We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Nuveen Quality Municipal Income Fund | NYSE:NAD | NYSE | Common Stock |

| Price Change | % Change | Share Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|

| 0.03 | 0.26% | 11.75 | 11.775 | 11.71 | 11.73 | 1,042,690 | 01:00:00 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-09297 |

Nuveen Quality Municipal Income Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Mark L. Winget

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | (312) 917-7700 |

| Date of fiscal year end: | October 31 |

| Date of reporting period: | October 31, 2023 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

|

|

Closed-End Funds

|

October 31, 2023

|

Nuveen Municipal Closed-End Funds

|

|

||||

| Nuveen Quality Municipal Income Fund |

NAD | |||

|

|

||||

| Nuveen AMT-Free Quality Municipal Income Fund |

NEA | |||

|

|

||||

Annual

Report

of Contents

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 7 | ||||

| 8 | ||||

| 10 | ||||

| 14 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 125 | ||||

| 126 | ||||

| 127 | ||||

| 128 | ||||

| 130 | ||||

| 133 | ||||

| 146 | ||||

| 167 | ||||

| 168 | ||||

| 169 | ||||

| 171 | ||||

| 178 | ||||

2

to Shareholders

|

Dear Shareholders,

Financial markets spent the past year focused on the direction of inflation and whether policy makers would be able to deliver a soft landing in their economies. After more than a year and a half of interest rate increases by the U.S. Federal Reserve (Fed) and other central banks, financial conditions have tightened and inflation rates have cooled considerably. The Fed increased the target fed funds rate from near zero in March 2022 to a range of 5.25% to 5.50% as of November 2023, with pauses in June 2023, September 2023 and November 2023. But current inflation rates remain above central banks’ targets, and the trajectory from here is difficult to predict given that monetary policy acts on the economy with long and variable lags.

Surprisingly, economies were relatively resilient for much of 2023. By year-end, the “most predicted recession” had yet to materialize in the U.S., while U.K. and European economic growth was just beginning to show signs of stagnation or decline. U.S. gross domestic product rose 5.2% in the third quarter of 2023, 2.1% in the second quarter of 2023 and 2.0% in the first quarter of 2023, after growing 2.1% in 2022 overall compared to 2021. Much of the growth was driven by a relatively strong jobs market, which kept consumer sentiment and spending elevated despite long-term interest rates nearing multi-year highs, a series of U.S. regional bank failures and shocks from flaring geopolitical tensions.

While central banks are likely nearing the end of this interest rate hiking cycle, there are still upside risks to inflation and downside risks to the economy. Some labor market and consumer indicators are softening. Government funding and deficits remain a concern, especially as the U.S. election year gets underway. The markets will continue to try to anticipate monetary policy shifts as the Fed evaluates incoming data and adjusts its rate setting activity on a meeting-by-meeting basis. Geopolitical risks – from relations with China, to wars in Europe and the Middle East – also expand the range of outcomes from economies and markets around the world. All these uncertainties, and others, will remain sources of short-term market volatility. In this environment, Nuveen remains committed to filtering the market noise for investable opportunities that ultimately serve long-term investment objectives. Maintaining a long-term perspective is also important for investors, and we encourage you to review your time horizon, risk tolerance and investment goals with your financial professional.

On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Terence J. Toth

Chair of the Board

December 22, 2023 |

3

Portfolio Manager Updates

Effective October 13, 2023, Michael Hamilton and Stephen Candido, CFA, were added as portfolio managers of the Funds. Christopher Drahn will also continue to serve as a portfolio manager of the Funds until his retirement on April 1, 2024. There were no other changes to the portfolio management of the Funds during the reporting period.

4

Comments

Nuveen Quality Municipal Income Fund (NAD)

Nuveen AMT-Free Quality Municipal Income Fund (NEA)

These Funds feature portfolio management by Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen Fund Advisors, LLC, the Funds’ investment adviser. Portfolio managers Christopher L. Drahn, CFA, Stephen J. Candido, CFA and Michael Hamilton manage the Nuveen Quality Municipal Income Fund (NAD) and the Nuveen AMT-Free Quality Municipal Income Fund (NEA).

Effective October 13, 2023, Stephen Candido and Michael Hamilton were added as portfolio managers of the Nuveen Quality Municipal Income Fund (NAD) and Nuveen AMT-Free Quality Municipal Income Fund (NEA). Christopher Drahn will be retiring as a portfolio manager of the Funds on April 1, 2024.

Here the portfolio managers discuss U.S. economic and municipal market conditions, key investment strategies and the Funds’ performance for the twelve-month reporting period ended October 31, 2023. For more information on the Funds’ investment objectives and policies, please refer to the Shareholder Update section at the end of the report.

What factors affected the U.S. economy and market conditions during the twelve-month annual reporting period ended October 31, 2023?

The U.S. economy performed better than expected despite persistent inflationary pressure and rising interest rates during the twelve-month period ended October 31, 2023. Gross domestic product accelerated sharply in third quarter of 2023 to an annualized rate of 5.2%, according to the U.S. Bureau of Economic Analysis second estimate, up from 2.1% in the second quarter of 2023. By comparison, GDP grew 2.1% in 2022 overall. Early in the reporting period, inflation had risen sharply because of supply chain disruptions and high food and energy prices, the Russia-Ukraine war and China’s zero-COVID restrictions (lifted in December 2022). Since then, price pressures have eased given normalization in supply chains, falling energy prices and aggressive measures by the U.S. Federal Reserve (Fed) and other global central banks to tighten financial conditions and slow demand in their economies. Nevertheless, during the reporting period inflation levels remained much higher than central banks’ target levels.

The Fed raised its target fed funds rate six times during the reporting period, bringing it to a range of 5.25% to 5.50% as of July 2023 and voting to hold it at that level at its next two meetings held near the end of the reporting period. For much of the reporting period, the Fed’s activity led to significant volatility in bond and stock markets, given the uncertainty of how rising interest rates would affect the economy. One of the most highly visible impacts occurred in the U.S. regional banking sector in March 2023, when Silicon Valley Bank, Signature Bank, First Republic Bank and Silvergate Bank failed. In the same month, Swiss bank UBS agreed to buy Credit Suisse, which was considered vulnerable in the current environment. The Fed’s monetary tightening policy also contributed to an increase in the U.S. dollar’s value relative to major world currencies, which acts as a headwind to the profits of international companies and U.S. domestic companies with overseas earnings.

During the reporting period, elevated inflation and higher borrowing costs weighed on some segments of the economy, including the real estate market. Consumer spending, however, has remained more resilient than expected, in part because of a still-strong labor market, another key gauge of the economy’s health. As of October 2023, the unemployment rate was 3.9%, rising from its pre-pandemic low, with monthly job growth continuing to moderate. The strong labor market and wage gains helped the U.S. economy during the reporting period, even as the Fed sought to soften job growth to help curb inflation pressures.

During the reporting period, investors also continued to monitor government funding and deficits. The U.S. government avoided a default scenario after approving an increase to the debt ceiling limit in June 2023. At the same time, the potential for a government shutdown loomed but was ultimately avoided with funding resolutions passed in September 2023 and, subsequent to the close of the reporting period, November 2023. Notably, in August 2023, ratings agency Fitch downgraded U.S. debt from AAA to AA+ based on concerns about the U.S.’s growing fiscal debt and reduced confidence in fiscal management.

The broad municipal bond market was impacted by interest rate volatility and economic uncertainty during the reporting period. Municipal yields rose across the maturity spectrum, but the move was uneven. The greatest increase in yields was at the shorter end of the curve as markets priced in a more aggressive pace of monetary tightening to combat persistently high inflation. Although municipal bonds continued to exhibit relatively strong credit fundamentals, there were periods of spread widening during the reporting period as the market sell-off continued.

5

Portfolio Managers’ Comments (continued)

What key strategies were used to manage the Funds during the twelve-month reporting period ended October 31, 2023?

Each Fund’s investment objective is to provide current income exempt from regular federal income tax, and in the case of NEA the alternative minimum tax (“AMT”) applicable to individuals. Both Funds invest primarily in a portfolio of municipal obligations issued by state and local government authorities or certain U.S. territories. The Funds use leverage. Leverage is discussed in more detail in the Fund Leverage section of this report.

During the reporting period, the Funds’ trading activity remained focused on pursuing the Funds’ investment objectives. The rising yield environment during this reporting period was favorable for the Funds to reset embedded yields higher in their portfolios, primarily by executing on tax-loss swap opportunities. This strategy involves selling depreciated bonds with lower embedded yields to reinvest in similarly structured, higher income-producing bonds to support the Funds’ income earnings and capture tax efficiencies.

As of October 31, 2023, the Funds continued to use inverse floating rate securities. The Funds employ inverse floating rate securities, which are the residual interest in a tender option bond (TOB) trust, and are sometimes referred to as “inverse floaters,” for a variety of reasons, including duration management and income and total return enhancement.

How did the Funds perform during the twelve-month reporting period ended October 31, 2023?

For the twelve-month reporting period ended October 31, 2023, the Funds underperformed the NAD and NEA Blended

Benchmarks. For the purposes of this Performance Commentary, references to relative performance are in comparison to the NAD and NEA Blended Benchmarks, which are both a blended return consisting of: (1) 80% S&P Municipal Bond Investment Grade Index and (2) 20% S&P Municipal Bond High Yield Index.

The primary driver of the Funds’ underperformance was their use of leverage, which detracted significantly. The Funds use leverage through their issuance of preferred shares and investments in inverse floating rate securities, which represent leveraged investments in underlying bonds. Leverage is discussed in more detail in the Fund Leverage section of this report.

Other key factors driving NAD’s underperformance included an underweight in industrial development revenue (IDR) bonds and an underweight in non-rated bonds, as both segments performed well in the reporting period.

Other key factors driving NEA’s underperformance included a lack of exposure to alternative minimum tax (AMT) bonds, which performed well but are not permitted in the Fund, and an underweight to the IDR sector. An underweight to non-rated bonds, which in general also performed well, also detracted from relative performance.

Partially offsetting the Funds’ underperformance were positive contributions from their overweights to longer-duration bonds and overweights to A and BBB rated bonds.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard

& Poor’s Group (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings, while BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Bond insurance guarantees only the payment of principal and interest on the bond when due, and not the value of the bonds themselves, which will fluctuate with the bond market and the financial success of the issuer and the insurer. Insurance relates specifically to the bonds in the portfolio and not to the share prices of a Fund. No representation is made as to the insurers’ ability to meet their commitments.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

6

IMPACT OF THE FUNDS’ LEVERAGE STRATEGY ON PERFORMANCE

One important factor impacting the returns of the Funds’ common shares relative to their comparative benchmarks was the Funds’ use of leverage through their issuance of preferred shares and/or investments in inverse floating rate securities, which represent leveraged investments in underlying bonds. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income. The opportunity arises when short-term rates that a Fund pays on its leveraging instruments are lower than the interest the Fund earns on its portfolio of long-term bonds that it has bought with the proceeds of that leverage.

However, use of leverage can expose Fund common shares to additional price volatility. When a Fund uses leverage, the Fund’s common shares will experience a greater increase in their net asset value if the securities acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the securities acquired through leverage decline in value. All this will make the shares’ total return performance more variable over time.

In addition, common share income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. In recent quarters, fund leverage expenses have generally tracked the overall movement of short-term interest rates. While fund leverage expenses are higher than their prior year lows, leverage nevertheless continues to provide the opportunity for incremental common share income, particularly over longer-term periods.

The Funds’ use of leverage detracted from relative performance over this reporting period.

As of October 31, 2023, the Funds’ percentages of leverage are as shown in the accompanying table.

| NAD | NEA | |||||||

|

|

||||||||

| Effective Leverage* |

42.58% | 42.58% | ||||||

| Regulatory Leverage* |

41.47% | 41.52% | ||||||

|

|

||||||||

| * | Effective Leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Currently, the leverage effects of Tender Option Bond (TOB) inverse floater holdings are included in effective leverage values, in addition to any regulatory leverage. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

THE FUNDS’ REGULATORY LEVERAGE

As of October 31, 2023, the following Funds have issued and outstanding preferred shares as shown in the accompanying table.

| Variable Rate Preferred* | Variable Rate Remarketed Preferred** |

|||||||||||

|

|

|

|

|

|||||||||

| Fund | Shares Issued at Liquidation Preference |

Shares Issued at Liquidation Preference |

Total | |||||||||

|

|

||||||||||||

| NAD |

$1,406,500,000 | $ 504,300,000 | $1,910,800,000 | |||||||||

|

|

||||||||||||

| NEA |

$ 643,000,000 | $ 1,728,300,000 | $2,371,300,000 | |||||||||

|

|

||||||||||||

* Preferred shares of the Fund featuring a floating rate dividend based on a predetermined formula or spread to an index rate. Includes the following preferred shares AMTP, iMTP, MFP-VRM and VRDP in Special Rate Mode, where applicable. See Notes to Financial Statements for further details.

** Preferred shares of the Fund featuring floating rate dividends set by a remarketing agent via a regular remarketing. Includes the following preferred shares VRDP not in Special Rate Mode MFP-VRRM and MFP-VRDM, where applicable. See Notes to Financial Statements for further details.

Refer to Notes to Financial Statements for further details on preferred shares and each Fund’s respective transactions.

7

COMMON SHARE DISTRIBUTION INFORMATION

The following information regarding the Funds’ distributions is current as of October 31, 2023. Each Fund’s distribution levels may vary over time based on each Fund’s investment activity and portfolio investment value changes.

During the current reporting period, each Fund’s distributions to common shareholders were as shown in the accompanying table.

| Per Common Share Amounts | ||||||||

|

|

|

|||||||

| Monthly Distributions (Ex-Dividend Date) | NAD | NEA | ||||||

|

|

||||||||

| November |

$0.0465 | $0.0445 | ||||||

| December |

0.0465 | 0.0445 | ||||||

| January |

0.0395 | 0.0350 | ||||||

| February |

0.0395 | 0.0350 | ||||||

| March |

0.0395 | 0.0350 | ||||||

| April |

0.0380 | 0.0350 | ||||||

| May |

0.0380 | 0.0350 | ||||||

| June |

0.0380 | 0.0350 | ||||||

| July |

0.0380 | 0.0350 | ||||||

| August |

0.0380 | 0.0350 | ||||||

| September |

0.0380 | 0.0350 | ||||||

| October |

0.0380 | 0.0350 | ||||||

|

|

||||||||

| Total Distributions from Net Investment Income |

$0.4775 | $0.4390 | ||||||

|

|

||||||||

| Yields | NAD | NEA | ||||||

|

|

||||||||

| Market Yield1 |

4.65 | % | 4.44% | |||||

| Taxable-Equivalent Yield1 |

7.84 | % | 7.49% | |||||

|

|

||||||||

| 1 | Market Yield is based on the Fund’s current annualized monthly dividend divided by the Fund’s current market price as of the end of the reporting period. Taxable- Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a federal income tax rate of 40.8%. Your actual federal income tax rate may differ from the assumed rate. The Taxable-Equivalent Yield also takes into account the percentage of the Fund’s income generated and paid by the Fund (based on payments made during the previous calendar year) that was not exempt from federal income tax. Separately, if the comparison were instead to investments that generate qualified dividend income, which is taxable at a rate lower than an individual’s ordinary graduated tax rate, the fund’s Taxable-Equivalent Yield would be lower. |

Each Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit each Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. Distributions to common shareholders are determined on a tax basis, which may differ from amounts recorded in the accounting records. In instances where the monthly dividend exceeds the earned net investment income, the Fund would report a negative undistributed net ordinary income. Refer to the Notes to Financial Statements for additional information regarding the amounts of undistributed net ordinary income and undistributed net long-term capital gains and the character of the actual distributions paid by the Fund during the period.

All monthly dividends paid by each Fund during the current reporting period were paid from net investment income. If a portion of the Fund’s monthly distributions is sourced or comprised of elements other than net investment income, including capital gains and/ or a return of capital, shareholders will be notified of those sources. For financial reporting purposes, the per share amounts of each Fund’s distributions for the reporting period are presented in this report’s Financial Highlights. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in the Notes to Financial Statements of this report.

Updated Distribution Policy

On October 23, 2023, the Funds’ Board of Trustees (the “Board”) updated each Fund’s distribution policy. Effective for distributions payable on December 1, 2023, each Fund’s distribution policy, which may be changed by the Board, is to make regular monthly cash distributions to holders of its common shares (stated in terms of a fixed cents per common share dividend distribution rate which may be set from time to time). The Fund intends to distribute all or substantially all of its net investment income through its regular monthly distribution and to distribute realized capital gains at least annually. In addition, in any monthly period, to maintain its declared per common share distribution amount, the Fund may distribute more or less than its net investment income during the period. In the event the Fund distributes more than its net investment income during any yearly period, such distributions may also include realized gains and/or a return of capital. To the extent that a distribution includes a return of capital the NAV per share may erode. If the Fund’s distribution includes anything other than net investment income, the Fund will provide a notice to shareholders of its best estimate of the distribution sources at that the time of the distribution. These estimates may not match the final tax characterization (for the full year’s distributions) contained in shareholders’ 1099-DIV forms after the end of the year.

8

NUVEEN CLOSED-END FUND DISTRIBUTION AMOUNTS

The Nuveen Closed-End Funds’ monthly and quarterly periodic distributions to shareholders are posted on www.nuveen.com and can be found on Nuveen’s enhanced closed-end fund resource page, which is at https://www.nuveen.com/resource-center-closedend funds, along with other Nuveen closed-end fund product updates. To ensure timely access to the latest information, shareholders may use a subscribe function, which can be activated at this web page (https://www.nuveen.com/subscriptions).

COMMON SHARE REPURCHASES

The Funds’ Board of Trustees reauthorized an open-market share repurchase program, allowing each Fund to repurchase and retire an aggregate of up to approximately 10% of its outstanding common shares.

As of October 31, 2023, (and since the inception of the Funds’ repurchase programs), each Fund has cumulatively repurchased and retired its outstanding common shares as shown in the accompanying table.

| NAD | NEA | |||||||

|

|

||||||||

| Common shares cumulatively repurchased and retired |

17,900 | 120,000 | ||||||

| Common shares authorized for repurchase |

23,340,000 | 29,900,000 | ||||||

|

|

||||||||

During the current reporting period, the following Funds repurchased and retired their common shares at a weighted average price per share and a weighted average discount per share as shown in the following table.

| NEA | ||||

|

|

||||

| Common shares repurchased and retired |

45,000 | |||

| Weighted average price per common share repurchased and retired |

$ 9.88 | |||

| Weighted average discount per common share repurchased and retired |

(17.23)% | |||

|

|

||||

OTHER COMMON SHARE INFORMATION

As of October 31, 2023, the Funds’ common share prices were trading at a premium/(discount) to their common share NAVs and trading at an average premium/(discount) to NAV during the current reporting period, as follows:

| NAD | NEA | |||||||

|

|

||||||||

| Common share NAV |

$11.56 | $11.17 | ||||||

| Common share price |

$9.81 | $9.47 | ||||||

| Premium/(Discount) to NAV |

(15.14)% | (15.22)% | ||||||

| Average premium/(discount) to NAV |

(13.10)% | (13.31)% | ||||||

|

|

||||||||

9

S&P Municipal Bond Index: An index designed to measure the performance of the tax-exempt U.S. municipal bond market. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

S&P Municipal Bond Investment Grade Index: An index designed to measure the performance of tax-exempt investment grade municipal bonds. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

S&P Municipal Bond High Yield Index: An index designed to measure the performance of tax-exempt high yield municipal bonds. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

NAD Blended Benchmark: Consists of: 1) 80% S&P Municipal Bond Investment Grade Index (defined herein), and 2) 20% S&P Municipal Bond High Yield Index (defined herein). The Fund’s performance was measured against the S&P Municipal Bond Index through September 11, 2016. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

NEA Blended Benchmark: Consists of: 1) 80% S&P Municipal Bond Investment Grade Index (defined herein), and 2) 20% S&P Municipal Bond High Yield Index (defined herein). The Fund’s performance was measured against the S&P Municipal Bond Index through September 11, 2016. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

10

| NAD | Nuveen Quality Municipal Income Fund Performance Overview and Holding Summaries October 31, 2023 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Fund Performance*

| Total Returns as of | ||||||||||||||||

| October 31, 2023 | ||||||||||||||||

| Average Annual | ||||||||||||||||

| Inception Date |

1-Year | 5-Year | 10-Year | |||||||||||||

|

|

||||||||||||||||

| NAD at Common Share NAV |

5/26/99 | 1.26% | (0.15)% | 2.62% | ||||||||||||

|

|

||||||||||||||||

| NAD at Common Share Price |

5/26/99 | (3.68)% | (0.03)% | 2.54% | ||||||||||||

|

|

||||||||||||||||

| S&P Municipal Bond Index |

– | 2.36% | 1.04% | 2.18% | ||||||||||||

|

|

||||||||||||||||

| NAD Blended Benchmark |

– | 2.57% | 1.15% | 2.31% | ||||||||||||

|

|

||||||||||||||||

* For purposes of Fund performance, relative results are measured against the NAD Blended Benchmark. The Fund’s Blended Benchmark consists of: 1) 80% S&P Municipal Bond Investment Grade Index and 2) 20% S&P Municipal Bond High Yield Index. The Fund’s performance was measured against the S&P Municipal Bond Index through September 11, 2016.

Performance data shown represents past performance and does not predict or guarantee future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

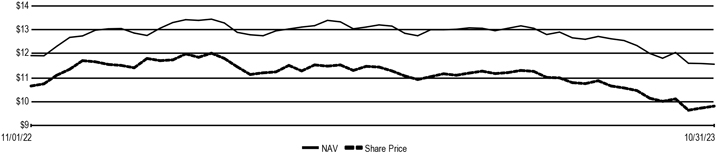

Daily Common Share NAV and Share Price

11

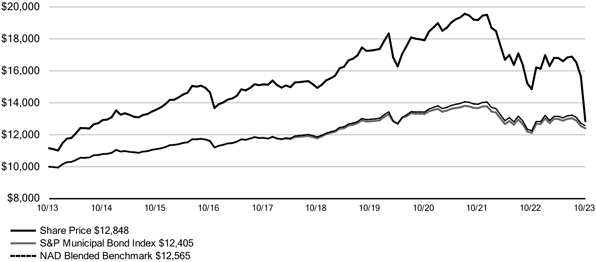

Growth of an Assumed $10,000

Investment as of October 31,

2023 - Class A

The graphs do not reflect the deduction of taxes, such as state and local income taxes or capital gains taxes that a shareholder may pay on Fund distributions or the redemptions of Fund shares.

12

Holdings Summaries as of October 31, 2023

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

The ratings disclosed are the lowest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| Fund Allocation (% of net assets) |

||||

|

|

||||

| Municipal Bonds |

168.8% | |||

|

|

||||

| Investment Companies |

0.0% | |||

|

|

||||

| Short-Term Municipal Bonds |

2.7% | |||

|

|

||||

| Other Assets & Liabilities, Net |

2.3% | |||

|

|

||||

| Floating Rate Obligations |

(2.9)% | |||

|

|

||||

| AMTP Shares, Net |

(27.0)% | |||

|

|

||||

| MFP Shares, Net |

(25.2)% | |||

|

|

||||

| VRDP Shares, Net |

(18.7)% | |||

|

|

||||

| Net Assets |

100% | |||

|

|

||||

| Bond Credit Quality (% of total investment exposure) |

||||

|

|

||||

| U.S. Guaranteed |

6.7% | |||

|

|

||||

| AAA |

2.3% | |||

|

|

||||

| AA |

27.1% | |||

|

|

||||

| A |

37.4% | |||

|

|

||||

| BBB |

14.9% | |||

|

|

||||

| BB or Lower |

5.2% | |||

|

|

||||

| N/R (not rated) |

6.4% | |||

|

|

||||

| Total |

100% | |||

|

|

||||

| Portfolio Composition | ||||

| (% of total investments) | ||||

|

|

||||

| Transportation |

27.9% | |||

|

|

||||

| Health Care |

19.3% | |||

|

|

||||

| Tax Obligation/Limited |

15.5% | |||

|

|

||||

| Tax Obligation/General |

10.6% | |||

|

|

||||

| Utilities |

9.4% | |||

|

|

||||

| U.S. Guaranteed |

6.7% | |||

|

|

||||

| Education and Civic Organizations |

4.2% | |||

|

|

||||

| Other |

6.4% | |||

|

|

||||

| Investment Companies |

0.0% | |||

|

|

||||

| Total |

100% | |||

|

|

||||

| States and Territories1 | ||||

| (% of total municipal bonds) | ||||

|

|

||||

| Texas |

10.6% | |||

|

|

||||

| Illinois |

9.0% | |||

|

|

||||

| Colorado |

8.1% | |||

|

|

||||

| California |

6.9% | |||

|

|

||||

| New York |

6.1% | |||

|

|

||||

| Florida |

5.7% | |||

|

|

||||

| Maryland |

5.7% | |||

|

|

||||

| Pennsylvania |

3.8% | |||

|

|

||||

| Missouri |

3.4% | |||

|

|

||||

| New Jersey |

3.1% | |||

|

|

||||

| South Carolina |

3.0% | |||

|

|

||||

| Ohio |

2.5% | |||

|

|

||||

| Michigan |

2.4% | |||

|

|

||||

| Louisiana |

2.1% | |||

|

|

||||

| Washington |

2.0% | |||

|

|

||||

| Minnesota |

1.9% | |||

|

|

||||

| Wisconsin |

1.7% | |||

|

|

||||

| Arizona |

1.7% | |||

|

|

||||

| Utah |

1.5% | |||

|

|

||||

| Oregon |

1.4% | |||

|

|

||||

| Other |

17.4% | |||

|

|

||||

| Total |

100% | |||

|

|

||||

| 1 | See the Portfolio of Investments for the remaining states comprising “Other” and not listed in the table above. |

13

| NEA | Nuveen AMT-Free Quality Municipal Income Fund Performance Overview and Holding Summaries October 31, 2023 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Fund Performance*

| Total Returns as of | ||||||||||||||||

| October 31, 2023 | ||||||||||||||||

| Average Annual | ||||||||||||||||

| Inception Date |

1-Year | 5-Year | 10-Year | |||||||||||||

|

|

||||||||||||||||

| NEA at Common Share NAV |

11/21/02 | 0.72% | (0.50)% | 2.64% | ||||||||||||

|

|

||||||||||||||||

| NEA at Common Share Price |

11/21/02 | (4.42)% | (0.31)% | 2.48% | ||||||||||||

|

|

||||||||||||||||

| S&P Municipal Bond Index |

– | 2.36% | 1.04% | 2.18% | ||||||||||||

|

|

||||||||||||||||

| NEA Blended Benchmark |

– | 2.57% | 1.15% | 2.31% | ||||||||||||

|

|

||||||||||||||||

* For purposes of Fund performance, relative results are measured against the NEA Blended Benchmark. The Fund’s Blended Benchmark consists of: 1) 80% S&P Municipal Bond Investment Grade Index and 2) 20% S&P Municipal Bond High Yield Index. The Fund’s performance was measured against the S&P Municipal Bond Index through September 11, 2016.

Performance data shown represents past performance and does not predict or guarantee future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

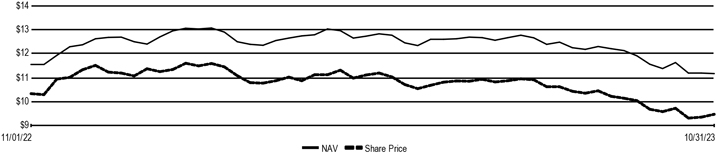

Daily Common Share NAV and Share Price

14

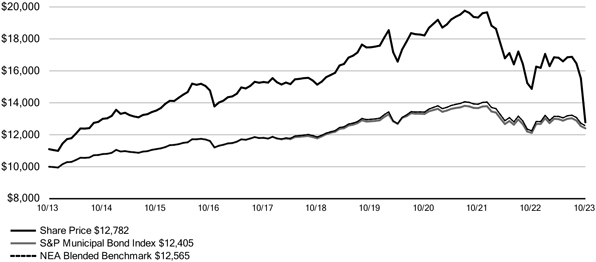

Growth of an Assumed $10,000

Investment as of October 31,

2023 - Class A

The graphs do not reflect the deduction of taxes, such as state and local income taxes or capital gains taxes that a shareholder may pay on Fund distributions or the redemptions of Fund shares.

15

Performance Overview and Holdings Summaries October 31, 2023 (continued)

Holdings Summaries as of October 31, 2023

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

The ratings disclosed are the lowest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| Fund Allocation | ||||

| (% of net assets) | ||||

|

|

||||

| Municipal Bonds |

169.1% | |||

|

|

||||

| Short-Term Municipal Bonds |

1.7% | |||

|

|

||||

| Other Assets & Liabilities, Net |

2.4% | |||

|

|

||||

| Floating Rate Obligations |

(2.3)% | |||

|

|

||||

| AMTP Shares, Net |

(5.2)% | |||

|

|

||||

| MFP Shares, Net |

(31.1)% | |||

|

|

||||

| VRDP Shares, Net |

(34.6)% | |||

|

|

||||

| Net Assets |

100% | |||

|

|

||||

| Bond Credit Quality | ||||

| (% of total investment exposure) | ||||

|

|

||||

| U.S. Guaranteed |

7.6% | |||

|

|

||||

| AAA |

2.3% | |||

|

|

||||

| AA |

33.5% | |||

|

|

||||

| A |

35.2% | |||

|

|

||||

| BBB |

13.1% | |||

|

|

||||

| BB or Lower |

3.1% | |||

|

|

||||

| N/R (not rated) |

5.2% | |||

|

|

||||

| Total |

100% | |||

|

|

||||

| Portfolio Composition | ||||

| (% of total investments) | ||||

|

|

||||

| Health Care |

21.6% | |||

|

|

||||

| Tax Obligation/Limited |

18.5% | |||

|

|

||||

| Transportation |

15.0% | |||

|

|

||||

| Tax Obligation/General |

12.6% | |||

|

|

||||

| Utilities |

11.9% | |||

|

|

||||

| U.S. Guaranteed |

8.0% | |||

|

|

||||

| Education and Civic Organizations |

7.3% | |||

|

|

||||

| Other |

5.1% | |||

|

|

||||

| Total |

100% | |||

|

|

||||

| States and Territories1 | ||||

| (% of total municipal bonds) | ||||

|

|

||||

| Illinois |

10.8% | |||

|

|

||||

| Colorado |

9.3% | |||

|

|

||||

| Michigan |

7.1% | |||

|

|

||||

| Texas |

6.7% | |||

|

|

||||

| New York |

6.5% | |||

|

|

||||

| Florida |

4.6% | |||

|

|

||||

| New Jersey |

4.5% | |||

|

|

||||

| California |

4.1% | |||

|

|

||||

| Pennsylvania |

3.6% | |||

|

|

||||

| Missouri |

3.5% | |||

|

|

||||

| Minnesota |

3.1% | |||

|

|

||||

| Ohio |

3.0% | |||

|

|

||||

| Georgia |

2.8% | |||

|

|

||||

| Wisconsin |

2.5% | |||

|

|

||||

| North Carolina |

2.3% | |||

|

|

||||

| Washington |

2.2% | |||

|

|

||||

| South Carolina |

2.2% | |||

|

|

||||

| District of Columbia |

2.1% | |||

|

|

||||

| Oregon |

1.7% | |||

|

|

||||

| Indiana |

1.6% | |||

|

|

||||

| Other |

15.8% | |||

|

|

||||

| Total |

100% | |||

|

|

||||

| 1 | See the Portfolio of Investments for the remaining states comprising "Other" and not listed in the table above. |

16

The annual meeting of shareholders was held on August 9, 2023, for NAD and NEA; at this meeting the shareholders were asked to elect Board members.

| NAD | NEA | |||||||||||||||

|

|

||||||||||||||||

| Common and | Common and | |||||||||||||||

| Preferred | Preferred | Preferred | Preferred | |||||||||||||

| shares voting | shares voting | shares voting | shares voting | |||||||||||||

| together | together | together | together | |||||||||||||

| as a class | as a class | as a class | as a class | |||||||||||||

|

|

||||||||||||||||

| Approval of the Board Members was reached as follows: |

||||||||||||||||

| Amy B.R. Lancellotta |

||||||||||||||||

| For |

174,000,515 | – | 217,189,079 | – | ||||||||||||

| Withhold |

12,322,058 | – | 26,121,923 | – | ||||||||||||

|

|

||||||||||||||||

| Total |

186,322,573 | – | 243,311,002 | – | ||||||||||||

|

|

||||||||||||||||

| John K. Nelson |

||||||||||||||||

| For |

172,461,624 | – | 214,668,845 | – | ||||||||||||

| Withhold |

13,860,949 | – | 28,642,157 | – | ||||||||||||

|

|

||||||||||||||||

| Total |

186,322,573 | – | 243,311,002 | – | ||||||||||||

|

|

||||||||||||||||

| Terence J. Toth |

||||||||||||||||

| For |

173,217,249 | – | 216,033,138 | – | ||||||||||||

| Withhold |

13,105,324 | – | 27,277,864 | – | ||||||||||||

|

|

||||||||||||||||

| Total |

186,322,573 | – | 243,311,002 | – | ||||||||||||

|

|

||||||||||||||||

| Robert L. Young |

||||||||||||||||

| For |

173,126,275 | – | 215,397,161 | – | ||||||||||||

| Withhold |

13,196,298 | – | 27,913,841 | – | ||||||||||||

|

|

||||||||||||||||

| Total |

186,322,573 | – | 243,311,002 | – | ||||||||||||

|

|

||||||||||||||||

| William C. Hunter |

||||||||||||||||

| For |

– | 19,108 | – | 347,609 | ||||||||||||

| Withhold |

– | – | – | – | ||||||||||||

|

|

||||||||||||||||

| Total |

– | 19,108 | – | 347,609 | ||||||||||||

|

|

||||||||||||||||

| Albin F. Moschner |

||||||||||||||||

| For |

– | 19,108 | – | 347,609 | ||||||||||||

| Withhold |

– | – | – | – | ||||||||||||

|

|

||||||||||||||||

| Total |

– | 19,108 | – | 347,609 | ||||||||||||

|

|

||||||||||||||||

17

Report of Independent Registered

Public Accounting Firm

To the Shareholders and Board of Trustees

Nuveen Quality Municipal Income Fund and Nuveen AMT-Free Quality Municipal Income Fund:

Opinions on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Nuveen Quality Municipal Income Fund and Nuveen AMT-Free Quality Municipal Income Fund (the Funds), including the portfolios of investments, as of October 31, 2023, the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the years in the two year period then ended, and the related notes (collectively, the financial statements) and the financial highlights for each of the years in the five year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Funds as of October 31, 2023, the results of their operations and their cash flows for the year then ended, the changes in their net assets for each of the years in the two year period then ended, and the financial highlights for each of the years in the five year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of October 31, 2023, by correspondence with custodians and brokers; when replies were not received from brokers, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

/s/ KPMG LLP

We have served as the auditor of one or more Nuveen investment companies since 2014.

Chicago, Illinois

December 28, 2023

18

| NAD | Nuveen Quality Municipal Income Fund Portfolio of Investments October 31, 2023 |

| Principal Amount (000) |

Description (a) | Optional Call Provisions (b) |

Value | |||||||||

| LONG-TERM INVESTMENTS - 168.8% (98.4% of Total Investments) | ||||||||||||

| MUNICIPAL BONDS - 168.8% (98.4% of Total Investments) | ||||||||||||

| Alabama - 1.4% (0.8% of Total Investments) | ||||||||||||

| $ 5,000 | Alabama Special Care Facilities Financing Authority, Revenue Bonds, Ascension Health, Series 2016C, 5.000%, 11/15/46 | 5/26 at 100.00 | $ | 4,774,506 | ||||||||

| Alabama State Port Authority, Docks Facilities Revenue Bonds, Refunding Series 2017A: | ||||||||||||

| 5,000 | 5.000%, 10/01/33 - AGM Insured, (AMT) | 10/27 at 100.00 | 5,029,825 | |||||||||

| 5,455 | 5.000%, 10/01/34 - AGM Insured, (AMT) | 10/27 at 100.00 | 5,479,379 | |||||||||

| 5,550 | 5.000%, 10/01/35 - AGM Insured, (AMT) | 10/27 at 100.00 | 5,558,363 | |||||||||

| 3,000 | Black Belt Energy Gas District, Alabama, Gas Supply Revenue Bonds, Series 2023 Sub B-2, 5.250%, 12/01/53, (Mandatory Put 12/01/30) | 9/30 at 100.32 | 3,024,306 | |||||||||

| 2,255 | Limestone County Water & Sewer Authority, Alabama, Water and Sewer Revenue Bonds, Series 2022, 5.000%, 12/01/45 | 6/32 at 100.00 | 2,260,261 | |||||||||

| 7,590 | Pike Road, Alabama, General Obligation Warrants, Series 2023, 5.000%, 3/01/52 | 3/33 at 100.00 | 7,663,133 | |||||||||

| 1,000 | Southeast Energy Authority, Alabama, Commodity Supply Revenue Bonds, Project 3, Fixed Rate Series 2022A-1, 5.500%, 1/01/53, (Mandatory Put 12/01/29) | 9/29 at 100.10 | 1,015,347 | |||||||||

| 4,165 | Tuscaloosa County Industrial Development Authority, Alabama, Gulf Opportunity Zone Bonds, Hunt Refining Project, Refunding Series 2019A, 5.250%, 5/01/44, 144A | 5/29 at 100.00 | 3,432,786 | |||||||||

|

|

|

|||||||||||

| Total Alabama | 38,237,906 | |||||||||||

|

|

||||||||||||

| Alaska - 0.3% (0.2% of Total Investments) | ||||||||||||

| Alaska Industrial Development and Export Authority, Power Revenue Bonds, Snettisham Hydroelectric Project, Refunding Series 2015: | ||||||||||||

| 1,580 | 5.000%, 1/01/24, (AMT) | No Opt. Call | 1,579,816 | |||||||||

| 3,400 | 5.000%, 1/01/25, (AMT) | No Opt. Call | 3,403,519 | |||||||||

| 1,000 | 5.000%, 1/01/28, (AMT) | 7/25 at 100.00 | 999,670 | |||||||||

| 1,075 | 5.000%, 1/01/29, (AMT) | 7/25 at 100.00 | 1,074,770 | |||||||||

| 300 | 5.000%, 1/01/31, (AMT) | 7/25 at 100.00 | 298,705 | |||||||||

|

|

|

|||||||||||

| Total Alaska | 7,356,480 | |||||||||||

|

|

||||||||||||

| Arizona - 2.9% (1.7% of Total Investments) | ||||||||||||

| 3,815 | Arizona Board of Regents, University of Arizona, Speed Revenue Bonds, Stimulus Plan for Economic and Educational Development, Refunding Series 2020A, 4.000%, 8/01/44 | 8/30 at 100.00 | 3,229,207 | |||||||||

| 2,500 | Arizona Health Facilities Authority, Revenue Bonds, Scottsdale Lincoln Hospitals Project, Refunding Series 2014A, 5.000%, 12/01/39 | 12/24 at 100.00 | 2,362,020 | |||||||||

| 1,000 | Arizona Industrial Development Authority Education Revenue Bonds, Academies of Math & Science Projects, Series 2023, 5.375%, 7/01/53 | 7/31 at 100.00 | 855,098 | |||||||||

| 2,000 | Arizona Industrial Development Authority, Arizona, Education Revenue Bonds, Academies of Math & Science Projects, Series 2018A, 5.000%, 7/01/48 | 1/28 at 100.00 | 1,830,468 | |||||||||

| 11,795 | Maricopa County Industrial Development Authority, Arizona, Revenue Bonds, Banner Health, Refunding Series 2016A, 4.000%, 1/01/36 | 1/27 at 100.00 | 11,045,086 | |||||||||

| 9,665 | Phoenix Civic Improvement Corporation, Arizona, Airport Revenue Bonds, Junior Lien Series 2019B, 5.000%, 7/01/49, (AMT) | 7/29 at 100.00 | 9,118,685 | |||||||||

| 15,935 | Phoenix Civic Improvement Corporation, Arizona, Airport Revenue Bonds, Senior Lien Series 2017A, 5.000%, 7/01/42, (AMT) | 7/27 at 100.00 | 15,626,095 | |||||||||

19

| NAD | Nuveen Quality Municipal Income Fund (continued) Portfolio of Investments October 31, 2023 |

| Principal Amount (000) |

Description (a) | Optional Call Provisions (b) |

Value | |||||||||

|

|

||||||||||||

| Arizona (continued) | ||||||||||||

| $ 7,000 | Phoenix Civic Improvement Corporation, Arizona, Revenue Bonds, Civic Plaza Expansion Project, Series 2005B, 5.500%, 7/01/39 - FGIC Insured | No Opt. Call | $ | 7,625,668 | ||||||||

| 1,000 | Pinal County Electrical District 4, Arizona, Electric System Revenue Bonds, Refunding Series 2015, 4.000%, 12/01/38 - AGM Insured | 12/25 at 100.00 | 887,401 | |||||||||

| Salt Verde Financial Corporation, Arizona, Senior Gas Revenue Bonds, Citigroup Energy Inc Prepay Contract Obligations, Series 2007: | ||||||||||||

| 500 | 5.500%, 12/01/29 | No Opt. Call | 511,482 | |||||||||

| 24,765 | 5.000%, 12/01/37 | No Opt. Call | 24,040,252 | |||||||||

| 1,100 | Student and Academic Services LLC, Arizona, Lease Revenue Bonds, Northern Arizona University Project, Series 2014, 5.000%, 6/01/34 - BAM Insured | 6/24 at 100.00 | 1,100,834 | |||||||||

|

|

|

|||||||||||

| Total Arizona | 78,232,296 | |||||||||||

|

|

||||||||||||

| Arkansas - 0.6% (0.3% of Total Investments) | ||||||||||||

| 5,020 | Arkansas Development Finance Authority, Arkansas, Environmental Improvement Revenue Bonds, United States Steel Corporation, Green Series 2022, 5.450%, 9/01/52, (AMT), 144A | 9/25 at 105.00 | 4,425,367 | |||||||||

| 6,550 | Arkansas Development Finance Authority, Arkansas, Environmental Improvement Revenue Bonds, United States Steel Corporation, Green Series 2023, 5.700%, 5/01/53, (AMT) | 5/26 at 105.00 | 5,977,485 | |||||||||

| 4,000 | Arkansas Development Finance Authority, Industrial Development Revenue Bonds, Big River Steel Project, Series 2019, 4.500%, 9/01/49, (AMT), 144A | 9/26 at 103.00 | 3,552,299 | |||||||||

| 2,055 | Arkansas State University, Student Fee Revenue Bonds, Jonesboro Campus, Series 2013, 4.875%, 12/01/43 | 12/23 at 100.00 | 1,817,459 | |||||||||

|

|

|

|||||||||||

| Total Arkansas | 15,772,610 | |||||||||||

|

|

||||||||||||

| California - 11.8% (6.9% of Total Investments) | ||||||||||||

| 2,665 | Alameda Corridor Transportation Authority, California, Revenue Bonds, Refunding Second Subordinate Lien Series 2022C, 5.000%, 10/01/52 - AGM Insured | 10/32 at 100.00 | 2,665,177 | |||||||||

| Anaheim Public Financing Authority, California, Lease Revenue Bonds, Public Improvement Project, Series 1997C: | ||||||||||||

| 2,945 | 0.000%, 9/01/27 - AGM Insured | No Opt. Call | 2,496,450 | |||||||||

| 7,150 | 0.000%, 9/01/28 - AGM Insured | No Opt. Call | 5,800,011 | |||||||||

| 2,455 | 0.000%, 9/01/32 - AGM Insured | No Opt. Call | 1,642,293 | |||||||||

| 105 | (c) | 0.000%, 9/01/35 - AGM Insured, (ETM) | No Opt. Call | 63,706 | ||||||||

| 95 | 0.000%, 9/01/35 - AGM Insured | No Opt. Call | 54,268 | |||||||||

| 1,055 | Brisbane School District, San Mateo County, California, General Obligation Bonds, Election 2003 Series 2005, 0.000%, 7/01/35 - AGM Insured | No Opt. Call | 616,156 | |||||||||

| Byron Unified School District, Contra Costa County, California, General Obligation Bonds, Series 2007B: | ||||||||||||

| 1,405 | 0.000%, 8/01/32 - SYNCORA GTY Insured | No Opt. Call | 938,998 | |||||||||

| 235 | (c) | 0.000%, 8/01/32 - SYNCORA GTY Insured, (ETM) | No Opt. Call | 165,918 | ||||||||

| 60 | (c) | 0.000%, 8/01/32, (ETM) | No Opt. Call | 42,362 | ||||||||

| Calexico Unified School District, Imperial County, California, General Obligation Bonds, Election of 2004 Series 2005B: | ||||||||||||

| 3,685 | 0.000%, 8/01/31 - FGIC Insured | No Opt. Call | 2,583,794 | |||||||||

| 4,505 | 0.000%, 8/01/33 - FGIC Insured | No Opt. Call | 2,868,821 | |||||||||

| California Health Facilities Financing Authority, California, Revenue Bonds, Sutter Health, Refunding Series 2016B: | ||||||||||||

| 10,000 | 5.000%, 11/15/46 | 11/26 at 100.00 | 9,821,977 | |||||||||

| 2,855 | (c) | 5.000%, 11/15/46, (Pre-refunded 11/15/26) | 11/26 at 100.00 | 2,974,624 | ||||||||

20

|

|

| Principal Amount (000) |

Description (a) | Optional Call Provisions (b) |

Value | |||||||||

|

|

|

|||||||||||

| California (continued) | ||||||||||||

| $ 16,665 | California Health Facilities Financing Authority, California, Revenue Bonds, Sutter Health, Refunding Series 2017A, 5.000%, 11/15/48 | 11/27 at 100.00 | $ | 16,451,740 | ||||||||

| 2,275 | California Health Facilities Financing Authority, California, Revenue Bonds, Sutter Health, Series 2018A, 4.000%, 11/15/42 | 11/27 at 100.00 | 2,014,648 | |||||||||

| 5,000 | California Municipal Finance Authority, Revenue Bonds, Linxs APM Project, Senior Lien Series 2018A, 5.000%, 12/31/43, (AMT) | 6/28 at 100.00 | 4,731,028 | |||||||||

| 3,250 | California Municipal Finance Authority, Reveue Bonds, Community Medical Centers, Series 2017A, 5.000%, 2/01/47 | 2/27 at 100.00 | 3,067,383 | |||||||||

| 815 | (c) | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Series 2013I, 5.000%, 11/01/38, (Pre-refunded 1/02/24) | 1/24 at 100.00 | 816,716 | ||||||||

| 500 | California Statewide Communities Development Authority, California, Revenue Bonds, Loma Linda University Medical Center, Series 2014A, 5.250%, 12/01/44 | 12/24 at 100.00 | 465,044 | |||||||||

| California Statewide Communities Development Authority, California, Revenue Bonds, Loma Linda University Medical Center, Series 2016A: | ||||||||||||

| 1,000 | 5.000%, 12/01/46, 144A | 6/26 at 100.00 | 883,669 | |||||||||

| 13,820 | 5.250%, 12/01/56, 144A | 6/26 at 100.00 | 12,243,712 | |||||||||

| California Statewide Community Development Authority, Revenue Bonds, Daughters of Charity Health System, Series 2005A: | ||||||||||||

| 29 | (d),(e) | 5.750%, 7/01/30 | 1/22 at 100.00 | 29,023 | ||||||||

| 80 | (d),(e) | 5.500%, 7/01/39 | 1/22 at 100.00 | 79,485 | ||||||||

| 4,890 | Clovis Unified School District, Fresno County, California, General Obligation Bonds, Series 2006B, 0.000%, 8/01/26 - NPFG Insured | No Opt. Call | 4,366,822 | |||||||||

| 1,000 | Coachella Valley Unified School District, Riverside County, California, General Obligation Bonds, Series 2005A, 0.000%, 8/01/30 - FGIC Insured | No Opt. Call | 744,623 | |||||||||

| 4,000 | East Bay Municipal Utility District, Alameda and Contra Costa Counties, California, Water System Revenue Bonds, Series 2014C, 5.000%, 6/01/44 | 6/24 at 100.00 | 4,009,618 | |||||||||

| 3,010 | El Camino Community College District, California, General Obligation Bonds, Election of 2002 Series 2012C, 0.000%, 8/01/25 | No Opt. Call | 2,808,137 | |||||||||

| 3,500 | Foothill/Eastern Transportation Corridor Agency, California, Toll Road Revenue Bonds, Refunding Senior Lien Series 2015A, 0.000%, 1/15/34 - AGM Insured | No Opt. Call | 2,196,959 | |||||||||

| Foothill/Eastern Transportation Corridor Agency, California, Toll Road Revenue Bonds, Refunding Series 2013A: | ||||||||||||

| 1,480 | (c) | 5.750%, 1/15/46, (Pre-refunded 1/15/24) | 1/24 at 100.00 | 1,486,016 | ||||||||

| 6,480 | (c) | 6.000%, 1/15/49, (Pre-refunded 1/15/24) | 1/24 at 100.00 | 6,509,166 | ||||||||

| 9,930 | (c) | Golden State Tobacco Securitization Corporation, California, Enhanced Tobacco Settlement Asset-Backed Revenue Bonds, Refunding Series 2015A, 5.000%, 6/01/45, (Pre-refunded 6/01/25) | 6/25 at 100.00 | 10,131,753 | ||||||||

| Golden State Tobacco Securitization Corporation, California, Enhanced Tobacco Settlement Asset-Backed Revenue Bonds, Series 2005A: | ||||||||||||

| 1,455 | (c) | 0.000%, 6/01/24 - AMBAC Insured, (ETM) | No Opt. Call | 1,424,449 | ||||||||

| 3,500 | (c) | 0.000%, 6/01/26 - AGM Insured, (ETM) | No Opt. Call | 3,186,760 | ||||||||

| 59,280 | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Bonds, Capital Appreciation Series 2021B-2, 0.000%, 6/01/66 | 12/31 at 27.75 | 4,862,282 | |||||||||

| 1,260 | Huntington Beach Union High School District, Orange County, California, Certificates of Participation, Capital Project, Series 2007, 0.000%, 9/01/35 - AGM Insured | No Opt. Call | 739,161 | |||||||||

| 5,240 | Huntington Beach Union High School District, Orange County, California, General Obligation Bonds, Series 2005, 0.000%, 8/01/30 - AGM Insured | No Opt. Call | 3,961,550 | |||||||||

21

| NAD | Nuveen Quality Municipal Income Fund (continued) Portfolio of Investments October 31, 2023 |

| Principal Amount (000) |

Description (a) | Optional Call Provisions (b) |

Value | |||||||||

|

|

|

|||||||||||

| California (continued) | ||||||||||||

| $ 2,500 | Huntington Beach Union High School District, Orange County, California, General Obligation Bonds, Series 2007, 0.000%, 8/01/32 - FGIC Insured | No Opt. Call | $ | 1,718,657 | ||||||||

| 5,000 | Kern Community College District, California, General Obligation Bonds, Safety, Repair & Improvement, Election 2002 Series 2006, 0.000%, 11/01/24 - AGM Insured | No Opt. Call | 4,802,538 | |||||||||

| 1,045 | Lake Tahoe Unified School District, El Dorado County, California, General Obligation Bonds, Series 2001B, 0.000%, 8/01/31 - NPFG Insured | No Opt. Call | 745,597 | |||||||||

| 9,140 | Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International Airport, Senior Lien Series 2015D, 5.000%, 5/15/41, (AMT) | 5/25 at 100.00 | 8,954,768 | |||||||||

| Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International Airport, Subordinate Lien Series 2021D: | ||||||||||||

| 12,835 | 5.000%, 5/15/46, (AMT) | 11/31 at 100.00 | 12,411,355 | |||||||||

| 40 | (c) | 5.000%, 5/15/46, (Pre-refunded 11/15/31), (AMT) | 11/31 at 100.00 | 42,030 | ||||||||

| 2,665 | Los Angeles Department of Water and Power, California, Power System Revenue Bonds, Series 2014B, 5.000%, 7/01/43 | 1/24 at 100.00 | 2,669,853 | |||||||||

| 6,215 | (c) | Martinez Unified School District, Contra Costa County, California, General Obligation Bonds, Series 2011, 5.875%, 8/01/31, (Pre-refunded 8/01/24) | 8/24 at 100.00 | 6,316,130 | ||||||||

| 5,955 | (f) | Mount San Antonio Community College District, Los Angeles County, California, General Obligation Bonds, Election of 2008, Series 2013A, 0.000%, 8/01/43 | 8/35 at 100.00 | 5,185,728 | ||||||||

| 2,700 | M-S-R Energy Authority, California, Gas Revenue Bonds, Citigroup Prepay Contracts, Series 2009A, 7.000%, 11/01/34 | No Opt. Call | 3,143,644 | |||||||||

| 2,200 | M-S-R Energy Authority, California, Gas Revenue Bonds, Citigroup Prepay Contracts, Series 2009C, 6.500%, 11/01/39 | No Opt. Call | 2,477,930 | |||||||||

| 3,605 | Ontario Redevelopment Financing Authority, San Bernardino County, California, Revenue Bonds, Redevelopment Project 1, Refunding Series 1995, 7.400%, 8/01/25 - NPFG Insured | No Opt. Call | 3,694,642 | |||||||||

| 4,930 | Patterson Joint Unified School District, Stanislaus County, California, General Obligation Bonds, 2008 Election Series 2009B, 0.000%, 8/01/42 - AGM Insured | No Opt. Call | 1,834,932 | |||||||||

| 6,000 | (c) | Placentia-Yorba Linda Unified School District, Orange County, California, Certificates of Participation, Series 2006, 0.000%, 10/01/34 - FGIC Insured, (ETM) | No Opt. Call | 3,843,811 | ||||||||

| 2,000 | Poway Unified School District, San Diego County, California, General Obligation Bonds, School Facilities Improvement District 2007-1, Series 2011A, 0.000%, 8/01/41 | No Opt. Call | 811,592 | |||||||||

| 5,000 | (f) | Rialto Unified School District, San Bernardino County, California, General Obligation Bonds, 2010 Election Series 2011A, 0.000%, 8/01/41 - AGM Insured | 8/36 at 100.00 | 5,218,794 | ||||||||

| 5,000 | Riverside County Asset Leasing Corporation, California, Leasehold Revenue Bonds, Riverside County Hospital Project, Series 1997, 0.000%, 6/01/25 - NPFG Insured | No Opt. Call | 4,665,742 | |||||||||

| 4,615 | Riverside County Redevelopment Agency, California, Tax Allocation Bonds, Jurupa Valley Project Area, Series 2011B, 0.000%, 10/01/38 | No Opt. Call | 2,133,239 | |||||||||

| 10,990 | San Diego County Regional Airport Authority, California, Airport Revenue Bonds, Subordinate Series 2021B, 5.000%, 7/01/46, (AMT) | 7/31 at 100.00 | 10,444,099 | |||||||||

| 14,055 | San Francisco Airports Commission, California, Revenue Bonds, San Francisco International Airport, Refunding Second Series 2019A, 5.000%, 5/01/49, (AMT) | 5/29 at 100.00 | 13,489,084 | |||||||||

22

|

|

| Principal Amount (000) |

Description (a) | Optional Call Provisions (b) |

Value | |||||||||

|

|

|

|||||||||||

| California (continued) | ||||||||||||

| $ 4,945 | San Francisco Airports Commission, California, Revenue Bonds, San Francisco International Airport, Second Series 2016B, 5.000%, 5/01/41, (AMT) | 5/26 at 100.00 | $ | 4,800,719 | ||||||||

| 10,000 | San Francisco Airports Commission, California, Revenue Bonds, San Francisco International Airport, Second Series 2017A, 5.000%, 5/01/42, (AMT) | 5/27 at 100.00 | 9,703,546 | |||||||||

| San Francisco Airports Commission, California, Revenue Bonds, San Francisco International Airport, Second Series 2019E: | ||||||||||||

| 11,000 | 5.000%, 5/01/45, (AMT) | 5/29 at 100.00 | 10,585,483 | |||||||||

| 8,405 | 5.000%, 5/01/50, (AMT) | 5/29 at 100.00 | 8,031,680 | |||||||||

| 2,000 | San Francisco City and County Redevelopment Agency Successor Agency, California, Special Tax Bonds, Community Facilities District 6 Mission Bay South Public Improvements, Series 2013C, 0.000%, 8/01/43 | 12/23 at 31.69 | 595,276 | |||||||||

| 2,000 | San Joaquin Hills Transportation Corridor Agency, Orange County, California, Toll Road Revenue Bonds, Refunding Junior Lien Series 2014B, 5.250%, 1/15/44 | 1/25 at 100.00 | 2,006,305 | |||||||||

| San Joaquin Hills Transportation Corridor Agency, Orange County, California, Toll Road Revenue Bonds, Refunding Senior Lien Series 2014A: | ||||||||||||

| 15,350 | (c) | 5.000%, 1/15/44, (Pre-refunded 1/15/25) | 1/25 at 100.00 | 15,596,040 | ||||||||

| 25,840 | (c) | 5.000%, 1/15/50, (Pre-refunded 1/15/25) | 1/25 at 100.00 | 26,254,182 | ||||||||

| San Jose, California, Airport Revenue Bonds, Refunding Series 2017A: | ||||||||||||

| 5,000 | 5.000%, 3/01/41, (AMT) | 3/27 at 100.00 | 4,854,617 | |||||||||

| 5,000 | 5.000%, 3/01/47, (AMT) | 3/27 at 100.00 | 4,732,111 | |||||||||

| 14,985 | San Ysidro School District, San Diego County, California, General Obligation Bonds, 1997 Election Series 2012G, 0.000%, 8/01/40 - AGM Insured | No Opt. Call | 6,294,031 | |||||||||

| 6,660 | San Ysidro School District, San Diego County, California, General Obligation Bonds, Refunding Series 2015, 0.000%, 8/01/43 | 8/25 at 38.93 | 2,335,832 | |||||||||

| 2,460 | Santee School District, San Diego County, California, General Obligation Bonds, Capital Appreciation, Election 2006, Series 2008D, 0.000%, 8/01/33 - AGC Insured | No Opt. Call | 1,611,988 | |||||||||

| 1,145 | Southern Kern Unified School District, Kern County, California, General Obligation Bonds, Series 2006C, 0.000%, 11/01/30 - AGM Insured | No Opt. Call | 848,841 | |||||||||

| 1,175 | Southern Kern Unified School District, Kern County, California, General Obligation Bonds, Series 2010B, 0.000%, 11/01/35 - AGM Insured | No Opt. Call | 678,921 | |||||||||

| 2,410 | Victor Elementary School District, San Bernardino County, California, General Obligation Bonds, Series 2002A, 0.000%, 8/01/26 - FGIC Insured | No Opt. Call | 2,141,184 | |||||||||

| 3,750 | (f) | Wiseburn School District, Los Angeles County, California, General Obligation Bonds, Series 2011B, 0.000%, 8/01/36 - AGM Insured | 8/31 at 100.00 | 3,768,299 | ||||||||

|

|

|

|||||||||||

| Total California | 319,387,519 | |||||||||||

|

|

||||||||||||

| Colorado - 14.0% (8.2% of Total Investments) | ||||||||||||

| 4,350 | Aerotropolis Regional Transportation Authority, Colorado, Special Revenue Bonds, Series 2021, 4.375%, 12/01/52 | 12/26 at 103.00 | 3,140,190 | |||||||||

| 3,000 | Anthem West Metropolitan District, Colorado, General Obligation Bonds, Refunding Series 2015, 5.000%, 12/01/35 - BAM Insured | 12/25 at 100.00 | 3,035,822 | |||||||||

| 2,000 | Arvada, Colorado, Water Enterprise Revenue Bonds, Series 2022, 4.000%, 12/01/48 | 12/32 at 100.00 | 1,672,414 | |||||||||

| 4,195 | Boulder Larimer & Weld Counties School District RE-1J Saint Vrain Valley, Colorado, General Obligation Bonds, Series 2016C, 4.000%, 12/15/34 | 12/26 at 100.00 | 3,968,865 | |||||||||

| 5,500 | Brighton, Colorado, Water Activity Enterprise Revenue Bonds, Water System Project, Series 2022, 5.000%, 6/01/47 | 6/32 at 100.00 | 5,570,232 | |||||||||

23

| NAD | Nuveen Quality Municipal Income Fund (continued) Portfolio of Investments October 31, 2023 |

| Principal Amount (000) |

Description (a) | Optional Call Provisions (b) |

Value | |||||||||

|

|

|

|||||||||||

| Colorado (continued) | ||||||||||||

| $ 1,775 | Centerra Metropolitan District 1, Loveland, Colorado, Special Revenue Bonds, Refunding & Improvement Series 2017, 5.000%, 12/01/29, 144A | 12/23 at 102.00 | $ | 1,703,018 | ||||||||

| 1,500 | Cherokee Metropolitan District, Colorado, Water and Wastewater Revenue Bonds, Series 2020, 4.000%, 8/01/50 - BAM Insured | 8/30 at 100.00 | 1,206,234 | |||||||||

| 2,945 | Colorado Educational and Cultural Facilities Authority, Charter School Revenue Bonds, Community Leadership Academy, Inc. Second Campus Project, Series 2013, 7.350%, 8/01/43 | 12/23 at 100.00 | 2,946,338 | |||||||||

| 1,715 | Colorado Educational and Cultural Facilities Authority, Charter School Revenue Bonds, Flagstaff Academy Project, Refunding Series 2016, 3.625%, 8/01/46 | 8/26 at 100.00 | 1,219,406 | |||||||||

| 500 | Colorado Educational and Cultural Facilities Authority, Charter School Revenue Bonds, Liberty Common Charter School, Series 2014A, 5.000%, 1/15/44 | 1/24 at 100.00 | 450,518 | |||||||||

| 1,000 | Colorado Educational and Cultural Facilities Authority, Charter School Revenue Bonds, Peak-to-Peak Charter School, Refunding Series 2014, 5.000%, 8/15/30 | 8/24 at 100.00 | 1,003,912 | |||||||||

| 3,915 | Colorado Educational and Cultural Facilities Authority, Charter School Revenue Bonds, Weld County School District 6 - Frontier Academy, Refunding & Improvement Series 2016, 3.250%, 6/01/46 | 6/26 at 100.00 | 2,670,206 | |||||||||

| 545 | Colorado Educational and Cultural Facilities Authority, Revenue Bonds, University Corporation for Atmospheric Research Project, Refunding Series 2017, 3.625%, 9/01/31 | 9/27 at 100.00 | 506,727 | |||||||||

| Colorado Educational and Cultural Facilities Authority, Revenue Bonds, University of Denver, Series 2017A: | ||||||||||||

| 1,200 | 4.000%, 3/01/36 | 3/27 at 100.00 | 1,086,177 | |||||||||

| 1,600 | 4.000%, 3/01/37 | 3/27 at 100.00 | 1,414,730 | |||||||||

| 5,460 | Colorado Health Facilities Authority, Colorado, Revenue Bonds, AdventHealth Obligated Group, Series 2019A, 4.000%, 11/15/43 | 11/29 at 100.00 | 4,709,550 | |||||||||

| Colorado Health Facilities Authority, Colorado, Revenue Bonds, AdventHealth Obligated Group, Series 2021A: | ||||||||||||

| 17,905 | 4.000%, 11/15/46 | 11/31 at 100.00 | 15,033,887 | |||||||||

| 11,090 | 4.000%, 11/15/50 | 11/31 at 100.00 | 9,051,547 | |||||||||

| 4,600 | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Christian Living Neighborhoods Project, Refunding Series 2016, 5.000%, 1/01/37 | 1/24 at 102.00 | 4,165,559 | |||||||||

| Colorado Health Facilities Authority, Colorado, Revenue Bonds, CommonSpirit Health, Series 2019A-2: | ||||||||||||

| 4,000 | 5.000%, 8/01/44 | 8/29 at 100.00 | 3,782,079 | |||||||||

| 15,395 | 4.000%, 8/01/49 | 8/29 at 100.00 | 11,909,118 | |||||||||

| Colorado Health Facilities Authority, Colorado, Revenue Bonds, CommonSpirit Health, Series 2022A: | ||||||||||||

| 2,725 | 5.500%, 11/01/47 | 11/32 at 100.00 | 2,704,774 | |||||||||

| 2,300 | 5.250%, 11/01/52 | 11/32 at 100.00 | 2,163,485 | |||||||||

| Colorado Health Facilities Authority, Colorado, Revenue Bonds, Evangelical Lutheran Good Samaritan Society Project, Series 2013A: | ||||||||||||

| 2,670 | (c) | 5.000%, 6/01/28, (Pre-refunded 6/01/25) | 6/25 at 100.00 | 2,711,921 | ||||||||

| 6,425 | (c) | 5.000%, 6/01/40, (Pre-refunded 6/01/25) | 6/25 at 100.00 | 6,525,876 | ||||||||

| 1,390 | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Frasier Meadows Project, Refunding & Improvement Series 2017A, 5.250%, 5/15/47 | 5/27 at 100.00 | 1,209,039 | |||||||||

| 5,000 | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Intermountain Healthcare, Series 2022A, 5.000%, 5/15/52 | 5/32 at 100.00 | 4,885,336 | |||||||||

24

|

|

| Principal Amount (000) |

Description (a) | Optional Call Provisions (b) |

Value | |||||||||

|

|

|

|||||||||||

| Colorado (continued) | ||||||||||||

| $ 3,785 | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Parkview Medical Center, Series 2020A, 4.000%, 9/01/50 | 9/30 at 100.00 | $ | 2,853,255 | ||||||||

| 5,535 | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Sanford Health, Series 2019A, 5.000%, 11/01/44 | 11/29 at 100.00 | 5,149,599 | |||||||||

| 3,300 | Colorado Health Facilities Authority, Colorado, Revenue Bonds, SCL Health System, Refunding Series 2019A, 4.000%, 1/01/37 | 1/30 at 100.00 | 3,057,902 | |||||||||

| 1,100 | Colorado High Performance Transportation Enterprise, C-470 Express Lanes Revenue Bonds, Senior Lien Series 2017, 5.000%, 12/31/56 | 12/24 at 100.00 | 990,285 | |||||||||

| Colorado State Board of Governors, Colorado State University Auxiliary Enterprise System Revenue Bonds, Refunding Series 2017C: | ||||||||||||

| 950 | (c) | 5.000%, 3/01/43, (Pre-refunded 3/01/28) - BAM Insured | 3/28 at 100.00 | 1,001,233 | ||||||||

| 710 | 5.000%, 3/01/43 - BAM Insured | 3/28 at 100.00 | 719,071 | |||||||||

| 2,360 | Colorado State Board of Governors, Colorado State University Auxiliary Enterprise System Revenue Bonds, Refunding Series 2017E, 4.000%, 3/01/43 | 3/28 at 100.00 | 2,055,813 | |||||||||

| 3,420 | Colorado State, Building Excellent Schools Today, Certificates of Participation, Series 2020R, 4.000%, 3/15/45 | 3/30 at 100.00 | 2,903,238 | |||||||||

| 4,000 | Colorado State, Building Excellent Schools Today, Certificates of Participation, Series 2021S, 4.000%, 3/15/41 | 3/31 at 100.00 | 3,530,883 | |||||||||

| 3,000 | (c) | Commerce City, Colorado, Sales and Use Tax Revenue Bonds, Series 2014, 5.000%, 8/01/44, (Pre-refunded 8/01/24) - AGM Insured | 8/24 at 100.00 | 3,020,829 | ||||||||

| 7,250 | (c) | Commerce City, Colorado, Sales and Use Tax Revenue Bonds, Series 2016, 5.000%, 8/01/46, (Pre-refunded 8/01/26) | 8/26 at 100.00 | 7,475,913 | ||||||||

| 8,250 | Denver City and County, Colorado, Airport System Revenue Bonds, Series 2022A, 5.500%, 11/15/53, (AMT) | 11/32 at 100.00 | 8,342,614 | |||||||||

| 3,400 | Denver City and County, Colorado, Airport System Revenue Bonds, Series 2022B, 5.250%, 11/15/53 | 11/32 at 100.00 | 3,485,620 | |||||||||

| Denver City and County, Colorado, Airport System Revenue Bonds, Series 2022D: | ||||||||||||

| 2,790 | 5.750%, 11/15/45, (AMT) | 11/32 at 100.00 | 2,927,001 | |||||||||

| 5,000 | 5.000%, 11/15/53, (AMT) | 11/32 at 100.00 | 4,703,261 | |||||||||

| 1,100 | Denver City and County, Colorado, Airport System Revenue Bonds, Subordinate Lien Series 2013A, 5.250%, 11/15/43, (AMT) | 12/23 at 100.00 | 1,091,616 | |||||||||

| 4,515 | Denver City and County, Colorado, Airport System Revenue Bonds, Subordinate Lien Series 2013B, 5.000%, 11/15/43 | 12/23 at 100.00 | 4,457,492 | |||||||||

| Denver City and County, Colorado, Airport System Revenue Bonds, Subordinate Lien Series 2018A: | ||||||||||||

| 17,000 | 5.000%, 12/01/43, (AMT) | 12/28 at 100.00 | 16,369,353 | |||||||||