00007465982023FYfalse00007465982023-08-302023-08-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 30, 2023 BRADY CORPORATION

(Exact name of registrant as specified in its charter) Commission File Number 1-14959 | | | | | | | | |

| | |

| Wisconsin | | 39-0178960 |

| (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

6555 West Good Hope Road

Milwaukee, Wisconsin 53223

(Address of Principal Executive Offices and Zip Code)

(414) 358-6600

(Registrant’s Telephone Number) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A Nonvoting Common Stock, par value $0.01 per share | BRC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

On September 5, 2023, Brady Corporation (the “Company”) issued a press release announcing its fiscal 2023 fourth quarter financial results. A copy of the press release is being furnished to the Securities and Exchange Commission as Exhibit 99.1 attached hereto and is incorporated herein by reference.

| | | | | |

| Item 7.01 | REGULATION FD DISCLOSURE |

On September 5, 2023, the Company hosted a conference call related to its fiscal 2023 fourth quarter financial results. A copy of the slides referenced in the conference call, which is also posted on the Company's website, is being furnished to the Securities and Exchange Commission as Exhibit 99.3 attached hereto and is incorporated herein by reference.

Increase in Annual Dividend

On August 30, 2023, the Company's Board of Directors approved an increase in the annual cash dividend on its Class A Common Stock from $0.92 to $0.94 per share. A quarterly dividend in the amount of $0.235 per share will be paid on October 31, 2023, to shareholders of record as of the close of business on October 10, 2023. A copy of the press release regarding the dividend is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Share Repurchase Authorization

On August 30, 2023, the Company's Board of Directors authorized an increase in the Company's share repurchase program, authorizing the repurchase of an additional $100 million of the Company's Class A Nonvoting Common Stock. The share repurchase program may be implemented from time to time on the open market or in privately negotiated transactions and has no expiration date. The repurchased shares will be available for use in connection with the Company's stock-based plans and for other corporate purposes. The share repurchase program was described in a press release issued by the Company in connection with its fiscal 2023 fourth quarter financial results, which is attached hereto as Exhibit 99.1 and is incorporated by reference.

| | | | | |

| Item 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

(d) Exhibits

| | | | | | | | |

| EXHIBIT NUMBER | | DESCRIPTION |

| 99.1 | | |

| 99.2 | | |

| | |

| 99.3 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | BRADY CORPORATION |

| | |

| Date: September 5, 2023 | | |

| | /s/ ANN E. THORNTON |

| | Ann E. Thornton |

| | Chief Financial Officer, Chief Accounting Officer and Treasurer |

EXHIBIT 99.1

For More Information:

Investor contact: Ann Thornton 414-438-6887

Media contact: Kate Venne 414-358-5176

Brady Corporation Reports Record EPS in its Fiscal 2023 Fourth Quarter, Expands its Share Buyback Program and Announces its Fiscal 2024 EPS Guidance

•Sales for the quarter increased 6.8 percent. Organic sales increased 6.9 percent.

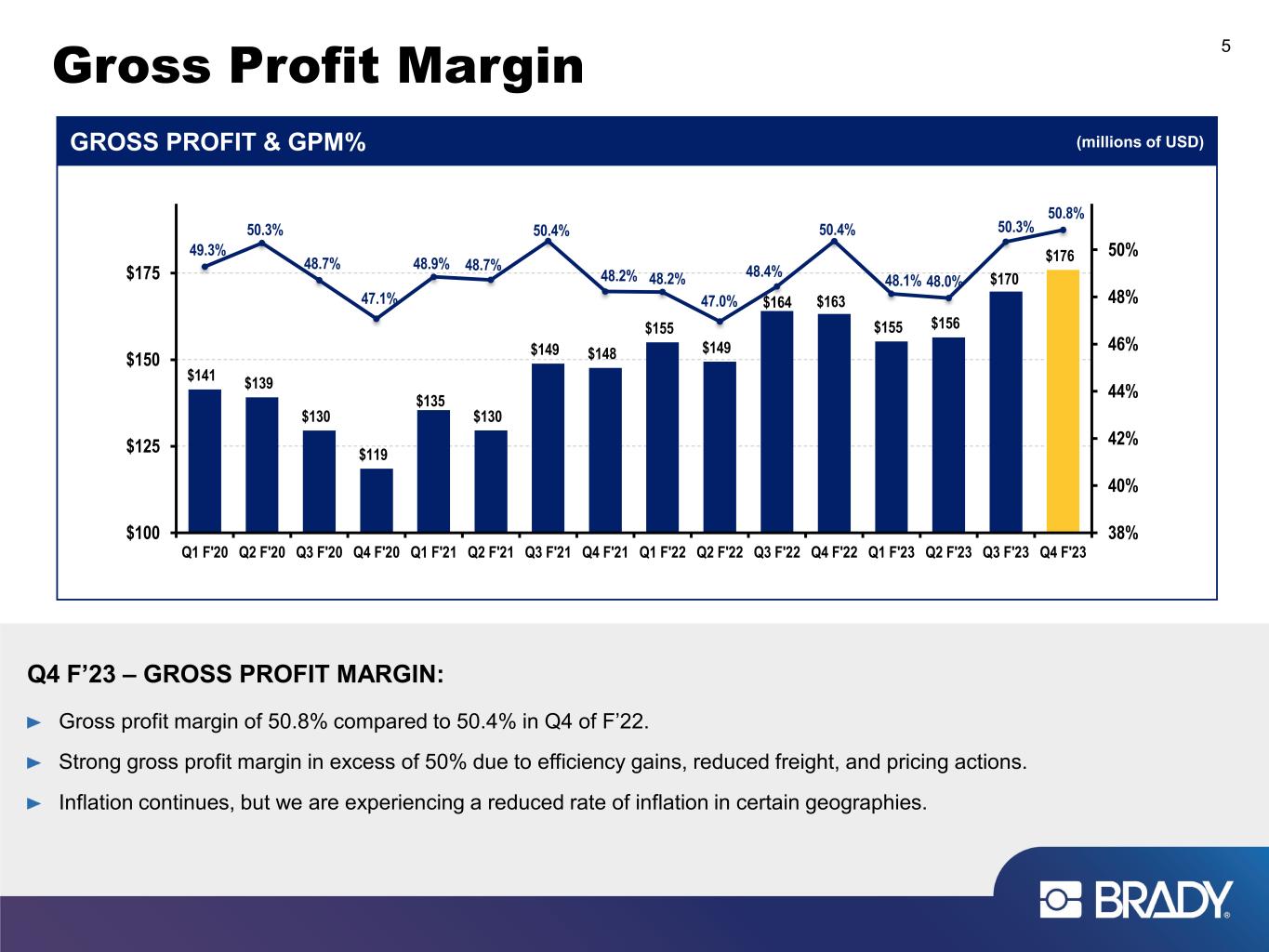

•Gross profit margin increased to 50.8 percent in the fourth quarter of F’23 compared to 50.4 percent in the fourth quarter of F’22.

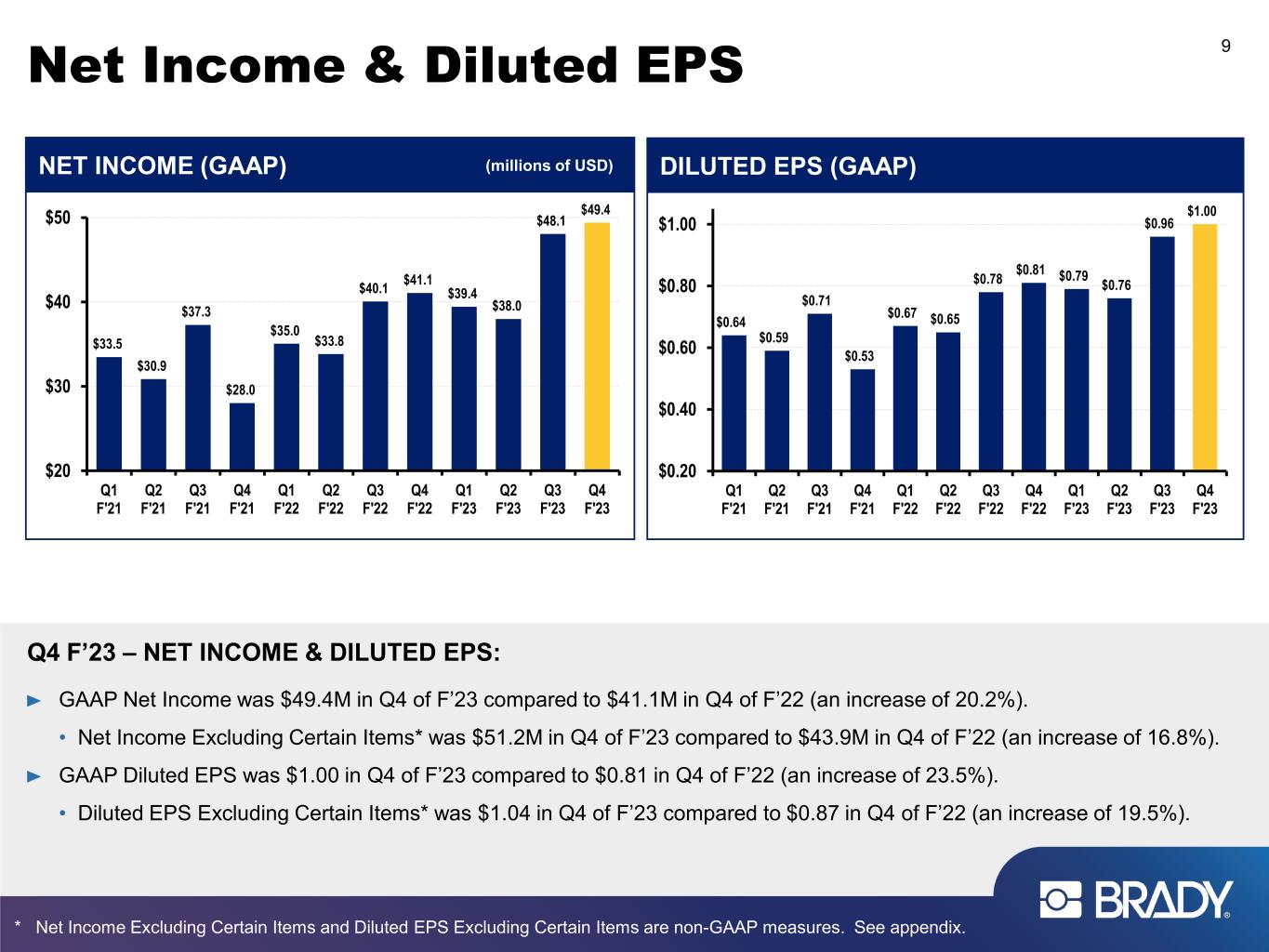

•Diluted EPS increased 23.5 percent to an all-time high of $1.00 in the fourth quarter of fiscal 2023 compared to $0.81 in the same quarter of the prior year. Diluted EPS Excluding Certain Items* increased 19.5 percent to an all-time record high of $1.04 in the fourth quarter of fiscal 2023 compared to $0.87 in the same quarter of the prior year.

•During the quarter and year ended July 31, 2023, we returned $56.4 million and $120.4 million, respectively, to our shareholders in the form of dividends and share repurchases. On August 30, 2023, Brady’s Board of Directors authorized an additional $100 million of shares for repurchase, which based on current share prices equates to approximately 2.0 million shares and approximately 4.4 percent of total outstanding shares.

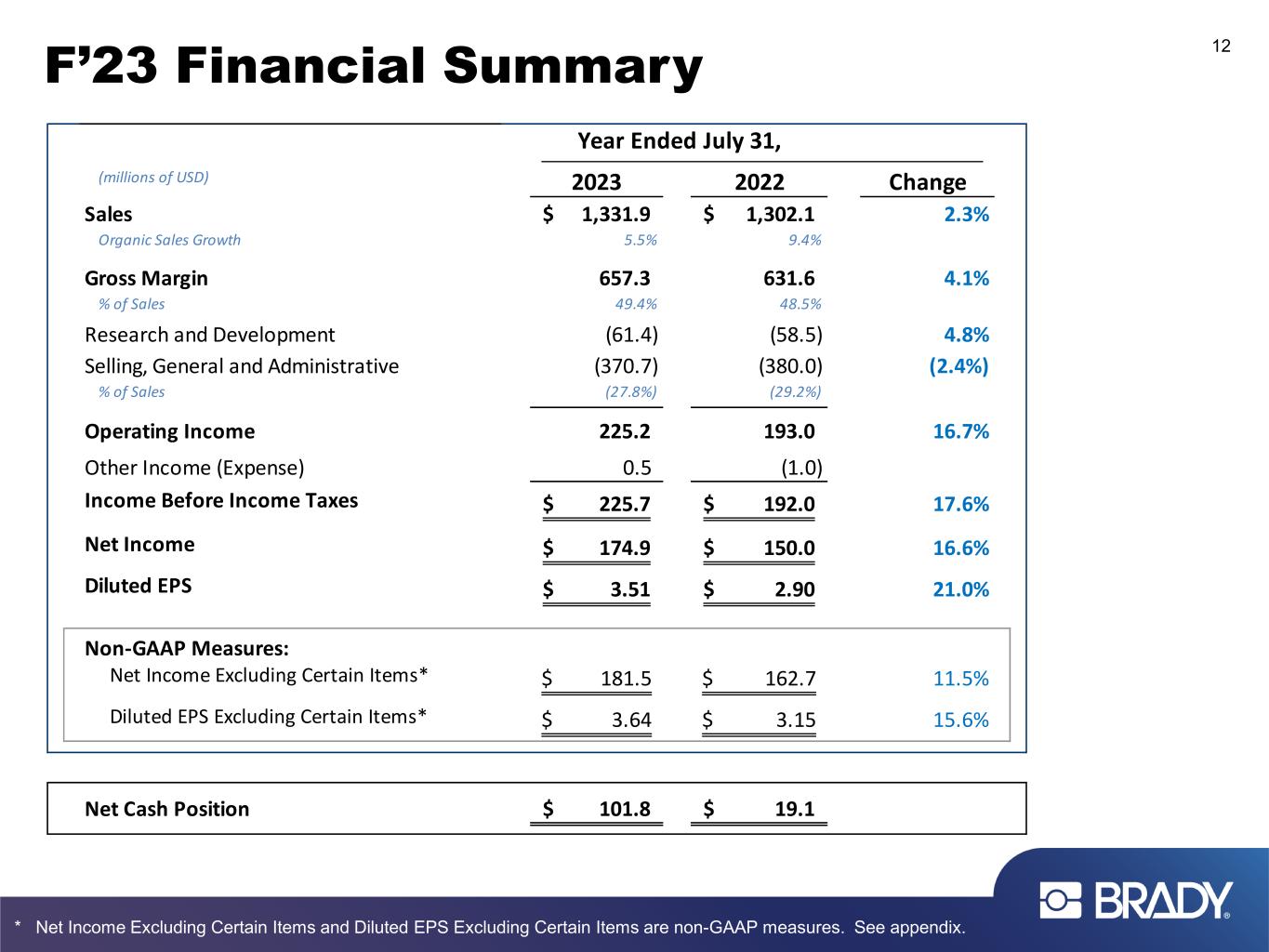

•Fiscal 2023 sales increased 2.3 percent and organic sales increased 5.5 percent. Diluted EPS increased 21.0 percent to an all-time high of $3.51 in fiscal 2023 compared to $2.90 in fiscal 2022.

•Diluted EPS guidance for the year ending July 31, 2024 was announced at a range of $3.70 to $3.95 on a GAAP basis, and a range of $3.85 to $4.10 on a non-GAAP basis. This GAAP EPS guidance range is an increase of 5.4 percent to 12.5 percent compared to GAAP EPS of $3.51 for the year ended July 31, 2023.

MILWAUKEE (September 5, 2023) -- Brady Corporation (NYSE: BRC) (“Brady” or “Company”), a world leader in identification solutions, today reported its financial results for its fiscal 2023 fourth quarter ended July 31, 2023.

Quarter Ended July 31, 2023 Financial Results:

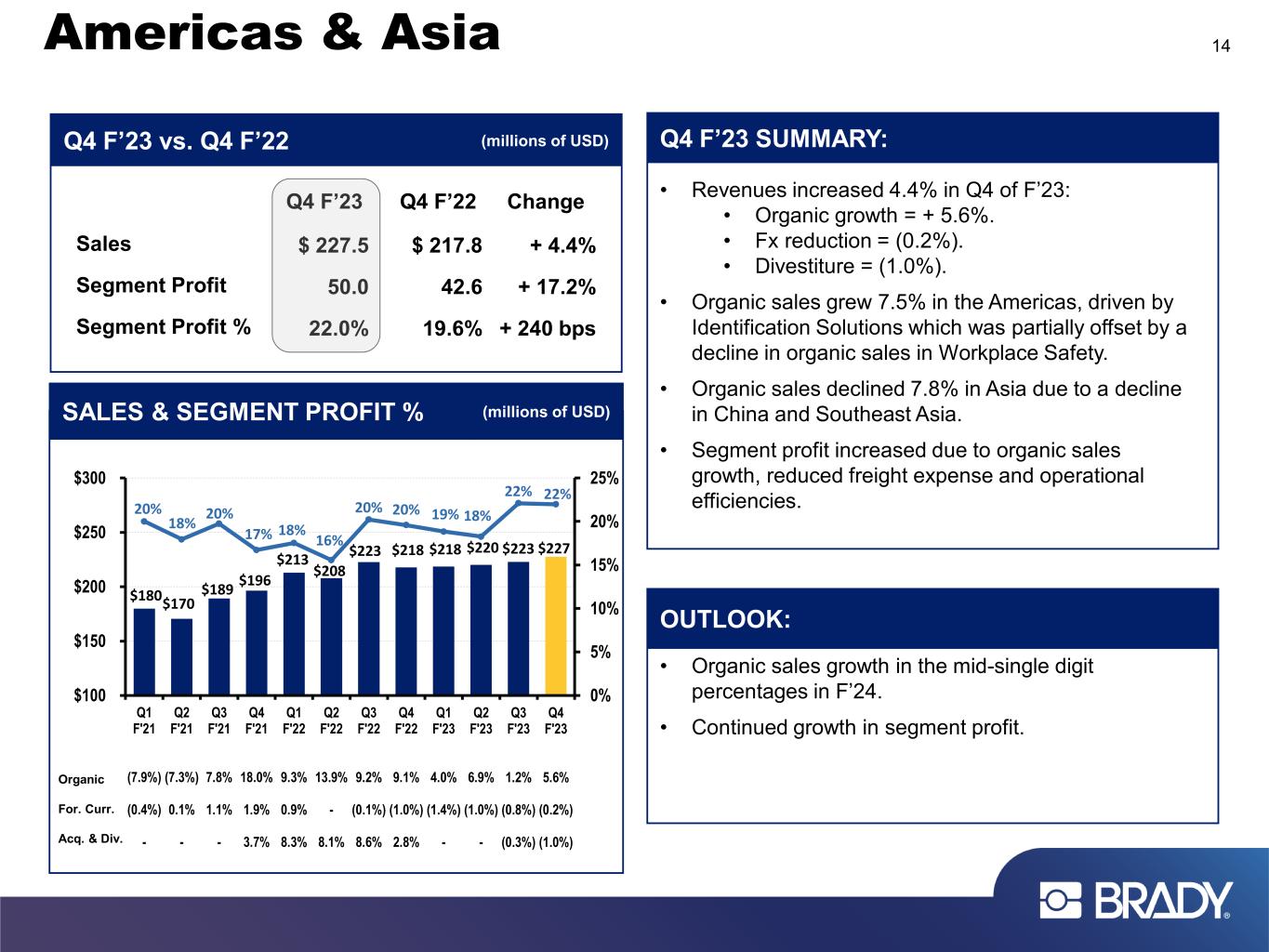

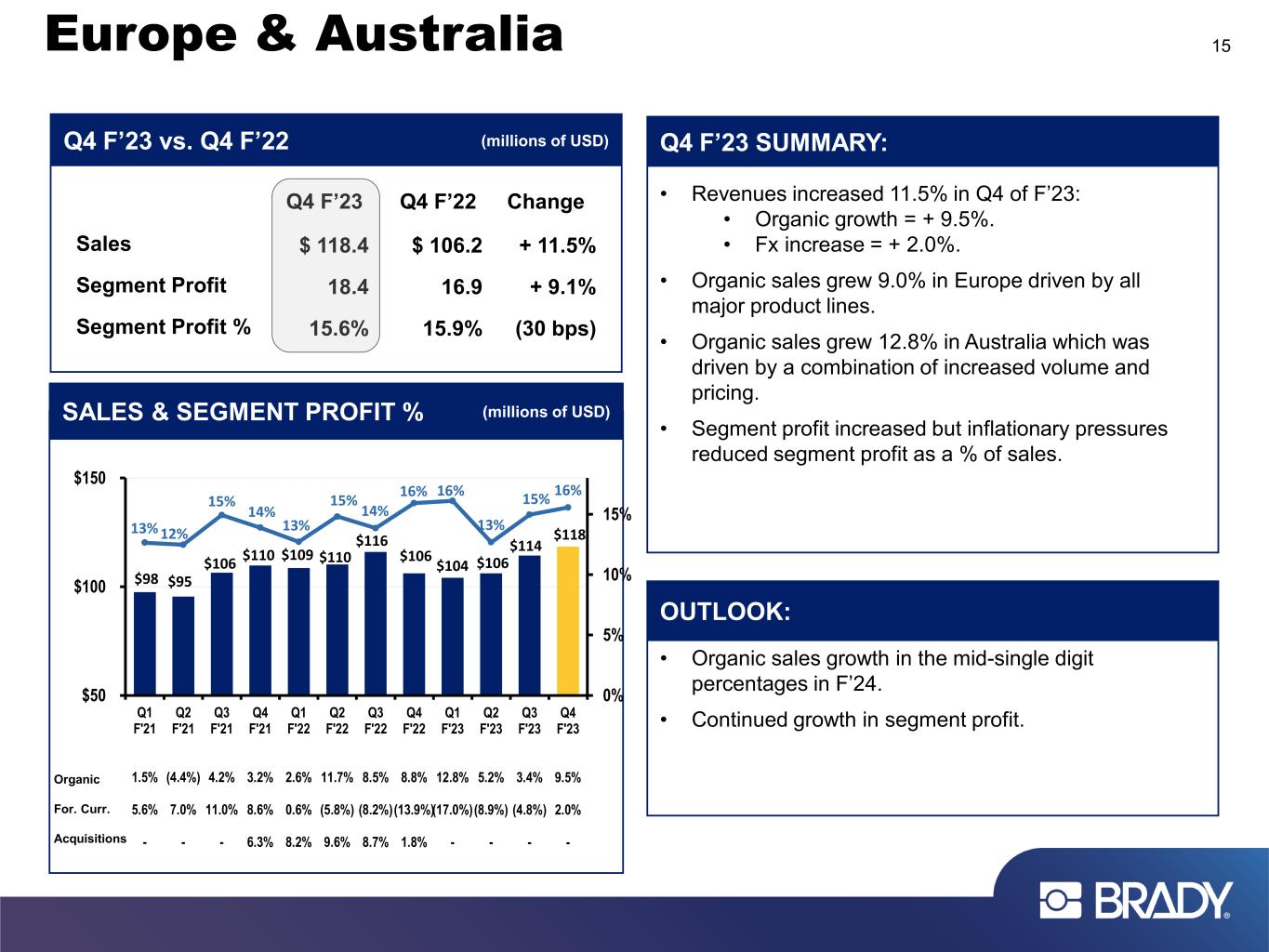

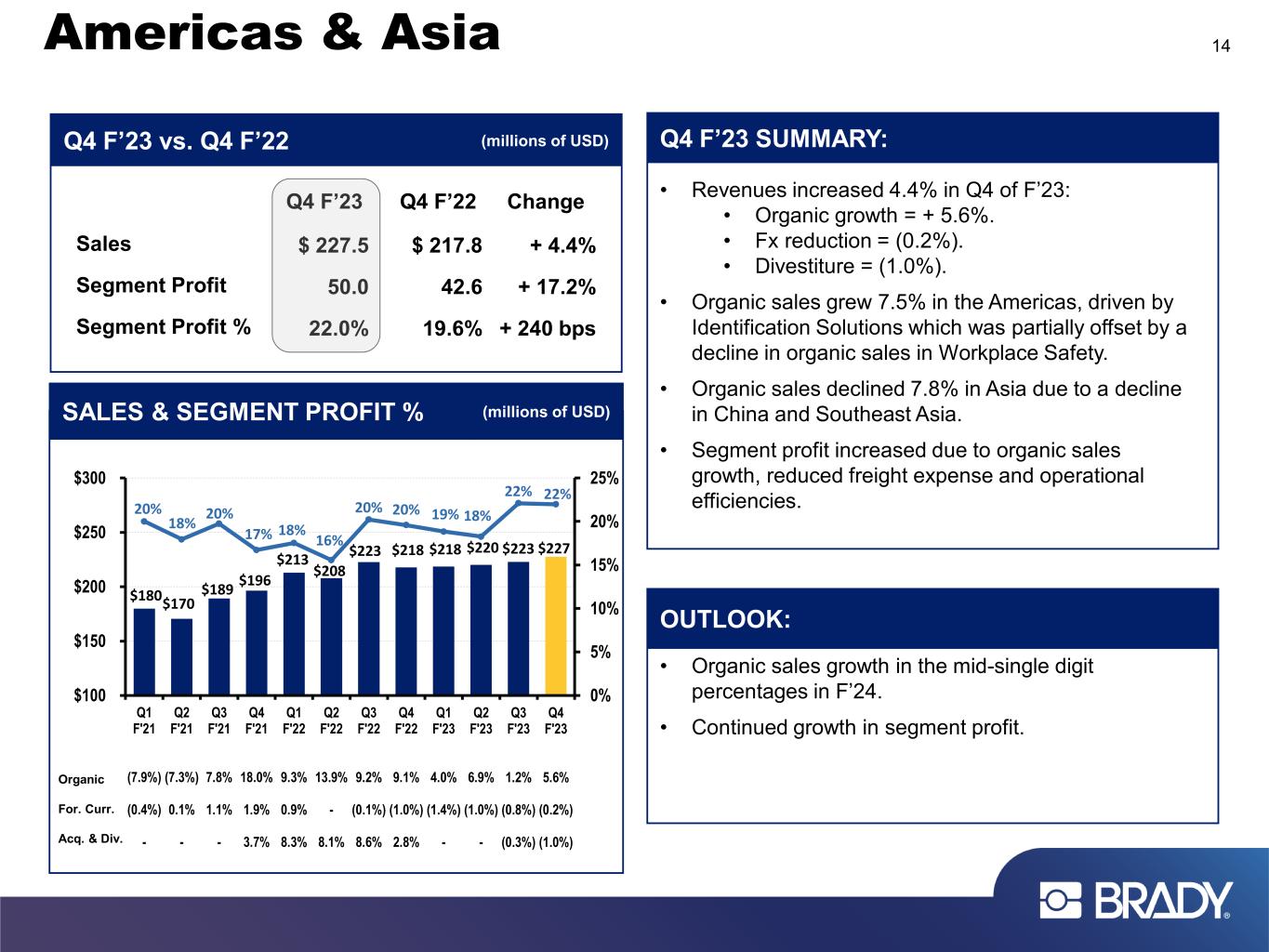

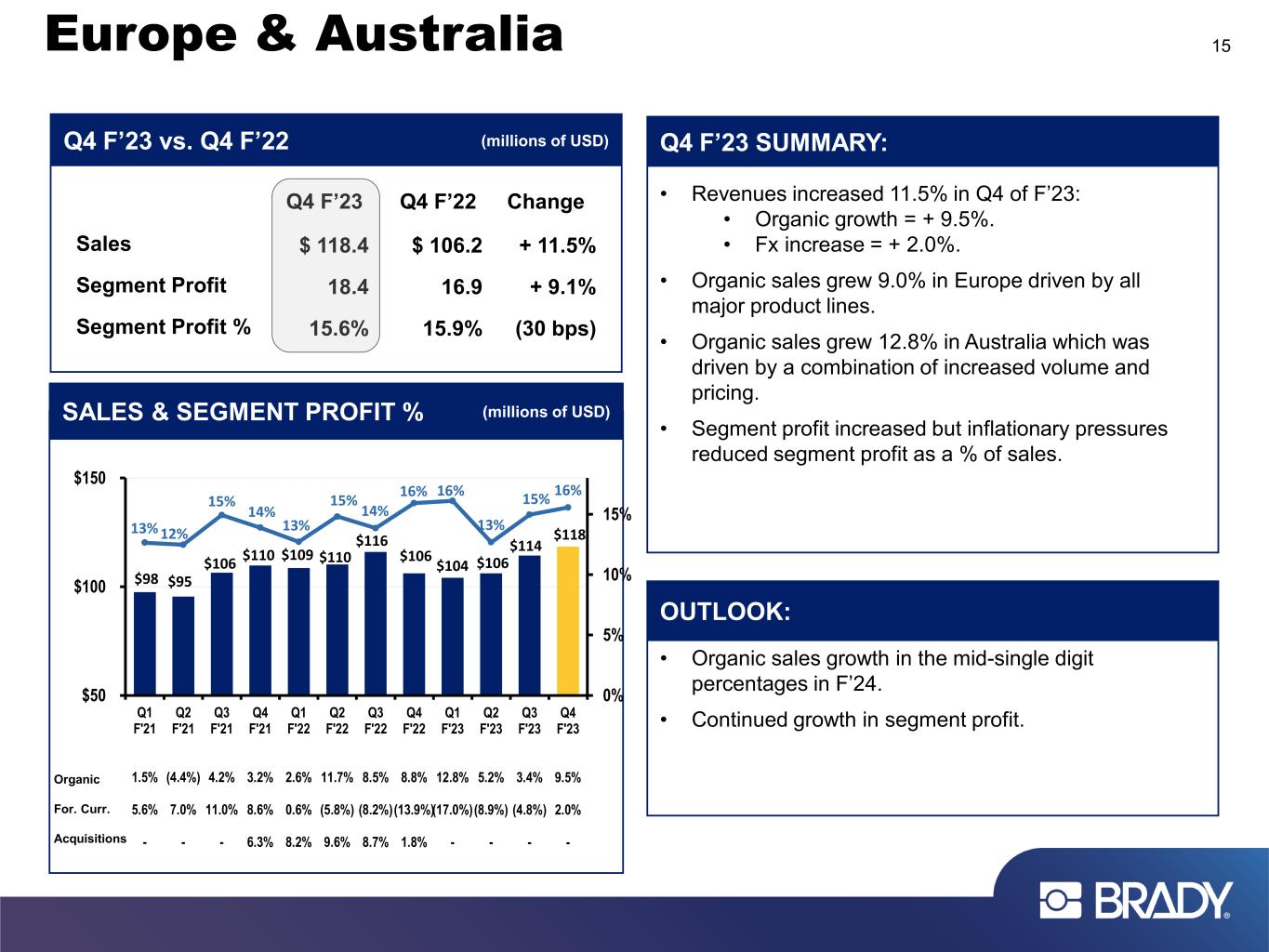

Sales for the quarter ended July 31, 2023 increased 6.8 percent, which consisted of an organic sales increase of 6.9 percent, an increase of 0.6 percent from foreign currency translation and a decrease of 0.7 percent from the divestiture of the PremiSys business. Sales for the quarter ended July 31, 2023 were $345.9 million compared to $324.0 million in the same quarter last year. By region, sales increased 4.4 percent in the Americas & Asia and increased 11.5 percent in Europe & Australia, which consisted of an organic sales increase of 5.6 percent in the Americas & Asia and an organic sales increase of 9.5 percent in Europe & Australia.

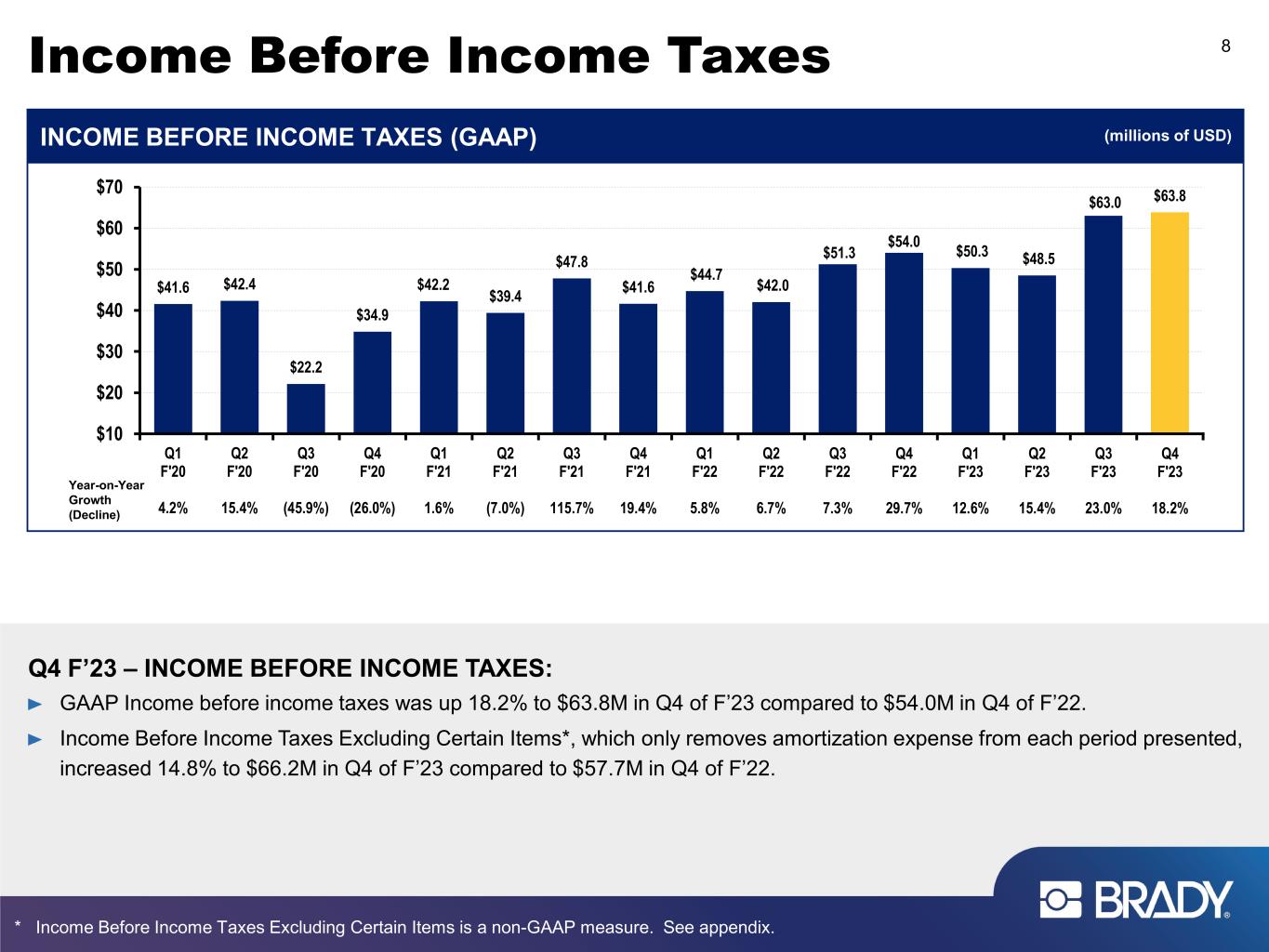

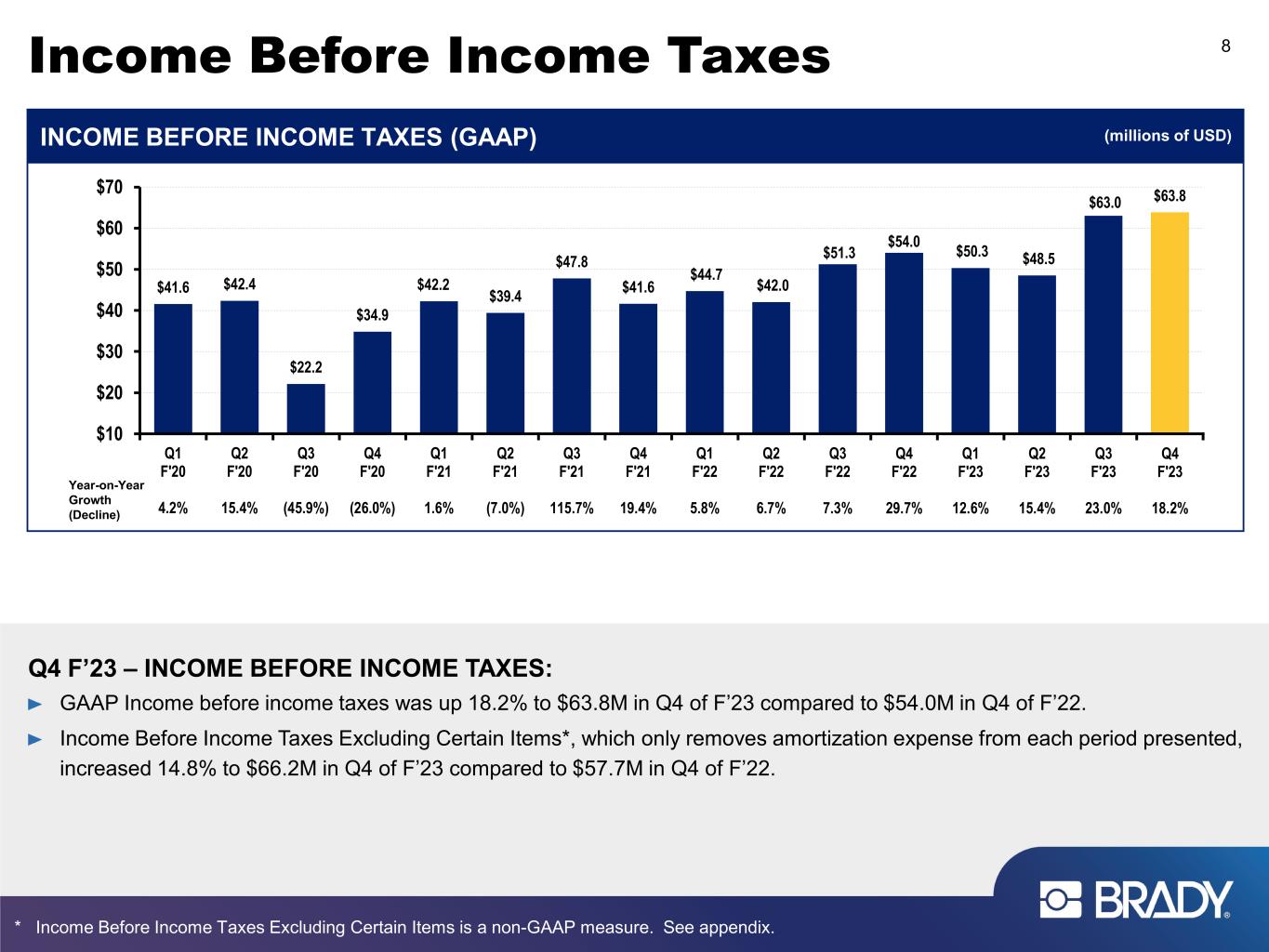

Income before income taxes increased 18.2 percent to $63.8 million for the quarter ended July 31, 2023, compared to $54.0 million in the same quarter last year. Income Before Income Taxes Excluding Certain Items* for the quarter ended July 31, 2023, which was adjusted for amortization expense of $2.4 million, was $66.2 million, an increase of 14.8 percent compared to the fourth quarter of last year. Income Before Income Taxes

Excluding Certain Items* for the quarter ended July 31, 2022, which was adjusted for amortization expense of $3.7 million, was $57.7 million.

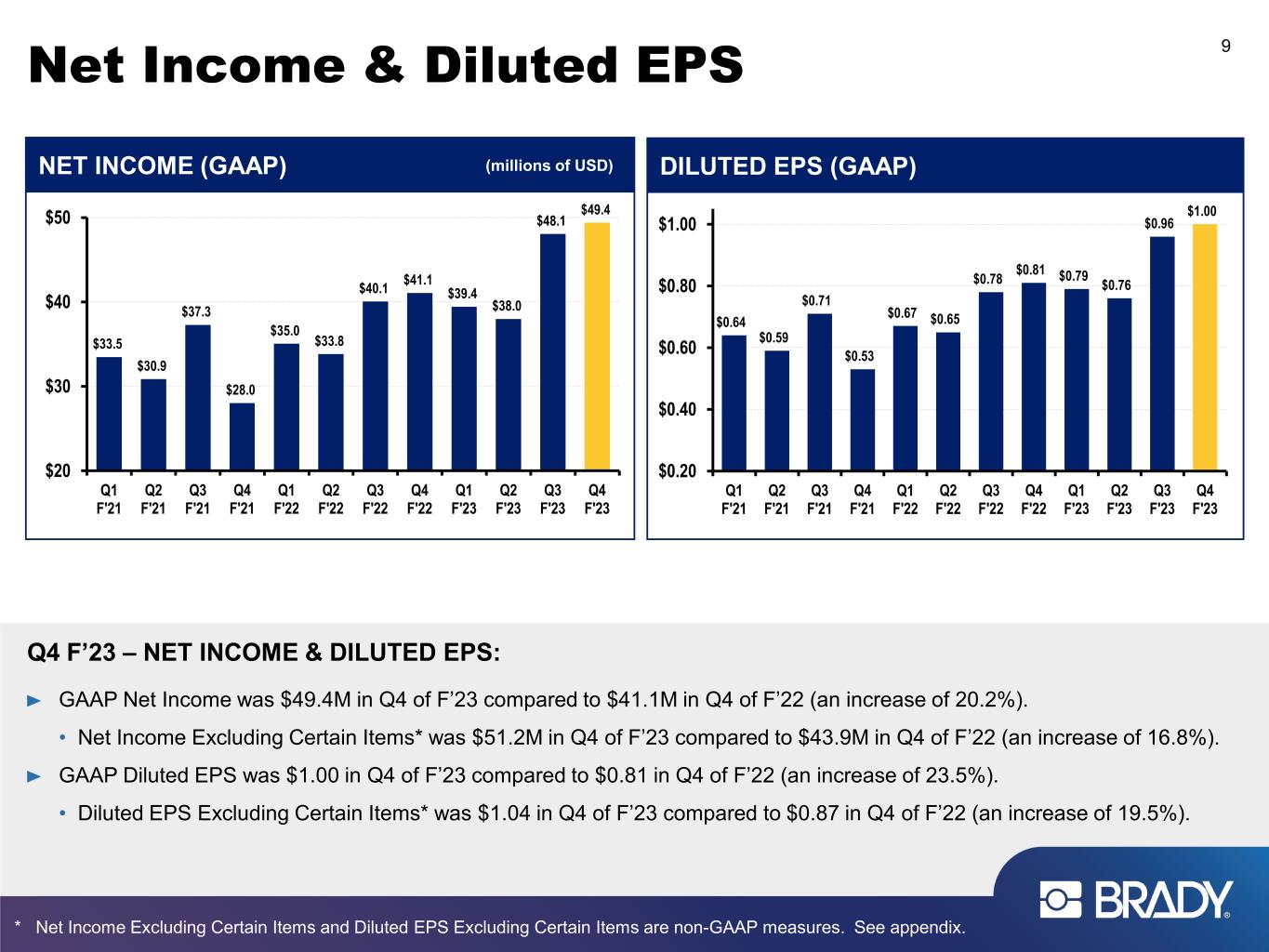

Net income for the quarter ended July 31, 2023 was $49.4 million compared to $41.1 million in the same quarter last year. Earnings per diluted Class A Nonvoting Common Share were $1.00 for the fourth quarter of fiscal 2023, compared to $0.81 in the same quarter last year. Net Income Excluding Certain Items* for the quarter ended July 31, 2023 was $51.2 million and Diluted EPS Excluding Certain Items* for the quarter ended July 31, 2023 was $1.04. Net Income Excluding Certain Items* for the quarter ended July 31, 2022 was $43.9 million, and Diluted EPS Excluding Certain Items* for the quarter ended July 31, 2022 was $0.87.

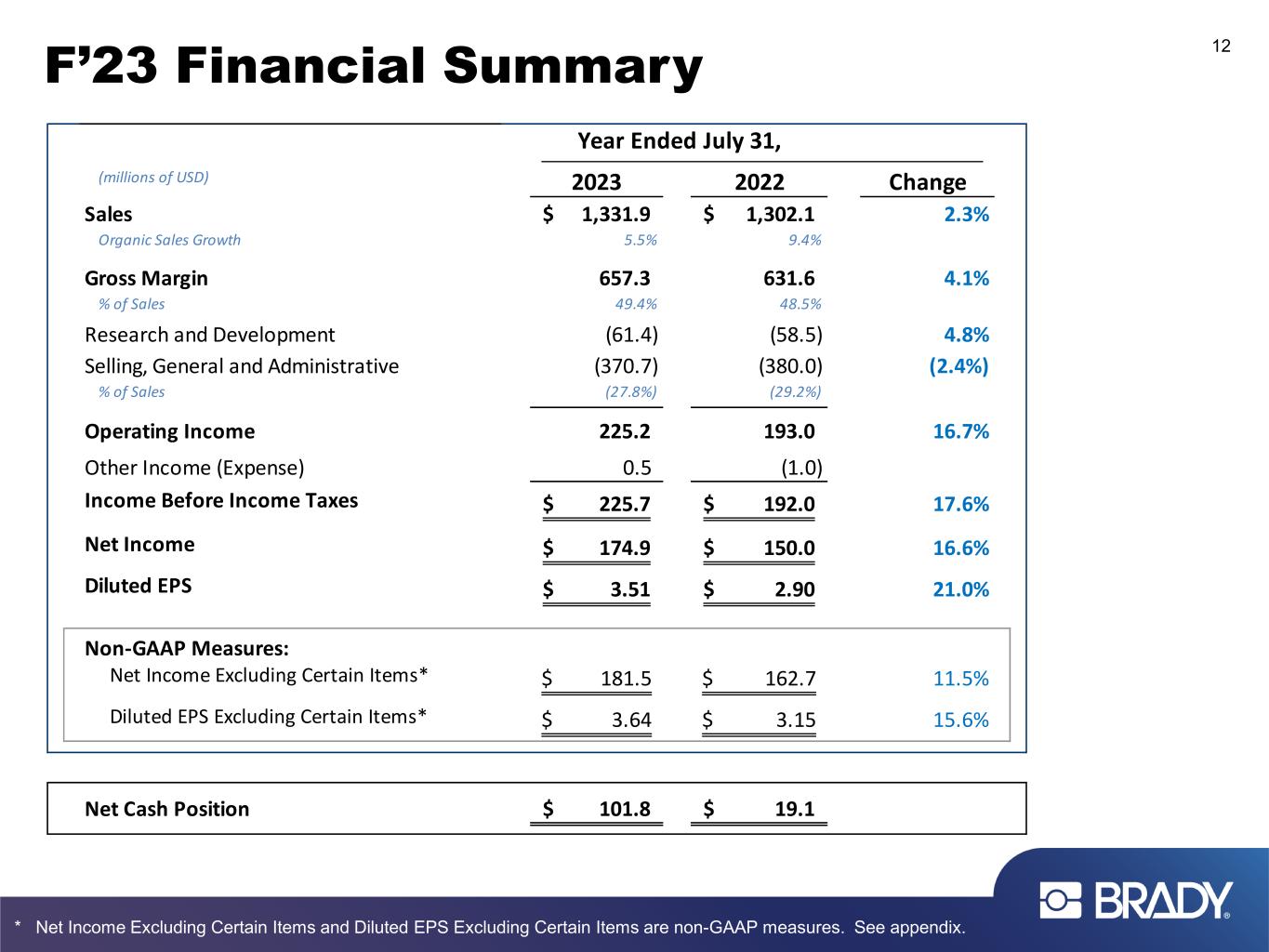

Year Ended July 31, 2023 Financial Results:

Sales for the year ended July 31, 2023 increased 2.3 percent, which consisted of an organic sales increase of 5.5 percent, a decrease of 3.0 percent from foreign currency translation and a decrease of 0.2 percent from the divestiture of the PremiSys business. Sales for the year ended July 31, 2023 were $1.33 billion compared to $1.30 billion in the same period last year. By region, sales increased 3.2 percent in the Americas & Asia and increased 0.5 percent in Europe & Australia, which consisted of an organic sales increase of 4.4 percent in the Americas & Asia and an organic sales increase of 7.6 percent in Europe & Australia.

Income before income taxes increased 17.6 percent to $225.7 million for the year ended July 31, 2023, compared to $192.0 million in the same period last year. Income Before Income Taxes Excluding Certain Items* for the year ended July 31, 2023 was $233.7 million, an increase of 11.9 percent compared to the same period last year. Income Before Income Taxes Excluding Certain Items* for the year ended July 31, 2023 was adjusted for amortization expense of $11.7 million and removes the $3.8 million gain on the sale of the PremiSys business. Income Before Income Taxes Excluding Certain Items* for the prior year ended July 31, 2022 was $208.8 million, which was adjusted for amortization expense of $15.0 million and non-recurring charges primarily to streamline the cost structure of our Workplace Safety business of $1.8 million.

Net income for the year ended July 31, 2023 was $174.9 million compared to $150.0 million in the same period last year. Earnings per diluted Class A Nonvoting Common Share were $3.51 for the year ended July 31, 2023, compared to $2.90 in the same period last year. Net Income Excluding Certain Items* for the year ended July 31, 2023 was $181.5 million and Diluted EPS Excluding Certain Items* for the year ended July 31, 2022 was $3.64. Net Income Excluding Certain Items* for the year ended July 31, 2022 was $162.7 million, and Diluted EPS Excluding Certain Items* for the year ended July 31, 2022 was $3.15.

Commentary:

“This quarter we once again reported all-time record high EPS, resulting in a strong finish and Brady’s best earnings year ever. For the full year ended July 31, 2023, our GAAP EPS was $3.51, which was a 21.0 percent increase over the previous year which was also a record,” said Brady’s President and Chief Executive Officer, Russell R. Shaller. “Both regions performed well this year with total organic sales growth of 5.5 percent and strong growth in operating income. We have exciting new products in our pipeline, our regional reorganization is driving benefits throughout our businesses, and we’re entering next fiscal year with positive momentum.”

“In addition to our organic revenue growth of 5.5 percent and record EPS this year, we also used our strong balance sheet and cash generation to return funds to our shareholders in the form of share buybacks and increased dividends. This year, we repurchased a total of 1.6 million shares for $75.0 million and we returned another $45.4

million to our shareholders in the form of dividends,” said Brady’s Chief Financial Officer, Ann Thornton. “Even after returning more than $120 million to our shareholders this year, we were still in a net cash position of $101.8 million at July 31, 2023. We are financially solid and are well-positioned for the future with a balance sheet that provides opportunities to invest in both organic and inorganic opportunities to increase shareholder value.”

Share Buyback Program:

On August 30, 2023, Brady’s Board of Directors authorized an additional $100 million of Class A Common Stock for repurchase under the Company’s share buyback program. The share buyback plan may be implemented from time to time in the open market or in privately negotiated transactions and has no expiration date.

Fiscal 2024 Guidance:

Brady expects GAAP earnings per diluted Class A Nonvoting Common Share to range from $3.70 to $3.95, which would be an increase of 5.4 percent to 12.5 percent over the GAAP earnings per diluted Class A nonvoting Common Share of $3.51 for the year ended July 31, 2023.

Brady also expects Diluted EPS Excluding Certain Items* to range from $3.85 to $4.10 for the year ending July 31, 2024, which would be an increase of 5.8 percent to 12.6 percent over Diluted EPS Excluding Certain Items* of $3.64 for the year ended July 31, 2023. Excluded from this Diluted EPS Excluding Certain Items* guidance is expected amortization expense equating to $0.15 per share for the year ending July 31, 2024.

Included in our fiscal 2024 guidance are a full-year income tax rate of approximately 22 percent and depreciation and amortization expense ranging from $32 million to $34 million. Capital expenditures are expected to approximate $75 million, which is inclusive of facility construction costs of approximately $55 million. Our fiscal 2024 guidance is based on foreign currency exchange rates as of July 31, 2023 and assumes continued economic growth.

A webcast regarding Brady’s fiscal 2023 fourth quarter and full year financial results will be available at www.bradycorp.com/investors beginning at 9:30 a.m. central time today.

Brady Corporation is an international manufacturer and marketer of complete solutions that identify and protect people, products and places. Brady’s products help customers increase safety, security, productivity and performance and include high-performance labels, signs, safety devices, printing systems and software. Founded in 1914, the Company has a diverse customer base in electronics, telecommunications, manufacturing, electrical, construction, medical, aerospace and a variety of other industries. Brady is headquartered in Milwaukee, Wisconsin and as of July 31, 2023, employed approximately 5,600 people in its worldwide businesses. Brady’s fiscal 2023 sales were approximately $1.33 billion. Brady stock trades on the New York Stock Exchange under the symbol BRC. More information is available on the Internet at www.bradyid.com.

* Income Before Income Taxes Excluding Certain Items, Net Income Excluding Certain Items, and Diluted EPS Excluding Certain Items are non-GAAP measures. See appendix for more information on these measures, including reconciliations to the most directly comparable GAAP measures.

###

In this news release, statements that are not reported financial results or other historic information are “forward-looking statements.” These forward-looking statements relate to, among other things, the Company's future financial position, business strategy, targets, projected sales, costs, earnings, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations.

The use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project,” “continue” or “plan” or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements by their nature address matters that are, to different degrees, uncertain and are subject to risks, assumptions, and other factors, some of which are beyond Brady’s control, that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. For Brady, uncertainties arise from: increased cost of raw materials, labor and freight as well as material shortages and supply chain disruptions; decreased demand for our products; our ability to compete effectively or to successfully execute our strategy; our ability to develop technologically advanced products that meet customer demands; difficulties in protecting our websites, networks, and systems against security breaches; Brady’s ability to identify, integrate, and grow acquired companies, and to manage contingent liabilities from divested businesses; risks associated with the loss of key employees; extensive regulations by U.S. and non-U.S. governmental and self-regulatory entities; litigation, including product liability claims; adverse impacts of the novel coronavirus (“COVID-19”) pandemic or other pandemics; foreign currency fluctuations; potential write-offs of goodwill and other intangible assets; changes in tax legislation and tax rates; differing interests of voting and non-voting shareholders; numerous other matters of national, regional and global scale, including major public health crises and government responses thereto and those of a political, economic, business, competitive, and regulatory nature contained from time to time in Brady’s U.S. Securities and Exchange Commission filings, including, but not limited to, those factors listed in the “Risk Factors” section within Item 1A of Part I of Brady’s Form 10-K for the year ended July 31, 2023.

These uncertainties may cause Brady's actual future results to be materially different than those expressed in its forward-looking statements. Brady does not undertake to update its forward-looking statements except as required by law.

BRADY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited; Dollars in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended July 31, | | Year ended July 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net sales | $ | 345,929 | | | $ | 323,981 | | | $ | 1,331,863 | | | $ | 1,302,062 | |

| Cost of goods sold | 170,049 | | | 160,805 | | | 674,588 | | | 670,510 | |

| Gross margin | 175,880 | | | 163,176 | | | 657,275 | | | 631,552 | |

| Operating expenses: | | | | | | | |

| Research and development | 16,340 | | | 15,753 | | | 61,365 | | | 58,548 | |

| Selling, general and administrative | 97,495 | | | 94,507 | | | 370,697 | | | 379,992 | |

| Total operating expenses | 113,835 | | | 110,260 | | | 432,062 | | | 438,540 | |

| | | | | | | |

| Operating income | 62,045 | | | 52,916 | | | 225,213 | | | 193,012 | |

| | | | | | | |

| Other income (expense): | | | | | | | |

| Investment and other income | 2,426 | | | 1,587 | | | 4,022 | | | 244 | |

| Interest expense | (653) | | | (513) | | | (3,539) | | | (1,276) | |

| | | | | | | |

| Income before income taxes | 63,818 | | | 53,990 | | | 225,696 | | | 191,980 | |

| | | | | | | |

| Income tax expense | 14,440 | | | 12,926 | | | 50,839 | | | 42,001 | |

| | | | | | | |

| Net income | $ | 49,378 | | | $ | 41,064 | | | $ | 174,857 | | | $ | 149,979 | |

| | | | | | | |

| Net income per Class A Nonvoting Common Share: | | | | | | | |

| Basic | $ | 1.01 | | | $ | 0.82 | | | $ | 3.53 | | | $ | 2.92 | |

| Diluted | $ | 1.00 | | | $ | 0.81 | | | $ | 3.51 | | | $ | 2.90 | |

| | | | | | | |

| Net income per Class B Voting Common Share: | | | | | | | |

| Basic | $ | 1.01 | | | $ | 0.82 | | | $ | 3.51 | | | $ | 2.91 | |

| Diluted | $ | 1.00 | | | $ | 0.81 | | | $ | 3.49 | | | $ | 2.89 | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 49,099 | | | 50,185 | | | 49,591 | | | 51,321 | |

| Diluted | 49,377 | | | 50,437 | | | 49,869 | | | 51,651 | |

BRADY CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited; Dollars in thousands)

| | | | | | | | | | | |

| July 31, 2023 | | July 31, 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 151,532 | | | $ | 114,069 | |

| Accounts receivable, net of allowance for credit losses of $8,467 and $7,355, respectively | 184,420 | | | 183,233 | |

| Inventories | 177,078 | | | 190,023 | |

| Prepaid expenses and other current assets | 11,790 | | | 10,743 | |

| Total current assets | 524,820 | | | 498,068 | |

| Property, plant and equipment—net | 142,149 | | | 139,511 | |

| Goodwill | 592,646 | | | 586,832 | |

| Other intangible assets | 62,096 | | | 74,028 | |

| Deferred income taxes | 15,716 | | | 15,881 | |

| Operating lease assets | 29,688 | | | 31,293 | |

| Other assets | 22,142 | | | 21,719 | |

| Total | $ | 1,389,257 | | | $ | 1,367,332 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 79,855 | | | $ | 81,116 | |

| Accrued compensation and benefits | 71,470 | | | 76,764 | |

| Taxes, other than income taxes | 13,575 | | | 12,539 | |

| Accrued income taxes | 12,582 | | | 8,294 | |

| Current operating lease liabilities | 14,726 | | | 15,003 | |

| Other current liabilities | 65,828 | | | 61,458 | |

| Total current liabilities | 258,036 | | | 255,174 | |

| Long-term debt | 49,716 | | | 95,000 | |

| Long-term operating lease liabilities | 16,217 | | | 19,143 | |

| Other liabilities | 74,369 | | | 86,717 | |

| Total liabilities | 398,338 | | | 456,034 | |

| Stockholders’ equity: | | | |

| Common stock: | | | |

| Class A nonvoting common stock—Issued 51,261,487 shares, and outstanding 45,008,724 and 46,370,708 shares, respectively (aggregate liquidation preference of $42,716) | 513 | | | 513 | |

| Class B voting common stock—Issued and outstanding, 3,538,628 shares | 35 | | | 35 | |

| Additional paid-in capital | 351,771 | | | 345,266 | |

| Retained earnings | 1,021,870 | | | 892,417 | |

| Treasury stock—6,252,763 and 4,890,779 shares, respectively of Class A nonvoting common stock, at cost | (290,209) | | | (217,856) | |

| Accumulated other comprehensive loss | (93,061) | | | (109,077) | |

| Total stockholders’ equity | 990,919 | | | 911,298 | |

| Total | $ | 1,389,257 | | | $ | 1,367,332 | |

BRADY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited; Dollars in thousands)

| | | | | | | | | | | |

| Year ended July 31, |

| | 2023 | | 2022 |

| Operating activities: | | | |

| Net income | $ | 174,857 | | | $ | 149,979 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 32,370 | | | 34,182 | |

| Stock-based compensation expense | 7,508 | | | 10,504 | |

| Gain on sale of business | (3,770) | | | — | |

| Deferred income taxes | (12,472) | | | (1,645) | |

| Other | (308) | | | 1,197 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 2,380 | | | (25,330) | |

| Inventories | 14,972 | | | (62,907) | |

| Prepaid expenses and other assets | (1,023) | | | 807 | |

| Accounts payable and accrued liabilities | (9,459) | | | 6,826 | |

| Income taxes | 4,094 | | | 4,836 | |

| Net cash provided by operating activities | 209,149 | | | 118,449 | |

| | | |

| Investing activities: | | | |

| Purchases of property, plant and equipment | (19,226) | | | (43,138) | |

| Sale of business | 8,000 | | | — | |

| Other | 12 | | | 67 | |

| Net cash used in investing activities | (11,214) | | | (43,071) | |

| | | |

| Financing activities: | | | |

| Payment of dividends | (45,404) | | | (45,931) | |

| Proceeds from exercise of stock options | 4,091 | | | 1,082 | |

| Payments for employee taxes withheld from stock-based awards | (2,041) | | | (5,127) | |

| Purchase of treasury stock | (74,996) | | | (109,229) | |

| Proceeds from borrowing on credit facilities | 127,660 | | | 243,716 | |

| Repayment of borrowing on credit facilities | (172,944) | | | (186,716) | |

| Other | 66 | | | 116 | |

| Net cash used in financing activities | (163,568) | | | (102,089) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | 3,096 | | | (6,555) | |

| | | |

| Net increase (decrease) in cash and cash equivalents | 37,463 | | | (33,266) | |

| Cash and cash equivalents, beginning of period | 114,069 | | | 147,335 | |

| | | |

| Cash and cash equivalents, end of period | $ | 151,532 | | | $ | 114,069 | |

| | | |

| Supplemental disclosures: | | | |

| Cash paid during the period for: | | | |

| Interest | $ | 3,408 | | | $ | 1,082 | |

| Income taxes | 58,829 | | | 33,834 | |

BRADY CORPORATION AND SUBSIDIARIES

SEGMENT INFORMATION

(Unaudited; Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended July 31, | | Year ended July 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| NET SALES | | | | | | | |

| Americas & Asia | $ | 227,482 | | | $ | 217,792 | | | $ | 888,857 | | | $ | 861,084 | |

| Europe & Australia | 118,447 | | | 106,189 | | | 443,006 | | | 440,978 | |

| Total | $ | 345,929 | | | $ | 323,981 | | | $ | 1,331,863 | | | $ | 1,302,062 | |

| | | | | | | |

| SALES INFORMATION | | | | | | | |

| Americas & Asia | | | | | | | |

| Organic | 5.6 | % | | 9.1 | % | | 4.4 | % | | 10.3 | % |

| Currency | (0.2) | % | | (1.0) | % | | (0.9) | % | | (0.1) | % |

| Divestiture | (1.0) | % | | — | % | | (0.3) | % | | — | % |

| Acquisition | — | % | | 2.8 | % | | — | % | | 6.9 | % |

| Total | 4.4 | % | | 10.9 | % | | 3.2 | % | | 17.1 | % |

| Europe & Australia | | | | | | | |

| Organic | 9.5 | % | | 8.8 | % | | 7.6 | % | | 7.9 | % |

| Currency | 2.0 | % | | (13.9) | % | | (7.1) | % | | (7.0) | % |

| Acquisition | — | % | | 1.8 | % | | — | % | | 6.9 | % |

| Total | 11.5 | % | | (3.3) | % | | 0.5 | % | | 7.8 | % |

| Total Company | | | | | | | |

| Organic | 6.9 | % | | 9.0 | % | | 5.5 | % | | 9.4 | % |

| Currency | 0.6 | % | | (5.7) | % | | (3.0) | % | | (2.6) | % |

| Divestiture | (0.7) | % | | — | % | | (0.2) | % | | — | % |

| Acquisition | — | % | | 2.5 | % | | — | % | | 6.9 | % |

| Total | 6.8 | % | | 5.8 | % | | 2.3 | % | | 13.7 | % |

| | | | | | | |

| SEGMENT PROFIT | | | | | | | |

| Americas & Asia | $ | 49,992 | | | $ | 42,648 | | | $ | 180,503 | | | $ | 157,307 | |

| Europe & Australia | 18,426 | | | 16,893 | | | 65,742 | | | 63,058 | |

| Total | $ | 68,418 | | | $ | 59,541 | | | $ | 246,245 | | | $ | 220,365 | |

| SEGMENT PROFIT AS A PERCENT OF NET SALES | | | | | | | |

| Americas & Asia | 22.0 | % | | 19.6 | % | | 20.3 | % | | 18.3 | % |

| Europe & Australia | 15.6 | % | | 15.9 | % | | 14.8 | % | | 14.3 | % |

| Total | 19.8 | % | | 18.4 | % | | 18.5 | % | | 16.9 | % |

| | | | | | | |

| | | | | | | |

| Three months ended July 31, | | Year ended July 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Total segment profit | $ | 68,418 | | | $ | 59,541 | | | $ | 246,245 | | | $ | 220,365 | |

| Unallocated amounts: | | | | | | | |

| Administrative costs | (6,373) | | | (6,625) | | | (24,802) | | | (27,353) | |

| Gain on sale of business | — | | | — | | | 3,770 | | | — | |

| Investment and other income | 2,426 | | | 1,587 | | | 4,022 | | | 244 | |

| Interest expense | (653) | | | (513) | | | (3,539) | | | (1,276) | |

| Income before income taxes | $ | 63,818 | | | $ | 53,990 | | | $ | 225,696 | | | $ | 191,980 | |

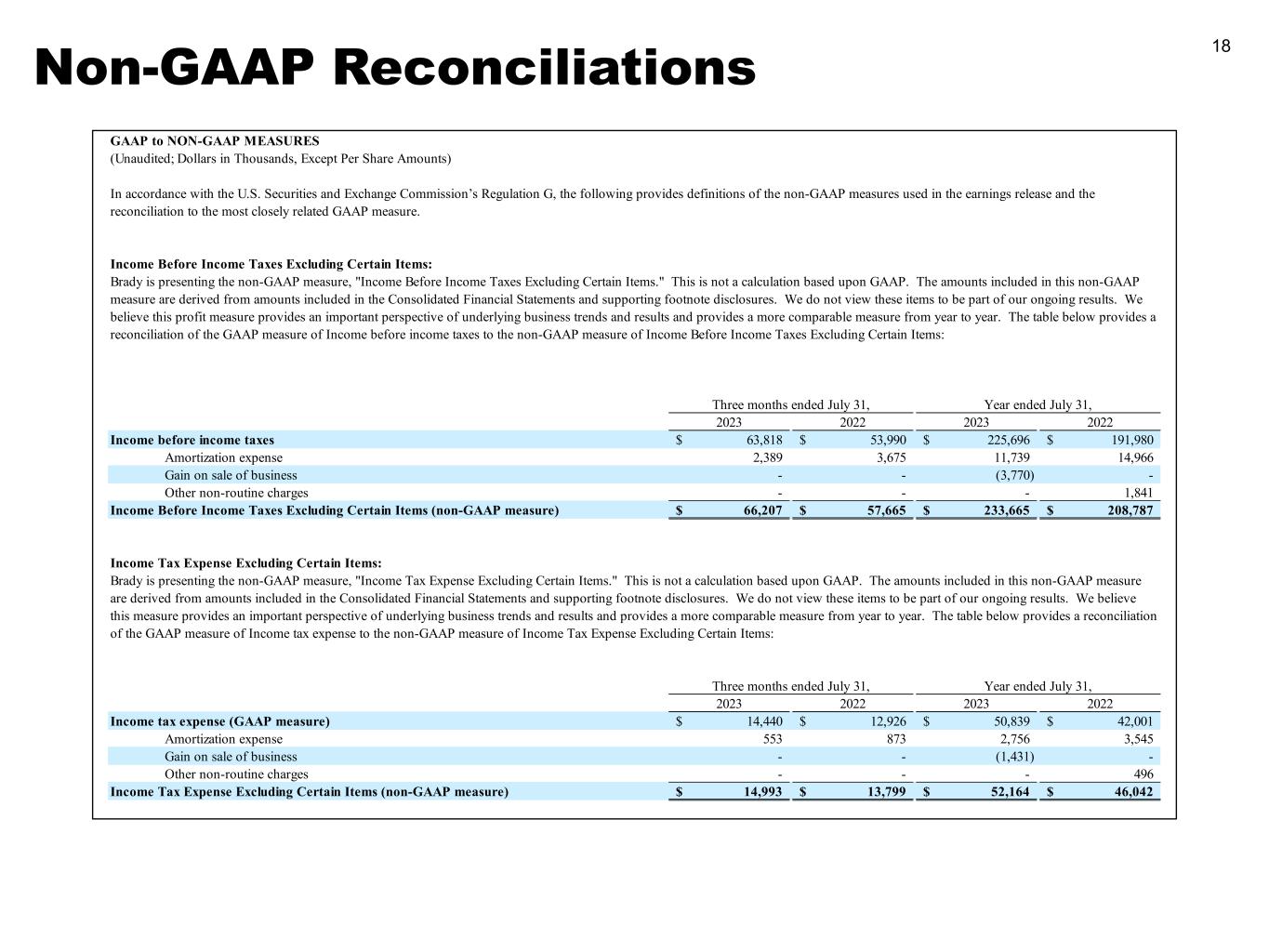

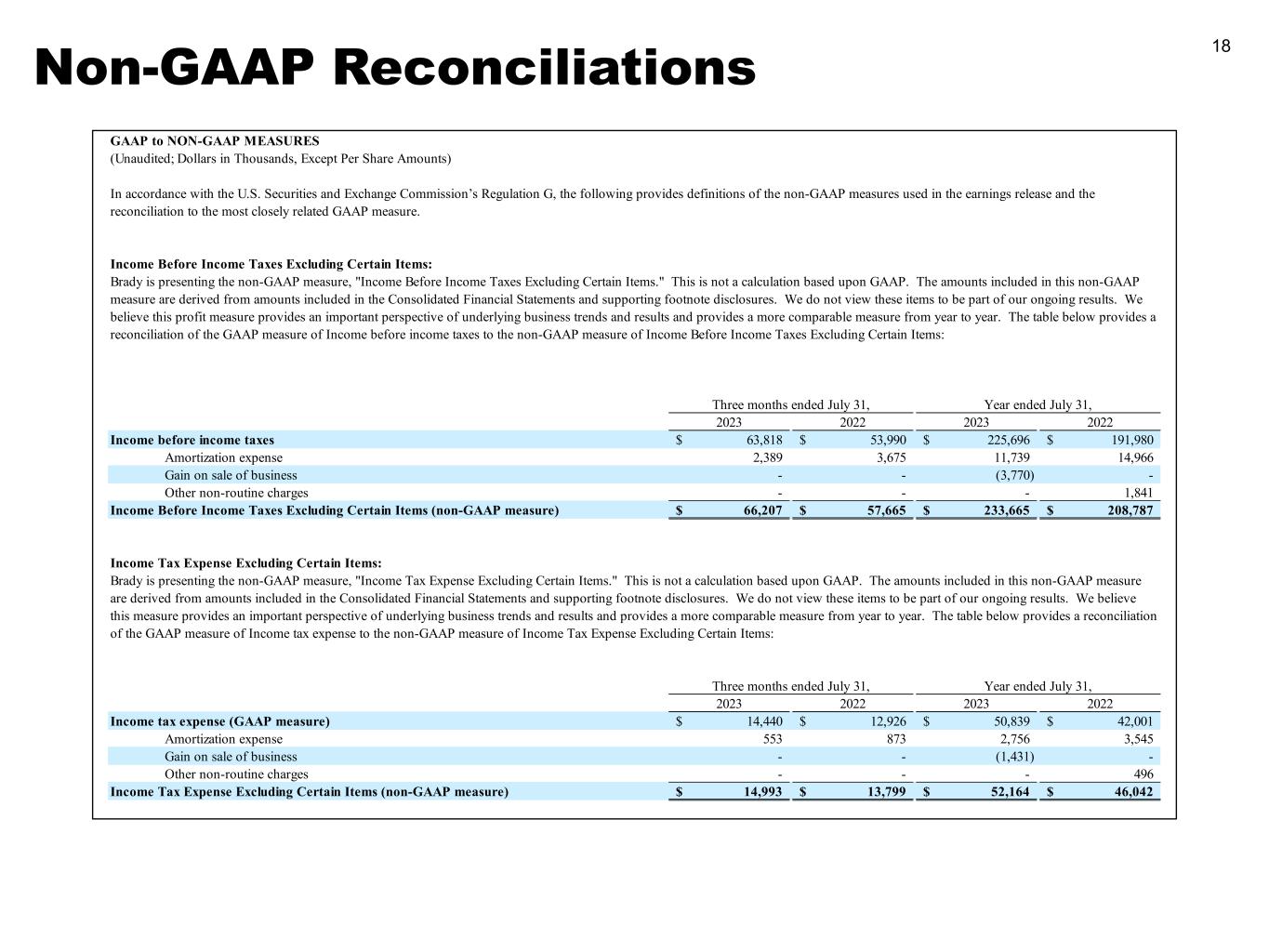

GAAP to NON-GAAP MEASURES

(Unaudited; Dollars in Thousands, Except Per Share Amounts)

In accordance with the U.S. Securities and Exchange Commission’s Regulation G, the following provides definitions of the non-GAAP measures used in the earnings release and the reconciliation to the most closely related GAAP measure.

Income Before Income Taxes Excluding Certain Items:

Brady is presenting the non-GAAP measure, "Income Before Income Taxes Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our ongoing results. We believe this profit measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Income before income taxes and losses of unconsolidated affiliate to the non-GAAP measure of Income Before Income Taxes Excluding Certain Items:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended July 31, | | Year ended July 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Income before income taxes (GAAP measure) | $ | 63,818 | | | $ | 53,990 | | | $ | 225,696 | | | $ | 191,980 | |

| Amortization expense | 2,389 | | | 3,675 | | | 11,739 | | | 14,966 | |

| Gain on sale of business | — | | | — | | | (3,770) | | | — | |

| Other non-routine charges | — | | | — | | | — | | | 1,841 | |

| Income Before Income Taxes Excluding Certain Items (non-GAAP measure) | $ | 66,207 | | | $ | 57,665 | | | $ | 233,665 | | | $ | 208,787 | |

Income Tax Expense Excluding Certain Items:

Brady is presenting the non-GAAP measure, "Income Tax Expense Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our ongoing results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Income tax expense to the non-GAAP measure of Income Tax Expense Excluding Certain Items:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended July 31, | | Year ended July 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Income tax expense (GAAP measure) | $ | 14,440 | | | $ | 12,926 | | | $ | 50,839 | | | $ | 42,001 | |

| Amortization expense | 553 | | | 873 | | | 2,756 | | | 3,545 | |

| Gain on sale of business | — | | | — | | | (1,431) | | | — | |

| Other non-routine charges | — | | | — | | | — | | | 496 | |

| Income Tax Expense Excluding Certain Items (non-GAAP measure) | $ | 14,993 | | | $ | 13,799 | | | $ | 52,164 | | | $ | 46,042 | |

Net Income Excluding Certain Items:

Brady is presenting the non-GAAP measure, "Net Income Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our ongoing results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Net income to the non-GAAP measure of Net Income Excluding Certain Items:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended July 31, | | Year ended July 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income (GAAP measure) | $ | 49,378 | | | $ | 41,064 | | | $ | 174,857 | | | $ | 149,979 | |

| Amortization expense | 1,836 | | | 2,802 | | | 8,983 | | | 11,421 | |

| Gain on sale of business | — | | | — | | | (2,339) | | | — | |

| Other non-routine charges | — | | | — | | | — | | | 1,345 | |

| Net Income Excluding Certain Items (non-GAAP measure) | $ | 51,214 | | | $ | 43,866 | | | $ | 181,501 | | | $ | 162,745 | |

Diluted EPS Excluding Certain Items:

Brady is presenting the non-GAAP measure, "Diluted EPS Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements. We do not view these items to be part of our ongoing results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Net income per Class A Nonvoting Common Share to the non-GAAP measure of Diluted EPS Excluding Certain Items:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended July 31, | | Year ended July 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income per Class A Nonvoting Common Share (GAAP measure) | $ | 1.00 | | | $ | 0.81 | | | $ | 3.51 | | | $ | 2.90 | |

| Amortization expense | 0.04 | | | 0.06 | | | 0.18 | | | 0.22 | |

| Gain on sale of business | — | | | — | | | (0.05) | | | — | |

| Other non-routine charges | — | | | — | | | — | | | 0.03 | |

| Diluted EPS Excluding Certain Items (non-GAAP measure) | $ | 1.04 | | | $ | 0.87 | | | $ | 3.64 | | | $ | 3.15 | |

Diluted EPS Excluding Certain Items Guidance:

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal 2024 Expectations |

| | | | | Low | | High |

| Earnings per Class A Nonvoting Common Share (GAAP measure) | | | | | $ | 3.70 | | | $ | 3.95 | |

| Amortization expense | | | | | 0.15 | | | 0.15 | |

| Diluted EPS Excluding Certain Items (non-GAAP measure) | | | | | $ | 3.85 | | | $ | 4.10 | |

EXHIBIT 99.2

For More Information Contact:

Investor contact: Ann Thornton 414-438-6887

Media contact: Kate Venne 414-358-5176

Brady Corporation increases its dividend to shareholders for the 38th consecutive year

MILWAUKEE (September 4, 2023) -- On August 30, 2023, Brady Corporation’s (NYSE: BRC) Board of Directors approved an increase in the annual dividend to shareholders of the Company’s Class A Common Stock from $0.92 per share to $0.94 per share. A quarterly dividend to shareholders of the Company’s Class A Common Stock of $0.235 per share will be paid on October 31, 2023, to shareholders of record at the close of business on October 10, 2023. This dividend represents the 38th consecutive annual increase in dividends.

Brady Corporation is an international manufacturer and marketer of complete solutions that identify and protect people, products and places. Brady’s products help customers increase safety, security, productivity and performance and include high-performance labels, signs, safety devices, printing systems and software. Founded in 1914, the Company has a diverse customer base in electronics, telecommunications, manufacturing, electrical, construction, medical, aerospace and a variety of other industries. Brady is headquartered in Milwaukee, Wisconsin and as of July 31, 2022, employed approximately 5,700 people in its worldwide businesses. Brady’s fiscal 2022 sales were approximately $1.30 billion. Brady stock trades on the New York Stock Exchange under the symbol BRC. More information is available on the Internet at www.bradycorp.com.

###

F’23 Q4 Financial Results Brady Corporation September 5, 2023

Forward-Looking Statements In this news release, statements that are not reported financial results or other historic information are “forward-looking statements.” These forward-looking statements relate to, among other things, the Company's future financial position, business strategy, targets, projected sales, costs, income, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations. The use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project,” “plan” or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements by their nature address matters that are, to different degrees, uncertain and are subject to risks, assumptions, and other factors, some of which are beyond Brady’s control, that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. For Brady, uncertainties arise from: increased cost of raw materials, labor and freight as well as raw material shortages and supply chain disruptions; decreased demand for our products; our ability to compete effectively or to successfully execute our strategy; our ability to develop technologically advanced products that meet customer demands; difficulties in protecting our websites, networks and systems against security breaches; Brady’s ability to identify, integrate, and grow acquired companies, and to manage contingent liabilities from divested businesses; risks associated with the loss of key employees; extensive regulations by U.S. and non-U.S. governmental and self-regulatory entities; litigation, including product liability claims; adverse impacts of the novel coronavirus (“COVID-19”) pandemic or other pandemics; foreign currency fluctuations; potential write-offs of goodwill and other intangible assets; changes in tax legislation and tax rates; differing interests of voting and non-voting shareholders; numerous other matters of national, regional and global scale, including major public health crises and government responses thereto and those of a political, economic, business, competitive, and regulatory nature contained from time to time in Brady’s U.S. Securities and Exchange Commission filings, including, but not limited to, those factors listed in the “Risk Factors” section within Item 1A of Part I of Brady’s Form 10-K for the year ended July 31, 2023. These uncertainties may cause Brady's actual future results to be materially different than those expressed in its forward- looking statements. Brady does not undertake to update its forward-looking statements except as required by law. 2

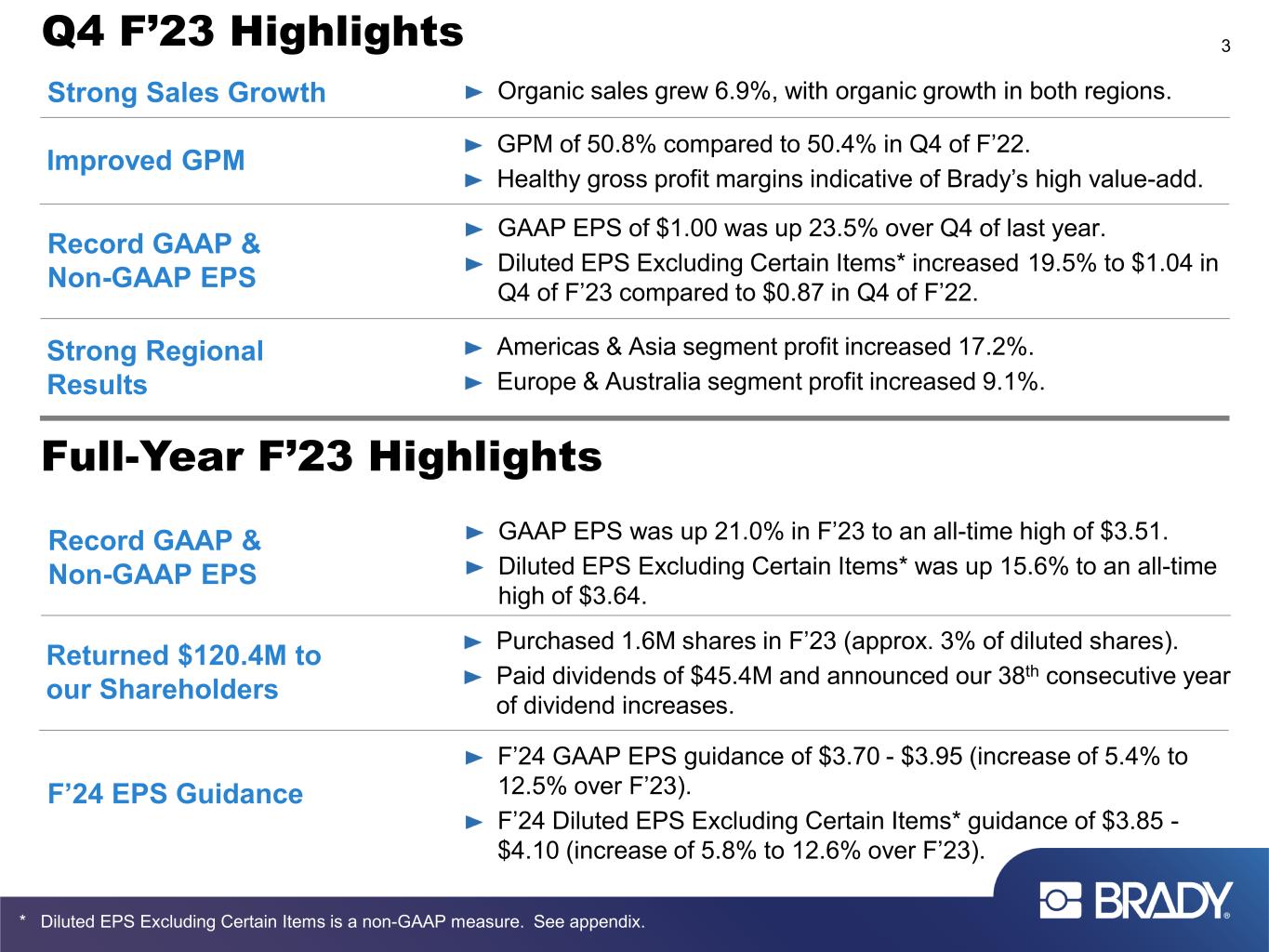

Q4 F’23 Highlights 3 * Diluted EPS Excluding Certain Items is a non-GAAP measure. See appendix. Organic sales grew 6.9%, with organic growth in both regions.Strong Sales Growth GPM of 50.8% compared to 50.4% in Q4 of F’22. Healthy gross profit margins indicative of Brady’s high value-add. Improved GPM GAAP EPS of $1.00 was up 23.5% over Q4 of last year. Diluted EPS Excluding Certain Items* increased 19.5% to $1.04 in Q4 of F’23 compared to $0.87 in Q4 of F’22. Record GAAP & Non-GAAP EPS Americas & Asia segment profit increased 17.2%. Europe & Australia segment profit increased 9.1%. Strong Regional Results Purchased 1.6M shares in F’23 (approx. 3% of diluted shares). Paid dividends of $45.4M and announced our 38th consecutive year of dividend increases. Returned $120.4M to our Shareholders F’24 GAAP EPS guidance of $3.70 - $3.95 (increase of 5.4% to 12.5% over F’23). F’24 Diluted EPS Excluding Certain Items* guidance of $3.85 - $4.10 (increase of 5.8% to 12.6% over F’23). F’24 EPS Guidance GAAP EPS was up 21.0% in F’23 to an all-time high of $3.51. Diluted EPS Excluding Certain Items* was up 15.6% to an all-time high of $3.64. Record GAAP & Non-GAAP EPS Full-Year F’23 Highlights

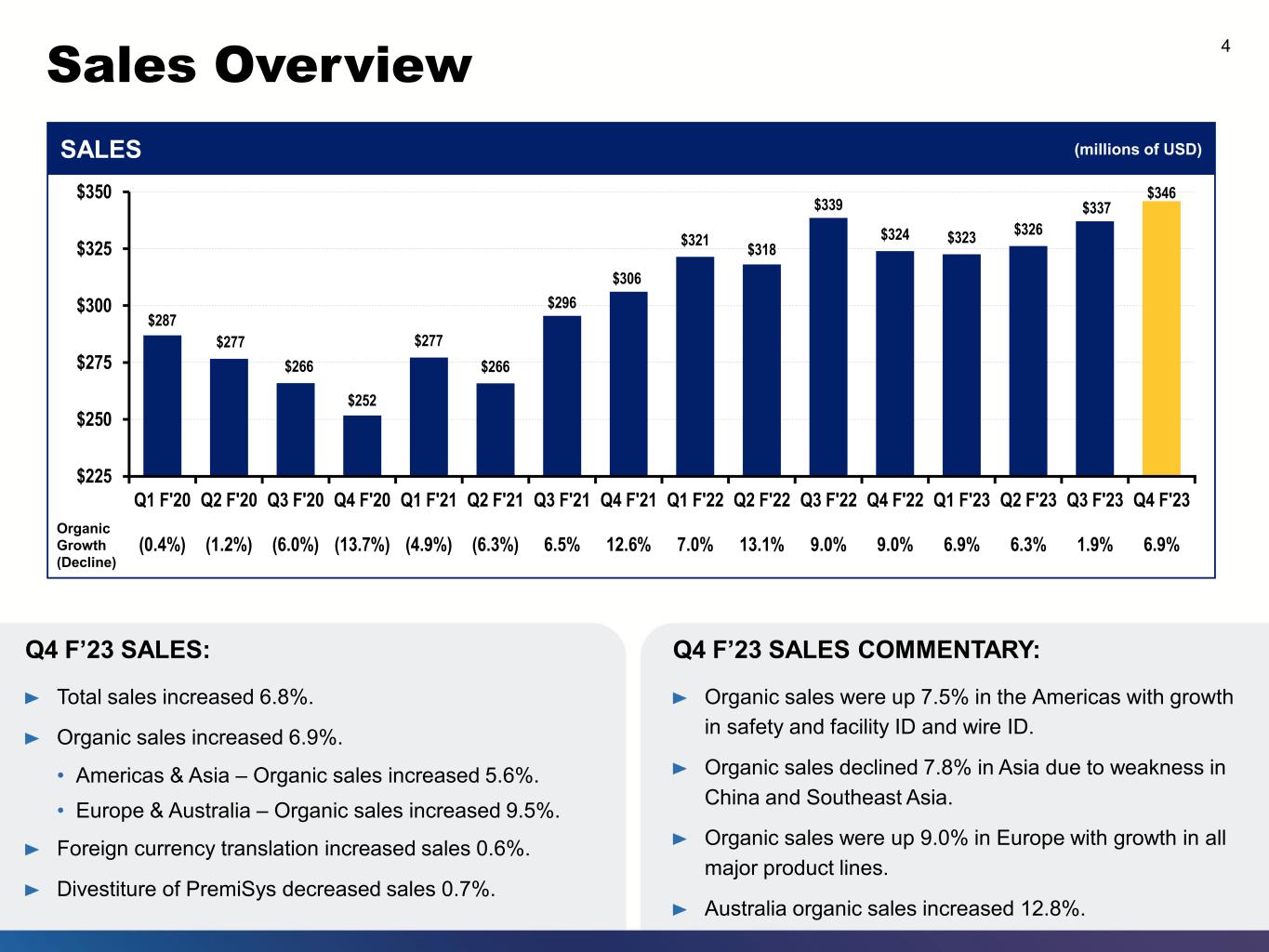

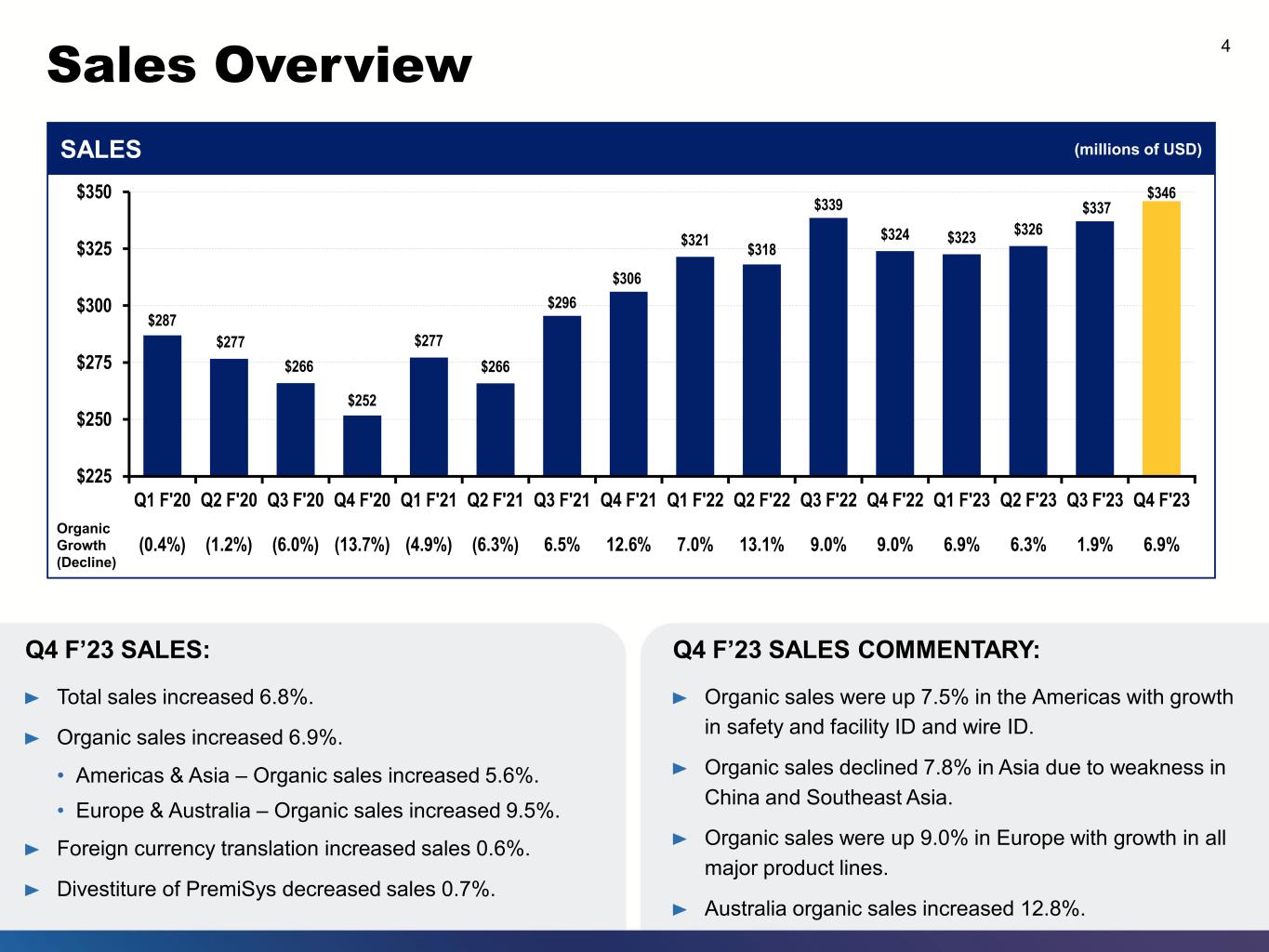

Sales Overview 4 Q4 F’23 SALES: Total sales increased 6.8%. Organic sales increased 6.9%. • Americas & Asia – Organic sales increased 5.6%. • Europe & Australia – Organic sales increased 9.5%. Foreign currency translation increased sales 0.6%. Divestiture of PremiSys decreased sales 0.7%. $287 $277 $266 $252 $277 $266 $296 $306 $321 $318 $339 $324 $323 $326 $337 $346 $225 $250 $275 $300 $325 $350 Q1 F'20 (0.4%) Q2 F'20 (1.2%) Q3 F'20 (6.0%) Q4 F'20 (13.7%) Q1 F'21 (4.9%) Q2 F'21 (6.3%) Q3 F'21 6.5% Q4 F'21 12.6% Q1 F'22 7.0% Q2 F'22 13.1% Q3 F'22 9.0% Q4 F'22 9.0% Q1 F'23 6.9% Q2 F'23 6.3% Q3 F'23 1.9% Q4 F'23 6.9% Organic Growth (Decline) SALES (millions of USD) Q4 F’23 SALES COMMENTARY: Organic sales were up 7.5% in the Americas with growth in safety and facility ID and wire ID. Organic sales declined 7.8% in Asia due to weakness in China and Southeast Asia. Organic sales were up 9.0% in Europe with growth in all major product lines. Australia organic sales increased 12.8%.

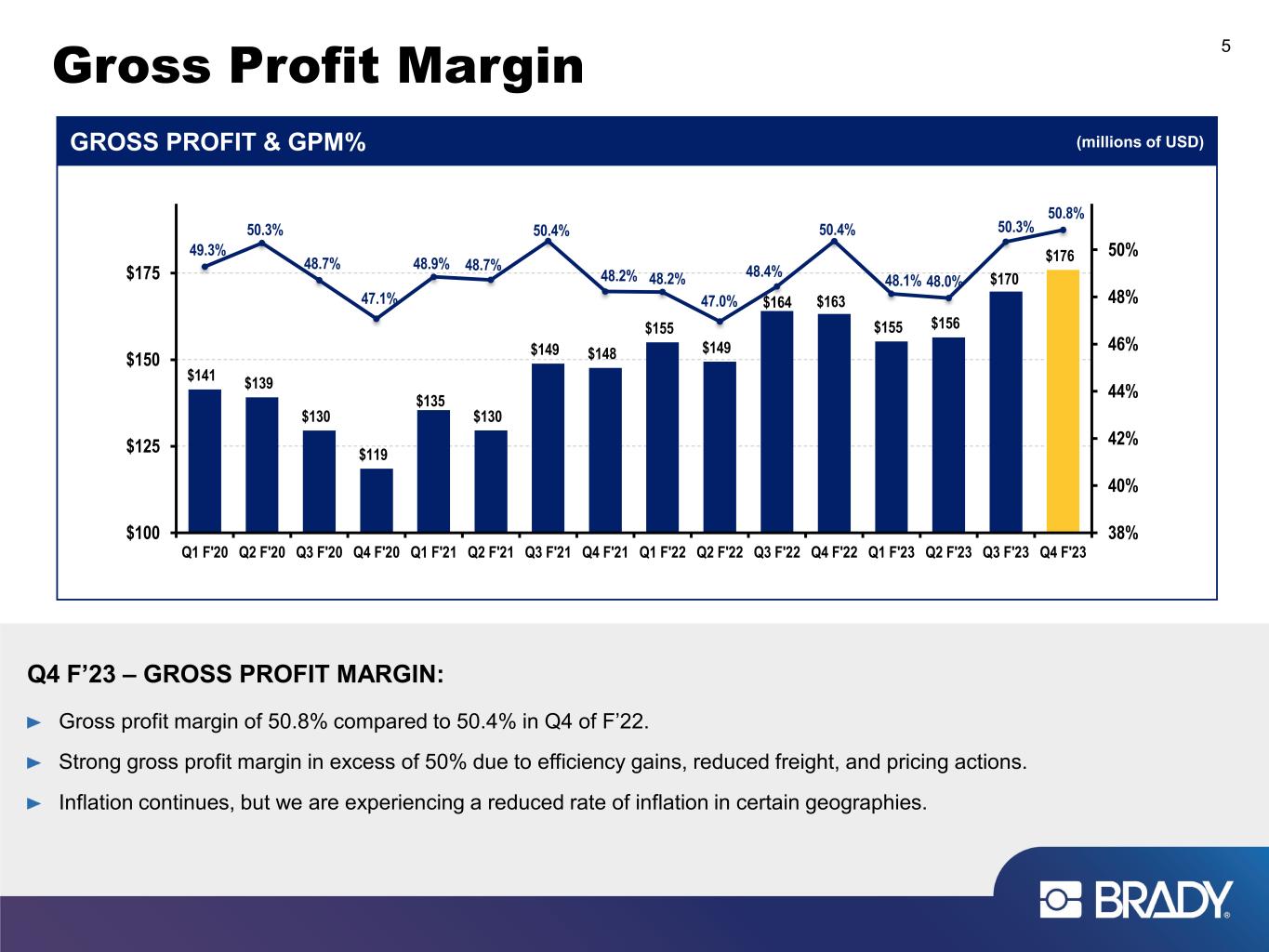

Gross Profit Margin 5 $141 $139 $130 $119 $135 $130 $149 $148 $155 $149 $164 $163 $155 $156 $170 $17649.3% 50.3% 48.7% 47.1% 48.9% 48.7% 50.4% 48.2% 48.2% 47.0% 48.4% 50.4% 48.1% 48.0% 50.3% 50.8% 38% 40% 42% 44% 46% 48% 50% $100 $125 $150 $175 Q1 F'20 Q2 F'20 Q3 F'20 Q4 F'20 Q1 F'21 Q2 F'21 Q3 F'21 Q4 F'21 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 Q2 F'23 Q3 F'23 Q4 F'23 GROSS PROFIT & GPM% (millions of USD) Q4 F’23 – GROSS PROFIT MARGIN: Gross profit margin of 50.8% compared to 50.4% in Q4 of F’22. Strong gross profit margin in excess of 50% due to efficiency gains, reduced freight, and pricing actions. Inflation continues, but we are experiencing a reduced rate of inflation in certain geographies.

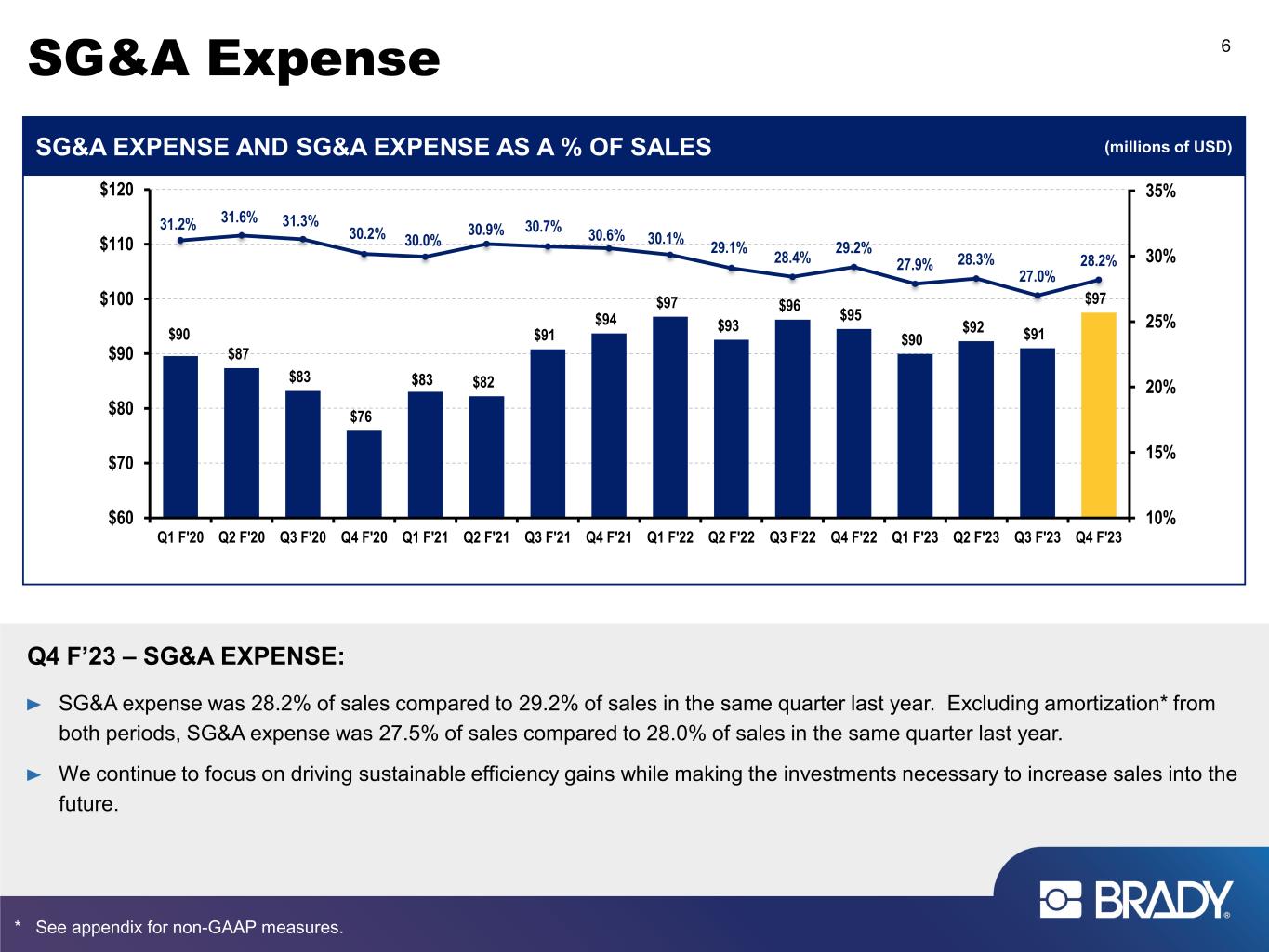

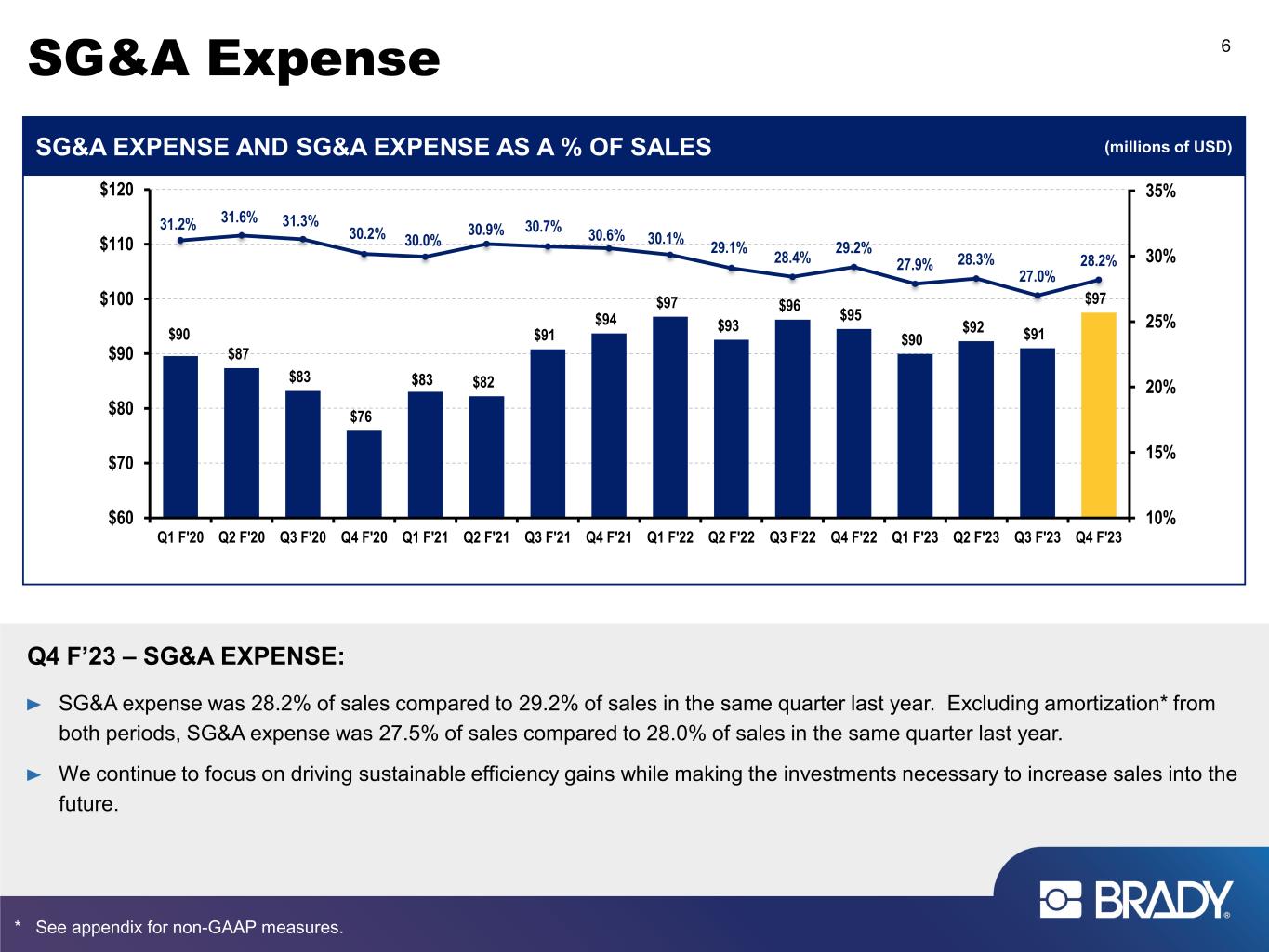

SG&A Expense 6 Q4 F’23 – SG&A EXPENSE: SG&A expense was 28.2% of sales compared to 29.2% of sales in the same quarter last year. Excluding amortization* from both periods, SG&A expense was 27.5% of sales compared to 28.0% of sales in the same quarter last year. We continue to focus on driving sustainable efficiency gains while making the investments necessary to increase sales into the future. $90 $87 $83 $76 $83 $82 $91 $94 $97 $93 $96 $95 $90 $92 $91 $97 31.2% 31.6% 31.3% 30.2% 30.0% 30.9% 30.7% 30.6% 30.1% 29.1% 28.4% 29.2% 27.9% 28.3% 27.0% 28.2% 10% 15% 20% 25% 30% 35% $60 $70 $80 $90 $100 $110 $120 Q1 F'20 Q2 F'20 Q3 F'20 Q4 F'20 Q1 F'21 Q2 F'21 Q3 F'21 Q4 F'21 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 Q2 F'23 Q3 F'23 Q4 F'23 SG&A EXPENSE AND SG&A EXPENSE AS A % OF SALES (millions of USD) * See appendix for non-GAAP measures.

R&D Expense 7 Q4 F’23 – R&D EXPENSE: We have a solid new product pipeline of high-quality materials and products to help our customers become more efficient. We are focused on ensuring that our R&D spend is both efficient and effective and we remain committed to investing in new product development. $11.0 $10.5 $9.8 $9.4 $10.2 $9.9 $11.3 $13.2 $13.9 $14.0 $14.9 $15.8 $13.9 $15.4 $15.7 $16.3 3.8% 3.8% 3.7% 3.7% 3.7% 3.7% 3.8% 4.3% 4.3% 4.4% 4.4% 4.9% 4.3% 4.7% 4.7% 4.7% 1.5% 2.5% 3.5% 4.5% $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 Q1 F'20 Q2 F'20 Q3 F'20 Q4 F'20 Q1 F'21 Q2 F'21 Q3 F'21 Q4 F'21 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 Q2 F'23 Q3 F'23 Q4 F'23 R&D EXPENSE AND R&D EXPENSE AS A % OF SALES (millions of USD)

Income Before Income Taxes 8 Q4 F’23 – INCOME BEFORE INCOME TAXES: GAAP Income before income taxes was up 18.2% to $63.8M in Q4 of F’23 compared to $54.0M in Q4 of F’22. Income Before Income Taxes Excluding Certain Items*, which only removes amortization expense from each period presented, increased 14.8% to $66.2M in Q4 of F’23 compared to $57.7M in Q4 of F’22. INCOME BEFORE INCOME TAXES (GAAP) (millions of USD) $41.6 $42.4 $22.2 $34.9 $42.2 $39.4 $47.8 $41.6 $44.7 $42.0 $51.3 $54.0 $50.3 $48.5 $63.0 $63.8 $10 $20 $30 $40 $50 $60 $70 Q1 F'20 4.2% Q2 F'20 15.4% Q3 F'20 (45.9%) Q4 F'20 (26.0%) Q1 F'21 1.6% Q2 F'21 (7.0%) Q3 F'21 115.7% Q4 F'21 19.4% Q1 F'22 5.8% Q2 F'22 6.7% Q3 F'22 7.3% Q4 F'22 29.7% Q1 F'23 12.6% Q2 F'23 15.4% Q3 F'23 23.0% Q4 F'23 18.2% Year-on-Year Growth (Decline) * Income Before Income Taxes Excluding Certain Items is a non-GAAP measure. See appendix.

Net Income & Diluted EPS 9 Q4 F’23 – NET INCOME & DILUTED EPS: GAAP Net Income was $49.4M in Q4 of F’23 compared to $41.1M in Q4 of F’22 (an increase of 20.2%). • Net Income Excluding Certain Items* was $51.2M in Q4 of F’23 compared to $43.9M in Q4 of F’22 (an increase of 16.8%). GAAP Diluted EPS was $1.00 in Q4 of F’23 compared to $0.81 in Q4 of F’22 (an increase of 23.5%). • Diluted EPS Excluding Certain Items* was $1.04 in Q4 of F’23 compared to $0.87 in Q4 of F’22 (an increase of 19.5%). * Net Income Excluding Certain Items and Diluted EPS Excluding Certain Items are non-GAAP measures. See appendix. $33.5 $30.9 $37.3 $28.0 $35.0 $33.8 $40.1 $41.1 $39.4 $38.0 $48.1 $49.4 $20 $30 $40 $50 Q1 F'21 Q2 F'21 Q3 F'21 Q4 F'21 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 Q2 F'23 Q3 F'23 Q4 F'23 NET INCOME (GAAP) (millions of USD) $0.64 $0.59 $0.71 $0.53 $0.67 $0.65 $0.78 $0.81 $0.79 $0.76 $0.96 $1.00 $0.20 $0.40 $0.60 $0.80 $1.00 Q1 F'21 Q2 F'21 Q3 F'21 Q4 F'21 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 Q2 F'23 Q3 F'23 Q4 F'23 DILUTED EPS (GAAP)

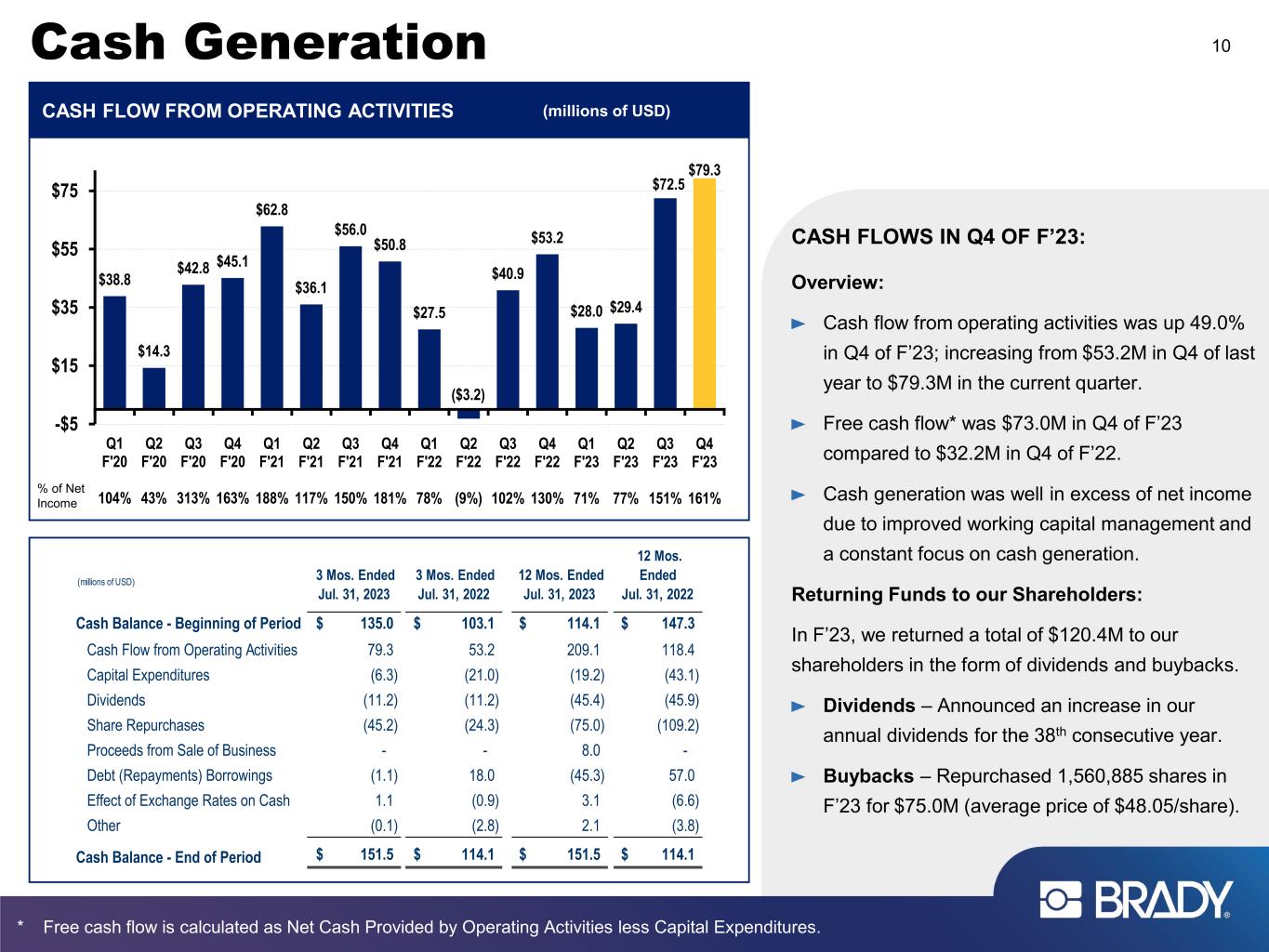

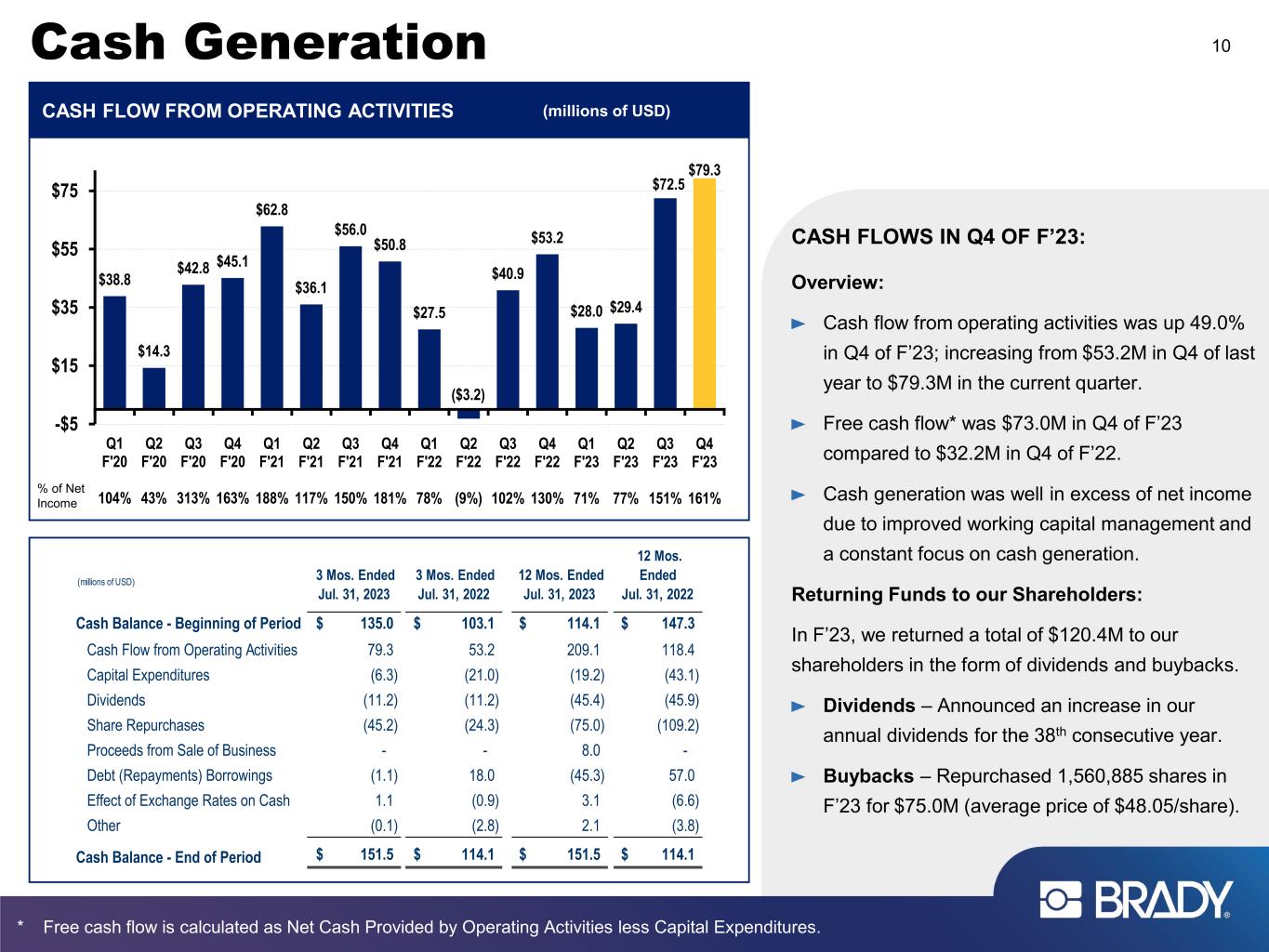

Cash Generation 10 CASH FLOW FROM OPERATING ACTIVITIES (millions of USD) $38.8 $14.3 $42.8 $45.1 $62.8 $36.1 $56.0 $50.8 $27.5 ($3.2) $40.9 $53.2 $28.0 $29.4 $72.5 $79.3 -$5 $15 $35 $55 $75 Q1 F'20 104% Q2 F'20 43% Q3 F'20 313% Q4 F'20 163% Q1 F'21 188% Q2 F'21 117% Q3 F'21 150% Q4 F'21 181% Q1 F'22 78% Q2 F'22 (9%) Q3 F'22 102% Q4 F'22 130% Q1 F'23 71% Q2 F'23 77% Q3 F'23 151% Q4 F'23 161%% of Net Income CASH FLOWS IN Q4 OF F’23: Overview: Cash flow from operating activities was up 49.0% in Q4 of F’23; increasing from $53.2M in Q4 of last year to $79.3M in the current quarter. Free cash flow* was $73.0M in Q4 of F’23 compared to $32.2M in Q4 of F’22. Cash generation was well in excess of net income due to improved working capital management and a constant focus on cash generation. Returning Funds to our Shareholders: In F’23, we returned a total of $120.4M to our shareholders in the form of dividends and buybacks. Dividends – Announced an increase in our annual dividends for the 38th consecutive year. Buybacks – Repurchased 1,560,885 shares in F’23 for $75.0M (average price of $48.05/share). * Free cash flow is calculated as Net Cash Provided by Operating Activities less Capital Expenditures. (millions of USD) 3 Mos. Ended Jul. 31, 2023 3 Mos. Ended Jul. 31, 2022 12 Mos. Ended Jul. 31, 2023 12 Mos. Ended Jul. 31, 2022 Cash Balance - Beginning of Period 135.0$ 103.1$ 114.1$ 147.3$ Cash Flow from Operating Activities 79.3 53.2 209.1 118.4 Capital Expenditures (6.3) (21.0) (19.2) (43.1) Dividends (11.2) (11.2) (45.4) (45.9) Share Repurchases (45.2) (24.3) (75.0) (109.2) Proceeds from Sale of Business - - 8.0 - Debt (Repayments) Borrowings (1.1) 18.0 (45.3) 57.0 Effect of Exchange Rates on Cash 1.1 (0.9) 3.1 (6.6) Other (0.1) (2.8) 2.1 (3.8) Cash Balance - End of Period 151.5$ 114.1$ 151.5$ 114.1$

Net Cash 11 STRONG BALANCE SHEET: July 31, 2023 cash = $151.5M. July 31, 2023 debt = $49.7M. Balance sheet provides flexibility for future organic and inorganic investments. $245 $240 $190 $218 $256 $278 $322 $109 $91 $64 $26 $19 $15 $31 $84 $102 $0 $50 $100 $150 $200 $250 $300 Q1 F'20 Q2 F'20 Q3 F'20 Q4 F'20 Q1 F'21 Q2 F'21 Q3 F'21 Q4 F'21 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 Q2 F'23 Q3 F'23 Q4 F'23 NET CASH (millions of USD)

F’23 Financial Summary 12 (millions of USD) 2023 2022 Change Sales 1,331.9$ 1,302.1$ 2.3% Organic Sales Growth 5.5% 9.4% Gross Margin 657.3 631.6 4.1% % of Sales 49.4% 48.5% Research and Development (61.4) (58.5) 4.8% Selling, General and Administrative (370.7) (380.0) (2.4%) % of Sales (27.8%) (29.2%) Operating Income 225.2 193.0 16.7% Other Income (Expense) 0.5 (1.0) Income Before Income Taxes 225.7$ 192.0$ 17.6% Net Income 174.9$ 150.0$ 16.6% Diluted EPS 3.51$ 2.90$ 21.0% Non-GAAP Measures: Net Income Excluding Certain Items* 181.5$ 162.7$ 11.5% Diluted EPS Excluding Certain Items* 3.64$ 3.15$ 15.6% Net Cash Position 101.8$ 19.1$ Year Ended July 31, * Net Income Excluding Certain Items and Diluted EPS Excluding Certain Items are non-GAAP measures. See appendix.

F’24 Diluted EPS Guidance GAAP Diluted EPS $3.70 to $3.95 (+5.4% to +12.5% vs. F’23) F’24 Diluted EPS, Excluding Certain Items* $3.85 to $4.10 (+5.8% to +12.6% vs. F’23) Guidance Assumptions: F’24 organic sales growth in the mid-single digit percentages. The only difference between GAAP Diluted EPS and Diluted EPS, Excluding Certain Items* F’24 guidance is the impact of amortization expense of $0.15 per share. Full-year income tax rate of approximately 22%. Foreign currency exchange rates as of July 31, 2023. Depreciation and amortization expense of $32M to $34M. Capital expenditures of approximately $75M (inclusive of $55M related to the conversion of previously leased critical manufacturing facilities). 13 * Diluted EPS Excluding Certain Items is a non-GAAP measure. See appendix.

Americas & Asia 14 • Revenues increased 4.4% in Q4 of F’23: • Organic growth = + 5.6%. • Fx reduction = (0.2%). • Divestiture = (1.0%). • Organic sales grew 7.5% in the Americas, driven by Identification Solutions which was partially offset by a decline in organic sales in Workplace Safety. • Organic sales declined 7.8% in Asia due to a decline in China and Southeast Asia. • Segment profit increased due to organic sales growth, reduced freight expense and operational efficiencies. Q4 F’23 SUMMARY:Q4 F’23 vs. Q4 F’22 (millions of USD) $180 $170 $189 $196 $213 $208 $223 $218 $218 $220 $223 $227 20% 18% 20% 17% 18% 16% 20% 20% 19% 18% 22% 22% 0% 5% 10% 15% 20% 25% $100 $150 $200 $250 $300 Q1 F'21 (7.9%) (0.4%) - Q2 F'21 (7.3%) 0.1% - Q3 F'21 7.8% 1.1% - Q4 F'21 18.0% 1.9% 3.7% Q1 F'22 9.3% 0.9% 8.3% Q2 F'22 13.9% - 8.1% Q3 F'22 9.2% (0.1%) 8.6% Q4 F'22 9.1% (1.0%) 2.8% Q1 F'23 4.0% (1.4%) - Q2 F'23 6.9% (1.0%) - Q3 F'23 1.2% (0.8%) (0.3%) Q4 F'23 5.6% (0.2%) (1.0%) SALES & SEGMENT PROFIT % (millions of USD) Q4 F’23 Q4 F’22 Change Sales $ 227.5 $ 217.8 + 4.4% Segment Profit 50.0 42.6 + 17.2% Segment Profit % 22.0% 19.6% + 240 bps Organic For. Curr. Acq. & Div. • Organic sales growth in the mid-single digit percentages in F’24. • Continued growth in segment profit. OUTLOOK:

Europe & Australia 15 • Revenues increased 11.5% in Q4 of F’23: • Organic growth = + 9.5%. • Fx increase = + 2.0%. • Organic sales grew 9.0% in Europe driven by all major product lines. • Organic sales grew 12.8% in Australia which was driven by a combination of increased volume and pricing. • Segment profit increased but inflationary pressures reduced segment profit as a % of sales. Q4 F’23 SUMMARY:Q4 F’23 vs. Q4 F’22 (millions of USD) $98 $95 $106 $110 $109 $110 $116 $106 $104 $106 $114 $118 13% 12% 15% 14% 13% 15% 14% 16% 16% 13% 15% 16% 0% 5% 10% 15% $50 $100 $150 Q1 F'21 1.5% 5.6% - Q2 F'21 (4.4%) 7.0% - Q3 F'21 4.2% 11.0% - Q4 F'21 3.2% 8.6% 6.3% Q1 F'22 2.6% 0.6% 8.2% Q2 F'22 11.7% (5.8%) 9.6% Q3 F'22 8.5% (8.2%) 8.7% Q4 F'22 8.8% (13.9%) 1.8% Q1 F'23 12.8% (17.0%) - Q2 F'23 5.2% (8.9%) - Q3 F'23 3.4% (4.8%) - Q4 F'23 9.5% 2.0% - SALES & SEGMENT PROFIT % (millions of USD) Q4 F’23 Q4 F’22 Change Sales $ 118.4 $ 106.2 + 11.5% Segment Profit 18.4 16.9 + 9.1% Segment Profit % 15.6% 15.9% (30 bps) Organic For. Curr. Acquisitions • Organic sales growth in the mid-single digit percentages in F’24. • Continued growth in segment profit. OUTLOOK:

Investor Relations Brady Contact: Ann Thornton Investor Relations 414-438-6887 Ann_Thornton@bradycorp.com See our website at www.bradycorp.com/investors 16

Appendix GAAP to Non-GAAP Reconciliations

Non-GAAP Reconciliations 18 2023 2022 2023 2022 63,818$ 53,990$ 225,696$ 191,980$ Amortization expense 2,389 3,675 11,739 14,966 Gain on sale of business - - (3,770) - Other non-routine charges - - - 1,841 66,207$ 57,665$ 233,665$ 208,787$ 2023 2022 2023 2022 14,440$ 12,926$ 50,839$ 42,001$ Amortization expense 553 873 2,756 3,545 Gain on sale of business - - (1,431) - Other non-routine charges - - - 496 14,993$ 13,799$ 52,164$ 46,042$ Income before income taxes Income Before Income Taxes Excluding Certain Items (non-GAAP measure) Income Tax Expense Excluding Certain Items: Brady is presenting the non-GAAP measure, "Income Tax Expense Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our ongoing results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Income tax expense to the non-GAAP measure of Income Tax Expense Excluding Certain Items: Year ended July 31, Income tax expense (GAAP measure) Year ended July 31, GAAP to NON-GAAP MEASURES (Unaudited; Dollars in Thousands, Except Per Share Amounts) In accordance with the U.S. Securities and Exchange Commission’s Regulation G, the following provides definitions of the non-GAAP measures used in the earnings release and the reconciliation to the most closely related GAAP measure. Income Before Income Taxes Excluding Certain Items: Brady is presenting the non-GAAP measure, "Income Before Income Taxes Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our ongoing results. We believe this profit measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Income before income taxes to the non-GAAP measure of Income Before Income Taxes Excluding Certain Items: Three months ended July 31, Three months ended July 31, Income Tax Expense Excluding Certain Items (non-GAAP measure)

Non-GAAP Reconciliations 19 2023 2022 2023 2022 49,378$ 41,064$ 174,857$ 149,979$ Amortization expense 1,836 2,802 8,983 11,421 Gain on sale of business - - (2,339) - Other non-routine charges - - - 1,345 51,214$ 43,866$ 181,501$ 162,745$ 2023 2022 2023 2022 $ 1.00 $ 0.81 $ 3.51 $ 2.90 Amortization expense 0.04 0.06 0.18 0.22 Gain on sale of business - - (0.05) - Other non-routine charges - - - 0.03 1.04$ 0.87$ 3.64$ 3.15$ Diluted EPS Excluding Certain Items Guidance: Low High Earnings per diluted Class A Common Share (GAAP measure) $ 3.70 $ 3.95 Amortization expense 0.15 0.15 Diluted EPS Excluding Certain Items (non-GAAP measure) 3.85$ 4.10$ Three months ended July 31, Diluted EPS Excluding Certain Items: Brady is presenting the non-GAAP measure, "Diluted EPS Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements. We do not view these items to be part of our ongoing results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Net income per Class A Nonvoting Common Share to the non-GAAP measure of Diluted EPS Excluding Certain Items: Year ended July 31, Net income per Class A Nonvoting Common Share (GAAP measure) Net Income Excluding Certain Items (non-GAAP measure) Fiscal 2024 Expectations GAAP to NON-GAAP MEASURES (Unaudited; Dollars in Thousands, Except Per Share Amounts) In accordance with the U.S. Securities and Exchange Commission’s Regulation G, the following provides definitions of the non-GAAP measures used in the earnings release and the reconciliation to the most closely related GAAP measure. Diluted EPS Excluding Certain Items (non-GAAP measure) Three months ended July 31, Net Income Excluding Certain Items: Brady is presenting the non-GAAP measure, "Net Income Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our ongoing results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Net income to the non-GAAP measure of Net Income Excluding Certain Items: Year ended July 31, Net income (GAAP measure)

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|