We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| TDCX Inc | NYSE:TDCX | NYSE | Common Stock |

| Price Change | % Change | Share Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 7.13 | 0 | 00:00:00 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-40841

TDCX Inc.

750D Chai Chee Road,

#06-01/06 ESR BizPark @ Chai Chee

Singapore 469004

(65) 6309-1688

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TDCX INC. | ||

| By: | /s/ Laurent Junique | |

| Name: | Laurent Junique | |

| Title: | Executive Chairman and Chief Executive Officer | |

Date: November 21, 2023

Exhibit 99.1

TDCX reports 2.3% year-on-year increase in third quarter 2023 profit, reaffirms full year guidance

Singapore, November 22, 2023 – TDCX Inc. (NYSE: TDCX) (“TDCX” or the “Company”), an award-winning digital customer experience (CX) solutions provider for technology and blue-chip companies, today announced its unaudited financial results for the third quarter ended September 30, 2023.

Third Quarter 2023 Financial Highlights1

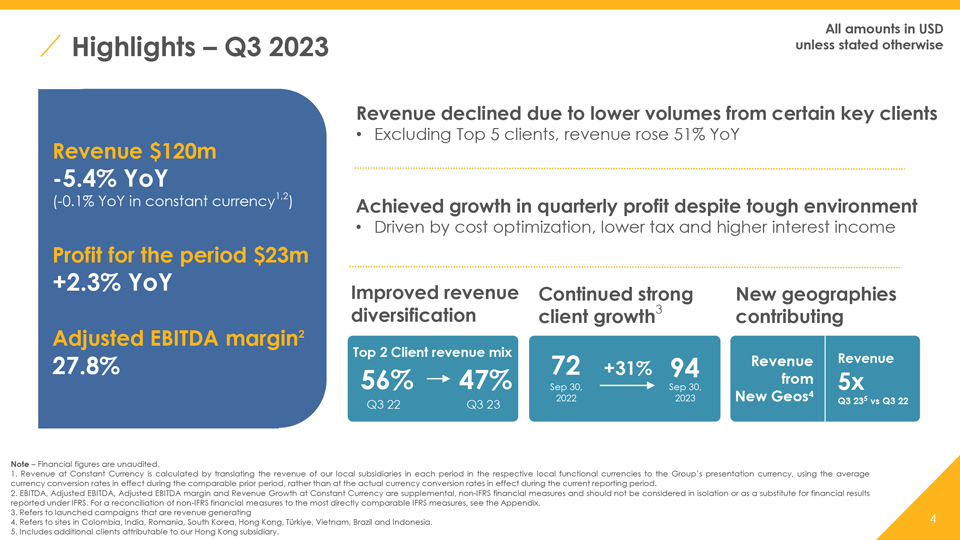

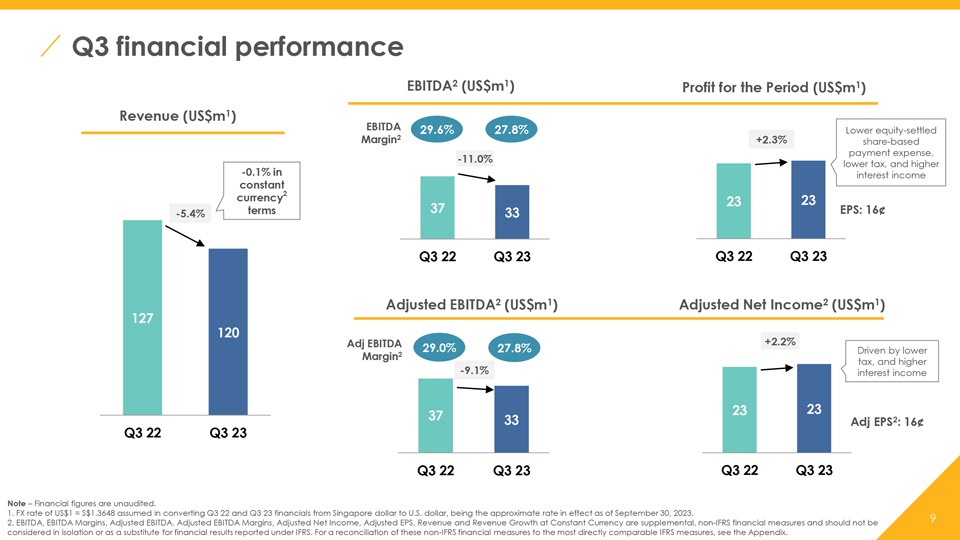

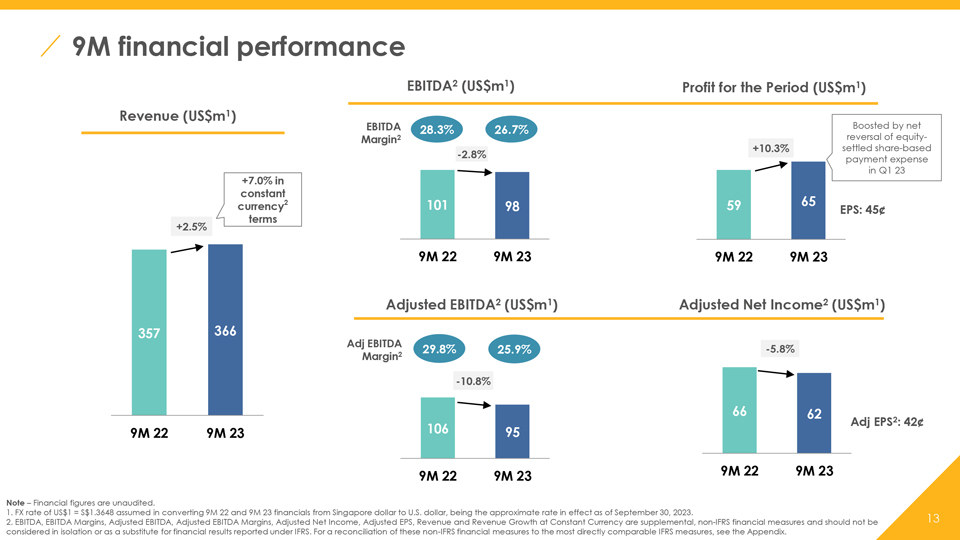

| • | Total revenue of US$119.8 million, down 5.4% year-on-year, including a 5.3% point negative impact of foreign exchange rates compared with the prior year period, and down 0.1% in constant currency terms2 |

| • | Profit for the period of US$23.2 million, up 2.3% year-on-year, primarily driven by cost optimization efforts, lower tax and higher interest income |

Mr. Laurent Junique, Chief Executive Officer and Founder of TDCX, said, “Our focused approach to growing our business continues to yield results. There remain bright spots in select sectors amid market uncertainties. This quarter, we welcomed new clients including a leading global airline based out of Asia and one of the world’s most popular mobile messaging apps. Such wins are testament to the sector expertise we have built in travel and hospitality and social media platforms.

“We are also seeing results from our efforts to diversify our client base. Our revenue from clients outside the top five has increased 51 per cent year-on-year. I am confident that the steps we have taken to enhance our value to our clients and to increase our efficiency will position us strongly for the long term.”

| (US$ million1, except for %) |

Q3 2022 | Q3 2023 | % Change | |||||||

| Revenue |

126.6 | 119.8 | -5.4% (-0.1% on a constant currency basis)2 | |||||||

| Profit for the period |

22.7 | 23.2 | 2.3% | |||||||

| Net profit margin (%) |

17.9 | % | 19.4 | % | ||||||

| EBITDA2 |

37.5 | 33.3 | -11.0% | |||||||

| EBITDA Margins2 (%) |

29.6 | % | 27.8 | % | ||||||

| Adjusted EBITDA2, 3 |

36.7 | 33.3 | -9.1% | |||||||

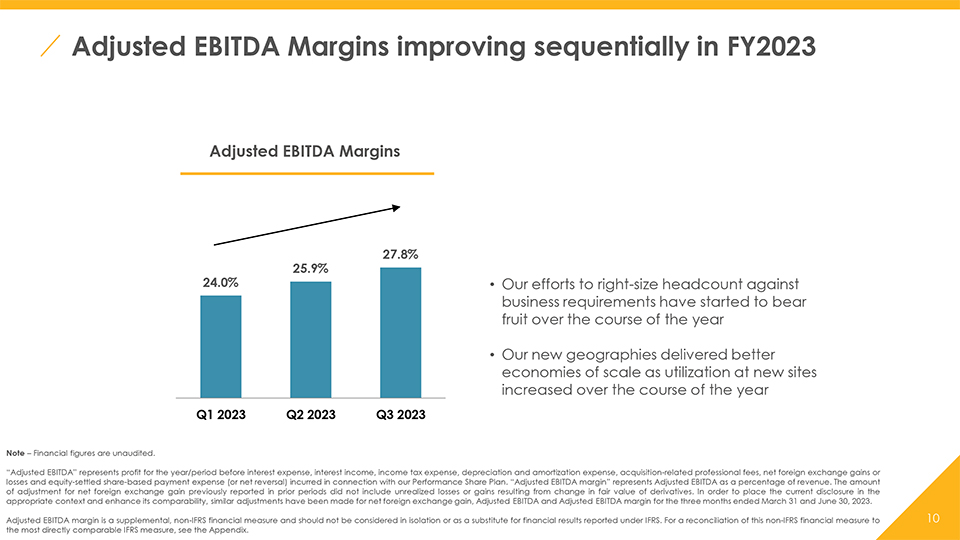

| Adjusted EBITDA Margins2,3 (%) |

29.0 | % | 27.8 | % | ||||||

| Adjusted Net Income2,3 |

22.8 | 23.3 | 2.2% | |||||||

Q3 23 Business Highlights

Continued strong client growth

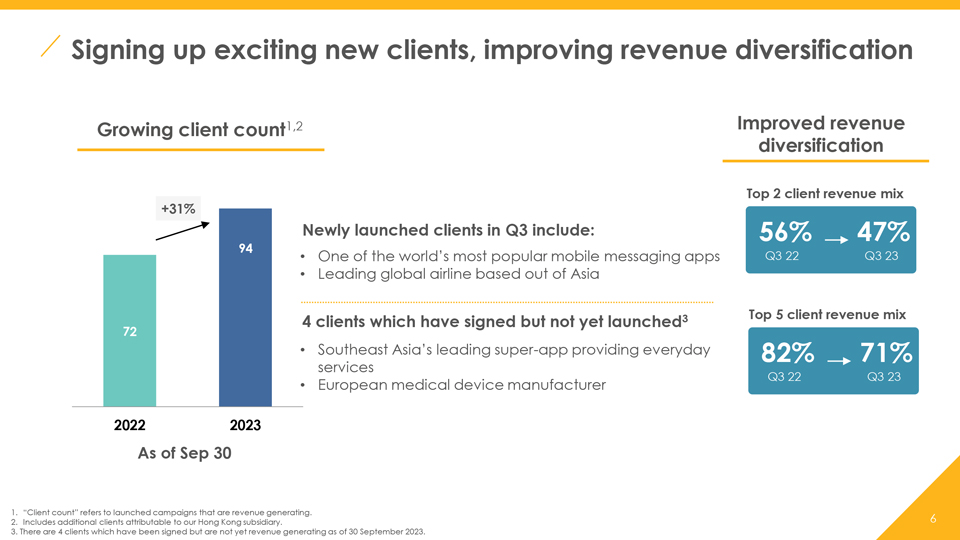

| • | Client count4,5 up 31% year-on-year, bringing total client count to 94 as of September 30, 2023, compared with 72 as of September 30, 2022 |

| • | Newly launched clients include one of the world’s most popular mobile messaging apps and a leading global airline based out of Asia |

Improved revenue diversification

| • | Revenue from clients outside the top five rose 51% year-on-year5 |

| • | Revenue mix from top five clients lowered to 71% in Q3 23, from 82% in Q3 22 |

Contribution from new geographies

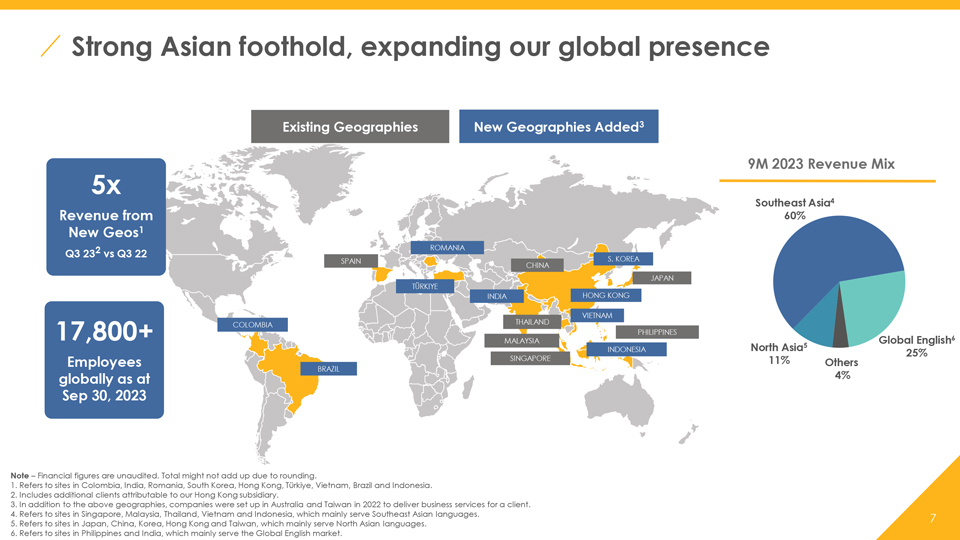

| • | Revenue from new geographies6 was five times in Q3 23 versus Q3 22 |

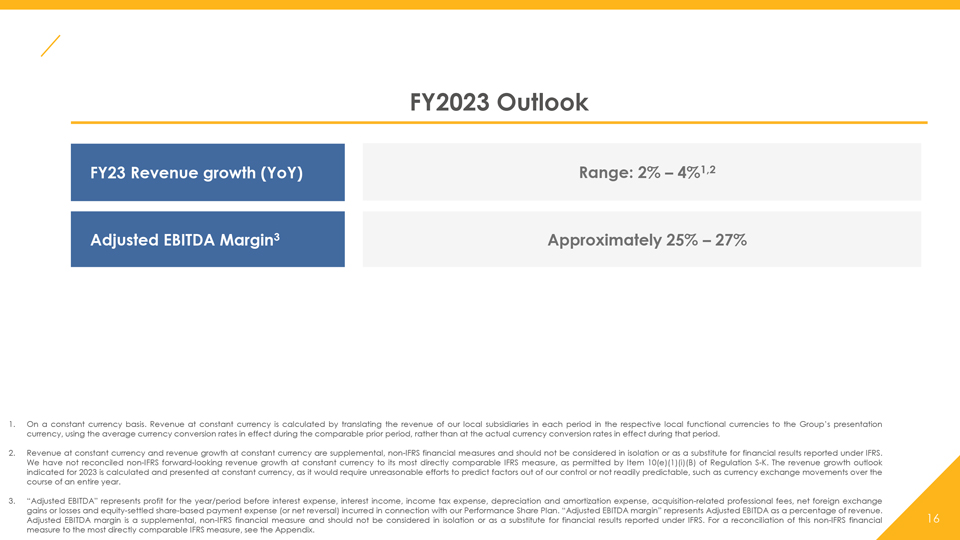

Full Year 2023 Outlook

For the full year 2023, TDCX expects its financial results to be:

| 2023 Outlook | ||

| Revenue growth (YoY) | Range: 2% – 4% (On a constant currency basis2,7) | |

| Adjusted EBITDA margin1 | Approximately 25% – 27% | |

Detailed Financial Information on the Form 6-K

Please refer to https://investors.tdcx.com/financials/quarterly-results/default.aspx for the detailed financial information contained in Form 6-K.

| 1 | FX rate of US$1 = S$1.3648, being the approximate rate in effect as of September 30, 2023, assumed in converting financials from SG dollar to U.S. dollar. |

| 2 | For a discussion of the use of non-IFRS financial measures, see “Non-IFRS Financial Measures”. |

| 3 | The reported amounts for Adjusted EBITDA and Adjusted Net Income for the three months ended September 30, 2023 include adjustments for certain items (i.e., acquisition-related professional fees and net foreign exchange gains or losses) which were not included in similar non-IFRS financial measures previously reported for the corresponding period last year. The amount of adjustment for net foreign exchange gain previously reported in prior periods did not include unrealized losses or gains resulting from change in fair value of derivatives. In order to place the current disclosure in the appropriate context and enhance its comparability, similar adjustments have been made for net foreign exchange gain, Adjusted EBITDA and Adjusted Net Income for the three months ended September 30, 2022. |

| 4 | “Client count” refers to launched campaigns that are revenue generating. |

| 5 | Includes additional clients attributable to our Hong Kong subsidiary. |

| 6 | Refers to sites in Colombia, India, Romania, South Korea, Hong Kong, Türkiye, Vietnam, Brazil and Indonesia. |

| 7 | We have not reconciled non-IFRS forward-looking revenue growth at constant currency to its most directly comparable IFRS measure, as permitted by Item 10(e)(1)(i)(B) of Regulation S-K. The revenue growth outlook indicated for 2023 is calculated and presented at constant currency, as it would require unreasonable efforts to predict factors out of our control or not readily predictable, such as currency exchange movements over the course of an entire year. |

Webcast and Conference Call Information

TDCX senior management will host a conference call to discuss the third quarter 2023 unaudited financial results.

A live webcast of this conference call will be available on TDCX’s website. Access information on the conference call and webcast is as follows:

| Date and time: | November 21, 2023, 7:30 PM (U.S. Eastern Time) | |

| November 22, 2023, 8:30 AM (Singapore / Hong Kong Time) | ||

| Webcast link: | https://events.q4inc.com/earnings/TDCX/Q3-2023 | |

| Dial-in numbers: | U.S. Toll Free: +1 833 470 1428 U.S. (Local): +1 404 975 4839 | |

| Singapore: +65 3158 0255 Hong Kong: +852 5803 6418 | ||

| UK Toll Free: +44 808 189 6484 All others: Dial-in numbers | ||

| Participant Access Code: | 704387 | |

A replay of the conference call will be available at TDCX’s investor relations website (investors.tdcx.com). An archived webcast will be available at the same link above.

For enquiries, please contact:

Investors / Analysts:

investors@tdcx.com

Media: Eunice Seow

eunice.seow@tdcx.com

About TDCX INC.

Singapore-headquartered TDCX provides transformative digital CX solutions, enabling world-leading and disruptive brands to acquire new customers, to build customer loyalty and to protect their online communities.

TDCX helps clients achieve their customer experience aspirations by harnessing technology, human intelligence and its global footprint. It serves clients in fintech, gaming, technology, travel and hospitality, digital advertising and social media, streaming and e-commerce. TDCX’s expertise and strong footprint in Asia has made it a trusted partner for clients, particularly high-growth, new economy companies, looking to tap the region’s growth potential.

TDCX’s commitment to delivering positive outcomes for our clients extends to its role as a responsible corporate citizen. Its Corporate Social Responsibility program focuses on positively transforming the lives of its people, its communities and the environment.

TDCX employs more than 17,800 employees across 30 campuses globally, specifically in Brazil, Colombia, Hong Kong, India, Indonesia, Japan, Malaysia, Mainland China, Philippines, Romania, Singapore, South Korea, Spain, Thailand, Türkiye, and Vietnam. For more information, please visit www.tdcx.com.

Convenience Translation

The Company’s financial information is stated in Singapore dollars, the legal currency of Singapore. Unless otherwise noted, all translations from Singapore dollars to U.S. dollars and from U.S. dollars to Singapore dollars in this press release were made at a rate of S$1.3648 to US$1.00, the approximate rate in effect as of September 30, 2023. We make no representation that any Singapore dollar or U.S. dollar amount could have been, or could be, converted into U.S. dollars or Singapore dollar, as the case may be, at any particular rate, the rate stated herein, or at all.

Non-IFRS Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with IFRS, we use the following non-IFRS financial measures to help evaluate our operating performance:

“EBITDA” represents profit for the year/ period before interest expense, interest income, income tax expense and depreciation and amortization expense. “EBITDA margin” represents EBITDA as a percentage of revenue.

“Adjusted EBITDA” represents profit for the year/ period before interest expense, interest income, income tax expense, depreciation and amortization expense, acquisition-related professional fees, net foreign exchange gains or losses and equity-settled share-based payment expense (or net reversal) incurred in connection with our Performance Share Plan. “Adjusted EBITDA margin” represents Adjusted EBITDA as a percentage of revenue.

“Adjusted Net Income” represents profit for the year/ period before acquisition-related professional fees, net foreign exchange gains or losses and equity-settled share-based payment expense (or net reversal) incurred in connection with our Performance Share Plan, net of any tax impact of such adjustments.

Revenue at constant currency is calculated by translating the revenue of our local subsidiaries in each period in the respective local functional currencies to the Company and its subsidiaries’ presentation currency, using the average currency conversion rates in effect during the comparable prior period, rather than at the actual currency conversion rates in effect during that period.

We believe that EBITDA, EBITDA Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Revenue at Constant Currency and Revenue Growth at Constant Currency help us to compare our operating performance on a consistent basis by removing the impact of items not directly resulting from our core operations, and thereby help us to identify underlying trends in our operating results, enhancing our understanding of past performance and future prospects.

We exclude items from Adjusted EBITDA and Adjusted Net Income, including acquisition-related professional fees, net foreign exchange gains or losses and equity-settled share-based payment expense (or net reversal) incurred in connection with our Performance Share Plan, as they are not indicative of our ongoing operating performance, and adjusting for such items is meaningful and useful to readers to understand the underlying performance of the business by eliminating the impact of certain items that may obscure trends in the underlying performance of the business.

The above non-IFRS financial measures have limitations as analytical tools and should not be considered in isolation or construed as an alternative to revenue, net income, or any other measure of performance or as an indicator of our operating performance. The non-IFRS financial measures presented here may not be comparable to similarly titled measures presented by other companies because other companies may calculate similarly titled measures differently. For more information on the non-IFRS financial measures, including full reconciliations to the nearest IFRS measure, please see the form 6-K section captioned “Non-IFRS Financial Measures” or the presentation slides.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “predicts,” “intends,” “trends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Among other things, the outlook for the full year, the business outlook and quotations from management in this announcement, as well as the Company’s strategic and operational plans, contain forward-looking statements. The Company may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about the Company’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: the performance of TDCX’s largest clients; the successful implementation of its business strategy; the continued service of its founder and certain of its key employees and management; its ability to compete effectively; its ability to navigate difficulties and successfully expand its operations into countries in which it has no prior operating experience; its ability to maintain its pricing, control costs or continue to grow its business; its ability to attract and retain enough highly trained employees; its compliance with service level and performance requirements by, and contractual obligations with, its clients; its exposure to various risks in Southeast Asia; its contractual relationship with key clients; clients and prospective clients’ spending on omnichannel CX solutions and content, trust and safety services; its ability to successfully identify, acquire and integrate companies; its spending on employee salaries and benefits expenses; and its involvement in any disputes, legal, regulatory, and other proceedings arising out of its business operations. Further information regarding these and other risks is included in the Company’s filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and the Company undertakes no obligation to update any forward-looking statement, except as required under applicable law.

UNAUDITED CONDENSED INTERIM CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

| For the three months ended September 30, | ||||||||||||

| 2023 | 2022 | |||||||||||

| US$’000 | S$’000 | S$’000 | ||||||||||

| Revenue |

119,791 | 163,491 | 172,770 | |||||||||

| Employee benefits expense |

(78,717 | ) | (107,433 | ) | (112,325 | ) | ||||||

| Depreciation and amortization expense |

(7,853 | ) | (10,718 | ) | (10,207 | ) | ||||||

| Rental and maintenance expense |

(2,249 | ) | (3,069 | ) | (2,648 | ) | ||||||

| Recruitment expense |

(1,550 | ) | (2,116 | ) | (4,452 | ) | ||||||

| Transport and travelling expense |

(218 | ) | (297 | ) | (386 | ) | ||||||

| Telecommunication and technology expense |

(2,603 | ) | (3,552 | ) | (3,080 | ) | ||||||

| Interest expense |

(438 | ) | (598 | ) | (429 | ) | ||||||

| Other operating expense (1) |

(2,260 | ) | (3,084 | ) | (655 | ) | ||||||

| Share of profit from an associate |

— | — | 61 | |||||||||

| Interest income |

2,411 | 3,290 | 1,233 | |||||||||

| Other operating income |

1,136 | 1,550 | 1,840 | |||||||||

|

|

|

|

|

|

|

|||||||

| Profit before income tax |

27,450 | 37,464 | 41,722 | |||||||||

| Income tax expense |

(4,263 | ) | (5,818 | ) | (10,799 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Profit for the period |

23,187 | 31,646 | 30,923 | |||||||||

| Item that may be reclassified subsequently to profit or loss: |

||||||||||||

| Exchange differences on translation of foreign operations |

(499 | ) | (681 | ) | (6,880 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total comprehensive income for the period |

22,688 | 30,965 | 24,043 | |||||||||

|

|

|

|

|

|

|

|||||||

| Profit attributable to: |

||||||||||||

| - Owners of TDCX Inc. |

23,188 | 31,647 | 30,922 | |||||||||

| - Non-controlling interests |

(1 | ) | (1 | ) | 1 | |||||||

|

|

|

|

|

|

|

|||||||

| 23,187 | 31,646 | 30,923 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Total comprehensive income attributable to: |

||||||||||||

| - Owners of TDCX Inc. |

22,689 | 30,966 | 24,042 | |||||||||

| - Non-controlling interests |

(1 | ) | (1 | ) | 1 | |||||||

|

|

|

|

|

|

|

|||||||

| 22,688 | 30,965 | 24,043 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Basic earnings per share (in US$ or S$) (2) |

0.16 | 0.22 | 0.21 | |||||||||

| Diluted earnings per share (in US$ or S$) (2) |

0.16 | 0.22 | 0.21 | |||||||||

| (1) | We reported foreign exchange gains or losses, as applicable, on a net basis for the relevant period under the “other operating expense” line item. |

| (2) | Basic and diluted earnings per share |

| For the three months ended September 30, |

||||||||

| 2023 | 2022 | |||||||

| Weighted average number of ordinary shares for the purposes of basic earnings per share |

144,935,217 | 144,943,516 | ||||||

| Weighted average number of ordinary shares for the purposes of diluted earnings per share |

144,958,043 | 144,943,516 | ||||||

|

|

|

|

|

|||||

The translation of Singapore Dollar amounts into United States Dollar amounts (“USD”) for the unaudited condensed interim consolidated statement of profit or loss and other comprehensive income above are included solely for the convenience of readers outside of Singapore and have been made at the rate of S$1.3648 to US$1.00, the approximate rate of exchange at September 30, 2023. Such translations should not be construed as representations that the Singapore Dollar amounts could be converted into USD at that or any other rate.

Comparison of the Three Months Ended September 30, 2023 and 2022

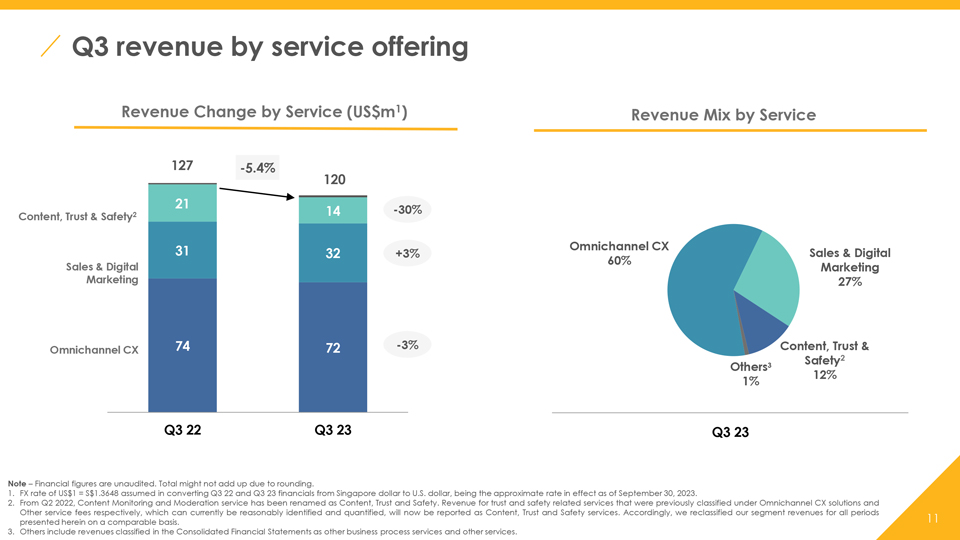

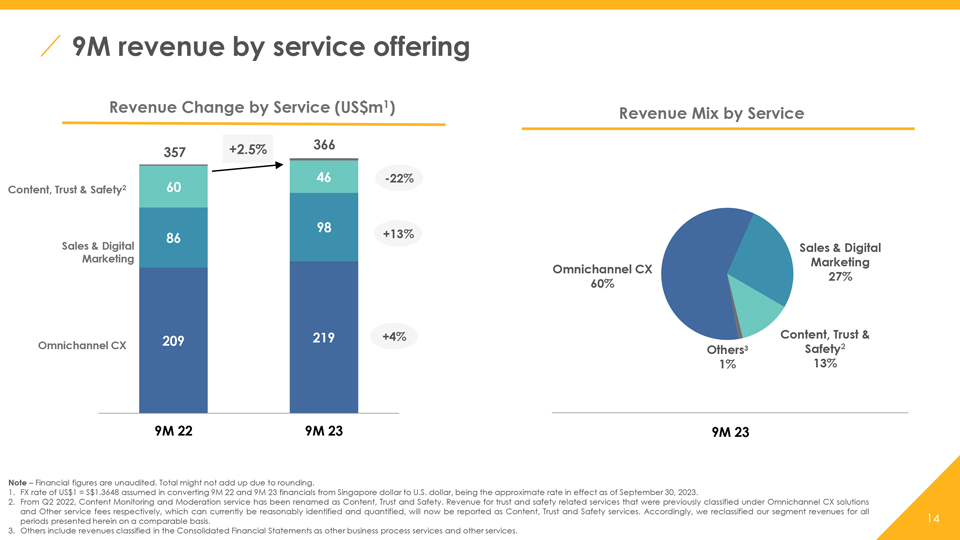

Revenue. Our revenue decreased by 5.4% to S$163.5 million (US$119.8 million) for the three months ended September 30, 2023 from S$172.8 million for the three months ended September 30, 2022 primarily driven by a 29.9% decrease in revenue from content, trust and safety services followed by a 2.8% decrease in revenue from omnichannel CX solutions services rendered partially offset by a 3.5% increase in revenue from sales and digital marketing services.

| • | Our revenue from omnichannel CX solutions services decreased by 2.8% to S$98.1 million (US$71.9 million) from S$100.9 million for the same period of 2022 primarily due to lower volumes requirement by existing clients in the digital advertising and media and fintech verticals, partially offset by a higher demand for our services by existing clients in the travel and hospitality, gaming, fast-moving consumer goods, financial services, technology and e-commerce verticals. |

| • | Our revenue from sales and digital marketing services increased by 3.5% to S$44.3 million (US$32.4 million) from S$42.8 million for the same period of 2022 primarily due to the expansion of existing campaigns by key digital advertising and media clients, fast moving consumer goods, technology and scaled up contributions from new clients secured during 2022. |

| • | Our revenue from content, trust and safety services decreased by 29.9% to S$19.7 million (US$14.4 million) from S$28.1 million for the same period of 2022 primarily due to the contraction of volumes requirement by the digital advertising and media vertical client but mitigated partially by higher volumes in the travel and hospitality vertical. |

| • | Our revenue from our other service fees increased by 47.1% to S$1.5 million (US$1.1 million) from S$1.0 million for the same period of 2022 primarily due to an expansion of existing campaigns. |

The following table sets forth our service provided by amount for the three months ended September 30, 2023 and 2022.

| For the three months ended September 30, | ||||||||||||

| 2023 | 2022 | |||||||||||

| US$’000 | S$’000 | S$’000 | ||||||||||

| Revenue by service |

||||||||||||

| Omnichannel CX solutions |

71,853 | 98,064 | 100,902 | |||||||||

| Sales and digital marketing |

32,446 | 44,283 | 42,799 | |||||||||

| Content, trust and safety |

14,403 | 19,657 | 28,058 | |||||||||

| Other service fees # |

1,089 | 1,487 | 1,011 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total revenue |

119,791 | 163,491 | 172,770 | |||||||||

|

|

|

|

|

|

|

|||||||

| # | Other service fees comprise revenue from other business process and other services. |

Employee Benefits Expense. Our employee benefits expense decreased by 4.4% to S$107.4 million (US$78.7 million) from S$112.3 million for the same period of 2022 primarily due to lower equity-settled share-based payment expenses resulting from changed expectations of the remaining awarded tranches reflecting the changing business and operating climate and recalibration of employee headcount and costs of several key operating units in response to business volume changes but offset partially by the presence of the acquired Hong Kong subsidiary that was completed on October 13, 2022 and commencement of greenfield operations of Türkiye, Brazil and Vietnam. For the quarter ended September 30, 2023, the equity-settled share-based payment expense decreased to S$0.8 million (US$0.6 million) as compared to the corresponding quarter in 2022 of S$3.8 million.

Depreciation and Amortization Expense. Our depreciation and amortization expense increased by 5.0% to S$10.7 million (US$7.9 million) from S$10.2 million for the same period of 2022 primarily due to the shift to leased office spaces in Türkiye and South Korea, take up of additional office space by the Philippines operations and the presence of the Hong Kong unit that was acquired on October 13, 2022 to become a wholly-owned subsidiary of the Group.

Rental and Maintenance Expense. Our rental and maintenance expense increased by 15.9% to S$3.1 million (US$2.2 million) from S$2.6 million for the same period of 2022 primarily due to the set-up of the new Brazil operation and higher office upkeep costs at the Philippines site.

Recruitment Expense. Our recruitment expense decreased by 52.5% to S$2.1 million (US$1.6 million) from S$4.5 million for the same period of 2022 primarily due to lower hiring and work permit renewal activities of largely foreign talents in Singapore and Malaysia.

Transport and Travelling Expense. Our transport and travelling expenses remained stable during the two comparative periods.

Telecommunication and Technology Expense. Our telecommunication and technology expense increased by 15.3% to S$3.6 million (US$2.6 million) from S$3.1 million for the same period of 2022 due to software and telecommunication requirement of campaigns of certain existing and new sites.

Interest Expense. Our interest expense increased by 39.4% to $0.6 million (US$0.4 million) from $0.4 million for the same period of 2022 primarily on the back of higher lease liability interest arising mainly from the shifting to leased office spaces in Türkiye and South Korea sites, additional office spaces taken up by the Philippines operations and the presence of the Hong Kong unit that was acquired on October 13, 2022 to become a wholly-owned subsidiary of the Group.

Other Operating Expense. Our other operating expense increased by 370.8% to S$3.1 million (US$2.3 million) from S$0.7 million for the same period of 2022 primarily due to lower net foreign exchange gain but partially offset by lower professional and advisory engagement fees.

Share of Profit from an Associate. This relates to our share of profit from an associated company in Hong Kong which later became a wholly-owned subsidiary on October 13, 2022 following the acquisition of the controlling shares in that business.

Interest Income. Our interest income increased by 166.8% to S$3.3 million (US$2.4 million) from S$1.2 million for the same period of 2022 primarily due to higher placements of liquid funds in interest earning deposits and an uptrend in deposit interest rates during the period.

Other Operating Income. Our other operating income decreased by 15.8% to S$1.6 million (US$1.1 million) from S$1.8 million for the same period of 2022 primarily due to lower government grants received by our Singapore subsidiaries. This is partially offset by the fair value gains on the financial assets measured at fair value through profit or loss.

Profit Before Income Tax. As a result of the foregoing, we achieved a profit before income tax of S$37.5 million (US$27.5 million) for the three months ended September 30, 2023 (S$41.7 million for the corresponding period of 2022).

Income Tax Expense. Our income tax expense decreased by 46.1% to S$5.8 million (US$4.3 million) from S$10.8 million for the same period of 2022 primarily due to the reinstatement of tax incentive in the Philippines that was temporarily suspended in 2022, lower profitability of a few key operating units and non-recurrence of the one-off ‘prosperity tax’ in Malaysia that was implemented in 2022.

Profit for the Period. As a result of the foregoing, our profit for the period increased by 2.3% to S$31.6 million (US$23.2 million) from S$30.9 million for the same period of 2022.

Exchange differences on translation of foreign operations. Exchange differences on translation of foreign operations recognized in other comprehensive income decreased by 90.1% to a loss of S$0.7 million (US$0.5 million) from a loss of S$6.9 million for the same period of 2022. This is largely due to the smaller impact of the functional currencies of several key foreign operations weakening against the Singapore Dollar during the three months ended September 30, 2023 as compared with the corresponding period of 2022.

Total Comprehensive Income for the Period. As a result of the foregoing, our total comprehensive income for the period increased by 28.8% to S$31.0 million (US$22.7 million) from S$24.0 million for the same period of 2022.

Additional Adjustments to Certain Non-IFRS Financial Measures

With effect from January 1, 2023, we have decided to include adjustments for net foreign exchange gains or losses and acquisition-related professional fees in Adjusted EBITDA, Adjusted Net Income and Adjusted EPS, in addition to an adjustment for equity-settled share-based payment expense (or net reversal) that was included in such previously reported non-IFRS measures in prior periods. Over the course of the previous year, we have identified such additional items as not indicative of our ongoing operating performance, and adjusting for such items is meaningful and useful to readers to understand the underlying performance of the business by eliminating the impact of certain items that may obscure trends in the underlying performance of the business. For further information, see “Non-IFRS Financial Measures” below.

Share Repurchase Program

On March 14, 2022, we announced that the board of directors had approved a US$30.0 million share repurchase program. The share repurchase program commenced on March 14, 2022. The repurchase program does not have an expiration date and may be suspended, modified or discontinued at any time without prior notice. We expect to fund repurchases under this program with our existing cash balance.

Our proposed repurchases may be made from time to time on the open market at prevailing market prices, in privately negotiated transactions, in block trades, and/or through other legally permissible means, depending on market conditions and in accordance with applicable rules and regulations and its insider trading policy. Our board of directors will review the share repurchase program periodically and may authorize adjustment of its terms and size. All share repurchases are subject to and will be carried out, if at all, in accordance with applicable regulatory requirements.

From July 1, 2023 to November 17, 2023, we purchased 930,913 American Depositary Shares (ADSs) at a cost of US$5,542,000 under our share repurchase program.

Reclassifications and comparative figures

In the third quarter of 2022, foreign exchange gains was reported under “other operating income” line item while foreign exchange losses for the quarter was reported under “other operating expenses” line item. From the fourth quarter of 2022 onwards, we reported foreign exchange gains or losses on a net basis under “other operating expenses” line item. Accordingly, reclassifications relating to foreign exchange gains and losses have been made to prior period’s financial statements to enable comparability with the current period’s financial statements and therefore, the below mentioned line items have been amended in the unaudited condensed interim consolidated statement of profit or loss and other comprehensive income. Comparative figures have been adjusted to conform to the current period’s presentation. The items were reclassified as follows:

| Previously reported |

After reclassification |

|||||||

| S$’000 | S$’000 | |||||||

| For the three months ended September 30, 2022: |

||||||||

| Other operating income |

6,775 | 1,840 | ||||||

| Other operating expenses |

(5,590 | ) | (655 | ) | ||||

| For the nine months ended September 30, 2022: |

||||||||

| Other operating income |

12,076 | 4,341 | ||||||

| Other operating expenses |

(12,962 | ) | (5,227 | ) | ||||

NON-IFRS FINANCIAL MEASURES

EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, Adjusted Net Income margin, Adjusted EPS, revenue at constant currency, and revenue growth at constant currency are non-IFRS financial measures. TDCX monitors EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, Adjusted Net Income margin, Adjusted EPS, revenue at constant currency and revenue growth at constant currency because they assist the Company in comparing its operating performance on a consistent basis by removing the impact of items not directly resulting from its core operations.

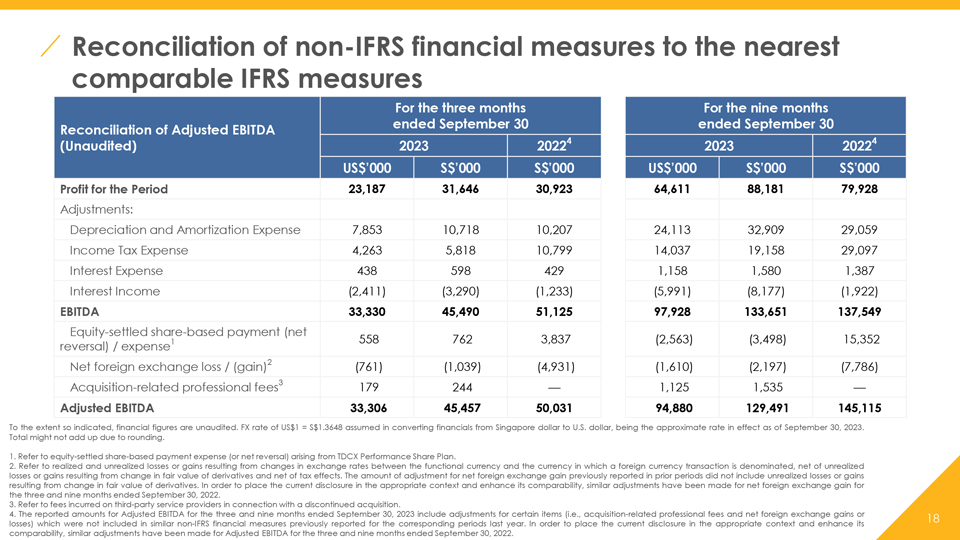

EBITDA, EBITDA margin, Adjusted EBITDA and Adjusted EBITDA margin

“EBITDA” represents profit for the period before interest expense, interest income, income tax expense, and depreciation and amortization expense. “EBITDA margin” represents EBITDA as a percentage of revenue. “Adjusted EBITDA” represents profit for the period before interest expense, interest income, income tax expense, depreciation and amortization expense, equity-settled share-based payment expense (or net reversal) incurred in connection with our Performance Share Plan, net foreign exchange gain or loss and acquisition-related professional fees. “Adjusted EBITDA margin” represents Adjusted EBITDA as a percentage of revenue.

| For the three months ended September 30, | ||||||||||||||||||||

| 2023 | 2022 (4) | |||||||||||||||||||

| US$’000 | S$’000 | Margin | S$’000 | Margin | ||||||||||||||||

| Revenue |

119,791 | 163,491 | — | 172,770 | — | |||||||||||||||

| Profit for the period and net profit margin |

23,187 | 31,646 | 19.4 | % | 30,923 | 17.9 | % | |||||||||||||

| Adjustments for: |

||||||||||||||||||||

| Depreciation and amortization expense |

7,853 | 10,718 | 6.5 | % | 10,207 | 5.9 | % | |||||||||||||

| Income tax expense |

4,263 | 5,818 | 3.5 | % | 10,799 | 6.3 | % | |||||||||||||

| Interest expense |

438 | 598 | 0.4 | % | 429 | 0.2 | % | |||||||||||||

| Interest income |

(2,411 | ) | (3,290 | ) | (2.0 | %) | (1,233 | ) | (0.7 | %) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA and EBITDA margin |

33,330 | 45,490 | 27.8 | % | 51,125 | 29.6 | % | |||||||||||||

| Adjustment: |

||||||||||||||||||||

| Equity-settled share-based payment expense (1) |

558 | 762 | 0.5 | % | 3,837 | 2.2 | % | |||||||||||||

| Net foreign exchange gain (2) |

(761 | ) | (1,039 | ) | (0.6 | %) | (4,931 | ) | (2.8 | %) | ||||||||||

| Acquisition-related professional fees (3) |

179 | 244 | 0.1 | % | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA and Adjusted EBITDA margin (4) |

33,306 | 45,457 | 27.8 | % | 50,031 | 29.0 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| For the nine months ended September 30, | ||||||||||||||||||||

| 2023 | 2022 (5) | |||||||||||||||||||

| US$’000 | S$’000 | Margin | S$’000 | Margin | ||||||||||||||||

| Revenue |

366,022 | 499,547 | — | 487,449 | — | |||||||||||||||

| Profit for the period and net profit margin |

64,611 | 88,181 | 17.7 | % | 79,928 | 16.4 | % | |||||||||||||

| Adjustments for: |

||||||||||||||||||||

| Depreciation and amortization expense |

24,113 | 32,909 | 6.5 | % | 29,059 | 6.0 | % | |||||||||||||

| Income tax expense |

14,037 | 19,158 | 3.8 | % | 29,097 | 6.0 | % | |||||||||||||

| Interest expense |

1,158 | 1,580 | 0.3 | % | 1,387 | 0.3 | % | |||||||||||||

| Interest income |

(5,991 | ) | (8,177 | ) | (1.6 | %) | (1,922 | ) | (0.4 | %) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA and EBITDA margin |

97,928 | 133,651 | 26.7 | % | 137,549 | 28.3 | % | |||||||||||||

| Adjustment: |

||||||||||||||||||||

| Equity-settled share-based payment (net reversal) / expense (1) |

(2,563 | ) | (3,498 | ) | (0.7 | %) | 15,352 | 3.1 | % | |||||||||||

| Net foreign exchange gain (2) |

(1,610 | ) | (2,197 | ) | (0.4 | %) | (7,786 | ) | (1.6 | %) | ||||||||||

| Acquisition-related professional fees (3) |

1,125 | 1,535 | 0.3 | % | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA and Adjusted EBITDA margin (5) |

94,880 | 129,491 | 25.9 | % | 145,115 | 29.8 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Refer to equity-settled share-based payment expense (or net reversal) arising from TDCX Performance Share Plan. |

| (2) | Refer to realized and unrealized losses or gains resulting from changes in exchange rates between the functional currency and the currency in which a foreign currency transaction is denominated, net of unrealized losses or gains resulting from change in fair value of derivatives. The amount of adjustment for net foreign exchange gain previously reported in prior periods did not include unrealized losses or gains resulting from change in fair value of derivatives. In order to place the current disclosure in the appropriate context and enhance its comparability, similar adjustments have been made for net foreign exchange gain for the three and nine months ended September 30, 2022. |

| (3) | Refer to fees incurred on third-party service providers in connection with a discontinued acquisition. |

| (4) | The reported amounts for Adjusted EBITDA for the three months ended September 30, 2023 include adjustments for certain items (i.e., acquisition-related professional fees and net foreign exchange gains or losses) which were not included in similar non-IFRS financial measures previously reported in prior periods. In order to place the current disclosure in the appropriate context and enhance its comparability, similar adjustments have been made for Adjusted EBITDA for the three months ended September 30, 2022. |

| (5) | The reported amounts for Adjusted EBITDA for the nine months ended September 30, 2023 include adjustments for certain items (i.e., acquisition-related professional fees and net foreign exchange gains or losses) which were not included in similar non-IFRS financial measures previously reported in prior periods. In order to place the current disclosure in the appropriate context and enhance its comparability, similar adjustments have been made for Adjusted EBITDA for the nine months ended September 30, 2022. |

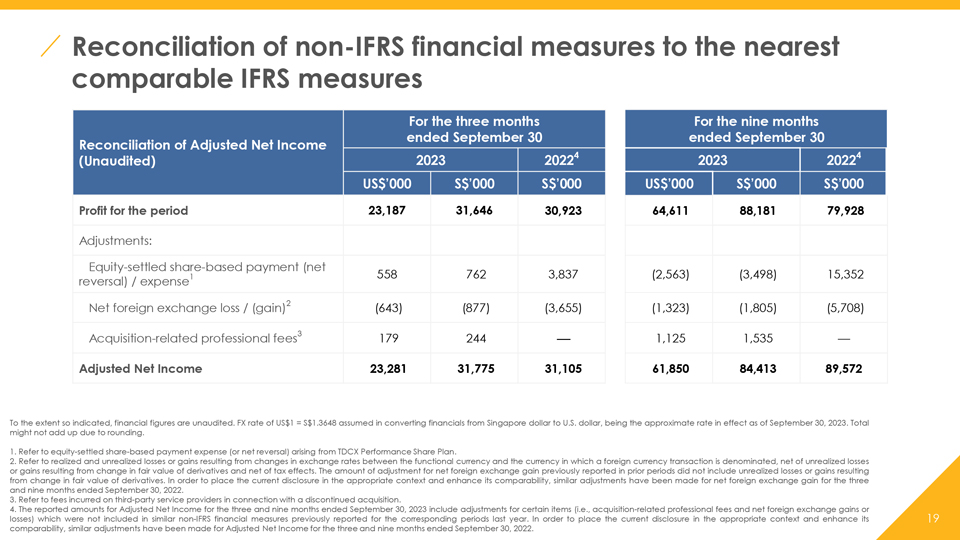

Adjusted Net Income and Adjusted Net Income margin

“Adjusted Net Income” represents profit for the period before equity-settled share-based payment expense (or net reversal) incurred in connection with our Performance Share Plan, net foreign exchange gain or loss and acquisition-related professional fees, net of any tax impact of such adjustments. “Adjusted Net Income margin” represents Adjusted Net Income as a percentage of revenue.

| For the three months ended September 30, | ||||||||||||||||||||

| 2023 | 2022 (4) | |||||||||||||||||||

| US$’000 | S$’000 | Margin | S$’000 | Margin | ||||||||||||||||

| Profit for the period and net profit margin |

23,187 | 31,646 | 19.4 | % | 30,923 | 17.9 | % | |||||||||||||

| Adjustment for: |

||||||||||||||||||||

| Equity-settled share-based payment expense (1) |

558 | 762 | 0.5 | % | 3,837 | 2.2 | % | |||||||||||||

| Net foreign exchange gain (2) |

(643 | ) | (877 | ) | (0.5 | %) | (3,655 | ) | (2.1 | %) | ||||||||||

| Acquisition-related professional fees (3) |

179 | 244 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted Net Income and Adjusted Net Income margin (4) |

23,281 | 31,775 | 19.4 | % | 31,105 | 18.0 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| For the nine months ended September 30, | ||||||||||||||||||||

| 2023 | 2022 (5) | |||||||||||||||||||

| US$’000 | S$’000 | Margin | S$’000 | Margin | ||||||||||||||||

| Profit for the period and net profit margin |

64,611 | 88,181 | 17.7 | % | 79,928 | 16.4 | % | |||||||||||||

| Adjustment for: |

||||||||||||||||||||

| Equity-settled share-based payment (net reversal) / expense (1) |

(2,563 | ) | (3,498 | ) | (0.7 | %) | 15,352 | 3.1 | % | |||||||||||

| Net foreign exchange gain (2) |

(1,323 | ) | (1,805 | ) | (0.4 | %) | (5,708 | ) | (1.1 | %) | ||||||||||

| Acquisition-related professional fees (3) |

1,125 | 1,535 | 0.3 | % | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted Net Income and Adjusted Net Income margin (5) |

61,850 | 84,413 | 16.9 | % | 89,572 | 18.4 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Refer to equity-settled share-based payment expense (or net reversal) arising from TDCX Performance Share Plan. |

| (2) | Refer to realized and unrealized losses or gains resulting from changes in exchange rates between the functional currency and the currency in which a foreign currency transaction is denominated, net of unrealized losses or gains resulting from change in fair value of derivatives and net of tax effects. The amount of adjustment for net foreign exchange gain previously reported in prior periods did not include unrealized losses or gains resulting from change in fair value of derivatives. In order to place the current disclosure in the appropriate context and enhance its comparability, similar adjustments have been made for net foreign exchange gain for the three and nine months ended September 30, 2022. |

| (3) | Refer to fees incurred on third-party service providers in connection with a discontinued acquisition. |

| (4) | The reported amounts for Adjusted Net Income for the three months ended September 30, 2023 include adjustments for certain items (i.e., acquisition-related professional fees and net foreign exchange gains or losses) which were not included in similar non-IFRS financial measures previously reported in prior periods. In order to place the current disclosure in the appropriate context and enhance its comparability, similar adjustments have been made for Adjusted Net Income for the three months ended September 30, 2022. |

| (5) | The reported amounts for Adjusted Net Income for the nine months ended September 30, 2023 include adjustments for certain items (i.e., acquisition-related professional fees and net foreign exchange gains or losses) which were not included in similar non-IFRS financial measures previously reported in prior periods. In order to place the current disclosure in the appropriate context and enhance its comparability, similar adjustments have been made for Adjusted Net Income for the nine months ended September 30, 2022. |

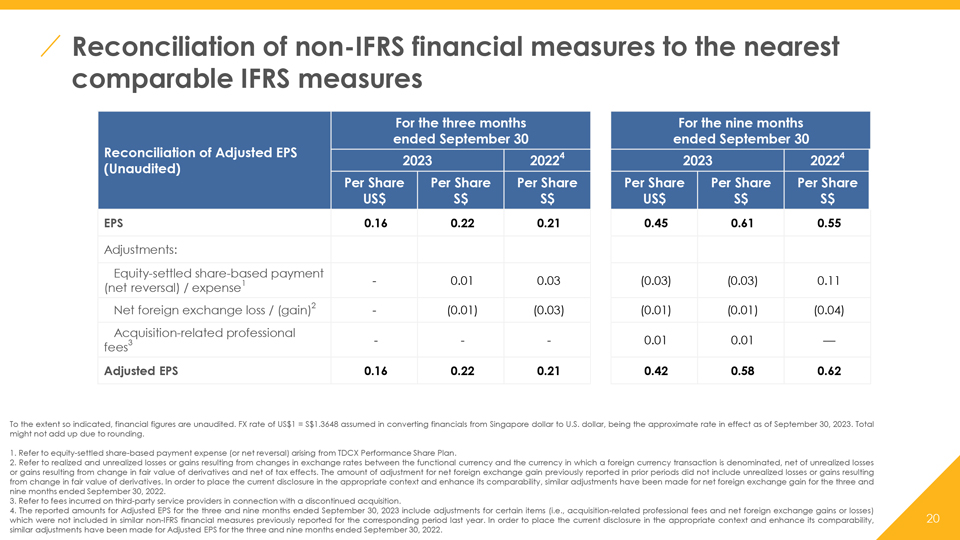

Adjusted EPS

“Adjusted EPS” represents earnings available to shareholders excluding the impact of equity-settled share-based payment expense (or net reversal), net foreign exchange gain or loss and acquisition-related professional fees.

Adjusted EPS is calculated as earnings available to shareholders excluding the impact of equity-settled share-based payment expense (or net reversal), net foreign exchange gain or loss and acquisition-related professional fees, divided by the diluted weighted-average number of shares outstanding.

| For the three months ended September 30, | ||||||||||||||||||||||||

| 2023 | 2022 (4) | |||||||||||||||||||||||

| Amount | Per Share |

Amount | Per Share |

Amount | Per Share |

|||||||||||||||||||

| US$’000 | US$ | S$’000 | S$ | S$’000 | S$ | |||||||||||||||||||

| Reported earnings available to shareholders and EPS |

23,188 | 0.16 | 31,647 | 0.22 | 30,922 | 0.21 | ||||||||||||||||||

| Adjustments for: |

||||||||||||||||||||||||

| Equity-settled share-based payment expense (1) |

558 | — | 762 | 0.01 | 3,837 | 0.03 | ||||||||||||||||||

| Net foreign exchange gain (2) |

(643 | ) | — | (877 | ) | (0.01 | ) | (3,655 | ) | (0.03 | ) | |||||||||||||

| Acquisition-related professional fees (3) |

179 | — | 244 | — | — | — | ||||||||||||||||||

| Adjusted earnings available to shareholders and Adjusted EPS (4) |

23,282 | 0.16 | 31,776 | 0.22 | 31,104 | 0.21 | ||||||||||||||||||

| For the nine months ended September 30, | ||||||||||||||||||||||||

| 2023 | 2022 (5) | |||||||||||||||||||||||

| Amount | Per Share |

Amount | Per Share |

Amount | Per Share |

|||||||||||||||||||

| US$’000 | US$ | S$’000 | S$ | S$’000 | S$ | |||||||||||||||||||

| Reported earnings available to shareholders and EPS |

64,570 | 0.45 | 88,125 | 0.61 | 79,926 | 0.55 | ||||||||||||||||||

| Adjustments for: |

||||||||||||||||||||||||

| Equity-settled share-based payment (net reversal) / expense (1) |

(2,563 | ) | (0.03 | ) | (3,498 | ) | (0.03 | ) | 15,352 | 0.11 | ||||||||||||||

| Net foreign exchange gain (2) |

(1,323 | ) | (0.01 | ) | (1,805 | ) | (0.01 | ) | (5,708 | ) | (0.04 | ) | ||||||||||||

| Acquisition-related professional fees (3) |

1,125 | 0.01 | 1,535 | 0.01 | — | — | ||||||||||||||||||

| Adjusted earnings available to shareholders and Adjusted EPS (5) |

61,809 | 0.42 | 84,357 | 0.58 | 89,570 | 0.62 | ||||||||||||||||||

| (1) | Refer to equity-settled share-based payment expense arising from TDCX Performance Share Plan. |

| (2) | Refer to realized and unrealized losses or gains resulting from changes in exchange rates between the functional currency and the currency in which a foreign currency transaction is denominated, net of unrealized losses or gains resulting from change in fair value of derivatives and net of tax effects. The amount of adjustment for net foreign exchange gain previously reported in prior periods did not include unrealized losses or gains resulting from change in fair value of derivatives. In order to place the current disclosure in the appropriate context and enhance its comparability, similar adjustments have been made for net foreign exchange gain for the three and nine months ended September 30, 2022. |

| (3) | Refer to fees incurred on third-party service providers in connection with a discontinued acquisition. |

| (4) | The reported amounts for Adjusted EPS for the three months ended September 30, 2023 include adjustments for certain items (i.e., acquisition-related professional fees and net foreign exchange gains or losses) which were not included in similar non-IFRS financial measures previously reported in prior periods. In order to place the current disclosure in the appropriate context and enhance its comparability, similar adjustments have been made for Adjusted EPS for the three months ended September 30, 2022. |

| (5) | The reported amounts for Adjusted EPS for the nine months ended September 30, 2023 include adjustments for certain items (i.e., acquisition-related professional fees and net foreign exchange gains or losses) which were not included in similar non-IFRS financial measures previously reported in prior periods. In order to place the current disclosure in the appropriate context and enhance its comparability, similar adjustments have been made for Adjusted EPS for the nine months ended September 30, 2022. |

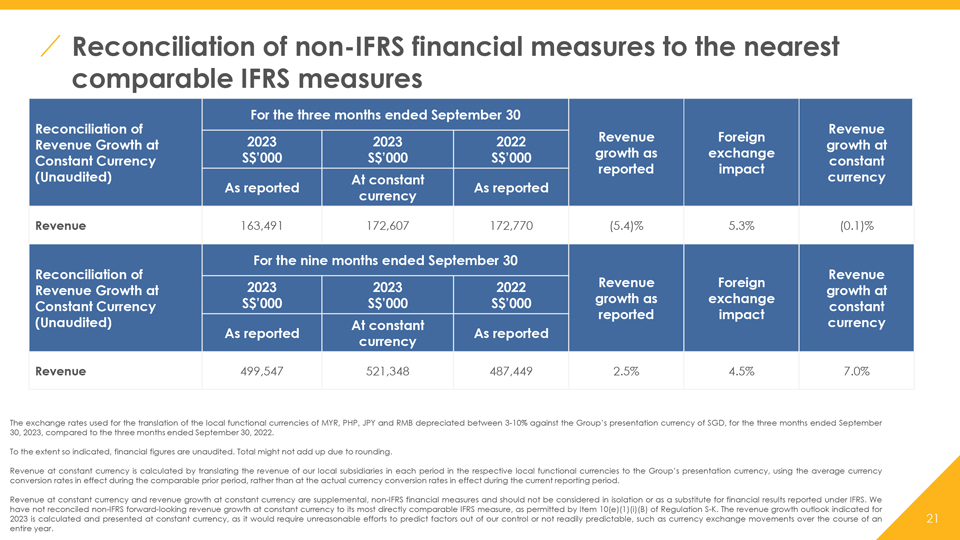

Revenue at Constant Currency and Revenue Growth at Constant Currency

Revenue at constant currency, which is revenue adjusted for the translation effect of foreign currencies so that certain financial results can be viewed without the impact of fluctuations in foreign currency exchange rates, thereby facilitating period-to-period comparisons of our business performance. Revenue at constant currency is calculated by translating the revenue of our local subsidiaries in each period in the respective local functional currencies to TDCX Inc.’s and its consolidated subsidiaries’ (together, the “Group”) presentation currency, using the average currency conversion rates in effect during the comparable prior period (rather than at the actual currency conversion rates in effect during the current reporting period). Revenue growth at constant currency means the period-over-period change in revenue at constant currency compared against revenue in the prior period.

| For the three months ended September 30, | ||||||||||||||||||

| 2023 | 2023 | 2022 | ||||||||||||||||

| S$’000 | S$’000 | S$’000 | ||||||||||||||||

| As reported | At constant currency |

As reported | Revenue growth as reported |

Foreign exchange impact |

Revenue growth at constant currency | |||||||||||||

| Revenue |

163,491 | 172,607 | 172,770 | (5.4)% | 5.3% | (0.1)% | ||||||||||||

| For the nine months ended September 30, | ||||||||||||||||||

| 2023 | 2023 | 2022 | ||||||||||||||||

| S$’000 | S$’000 | S$’000 | ||||||||||||||||

| As reported | At constant currency |

As reported | Revenue growth as reported |

Foreign exchange impact |

Revenue growth at constant currency | |||||||||||||

| Revenue |

499,547 | 521,348 | 487,449 | 2.5% | 4.5% | 7.0% | ||||||||||||

The Company has not reconciled non-IFRS forward-looking revenue growth at constant currency to its most directly comparable IFRS measure, as permitted by Item 10(e)(1)(i)(B) of Regulation S-K. The revenue growth outlook indicated for 2023 is calculated and presented at constant currency, as it would require unreasonable efforts to predict factors that are out of the Company’s control or are not readily predictable, such as currency exchange movements over the course of an entire year.

The Company uses revenue at constant currency and revenue growth at constant currency, which are supplemental non-IFRS financial measures, to provide better comparability of revenue trends period-over-period (without the impact of fluctuations in foreign currency exchange rates) because it is a global company that transacts business in multiple currencies and reports financial information in the Group’s functional reporting currency. Foreign currency exchange rate fluctuations affect the amounts reported by the Company in the Group’s functional reporting currency with respect to its foreign revenues. Generally, when the Group’s functional reporting currency dollar either strengthens or weakens against other currencies, revenue at constant currency rates and revenue growth at constant currency rates will be higher or lower than revenue and revenue growth reported at actual exchange rates.

The Company believes that non-IFRS financial measures such as EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, Adjusted Net Income margin, Adjusted EPS, revenue at constant currency and revenue growth at constant currency help us to identify underlying trends in our operating results, enhancing our understanding of past performance and future prospects.

While the Company believes that such non-IFRS financial measures provide useful information to investors in understanding and evaluating the Company’s results of operations in the same manner as its management, the Company’s use of such non-IFRS financial measures have limitations as analytical tools and you should not consider these in isolation or as a substitute for analysis of the Company’s results of operations or financial condition as reported under IFRS.

TDCX’s non-IFRS financial measures do not reflect all items of income and expense that affect the Company’s operations and do not represent the residual cash flow available for discretionary expenditures. Further, these non-IFRS measures may differ from the non-IFRS information used by other companies, including peer companies, and therefore their comparability may be limited. The Company compensates for these limitations by reconciling the non-IFRS financial measures to the nearest IFRS performance measure, all of which should be considered when evaluating performance. The Company encourages you to review the company’s financial information in its entirety and not rely on any single financial measure.

The translation of Singapore Dollar amounts into United States Dollar amounts for the unaudited condensed interim consolidated statement of profit or loss and other comprehensive income above are included solely for the convenience of readers outside of Singapore and have been made at the rate of S$1.3648 to US$1.00, the approximate rate of exchange at September 30, 2023. Such translations should not be construed as representations that the Singapore Dollar amounts could be converted into USD at that or any other rate.

UNAUDITED CONDENSED INTERIM CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

| For the nine months ended September 30, | ||||||||||||

| 2023 | 2022 | |||||||||||

| US$’000 | S$’000 | S$’000 | ||||||||||

| Revenue |

366,022 | 499,547 | 487,449 | |||||||||

| Employee benefits expense |

(239,135 | ) | (326,372 | ) | (321,540 | ) | ||||||

| Depreciation and amortization expense |

(24,113 | ) | (32,909 | ) | (29,059 | ) | ||||||

| Rental and maintenance expense |

(7,051 | ) | (9,623 | ) | (7,290 | ) | ||||||

| Recruitment expense |

(5,530 | ) | (7,547 | ) | (10,797 | ) | ||||||

| Transport and travelling expense |

(835 | ) | (1,140 | ) | (971 | ) | ||||||

| Telecommunication and technology expense |

(7,712 | ) | (10,526 | ) | (8,551 | ) | ||||||

| Interest expense |

(1,158 | ) | (1,580 | ) | (1,387 | ) | ||||||

| Other operating expense (1) |

(9,779 | ) | (13,347 | ) | (5,227 | ) | ||||||

| Share of profit from an associate |

— | — | 135 | |||||||||

| Interest income |

5,991 | 8,177 | 1,922 | |||||||||

| Other operating income |

1,948 | 2,659 | 4,341 | |||||||||

|

|

|

|

|

|

|

|||||||

| Profit before income tax |

78,648 | 107,339 | 109,025 | |||||||||

| Income tax expenses |

(14,037 | ) | (19,158 | ) | (29,097 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Profit for the period |

64,611 | 88,181 | 79,928 | |||||||||

| Item that may be reclassified subsequently to profit or loss: |

||||||||||||

| Exchange differences on translation of foreign operations |

(2,656 | ) | (3,625 | ) | 1,747 | |||||||

|

|

|

|

|

|

|

|||||||

| Total comprehensive income for the period |

61,955 | 84,556 | 81,675 | |||||||||

|

|

|

|

|

|

|

|||||||

| Profit attributable to: |

||||||||||||

| - Owners of the Group |

64,570 | 88,125 | 79,926 | |||||||||

| - Non-controlling interests |

41 | 56 | 2 | |||||||||

|

|

|

|

|

|

|

|||||||

| 64,611 | 88,181 | 79,928 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Total comprehensive income attributable to: |

||||||||||||

| - Owners of the Group |

61,914 | 84,500 | 81,673 | |||||||||

| - Non-controlling interests |

41 | 56 | 2 | |||||||||

|

|

|

|

|

|

|

|||||||

| 61,955 | 84,556 | 81,675 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Basic earnings per share (in S$) (2) |

0.45 | 0.61 | 0.55 | |||||||||

| Diluted earnings per share (in S$) (2) |

0.45 | 0.61 | 0.55 | |||||||||

|

|

|

|

|

|

|

|||||||

| (1) | We reported foreign exchange gains or losses, as applicable, on a net basis for the relevant period under the “other operating expense” line item. |

| (2) | Basic and diluted earnings per share |

| For the nine months ended September 30, |

||||||||

| 2023 | 2022 | |||||||

| Weighted average number of ordinary shares for the purposes of basic earnings per share |

144,978,861 | 145,425,637 | ||||||

| Weighted average number of ordinary shares for the purposes of diluted earnings per share |

145,032,964 | 145,425,637 | ||||||

|

|

|

|

|

|||||

UNAUDITED CONDENSED INTERIM CONSOLIDATED STATEMENT OF FINANCIAL POSITION

| As of September 30, 2023 | As of December 31, 2022 | |||||||||||

| US$’000 | S$’000 | S$’000 | ||||||||||

| ASSETS |

||||||||||||

| Current assets |

||||||||||||

| Cash and cash equivalents |

317,729 | 433,637 | 389,100 | |||||||||

| Fixed and pledged deposits |

— | — | 6,551 | |||||||||

| Trade receivables |

69,934 | 95,446 | 88,808 | |||||||||

| Contract assets |

46,958 | 64,088 | 58,808 | |||||||||

| Other receivables |

13,812 | 18,850 | 15,885 | |||||||||

| Financial assets measured at fair value through profit or loss |

42,243 | 57,653 | 29,776 | |||||||||

| Income tax receivable |

314 | 428 | 354 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current assets |

490,990 | 670,102 | 589,282 | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-current assets |

||||||||||||

| Pledged deposits |

426 | 582 | 584 | |||||||||

| Goodwill and intangible assets |

2,005 | 2,737 | 2,924 | |||||||||

| Other receivables |

1,937 | 2,643 | 5,019 | |||||||||

| Plant and equipment |

25,134 | 34,303 | 41,292 | |||||||||

| Right-of-use assets |

23,434 | 31,983 | 35,236 | |||||||||

| Deferred tax assets |

2,799 | 3,820 | 3,463 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-current assets |

55,735 | 76,068 | 88,518 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total assets |

546,725 | 746,170 | 677,800 | |||||||||

|

|

|

|

|

|

|

|||||||

| LIABILITIES AND EQUITY |

||||||||||||

| Current liabilities |

||||||||||||

| Other payables |

38,123 | 52,030 | 49,723 | |||||||||

| Lease liabilities |

12,142 | 16,572 | 17,818 | |||||||||

| Provision for reinstatement cost |

2,859 | 3,902 | 5,282 | |||||||||

| Income tax payable |

7,066 | 9,644 | 16,560 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current liabilities |

60,190 | 82,148 | 89,383 | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-current liabilities |

||||||||||||

| Lease liabilities |

13,423 | 18,320 | 20,644 | |||||||||

| Provision for reinstatement cost |

3,997 | 5,456 | 3,572 | |||||||||

| Defined benefit obligation |

1,620 | 2,211 | 1,497 | |||||||||

| Deferred tax liabilities |

596 | 813 | 852 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-current liabilities |

19,636 | 26,800 | 26,565 | |||||||||

|

|

|

|

|

|

|

|||||||

| Capital, reserves and non-controlling interests |

||||||||||||

| Share capital |

15 | 20 | 19 | |||||||||

| Reserves |

151,536 | 206,817 | 219,590 | |||||||||

| Retained earnings |

315,319 | 430,346 | 342,260 | |||||||||

|

|

|

|

|

|

|

|||||||

| Equity attributable to owners of the Group |

466,870 | 637,183 | 561,869 | |||||||||

| Non-controlling interests |

29 | 39 | (17 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Total equity |

466,899 | 637,222 | 561,852 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities and equity |

546,725 | 746,170 | 677,800 | |||||||||

|

|

|

|

|

|

|

|||||||

The translation of Singapore Dollar amounts into United States Dollar amounts for the unaudited condensed interim consolidated statement of financial position above are included solely for the convenience of readers outside of Singapore and have been made at the rate of S$1.3648 to US$1.00, the approximate rate of exchange at September 30, 2023. Such translations should not be construed as representations that the Singapore Dollar amounts could be converted into USD at that or any other rate.

UNAUDITED CONDENSED INTERIM CONSOLIDATED STATEMENT OF CASH FLOWS

| For the nine months ended September 30, | ||||||||||||

| 2023 | 2022 | |||||||||||

| US$’000 | S$’000 | S$’000 | ||||||||||

| Operating activities |

||||||||||||

| Profit before income tax |

78,648 | 107,339 | 109,025 | |||||||||

| Adjustments for: |

||||||||||||

| Depreciation and amortization expense |

24,113 | 32,909 | 29,059 | |||||||||

| Gain on early termination of right-of-use assets |

(6 | ) | (8 | ) | — | |||||||

| Changes in fair value of financial assets at FVTPL |

(763 | ) | (1,042 | ) | — | |||||||

| Equity-settled share-based payment (net reversal) / expense |

(2,563 | ) | (3,498 | ) | 15,352 | |||||||

| Provision for office reinstatement cost |

(3 | ) | (4 | ) | 995 | |||||||

| Bank loan transaction cost |

23 | 32 | 41 | |||||||||

| Interest income |

(5,991 | ) | (8,177 | ) | (1,922 | ) | ||||||

| Interest expense |

1,158 | 1,580 | 1,387 | |||||||||

| Retirement benefit service cost |

502 | 685 | 566 | |||||||||

| Loss / (Gain) on disposal and write-off of plant and equipment |

29 | 39 | (1 | ) | ||||||||

| Share of profit from an associate |

— | — | (135 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Operating cash flows before movements in working capital |

95,147 | 129,855 | 154,367 | |||||||||

| Trade receivables |

(6,331 | ) | (8,640 | ) | 716 | |||||||

| Contract assets |

(5,105 | ) | (6,967 | ) | (16,180 | ) | ||||||

| Other receivables |

(1,066 | ) | (1,455 | ) | (2,399 | ) | ||||||

| Other payables |

3,510 | 4,790 | 19,427 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cash generated from operations |

86,155 | 117,583 | 155,931 | |||||||||

| Interest received |

5,991 | 8,177 | 1,922 | |||||||||

| Income tax paid |

(19,667 | ) | (26,841 | ) | (27,617 | ) | ||||||

| Income tax refunded |

274 | 374 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Net cash from operating activities |

72,753 | 99,293 | 130,236 | |||||||||

|

|

|

|

|

|

|

|||||||

| Investing activities |

||||||||||||

| Purchase of plant and equipment |

(6,868 | ) | (9,374 | ) | (19,501 | ) | ||||||

| Proceeds from sales of plant and equipment |

21 | 29 | 50 | |||||||||

| Decrease in fixed deposits |

4,677 | 6,383 | 1,735 | |||||||||

| Investment in financial assets measured at fair value through profit or loss |

(18,974 | ) | (25,896 | ) | — | |||||||

|

|

|

|

|

|

|

|||||||

| Net cash used in investing activities |

(21,144 | ) | (28,858 | ) | (17,716 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Financing activities |

||||||||||||

| Dividends paid |

(29 | ) | (40 | ) | (41 | ) | ||||||

| Repayment of lease liabilities |

(13,206 | ) | (18,023 | ) | (14,426 | ) | ||||||

| Interest paid |

— | — | (212 | ) | ||||||||

| Repayment of bank loan |

— | — | (16,234 | ) | ||||||||

| Repurchase of American Depositary Shares |

(4,619 | ) | (6,304 | ) | (13,590 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net cash used in financing activities |

(17,854 | ) | (24,367 | ) | (44,503 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net increase in cash and cash equivalents |

33,755 | 46,068 | 68,017 | |||||||||

| Effect of foreign exchange rate changes on cash held in foreign currencies |

(1,123 | ) | (1,531 | ) | 5,277 | |||||||

| Cash and cash equivalents at beginning of period |

285,097 | 389,100 | 313,147 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cash and cash equivalents at end of period |

317,729 | 433,637 | 386,441 | |||||||||

|

|

|

|

|

|

|

|||||||

The translation of Singapore Dollar amounts into United States Dollar amounts for the unaudited condensed interim consolidated statement of cash flows above are included solely for the convenience of readers outside of Singapore and have been made at the rate of S$1.3648 to US$1.00, the approximate rate of exchange at September 30, 2023. Such translations should not be construed as representations that the Singapore Dollar amounts could be converted into USD at that or any other rate.

Exhibit 99.2

Third Quarter 2023 Results November 2023

Disclaimer This presentation is provided solely by TDCX Inc. (the “Company”) acting in its own capacity and on behalf of its subsidiaries. Forward-looking statements. This presentation may contain forward-looking statements, outcomes, forecasts, estimates, projections and opinions (“forward-looking statements”). No representation or promise is made or will be made that any forward-looking statement will be achieved or will eventuate in the future. Actual events, results, returns and operations could vary materially from those reflected or contemplated in such forward-looking statements. Similarly, no representation or promise is given by the Company that the assumptions, variables and other inputs used in or underlying this presentation are reasonable, reliable or accurate. Circumstances may change and the contents of this presentation may become outdated as a result. Forward- looking statements are by their nature subject to significant uncertainties and contingencies and reliance should not be placed upon them. Past performance of the Company and any of its subsidiaries cannot be relied upon as a guide to future performance. Non-IFRS financial measures. This presentation includes certain financial measures not presented in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”) including EBITDA, EBITDA Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Net Income Margin, Adjusted EPS, Revenue at Constant Currency and Revenue Growth at Constant Currency. These non-IFRS financial measures are not measures of financial performance in accordance with IFRS and may exclude items that are significant in understanding and assessing the Company’s financial results or position. Therefore, these measures should not be considered in isolation or as an alternative to gross profit, profit for the period, cash flow or other measures of profitability, liquidity or performance under IFRS. You should be aware that the Company’s presentation of these measures may not be comparable to similarly-titled measures used by other companies which may be defined and calculated differently. See the Reconciliation section in the Appendix for a reconciliation of these non-IFRS measures to the most directly comparable IFRS measure. We have not reconciled non-IFRS forward-looking revenue growth at constant currency to its most directly comparable IFRS measure, as permitted by Item 10(e)(1)(i)(B) of Regulation S-K. The revenue growth outlook indicated for 2023 is calculated and presented at constant currency, as it would require unreasonable efforts to predict factors out of our control or not readily predictable, such as currency exchange movements over the course of an entire year. No representation. In preparing this presentation, the Company has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which has otherwise been reviewed. Any information regarding price or value in this presentation should not be interpreted as an actual or guaranteed realizable price or value. The Company does not warrant or guarantee the performance of the Company, its assets, business, any financial product or any return associated with any investment. The Company does not make any representation or warranty, express or implied, with respect to the accuracy or completeness of this presentation, or the reasonableness of any assumption contained in this presentation and is not under any obligation to provide you with access to any additional material and reserves the right to amend or replace the same at any time upon its sole discretion. The materials in this presentation is not complete, and not intended to be relied upon, or provide the sole or principal basis of any decision or other action in relation to any transaction. No advice and not an offer. Nothing in this presentation should be construed as or constitutes legal, tax, regulatory, accounting, investment or other (including financial product) advice or as a securities or other recommendation. Furthermore, this presentation is not intended, and does not, constitute or form part of any offer, invitation or the solicitation of an offer to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of, any securities of TDCX Inc. and any of its subsidiaries or undertakings or any other invitation or inducement to engage in investment activities, nor shall this presentation (or any part of it) nor the fact of its distribution form the basis of, or be relied on in connection with, any contract or investment decision. Industry information. Certain industry, market and competitive position data in this presentation is based on third-party data provided by Frost & Sullivan. Such data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates, as there is no assurance that any of them will be reached. Industry publications, reports, research, surveys and studies generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources and estimates are subject to the same qualifications and uncertainties. Convenience translation. The Company’s financial information is stated in Singapore dollars, the legal currency of Singapore. Unless otherwise noted, all translations from Singapore dollars to U.S. dollars and from U.S. dollars to Singapore dollars in this presentation were made at a rate of S$1.3648 to US$1.00, being the approximate rate in effect as of September 30, 2023. We make no representation that any Singapore dollar or U.S. dollar amount could have been, or could be, converted into U.S. dollars or Singapore dollar, as the case may be, at any particular rate, the rate stated herein, or at all. 2

01. HIGHLIGHTS & OVERVIEW3

All amounts in USD Highlights – Q3 2023 unless stated otherwise Revenue declined due to lower volumes from certain key clients Excluding Top 5 clients, revenue rose 51% YoY Revenue $120m -5.4% YoY (-0.1% YoY in constant currency1,2) Achieved growth in quarterly profit despite tough environment Driven by cost optimization, lower tax and higher interest income Profit for the period $23m +2.3% YoY Improved revenue Continued strong New geographies diversification client growth3 contributing Adjusted EBITDA margin2 Top 2 Client revenue mix Revenue 27.8% 72 +31% 94 Revenue 56% 47% from 5x Sep 30, Sep 30, 4 Q3 22 Q3 23 2022 2023 New Geos Q3 235 vs Q3 22 Note – Financial figures are unaudited. 1. Revenue at Constant Currency is calculated by translating the revenue of our local subsidiaries in each period in the respective local functional currencies to the Group’s presentation currency, using the average currency conversion rates in effect during the comparable prior period, rather than at the actual currency conversion rates in effect during the current reporting period. 2. EBITDA, Adjusted EBITDA, Adjusted EBITDA margin and Revenue Growth at Constant Currency are supplemental, non-IFRS financial measures and should not be considered in isolation or as a substitute for financial results reported under IFRS. For a reconciliation of non-IFRS financial measures to the most directly comparable IFRS measures, see the Appendix. 3. Refers to launched campaigns that are revenue generating 4 4. Refers to sites in Colombia, India, Romania, South Korea, Hong Kong, Türkiye, Vietnam, Brazil and Indonesia. 5. Includes additional clients attributable to our Hong Kong subsidiary.

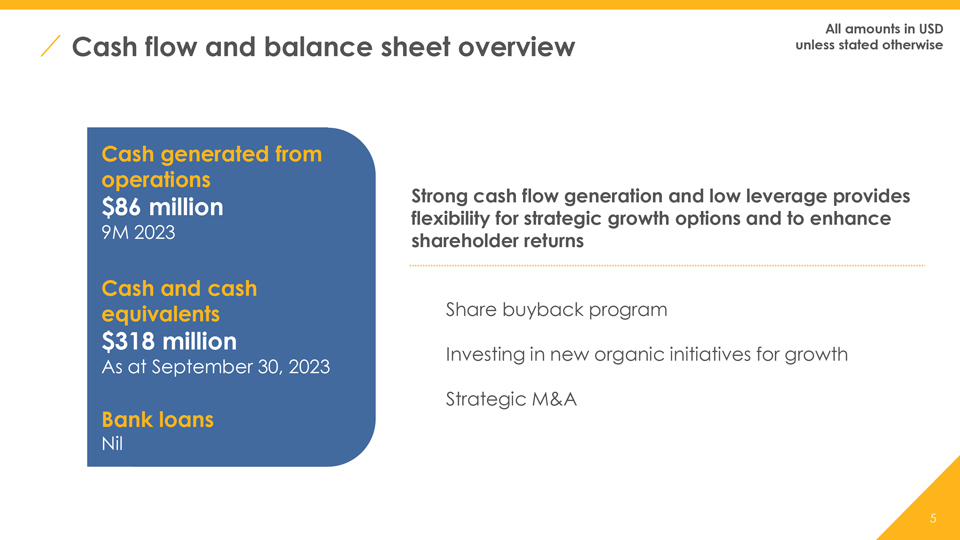

All amounts in USD unless stated otherwiseCash flow and balance sheet overview Strong cash flow generation and low leverage provides flexibility for strategicgrowth options and to enhance shareholder returnsCash generated from operations$86 million9M 2023 Cash and cash equivalents $318 millionAs at September 30, 2023Bank loans Nil Share buybackprogramInvesting in new organic initiatives for growth Strategic M&A5

Signing up exciting new clients, improving revenue diversification Growing client count1,2 Improved revenue diversification Top 2 client revenue mix +31% Newly launched clients in Q3 include: 56% 47% 94 One of the world’s most popular mobile messaging apps Q3 22 Q3 23 Leading global airline based out of Asia 4 clients which have signed but not yet launched3 Top 5 client revenue mix 72 Southeast Asia’s leading super-app providing everyday 82% 57% 50% 71% services Q3 2 22 Q2 3 23 European medical device manufacturer 2022 2023 As of Sep 30 1. “Client count” refers to launched campaigns that are revenue generating. 6 2. Includes additional clients attributable to our Hong Kong subsidiary. 3. There are 4 clients which have been signed but are not yet revenue generating as of 30 September 2023.

Strong Asian foothold, expanding our global presence Existing Geographies New Geographies Added3 9M 2023 Revenue Mix 5x Southeast Asia4 Revenue from 60% New Geos1 Q3 232 vs Q3 22 ROMANIA SPAIN CHINA S. KOREA JAPAN TÜRKIYE INDIA HONG KONG THAILAND VIETNAM 17,800+ COLOMBIA PHILIPPINES MALAYSIA North Asia5 Global English6 INDONESIA 25% Employees SINGAPORE 11% Others BRAZIL globally as at 4% Sep 30, 2023 Note – Financial figures are unaudited. Total might not add up due to rounding. 1. Refers to sites in Colombia, India, Romania, South Korea, Hong Kong, Türkiye, Vietnam, Brazil and Indonesia. 2. Includes additional clients attributable to our Hong Kong subsidiary. 3. In addition to the above geographies, companies were set up in Australia and Taiwan in 2022 to deliver business services for a client. 4. Refers to sites in Singapore, Malaysia, Thailand, Vietnam and Indonesia, which mainly serve Southeast Asian languages. 7 5. Refers to sites in Japan, China, Korea, Hong Kong and Taiwan, which mainly serve North Asian languages. 6. Refers to sites in Philippines and India, which mainly serve the Global English market.

02.Q32023PERFORMANCE

;Q3 financial performance EBITDA2 (US$m1) Profit for the Period (US$m1) Revenue (US$m1) EBITDA 29.6% 27.8% Lower equity-settled Margin2 +2.3% share-based payment expense, -11.0% lower tax, and higher -0.1% in interest income constant2 currency 23 23 -5.4% terms 37 33 EPS: 16¢ Q3 22 Q3 23 Q3 22 Q3 23 Adjusted EBITDA2 (US$m1) Adjusted Net Income2 (US$m1) 127 120 Adj EBITDA +2.2% 29.0% 27.8% Driven by lower Margin2 tax, and higher -9.1% interest income 37 23 23 2 Q3 22 Q3 23 33 Adj EPS : 16¢ Q3 22 Q3 23 Q3 22 Q3 23 Note – Financial figures are unaudited. 1. FX rate of US$1 = S$1.3648 assumed in converting Q3 22 and Q3 23 financials from Singapore dollar to U.S. dollar, being the approximate rate in effect as of September 30, 2023. 9 2. EBITDA, EBITDA Margins, Adjusted EBITDA, Adjusted EBITDA Margins, Adjusted Net Income, Adjusted EPS, Revenue and Revenue Growth at Constant Currency are supplemental, non-IFRS financial measures and should not be considered in isolation or as a substitute for financial results reported under IFRS. For a reconciliation of these non-IFRS financial measures to the most directly comparable IFRS measures, see the Appendix.