We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| National Healthcare Properties Inc (PK) | USOTC:HLTC | OTCMarkets | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 1.84 | 1.84 | 1.84 | 0.00 | 00:00:00 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

(Exact Name of Registrant as Specified in Charter)

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

|

|

(Address, including zip code, of Principal Executive Offices)

Registrant’s telephone number,

including area code: ( |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading Symbol(s) | Name of each exchange on which registered: | ||

| The Global Market | ||||

| The Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

Investor Presentation and Transcript

Healthcare Trust, Inc. (the “Company”) prepared an investor presentation containing certain portfolio information and financial highlights. Representatives of the Company intend to present some of or all of this presentation to current investors and their financial advisors at various conferences and meetings, including webinars. A copy of the investor presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

On August 30, 2023, the Company hosted a conference call to discuss its financial and operating results for the quarter ended June 30, 2023. A transcript of the pre-recorded portion of the webcast is furnished as Exhibit 99.2 to this Current Report on Form 8-K. A copy of the presentation and replay of this webcast will be available on the Company’s website at www.healthcaretrustinc.com in the news section.

Neither the investor presentation nor transcript shall be deemed “filed” for any purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Item 7.01, as well as Exhibit 99.1 and Exhibit 99.2, shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language in such filing.

Forward-Looking Statements

The statements in this Current Report on Form 8-K that are not historical facts may be forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause actual results or events to be materially different. The words “anticipates,” “believes,” “expects,” “estimates,” “projects,” “plans,” “intends,” “may,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties and other factors, many of which are outside of the Company’s control, which could cause actual results to differ materially from the results contemplated by the forward-looking statements. These risks and uncertainties include the potential adverse effects of (i) the global COVID-19 pandemic, including actions taken to contain or treat COVID-19, (ii) the geopolitical instability due to the ongoing military conflict between Russia and Ukraine, including related sanctions and other penalties imposed by the U.S. and European Union, and the related impact on the Company, the Company’s tenants, the Company’s operators and the global economy and financial markets, and (iii) inflationary conditions and higher interest rate environments, as well as those risks and uncertainties set forth in the Risk Factors section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed on March 17, 2023, and all other filings with the Securities and Exchange Commission after that date, as such risks, uncertainties and other important factors may be updated from time to time in the Company’s subsequent reports. Further, forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise any forward-looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required to do so by law.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Investor Presentation | |

| 99.2 | Transcript | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| HEALTHCARE TRUST, INC. | ||

| Date: August 30, 2023 | By: | /s/ Scott M. Lappetito |

|

Scott M. Lappetito Chief Financial Officer, Secretary and Treasurer | ||

Exhibit 99.1

1 Healthcare Trust, Inc. Second Quarter 2023 Investor Webcast Presentation

2 Q2’23 Company Overview (1) Based on total real estate investments, at cost of approximately $2.6 billion, net of gross market lease intangible liabiliti es of $29.4 million as of June 30, 2023. (2) Percentages are based on NOI for the three months ended June 30, 2023. See appendix for Non - GAAP reconciliations. (3) See Definitions in the Appendix for a full description. (4) As of August 2, 2023. See Definitions in the Appendix for a full description. (5) Refer to page 6 for additional information. (6) Renewal leasing activity from January 1, 2023 through August 15, 2023 HTI is a $2.6 billion (1) healthcare REIT with a high - quality portfolio focused on two segments, Medical Office Buildings (“MOB”) and Senior Housing Operating Properties (“SHOP”) High Quality Portfolio x High - quality portfolio featuring 202 properties that are 75% MOB and 25% SHOP (2) x Proactive MOB leasing activity with 12 lease renewals completed in Q2’23 totaling over 59,400 SF. Year to date (6) , HTI completed 35 lease renewals totaling over 207,500 SF at a positive Lease Renewal Rental Spread (3) of 5.4% x Geographically diversified portfolio across 33 states with select concentrations in states that management believes to have favorable demographic tailwinds Diligent Acquisition Program (5) x HTI is negotiating the acquisition of a two - property portfolio which would bring total YTD 2023 closed and pipeline acquisitions to $35 million at a weighted average cap rate of 7.6% and a weighted average lease term remaining of 10.2 years Resilient Performance x SHOP portfolio NOI improved by 14.1% to $8.1 million in Q2'23 from $7.1 million in Q2’22 as a result of increased revenue and reduced expenses x MOB portfolio NOI improved by 1.7% to $24.5 million in Q2'23 from $24.1 million in Q2’22 as revenues continued to increase as a result of accretive acquisitions and leasing activity x Collected nearly 100% of MOB Cash Rent (4) due in Q2'23 x HTI’s exposure to MOB, which management believes to have more predictable cash flows than SHOP assets, was 75% (2) as of Q2'23 x As of Q2'23, HTI maintained Net Leverage (3) of 38.9% Experienced Management Team x Proven track record with significant public REIT market experience x Dedicated SHOP management team that collectively has over 80 years of SHOP operating experience

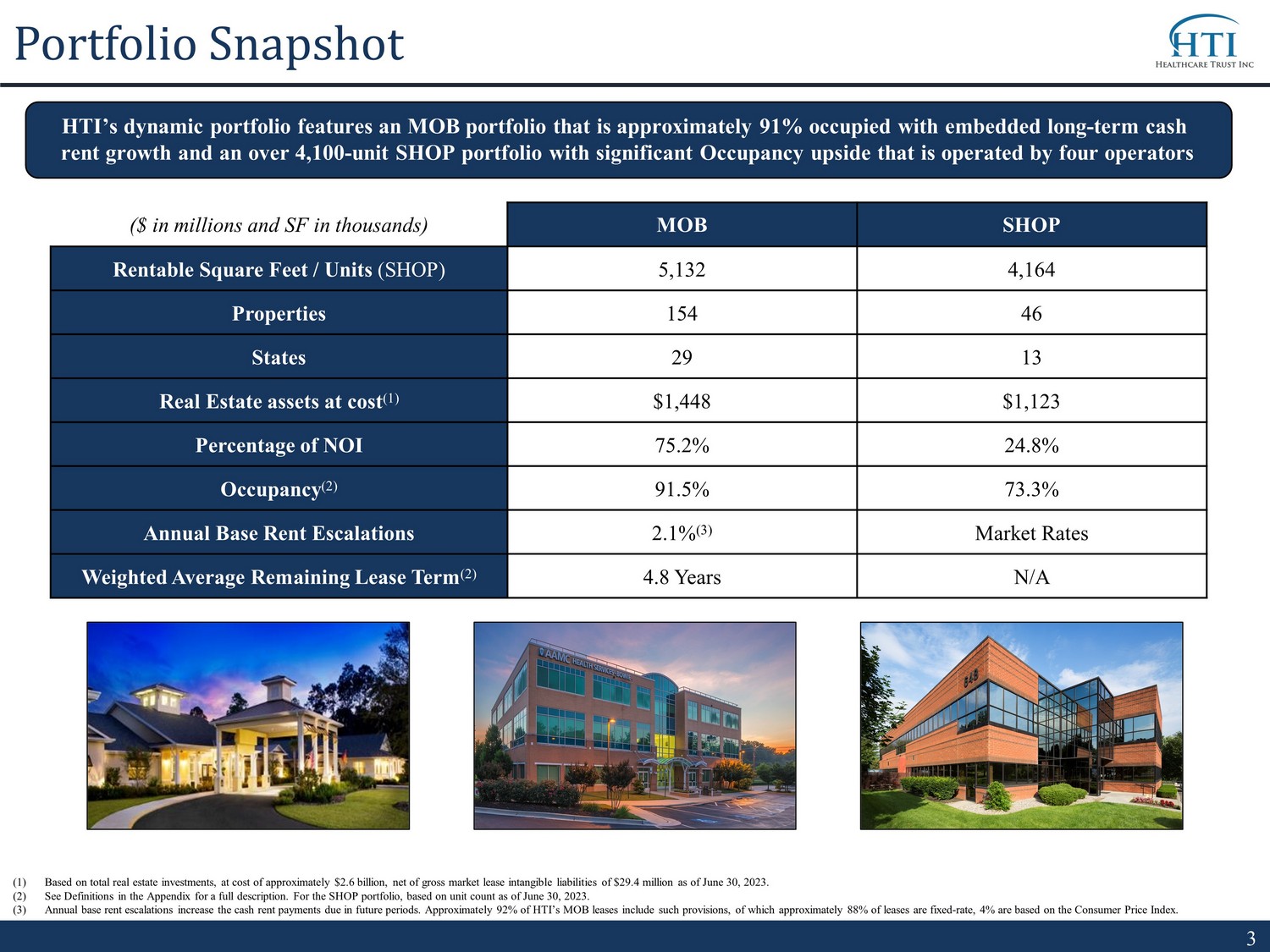

3 (1) Based on total real estate investments, at cost of approximately $2.6 billion, net of gross market lease intangible liabiliti es of $29.4 million as of June 30, 2023. (2) See Definitions in the Appendix for a full description. For the SHOP portfolio, based on unit count as of June 30, 2023. (3) Annual base rent escalations increase the cash rent payments due in future periods. Approximately 92% of HTI’s MOB leases inc lud e such provisions, of which approximately 88% of leases are fixed - rate, 4% are based on the Consumer Price Index. Portfolio Snapshot HTI’s dynamic portfolio features an MOB portfolio that is approximately 91% occupied with embedded long - term cash rent growth and an over 4,100 - unit SHOP portfolio with significant Occupancy upside that is operated by four operators ($ in millions and SF in thousands) MOB SHOP Rentable Square Feet / Units (SHOP) 5,132 4,164 Properties 154 46 States 29 13 Real Estate assets at cost (1) $1,448 $1,123 Percentage of NOI 75.2% 24.8% Occupancy (2) 91.5% 73.3% Annual Base Rent Escalations 2.1% (3) Market Rates Weighted Average Remaining Lease Term (2) 4.8 Years N/A

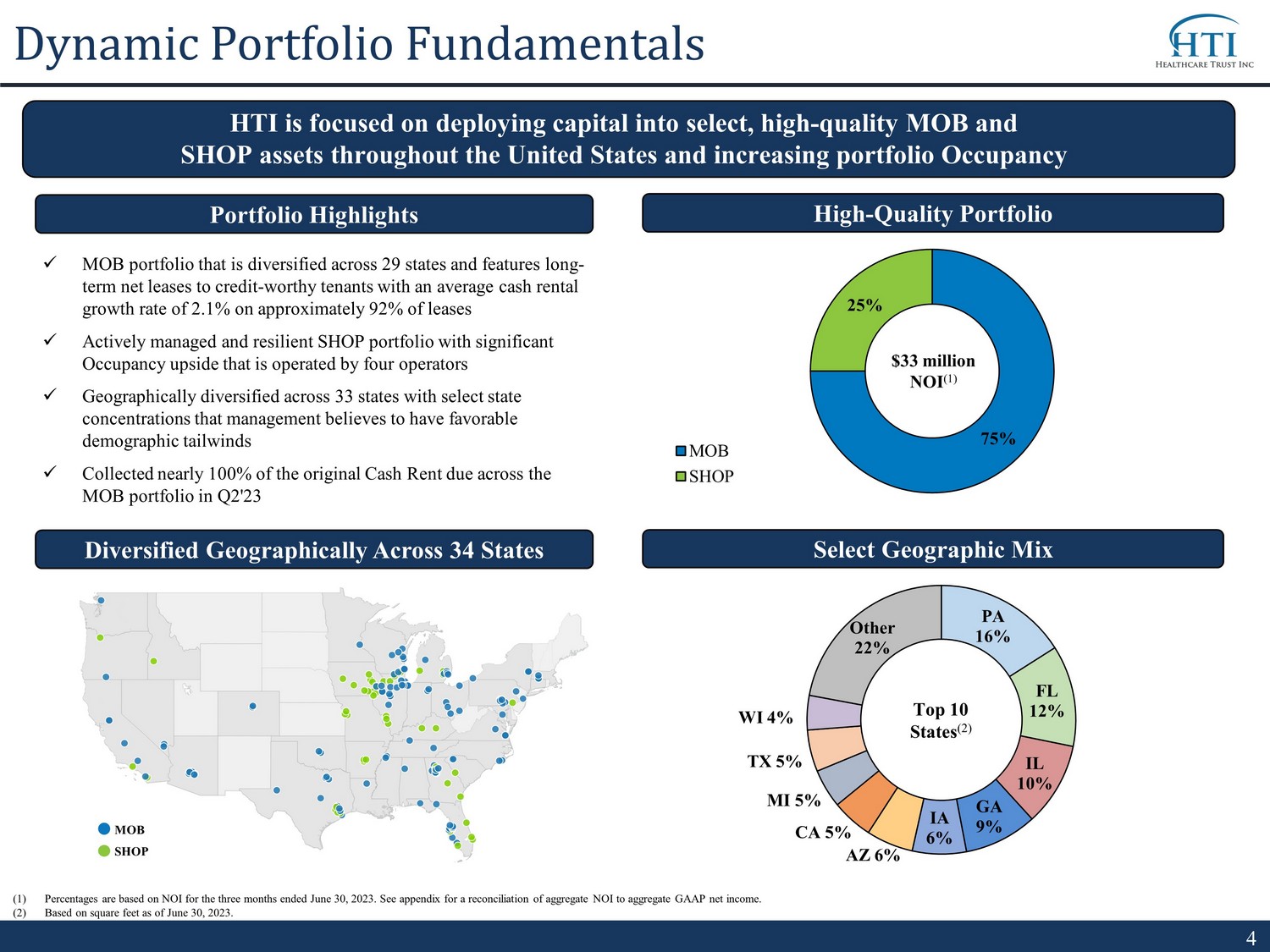

4 75% 25% MOB SHOP PA 16% FL 12% IL 10% GA 9% IA 6% AZ 6% CA 5% MI 5% TX 5% WI 4% Other 22% Dynamic Portfolio Fundamentals HTI is focused on deploying capital into select, high - quality MOB and SHOP assets throughout the United States and increasing portfolio Occupancy Select Geographic Mix (1) Percentages are based on NOI for the three months ended June 30, 2023. See appendix for a reconciliation of aggregate NOI to agg regate GAAP net income. (2) Based on square feet as of June 30 , 2023. $ 33 million NOI (1) Diversified Geographically Across 34 States High - Quality Portfolio Top 10 States (2) x MOB portfolio that is diversified across 29 states and features long - term net leases to credit - worthy tenants with an average cash rental growth rate of 2.1% on approximately 92% of leases x Actively managed and resilient SHOP portfolio with significant Occupancy upside that is operated by four operators x Geographically diversified across 33 states with select state concentrations that management believes to have favorable demographic tailwinds x Collected nearly 100% of the original Cash Rent due across the MOB portfolio in Q2'23 Portfolio Highlights MOB SHOP

5 x DaVita (NYSE: DVA) and Fresenius (NYSE: FMS) are industry leading publicly traded companies with a combined market cap of $23 billion (1) x Streamlined SHOP portfolio to only four operators, including two industry leaders, as compared to over 15 operators in 2019 x Developed strong tenant relationships with leading medical institutions such as UPMC, a leading health enterprise with over 95,000 employees and 800 clinical locations x HTI remains committed to developing strong partnerships with leading healthcare brands which HTI believes benefits patients and other stakeholders Strategic Partners HTI leases its properties to top healthcare brands in well - established markets MOB SHOP (1) Market capitalization data as of June 30, 2023.

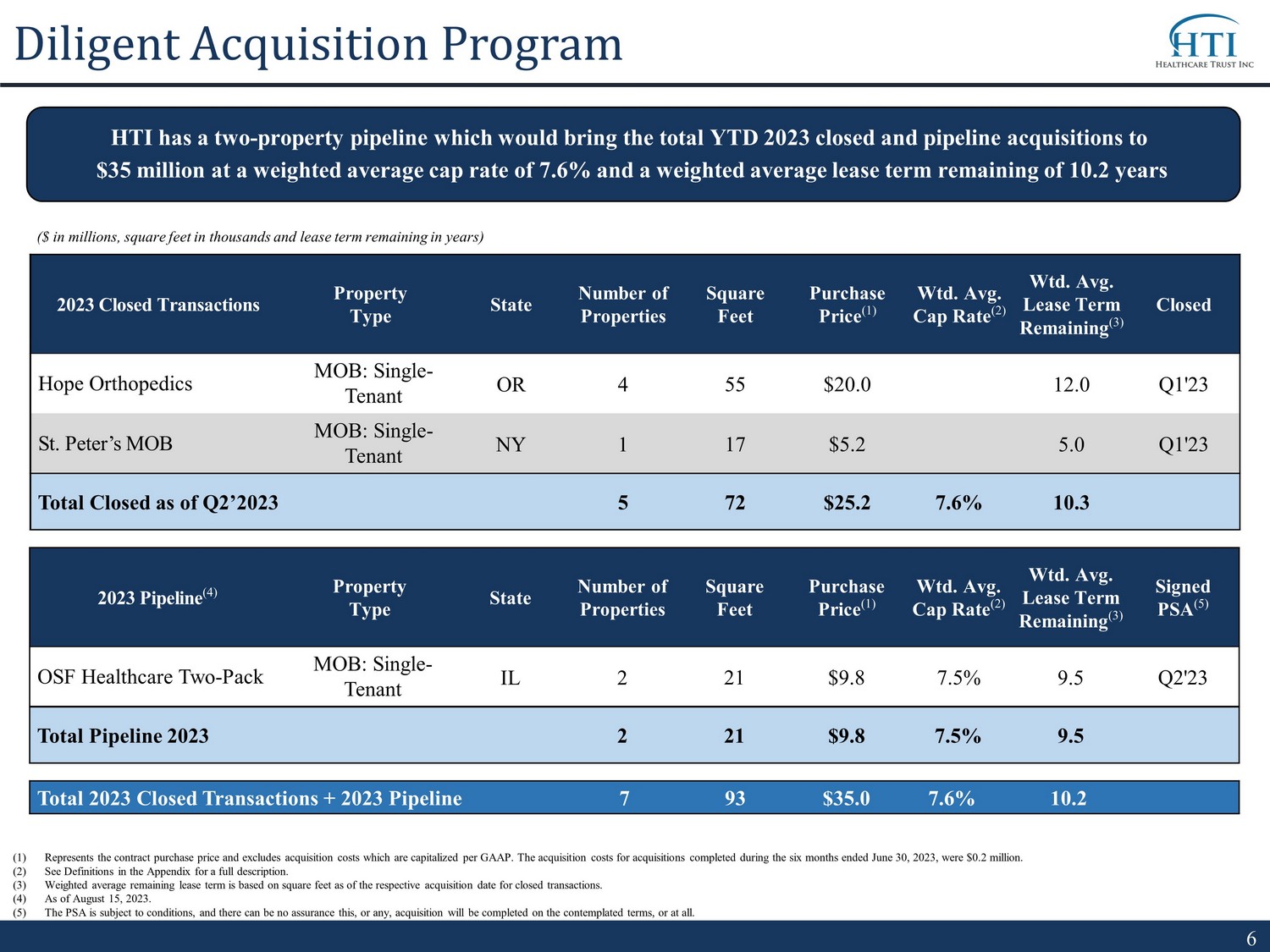

6 HTI has a two - property pipeline which would bring the total YTD 2023 closed and pipeline a cquisitions to $35 million at a weighted average cap rate of 7.6% and a weighted average lease term remaining of 10.2 years (1) Represents the contract purchase price and excludes acquisition costs which are capitalized per GAAP. The acquisition costs f or acquisitions completed during the six months ended June 30 , 2023, were $0.2 million. (2) See Definitions in the Appendix for a full description. (3) Weighted average remaining lease term is based on square feet as of the respective acquisition date for closed transactions. (4) As of August 15, 2023. (5) The PSA is subject to conditions, and there can be no assurance this, or any, acquisition will be completed on the contemplat ed terms, or at all. ($ in millions, square feet in thousands and lease term remaining in years) Diligent Acquisition Program 2023 Closed Transactions Property Type State Number of Properties Square Feet Purchase Price (1) Wtd. Avg. Cap Rate (2) Wtd. Avg. Lease Term Remaining (3) Closed Hope Orthopedics MOB: Single - Tenant OR 4 55 $20.0 12.0 Q1'23 St. Peter’s MOB MOB: Single - Tenant NY 1 17 $5.2 5.0 Q1'23 Total Closed as of Q2’2023 5 72 $25.2 7.6% 10.3 2023 Pipeline (4) Property Type State Number of Properties Square Feet Purchase Price (1) Wtd. Avg. Cap Rate (2) Wtd. Avg. Lease Term Remaining (3) Signed PSA (5) OSF Healthcare Two - Pack MOB: Single - Tenant IL 2 21 $9.8 7.5% 9.5 Q2'23 Total Pipeline 2023 2 21 $9.8 7.5% 9.5 Total 2023 Closed Transactions + 2023 Pipeline 7 93 $35.0 7.6% 10.2

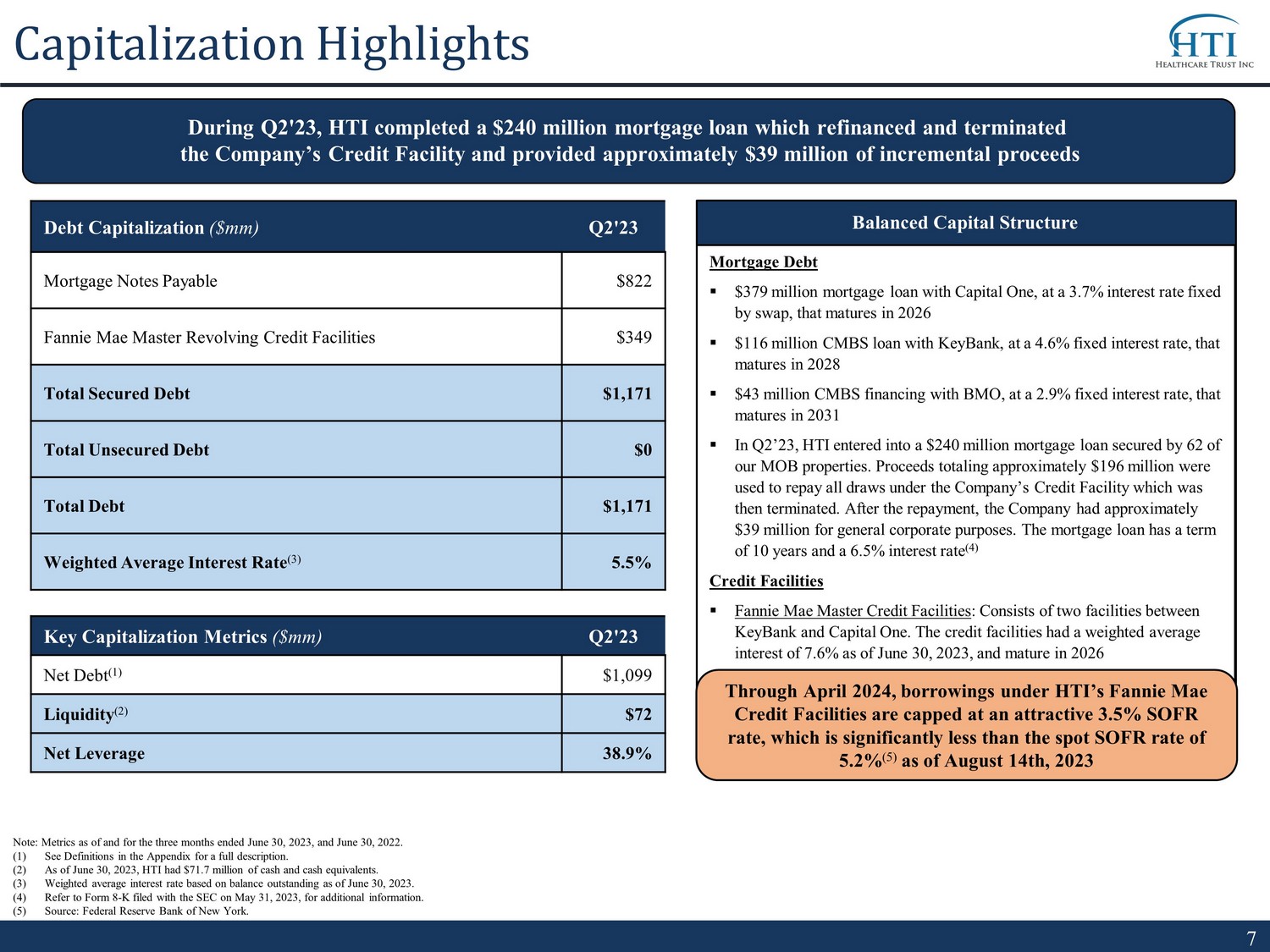

7 Debt Capitalization ($mm) Q2'23 Mortgage Notes Payable $822 Fannie Mae Master Revolving Credit Facilities $349 Total Secured Debt $1,171 Total Unsecured Debt $0 Total Debt $1,171 Weighted Average Interest Rate (3) 5.5% Key Capitalization Metrics ($mm) Q2'23 Net Debt (1) $1,099 Liquidity (2) $72 Net Leverage 38.9% Balanced Capital Structure During Q2'23, HTI completed a $240 million mortgage loan which refinanced and terminated the Company’s Credit Facility and provided approximately $39 million of incremental proceeds Note: Metrics as of and for the three months ended June 30, 2023, and June 30, 2022. (1) See Definitions in the Appendix for a full description. (2) As of June 30, 2023, HTI had $71.7 million of cash and cash equivalents. (3) Weighted average interest rate based on balance outstanding as of June 30 , 2023. (4) Refer to Form 8 - K filed with the SEC on May 31 , 2023, for additional information. (5) Source: Federal Reserve Bank of New York. Capitalization Highlights Mortgage Debt ▪ $379 million mortgage loan with Capital One, at a 3.7% interest rate fixed by swap, that matures in 2026 ▪ $116 million CMBS loan with KeyBank, at a 4.6% fixed interest rate, that matures in 2028 ▪ $43 million CMBS financing with BMO, at a 2.9% fixed interest rate, that matures in 2031 ▪ In Q2’23, HTI entered into a $240 million mortgage loan secured by 62 of our MOB properties. Proceeds totaling approximately $196 million were used to repay all draws under the Company’s Credit Facility which was then terminated. After the repayment, the Company had approximately $39 million for general corporate purposes. The mortgage loan has a term of 10 years and a 6.5% interest rate (4) Credit Facilities ▪ Fannie Mae Master Credit Facilities : Consists of two facilities between KeyBank and Capital One. The credit facilities had a weighted average interest of 7.6 % as of June 30, 2023, and mature in 2026 Through April 2024, borrowings under HTI’s Fannie Mae Credit Facilities are capped at an attractive 3.5% SOFR rate, which is significantly less than the spot SOFR rate of 5.2% (5) as of August 14th, 2023

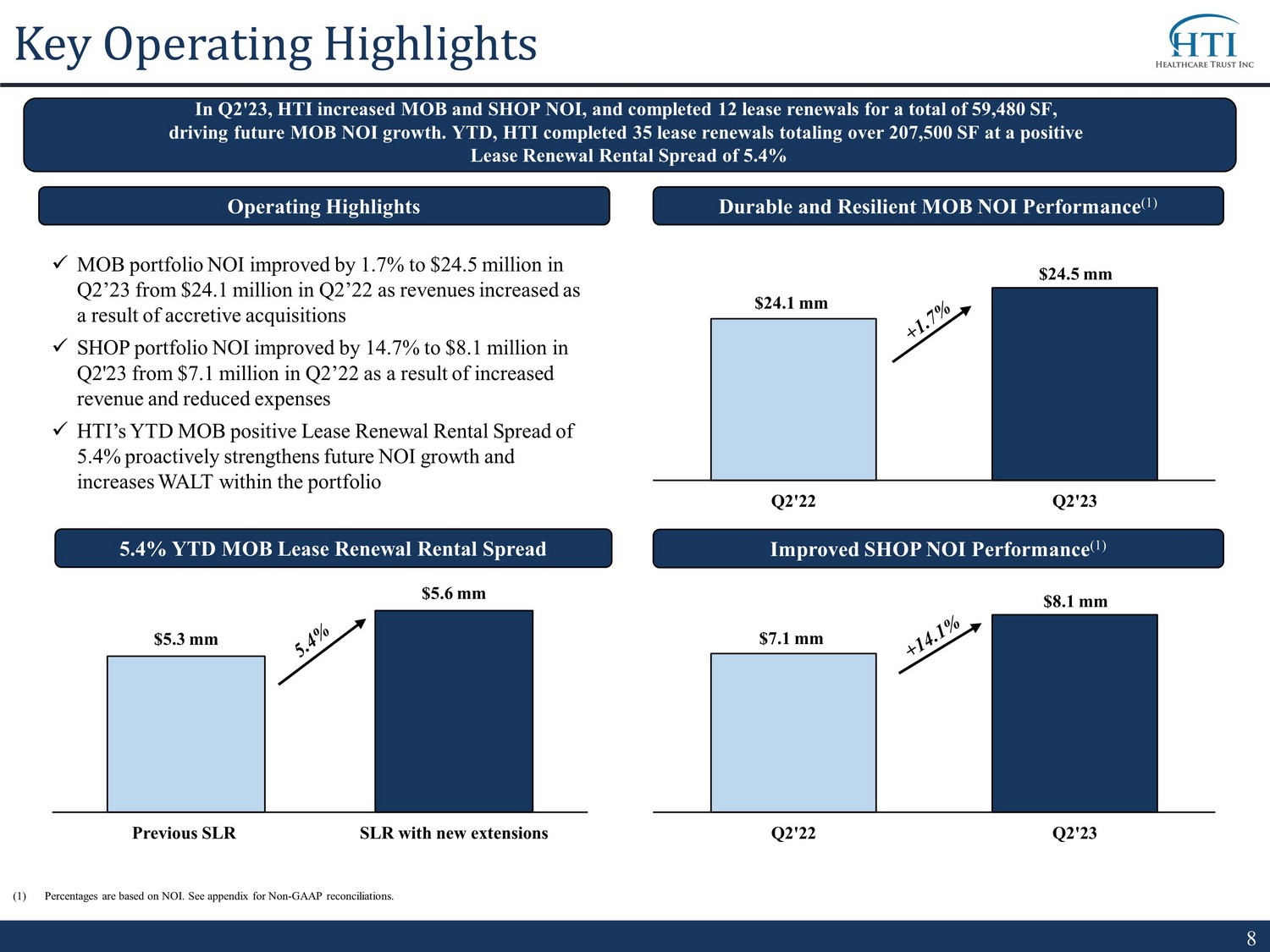

8 Key Operating Highlights In Q2'23, HTI increased MOB and SHOP NOI, and completed 12 lease renewals for a total of 59,480 SF, driving future MOB NOI growth. YTD, HTI completed 35 lease renewals totaling over 207,500 SF at a positive Lease Renewal Rental Spread of 5.4% Durable and Resilient MOB NOI Performance (1) x MOB portfolio NOI improved by 1.7% to $24.5 million in Q2’23 from $24.1 million in Q2’22 as revenues increased as a result of accretive acquisitions x SHOP portfolio NOI improved by 14.7% to $8.1 million in Q2'23 from $7.1 million in Q2’22 as a result of increased revenue and reduced expenses x HTI’s YTD MOB positive Lease Renewal Rental Spread of 5.4% proactively strengthens future NOI growth and increases WALT within the portfolio Operating Highlights $24.1 mm $24.5 mm Q2'22 Q2'23 $5.3 mm $5.6 mm Previous SLR SLR with new extensions 5.4% YTD MOB Lease Renewal Rental Spread (1) Percentages are based on NOI. See appendix for Non - GAAP reconciliations. Improved SHOP NOI Performance (1) $7.1 mm $8.1 mm Q2'22 Q2'23

9 Company Highlights In the second quarter, HTI continued to focus on increasing MOB Occupancy, acquiring high - quality MOB assets, improving SHOP NOI performance, and maintaining a conservative balance sheet x High - Quality Portfolio of 202 properties comprised of 75% MOB and 25% SHOP properties (1) x Diligent Acquisition Program (2) with total YTD 2023 closed and pipeline acquisitions of $35 million at a weighted average cap rate of 7.6% and a weighted average lease term remaining of 10.2 years x Resilient MOB Performance with an increase in MOB NOI to $24.5 million in Q2’23 compared to $24.1 million in Q2’22 and a YTD Lease Renewal Rental Spread of 5.4% across 207,577 SF x Improving SHOP NOI in Q2’23 to $8.1 million from $7.1 million in Q2’22, a 14.1% year - over - year increase as a result of increased revenues and reduced expenses x Streamlined SHOP Portfolio consisting of only four operators, including two industry leaders x Collected nearly 100% of the original Cash Rent due from the MOB portfolio in Q2'23 x Prudent Capitalization as of Q2'23 with Net Leverage of 38.9% x Experienced Management Team with a proven track record and significant public REIT experience (1) Percentages based on NOI for the three months ended June 30, 2023. See appendix for Non - GAAP reconciliations. (2) See page 6 for further details.

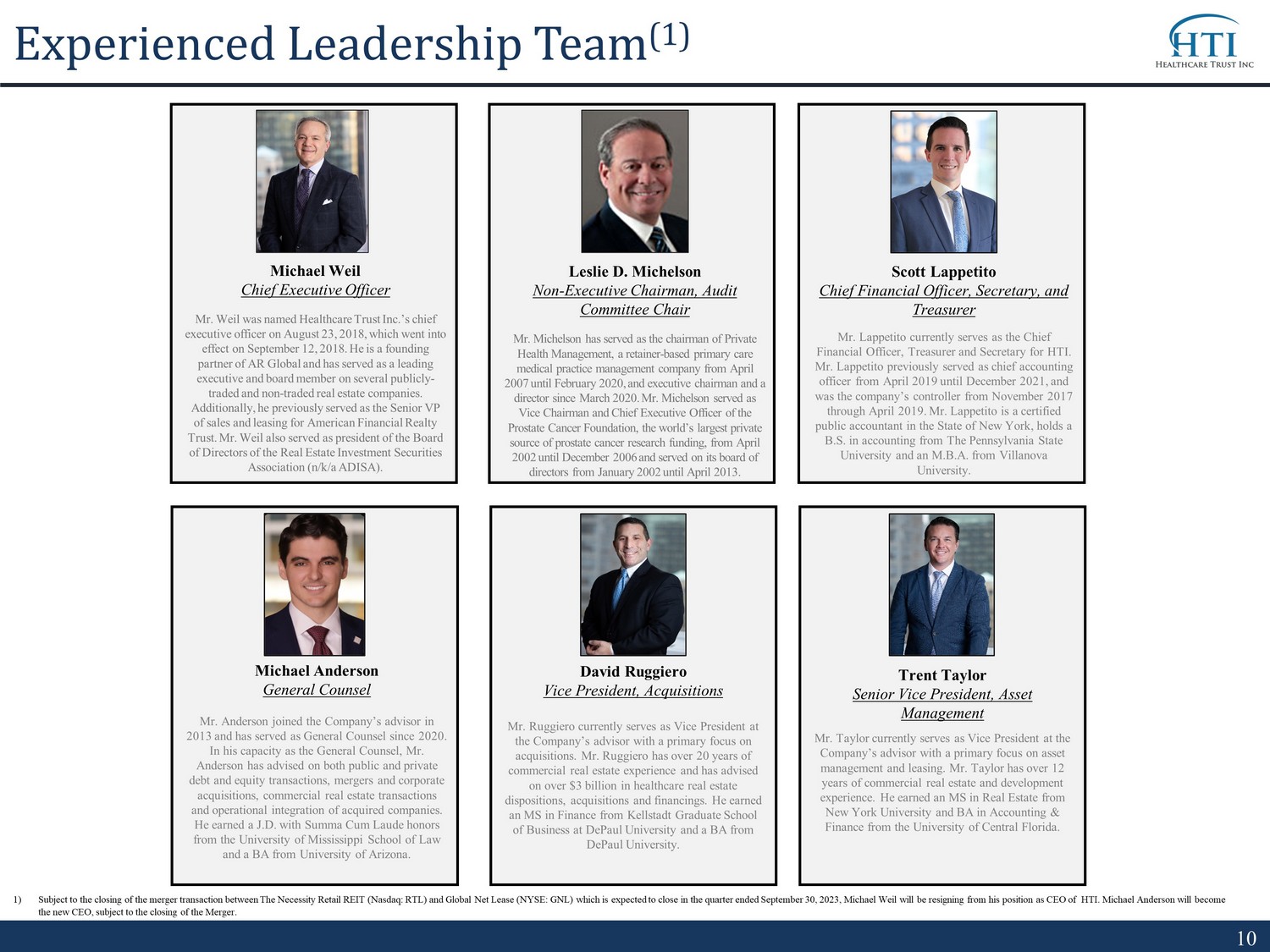

10 Experienced Leadership Team (1) (1) Scott Lappetito Chief Financial Officer, Secretary, and Treasurer Mr. Lappetito currently serves as the Chief Financial Officer, Treasurer and Secretary for HTI. Mr. Lappetito previously served as chief accounting officer from April 2019 until December 2021, and was the company’s controller from November 2017 through April 2019. Mr. Lappetito is a certified public accountant in the State of New York, holds a B.S. in accounting from The Pennsylvania State University and an M.B.A. from Villanova University. Leslie D. Michelson Non - Executive Chairman, Audit Committee Chair Mr. Michelson has served as the chairman of Private Health Management, a retainer - based primary care medical practice management company from April 2007 until February 2020, and executive chairman and a director since March 2020. Mr. Michelson served as Vice Chairman and Chief Executive Officer of the Prostate Cancer Foundation, the world’s largest private source of prostate cancer research funding, from April 2002 until December 2006 and served on its board of directors from January 2002 until April 2013. David Ruggiero Vice President, Acquisitions Mr. Ruggiero currently serves as Vice President at the Company’s advisor with a primary focus on acquisitions. Mr. Ruggiero has over 20 years of commercial real estate experience and has advised on over $3 billion in healthcare real estate dispositions, acquisitions and financings. He earned an MS in Finance from Kellstadt Graduate School of Business at DePaul University and a BA from DePaul University. Trent Taylor Senior Vice President, Asset Management Mr. Taylor currently serves as Vice President at the Company’s advisor with a primary focus on asset management and leasing. Mr. Taylor has over 12 years of commercial real estate and development experience. He earned an MS in Real Estate from New York University and BA in Accounting & Finance from the University of Central Florida. Michael Weil Chief Executive Officer Mr. Weil was named Healthcare Trust Inc.’s chief executive officer on August 23, 2018, which went into effect on September 12, 2018. He is a founding partner of AR Global and has served as a leading executive and board member on several publicly - traded and non - traded real estate companies. Additionally, he previously served as the Senior VP of sales and leasing for American Financial Realty Trust. Mr. Weil also served as president of the Board of Directors of the Real Estate Investment Securities Association (n/k/a ADISA). Michael Anderson General Counsel Mr. Anderson joined the Company’s advisor in 2013 and has served as General Counsel since 2020. In his capacity as the General Counsel, Mr. Anderson has advised on both public and private debt and equity transactions, mergers and corporate acquisitions, commercial real estate transactions and operational integration of acquired companies. He earned a J.D. with Summa Cum Laude honors from the University of Mississippi School of Law and a BA from University of Arizona. 1) Subject to the closing of the merger transaction between The Necessity Retail REIT (Nasdaq: RTL) and Global Net Lease (NYSE: GNL ) which is expected to close in the quarter ended September 30, 2023, Michael Weil will be resigning from his position as CEO of HTI. Michael Anderson will become the new CEO, subject to the closing of the Merger .

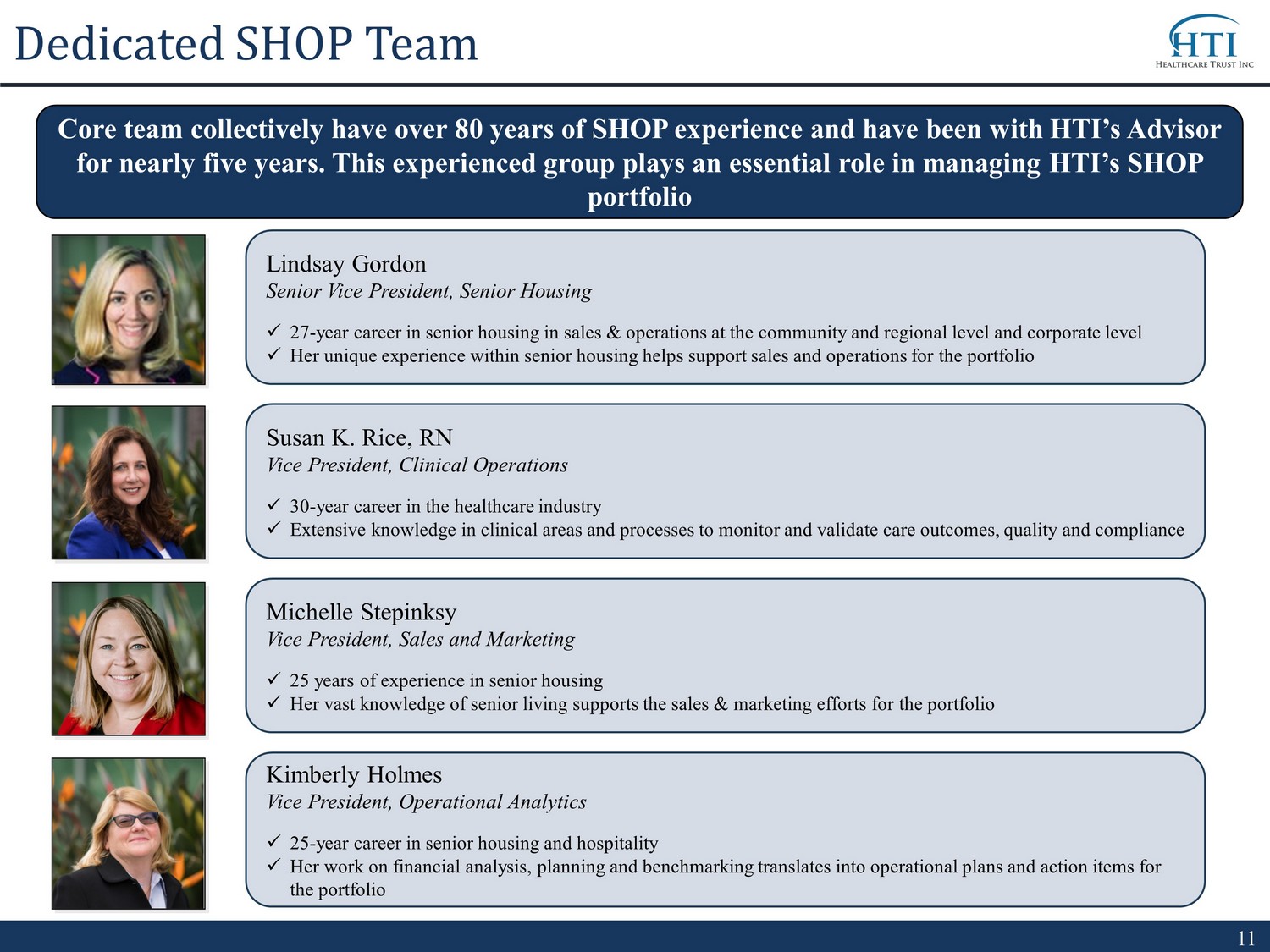

11 Dedicated SHOP Team Core team collectively have over 80 years of SHOP experience and have been with HTI’s Advisor for nearly five years. This experienced group plays an essential role in managing HTI’s SHOP portfolio Kimberly Holmes Vice President, Operational Analytics x 25 - year career in senior housing and hospitality x Her work on financial analysis, planning and benchmarking translates into operational plans and action items for the portfolio Lindsay Gordon Senior Vice President, Senior Housing x 27 - year career in senior housing in sales & operations at the community and regional level and corporate level x Her unique experience within senior housing helps support sales and operations for the portfolio Susan K. Rice, RN Vice President, Clinical Operations x 30 - year career in the healthcare industry x Extensive knowledge in clinical areas and processes to monitor and validate care outcomes, quality and compliance Michelle Stepinksy Vice President, Sales and Marketing x 25 years of experience in senior housing x Her vast knowledge of senior living supports the sales & marketing efforts for the portfolio

12 Legal Notice

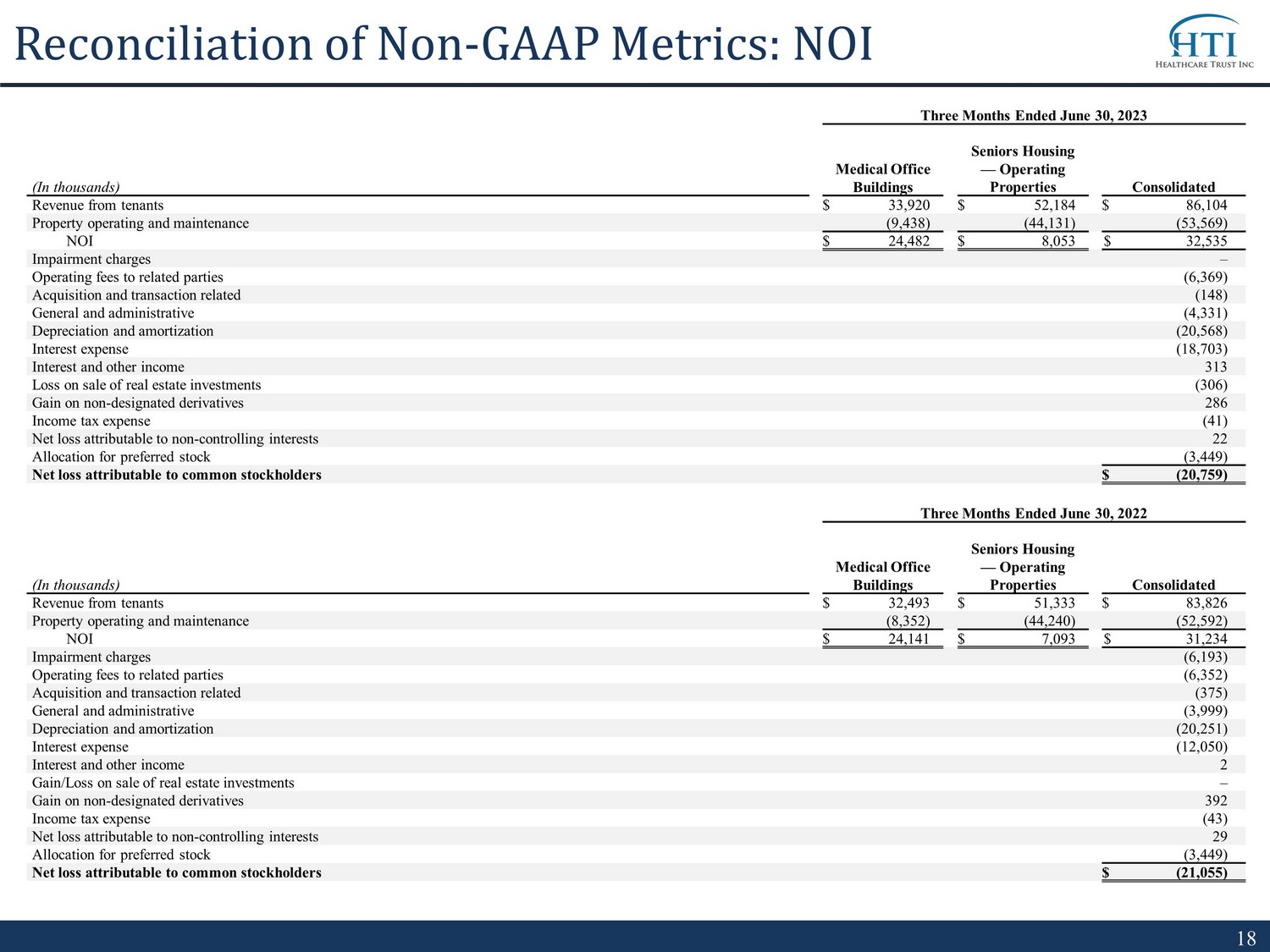

13 Disclaimer References in this presentation to the “Company,” “we,” “us” and “our” refer to Healthcare Trust, Inc. (“ HTI”) and its consolidated subsidiaries. The statements in this presentation that are not historical facts may be forward - looking statements. These forward - looking state ments involve risks and uncertainties that could cause actual results or events to be materially different. Forward - looking statements may include, but are not limited to, statements regarding stockholder liquidity and investment value and returns. The words “anticipates,” “believes,” “expects,” “estimates, ” “ projects,” “plans,” “intends,” “may,” “will,” “would” and similar expressions are intended to identify forward - looking statements, although not all forward - loo king statements contain these identifying words. Actual results may differ materially from those contemplated by such forward - looking statements, including th ose set forth in the section titled Risk Factors of HTI’s Annual Report on Form 10 - K for the year ended December 31, 2022 filed on March 17, 2023 and all other filings with the Securities and Exchange Commission (the “SEC”) after that date, as such risks, uncertainties and other important factors may be updated from time to time in HTI’s subsequent reports. Please see pages 14 and 15 for further information. Further, forward - looking statements speak only as of the date they are made, and HTI undertakes no obligation to update or revise any forward - looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results, unless required to do so by law. This presentation includes estimated projections of future operating results. These projections were not prepared in accordan ce with published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of financial projections. This information is not fact and should not be relied upon as being necessarily indicative of future results; the projections were pr epared in good faith by management and are based on numerous assumptions that may prove to be wrong. Important factors that may affect actual results an d cause the projections to not be achieved include, but are not limited to, risks and uncertainties relating to the Company and other factors described in the section titled Risk Factors of HTI’s Annual Report on Form 10 - K for the year ended December 31, 2022 filed on March 17, 2023 and all other filings with the SEC after that date. The projections also reflect assumptions as to certain business decisions that are subject to change. As a result, actual results ma y differ materially from those contained in the estimates. Accordingly, there can be no assurance that the estimates will be realized. This presentation includes certain non - GAAP financial measures, including net operating income (“NOI”). NOI is a non - GAAP measur e of our financial performance and should not be considered as an alternative to net income as a measure of financial performance, or any other per formance measure derived in accordance with GAAP and it should not be construed as an inference that our future results will be unaffected by unusual or non - recurring items. The reconciliation of net income to NOI for the applicable periods is set forth on page 18 to this presentation.

14 Forward - Looking Statements Certain statements made in this presentation are “forward - looking statements” (as defined in Section 21E of the Securities Excha nge Act of 1934, as amended), which reflect the expectations of the Company regarding future events. The forward - looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward - looking statements. Such forward - lookin g statements include, but are not limited to, market and other expectations, objectives, and intentions, as well as any other statements that are not historica l f acts. Our potential risks and uncertainties are presented in the section titled “Item 1A - Risk Factors” disclosed in our Annual Report on Form 10 - K for the year ended December 31, 2022 filed with the SEC on March 17, 2023 and all other filings with the SEC after that date. We disclaim any ob lig ation to update and revise statements contained in these materials to reflect changed assumptions, the occurrence of unanticipated events or changes to fut ure operating results over time, unless required by law. The following are some of the risks and uncertainties relating to us, although not all risks and unce rta inties, that could cause our actual results to differ materially from those presented in our forward - looking statements: • Our operating results are affected by economic and regulatory changes that have an adverse impact on the real estate market i n g eneral. • Our property portfolio has a high concentration of properties located in Florida. Our properties may be adversely affected by ec onomic cycles and risks inherent to those states. • Our loan agreement in connection with the Barclay’s MOB Loan requires us to maintain a minimum balance of cash and cash equiv ale nts totaling $12.5 million, which may restrict our ability to use cash that would otherwise be available to us. • A reduction in our NOI can impact our ability to satisfy debt covenants and could adversely affect our business. • We are subject to risks associated with a pandemic, epidemic or outbreak of a contagious disease, such as the global COVID - 19 pa ndemic, including negative impacts on our tenants and operators and their respective businesses. • Inflation and continuing increases in the inflation rate will have an adverse effect on our investments and results of operat ion s. • No public market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid. • In owning properties we may experience, among other things, unforeseen costs associated with complying with laws and regulati ons and other costs, potential difficulties selling properties and potential damages or losses resulting from climate change. • We focus on acquiring and owning a diversified portfolio of healthcare - related assets located in the United States and are subje ct to risks inherent in concentrating investments in the healthcare industry. • The healthcare industry is heavily regulated, and we, our tenants, and operators may be impacted by new or existing laws or r egu lations, or changes to these laws or regulations, such as the CARES Act and the auditing and reporting requirements instituted by the CARES Act. • Loss of licensure or failure to obtain licensure could result in the inability of tenants to make lease payments to us. • We depend on tenants for our rental revenue and, accordingly, our rental revenue depends upon the success and economic viabil ity of our tenants. Lease terminations, tenant default and bankruptcy have adversely affected and could in the future adversely affect our income and c ash flow. • We assume additional operating risks and are subject to additional regulation and liability because we depend on eligible ind epe ndent contractors to manage some of our facilities.

15 Forward - Looking Statements (Continued) • We have substantial indebtedness and may be unable to repay, refinance, restructure or extend our indebtedness as it becomes due . Increases in interest rates could increase the amount of our debt payments. We will likely incur additional indebtedness in the future. • We depend on our Advisor and our Property Manager to provide us with executive officers, key personnel and all services requi red for us to conduct our operations and our operating performance may be impacted by an adverse changes in the financial health or reputation of our Advisor and our Property Manager. • All of our executive officers face conflicts of interest, such as conflicts created by the terms of our agreements with the A dvi sor and compensation payable thereunder, conflicts allocating investment opportunities to us, and conflicts in allocating their time and attention to our mat ters. Conflicts that arise may not be resolved in our favor and could result in actions that are adverse to us. • We have long - term agreements with our Advisor and its affiliates that may be terminated only in limited circumstances and may re quire us to pay a termination fee in some cases. • Estimated Per - Share NAV may not accurately reflect the value of our assets and may not represent what a stockholder may receive on a sale of the shares, what they may receive upon a liquidation of our assets and distribution of the net proceeds or what a third party may pay to acquire us . • The stockholder rights plan adopted by our board of directors, our classified board and other aspects of our corporate struct ure and Maryland law may discourage a third party from acquiring us in a manner that might result in a premium price to our stockholders. • Restrictions on share ownership contained in our charter may inhibit market activity in shares of our stock and restrict our bus iness combination opportunities. • We may fail to continue to qualify as a REIT.

16 Appendix

17 Definitions Annualized Straight - Line Base Rent : Represents the total contractual base rents on a straight - line basis to be received throughout the duration of the lease currently in place expressed as a per annum value . Includes adjustments for non - cash portions of rent . Cap Rate : Capitalization rate is a rate of return on a real estate investment property based on the expected, annualized straight - lined rental income that the property will generate under its existing lease during its first year of ownership . Capitalization rate is calculated by dividing the annualized straight - lined rental income the property will generate (before debt service and depreciation and after fixed costs and variable costs) by the purchase price of the property . The weighted average capitalization rate is based upon square feet . Cash Rent : Represents total of all contractual rents on a cash basis due from tenants as stipulated in the originally executed lease agreements at inception or any lease amendments thereafter . We calculate “original Cash Rent collections” by comparing the total amount of rent collected during the period to the original Cash Rent due . Total rent collected during the period includes both original Cash Rent due and payments made by tenants pursuant to rent deferral agreements . Lease Term Remaining : Current portfolio calculated from June 30 , 2023 . Weighted based on square feet . Liquidity : As of June 30 , 2023 , HTI had $ 71 . 7 million in cash and cash equivalents, and $ 189 . 2 million available for future borrowings under HTI's credit facility, of which $ 112 . 0 million was available for general corporate purposes and acquisitions, with the remainder available to repay other existing debt obligations . During Q 2 ’ 23 , HTI terminated its Credit Facility which eliminated its borrowing availability thereunder . Net Debt : Total gross debt of $ 1 . 2 billion less cash and cash equivalents of $ 71 . 7 million as of June 30 , 2023 . NOI : Defined as a non - GAAP financial measure used by us to evaluate the operating performance of our real estate . NOI is equal to revenue from tenants, less property operating and maintenance expenses . NOI excludes all other items of expense and income included in the financial statements in calculating net income (loss) . Net Leverage : Represents “Net Debt” as defined above divided by total assets of approximately $ 2 . 2 billion (which includes cash and cash equivalents) plus accumulated depreciation and amortization of $ 643 . 7 million as of June 30 , 2023 . Occupancy : For MOB properties, occupancy represents percentage of square footage of which the tenant has taken possession of divided by the respective total rentable square feet as of the date or period end indicated . For SHOP properties, occupancy represents total units occupied divided by total units available as of the date or period end indicated . Lease Renewal Rental Spread : Percentage change from prior lease annualized SLR to renewal lease annualized SLR

18 Reconciliation of Non - GAAP Metrics: NOI Three Months Ended June 30, 2023 (In thousands) Medical Office Buildings Seniors Housing — Operating Properties Consolidated Revenue from tenants $ 33,920 $ 52,184 $ 86,104 Property operating and maintenance (9,438) (44,131) (53,569) NOI $ 24,482 $ 8,053 $ 32,535 Impairment charges – Operating fees to related parties (6,369) Acquisition and transaction related (148) General and administrative (4,331) Depreciation and amortization (20,568) Interest expense (18,703) Interest and other income 313 Loss on sale of real estate investments (306) Gain on non - designated derivatives 286 Income tax expense (41) Net loss attributable to non - controlling interests 22 Allocation for preferred stock (3,449) Net loss attributable to common stockholders $ (20,759) Three Months Ended June 30, 2022 (In thousands) Medical Office Buildings Seniors Housing — Operating Properties Consolidated Revenue from tenants $ 32,493 $ 51,333 $ 83,826 Property operating and maintenance (8,352) (44,240) (52,592) NOI $ 24,141 $ 7,093 $ 31,234 Impairment charges (6,193) Operating fees to related parties (6,352) Acquisition and transaction related (375) General and administrative (3,999) Depreciation and amortization (20,251) Interest expense (12,050) Interest and other income 2 Gain/Loss on sale of real estate investments – Gain on non - designated derivatives 392 Income tax expense (43) Net loss attributable to non - controlling interests 29 Allocation for preferred stock (3,449) Net loss attributable to common stockholders $ (21,055)

19 HealthcareTrustInc.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts at www.computershare.com/advisorportal ▪ Shareholders may access their accounts at www.computershare.com/hti

Exhibit 99.2

Opening – Curtis Parker

Welcome to the second quarter 2023 Healthcare Trust, Inc., or HTI, webcast. All participants will be in listen-only mode.

Please note, this event is being recorded. Also note that certain statements and assumptions in this webcast presentation which are not historical facts will be forward-looking and are being made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are subject to certain assumptions and risk factors which could cause HTI’s actual results to differ materially from the forward-looking statements. We refer all of you to our SEC filings including the Form 10-K for the year ended December 31, 2022, filed on March 17, 2023, and all other SEC filings after that date for a more detailed discussion of the risk factors that could cause these differences and impact our business.

During today's call, we will discuss non-GAAP financial measures of HTI. These measures should not be considered in isolation or as a substitution for the financial results prepared in accordance with GAAP. HTI has provided a reconciliation of these measures to the most directly comparable GAAP measure as part of the second quarter 2023 investor presentation for HTI (available on HTI’s website at www.healthcaretrustinc.com).

You may submit questions during today’s webcast by typing them in the box on the screen and a member of our investor relations group will follow-up to answer questions directly after this presentation. Also, please note that later today a copy of this presentation and replay of the webcast will be available on HTI’s website.

I would now like to turn the call over to Michael Weil, Chief Executive Officer. Please go-ahead Mike.

Opening Script

HTI Webinar Script

Slide 2: Company Overview – (Mike Weil)

Thanks Curtis and thank you all for joining us today. I’m pleased to report that in the second quarter HTI grew Net Operating Income, or NOI, by $1.3 million to $32.5 million from $31.2 million, a 4.2% increase compared to the second quarter of 2022, including an increase of $1.0 million, or nearly 14%, in the SHOP segment of our portfolio. Additionally, year to date we have achieved a 5.4% leasing spread on renewals in our MOB portfolio while building an accretive acquisitions pipeline. We remain confident in our long-term strategy of owning high quality Seniors Housing and Medical Office Buildings across the US.

In the MOB segment, second-quarter NOI grew by 1.7% to $24.5 million, up from $24.1 million in the second quarter of 2022. Occupancy in this segment grew from the end of the first quarter to 91.5% as of June 30th, 2023.

1

In our SHOP segment, second quarter NOI grew to $8.1 million, compared to $7.1 million in the second quarter of 2022, which was driven by higher revenue and reduced expenses. We believe that SHOP occupancy will increase as the effects of the pandemic continue to subside and the investments we’ve made differentiate our properties from competitors in the same markets.

Looking at the balance sheet, as of June 30, 2023, HTI had Net Leverage of 38.9%. In May, we completed a $240 million loan that is secured by, among other things, 62 of our MOBs. A portion of the proceeds from the loan were used to repay and terminate our previous credit facility. We are pleased to have completed this financing and believe it will enhance our capacity to grow and respond to the dynamic realities of the current healthcare real estate environment.

We believe the continued execution of our corporate initiatives, including completing accretive acquisitions as well as dispositions, leasing of available space to high-quality tenants in our medical office buildings and enhancements to our shop portfolio, all positively impact the factors our board will likely consider when it decides to evaluate a liquidity event in the future.

Slide 3: Portfolio Snapshot

As of June 30, 2023, HTI owned over 200 properties, totaling over 9 million rentable square feet in 33 states. The portfolio consisted of 154 medical office buildings, 46 seniors housing operating properties with over 4,100 individual units, and two land parcels. Based on NOI, the portfolio was comprised of 75% MOB and 25% SHOP assets.

At quarter end, our medical office building portfolio was 91.5% occupied, up from 90.9% at the end of the first quarter, with a weighted-average remaining lease term of 4.8 years and featured annual rent escalators that averaged 2.1% on approximately 92% of leases, which increase the cash rental payments in future periods.

During the second quarter, we sold four SHOP properties and one MOB for an aggregate sales price of $13.8 million. Additionally, we have an additional SHOP disposition in our pipeline for a total of $8.0 million. We review our portfolio on an ongoing basis and seek opportunities to strategically acquire or dispose of properties that we believe will create value for HTI shareholders and enhance our existing portfolio.

Slide 4: Dynamic Portfolio Fundamentals

We have diligently constructed a portfolio of MOB and SHOP assets and continue to deploy capital into select high-quality assets throughout the US. Our portfolio is geographically well-diversified across 33 states with only two states representing more than 10% of the total portfolio by square feet. Second quarter NOI for the portfolio was approximately $33 million, 75% of which was generated by medical office buildings.

Slide 5: Strategic Partners

We partner with top healthcare brands in well-established markets to maintain a durable portfolio of healthcare real estate. We believe that the quality of our tenants is essential to our success in the long-term and that developing strong relationships with well-respected brands gives our portfolio stability and focus. We believe our partnerships with tenants such as DaVita, Fresenius and UPMC in the MOB portfolio benefit not only HTI’s shareholders, but patients and other stakeholders as well.

2

As we grow our portfolio, we continue to seek high-quality tenants to add to HTI’s MOB portfolio and to maintain strong relationships with our current SHOP operators.

Slide 6: Diligent Acquisition Program

As of August 15th, 2023, we have a 2-pack of medical office buildings in our acquisitions pipeline. Combined with our first quarter acquisitions, this brings us to 7 properties acquired or in the pipeline for 2023, totaling $35 million of purchase price at a weighted-average cap rate of 7.6% and with a weighted average remaining lease term of 10.2 years, assuming the properties in our pipeline are acquired on the terms contemplated in the purchase and sale agreement, which is not assured. We believe we are well positioned to continue diligently seeking accretive acquisitions at opportunistic cap rates.

Scott, will you take us through the financials please?

Slide 7: Capitalization Highlights – (Scott Lappetito)

Thank you, Mike.

We continued to actively manage our capital structure during the second quarter. As of June 30, 2023, our Net Leverage was 38.9%.

Additionally, as Mike mentioned earlier, in May we entered into a $240 million loan. A portion of the proceeds from the loan were used to repay and terminate our previous Credit Facility, and provided approximately $39 million for acquisitions and general corporate purposes. This new loan has an interest-only term of 10 years at a 6.5% interest rate.

Slide 8: Key Operating Highlights

HTI continues to execute on our operational initiatives by increasing NOI in both the MOB and SHOP segments of our portfolio and by increasing straight-line rent through lease renewals.

As Mike mentioned earlier, SHOP NOI has grown over 14% year-over-year to $8.1 million in the second quarter as revenue increased and expenses were reduced. In the MOB segment of our portfolio, NOI grew 1.7% compared to the same quarter of 2022 as a result of the accretive acquisitions we have completed.

Among MOB leases renewed year to date, straight-line rent increased to approximately $5.6 million from $5.3 million, a 5.4% increase compared to the prior leases, illustrating the continued demand for medical office building space and validating our continued investments in this segment of our portfolio.

I would now like to turn the call back to Mike for some color on the HTI team and some closing remarks.

Slide 9: Company Highlights – (Mike Weil)

Thanks Scott.

3

We continue to position HTI for a liquidity event and long-term earnings growth by, among other things, capitalizing on leasing available space and acquiring high-quality MOB properties. Our portfolio continues to demonstrate its resilience, as we captured a positive spread on lease renewals in the MOB portfolio during the first half of the year, built an acquisitions pipeline and grew NOI compared to last year. We have an experienced management team that we believe is well positioned to maximize the opportunities created by demographic trends that favor long-term investment in healthcare real estate.

Slide 10: Experienced Leadership Team

We believe we have the right team in place to execute our strategy to drive long-term value.

Trent Taylor is Senior Vice President of asset manager and ensures that our existing properties are leased, performing as expected, and that our tenants’ needs are being met by local property managers. David Ruggiero is responsible for MOB acquisitions, applying over 20 years of experience and a $3 billion acquisitions track record to our strict investment guidelines and underwriting standards.

Slide 11: Dedicated SHOP Team

Our dedicated SHOP team has over 80 years of collective experience in the Seniors Housing space. Susan Rice and Kimberly Holmes have been with HTI for nearly five years, helping steer our SHOP properties through uncharted waters throughout the Covid-19 pandemic. This year Lindsay Gordon and Michelle Stepinsky both joined the team, bringing vast knowledge and experience to the operations and sales groups at our properties. We believe our team is well-qualified to continue guiding the recovery of our seniors housing portfolio. We look forward to the new perspective Lindsay and Michelle will bring to our portfolio going forward.

Closing Statements – (Mike Weil)

We are pleased with the continued strong, dependable performance of our MOB portfolio and are encouraged by the year over year increase in SHOP portfolio NOI, reflecting not only the ongoing recovery of this segment from the impacts of COVID-19, but also the results of our team’s dedication to improving our SHOP facilities, operations, accessibility and attractiveness to seniors and their families. Our focus remains on the future and positioning HTI for an eventual liquidity event.

In May, we announced that upon the completion of a proposed merger between Global Net Lease and the Necessity Retail REIT, I would be resigning my position as CEO of HTI. As such, this may be the last time that I get to discuss the company's results with you. I’d like to thank you for your insight, support, and ownership of HTI over the years and I take great comfort leaving the company in the hands of Michael Anderson, who was recently approved by the board for the position of CEO, and Scott, who will remain the CFO. Michael has been a long-time employee of our advisor, AR Global, starting in 2013 and has risen to become general counsel. I believe I speak for Michael, Scott and the board when I say that we are excited about the opportunities ahead of us. Thank you for joining us today.

Operator Closes the Call

The conference has now concluded. If you have submitted questions during today’s webcast, a member of our investor relations group will follow-up to answer your questions. Also, please note that a copy of the presentation and replay of this webcast will be available on the company’s website at www.healthcaretrustinc.com. Thank you for attending today’s presentation. You may now disconnect.

4

1 Year National Healthcare Prop... (PK) Chart |

1 Month National Healthcare Prop... (PK) Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions