2020 Second Quarter Results

30/07/2020 1:00pm

GlobeNewswire Inc.

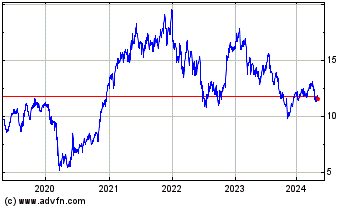

CNH Industrial NV (NYSE:CNHI)

Historical Stock Chart

From May 2019 to May 2024

The following is an extract from the “CNH Industrial 2020 second quarter results” press release. The complete press release can be accessed by visiting the media section of the CNH Industrial corporate website: https://www.cnhindustrial.com/en-us/media/press_releases/Pages/default.aspx or consulting the accompanying PDF:

With all plants and depots up and running by the end of the second quarter,CNH Industrial reported consolidated revenues of $5.6 billion,net income of $361 million and adjusted net loss of $85 million.Net debt of Industrial Activities at $2.3 billion, with positive free cash flow of $97 million helped by end-demand resuming in most markets and the Company’s cost reduction and cash preservation measures.CNH Industrial ended the quarter with strong available liquidity of $11.5 billion.

Financial results presented under U.S. GAAP

CONSOLIDATED RESULTS

- Consolidated revenues of $5.6 billion in the second quarter of 2020, down 26% compared to the second quarter of 2019 (down 23% at constant currency)

- Reported net income of $361 million (or $0.26 per share) in the second quarter of 2020 including a gain of $1,475 million from the remeasurement to fair value of the investment in Nikola Corporation (NKLA), partially offset by $840 million of non-cash impairment charges primarily related to the goodwill allocated to Construction, as well as asset optimization charges of $282 million, mainly as a result of the adverse COVID-19 impacts on used trucks final markets in Europe

- Adjusted net loss of $85 million in the second quarter of 2020 compared to adjusted net income of $430 million in the second quarter of 2019

- Adjusted diluted earnings per share loss of $0.07 in the second quarter of 2020 compared to adjusted diluted earnings per share of $0.31 in the second quarter of 2019

- On June 15, Fitch Ratings (“Fitch”) affirmed CNH Industrial N.V. and CNH Industrial Capital LLC’s long-term issuer default rating at “BBB-” and changed the outlook to stable from positive

INDUSTRIAL ACTIVITIES

- Net sales of $5.2 billion in the second quarter of 2020, down 27% compared to the second quarter of 2019 (down 24% on a constant currency basis), due to severe adverse COVID-19 impacts on supply chain and market conditions across all regions and segments

- Adjusted EBIT loss of $58 million in the second quarter of 2020 compared to adjusted EBIT of $527 million in the second quarter of 2019, strongly impacted by industry demand disruption, negative absorption caused by plant shutdowns and other actions to lower inventory levels, only partially offset by reduced selling, general and administrative expenses and deferral of certain research and development expenses not related to new product launches

- Net debt at June 30, 2020 of $2.3 billion, in line with March 31, 2020 despite the adverse impacts of COVID-19, as a result of positive free cash flow of $97 million and a variety of cash preservation measures

COVID-19 RELATED MATTERS

- All plants and depots resumed activities in May 2020, with safety protocols in place

- Continued social distancing rules in place with a gradual return to the office for employees who are able to work from home

- Continued support to communities

- Financial Services offered payment deferrals and debt rescheduling to the Company’s customers and dealers

-

20200730_PR_CNH_INDUSTRIAL_Q2_2020