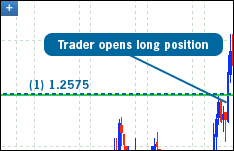

After opening the trade on based on a certain analysis and technical picture, price breaks in the opposite direction!

Traders that use risk management techniques such as exposure per trade, are less likely to close a position at the first instance of the market swinging against them.

A trader with a risk management plan is not as easily affected by fear because he has already determined when he would exit the position if the market continues to move in the wrong direction. Therefore, the price movement after the position is open is considered noise. With this trading strategy in place the trader would be able to gain once the market turned back up. Fortunately for the trader, the market changed direction at an opportune moment as the stop was very close to being activated. However, if price did not turn around and kept heading downward, the trader would close the position once his maximum risk level for any particular trade was reached. Sizing a Position

In another scenario, a trader wants to enter when the market breaks the (1) high, and also establishes a stop at 1.2480. The next time that price breaks 1.2575 is a few days later.

Let’s first look at a trader that has a $20,000 account and is willing to risk 5%, or $1,000, as his exposure per trade. Since the stop is 100 pips away, or $1,000 away on a standard 1 Lot, he would take out a 1 Lot position. With this size trade, if the market moves against him and the position gets stopped out, he would have lost only 5% of equity as planned.

If there was a similar trader that chose 5% as her exposure per trade and had the same stop, but had $10,000 in her account then a 1 Lot position would not work for her. If she was to open a 1 Lot trade, and her stop was reached, she would lose 10% of her account, not 5%. Therefore, the proper size for her risk threshold would be a position that is 5 mini-lots or .5 standard Lots.

Let’s go back to the trader from our first example, but now he does not place a trade right away.

After there is a new bottom the next day, and the currency starts to show strength again, this trader wants to enter when a new high at 1.2520 is broken. He will get that chance either then or a few days later. Entering at this level, while having the same stop means the trader can take on a bigger position as the amount of pips to get to the stop (risk) is now smaller by about half.

For a $20,000 dollar account, with a 5% risk per trade threshold, the position can be 2.5 Lots. An adverse move to reach the stop is around 40 pips, which is equivalent to $400 for 1 Lot. Since the trader has $1000 to risk on this trade, he divides $1,000 (exposure per trade) by $400 (possible loss for 1 Lot) to get the number of Lots he would take out for this position. For example, a 1 Lot position, when the stop is reached would have used 2% of equity (20,000/400=.02). For a 2 Lot position the stop would be activated at 4% of equity. The trade size that fits the trader’s exposure per trade is 2.5 Lots.

In the same scenario, for a trader with $10,000 in her account and 5% as a chosen exposure per trade, the position she would open would be 1.25 Lots. The number is calculated by dividing her exposure per trade, $500, by the possible loss for a 1 lot trade to the stop, $400.

Therefore, $500/$400 = 1.25 Lots.

The information provided in this article is for informational purposes only and should not be construed as financial, investment, or professional advice. The views expressed are those of the author and do not necessarily reflect the opinions or recommendations of any organizations or individuals mentioned. Always consult with a qualified financial advisor or other professionals before making any financial decisions. The author and publisher are not responsible for any actions taken based on the content provided.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions