We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Name | Symbol | Market | Type |

|---|---|---|---|

| Companhia Energetica de Minas Gerais Cemig | NYSE:CIG | NYSE | Depository Receipt |

| Price Change | % Change | Price | High Price | Low Price | Open Price | Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|

| 0.05 | 2.49% | 2.06 | 2.07 | 2.03 | 2.045 | 1,778,759 | 01:00:00 |

United States

Securities and

exchange commission

washington, d.c. 20549

FORM 6-K

report of foreign

private issuer

pursuant to rule 13a-16 or 15d-16 of

the securities exchange act of 1934

For the month of July 2023

Commission File Number 1-15224

Energy Company of Minas Gerais

(Translation of Registrant’s Name into English)

Avenida Barbacena, 1200

30190-131 Belo Horizonte, Minas Gerais, Brazil

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F a Form 40-F ___

Item Description of Items

| 1. | Material Fact dated May 31, 2023 – Cemig GT executed Agreement regulating the purchase of all shares of Baguari I |

| 2. | Notice to the Market dated June 7, 2023 –Cemig D concluded the settlement of its 9th issue of simple debentures |

| 3. | Notice to Shareholders dated June 12, 2023 – Payment of First Installment of Dividends and Interest on Equity |

| 4. | Notice to Shareholders dated June 20, 2023 – Declaration of Interest on Equity |

| 2 |

Forward-Looking Statements

This report contains statements about expected future events and financial results that are forward-looking and subject to risks and uncertainties. Actual results could differ materially from those predicted in such forward-looking statements. Factors which may cause actual results to differ materially from those discussed herein include those risk factors set forth in our most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission. CEMIG undertakes no obligation to revise these forward-looking statements to reflect events or circumstances after the date hereof, and claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

| 3 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

COMPANHIA ENERGÉTICA DE MINAS GERAIS – CEMIG

By: /s/ Leonardo George de Magalhães .

Name: Leonardo George de Magalhães

Title: Chief Finance and Investor Relations Officer

Date: July 12, 2023

| 4 |

| 1. | Material Fact dated May 31, 2023 – Cemig GT executed Agreement regulating the purchase of all shares of Baguari I |

| 5 |

COMPANHIA ENERGÉTICA DE MINAS GERAIS - CEMIG

PUBLICLY-HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 17.155.730/0001-64

Company Registry (NIRE): 31300040127

CEMIG GERAÇÃO E TRANSMISSÃO S.A.

PUBLICLY-HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 06.981.176/0001-58

Company Registry (NIRE): 31300020550

MATERIAL FACT

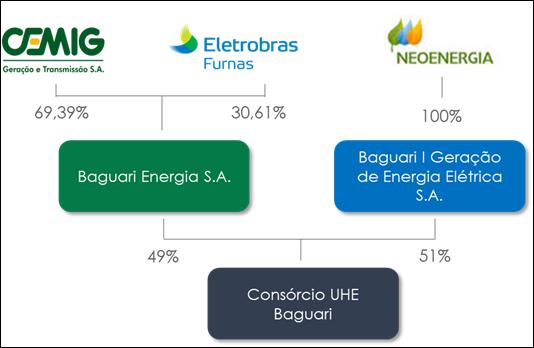

COMPANHIA ENERGÉTICA DE MINAS GERAIS – CEMIG (“CEMIG” or “Company”), a publicly held company with shares traded on the stock exchanges of São Paulo, New York, and Madrid, hereby informs, under CVM Resolution 44/2021, of August 23, 2021, the Brazilian Securities and Exchange Commission (CVM), B3 S.A. – Brasil, Bolsa, Balcão (“B3”), and the market in general that on May 30, 2023, that it executed a Share Purchase Agreement regulating the purchase of all shares of Baguari I Geração de Energia Elétrica S.A. (“Baguari I“), a company controlled by NEOENERGIA S.A. (“NEOENERGIA”), by Baguari Energia S.A (“Baguari Energia”), a company controlled by CEMIG GERAÇÃO E TRANSMISSÃO S.A. (“CEMIG GT”), with 69.39% of the capital stock, and FURNAS CENTRAIS ELÉTRICAS S.A. (“FURNAS”), with the remaining 30.61%.

Baguari Energia and Baguari I hold an interest of 49% and 51%, respectively, in Consórcio UHE Baguari, as shown below:

On December 16, 2022, Neoenergia notified Baguari Energia about the execution of an agreement executed with CENTRAIS ELÉTRICAS DO NORTE DO BRASIL S.A. (“ELETRONORTE”) for the transfer of the interest held in Baguari I, formalizing the offer to Baguari Energia of its preemptive right in the acquisition of 100% of the capital stock of Baguari I, for R$453.9 million. This price is not subject to any type of adjustment.

| 6 |

On March 14, 2023, the Company disclosed a Material Fact informing the disposal of the entire equity interest it held in Baguari Energia to FURNAS for R$393.0 million – (“Transaction 1”).

On March 17, 2023, after approval by the General Shareholders’ Meeting of Baguari Energia of the exercise of the preemptive right for the acquisition of all shares of Baguari I, Neoenergia was duly notified by Baguari Energia about the preemptive right exercised – (“Transaction 2").

With the conclusion of Transaction 1, the Company will no longer hold any interest in Baguari Energia and, consequently, will not be part of Consórcio UHE Baguari. Should Transaction 2 be concluded before the completion of Transaction 1, the Company will participate in the capital increase of Baguari Energia, in the proportion of its shares, for the acquisition of 100% of Baguari I and, at the end of both Transactions, it will sell 100% of the interest it holds in Consórcio UHE Baguari to FURNAS.

The conclusion of Transaction 1 and Transaction 2 will be subject to compliance with the usual conditions precedent for this type of transaction, including the applicable authorizations.

CEMIG and CEMIG GT reaffirm their commitment to keeping shareholders, the market in general, and other stakeholders duly and timely informed about the outcome of the Transactions, under the applicable regulation, and in compliance with the restrictions outlined in CVM rules and other applicable laws.

Belo Horizonte, May 31, 2023.

Leonardo George de Magalhães

Chief Financial and Investor Relations Officer

| 7 |

| 2. | Notice to the Market dated June 7, 2023 –Cemig D concluded the settlement of its 9th issue of simple debentures |

| 8 |

COMPANHIA ENERGÉTICA DE MINAS GERAIS - CEMIG

PUBLICLY HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 17.155.730/0001-64

Company Registry (NIRE): 31300040127

CEMIG DISTRIBUIÇÃO S.A.

PUBLICLY HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 06.981.180/0001-16

Company Registry (NIRE): 31300040127

NOTICE TO THE MARKET

COMPANHIA ENERGÉTICA DE MINAS GERAIS – CEMIG (“Cemig”), a category “A” publicly held company, with shares traded on the stock exchanges of São Paulo, New York, and Madrid, hereby informs the Brazilian Securities and Exchange Commission (CVM), B3 S.A. – Brasil, Bolsa, Balcão, and the market in general that, on 06/06/2023, CEMIG DISTRIBUIÇÃO S.A. (“Cemig D”), a category “B” publicly held company, under operational phase, a wholly-owned subsidiary of Cemig, concluded all the procedures related to the financial settlement of the 9th (ninth) issue of simple, unsecured debentures, not convertible into shares, with an additional personal guarantee, in a single series, for public distribution, under automatic distribution regime, under Resolution 160 of the Brazilian Securities and Exchange Commission, of 07/13/2022, as amended (“Issue”), with a guarantee granted by Cemig (“Debentures”).

A total of 2,000,000 (two million) Debentures were issued, totaling R$2,000,000,000.00 (two billion reais), subscribed as follows:

| Quantity | Value | Rate | Term | Amortization |

| 2,000,000 | R$2,000,000,000.00 | CDI + 2.05% | 3 years | 24th and 36th months |

The net proceeds raised by Cemig D with the Issue will be allocated to recompose Cemig D’s cash position, comprising, but not limited to, Cemig D’s transactions and the investments made.

Finally, we hereby inform that the credit rating agency Fitch Ratings attributed an AA+(bra) rating to the Issue.

This notice is for information purposes only, under the terms of the legislation in force, and should not be interpreted as a selling material, or an offer, invitation, or request for the acquisition of the Debentures.

Belo Horizonte, June 07, 2023.

Leonardo George de Magalhães

Chief Financial and Investor Relations Officer

| 9 |

| 3. | Notice to Shareholders dated June 12, 2023 – Payment of First Installment of Dividends and Interest on Equity |

| 10 |

COMPANHIA ENERGÉTICA DE MINAS GERAIS - CEMIG

PUBLICLY-HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 17.155.730/0001-64

Company Registry (NIRE): 31300040127

NOTICE TO SHAREHOLDERS

We hereby inform our shareholders that on June 30, 2022, CEMIG will pay the first installment of proceeds related to the 2022 FY, as follows:

| Type of Payout | Approval Date | Date “with rights” | Date “ex-rights” | Per common/preferred share (R$) | Total Amount (R$ ‘000) |

| Interest on Equity | June 15, 2022 | June 24, 2022 | June 27, 2022 | 0.08020814950 | 176,500 |

| Interest on Equity | September 20, 2022 | September 23, 2022 | September 26, 2022 | 0.10714013747 | 235,765 |

| Interest on Equity | December 14, 2022 | December 21, 2022 | December 22, 2022 | 0.09057090609 | 199,304 |

| Interest on Equity | December 22, 2022 | December 27, 2022 | December 28, 2022 | 0.11713434556 | 257,757 |

| Dividends | April 27, 2023 | April 27, 2023 | April 28, 2023 | 0.05653493004 | 124,407 |

| TOTAL | 0.45158846866 | 993,732 | |||

As for the payment of Interest on Equity (IOE), a 15% income tax will be withheld, except for shareholders exempt from said withholding, under the terms of the law in force.

Shareholders whose bank details are updated with the Custodian Bank of CEMIG's Registered Shares (Banco Itaú Unibanco S.A.) will have their credits automatically made on the first payment day. If a shareholder does not receive the aforementioned credit, he/she shall go to a branch of Banco Itaú Unibanco S.A. to update his/her registration data. The proceeds related to the shares held in custody by Companhia Brasileira de Liquidação e Custódia - CBLC will be credited to that entity, and the Depository Brokers will be responsible for transferring them to shareholders.

Belo Horizonte, June 12, 2023.

Leonardo George de Magalhães

Chief Financial and Investor Relations Officer

| 11 |

| 4. | Notice to Shareholders dated June 20, 2023 – Declaration of Interest on Equity |

| 12 |

COMPANHIA ENERGÉTICA DE MINAS GERAIS - CEMIG

PUBLICLY-HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 17.155.730/0001-64

Company Registry (NIRE): 31300040127

NOTICE TO SHAREHOLDERS

We hereby inform our shareholders that the Executive Board resolved on the declaration of Interest on Equity - IoE. Detailed information about the payment is as follows:

1. Gross value: R$426,698,000.00 (four hundred, twenty-six million, six hundred and ninety-eight thousand reais)

2. Gross value per share: R$0.19390740496 per share, to be paid with the mandatory minimum dividend referring to 2023, with a 15% withholding income tax, except for shareholders exempt from said withholding, under the law in force;

3. Date “with rights”: shareholders of record on June 23, 2023 that hold common and preferred shares will be entitled to the payment;

4. Date “ex-rights”: 06-26-2023;

5. Payment date: 2 (two) equal installments, the first of which to be paid by June 30, 2024, and the second by December 30, 2024.

Shareholders whose shares are not held in custody at CBLC (Companhia Brasileira de Liquidação e Custódia) and whose registration data is outdated are advised to go to a branch of Banco Itaú Unibanco S.A. (the institution managing CEMIG’s Registered Share System) bearing their personal documents for the due update.

Belo Horizonte, June 20, 2023.

Leonardo George de Magalhães

Chief Financial and Investor Relations Officer

| 13 |

1 Year Companhia Energetica de ... Chart |

1 Month Companhia Energetica de ... Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions