We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Spirit Airlines Inc | NYSE:SAVE | NYSE | Common Stock |

| Price Change | % Change | Share Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 1.08 | 0 | 00:00:00 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

FORM

____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 18, 2024 (

____________________________

(Exact name of registrant as specified in its charter)

____________________________

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

(Address of principal executive offices, including zip code)

(

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Class |

Trading |

Name

of each exchange |

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

Restructuring Support Agreement

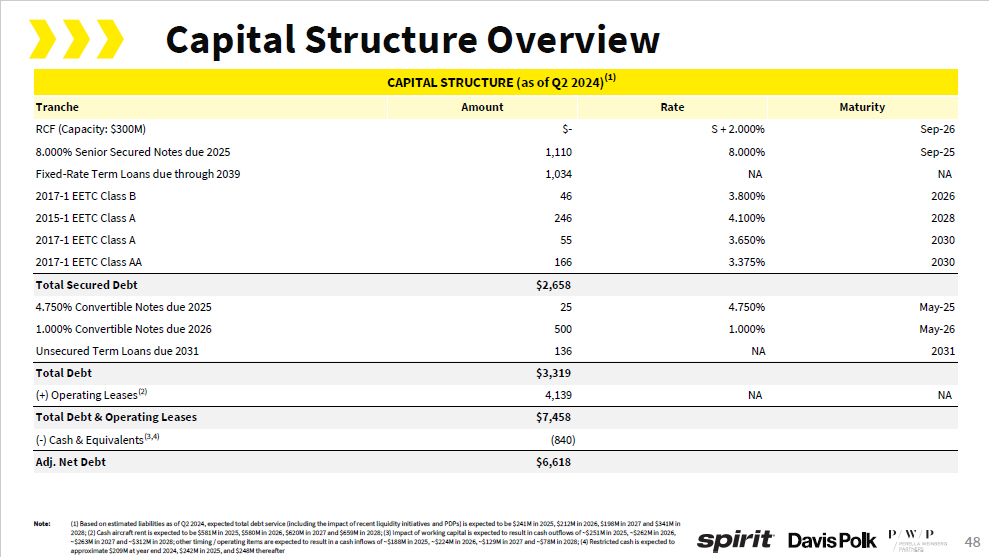

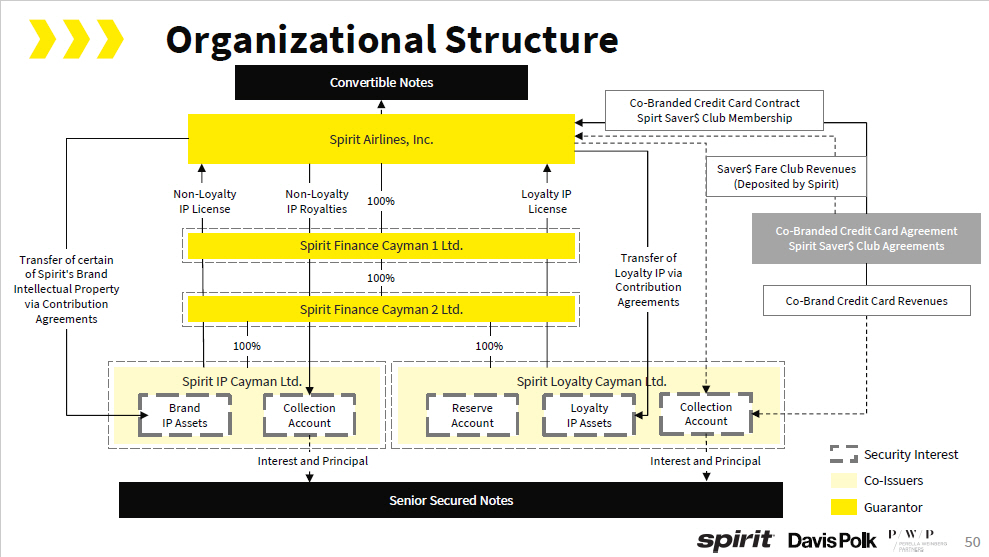

On November 18, 2024, Spirit Airlines, Inc. (the "Spirit”, and together with its direct and indirect subsidiaries, “the Company”) entered into a Restructuring Support Agreement (the "Restructuring Support Agreement" and the holders parties thereto, the “Supporting Stakeholders”) with (i) holders in the aggregate of approximately 78.6% of the Company's 8.00% Senior Secured Notes due 2025 issued by Spirit IP Cayman Ltd. and Spirit Loyalty Cayman Ltd. (the “Senior Secured Notes,” and the holders, the “Senior Secured Noteholders”) and (ii) holders in the aggregate of approximately 84.1% of the Company’s 4.75% Convertible Senior Notes due 2025 (the “2025 Convertible Notes”) and 1.00% Convertible Senior Notes due 2026 issued by Spirit Airlines, Inc. (together, with the 2025 Convertible Notes, the “Convertible Notes,” and the holders, the “Convertible Noteholders”). The transactions contemplated in the Restructuring Support Agreement are expected to be implemented through a pre-arranged chapter 11 process (the "Chapter 11 Cases") in the United States Bankruptcy Court for the Southern District of New York (the "Bankruptcy Court").

The Restructuring Support Agreement and the proposed pre-arranged plan of reorganization (the “Plan”) attached thereto contemplate the equitization of $410 million of outstanding Senior Secured Notes and $385 million of outstanding Convertible Notes, as well as a backstopped $350 million new money equity raise upon emergence from the Chapter 11 Cases, as described in greater detail below. Specifically, the Restructuring Support Agreement and the Plan provide, in pertinent part, as follows:

| · | Vendors, aircraft lessors and holders of secured aircraft indebtedness will continue to be paid in the ordinary course and will not be impaired; |

| · | The Supporting Stakeholders have committed to provide a $300 million new money senior secured superpriority debtor-in-possession facility (the “DIP Facility”), as further described under “Debtor-in-Possession Financing”. The DIP Facility is expected to be repaid in full in cash on the effective date of the Plan (the “Effective Date”). |

| · | On the Effective Date, the Company (as reorganized, “Reorganized Spirit”) will issue a single class of common equity interests (the “New Common Equity”) to certain of its creditors as follows: (a) 76% pro rata to the Senior Secured Noteholders and (b) 24% pro rata to the Convertible Noteholders, subject to dilution on account of the Management Incentive Plan (as defined in the Plan), the $350 million Equity Rights Offering (as defined hereafter), as further described under “Backstop Commitment Agreement, and certain adjustments set forth in the Plan. |

| · | On the Effective Date, Reorganized Spirit will issue $840 million of senior secured notes (the “Exit Secured Notes”), the material terms of which are described in the Exit Secured Notes Facility Term Sheet attached as Exhibit G to the Restructuring Support Agreement, to certain of its creditors as follows: (a) $700 million in the aggregate, pro rata, to the Senior Secured Noteholders and (b) $140 million in the aggregate, pro rata, to the Convertible Noteholders, subject to certain adjustments set forth in the Plan. |

| · | All of the Company’s existing common stock and other equity interests will be cancelled without any distributions to the holders of such common stock and other equity interests on account thereof. |

The Restructuring Support Agreement includes certain milestones for the progress of the Chapter 11 Cases, which include the dates by which Spirit is required to, among other things, obtain certain court orders and consummate the transactions contemplated therein. Failure to meet these milestones allows the Restructuring Support Agreement to be terminated by the non-Spirit signatories thereto. In addition, the signatories to the Restructuring Support Agreement have the right to terminate the Restructuring Support Agreement under certain circumstances, including if the board of directors of Spirit (the "Board") determines in good faith that performance under the Restructuring Support Agreement would be inconsistent with its fiduciary duties as set forth therein. The Plan remains subject to

Bankruptcy Court approval and the satisfaction of certain conditions precedent. Accordingly, no assurance can be given that the transactions described in the Restructuring Support Agreement or the Plan will be consummated.

The foregoing description of the Restructuring Support Agreement does not purport to be complete and is qualified in its entirety by reference to its full text, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference in this Item 1.01.

Backstop Commitment Agreement

On November 18, 2024, Spirit entered into a Backstop Commitment Agreement (the “Backstop Commitment Agreement”) with the backstop commitment parties named therein (the “Backstop Commitment Parties”). The terms of the Backstop Agreement are, in pertinent part, as follows:

| · | Pursuant to the Backstop Commitment Agreement, the Backstop Commitment Parties have agreed to backstop an equity rights offering of New Common Equity (the “Equity Rights Offering”) for an aggregate purchase price of $350 million at 70% of Plan Equity Value (as defined in the Backstop Agreement) (such New Common Equity, the “Offering Shares”), as contemplated by the Restructuring Support Agreement. |

| · | Subject to adjustments described below, the Backstop Commitment Agreement provides that $175 million of the Offering Shares will be raised by soliciting commitments from certain of the Company’s creditors as follows: (a) $137.81 million from Senior Secured Noteholders (the “Senior Secured Notes Subscription Rights”) and (b) $37.19 million from Convertible Noteholders (the “Convertible Notes Subscription Rights”). |

| · | Subject to adjustments described below, the Backstop Commitment Agreement provides that $175 million of the Offering Shares will be reserved for purchase by the Backstop Commitment Parties as follows: $137.81 million by the Senior Secured Backstop Commitment Parties (as defined in the Backstop Commitment Agreement) (the “Senior Secured Direct Allocation”) and $37.19 million by the Convertible Backstop Commitment Parties (as defined in the Backstop Commitment Agreement) (the “Convertible Direct Allocation”). |

| · | If Senior Secured Noteholders holding, in the aggregate, at least 90.00% of the aggregate principal amount of the Senior Secured Notes claims shall have executed the Restructuring Support Agreement by 11:59 p.m., New York City time, on November 25, 2024 (or as such time may be extended pursuant to the Backstop Commitment Agreement), then the amount of the Senior Secured Notes Subscription Rights will be increased to $248.06 million and the Senior Secured Direct Allocation will be reduced to $27.56 million. |

| · | If Convertible Noteholders holding, in the aggregate, at least 90.00% of the aggregate principal amount of the Convertible Notes claims shall have executed the Restructuring Support Agreement by 11:59 p.m., New York City time, on November 25, 2024 (or as such time may be extended pursuant to the Backstop Commitment Agreement), then the amount of the Convertible Notes Subscription Rights will be increased to $66.94 million and the Convertible Direct Allocation will be reduced to $7.44 million. |

| · | As consideration for the commitment by the Backstop Commitment Parties, and subject to approval by the Bankruptcy Court: (i) a “Backstop Premium” will be paid to the Backstop Commitment Parties by the Company in an aggregate number of shares of New Common Equity equal to 10% of the total number of shares of New Common Equity issued by the Company upon emergence from bankruptcy as distributions under the Plan. If the Backstop Commitment Agreement is terminated under certain circumstances as set forth therein, the Backstop Commitment Agreement provides for a cash payment of $35 million to the Backstop Commitment Parties. |

The transactions contemplated by the Backstop Commitment Agreement are conditioned upon the satisfaction or waiver of customary conditions for transactions of this nature, including, among other things. that (i) the Bankruptcy Court shall have confirmed the Plan, (ii) the Effective Date shall have occurred, and (iii) the Restructuring Support Agreement remains in full force and effect.

The foregoing description of the Backstop Commitment Agreement is not complete and is qualified in its entirety by reference to the Backstop Commitment Agreement, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.2 and is hereby incorporated by reference into this Item 1.01.

Debtor-in-Possession Financing

The information set forth under the heading "Debtor-in-Possession Financing" in Item 1.03 below is hereby incorporated by reference into this Item 1.01.

| Item 1.03 | Bankruptcy or Receivership. |

Voluntary Petition for Reorganization

On November 18, 2024, Spirit filed a petition under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the Bankruptcy Court. Concurrently, Spirit filed a pre-arranged chapter 11 plan of reorganization (the “Plan”) with the Bankruptcy Court.

Spirit will continue to operate its business as a “debtor-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and the orders of the Bankruptcy Court. The Plan and requested first day relief anticipate that trade claimants and other unsecured creditors who continue to work with Spirit on existing terms will be paid in full and in the ordinary course of business. Vendors, aircraft lessors and holders of secured aircraft indebtedness will continue to be paid in the ordinary course and will not be impaired.

Additional information about the Chapter 11 Cases may be obtained at https://dm.epiq11.com/SpiritGoForward.

Debtor-in-Possession Financing

Spirit has secured a commitment from certain of its prepetition debtholders (collectively, the “DIP Lenders”), to provide approximately $300 million in financing in the form of a senior secured debtor-in-possession facility (the “DIP Facility”). The DIP Facility is comprised of (i) new money term loans and (ii) new money notes (collectively, the “DIP Commitments”). Upon entry of the DIP Order by the Bankruptcy Court, the DIP Commitments shall be available to Spirit to draw upon. Spirit’s uses for the payment shall include, among other items, (i) prepetition obligations, (ii) adequate protection payments, (iii) the fees, costs, and expenses of administering the Chapter 11 Cases and (iv) working capital and other general corporate needs of Spirit in the ordinary course of business.

Spirit’s obligations under the proposed DIP Facility will be guaranteed by each subsidiary of Spirit. In addition, upon entry and subject to the terms of the DIP Order approving the DIP Facility, the claims of the DIP Lenders will be (i) entitled to superpriority administrative expense claim status, subject to certain customary exclusions in the credit documentation and (ii) secured by perfected senior security interests and liens on certain property of the Company, subject to a certain exclusions and exceptions carve out.

Subject to certain exceptions and conditions, Spirit will be obligated to prepay the obligations thereunder with the net cash proceeds of certain asset sales, with casualty insurance proceeds, extraordinary receipts and the proceeds of certain indebtedness. The DIP Facility will bear an interest rate equal to Spirit’s choice of (a) SOFR plus 7.00% per annum or (b) Alternate Base Rate plus 6.00% per annum.

The foregoing descriptions of the DIP Facility and DIP Commitments do not purport to be complete and are qualified in their entirety by reference to the DIP Term Sheet filed hereto as Exhibit 10.3.

| Item 2.04 | Triggering Events that Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement. |

The filing of the Chapter 11 Cases described above in Item 1.03 constitutes an event of default that accelerated the Company’s obligations under the following debt instruments (the "Debt Instruments"):

| · | Approximately $300.0 million of borrowings (plus any accrued but unpaid interest in respect thereof) under the Credit and Guaranty Agreement (the “Revolving Credit Agreement), dated as of March 30, 2020, by and among the Company, the lenders party thereto from time to time, Wilmington Trust, National Association (“Wilmington”), as collateral agent, and Citibank, N.A., as administrative agent, as amended, waived, |

supplemented or otherwise modified, relating to our Revolving Loans (as defined in the Revolving Credit Agreement).

| · | Approximately $525.1 million of borrowings (plus any accrued but unpaid interest in respect thereof) under the Indenture dated May 12, 2020, among the Company, as issuer, and Wilmington as trustee, as amended and supplemented, relating to our Convertible Notes. |

| · | Approximately $505.0 million of borrowings (plus any accrued but unpaid interest in respect thereof) under certain enhanced equipment trust certificates ("EETCs") debt agreements between the Company and Wilmington, as trustee. |

The Debt Instruments provide that, as a result of the Chapter 11 Cases, the principal and interest due thereunder shall be immediately due and payable. Any efforts to enforce such payment obligations under the Debt Instruments are automatically stayed as a result of the commencement of the Chapter 11 Cases, and the creditors’ rights of enforcement in respect of the Debt Instruments are subject to the applicable provisions of the Bankruptcy Code.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On November 12, 2024, the Board of Directors of Spirit approved the payment of one-time cash retention awards (“Retention Awards”) to Spirit’s named executive officers in the amounts set forth in the table below, which were paid pursuant to the terms of a retention award agreement (the “Retention Agreement”). Pursuant to the terms of the Retention Agreement, if the named executive officer ceases to be actively employed by Spirit in good standing prior to the earlier of (i) the one-year anniversary of the effective date of the Retention Agreement and (ii) the date that is 60 days following the date of a “change in control” (as defined in the Retention Agreement), then the executive is required to repay to Spirit the gross amount of the Retention Award within 10 days, except if the executive’s employment terminates due to death or “disability”, by Spirit without “cause” or due to the executive’s resignation for “good reason” (each as defined in the Retention Agreement).

In addition, each of Spirit’s named executive officers received their earned cash bonus under Spirit’s Short-Term Cash Incentive Program (the “2024 STIP”) for (i) the cash bonus earned under the individual component of the 2024 STIP for the first measurement period of 2024 (the “2024 H1 STIP Bonus”) and (ii) the second measurement period of 2024 (the “2024 H2 STIP Bonus”), in each case in the amounts set forth in the table below, which were paid pursuant to the terms of the Retention Agreement. Pursuant to the terms of the Retention Agreement, if the named executive officer ceases to be actively employed by Spirit in good standing prior to the earlier of (i) January 31, 2025 and (B) the date that is 60 days following the date of a “change in control”, then the executive is required to repay to Spirit the gross amount of the 2024 H1 STIP Bonus and the 2024 H2 STIP Bonus within 10 days, except if the executive’s employment terminates due to death or “disability”, by Spirit without “cause” or due to the executive’s resignation for “good reason” (each as defined in the Retention Agreement).

As set forth in the Retention Agreement, each of the named executive officers’ unpaid time-based or performance-based long-term cash incentive awards and any payment under Spirit’s short-term incentive plan for 2024 (except as set forth below) were forfeited in their entirety.

The foregoing description of the Retention Agreements does not purport to be complete and is qualified in its entirety by reference to the Retention Agreements, the form of which is filed herewith as Exhibit 10.4 and is incorporated herein by reference.

| Named Executive Officer | Retention Award | 2024 STIP Bonus |

| Edward M. Christie III, President & Chief Executive Officer | $3,800,000 | $419,866 |

| Frederick A. Cromer, Executive Vice President & Chief Financial Officer | $175,000 | $277,508 |

| John Bendoraitis, Executive Vice President & Chief Operating Officer | $850,000 | $400,275 |

| Matthew H. Klein, Executive Vice President & Chief Commercial Officer | $250,000 | $266,063 |

| Rocky B. Wiggins, Senior Vice President & Chief Information Officer | $300,000 | $276,581 |

| Item 7.01 | Regulation FD Disclosure. |

Press Release

On November 18, 2024, Spirit issued a press release announcing the filing of the Chapter 11 Cases. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Cleansing Material

Prior to the filing of the Chapter 11 Cases, the Company entered into confidentiality agreements (collectively, the "NDAs") with certain Senior Secured Noteholders and Convertible Noteholders (the “NDA Parties”). The Company engaged in negotiations with the NDA Parties relating to the Restructuring Support Agreement, the Plan, the Backstop Commitment Agreement and the DIP Commitments. Pursuant to the NDAs, the Company provided the NDA Parties with confidential information and agreed to publicly disclose certain information (the "Cleansing Material") upon the occurrence of certain events set forth in the NDAs. A copy of the Cleansing Material is attached to this Current Report on Form 8-K as Exhibit 99.2. The Cleansing Material was prepared by the Company solely to facilitate a discussion with the parties to the NDAs and was not prepared with a view toward public disclosure and should not be relied upon to make an investment decision with respect to the Company. The Cleansing Material should not be regarded as an indication that the Company or any third party considers the Cleansing Material to be a reliable prediction of future events, and the Cleansing Material should not be relied upon as such. The Cleansing Material includes certain values for illustrative purposes only and such values are not the result of, and do not represent, actual valuations, estimates, forecasts or projections of the Company or any third party and should not be relied upon as such. Neither the Company nor any third party has made or makes any representation to any person regarding the accuracy of any Cleansing Material or undertakes any obligation to publicly update the Cleansing Material to reflect circumstances existing after the date when the Cleansing Material was prepared or conveyed or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying the Cleansing Material are shown to be in error.

The information contained in this Item 7.01, including in Exhibits 99.1 and 99.2 shall not be deemed to be “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (“the Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing. The filing of this Current Report on Form 8-K (including any exhibit hereto or any information included herein or therein) shall not be deemed an admission to the materiality of any information herein that is required to be disclosed solely by reason of Regulation FD.

Cautionary Note Regarding the Chapter 11 Cases

The Company cautions that trading in the Company’s common stock during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices for the Company’s common stock may bear little or no relationship to the actual recovery, if any, by holders of the Company’s common stock in the Chapter 11 Cases. The Company expects that holders of the Company’s common stock will not receive distributions in the Chapter 11 Cases, and that the equity will be canceled under the Plan.

Cautionary Statement Regarding Forward Looking Statements

This Current Report on Form 8-K (this “Current Report”) contains various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on our management's beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,” and similar expressions intended to identify forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding Spirit’s expectations with respect to operating in the normal course, the Chapter 11 process, the DIP and potential delisting of Spirit’s common stock by the New York Stock Exchange. Forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors include, among others, risks attendant to the bankruptcy process, including the Company's ability to obtain court approval from the Court with respect to motions or other requests made to the Court throughout the course of Chapter 11, including with respect the DIP; the effects of Chapter 11, including increased legal and other professional costs necessary to execute the Company's restructuring process, on the Company's liquidity (including the availability of operating capital during the pendency of Chapter 11); the effects of Chapter 11 on the interests of various constituents and financial stakeholders; the length of time that the Company will operate under Chapter 11 protection and the continued availability of operating capital during the pendency of Chapter 11; objections to the Company's restructuring process, the DIP, or other pleadings filed that could protract Chapter 11; risks associated with third-party motions in Chapter 11; Court rulings in the Chapter 11 and the outcome of Chapter 11 in general; the Company's ability to comply with the restrictions imposed by the terms and conditions of the DIP and other financing arrangements; employee attrition and the Company's ability to retain senior management and other key personnel due to the distractions and uncertainties; risks associated with the potential delisting or the suspension of trading in its common stock by the New York Stock Exchange, the impact of litigation and regulatory proceedings; and other factors discussed in the Company's Annual Report on Form 10-K and subsequent quarterly reports on Form 10-Q filed with the SEC and other factors, as described in the Company's filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as supplemented in the Company's Quarterly Report on Form 10-Q for the fiscal quarters ended March 31, 2024 and June 30, 2024. Furthermore, such forward-looking statements speak only as of the date of this Current Report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. Risks or uncertainties (i) that are not currently known to us, (ii) that we currently deem to be immaterial, or (iii) that could apply to any company, could also materially adversely affect our business, financial condition, or future results.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SPIRIT AIRLINES, INC. | ||||

| Date: November 18, 2024 | By: | /s/ Thomas Canfield | ||

| Thomas Canfield | ||||

| Senior Vice President - General Counsel & Secretary | ||||

Exhibit 10.1

THIS RESTRUCTURING SUPPORT AGREEMENT IS NOT AN OFFER OR ACCEPTANCE WITH RESPECT TO ANY SECURITIES OR A SOLICITATION OF ACCEPTANCES OF A CHAPTER 11 PLAN WITHIN THE MEANING OF SECTION 1125 OF THE BANKRUPTCY CODE. ANY SUCH OFFER OR SOLICITATION WILL COMPLY WITH ALL APPLICABLE SECURITIES LAWS AND/OR PROVISIONS OF THE BANKRUPTCY CODE. Nothing contained in thIS RESTRUCTURING SUPPORT AGREEMENT shall be an admission of fact or liability OR, UNTIL THE OCCURRENCE OF THE AGREEMENT EFFECTIVE DATE ON THE TERMS DESCRIBED IN THIS AGREEMENT, DEEMED BINDING ON ANY OF THE PARTIES to this agreement.

RESTRUCTURING SUPPORT AGREEMENT

This RESTRUCTURING SUPPORT AGREEMENT (including all exhibits, annexes, and schedules attached to this agreement in accordance with Section 12.02, as amended, restated, supplemented or modified from time to time in accordance with the terms hereof, this “Agreement”) is made and entered into as of November 18, 2024, by and among the following parties (each of the following described in sub-clauses (i) through (iii) of this preamble, individually, a “Party” and, collectively, the “Parties”):1

| (i) | Spirit Airlines, Inc., a corporation incorporated under the laws of Delaware (the “Company”), and each of its direct or indirect subsidiaries that executes and delivers a Company Acknowledgment after the date hereof in accordance with this Agreement (together with the Company, each a “Company Party,” and collectively, the “Company Parties”); |

| (ii) | the undersigned beneficial holders of, or investment advisors, sub-advisors, or managers of discretionary accounts or funds that beneficially hold, Senior Secured Notes Claims (as defined below) that have executed and delivered counterpart signature pages to this Agreement (in each case solely in their capacity as such, together with each Senior Secured Noteholder (as defined below) that executes and delivers a Joinder from time to time after the date hereof, the “Consenting Senior Secured Noteholders”) to counsel to the Company Parties and counsel to the Consenting Senior Secured Noteholders; and |

| (iii) | the undersigned beneficial holders of, or investment advisors, sub-advisors, or managers of discretionary accounts or funds that beneficially hold, Convertible Notes Claims (as defined below) that have executed and delivered counterpart signature pages to this Agreement (in each case solely in their capacity as such, together with each Convertible Noteholder (as defined below) that executes and delivers a Joinder from time to time and after the date hereof, the “Consenting Convertible Noteholders” and, together with the Consenting Senior Secured Noteholders, the “Consenting Stakeholders”). |

1 Capitalized terms used but not defined in the preamble and recitals to this Agreement have the meanings ascribed to them in Section 1.

RECITALS

WHEREAS, the Company Parties and the Consenting Stakeholders have in good faith and at arm’s length negotiated and agreed upon the material terms of a comprehensive restructuring with respect to the Company Parties’ capital structure (the “Restructuring Transactions”) in accordance with and subject to the terms and conditions set forth in this Agreement and the terms set forth in the chapter 11 plan of reorganization attached hereto as Exhibit A (together with the exhibits and appendices annexed thereto, the “Plan”);

WHEREAS, the Restructuring Transactions shall be implemented through the commencement by the Company and its subsidiaries of voluntary cases (the “Chapter 11 Cases”) under chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”);

WHEREAS, as of the date hereof, (a) the Consenting Senior Secured Noteholders hold, in the aggregate, 78.6% of the aggregate principal amount of the Senior Secured Notes Claims (including Loaned Claims), and (b) the Consenting Convertible Noteholders hold, in the aggregate, 84.1% of the aggregate principal amount of Convertible Notes Claims;

WHEREAS, the Parties have agreed to express their mutual support and take certain actions in support of the Restructuring Transactions on the terms and conditions set forth in this Agreement; and

NOW, THEREFORE, in consideration of the covenants and agreements contained in this Agreement, and for other valuable consideration, the receipt and sufficiency of which are acknowledged, each Party, severally, and not jointly and severally, intending to be legally bound by this Agreement, agrees as follows:

AGREEMENT

Section 1. Definitions and Interpretation.

1.01. Definitions. The following terms shall have the following definitions:

“2025 Convertible Notes” means the Company’s 4.75% Convertible Senior Notes due 2025, issued under the 2025 Convertible Notes Indenture.

“2025 Convertible Notes Claims” means any Claim on account of the 2025 Convertible Notes.

“2025 Convertible Notes Indenture” means that certain Indenture, dated as of May 12, 2020, between the Company and Wilmington Trust, National Association, as trustee, as supplemented by that certain First Supplemental Indenture, dated as of May 12, 2020, between the Company and Wilmington Trust, National Association, as trustee, as amended or supplemented to the date of this Agreement.

2

“2025 Convertible Notes Trustee” means Wilmington Trust, National Association, in its capacity as trustee under the 2025 Convertible Notes Indenture, and any successor trustee appointed pursuant to the terms thereof.

“2026 Convertible Notes” means the Company’s 1.00% Convertible Senior Notes due 2026, issued under the 2026 Convertible Notes Indenture.

“2026 Convertible Notes Claims” means any Claim on account of the 2026 Convertible Notes.

“2026 Convertible Notes Indenture” means that certain Indenture, dated as of May 12, 2020, between the Company and Wilmington Trust, National Association, as trustee, as supplemented by that certain Second Supplemental Indenture, dated as of April 30, 2021, between the Company and Wilmington Trust, National Association, as trustee, as amended or supplemented to the date of this Agreement.

“2026 Convertible Notes Trustee” means Wilmington Trust, National Association, in its capacity as trustee under the 2026 Convertible Notes Indenture, and any successor trustee appointed pursuant to the terms thereof.

“Ad Hoc Group of Convertible Noteholders” means that certain ad hoc group of Convertible Noteholders represented by the Ad Hoc Group of Convertible Noteholders Advisors.

“Ad Hoc Group of Convertible Noteholders Advisors” means (i) Paul Hastings LLP, (ii) Ducera Partners LLC, (iii) one commercial aviation counsel to the Ad Hoc Group of Convertible Noteholders with prior written consent of the Company Parties (such consent not to be unreasonably withheld), and (iv) one Cayman Islands local counsel to the Ad Hoc Group of Convertible Noteholders.

“Ad Hoc Group of Senior Secured Noteholders” means that certain ad hoc group of Senior Secured Noteholders represented by the Ad Hoc Group of Senior Secured Noteholders Advisors.

“Ad Hoc Group of Senior Secured Noteholders Advisors” means (i) Akin Gump Strauss Hauer & Feld LLP, (ii) Evercore Group L.L.C., (iii) one Cayman Islands local counsel to the Ad Hoc Group of Senior Secured Noteholders, (iv) one commercial aviation counsel to the Ad Hoc Group of Senior Secured Noteholders, and (v) any consultants or other professionals retained by the Consenting Senior Secured Noteholders in connection with the Restructuring Transactions, with prior written consent of the Company Parties (such consent not to be unreasonably withheld).

“Adequate Protection Order” means an interim order of the Bankruptcy Court authorizing the Debtors’ use of the Cash Collateral (if any) and providing adequate protection for the Senior Secured Noteholders, the Secured Notes Trustee and the agent or lenders under the Company’s prepetition revolving credit facility.

“Affiliate” means, with respect to any specified Entity, any other Entity directly or indirectly controlling or controlled by or under direct or indirect common control with such

3

specified Entity. For purposes of this definition, “control” (including, with correlative meanings, the terms “controlling,” “controlled by,” and “under common control with”), as used with respect to any Entity, shall mean the possession, directly or indirectly, of the right or power to direct or cause the direction of the management or policies of such Entity, whether through the ownership of voting securities, by agreement, or otherwise. A Related Fund of any Person shall be deemed to be the Affiliate of such Person.

“Agreement” has the meaning set forth in the preamble hereto and, for the avoidance of doubt, includes all the exhibits, annexes, and schedules attached hereto in accordance with Section 12.02.

“Agreement Effective Date” means the date on which the conditions set forth in Section 2 have been satisfied or waived in accordance with this Agreement.

“Agreement Effective Period” means, with respect to a Party, the period from the Agreement Effective Date (or, in the case of any Company Party or Consenting Stakeholder that becomes a party hereto after the Agreement Effective Date, as of the date and time such Company Party or Consenting Stakeholder executes and delivers a Company Acknowledgment or Joinder, as applicable, in accordance with the terms hereof) to the Termination Date applicable to that Party.

“Alternative Restructuring Proposal” means any written or verbal inquiry, proposal, offer, bid, term sheet, discussion, or agreement with respect to a sale, disposition, new-money investment, restructuring, reorganization, merger, amalgamation, acquisition, consolidation, dissolution, debt investment, equity investment, financing (debt or equity), joint venture, partnership, liquidation, tender offer, recapitalization, plan of reorganization, share exchange, business combination, or similar transaction involving the Company or any of its direct or indirect subsidiaries or the debt, equity, or other interests in the Company or any of its direct or indirect subsidiaries that in each case is an alternative to, or is inconsistent with, the Restructuring Transactions, but in each case excluding any debtor in possession financing facility.

“Backstop Commitment” has the meaning set forth in the Backstop Commitment Agreement.

“Backstop Commitment Agreement” means the backstop commitment agreement (including all exhibits, annexes, and schedules thereto and as amended, supplemented, or modified pursuant to the terms thereof), substantially in the form attached hereto as Exhibit C.

“Backstop Commitment Parties” has the meaning set forth in the Backstop Commitment Agreement.

“Backstop Motion” means the motion seeking entry of the Backstop Order.

“Backstop Order” means the order entered by the Bankruptcy Court approving and authorizing the Debtors’ assumption of the Backstop Commitment Agreement and the Debtors’ performance thereunder.

4

“Bankruptcy Code” means title 11 of the United States Code, 11 U.S.C. §§ 101–1532, as amended.

“Bankruptcy Court” has the meaning set forth in the recitals to this Agreement.

“Business Day” means any day other than a Saturday, Sunday, or other day on which commercial banks are authorized to close under the Laws of, or are in fact closed in, the state of New York.

“Cash Collateral” has the meaning set forth in section 363(a) of the Bankruptcy Code.

“Chapter 11 Cases” has the meaning set forth in the recitals to this Agreement.

“Claim” has the meaning ascribed to it in section 101(5) of the Bankruptcy Code.

“Closing Date” means, the effective date of the Restructuring Transactions pursuant to the Plan.

“Company Acknowledgment” means an acknowledgment and joinder to this Agreement substantially in the form attached to this Agreement as Exhibit D.

“Company Claims” means any Claim against the Company or any direct or indirect subsidiary thereof including, without limitation, the Senior Secured Notes Claims and the Convertible Notes Claims. Solely for the purpose of Sections 7, 8(a), 8(b), and 8(c) hereof, Company Claims shall exclude all debt financing claims secured by aircraft.

“Company Claims/Interests” means, collectively, any Company Claims and Company Interests.

“Company Interests” means any Equity Interests in the Company or any direct or indirect subsidiary thereof.

“Company Termination Notice” has the meaning set forth in Section 10.03.

“Confidentiality Agreement” means an executed confidentiality agreement, including, but not limited to, with respect to the issuance of a “cleansing letter” or other public disclosure of material non-public information in connection with or related to any potential restructuring.

“Confirmation Order” means, the order of the Bankruptcy Court confirming the Plan under section 1129 of the Bankruptcy Code, which Confirmation Order shall be consistent with this Agreement.

“Consent Solicitation” has the meaning set forth in Section 4(c).

“Consent Solicitation Date” has the meaning set forth in Section 4.

“Consenting Convertible Noteholders” has the meaning set forth in the preamble to this Agreement.

5

“Consenting Convertible Noteholder Termination Notice” has the meaning set forth in Section 10.02.

“Consenting Senior Secured Noteholders” has the meaning set forth in the preamble to this Agreement.

“Consenting Senior Secured Noteholder Termination Notice” has the meaning set forth in Section 10.01.

“Consenting Stakeholder Fees and Expenses” has the meaning set forth in Section 12.18.

“Consenting Stakeholders” has the meaning set forth in the preamble to this Agreement.

“Convertible Notes Claims” 2025 Convertible Notes Claims and 2026 Convertible Notes Claims.

“Convertible Noteholder” means, collectively, a “Holder” as defined in the 2025 Convertible Notes Indenture or the 2026 Convertible Notes Indenture.

“Debtors” means, collectively, the Company and its direct or indirect subsidiaries that file the Chapter 11 Cases.

“Definitive Documents” means the definitive documents listed in Section 3.01.

“DIP Credit Agreement” means the Credit Agreement with respect to the DIP Facility.

“DIP Facility” means the post-petition senior secured credit facility to be provided pursuant to, and subject to the terms and conditions of, the DIP Financing Documents.

“DIP Financing Documents” means the documentation governing the DIP Facility, including any DIP Order, Adequate Protection Order, the DIP Term Sheet, the DIP Credit Agreement, and any related credit agreement, security agreement or similar documents, as may be amended, modified, or supplemented from time to time, in accordance with the terms and conditions set forth therein.

“DIP Order” means, as applicable, the interim and final orders of the Bankruptcy Court approving the DIP Facility and granting the Debtors authority to use Cash Collateral in the Chapter 11 Cases.

“DIP Term Sheet” means the term sheet setting forth the terms of the DIP Facility attached hereto as Exhibit E.

“Disclosure Statement” means, the disclosure statement with respect to the Plan.

“Entity” shall have the meaning set forth in Section 101(15) of the Bankruptcy Code.

“Equity Interests” means any common stock, limited liability company interest, equity security (as defined in section 101(16) of the Bankruptcy Code), equity, ownership, profit interests,

6

unit, or share in a Debtor, including all issued, unissued, authorized, or outstanding shares of capital stock of the Debtors and any other rights, options, warrants, stock appreciation rights, phantom stock rights, restricted stock units, redemption rights, repurchase rights, convertible, exercisable or exchangeable securities or other agreements, arrangements or commitments of any character relating to, or whose value is related to, any such interest or other ownership interest in any Debtor.

“Equity Rights Offering” means the equity rights offering to be conducted in connection with the Plan and consummated on the Plan Effective Date in accordance with the Equity Rights Offering Documents.

“Equity Rights Offering Documents” means the Backstop Commitment Agreement, the Backstop Motion, the Backstop Order, and any and all other agreements, documents, and instruments delivered or entered into in connection with, or otherwise governing, the Equity Rights Offering, including the Equity Rights Offering procedures, subscription forms, and any other materials distributed in connection with the Equity Rights Offering.

“Event” means any event, development, occurrence, circumstance, effect, condition, result, state of facts or change.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Exit Financing Facilities” means, collectively, the Exit Secured Notes Facility and Exit Revolving Credit Facility.

“Exit Financing Facilities Documents” means, collectively, the Exit Secured Notes Documents and Exit RCF Documents.

“Exit RCF Documents” means all documentation effectuating the incurrence of the Exit Revolving Credit Facility.

“Exit Revolving Credit Facility” means a senior secured revolving credit facility to be entered into by one or more Reorganized Company Parties in accordance with the Exit RCF Documents.

“Exit Secured Notes Documents” means all documentation effectuating the incurrence of the Exit Secured Notes Facility.

“Exit Secured Notes Facility” means $840 million of senior secured notes to be issued by the Reorganized Company Parties in accordance with the Exit Secured Notes Facility Term Sheet and the Exit Secured Notes Documents.

“Exit Secured Notes Facility Term Sheet” means the term sheet setting forth the material terms of the Exit Secured Notes Facility attached hereto as Exhibit G.

“First Day Pleadings” means, the first-day pleadings that the Company determines are necessary or desirable to file with the Bankruptcy Court.

7

“Governance Term Sheet” means the term sheet setting forth the material governance terms of the Reorganized Company Parties, substantially in the form attached hereto as Exhibit H.

“Governing Body” means the board of directors, board of managers, manager, general partner, investment committee, special committee, or such similar governing body of an Entity.

“Governmental Authority” means any applicable federal, state, local or foreign government or any agency, bureau, board, commission, court or arbitral body, department, political subdivision, regulatory or administrative authority, tribunal or other instrumentality thereof, or any self-regulatory organization.

“Intercompany Claim” means any Claim on account of the Intercompany Note.

“Intercompany Note” means that certain Loyalty Program Intercompany Note originally dated as of September 17, 2020, by and among Spirit Airlines, Inc., as Payor, and Spirit IP Cayman Ltd. and Spirit Loyalty Cayman Ltd., each as Payee, as amended by that certain Amended and Restated Loyalty Program Intercompany Note, dated as of November 17, 2022, as further amended, restated, amended and restated, supplemented or otherwise modified from time to time.

“Joinder” means a joinder to this Agreement substantially in the form attached to this Agreement as Exhibit I.

“Joint Administration Motion” means the motion seeking joint administration of the Chapter 11 Cases of the Company Parties.

“Law” means any federal, state, local, or foreign law (including common law), statute, code, ordinance, rule, regulation, order, ruling, or judgment, in each case, that is validly adopted, promulgated, issued, or entered by a Governmental Authority of competent jurisdiction (including the Bankruptcy Court).

“Loaned Claims” has the meaning set forth in Section 8(a).

“Milestones” means the milestones set forth in Section 4, as any such milestone may be extended or waived in writing (including via email in accordance with Section 12.17) in accordance with the terms of Section 4.

“New Common Equity” means the equity interests in the Reorganized Company.

“New Organizational Documents” means, on or after the Closing Date, the organizational and governance documents for the Reorganized Company Parties, including, without limitation, certificates of incorporation (including any certificate of designations), certificates of formation or certificates of limited partnership (or equivalent organizational documents), certificates of designation, bylaws, limited liability company agreements, shareholders’ agreements, and limited partnership agreements (or equivalent governing documents), as applicable, in each case, consistent with the terms and conditions set forth in this Agreement, including the Governance Term Sheet.

8

"Offshore Documents" means:

(i) the Amended and Restated Declaration of Trust in respect of the special share in Spirit Loyalty Cayman Ltd. to be made by Walkers Fiduciary Limited as trustee;

(ii) the Amended and Restated Declaration of Trust in respect of the special share in Spirit Finance Cayman 2 Ltd. to be made by Walkers Fiduciary Limited as trustee;

(iii) the Amended and Restated Declaration of Trust in respect of the special share in Spirit Finance Cayman 1 Ltd. to be made by Walkers Fiduciary Limited as trustee;

(iv) the Amended and Restated Declaration of Trust in respect of the special share in Spirit IP Cayman Ltd. to be made by Walkers Fiduciary Limited as trustee;

(v) the Amended and Restated Administration Agreement in respect of Spirit Loyalty Cayman Ltd. to be entered into among Walkers Fiduciary Limited as shareholder, Walkers Fiduciary Limited as administrator, Spirit Loyalty Cayman Ltd. and the Company as obligor;

(vi) the Amended and Restated Administration Agreement in respect of Spirit Finance Cayman 2 Ltd. to be entered into among Walkers Fiduciary Limited as shareholder, Walkers Fiduciary Limited as administrator, Spirit Finance Cayman 2 Ltd. and the Company as obligor;

(vii) the Amended and Restated Administration Agreement in respect of Spirit Finance Cayman 1 Ltd. to be entered into among Walkers Fiduciary Limited as shareholder, Walkers Fiduciary Limited as administrator, Spirit Finance Cayman 1 Ltd. and the Company as obligor;

(viii) the Amended and Restated Administration Agreement in respect of Spirit IP Cayman Ltd. to be entered into among Walkers Fiduciary Limited as shareholder, Walkers Fiduciary Limited as administrator, Spirit IP Cayman Ltd. and the Company as obligor;

(ix) the Amended and Restated Deed of Undertaking in respect of Spirit Loyalty Cayman Ltd. to be entered into among Spirit Loyalty Cayman Ltd., Spirit Finance Cayman 2 Ltd. as shareholder, Walkers Fiduciary Limited as special shareholder and Wilmington Trust, National Association as collateral agent;

(x) the Amended and Restated Deed of Undertaking in respect of Spirit Finance Cayman 2 Ltd. to be entered into among Spirit Finance Cayman 2 Ltd., Spirit Finance Cayman 1 Ltd. as shareholder, Walkers Fiduciary Limited as special shareholder and Wilmington Trust, National Association as collateral agent;

(xi) the Amended and Restated Deed of Undertaking in respect of Spirit Finance Cayman 1 Ltd. to be entered into among Spirit Finance Cayman 1 Ltd., the Company as shareholder, Walkers Fiduciary Limited as special shareholder and Wilmington Trust, National Association as collateral agent;

(xii) the Amended and Restated Deed of Undertaking in respect of Spirit IP Cayman Ltd. to be entered into among Spirit IP Cayman Ltd., Spirit Finance Cayman 2 Ltd. as shareholder,

9

Walkers Fiduciary Limited as special shareholder and Wilmington Trust, National Association as collateral agent;

(xiii) the shareholder resolutions of Spirit Loyalty Cayman Ltd., together with the second amended and restated memorandum and articles of association of Spirit Loyalty Cayman Ltd. annexed thereto;

(xiv) the shareholder resolutions of Spirit Finance Cayman 2 Ltd., together with the second amended and restated memorandum and articles of association of Spirit Finance Cayman 2 Ltd. annexed thereto;

(xv) the shareholder resolutions of Spirit Finance Cayman 1 Ltd., together with the second amended and restated memorandum and articles of association of Spirit Finance Cayman 1 Ltd. annexed thereto;

(xvi) the shareholder resolutions of Spirit IP Cayman Ltd., together with the second amended and restated memorandum and articles of association of Spirit IP Cayman Ltd. annexed thereto;

(xvii) the consent in respect of Spirit Loyalty Cayman Ltd. to be granted by Wilmington Trust, National Association as collateral agent and controlling beneficiary;

(xviii) the consent in respect of Spirit Finance Cayman 2 Ltd. to be granted by Wilmington Trust, National Association as collateral agent and controlling beneficiary;

(xix) the consent in respect of Spirit Finance Cayman 1 Ltd. to be granted by Wilmington Trust, National Association as collateral agent and controlling beneficiary; and

(xx) the consent in respect of Spirit IP Cayman Ltd. to be granted by Wilmington Trust, National Association as collateral agent and controlling beneficiary.

“Parties” has the meaning set forth in the preamble to this Agreement.

“Permitted Transferee” means each Transferee of any Company Claim/Interest that meets the requirements of Section 7.02.

“Person” means any natural person, corporation, limited liability company, professional association, limited partnership, general partnership, joint stock company, joint venture, association, company, trust, bank, trust company, land trust, business trust or other organization, whether or not a legal entity, and any Governmental Authority.

“Petition Date” means the date on which the Chapter 11 Cases are commenced.

“Plan Effective Date” means the date upon which all conditions precedent to the effectiveness of the Plan have been satisfied or are waived in accordance with the terms of this Agreement and the Plan, and on which the Restructuring Transactions become effective or are consummated.

10

“Plan Supplement” means, the compilation of certain documents and forms of documents, schedules, and exhibits to the Plan that will be filed by the Debtors with the Bankruptcy Court prior to the hearing held by the Bankruptcy Court to consider confirmation of the Plan, each of which shall be consistent with this Agreement.

“Proposed Amendments” has the meaning set forth in Section 4(c).

“Qualified Marketmaker” means an entity that (a) holds itself out to the market as standing ready in the ordinary course of business to purchase from customers and sell to customers Company Claims/Interests (or enter with customers into long and short positions in Company Claims/Interests), in its capacity as a dealer or market maker in Company Claims/Interests and (b) is in fact regularly in the business of making a market in claims against issuers or borrowers (including debt securities or other debt).

“Registration Rights Agreement” has the meaning set forth in the Governance Term Sheet.

“Related Fund” means, with respect to any Person, any fund, account, or investment vehicle that is controlled or managed by (i) such Person, (ii) an Affiliate of such Person, or (iii) the same investment manager, advisor or subadvisor as such Person or an Affiliate of such investment manager, advisor or subadvisor.

“Reorganized Company Parties” means, the Company Parties, as reorganized pursuant to the Plan, or any successor thereto or assignee thereof, by merger, consolidation, reorganization, or otherwise, in the form of a corporation, limited liability company, partnership, or other form, as the case may be, immediately after the Closing Date.

“Required Backstop Commitment Parties” shall have the meaning as provided in the Backstop Commitment Agreement.

“Required Consenting Convertible Noteholders” means, as of the relevant date, those holders of Convertible Notes Claims that are party to this Agreement holding greater than 50% of the aggregate outstanding principal amount of the Convertible Notes Claims that are held by all such holders in the aggregate.

“Required Consenting Senior Secured Noteholders” means, as of the relevant date, those holders of Senior Secured Notes Claims that are party to this Agreement holding greater than 50% of the aggregate outstanding principal amount of the Senior Secured Notes Claims that are held by all such holders in the aggregate.

“Required Consenting Stakeholders” means, collectively, the Required Consenting Senior Secured Noteholders and the Required Consenting Convertible Noteholders.

“Restructuring Transactions” has the meaning set forth in the recitals to this Agreement.

“Rules” means Rule 501(a)(1), (2), (3), (7), (8), (9), (12), and (13) under the Securities Act.

11

“Securities Act” means the Securities Act of 1933, as amended.

“Senior Secured Notes” means the 8.00% Senior Secured Notes due 2025 issued by Spirit IP Cayman Ltd. and Spirit Loyalty Cayman Ltd. under the Senior Secured Notes Indenture.

“Senior Secured Notes Claims” means any Claim on account of the Senior Secured Notes.

“Senior Secured Notes Indenture” means that certain Indenture originally dated as of September 17, 2020, by and among Spirit IP Cayman Ltd. and Spirit Loyalty Cayman Ltd., each as co-issuers, the Company, as parent guarantor, the other guarantors from time to time party thereto and Wilmington Trust, National Association, as trustee and collateral custodian, as amended by that certain First Supplemental Indenture, dated as of November 17, 2022, as further amended, restated, amended and restated, supplemented or otherwise modified from time to time.

“Senior Secured Noteholder” means a “Holder” as defined in the Senior Secured Notes Indenture.

“Senior Secured Notes Trustee” means Wilmington Trust, National Association, in its capacity as trustee under the Senior Secured Notes Indenture, and any successor trustee appointed pursuant to the terms thereof.

“Solicitation” means the solicitation of votes with respect to the Plan.

“Solicitation Materials” means the Disclosure Statement, ballots, documents, forms, and all other materials provided in connection with the solicitation of the Plan pursuant to sections 1125 and 1126 of the Bankruptcy Code, which shall be consistent with this Agreement.

“Solicitation Procedures Motion” means the motion seeking final approval of the Disclosure Statement and approval of the Solicitation Procedures Order.

“Solicitation Procedures Order” means the order of the Bankruptcy Court approving the Solicitation procedures, the Equity Rights Offering procedures, subscription forms and other materials to be distributed in connection with Equity Rights Offering, granting approval of the adequacy of the Disclosure Statement, and scheduling a hearing for final approval of the Plan.

“Termination Date” means, with respect to a Party to this Agreement, the date on which termination of this Agreement as to such Party is effective in accordance with Section 10.

“Transaction Documentation” means all documents or agreements memorializing the Restructuring Transactions.

“Transfer” means to, directly or indirectly, sell, assign, grant, transfer, convey, pledge, hypothecate, or otherwise dispose of, but in each case only upon the date of settlement of the Transfer and excluding any pledge or assignment of security interest to secure obligations of a party to a Federal Reserve Bank or any other central bank.

“Transferee” means the recipient of a Transfer.

12

“Trustee” means, as applicable, the 2025 Convertible Notes Trustee, 2026 Convertible Notes Trustee or Senior Secured Notes Trustee.

1.02. Interpretation. For purposes of this Agreement:

(a) in the appropriate context, each term, whether stated in the singular or the plural, shall include both the singular and the plural, and pronouns stated in the masculine, feminine, or neutral gender shall include the masculine, feminine, and the neutral gender;

(b) capitalized terms defined only in the plural or singular form shall nonetheless have their defined meanings when used in the opposite form. Where a word or phrase is defined herein, each of its other grammatical forms shall have a corresponding meaning;

(c) unless otherwise specified, any reference in this Agreement to a contract, lease, instrument, release, indenture, or other agreement or document (other than a Definitive Document) being in a particular form or on particular terms and conditions means that such document shall be substantially in such form or substantially on such terms and conditions, provided that references in this Agreement to any Definitive Document shall mean such Definitive Document in form and substance as required pursuant to Section 3.02;

(d) unless otherwise specified, any reference in this Agreement to an existing document, schedule, or exhibit shall mean such document, schedule, or exhibit, as it may have been or may be amended, restated, supplemented, or otherwise modified from time to time; notwithstanding the foregoing, any capitalized terms in this Agreement that are defined with reference to another agreement, are defined with reference to such other agreement as of the date of this Agreement, without giving effect to any termination of such other agreement or amendments to such capitalized terms in any such other agreement following the date of this Agreement;

(e) unless otherwise specified, all references in this Agreement to “Sections” are references to Sections of this Agreement;”

(f) the words “herein,” “hereof,” and “hereto” refer to this Agreement in its entirety rather than to any particular portion of this Agreement;

(g) captions and headings to Sections are inserted for convenience of reference only and are not intended to be a part of or to affect the interpretation of this Agreement;

(h) references to “shareholders,” “directors,” and/or “officers” shall also include “members” and/or “managers,” as applicable, as such terms are defined under the applicable limited liability company Laws;

(i) the use of “include” or “including” is without limitation, whether stated or not; and

(j) the word “or” shall not be exclusive.

13

Section 2. Effectiveness of this Agreement. This Agreement shall become effective and binding upon each of the Parties on the date and time by which all of the following conditions have been satisfied or waived in accordance with this Agreement:

(a) the Company shall have executed and delivered counterpart signature pages of this Agreement (which signature pages may be delivered by counsel and in electronic form) to counsel to the Consenting Stakeholders;

(b) the following shall have executed and delivered counterpart signature pages of this Agreement (which signature pages may be delivered by counsel and in electronic form) to the Company:

(i) holders of more than 66 2/3% of the aggregate outstanding principal amount of the Senior Secured Notes Claims; and

(ii) holders of more than 66 2/3% of the aggregate outstanding principal amount of the Convertible Notes Claims.

(c) the Company shall have paid in full the Consenting Stakeholder Fees and Expenses for which an invoice has been received by the Company on or before two (2) Business Days prior to the Agreement Effective Date.

With respect to any Company Party that becomes a party to this Agreement after the Agreement Effective Date, this Agreement shall become effective as to and fully binding upon such Company Party at the time it executes and delivers a Company Acknowledgment in accordance with the terms hereof, and such Company Party, as of such time and without further action, shall be deemed to have made to the other Parties all representations and warranties in Section 9 of the Agreement. Prior to the date that the Company Parties set forth on Exhibit F become a party to this Agreement, references to “Company Parties” in this Agreement shall be deemed to be a reference to the Company.

With respect to any Consenting Stakeholder that becomes a party to this Agreement pursuant to Section 7 hereof, this Agreement shall become effective as to such Consenting Stakeholder at the time it executes and delivers a Joinder in accordance with the terms hereof.

Section 3. Definitive Documents.

3.01. The definitive documents shall consist of the following (the “Definitive Documents”):

(i) the Plan;

(ii) the Confirmation Order;

(iii) the Disclosure Statement and all other Solicitation Materials; (iv) the Solicitation Procedures Order; 14 (v)

the First Day Pleadings and all orders sought pursuant thereto; (vi)

the Plan Supplement; (vii)

the DIP Financing Documents; (viii) the Exit Financing Facilities Documents; (ix)

the Equity Rights Offering Documents; (x)

the Registration Rights Agreement; (xi)

the New Organizational Documents; (xii) the Offshore Documents; (xiii)

the Adequate Protection Order; (xiv)

the documents relating to the Consent Solicitation, including the supplemental indentures, collateral agreement amendments, consent

solicitation statements and other documentation necessary to consummate the Consent Solicitation; (xv)

such other motions, orders, agreements, and documentation necessary or desirable to consummate and document the transactions contemplated

by this Agreement, including any plan prepared pursuant to Section 382 of the Internal Revenue Code; (xvi)

to the extent not included above, all financing documents needed to effectuate the Restructuring; and (xvii)

all other material customary filings, deeds, agreements, notifications, certificates or other documents delivered in connection

with transactions of this type (including, without limitation, any and all other documents implementing, achieving, contemplated by or

relating to the Restructuring Transactions). 3.02.

The Definitive Documents that are not executed or in a form attached to this Agreement as of the Agreement Effective Date remain

subject to good faith negotiation, agreement and completion. Upon completion, the Definitive Documents and every other document, deed,

agreement, filing, notification, letter, or instrument related to the Restructuring Transactions shall contain terms, conditions, representations,

warranties, and covenants consistent with the terms of this Agreement, as they may be modified, amended, or supplemented in accordance

with this Agreement. The Definitive Documents that are not executed or in a form attached to this Agreement as of the Effective Date,

and any amendments, modifications, or supplements to any Definitive Documents, shall be consistent with this Agreement and otherwise shall

be in form and substance reasonably acceptable to the Company, the Required Consenting Senior Secured Noteholders, and the Required Consenting

Convertible Noteholders. Notwithstanding anything herein

to the contrary, (i) the DIP Financing Documents shall further be required to be reasonably acceptable in form and substance to the Required

DIP Lenders (as 15 defined in the DIP Financing Documents); (ii) the Backstop Commitment

Agreement shall further be required to be reasonably acceptable in form and substance to the Required Backstop Commitment Parties and

(iii) the Adequate Protection Order shall be in form and substance acceptable to the Required Consenting Senior Secured Noteholders only

(provided that any modifications that increase the amount of any payments on account of the adequate protection provided for the benefit

of the Senior Secured Noteholders shall require the reasonable consent of the Required Consenting Convertible Noteholders). Section

4.

Milestones. The following milestones (collectively, the “Milestones”)

shall apply to this Agreement (unless extended or waived in writing (including via email in accordance with Section 12.17)

with the consent (not to be unreasonably withheld) of the Company Parties, the Required Consenting Senior Secured Noteholders, and, with

respect to Milestones other than those set forth in clauses (d) and (g)(ii), the Required Consenting Convertible Noteholders): (a)

no later than November 18, 2024, the Company shall file a voluntary petition for relief pursuant to chapter 11 of the Bankruptcy

Code in the Bankruptcy Court (the date of filing of such voluntary petition, the “Petition Date”); (b)

no later than November 18, 2024 the Company shall file with the Bankruptcy Court a motion seeking entry of the Adequate Protection

Order and DIP Order; (c)

no later than November 19, 2024, the Debtors shall launch a consent solicitation (the “Consent Solicitation”

and such date, the “Consent Solicitation Date”) seeking consent to certain amendments to the Senior Secured

Notes Indenture and as set out in the Offshore Documents (collectively, the “Proposed Amendments”) in order

to facilitate the commencement of Chapter 11 Cases for the Company Parties identified on Exhibit F hereto; (d)

no later than November 20, 2024, the Bankruptcy Court shall have entered the Adequate Protection Order; (e)

no later than November 27, 2024, the Company shall file the Backstop Moton with the Bankruptcy Court; (f)

no later than November 29, 2024, the Company Parties identified on Exhibit F shall have (i) executed and delivered the Company

Acknowledgment to counsel to the Consenting Stakeholders, (ii) filed voluntary petitions for relief pursuant to chapter 11 of the Bankruptcy

Code in the Bankruptcy Court and (iii) filed a Joint Administration Motion; (g)

no later than December 2, 2024, the Bankruptcy Court shall have entered (i) an order granting the Joint Administration Motion,

(ii) an order deeming the Adequate Protection Order applicable and binding with respect to all Company Parties, and (iii) an order deeming

all other applicable orders applicable and binding with respect to all Company Parties; (h)

no later than December 2, 2024, the Company shall file with the Bankruptcy Court the Plan, the Disclosure Statement, the Solicitation

Procedures Motion; 16 (i)

no later than December 23, 2024, the Bankruptcy Court shall have entered (i) the final DIP Order and (ii) the Backstop Order; (j)

no later than January 13, 2025, the Bankruptcy Court shall have entered the Solicitation Procedures Order; (k)

no later than February 17, 2025, the Bankruptcy Court shall have entered the Confirmation Order; (l)

the Plan shall have become effective in accordance with its terms no later than March 4, 2025; provided, however, such date

may be automatically extended by up to forty-five (45) days to the extent regulatory approvals are the only outstanding conditions to

effectiveness of the Plan. 5.01.

Affirmative Commitments. During the Agreement Effective Period, each Consenting Stakeholder severally, and not jointly and

severally, agrees in respect of all of its Company Claims/Interests (subject to Section 5.04) to: (a)

support and consummate the Plan in accordance with the terms and conditions set forth in this Agreement, and timely take all actions

contemplated thereby and as necessary to support and achieve consummation of the Restructuring Transactions, including with respect to

providing information as may be reasonably requested and necessary to obtain any necessary regulatory approvals to consummate the Restructuring

Transactions; (b)

act in good faith and support the Restructuring Transactions, subject to finalization of the Definitive Documents in accordance

with the terms and conditions set forth in this Agreement, including to vote and exercise any powers or rights available to it (including

in any creditors’ meeting or in any process requiring voting or approval to which such Consenting Stakeholder is legally entitled

to participate), in each case in favor of any matter requiring approval to the extent necessary to implement the Restructuring Transactions

and within the timeframe outlined herein and in the Definitive Documents and not change or withdraw (or cause to be changed or withdrawn)

any such vote; (c)

with respect to the Consenting Senior Secured Noteholders, provide consent in accordance with the Consent Solicitation in order

to effectuate the Proposed Amendments; (d)

use commercially reasonable efforts to cooperate with and assist the Company, as may be reasonably requested by the Company in

obtaining additional support for the Restructuring Transactions from the Company Party’s other stakeholders; (e)

use commercially reasonable efforts to give any notice, order, instruction, or direction to any applicable agent reasonably necessary

to give effect to the Restructuring Transactions (including, for the avoidance of doubt, any notice, order, instruction, or direction

required in connection with the execution and delivery of the Definitive Documents), on the terms and subject to the conditions of this

Agreement; provided that no Consenting Stakeholder shall be 17 required to provide an indemnity

or incur any potential expense or liability in connection therewith, other than expenses that the Company parties have agreed in writing

to reimburse or indemnify on terms satisfactory to such Consenting Stakeholder; (f)

negotiate in good faith and use commercially reasonable efforts to finalize, execute and deliver the Definitive Documents to which

it is required to be a party or to which it has a consent right pursuant to Section 3.02; (g)

consider in good faith any appropriate additional or alternative provisions or agreement necessary to address any legal, financial,

or structural impediment that may arise that would prevent, hinder, impede, delay or are necessary to effectuate the consummation of the

Restructuring Transactions in accordance with this Agreement. 5.02.

Negative Commitments. During the Agreement Effective Period, except as otherwise provided in Section 5.04, each Consenting

Stakeholder, as applicable, severally, and not jointly and severally, agrees in respect of all of its Company Claims/Interests (subject

to Section 5.04) that it shall not, directly or indirectly, and shall not direct any Trustee or other Entity to: (a)

take any action that is inconsistent with this Agreement or the Restructuring Transactions or that would reasonably be expected

to interfere with, delay, or impede the solicitation and approval of the Disclosure Statement or the confirmation and consummation of

the Plan and the Restructuring Transactions; (b)

directly or indirectly, through any Person, seek, solicit, propose, support, engage in negotiations in connection with or participate

in the formulation, preparation, filing, or prosecution of any Alternative Restructuring Proposal; (c)

file any motion, objection, pleading, or other document with the Bankruptcy Court or any other court (including any modifications

or amendments thereof) that, in whole or in part, is inconsistent with this Agreement, the Plan or the Restructuring Transactions; (d)

take (directly or indirectly), or direct the applicable Trustee to take, any action to enforce or exercise any right or remedy

for the enforcement, collection, or recovery of any of the Company Claims/Interests, including rights or remedies arising from or asserting

or bringing any claims under or with respect to the Senior Secured Notes Indenture and any Transaction Document (as defined in the Senior

Secured Notes Indenture), the 2025 Convertible Notes Indenture or the 2026 Convertible Notes Indenture, as applicable, to the extent inconsistent

with this Agreement; (e)

enter into any cooperation agreement or similar agreement or arrangement with any other holder of Company Claims/Interests that

both (i) relates to the holding, voting or disposition of any instrument, security or notes in connection with the Company Parties or

the Reorganized Company Parties, or any entitlement to distributions, sharing of recoveries, opportunities to participate in future transactions

in relation to such instrument, security or notes, and (ii) by its terms remains in effect after the Closing Date; (f)

initiate, or have initiated on its behalf, any litigation or proceeding of any kind (including a derivative action), including,

without limitation, with respect to this Agreement, the 18 Restructuring Transactions,

or the Chapter 11 Cases, against the Company or any of its direct or indirect subsidiaries or the other Parties (other than to enforce

this Agreement or any Definitive Document or as otherwise consistent with this Agreement); (g)

object to, delay, impede, or take any other action to interfere with the Company’s or its direct or indirect subsidiaries’

ownership and possession of its or their assets, wherever located, or interfere with the automatic stay arising under section 362 of the

Bankruptcy Code in the Chapter 11 Cases. 5.03.

Commitments with Respect to Chapter 11 Cases. Subject to Section 5.04, each Consenting Stakeholder agrees, severally,

and not jointly and severally, during the Agreement Effective Period, that it shall: (a)

timely vote each of its Company Claims/Interests it is entitled to vote to accept the Plan by timely delivering its duly executed

and completed ballot(s) accepting the Plan following the date of the Solicitation and its actual receipt of the Solicitation Materials

and the ballot; (b)

(i) to the extent it is permitted to elect whether to opt out of the releases set forth in the Plan, elect not to opt out of such

releases and (ii) to the extent it is permitted to elect whether to opt in to the releases set forth in the Plan, elect to opt in to such

releases, in each case by delivering its duly executed and completed ballot(s) indicating such election prior to the deadline for such

delivery; and (c)

not change, withdraw, amend, or revoke (or cause to be changed, withdrawn, amended, or revoked) any vote or election referred to

in clause (a) or (b) above; provided, however, that nothing in this Agreement shall prevent any Consenting Stakeholder from withholding,

amending, or revoking (or causing the same) its timely consent or vote with respect to the Plan if this Agreement has been terminated

in accordance with its terms with respect to such Consenting Stakeholder. 5.04.