0000832101false00008321012024-07-232024-07-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of Report: July 23, 2024

(Date of earliest event reported)

IDEX CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-10235 | | 36-3555336 |

| (State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

| of incorporation) | | | | Identification No.) |

3100 Sanders Road, Suite 301

Northbrook, Illinois 60062

(Address of principal executive offices, including zip code)

(847) 498-7070

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $.01 per share | | IEX | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Emerging growth company | ☐ |

| | | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item 7.01 – Regulation FD Disclosure.

A copy of the press release and investor presentation relating to the transaction described below are attached hereto as Exhibit 99.1 and 99.2 and are furnished herewith.

IDEX Corporation (the “Company”) will host a conference call to discuss the transaction described below at 9:30 a.m. Central Time (CDT) on July 23, 2024. The conference call will be webcast live from the Company’s investor relations website at https://investors.idexcorp.com. The conference call can also be accessed live over the phone by dialing 1-877-709-8150 or +1 201-689-8354. The conference ID is 13747873. A replay will be available approximately three hours after the call and can be accessed by dialing 877-660-6853 or +1 201-612-7415 for international callers. The replay will be available through August 23, 2024.

The information contained in this Item 7.01 (including Exhibit 99.1 and Exhibit 99.2) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 8.01 – Other Events.

On July 23, 2024, the Company issued a press release announcing that it has entered into a definitive agreement (the “Purchase Agreement”) to acquire from the Mott Corporation Employee Stock Ownership Trust, which is maintained pursuant to and in connection with the Mott Corporation Employee Stock Ownership Plan, all of the issued and outstanding capital stock of Mott Corporation, a Connecticut corporation, and its subsidiaries (“Mott”). Mott is a leading microfiltration business specializing in the design, customization, and manufacturing of sintered porous metal components and engineered solutions used in fluidic applications.

Pursuant to the terms of the Purchase Agreement, the Company has agreed to acquire Mott for cash consideration of $1 billion, subject to customary adjustments. The transaction is expected to close by the end of the third quarter of 2024, subject to regulatory approvals and customary closing conditions.

Cautionary Note Regarding Forward-Looking Statements

This Current Report and the Exhibits hereto contain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements regarding the expected benefits of the acquisition of Mott, the expected impact of the acquisition on the Company’s product offerings or proposed product offerings, the Company’s combined existing and new customers and access to high-value end markets, the enhancement of the Company’s business strategy, integration plans, the expected growth opportunities, profitability and synergies resulting from the acquisition, including the timing of such expected synergies, the present value of expected tax benefits, the anticipated long-term value to the Company’s shareholders, the projected revenue, EBITDA and EBITDA margin of Mott and the related impact and timing for such impact on the Company’s earnings, return on invested capital, and the expected timing for the closing of the transaction. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this report. The risks and uncertainties include, but are not limited to, the following: levels of industrial activity and economic conditions in the U.S. and other countries around the world, including uncertainties in the financial markets; pricing pressures, including inflation and rising interest rates and other competitive factors and levels of capital spending in certain industries; the impact of catastrophic weather events, natural disasters and public health threats; economic and political consequences resulting from terrorist attacks and wars; risks relating to the satisfaction of the closing conditions set forth in the definitive agreement; the Company’s ability to integrate Mott and to acquire, integrate and operate other acquired businesses on a profitable basis; cybersecurity incidents; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which the Company operates; developments with respect to trade policy and tariffs; interest rates; capacity utilization and the effect this has on costs; labor markets; supply chain conditions; market conditions and material costs; risks related

to environmental, social and corporate governance issues, including those related to climate change and sustainability; and developments with respect to contingencies, such as litigation and environmental matters. Additional factors that could cause actual results to differ materially from those reflected in the forward-looking statements include, but are not limited to, the risks discussed in the “Risk Factors” section included in the Company’s most recent annual report on Form 10-K and the Company’s subsequent quarterly reports filed with the Securities and Exchange Commission (“SEC”) and the other risks discussed in the Company’s filings with the SEC. The forward-looking statements included here are only made as of the date of this report, and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances, except as may be required by law. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented here.

Item 9.01 – Financial Statements and Exhibits.

(a) Exhibits

99.1 Press release dated July 23, 2024.

99.2 Investor Presentation, dated July 23, 2024.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| IDEX CORPORATION |

| | |

| By: | /s/ ABHISHEK KHANDELWAL |

| | Abhishek Khandelwal |

| | Senior Vice President and Chief Financial Officer |

| July 23, 2024 | | |

EX-99.1

EX-99.1IDEX Corporation to Acquire Mott Corporation, Expanding Applied Materials Science Technology Capabilities Across High-Value End Markets

•Enhances ability to deliver innovative, customized, and highly technical micro-precision solutions that are increasingly essential to customer product performance

•Increases opportunities in semiconductor wafer fab equipment, energy transition, medical technologies, space & defense, and water purification industries

•Complements successful integration of the Muon Group, Iridian Spectral Technologies, and STC Material Solutions, providing unique process-based capabilities working with specialized materials

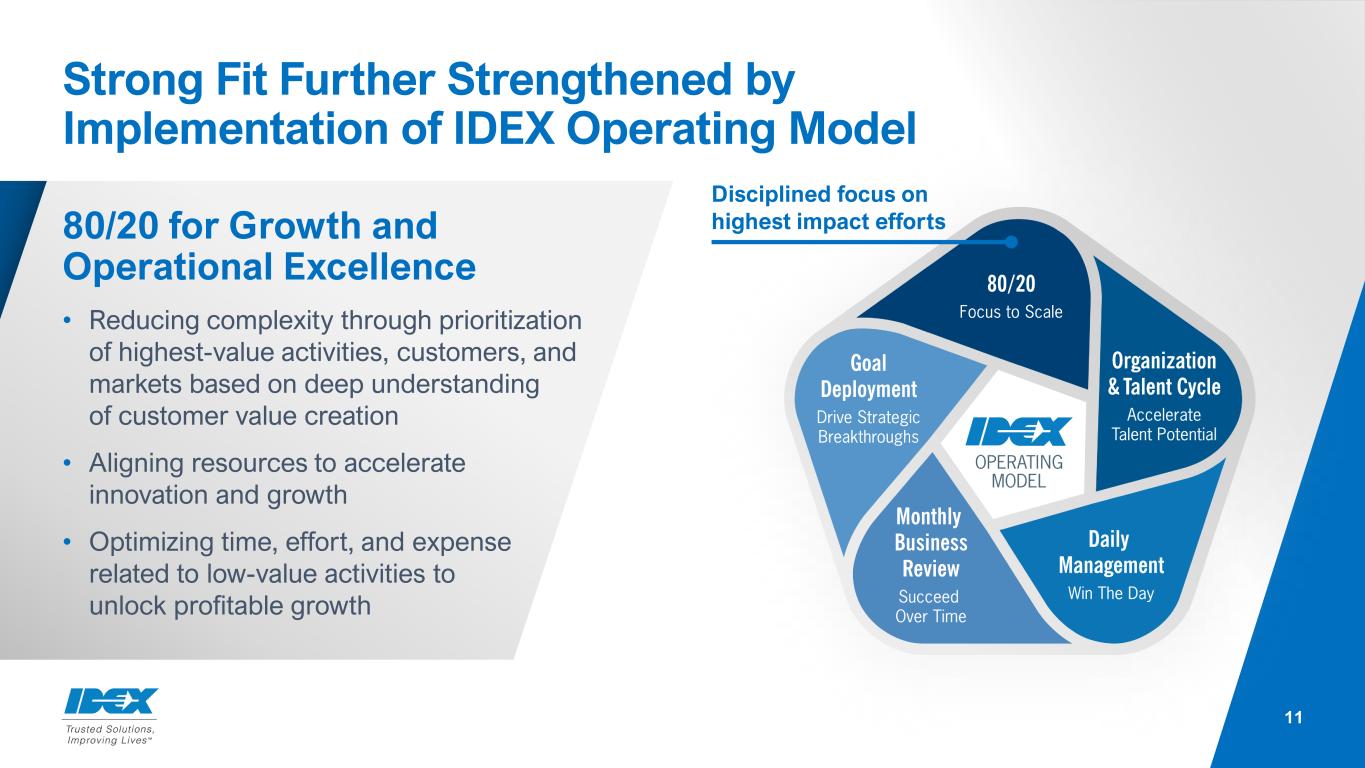

•Drives near- and long-term value creation through implementation of 8020 and the IDEX Operating Model

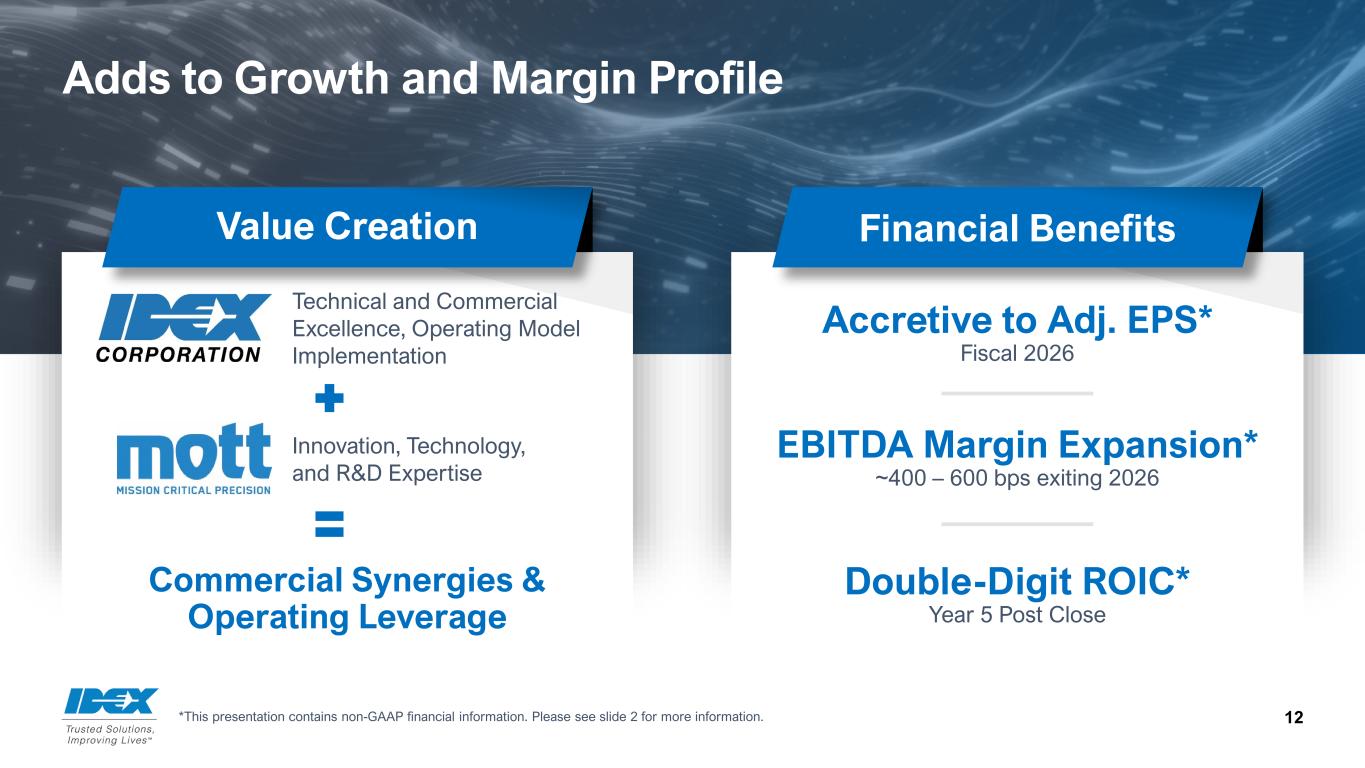

NORTHBROOK, Ill., July 23, 2024-- IDEX Corporation (NYSE: IEX) (“IDEX”) today announced it has entered into a definitive agreement to acquire Mott Corporation and its subsidiaries (“Mott”) for cash consideration of $1 billion (the “transaction”), subject to customary adjustments. When adjusted for the present value of expected tax benefits of approximately $100 million, the net transaction value is approximately $900 million. This represents approximately 19x Mott’s forecasted full year 2024 EBITDA and a mid-teens multiple based on forecasted 2025 EBITDA. The transaction is expected to be accretive to adjusted earnings per share in fiscal year 2026.

Mott is a leader in the design and manufacturing of sintered porous material structures and flow control solutions, with deep applied material science knowledge and process control capabilities. For more than 60 years, Mott has solved highly complex engineering challenges by co-innovating with the world’s largest technical brands and OEMs in dynamic markets including semiconductor, energy, water, and space.

“Mott’s business fits the IDEX sweet spot of highly engineered, configurable mission-critical components focused on scalable select applications. The addition of Mott represents an important step in our evolution, as we continue building our differentiated capabilities in applied materials technologies. Mott brings advanced technical and application expertise that will expand our capabilities in high-value end markets and open new organic growth opportunities. Our focus on driving profitable growth through the enterprise-wide application of 80/20 is expected to yield material benefits,” said Eric D. Ashleman, Chief Executive Officer and President of IDEX. “The addition of Mott supports our strategy to deliver long-term, compounding value to our customers, employees, and shareholders, which includes targeted inorganic growth funded by strong cash flow generation. With shared cultural values, including a deep passion for solving customer challenges through technical capabilities and innovative solutions, our great teams combine to offer meaningful go-to-market opportunities. We look forward to welcoming the over 500 Mott employees to IDEX.”

Transaction Expected to Deliver Significant Strategic and Financial Benefits

Expands applied material science technologies portfolio: Brings scale to IDEX’s growing suite of focused, high-value businesses – including IDEX Optical Technologies, the Muon Group, and recently acquired Iridian Spectral Technologies and STC Material Solutions – that

address customer demand for novel solutions and expertise across advanced materials, microscale features, precision components, and proprietary production processes.

Extends similar value proposition into new customer relationships: Like IDEX, Mott develops and delivers essential products and solutions that represent a modest cost relative to the scale of the overall systems and processes that they support. Mott’s strong tradition of innovating closely with OEM customers brings additive, long-term customer relationships, enabling efficient integration into the IDEX family.

Extends capabilities to address unique customer needs: Adds advanced customization and system-design capabilities, deepening IDEX’s position as an innovation partner. This allows IDEX to further address customer needs for extremely precise solutions in fluidic applications from the product to system-level, including the opportunity to offer tailored, cross-functional products. For example, we expect Mott, IDEX Health & Science, Muon, and our Material Processing Technologies businesses to find additive commercial and technology solutions for medical device, healthcare and biotech customers. Within transitioning energy markets, Mott and IDEX’s pneumatics businesses could bring operational and applications expertise to meet customer needs for more efficiency and lower carbon emissions.

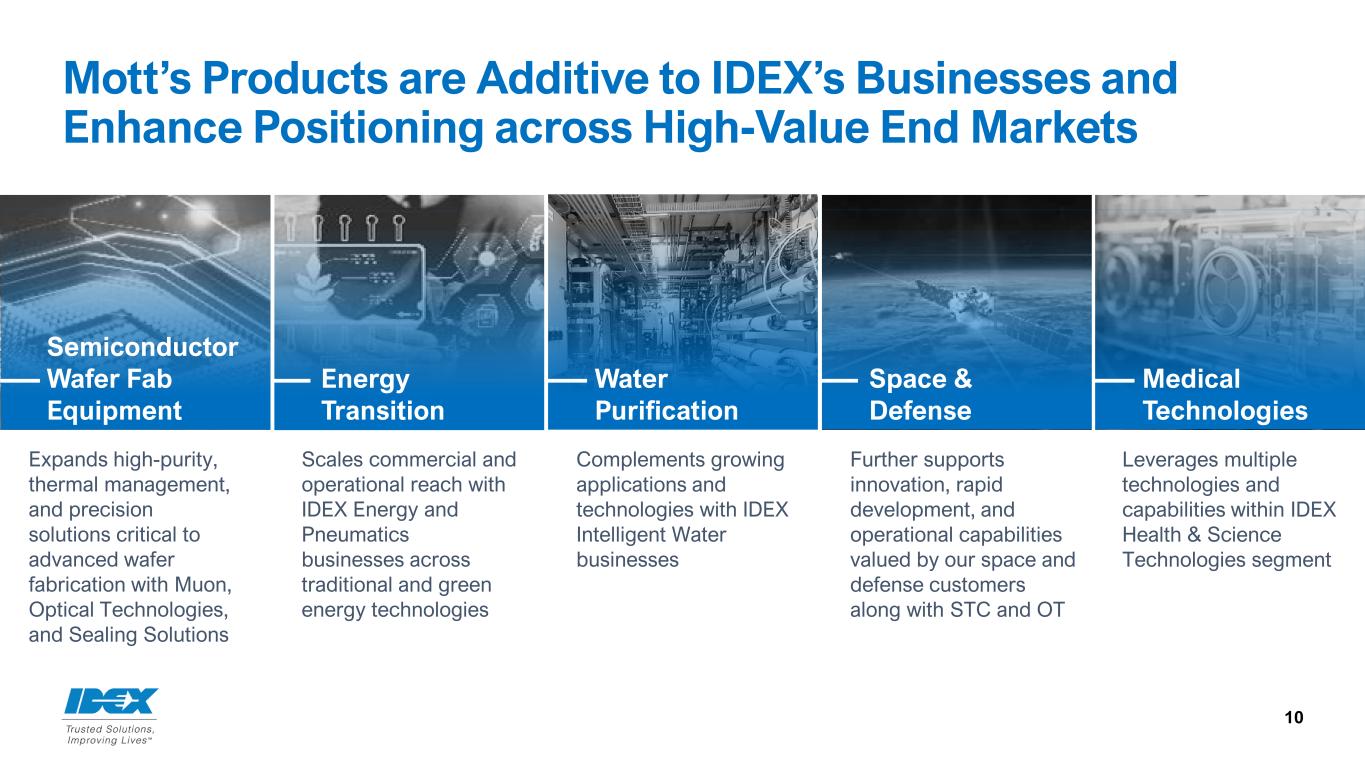

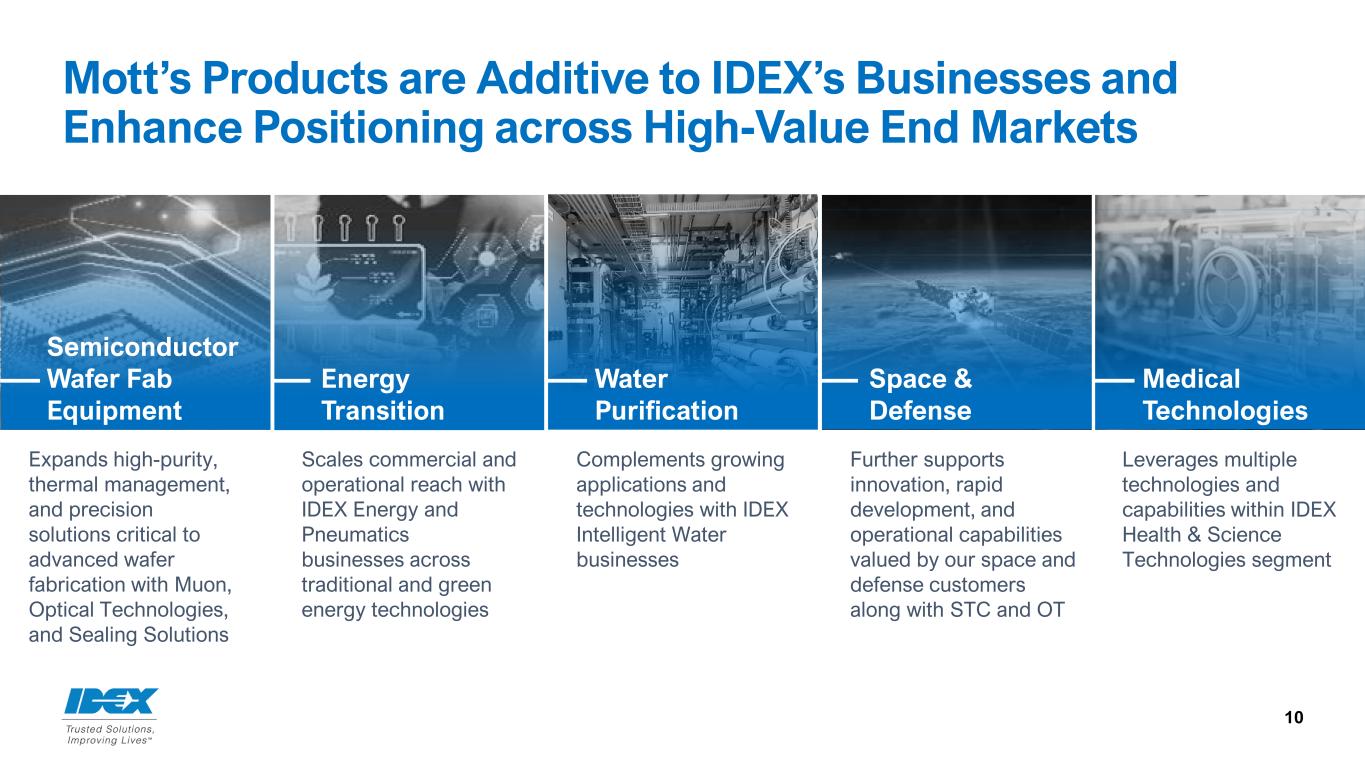

Enhances positioning across high-value end markets: Bolsters ability to grow presence in select, technology-enabled applications with substantial growth potential, including across semiconductor wafer fab equipment, the energy transition, medical technologies, space & defense, and water purification.

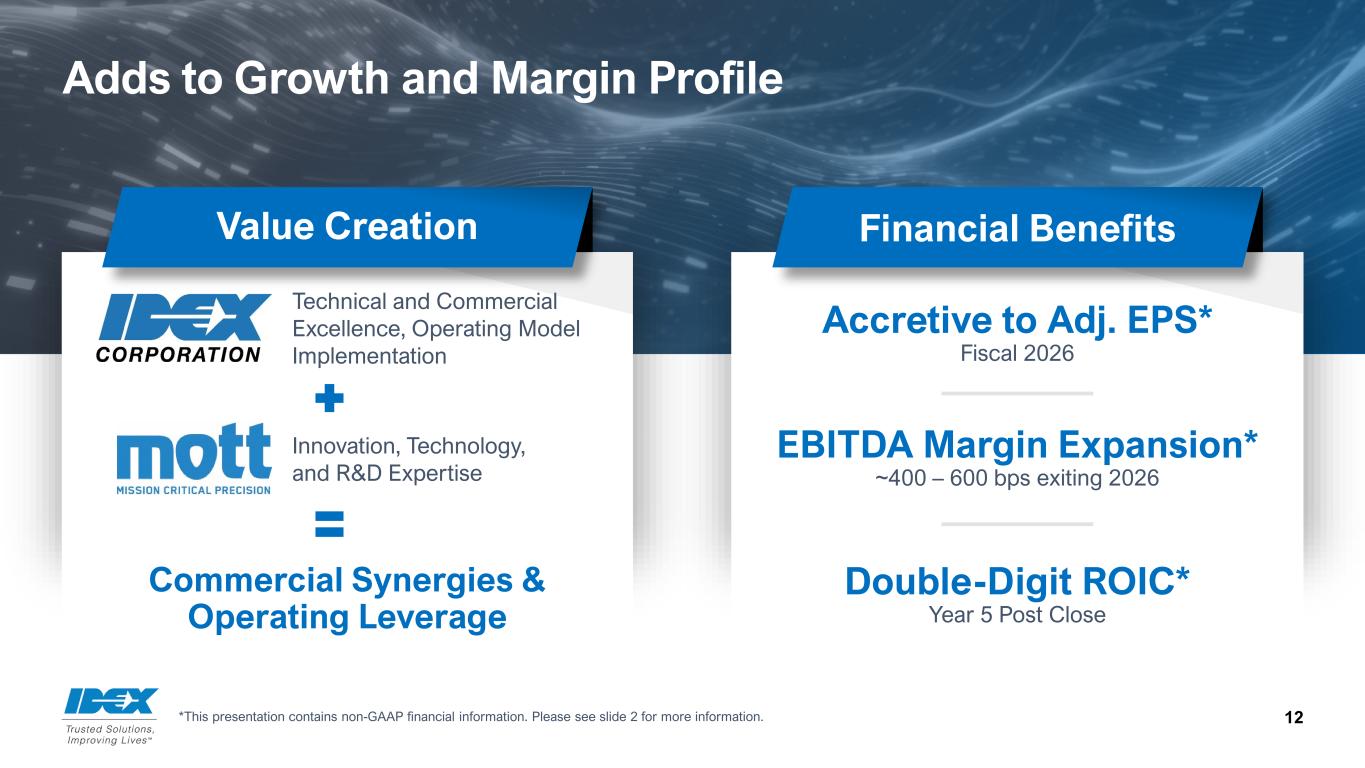

Adds to long-term growth and margin profile: Combines the technical and commercial excellence of IDEX with leading-edge innovation, technology, and R&D expertise of Mott, which is anticipated to yield meaningful commercial growth synergies over the next three years and drive EBITDA expansion through the proven application of 80/20 as part of the IDEX Operating Model.

“We’re excited to join an industry leader with a strong record of helping customers solve their toughest problems. Mott brings applied material science, chemistry, and application expertise, an additive and complementary customer base, and a growing pipeline of opportunities. When combined with the scale of IDEX, industry-leading positions, and deep technological know-how, this will yield meaningful synergies and benefits. Our culture and capabilities align with IDEX, and our employees will add tremendous value to the company, just as they’ve driven Mott’s growth for generations.” said Boris Levin, President and Chief Executive Officer of Mott.

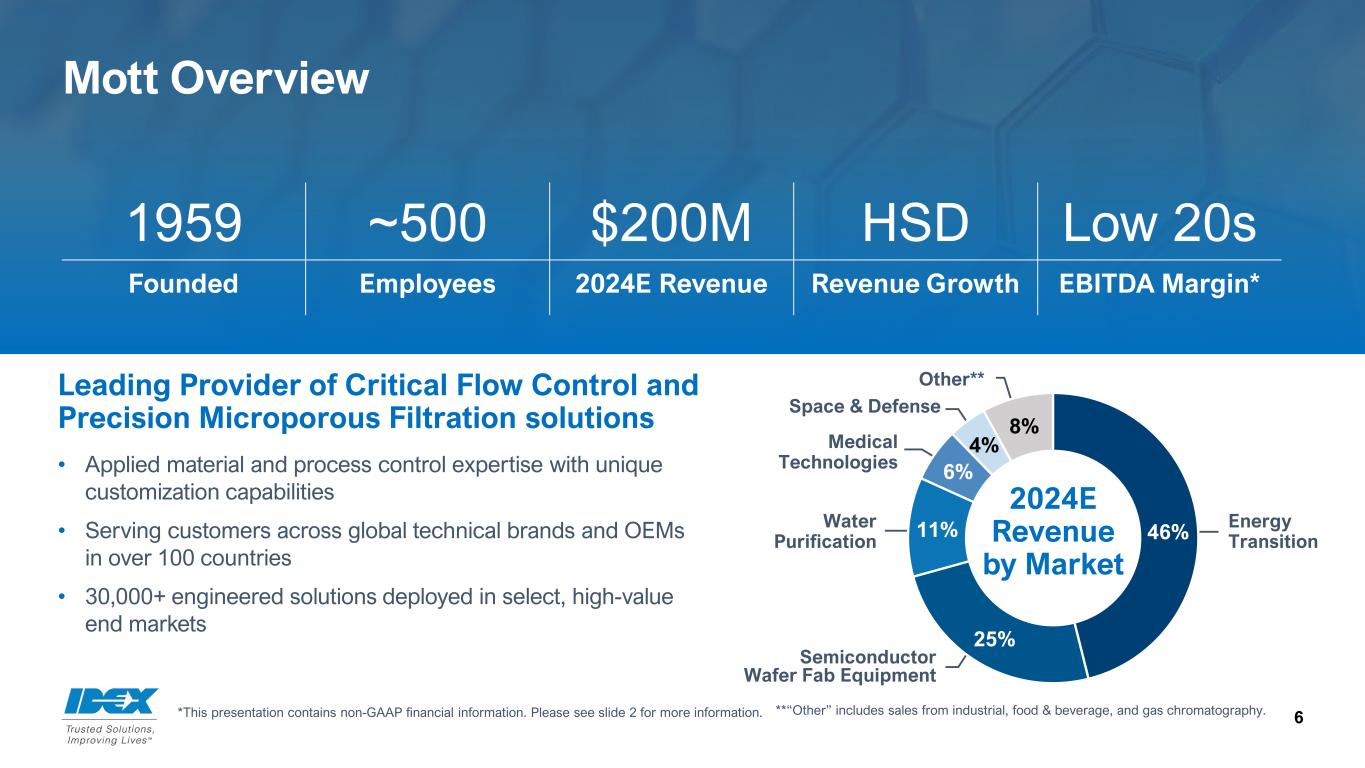

In 2024, Mott is expected to generate approximately $200 million of revenue, with an EBITDA margin in the low 20s. Mott will join IDEX’s Health & Science Technologies segment. The transaction will be funded through a combination of cash on hand, borrowings from IDEX’s current credit facility, and potential debt issuance, and it is expected to close by the end of the third quarter of 2024, subject to regulatory approvals and customary closing conditions.

Conference Call Information

IDEX will host a conference call to discuss the transaction at 9:30 am Central Time (CDT) today. The conference call will be webcast live from IDEX’s investor relations website at https://investors.idexcorp.com. The conference call can also be accessed live over the phone by

dialing 1-877-709-8150 or +1 201-689-8354. The conference ID is 13747873. A replay will be available approximately three hours after the call and can be accessed by dialing 877-660-6853 or +1 201-612-7415 for international callers. The replay will be available through August 23, 2024.

About IDEX

IDEX Corporation (NYSE: IEX) designs and builds engineered products and mission-critical components that make everyday life better. IDEX precision components help craft the microchip powering your electronics, treat water so it is safe to drink, and protect communities and the environment from sewer overflows. Our optics enable communications across outer space, and our pumps move challenging fluids that range from hot, to viscous, to caustic. IDEX components assist healthcare professionals in saving lives as part of many leading diagnostic machines, including DNA sequencers that help doctors personalize treatment. And our fire and rescue tools, including the industry-leading Hurst Jaws of Life®, are trusted by rescue workers around the world. These are just some of the thousands of products that help IDEX live its purpose – Trusted Solutions, Improving Lives™. Founded in 1988 with three small, entrepreneurial manufacturing companies, IDEX now includes more than 50 diverse businesses around the world. With about 8,800 employees and manufacturing operations in more than 20 countries, IDEX is a diversified, high-performing, global company with approximately $3.3 billion in annual sales.

For further information on IDEX Corporation and its business units, visit the company’s website at www.idexcorp.com

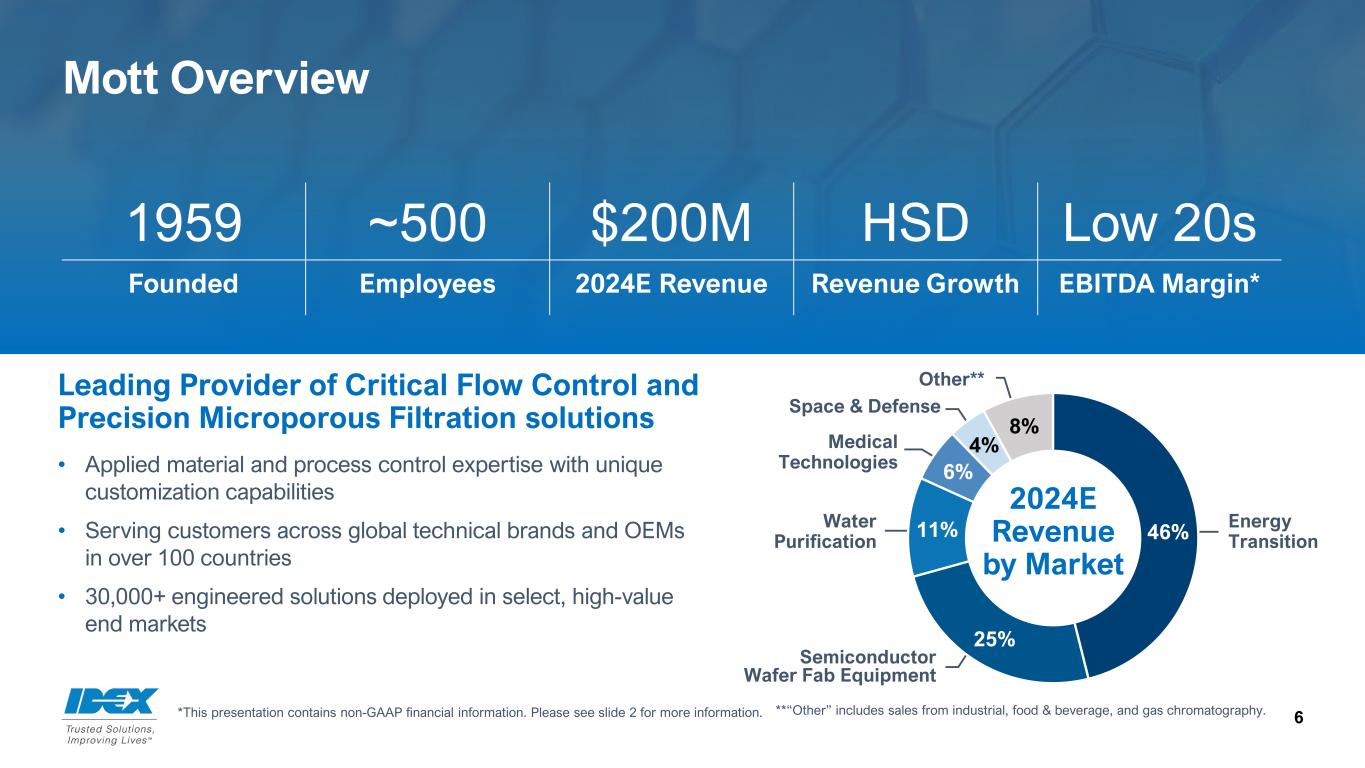

About Mott

Mott is a leading microfiltration business specializing in the design, customization, and manufacturing of sintered porous metal components and engineered solutions used in fluidic applications. Mott combines design expertise for thousands of applications with the power of cutting-edge technology to create highly engineered products. Founded in 1959 in Farmington, CT, Mott is globally known for its reliability and unmatched dependability, serving the highest-cost of failure applications. With approximately 500 employees, Mott partners with world-class customers with demanding technical specifications to design, engineer, produce, and employ innovative products to solve their most challenging filtration and flow control problems.

Use of Non-GAAP Financial Information

IDEX prepares its public financial statements in conformity with accounting principles generally accepted in the United States of America (GAAP). IDEX supplements certain GAAP financial performance metrics with non-GAAP financial performance metrics. Management believes these non-GAAP financial performance metrics provide investors with greater insight, transparency and a more comprehensive understanding of the financial information used by management in its financial and operational decision-making because certain of these non-GAAP metrics exclude items not reflective of ongoing operations. Non-GAAP financial performance metrics should not be considered a substitute for, nor superior to, the financial data prepared in accordance with GAAP. EBITDA is calculated as net income plus interest expense plus provision for income taxes plus depreciation and amortization. EBITDA margin is calculated as EBITDA divided by net sales.

IDEX has not provided a reconciliation of Mott’s expected EBITDA and EBITDA margin for fiscal year 2024 or 2025 because we are unable to quantify certain amounts that would be required to be included in Mott’s contribution to net income without unreasonable efforts. In addition, IDEX believes such reconciliation would imply a degree of precision that would be confusing or misleading to investors.

Cautionary Note Regarding Forward-Looking Statements

This press release contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements regarding the expected benefits of the acquisition of Mott, the expected impact of the acquisition on IDEX’s product offerings or proposed product offerings, IDEX’s combined existing and new customers and access to high-value end markets, the enhancement of IDEX’s business strategy, integration plans, the expected growth opportunities, profitability and synergies resulting from the acquisition, including the timing of such expected synergies, the present value of expected tax benefits, the anticipated long-term value to IDEX’s shareholders, the projected revenue, EBITDA and EBITDA margin of Mott and the related impact and timing for such impact on IDEX’s earnings, return on invested capital, and the expected timing for the closing of the transaction. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this press release. The risks and uncertainties include, but are not limited to, the following: levels of industrial activity and economic conditions in the U.S. and other countries around the world, including uncertainties in the financial markets; pricing pressures, including inflation and rising interest rates and other competitive factors and levels of capital spending in certain industries; the impact of catastrophic weather events, natural disasters and public health threats; economic and political consequences resulting from terrorist attacks and wars; risks relating to the satisfaction of the closing conditions set forth in the definitive agreement; IDEX’s ability to integrate Mott and to acquire, integrate and operate other acquired businesses on a profitable basis; cybersecurity incidents; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which IDEX operates; developments with respect to trade policy and tariffs; interest rates; capacity utilization and the effect this has on costs; labor markets; supply chain conditions; market conditions and material costs; risks related to environmental, social and corporate governance issues, including those related to climate change and sustainability; and developments with respect to contingencies, such as litigation and environmental matters. Additional factors that could cause actual results to differ materially from those reflected in the forward-looking statements include, but are not limited to, the risks discussed in the “Risk Factors” section included in IDEX’s most recent annual report on Form 10-K and IDEX’s subsequent quarterly reports filed with the Securities and Exchange Commission (“SEC”) and the other risks discussed in IDEX’s filings with the SEC. The forward-looking statements included here are only made as of the date of this press release and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances, except as may be required by law. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented here.

Investor Contact:

Wendy Palacios

Vice President, FP&A and Investor Relations

(847) 457-3723

wpalacios@idexcorp.com

Media Contact:

Mark Spencer

Vice President, Global Communications

(847) 457-3793

mdspencer@idexcorp.com

1 Strategic Acquisition of Mott July 23, 2024

2 Cautionary Note Regarding Forward-Looking Statements Cautionary Statement Under the Private Securities Litigation Reform Act; Non-GAAP Measures This press release contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements include statements regarding the expected benefits of the acquisition of Mott, the expected impact of the acquisition on IDEX’s product offerings or proposed product offerings, IDEX’s combined existing and new customers and access to high-value end markets, the enhancement of IDEX’s business strategy, integration plans, the expected growth opportunities, profitability and synergies resulting from the acquisition, including the timing of such expected synergies, the present value of expected tax benefits, the anticipated long-term value to IDEX’s shareholders, the projected revenue, EBITDA and EBITDA margin of Mott and the related impact and timing for such impact on IDEX’s earnings, return on invested capital, and the expected timing for the closing of the transaction. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this press release. The risks and uncertainties include, but are not limited to, the following: levels of industrial activity and economic conditions in the U.S. and other countries around the world, including uncertainties in the financial markets; pricing pressures, including inflation and rising interest rates and other competitive factors and levels of capital spending in certain industries; the impact of catastrophic weather events, natural disasters and public health threats; economic and political consequences resulting from terrorist attacks and wars; risks relating to the satisfaction of the closing conditions set forth in the definitive agreement; IDEX’s ability to integrate Mott and to acquire, integrate and operate other acquired businesses on a profitable basis; cybersecurity incidents; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which IDEX operates; developments with respect to trade policy and tariffs; interest rates; capacity utilization and the effect this has on costs; labor markets; supply chain conditions; market conditions and material costs; risks related to environmental, social and corporate governance issues, including those related to climate change and sustainability; and developments with respect to contingencies, such as litigation and environmental matters. Additional factors that could cause actual results to differ materially from those reflected in the forward-looking statements include, but are not limited to, the risks discussed in the “Risk Factors” section included in IDEX’s most recent annual report on Form 10-K and IDEX’s subsequent quarterly reports filed with the Securities and Exchange Commission (“SEC”) and the other risks discussed in IDEX’s filings with the SEC. The forward-looking statements included here are only made as of the date of this press release and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances, except as may be required by law. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented here. Non-GAAP Measures. During this presentation we will discuss certain forward-looking non-GAAP financial measures, including EBITDA, EBITDA margin, adjusted earnings per share (EPS) and return on invested capital. We do not provide a reconciliation of forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures on a forward-looking basis because we are unable to predict certain items contained in the GAAP measures without unreasonable efforts. In addition, IDEX believes such reconciliation would imply a degree of precision that would be confusing or misleading to investors.

3 Mott – A Strategic Value Creation Acquisition Enhances ability to deliver innovative, customized, and highly technical micro-precision solutions that are increasingly essential to customer product performance Increases opportunities in semiconductor wafer fab equipment, energy transition, medical technologies, space & defense, and water purification industries Complements our applied materials-focused businesses, including recently acquired Muon Group, Iridian Spectral Technologies, and STC Material Solutions, providing unique process-based capabilities working with specialized materials Drives near- and long-term value creation through implementation of 8020 and the IDEX Operating Model Strong fit with IDEX culture and way of doing business

4 Mott is a Leader in the Design and Manufacturing of Sintered Porous Material Structures and Flow Control Solutions • Precision, microporous structures • Extreme, harsh environments (e.g.,1,700°F) • Ultra-high purity (e.g., 99.9999999%) • Leader in porous metal filtration • Mission-critical components and systems • High value and small % of customers’ bill of materials • Highly engineered products, systems, and processes • B2B

5Mott makes the little things that make big things possible State-of-the-art transition metal flow control and low vapor pressure filtration technologies critical for the production of next generation Artificial Intelligence and Quantum Computing chips Advanced porous transport layers (PTL) enable electrolyzer stacks to operate at the highest current density on the market, reducing stack cost and improving overall scalability 3D printed thrust management solutions to support precise altitude control for mission-critical operation windows while simultaneously broadening the usage of highly efficient, non-corrosive propulsion systems Cutting-edge treatment plants utilizing unique membrane filtration equipment created in collaboration with private and public partners to process nearly 1,000,000 gallons per day of agricultural digestate and return over 400,000 gallons per day of clean water to the environment Amplifies Ability to Partner with Customers to Develop Innovative Solutions

6 46% 25% 11% 6% 4% 8% Mott Overview 1959 ~500 $200M HSD Low 20s Founded Employees 2024E Revenue Revenue Growth EBITDA Margin* Leading Provider of Critical Flow Control and Precision Microporous Filtration solutions • Applied material and process control expertise with unique customization capabilities • Serving customers across global technical brands and OEMs in over 100 countries • 30,000+ engineered solutions deployed in select, high-value end markets Semiconductor Wafer Fab Equipment Energy Transition Water Purification Space & Defense Medical Technologies Other** 2024E Revenue by Market **“Other” includes sales from industrial, food & beverage, and gas chromatography.*This presentation contains non-GAAP financial information. Please see slide 2 for more information.

7 Transaction Highlights *This presentation contains non-GAAP financial information. Please see slide 2 for more information. Consideration and Valuation • Cash consideration of $1B; when adjusted for present value of expected tax benefits of ~$100 million, net transaction value is ~$900M • Represents ~19x forecasted full year 2024 EBITDA* and mid-teens multiple for 2025* Financing • Funded through cash on hand, credit facility borrowing, and potential debt issuance • Transaction not subject to any financing conditions • Net leverage of ~1.8x at closing Financial Impact • Expected to generate ~$200M revenue and low-20s EBITDA margin* in full year 2024 • Anticipated accretion to Adj. EPS* in fiscal 2026 and double-digit ROIC* in year 5 post close • Projected meaningful commercial and new product development synergies Timing and Approvals • Transaction subject to customary closing conditions • Expected to close by the end of the third quarter of 2024

8 Expect to Deliver Significant Strategic and Financial Benefits Brings scale to IDEX’s applied material science technologies portfolio that includes Optical Technologies, the Muon Group, and STC Material Solutions Broadens presence in technology-enabled applications with significant long-term growth potential, such as semiconductor wafer fab equipment, energy transition, medical technologies, space & defense, and water purification Enhances IDEX’s ability to serve as an innovation partner for global companies through complementary customization and system-design capabilities that address customer needs for extremely precise solutions Combines IDEX’s 80/20 operating philosophy and commercial excellence with Mott’s innovation, technical, and R&D expertise to drive potential long- term growth and margin expansion Supports IDEX’s strategy to create long-term value for shareholders through organic growth, focused inorganic growth, and margin expansion 1 2 3 4 5

9 Mott Further Expands Applied Material Science Technologies Portfolio Industry-Leading Surface Sciences and Optical Components World-Leader in Micro-Precision Components Highly Engineered Advanced Materials and Technical Ceramics Critical Flow Control and Precision Microporous Filtration Solutions E xp er tis e • Optical design expertise from concept to production • Industry leader in precision optical coatings • Extensive substrate polish and precision assembly capabilities • Expanded with Iridian acquisition • Unique process technologies for micro-precision solutions • Process R&D enables precision beyond industry • Breadth of advanced laser, CNC, deposition, and etch capabilities • Extensive work with advanced, difficult-to- process materials • Ceramics and hermetics experts in mission-critical applications • Material formulation, part design, and validation • Broad range of technical ceramics manufacturing, high value-add finishing, and assembly • Deep applied materials, chemistry, and application knowledge • Cutting-edge technology providing extremely precise porosity control across entire profile of finished products • Trusted innovation partner to global OEMs and leading technology brands + Adds scale and long-standing customer relationships with global OEMs and technical brands

10 Mott’s Products are Additive to IDEX’s Businesses and Enhance Positioning across High-Value End Markets 10 Semiconductor Wafer Fab Equipment Water Purification Medical Technologies Energy Transition Space & Defense Expands high-purity, thermal management, and precision solutions critical to advanced wafer fabrication with Muon, Optical Technologies, and Sealing Solutions Scales commercial and operational reach with IDEX Energy and Pneumatics businesses across traditional and green energy technologies Complements growing applications and technologies with IDEX Intelligent Water businesses Further supports innovation, rapid development, and operational capabilities valued by our space and defense customers along with STC and OT Leverages multiple technologies and capabilities within IDEX Health & Science Technologies segment

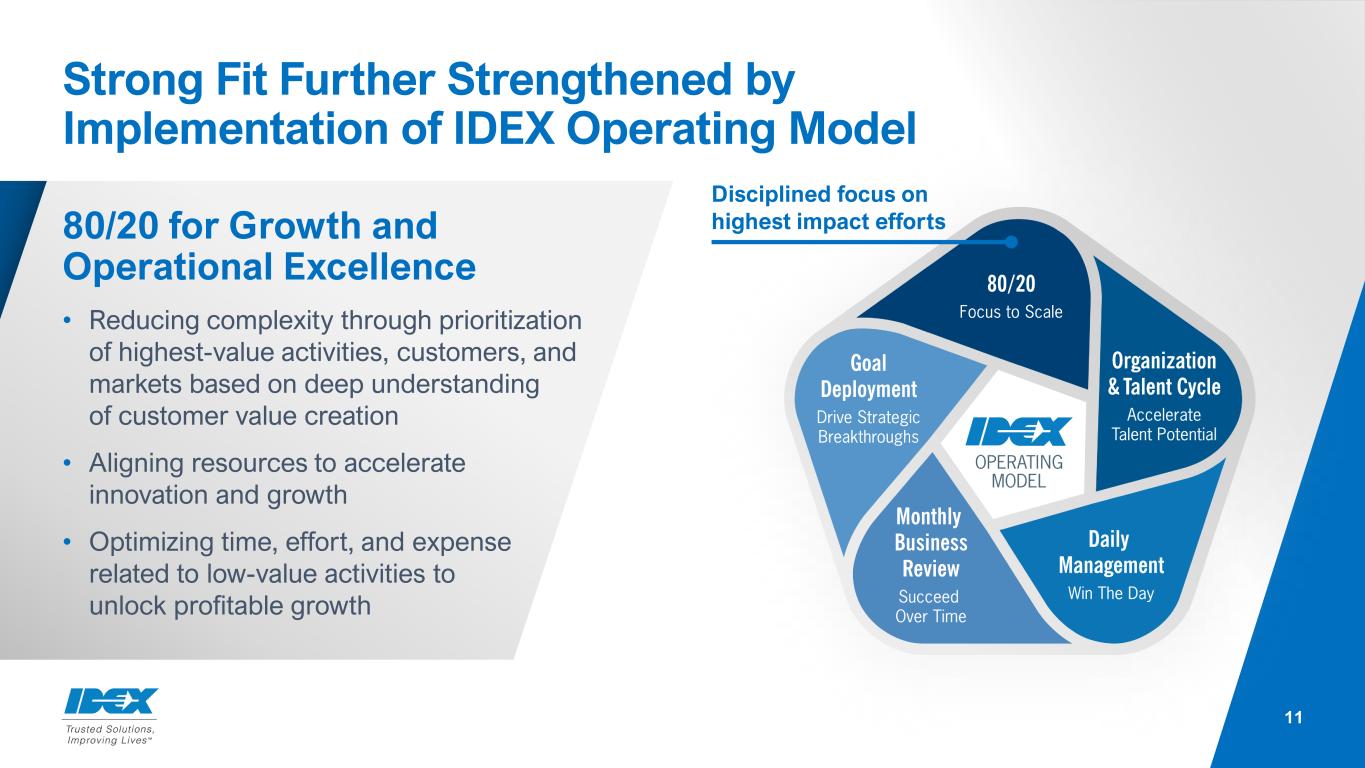

11 Strong Fit Further Strengthened by Implementation of IDEX Operating Model 80/20 for Growth and Operational Excellence • Reducing complexity through prioritization of highest-value activities, customers, and markets based on deep understanding of customer value creation • Aligning resources to accelerate innovation and growth • Optimizing time, effort, and expense related to low-value activities to unlock profitable growth Disciplined focus on highest impact efforts

12 Adds to Growth and Margin Profile Commercial Synergies & Operating Leverage Accretive to Adj. EPS* Fiscal 2026 EBITDA Margin Expansion* ~400 – 600 bps exiting 2026 Double-Digit ROIC* Year 5 Post Close Technical and Commercial Excellence, Operating Model Implementation Innovation, Technology, and R&D Expertise Value Creation Financial Benefits *This presentation contains non-GAAP financial information. Please see slide 2 for more information.

13 Strategic Acquisition with Significant Value Creation Opportunity Enhances ability to deliver innovative, customized, and highly technical micro-precision solutions that are increasingly essential to customer product performance Increases opportunities in semiconductor wafer fab equipment, energy transition, medical technologies, space & defense, and water purification industries Complements successful integration of the Muon Group, Iridian Spectral Technologies, and STC Material Solutions, providing unique process-based capabilities working with specialized materials Drives near- and long-term value creation through implementation of 8020 and the IDEX Operating Model Strong fit with IDEX culture and way of doing business

14 Q&A

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

EX-99.1

EX-99.1