We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Avricore Health Inc (QB) | USOTC:AVCRF | OTCMarkets | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| -0.008 | -16.19% | 0.0414 | 0.0333 | 0.05 | 0.0414 | 0.0414 | 0.0414 | 160,000 | 21:30:13 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2024.

Commission File Number: 000-51848

Avricore Health Inc.

(Exact name of registrant as specified in its charter)

1120-789 West Pender St, Vancouver, BC, V6C 1H2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): NO

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): NO

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Exhibits

The following exhibits are included in this form 6-K:

| Exhibit No. | Description | Date Released | ||

| 1 | News Release-HEALTHTAB™ SIGNS AGREEMENT FOR MORE REXALL® PHARMACY LOCATIONS | 2024-04-04 | ||

| 2 | Notice Of Meeting | 2024-04-15 | ||

| 3 | Notice Of Meeting Amended | 2024-04-16 | ||

| 4 | Audited Annual Financial Statements | 2024-04-29 | ||

| 5 | Annual MD&A | 2024-04-29 | ||

| 7 | 52-109FV1-Certification Of Annual Filings-CEO | 2024-04-29 | ||

| 8 | 52-109FV1-Certification Of Annual Filings-CFO | 2024-04-29 | ||

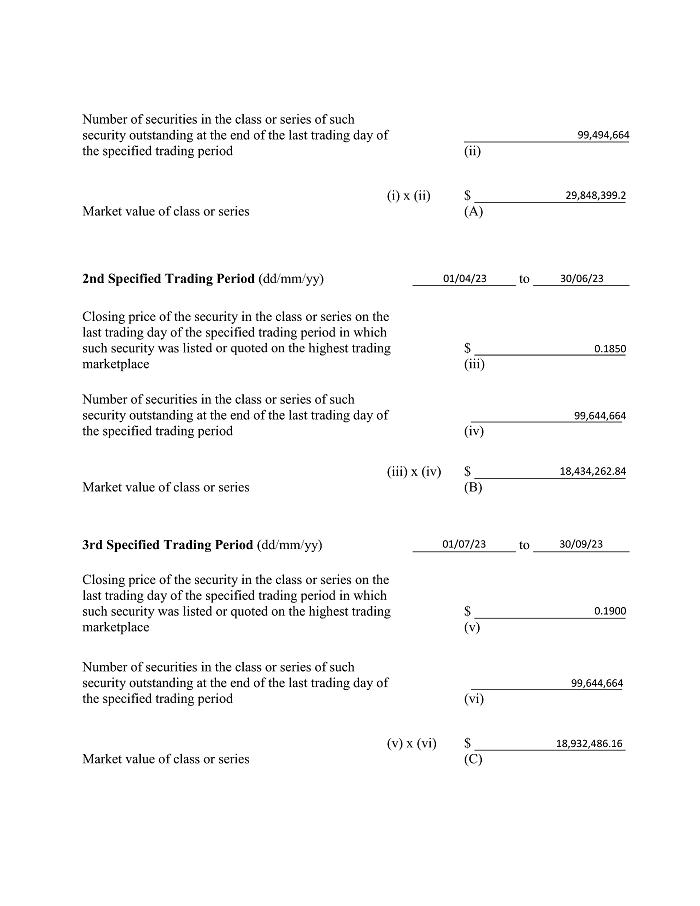

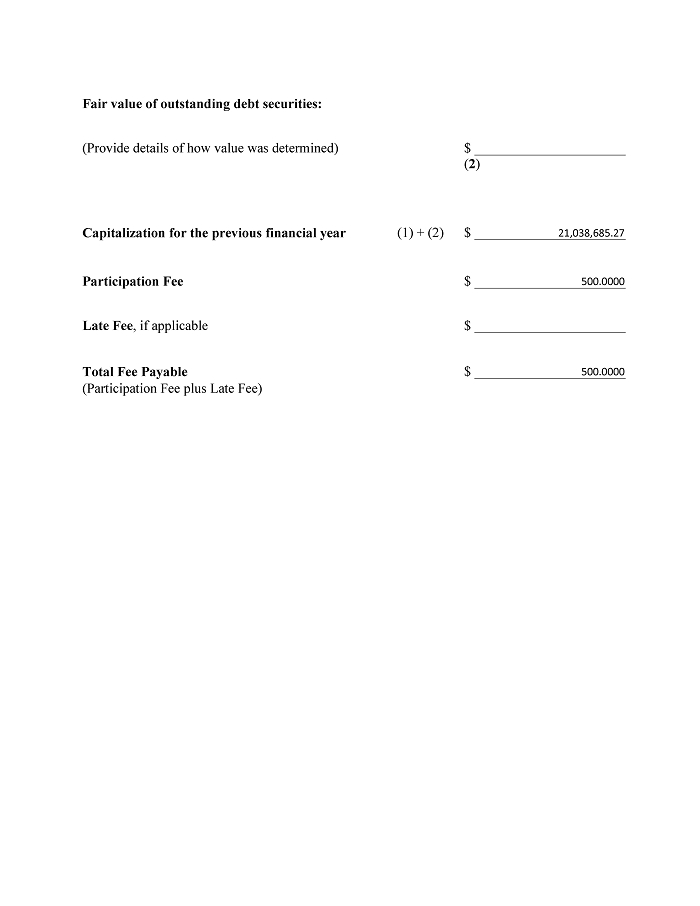

| 9 | AB Form 13-501F1 (Class1 and 3B reporting issuers-participation fee) | 2024-04-29 | ||

| 10 | News Release-AVRICORE HEALTH CORPORATE UPDATE AND AUDITED RESULTS FOR 2023 |

2024-04-30 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| AVRICORE HEALTH INC. | ||

| Date: May 08, 2024 | By | “Kiki Smith” |

| Kiki Smith | ||

| Chief Financial Officer | ||

| SEC1815(04-09) | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number |

Exhibit 1

HEALTHTAB™

SIGNS AGREEMENT FOR MORE REXALL® PHARMACY LOCATIONS

VANCOUVER, BC – (GLOBE NEWSWIRE) – April 4, 2024 – Avricore Health Inc. (TSXV: AVCR, OTC: AVCRF) (“Avricore Health” or the “Company”) is pleased to announce further expansion of HealthTab™ with Rexall Pharmacy Group ULC (“Rexall”). The Companies have been working closely to develop the best patient approaches and internal workflows to ensure the most successful deployment of this powerful point-of-care testing platform.

“To successfully screen and manage chronic and infectious disease, healthcare systems need pharmacists to play an active role,” said Hector Bremner, CEO of Avricore Health. “To do this well pharmacists need the best tools to have confidence in their results and the data to drive deeper insights.”

Last September, the Company announced its first testing location within Rexall’s Pharmacy Walk-In Clinic in Sherwood Park, Alberta. That location, a first for Rexall as well, offers both the Afinion 2™ blood-chemistry analyzer as well as the ID Now™ molecular platform by Abbott Rapid Diagnostics, giving patients quick access to their test results, and allowing for immediate consultation with their pharmacist.

The next steps will be to deploy a minimum of another 20 locations spread out between stores in Alberta and Ontario. After each deployment, the teams will collaborate to assess deployment workflow, refine processes and identify further deployment opportunities based on patient and pharmacist feedback.

With approximately 800 locations across Canada, HealthTab is expected to deepen its reach and empower more patients, and pharmacists, with health data insights that will drive better treatment plans, therapy adherence and patient outcomes.

About Rexall

With a dynamic history of innovation and growth dating back over a century, Rexall is a leading pharmacy retailer in Canada, dedicated to caring for Canadians’ health, one person at a time. Operating approximately 400 pharmacies across Canada, Rexall’s 8,000 employees provide compassionate care to patients, becoming their trusted health partners along their wellness journey.

Rexall is part of the Rexall Pharmacy Group ULC and a proud member of the global McKesson Canada Corporation family, a diversified healthcare company with deep roots in supporting patients across Canada.

For more information, visit rexall.ca. Follow us on Twitter: @RexallDrugStore, on Instagram at @RexallDrugStoreOfficial, and @RexallCareNetwork and on Facebook at @RexallDrugStore

HealthTab™ Market Fast Facts

| ● | Point of Care Testing Market to reach $93.21 Billion USD in 2030 (Source) | |

| ● | Nearly 13.6 Million Canadians are expected to be diabetic or prediabetic by 2030, with many undiagnosed (Source) | |

| ● | Over 1 in 3 Americans, approximately 88 million people, have pre-diabetes (Source) | |

| ● | Close to 160,000 Canadians 20 years and older are diagnosed with heart disease each year, often it’s only after a heart attack they are diagnosed. (Source) | |

| ● | There are more than 10,000 pharmacies in Canada, 88,000 pharmacies in the US, and nearly 12,000 in the UK. |

About HealthTab™

HealthTab™ is a turnkey point-of-care testing solution that combines best-in-class point-of-care technologies with a secure, cloud-based platform for tackling pressing global health issues. With just a few drops of blood from a finger prick, the system generates lab-accurate results on the spot and data is reported in real-time. The test menu includes up to 23 key biomarkers for screening and managing chronic diseases, such as diabetes and heart disease (e.g., HbA1c, Lipid Profile, eGFR). HealthTab™ has also recently added capabilities for bacterial and viral tests, such as strep and COVID-19.

The HealthTab™ network model is unlike anything in pharmacy today. It gives knowledgeable and trusted pharmacists a greater role in primary care delivery while empowering patients to take more control of their health. It also reduces costs and waiting times and provides many potential revenue streams including equipment leasing & consumables, direct access testing, disease prevention & management programs, sponsored health programs, decentralized clinical trials, real-world data (RWD) sets, and third-party app integration through API.

About Avricore Health Inc.

Avricore Health Inc. (TSXV: AVCR) is a pharmacy service innovator focused on acquiring and developing early-stage technologies aimed at moving pharmacy forward. Through its flagship offering HealthTab™, a wholly owned subsidiary, the Company’s mission is to make actionable health information more accessible to everyone by creating the world’s largest network of rapid testing devices in community pharmacies.

Contact:

Avricore Health Inc.

Hector Bremner, CEO 604-773-8943

info@avricorehealth.com

www.avricorehealth.com

Cautionary Note Regarding Forward-Looking Statements

Information in this press release that involves Avricore Health’s expectations, plans, intentions, or strategies regarding the future are forward-looking statements that are not facts and involve a number of risks and uncertainties. Avricore Health generally uses words such as “outlook,” “will,” “could,” “would,” “might,” “remains,” “to be,” “plans,” “believes,” “may,” “expects,” “intends,” “anticipates,” “estimate,” “future,” “positioned,” “potential,” “project,” “remain,” “scheduled,” “set to,” “subject to,” “upcoming,” and similar expressions to help identify forward-looking statements. In this press release, forward-looking statements include statements regarding the completion of the placement and the expected timing thereof and the Company’s expected use of proceeds from the placement; the unique features that the HealthTab™ platform offers to pharmacists and patients. Forward-looking statements reflect the then-current expectations, beliefs, assumptions, estimates and forecasts of Avricore Health’s management. The forward-looking statements in this press release are based upon information available to Avricore Health as of the date of this press release. Forward-looking statements believed to be true when made may ultimately prove to be incorrect. These statements are not guarantees of the future performance of Avricore Health and are subject to a few risks, uncertainties, and other factors, some of which are beyond its control and may cause actual results to differ materially from current expectations, including without limitation: failure to meet regulatory requirements; changes in the market; potential downturns in economic conditions; and other risk factors described in Avricore’s public filings. These forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update them publicly to reflect new information or the occurrence of future events or circumstances unless otherwise required to do so by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy for the adequacy or accuracy of the release.

Exhibit 2

AVRICORE HEALTH INC.

NOTICE OF MEETING

April 15, 2024

| To: | All Canadian Securities Regulatory Authorities |

| Re: | Avricore Health Inc. (the “Company”) |

| Annual General & Special Meeting of Shareholders |

In connection with section 2.2 of National Instrument 54-101, we wish to advise you of the following information with respect to the Company’s upcoming Meeting of shareholders:

| Issuer: | AVRICORE HEALTH INC. |

| Meeting Type: | Annual General & Special Meeting |

| ISIN: | CA0545211090 |

| CUSIP: | 054521109 |

| Meeting Date: | Thursday, May 16, 2024 |

| Record date for Notice: | Thursday, May 16, 2024 |

| Record date for Voting: | Thursday, May 16, 2024 |

| Beneficial Ownership Determination Date: | Thursday, June 20, 2024 |

| Class of securities entitled to receive notice: | COMMON SHARES |

| Class of securities entitled to vote: | COMMON SHARES |

Issuer sending proxy related materials directly to NOBO: |

Yes |

| Issuer paying for delivery to OBO: | No |

| Meeting location | Vancouver, BC |

Suite 1120 - 789 West Pender Street, Vancouver, BC V6C 1H2

Tel: (778)968-1176

| Notice and Access (NAA) Requirements: | |

| NAA for Beneficial Holders | No |

| Beneficial Holders Stratification Criteria: | |

| Number of shares greater than: | n/a |

| Holder Consent Type(s): | n/a |

| Holder Provinces-Territories: | n/a |

| NAA for Registered Holders | No |

| Registered Holders Stratification Criteria: | |

| Number of shares greater than: | n/a |

| Holder Provinces-Territories: | n/a |

Yours truly,

“Kiriaki Smith”

Kiriaki Smith

CFO & Corporate Secretary

| cc: Alberta Securities Commission | cc: P.E.I. Securities Commission |

| cc: Manitoba Securities Commission | cc: Quebec Securities Commission |

| cc: New Brunswick Securities Commission | cc: Saskatchewan Securities Commission |

| cc: Nova Scotia Securities Commission | cc: Registrar of Securities – Northwest Territories |

| cc: Ontario Securities Commission | cc: Registrar of Securities – Yukon Territories |

| cc: Nunavut Securities Commission | cc: TSX Venture Exchange |

| cc: Newfoundland Securities Commission | cc: CDS Inc. |

Suite 1120 - 789 West Pender Street, Vancouver, BC V6C 1H2

Tel: (778)968-1176

Exhibit 3

AVRICORE HEALTH INC.

AMENDED NOTICE OF MEETING

April 15, 2024

| To: | All Canadian Securities Regulatory Authorities |

| Re: | Avricore Health Inc. (the “Company”) |

| Annual General & Special Meeting of Shareholders |

In connection with section 2.2 of National Instrument 54-101, we wish to advise you of the following information with respect to the Company’s upcoming Meeting of shareholders:

| Issuer: | AVRICORE HEALTH INC. |

| Meeting Type: | Annual General & Special Meeting |

| ISIN: | CA0545211090 |

| CUSIP: | 054521109 |

| Meeting Date: | Thursday, June 20, 2024 |

| Record date for Notice: | Thursday, May 16, 2024 |

| Record date for Voting: | Thursday, May 16, 2024 |

| Beneficial Ownership Determination Date: | Thursday, May 16, 2024 |

| Class of securities entitled to receive notice: | COMMON SHARES |

| Class of securities entitled to vote: | COMMON SHARES |

Issuer sending proxy related materials directly to NOBO: |

Yes |

| Issuer paying for delivery to OBO: | No |

| Meeting location | Vancouver, BC |

Suite 1120 - 789 West Pender Street, Vancouver, BC V6C 1H2

Tel: (778)968-1176

| Notice and Access (NAA) Requirements: | |

| NAA for Beneficial Holders | No |

| Beneficial Holders Stratification Criteria: | |

| Number of shares greater than: | n/a |

| Holder Consent Type(s): | n/a |

| Holder Provinces-Territories: | n/a |

| NAA for Registered Holders | No |

| Registered Holders Stratification Criteria: | |

| Number of shares greater than: | n/a |

| Holder Provinces-Territories: | n/a |

Yours truly,

“Kiriaki Smith”

Kiriaki Smith

CFO & Corporate Secretary

| cc: Alberta Securities Commission | cc: P.E.I. Securities Commission |

| cc: Manitoba Securities Commission | cc: Quebec Securities Commission |

| cc: New Brunswick Securities Commission | cc: Saskatchewan Securities Commission |

| cc: Nova Scotia Securities Commission | cc: Registrar of Securities – Northwest Territories |

| cc: Ontario Securities Commission | cc: Registrar of Securities – Yukon Territories |

| cc: Nunavut Securities Commission | cc: TSX Venture Exchange |

| cc: Newfoundland Securities Commission | ccCDS Inc. |

Suite 1120 - 789 West Pender Street, Vancouver, BC V6C 1H2

Tel: (778)968-1176

Exhibit 4

Avricore Health Inc.

Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Directors of Avricore Health Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated statements of financial position of Avricore Health Inc. and its subsidiaries (together, the “Company”) as of December 31, 2023 and 2022, and the related consolidated statements of operations and comprehensive loss, changes in shareholders’ equity and cash flows for the years ended December 31, 2023, 2022 and 2021, including the related notes (collectively referred to as the “financial statements”).

In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2023 and 2022, and its financial performance and its cash flows for the years ended December 31, 2023, 2022 and 2021 in conformity with IFRS Accounting Standards (“IFRS”) as issued by the International Accounting Standards Board.

Explanatory Paragraph – Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As described in Note 1, the Company has historically experienced operating losses and negative cash flows from operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s evaluation of the events and conditions and plans in regard to these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are matters arising from the current-period audit of the financial statements that were communicated or required to be communicated to the audit committee and that (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

Recognition of Revenue

Critical Audit Matter Description

We draw your attention to Notes 3(a), 14 and 19 of the financial statements. During the year ended December 31, 2023, the Company recognized revenues of $3,485,147. The Company recognizes revenues upon transfer of control of promised products or services to customers in an amount that reflects the consideration the Company expects to receive in exchange for those products or services. Significant judgment is exercised by the Company in determining whether the revenue recognition criteria has been met, and includes the following:

| ● | The point upon which control is transferred to the customer and revenue is deemed earned pursuant to IFRS 15, Revenues from Contracts with Customers, and can be recognized for each distinct performance obligation. | |

| ● | Determination of whether products and services are considered distinct performance obligations that should be accounted for separately versus together, such as software and services which are provided in conjunction with equipment leased to the customers under operating lease arrangements. | |

| ● | Determination of whether the Company acts as a principal or agent. |

Given these factors, the related audit effort in evaluating management’s judgments in determining revenue recognition was extensive and required a high degree of auditor judgment.

How the Critical Audit Matter was Addressed in the Audit

We responded to this matter by performing the following procedures:

| ● | We evaluated management’s material accounting policies related to revenue recognition and ensured these are in accordance with IFRS 15 for the Company’s contracts with its customers. | |

| ● | We reviewed the underlying customer agreements, including master agreements, statements of works and other documents that were part of the agreements, and ensured that the Company’s evaluation of the agreements is appropriate, management has appropriately identified distinct performance obligations pursuant to the agreements, and the Company has appropriately recognized revenues in accordance with IFRS 15. We ensured that service revenues are recorded at a point in time when revenue recognition criteria are met. | |

|

● | We selected a sample of sales transactions and vouched each transaction to underlying supporting documents, including invoices, receipt of payment and delivery confirmation to ensure that the Company has recorded revenues from sale of product upon meeting the revenue recognition criteria in accordance with IFRS 15. We also obtained a confirmation from the Company’s significant customer confirming the sales transactions during the year. |

| ● | We evaluated management’s assessment of whether it acts as a principal or agent pursuant to IFRS 15, and reviewed the underlying agreements with the Company’s vendors and customers. |

/s/ Manning Elliott LLP

CHARTERED PROFESSIONAL ACCOUNTANTS

Vancouver, Canada

April 29, 2024

PCAOB ID: 1524

We have served as the Company’s auditor since 2020.

Avricore Health Inc.

Consolidated Statements of Financial Position

(Expressed in Canadian Dollars)

| Note | 2023 | 2022 | ||||||||

| $ | $ | |||||||||

| ASSETS | ||||||||||

| Current Assets | ||||||||||

| Cash and cash equivalents | 276,571 | 620,527 | ||||||||

| Term deposit | 10,000 | 10,000 | ||||||||

| Accounts receivable | 4 | 427,689 | 770,373 | |||||||

| Prepaid expenses and deposits | 5 | 38,625 | 30,231 | |||||||

| Inventory | 20,676 | - | ||||||||

| 773,561 | 1,431,131 | |||||||||

| Equipment | 6 | 1,717,995 | 1,107,991 | |||||||

| Intangible assets | 7 | 46,649 | 29,861 | |||||||

| Total Assets | 2,538,205 | 2,568,983 | ||||||||

| LIABILITIES | ||||||||||

| Current Liabilities | ||||||||||

| Accounts payable and accrued liabilities | 8 | 489,218 | 312,893 | |||||||

| Deferred revenue | - | 252,000 | ||||||||

| Loans payable | 9 | 40,000 | 40,000 | |||||||

| 529,218 | 604,893 | |||||||||

| SHAREHOLDERS’ EQUITY | ||||||||||

| Share capital | 10 | 27,186,114 | 27,064,727 | |||||||

| Reserves | 10 | 6,558,433 | 5,933,708 | |||||||

| Deficit | (31,735,560 | ) | (31,034,345 | ) | ||||||

| 2,008,987 | 1,964,090 | |||||||||

| Total Liabilities and Shareholders’ Equity | 2,538,205 | 2,568,983 | ||||||||

Nature of operations and going concern (Note 1)

Approved and authorized for issuance on behalf of the Board of Directors on April 29, 2024.

| “Hector Bremner” | “David Hall” | |

| Hector Bremner, Director | David Hall, Chairman |

The accompanying notes are an integral part of these consolidated financial statements.

| 3 |

Avricore Health Inc.

Consolidated Statements of Operations and Comprehensive Loss

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| Note | 2023 | 2022 | 2021 | |||||||||||

| $ | $ | $ | ||||||||||||

| Revenue | 14 & 18 | 3,485,147 | 1,768,374 | 122,808 | ||||||||||

| Cost of sales | (2,281,751 | ) | (1,311,581 | ) | (92,287 | ) | ||||||||

| Gross profit | 1,203,396 | 456,793 | 30,521 | |||||||||||

| Expenses | ||||||||||||||

| Advertising and promotion | 1,035 | 2,961 | - | |||||||||||

| Amortization | 2,347 | 631 | 17,984 | |||||||||||

| Consulting | 12 | 236,117 | 197,860 | 355,350 | ||||||||||

| General and administrative | 11 | 339,369 | 250,144 | 182,847 | ||||||||||

| Management Fees | 12 | 216,000 | 168,000 | 205,000 | ||||||||||

| Shareholder communications | 112,234 | 173,035 | 329,342 | |||||||||||

| Professional fees | 12 | 285,935 | 150,585 | 189,796 | ||||||||||

| Share-based compensation | 10 & 12 | 703,612 | 331,522 | 495,791 | ||||||||||

| (1,896,649 | ) | (1,274,738 | ) | (1,776,110 | ) | |||||||||

| Loss before other income (expense) | (693,253 | ) | (817,945 | ) | (1,745,589 | ) | ||||||||

| Other income (expense) | ||||||||||||||

| Finance costs | - | - | (38,438 | ) | ||||||||||

| Gain on settlement and write-off of liabilities | - | - | 75,467 | |||||||||||

| Foreign exchange gain (loss) | (6,652 | ) | 298 | (153 | ) | |||||||||

| Interest income | 3,284 | 8,086 | 581 | |||||||||||

| Write-off of accounts receivable | (4,594 | ) | (8,667 | ) | - | |||||||||

| Net loss and comprehensive loss for the year | (701,215 | ) | (818,228 | ) | (1,708,132 | ) | ||||||||

| Basic and Diluted Loss Per Share | (0.01 | ) | (0.01 | ) | (0.02 | ) | ||||||||

| Weighted Average Number of Common Shares Outstanding | 99,559,459 | 97,859,216 | 92,610,766 | |||||||||||

Segmented information (Note 14)

The accompanying notes are an integral part of these consolidated financial statements

| 4 |

Avricore Health Inc.

Consolidated Statements of Changes in Shareholder’s Equity

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| Number of Shares | Share Capital | Warrant Reserve | Option Reserve | Deficit | Total | |||||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||||||

| Balance, December 31, 2020 | 69,795,584 | 22,286,852 | 914,531 | 4,582,561 | (28,507,985 | ) | (724,041 | ) | ||||||||||||||||

| Shares issued for cash | 15,740,000 | 2,414,000 | - | - | - | 2,414,000 | ||||||||||||||||||

| Exercise of warrants | 10,058,660 | 1,805,132 | (151,395 | ) | - | - | 1,653,737 | |||||||||||||||||

| Exercise of stock options | 1,666,020 | 312,052 | - | (186,395 | ) | - | 125,657 | |||||||||||||||||

| Share issued for services | 275,000 | 38,500 | - | - | - | 38,500 | ||||||||||||||||||

| Share issuance costs | - | (238,221 | ) | 139,625 | - | - | (98,596 | ) | ||||||||||||||||

| Share-based compensation | - | - | - | 495,791 | - | 495,791 | ||||||||||||||||||

| Net loss for the year | - | - | - | - | (1,708,132 | ) | (1,708,132 | ) | ||||||||||||||||

| Balance, December 31, 2021 | 97,535,264 | 26,618,315 | 902,761 | 4,891,957 | (30,216,117 | ) | 2,196,916 | |||||||||||||||||

| Exercise of warrants | 909,400 | 175,412 | (1,532 | ) | - | - | 173,880 | |||||||||||||||||

| Exercise of options | 800,000 | 271,000 | - | (191,000 | ) | - | 80,000 | |||||||||||||||||

| Share-based compensation | - | - | - | 331,522 | - | 331,522 | ||||||||||||||||||

| Net loss for the year | - | - | - | - | (818,228 | ) | (818,228 | ) | ||||||||||||||||

| Balance, December 31, 2022 | 99,244,664 | 27,064,727 | 901,229 | 5,032,479 | (31,034,345 | ) | 1,964,090 | |||||||||||||||||

| Exercise of options | 400,000 | 121,387 | - | (78,887 | ) | - | 42,500 | |||||||||||||||||

| Share-based compensation | - | - | - | 703,612 | - | 703,612 | ||||||||||||||||||

| Net loss for the year | - | - | - | - | (701,215 | ) | (701,215 | ) | ||||||||||||||||

| Balance, December 31, 2023 | 99,644,664 | 27,186,114 | 901,229 | 5,657,204 | (31,735,560 | ) | 2,008,987 | |||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 5 |

Avricore Health Inc.

Consolidated Statements of Cash Flows

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 2023 | 2022 | 2021 | ||||||||||

| $ | $ | $ | ||||||||||

| Operating Activities | ||||||||||||

| Net loss | (701,215 | ) | (818,228 | ) | (1,708,132 | ) | ||||||

| Adjustment for non-cash items: | ||||||||||||

| Amortization | 420,067 | 183,047 | 17,984 | |||||||||

| Finance cost | - | - | 38,438 | |||||||||

| Share-based payments | 703,612 | 331,522 | 495,791 | |||||||||

| Write-off of accounts receivable | 4,594 | 8,667 | - | |||||||||

| Change in working capital items: | ||||||||||||

| Accounts receivable | 338,090 | (687,492 | ) | (79,620 | ) | |||||||

| Inventory | (20,676 | ) | - | - | ||||||||

| Prepaid expenses and deposits | (8,394 | ) | 24,236 | 70,977 | ||||||||

| Deferred revenue | (252,000 | ) | 252,000 | - | ||||||||

| Accounts payable and accrued liabilities | 176,325 | 268,416 | (69,592 | ) | ||||||||

| Net cash provided by (used in) operating activities | 660,403 | (437,832 | ) | (1,234,154 | ) | |||||||

| Investing Activities | ||||||||||||

| Intangible assets | (25,288 | ) | (5,171 | ) | (35,006 | ) | ||||||

| Purchase of equipment | (1,021,571 | ) | (1,193,345 | ) | (105,358 | ) | ||||||

| Term deposit | - | (10,000 | ) | - | ||||||||

| Net cash used in investing activities | (1,046,859 | ) | (1,208,516 | ) | (140,364 | ) | ||||||

| Financing Activities | ||||||||||||

| Proceeds from issuance of shares | - | - | 2,404,000 | |||||||||

| Proceeds from exercise of warrants | - | 173,880 | 1,653,737 | |||||||||

| Proceeds from exercise of stock options | 42,500 | 80,000 | 125,657 | |||||||||

| Share issuance costs | - | - | (98,596 | ) | ||||||||

| Loan repaid | - | - | (1,000,000 | ) | ||||||||

| Net cash provided by financing activities | 42,500 | 253,880 | 3,084,798 | |||||||||

| Decrease in cash and cash equivalents | (343,956 | ) | (1,392,468 | ) | 1,710,280 | |||||||

| Cash and cash equivalents, beginning of year | 620,527 | 2,012,995 | 302,715 | |||||||||

| Cash and cash equivalents, end of year | 276,571 | 620,527 | 2,012,995 | |||||||||

| Cash and cash equivalents consist of: | ||||||||||||

| Cash in bank accounts | 276,571 | 620,527 | 1,702,995 | |||||||||

| Guaranteed investment certificates | - | - | 310,000 | |||||||||

| Cash and cash equivalents | 276,571 | 620,527 | 2,012,995 | |||||||||

Supplemental cash flow information (Note 15)

The accompanying notes are an integral part of these consolidated financial statements.

| 6 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 1. | NATURE OF OPERATIONS AND GOING CONCERN |

Avricore Health Inc. (the “Company”) was incorporated under the Company Act of British Columbia on May 30, 2000. The Company’s common shares trade on the TSX Venture Exchange (the “Exchange”) under the symbol “AVCR” and are quoted on the OTCIQ Market as “NUVPF”. The Company’s registered office is at 700 – 1199 West Hastings Street, Vancouver, British Columbia, V6E 3T5.

The Company is involved in the business of health data and point-of-care technologies (“POCT”).

The consolidated financial statements have been prepared on the basis of accounting principles applicable to a going concern, which assumes that the Company will continue in operations for the foreseeable future and be able to realize assets and satisfy liabilities in the normal course of business. The Company has historically experienced operating losses and negative operating cash flows. As at December 31, 2023, the Company has an accumulated deficit of $31,735,560 and working capital of $244,343 which is insufficient to finance the Company’s operations over the next twelve months. These conditions indicate the existence of material uncertainty that may cast significant doubt on the Company’s ability to continue as a going concern.

The continuation of the Company as a going concern is dependent upon its ability to generate revenue from its operations and/or raise additional financing to cover ongoing cash requirements. The consolidated financial statements do not reflect any adjustments, which could be material, to the carrying values of assets and liabilities, which may be required should the Company be unable to continue as a going concern.

| 2. | BASIS OF PRESENTATION |

| a) | Statement of Compliance |

The consolidated financial statements for the year ended December 31, 2023 have been prepared in accordance with IFRS Accounting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”).

| b) | Basis of preparation |

The consolidated financial statements of the Company have been prepared on an accrual basis and are based on historical costs, modified where applicable. The material accounting policies are presented in Note 3 and have been consistently applied in each of the periods presented. The consolidated financial statements are presented in Canadian dollars, which is also the Company’s and its subsidiary’s functional currency, unless other indicated.

| 7 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 2. | BASIS OF PRESENTATION (continued) |

| b) | Basis of preparation (continued) |

The preparation of consolidated financial statements in accordance with IFRS requires the Company’s management to make estimates, judgments and assumptions that affect amounts reported in the consolidated financial statements and accompanying notes. The areas involving a higher degree of judgment and complexity, or areas where assumptions and estimates are significant to the consolidated financial statements are disclosed below. Actual results might differ from these estimates. The Company’s management reviews these estimates and underlying judgments on an ongoing basis, based on experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. Revisions to estimates are adjusted for prospectively in the year in which the estimates are revised.

| c) | Basis of consolidation |

Consolidated financial statements include the assets, liabilities and results of operations of all entities controlled by the Company. Inter-company balances and transactions, including unrealized income and expenses arising from inter-company transactions, are eliminated in preparing the Company’s the condensed interim consolidated financial statements. Where control of an entity is obtained during a financial year, its results are included in the consolidated statements of operations and comprehensive loss from the date on which control commences. Where control of an entity ceases during a financial year, its results are included for that part of the year during which control exists.

These consolidated financial statements include the accounts of the Company and its controlled wholly owned Canadian subsidiary HealthTab™ Inc.

| 3. | SUMMARY OF MATERIAL ACCOUNTING POLICIES |

| a) | Revenue recognition |

The Company’s revenues are generated from operating leases of the POCT system and sale of testing panels. Revenue comprises the fair value of the consideration received or receivable and is shown net of tax and discounts.

The Company recognizes revenue to depict the transfer of goods and services to clients in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods and services by applying the following steps:

| ● | Identify the contract with a customer; |

| ● | Identify the performance obligations in the contract; |

| ● | Determine the transaction price; |

| ● | Allocate the transaction price to the performance obligations; and |

| ● | Recognize revenue when, or as, the Company satisfies a performance obligation. |

Revenue may be earned over time as the performance obligations are satisfied or at a point in time which is when the entity has earned a right to payment, the customer has possession of the asset and the related significant risks and rewards of ownership, and the customer has accepted the asset.

The Company’s arrangements with customers can include multiple performance obligations. When contracts involve various performance obligations, the Company evaluates whether each performance obligation is distinct and should be accounted for as a separate unit of accounting under IFRS 15, Revenue from Contracts with Customers.

| 8 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 3. | SUMMARY OF MATERIAL ACCOUNTING POLICIES (continued) |

| a) | Revenue recognition (continued) |

The Company determines the standalone selling price by considering its overall pricing objectives and market conditions. Significant pricing practices taken into consideration include discounting practices, the size and volume of our transactions, our marketing strategy, historical sales and contract prices. The determination of standalone selling prices is made through consultation with and approval by management, taking into consideration our go-to-market strategy. As the Company’s go-to-market strategies evolve, the Company may modify its pricing practices in the future, which could result in changes in relative standalone selling prices.

The Company generally receives payment from its customers after invoicing within the normal 28-day commercial terms. If a customer is specifically identified as a credit risk, recognition of revenue is deferred except to the extent of fees that have already been collected.

| b) | Leases |

A contract is, or contains, a lease if the contract conveys a lessee the right to control the use of lessor’s identified asset for a period of time in exchange for consideration.

The Company as a lessee

A lease liability is recognized at the commencement of the lease term at the present value of the lease payments that are not paid at that date. At the commencement date, a corresponding right-of-use asset is recognized at the amount of the lease liability, adjusted for lease incentives received, retirement costs and initial direct costs. Depreciation is recognized on the right-of-use asset over the lease term. Interest expense is recognized on the lease liabilities using the effective interest rate method and payments are applied against the lease liability.

Key areas where management has made judgments, estimates, and assumptions related to the application of IFRS 16 include:

| - | The incremental borrowing rates are based on judgments including economic environment, term, currency, and the underlying risk inherent to the asset. The carrying balance of the right-of-use assets, lease liabilities, and the resulting interest expense and depreciation expense, may differ due to changes in the market conditions and lease term. | |

| - | Lease terms are based on assumptions regarding extension terms that allow for operational flexibility and future market conditions. |

The Company as a lessor

A lease is classified as an operating lease if it does not transfer substantially all the risks and rewards incidental to ownership of an underlying asset. All other leases are classified as finance leases.

Leases of the Company’s POCT systems to customers are classified as operating leases. Lease payments from operating leases are recognized as income on a straight-line basis. All costs, including depreciation, incurred in earning the operating lease income are recognized as cost of sales. Initial direct costs incurred in obtaining an operating lease are added to the carrying amount of the underlying asset and recognized as an expense over the lease term on the same basis as the lease income. The depreciation for depreciable underlying assets subject to operating leases is in accordance with depreciation policy for the Company’s equipment.

| 9 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 3. | SUMMARY OF MATERIAL ACCOUNTING POLICIES (continued) |

| c) | Foreign currency |

Foreign currency transactions are translated into the functional currency of the respective entity, using the exchange rates prevailing at the dates of the transactions. Foreign exchange gains and losses resulting from the settlement of such transactions and from the remeasurement of monetary items at year-end exchange rates are recognized in profit or loss.

Non-monetary items measured at historical cost are translated using the exchange rates at the date of the transaction and are not retranslated. Non-monetary items measured at fair value are translated using the exchange rates at the date when fair value was determined.

| d) | Cash and cash equivalents |

Cash and cash equivalents include cash on account, demand deposits and money market investments with maturities from the date of acquisition of three months or less, which are readily convertible to known amounts of cash and are subject to insignificant changes in value.

| e) | Inventory |

Inventories consist of raw materials comprising the ingredients used to manufacture OTC pharmaceuticals, as well as the packaging for these products, and finished goods comprising Canadian generic pharmaceuticals. All inventories are recorded at the lower of cost on a weighted average basis and net realizable value. The stated value of all inventories includes purchase, shipping and freight, and quality control testing. A regular review is undertaken to determine the extent of any provision for obsolescence.

| f) | Intangible assets |

All intangible assets acquired separately by the Company are recorded at cost on the date of acquisition. Intangible assets that have indefinite lives are measured at cost less accumulated impairment losses. Intangible assets that have finite useful lives are measured at cost less accumulated amortization and accumulated impairment losses. Intangible assets comprise of software, intellectual property, trademarks and web domains and distribution rights, which are amortized on a straight-line basis over 3 years. Amortization rates are reviewed annually to ensure they are aligned with estimates of remaining economic useful lives of the associated intangible assets.

| g) | Equipment |

Equipment acquired by the Company is recorded at cost on the date of acquisition. Equipment is stated at historical cost less accumulated amortization and accumulated impairment losses. Amortization is calculated on a declining balance method over their estimated useful lives. The Company’s system hardware is amortized at 55% and system analyzers and software at 20%.

| 10 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 3. | SUMMARY OF MATERIAL ACCOUNTING POLICIES (continued) |

| h) | Share-based payments |

The Company operates an incentive share purchase option plan. Share-based payments to employees are measured at the fair value of the instruments issued and amortized over the vesting periods. Share- based payments to non-employees are measured at the fair value of goods or services received or the fair value of the equity instruments issued, if it is determined the fair value of the goods or services cannot be reliably measured, and are recorded at the date the goods or services are received. The corresponding amount is recorded to the option reserve. The fair value of options is determined using the Black-Scholes option pricing model, which incorporates all market vesting conditions. The number of shares and options expected to vest is reviewed and adjusted at the end of each reporting period such that the amount recognized for services received as consideration for the equity instruments granted shall be based on the number of equity instruments that eventually vest.

| i) | Share capital |

Proceeds from the exercise of stock options and warrants are recorded as share capital in the amount for which the option or warrant enabled the holder to purchase a share in the Company. Any previously recorded share-based payment included in the reserves account is transferred to share capital on exercise of options. Share capital issued for non-monetary consideration is valued at the closing market price at the date of issuance. The proceeds from issuance of units are allocated between common shares and warrants based on the residual method. Under this method, the proceeds are allocated first to share capital based on the fair value of the common shares at the time the units are priced and any residual value is allocated to the warrants reserve. Consideration received for the exercise of warrants is recorded in share capital, and any related amount recorded in warrants reserve is transferred to share capital.

| j) | Loss per share |

Basic loss per share is calculated by dividing the net loss available to common shareholders by the weighted average number of shares outstanding during the year. Diluted earnings per share reflect the potential dilution of securities that could share in earnings of an entity. In a loss year, potentially dilutive common shares are excluded from the loss per share calculation as the effect would be anti-dilutive. Basic and diluted loss per share are the same for the periods presented.

| k) | Income taxes |

Income tax expense, consisting of current and deferred tax expense, is recognized in the statements of operations. Current tax expense is the expected tax payable on the taxable income for the period, using tax rates enacted or substantively enacted at period-end, adjusted for amendments to tax payable with regard to previous years.

Deferred tax assets and liabilities and the related deferred income tax expense or recovery are recognized for deferred tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using the enacted or substantively enacted tax rates expected to apply when the asset is realized or the liability settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income (loss) in the period that substantive enactment occurs.

A deferred tax asset is recognized to the extent that it is probable that future taxable profits will be available against which the asset can be utilized. To the extent that the Company does not consider it probable that a deferred tax asset will be recovered, the deferred tax asset is reduced. Deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against current tax liabilities and when they relate to income taxes levied by the same taxation authority and the Company intends to settle its current tax assets and liabilities on a net basis.

| 11 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 3. | SUMMARY OF MATERIAL ACCOUNTING POLICIES (continued) |

| l) | Financial Instruments |

Classification

The Company classifies its financial instruments in the following categories: at fair value through profit and loss (“FVTPL”), at fair value through other comprehensive income (loss) (“FVTOCI”), or at amortized cost. The Company determines the classification of financial assets at initial recognition. The classification of debt instruments is driven by the Company’s business model for managing the financial assets and their contractual cash flow characteristics. Equity instruments that are held for trading are classified as FVTPL. For other equity instruments, on the day of acquisition the Company can make an irrevocable election (on an instrument-by-instrument basis) to designate them as at FVTOCI. Financial liabilities are measured at amortized cost, unless they are required to be measured at FVTPL (such as instruments held for trading or derivatives) or the Company has opted to measure them at FVTPL.

The Company has classified its cash and cash equivalents as FVTPL and term deposit, accounts receivable, accounts payable and loans payable as amortized cost.

Measurement

Financial assets and liabilities at amortized cost

Financial assets and liabilities at amortized cost are initially recognized at fair value plus or minus transaction costs, respectively, and subsequently carried at amortized cost less any impairment.

Financial assets and liabilities at FVTPL

Financial assets and liabilities carried at FVTPL are initially recorded at fair value and transaction costs are expensed in profit or loss. Realized and unrealized gains and losses arising from changes in the fair value of the financial assets and liabilities held at FVTPL are included in the profit or loss in the period in which they arise.

Financial assets at FVTOCI

Investments in equity instruments at FVTOCI are initially recognized at fair value plus transaction costs. Subsequently they are measured at fair value, with gains and losses arising from changes in fair value recognized in other comprehensive income (loss) as they arise.

Impairment of financial assets at amortized cost

An ‘expected credit loss’ impairment model applies which requires a loss allowance to be recognized based on expected credit losses. The estimated present value of future cash flows associated with the asset is determined and an impairment loss is recognized for the difference between this amount and the carrying amount as follows: the carrying amount of the asset is reduced to estimated present value of the future cash flows associated with the asset, discounted at the financial asset’s original effective interest rate, either directly or through the use of an allowance account and the resulting loss is recognized in profit or loss for the period. In a subsequent period, if the amount of the impairment loss related to financial assets measured at amortized cost decreases, the previously recognized impairment loss is reversed through profit or loss to the extent that the carrying amount of the investment at the date the impairment is reversed does not exceed what the amortized cost would have been had the impairment not been recognized.

| 12 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 3. | SUMMARY OF MATERIAL ACCOUNTING POLICIES (continued) |

| l) | Financial Instruments (continued) |

Derecognition

Financial assets

The Company derecognizes financial assets only when the contractual rights to cash flows from the financial assets expire, or when it transfers the financial assets and substantially all of the associated risks and rewards of ownership to another entity. Gains and losses on derecognition are generally recognized in profit or loss.

| m) | Impairment of equipment and intangible assets |

At the end of each reporting period, if there are indicators of impairment, the Company reviews the carrying amounts of its equipment and intangible assets to determine whether there is any indication that those assets have suffered an impairment loss. Individual assets are grouped together as a cash generating unit for impairment assessment purposes at the lowest level at which there are identifiable cash flows that are independent from other group assets.

If any such indication of impairment exists, the Company makes an estimate of its recoverable amount. The recoverable amount is the higher of fair value less costs to sell and value in use. Where the carrying amount of a cash generating unit exceeds its recoverable amount, the cash generating unit is considered impaired and is written down to its recoverable amount. In assessing the value in use, the estimated future cash flows are adjusted for the risks specific to the cash generating unit and are discounted to their present value with a discount rate that reflects the current market indicators. The recoverable amount of intangible assets with an indefinite useful life, intangible assets not available for use, or goodwill acquired in a business combination are measured annually whether or not there are any indications that impairment exists.

Where an impairment loss subsequently reverses, the carrying amount of the cash generating unit is increased to the revised estimate of its recoverable amount, to the extent that the increased carrying amount does not exceed the carrying amount that would have been determined had no impairment loss been recognized for the cash generating unit in prior years. A reversal of an impairment loss is recognized as income immediately.

| n) | Significant accounting estimates and judgments |

Estimates

Significant estimates used in applying accounting policies that have the most significant effect on the amounts recognized in the financial statements are as follows:

| 13 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 3. | SUMMARY OF MATERIAL ACCOUNTING POLICIES (continued) |

| n) | Significant accounting estimates and judgments (continued) |

Share-based payments

The Company grants share-based awards to certain directors, officers, employees, consultants and other eligible persons. For equity-settled awards, the fair value is charged to the statement of operations and comprehensive loss and credited to the reserves over the vesting period using the graded vesting method, after adjusting for the estimated number of awards that are expected to vest.

The fair value of equity-settled awards is determined at the date of the grant using the Black-Scholes option pricing model. For equity-settled awards to non-employees, the fair value is measured at each vesting date. The estimate of warrant and option valuation also requires determining the most appropriate inputs to the valuation model, including the volatility, expected life of warrants and options, risk free interest rate and dividend yield. Management must also make significant judgments or assessments as to how financial assets and liabilities are categorized.

Estimation of useful lives of equipment and software

Amortization of equipment and software is dependent upon estimates of their useful lives. The actual lives of the assets are assessed annually and may vary depending on a number of factors. In reassessing asset lives, factors such as technological innovation, product lifecycles, and maintenance are taken into account.

Judgements

Significant judgments used in applying accounting policies that have the most significant effect on the amounts recognized in the financial statements are as follows:

Revenue recognition

Revenue is recognized when the revenue recognition criteria expressed in the accounting policy stated above have been met. Judgment may be required when allocating revenue or discounts on sales amongst the various elements in a sale involving multiple deliverables.

Deferred income taxes

Tax interpretations, regulations and legislation in the various jurisdictions in which the Company operates are subject to change. The determination of income tax expense and deferred tax involves judgment and estimates as to the future taxable earnings, expected timing of reversals of deferred tax assets and liabilities, and interpretations of laws in the countries in which the Company operates. The Company is subject to assessments by tax authorities who may interpret the tax law differently. Changes in these estimates may materially affect the final amount of deferred taxes or the timing of tax payments. If a positive forecast of taxable income indicates the probable use of a deferred tax asset, especially when it can be utilized without a time limit, that deferred tax asset is usually recognized in full.

Going concern

Management has applied judgements in the assessment of the Company’s ability to continue as a going concern when preparing its financial statements for the year ended December 31, 2023. In assessing whether the going concern assumption is appropriate, management takes into account all available information about the future, which is at least, but is not limited to, twelve months from the end of the reporting period. The factors considered by management are disclosed in Note 1.

| 14 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 3. | SUMMARY OF MATERIAL ACCOUNTING POLICIES (continued) |

| o) | Application of new and revised Accounting Standards and accounting standards issued but not yet effective |

There are no significant changes in accounting policies but several amendments to IFRS Accounting Standards and interpretations became effective for annual periods beginning on or after January 1, 2023.

The Company has adopted the amendments to IAS 1 Presentation of Financial Statements as well as IAS 8 Changes in Accounting Estimates and Errors regarding the disclosure of accounting policies and accounting estimates, which were effective for annual periods beginning on January 1, 2023. The amendments did not have a material impact on the Company’s financial statements. There are no accounting pronouncements with future effective dates that are applicable or are expected to have a material impact on the Company’s consolidated financial statements.

| 4. | ACCOUNTS RECEIVABLE |

The Company’s accounts receivable consists of the following:

| 2023 | 2022 | |||||||

| $ | $ | |||||||

| Trade receivables | 420,998 | 748,097 | ||||||

| GST receivable | 6,691 | 22,276 | ||||||

| 427,689 | 770,373 | |||||||

| 5. | PREPAID EXPENSES AND DEPOSITS |

The balance consists of prepaid expenses to vendors of $16,889 (2022 - $6,932), prepaid business insurance of $9,736 (2022 - $11,299) and security deposits of $12,000 (2022 - $12,000).

| 6. | EQUIPMENT |

| Equipment | ||||

| $ | ||||

| Cost | ||||

| Balance, December 31, 2021 | 105,358 | |||

| Additions | 1,193,345 | |||

| Balance, December 31, 2022 | 1,298,703 | |||

| Additions | 1,021,572 | |||

| Balance, December 31, 2023 | 2,320,275 | |||

| Accumulated Amortization | ||||

| Balance, December 31, 2021 | 14,483 | |||

| Amortization | 176,229 | |||

| Balance, December 31, 2022 | 190,712 | |||

| Amortization | 411,568 | |||

| Balance, December 31, 2023 | 602,280 | |||

| Carrying value | ||||

| As at December 31, 2022 | 1,107,991 | |||

| As at December 31, 2023 | 1,717,995 | |||

Equipment is comprised primarily of assets leased to earn revenues.

| 15 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 7. | INTANGIBLE ASSETS |

| Software | HealthTab™ | Corozon | Emerald | Total | ||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

| Cost | ||||||||||||||||||||

| Balance, December 31, 2021 | 35,006 | 1 | 1 | 1 | 35,009 | |||||||||||||||

| Additions | 5,171 | - | - | - | 5,171 | |||||||||||||||

| Balance, December 31, 2022 | 40,177 | 1 | 1 | 1 | 40,180 | |||||||||||||||

| Additions | 25,288 | - | - | - | 25,288 | |||||||||||||||

| Balance, December 31, 2023 | 65,465 | 1 | 1 | 1 | 65,468 | |||||||||||||||

| Accumulated Amortization | ||||||||||||||||||||

| Balance, December 31, 2021 | 3,501 | - | - | - | 3,501 | |||||||||||||||

| Amortization | 6,818 | - | - | - | 6,818 | |||||||||||||||

| Balance, December 31, 2022 | 10,319 | - | - | - | 10,319 | |||||||||||||||

| Amortization | 8,500 | - | - | - | 8,500 | |||||||||||||||

| Balance, December 31, 2023 | 18,819 | - | - | - | 18,819 | |||||||||||||||

| Carrying value | ||||||||||||||||||||

| As at December 31, 2022 | 29,858 | 1 | 1 | 1 | 29,861 | |||||||||||||||

| As at December 31, 2023 | 46,646 | 1 | 1 | 1 | 46,649 | |||||||||||||||

| 8. | ACCOUNTS PAYABLE AND ACCRUED LIABILITIES |

The Company’s accounts payable and accrued liabilities consist of the following:

| 2023 | 2022 | |||||||

| $ | $ | |||||||

| Trade accounts payable | 428,677 | 261,493 | ||||||

| GST payable | 60,541 | 51,400 | ||||||

| 489,218 | 312,893 | |||||||

| 9. | LOANS PAYABLE |

During the year ended December 31, 2020, the Company received a Canada Emergency Business Account loan of $40,000 to be repaid on or before December 31, 2024. The loan was interest-free until January 18, 2024. Thereafter, the outstanding loan balance will bear interest at the rate of 5% per annum. The loan was repaid in full on January 18, 2024.

| 16 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 10. | SHARE CAPITAL |

Authorized share capital

Authorized: Unlimited number of common shares without par value.

Issued share capital

During the year ended December 31, 2023:

The Company issued 400,000 common shares upon exercise of stock options for gross proceeds of $42,500.

During the year ended December 31, 2022:

The Company issued 909,400 common shares upon exercise of warrants for gross proceeds of $173,880.

The Company issued 800,000 common shares upon exercise of stock options for gross proceeds of $80,000.

During the year ended December 31, 2021:

On February 12, 2021, the Company completed a non-brokered private placement and issued 7,000,000 units at a price of $0.22 per unit for gross proceeds of $1,540,000. Each unit consisted of one common share and one share purchase warrant entitling the holder thereof to acquire an additional common share of the Company at a price of $0.30 per share for a period of 12 months from the date of closing subject to an accelerated expiry condition. The Company’s directors and officers participated in the private placement. The Company paid finder’s fee totaling $56,320 and issued 256,000 finder’s warrants valued at $39,206.

On January 28, 2021, the Company closed the final tranche of a non-brokered private placement and issued 8,740,000 units at a price of $0.10 per unit for gross proceeds of $874,000. Each unit consisted of one common share and one share purchase warrant entitling the holder thereof to acquire an additional common share of the Company at a price of $0.15 per share for a period of 12 months from the date of closing subject to an accelerated expiry condition. The Company’s directors and officers participated in the private placement. The Company paid finder’s fee totaling $27,800 and issued 278,000 finder’s warrants valued at $100,419.

Stock options

The Company has adopted an incentive share purchase option plan under the rules of the Exchange pursuant to which it is authorized to grant options to executive officers, directors, employees and consultants, enabling them to acquire up to 10% of the issued and outstanding common shares of the Company. The options can be granted for a maximum term of ten years and generally vest either immediately or in specified increments of up to 25% in any three-month period.

| 17 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 10. | SHARE CAPITAL (continued) |

Stock options (continued)

The changes in stock options including those granted to directors, officers, employees and consultants are summarized as follows:

| 2023 | 2022 | 2021 | ||||||||||||||||||||||

| Number of Options | Weighted Average Exercise Price | Number of Options | Weighted Average Exercise Price | Number of Options | Weighted Average Exercise Price | |||||||||||||||||||

| Beginning Balance | 8,635,000 | $ | 0.14 | 7,880,052 | $ | 0.13 | 6,706,072 | $ | 0.08 | |||||||||||||||

| Options granted | 2,365,000 | $ | 0.26 | 3,125,000 | $ | 0.15 | 2,840,000 | $ | 0.22 | |||||||||||||||

| Expired/Cancelled | (250,000 | ) | $ | 0.17 | (1,570,052 | ) | $ | 0.13 | - | - | ||||||||||||||

| Exercised | (400,000 | ) | $ | 0.11 | (800,000 | ) | $ | 0.10 | (1,666,020 | ) | $ | 0.08 | ||||||||||||

| Ending Balance | 10,350,000 | $ | 0.17 | 8,635,000 | $ | 0.14 | 7,880,052 | $ | 0.13 | |||||||||||||||

| Exercisable | 9,132,250 | $ | 0.17 | 6,216,250 | $ | 0.14 | 7,692,552 | $ | 0.13 | |||||||||||||||

The following table summarizes information about stock options outstanding and exercisable as at December 31, 2023:

| Exercise Price | Expiry date | Options | ||||||||||

| Outstanding | Exercisable | |||||||||||

| $ | 0.075 | January 24, 2024 | 140,000 | 140,000 | ||||||||

| $ | 0.06 | April 1, 2024 | 140,000 | 140,000 | ||||||||

| $ | 0.05 | October 15, 2024 | 1,470,000 | 1,470,000 | ||||||||

| $ | 0.08 | November 18, 2025 | 500,000 | 500,000 | ||||||||

| $ | 0.08 | December 8, 2025 | 710,000 | 710,000 | ||||||||

| $ | 0.19 | January 28, 2026 | 150,000 | 150,000 | ||||||||

| $ | 0.25 | March 22, 2026 | 1,800,000 | 1,800,000 | ||||||||

| $ | 0.15 | August 10, 2027 | 2,675,000 | 2,675,000 | ||||||||

| $ | 0.15 | August 12, 2027 | 100,000 | 100,000 | ||||||||

| $ | 0.16 | October 12, 2027 | 300,000 | 300,000 | ||||||||

| $ | 0.28 | May 15, 2028 | 1,825,000 | 912,500 | ||||||||

| $ | 0.20 | June 21, 2028 | 400,000 | 200,000 | ||||||||

| $ | 0.20 | September 15, 2028 | 140,000 | 35,000 | ||||||||

| 10,350,000 | 9,132,250 | |||||||||||

The weighted average remaining life of the stock options outstanding at December 31, 2023 is 2.84 years (December 31, 2022: 3.17 years).

Share-based compensation

Share-based compensation of $703,612 was recognized during the year ended December 31, 2023 (2022 - $331,522, 2021 – 495,791), respectively, for stock options granted and/or vested during the year. Options issued to directors and officers of the Company vested immediately, while those issued to consultants vest over one year, however, the Board may change such provisions at its discretion or as required on a grant-by-grant basis.

| 18 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 10. | SHARE CAPITAL (continued) |

Share-based compensation (continued)

Share-based payments for options granted and repriced was measured using the Black-Scholes option pricing model with the following assumptions:

| 2023 | 2022 | 2021 | ||||||||||

| Expected life | 3.30 years | 0.8 – 2.65 years | 1 – 5 years | |||||||||

| Volatility | 134% - 174% | 94% - 193% | 134% - 211% | |||||||||

| Dividend yield | 0 | % | 0 | % | 0 | % | ||||||

| Risk-free interest rate | 3.28% – 4.20% | 1.46% – 3.71% | 0.32% - 0.99% | |||||||||

Option pricing models require the use of highly subjective estimates and assumptions, including the expected stock price volatility. Changes in the underlying assumptions can materially affect the fair value estimates.

Warrants

The Company has issued warrants entitling the holders to acquire common shares of the Company. The summary of changes in warrants is presented below.

| 2023 | 2022 | 2021 | ||||||||||||||||||||||

| Number of Warrants | Weighted Average Exercise Price | Number of Warrants | Weighted Average Exercise Price | Number of Warrants | Weighted Average Exercise Price | |||||||||||||||||||

| Beginning Balance | - | - | 18,781,066 | $ | 0.21 | 18,743,226 | $ | 0.16 | ||||||||||||||||

| Warrants issued | - | - | - | - | 16,274,000 | $ | 0.22 | |||||||||||||||||

| Warrants exercised | - | - | (909,400 | ) | $ | 0.19 | (10,058,660 | ) | $ | 0.16 | ||||||||||||||

| Warrants expired | - | - | (17,871,666 | ) | $ | 0.22 | (6,177,500 | ) | $ | 0.15 | ||||||||||||||

| Outstanding | - | - | - | - | 18,781,066 | $ | 0.21 | |||||||||||||||||

Fair value of the finder’s warrants granted was measured using the Black-Scholes pricing model. Black-Scholes pricing models require the use of highly subjective estimates and assumptions, including the expected stock price volatility. Changes in the underlying assumptions can materially affect the fair value estimates.

| 19 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 11. | GENERAL AND ADMINISTRATIVE EXPENSES |

| 2023 | 2022 | 2021 | ||||||||||

| $ | $ | $ | ||||||||||

| Bank service charges | 6,008 | 5,421 | 6,806 | |||||||||

| Filing and registration fees | 61,569 | 40,563 | 59,635 | |||||||||

| Insurance | 92,812 | 60,251 | 44,784 | |||||||||

| Investor relations | - | - | 5,312 | |||||||||

| Office maintenance | 44,545 | 31,888 | 30,738 | |||||||||

| Payroll | 70,495 | 34,813 | - | |||||||||

| Regulatory fees | 7,373 | 5,238 | 8,380 | |||||||||

| Rent | 18,000 | 16,800 | 12,810 | |||||||||

| Travel | 35,317 | 55,170 | 14,382 | |||||||||

| Warranty expense | 3,250 | - | - | |||||||||

| 339,369 | 250,144 | 182,847 | ||||||||||

| 12. | RELATED PARTY TRANSACTIONS |

For the year ended December 31, 2023 and 2022, the Company recorded the following transactions with related parties:

| a) | $6,000 in office rent (2022 – $6,000, 2021 - $6,000) to a company controlled by the Chief Technology Officer of the Company. |

| b) | $12,000 in office rent (2022 – $9,000, 2021 - $Nil) to a company controlled by the Chief Financial Officer of the Company. |

| c) | $231,393 worth of purchases (2022 - $Nil, 2021 - $Nil) to a company controlled by Chief Technology Officer of the Company. |

Related party transactions not otherwise described in the consolidated financial statements are shown below. The remuneration of the Company’s directors and other members of key management, who have the authority and responsibility for planning, directing and controlling the activities of the Company directly or indirectly, consist of the following:

| Type of transaction | 2023 | 2022 | 2021 | |||||||||

| $ | $ | $ | ||||||||||

| Consulting fees | 216,000 | 168,000 | 162,500 | |||||||||

| Management fees | 216,000 | 168,000 | 205,000 | |||||||||

| Professional fees | 128,400 | 124,200 | 150,000 | |||||||||

| Share-based compensation | 495,348 | 151,088 | 264,393 | |||||||||

| 1,055,748 | 611,288 | 781,893 | ||||||||||

There were no amounts due to related parties as at December 31, 2023 (2022 - $Nil).

| 20 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 13. | CAPITAL DISCLOSURES |

The Company includes Common shares, Options reserve and Warrants reserve in the definition of capital net of share issue costs. The Company’s objective when managing capital is to maintain sufficient cash resources to support its day-to-day operations. The availability of capital is solely through the issuance of the Company’s common shares. The Company intends to issue additional equity at such time when funds are needed and the market conditions become favorable to the Company. There are no assurances that funds will be made available to the Company when required. The Company makes every effort to safeguard its capital and minimize its dilution to its shareholders.

The Company is not subject to any externally imposed capital requirements. There were no changes in the Company’s approach to capital management during the year ended December 31, 2023.

| 14. | SEGMENTED INFORMATION |

At December 31, 2023, 2022 and 2021, the Company has only one segment, being the HealthTab™ - Point of Care Business in Canada.

Revenue from the major customer was $3,484,247 during the year ended December 31, 2023 (2022 - $1,768,374, 2021 - $122,808). The major customer purchases goods and services from the Company’s only segment HealthTab™ - Point of Care Business. The loss of this major customer could significantly impact the Company’s revenue and financial position.

| 15. | SUPPLEMENTAL CASH FLOW INFORMATION |

There were no non-cash transactions during the year ended December 31, 2023, 2022 and 2021.

| 16. | INCOME TAXES |

The following table reconciles the expected income tax expense (recovery) at the Canadian statutory income tax rates to the amounts recognized in the consolidated statements of operations and comprehensive loss for the year ended December 31, 2023 and 2022:

| 2023 | 2022 |

2021 | ||||||||||

| $ | $ | $ | ||||||||||

| Loss for the year | (701,215 | ) | (818,228 | ) | (1,708,132 | ) | ||||||

| Expected income tax recovery (27%) | (189,000 | ) | (221,000 | ) | (461,000 | ) | ||||||

| Change in statutory, foreign tax, foreign exchange rates and other | (54,000 | ) | (2,000 | ) | - | |||||||

| Permanent differences and other | 192,000 | 91,000 | 134,000 | |||||||||

| Share issue cost | - | (5,000 | ) | (5,000 | ) | |||||||

| Change in unrecognized deductible temporary differences | 51,000 | 137,000 | 356,000 | |||||||||

| Total income tax expense (recovery) | - | - | ||||||||||

| 21 |

Avricore Health Inc.

Notes to the Consolidated Financial Statements

For the Years Ended December 31, 2023, 2022 and 2021

(Expressed in Canadian Dollars)

| 16. | INCOME TAXES (continued) |

The significant components of the Company’s deferred tax assets are as follows:

| 2023 | 2022 |

2021 | ||||||||||

| $ | $ | $ | ||||||||||

| Share issue costs | 19,000 | 26,000 | 29,000 | |||||||||

| Property and equipment | 332,000 | 219,000 | 164,000 | |||||||||

| Intangible asset | 157,000 | 157,000 | 157,000 | |||||||||

| Non-capital losses | 5,664,000 | 5,719,000 | 5,636,000 | |||||||||

| Total | 6,172,000 | 6,121,000 | 5,986,000 | |||||||||

| Unrecognized deferred tax assets | 6,172,000 | (6,121,000 | ) | (5,986,000 | ) | |||||||

| Deferred income tax asset (liability) | - | - | ||||||||||

The Company has approximately $21,180,000 in non-capital losses for Canadian tax purposes which begin expiring in 2026.

| 17. | FINANCIAL INSTRUMENTS AND FINANCIAL RISK MANAGEMENT |

The Company’s financial instruments include cash and cash equivalents, term deposit, accounts receivable, accounts payable and loans payable. The Company’s risk management policies are established to identify and analyze the risks faced by the Company, to set appropriate risk limits and controls, and to monitor risks and adherence to market conditions and the Company’s activities. The Company has exposure to credit risk, liquidity risk and market risk as a result of its use of financial instruments.

This note presents information about the Company’s exposure to each of the above risks and the Company’s objectives, policies and processes for measuring and managing these risks. Further quantitative disclosures are included throughout the condensed interim consolidated financial statements. The Board of Directors has overall responsibility for the establishment and oversight of the Company’s risk management framework. The Board has implemented and monitors compliance with risk management policies.

| a) | Credit risk |

Credit risk is the risk of financial loss to the Company if a customer or counterparty to a financial instrument fails to meet its contractual obligations and arises primarily from the Company’s cash and cash equivalents and accounts receivable. The Company’s cash and cash equivalents are held through a large Canadian financial institution. The Company does not have financial assets that are invested in asset-backed commercial paper.

The Company performs ongoing credit evaluations of its accounts receivable but does not require collateral. The Company establishes an allowance for expected credit losses based on the credit risk applicable to particular customers and historical data.

Approximately 99% of trade receivables are due from one customer at December 31, 2023 (December 31, 2022 – 99% from one customer).