We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| ATAC Resources Ltd | TSXV:ATC | TSX Venture | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 0.125 | 0.12 | 0.13 | 0 | 00:00:00 |

VANCOUVER, BC, July 28, 2022 /CNW/ - ATAC Resources Ltd. ("ATAC") (TSXV: ATC) (OTCQB: ATADF) is pleased to announce completion of an updated Mineral Resource Estimate for its 100%-owned Osiris Deposit, at the Rackla Gold Property, Yukon. The Resource Estimate was completed by Mine Development Associates ("MDA") of Reno, Nevada, a division of RESPEC, with support from Blue Coast Research ("Blue Coast") of Parksville, BC.

Osiris Deposit Resource Update Highlights:

"We are very pleased to demonstrate significant conversion of resources from the Inferred to Indicated category at Osiris," stated President and CEO, Graham Downs. "This continues to demonstrate the confidence we have in this extensive, high-grade Carlin-style system that hosts some of the best gold intervals ever reported in Yukon. Work over the past two years has focused on technical studies and modeling, leading to growth of the deposit and improved classification of part of the resources at Osiris. We have recently completed 1,500 m of drilling stepping out on open near-surface parts of the resource and look forward to releasing those results when available."

Osiris Deposit – Mineral Resource Estimate Summary1,2,3

Classification | Type | Gold Cut-off | Tonnes | Grade (Au g/t) | Gold (ounces) |

Indicated | Open-Pit3 | 1.0 | 4,658,000 | 4.03 | 604,000 |

Underground | 2.0 | 870,400 | 4.58 | 128,000 | |

Total | Variable | 5,528,400 | 4.12 | 732,000 | |

Inferred | Open-Pit3 | 1.0 | 5,370,000 | 3.07 | 530,000 |

Underground | 2.0 | 3,990,000 | 4.01 | 514,000 | |

Total | Variable | 9,360,000 | 3.47 | 1,044,000 |

1. | CIM definition standards were used for the Mineral Resource. The Qualified Person is Steven Ristorcelli, C.P.G., associate of MDA. |

2. | Numbers may not add due to rounding. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

3. | Open-Pit material was constrained using a Whittle™ optimization at US$1,800/oz gold price. |

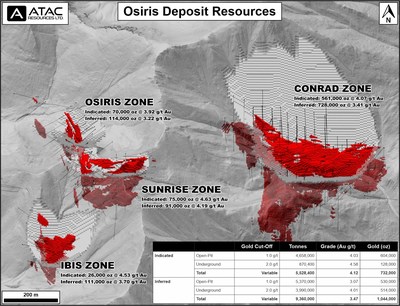

Figure 1 – Osiris Deposit Overview

Figure 2 – Conrad Zone Long Section

Figure 3 – Osiris Deposit Cross Section

Figure 4 – Nadaleen Trend Arsenic-in-Soil

Figure 5 – Nadaleen Trend Location

Updates From the 2018 Osiris Resource

This resource incorporates a number of updates from the previously released 2018 mineral resource estimate. Approximately 7,800 m of drilling in 20 additional holes (completed in 2018 subsequent to the initial resource estimate) have been included. Additional geological modeling, geotechnical studies, and metallurgical testwork have also been completed. Cut-off grades have been modified to reflect current pricing for gold, updated benchmark mining and process costs, and projected metallurgical recoveries.

This work has collectively allowed for an improvement in classification of a portion of the resource, with a total of 732,000 ounces of gold now reporting to the indicated classification (approximately 43% of the 2018 total inferred resource amount of 1,685,000 ounces of gold).

About the Osiris Deposit

The Osiris Deposit is located at the eastern end of ATAC's Nadaleen Project nearby Snowline Gold's Einarson project and Fireweed Metals' MacMillan Pass project. The Osiris Deposit is comprised of four zones: Conrad, Sunrise, Osiris and Ibis. All zones remain open in multiple directions, and numerous additional targets exist at the pre-resource stage, with 20 Carlin-type gold occurrences defined to-date long a 25 km trend.

Additional drilling was recently completed on priority targets outside the resource, with five drill-holes totaling 1,550 m completed in 2022. This work included a step-out on OS-18-273 which intersected 26.70 m of 12.95 g/t gold, and evaluation of other targets based on updated modeling completed for the 2022 resource. Assays are pending for all 2022 work and will be released when received and compiled.

The Nadaleen project also includes the under-explored Anubis cluster, located 10 km west of the Osiris Deposit. Anubis hosts 13 Carlin-type gold occurrences along a 2.5 km strike length, with down-dip extension to 540 m depth. Highlights include 8.51 m of 19.85 g/t gold in hole AN-12-001. Anubis has seen comparatively little drilling, with a total of 49 holes completed to-date, and offers significant opportunity for definition of additional resources.

For more details on the Nadaleen Project, Osiris and Anubis, please see ATAC's website at https://atacresources.com/projects/rackla-gold-property/nadaleen-project/.

Metallurgical Testwork Updates

A comprehensive metallurgical testwork program was completed by Blue Coast Research of Parksville, BC. The testwork included geometallurgical variability testing, with 147 samples analyzed from across the resource to assess standard 'Carlin-style' characteristics.

A master composite and 6 variability composites were produced based on the geometallurgical work for further metallurgical testing. Subsequent work focused on evaluating performance of a flowsheet comprising flotation, oxidation, and cyanidation. Flotation testwork demonstrated that a significant amount of barren arsenic sulphides can be removed with minor gold losses, with 80% arsenic rejection at 6.7% gold loss. Gold losses are highly correlated to the degree of arsenic rejection and gold losses can be reduced by eliminating less arsenic.

Roasting and alkaline pressure oxidation testwork was conducted on arsenic flotation tailings products, with recoveries of up to 86.5% for roasting and 85% for alkaline pressure oxidation after cyanide leaching. Projected overall metallurgical recoveries for combined flotation, oxidation and leaching are 83% based on the currently available testwork data.

Acid pressure oxidation testwork was also successful in liberating gold, with up to 92% recovery after cyanidation. However, the elevated carbonate content of the feed material incurs a high acid consumption. Further opportunities exist to optimize the flotation and oxidation circuits to improve recoveries and evaluate opportunities to reject more barren carbonate material.

Resource Methodology

The 2022 Mineral Resource estimate is based on diamond drilling completed at the Osiris Project between 2010 and 2018. Other than 2022 drill holes for which assays are pending, no drilling has been undertaken subsequent to 2018. Data analysis, domain modeling, grade interpolation and classification were supervised by or undertaken by Steven Ristorcelli, C.P.G., associate of MDA. The estimate was prepared using 280 diamond drill holes totaling 92,995 m.

Explicitly modelled gold domains were interpreted using wire frames of the geological model as a guide. In each of the Conrad, Sunrise, Osiris, and Ibis zones, high- and low-grade gold domains were modeled. Each domain reflects different styles of mineralization. The grade ranges for the domains were defined separately for each zone based on population breaks for gold on cumulative probability plots, and each domain represents distinct and unique geological and mineralogical characteristics. Outliers within each domain were capped prior to three-metre down-hole compositing.

Gold grades were estimated into the block model using inverse distance to the third power. Separate estimations using polygonal, nearest neighbour, and ordinary kriging were also completed for validation purposes.

For reporting, technical and economic factors likely to influence the "reasonable prospects for eventual economic extraction" were evaluated by running a series of pit and mine-stope optimizations at variable gold prices, mining costs, processing costs, and anticipated metallurgical recoveries.

MDA reports resources at cut-offs that are reasonable for deposits like those at Osiris, given anticipated mining methods and processing costs. A gold price of US$1,800 per ounce was used to determine the cut-off grades. Tables showing the pit-constrained and underground Mineral Resources at varying cut-off grades are presented below.

Pit-Constrained Resources at Varying Cut-Off Grades by Classification1,2,3

Gold Cut- (g Au/t) | Indicated | Inferred | ||||

Tonnes | Grade (Au g/t) | Gold | Tonnes | Grade (Au g/t) | Gold | |

0.5 | 5,705,000 | 3.43 | 629,000 | 8,354,000 | 2.22 | 597,000 |

1.0 | 4,658,000 | 4.03 | 604,000 | 5,370,000 | 3.07 | 530,000 |

1.2 | 4,385,000 | 4.22 | 595,000 | 4,820,000 | 3.29 | 510,000 |

1.3 | 4,247,000 | 4.32 | 590,000 | 4,558,000 | 3.41 | 499,000 |

1.4 | 4,105,000 | 4.42 | 583,000 | 4,312,000 | 3.53 | 489,000 |

1.6 | 3,839,000 | 4.62 | 570,000 | 3,813,000 | 3.79 | 465,000 |

1.8 | 3,583,000 | 4.83 | 556,000 | 3,360,000 | 4.07 | 440,000 |

2.0 | 3,342,000 | 5.04 | 541,000 | 3,003,000 | 4.33 | 418,000 |

2.5 | 2,793,000 | 5.59 | 502,000 | 2,261,000 | 5.01 | 364,000 |

2.6 | 2,678,000 | 5.71 | 492,000 | 2,139,000 | 5.16 | 355,000 |

3.0 | 2,270,000 | 6.23 | 455,000 | 1,775,000 | 5.62 | 321,000 |

4.0 | 1,567,000 | 7.50 | 378,000 | 1,156,000 | 6.81 | 253,000 |

5.0 | 1,143,000 | 8.63 | 317,000 | 792,000 | 7.89 | 201,000 |

Underground Resources at Varying Cut-Off Grades by Classification1,2,3

Gold Cut- (g Au/t) | Indicated | Inferred | ||||

Tonnes | Grade (Au g/t) | Gold | Tonnes | Grade (Au g/t) | Gold | |

0.5 | 1,365,700 | 3.40 | 149,200 | 7,075,000 | 2.82 | 641,000 |

1.0 | 1,227,000 | 3.68 | 145,200 | 6,114,000 | 3.15 | 619,000 |

1.2 | 1,155,700 | 3.88 | 144,200 | 5,714,000 | 3.29 | 605,000 |

1.3 | 1,125,700 | 3.90 | 141,200 | 5,530,000 | 3.36 | 598,000 |

1.4 | 1,097,000 | 4.00 | 141,200 | 5,330,000 | 3.44 | 589,000 |

1.6 | 1,021,400 | 4.14 | 136,100 | 4,901,000 | 3.60 | 568,000 |

1.8 | 939,400 | 4.37 | 132,100 | 4,447,000 | 3.80 | 544,000 |

2.0 | 870,400 | 4.58 | 128,100 | 3,990,000 | 4.01 | 514,000 |

2.5 | 712,000 | 5.07 | 116,100 | 2,997,000 | 4.62 | 445,000 |

2.6 | 682,000 | 5.25 | 115,100 | 2,829,000 | 4.73 | 430,000 |

3.0 | 566,300 | 5.72 | 104,100 | 2,243,000 | 5.23 | 377,000 |

4.0 | 393,300 | 6.73 | 85,100 | 1,314,000 | 6.49 | 274,000 |

5.0 | 274,000 | 7.72 | 68,000 | 854,000 | 7.61 | 209,000 |

1. | CIM definition standards were used for the Mineral Resource. The Qualified Person is Steven Ristorcelli, C.P.G., associate of MDA. |

2. | Numbers may not add due to rounding. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

3. | Open-Pit material was constrained using a Whittle™ optimization at US$1,800/oz gold price. |

Qualified Persons

The Mineral Resource estimate was completed by MDA. Steven Ristorcelli, C.P.G., associate of MDA is the Qualified Person for the purpose of National Instrument 43-101 for all technical information pertaining to the current Mineral Resource.

All other technical information in this news release has been approved by Andrew Carne, M.Eng., P.Eng., VP Corporate & Project Development for ATAC and a Qualified Person for the purposes of National Instrument 43-101.

Further details supporting the geological model, estimation procedure and metallurgical testwork will be available in a National Instrument 43-101 Technical Report authored by Steven Ristorcelli, C.P.G., associate of Mine Development Associates, Peter Ronning, P.Eng., Odin Christensen, C.P.G., of Hardrock Mineral Exploration Inc., Nichola McKay, P.Geo., of Blue Coast Research Ltd., and Andrew Kelly, P.Eng., of Blue Coast Research Ltd. The report will be posted under the ATAC profile at www.sedar.com within 45 days from the date of this news release.

About ATAC

ATAC Resources is a Canadian exploration company focusing on exploring for gold and copper in Yukon, BC, and Nevada. Work on its ~1,700 km2 Rackla Gold Property in Yukon has resulted in the Osiris Deposit Indicated Resource of 732,000 oz of gold at 4.12 g/t (in 5.53 Mt) and Inferred Resource of 1,044,000 oz of gold at 3.47 g/t (in 9.4 Mt), the Tiger Deposit Measured & Indicated Resource of 464,000 oz of gold at an average grade of 3.19 g/t (in 4.5 Mt), a positive Preliminary Economic Assessment for the Tiger Gold Deposit (Pre-tax NPV of $118.2M and IRR of 54.5%), and numerous early-stage gold and base metal discoveries. ATAC is well-financed with approximately $7.5 million in working capital.

On behalf of ATAC Resources Ltd.

Graham Downs, President and CEO

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE.

Cautionary note regarding forward-looking statements:

This press release may contain "forward-looking information" within the meaning of applicable securities laws. Readers are cautioned to not place undue reliance on forward-looking information. Actual results and developments may differ materially from those contemplated by these statements. The statements in this press release are made as of the date of this press release. The Company undertakes no obligation to update forward-looking information, except as required by securities laws.

Cautionary Note to U.S. Investors concerning estimates of Measured, Indicated, and Inferred Resources:

The mineral resource estimates included in this press release have been prepared in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects. The United States Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements. U.S. investors are cautioned that the disclosure the Company provides on its mineral properties in this news release may be different from the disclosure that an issuer subject to SEC reporting requirements would otherwise be required to provide. Therefore, the information contained in this news release containing descriptions of the Company's mineral properties may not be comparable to similar information made public by U.S. companies subject to reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder.

Additional information about the Tiger Deposit PEA is summarized in ATAC's February 27, 2020 technical report titled "Technical Report and Preliminary Economic Assessment for the Tiger Deposit, Rackla Gold Project, Yukon, Canada", which can be viewed at www.sedar.com under the ATAC profile or on the ATAC website at www.atacresources.com. Additional information about the Osiris Resource Estimate will be summarized in a technical report filed within 45 days of this news release.

SOURCE ATAC Resources Ltd.

Copyright 2022 Canada NewsWire

1 Year ATAC Resources Chart |

1 Month ATAC Resources Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions