We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Skeena Resources Ltd | NYSE:SKE | NYSE | Common Stock |

| Price Change | % Change | Share Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|

| 0.07 | 0.77% | 9.12 | 9.19 | 8.87 | 9.19 | 108,235 | 18:43:18 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of August 2023

SKEENA RESOURCES LIMITED | ||

(Translation of Registrant’s Name into English) | ||

| | |

| 001-40961 | |

| (Commission File Number) | |

| | |

1021 West Hastings Street, Suite 650, Vancouver, British Columbia, V6E 0C3, Canada | ||

(Address of Principal Executive Offices) | ||

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F | ☐ | | Form 40-F | ☑ |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Exhibits 99.1, 99.2 and 99.3 to this report, furnished on Form 6-K, are furnished, not filed, and will not be incorporated by reference into any registration statement filed by the registrant under the Securities Act of 1933, as amended.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 10, 2023

| SKEENA RESOURCES LIMITED | |

| | |

| By: | /s/ Andrew MacRitchie |

| | Andrew MacRitchie |

| | Chief Financial Officer |

Exhibit 99.1

Condensed Interim Consolidated Financial Statements

Three and six months ended June 30, 2023 and 2022

(Unaudited)

SKEENA RESOURCES LIMITED

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Unaudited – expressed in thousands of Canadian dollars)

| | | | | | | | |

| | Note |

| June 30, 2023 |

| December 31, 2022 | ||

ASSETS |

|

|

| |

|

| |

|

| | | | | | | | |

Current |

| |

| |

|

| |

|

Cash and cash equivalents |

| | | $ | 73,446 | | $ | 40,602 |

Marketable securities |

| | |

| 1,793 | |

| 2,494 |

Receivables |

| 6 | |

| 4,868 | |

| 5,682 |

Prepaid expenses |

| | |

| 2,239 | |

| 1,346 |

| | | | | 82,346 | |

| 50,124 |

|

|

| |

| | | | |

Prepaid expenses | | | | | 22 | | | 54 |

Deposits |

| | |

| 2,405 | |

| 2,128 |

Exploration and evaluation interests |

| 5 | |

| 95,938 | |

| 95,438 |

Capital assets |

| | |

| 22,439 | |

| 20,236 |

| | | | | | | | |

Total assets |

|

| | $ | 203,150 | | $ | 167,980 |

| | | | | | | | |

LIABILITIES |

|

| |

|

| |

|

|

| | | | | | | | |

Current |

|

| |

|

| |

|

|

Accounts payable and accrued liabilities |

| 6 | | $ | 12,491 | | $ | 13,977 |

Current portion of lease liabilities |

| | |

| 569 | |

| 545 |

Flow-through share premium liability |

| | |

| 3,439 | |

| 4,557 |

Current portion of other liabilities | | | | | 427 | | | 1,806 |

| | | | | 16,926 | |

| 20,885 |

|

|

| |

| | | | |

Long-term lease liabilities |

| | |

| 2,730 | |

| 3,017 |

Provision for closure and reclamation |

| | |

| 5,686 | |

| 6,160 |

Other liabilities | | | | | 472 | | | 691 |

| | | | | | | | |

Total liabilities |

|

| |

| 25,814 | |

| 30,753 |

| | | | | | | | |

SHAREHOLDERS’ EQUITY |

|

| |

|

| |

|

|

| | | | | | | | |

Capital stock |

| 7 | |

| 537,949 | |

| 464,029 |

Commitment to issue shares | | | | | 1,000 | | | 1,250 |

Reserves |

| 7 | |

| 42,547 | |

| 39,879 |

Deficit |

|

| |

| (404,160) | |

| (367,931) |

| | | | | | | | |

Total shareholders’ equity |

|

| |

| 177,336 | |

| 137,227 |

| | | | | | | | |

Total liabilities and shareholders’ equity |

|

| | $ | 203,150 | | $ | 167,980 |

NATURE OF OPERATIONS (NOTE 1)

CONTINGENCIES (NOTE 9)

SUBSEQUENT EVENT (NOTE 10)

ON BEHALF OF THE BOARD OF DIRECTORS:

signed “Craig Parry” |

| signed “Suki Gill” |

Director | | Director |

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

| Condensed Interim Consolidated Financial Statements | 2 | |

SKEENA RESOURCES LIMITED

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF LOSS AND COMPREHENSIVE LOSS

(Unaudited – expressed in thousands of Canadian dollars, except share and per share amounts)

| | | | | | | | | | | | | | |

| | | | For the three months ended | | For the six months ended | ||||||||

| | | | June 30, | | June 30, | ||||||||

|

| Note | | 2023 |

| 2022 |

| 2023 |

| 2022 | ||||

Accretion |

| | | $ | 58 | | $ | 16 | | $ | 121 | | $ | 34 |

Administrative compensation |

| 6 | |

| 1,427 | |

| 1,209 | |

| 2,811 | |

| 1,772 |

Communications |

|

| |

| 337 | |

| 649 | |

| 624 | |

| 1,202 |

Consulting |

| | |

| 376 | |

| 128 | |

| 514 | |

| 254 |

Depreciation |

| | |

| 71 | |

| 67 | |

| 142 | |

| 144 |

Exploration and evaluation |

| 5 | | | 14,677 | | | 22,955 | | | 25,729 | | | 42,959 |

Flow-through share premium recovery |

| | |

| (921) | |

| (4,246) | |

| (1,118) | |

| (7,114) |

Insurance | | | | | 585 | | | 469 | | | 1,117 | | | 1,011 |

Interest income |

|

| |

| (438) | |

| (90) | |

| (680) | |

| (146) |

Loss (gain) on marketable securities | | | |

| 188 | |

| 1,023 | |

| 553 | |

| (771) |

Office and administration |

| | |

| 316 | |

| 251 | |

| 701 | |

| 446 |

Professional fees |

| | |

| 376 | |

| 200 | |

| 871 | |

| 638 |

Share-based payments |

| 6,7 | |

| 2,352 | |

| 1,903 | |

| 4,512 | |

| 3,072 |

Transfer agent and listing fees |

|

| |

| 82 | |

| 153 | |

| 332 | |

| 202 |

| | | | | | | | | | | | | | |

Loss and comprehensive loss for the period |

|

| | $ | (19,486) | | $ | (24,687) | | $ | (36,229) | | $ | (43,703) |

| | | | | | | | | | | | | | |

Loss per share – basic and diluted |

|

| | $ | (0.24) | | $ | (0.36) | | $ | (0.45) | | $ | (0.65) |

| | | | | | | | | | | | | | |

Weighted average number of common shares outstanding – basic and diluted |

| | |

| 82,197,543 | |

| 69,059,604 | |

| 80,045,553 | |

| 67,447,971 |

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

| Condensed Interim Consolidated Financial Statements | 3 | |

SKEENA RESOURCES LIMITED

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(Unaudited – expressed in thousands of Canadian dollars, except shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | Total | ||

| | Capital Stock | | Commitment to | | Reserves | | | | | Shareholders’ | ||||||||||||||||||

| | (Note 7) | | Issue Shares | | (Note 7) | | | Deficit | | Equity | ||||||||||||||||||

|

| Shares |

| Amount | | |

| Options |

| Restricted Share Units |

| Deferred Share Units |

| Investment Rights |

| Warrants |

| |

| | | ||||||||

Balance December 31, 2021 |

| 65,392,363 | | $ | 361,982 | | $ | — | | $ | 23,710 | | $ | 198 | | $ | — | | $ | 2,500 | | $ | 14,200 | | $ | (279,041) | | $ | 123,549 |

Acquisition of QuestEx Gold & Copper Ltd. (Note 1) | | 1,082,553 | | | 9,528 | | | — | | | 267 | | | — | | | — | | | — | | | 61 | | | — | | | 9,856 |

Exercise of options |

| 456,456 | |

| 3,605 | | | — | |

| (1,198) | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 2,407 |

Vesting of Restricted Share Units | | 48,074 | | | 200 | | | — | | | — | | | (200) | | | — | | | — | | | — | | | — | | | — |

Exercise of warrants |

| 2,812,500 | |

| 41,701 | | | — | |

| — | |

| — | |

| — | |

| — | |

| (11,326) | |

| — | |

| 30,375 |

Share issue costs | | — | | | (39) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (39) |

Share-based payments |

| — | |

| — | | | — | |

| 3,879 | |

| 813 | |

| — | |

| — | |

| — | |

| — | |

| 4,692 |

Loss for the period |

| — | |

| — | | | — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| (43,703) | |

| (43,703) |

Balance June 30, 2022 |

| 69,791,946 | | $ | 416,977 | | $ | — | | $ | 26,658 | | $ | 811 | | $ | — | | $ | 2,500 | | $ | 2,935 | | $ | (322,744) | | $ | 127,137 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance December 31, 2022 |

| 77,655,882 | | $ | 464,029 | | $ | 1,250 | | $ | 29,640 | | $ | 4,804 | | $ | — | | $ | 2,500 | | $ | 2,935 | | $ | (367,931) | | $ | 137,227 |

Bought deal offering | | 10,005,000 | | | 73,537 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 73,537 |

Acquisition of exploration and evaluation interests (Note 5) | | 30,413 | | | 250 | | | (250) | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

Exercise of options | | 267,108 | | | 1,617 | | | — | | | (585) | | | — | | | — | | | — | | | — | | | — | | | 1,032 |

Vesting of Restricted Share Units | | 76,923 | | | 1,000 | | | — | | | — | | | (1,000) | | | — | | | — | | | — | | | — | | | — |

Tahltan Investment Rights |

| 119,785 | |

| 1,500 | | | — | |

| — | |

| — | |

| — | |

| (1,500) | |

| — | |

| — | |

| — |

Exercise of warrants |

| 9,657 | |

| 90 | | | — | |

| — | |

| — | |

| — | |

| — | |

| (25) | |

| — | |

| 65 |

Share issue costs | | — | | | (4,074) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (4,074) |

Share-based payments | | — | | | — | | | — | | | 1,728 | | | 3,975 | | | 75 | | | — | | | — | | | — | | | 5,778 |

Loss for the period |

| — | |

| — | | | — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| (36,229) | |

| (36,229) |

Balance June 30, 2023 |

| 88,164,768 | | $ | 537,949 | | $ | 1,000 | | $ | 30,783 | | $ | 7,779 | | $ | 75 | | $ | 1,000 | | $ | 2,910 | | $ | (404,160) | | $ | 177,336 |

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

| Condensed Interim Consolidated Financial Statements | 2 | |

SKEENA RESOURCES LIMITED

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited – expressed in thousands of Canadian dollars)

| | | | | | | | | | | | | | |

| | | | For the three months ended | | For the six months ended | ||||||||

| | | | June 30, | | June 30, | ||||||||

| | Note | | 2023 |

| 2022 | | 2023 |

| 2022 | ||||

OPERATING ACTIVITIES | |

| | |

|

| |

| | |

|

| |

|

Loss for the period | | | | $ | (19,486) | | $ | (24,687) | | $ | (36,229) | | $ | (43,703) |

Items not affecting cash | | | |

|

| |

|

| |

|

| |

|

|

Accretion | | | |

| 110 | |

| 18 | |

| 226 | |

| 38 |

Depreciation | | | |

| 510 | |

| 345 | |

| 1,014 | |

| 931 |

Loss on sale of equipment | | | | | — | | | 87 | | | — | | | 87 |

Flow-through share premium recovery | | | |

| (921) | |

| (4,246) | |

| (1,118) | |

| (7,114) |

Loss (gain) on marketable securities | | | |

| 188 | |

| 1,023 | |

| 553 | |

| (771) |

Share-based payments | | 7 | |

| 3,340 | |

| 2,780 | |

| 5,778 | |

| 4,692 |

Changes in non-cash operating working capital | | | |

| | |

| | |

|

| |

|

|

Receivables | | | |

| 1,265 | |

| 134 | |

| 814 | |

| 3,054 |

Prepaid expenses | | | |

| 60 | |

| 1,029 | |

| (861) | |

| 3,025 |

Accounts payable and accrued liabilities | | | |

| 363 | |

| (2,135) | |

| (2,557) | |

| (1,470) |

Net cash used in operating activities | | | |

| (14,571) | |

| (25,652) | |

| (32,380) | |

| (41,231) |

| | | | | | | | | | | | | | |

INVESTING ACTIVITIES | | | |

|

| |

|

| |

|

| |

|

|

Proceeds from sale of marketable securities | | | | | 147 | | | — | | | 148 | | | — |

Deposits refunded (paid) | | | |

| (149) | |

| 501 | |

| (1,963) | |

| 501 |

Exploration and evaluation asset expenditures | | | | | (1,011) | | | (6) | | | (1,011) | | | (6) |

Purchase of capital assets | | | |

| (432) | |

| (486) | |

| (592) | |

| (638) |

Proceeds from disposal of capital assets | | | | | — | | | 239 | | | — | | | 239 |

Settlement of other liabilities arising from mineral property acquisitions | | 5 | | | (1,650) | | | — | | | (1,650) | | | — |

Consideration paid on acquisition of QuestEx Gold & Copper Ltd. | | 1 | | | — | | | (18,749) | | | — | | | (18,749) |

Transaction costs on acquisition of QuestEx Gold & Copper Ltd. | | 1 | | | — | | | (548) | | | — | | | (889) |

Cash acquired on acquisition of QuestEx Gold & Copper Ltd. | | 1 | | | — | | | 5,037 | | | — | | | 5,037 |

Proceeds from sale of assets acquired from QuestEx Gold & Copper Ltd. | | 1 | | | — | | | 19,341 | | | — | | | 19,341 |

Net cash provided by (used in) investing activities | | | |

| (3,095) | |

| 5,329 | |

| (5,068) | |

| 4,836 |

| | | | | | | | | | | | | | |

FINANCING ACTIVITIES | | | |

|

| |

|

| |

|

| |

|

|

Lease payments | | | | | (203) | | | (87) | | | (406) | | | (175) |

Proceeds from bought deal financing | | 7 | | | 73,537 | | | — | | | 73,537 | | | — |

Proceeds from option exercises | | 7 | | | 12 | | | 66 | | | 1,032 | | | 2,407 |

Proceeds from warrant exercises | | 7 | |

| — | |

| — | |

| 65 | |

| 30,375 |

Share issue costs | | 7 | |

| (3,936) | |

| (9) | |

| (3,936) | |

| (39) |

Net cash provided by (used in) financing activities | | | |

| 69,410 | |

| (30) | |

| 70,292 | |

| 32,568 |

| | | | | | | | | | | | | | |

Change in cash and cash equivalents during the period | | | |

| 51,744 | |

| (20,353) | |

| 32,844 | |

| (3,827) |

Cash and cash equivalents, beginning of the period | | | |

| 21,702 | |

| 56,839 | |

| 40,602 | |

| 40,313 |

| | | | | | | | | | | | | | |

Cash and cash equivalents, end of the period | | | | $ | 73,446 | | $ | 36,486 | | $ | 73,446 | | $ | 36,486 |

| | | | | | | | | | | | | | |

Cash and cash equivalents are comprised of: | | | | | | | | | | | | | | |

Cash | | | | | | | | | | $ | 23,129 | | $ | 26,829 |

Cash equivalents | | | | | | | | | | | 50,317 | | | 9,657 |

Cash and cash equivalents | | | | | | | | | | $ | 73,446 | | $ | 36,486 |

SUPPLEMENTAL DISCLOSURE WITH RESPECT TO CASH FLOWS (NOTE 8)

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

| Condensed Interim Consolidated Financial Statements | 2 | |

SKEENA RESOURCES LIMITED

Notes to the CONDENSED INTERIM consolidated Financial Statements

For the three and six months ended June 30, 2023

(Unaudited – expressed in thousands of Canadian dollars within tables, unless otherwise noted)

1. | NATURE OF OPERATIONS |

Skeena Resources Limited (“Skeena” or the “Company”) is incorporated under the laws of the province of British Columbia, Canada. Its principal business activity is the exploration of mineral properties, primarily in British Columbia. The Company’s corporate office is located at Suite 650, 1021 West Hastings Street, Vancouver, British Columbia V6E 0C3. The Company’s stock is trading on the Toronto Stock Exchange (“TSX”) and New York Stock Exchange under the ticker symbol “SKE”, and on the Frankfurt Stock Exchange under the ticker symbol “RXF”. The Company is in the exploration stage with respect to its mineral property interests.

The Company relies on share issuances in order to fund its exploration and evaluation activities and other business objectives. As at June 30, 2023, the Company has cash and cash equivalents of $73,446,000. Based on forecasted expenditures, this balance will be sufficient to fund the Company’s committed exploration and evaluation expenditures and general administrative costs for at least the next twelve months. However, if the Company continues its current level of exploration and evaluation activities throughout the next twelve months, the current cash balances will not be sufficient to fund these expenditures. In the longer term, the Company’s ability to continue as a going concern is dependent upon successful execution of its business plan (including bringing the Eskay Creek project to profitable operation), raising additional capital or evaluating strategic alternatives for its mineral property interests. The Company expects to continue to raise the necessary operating funds primarily through the issuance of shares, with construction financing anticipated to be provided through a combination of debt, equity and other instruments at the appropriate time. There can be no guarantees that future equity financings will be available on acceptable terms or at all, in which case the Company may need to reduce or delay its longer-term exploration and evaluation plans.

On June 1, 2022, the Company acquired all of the issued and outstanding common shares of QuestEx Gold & Copper Ltd. (“QuestEx”) for cash and share consideration totalling $41,250,000, including replacement options and warrants to the holders of QuestEx options and warrants (“QuestEx Transaction”). Concurrent with the QuestEx Transaction, the Company sold certain mineral properties to an affiliate of Newmont Corporation for $25,598,000.

2. | BASIS OF PRESENTATION |

Statement of compliance

These unaudited condensed interim consolidated financial statements have been prepared in accordance with International Accounting Standard 34, Interim Financial Reporting (“IAS 34”) as issued by the International Accounting Standards Board (“IASB”). They do not include all of the information and footnotes required for annual financial statements prepared using International Financial Reporting Standards (“IFRS”) and should be read in conjunction with the Company’s audited consolidated financial statements as at and for the year ended December 31, 2022.

The accounting policies applied in the preparation of these unaudited condensed interim consolidated financial statements are consistent with those applied and disclosed in the Company’s audited annual consolidated financial statements as at and for the year ended December 31, 2022.

The Board of Directors approved these unaudited condensed interim consolidated financial statements for issuance on August 10, 2023.

| Condensed Interim Consolidated Financial Statements | 3 | |

SKEENA RESOURCES LIMITED

Notes to the CONDENSED INTERIM consolidated Financial Statements

For the three and six months ended June 30, 2023

(Unaudited – expressed in thousands of Canadian dollars within tables, unless otherwise noted)

2. | BASIS OF PRESENTATION (continued) |

Significant accounting estimates and judgments

The preparation of these unaudited condensed interim consolidated financial statements requires management to make estimates and judgments that affect the reported amounts of assets and liabilities at the date of the unaudited condensed interim consolidated financial statements and reported amounts of expenses during the reporting periods. Actual outcomes could differ from these estimates and judgments, which, by their nature, are uncertain. Significant judgments made by management in applying the Company’s accounting policies and the key sources of estimation uncertainty are the same as those that applied to the annual consolidated financial statements as at and for the year ended December 31, 2022.

3. | NEW STANDARDS, AMENDMENTS AND INTERPRETATIONS ADOPTED |

New accounting policies adopted on January 1, 2023

Disclosure of Accounting Policies (Amendment to IAS 1 and IFRS Practice Statement 2)

In February 2021, the IASB issued amendments to IAS 1, Presentation of Financial Statements, and the IFRS Practice Statement 2, Making Materiality Judgements, to provide guidance on the application of materiality judgments to accounting policy disclosures. The amendments to IAS 1 replace the requirement to disclose ‘significant’ accounting policies with a requirement to disclose ‘material’ accounting policies. Guidance and illustrative examples are added in the Practice Statement to assist in the application of materiality concept when making judgments about accounting policy disclosures.

These amendments are effective for annual financial statements for periods beginning on or after January 1, 2023. There was no material impact on the Company’s consolidated financial statements resulting from the adoption of these amendments.

4. | FINANCIAL INSTRUMENTS AND RISK MANAGEMENT |

The carrying values of the Company’s financial instruments are comprised of the following:

| | | | | | | | |

Financial Instrument |

| Category |

| June 30, 2023 |

| December 31, 2022 | ||

Cash and cash equivalents |

| Amortized cost | | $ | 73,446 | | $ | 40,602 |

Marketable securities |

| FVTPL | | $ | 1,793 | | $ | 2,494 |

Receivables |

| Amortized cost | | $ | 644 | | $ | 35 |

Deposits | | Amortized cost | | $ | 2,405 | | $ | 2,128 |

Contingent consideration receivable | | FVTPL | | $ | — | | $ | — |

Accounts payable |

| Amortized cost | | $ | 4,006 | | $ | 10,209 |

Other liabilities |

| Amortized cost | | $ | 899 | | $ | 2,497 |

Financial instruments measured at fair value are classified into one of three levels in the fair value hierarchy according to the relative reliability of the inputs used to estimate the fair values. The three levels of the fair value hierarchy are:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities;

Level 2 – Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly; and

Level 3 – Inputs that are not based on observable market data.

| Condensed Interim Consolidated Financial Statements | 4 | |

SKEENA RESOURCES LIMITED

Notes to the CONDENSED INTERIM consolidated Financial Statements

For the three and six months ended June 30, 2023

(Unaudited – expressed in thousands of Canadian dollars within tables, unless otherwise noted)

4. | FINANCIAL INSTRUMENTS AND RISK MANAGEMENT (continued) |

The carrying values of the Company’s marketable securities, except for warrants, are measured using Level 1 inputs. Warrants within marketable securities and contingent consideration receivable are measured using Level 3 inputs.

The Company’s risk exposure and the impact on the Company’s financial instruments are summarized below:

Credit risk

Where judged to be potentially significant, expected credit losses are measured using a present value and probability-weighted model that considers all reasonable and supportable information available without undue cost or effort along with information available concerning past defaults, current conditions and forecasts at the reporting date.

IFRS 9, Financial Instruments, requires the recognition of 12 month expected credit losses (the portion of lifetime expected credit losses from default events that are expected within 12 months of the reporting date) if credit risk has not significantly increased since initial recognition (stage 1), lifetime expected credit losses for financial instruments for which the credit risk has increased significantly since initial recognition (stage 2) or which are credit impaired (stage 3). There are no material expected credit losses with respect to the Company’s financial instruments held at amortized cost.

Market risk

Market risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate due to changes in market prices. Market risk consists of interest rate risk, foreign currency risk and other price risk. As at June 30, 2023, the Company is exposed to market risk on its marketable securities. A 10% decrease in the share price of the Company’s marketable securities at June 30, 2023 would have resulted in a $181,000 decrease to the carrying value of the Company’s marketable securities and an increase of the same amount to the Company’s unrealized loss on marketable securities.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its obligations as they become due. The Company manages its liquidity risk by forecasting cash flows from operations and anticipating any investing and financing activities to ensure that it will have sufficient cash to meet liabilities when due. Management and the Board of Directors are actively involved in the review, planning and approval of significant expenditures and commitments.

The undiscounted financial liabilities as of June 30, 2023 will mature as follows:

| | | | | | | | |

| Less than | 1-5 years | Greater than | Total | ||||

Accounts payable | $ | 4,006 | $ | — | $ | — | $ | 4,006 |

Other liabilities | | 500 | | 500 | | — | | 1,000 |

Total | $ | 4,506 | $ | 500 | $ | — | $ | 5,006 |

| Condensed Interim Consolidated Financial Statements | 5 | |

SKEENA RESOURCES LIMITED

Notes to the CONDENSED INTERIM consolidated Financial Statements

For the three and six months ended June 30, 2023

(Unaudited – expressed in thousands of Canadian dollars within tables, unless otherwise noted)

4. | FINANCIAL INSTRUMENTS AND RISK MANAGEMENT (continued) |

In late February 2022, Russia launched a large-scale military attack on Ukraine. The invasion significantly amplified already existing geopolitical tensions among Russia, Ukraine, Europe, NATO and the West, including Canada. In response to the military action by Russia, various countries, including Canada, the United States, the United Kingdom and European Union issued broad-ranging and evolving economic sanctions against Russia. Such sanctions (and any future sanctions) and other actions against Russia may adversely impact, among other things, the global economy and various sectors of the economy, including, but not limited to, financials, energy, metals and mining. Accordingly, the actions discussed above and potential for a wider conflict could increase financial market volatility and cause severe negative effects on regional and global economic markets, either in specific sectors or more broadly.

Additionally, global stock markets have also experienced great volatility and significant weakening of certain sectors as concerns over inflation continue. Governments and central banks have responded with monetary and fiscal interventions designed to stabilize economic conditions.

To date, the Company’s operations have not been materially negatively affected by these events, apart from increasing costs. In 2022 and 2023, operations have experienced higher inflation on material inputs. The future impact of Russia’s military action against Ukraine, as well as the effectiveness of government and central bank responses, remain unclear at this time. It is not possible to reliably estimate the duration of the impact, the severity of the consequences, nor the impact, if any, on the financial position and results of the Company for future periods.

5. | EXPLORATION AND EVALUATION INTERESTS |

Exploration and evaluation assets

| | | | | | | | | | | | | | |

| Eskay | KSP | Kingpin | Red Chris | Snip | Sofia | Total | |||||||

Balance, December 31, 2021 | $ | 74,444 | $ | — | $ | — | $ | — | $ | 1,087 | $ | — | $ | 75,531 |

Adjust closure liability |

| 1,162 |

| — |

| — |

| — |

| (153) |

| — |

| 1,009 |

Acquisition of QuestEx properties | | — | | 7,872 | | 3,936 | | — | | — | | 1,312 | | 13,120 |

Additions |

| 2,882 |

| — |

| — |

| 2,871 |

| 25 |

| — |

| 5,778 |

Balance, December 31, 2022 | $ | 78,488 | $ | 7,872 | $ | 3,936 | $ | 2,871 | $ | 959 | $ | 1,312 | $ | 95,438 |

Adjust closure liability |

| (392) |

| — |

| — |

| — |

| (119) |

| — |

| (511) |

Additions | | 1,011 | | — | | — | | — | | — | | — | | 1,011 |

Balance, June 30, 2023 | $ | 79,107 | $ | 7,872 | $ | 3,936 | $ | 2,871 | $ | 840 | $ | 1,312 | $ | 95,938 |

Eskay Creek Property, British Columbia, Canada

On October 28, 2022, the Company acquired the Eskay North mineral property in the Golden Triangle area, near Eskay, from Tudor Gold Corp. for 231,404 common shares issued at closing and cash consideration of $1,400,000 paid during the six months ended June 30, 2023.

During the six months ended June 30, 2023, the Company incurred $1,011,000 (2022 – $nil) relating to earthworks for certain infrastructures at Eskay Creek.

| Condensed Interim Consolidated Financial Statements | 6 | |

SKEENA RESOURCES LIMITED

Notes to the CONDENSED INTERIM consolidated Financial Statements

For the three and six months ended June 30, 2023

(Unaudited – expressed in thousands of Canadian dollars within tables, unless otherwise noted)

5. | EXPLORATION AND EVALUATION INTERESTS (continued) |

Red Chris Properties, British Columbia, Canada

On October 18, 2022, the Company acquired three properties in the Golden Triangle area that are located on either side of Newcrest and Imperial Metals’ Red Chris mine, approximately 20km southeast of the village of Iskut (the “Red Chris Properties”), from Coast Copper Corp. for $3,000,000, payable in six equal payments of $250,000 in cash and $250,000 in common shares. In April 2023, the Company paid $250,000 in cash and issued 30,413 common shares to Coast Copper Corp.

Snip Property, British Columbia, Canada

On October 14, 2021, Hochschild Mining Holdings Limited (“Hochschild”) initiated its right to earn 60% of Snip. Pursuant to the option agreement, to exercise its option, Hochschild would have had to have incurred expenditures of approximately $100 million during the option period. In April 2023, Hochschild terminated its right to earn 60% of Snip.

Exploration and evaluation expenses

Three months ended June 30, 2023 | | Eskay | | KSP | | Kingpin | | Red Chris | | Snip | | Sofia | | Total | |||||||

Accretion | | $ | 52 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 52 |

Assays and analysis/storage | |

| 94 | | | 8 | | | 6 | | | 2 | |

| — | |

| 7 | |

| 117 |

Camp and safety | |

| 215 | | | 2 | | | 3 | | | — | |

| — | |

| — | |

| 220 |

Claim renewals and permits | | | 204 | | | — | | | — | | | — | | | — | | | 10 | | | 214 |

Community relations | |

| — | | | — | | | — | | | — | |

| — | |

| 2 | |

| 2 |

Depreciation | | | 439 | | | — | | | — | | | — | | | — | | | — | | | 439 |

Drilling | |

| 616 | | | — | | | — | | | — | |

| — | |

| — | |

| 616 |

Electrical | | | 2 | | | — | | | — | | | — | | | — | | | — | | | 2 |

Environmental studies | |

| 3,924 | | | — | | | — | | | — | |

| 36 | |

| — | |

| 3,960 |

Equipment rental | |

| 216 | | | — | | | 1 | | | — | |

| — | |

| — | |

| 217 |

Fieldwork, camp support | |

| 1,803 | | | 7 | | | 8 | | | 2 | |

| (8) | |

| 21 | |

| 1,833 |

Fuel | | | 392 | | | 10 | | | 1 | | | 3 | | | 5 | | | — | | | 411 |

Geology, geophysics, and geochemical | |

| 4,182 | | | 52 | | | — | | | — | |

| — | |

| 1 | |

| 4,235 |

Helicopter | | | 300 | | | 46 | | | 8 | | | 27 | | | 23 | | | — | | | 404 |

Metallurgy | | | 425 | | | — | | | — | | | — | | | — | | | — | | | 425 |

Part XII.6 tax, net of METC | |

| (294) | | | — | | | — | | | — | |

| — | |

| (27) | |

| (321) |

Share-based payments (Note 6) | |

| 988 | | | — | | | — | | | — | |

| — | |

| — | |

| 988 |

Transportation and logistics | |

| 842 | | | — | | | — | | | 20 | |

| — | |

| 1 | |

| 863 |

Total for the period | | $ | 14,400 | | $ | 125 | | $ | 27 | | $ | 54 | | $ | 56 | | $ | 15 | | $ | 14,677 |

| Condensed Interim Consolidated Financial Statements | 7 | |

SKEENA RESOURCES LIMITED

Notes to the CONDENSED INTERIM consolidated Financial Statements

For the three and six months ended June 30, 2023

(Unaudited – expressed in thousands of Canadian dollars within tables, unless otherwise noted)

5. | EXPLORATION AND EVALUATION INTERESTS (continued) |

Exploration and evaluation expenses (continued)

Six months ended June 30, 2023 | | Eskay | | KSP | | Kingpin | | Red Chris | | Snip | | Sofia | | Total | |||||||

Accretion | | $ | 105 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 105 |

Assays and analysis/storage | |

| 1,002 | |

| 8 | |

| 6 | |

| 2 | |

| — | |

| 54 | |

| 1,072 |

Camp and safety | |

| 223 | |

| 2 | |

| 3 | |

| — | |

| — | |

| — | |

| 228 |

Claim renewals and permits | | | 517 | | | — | | | — | | | — | | | 17 | | | 15 | | | 549 |

Community relations | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 5 | |

| 5 |

Depreciation | | | 872 | | | — | | | — | | | — | | | — | | | — | | | 872 |

Drilling | |

| 616 | |

| — | |

| — | |

| — | |

| — | |

| 2 | |

| 618 |

Electrical | | | 4 | | | — | | | — | | | — | | | — | | | — | | | 4 |

Environmental studies | |

| 7,178 | |

| — | |

| — | |

| — | |

| 111 | |

| — | |

| 7,289 |

Equipment rental | |

| 382 | |

| — | |

| 1 | |

| — | |

| — | |

| 1 | |

| 384 |

Fieldwork, camp support | |

| 2,444 | |

| 7 | |

| 8 | |

| 2 | |

| — | |

| 64 | |

| 2,525 |

Fuel | | | 426 | | | 10 | | | 1 | | | 3 | | | 5 | | | — | | | 445 |

Geology, geophysics, and geochemical | |

| 7,915 | |

| 52 | |

| — | |

| — | |

| — | |

| 3 | |

| 7,970 |

Helicopter | | | 356 | | | 46 | | | 8 | | | 27 | | | 23 | | | — | | | 460 |

Metallurgy | | | 814 | | | — | | | — | | | — | | | — | | | — | | | 814 |

Part XII.6 tax, net of METC | |

| (108) | |

| — | |

| — | |

| — | |

| — | |

| (4) | |

| (112) |

Share-based payments (Note 6) | |

| 1,266 | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 1,266 |

Transportation and logistics | |

| 1,211 | |

| — | |

| — | |

| 20 | |

| — | |

| 4 | |

| 1,235 |

Total for the period | | $ | 25,223 | | $ | 125 | | $ | 27 | | $ | 54 | | $ | 156 | | $ | 144 | | $ | 25,729 |

Three months ended June 30, 2022 |

| Eskay | | Snip |

| Sofia |

| Total | ||||

Accretion | | $ | 2 | | $ | — | | $ | — | | $ | 2 |

Assays and analysis/storage | |

| 392 | | | 3 | |

| — | |

| 395 |

Camp and safety | |

| 763 | | | — | |

| — | |

| 763 |

Claim renewals and permits | | | 286 | | | 14 | | | — | | | 300 |

Depreciation | | | 278 | | | — | | | — | | | 278 |

Drilling | |

| 4,300 | | | — | |

| — | |

| 4,300 |

Electrical | | | 107 | | | — | | | — | | | 107 |

Environmental studies | |

| 1,361 | | | 75 | |

| — | |

| 1,436 |

Equipment rental | |

| 1,378 | | | 2 | |

| 3 | |

| 1,383 |

Fieldwork, camp support | |

| 4,774 | | | 46 | |

| 46 | |

| 4,866 |

Fuel | |

| 814 | | | — | |

| 6 | |

| 820 |

Geology, geophysics, and geochemical | |

| 4,982 | | | 18 | |

| 10 | |

| 5,010 |

Helicopter | | | 885 | | | — | | | 16 | | | 901 |

Metallurgy | | | 110 | | | — | | | — | | | 110 |

Part XII.6 tax | | | 23 | | | — | | | — | | | 23 |

Share-based payments (Note 6) | | | 877 | | | — | | | — | | | 877 |

Transportation and logistics | |

| 1,383 | | | — | |

| 1 | |

| 1,384 |

Total for the period | | $ | 22,715 | | $ | 158 | | $ | 82 | | $ | 22,955 |

There were no exploration and evaluation expenses incurred on KSP and Kingpin during the three months ended June 30, 2022.

| Condensed Interim Consolidated Financial Statements | 8 | |

SKEENA RESOURCES LIMITED

Notes to the CONDENSED INTERIM consolidated Financial Statements

For the three and six months ended June 30, 2023

(Unaudited – expressed in thousands of Canadian dollars within tables, unless otherwise noted)

5. | EXPLORATION AND EVALUATION INTERESTS (continued) |

Exploration and evaluation expenses (continued)

Six months ended June 30, 2022 |

| Eskay | | Snip |

| Sofia |

| Total | ||||

Accretion | | $ | 4 | | $ | — | | $ | — | | $ | 4 |

Assays and analysis/storage | |

| 1,360 | | | 239 | |

| — | |

| 1,599 |

Camp and safety | |

| 1,178 | | | — | |

| — | |

| 1,178 |

Claim renewals and permits | | | 377 | | | 28 | | | — | | | 405 |

Depreciation | | | 787 | | | — | | | — | | | 787 |

Drilling | |

| 4,883 | | | — | |

| — | |

| 4,883 |

Electrical | | | 390 | | | — | | | — | | | 390 |

Environmental studies | |

| 2,654 | | | 100 | |

| — | |

| 2,754 |

Equipment rental | |

| 3,640 | | | 3 | |

| 3 | |

| 3,646 |

Fieldwork, camp support | |

| 9,359 | | | 89 | |

| 46 | |

| 9,494 |

Fuel | |

| 1,499 | | | — | |

| 6 | |

| 1,505 |

Geology, geophysics, and geochemical | |

| 10,741 | | | 18 | |

| 10 | |

| 10,769 |

Helicopter | | | 1,147 | | | — | | | 16 | | | 1,163 |

Metallurgy | | | 127 | | | — | | | — | | | 127 |

Part XII.6 tax | | | 23 | | | — | | | — | | | 23 |

Share-based payments (Note 6) | | | 1,620 | | | — | | | — | | | 1,620 |

Transportation and logistics | |

| 2,610 | | | 1 | |

| 1 | |

| 2,612 |

Total for the period | | $ | 42,399 | | $ | 478 | | $ | 82 | | $ | 42,959 |

There were no exploration and evaluation expenses incurred on KSP and Kingpin during the six months ended June 30, 2022.

6. | RELATED PARTY TRANSACTIONS |

Key management compensation

Key management personnel at the Company are the directors and officers of the Company. The remuneration of key management personnel during the three and six months ended June 30, 2023 and 2022 is as follows:

| For the three months ended | For the six months ended | ||||||||||

| June 30, | June 30, | ||||||||||

| | | 2023 | | | 2022 | | | 2023 | | | 2022 |

Director remuneration | | $ | 82 | | $ | 2 | | $ | 163 | | $ | 88 |

Officer & key management remuneration1 | | $ | 843 | | $ | 894 | | $ | 1,697 | | $ | 1,712 |

Termination benefits | | $ | — | | $ | — | | $ | 675 | | $ | — |

Share-based payments | | $ | 2,424 | | $ | 1,851 | | $ | 4,054 | | $ | 2,943 |

| 1 | Remuneration consists exclusively of salaries, bonuses, and health benefits for officers and key management. These costs are components of both administrative wages and exploration expenses categories in the unaudited condensed interim consolidated statements of loss and comprehensive loss. |

| Condensed Interim Consolidated Financial Statements | 9 | |

SKEENA RESOURCES LIMITED

Notes to the CONDENSED INTERIM consolidated Financial Statements

For the three and six months ended June 30, 2023

(Unaudited – expressed in thousands of Canadian dollars within tables, unless otherwise noted)

6. | RELATED PARTY TRANSACTIONS (continued) |

Key management compensation (continued)

Share-based payment expenses for the three and six months ended June 30, 2023 are recorded in two separate categories: exploration and evaluation expense with a related party component of $239,000 (2022 – $389,000) and $365,000 (2022 – $691,000), respectively, and general and administrative expense with a related party component of $2,185,000 (2022 – $1,462,000) and $3,689,000 (2022 – $2,252,000), respectively.

Recoveries

During the three and six months ended June 30, 2023, the Company recovered $2,000 (2022 – $4,000) and $6,000 (2022 – $5,000), respectively, from a company with a common officer as a result of billing for employee time used to provide services. The salary recoveries were recorded in administrative compensation expense.

Receivables

Included in receivables at June 30, 2023 is $5,000 (December 31, 2022 – $6,000) due from companies with common directors or officers in relation to salary and other recoveries.

Accounts payable and accrued liabilities

Included in accounts payable and accrued liabilities at June 30, 2023 is $798,000 (December 31, 2022 – $708,000) due to key management personnel in relation to compensation noted above.

7. | CAPITAL STOCK AND RESERVES |

Authorized – unlimited number of voting common shares without par value.

Private placements and bought deal offerings

Transactions during the six months ended June 30, 2023

On May 24, 2023, the Company closed a bought deal public offering, whereby gross proceeds of $73,537,000 were raised by the issuance of 10,005,000 common shares at a price of $7.35 per common share. In connection with the bought deal offering, the Company incurred share issuance costs of $4,074,000.

Transactions during the six months ended June 30, 2022

There were no private placements or bought deal offerings during the six months ended June 30, 2022.

Tahltan Investment Rights

On April 16, 2021, the Company entered into an investment agreement with the Tahltan Central Government (“TCG”), pursuant to which TCG invested $5,000,000 into Skeena by purchasing 399,285 Tahltan Investment Rights (“Rights”) for approximately $12.52 per Right. Each Right will vest by converting into one common share upon the achievement of key Company and permitting milestones (“Milestones”), or over time, as follows:

| Condensed Interim Consolidated Financial Statements | 10 | |

SKEENA RESOURCES LIMITED

Notes to the CONDENSED INTERIM consolidated Financial Statements

For the three and six months ended June 30, 2023

(Unaudited – expressed in thousands of Canadian dollars within tables, unless otherwise noted)

7. | CAPITAL STOCK AND RESERVES (continued) |

Tahltan Investment Rights (continued)

· | 119,785 Rights: earlier of Milestone 1 achievement or April 16, 2023; |

· | 119,785 Rights: earlier of Milestone 2 achievement or April 16, 2023; |

· | 79,857 Rights: earlier of Milestone 3 achievement or April 16, 2023; and |

· | 79,858 Rights: earlier of Milestone 4 achievement or April 16, 2024. |

As at December 31, 2022, Milestones 2 and 3 set forth within the agreement were met. During the six months ended June 30, 2023, Milestone 1 was met, resulting in the conversion of 119,785 Rights into 119,785 common shares of the Company valued at $1,500,000. As at June 30, 2023, only Milestone 4 is to be achieved.

Share-based payments

During the six months ended June 30, 2023, the Company adopted the 2023 Omnibus Equity Incentive Plan (“Omnibus Plan”), which governs the terms of stock options, restricted share units (“RSUs”), performance share units (“PSUs”) and deferred share units (“DSUs”). Any awards granted after the effective date of the Omnibus Plan will fall under the Omnibus Plan.

Stock options

The stock options have a maximum expiry date period of 5 years from the grant date.

Restricted Share Units and Performance Share Units

Upon each vesting date, participants will receive, at the sole discretion of the Board of Directors: (a) common shares equal to the number of RSUs or DSUs that vested; (b) cash payment equal to the 5-day volume weighted average trading price of common shares; or (c) a combination of (a) and (b).

Deferred Share Units

The DSUs are granted to independent members of the Board of Directors. The DSUs vest immediately and have all of the rights and restrictions that are applicable to RSUs, except that the DSUs may not be redeemed until the participant has ceased to hold all offices, employment and directorships with the Company.

| Condensed Interim Consolidated Financial Statements | 11 | |

SKEENA RESOURCES LIMITED

Notes to the CONDENSED INTERIM consolidated Financial Statements

For the three and six months ended June 30, 2023

(Unaudited – expressed in thousands of Canadian dollars within tables, unless otherwise noted)

7. | CAPITAL STOCK AND RESERVES (continued) |

Share-based payments (continued)

Share purchase warrant, RSU, DSU and stock option transactions are summarized as follows:

| | Warrants | | RSUs | | DSUs | | Stock Options | ||||||

| | | | Weighted | | | | | | | | Weighted | ||

| | | | Average | | | | | | | | Average | ||

|

| Number |

| Exercise Price |

| Number |

| Number | | Number |

| Exercise Price | ||

Outstanding, December 31, 2021 | | 2,812,500 | | $ | 10.80 |

| 56,074 |

| — | | 5,275,124 | | $ | 10.18 |

Granted |

| — | | $ | — |

| 1,836,766 |

| — | | 399,306 | | $ | 8.61 |

Replacement warrants and options | | 150,691 | | $ | 14.19 | | — | | — | | 77,158 | | $ | 9.87 |

Exercised |

| (2,812,500) | | $ | 10.80 |

| (48,074) |

| — | | (479,169) | | $ | 5.19 |

Cancelled |

| (137,868) | | $ | 14.88 |

| (8,945) |

| — | | (238,994) | | $ | 11.80 |

Outstanding, December 31, 2022 |

| 12,823 | | $ | 6.77 |

| 1,835,821 |

| — | | 5,033,425 | | $ | 10.44 |

Granted |

| — | | $ | — |

| 607,750 |

| 11,755 | | 155,151 | | $ | 8.42 |

Exercised |

| (9,657) | | $ | 6.81 |

| (76,923) |

| — | | (267,108) | | $ | 3.86 |

Cancelled |

| (3,166) | | $ | 6.81 |

| (187,960) |

| — | | (287,137) | | $ | 12.30 |

Outstanding, June 30, 2023 |

| — | | $ | 2.72 |

| 2,178,688 |

| 11,755 | | 4,634,331 | | $ | 10.64 |

Exercisable, June 30, 2023 |

| — | | $ | 2.72 |

| — |

| — | | 3,961,941 | | $ | 10.56 |

The weighted average share price at the date of exercise of the stock options was $7.46 during the six months ended June 30, 2023 (2022 – $15.51). The weighted average share price at the date of exercise of the warrants was $7.69 during the six months ended June 30, 2023 (2022 – $15.78).

| |

| |

| Weighted Average |

| |

| Exercise Price | | | | Remaining Life | | |

| ($/Share) | | Outstanding | | (Years) | | Exercisable |

Options | 1.00 - 5.00 |

| 789,845 |

| 1.71 |

| 789,845 |

| 5.01 - 10.00 |

| 442,936 |

| 4.23 |

| 38,062 |

| 10.01 - 15.00 |

| 3,401,550 |

| 2.83 |

| 2,864,034 |

| |

| 4,634,331 |

| 2.77 |

| 3,691,941 |

| | Outstanding | | Vesting Year |

RSUs | | 323,853 |

| 2023 |

| | 1,450,007 | | 2024 |

| | 202,415 | | 2025 |

| | 202,413 |

| 2026 |

| | 2,178,688 | | |

| Condensed Interim Consolidated Financial Statements | 12 | |

SKEENA RESOURCES LIMITED

Notes to the CONDENSED INTERIM consolidated Financial Statements

For the three and six months ended June 30, 2023

(Unaudited – expressed in thousands of Canadian dollars within tables, unless otherwise noted)

7. | CAPITAL STOCK AND RESERVES (continued) |

Share-based payments (continued)

Transactions during the six months ended June 30, 2023

On February 14, 2023, the Company granted 145,000 RSUs to various employees of the Company. The RSUs were valued using the share price on the grant date and had a fair value of $1,056,000. The RSUs will vest over a 36-month period, with one third of the RSUs vesting after 12 months, one third vesting after 24 months, and one third vesting after 36 months.

On May 15, 2023, the Company granted 155,151 stock options to various directors, officers and employees of the Company. The options have a term of 5 years, expiring on May 15, 2028. All of the options vest over a 36-month period, with one third of the options vesting after 12 months, one third vesting after 24 months, and one third vesting after 36 months. Each option will allow the holder thereof to purchase one common share of the Company at a price of $8.42 per common share. The options were valued using the Black-Scholes option pricing model and had a fair value of $631,000.

On May 15, 2023, the Company granted 462,750 RSUs to various directors, officers and employees of the Company. All of the RSUs vest over a 36-month period, with one third of the RSUs vesting after 12 months, one third vesting after 24 months, and one third vesting after 36 months. The RSUs were valued using the share price on the grant date and had a fair value of $3,896,000.

On June 22, 2023, the Company granted 11,755 DSUs to a director of the Company. The DSUs were valued using the share price on the grant date and had a fair value of $75,000.

Transactions during the six months ended June 30, 2022

On April 21, 2022, the Company granted 103,264 stock options to various directors, officers, employees and consultants of the Company. The options have a term of 5 years, expiring on April 21, 2027. All of the options vest over a 36-month period, with 34% of the options vesting after 12 months, 33% vesting after 24 months, and 33% vesting after 36 months. Each option allows the holder thereof to purchase one common share of the Company at a price of $13.00 per common share. The options were valued using the Black-Scholes option pricing model and had a fair value of $675,000.

On April 21, 2022, the Company granted 291,285 RSUs to various directors, officers, employees and consultants of the Company. The RSUs were valued using the share price on the grant date and had a fair value of $3,787,000. The RSUs will vest on April 21, 2024.

On April 21, 2022, the Company granted 230,769 RSUs to an officer of the Company. The RSUs were valued using the share price on the grant date and had a fair value of $3,000,000. The RSUs will vest over a 24-month period, with one third of the RSUs vesting on each of April 21, 2023, October 21, 2023, and April 21, 2024.

On June 1, 2022, the Company issued 1,058,597 common shares valued at $9,178,000 to the shareholders of QuestEx pursuant to the QuestEx Transaction. The Company also issued 23,956 common shares valued at $350,000 to a third party relating to transaction costs associated with the QuestEx Transaction.

| Condensed Interim Consolidated Financial Statements | 13 | |

SKEENA RESOURCES LIMITED

Notes to the CONDENSED INTERIM consolidated Financial Statements

For the three and six months ended June 30, 2023

(Unaudited – expressed in thousands of Canadian dollars within tables, unless otherwise noted)

7. | CAPITAL STOCK AND RESERVES (continued) |

Share-based payments (continued)

On June 1, 2022, the Company issued 77,158 replacement options to the holders of QuestEx options pursuant to the QuestEx Transaction. The replacement options have expiry dates between June 6, 2022 and December 21, 2026. All of the replacement options vested immediately. Each replacement option allows the holder thereof to purchase one common share of the Company at a price between $1.36 to $53.13 per common share. The replacement options were valued using the Black-Scholes option pricing model and had a fair value of $267,000.

On June 1, 2022, the Company issued 150,691 replacement warrants to the holders of QuestEx warrants pursuant to the QuestEx Transaction. The replacement warrants have expiry dates between August 20, 2022 and April 15, 2023. All of the replacement warrants vested immediately. Each replacement warrant allows the holder thereof to purchase one common share of the Company at a price between $2.72 to $23.16 per common share. The replacement warrants were valued using the Black-Scholes option pricing model and had a fair value of $61,000.

Share purchase warrant and stock option pricing models require the input of highly subjective assumptions including the expected price volatility. Changes in the subjective input assumptions can materially affect the fair value estimate. Weighted average inputs used were as follows:

| Warrants | | Stock Options | | ||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||

Expected life (years) |

| | — | | 0.3 | | | 3.5 | | | 3.2 | |

Annualized volatility | | | — | | 35.00 | % | | 65.00 | % | | 65.00 | % |

Dividend rate |

| | — | | 0.00 | % | | 0.00 | % | | 0.00 | % |

Risk-free interest rate | |

| — |

| 2.74 | % |

| 3.86 | % |

| 2.65 | % |

8. | SUPPLEMENTAL DISCLOSURE WITH RESPECT TO CASH FLOWS |

Non-cash transactions during the three and six months ended June 30, 2023 and 2022 that were not presented elsewhere in the unaudited condensed interim consolidated financial statements are as follows:

| For the three months ended | For the six months ended | ||||||||||

| June 30, | June 30, | ||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||

Capital asset additions in accounts payable and accrued liabilities | | $ | 1,138 | | $ | 208 | | $ | 1,138 | | $ | 208 |

Deposits reclassified to capital assets | | $ | 1,686 | | $ | — | | $ | 1,686 | | $ | — |

Proceeds from sale of equipment recorded in receivables | | $ | — | | $ | 16 | | $ | — | | $ | 16 |

Share issue costs in accounts payable and accrued liabilities | | $ | 138 | | $ | — | | $ | 138 | | $ | — |

During the three and six months ended June 30, 2023 and 2022, the Company did not make any payments towards interest or income taxes.

| Condensed Interim Consolidated Financial Statements | 14 | |

SKEENA RESOURCES LIMITED

Notes to the CONDENSED INTERIM consolidated Financial Statements

For the three and six months ended June 30, 2023

(Unaudited – expressed in thousands of Canadian dollars within tables, unless otherwise noted)

9. | CONTINGENCIES |

Due to the nature of the Company’s operations, various legal and tax matters arise in the ordinary course of business. The Company accrues such items as liabilities when the amount can be reasonably estimated, and settlement of the matter is probable to require an outflow of future economic benefits from the Company.

10. | SUBSEQUENT EVENT |

On July 7, 2023, the Company acquired five mineral claims surrounding Eskay Creek from Eskay Mining Corp. for cash consideration of $4,000,000, of which $2,000,000 was paid on closing and $1,000,000 is payable on each of October 31, 2023 and December 31, 2023. The mineral claims are subject to a 2% net smelter return (“NSR”) royalty, of which 1% of the NSR royalty can be purchased at any time for $2,000,000.

| Condensed Interim Consolidated Financial Statements | 15 | |

Exhibit 99.2

MANAGEMENT’S DISCUSSION AND ANALYSIS

Three and six months ended June 30, 2023

SKEENA RESOURCES LIMITED

Management Discussion and Analysis

For the three and six months ended June 30, 2023

(Expressed in thousands of Canadian dollars within tables, unless otherwise noted)

INTRODUCTION

The Management’s Discussion & Analysis (“MD&A”) has been prepared by management and reviewed and approved by the Board of Directors of Skeena Resources Limited (“Skeena”, “us”, “our” or the “Company”) on August 10, 2023. The following discussion of performance, financial condition and future prospects should be read in conjunction with the condensed interim consolidated financial statements and the related notes thereto for the three and six months ended June 30, 2023 and June 30, 2022. In addition, this MD&A should be read in conjunction with the audited annual consolidated financial statements and the related notes thereto for the years ended December 31, 2022 and December 31, 2021. The information provided herein supplements but does not form part of the condensed interim consolidated financial statements. This discussion covers the three and six months ended June 30, 2023 and the subsequent period up to August 10, 2023, the date of issue of this MD&A. Monetary amounts in the following discussion are in Canadian dollars, unless otherwise noted.

Additional information, including audited annual consolidated financial statements and more detail on specific mineral exploration properties discussed in this MD&A can be found on the Company’s System for Electronic Document Analysis and Retrieval (“SEDAR+”) profile at www.sedarplus.ca, the Company’s Electronic Data Gathering, Analysis, and Retrieval system (“EDGAR”) profile at www.sec.gov, or on the Company’s website: www.skeenaresources.com. Information on risks associated with investing in the Company’s securities is contained in the most recently filed Annual Information Form.

The technical information presented herein has been reviewed by Paul Geddes, P.Geo, the Company’s Senior Vice President of Exploration & Resource Development, and a qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) (see “Responsibility for Technical Information” section below).

This MD&A contains forward looking information. |

| Management’s Discussion & Analysis | 2 |

SKEENA RESOURCES LIMITED

Management Discussion and Analysis

For the three and six months ended June 30, 2023

(Expressed in thousands of Canadian dollars within tables, unless otherwise noted)

FORWARD LOOKING STATEMENTS

This MD&A contains certain forward-looking statements or forward-looking information within the meaning of applicable Canadian and US securities laws. All statements and information, other than statements of historical fact, included in or incorporated by reference into this MD&A are forward-looking statements and forward-looking information, including, without limitation, statements regarding activities, events or developments that we expect or anticipate may occur in the future. Such forward-looking statements and information can be identified by the use of forward-looking words such as “plans”, “expects” or “does not expect”, “is expected”, “budget” or “budgeted”, “scheduled”, “estimates”, “projects”, “intends”, “proposes”, “progressing towards”, “in search of”, “complete”, “anticipates” or “does not anticipate”, “believes”, “often”, “likely”, “may”, “will”, “should”, “intend”, “anticipate”, “proposed”, “potential”, or variations of such words and phrases or statements that certain actions, events, or results “may”, “can”, “could”, “would”, “might”, “will be taken”, “occur”, “continue”, or “be achieved” or similar words and expressions or the negative and grammatical variations thereof, or statements that certain events or conditions “may” or “will” happen, or by discussions of strategy. There can be no assurance that the plans, intentions or expectations upon which such forward-looking statements and information are based will occur or, even if they do occur, will result in the performance, events or results expected.

The forward-looking statements and forward-looking information reflect the current beliefs of the Company, and are based on currently available information. Accordingly, these statements are subject to known and unknown risks, uncertainties and other factors which could cause the actual results, performance or achievements of the Company to be materially different from those expressed in or implied by the forward-looking statements. The forward-looking information in this MD&A includes, without limitation, estimates, forecasts, plans, priorities, strategies and statements as to the Company’s current expectations and assumptions concerning, among other things, ability to access sufficient funds to carry on operations, financial and operational performance and prospects, ability to minimize negative environmental impacts of the Company’s operations, anticipated outcomes of lawsuits and other legal issues, particularly in relation to potential receipt or retention of regulatory approvals and any future appeals made by the Company in relation to the Albino Lake Storage Facility, permits and licenses, treatment under governmental regulatory regimes, stability of various governments including those who consider themselves self-governing, continuation of rights to explore and mine, collection of receivables, the success of exploration programs, the estimation of mineral resources, the ability to convert resources or mineral reserves, anticipated conclusions of economic assessments of projects, the suitability of our mineral projects to become open-pit mines, our ability to attract and retain skilled staff, expectations of market prices and costs, exploration, development and expansion plans and objectives, requirements for additional capital, the availability of financing, and the future development and costs and outcomes of the Company’s exploration projects. The foregoing list of assumptions is not exhaustive. Events or circumstances could cause actual results to vary materially.

| Management’s Discussion & Analysis | 3 |

SKEENA RESOURCES LIMITED

Management Discussion and Analysis

For the three and six months ended June 30, 2023

(Expressed in thousands of Canadian dollars within tables, unless otherwise noted)

We caution readers of this MD&A not to place undue reliance on forward-looking statements and information contained herein, which are not a guarantee of performance, events or results and are subject to a number of risks, uncertainties and other factors that could cause actual performance, events or results to differ materially from those expressed or implied by such forward-looking statements and information. Such statements and information are based on numerous assumptions regarding, among other things, favourable equity markets, global financial condition, present and future business strategies and the environment in which the Company will operate in the future, including the price of commodities, anticipated costs, ability to achieve goals (including, without limitation, timing and amount of production), timing and availability of additional required financing on favourable terms, decision to implement (including the business strategy, timing and structure thereof), the ability to successfully complete proposed mergers and acquisitions and the expected results of such acquisitions on our operations, the ability to obtain or maintain permits, mineability and marketability, exchange and interest rate assumptions, including, without limitation, being approximately consistent with the assumptions in the FS (as defined herein), the availability of certain consumables and services and the prices for power and other key supplies, including, without limitation, being approximately consistent with assumptions in the FS, labour and materials costs, including, without limitation, assumptions underlying Mineral Reserve (as defined herein) and Mineral Resource (as defined herein) estimates, assumptions made in the feasibility economic assessment estimates, including, but not limited to, geological interpretation, grades, metal price assumptions, metallurgical and mining recovery rates, geotechnical and hydrogeological assumptions, capital and operating cost estimates, and general marketing, political, business and economic conditions, as applicable, results of exploration activities, ability to develop infrastructure, assumptions made in the interpretation of drill results, geology, grade and continuity of mineral deposits, expectations regarding access and demand for equipment, skilled labour and services needed for exploration and development of mineral properties, and that activities will not be adversely disrupted or impeded by exploration, development, operating, regulatory, political, community, economic and/or environmental risks. Forward-looking statements are subject to known and unknown risks, uncertainties and other important factors. These factors include: the ability to obtain permits or approvals required to conduct planned exploration, development, construction and operation; the results of exploration and development; inaccurate geological and engineering assumptions; unanticipated future operational difficulties (including cost escalation, unavailability of materials and equipment, industrial disturbances or other job action and unanticipated events related to health, safety and environmental matters); social unrest; failure of counterparties to perform their contractual obligations; changes in priorities, plans, strategies and prospects; general economic, industry, business and market conditions; disruptions or changes in the credit or securities markets; changes in law, regulation, or application and interpretation of the same; the ability to implement business plans and strategies, and to pursue business opportunities; rulings by courts or arbitrators, proceedings and investigations; inflationary pressures; the COVID-19 pandemic; the ability of the Company to integrate QuestEx (as defined herein) and other acquired properties into its current business; and various other events, conditions or circumstances that could disrupt Skeena’s priorities, plans, strategies and prospects including those detailed from time to time in the Company’s reports and public filings with the Canadian and US securities administrators, filed on SEDAR+ and EDGAR.

This information speaks only as of the date of this MD&A. The Company undertakes no obligation to revise or update forward-looking information after the date of this document, nor to make revisions to reflect the occurrence of future unanticipated events, except as required under applicable securities laws or the policies of the Toronto Stock Exchange or the New York Stock Exchange.

| Management’s Discussion & Analysis | 4 |

SKEENA RESOURCES LIMITED

Management Discussion and Analysis

For the three and six months ended June 30, 2023

(Expressed in thousands of Canadian dollars within tables, unless otherwise noted)

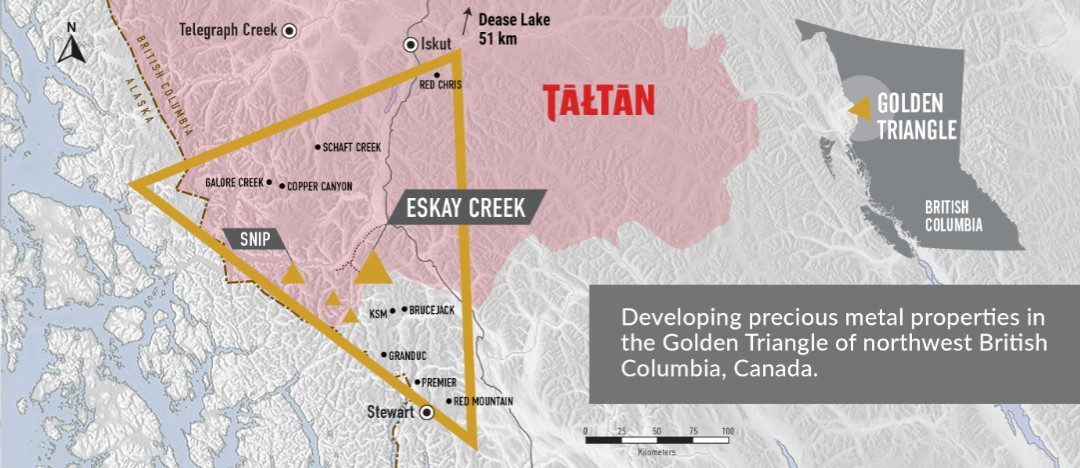

THE COMPANY

The principal business of Skeena is the exploration and development of mineral properties in the Golden Triangle region of northwest British Columbia, Canada. The Company owns or controls several exploration-stage properties in the region, including the past-producing Eskay Creek gold-silver mine, now referred to as the Eskay Creek Revitalization Project (“Eskay Creek”or “Eskay Creek Project”), and the past-producing Snip gold mine (“Snip”). The Company released a Feasibility Study (“FS”) on Eskay Creek in September 2022, which highlights an after-tax net present value (“NPV”) of $1.4 billion (5% discount rate), 50% IRR, and a 1-year payback at US$1,700/oz gold (“Au”) and US$19/oz silver (“Ag”). Skeena anticipates that the results from a FS update for Eskay Creek will be released in the latter half of 2023.

The Company was awarded the 2023 A.O. Dufresne Exploration Achievement Award for exploration success and resource growth at Eskay Creek. The award was presented to Skeena during the Canadian Institute of Mining, Metallurgy and Petroleum Awards Gala on May 1, 2023.

In addition to Eskay Creek and Snip, the Company also owns several exploration stage mineral properties including KSP, Kingpin, Sofia, and the Red Chris properties (Eldorado and Gin).

Figure 1: Property Locations – British Columbia’s Golden Triangle

The Company is a reporting issuer in all the provinces of Canada except Quebec, and trades on the Toronto Stock Exchange (“TSX”) and the New York Stock Exchange (“NYSE”), both under the symbol SKE, and on the Frankfurt Stock Exchange under the symbol RXF.

| Management’s Discussion & Analysis | 5 |

SKEENA RESOURCES LIMITED

Management Discussion and Analysis

For the three and six months ended June 30, 2023

(Expressed in thousands of Canadian dollars within tables, unless otherwise noted)

EXPLORATION PROPERTIES

See “The Company” section above for discussion of the exploration properties held by the Company. The Company considers the Eskay Creek Project to be its primary project.

Eskay Creek Project, British Columbia, Canada

Geological background

The Eskay Creek volcanogenic massive sulphide (“VMS”) and epigenetic deposits were emplaced in a submarine bimodal volcanic environment which are believed to be constrained within a contemporaneous fault-bounded basin. The volcanic sequence consists of footwall rhyolite units overlain by younger basalt units. The two are separated by the Contact Mudstone which hosts most of the historically exploited mineralization at Eskay Creek. The Contact Mudstone terrigenous sediments were deposited at a time of depositional quiescence during an otherwise active period of volcanism. This mudstone is spatially and temporally related to the main mineralizing event at Eskay Creek.

The Company’s more recent drilling has intercepted a compositionally similar mudstone unit (the Lower Mudstone) positioned approximately 100 metres (“m”) stratigraphically below the Contact Mudstone. The Lower Mudstone represents a similar period of volcanic quiescence during which clastic sedimentation dominated prior to the onset of bimodal volcanism that formed the Eskay Creek deposits. The presence of the Lower Mudstone demonstrates the stratigraphic cyclicity which is common to the group of VMS deposits worldwide, of which Eskay Creek is a member.

The bonanza precious metal Au-Ag grades and epigenetic suite of associated elements (Hg-Sb-As) occur predominantly within the Contact Mudstone but are not distributed uniformly throughout the unit. Rather, they are spatially associated with, and concentrated near interpreted hydrothermal vents fed from underlying syn-volcanic feeders. Company drilling has recently intercepted feeder-style, discordant mineralization in the footwall rhyolites.

Historically, the underlying rhyolite-hosted feeder style mineralization was minimally exploited due to its lower Au-Ag grades. It is noteworthy this rhyolite-hosted mineralization is not enriched in the Hg-Sb-As suite of elements and was often blended with mudstone-hosted zones to reduce smelter penalties for the on-site milled concentrates and direct shipping ore.

Mining history

The Eskay Creek property was historically operated as a high-grade underground operation. Underground mining operations were conducted from 1995 to 2008. From 1995 to 1997, ore was direct-shipped after blending and primary crushing. From 1997 to closure in 2008, ore was milled on site to produce a shipping concentrate.

Eskay Creek’s historic production was 3.3 million ounces of gold and 162 million ounces of silver from 2.3 million tonnes (“Mt”) of ore from 1995 until closure in 2008. The property was regarded as having been the highest-grade operation in the world at 45 grams per tonne (“g/t”) gold average grade non inclusive of silver credits.

The Eskay Creek mine historical production is summarized in Figure 2.

| Management’s Discussion & Analysis | 6 |

SKEENA RESOURCES LIMITED

Management Discussion and Analysis

For the three and six months ended June 30, 2023

(Expressed in thousands of Canadian dollars within tables, unless otherwise noted)

Figure 2: Eskay Creek Historical Production

Skeena exploration history

In August 2018, Skeena commenced an initial surface drill program at Eskay Creek. This first phase of exploratory and definition drilling was focused on the historically unmined portions of the 21A, 21C and 22 Zones of mineralization.

These near-surface targets are located proximal to the historical mine footprint and held potential for expansion of mineralization which may be suitable for open-pit mining. The goal of the Phase I program was to increase drill density in select areas of mineralization to increase confidence in the resource and allow for future mine planning, collect fresh material for preliminary metallurgical testing and expand exploration into areas that had not previously been drill tested to delineate additional resources. The results of this drill program were incorporated into the results of an initial resource estimate for the Eskay deposit.

The 2019 Phase I infill and expansion drilling program at Eskay Creek successfully upgraded the Inferred Resources hosted in the various zones. During this program, two additional drill holes (SK-19-063 and SK-19-067) were extended below the Inferred resources to test the exploration potential of a secondary and lesser-known mineralized mudstone horizon, termed the Lower Mudstone.

On November 7, 2019, the Company published a Preliminary Economic Assessment (“PEA”) prepared by Ausenco Engineering Canada Inc. (“Ausenco”), supported by SRK Consulting (Canada) Inc. (“SRK”), and AGP Mining Consultants Inc. (“AGP”), for the Eskay Creek Project. On September 1, 2021, the Company advanced the PEA to a Prefeasibility Study for the Eskay Creek Project prepared by Ausenco, SRK, and AGP (the “PFS”).

On September 19, 2022, the Company published a FS for the Eskay Creek Project, prepared by Ausenco. See below for further details relating to the FS.

2022 Feasibility Study - Eskay Creek Project

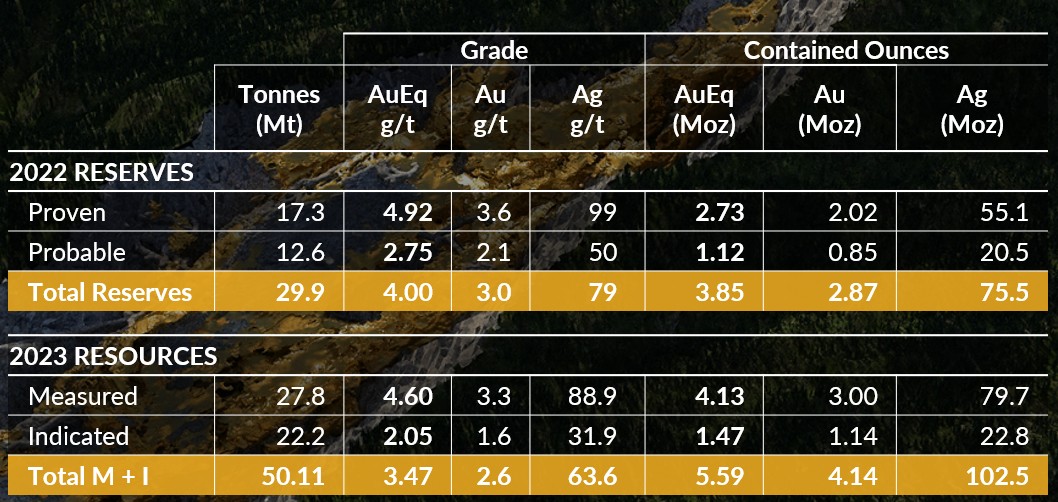

On September 8, 2022, the Company announced the results of a FS which was filed on SEDAR+ on September 19, 2022. Cut-off grades are based on a price of US$1,700 per ounce of gold, US$23 per ounce silver, and gold recoveries of 90%, silver recoveries of 80% and without considering revenues from other metals. Gold equivalent is determined as Au (g/t) plus Ag (g/t) divided by 74.

| Management’s Discussion & Analysis | 7 |

SKEENA RESOURCES LIMITED

Management Discussion and Analysis

For the three and six months ended June 30, 2023

(Expressed in thousands of Canadian dollars within tables, unless otherwise noted)

The FS highlights include:

| ● | After-tax NPV (5%) of $1.41 billion at a base case of US$1,700 gold and US$19 silver |

| ● | Robust economics with an after-tax internal rate of return (“IRR”) of 50.2% and an after-tax payback on pre-production capital expenditures of 1 year |

| ● | High-grade open pit averaging 3.87 g/t AuEq (2.99 g/t gold, 79 g/t silver) (diluted) with a strip ratio of 7.5:1 |

| ● | Years 1 - 5 average annual production of 431,000 AuEq ounces (“oz”), or 431 thousand ounces (“koz”) |

| ● | Life of mine (“LOM”) production of 3.2 million AuEq oz from 2.4 million oz of gold and 66.7 million oz of silver |

| ● | Estimated pre-production capital expenditures (“CAPEX”) of C$592 million, yielding an after-tax NPV:CAPEX ratio of 2.4:1 |

| ● | LOM all-in sustaining cost (“AISC”) of US$652/oz AuEq recovered in concentrate |

| ● | Proven and Probable open-pit mineral Reserves of 29.9 million tonnes containing 2.87 million oz gold and 75.5 million oz silver (combined 3.85 million AuEq oz) |

| ● | A carbon intensity of 0.20 t CO2e/oz AuEq produced, positioning Eskay Creek to be one of the lowest carbon intensity mines worldwide |

Figure 3: Pit-Constrained 2022 Reserves and 2023 Resources