0001018840false00010188402024-05-292024-05-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 29, 2024

| | |

| Abercrombie & Fitch Co. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 1-12107 | | 31-1469076 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | |

| 6301 Fitch Path | New Albany | Ohio | | | | 43054 |

| (Address of principal executive offices) | | | | (Zip Code) |

| | | | | | |

| Registrant’s telephone number, including area code: | (614) | | 283-6500 | | |

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.01 Par Value | | ANF | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On May 29, 2024, Abercrombie & Fitch Co. (the “Company”) issued a news release (the “Release”) reporting the Company’s unaudited financial results for the first quarter ended May 4, 2024. A copy of the Release is included as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

In conjunction with the Release, the Company also made available additional unaudited quarterly financial information for the first quarter ended May 4, 2024, and for each of the quarters in the fiscal year ended February 3, 2024. The Company also made available additional unaudited financial information for the fiscal years ended February 3, 2024 and January 28, 2023. The additional financial information is included as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

In conjunction with the Release, the Company also made available an investor presentation of results for the first quarter ended May 4, 2024. The presentation, which is available under the “Investors” section of the Company’s website, located at corporate.abercrombie.com, is included as Exhibit 99.3 to this Current Report on Form 8-K and is incorporated herein by reference. Information on the Company’s website is not, and will not be deemed to be, a part of this Current Report on Form 8-K or incorporated into any other filings the Company may make with the Securities and Exchange Commission.

The Company’s management conducted a conference call on May 29, 2024 to review the Company’s financial results for the first quarter ended May 4, 2024. A copy of the transcript of the conference call is included as Exhibit 99.4 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02, including the accompanying Exhibits, are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(a) through (c) Not applicable

(d) Exhibits:

The following exhibits are included with this Current Report on Form 8-K:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 99.4 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Abercrombie & Fitch Co. |

| | | |

Dated: May 30, 2024 | By: | /s/ Scott D. Lipesky |

| | | Scott D. Lipesky |

| | | Executive Vice President, Chief Financial Officer and Chief Operating Officer |

ABERCROMBIE & FITCH CO. REPORTS FIRST QUARTER FISCAL 2024 RESULTS

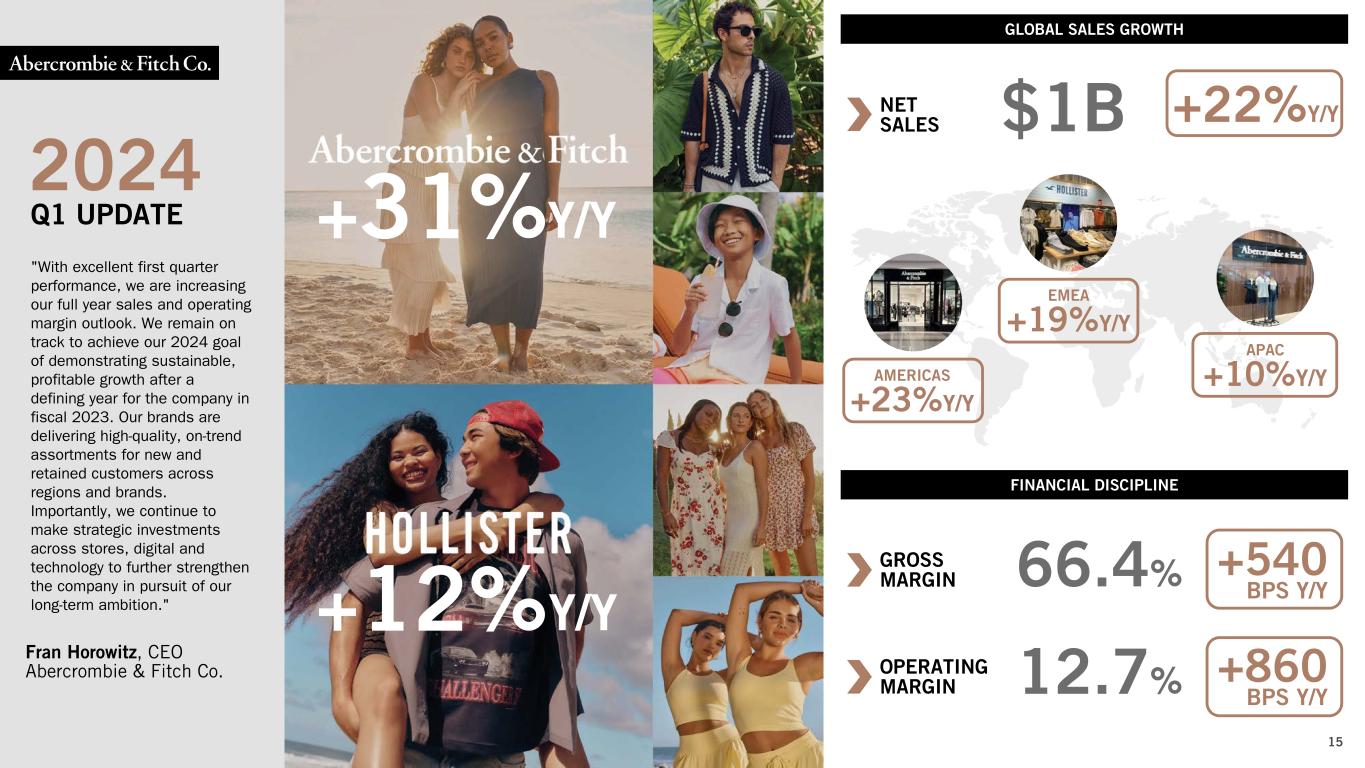

•Net sales of $1.0 billion, up 22% from last year with comparable sales growth of +21%, resulting in the highest first quarter net sales in company history

•Broad-based net sales growth across regions and brands; with Abercrombie brands growth of +31%

•First quarter operating margin of 12.7%, up 860 basis points from last year

•Increases full year outlook to net sales growth of around 10%, and operating margin of around 14%

New Albany, Ohio, May 29, 2024: Abercrombie & Fitch Co. (NYSE: ANF) today announced results for the first quarter ended May 4, 2024. These compare to results for the first quarter ended April 29, 2023. Descriptions of the use of non-GAAP financial measures and reconciliations of GAAP and non-GAAP financial measures accompany this release.

Fran Horowitz, Chief Executive Officer, said, “Our outstanding first quarter results reflect the power of our brands and strong execution of our global playbook. We successfully navigated seasonal transitions with relevant assortments and compelling marketing, leveraging agile chase capabilities and inventory discipline, driving sales above our expectations. Growth was broad-based across regions and brands with Abercrombie brands registering 31% growth and Hollister brands delivering growth of 12%. Strong top-line growth, along with gross profit rate expansion, led to record first quarter operating income and an operating margin of 12.7%.

With excellent first quarter performance, we are increasing our full year sales and operating margin outlook. We remain on track to achieve our 2024 goal of demonstrating sustainable, profitable growth after a defining year for the company in fiscal 2023. Our brands are delivering high-quality, on-trend assortments for new and retained customers across regions and brands. Importantly, we continue to make strategic investments across stores, digital and technology to further strengthen the company in pursuit of our long-term ambition.”

Details related to reported net income per diluted share and adjusted net income per diluted share for the first quarter are as follows:

| | | | | | | | | | | | | | |

| | 2024 | | 2023 |

| GAAP | | $ | 2.14 | | | $ | 0.32 | |

Excluded items, net of tax effect (1) | | — | | | (0.06) | |

| Adjusted non-GAAP | | $ | 2.14 | | | $ | 0.39 | |

Impact from changes in foreign currency exchange rates (2) | | — | | | — | |

| Adjusted non-GAAP constant currency | | $ | 2.14 | | | $ | 0.39 | |

(1)Excluded items consist of pre-tax store asset impairment charges in the prior year.

(2)The estimated impact from foreign currency is calculated by applying current period exchange rates to prior year results using a 26% tax rate.

A summary of results for the first quarter ended May 4, 2024 as compared to the first quarter ended April 29, 2023:

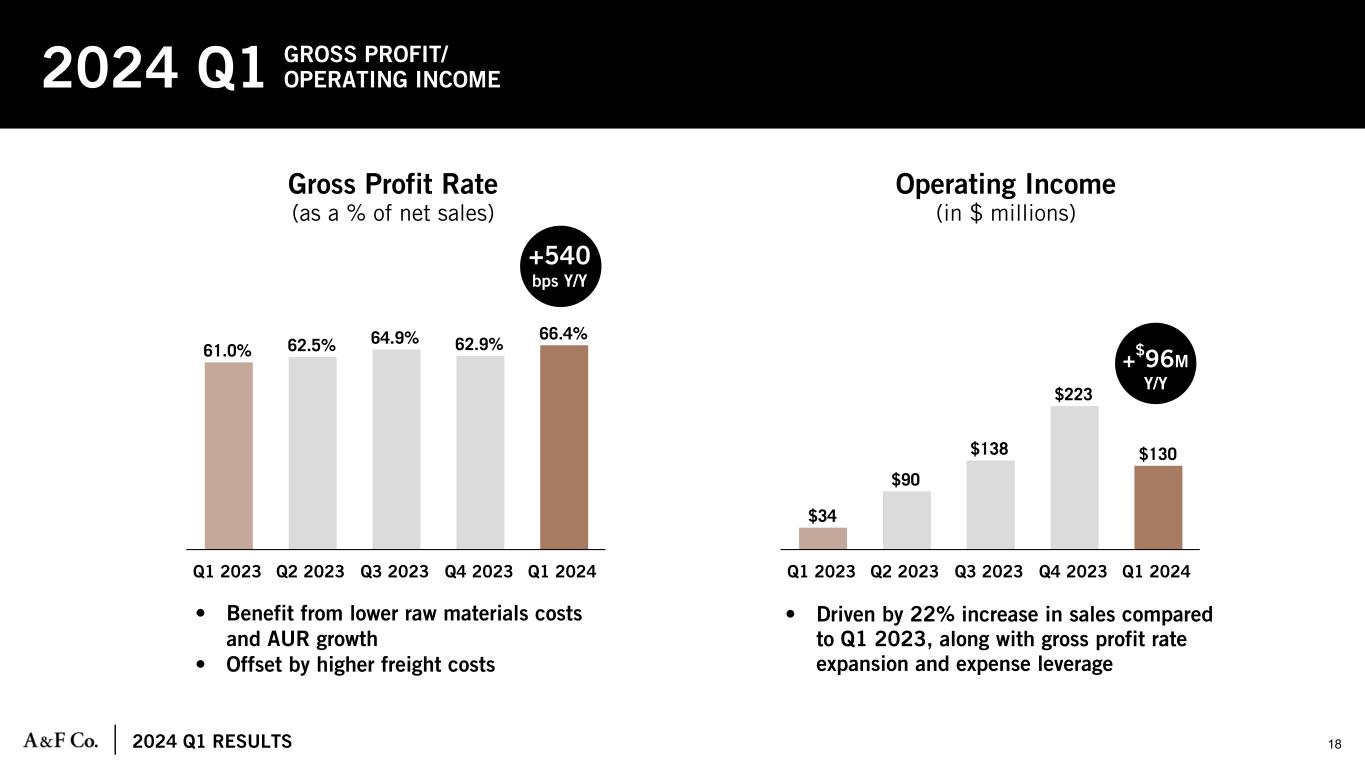

•Net sales of $1.0 billion, up 22% as compared to last year on a reported basis and constant currency basis.

•Comparable sales up 21%.

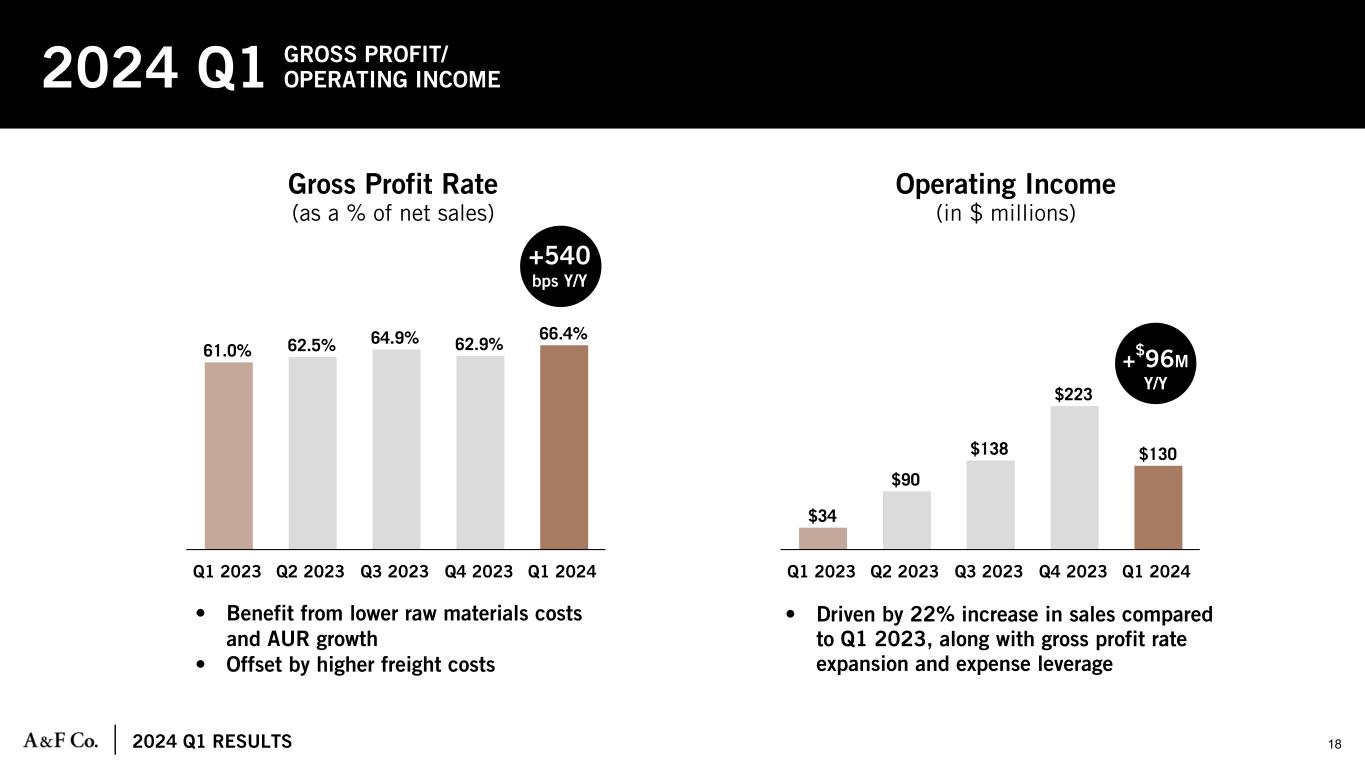

•Gross profit rate of 66.4%, up approximately 540 basis points as compared to last year.

•Operating expense, excluding other operating income, net, of $549.6 million for the quarter, decreased to 53.8% of sales from 57.3% last year.

•Operating income of $130 million as compared to operating income last year of $34 million and $38 million, on a reported and adjusted non-GAAP basis, respectively.

•Net income per diluted share of $2.14 as compared to net income per diluted share last year of $0.32 and $0.39 on a reported and adjusted non-GAAP basis, respectively.

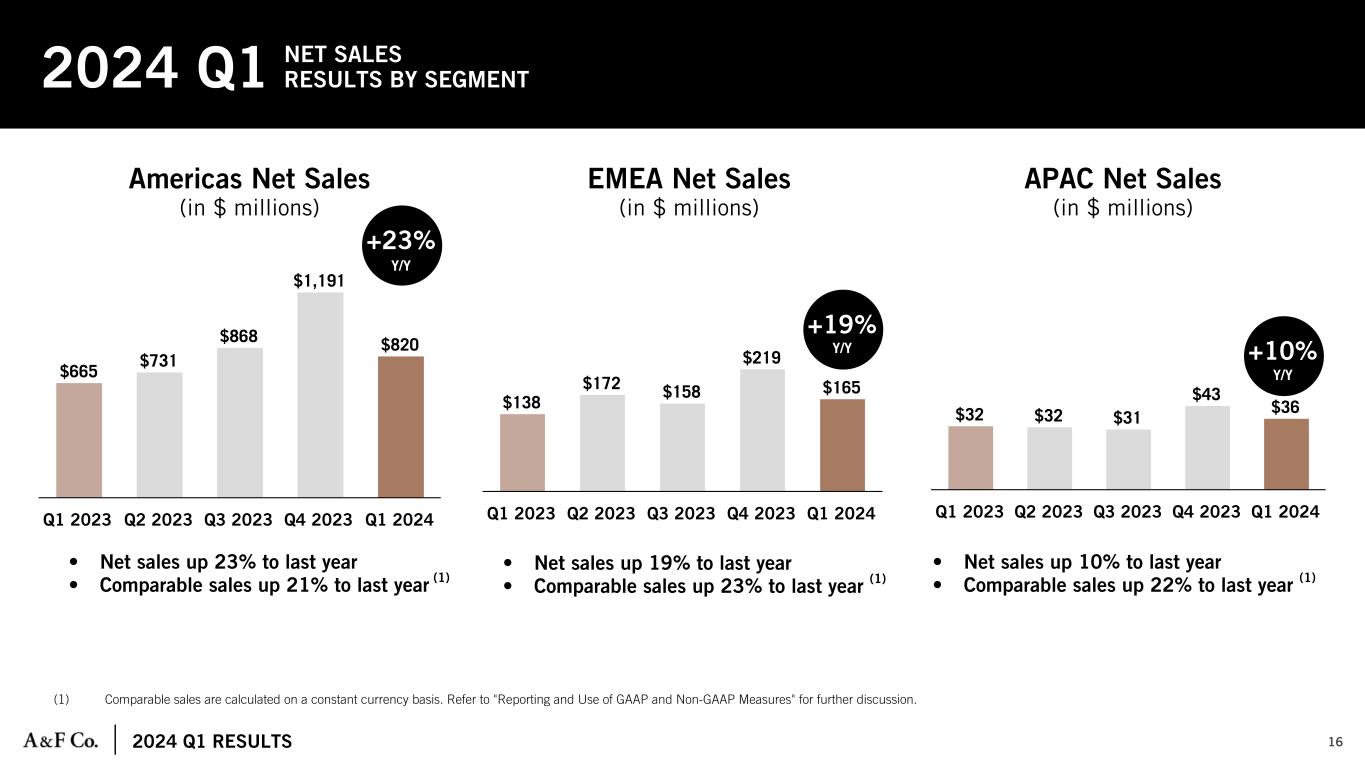

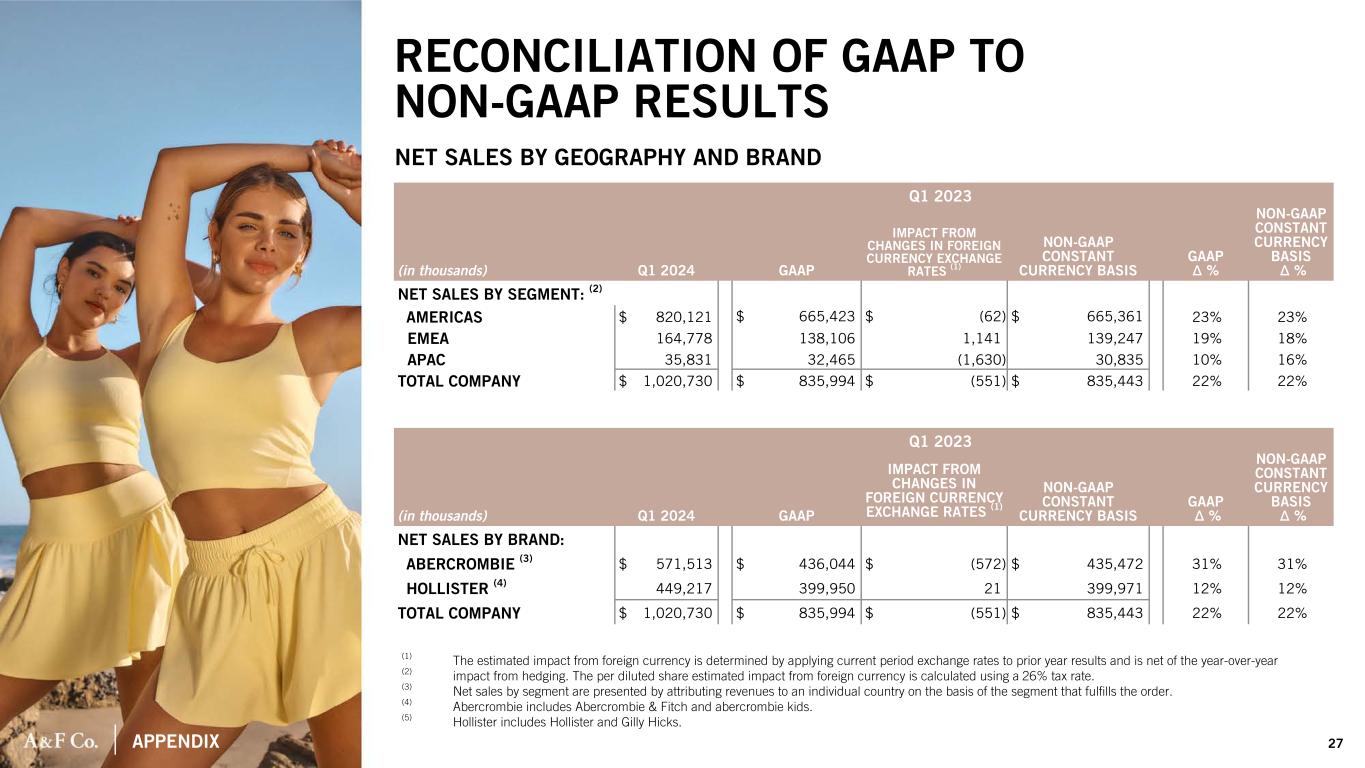

Net sales by segment and brand for the first quarter are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | 2024 | | 2023 | | 1 YR % Change | | Comparable sales (2) |

Net sales by segment: (1) | | | | | | | | | |

Americas (3) | $ | 820,121 | | | | $ | 665,423 | | | | 23% | | 21% |

EMEA (4) | 164,778 | | | | 138,106 | | | | 19% | | 23% |

APAC (5) | 35,831 | | | | 32,465 | | | | 10% | | 22% |

| Total company | $ | 1,020,730 | | | | $ | 835,994 | | | | 22% | | 21% |

| | | | | | | | | |

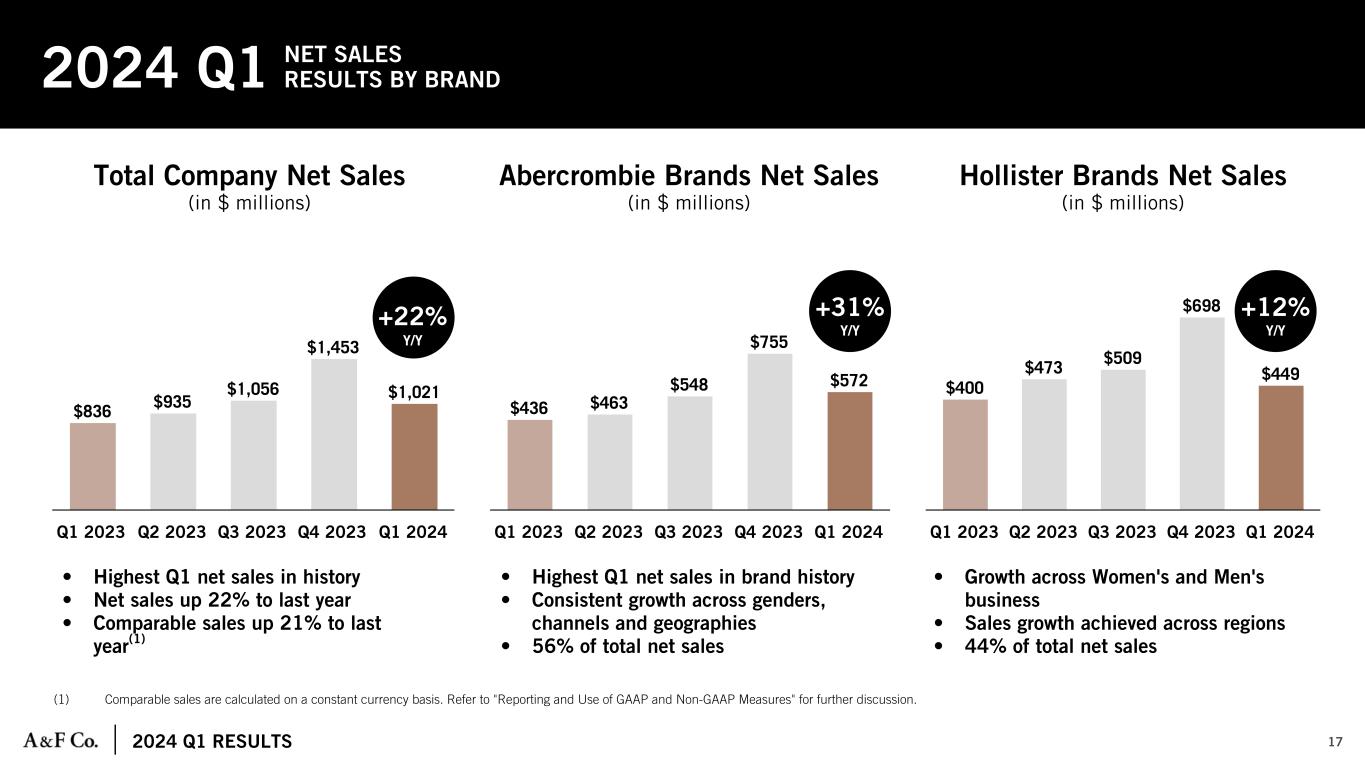

| 2024 | | 2023 | | 1 YR % Change | | Comparable sales (2) |

| Net sales by brand: | | | | | | | | | |

Abercrombie (6) | 571,513 | | | | 436,044 | | | | 31% | | 29% |

Hollister (7) | $ | 449,217 | | | | $ | 399,950 | | | | 12% | | 13% |

| Total company | $ | 1,020,730 | | | | $ | 835,994 | | | | 22% | | 21% |

(1) Net sales by segment are presented by attributing revenues to an individual country on the basis of the segment that fulfills the order.

(2) Comparable sales are calculated on a constant currency basis. Refer to "REPORTING AND USE OF GAAP AND NON-GAAP MEASURES," for further discussion.

(3) The Americas segment includes the results of operations in North America and South America.

(4) The EMEA segment includes the results of operations in Europe, the Middle East and Africa.

(5) The APAC segment includes the results of operations in the Asia-Pacific region, including Asia and Oceania.

(6) For purposes of the above table, Abercrombie includes Abercrombie & Fitch and abercrombie kids.

(7) For purposes of the above table, Hollister includes Hollister and Gilly Hicks.

| | |

| Financial Position and Liquidity |

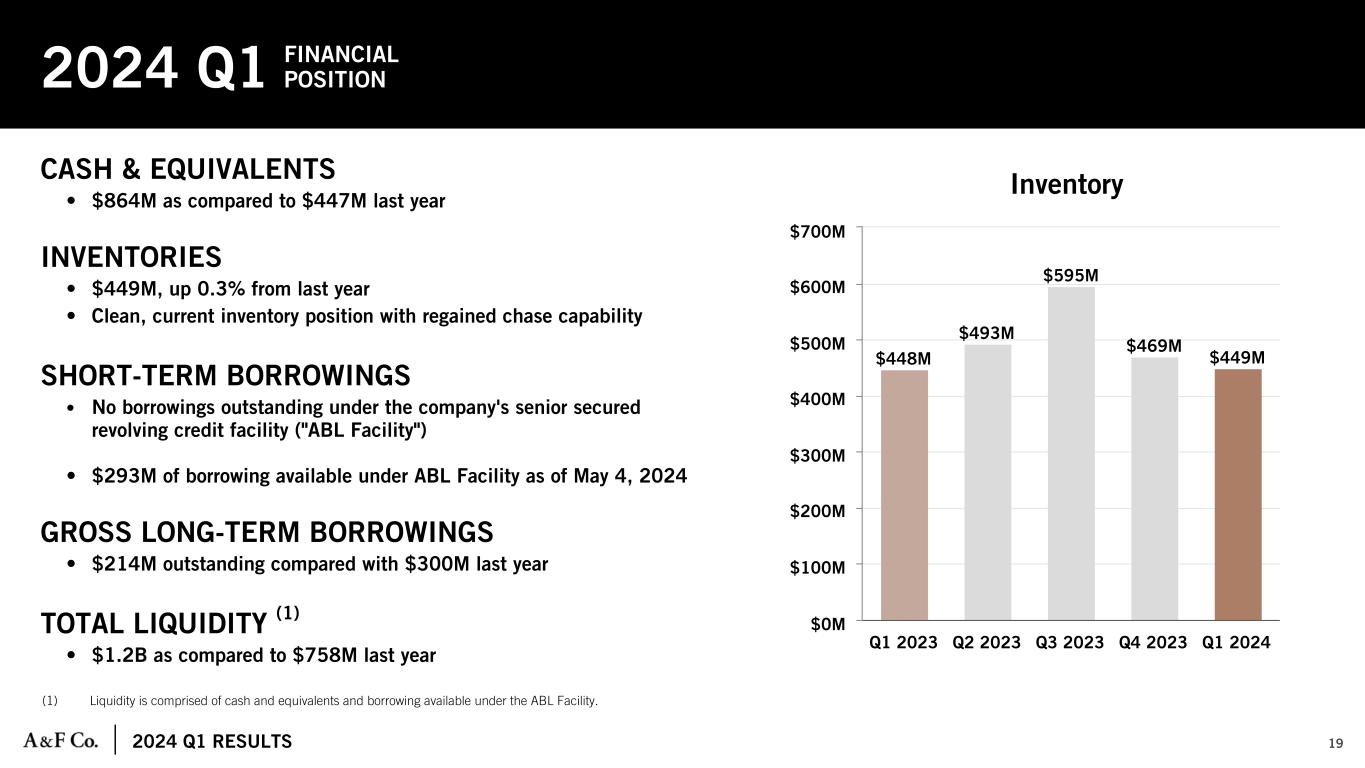

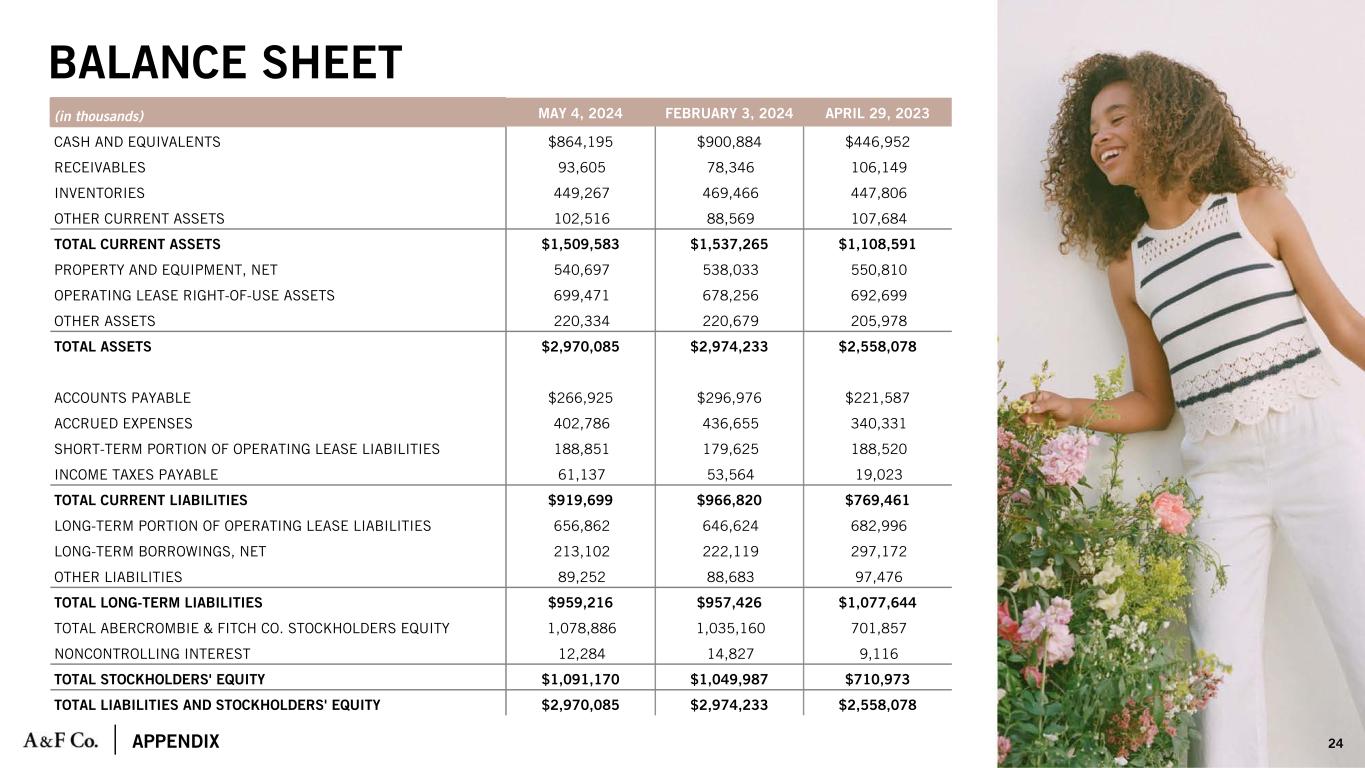

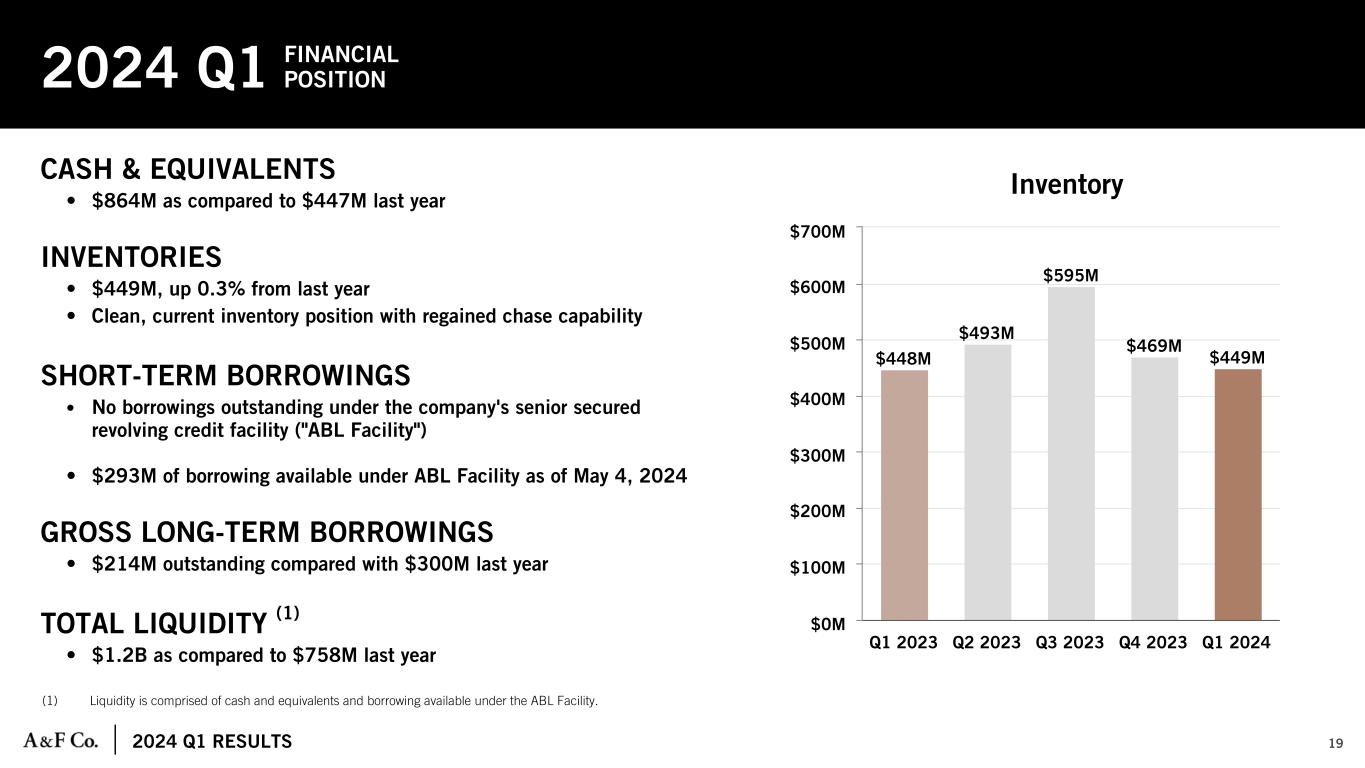

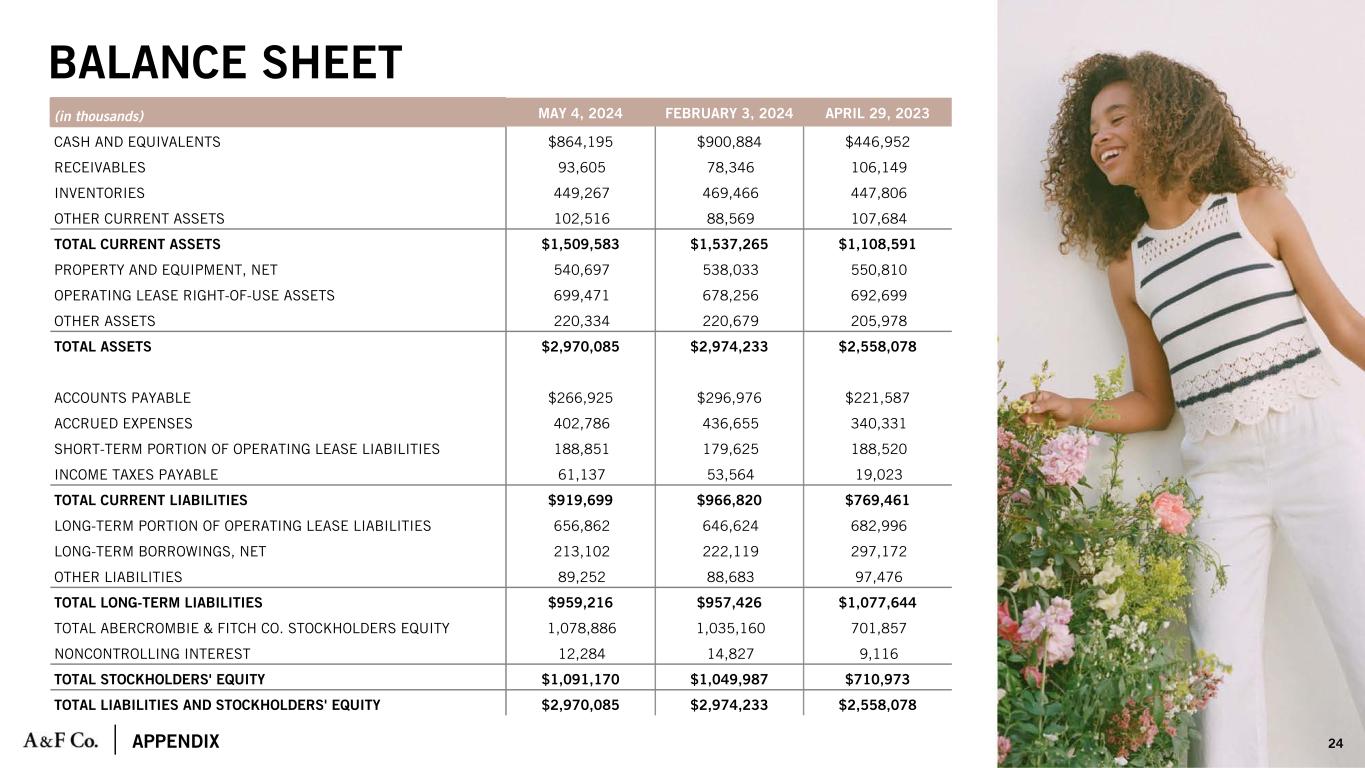

As of May 4, 2024 the company had:

•Cash and equivalents of $864 million. This compares to cash and equivalents of $901 million and $447 million as of February 3, 2024 and April 29, 2023, respectively.

•Inventories of $449 million. This compares to inventories of $469 million and $448 million as of February 3, 2024 and April 29, 2023, respectively.

•Long-term gross borrowings under the company’s senior secured notes of $214 million (the “Senior Secured Notes”) which mature in July 2025 and bear interest at a rate of 8.75% per annum.

•Borrowing available under the senior-secured asset-based revolving credit facility (the “ABL Facility”) of $293 million.

•Liquidity, comprised of cash and equivalents and borrowing available under the ABL Facility, of approximately $1.2 billion. This compares to liquidity of $1.2 billion and $0.8 billion as of February 3, 2024 and April 29, 2023, respectively.

| | |

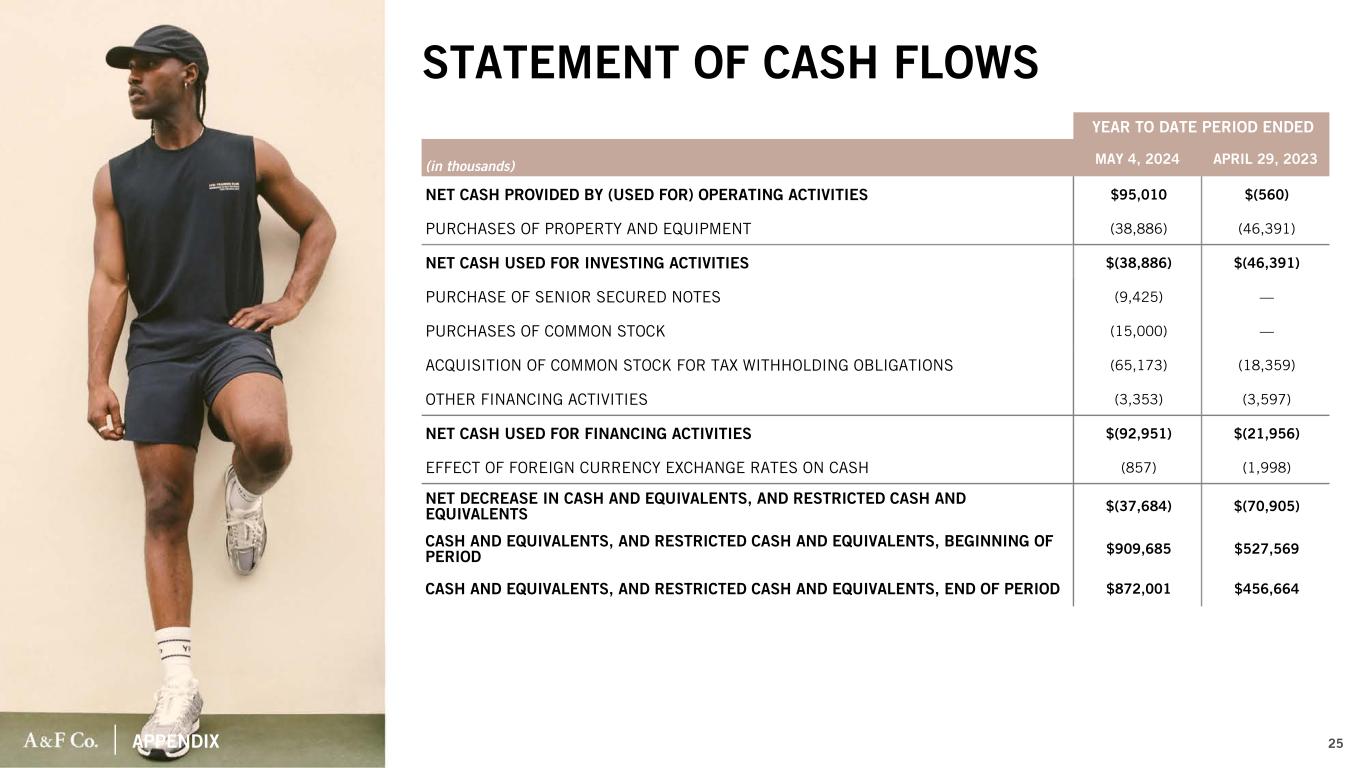

Cash Flow and Capital Allocation |

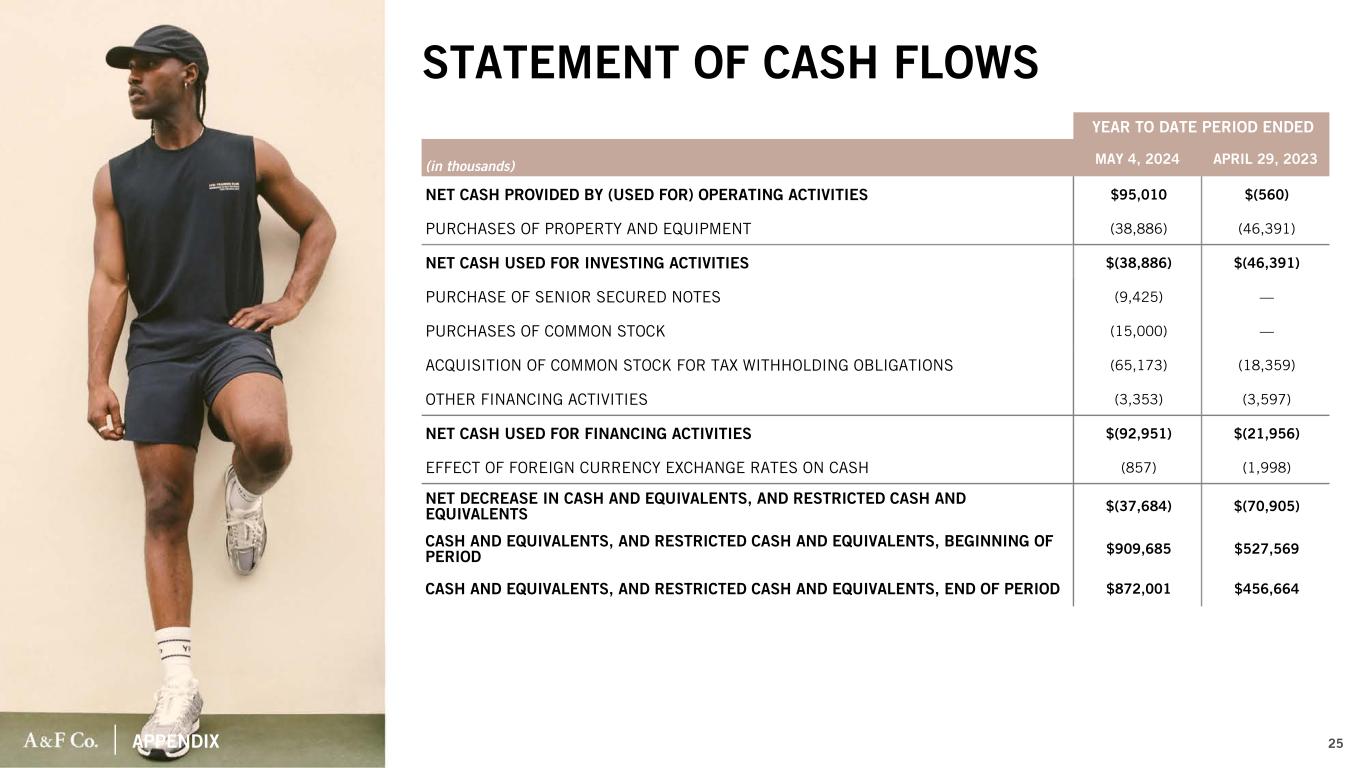

Details related to the company’s cash flows for the year-to-date period ended May 4, 2024 are as follows:

•Net cash provided by operating activities of $95 million.

•Net cash used for investing activities of $39 million.

•Net cash used for financing activities of $93 million.

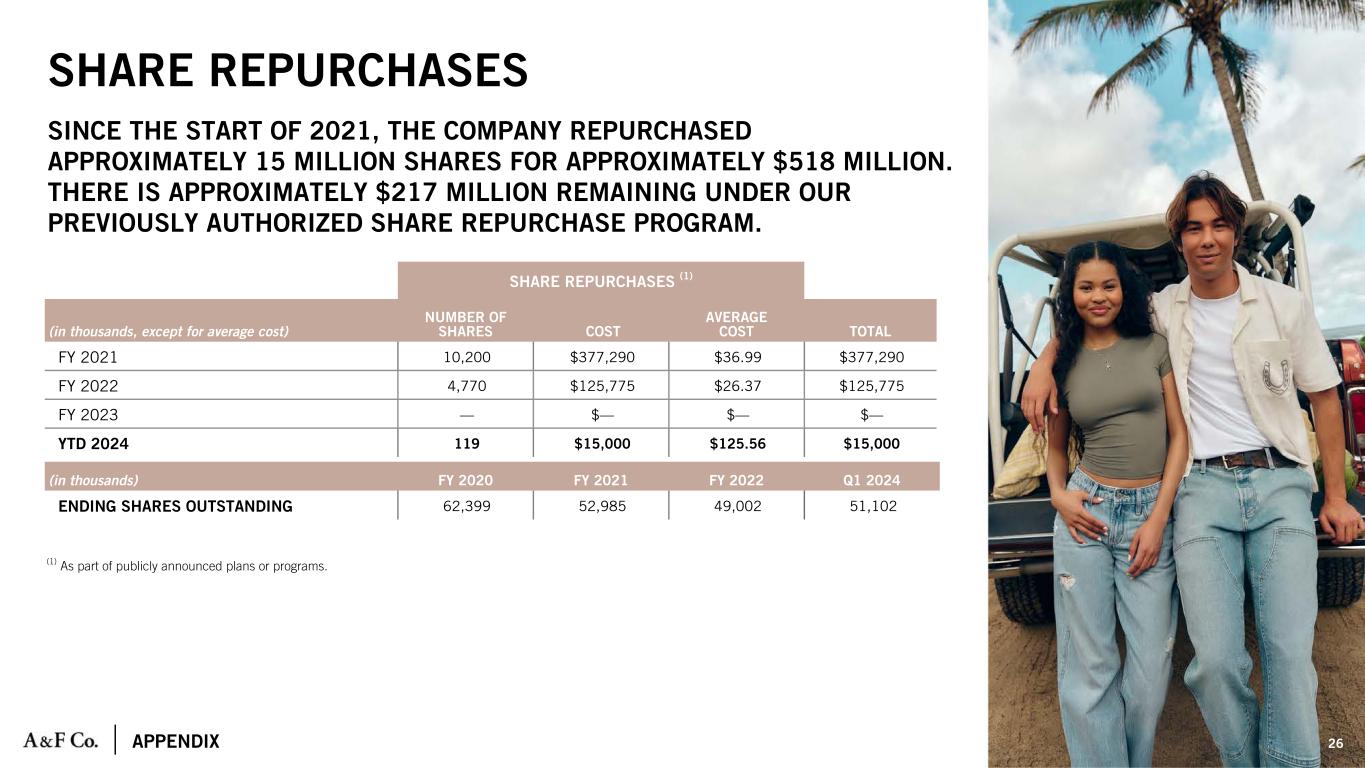

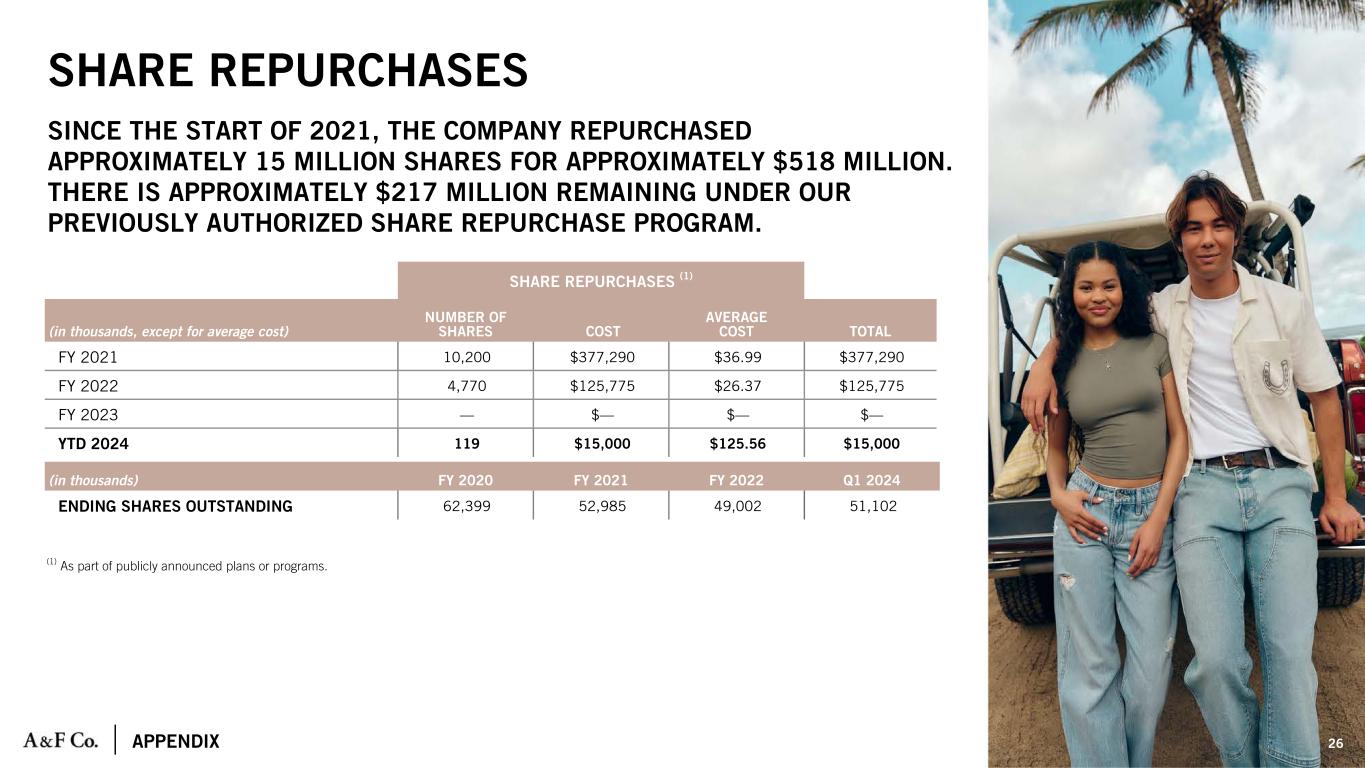

During the first quarter of 2024, the company purchased approximately $9 million, at a slight premium to par value, of its outstanding Senior Secured Notes. In addition, in the 2024 first quarter, the company repurchased 119,000 shares for approximately $15 million. The company has $217 million remaining on the share repurchase authorization established in November 2021.

Depreciation and amortization was $38 million for the year-to-date period ended May 4, 2024.

| | |

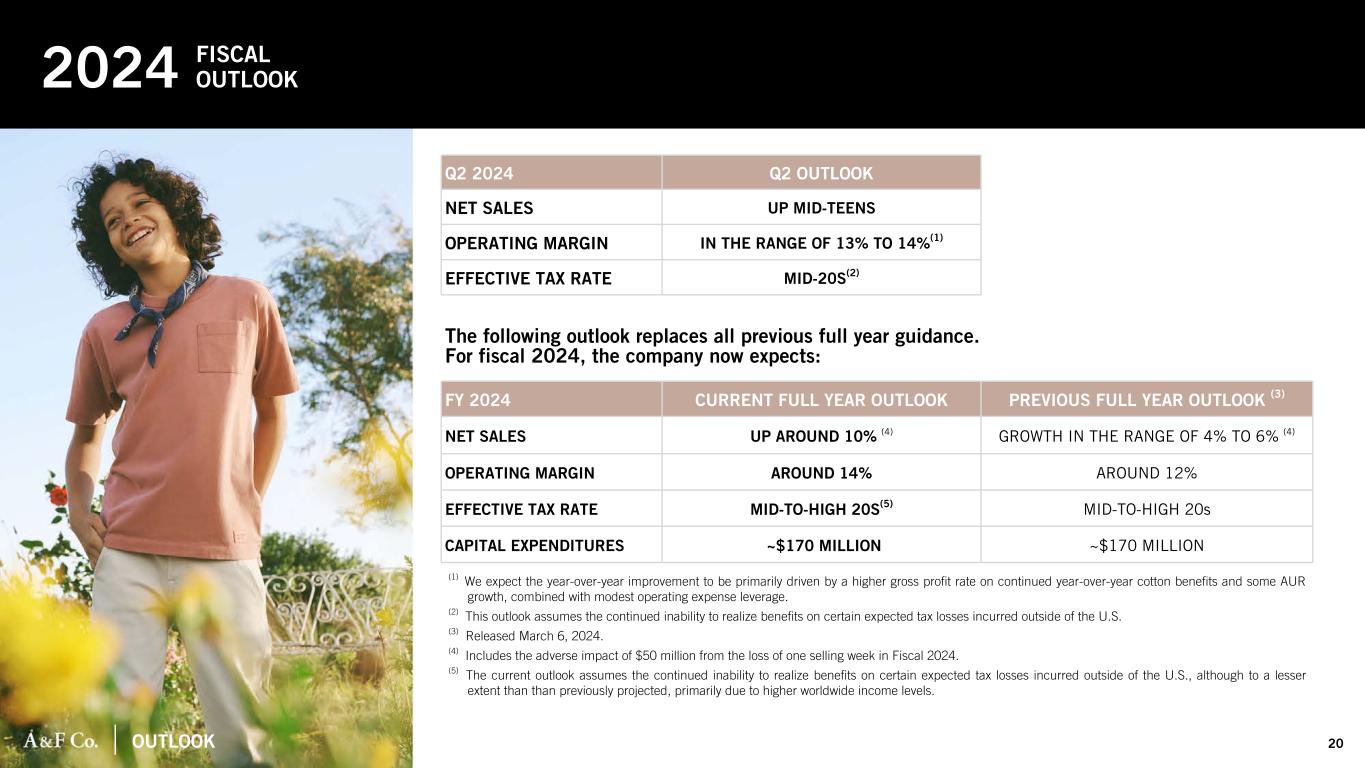

Fiscal 2024 Full Year Outlook |

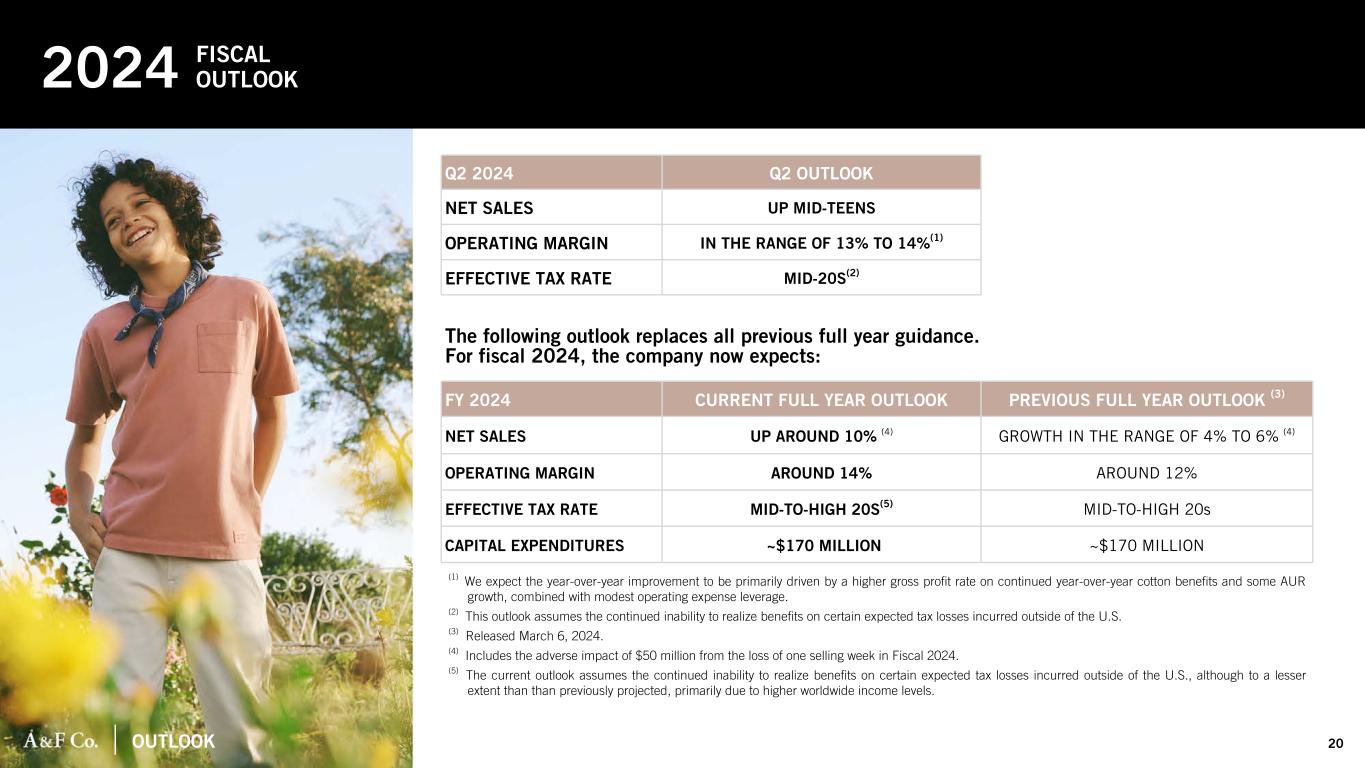

The following outlook replaces all previous full year guidance. For fiscal 2024, the company now expects:•Net sales up around 10% from $4.3 billion in fiscal 2023. This is an increase to the previous outlook of growth in the range of 4% to 6%. We expect Abercrombie brands will continue to outperform Hollister brands and the Americas will continue to lead the regional performance.

The following table illustrates the expected quarterly and full year net sales and related basis point impact of the calendar shift and loss of one selling week in fiscal 2024 compared to fiscal 2023.

| | | | | | | | | | | | | | | | | |

| |

| Q1 | Q2 | Q3 | Q4 | Fiscal 2024 |

Net sales impact (in millions) | $+10M | $+30M | $-10M | $-80M | $-50M |

Basis point impact | +120 bps | +320 bps | -90 bps | -550 bps | -120 bps |

•Operating margin to be around 14%. This range improves from the previous outlook of around 12%. We expect the year-over-year improvement to be driven by a higher gross profit rate and some operating expense leverage.

•Effective tax rate to be in the mid-to-high 20s, with the rate being sensitive to the jurisdictional mix and level of income.

•Capital expenditures of approximately $170 million.

| | |

Fiscal 2024 Second Quarter Outlook |

For the second quarter of fiscal 2024, the company expects:•Net sales growth to be up mid-teens compared to fiscal second quarter 2023 level of $935 million.

•Operating margin to be in the in the range of 13% to 14% compared to an operating margin of 9.6% in Q2 2023.

•Effective tax rate to be mid-20s, with the rate being sensitive to the jurisdictional mix and level of income.

Today at 8:30 a.m. ET, the company will conduct a conference call and provide additional details around its quarterly results and its outlook for the second quarter. To access the call by phone, participants will need to register at the following URL address to obtain a dial-in number and passcode:

https://register.vevent.com/register/BIc2b07a146008478c825c3b93c929d4ac

A presentation of first quarter results will be available in the “Investors” section at corporate.abercrombie.com at approximately 7:30 a.m. ET, today. Important information may be disseminated initially or exclusively via the website; investors should consult the site to access this information.

| | |

| Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 |

This Press Release and related statements by management or spokespeople of Abercrombie & Fitch Co. (A&F) contain forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995). These statements, including, without limitation, statements regarding our second quarter and annual fiscal 2024 results, relate to our current assumptions, projections and expectations about our business and future events. Any such forward-looking statements involve risks and uncertainties and are subject to change based on various important factors, many of which may be beyond the company’s control. The inclusion of such information should not be regarded as a representation by the company, or any other person, that the objectives of the company will be achieved. Words such as “estimate,” “project,” “plan,” “goal,” “believe,” “expect,” “anticipate,” “intend,” “should,” “are confident,” “will,” “could,” “outlook,” and similar expressions may identify forward-looking statements. Except as may be required by applicable law, we assume no obligation to publicly update or revise any forward-looking statements, including any financial targets or estimates, whether as a result of new information, future events, or otherwise. Factors that may cause results to differ from those expressed in our forward-looking statements include, but are not limited to, the factors disclosed in Part I, Item 1A. “Risk Factors” of the company’s Annual Report on Form 10-K for the fiscal year ended February 3, 2024, and otherwise in our reports and filings with the Securities and Exchange Commission, as well as the following factors: risks related to changes in global economic and financial conditions, including inflation, and the resulting impact on consumer spending generally and on our operating results, financial condition, and expense management, and our ability to adequately mitigate the impact; risks related to geopolitical conflict, armed conflict, the conflicts between Russia and Ukraine or Israel and Hamas and the expansion of conflict in the surrounding areas, including the impact of such conflicts on international trade, supplier delivery or increased freight costs, acts of terrorism, mass casualty events, social unrest, civil disturbance or disobedience; risks related to our failure to engage our customers, anticipate customer demand and changing fashion trends, and manage our inventory; risks related to our failure to operate effectively in a highly competitive and constantly evolving industry; risks related to our ability to execute on, and maintain the success of, our strategic and growth initiatives, including those outlined in our Always Forward Plan; risks related to fluctuations in foreign currency exchange rates; risks related to fluctuations in our tax obligations and effective tax rate, including as a result of earnings and losses generated from our global operations, may result in volatility in our results of operations; risks and uncertainty related to adverse public health developments; risks associated with climate change and other corporate responsibility issues; risks related to reputational harm to the company, its officers, and directors; risks related to actual or threatened litigation; risks related to cybersecurity threats and privacy or data security breaches; and the potential loss or disruption to our information systems.

This document includes certain adjusted non-GAAP financial measures where management believes it to be helpful in understanding the company's results of operations or financial position. Additional details about non-GAAP financial measures and a reconciliation of GAAP financial measures to non-GAAP financial measures can be found in the "Reporting and Use of GAAP and Non-GAAP Measures" section. Sub-totals and totals may not foot due to rounding. Net income and net income per share financial measures included herein are attributable to Abercrombie & Fitch Co., excluding net income attributable to noncontrolling interests.

As used in this document, unless otherwise defined, "Abercrombie brands" refers to Abercrombie & Fitch and abercrombie kids and "Hollister brands" refers to Hollister and Gilly Hicks. Additionally, references to "Americas" includes North America and South America, "EMEA" includes Europe, the Middle East and Africa and "APAC" includes the Asia-Pacific region, including Asia and Oceania.

| | |

| About Abercrombie & Fitch Co. |

Abercrombie & Fitch Co. (NYSE: ANF) is a leading, global, omnichannel specialty retailer of apparel and accessories for men, women and kids. Abercrombie & Fitch was born in 1892 and aims to make every day feel as exceptional as the start of a long weekend. abercrombie kids sees the world through kids’ eyes, where play is life and every day is an opportunity to be anything and better anything. Hollister believes in liberating the spirit of an endless summer inside everyone and making teens feel celebrated and comfortable in their own skin. Gilly Hicks, offering active lifestyle products, is designed to create happiness through movement.

The brands share a commitment to offering products of enduring quality and exceptional comfort that allow consumers around the world to express their own individuality and style. Abercrombie & Fitch Co. operates approximately 750 stores under these brands across North America, Europe, Asia and the Middle East, as well as the e-commerce sites www.abercrombie.com, www.abercrombiekids.com, www.hollisterco.com and www.gillyhicks.com

| | | | | | | | |

| Investor Contact: | | Media Contact: |

| | |

| Mo Gupta | | Kate Wagner |

| Abercrombie & Fitch Co. | | Abercrombie & Fitch Co. |

| (614) 283-6751 | | (614) 283-6192 |

| Investor_Relations@anfcorp.com | | Public_Relations@anfcorp.com |

| | | | | | | | | | | | | | | | | | | | | | | |

| Abercrombie & Fitch Co. |

| Condensed Consolidated Statements of Operations |

| (in thousands, except per share data) |

| (Unaudited) |

| | | | | | | |

| Thirteen Weeks Ended | | Thirteen Weeks Ended |

| May 4, 2024 | | % of

Net Sales | | April 29, 2023 | | % of

Net Sales |

| Net sales | $ | 1,020,730 | | | 100.0 | % | | $ | 835,994 | | | 100.0 | % |

| Cost of sales, exclusive of depreciation and amortization | 343,273 | | | 33.6 | % | | 326,200 | | | 39.0 | % |

| Gross profit | 677,457 | | | 66.4 | % | | 509,794 | | | 61.0 | % |

| Stores and distribution expense | 371,686 | | | 36.4 | % | | 336,049 | | | 40.2 | % |

| Marketing, general and administrative expense | 177,880 | | | 17.4 | % | | 142,631 | | | 17.1 | % |

| | | | | | | |

| | | | | | | |

| Other operating income, net | (1,958) | | | (0.2) | % | | (2,894) | | | (0.3) | % |

| Operating income | 129,849 | | | 12.7 | % | | 34,008 | | | 4.1 | % |

| Interest expense | 5,780 | | | 0.6 | % | | 7,458 | | | 0.9 | % |

| Interest income | (10,803) | | | (1.1) | % | | (4,015) | | | (0.5) | % |

| Interest (income) expense, net | (5,023) | | | (0.5) | % | | 3,443 | | | 0.4 | % |

| Income before income taxes | 134,872 | | | 13.2 | % | | 30,565 | | | 3.7 | % |

| Income tax expense | 19,794 | | | 1.9 | % | | 12,718 | | | 1.5 | % |

| Net income | 115,078 | | | 11.3 | % | | 17,847 | | | 2.1 | % |

| Less: Net income attributable to noncontrolling interests | 1,228 | | | 0.1 | % | | 1,276 | | | 0.2 | % |

| Net income attributable to A&F | $ | 113,850 | | | 11.2 | % | | $ | 16,571 | | | 2.0 | % |

| | | | | | | |

| Net income per share attributable to A&F | | | | | | | |

| Basic | $ | 2.24 | | | | | $ | 0.33 | | | |

| Diluted | $ | 2.14 | | | | | $ | 0.32 | | | |

| | | | | | | |

| Weighted-average shares outstanding: | | | | | | | |

| Basic | 50,893 | | | | | 49,574 | | | |

| Diluted | 53,276 | | | | | 51,467 | | | |

| | | | | | | |

Reporting and Use of GAAP and Non-GAAP Measures

The company believes that each of the non-GAAP financial measures presented are useful to investors as they provide a measure of the company’s operating performance excluding the effect of certain items which the company believes do not reflect its future operating outlook, such as asset impairment charges, therefore supplementing investors’ understanding of comparability of operations across periods. Management used these non-GAAP financial measures during the periods presented to assess the company’s performance and to develop expectations for future operating performance. Non-GAAP financial measures should be used supplemental to, and not as an alternative to, the company’s GAAP financial results, and may not be calculated in the same manner as similar measures presented by other companies.

The company provides comparable sales, defined as the percentage year-over-year change in the aggregate of: (1) sales for stores that have been open as the same brand at least one year and whose square footage has not been expanded or reduced by more than 20% within the past year, with prior year’s net sales converted at the current year’s foreign currency exchange rate to remove the impact of foreign currency rate fluctuation, and (2) digital net sales with prior year’s net sales converted at the current year’s foreign currency exchange rate to remove the impact of foreign currency rate fluctuation.

The company also provides certain financial information on a constant currency basis to enhance investors’ understanding of underlying business trends and operating performance, by removing the impact of foreign currency exchange rate fluctuations. The effect from foreign currency, calculated on a constant currency basis, is determined by applying current year average exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share effect from foreign currency is calculated using a 26% tax rate.

In addition, the company provides EBITDA and Adjusted EBITDA as supplemental measures used by the company's executive management to assess the company's performance. We also believe these supplemental performance measures are meaningful information for investors and other interested parties to use in computing the company's core financial performance over multiple periods and with other companies by excluding the impact of differences in tax jurisdictions, debt service levels and capital investment.

| | | | | | | | | | | | | | | | | | | |

| Abercrombie & Fitch Co. |

| Reconciliation of Constant Currency Financial Measures |

Thirteen Weeks Ended May 4, 2024 and April 29, 2023 |

| (in thousands, except percentage and basis point changes and per share data) |

| (Unaudited) |

| | | | | | | |

| 2024 | | 2023 | | | | % Change |

| Net sales | | | | | | | |

GAAP (1) | $ | 1,020,730 | | | $ | 835,994 | | | | | 22% |

Impact from changes in foreign currency exchange rates (2) | — | | | (551) | | | | | —% |

| Net sales on a constant currency basis | $ | 1,020,730 | | | $ | 835,443 | | | | | 22% |

| | | | | | | |

| Gross profit | 2024 | | 2023 | | | | BPS Change (3) |

GAAP (1) | $ | 677,457 | | | $ | 509,794 | | | | | 540 |

Impact from changes in foreign currency exchange rates (2) | — | | | 930 | | | | | (10) |

| Gross profit on a constant currency basis | $ | 677,457 | | | $ | 510,724 | | | | | 530 |

| | | | | | | |

| Operating income | 2024 | | 2023 | | | | BPS Change (3) |

GAAP (1) | $ | 129,849 | | | $ | 34,008 | | | | | 860 |

Excluded items (4) | — | | | (4,436) | | | | | 50 |

| Adjusted non-GAAP | $ | 129,849 | | | $ | 38,444 | | | | | 810 |

Impact from changes in foreign currency exchange rates (2) | — | | | 463 | | | | | (10) |

| Adjusted non-GAAP constant currency basis | $ | 129,849 | | | $ | 38,907 | | | | | 800 |

| | | | | | | |

| Net income attributable to A&F | 2024 | | 2023 | | | | $ Change |

GAAP (1) | $ | 2.14 | | | $ | 0.32 | | | | | $1.82 |

Excluded items, net of tax (4) | — | | | (0.06) | | | | | 0.06 |

| Adjusted non-GAAP | $ | 2.14 | | | $ | 0.39 | | | | | $1.75 |

Impact from changes in foreign currency exchange rates (2) | — | | | — | | | | | — |

| Adjusted non-GAAP constant currency basis | $ | 2.14 | | | $ | 0.39 | | | | | $1.75 |

(1) “GAAP” refers to accounting principles generally accepted in the United States of America.

(2) The estimated impact from foreign currency is determined by applying current period exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share estimated impact from foreign currency is calculated using a 26% tax rate.

(3) The estimated basis point change has been rounded based on the percentage change.

(4) Excluded items consist of $4.4 million pre-tax store impairment charges for the prior year.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Abercrombie & Fitch Co. |

| Reconciliation of Constant Currency Net Sales by Geography and Brand |

Thirteen Weeks Ended May 4, 2024 and April 29, 2023 |

| (in thousands, except percentage changes) |

| (Unaudited) |

| 2024 | | 2023 | | GAAP

% Change | Non-GAAP Constant Currency Basis

% Change |

| GAAP | GAAP | Impact From Changes In Foreign Currency Exchanges Rates (1) | Non-GAAP Constant

Currency Basis |

Net sales by segment: (2) | | | | | | | | |

Americas (3) | $ | 820,121 | | | $ | 665,423 | | $ | (62) | | $ | 665,361 | | | 23% | 23% |

EMEA (4) | 164,778 | | | 138,106 | | 1,141 | | 139,247 | | | 19% | 18% |

APAC (5) | 35,831 | | | 32,465 | | (1,630) | | 30,835 | | | 10% | 16% |

| Total company | $ | 1,020,730 | | | $ | 835,994 | | $ | (551) | | $ | 835,443 | | | 22% | 22% |

| | | | | | | | |

| | | | | | | | |

| 2024 | | 2023 | | GAAP

% Change | Non-GAAP Constant Currency Basis

% Change |

| GAAP | GAAP | Impact From Changes In Foreign Currency Exchanges Rates (1) | Non-GAAP Constant

Currency Basis |

| Net sales by brand: | | | | | | | | |

Abercrombie (6) | 571,513 | | | 436,044 | | (572) | | 435,472 | | | 31% | 31% |

Hollister (7) | $ | 449,217 | | | $ | 399,950 | | $ | 21 | | $ | 399,971 | | | 12% | 12% |

| Total company | $ | 1,020,730 | | | $ | 835,994 | | $ | (551) | | $ | 835,443 | | | 22% | 22% |

(1)The estimated impact from foreign currency is determined by applying current period exchange rates to prior year results and is net of the year-over-year impact from hedging.

(2)Net sales by segment are presented by attributing revenues to an individual country on the basis of the segment that fulfills the order.

(3)The Americas segment includes the results of operations in North America and South America.

(4)The EMEA segment includes the results of operations in Europe, the Middle East and Africa.

(5)The APAC segment includes the results of operations in the Asia-Pacific region, including Asia and Oceania.

(6)For purposes of the above table, Abercrombie includes Abercrombie & Fitch and abercrombie kids.

(7)For purposes of the above table, Hollister includes Hollister and Gilly Hicks.

| | | | | | | | | | | | | | | | | | | | |

| Abercrombie & Fitch Co. |

Reconciliation of EBITDA and Adjusted EBITDA |

Thirteen Weeks Ended May 4, 2024 and April 29, 2023 |

| (in thousands) |

| (Unaudited) |

| | | | | | |

| 2024 | | % of

Net Sales | 2023 | | % of

Net Sales |

| Net income | $ | 115,078 | | | 11.3 | % | $ | 17,847 | | | 2.1 | % |

| Income tax expense | 19,794 | | | 1.9 | | 12,718 | | | 1.5 | |

| Interest (income) expense, net | (5,023) | | | (0.5) | | 3,443 | | | 0.4 | |

Depreciation and amortization | 37,689 | | | 3.7 | | 36,028 | | | 4.3 | |

EBITDA (1) | $ | 167,538 | | | 16.4 | % | $ | 70,036 | | | 8.4 | % |

| | | | | | |

| Adjustments to EBITDA | | | | | | |

| Asset impairment | — | | | — | | 4,436 | | | 0.5 | |

Adjusted EBITDA (1) | $ | 167,538 | | | 16.4 | % | $ | 74,472 | | | 8.9 | % |

| | | | | | |

|

|

|

|

|

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

(1)EBITDA and Adjusted EBITDA are supplemental financial measures that are not defined or prepared in accordance with GAAP. EBITDA is defined as net income before interest, income taxes and depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for asset impairment.

| | | | | | | | | | | | | | | | | |

| Abercrombie & Fitch Co. |

| Condensed Consolidated Balance Sheets |

| (in thousands) |

| (Unaudited) |

| | | | | |

| May 4, 2024 | | February 3, 2024 | | April 29, 2023 |

| Assets | | | | | |

| Current assets: | | | | | |

| Cash and equivalents | $ | 864,195 | | | $ | 900,884 | | | $ | 446,952 | |

| Receivables | 93,605 | | | 78,346 | | | 106,149 | |

| Inventories | 449,267 | | | 469,466 | | | 447,806 | |

| Other current assets | 102,516 | | | 88,569 | | | 107,684 | |

| Total current assets | 1,509,583 | | | 1,537,265 | | | 1,108,591 | |

| Property and equipment, net | 540,697 | | | 538,033 | | | 550,810 | |

| Operating lease right-of-use assets | 699,471 | | | 678,256 | | | 692,699 | |

| Other assets | 220,334 | | | 220,679 | | | 205,978 | |

| Total assets | $ | 2,970,085 | | | $ | 2,974,233 | | | $ | 2,558,078 | |

| | | | | |

| Liabilities and stockholders’ equity | | | | | |

| Current liabilities: | | | | | |

| Accounts payable | $ | 266,925 | | | $ | 296,976 | | | $ | 221,587 | |

| Accrued expenses | 402,786 | | | 436,655 | | | 340,331 | |

| Short-term portion of operating lease liabilities | 188,851 | | | 179,625 | | | 188,520 | |

| | | | | |

| Income taxes payable | 61,137 | | | 53,564 | | | 19,023 | |

| Total current liabilities | 919,699 | | | 966,820 | | | 769,461 | |

| Long-term liabilities: | | | | | |

| Long-term portion of operating lease liabilities | $ | 656,862 | | | $ | 646,624 | | | $ | 682,996 | |

| Long-term borrowings, net | 213,102 | | | 222,119 | | | 297,172 | |

| Other liabilities | 89,252 | | | 88,683 | | | 97,476 | |

| Total long-term liabilities | 959,216 | | | 957,426 | | | 1,077,644 | |

| Total Abercrombie & Fitch Co. stockholders’ equity | 1,078,886 | | | 1,035,160 | | | 701,857 | |

| Noncontrolling interests | 12,284 | | | 14,827 | | | 9,116 | |

| Total stockholders’ equity | 1,091,170 | | | 1,049,987 | | | 710,973 | |

| Total liabilities and stockholders’ equity | $ | 2,970,085 | | | $ | 2,974,233 | | | $ | 2,558,078 | |

| | | | | | | | | | | |

| Abercrombie & Fitch Co. |

| Condensed Consolidated Statements of Cash Flows |

| (in thousands, except per share data) |

| (Unaudited) |

| | | |

| | | |

| | Thirteen Weeks Ended |

| | May 4, 2024 | | April 29, 2023 |

| Operating activities | | | |

| Net cash provided by (used for) operating activities | $ | 95,010 | | | $ | (560) | |

| | | |

| Investing activities | | | |

| Purchases of property and equipment | $ | (38,886) | | | $ | (46,391) | |

| | | |

| | | |

| | | |

| Net cash used for investing activities | $ | (38,886) | | | $ | (46,391) | |

| | | |

| Financing activities | | | |

| | | |

| | | |

| | | |

| | | |

| Purchase of senior secured notes | (9,425) | | | — | |

| | | |

| Purchases of common stock | (15,000) | | | — | |

| | | |

| Acquisition of common stock for tax withholding obligations | (65,173) | | | (18,359) | |

| Other financing activities | (3,353) | | | (3,597) | |

| Net cash used for financing activities | $ | (92,951) | | | $ | (21,956) | |

| | | |

| Effect of foreign currency exchange rates on cash | $ | (857) | | | $ | (1,998) | |

| Net decrease in cash and equivalents, and restricted cash and equivalents | $ | (37,684) | | | $ | (70,905) | |

| Cash and equivalents, and restricted cash and equivalents, beginning of period | $ | 909,685 | | | $ | 527,569 | |

| Cash and equivalents, and restricted cash and equivalents, end of period | $ | 872,001 | | | $ | 456,664 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Abercrombie & Fitch Co. | | | | |

| Financial Information | | | | |

| (Unaudited) | | | | |

| (in thousands, except per share data) | | | | |

| | | Fiscal 2023 | | | | Fiscal 2024 | | | | |

| 2022 | | Q1 | Q2 | Q3 | Q4 | | 2023 | | Q1 | | | | |

| Net sales | $ | 3,697,751 | | | $ | 835,994 | | $ | 935,345 | | $ | 1,056,431 | | $ | 1,452,907 | | | $ | 4,280,677 | | | $ | 1,020,730 | | | | | |

| Cost of sales, exclusive of depreciation and amortization | 1,593,213 | | | 326,200 | | 350,965 | | 370,762 | | 539,338 | | | 1,587,265 | | | 343,273 | | | | | |

| Gross profit | 2,104,538 | | | 509,794 | | 584,380 | | 685,669 | | 913,569 | | | 2,693,412 | | | 677,457 | | | | | |

| Stores and distribution expense | 1,496,962 | | | 336,049 | | 352,730 | | 383,883 | | 499,075 | | | 1,571,737 | | | 371,686 | | | | | |

| Marketing, general and administrative expense | 517,602 | | | 142,631 | | 144,502 | | 162,510 | | 193,234 | | | 642,877 | | | 177,880 | | | | | |

| Other operating (income) loss, net | (2,674) | | | (2,894) | | (2,694) | | 1,256 | | (1,541) | | | (5,873) | | | (1,958) | | | | | |

| Operating income | 92,648 | | | 34,008 | | 89,842 | | 138,020 | | 222,801 | | | 484,671 | | | 129,849 | | | | | |

| Interest expense | 30,236 | | | 7,458 | | 7,635 | | 8,568 | | 6,691 | | | 30,352 | | | 5,780 | | | | | |

| Interest income | (4,604) | | | (4,015) | | (6,538) | | (7,897) | | (11,530) | | | (29,980) | | | (10,803) | | | | | |

| Interest (income) expense, net | 25,632 | | | 3,443 | | 1,097 | | 671 | | (4,839) | | | 372 | | | (5,023) | | | | | |

| Income before income taxes | 67,016 | | | 30,565 | | 88,745 | | 137,349 | | 227,640 | | | 484,299 | | | 134,872 | | | | | |

| Income tax expense | 56,631 | | | 12,718 | | 30,014 | | 39,617 | | 66,537 | | | 148,886 | | | 19,794 | | | | | |

| Net income | 10,385 | | | 17,847 | | 58,731 | | 97,732 | | 161,103 | | | 335,413 | | | 115,078 | | | | | |

| Less: Net income attributable to noncontrolling interests | 7,569 | | | 1,276 | | 1,837 | | 1,521 | | 2,656 | | | 7,290 | | | 1,228 | | | | | |

| Net income attributable to Abercrombie & Fitch Co. | $ | 2,816 | | | $ | 16,571 | | $ | 56,894 | | $ | 96,211 | | $ | 158,447 | | | $ | 328,123 | | | $ | 113,850 | | | | | |

| | | | | | | | | | | | | | |

| Net income per share attributable to Abercrombie & Fitch Co.: | | | | | | | | | | | | | | |

| Basic | $0.06 | | $0.33 | $1.13 | $1.91 | $3.13 | | $6.53 | | $2.24 | | | | |

| Diluted | $0.05 | | $0.32 | $1.10 | $1.83 | $2.97 | | $6.22 | | $2.14 | | | | |

| | | | | | | | | | | | | | |

| Weighted-average shares outstanding: | | | | | | | | | | | | | | |

| Basic | 50,307 | | 49,574 | 50,322 | 50,504 | 50,559 | | 50,250 | | 50,893 | | | | |

| Diluted | 52,327 | | 51,467 | 51,548 | 52,624 | 53,399 | | 52,726 | | 53,276 | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Abercrombie & Fitch Co. | | | | |

| Financial Information | | | | |

| | | | | | | | | | | | | | |

| (Unaudited) | | |

| | | Fiscal 2023 | | | | Fiscal 2024 | | | | |

| 2022 | | Q1 | Q2 | Q3 | Q4 | | 2023 | | Q1 | | | | |

Segment comparable sales (1) | | | | | | | | | | | | | | |

Americas comparable sales (2) (3) | Not provided | | Not provided | 14 | % | 16 | % | 17 | % | | 13 | % | | 21 | % | | | | |

EMEA comparable sales (2) (4) | Not provided | | Not provided | 6 | % | 15 | % | 10 | % | | 7 | % | | 23 | % | | | | |

APAC comparable sales (2) (5) | Not provided | | Not provided | 26 | % | 32 | % | 21 | % | | 26 | % | | 22 | % | | | | |

Comparable sales (2) | Not provided | | 3 | % | 13 | % | 16 | % | 16 | % | | 13 | % | | 21 | % | | | | |

| | | | | | | | | | | | | | |

| Branded comparable sales | | | | | | | | | | | | | | |

Abercrombie comparable sales (2) (6) | Not provided | | 14 | % | 23 | % | 26 | % | 28 | % | | 23 | % | | 29 | % | | | | |

Hollister comparable sales (2) (7) | Not provided | | (6) | % | 5 | % | 7 | % | 6 | % | | 4 | % | | 13 | % | | | | |

Comparable sales (2) | Not provided | | 3 | % | 13 | % | 16 | % | 16 | % | | 13 | % | | 21 | % | | | | |

| | | | | | | | | | | | | | |

(1) Net sales by segment are presented by attributing revenues to an individual country on the basis of the segment that fulfills the order. |

(2) Comparable sales are calculated on a constant currency basis. Refer to "REPORTING AND USE OF GAAP AND NON-GAAP MEASURES," for further discussion. The Company did not provide comparable sales results for fiscal 2022 due to temporary store closures as a result of COVID-19. |

(3) The Americas segment includes the results of operations in North America and South America. |

(4) The EMEA segment includes the results of operations in Europe, the Middle East and Africa. |

(5) The APAC segment includes the results of operations in the Asia-Pacific region, including Asia and Oceania. |

(6) For purposes of the above table, Abercrombie includes Abercrombie & Fitch and abercrombie kids. |

(7) For purposes of the above table, Hollister includes Hollister and Gilly Hicks. |

INVESTOR PRESENTATION: FIRST QUARTER 2024

Safe Harbor and Other Information 3 Company Overview 5 Q1 2024 Results 15 Appendix 21 2 TABLE OF CONTENTS

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 This presentation contains forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995). These statements, including, without limitation, statements regarding our second quarter and annual fiscal 2024 results, relate to our current assumptions, projections and expectations about our business and future events. Any such forward-looking statements involve risks and uncertainties and are subject to change based on various important factors, many of which may be beyond the company’s control. The inclusion of such information should not be regarded as a representation by the company, or any other person, that the objectives of the company will be achieved. Words such as “estimate,” “project,” “plan,” “goal,” “believe,” “expect,” “anticipate,” “intend,” “should,” “are confident,” “will,” “could,” “outlook,” and similar expressions may identify forward-looking statements. Except as may be required by applicable law, we assume no obligation to publicly update or revise any forward- looking statements, including any financial targets or estimates, whether as a result of new information, future events, or otherwise. Factors that may cause results to differ from those expressed in our forward-looking statements include, but are not limited to, the factors disclosed in Part I, Item 1A. “Risk Factors” of the company’s Annual Report on Form 10-K for the fiscal year ended February 3, 2024, and otherwise in our reports and filings with the Securities and Exchange Commission, as well as the following factors: risks related to changes in global economic and financial conditions, including inflation, and the resulting impact on consumer spending generally and on our operating results, financial condition, and expense management, and our ability to adequately mitigate the impact; risks related to geopolitical conflict, armed conflict, the conflicts between Russia and Ukraine or Israel and Hamas and the expansion of conflict in the surrounding areas, including the impact of such conflicts on international trade, supplier delivery or increased freight costs, acts of terrorism, mass casualty events, social unrest, civil disturbance or disobedience; risks related to our failure to engage our customers, anticipate customer demand and changing fashion trends, and manage our inventory; risks related to our failure to operate effectively in a highly competitive and constantly evolving industry; risks related to our ability to execute on, and maintain the success of, our strategic and growth initiatives, including those outlined in our Always Forward Plan; risks related to fluctuations in foreign currency exchange rates; risks related to fluctuations in our tax obligations and effective tax rate, including as a result of earnings and losses generated from our global operations, may result in volatility in our results of operations; risks and uncertainty related to adverse public health developments; risks associated with climate change and other corporate responsibility issues; risks related to reputational harm to the company, its officers, and directors; risks related to actual or threatened litigation; risks related to cybersecurity threats and privacy or data security breaches; and the potential loss or disruption to our information systems. OTHER INFORMATION As used in this presentation, unless otherwise defined, references to "Abercrombie" and "Abercrombie Brands" includes Abercrombie & Fitch and abercrombie kids and references to "Hollister" and "Hollister Brands" includes Hollister and Gilly Hicks. Additionally, references to "Americas" includes North America and South America, "EMEA" includes Europe, the Middle East and Africa and "APAC" includes the Asia-Pacific region, including Asia and Oceania. 3

4 REPORTING AND USE OF GAAP AND NON-GAAP MEASURES The following presentation includes certain adjusted non-GAAP financial measures. Additional details about non-GAAP financial measures and a reconciliation of GAAP financial measures to non-GAAP financial measures is included in the Appendix to this presentation. As used in the presentation, "GAAP" refers to accounting principles generally accepted in the United States of America. Sub-totals and totals may not foot due to rounding. Net income and net income per share financial measures included herein are attributable to Abercrombie & Fitch Co., excluding net income attributable to noncontrolling interests. The company believes that each of the non-GAAP financial measures presented are useful to investors as they provide a measure of the company’s operating performance excluding the effect of certain items which the company believes do not reflect its future operating outlook, such as asset impairment charges, therefore supplementing investors’ understanding of comparability of operations across periods. Management used these non-GAAP financial measures during the periods presented to assess the company’s performance and to develop expectations for future operating performance. Non-GAAP financial measures should be used supplemental to, and not as an alternative to, the company’s GAAP financial results, and may not be calculated in the same manner as similar measures presented by other companies. The company provides comparable sales, defined as the percentage year-over-year change in the aggregate of: (1) sales for stores that have been open as the same brand at least one year and whose square footage has not been expanded or reduced by more than 20% within the past year, with prior year’s net sales converted at the current year’s foreign currency exchange rate to remove the impact of foreign currency rate fluctuation, and (2) digital net sales with prior year’s net sales converted at the current year’s foreign currency exchange rate to remove the impact of foreign currency rate fluctuation. The company also provides certain financial information on a constant currency basis to enhance investors’ understanding of underlying business trends and operating performance, by removing the impact of foreign currency exchange rate fluctuations. The effect from foreign currency, calculated on a constant currency basis, is determined by applying current year average exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share effect from foreign currency is calculated using a 26% tax rate.

5 Abercrombie & Fitch Co. is a global, digitally-led, omnichannel apparel and accessories retailer catering to kids through millennials with assortments curated for their specific lifestyle needs Our corporate purpose of 'We are here for you on the journey to being and becoming who you are' fuels our customer-led brands and our global associates

COMPANY OVERVIEW 6

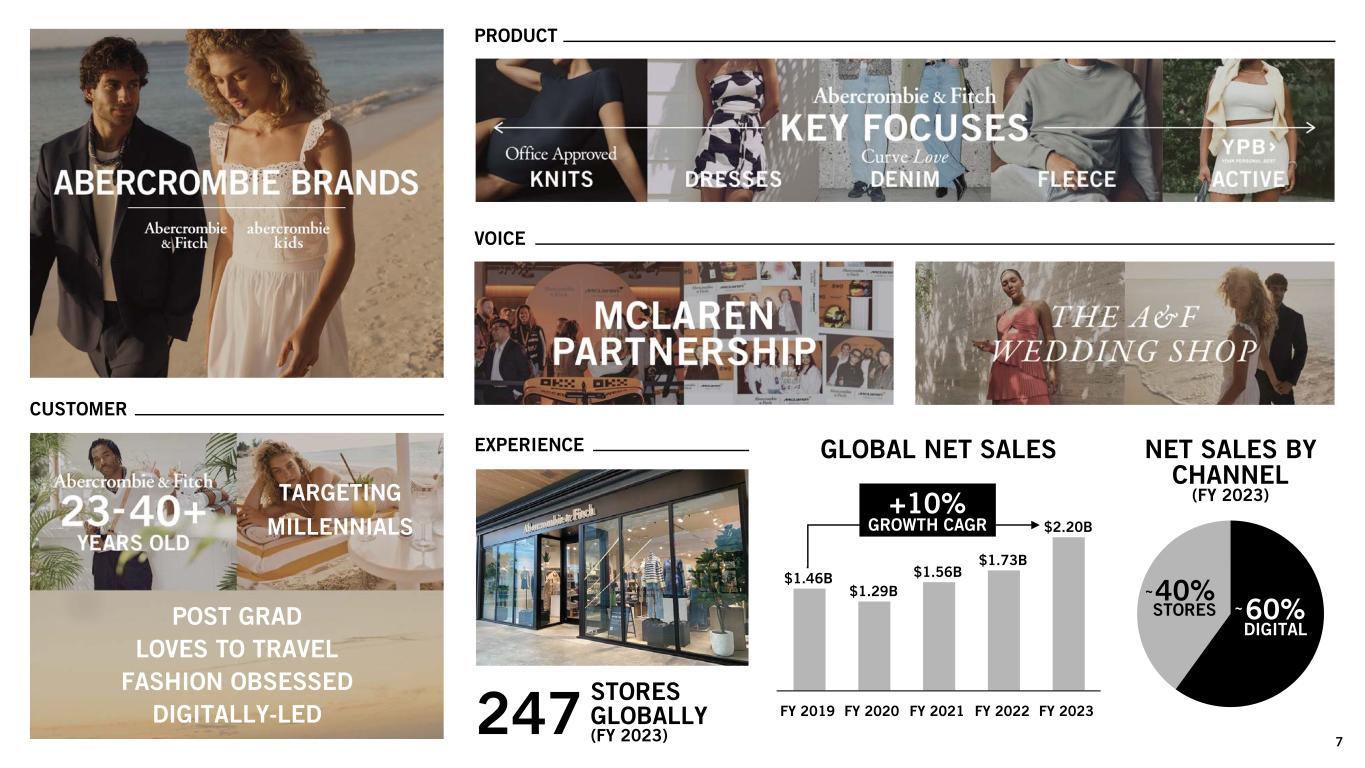

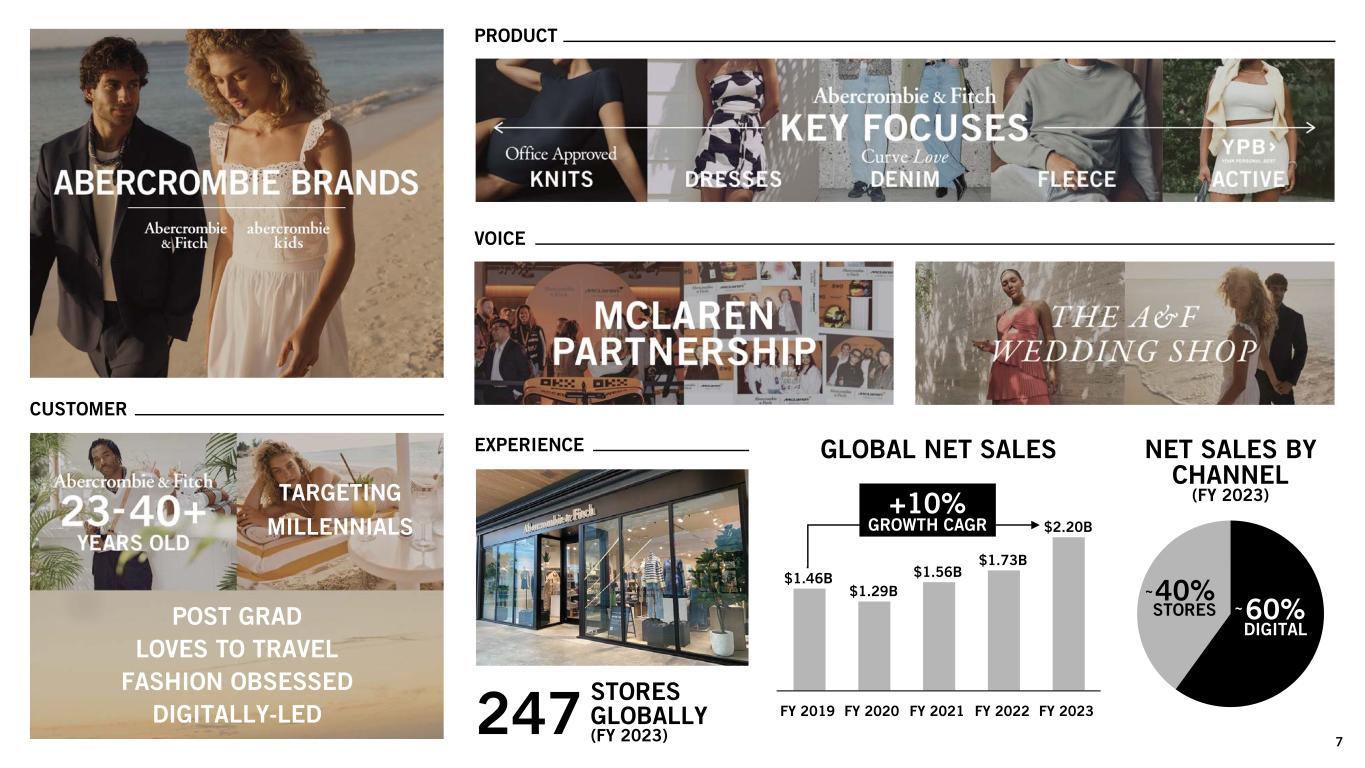

$1.46B $1.29B $1.56B $1.73B $2.20B FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 60% 40% PRODUCT 247 GLOBAL NET SALES CUSTOMER VOICE EXPERIENCE STORES GLOBALLY (FY 2023) STORES DIGITAL +10% GROWTH CAGR NET SALES BY CHANNEL (FY 2023) POST GRAD LOVES TO TRAVEL FASHION OBSESSED DIGITALLY-LED TARGETING MILLENNIALS ~ ~ 7

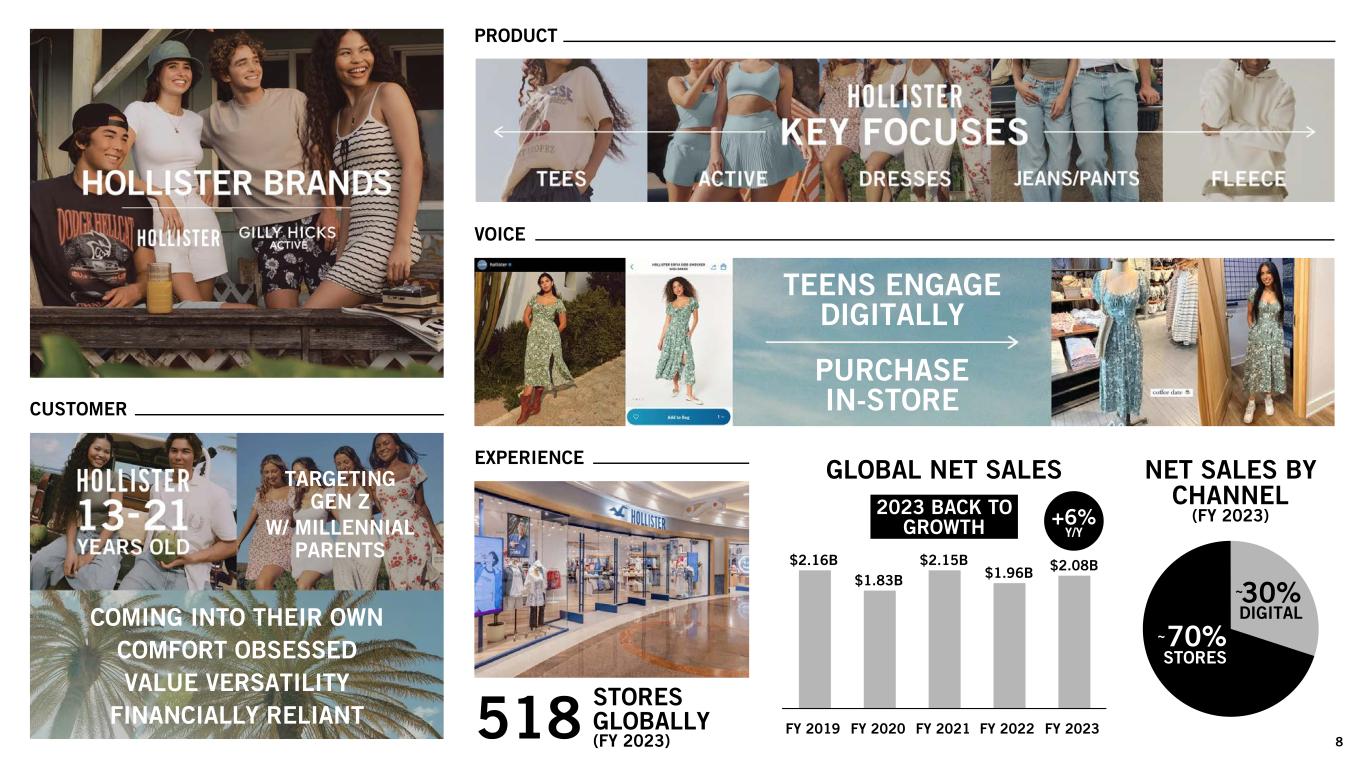

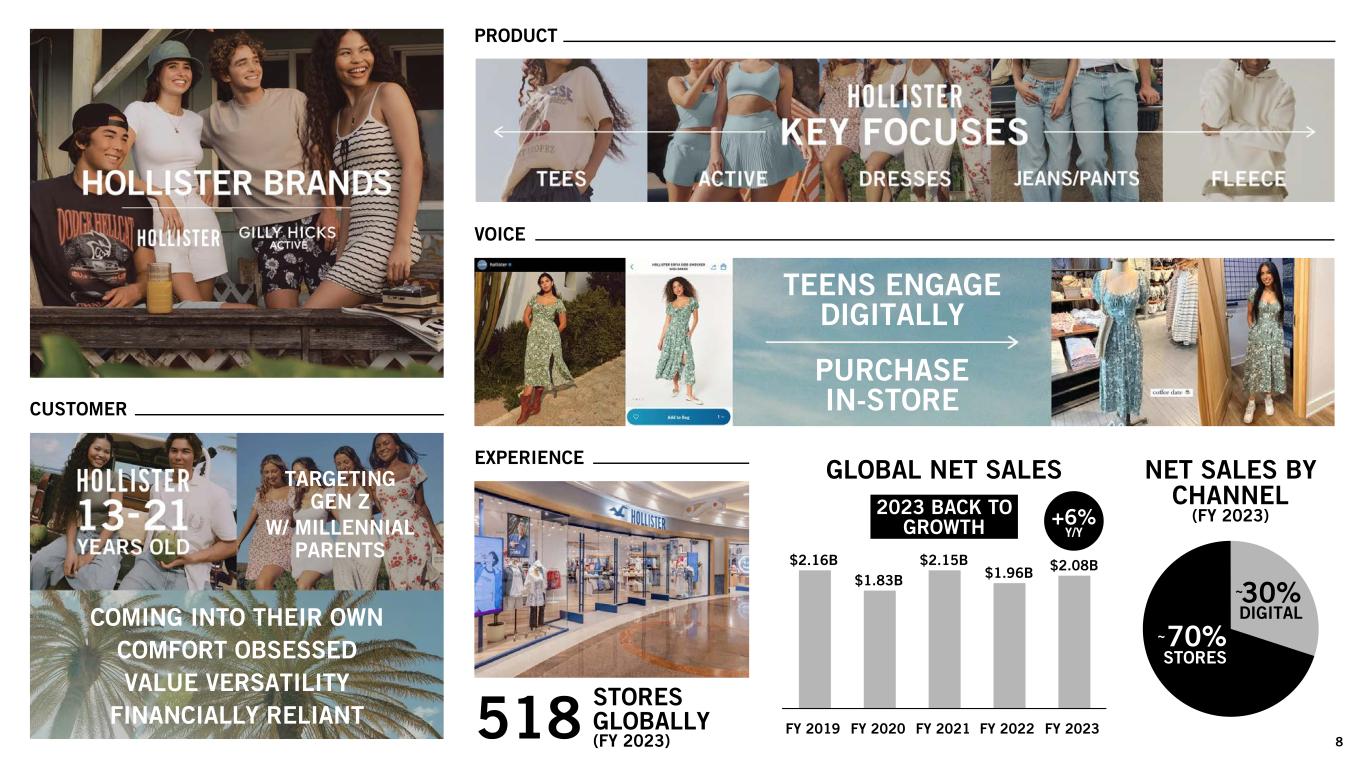

EXPERIENCE $2.16B $1.83B $2.15B $1.96B $2.08B FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 8 518 PRODUCT CUSTOMER VOICE TEENS ENGAGE DIGITALLY GLOBAL NET SALES NET SALES BY CHANNEL (FY 2023) PURCHASE IN-STORE 30% 70% STORES DIGITAL 2023 BACK TO GROWTH +6% Y/Y COMING INTO THEIR OWN COMFORT OBSESSED VALUE VERSATILITY FINANCIALLY RELIANT TARGETING GEN Z W/ MILLENNIAL PARENTS ~ ~ STORES GLOBALLY (FY 2023)

COMPANY OVERVIEW Fiscal 2017 - 2022 STABILIZE & TRANSFORM 9 FOCUS ON SUSTAINABLE, PROFITABLE GROWTH 2022: $3.7B Sales 3% Op Margin 2025 Target1: $4.1-$4.3B Sales 8%+ Op Margin Longer-Term Ambition1: $5B Sales 10%+ Op Margin 2023 - 2025 ALWAYS FORWARD PLAN BUILT ON YEARS OF TRANSFORMATION 2023 Results: $4.3B Sales 11% Op Margin BEYOND 2025 (1) As presented in our June 2022 Investor Day

COMPANY OVERVIEW $72 $127 $70 $(20) $343 $93 $485 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 $3.5 $3.6 $3.6 $3.1 $3.7 $3.7 $4.3 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 STABILIZE & TRANSFORM STABILIZE & TRANSFORM SALES & PROFITABILITY 10 Net Sales (in $ billions) Operating Income (Loss) (in $ millions) COVID CLOSURE IMPACT COVID CLOSURE IMPACT EXPECT ~10% GROWTH OP MARGIN 11%3%9%(1%)2%4%2% EXPECT ~14% MARGIN Y/Y GROWTH 16%0%19%(14%)1%3%5%

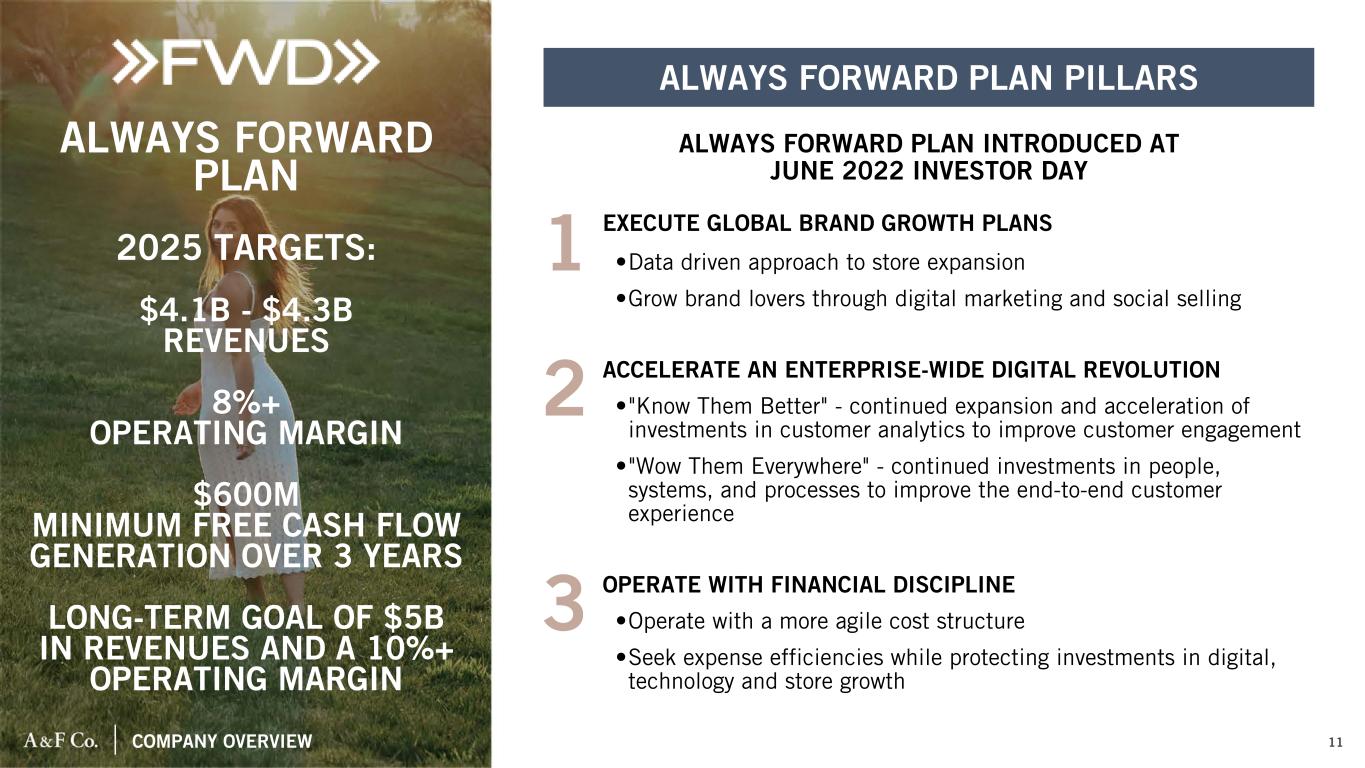

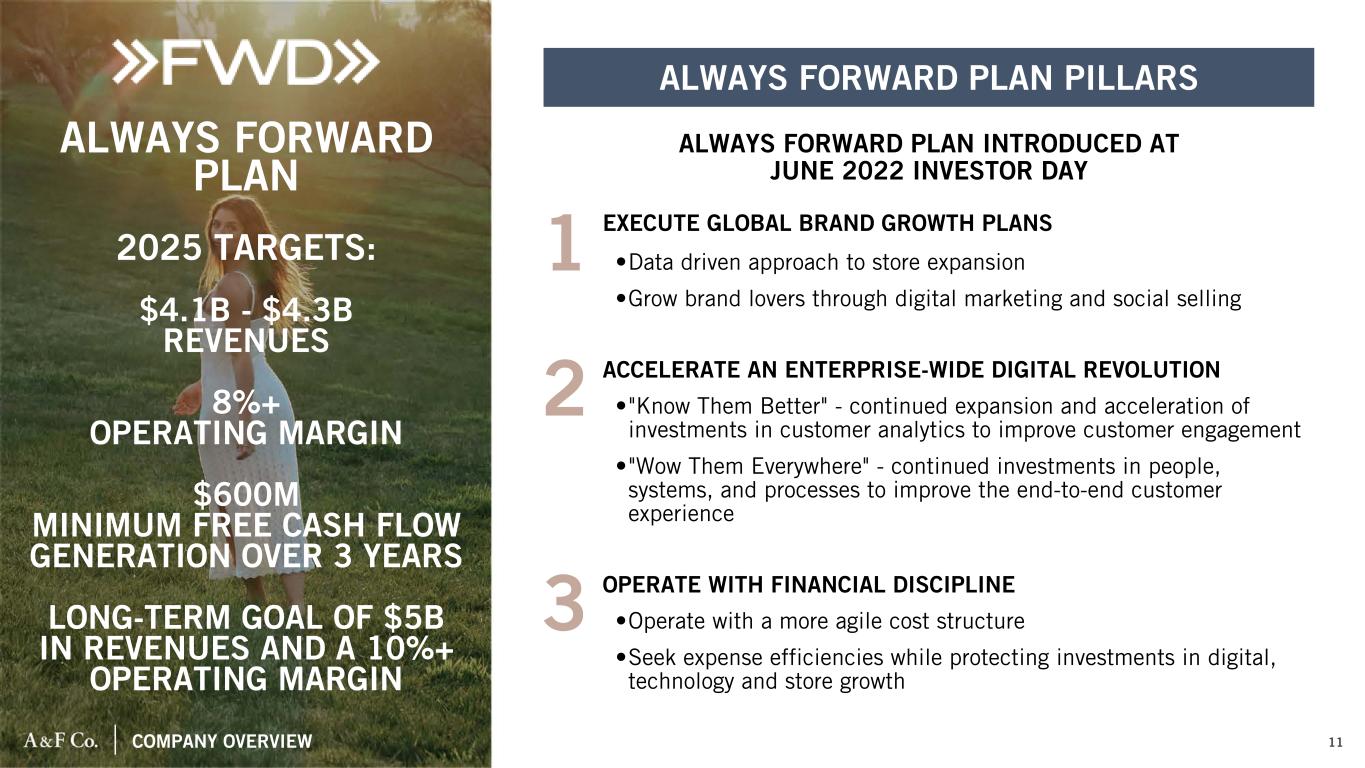

COMPANY OVERVIEW ALWAYS FORWARD PLAN EXECUTE GLOBAL BRAND GROWTH PLANS •Data driven approach to store expansion •Grow brand lovers through digital marketing and social selling ACCELERATE AN ENTERPRISE-WIDE DIGITAL REVOLUTION •"Know Them Better" - continued expansion and acceleration of investments in customer analytics to improve customer engagement •"Wow Them Everywhere" - continued investments in people, systems, and processes to improve the end-to-end customer experience OPERATE WITH FINANCIAL DISCIPLINE •Operate with a more agile cost structure •Seek expense efficiencies while protecting investments in digital, technology and store growth 2025 TARGETS: $4.1B - $4.3B REVENUES 8%+ OPERATING MARGIN $600M MINIMUM FREE CASH FLOW GENERATION OVER 3 YEARS LONG-TERM GOAL OF $5B IN REVENUES AND A 10%+ OPERATING MARGIN 1 2 3 11 ALWAYS FORWARD PLAN INTRODUCED AT JUNE 2022 INVESTOR DAY ALWAYS FORWARD PLAN PILLARS

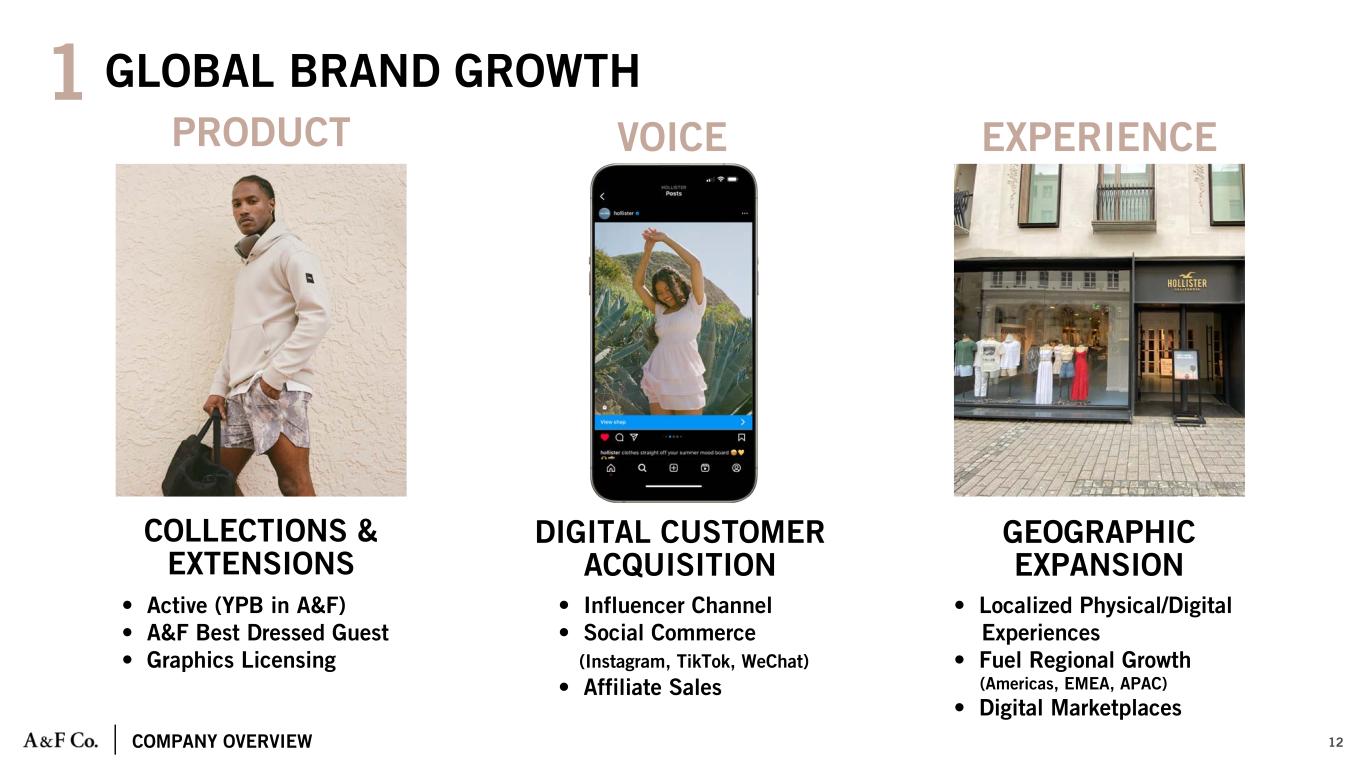

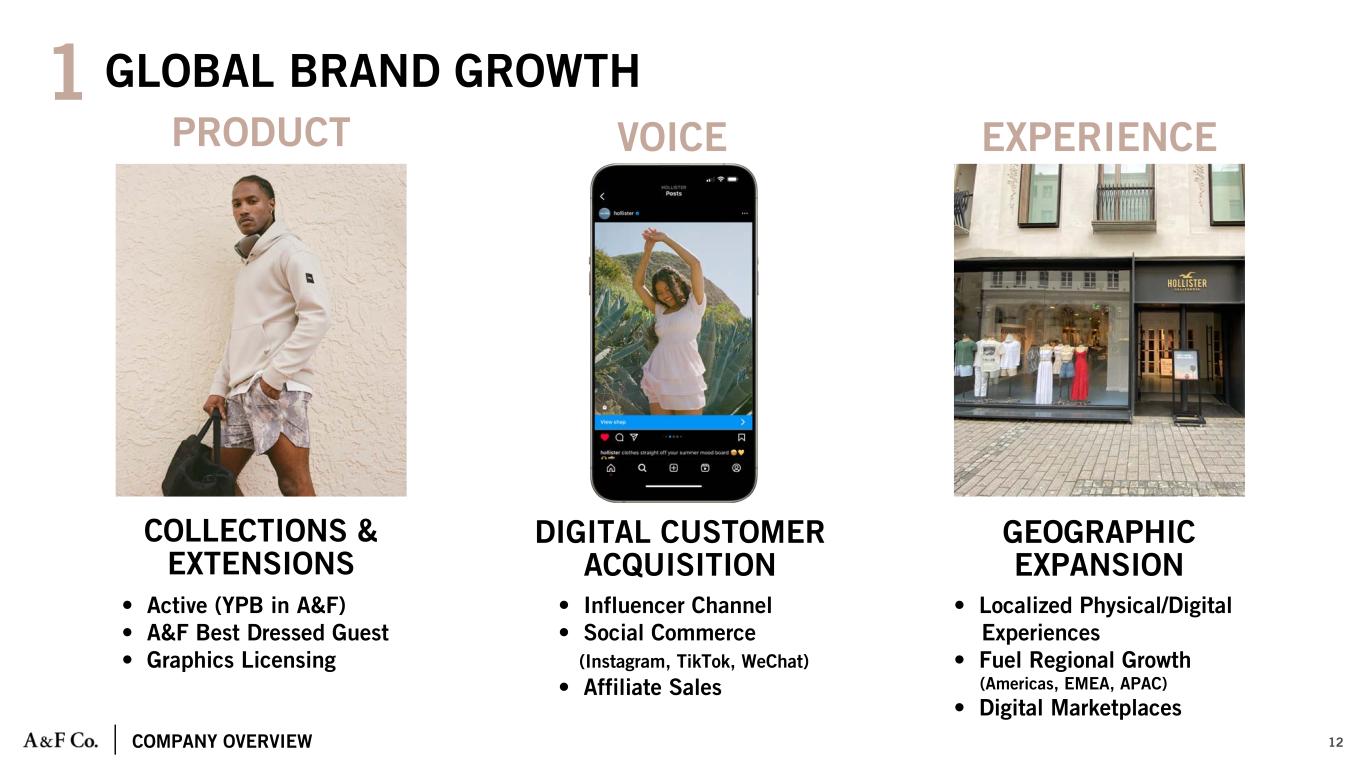

COMPANY OVERVIEW 1 PRODUCT GLOBAL BRAND GROWTH 12 COLLECTIONS & EXTENSIONS • Active (YPB in A&F) • A&F Best Dressed Guest • Graphics Licensing DIGITAL CUSTOMER ACQUISITION • Influencer Channel • Social Commerce (Instagram, TikTok, WeChat) • Affiliate Sales GEOGRAPHIC EXPANSION • Localized Physical/Digital Experiences • Fuel Regional Growth (Americas, EMEA, APAC) • Digital Marketplaces VOICE EXPERIENCE

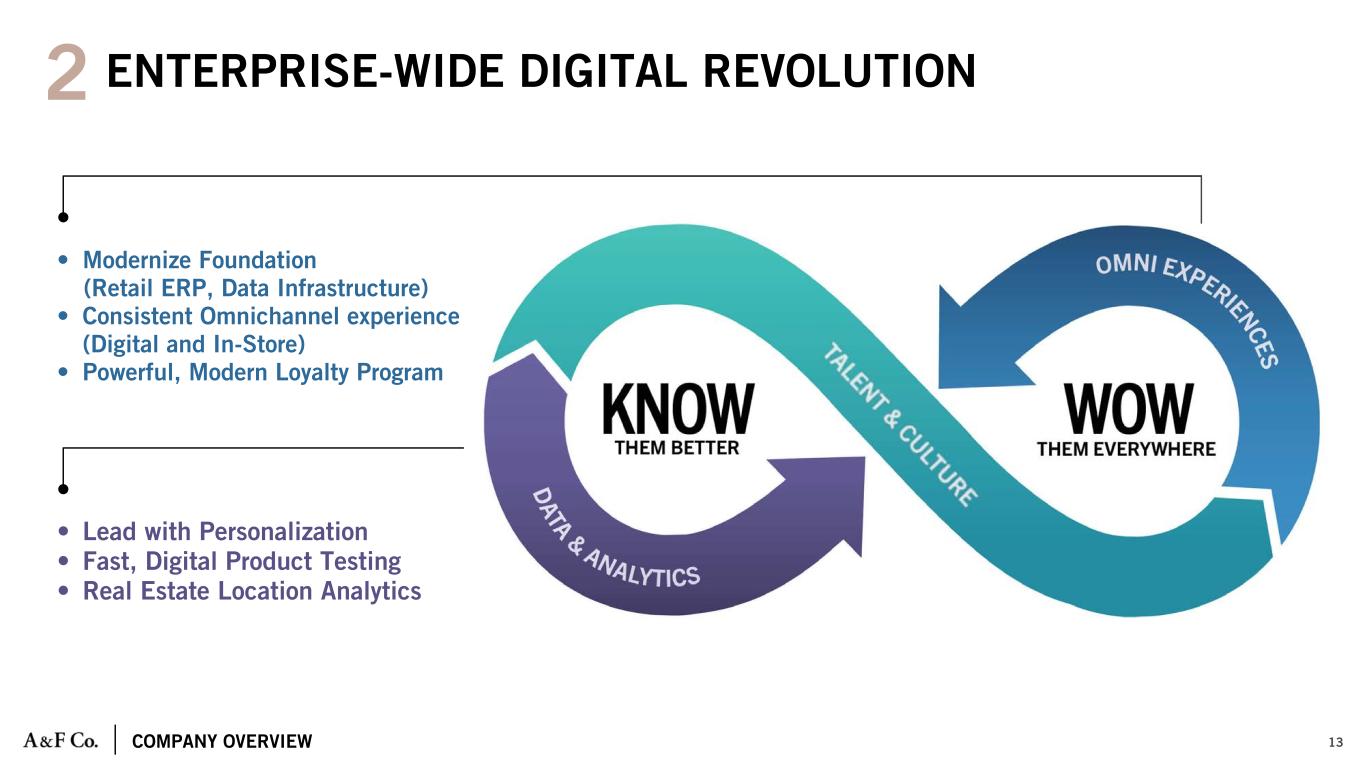

COMPANY OVERVIEW 13 • Lead with Personalization • Fast, Digital Product Testing • Real Estate Location Analytics • Modernize Foundation (Retail ERP, Data Infrastructure) • Consistent Omnichannel experience (Digital and In-Store) • Powerful, Modern Loyalty Program ENTERPRISE-WIDE DIGITAL REVOLUTION2

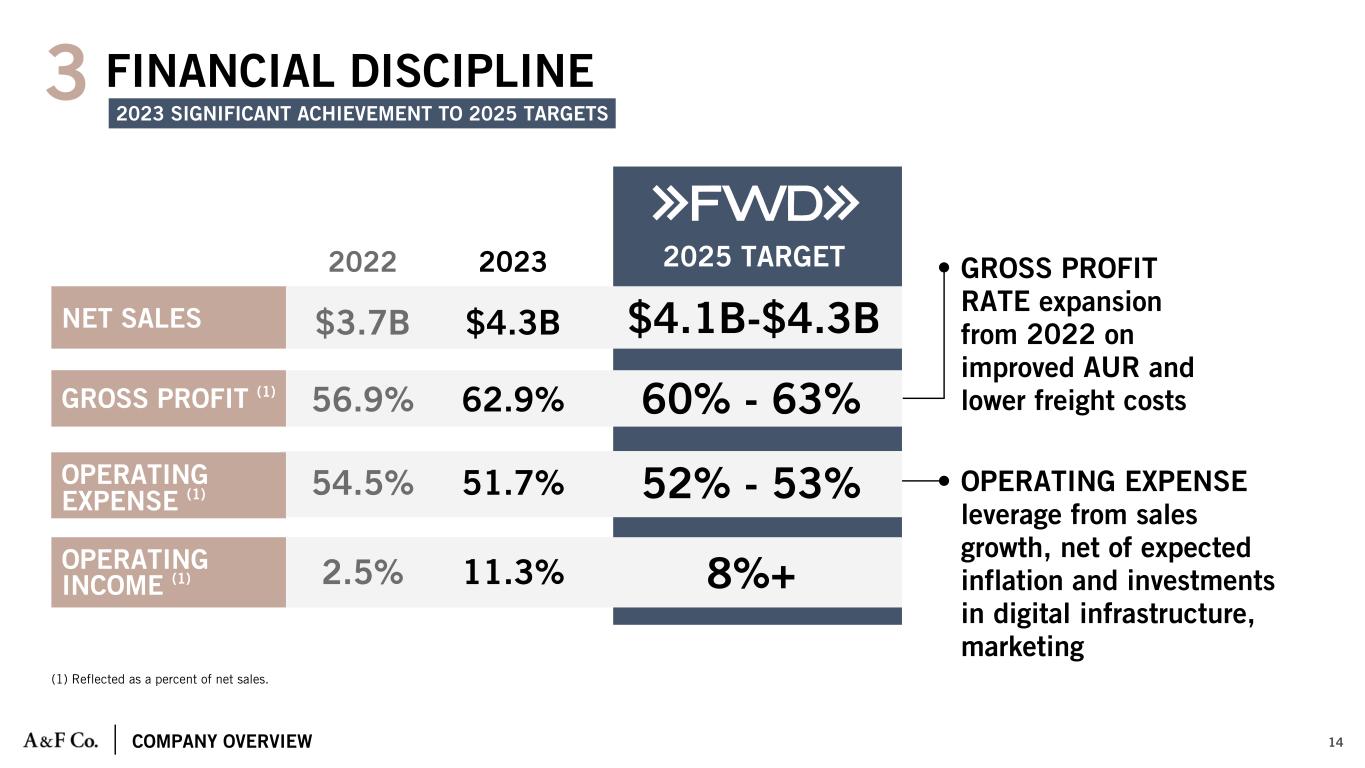

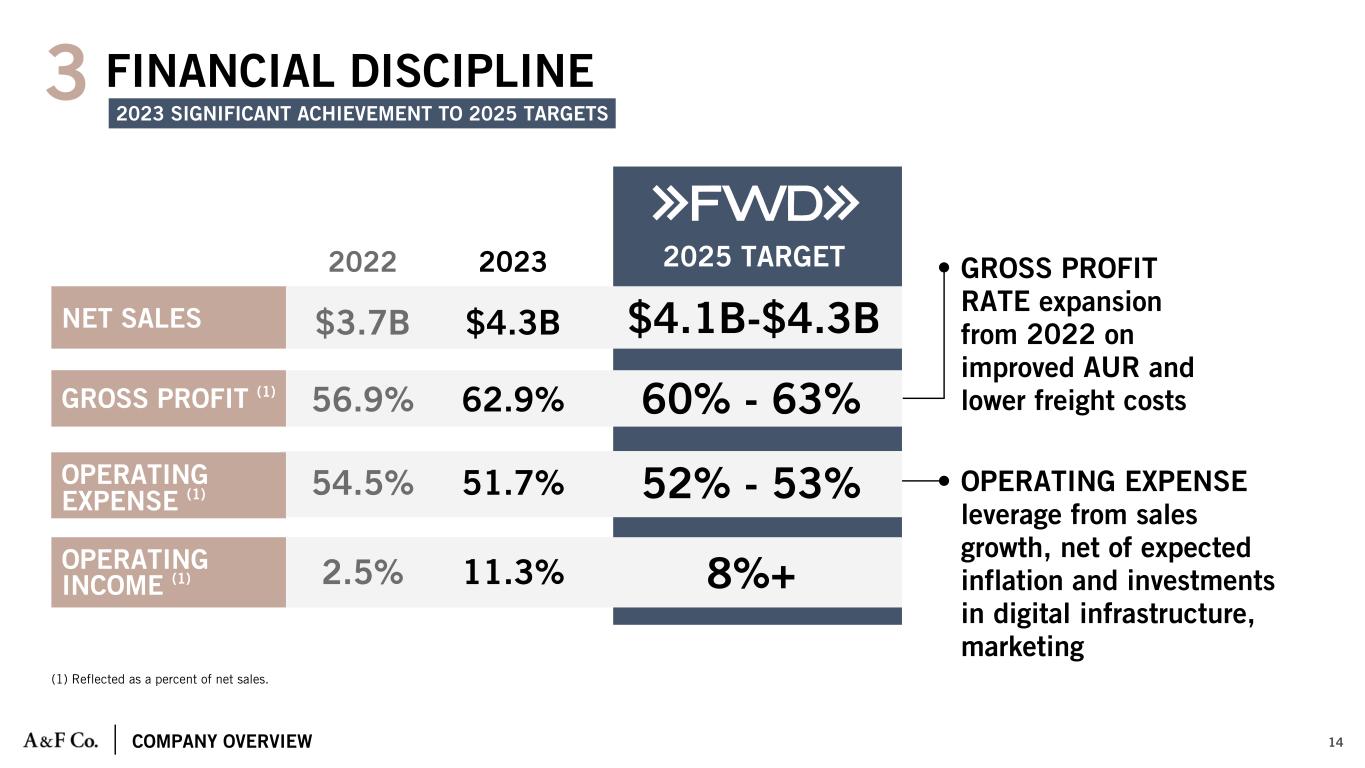

COMPANY OVERVIEW (1) Reflected as a percent of net sales. 14 $4.3B 62.9% 2023 51.7% 11.3% OPERATING EXPENSE (1) $4.1B-$4.3B 60% - 63% 52% - 53% 8%+OPERATING INCOME (1) GROSS PROFIT (1) NET SALES FINANCIAL DISCIPLINE3 $3.7B 56.9% 2022 54.5% 2.5% 2025 TARGET GROSS PROFIT RATE expansion from 2022 on improved AUR and lower freight costs OPERATING EXPENSE leverage from sales growth, net of expected inflation and investments in digital infrastructure, marketing 2023 SIGNIFICANT ACHIEVEMENT TO 2025 TARGETS

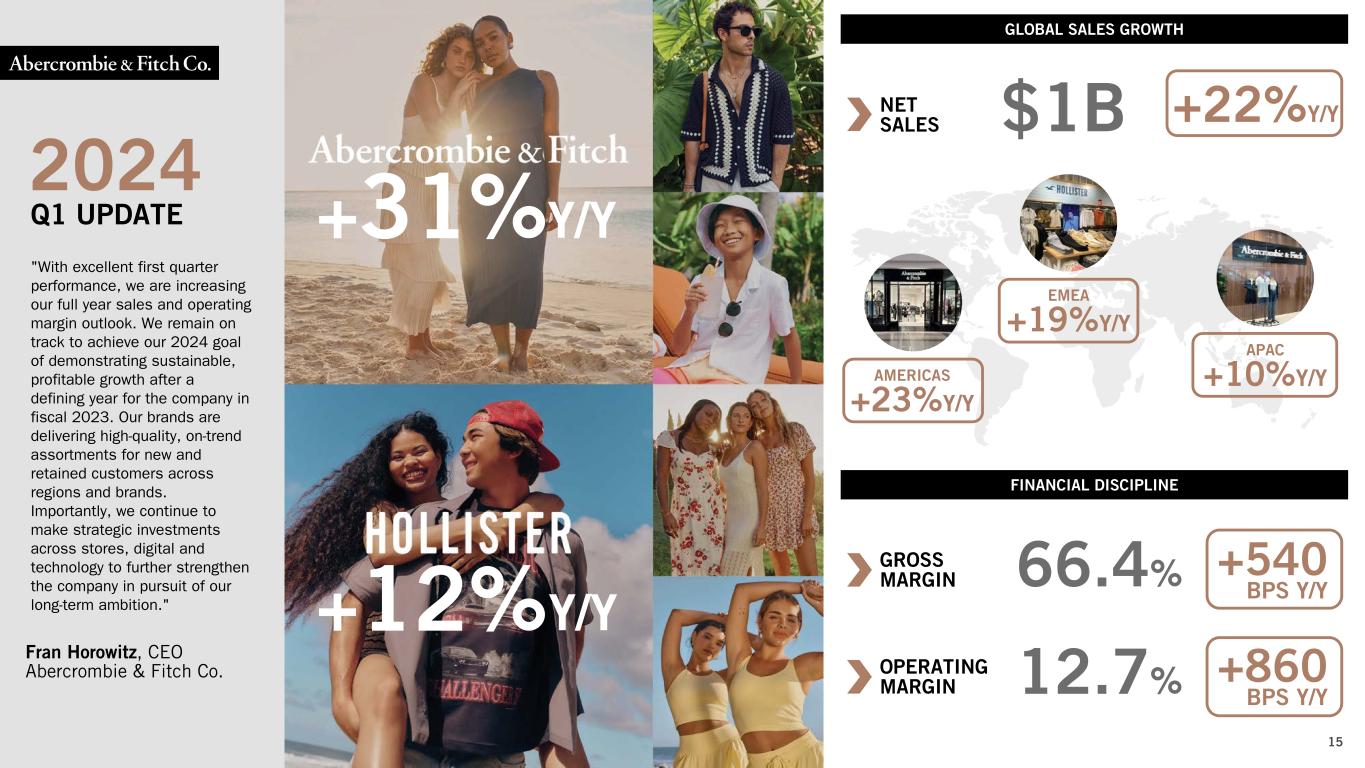

+860 BPS Y/Y GROSS MARGIN 66.4% 12.7% "With excellent first quarter performance, we are increasing our full year sales and operating margin outlook. We remain on track to achieve our 2024 goal of demonstrating sustainable, profitable growth after a defining year for the company in fiscal 2023. Our brands are delivering high-quality, on-trend assortments for new and retained customers across regions and brands. Importantly, we continue to make strategic investments across stores, digital and technology to further strengthen the company in pursuit of our long-term ambition." Fran Horowitz, CEO Abercrombie & Fitch Co. 15 2024 +22%Y/Y OPERATING MARGIN NET SALES GLOBAL SALES GROWTH FINANCIAL DISCIPLINE +540 BPS Y/Y $1B AMERICAS +23%Y/Y EMEA +19%Y/Y APAC +10%Y/Y Q1 UPDATE +31%Y/Y +12%Y/Y

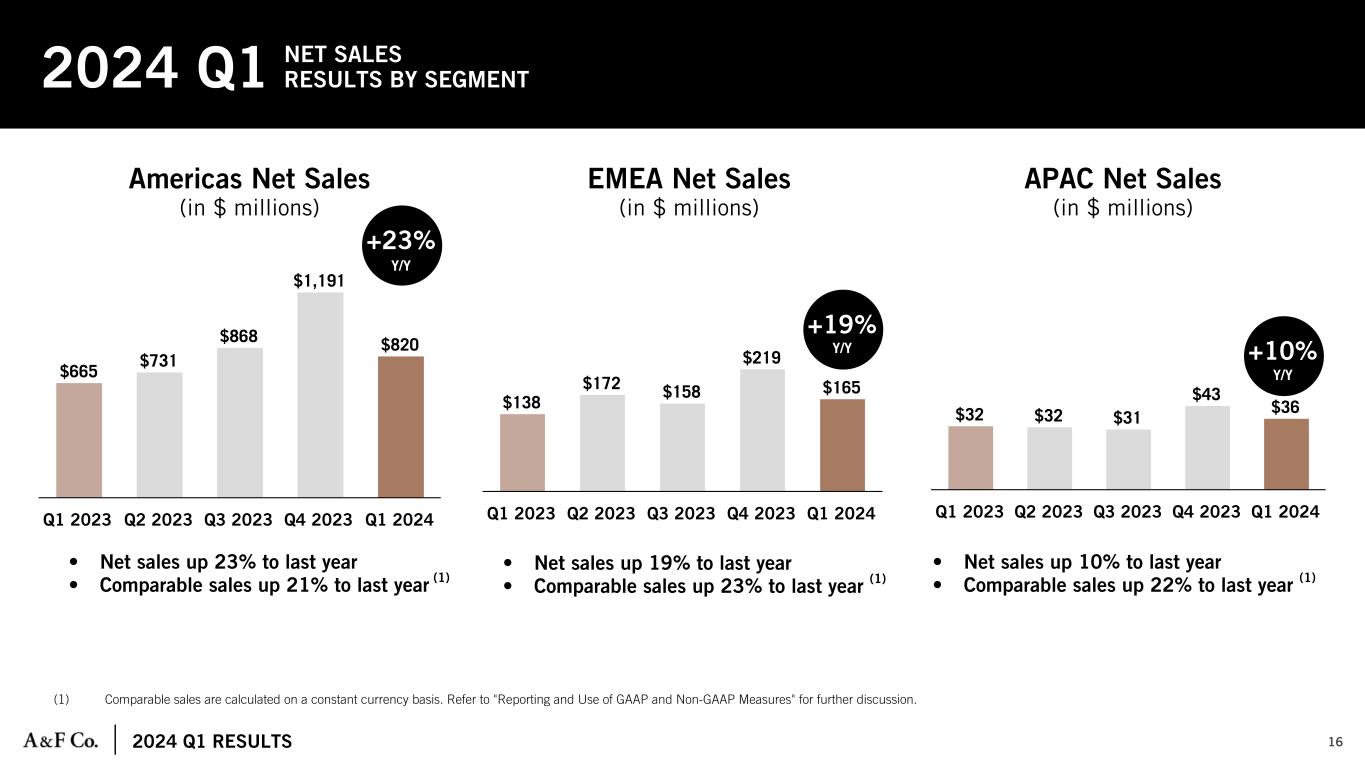

2024 Q1 RESULTS $32 $32 $31 $43 $36 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 $665 $731 $868 $1,191 $820 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 $138 $172 $158 $219 $165 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 16 Americas Net Sales (in $ millions) EMEA Net Sales (in $ millions) APAC Net Sales (in $ millions) • Net sales up 23% to last year • Comparable sales up 21% to last year (1) • Net sales up 19% to last year • Comparable sales up 23% to last year (1) • Net sales up 10% to last year • Comparable sales up 22% to last year (1) (1) Comparable sales are calculated on a constant currency basis. Refer to "Reporting and Use of GAAP and Non-GAAP Measures" for further discussion. 2024 Q1 NET SALES RESULTS BY SEGMENT +23% Y/Y +19% Y/Y +10% Y/Y

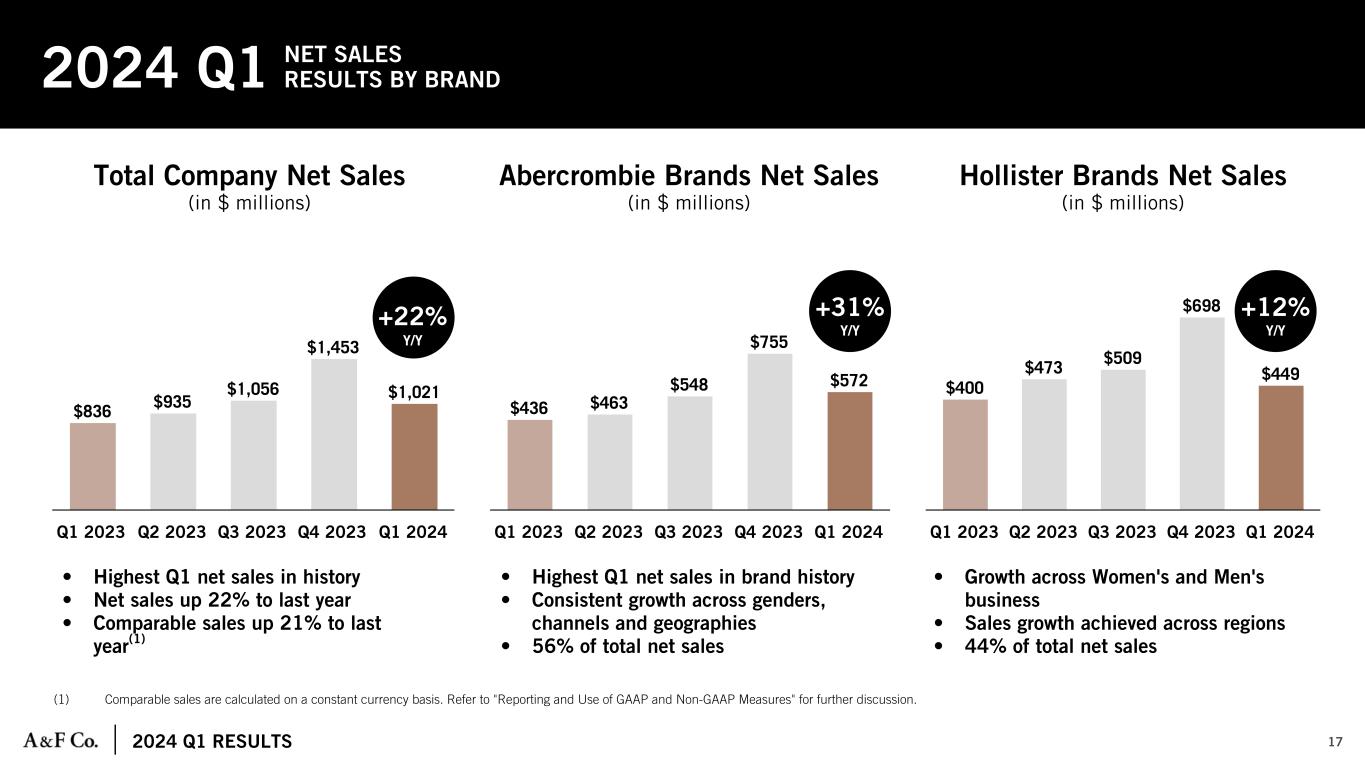

2024 Q1 RESULTS $400 $473 $509 $698 $449 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 $836 $935 $1,056 $1,453 $1,021 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 $436 $463 $548 $755 $572 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 17 Total Company Net Sales (in $ millions) Abercrombie Brands Net Sales (in $ millions) Hollister Brands Net Sales (in $ millions) • Highest Q1 net sales in history • Net sales up 22% to last year • Comparable sales up 21% to last year(1) • Highest Q1 net sales in brand history • Consistent growth across genders, channels and geographies • 56% of total net sales • Growth across Women's and Men's business • Sales growth achieved across regions • 44% of total net sales (1) Comparable sales are calculated on a constant currency basis. Refer to "Reporting and Use of GAAP and Non-GAAP Measures" for further discussion. 2024 Q1 NET SALES RESULTS BY BRAND +22% Y/Y +31% Y/Y +12% Y/Y

2024 Q1 RESULTS • Benefit from lower raw materials costs and AUR growth • Offset by higher freight costs 61.0% 62.5% 64.9% 62.9% 66.4% Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 $34 $90 $138 $223 $130 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 18 Gross Profit Rate (as a % of net sales) Operating Income (in $ millions) • Driven by 22% increase in sales compared to Q1 2023, along with gross profit rate expansion and expense leverage 2024 Q1 GROSS PROFIT/ OPERATING INCOME +540 bps Y/Y +$96M Y/Y

2024 Q1 RESULTS CASH & EQUIVALENTS • $864M as compared to $447M last year INVENTORIES • $449M, up 0.3% from last year • Clean, current inventory position with regained chase capability SHORT-TERM BORROWINGS • No borrowings outstanding under the company's senior secured revolving credit facility ("ABL Facility") • $293M of borrowing available under ABL Facility as of May 4, 2024 GROSS LONG-TERM BORROWINGS • $214M outstanding compared with $300M last year TOTAL LIQUIDITY (1) • $1.2B as compared to $758M last year $448M $493M $595M $469M $449M Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 $0M $100M $200M $300M $400M $500M $600M $700M (1) Liquidity is comprised of cash and equivalents and borrowing available under the ABL Facility. 19 Inventory 2024 Q1 FINANCIAL POSITION

OUTLOOK 20 2024 FISCAL OUTLOOK PREVIOUS FULL YEAR OUTLOOK (1) Q2 2024 Q2 OUTLOOK NET SALES UP MID-TEENS OPERATING MARGIN IN THE RANGE OF 13% TO 14%(1) EFFECTIVE TAX RATE MID-20S(2) The following outlook replaces all previous full year guidance. For fiscal 2024, the company now expects: FY 2024 CURRENT FULL YEAR OUTLOOK PREVIOUS FULL YEAR OUTLOOK (3) NET SALES UP AROUND 10% (4) GROWTH IN THE RANGE OF 4% TO 6% (4) OPERATING MARGIN AROUND 14% AROUND 12% EFFECTIVE TAX RATE MID-TO-HIGH 20S(5) MID-TO-HIGH 20s CAPITAL EXPENDITURES ~$170 MILLION ~$170 MILLION (1) We expect the year-over-year improvement to be primarily driven by a higher gross profit rate on continued year-over-year cotton benefits and some AUR growth, combined with modest operating expense leverage. (2) This outlook assumes the continued inability to realize benefits on certain expected tax losses incurred outside of the U.S. (3) Released March 6, 2024. (4) Includes the adverse impact of $50 million from the loss of one selling week in Fiscal 2024. (5) The current outlook assumes the continued inability to realize benefits on certain expected tax losses incurred outside of the U.S., although to a lesser extent than than previously projected, primarily due to higher worldwide income levels.

21 APPENDIX

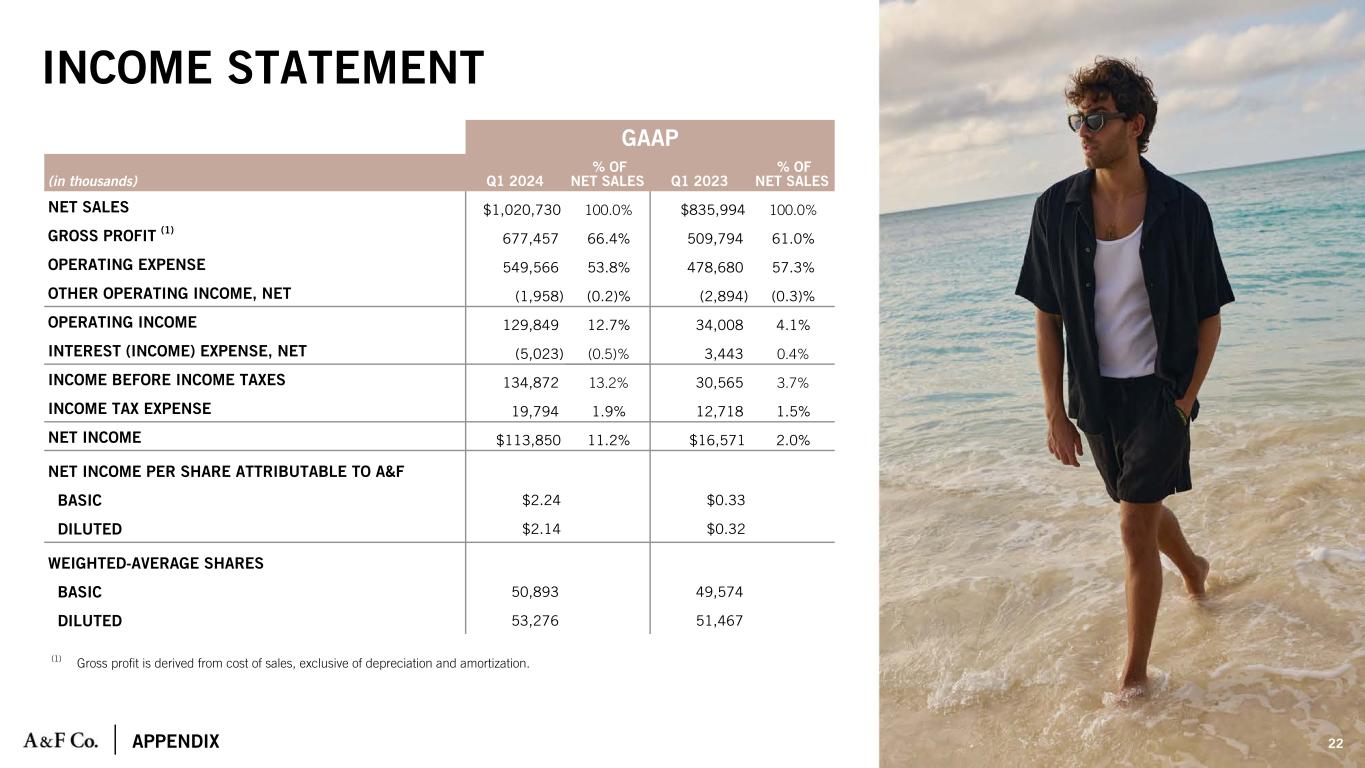

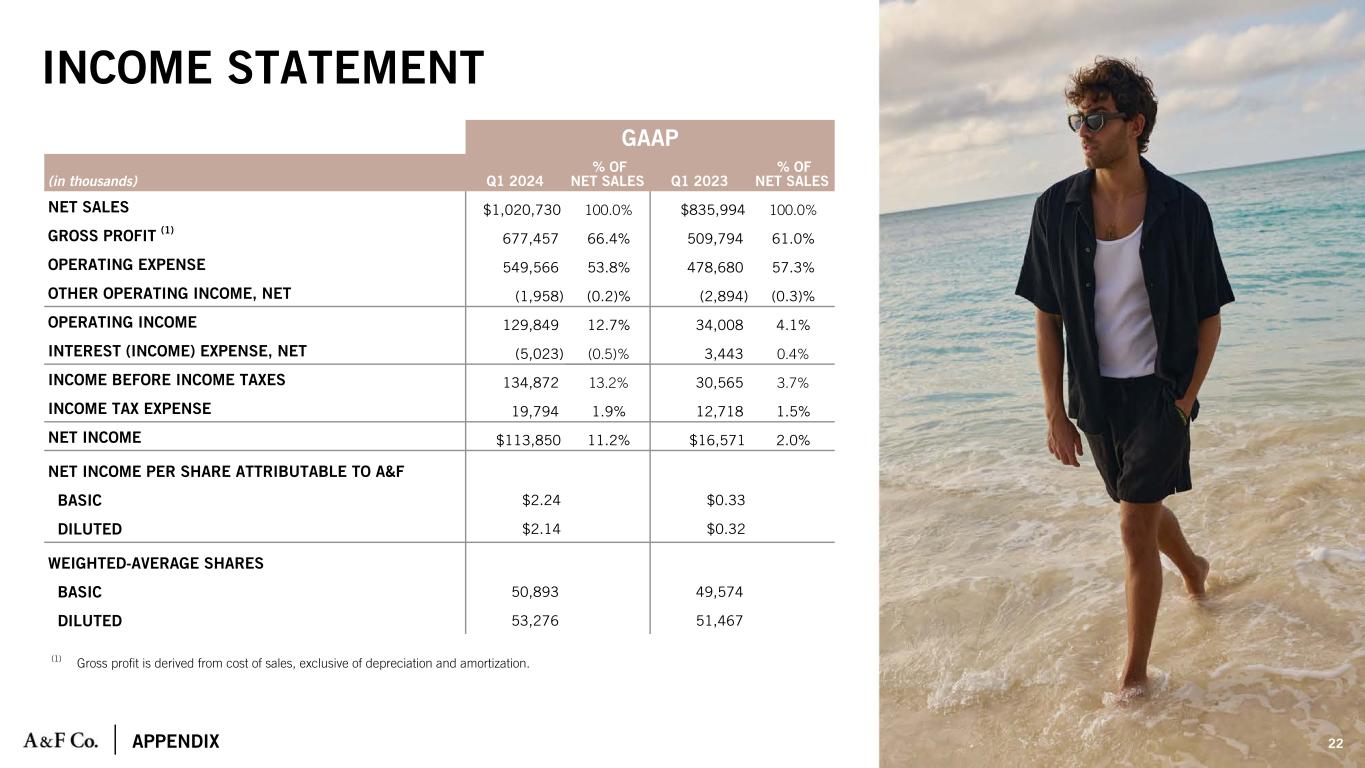

APPENDIX INCOME STATEMENT (1) Gross profit is derived from cost of sales, exclusive of depreciation and amortization. GAAP (in thousands) Q1 2024 % OF NET SALES Q1 2023 % OF NET SALES NET SALES $1,020,730 100.0% $835,994 100.0% GROSS PROFIT (1) 677,457 66.4% 509,794 61.0% OPERATING EXPENSE 549,566 53.8% 478,680 57.3% OTHER OPERATING INCOME, NET (1,958) (0.2)% (2,894) (0.3)% OPERATING INCOME 129,849 12.7% 34,008 4.1% INTEREST (INCOME) EXPENSE, NET (5,023) (0.5)% 3,443 0.4% INCOME BEFORE INCOME TAXES 134,872 13.2% 30,565 3.7% INCOME TAX EXPENSE 19,794 1.9% 12,718 1.5% NET INCOME $113,850 11.2% $16,571 2.0% NET INCOME PER SHARE ATTRIBUTABLE TO A&F BASIC $2.24 $0.33 DILUTED $2.14 $0.32 WEIGHTED-AVERAGE SHARES BASIC 50,893 49,574 DILUTED 53,276 51,467 22

APPENDIX (in thousands) Q1 2024 % OF NET SALES Q1 2023 % OF NET SALES 1 YR Δ BPS (1) STORES AND DISTRIBUTION $371,686 36.4% $336,049 40.2% (380) MARKETING, GENERAL & ADMINISTRATIVE 177,880 17.4% 142,631 17.1% 30 TOTAL OPERATING EXPENSE - GAAP $549,566 53.8% $478,680 57.3% (350) RECONCILIATION OF GAAP TO NON-GAAP OPERATING EXPENSE TOTAL OPERATING EXPENSE - GAAP 549,566 53.8% 478,680 57.3% (350) EXCLUDED ITEMS (2) — 0.0% 4,436 0.5% (50) TOTAL ADJUSTED OPERATING EXPENSE - NON-GAAP $549,566 53.8% $474,244 56.7% (290) (1) Rounded based on reported percentages. (2) Excluded items consist of pre-tax store and other asset impairment charges for the prior year, respectively. OPERATING EXPENSE 23

APPENDIX (in thousands) MAY 4, 2024 FEBRUARY 3, 2024 APRIL 29, 2023 CASH AND EQUIVALENTS $864,195 $900,884 $446,952 RECEIVABLES 93,605 78,346 106,149 INVENTORIES 449,267 469,466 447,806 OTHER CURRENT ASSETS 102,516 88,569 107,684 TOTAL CURRENT ASSETS $1,509,583 $1,537,265 $1,108,591 PROPERTY AND EQUIPMENT, NET 540,697 538,033 550,810 OPERATING LEASE RIGHT-OF-USE ASSETS 699,471 678,256 692,699 OTHER ASSETS 220,334 220,679 205,978 TOTAL ASSETS $2,970,085 $2,974,233 $2,558,078 ACCOUNTS PAYABLE $266,925 $296,976 $221,587 ACCRUED EXPENSES 402,786 436,655 340,331 SHORT-TERM PORTION OF OPERATING LEASE LIABILITIES 188,851 179,625 188,520 INCOME TAXES PAYABLE 61,137 53,564 19,023 TOTAL CURRENT LIABILITIES $919,699 $966,820 $769,461 LONG-TERM PORTION OF OPERATING LEASE LIABILITIES 656,862 646,624 682,996 LONG-TERM BORROWINGS, NET 213,102 222,119 297,172 OTHER LIABILITIES 89,252 88,683 97,476 TOTAL LONG-TERM LIABILITIES $959,216 $957,426 $1,077,644 TOTAL ABERCROMBIE & FITCH CO. STOCKHOLDERS EQUITY 1,078,886 1,035,160 701,857 NONCONTROLLING INTEREST 12,284 14,827 9,116 TOTAL STOCKHOLDERS' EQUITY $1,091,170 $1,049,987 $710,973 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $2,970,085 $2,974,233 $2,558,078 24 BALANCE SHEET

APPENDIX YEAR TO DATE PERIOD ENDED (in thousands) MAY 4, 2024 APRIL 29, 2023 NET CASH PROVIDED BY (USED FOR) OPERATING ACTIVITIES $95,010 $(560) PURCHASES OF PROPERTY AND EQUIPMENT (38,886) (46,391) NET CASH USED FOR INVESTING ACTIVITIES $(38,886) $(46,391) PURCHASE OF SENIOR SECURED NOTES (9,425) — PURCHASES OF COMMON STOCK (15,000) — ACQUISITION OF COMMON STOCK FOR TAX WITHHOLDING OBLIGATIONS (65,173) (18,359) OTHER FINANCING ACTIVITIES (3,353) (3,597) NET CASH USED FOR FINANCING ACTIVITIES $(92,951) $(21,956) EFFECT OF FOREIGN CURRENCY EXCHANGE RATES ON CASH (857) (1,998) NET DECREASE IN CASH AND EQUIVALENTS, AND RESTRICTED CASH AND EQUIVALENTS $(37,684) $(70,905) CASH AND EQUIVALENTS, AND RESTRICTED CASH AND EQUIVALENTS, BEGINNING OF PERIOD $909,685 $527,569 CASH AND EQUIVALENTS, AND RESTRICTED CASH AND EQUIVALENTS, END OF PERIOD $872,001 $456,664 STATEMENT OF CASH FLOWS 25

APPENDIX SHARE REPURCHASES (1) (in thousands, except for average cost) NUMBER OF SHARES COST AVERAGE COST TOTAL FY 2021 10,200 $377,290 $36.99 $377,290 FY 2022 4,770 $125,775 $26.37 $125,775 FY 2023 — $— $— $— YTD 2024 119 $15,000 $125.56 $15,000 (in thousands) FY 2020 FY 2021 FY 2022 Q1 2024 ENDING SHARES OUTSTANDING 62,399 52,985 49,002 51,102 26 (1) As part of publicly announced plans or programs. SHARE REPURCHASES SINCE THE START OF 2021, THE COMPANY REPURCHASED APPROXIMATELY 15 MILLION SHARES FOR APPROXIMATELY $518 MILLION. THERE IS APPROXIMATELY $217 MILLION REMAINING UNDER OUR PREVIOUSLY AUTHORIZED SHARE REPURCHASE PROGRAM.

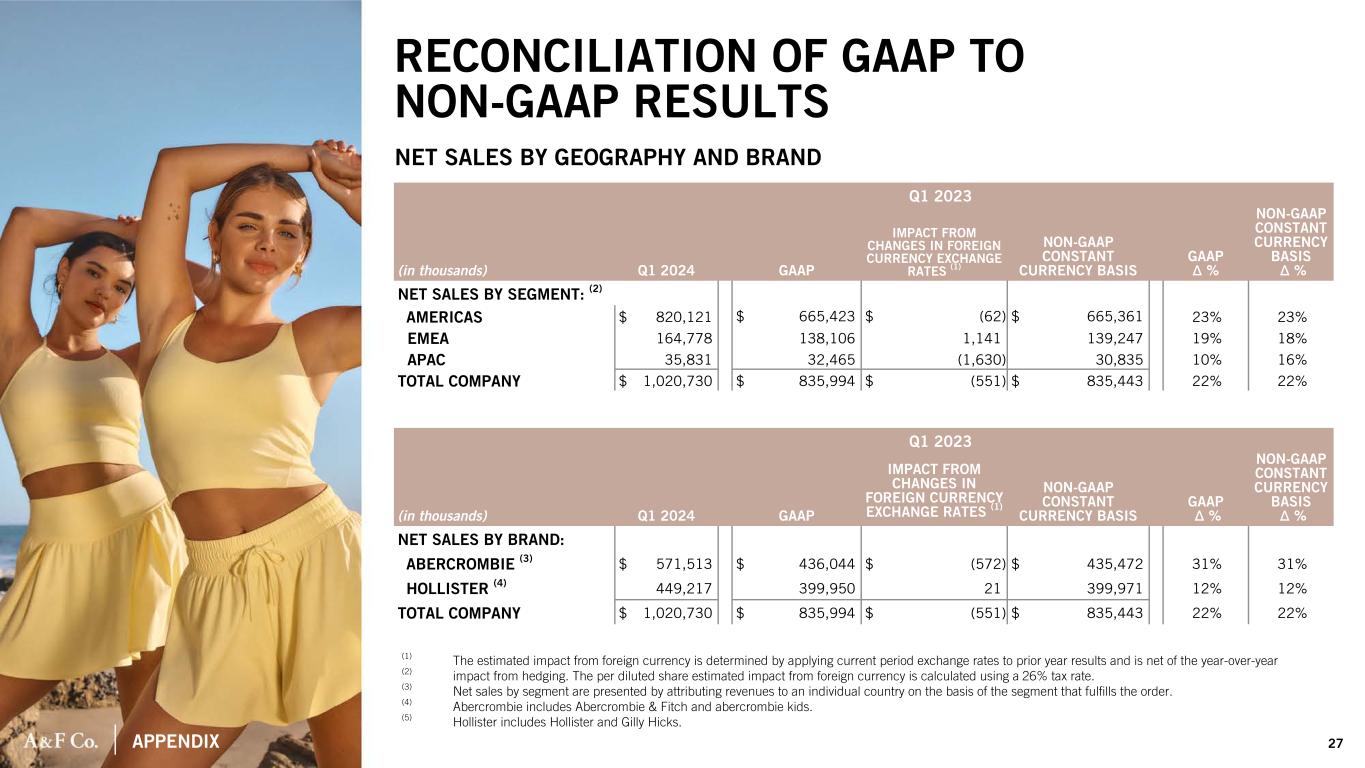

APPENDIX (1) The estimated impact from foreign currency is determined by applying current period exchange rates to prior year results and is net of the year-over-year (2) impact from hedging. The per diluted share estimated impact from foreign currency is calculated using a 26% tax rate. (3) Net sales by segment are presented by attributing revenues to an individual country on the basis of the segment that fulfills the order. (4) Abercrombie includes Abercrombie & Fitch and abercrombie kids. (5) Hollister includes Hollister and Gilly Hicks. (in thousands) Q1 2024 Q1 2023 GAAP Δ % NON-GAAP CONSTANT CURRENCY BASIS Δ %GAAP IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) NON-GAAP CONSTANT CURRENCY BASIS NET SALES BY SEGMENT: (2) AMERICAS $ 820,121 $ 665,423 $ (62) $ 665,361 23% 23% EMEA 164,778 138,106 1,141 139,247 19% 18% APAC 35,831 32,465 (1,630) 30,835 10% 16% TOTAL COMPANY $ 1,020,730 $ 835,994 $ (551) $ 835,443 22% 22% (in thousands) Q1 2024 Q1 2023 GAAP Δ % NON-GAAP CONSTANT CURRENCY BASIS Δ % GAAP IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) NON-GAAP CONSTANT CURRENCY BASIS NET SALES BY BRAND: ABERCROMBIE (3) $ 571,513 $ 436,044 $ (572) $ 435,472 31% 31% HOLLISTER (4) 449,217 399,950 21 399,971 12% 12% TOTAL COMPANY $ 1,020,730 $ 835,994 $ (551) $ 835,443 22% 22% RECONCILIATION OF GAAP TO NON-GAAP RESULTS 27 NET SALES BY GEOGRAPHY AND BRAND

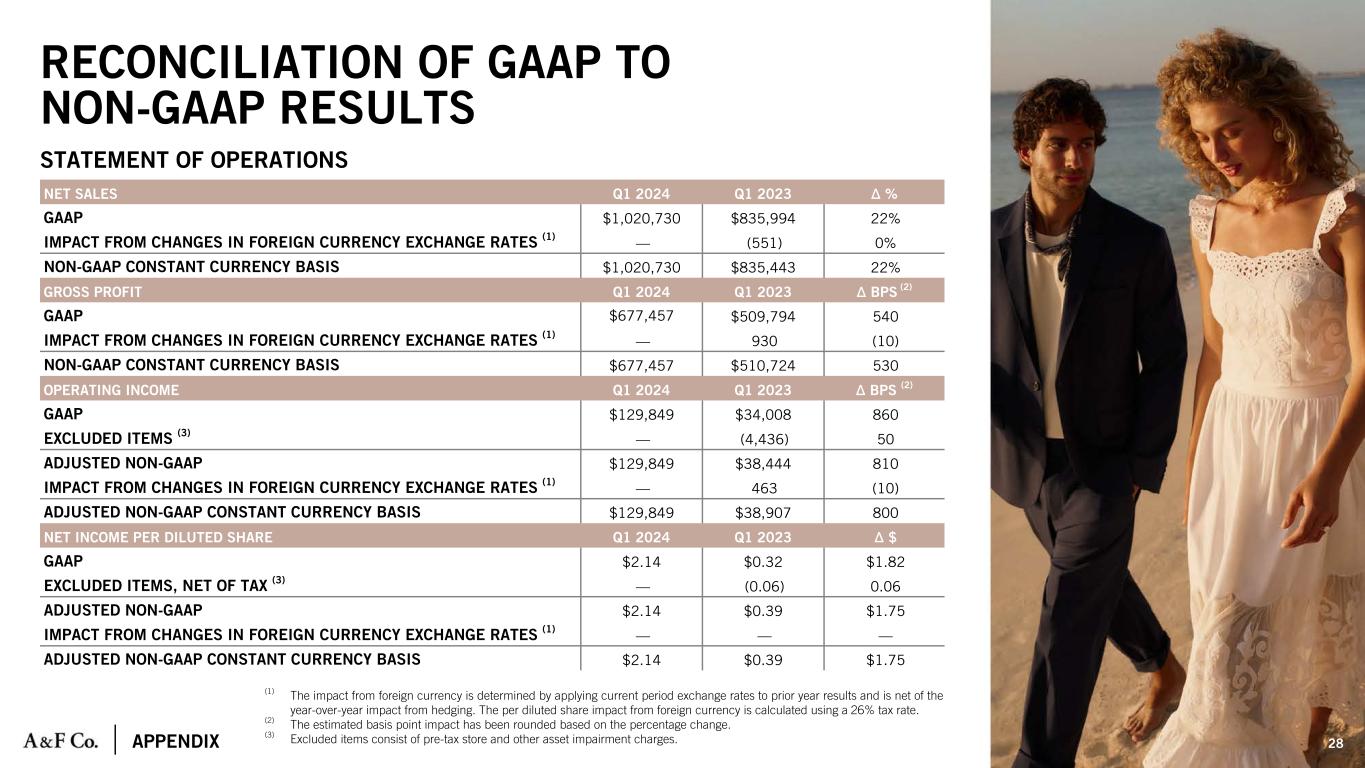

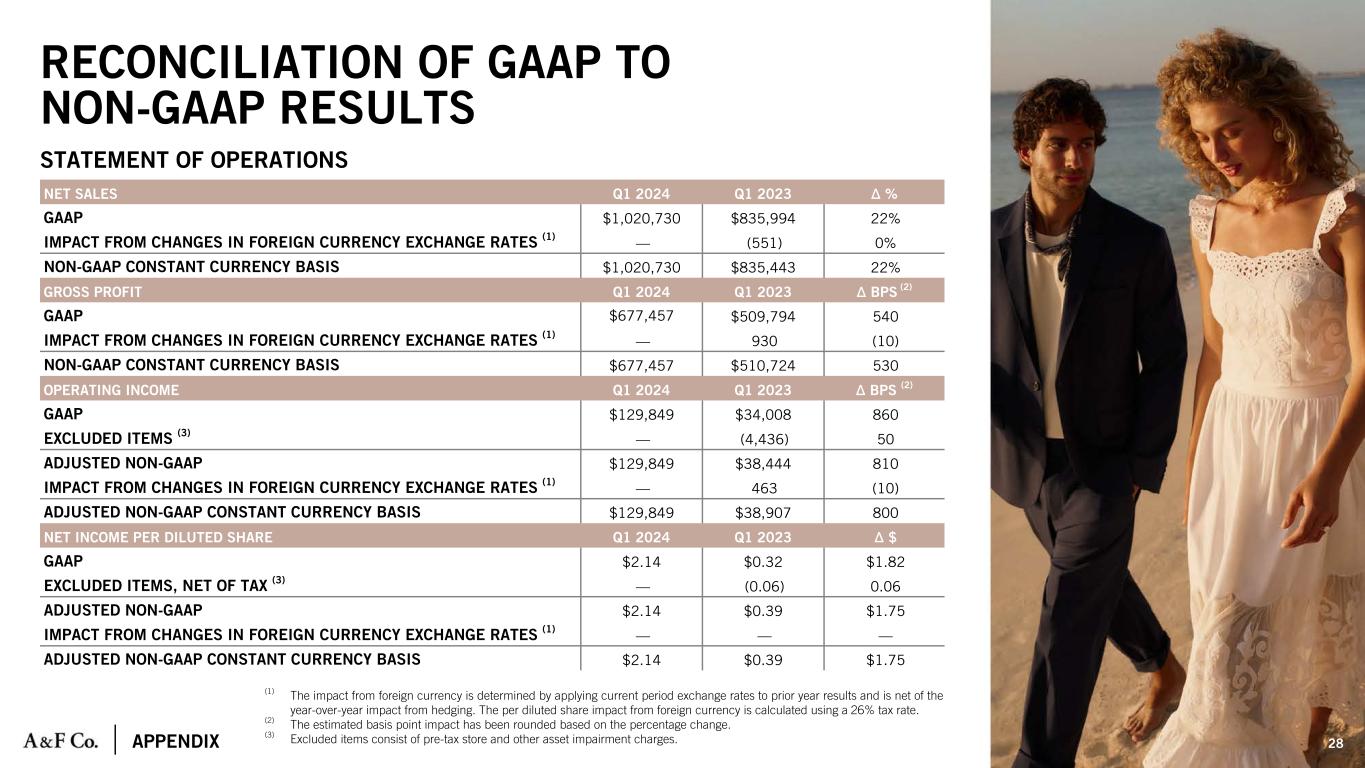

APPENDIX RECONCILIATION OF GAAP TO NON-GAAP RESULTS NET SALES Q1 2024 Q1 2023 Δ % GAAP $1,020,730 $835,994 22% IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — (551) 0% NON-GAAP CONSTANT CURRENCY BASIS $1,020,730 $835,443 22% GROSS PROFIT Q1 2024 Q1 2023 Δ BPS (2) GAAP $677,457 $509,794 540 IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — 930 (10) NON-GAAP CONSTANT CURRENCY BASIS $677,457 $510,724 530 OPERATING INCOME Q1 2024 Q1 2023 Δ BPS (2) GAAP $129,849 $34,008 860 EXCLUDED ITEMS (3) — (4,436) 50 ADJUSTED NON-GAAP $129,849 $38,444 810 IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — 463 (10) ADJUSTED NON-GAAP CONSTANT CURRENCY BASIS $129,849 $38,907 800 NET INCOME PER DILUTED SHARE Q1 2024 Q1 2023 Δ $ GAAP $2.14 $0.32 $1.82 EXCLUDED ITEMS, NET OF TAX (3) — (0.06) 0.06 ADJUSTED NON-GAAP $2.14 $0.39 $1.75 IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — — — ADJUSTED NON-GAAP CONSTANT CURRENCY BASIS $2.14 $0.39 $1.75 (1) The impact from foreign currency is determined by applying current period exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share impact from foreign currency is calculated using a 26% tax rate. (2) The estimated basis point impact has been rounded based on the percentage change. (3) Excluded items consist of pre-tax store and other asset impairment charges. 28 STATEMENT OF OPERATIONS

REFINITIV STREETEVENTS EDITED TRANSCRIPT ANF.N - Q1 2024 Abercrombie & Fitch Co Earnings Call EVENT DATE/TIME: MAY 29, 2024 / 12:30PM GMT REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

C O R P O R A T E P A R T I C I P A N T S Fran Horowitz Abercrombie & Fitch Co. - CEO & Director Mohit Gupta Scott D. Lipesky Abercrombie & Fitch Co. - Executive VP, COO & CFO C O N F E R E N C E C A L L P A R T I C I P A N T S Alexandra Ann Straton Morgan Stanley, Research Division - America Equity Analyst Dana Lauren Telsey Telsey Advisory Group LLC - CEO & Chief Research Officer Janet Joseph Kloppenburg JJK Research Associates, Inc. - President Kelly Crago Citigroup Inc., Research Division - VP Marni Shapiro The Retail Tracker - Co-Founder Matthew Robert Boss JPMorgan Chase & Co, Research Division - MD & Senior Analyst Mauricio Serna Vega UBS Investment Bank, Research Division - Analyst P R E S E N T A T I O N Operator Good day, and thank you for standing by. Welcome to the Abercrombie & Fitch Fourth Quarter Fiscal Year 2023 Earnings Call. Today's conference is being recorded. (Operator Instructions) I would now like to hand the conference over to Mo Gupta. Please go ahead. Mohit Gupta Thank you. Good morning, and welcome to our first quarter 2024 earnings call. Joining me are Fran Horowitz, Chief Executive Officer and Scott Lipesky, Chief Financial Officer and Chief Operating Officer. Earlier this morning, we issued our first quarter earnings release, which is available on our website at corporate.abercrombie.com under the Investors section. Also available on our website is an investor presentation. Keep in mind that we will make certain forward-looking statements on the call. These statements are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and are subject to risks and uncertainties that could cause actual results to differ materially from the expectations and assumptions we mentioned today. These factors and uncertainties are discussed in our reports and filings with the Securities and Exchange Commission. In addition, we will be referring to certain non-GAAP financial measures during the call. Additional details and reconciliations of GAAP to adjusted non-GAAP financial measures are included in the release and investor presentation issued earlier this morning. Finally, references to Abercrombie Brands include Abercrombie & Fitch and abercrombie kids, and references to Hollister brands includes Hollister and Gilly Hicks. With that, I'll turn the call over to Fran. Fran Horowitz - Abercrombie & Fitch Co. - CEO & Director Thanks, Mo. Good morning, and thank you for joining us to discuss what has been a very busy and productive start to 2024. And I'm happy to report that our sales trend remained strong throughout the first quarter, exceeding the expectations we provided in early March. Net sales of $1 billion and operating income of $130 million were both the best first quarter results in the history of the company. First quarter sales grew 22% year-over-year with broad-based growth across regions, brands and direct channels. 2 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. MAY 29, 2024 / 12:30PM, ANF.N - Q1 2024 Abercrombie & Fitch Co Earnings Call

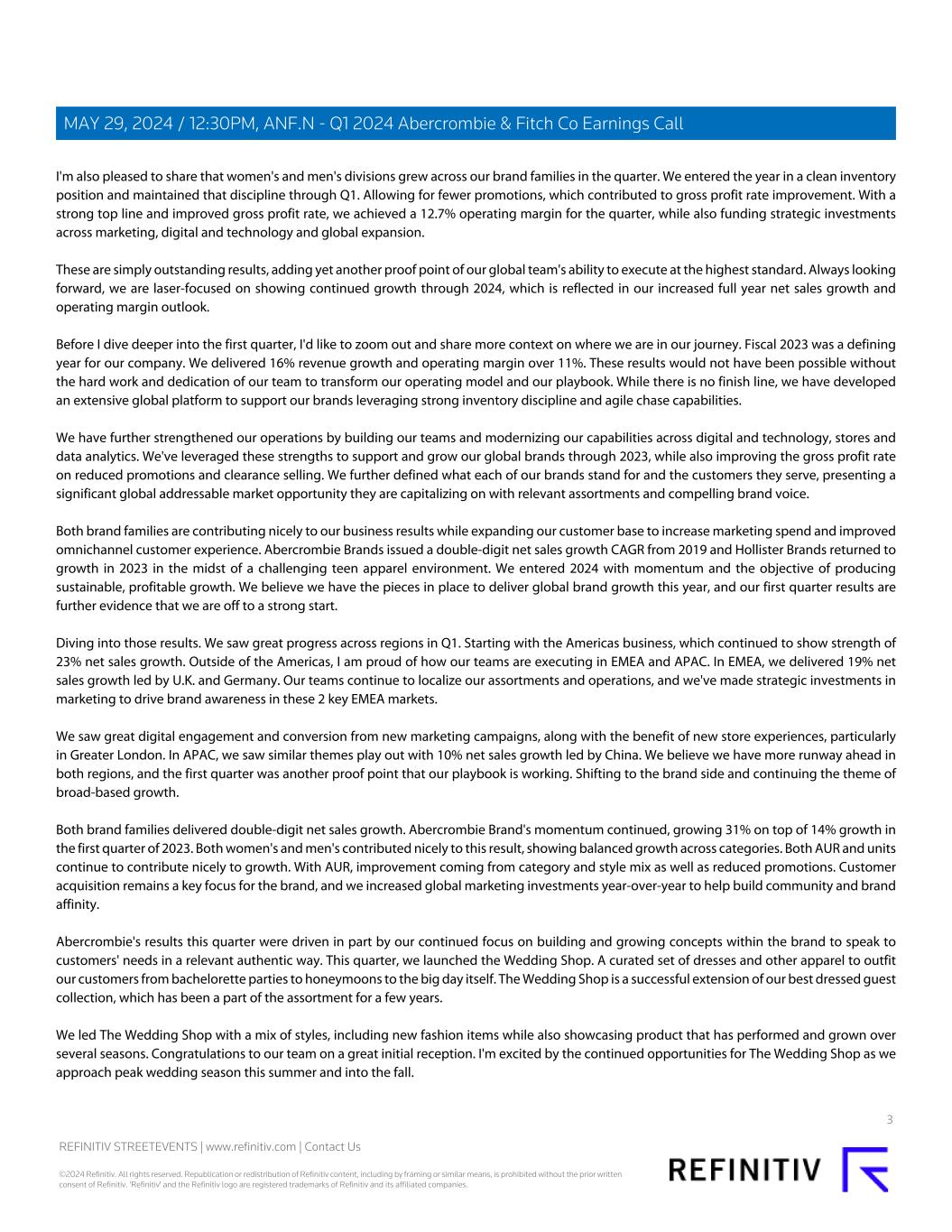

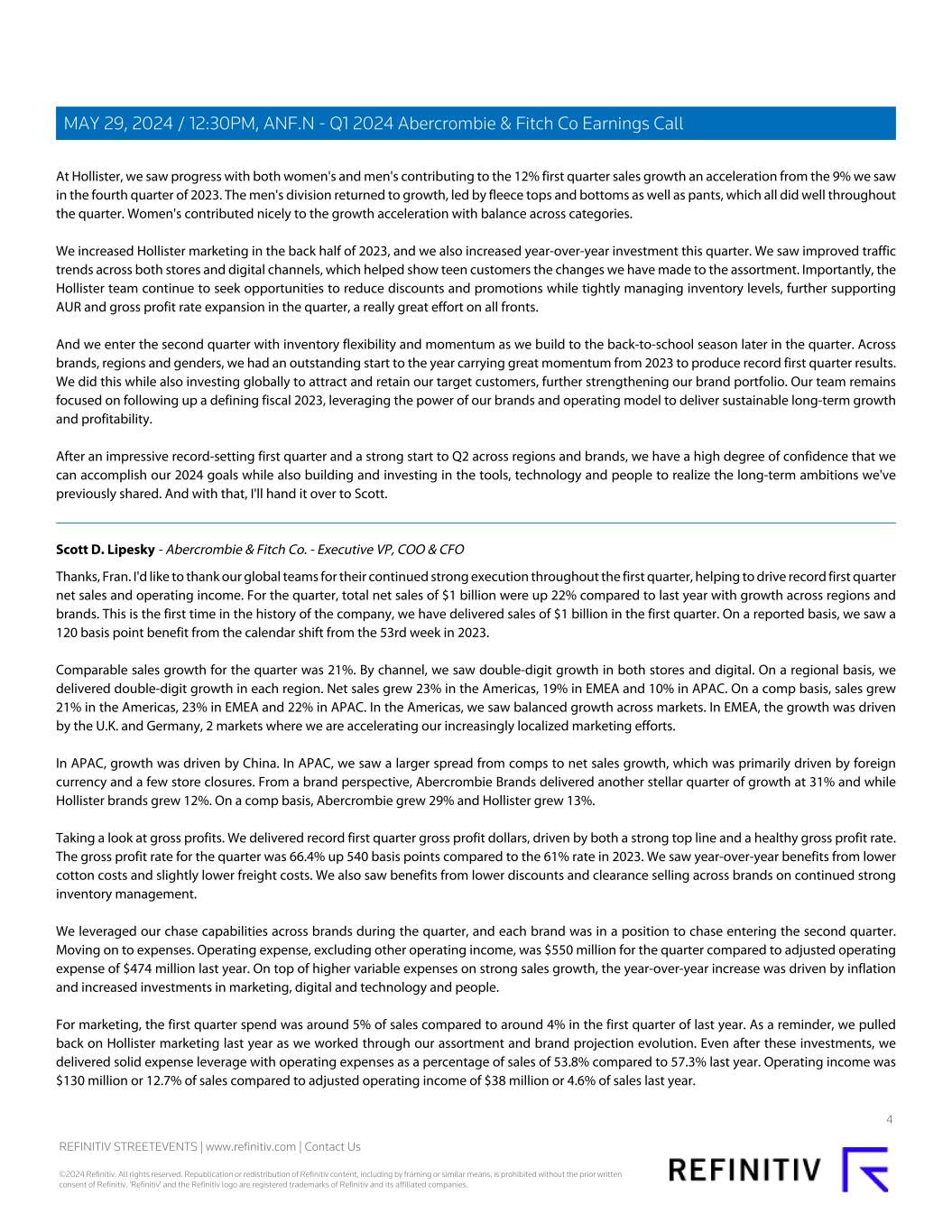

I'm also pleased to share that women's and men's divisions grew across our brand families in the quarter. We entered the year in a clean inventory position and maintained that discipline through Q1. Allowing for fewer promotions, which contributed to gross profit rate improvement. With a strong top line and improved gross profit rate, we achieved a 12.7% operating margin for the quarter, while also funding strategic investments across marketing, digital and technology and global expansion. These are simply outstanding results, adding yet another proof point of our global team's ability to execute at the highest standard. Always looking forward, we are laser-focused on showing continued growth through 2024, which is reflected in our increased full year net sales growth and operating margin outlook. Before I dive deeper into the first quarter, I'd like to zoom out and share more context on where we are in our journey. Fiscal 2023 was a defining year for our company. We delivered 16% revenue growth and operating margin over 11%. These results would not have been possible without the hard work and dedication of our team to transform our operating model and our playbook. While there is no finish line, we have developed an extensive global platform to support our brands leveraging strong inventory discipline and agile chase capabilities. We have further strengthened our operations by building our teams and modernizing our capabilities across digital and technology, stores and data analytics. We've leveraged these strengths to support and grow our global brands through 2023, while also improving the gross profit rate on reduced promotions and clearance selling. We further defined what each of our brands stand for and the customers they serve, presenting a significant global addressable market opportunity they are capitalizing on with relevant assortments and compelling brand voice. Both brand families are contributing nicely to our business results while expanding our customer base to increase marketing spend and improved omnichannel customer experience. Abercrombie Brands issued a double-digit net sales growth CAGR from 2019 and Hollister Brands returned to growth in 2023 in the midst of a challenging teen apparel environment. We entered 2024 with momentum and the objective of producing sustainable, profitable growth. We believe we have the pieces in place to deliver global brand growth this year, and our first quarter results are further evidence that we are off to a strong start. Diving into those results. We saw great progress across regions in Q1. Starting with the Americas business, which continued to show strength of 23% net sales growth. Outside of the Americas, I am proud of how our teams are executing in EMEA and APAC. In EMEA, we delivered 19% net sales growth led by U.K. and Germany. Our teams continue to localize our assortments and operations, and we've made strategic investments in marketing to drive brand awareness in these 2 key EMEA markets. We saw great digital engagement and conversion from new marketing campaigns, along with the benefit of new store experiences, particularly in Greater London. In APAC, we saw similar themes play out with 10% net sales growth led by China. We believe we have more runway ahead in both regions, and the first quarter was another proof point that our playbook is working. Shifting to the brand side and continuing the theme of broad-based growth. Both brand families delivered double-digit net sales growth. Abercrombie Brand's momentum continued, growing 31% on top of 14% growth in the first quarter of 2023. Both women's and men's contributed nicely to this result, showing balanced growth across categories. Both AUR and units continue to contribute nicely to growth. With AUR, improvement coming from category and style mix as well as reduced promotions. Customer acquisition remains a key focus for the brand, and we increased global marketing investments year-over-year to help build community and brand affinity. Abercrombie's results this quarter were driven in part by our continued focus on building and growing concepts within the brand to speak to customers' needs in a relevant authentic way. This quarter, we launched the Wedding Shop. A curated set of dresses and other apparel to outfit our customers from bachelorette parties to honeymoons to the big day itself. The Wedding Shop is a successful extension of our best dressed guest collection, which has been a part of the assortment for a few years. We led The Wedding Shop with a mix of styles, including new fashion items while also showcasing product that has performed and grown over several seasons. Congratulations to our team on a great initial reception. I'm excited by the continued opportunities for The Wedding Shop as we approach peak wedding season this summer and into the fall. 3 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. MAY 29, 2024 / 12:30PM, ANF.N - Q1 2024 Abercrombie & Fitch Co Earnings Call

At Hollister, we saw progress with both women's and men's contributing to the 12% first quarter sales growth an acceleration from the 9% we saw in the fourth quarter of 2023. The men's division returned to growth, led by fleece tops and bottoms as well as pants, which all did well throughout the quarter. Women's contributed nicely to the growth acceleration with balance across categories. We increased Hollister marketing in the back half of 2023, and we also increased year-over-year investment this quarter. We saw improved traffic trends across both stores and digital channels, which helped show teen customers the changes we have made to the assortment. Importantly, the Hollister team continue to seek opportunities to reduce discounts and promotions while tightly managing inventory levels, further supporting AUR and gross profit rate expansion in the quarter, a really great effort on all fronts. And we enter the second quarter with inventory flexibility and momentum as we build to the back-to-school season later in the quarter. Across brands, regions and genders, we had an outstanding start to the year carrying great momentum from 2023 to produce record first quarter results. We did this while also investing globally to attract and retain our target customers, further strengthening our brand portfolio. Our team remains focused on following up a defining fiscal 2023, leveraging the power of our brands and operating model to deliver sustainable long-term growth and profitability. After an impressive record-setting first quarter and a strong start to Q2 across regions and brands, we have a high degree of confidence that we can accomplish our 2024 goals while also building and investing in the tools, technology and people to realize the long-term ambitions we've previously shared. And with that, I'll hand it over to Scott. Scott D. Lipesky - Abercrombie & Fitch Co. - Executive VP, COO & CFO Thanks, Fran. I'd like to thank our global teams for their continued strong execution throughout the first quarter, helping to drive record first quarter net sales and operating income. For the quarter, total net sales of $1 billion were up 22% compared to last year with growth across regions and brands. This is the first time in the history of the company, we have delivered sales of $1 billion in the first quarter. On a reported basis, we saw a 120 basis point benefit from the calendar shift from the 53rd week in 2023. Comparable sales growth for the quarter was 21%. By channel, we saw double-digit growth in both stores and digital. On a regional basis, we delivered double-digit growth in each region. Net sales grew 23% in the Americas, 19% in EMEA and 10% in APAC. On a comp basis, sales grew 21% in the Americas, 23% in EMEA and 22% in APAC. In the Americas, we saw balanced growth across markets. In EMEA, the growth was driven by the U.K. and Germany, 2 markets where we are accelerating our increasingly localized marketing efforts. In APAC, growth was driven by China. In APAC, we saw a larger spread from comps to net sales growth, which was primarily driven by foreign currency and a few store closures. From a brand perspective, Abercrombie Brands delivered another stellar quarter of growth at 31% and while Hollister brands grew 12%. On a comp basis, Abercrombie grew 29% and Hollister grew 13%. Taking a look at gross profits. We delivered record first quarter gross profit dollars, driven by both a strong top line and a healthy gross profit rate. The gross profit rate for the quarter was 66.4% up 540 basis points compared to the 61% rate in 2023. We saw year-over-year benefits from lower cotton costs and slightly lower freight costs. We also saw benefits from lower discounts and clearance selling across brands on continued strong inventory management. We leveraged our chase capabilities across brands during the quarter, and each brand was in a position to chase entering the second quarter. Moving on to expenses. Operating expense, excluding other operating income, was $550 million for the quarter compared to adjusted operating expense of $474 million last year. On top of higher variable expenses on strong sales growth, the year-over-year increase was driven by inflation and increased investments in marketing, digital and technology and people. For marketing, the first quarter spend was around 5% of sales compared to around 4% in the first quarter of last year. As a reminder, we pulled back on Hollister marketing last year as we worked through our assortment and brand projection evolution. Even after these investments, we delivered solid expense leverage with operating expenses as a percentage of sales of 53.8% compared to 57.3% last year. Operating income was $130 million or 12.7% of sales compared to adjusted operating income of $38 million or 4.6% of sales last year. 4 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. MAY 29, 2024 / 12:30PM, ANF.N - Q1 2024 Abercrombie & Fitch Co Earnings Call