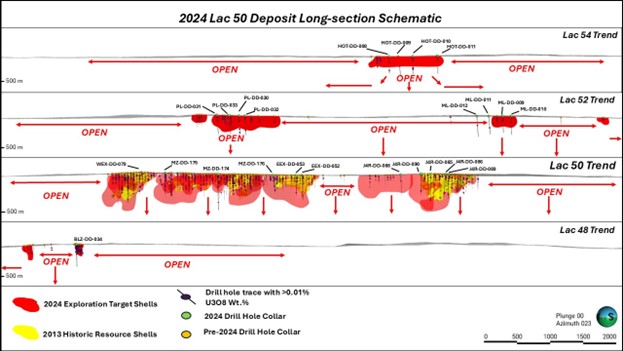

Conclusions from the Report – in accordance with the guidelines set forth in the National Instrument NI 43-101 – establish a baseline Exploration Target (the “Exploration Target”) for the Lac 50 Deposit ranging between 60.8 M lbs U3O8 and 98.2 M lbs U3O8, with an average grade range between 0.37% U3O8 and 0.48% U3O8 (Table 1) - restricted to drill results from the Lac 48, 50, 52, and 54 mineralized Trends (known as the “Lac 50 Deposit”) (Figures 2a & 2b). The updated 2024 Technical Report utilized technical information collected predominately from 2009 through to 2024 – inclusive of assay results from the 2024 Angilak Exploration Program and will be prepared by Mr. Matthew Batty, MSc., P.Geo, owner of Understood Minerals Resources Ltd. The updated 2024 Technical Report will also include details regarding the Exploration Target Model (the “Exploration Target Model”) presented herein, and will be filed on SEDAR (www.sedar.com) within 45 days of this release.

The Company is also pleased to announce assay results from its Phase I: diamond drilling campaign completed as part of the 2024 Angilak Exploration Program. The 2024 Angilak Exploration Program resulted in the expansion of mineralized domains along the Lac 50 Trend where grades of up to 5.85% U3O8 over 0.5 m were intersected. Additionally, the program identified and expanded mineralization along parallel trends, defined as Lac 48, Lac 52, and Lac 54 Trends.

Troy Boisjoli, CEO added: “ATHA was built with a large-scale vision that reflects our belief in the generational opportunity within the uranium sector and we believe our exploration program at Angilak exemplifies this approach. Rather than relying on incremental delineation at Angilak, the unique strength of our balance sheet amongst exploration peers and deep technical bench provided us the opportunity to design and successfully execute an exploration program seeking long-term value creation that give us both resolution on the future scale of Angilak and also significantly de-risks future exploration programs. We are extremely pleased with the outcome of this choice and believe these exploration results not only establish the large-scale resource potential at Angilak but also prove the viability of Nunavut as a tier 1 uranium jurisdiction globally.”

Cliff Revering, VP Exploration added: “The objectives we had set for ATHA’s 2024 drilling at Angilak were to expand the footprint of mineralization of the historic Lac 50 mineralized domains, as well as to identify new zones of mineralization within the main Lac 50 Trend and proximal exploration target areas. The success we had in meeting these objectives has now been contextualized by the 2024 Exploration Target model which further demonstrates the potential that exists within the Lac 50 Deposit. The additional prospectivity we see regionally within the Angilak Project, where numerous additional mineralized discoveries and showings have already been identified by limited drill testing, provides even more exploration upside and growth potential for the project.”

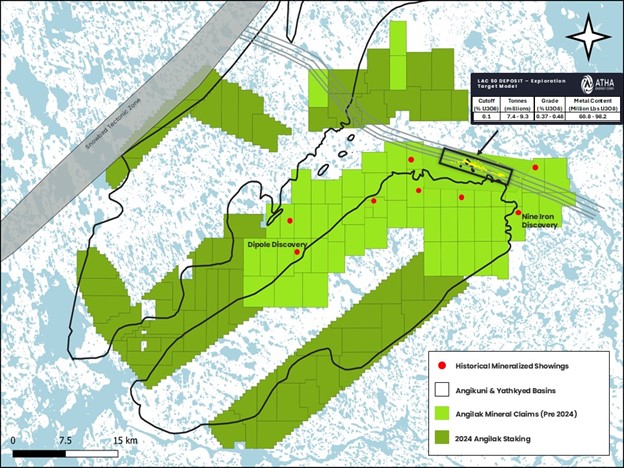

ANGILAK PROJECT – NUNAVUT

The Angilak Project is situated within the Angikuni Basin, approximately 225 km southwest of Baker Lake in the Kivalliq Region of Nunavut (Figure 1). The project notably hosts the Lac 50 Uranium Deposit, which has a historical mineral resource estimate of 43.3M lbs at an average grade of 0.69% U3O8.1 Additionally, numerous regional discoveries of uranium mineralization have been made outside of the Lac 50 Corridor, both within Angikuni Basin as well as along its rim – demonstrating many similarities to high-grade uranium discoveries in the Athabasca Basin, Saskatchewan. One such prominent regional discovery within the Angilak Project area is the Dipole Showing, located along the western rim of the Angikuni Basin 25 km to the southwest of the Lac 50 Corridor. Previous operators of the Project completed 24 diamond drill holes in the Dipole Showing and intersected grades of up to 5.53% U3O8 over 0.5 m.

Figure 1: Plan Map detailing Lac 50 Deposit location with the Angilak Uranium Project

SUMMARY NOVEMBER 2024 ANGILAK PROJECT TECHNICAL REPORT:

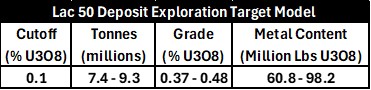

Table 1: Lac 50 Deposit Exploration Target Model

*Notes - The stated potential quantity and grade is conceptual in nature, and there has not been sufficient exploration to define a mineral resource, and it is uncertain if further exploration will result in the target being delineated as a mineral resource. **Significant digits have been rounded to the nearest decimal. ***The ranges were derived from a block model approach using interpreted vein wireframes, drill core assays, grade interpolation via Ordinary Kriging, and applied uncertainty bandwidths.

Figure 2a: 2024 Lac 50 Deposit Planview Schematic

Figure 2b: 2024 Lac 50 Deposit Long-section Schematic

ANGILAK 2024 EXPLORATION PROGRAM:

NOVEMBER 2024 ANGILAK PROJECT TECHNICAL REPORT

Understood Mineral Resources Ltd. (UMR) provided ATHA Energy Corp. (ATHA or The Company) ranges for potential uranium quantity and grade as a target for further exploration on Angilak's Lac 50 Deposit. The ranges were derived from a block model approach using interpreted vein wireframes, drill core assays, grade interpolation via Ordinary Kriging, and applied uncertainty bandwidths.

The wireframes were modelled using a grade intercept limit equal to or greater than a minimum grade of 0.01 % U3O8, although lower grades were incorporated in places to maintain continuity and represent the structural setting and continuity of the mineralized system. Extension distance for the mineralized wireframes was halfway to the next hole, or 200 m in areas of no drilling, representing the potential at the deposit.

Assays were composited to 4 metre lengths within the mineralized boundaries, capped at 5% U3O8, and used for variography. The blocks within the wireframes were interpolated with grade values using the composites, variography, ordinary kriging (OK), and a High Yield Limit set at 2.5% U3O8 (50% of search range).

UMR applied an uncertainty bandwidth to define a range for potential uranium using the block model as the midpoint. The well-informed portions of the wireframes with < 50 m drill hole spacing used a bandwidth of ± 5 % tonnes and ± 15 % metal content. An uncertainty bandwidth of ± 10 % tonnes and ± 30 % metal content was used for the remaining wireframes with drill hole spacing greater than 50 m. The stated potential quantity and grade is conceptual in nature, and there has not been sufficient exploration to define a mineral resource, and it is uncertain if further exploration will result in the target being delineated as a mineral resource.

INVESTOR RELATIONS

The Company further reports that it has entered into an agreement with Machai Capital Inc. ("Machai") dated 22 November, 2024, pursuant to which Machai will provide a digital marketing campaign (the “Machai Agreement”). The term of the Machai Agreement is for three months for a total retainer of $220,000, to be paid upfront.

Under the agreement Machai will execute a comprehensive digital media marketing campaign for the Company commencing in November, 2024 including branding and content creation, data optimization services including search engine optimization, search engine marketing, lead generation, digital marketing, social media marketing, email marketing, and brand marketing.

Machai is a marketing, advertising and public awareness firm based out of Vancouver, British Columbia, specializing in advertising and public awareness in the metals & mining, technology, and special situation sectors. Machai and its principal, Suneal Sandhu are arms length to the Company and hold no interest, directly or indirectly, in the securities of the Company or any right to acquire such an interest. The engagement of Machai is subject to the approval of the TSX Venture Exchange.

Qualified Person

The scientific and technical information contained in this news release have been reviewed and approved by Cliff Revering, P.Eng., Vice President, Exploration of ATHA, who is a "qualified person" as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

The ranges for potential uranium quantity and grade for the Lac 50 Deposit were completed by Mr. Matthew Batty, MSc, P.Geo of Understood Mineral Resources Ltd. Mr. Batty is an independent Qualified Persons in accordance with the requirements of National Instrument (NI) 43-101 and he has approved the disclosure herein.

About Understood Mineral Resources Ltd.

Understood Mineral Resources Ltd. is a small, well-trained team with experience in numerous commodities and geologic environments, specializing in project development, geological modeling, deterministic and probabilistic mineral resource estimation, production reconciliation, grade control, and mine planning. UMR’s academic training gives them the unique skills to generate probabilistic resource modelling products in conjunction with more conventional techniques such as ordinary kriging. Understood's primary objective is to bring high-quality, reliable, auditable resource models to all mining companies using the latest geostatistical techniques and strategies.

About ATHA

ATHA is a Canadian mineral company engaged in the acquisition, exploration, and development of uranium assets in the pursuit of a clean energy future. With a strategically balanced portfolio including three 100%-owned post discovery uranium projects (the Angilak Project located in Nunavut, and CMB Discoveries in Labrador hosting historical resource estimates of 43.3 million lbs and 14.5 million lbs U3O8 respectively, and the newly discovered basement hosted GMZ high-grade uranium discovery located in the Athabasca Basin). In addition, the Company holds the largest cumulative prospective exploration land package (8.4 million acres) in two of the world’s most prominent basins for uranium discoveries - ATHA is well positioned to drive value. ATHA also holds a 10% carried interest in key Athabasca Basin exploration projects operated by NexGen Energy Ltd. and IsoEnergy Ltd. For more information visit www.athaenergy.com. 1,2,3.

For more information, please contact:

Troy Boisjoli

Chief Executive Officer

Email: info@athaenergy.com

www.athaenergy.com

Historical Mineral Resource Estimates

All mineral resources estimates presented in this news release are considered to be “historical estimates” as defined under NI 43-101, and have been derived from the following (See notes below). In each instance, the historical estimate is reported using the categories of mineral resources and mineral reserves as defined by the CIM Definition Standards for Mineral Reserves, and mineral reserves at that time, and these “historical estimates” are not considered by ATHA to be current. In each instance, the reliability of the historical estimate is considered reasonable, but a Qualified Person has not done sufficient work to classify the historical estimate as a current mineral resource, and ATHA is not treating the historical estimate as a current mineral resource. The historical information provides an indication of the exploration potential of the properties but may not be representative of expected results.

Notes on the Historical Mineral Resource Estimate for the Angilak Deposit:

Cautionary Statement Regarding Forward-Looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. These forward-looking statements or information may relate to ATHA’s proposed exploration program, including statements with respect to the expected benefits of ATHA’s proposed exploration program, any results that may be derived from ATHA’s proposed exploration program, the timing, scope, nature, breadth and other information related to ATHA’s proposed exploration program, any results that may be derived from the diversification of ATHA’s portfolio, the successful integration of the businesses of ATHA, Latitude Uranium and 92 Energy, the prospects of ATHA’s projects, including mineral resources estimates and mineralization of each project, the prospects of ATHA’s business plans and any expectations with respect to defining mineral resources or mineral reserves on any of ATHA’s projects, and any expectation with respect to any permitting, development or other work that may be required to bring any of the projects into development or production.

Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management at the time, are inherently subject to business, market and economic risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Such assumptions include, but are not limited to, assumptions that the anticipated benefits of ATHA’s proposed exploration program will be realized, that no additional permit or licenses will be required in connection with ATHA’s exploration programs, the ability of ATHA to complete its exploration activities as currently expected and on the current anticipated timelines, including ATHA’s proposed exploration program, that ATHA will be able to execute on its current plans, that ATHA’s proposed explorations will yield results as expected, the synergies between ATHA, 92 Energy and Latitude Uranium’s assets, and that general business and economic conditions will not change in a material adverse manner. Although each of ATHA and 92E have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Such statements represent the current view of ATHA with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by ATHA, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Risks and uncertainties include, but are not limited to the following: inability of ATHA to realize the benefits anticipated from the exploration and drilling targets described herein or elsewhere; in ability of ATHA to complete current exploration plans as presently anticipated or at all; inability for ATHA to economically realize on the benefits, if any, derived from the exploration program; failure to complete business plans as it currently anticipated; overdiversification of ATHA’s portfolio; failure to realize on benefits, if any, of a diversified portfolio; unanticipated changes in market price for ATHA shares; changes to ATHA’s current and future business and exploration plans and the strategic alternatives available thereto; growth prospects and outlook of the business of ATHA; any impacts of COVID-19 on the business of ATHA and the ability to advance the Company projects and its proposed exploration program; risks inherent in mineral exploration including risks related worker safety, weather and other natural occurrences, accidents, availability of personnel and equipment, and other factors; aboriginal title; failure to obtain regulatory and permitting approvals; no known mineral resources/reserves; reliance on key management and other personnel; competition; changes in laws and regulations; uninsurable risks; delays in governmental and other approvals, community relations; stock market conditions generally; demand, supply and pricing for uranium; and general economic and political conditions in Canada, Australia and other jurisdictions where ATHA conducts business. Other factors which could materially affect such forward-looking information are described in the filings of ATHA with the Canadian securities regulators which are available on ATHA’s profile on SEDAR+ at www.sedarplus.ca. ATHA does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/068beb8b-779f-4d05-885b-47b367bbd4e9

https://www.globenewswire.com/NewsRoom/AttachmentNg/d518a3d2-855c-4848-b4fc-ba8100695c87

https://www.globenewswire.com/NewsRoom/AttachmentNg/ba9a2ee7-85b3-42b7-889c-6a9ee9ef8002

https://www.globenewswire.com/NewsRoom/AttachmentNg/7203b752-a575-431e-af74-184028056dcd

1 Year ATHA Energy Chart |

1 Month ATHA Energy Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions