0001172069false--03-31FY2024false0.0015000000006794651367946513250000.0015000000000011720692023-04-012024-03-310001172069ptos:ReclassificationMember2023-03-310001172069ptos:OriginallyReportingMember2023-03-310001172069ptos:AnotherDirectorMember2023-03-310001172069ptos:DirectorAndOfficerMember2023-03-310001172069ptos:AnotherDirectorMember2024-03-310001172069ptos:DirectorAndOfficerMember2024-03-310001172069ptos:DirectorAndOfficerMember2022-04-012023-03-310001172069ptos:DirectorAndOfficerMember2023-04-012024-03-310001172069ptos:PromissoryNotesMember2023-04-012024-03-310001172069ptos:AzariahZemariumMember2023-04-012024-03-310001172069ptos:ConvertibleNoteMemberptos:SeptemberTwoThousandTwoThreeMember2023-04-012024-03-310001172069ptos:ConvertibleNoteMemberptos:SeptemberTwoThousandTwoThreeMember2023-03-310001172069ptos:ConvertibleNoteMemberptos:SeptemberTwoThousandTwoThreeMember2024-03-310001172069ptos:ConvertibleNotesMemberptos:AugustTwoThousandTwentyThreeMember2023-04-012024-03-310001172069ptos:ConvertibleNotesMemberptos:AugustTwoThousandTwentyThreeMember2023-03-310001172069ptos:ConvertibleNotesMemberptos:AugustTwoThousandTwentyThreeMember2024-03-310001172069ptos:ConvertibleNotesMemberptos:JuneTwoThousandTwoThreeMember2023-04-012024-03-310001172069ptos:ConvertibleNotesMemberptos:JuneTwoThousandTwoThreeMember2023-03-310001172069ptos:ConvertibleNotesMemberptos:JuneTwoThousandTwoThreeMember2024-03-310001172069ptos:FebruaryTwoThousandTwentyThreeMemberptos:ConvertibleNotesMember2023-04-012024-03-310001172069ptos:FebruaryTwoThousandTwentyThreeMemberptos:ConvertibleNotesMember2023-03-310001172069ptos:FebruaryTwoThousandTwentyThreeMemberptos:ConvertibleNotesMember2024-03-310001172069ptos:DecemberTwoThousandTwentyTwoMemberptos:ConvertibleNotesMember2023-04-012024-03-310001172069ptos:DecemberTwoThousandTwentyTwoMemberptos:ConvertibleNotesMember2023-03-310001172069ptos:DecemberTwoThousandTwentyTwoMemberptos:ConvertibleNotesMember2024-03-310001172069ptos:NovemberTwoThousandTwoOneMemberus-gaap:CommercialPaperMember2023-04-012024-03-310001172069ptos:AugustTwoThousandTwoOneMemberptos:CommercialPaper1Member2023-04-012024-03-310001172069ptos:AugustTwoThousandTwoOneMemberus-gaap:CommercialPaperMember2023-04-012024-03-310001172069ptos:JuneTwoThousandTwoOneMemberus-gaap:CommercialPaperMember2023-04-012024-03-310001172069ptos:JanuaryTwoThousandEighteenMemberus-gaap:CommercialPaperMember2023-04-012024-03-310001172069ptos:SeptemberTwoThousandFifteenMemberus-gaap:CommercialPaperMember2023-04-012024-03-310001172069ptos:SeptemberTwoThousandFourteenMemberus-gaap:CommercialPaperMember2023-04-012024-03-310001172069ptos:JulyTwoThousandFourteenMemberus-gaap:CommercialPaperMember2023-04-012024-03-310001172069ptos:MayTwoThousandFourteenMemberptos:CommercialPaper1Member2023-04-012024-03-310001172069ptos:MarchTwoThousandFourteenMemberus-gaap:CommercialPaperMember2023-04-012024-03-310001172069ptos:FebruaryTwoThousandFourteenMemberus-gaap:CommercialPaperMember2023-04-012024-03-310001172069ptos:JanuaryTwoThousandFourteenMemberus-gaap:CommercialPaperMember2023-04-012024-03-310001172069ptos:DecemberTwoThousandThirteenMemberus-gaap:CommercialPaperMember2023-04-012024-03-310001172069ptos:NovemberTwoThousandThirteenMemberptos:CommercialPaper1Member2023-04-012024-03-310001172069ptos:NovemberTwoThousandThirteenMemberus-gaap:CommercialPaperMember2023-04-012024-03-310001172069ptos:OctoberTwoThousandThirteenMemberus-gaap:CommercialPaperMember2023-04-012024-03-310001172069ptos:SeptemberTwoThousandElevenMemberus-gaap:CommercialPaperMember2023-04-012024-03-310001172069ptos:NovemberTwoThousandTwoOneMemberus-gaap:CommercialPaperMember2023-03-310001172069ptos:NovemberTwoThousandTwoOneMemberus-gaap:CommercialPaperMember2024-03-310001172069ptos:AugustTwoThousandTwoOneMemberptos:CommercialPaper1Member2023-03-310001172069ptos:AugustTwoThousandTwoOneMemberptos:CommercialPaper1Member2024-03-310001172069ptos:AugustTwoThousandTwoOneMemberus-gaap:CommercialPaperMember2023-03-310001172069ptos:AugustTwoThousandTwoOneMemberus-gaap:CommercialPaperMember2024-03-310001172069ptos:JuneTwoThousandTwoOneMemberus-gaap:CommercialPaperMember2023-03-310001172069ptos:JuneTwoThousandTwoOneMemberus-gaap:CommercialPaperMember2024-03-310001172069ptos:JanuaryTwoThousandEighteenMemberus-gaap:CommercialPaperMember2023-03-310001172069ptos:SeptemberTwoThousandFifteenMemberus-gaap:CommercialPaperMember2024-03-310001172069ptos:SeptemberTwoThousandFifteenMemberus-gaap:CommercialPaperMember2023-03-310001172069ptos:SeptemberTwoThousandFourteenMemberus-gaap:CommercialPaperMember2024-03-310001172069ptos:SeptemberTwoThousandFourteenMemberus-gaap:CommercialPaperMember2023-03-310001172069ptos:JulyTwoThousandFourteenMemberus-gaap:CommercialPaperMember2024-03-310001172069ptos:JulyTwoThousandFourteenMemberus-gaap:CommercialPaperMember2023-03-310001172069ptos:MayTwoThousandFourteenMemberptos:CommercialPaper1Member2024-03-310001172069ptos:MayTwoThousandFourteenMemberptos:CommercialPaper1Member2023-03-310001172069ptos:MarchTwoThousandFourteenMemberus-gaap:CommercialPaperMember2024-03-310001172069ptos:MarchTwoThousandFourteenMemberus-gaap:CommercialPaperMember2023-03-310001172069ptos:FebruaryTwoThousandFourteenMemberus-gaap:CommercialPaperMember2024-03-310001172069ptos:FebruaryTwoThousandFourteenMemberus-gaap:CommercialPaperMember2023-03-310001172069ptos:JanuaryTwoThousandFourteenMemberus-gaap:CommercialPaperMember2024-03-310001172069ptos:JanuaryTwoThousandFourteenMemberus-gaap:CommercialPaperMember2023-03-310001172069ptos:DecemberTwoThousandThirteenMemberus-gaap:CommercialPaperMember2024-03-310001172069ptos:DecemberTwoThousandThirteenMemberus-gaap:CommercialPaperMember2023-03-310001172069ptos:NovemberTwoThousandThirteenMemberptos:CommercialPaper1Member2024-03-310001172069ptos:NovemberTwoThousandThirteenMemberptos:CommercialPaper1Member2023-03-310001172069ptos:NovemberTwoThousandThirteenMemberus-gaap:CommercialPaperMember2024-03-310001172069ptos:NovemberTwoThousandThirteenMemberus-gaap:CommercialPaperMember2023-03-310001172069ptos:OctoberTwoThousandThirteenMemberus-gaap:CommercialPaperMember2024-03-310001172069ptos:OctoberTwoThousandThirteenMemberus-gaap:CommercialPaperMember2023-03-310001172069ptos:SeptemberTwoThousandElevenMemberus-gaap:CommercialPaperMember2024-03-310001172069ptos:SeptemberTwoThousandElevenMemberus-gaap:CommercialPaperMember2023-03-310001172069ptos:JanuaryTwoThousandEighteenMemberus-gaap:CommercialPaperMember2024-03-3100011720692023-02-012023-02-220001172069ptos:CustomerThreeMember2024-03-310001172069ptos:CustomerFiveMember2023-04-012024-03-310001172069us-gaap:ForeignExchangeMember2022-04-012023-03-310001172069us-gaap:ForeignExchangeMember2023-04-012024-03-3100011720692022-11-012022-11-240001172069us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001172069us-gaap:RetainedEarningsMember2024-03-310001172069us-gaap:AdditionalPaidInCapitalMember2024-03-310001172069us-gaap:CommonStockMember2024-03-310001172069us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012024-03-310001172069us-gaap:RetainedEarningsMember2023-04-012024-03-310001172069us-gaap:AdditionalPaidInCapitalMember2023-04-012024-03-310001172069us-gaap:CommonStockMember2023-04-012024-03-310001172069us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001172069us-gaap:RetainedEarningsMember2023-03-310001172069us-gaap:AdditionalPaidInCapitalMember2023-03-310001172069us-gaap:CommonStockMember2023-03-310001172069us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012023-03-310001172069us-gaap:RetainedEarningsMember2022-04-012023-03-310001172069us-gaap:AdditionalPaidInCapitalMember2022-04-012023-03-310001172069us-gaap:CommonStockMember2022-04-012023-03-3100011720692022-03-310001172069us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001172069us-gaap:RetainedEarningsMember2022-03-310001172069us-gaap:AdditionalPaidInCapitalMember2022-03-310001172069us-gaap:CommonStockMember2022-03-3100011720692022-04-012023-03-3100011720692023-03-3100011720692024-03-3100011720692024-07-0700011720692023-09-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended March 31, 2024

or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________________ to _____________________

Commission file number 333-91190

P2 SOLAR, INC. |

(Exact name of registrant as specified in its charter) |

Delaware | | 98-0234680 |

State or other jurisdiction of incorporation | | (IRS Employer Identification Number) |

| | |

13718 91 Avenue, Surrey, British Columbia, Canada | | V3V 7X1 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (778) 321-0047

Securities registered pursuant to Section 12(b) of the Act: None

Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered pursuant to section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of Common Stock held by non-affiliates of the Registrant as of September 30, 2023, the last business day of the Registrant’s most recently completed second fiscal quarter, was approximately $244,550 based on a $0.0047 average bid and asked price on such date. Solely for the purpose of this disclosure, such shares of common stock held by executive officers, directors, and beneficial holders of 10% or more of the outstanding common stock of the Registrant as of such date have been excluded because such persons may be deemed to be affiliates.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

As of July 7, 2024, the Company had 67,946,513 shares issued and outstanding.

Table of Contents

PART I

SPECIAL NOTE OF CAUTION REGARDING FORWARD-LOOKING STATEMENTS

CERTAIN STATEMENTS IN THIS REPORT, INCLUDING STATEMENTS IN THE FOLLOWING DISCUSSION, ARE WHAT ARE KNOWN AS "FORWARD LOOKING STATEMENTS", WHICH ARE BASICALLY STATEMENTS ABOUT THE FUTURE. FOR THAT REASON, THESE STATEMENTS INVOLVE RISK AND UNCERTAINTY SINCE NO ONE CAN ACCURATELY PREDICT THE FUTURE. WORDS SUCH AS "PLANS," "INTENDS," "WILL," "HOPES," "SEEKS," "ANTICIPATES," "EXPECTS "AND THE LIKE OFTEN IDENTIFY SUCH FORWARD LOOKING STATEMENTS BUT ARE NOT THE ONLY INDICATION THAT A STATEMENT IS A FORWARD LOOKING STATEMENT. SUCH FORWARD LOOKING STATEMENTS INCLUDE STATEMENTS CONCERNING THE PLANS AND OBJECTIVES OF THE COMPANY WITH RESPECT TO THE PRESENT AND FUTURE OPERATIONS OF THE COMPANY, AND STATEMENTS WHICH EXPRESS OR IMPLY THAT SUCH PRESENT AND FUTURE OPERATIONS WILL OR MAY PRODUCE REVENUES, INCOME OR PROFITS. NUMEROUS FACTORS AND FUTURE EVENTS COULD CAUSE THE COMPANY TO CHANGE SUCH PLANS AND OBJECTIVES OR FAIL TO SUCCESSFULLY IMPLEMENT SUCH PLANS OR ACHIEVE SUCH OBJECTIVES OR CAUSE SUCH PRESENT AND FUTURE OPERATIONS TO FAIL TO PRODUCE REVENUES, INCOME OR PROFITS. THEREFORE, THE READER IS ADVISED THAT THE FOLLOWING DISCUSSION SHOULD BE CONSIDERED IN LIGHT OF THE DISCUSSION OF RISKS AND OTHER FACTORS CONTAINED IN THIS REPORT ON FORM 10-K AND IN THE COMPANY'S OTHER FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION. NO STATEMENTS CONTAINED IN THE FOLLOWING DISCUSSION SHOULD BE CONSTRUED AS A GUARANTEE OR ASSURANCE OF FUTURE PERFORMANCE OR FUTURE RESULTS.

ITEM 1. BUSINESS

General

P2 Solar, Inc., a Delaware corporation (hereinafter referred to as “we”, “us”, the “Company”, “P2 Solar” or the “Registrant”) has been in existence as a Company (including its predecessor British Columbia Corporation) since 1990. As discussed more fully below, the Company’s current business operations are focused on the construction of residential and commercial rooftop and ground mount solar power plants in Canada.

The Company was initially organized under the laws of British Columbia, Canada, on November 21, 1990, as Spectrum Trading Inc. The Company’s initial business plan was to import leather products from India and sell them in Canada. However, the supplier in India did not materialize and the Company remained dormant until 1997. In 1997, the Company began the chemical manufacturing business. On May 14, 1999, pursuant to Section 388 of the Delaware General Corporation Law, the Company domesticated to Delaware and began a chemical manufacturing business; these operations were phased out at the end of 2008. Subsequent to the Company’s domestication to Delaware, on September 3, 2004, the Company changed its name to Natco International, Inc. On March 11, 2009, the Company changed its name to P2 Solar, Inc.

The principal office of the Company is located at 13718 91 Avenue, Surrey, British Columbia, Canada, V3V 7X1. The address of the registered office of the Company is 16192 Coastal Highway, Lewes, Delaware 19958.

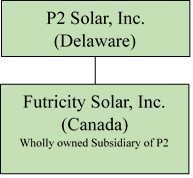

Inter-corporate Relationships

The chart below illustrates the corporate structure of the Company, including its subsidiaries, the jurisdictions of incorporation, and the percentage of voting securities held.

Recent History

April 1, 2022, to March 31, 2023

On March 6, 2015, the Company received a cease trade order from the British Columbia Securities Commission for failure to file records required as an OTC reporting issuer. On November 24, 2022, the Company received a partial revocation order from the British Columbia Securities Commission, permitting the Company to conduct a private placement of an amount of up to $110,000 CAD by way of the issuance of debt securities that are convertible into common shares at $0.03 CAD per share (the “Offering”). Management of the Company has filed the Company’s audited financial statements and paid all outstanding fees to the British Columbia Securities Commission and applied to have the cease trade order fully revoked. There is no guarantee the issuance of a full revocation of the cease trade order in British Columbia in the future.

On December 30, 2022, the Company issued a promissory note on receipt of $10,000 CAD ($7,389 USD). The promissory note is due on demand and bears an interest rate of 5% per annum.

On February 22, 2023, the Company bought all outstanding shares of Futricity Solar, Inc. (“Futricity”), and it became a wholly owned subsidiary of P2 Solar. Futricity was wholly owned by the Director and Officer of the Company. The purchase price is equal to 25% of future operating income of Futricity for the next five years calculated annually to be paid in cash annually for the next five years, payable on April 30th every year starting in 2024 with the last payment to be due on April 30, 2028. Futricity is an installer of rooftop and ground mount solar systems for both residential and commercial properties.

On February 27, 2023, the Company issued a promissory note on receipt of $15,000 CAD ($11,084 USD). The promissory note is due on demand and bears an interest rate of 5% per annum.

April 1, 2023, to March 31, 2024

At the time of the Company’s acquisition of Futricity Solar, Inc. (Futricity) on February 22, 2023, Futricity had $18,000 CAD worth of orders to install rooftop solar systems. Since March 31, 2023, the Company acquired more orders for rooftop solar systems and in the 12 months ending March 31, 2024, have had sales of approximately 166,000 USD. The company completed 112 KW of installations.

On June 15, 2023, the Company paid out in full the Promissory Note payable to Azariah Zemarium in the amount of US$17,841.

On June 29th, 2023, the Company issued a convertible note for $30,000 CAD. The promissory note is due on demand and bears an interest rate of 5% per annum.

On August 14, 2023, the Company issued a convertible note for $20,000 CAD. The promissory note is due on demand and bears an interest rate of 5% per annum.

On September 14, 2023, the Company issued a convertible note for $35,000 CAD. The promissory note is due on demand and bears an interest rate of 5% per annum.

On September 22, 2023, the Company paid out in full the Promissory Notes payable to Tracy Pettersen in the amount of US$36,331 (CAD $49,000).

Description of Business

Principal Products or Services and their Markets

The Company, through its subsidiary Futricity Solar, Inc installs and maintains small residential and commercial rooftop solar systems in Canada. Based on the specific needs of its customers, the Company purchases its solar modules, inverters and other parts from third parties. The Company’s operations to date have been solely in British Columbia but the Company intends to expand to other regions in Canada and potentially certain U.S. states in the next two years.

Sales and Marketing Products and Services

Sales to date of the Company’s products and services have been driven by educational seminars given by management focused on educating builders, contractors and other industry professionals about the advantages and use of solar technology. These seminars also educate them how best to design, sell, and implement solar technology in their projects.

The Company also sells its products and services direct to residential homeowners and small commercial enterprises primarily through referrals from other customers. Management of the Company believes that customer referrals will increase in as the Company develops a foothold in a market and that shortly after market entry customer referral will become an increasingly effective way to market the Company’s solar energy systems.

Status of any Publicly Announced New Product or Service

As of the Company's acquisition of Futricity on February 22, 2023, Futricity had $18000 CAD worth of orders for rooftop solar system installations. As of March 31, 2024, the Company has had sales of $166,000 USD for eight solar systems totaling 112 KW. Management believes these developments show promising progress in the Company's new solar energy business line but there is no guarantee all orders will continue to materialize at this pace.

In addition to the above, the Company diligently accesses new opportunities aimed at expanding its product offerings and services to its customers. The Company remains open to engaging in acquisitions of businesses or product lines, that hold the potential of increasing its market position, granting access to new markets, enhancing the Company’s technological capabilities, and create synergistic opportunities.

Competition

In the solar installation market, the Company competes with companies that offer products similar to its products. Some of these companies have greater financial resources, operational experience, and technical capabilities than the Company. When bidding for solar installation projects, however, the Company’s current experience suggests that there is no clear dominant or preferred competitor in the markets in which the Company competes. Management of the Company does not believe that any competitor has more than 10% of the market across all the areas in which the Company operates.

In the energy sector, the entire solar industry competes with other power generation sources, including conventional options and emerging technologies. Solar power offers distinct advantages and disadvantages when compared to other power-generating technologies. Notable advantages include the flexibility to deploy products in various sizes and configurations, the ability to install products nearly anywhere globally, providing reliable power for numerous applications, and contributing to reduced air, water, and noise pollution. However, other energy sources also have their own advantages, leading electric utilities, grid companies, or other off takers to consider power purchase agreements or other electricity purchase arrangements with specialized companies in those energy sources, rather than with entities such as the Company or other companies specializing in solar power. The advantage solar energy offers over traditional utilities is that it offers customers the opportunity to create their own electricity and reduce dependency from the traditional electrical grid.

Sources and Availability of Raw Materials and the Names of Principal Suppliers

The Company’s primary supply chain involves the procurement of solar equipment for its projects,

together with managing sub-contractors during project construction. The Company purchases equipment, such as solar panels, inverters, and batteries, from various manufacturers and suppliers situated in North America and Asia. This approach ensures that it is not reliant on any single supplier or manufacturer to fulfill product requirements. In the event that any of the Company’s current suppliers reduce or halt production, management is confident in its ability to promptly identify and qualify alternative sources under favorable terms.

In addition, management of the Company is in negotiations to potentially import proprietary panels from a manufacturer in India, which could become the Company’s first branded product.

Dependence on One or a Few Major Customers

The Company earns revenue from completing projects for, or providing defined services to, individual customers. The Company is an early stage company with limited revenue to date. It is therefore possible that revenue for a given period is dependent on a small number of customers.

Intellectual Property

Generally, the Company’s residential and commercial solar installation and maintenance business is not dependent on intellectual property. The Company has no patents, trademarks or copyrights or any other

proprietary rights at the present time. As needed, the Company intends to rely on intellectual property laws, primarily a combination of copyright and trade secret laws in the U.S., and Canada as well as license agreements and other contractual provisions, to protect any proprietary technology of third parties or its own.

Need for Any Government Approval of Principal Products or Services

The Company is licensed as an electrical contractor in British Columbia. If the Company is to operate in other jurisdictions in Canada it will need to obtain the required licenses or contract third parties with the required licenses necessary to operate in that jurisdiction.

The installation of solar energy systems is subject to oversight and regulation in accordance with national, provincial, and local laws and ordinances relating to building, fire and electrical codes, safety, environmental protection, utility interconnection and metering, and related matters. The Company cannot begin the installation of any solar system until it has obtained all necessary approvals and permits for the installation of the system from local authorities and applicable utility electricity providers.

Effect of Existing or Probable Governmental Regulations on the Business

Management believes that there are no identified existing or probable government regulations that will adversely impact the Company’s business.

Under the 2015 Paris Agreement, Canada has pledged to reduce greenhouse gas (GHG) emissions by 40–45% from 2005 levels by 2030 and has made a commitment to reach net zero emissions by 2050. As a result, the Canadian federal and provincial governments offer various tax incentives and grant programs to promote clean energy which includes solar energy.

For instance, the Canadian federal government offers a federal Investment Tax Credit (ITC) for businesses investing in solar energy projects. The ITC provides a tax credit based on a percentage of the total investment cost of eligible solar equipment. This credit helps reduce the overall tax liability of the business, making solar projects more financially viable. The Canadian federal government also has an accelerated capital cost allowance tax incentive that allows businesses to claim a higher rate of depreciation for qualifying solar assets. This means businesses can recover the cost of their solar equipment more quickly, resulting in significant tax savings.

In 2023, the Canadian federal government introduced the Canada Greener Homes Grant through Natural Resources Canada. Under this program Canadian homeowners are eligible up to $40,000 CAD in interest-free loans to help purchase environmentally friendly retrofits. These can include solar panels, more efficient furnaces, or higher quality sealing for windows and doors.

In addition to federal incentives, several Canadian provinces offer their own solar incentive programs. These programs vary by region but may include grants, rebates, feed-in tariffs, or net metering arrangements.

Costs and Effects of Compliance with Environmental Laws

At this time, management of the Company is not aware of any negative costs and effects associated with compliance with environmental laws in its business.

The Company has no intentions of undertaking product manufacturing for the items it plans to market, sell, and install. The manufacturers responsible for producing these products may engage in research, development, manufacturing, and construction activities that involve the use, generation, and discharge of toxic, volatile, or otherwise hazardous chemicals and wastes. These manufacturers are likely to be subject to various federal, state, and local governmental laws and regulations concerning the acquisition, storage, utilization, and disposal of hazardous materials. Moreover, these laws and regulations may impose significant liabilities for non-compliance or for any environmental contamination resulting from the operations associated with the assets of the Company.

Environmental protection regulations have grown increasingly stringent in recent years and may, in certain circumstances, impose "strict liability," making an entity accountable for environmental damage irrespective of negligence or fault on their part. Consequently, such laws and regulations may expose the Company to liability for the actions or conditions caused by others or for the Company’s own actions that were in compliance with all applicable laws at the time they were performed. If these manufacturers fail to adhere to these regulations and are unable to produce the products the Company intends to market and sell, the Company’s business could be adversely affected. In such a scenario, finding replacement manufacturers and products might be both costly and have a material adverse impact on the business and financial results of the Company.

Seasonality

The solar energy market experiences seasonal and quarterly fluctuations due to weather conditions. For instance, in regions like Canada and the northeastern U.S. where winters are notably cold and snowy, there is a usual decrease in solar panel installations. This decline can have an impact on the timing of orders for the Company's solar installation products.

Employees

As of the date of this Form 10-K, the Company does not have any full or part-time employees. All work relating to the Company is carried out by the Company’s management and the installations are sub-contracted.

Reports to Security Holders

The Company files reports with the SEC under section 15d of the Securities Exchange Act of 1934. The reports will be filed electronically. You may read copies of any materials the Company files with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Room 1580, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that will contain copies of the reports the Company files electronically. The address for the SEC Internet site is http://www.sec.gov.

ITEM 1A. RISK FACTORS

With an experienced management team and existing market demand, the management of the Company anticipates growth in the rollout of its business plan. There are, however, factors that are sources of uncertainty, as outlined below.

Risks Related to the Financial Position and Capital Requirements of the Company

The auditors of the Company have indicated doubt about the ability of the Company to continue as a going concern.

The auditors of the Company have expressed doubt about the ability of the Company to continue as a going concern. The financial statements of the Company do not include adjustments that might result from the outcome of this uncertainty. If the Company is unable to generate significant revenue or secure financing, it may be required to cease or curtail its operations.

The operating losses and working capital deficiency of the Company raise substantial doubt about its ability to continue as a going concern. If the Company does not continue as a going concern, investors could lose their entire investment.

The operating losses and working capital deficiency of the Company raise substantial doubt about its ability to continue as a going concern. The Company had an accumulated deficit of $8,105,900 and $7,961,863 as of March 31, 2024 and March 31, 2023, respectively. The Company has incurred annual operating losses from inception until 2024. The Company anticipated becoming profitable as it reduces costs and increases installation revenues as it grows its business. However, there can be no assurances that these actions will result in future or sustained profitability. The Company is subject to all the risks incidental to the sales, development, and costs of construction of new solar energy revenues, and the Company may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect the business of the Company. If the Company does not generate sufficient revenues, does not achieve profitability, or does not have other sources of financing to conduct its business, the Company may have to curtail or cease its development plans and operations, which could cause investors to lose the entire amount of their investment.

The Company has a limited operating history, which could make it difficult to accurately evaluate its business and prospects.

Although the Company was formed in 1990, it did not begin selling solar systems until it acquired Futricity in February 2023. Management believes that its success will depend in large part on its ability to successfully sell solar systems in British Columbia and other provinces against other solar installation companies. Management cannot assure that the Company will operate profitably or that it will have adequate working capital to meet its obligations as they become due.

The Company requires substantial additional funding which may not be available to it on acceptable terms, or at all. If the Company fails to raise the necessary additional capital, it will be unable to achieve growth of its operations.

The Company's ability to obtain the necessary financing to execute its business plan is subject to a number of factors, including general market conditions and investor acceptance of the business plan. These factors may make the timing, amount, terms, and conditions of such financing unattractive or unavailable to the Company. If the Company is unable to raise sufficient funds or generate them through revenues, it will have to significantly reduce its spending, delay or cancel its planned activities, or substantially change its current corporate structure. There is no guarantee that the Company will be able to obtain any funding or that it will have sufficient resources to continue to conduct its operations as projected, any of which could mean that it will be forced to discontinue its operations.

The financial results of the Company may fluctuate and may be difficult to forecast, and this may cause a decline in the trading price of the common stock of the Company.

The revenues, expenses and operating results of the Company are difficult to predict given the limited history of current operations of the Company. Management of the Company expects that its operating results will continue to fluctuate in the future due to a number of factors, some of which are beyond control of the Company. These factors include, but are not limited to:

| · | ability to create and increase brand awareness; |

| · | ability to attract new customers; |

| · | ability to increase customer base; |

| · | seasonal consumer demand for solar energy products; |

| · | the amount and timing of costs relating to the expansion of operations, including sales and marketing expenditures; |

| · | changes in competitive and economic conditions generally; |

| · | ability to manage third-party outsourced operations; and |

| · | changes in the cost or availability of outside contractors. |

Due to all of these factors, the operating results of the Company may fall below the expectations of investors, which could cause a decline in the trading price of the common stock of the Company.

The Company does not have an compensation committee, stockholders will have to rely on the entire Board of Directors to perform these functions.

The Company does not have an compensation committee comprised of independent directors. Indeed, it does not have any compensation committee. These functions are performed by the Board of Directors as a whole which currently consists of three people. Thus, there is a potential conflict in that board members who are also part of management will participate in discussions concerning management compensation issues that may affect management decisions.

If the Company fails to maintain an effective system of internal controls, it may not be able to accurately report on its financial results or detect fraud. Consequently, investors could lose confidence in the financial reporting of the Company and this may decrease the trading price of the common stock of the Company.

The Company must maintain effective internal controls to provide reliable financial reports and detect fraud. Management of the Company has been assessing the internal controls of the Company to identify areas that need improvement. Failure to identify and thereafter implement required changes to the internal controls of the Company or any others that management identifies as necessary to maintain an effective system of internal controls, if any, could harm the operating results of the Company and cause investors to lose confidence in the reported financial information of the Company. Any such loss of confidence would have a negative effect on the trading price of the common stock of the Company.

The Company is an “emerging growth company,” and as a result has reduced reporting requirements which may make the common stock of the Company less attractive to investors.

The Company is an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the JOBS Act. As an emerging growth company, it is exempt from a number of reporting requirements that are applicable to other public companies that are not emerging growth companies, including:

| · | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| · | not being required to comply with the auditor attestation requirements in the assessment of its internal control over financial reporting; |

| · | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| · | reduced disclosure obligations regarding executive compensation; and |

| · | not being required to hold a non-binding advisory vote on executive compensation or obtain stockholder approval of any golden parachute payments not previously approved. |

Further, the JOBS Act permits an “emerging growth company” such as the Company to take advantage of an extended transition time to comply with new or revised accounting standards as applicable to public companies. The Company has elected to extend the transition period for complying with new or revised accounting standards applicable to public companies. The Company has also elected to extend the transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act until the earlier of the date where the Company (i) is no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in the JOBS Act. As a result, the financial statements of the Company may not be comparable to companies that comply with new or revised accounting pronouncements as of public company effective dates.

The Company intends to take advantage of these reporting exemptions until it is no longer an emerging growth company. The Company will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of a sale of securities of the Company under a registration statement, (b) it has total annual gross revenue of at least $1.235 billion or (c) it is deemed to be a large accelerated filer, which means the market value of the common stock of the Company that is held by non- affiliates exceeds $700 million as of the prior September 30 and (2) the date on which the Company has issued more than $1.0 billion in non-convertible debt during the prior three-year period.

Risks Related to the Business of the Company

The business of the Company is concentrated in British Columbia, putting it at risk of region-specific disruptions.

Currently, 100% of the solar installations completed by the Company are in British Columbia. In addition, management of the Company expects future growth to occur in British Columbia during the fiscal years of 2023-2024, which will further concentrate the Company’s customer base and operational infrastructure. Accordingly, the business and results of operations of the Company are particularly susceptible to adverse economic, regulatory, political, weather and other conditions in British Columbia and in other markets that it may become similarly concentrated.

The Company has a limited operating history in the solar installation industry and as such may not be successful in overcoming certain risks experienced by early stage companies.

The Company has a limited operating history with its solar energy installation products and has been involved primarily in organizational matters. It has also generated limited revenues from its solar energy products to date. Consequently, the Company's operations are subject to all the risks inherent in the establishment of new technology and products in industries within which it is not necessarily familiar. The Company has encountered and will continue to encounter risks and difficulties frequently experienced by early stage companies, including the risks described in this document. If these risks are not addressed successfully, the Company's business, financial condition, results of operations, and prospects will be adversely affected, and the market price of its common stock could decline. As such, any predictions about the Company's future revenue and expenses may not be as accurate as they would be if it had a longer operating history in solar energy technology and products or operated in a more predictable market.

The Company acts as the licensed general contractor for its customers and is subject to risks associated with construction, cost overruns, delays, regulatory compliance, and other contingencies, any of which could have a material adverse effect on its business and results of operations.

The Company is a licensed contractor and serves as the general contractor, electrician, construction manager, and installer for its solar energy systems. It may be liable to customers for any damage it causes to their home, belongings, or property during the installation of its systems. For instance, the Company penetrates its customers' roofs during the installation process and may incur liability for the failure to adequately weatherproof such penetrations following the completion of solar energy systems installation. Additionally, since the solar energy systems deployed are high-voltage energy systems, the Company may incur liability for the failure to comply with electrical standards and manufacturer recommendations. The Company's profit on a particular installation is based, in part, on assumptions about the project's cost, and cost overruns, delays, or other execution issues may prevent it from achieving expected results or covering its costs for that project.

Furthermore, the installation of solar energy systems is subject to oversight and regulation in accordance with national, state, and local laws and ordinances relating to building, fire and electrical codes, safety, environmental protection, utility interconnection, metering, and related matters. It is difficult and costly for the Company to track the requirements of every authority having jurisdiction over its operations and solar energy systems. Any new government regulations or utility policies pertaining to the Company's systems, or changes to existing government regulations or utility policies pertaining to its systems, may result in significant additional expenses to the Company and its customers, potentially causing a significant reduction in demand for its systems.

The Company depends on its Chief Executive Officer to manage the business of the Company. The loss of services of this officer could adversely affect the business of the Company and negatively affect the financial condition, results of operations, cash flow and trading price of the common stock of the Company.

The business of the Company is largely dependent upon the continued efforts of its chief executive officer, Raj-Mohinder Gurm. Although the Company has an employment agreement with Mr. Gurm, it does not guarantee that Mr. Gurm will continue to work for the Company. The loss of Mr. Gurm could affect the ability of the Company to operate and, depending upon the nature of the termination of his relationship, could result in substantial severance payments which the Company may have difficulty in funding.

The Company has a heighted risk of conflict of interest and self-dealing given the size of its Board of Directors.

The Company's Board of Directors comprises only two members, one of which is also the only officer of the Company, which heightens the risk of conflicts of interest and potential self-dealing. With a limited number of directors, individual decisions and actions may carry greater weight, increasing the potential for personal interests to conflict with the best interests of the Company and its shareholders. For instance, the Chief Executive Officer, who is also a Director of the Company, will be able to control his own compensation and to approve dealings, if any, by the Company with other entities with which he is also involved.

The small Board size raises concerns about independent oversight and objectivity in corporate governance practices. Conflicts of interest could lead to decisions favoring personal gain or external affiliations over shareholder value, potentially resulting in reputational damage, regulatory scrutiny, and legal liabilities. Although the Chief Executive and Board intends to act fairly and in full compliance with their fiduciary obligations, there can be no assurance that the Company will not, as a result of the conflict of interest described above, sometimes enter into arrangements under terms less beneficial to the Company than it could have obtained had it been dealing with unrelated persons.

The Company operates in a highly competitive industry with no barrier to entry. Existing or future competitors may have significantly greater resources than the Company, which may make it difficult for the Company to compete.

The Company is involved in a highly competitive industry where many of its current and potential competitors have longer operating histories, larger customer bases, greater brand recognition, and significantly more substantial financial, marketing, and other resources compared to its own. Additionally, some of its competitors may be able to allocate greater resources to marketing and promotional campaigns, adopt more aggressive pricing strategies, and dedicate substantially more resources to systems development than the Company can. The intensification of competition may lead to reduced operating margins, loss of market share, and a potential weakening of the Company's brand franchise. The Company cannot provide assurance that it will be able to compete successfully against existing or future competitors.

The Company does not have any full-time employees or consultants, which could have a negative impact on the business of the Company and its profitability.

The Company's operational structure lacks full-time employees or consultants. Further, consultants and contractors working with the Company are not subjected to an exclusive contractual relationship with it. Relying on external contractors or temporary consultants may lead to dependency on third-party services, impacting the quality, availability, and consistency of support crucial for achieving the business objectives of the Company. Furthermore, the Company's reliance on external resources may be subject to fluctuations in availability and competition from other organizations, leading to potential delays in project timelines or inefficient scaling of operations. It may also result in variable costs and unexpected expenses due to fluctuations in contractor rates, market conditions, or the need for additional expertise. As a consequence, the budgeting and financial planning of the Company may be impacted. The Company may face challenges in ensuring consistency and meeting expected performance levels, as it may have limited control and oversight over the activities and deliverables of external parties. These risks could adversely affect the Company’s business, financial condition, and results of operations.

The Company’s business will be impaired it if loses any of the necessary license to operate or if more stringent government regulations are enacted or if the Company fails to comply with the growing number of regulations pertaining to solar energy and consumer financing industries.

The installation of solar energy systems performed by the Company is subject to oversight and regulation under local ordinances, building, zoning and fire codes, environmental protection regulation, utility interconnection requirements, and other rules and regulations. Any financing transactions by the Company are subject to numerous consumer credit and financing regulations. There is no guarantee that the Company will properly and timely comply with all laws and regulations that may affect its business. If the Company fails to comply with these laws and regulations, it may be subject to civil and criminal penalties. In addition, non-compliance with certain consumer disclosure requirements related to home solicitation sales and home improvement contract sales affords residential customers with a right to rescind such contracts in some jurisdictions.

Risks Related to Industry

The reduction, elimination or expiration of government subsidies and economic incentives for solar electricity applications could reduce demand for solar power systems and harm the Company’s business.

The demand for solar power systems in the market is closely tied to the availability and scale of government subsidies and economic incentives at the local, provincial, and federal levels, which can vary significantly across geographic regions. The reduction, elimination, or expiration of these subsidies and incentives for solar electricity applications poses a potential threat to the business of the Company.

Solar electricity currently enjoys a competitive edge over conventional and non-solar renewable sources due to its cost-effectiveness, a trend management expects to continue in the foreseeable future. To promote the adoption of solar electricity and reduce reliance on traditional energy sources, federal, provincial, and local governments in Canada have provided incentives such as feed-in tariffs, rebates, tax credits, and other forms of support to system owners, distributors, system integrators, and solar power system manufacturers.

However, many of these government incentives have expiration dates, may phase out gradually, or depend on allocated funding that can deplete over time. Furthermore, some incentives require renewal by the relevant authorities to sustain their effectiveness. The risk also lies in the possibility of other electric utility companies or generators lobbying for legislative changes that could adversely impact the solar industry.

Any reduction, elimination, or expiration of government incentives could tilt the competitive balance in favor of non-solar renewable sources and traditional electricity, leading to a potential decline in demand for solar PV systems and adversely affecting product sales and overall revenue of the Company.

As the Company relies on these incentives to foster a favorable market environment for its solar energy solutions, any adverse changes in the incentive landscape could hinder the growth of the solar electricity industry and pose risks to the financial performance of the business of the Company. The Company continually monitors regulatory developments and strives to adapt its strategies accordingly to mitigate potential impacts on its operations. However, there remains inherent uncertainty concerning the sustainability of government incentives and their long-term effects on the business of the Company.

A material reduction in the retail price of traditional utility-generated electricity or electricity from other sources could have adverse effects on the Company's business, financial condition, results of operations, and prospects.

The Company believes that a significant portion of its customers choose solar energy to benefit from lower electricity costs compared to those offered by traditional utilities. However, the broad market adoption of distributed commercial and residential solar energy remains relatively low, with penetration into less than 5% of its total addressable market in Canada.

Moreover, customers' decisions to opt for solar energy may also be influenced by the cost of other renewable energy sources. Any decrease in the retail prices of electricity from traditional utilities or alternative renewable sources could impede the Company's ability to maintain competitive pricing and negatively impact its business. Factors contributing to potential declines in utility electricity prices include the construction of new power generation plants, improvements in energy transmission efficiency, reductions in natural gas prices, utility rate adjustments, energy conservation technologies, public initiatives to reduce electricity consumption, advancements in energy storage technologies, or the development of more cost-effective energy generation technologies.

Should utility electricity prices decrease due to any of these reasons or other factors, the Company may face a competitive disadvantage, challenges in attracting new customers, and limitations on its growth potential. The economic attractiveness of purchasing or leasing the Company's solar energy systems could diminish, thereby impacting on its overall market competitiveness and growth prospects.

The Company's ability to offer economically viable solar energy systems to customers depends on its capacity to assist customers in arranging financing for such installations, which may be impeded by changes to government subsidies and grant programs.

The solar energy systems the Company installs have historically been eligible for Federal tax credits, Federal and provincial grants, as well as depreciation benefits. The Company has relied on financing structures that monetize a significant portion of these benefits, facilitating financing for the solar energy systems. Should customers become unable to monetize these benefits through such government programs, the Company's ability to provide and maintain solar energy systems for new customers on an economically viable basis may be compromised.

The availability of tax-advantaged financing relies on various factors, including financial and credit market conditions, changes in legal or tax risks associated with such financings, and the potential non-renewal or reduction of associated incentives. If government incentivized grants are no longer available for new solar energy systems, changes in laws or interpretations by the Canada Revenue Agency and the courts could reduce funding sources' willingness to provide funds for customers seeking to adopt these solar energy systems. The Company cannot guarantee the continuous availability of this type of financing to its customers. If financing for solar energy systems becomes unattainable, the Company may be unable to offer solar energy systems to new customers on an economically viable basis, which could have a material adverse impact on its business, financial condition, and results of operations.

The purchase and installation of solar energy systems faces potential adverse effects from rising interest rates.

Increases in interest rates could elevate its cost of capital, resulting in higher interest expenses and increased costs for purchasing solar energy systems for installation. Moreover, higher interest rates may negatively affect the Company's ability to arrange favorable financing terms for customers purchasing its solar energy systems. As the majority of the Company's cash flows have originated from solar energy system sales, rising interest rates may dampen consumer purchasing behavior due to increased financing costs. Consequently, higher interest rates could impact the Company's costs and revenue, leading to an adverse effect on its business, financial condition, and results of operations.

The Company faces the risk of not being able to compete successfully against other solar and energy companies, which may hinder the development of its operations and lead to negative consequences for its business.

The solar and energy industries are highly competitive in Canada and globally, with rapid technological advancements. The Company competes with other solar companies that have similar business models, as well as those in the downstream value chain of solar energy. This includes finance-driven organizations that acquire customers and subcontract installation, installation businesses seeking external financing, large construction companies, utilities, and increasingly, sophisticated electrical and roofing companies. Some competitors specialize in the commercial or residential solar energy market and may offer energy at lower costs. Additionally, certain competitors are vertically integrating to ensure supply and control costs. Many of these competitors have strong brand recognition and extensive knowledge of the Company's target markets. If the Company cannot effectively compete in this competitive market, it will have adverse effects on its business, financial condition, and results of operations.

Adverse economic conditions may have material adverse consequences on the solar energy industry and on the Company’s business, results of operations and financial condition.

The solar energy industry may be significantly impacted by adverse economic conditions. Unpredictable changes, such as recession, inflation, increased government intervention, or other economic shifts, could adversely affect the solar energy industry and the Company’s general business strategy. The Company relies on generating additional sources of liquidity and may need to raise additional funds through public or private debt or equity financings to fund existing operations or capitalize on opportunities, including acquisitions. Any adverse economic event could have a material adverse impact on the Company's business, results of operations, and financial condition.

Developments in alternative technologies or improvements in distributed solar energy generation may materially adversely affect demand for the current solar energy products.

Significant developments in alternative technologies, such as advances in other forms of distributed solar power generation, storage solutions such as batteries, the widespread use or adoption of fuel cells for residential or commercial properties or improvements in other forms of centralized power production may materially and adversely affect the Company’s business and prospects in ways management of the Company do not currently anticipate. Any failure by the Company to adopt new or enhanced technologies or processes, or to react to changes in existing technologies, could materially delay deployment of oits solar energy systems, which could result in product obsolescence, the loss of competitiveness of the systems the Company sells and installs, decreased revenue and a loss of market share to competitors.

Risks Related to the Common Stock of the Company

The British Columbia Securities Commission has issued a cease trade order in respect of the securities of the Company for failing to comply with certain reporting obligations under applicable Canadian securities laws.

As an “OTC reporting issuer” under applicable Canadian securities laws, the Company is required to make periodic filings with applicable Canadian securities authorities, including annual and interim financial statements and management’s discussion & analysis relating to those periods. Due to a lack of sufficient funds, the Company did not file its interim financial statements and Management's Discussion and Analysis for the interim period ended December 31, 2014. On March 6, 2015, the British Columbia Securities Commission issued a cease trade order in respect of the securities of the Company. As a result of this order, holders of securities of the Company in Canada are not able to trade securities of the Company until the order is revoked.

On November 24, 2022, the Company received a Partial Revocation Order from the British Columbia Securities Commission, permitting the Company to conduct a private placement of an amount of up to $110,000 by way of the issuance of debt securities that are convertible into common shares at $0.03 per share. Management of the Company has filed the Company’s audited financial statements and paid all outstanding fees to the British Columbia Securities Commission and has applied to have the cease trade order fully revoked. There is no guarantee the issuance of a full revocation of the cease trade order in British Columbia in the future.

The Company does not expect to declare a cash dividend on its common stock in the foreseeable future.

The Company has never declared or paid a cash dividend on its common stock, and management does not anticipate paying cash dividends in the foreseeable future. The Company expects to use future earnings, if any, as well as any capital that may be raised in the future, to fund business growth. Consequently, a stockholder’s only opportunity to achieve a return on investment would be for the price of the Company’s common stock to appreciate. Management of the Company cannot assure stockholders of a positive return on their investment when they sell their shares, nor can management assure that stockholders will not lose the entire amount of their investment.

There has been only a limited public market for the common stock of the Company and an active trading market for the common stock may not develop in the future.

There has not been any broad public market for the common stock of the Company, and an active trading market may not develop or be sustained. The trading volume of the common stock of the Company may be and has been limited and sporadic. It is doubtful a broader or more active public trading market for the common stock of the Company will develop or be sustained.

Investors may have difficulty in reselling their shares due to the lack of market.

The common stock of the Company is not currently traded on any exchange but is quoted on OTC Markets Pink marketplace under the trading symbol “PTOS.” There is a limited trading market for the common stock of the Company. There is no guarantee that any significant market for the securities of the Company will ever develop.

Moreover, the common stock of the Company falls under the category of "Penny Stock" in the United States, according to SEC Rule 15g-9, and is subject to specific regulations governing its sale to investors. A "Penny Stock" is defined as any equity security with a market price of less than $5.00 per share or an exercise price of less than $5.00 per share, with certain exceptions.

Due to these regulations, brokers must comply with stringent requirements when handling transactions involving "Penny Stocks." This includes obtaining financial information and investment experience objectives of the investor, making a reasonable determination of the suitability of penny stock transactions for the investor, and ensuring the investor possesses sufficient knowledge and experience in financial matters to assess the associated risks.

Additionally, brokers are obligated to deliver a disclosure schedule prescribed by the SEC, outlining the basis for the suitability determination and the signed, written agreement from the investor before proceeding with any penny stock transaction. There are also mandatory disclosures about the risks of investing in penny stocks, commissions payable to the broker-dealer and registered representative, current quotations for the securities, and the rights and remedies available to investors in case of fraud in penny stock transactions. Furthermore, monthly statements must be provided, including recent price information for the penny stock held in the account and details about the limited market for penny stocks.

Due to these regulatory complexities and disclosure requirements, brokers may be less willing to execute transactions involving securities subject to "penny stock" rules. As a result, it may be more challenging for the Company's stockholders to sell shares of the common stock of the Company.

The market price of the common stock of the Company may fluctuate significantly, and stockholders may lose all or a part of their investment.

The market prices for securities of solar and energy companies have historically been highly volatile, and the market has from time-to-time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. The market price of the common stock of the Company may fluctuate significantly in response to numerous factors, some of which are beyond its control, such as:

| · | adverse regulatory decisions; |

| · | changes in laws or regulations applicable to the products or services of the Company; |

| · | legal disputes or other developments relating to proprietary rights, including patents, litigation matters, and the results of any proceedings or lawsuits, including patent or stockholder litigation; |

| · | the Company’s dependence on third parties; |

| · | announcements of the introduction of new products by competitors; |

| · | market conditions in the solar and energy sectors; |

| · | announcements concerning product development results or intellectual property rights of others; |

| · | future issuances of common stock or other securities; |

| · | the addition or departure of key personnel; |

| · | failure to meet or exceed any financial guidance or expectations that the Company may provide to the public; |

| · | actual or anticipated variations in quarterly operating results; |

| · | the Company’s failure to meet or exceed the estimates and projections of the investment community; |

| · | overall performance of the equity markets and other factors that may be unrelated to the operating performance of the Company or the operating performance of its competitors, including changes in market valuations of similar companies; |

| · | announcements of significant acquisitions, strategic partnerships, joint ventures or capital commitments by the Company or its competitors; |

| · | issuances of debt or equity securities; |

| · | sales of common stock by the Company or its stockholders in the future; |

| · | trading volume of the common stock of the Company; |

| · | ineffectiveness of the internal controls of the Company; |

| · | publication of research reports about the Company or the solar industry or positive or negative recommendations or withdrawal of research coverage by securities analysts; |

| · | general political and economic conditions; |

| · | effects of natural or man-made catastrophic events; and, |

| · | other events or factors, many of which are beyond the control of the Company. |

Further, the equity markets in general have recently experienced extreme price and volume fluctuations. Continued market fluctuations could result in extreme volatility in the price of the common stock of the Company, which could cause a decline in the value of the common stock. Price volatility of the common stock of the Company might worsen if the trading volume of the common stock is low. The realization of any of the above risks or any of a broad range of other risks, including those described in these “Risk Factors,” could have a dramatic and material adverse impact on the market price of the common stock of the Company.

Future issuances of debt securities and equity securities may have adverse effects on the market price of shares of the Company's common stock and could be dilutive to existing stockholders.

In the future, the Company may choose to issue debt or equity securities or incur other financial obligations, including stock dividends and shares exchanged for common units and equity plan shares/units. In the event of liquidation, holders of the Company's debt securities, other loans, and preferred stock will be entitled to receive distributions from its available assets before common stockholders. The Company is not obligated to offer any such additional debt or equity securities to existing stockholders on a pre-emptive basis. Consequently, any issuance of additional common stock, whether directly or through convertible or exchangeable securities (such as common units and convertible preferred units), warrants, or options, could result in the dilution of existing common stockholders' holdings. Additionally, the perception of such issuances may negatively impact the market price of the Company's common stock.

If the Company issues convertible preferred units or any series or class of preferred stock, such securities may carry preferences on distribution payments, periodically or upon liquidation. These preferences could limit or eliminate the Company's ability to distribute to common stockholders.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not Applicable.

ITEM 2. PROPERTIES

The Company does not own or lease any property.

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

The Company’s shares trade on the OTCPK under the symbol “PTOS.” The following table sets forth the high and low bid prices of common stock of the Company (USD) for the last two fiscal years and subsequent interim period, as reported by the OTC Markets Group Inc. and represents inter dealer quotations, without retail mark-up, mark-down or commission and may not be reflective of actual transactions:

| | (U.S. $) | |

| | | | | | |

2021 | | HIGH | | | LOW | |

Quarter Ended Jun 30, 2021 | | | 0.0300 | | | | 0.0002 | |

Quarter Ended September 30, 2021 | | | 0.0975 | | | | 0.0001 | |

Quarter Ended December 31, 2021 | | | 0.0799 | | | | 0.0125 | |

Quarter Ended March 31, 2022 | | | 0.0397 | | | | 0.0101 | |

| | | | | | | | |

2022 | | HIGH | | | LOW | |

Quarter Ended Jun 30, 2022 | | | 0.11875 | | | | 0.01100 | |

Quarter Ended September 30, 2022 | | | 0.06500 | | | | 0.01500 | |

Quarter Ended December 31, 2022 | | | 0.03000 | | | | 0.00152 | |

Quarter Ended March 31, 2023 | | | 0.03500 | | | | 0.00610 | |

| | | | | | | | |

2023 | | HIGH | | | LOW | |

Quarter Ended Jun 30, 2023 | | | 0.0100 | | | | 0.0043 | |

Quarter Ended September 30, 2023 | | | 0.0100 | | | | 0.0280 | |

Quarter Ended December 31, 2023 | | | 0.0077 | | | | 0.0043 | |

Quarter Ended March 31, 2024 | | | 0.0080 | | | | 0.0043 | |

Holders

As of March 31, 2024, there were 67,946,513 shares of common stock issued and outstanding and approximately 80 holders of record.

Dividends

The Company has not declared or paid any cash dividends on its common stock during the fiscal years ended March 31, 2024 or 2023. There are no restrictions on the common stock that limit the ability of us to pay dividends if declared by the Board of Directors and the loan agreements and general security agreements covering the Company’s assets do not limit its ability to pay dividends. The holders of common stock are entitled to receive dividends when and if declared by the Board of Directors, out of funds legally available therefore and to share pro-rata in any distribution to the stockholders. Generally, the Company is not able to pay dividends if after payment of the dividends, it would be unable to pay its liabilities as they become due or if the value of the Company’s assets, after payment of the liabilities, is less than the aggregate of the Company’s liabilities and stated capital of all classes.

Exchange Rates

The Company is a Delaware company based in Canada. The Company maintains its books of account in Canadian dollars and its shares of its common stock trade on the OTCPK in United States of America. The Company’s common stock trades in US dollars and therefore, this report is presented in US dollars. The following table sets forth, for the periods indicated, certain exchange rates based on the noon rate provided by the Bank of Canada. Such rates are the number of Canadian dollars per one (1) U.S. dollar. The high and low exchange rates for each month during the previous six months were as follows:

| | High | | | Low | |

June 2024 | | | 0.7334 | | | | 0.7264 | |

May 2024 | | | 0.7345 | | | | 0.7268 | |

April 2024 | | | 0.7405 | | | | 0.7235 | |

March 2024 | | | 0.7423 | | | | 0.7357 | |

February 2024 | | | 0.7460 | | | | 0.7363 | |

January 2024 | | | 0.7510 | | | | 0.7395 | |

December 2023 | | | 0.7573 | | | | 0.7353 | |

ITEM 6. RESERVED

Not Applicable.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

Background and Overview

P2 Solar, Inc., incorporated in the State of Delaware, has been in existence as a Company (including its predecessor British Columbia Corporation) since 1990. the Company’s current business operations are focused on the construction and installation of residential and commercial rooftop and ground mount solar energy systems in Canada. The Company is currently an emerging stage company.

The Company has limited revenues and is dependent upon financing to continue basic operations. Management intends to rely upon advances or loans from management, significant stockholders or third parties to meet the cash requirements of the Company, but the Company has not entered into written agreements guaranteeing funds and, therefore, no one is obligated to provide funds to the Company in the future. These factors raise substantial doubt as to the ability of the Company to continue as a going concern.

Results of Operation

The following discussion and analysis provide information that management of the Company believes is relevant to an assessment and understanding of the results of operation and financial condition of the Company for the year ended March 31, 2024, as compared to the year ended March 31, 2023. The Company’s financial statements are stated in US Dollars and are prepared in accordance with generally accepted accounting principles of the United States (“GAAP”).

Year ended March 31, 2024, and March 31, 2023

| | Year Ended | | | | | | | |

| | March 31, | | | Change | | | Change | |

| | 2024 | | | 2023 | | | Amount | | | Percentage | |

Revenue | | $ | 166,288 | | | $ | - | | | $ | 166,288 | | | | 100 | % |

Cost of Goods Sold | | | 99,313 | | | | - | | | | 99,313 | | | | 100 | % |

Gross Profit | | | 66,975 | | | | - | | | | 66,975 | | | | 100 | % |

Operating expenses | | | 181,917 | | | | 88,487 | | | | 93,429 | | | | 106 | % |

Loss from operations | | | (114,942 | ) | | | (88,487 | ) | | | (26,455 | ) | | | 30 | % |

Other expenses | | | (33,486 | ) | | | (89,041 | ) | | | 55,556 | | | | -62 | % |

Net Loss | | $ | (148,426 | ) | | $ | (177,528 | ) | | $ | 29,102 | | | | -16 | % |

Foreign currency adjustment | | | 2,812 | | | | 129,580 | | | | (126,788 | ) | | | -98 | % |

Comprehensive income (loss) | | | (145,614 | ) | | | (47,948 | ) | | | (97,666 | ) | | | 204 | % |

Sales

During the year ended March 31, 2024, the Company had sales of $166,288 as compared to sales of $nil during the year ended March 31, 2023. The Company started to generate sales from installation of rooftop solar systems during Q1 ended June 30, 2023 upon the acquisition of Futricity in February 2023.

Operating Expenses

During the year ended March 31, 2024, the Company had operating expenses of $181,917 as compared to operating expenses of $88,487 during the year ended March 31, 2023, an increase of $93,429, or approximately 106%. The increase in operating expenses was attributed to the increase in general and administration expenses and professional fees in supporting the increased business activities resulted from the acquisition of Futricity.

Comprehensive Loss

The Company had comprehensive loss of $145,614 for the year ended March 31, 2024, as compared to a loss and comprehensive loss of $47,948 for the year ended March 31, 2023, a change of $97,666 or approximately 204%. The increase in comprehensive loss for the year ended March 31, 2024 from the year ended March 31, 2023 was primarily attributable to an decrease in foreign currency gain for the year ended March 31, 2024. Actual net loss for the year ended March 31, 2024 was $148,426 as compared to net loss of $177,528 for the year ended March 31, 2023.

Liquidity and Capital Resources

Working Capital (Deficiency) | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | March 31, 2024 | | | March 31, 2023 | | | Change Amount | | | hange Percentage | |

Current Assets | | $ | 24,358 | | | $ | 16,907 | | | $ | 7,451 | | | | 44 | % |

Current Liabilities | | | 1,860,218 | | | | 1,707,152 | | | | 153,066 | | | | 9 | % |

Working Capital (Deficiency) | | $ | (1,835,861 | ) | | $ | (1,690,245 | ) | | | (145,616 | ) | | | 9 | % |

As of March 31, 2024, the Company’s audited balance sheet reflects total assets of $24,358, as compared to total assets of $16,907 during the fiscal year ended March 31, 2023, an increase of $7,451 or approximately 44%. The increase was primarily attributable to an increase in accounts receivable and prepaid expenses.