We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| DATA443 Risk Mitigation Inc (PK) | USOTC:ATDS | OTCMarkets | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 2.01 | 1.76 | 5.25 | 0.00 | 21:30:14 |

October 2, 2020 -- InvestorsHub NewsWire -- via pennymillions --

The IPO market has evolved into a platform for mega-sized companies where the exciting initial listing upside opportunity is reserved for elite investors. But now, the resilience of the entrepreneurial spirit, and the indomitable demand of genuine retail investors is finding a way to end-run the IPO juggernaut that is otherwise out of reach to all but the inside circle of Wall Street’s Masters of the Universe.

Special Purpose Acquisitions Companies or SPACs and Now Direct Listings are becoming popular alternatives to IPO’s. The recent Electric Vehicle (EV) market surge starting in August and recently pulling back to a simmer before the likely next rolling boil, has witnessed the rise of SPACs … or maybe it was SPACs that sparked the surge in the first place.

The Nikola (NKLA) and Fisker (SPAQ) SPAC deals are now famous. In addition to sparking an explosive EV market, the EV SPAC deals also ignited a SPAC market for the sake of SPACs. Notably, Richard Branson has promptly thrown his hat in the SPAC ring with the launch of VG Acquisition.

SPAC and Direct Listing IPO End-Runs

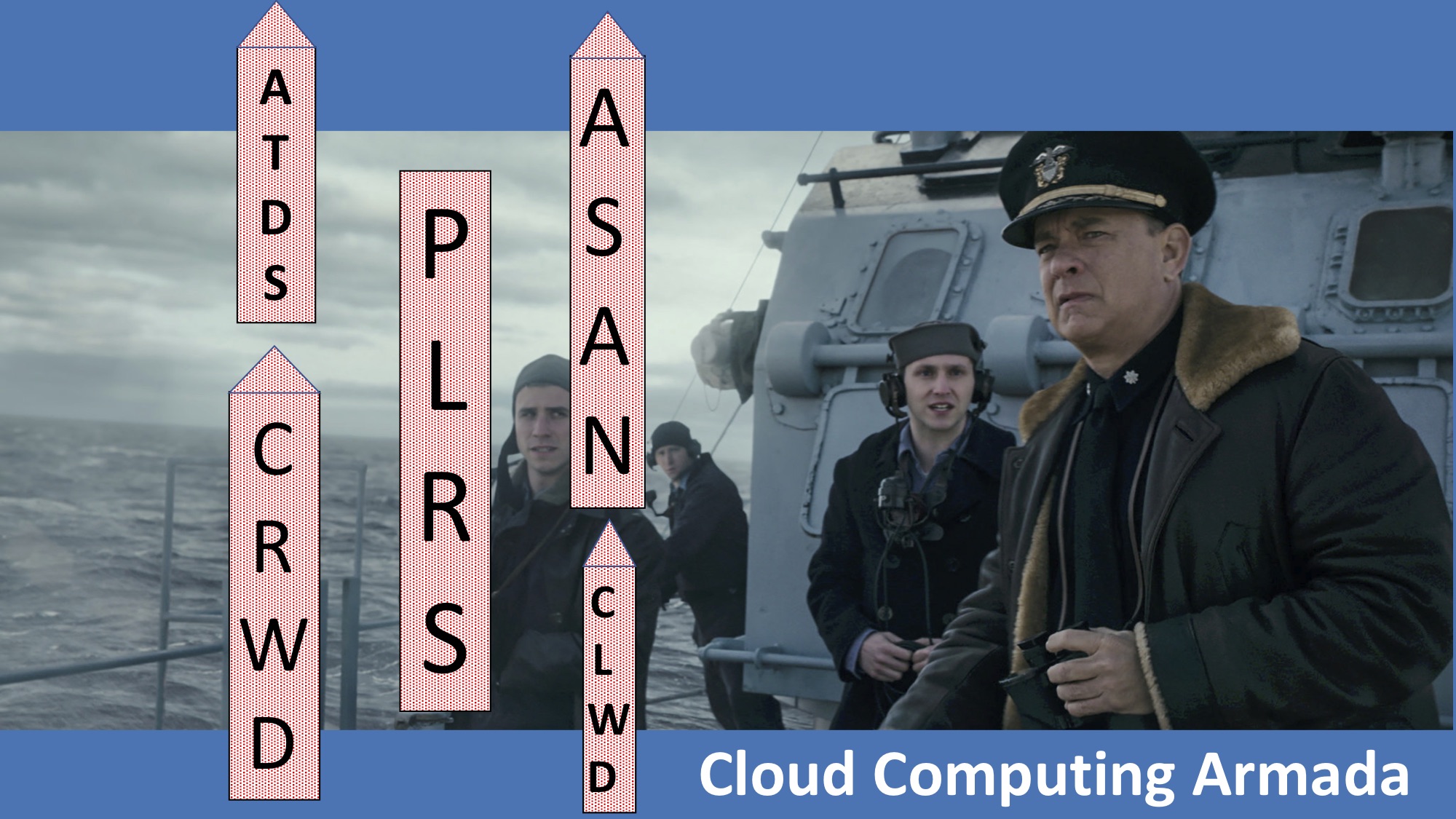

Now that SPACs are well on their way to the mainstream, Palantir (PLTR) yesterday added to the IPO end-run momentum with a Direct Listing on the NYSE. PLTR’s CIA backed, Osama Bind Laden killing, Cloud Computing AI may both create a SPAC like surge in Direct Listings and an overall EV like market reaction within the $800 billion Cloud Computing market.

EV Market Armada Of Opportunities For Investors Of All Sizes And Appetites

But the entrepreneurial spirited and indomitable retail investor end run is bigger than just SPACs and Direct Listings. When the NKLA and SPAQ opportunities set sail, they were joined by a fleet of opportunities ranging from destroyer class to frigate to amphibious landing craft.

The NASDAQ and NYSE IPO end run plays are joined by OTC contenders broadening the armada of opportunities with a range of entry prices suited for investors of all sizes. For instance, micro-cap electric vehicle company, Alternet Systems (ALYI) saw its PPS soar in the EV market surge from under a penny to over $0.05 on massive volume. OTC quoted battery company, Bio Solar (BSRC), saw its PPS also soar from under a penny to over $0.04 on equally massive volume.

Cloud Computing Market Surge Setting Sail

Get ready for the Cloud Computing armada to set sail with a range of opportunities from sub penny to hundreds of dollars. PLTR has made its landmark NYSE debut alongside a second direct listing also in the Cloud Computing sector - Asana (ASAN). As the market absorbs the Cloud Computing growth stock investment opportunity centered around a $300 billion market expected to grow to over $800 billion in the next few years, watch for more opportunities to set sale.

The Motley Fool recently went on record saying, “Among tech stocks, there are a number of explosive growth industries to choose from, such as cloud computing, artificial intelligence (AI), and the Internet of Things. But when push comes to shove, few offer the reliability of cybersecurity. That's why CrowdStrike Holdings (CRWD) makes for such an intriguing buy.”

Lower entry price opportunities in the Cloud Computing fleet now setting sail include Data443 (ATDS) with a range of Cloud Computing security solutions and a host of new customers including Zoom (ZM), a growing list of NFL teams, Hewlett Packard (HPQ), and Citrix (CTXS) – not to mention a new board member from Google (GOOGL).

Reg A+ contender CloudCommerce (CLWD) is another low entry price Cloud Computing market opportunity that may soon get wind in its sails and join the Cloud Computing fleet.

Hats off to the reliance of entrepreneurial spirt and the indomitable nature of retail investors, and a warm welcome to SPACs and Direct Listings and thank you for the new opportunity they bring to the OTC Market.

By Paul Martin Jr

Source: pennymillions

1 Year DATA443 Risk Mitigation (PK) Chart |

1 Month DATA443 Risk Mitigation (PK) Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions