0001015328false00010153282023-10-172023-10-170001015328us-gaap:CommonStockMember2023-10-172023-10-170001015328us-gaap:SeriesDPreferredStockMember2023-10-172023-10-170001015328wtfc:DepositarySharesSeriesEPreferredStockMember2023-10-172023-10-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 17, 2023

WINTRUST FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Illinois | 001-35077 | | 36-3873352 |

| (State or other jurisdiction of Incorporation) | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

| | | |

| 9700 W. Higgins Road, Suite 800 | Rosemont | Illinois | | 60018 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (847) 939-9000

Not Applicable

(Former name or former address, if changed since last year)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Title of Each Class | Ticker Symbol | Name of Each Exchange on Which Registered |

| Common Stock, no par value | WTFC | The NASDAQ Global Select Market |

| Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series D, no par value | WTFCM | The NASDAQ Global Select Market |

Depositary Shares, Each Representing a 1/1,000th Interest in a Share of | WTFCP | The NASDAQ Global Select Market |

| 6.875% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series E, no par value | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

The information in this Current Report is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

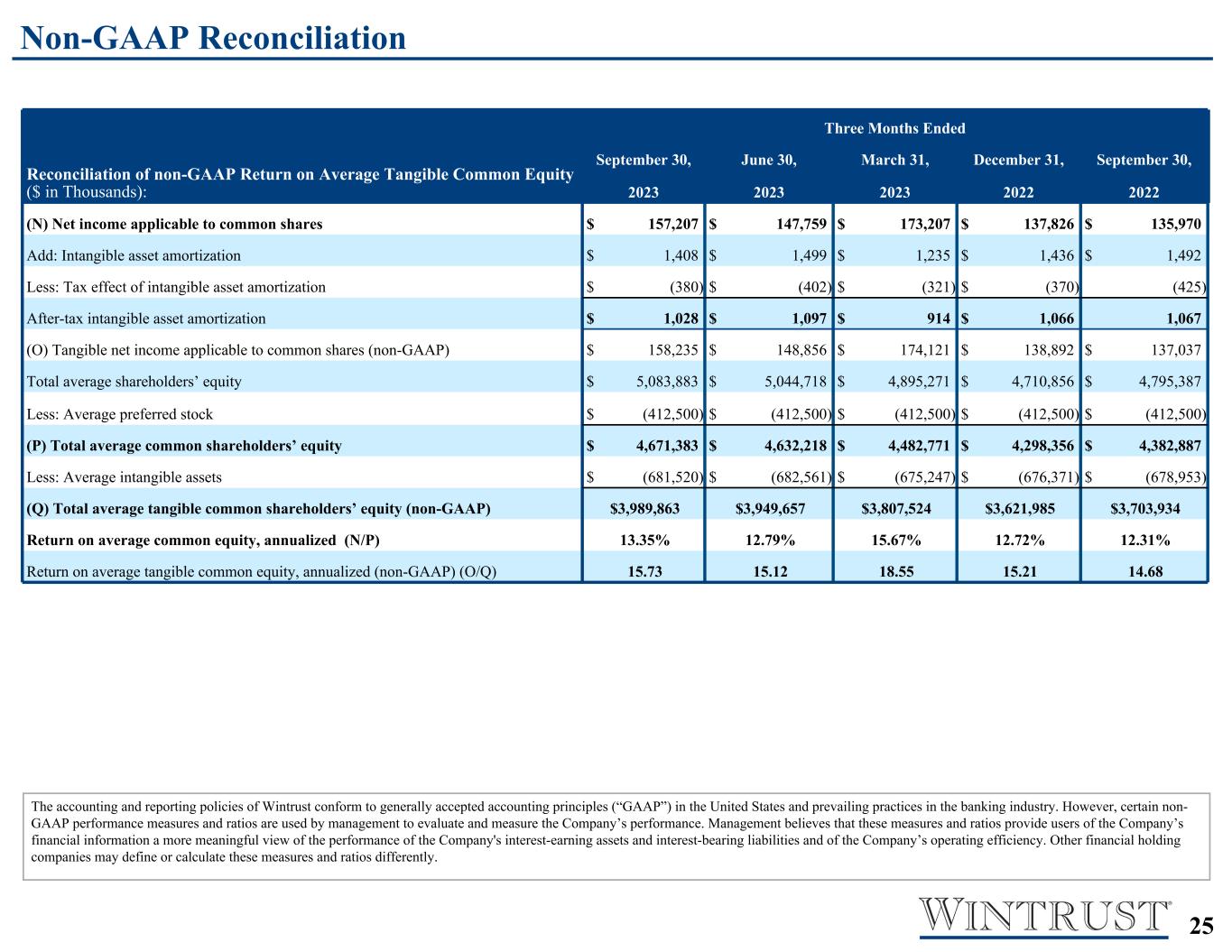

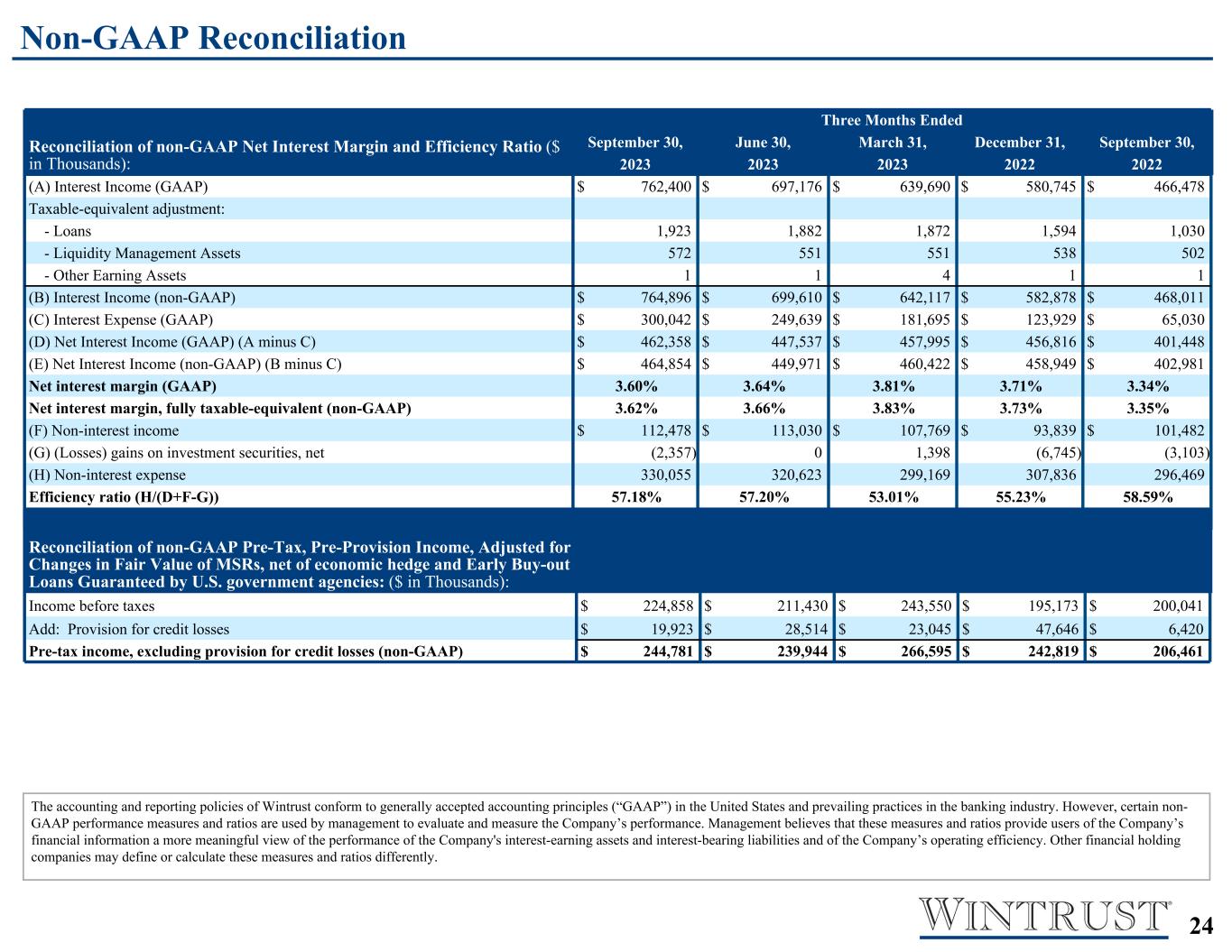

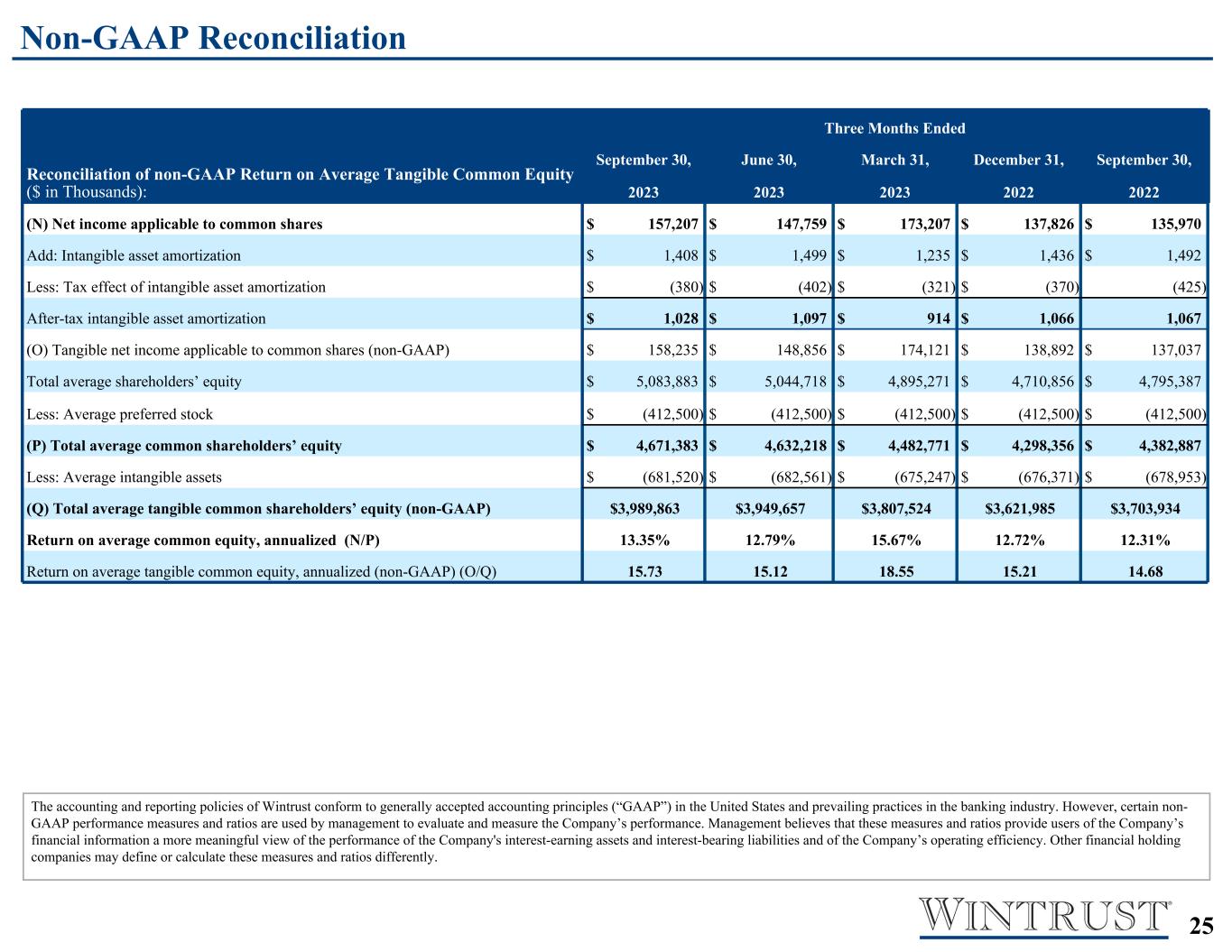

On October 17, 2023, Wintrust Financial Corporation (the “Company”) announced earnings for the third quarter of 2023 and posted on its website the Third Quarter 2023 Earnings Release Presentation. Copies of the press release relating to the Company’s earnings results and the related presentation are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively. Certain supplemental information relating to non-GAAP financial measures reported in the attached press release and presentation is included on pages 32 through 33 of Exhibit 99.1 and pages 24 through 25 of Exhibit 99.2.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | WINTRUST FINANCIAL CORPORATION

(Registrant) |

| |

| By: | /s/ David L. Stoehr |

| | David L. Stoehr

Executive Vice President and

Chief Financial Officer |

Date: October 17, 2023

INDEX TO EXHIBITS

Exhibit 99.1

Wintrust Financial Corporation

9700 W. Higgins Road, Suite 800, Rosemont, Illinois 60018

News Release

| | | | | | | | |

| | |

| FOR IMMEDIATE RELEASE | | October 17, 2023 |

FOR MORE INFORMATION CONTACT:

Timothy S. Crane, President & Chief Executive Officer

David A. Dykstra, Vice Chairman & Chief Operating Officer

(847) 939-9000

Web site address: www.wintrust.com

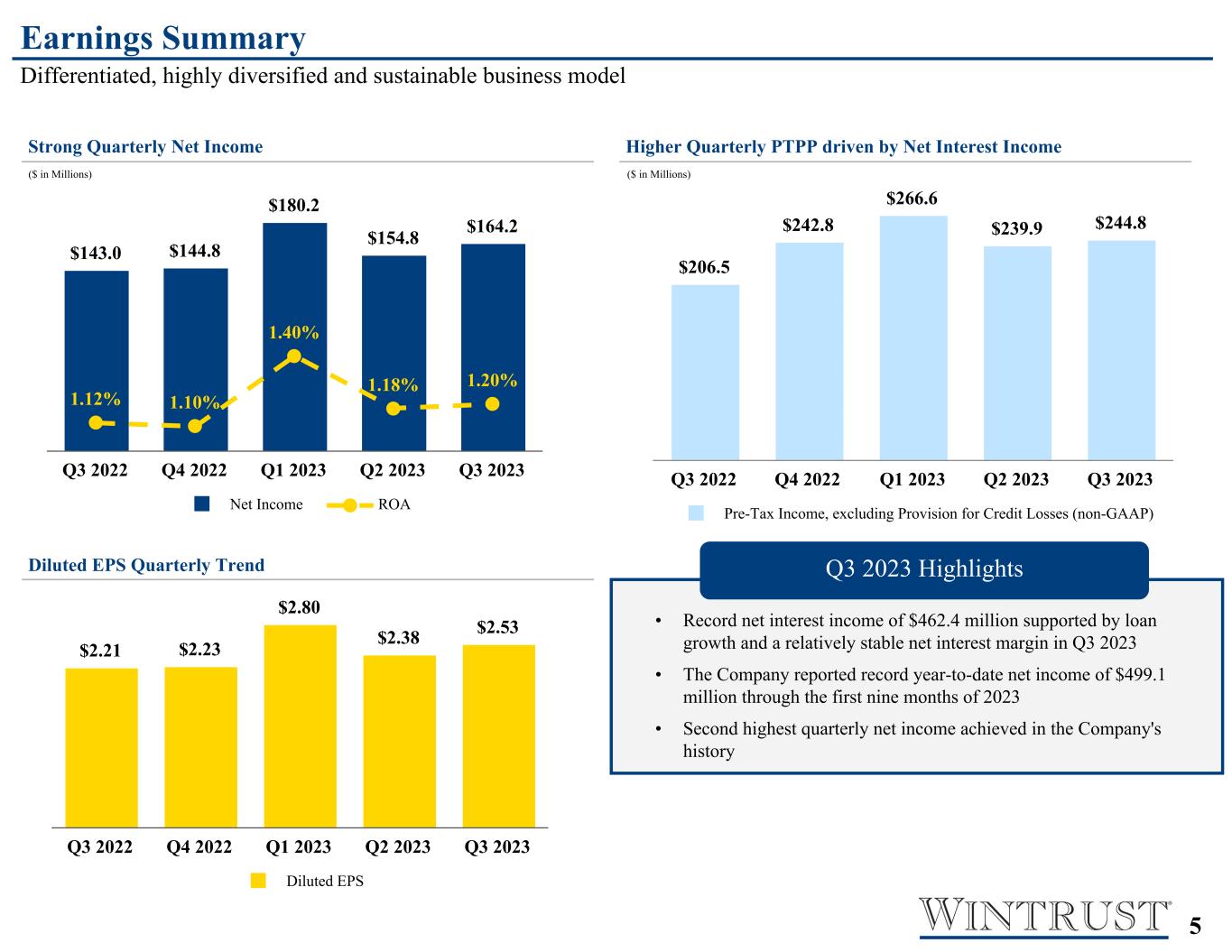

Wintrust Financial Corporation Reports Record Year-to-Date Net Income

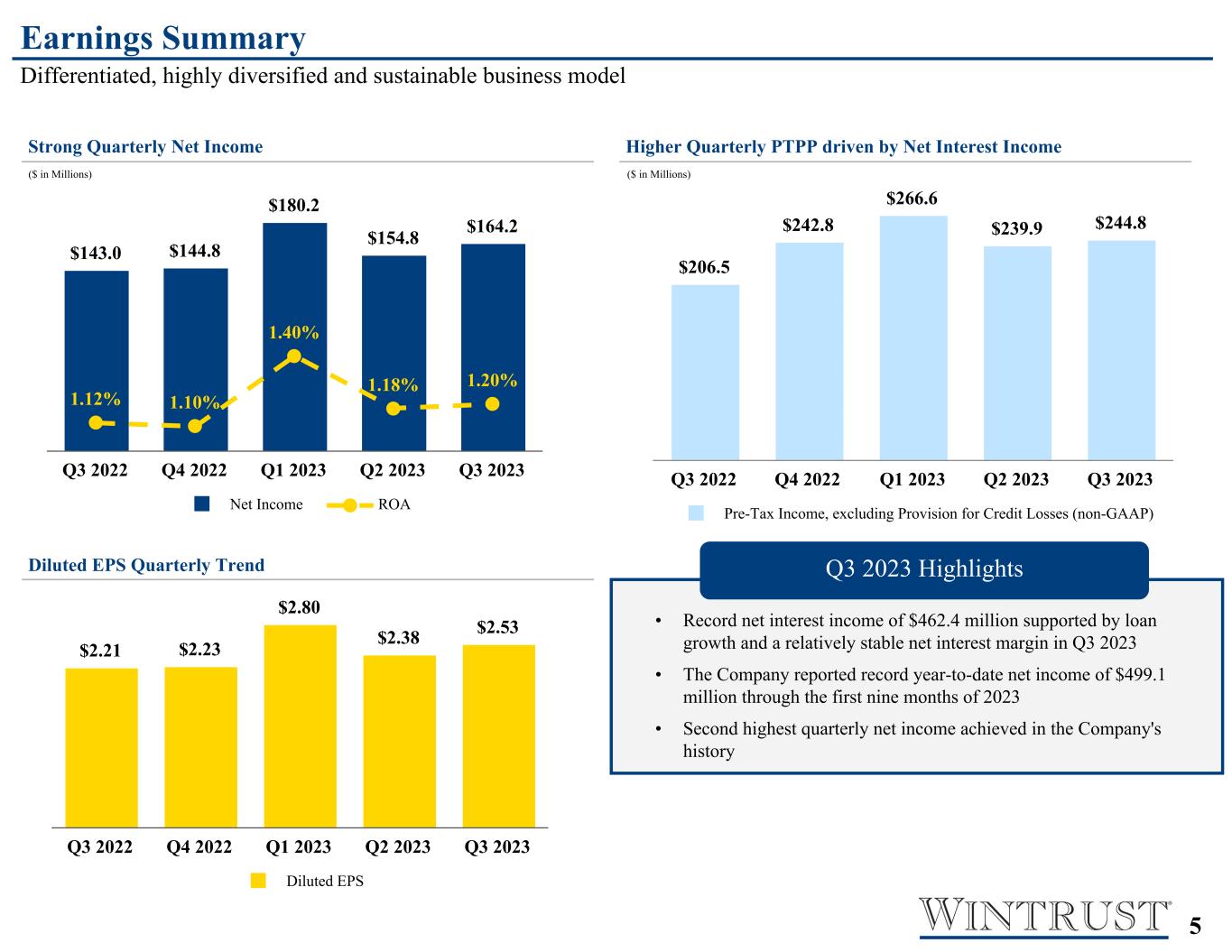

ROSEMONT, ILLINOIS – Wintrust Financial Corporation (“Wintrust”, “the Company”, “we” or “our”) (Nasdaq: WTFC) announced record net income of $499.1 million or $7.71 per diluted common share for the first nine months of 2023 compared to net income of $364.9 million or $5.78 per diluted common share for the same period of 2022, an increase in diluted earnings per common share of 33%. Pre-tax, pre-provision income (non-GAAP) for the first nine months of 2023 totaled $751.3 million as compared to $536.3 million in the first nine months of 2022, an increase in pre-tax, pre-provision income of 40%.

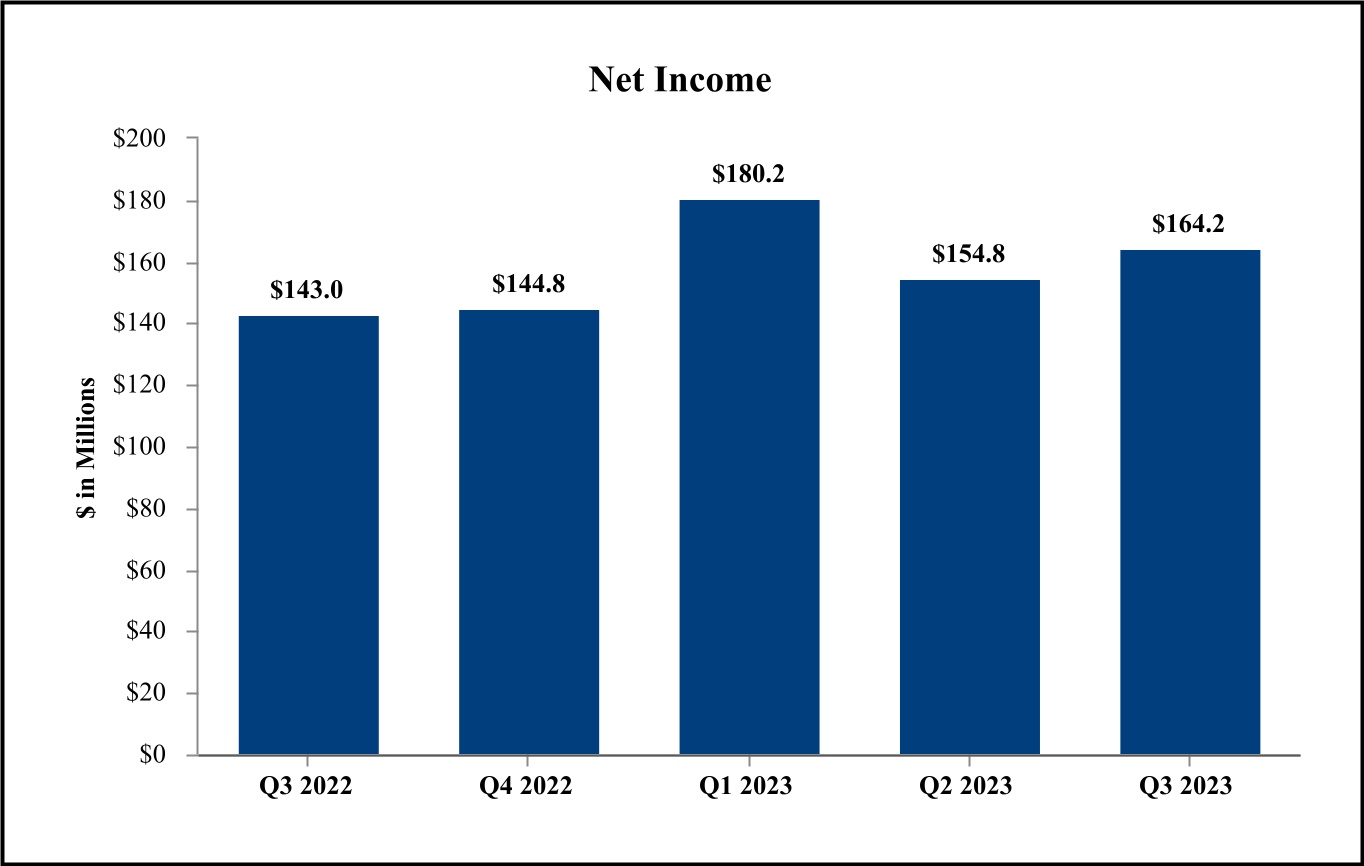

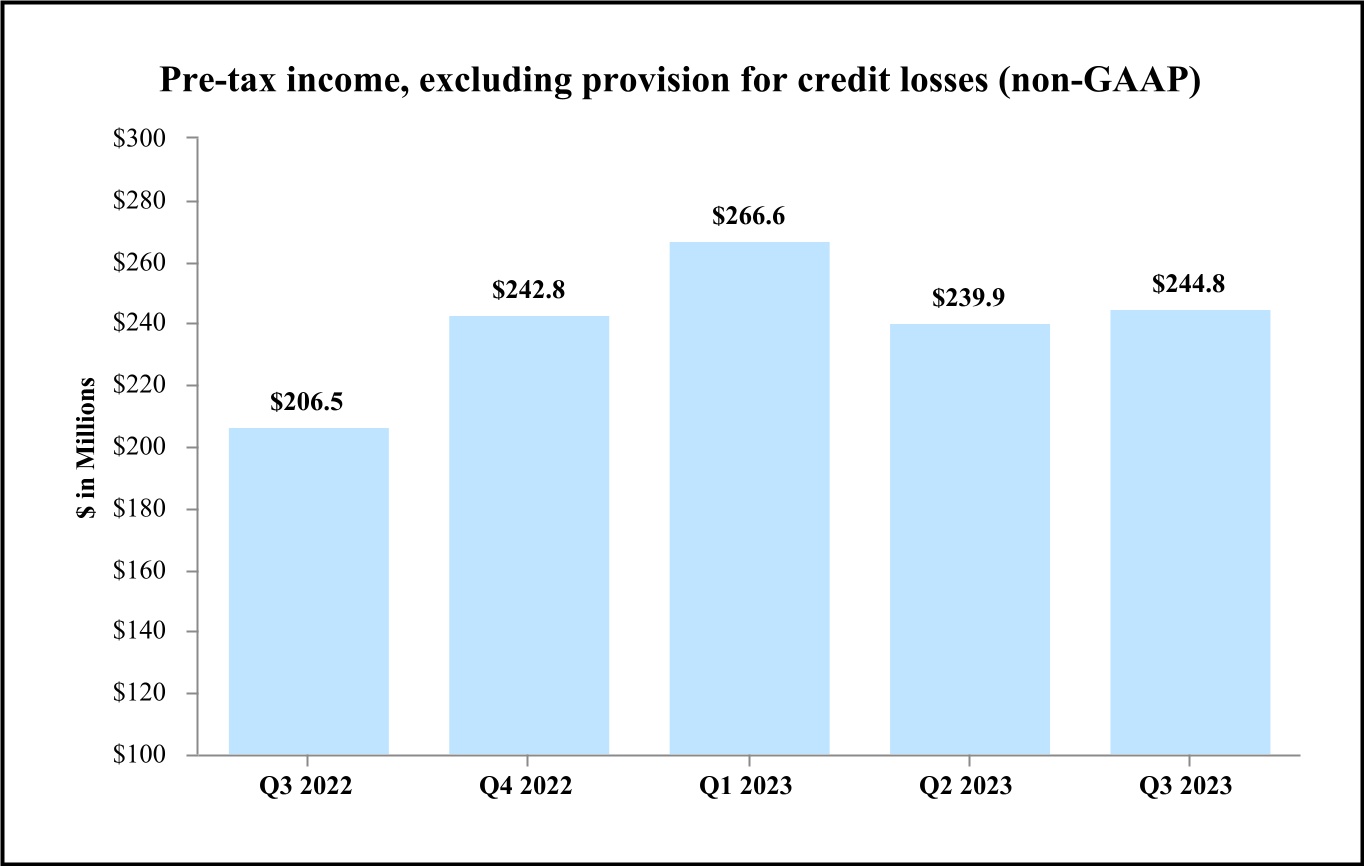

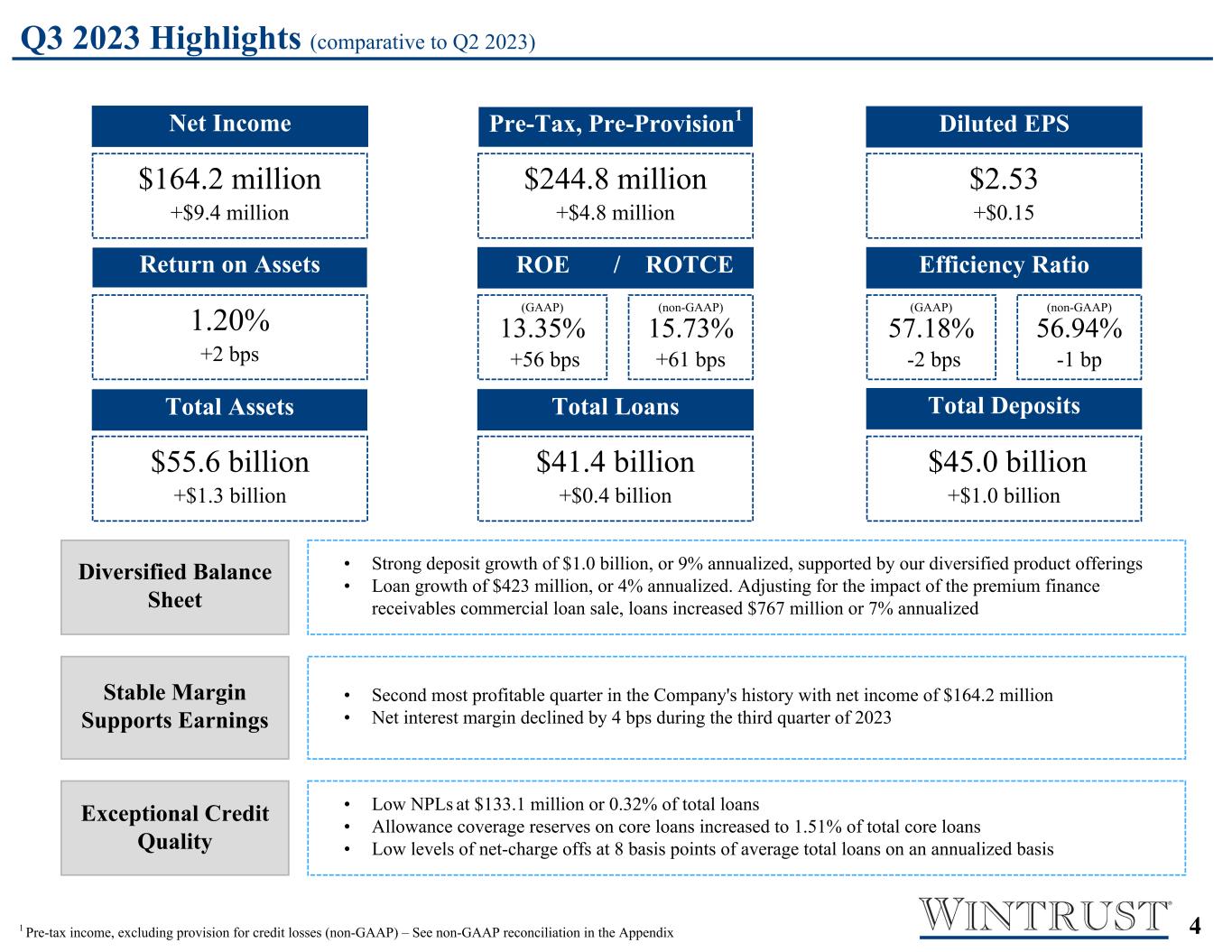

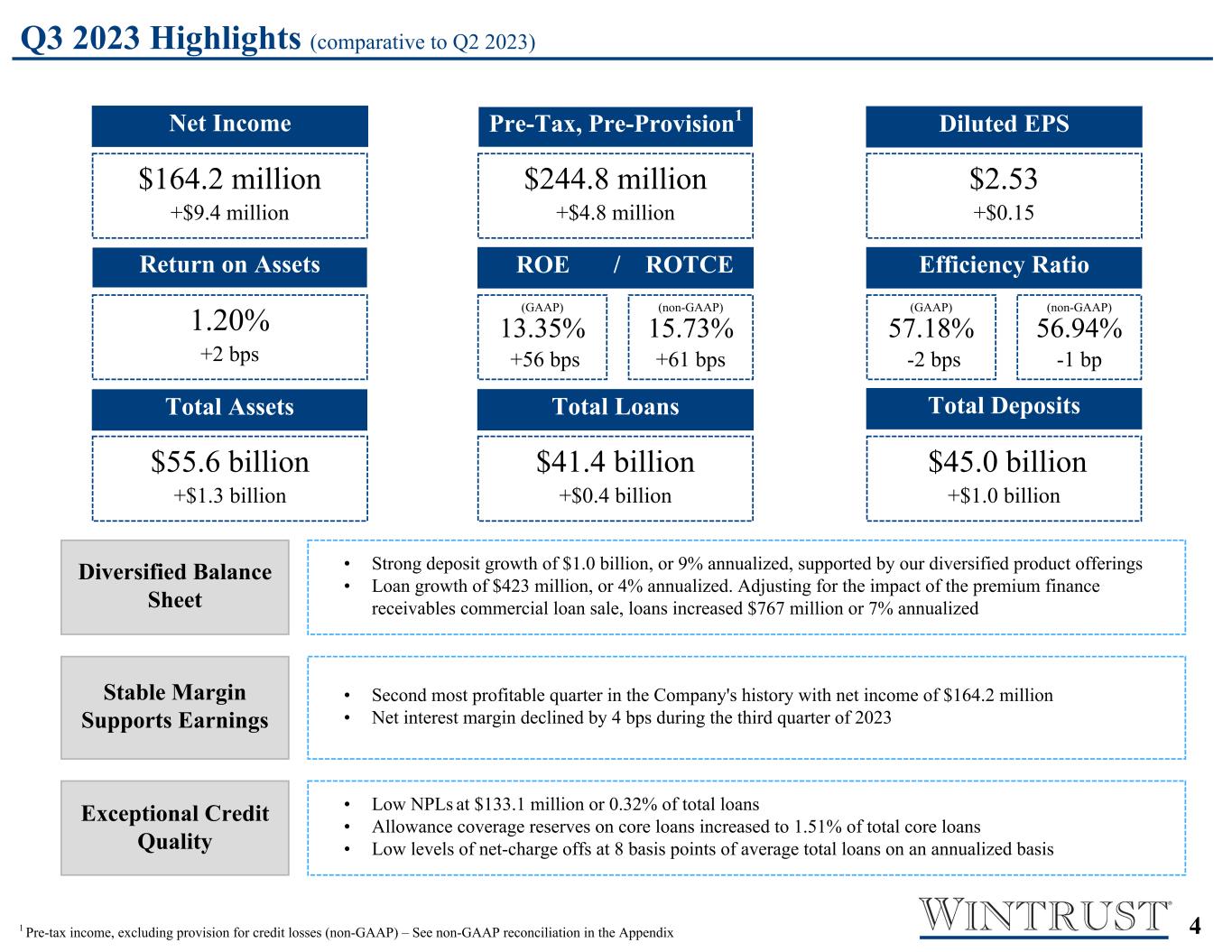

The Company recorded quarterly net income of $164.2 million or $2.53 per diluted common share for the third quarter of 2023, an increase in diluted earnings per common share of 6% compared to the second quarter of 2023 and 14% compared to the third quarter of 2022. Pre-tax, pre-provision income (non-GAAP) totaled $244.8 million as compared to $239.9 million for the second quarter of 2023 and $206.5 million for the third quarter of 2022.

Timothy S. Crane, President and Chief Executive Officer, commented, “As demonstrated by our strong results, we followed our record first half of 2023 with continued momentum in the third quarter of 2023. We leveraged our position in the markets we serve to sustain growth in loans and deposits during the quarter.”

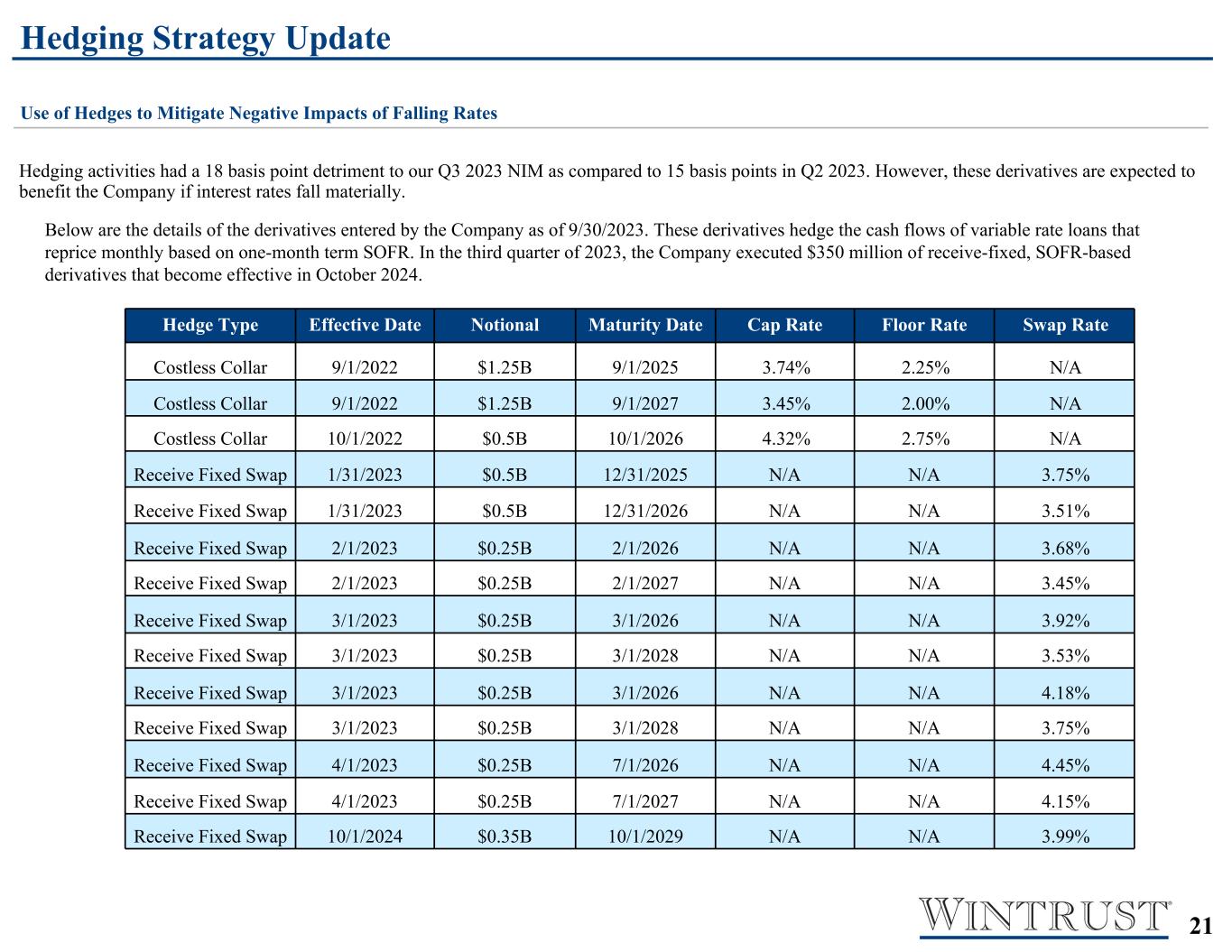

Additionally, Mr. Crane noted, “Our net interest margin for the quarter was within our expected range, down slightly due primarily to the impact of hedging activities. In the current interest rate environment, we expect to maintain our net interest margin within a narrow range around current levels for the remainder of 2023 and continuing into the beginning of 2024. We believe this growth and stability in net interest margin will drive strong financial performance in future quarters.”

Highlights of the third quarter of 2023:

Comparative information to the second quarter of 2023, unless otherwise noted

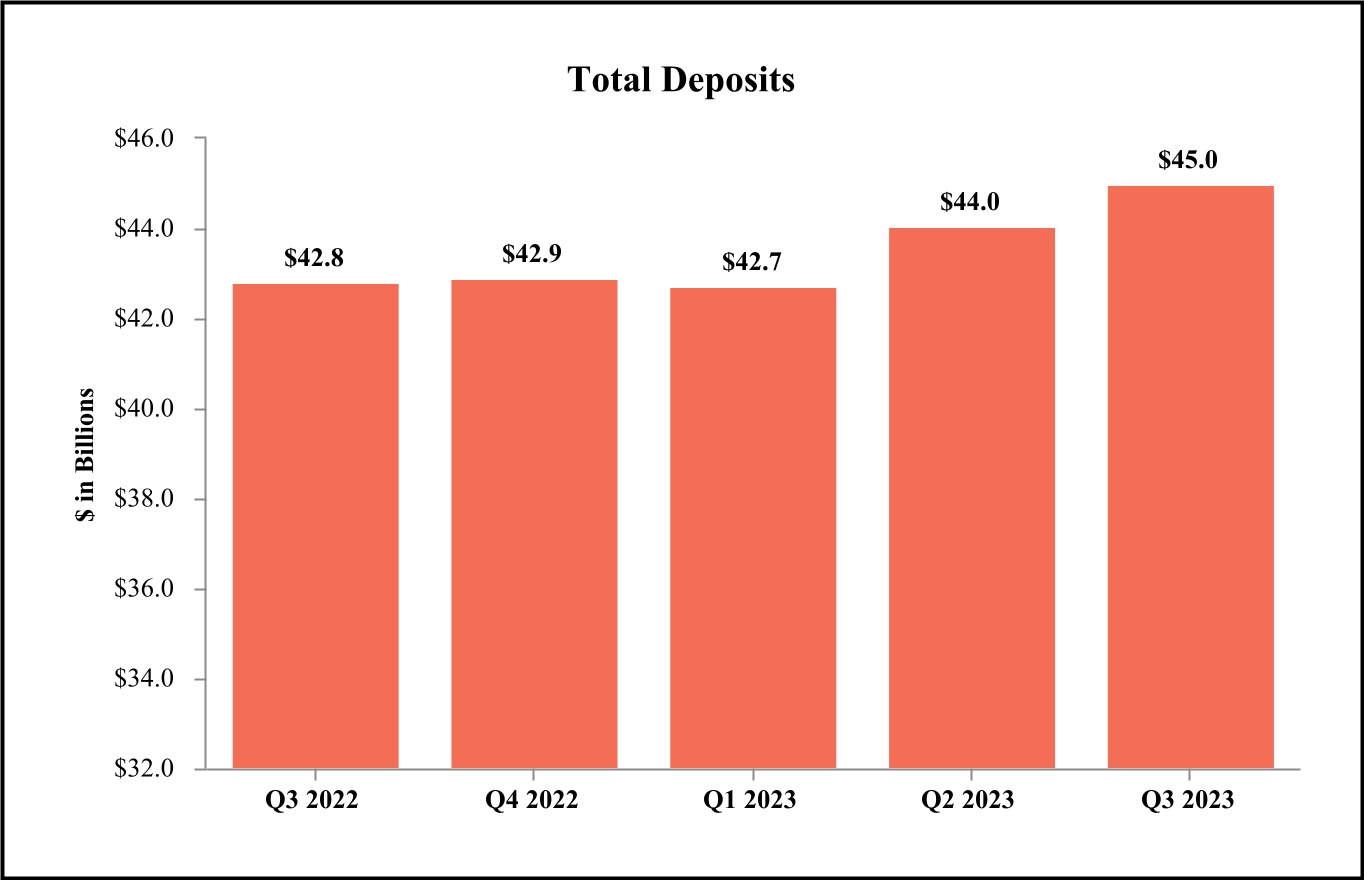

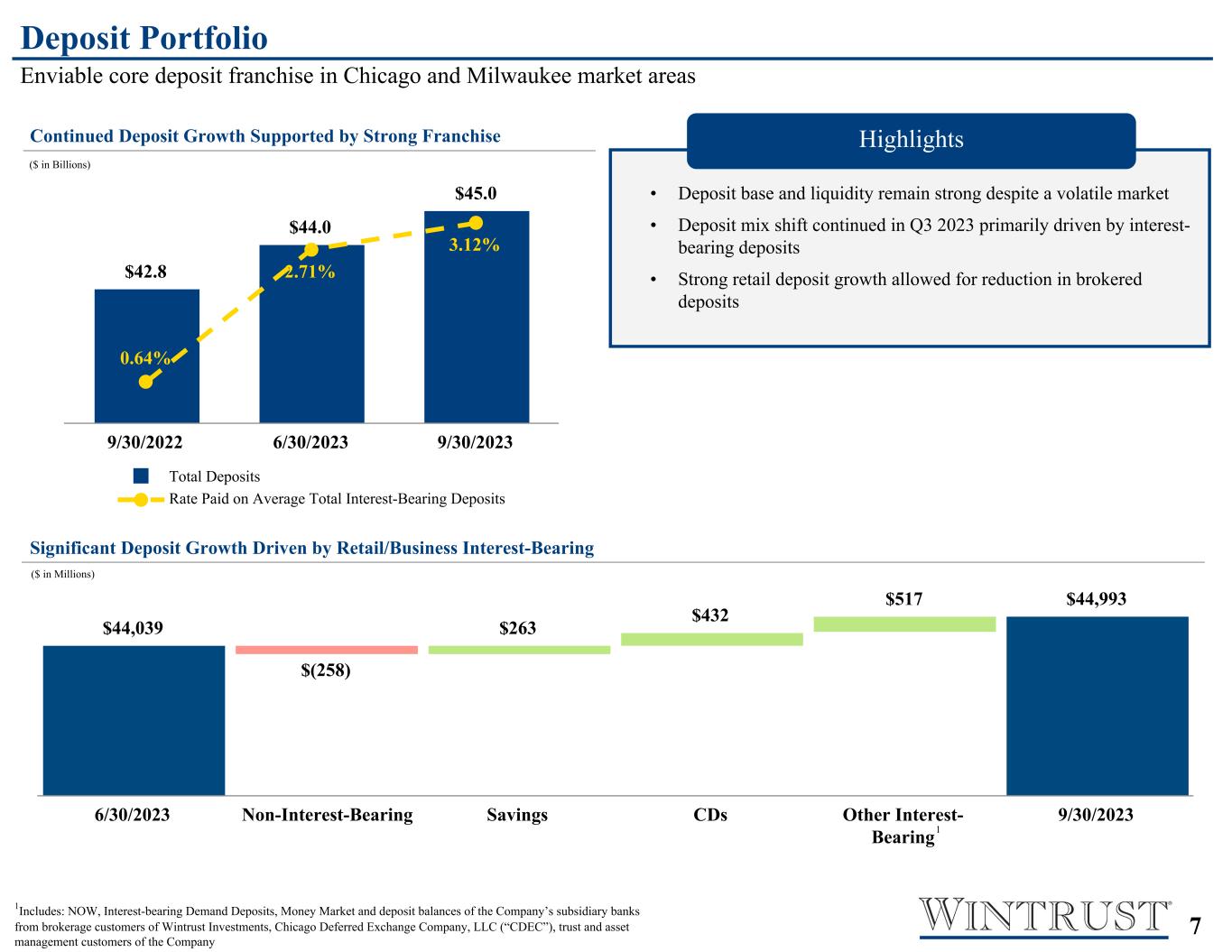

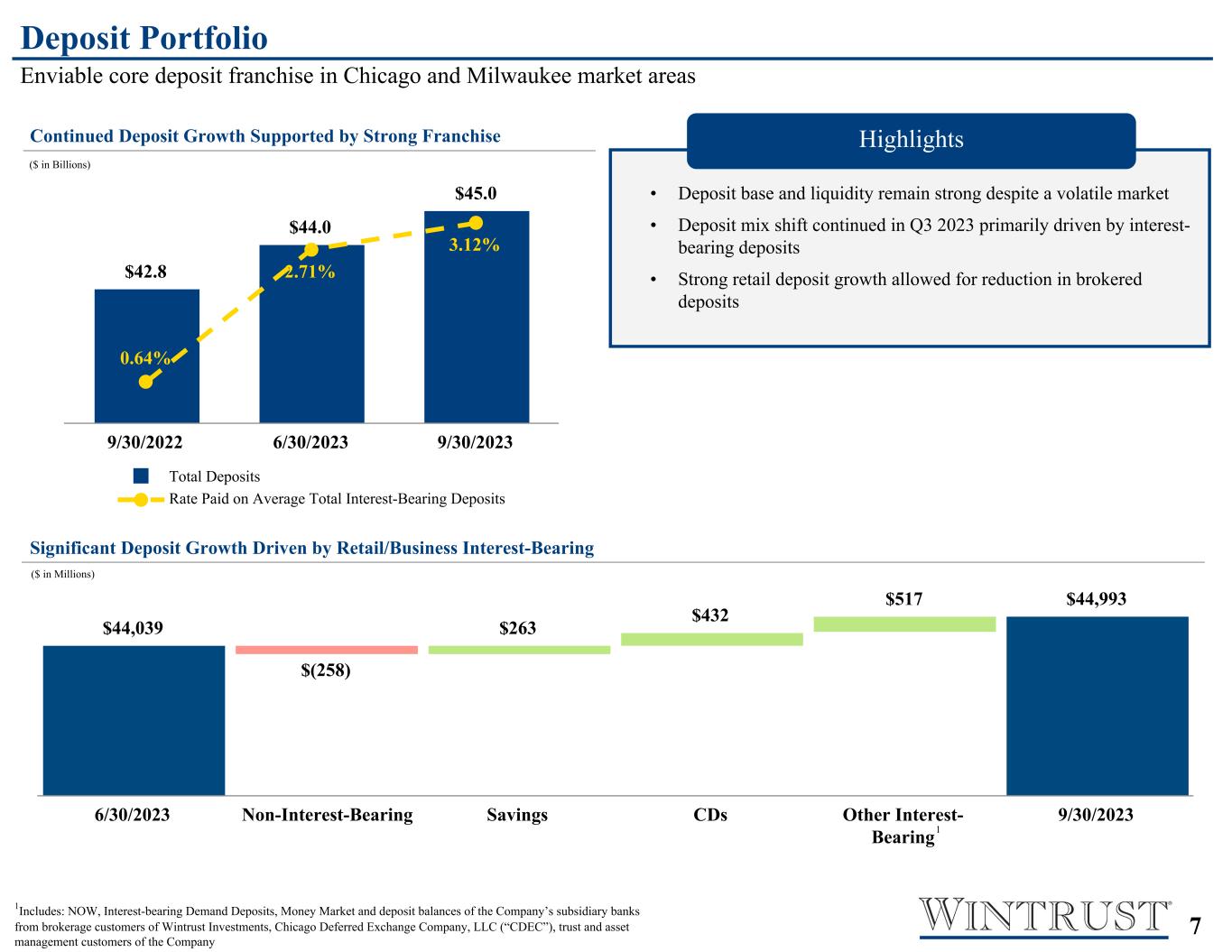

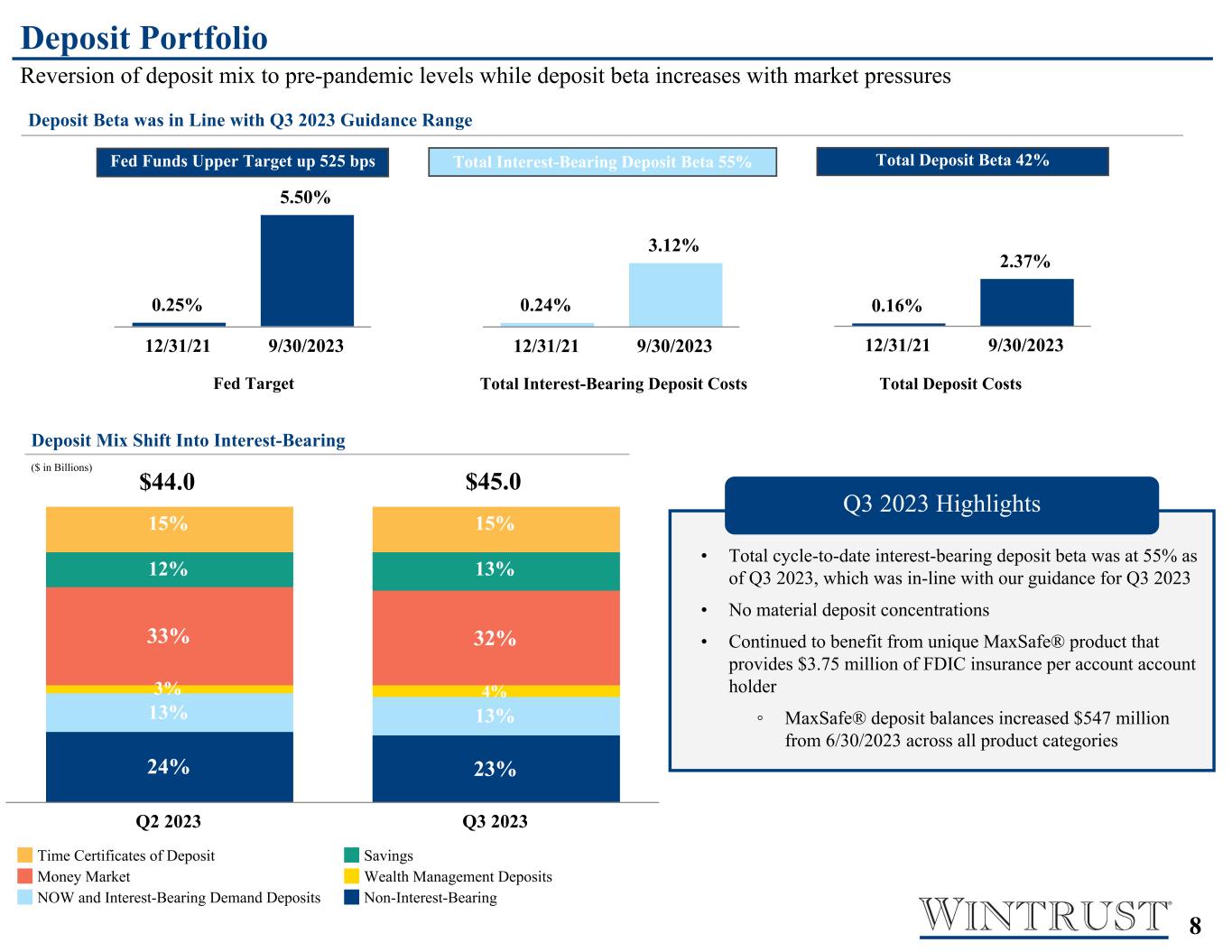

•Total deposits grew by approximately $1 billion, or 9% annualized.

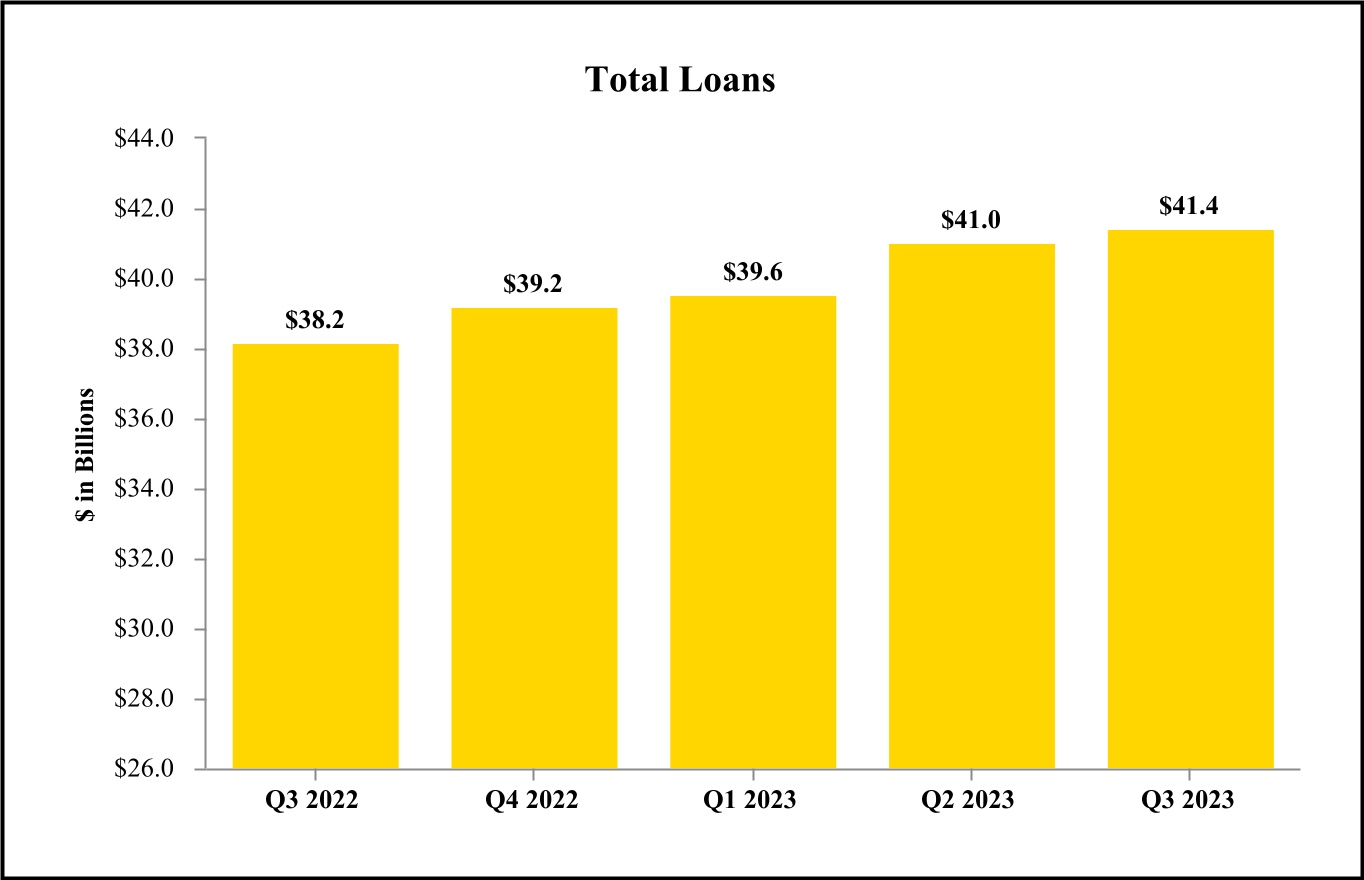

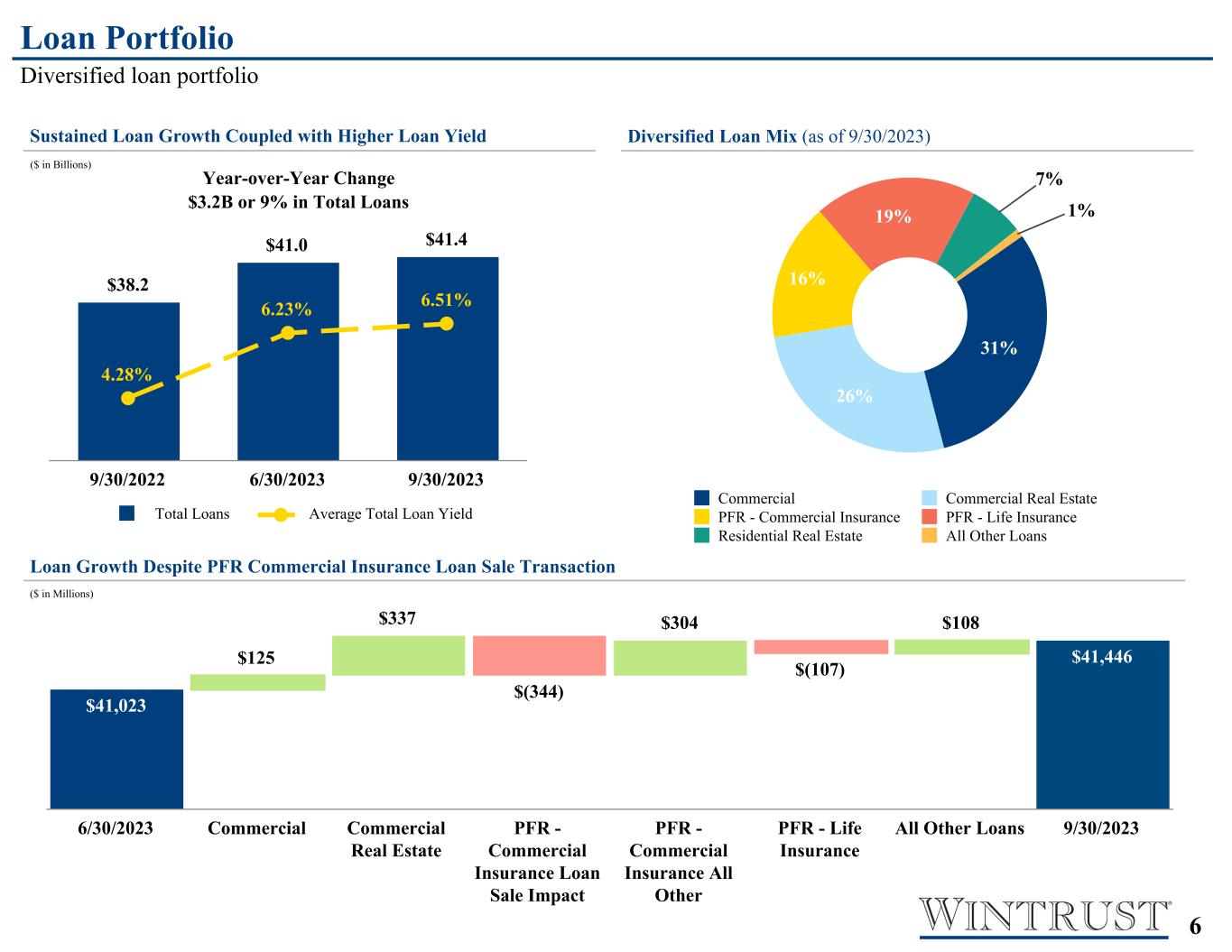

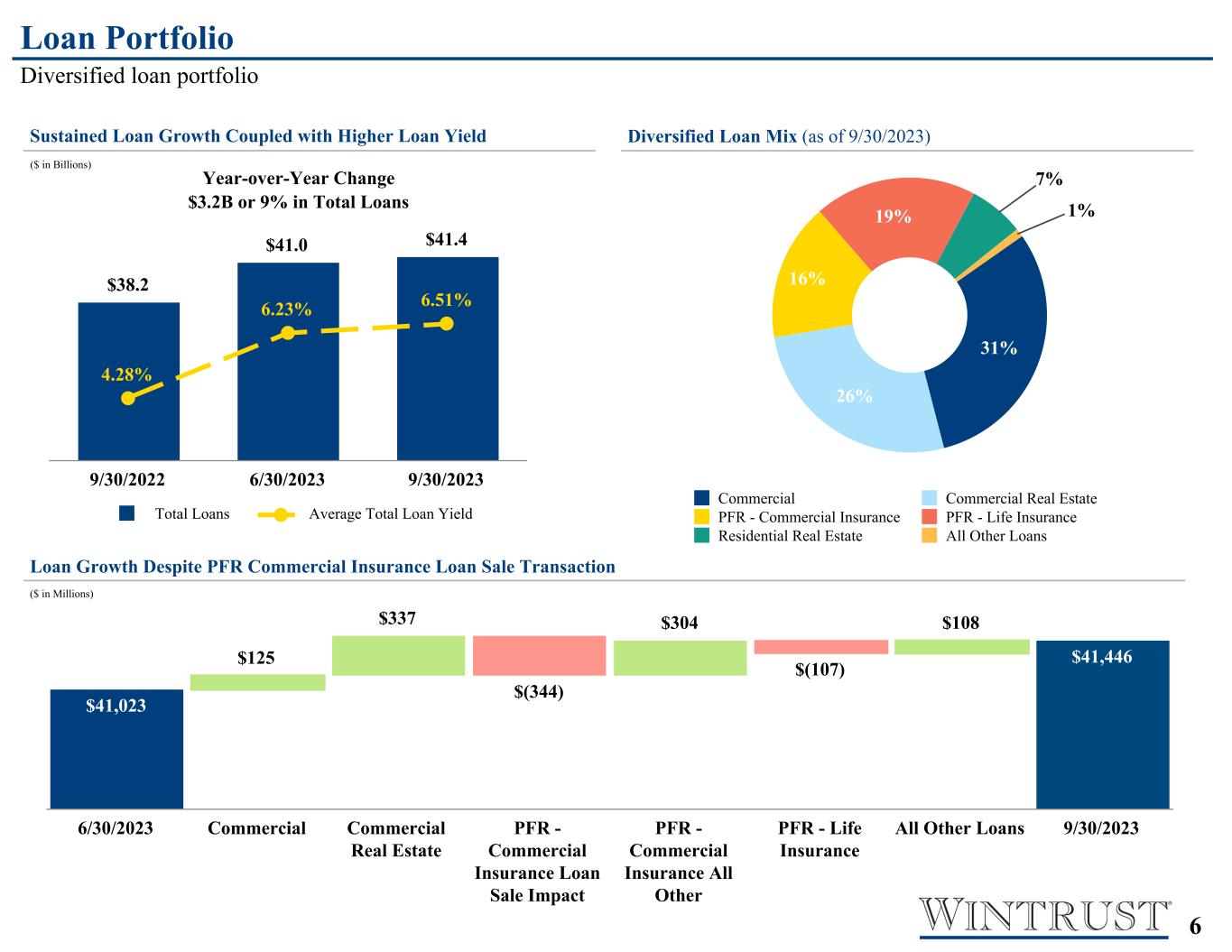

•Total loans increased by approximately $423 million, or 4% annualized. Adjusting for the impact of a loan sale transaction within our property and casualty insurance premium finance receivables portfolio during the third quarter of 2023, total loans would have increased $767 million, or 7% annualized.

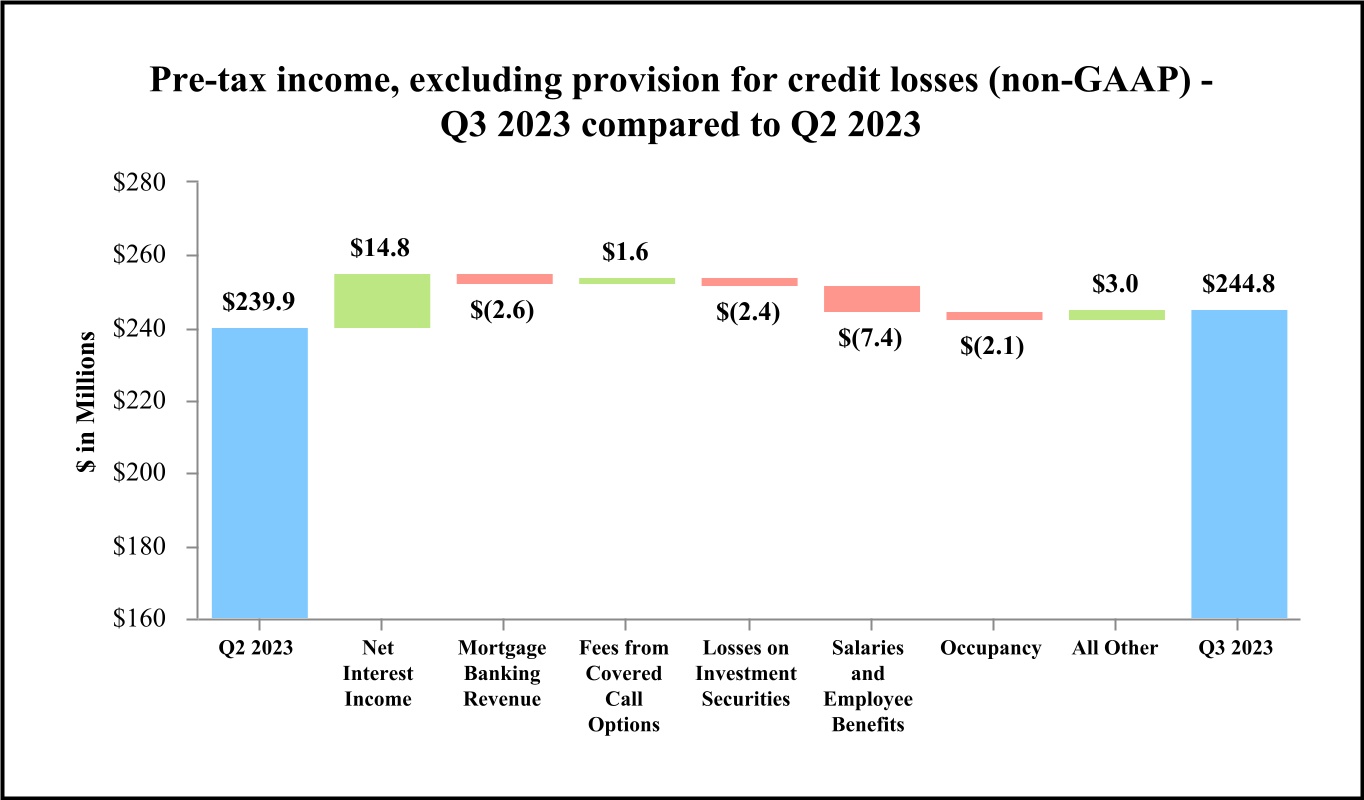

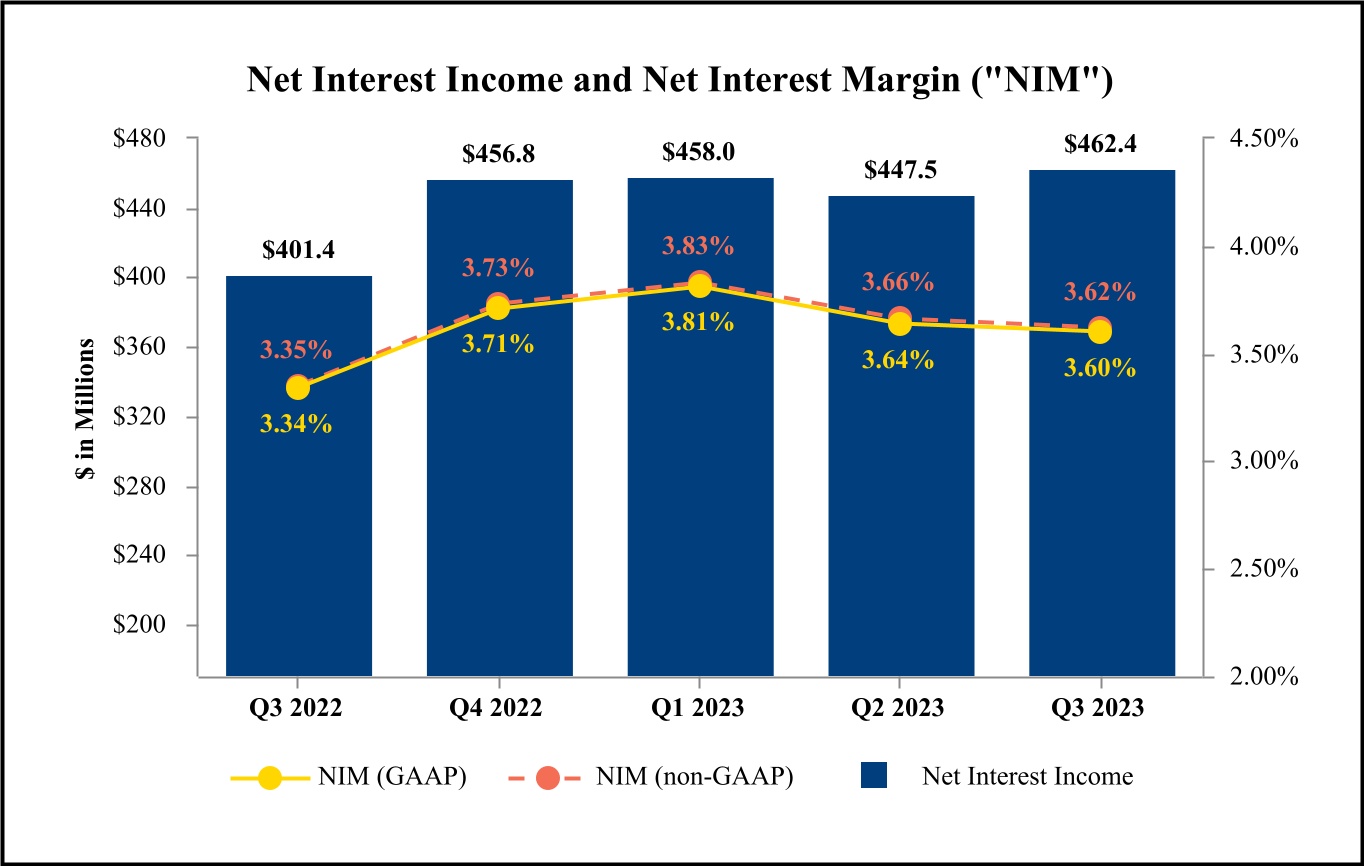

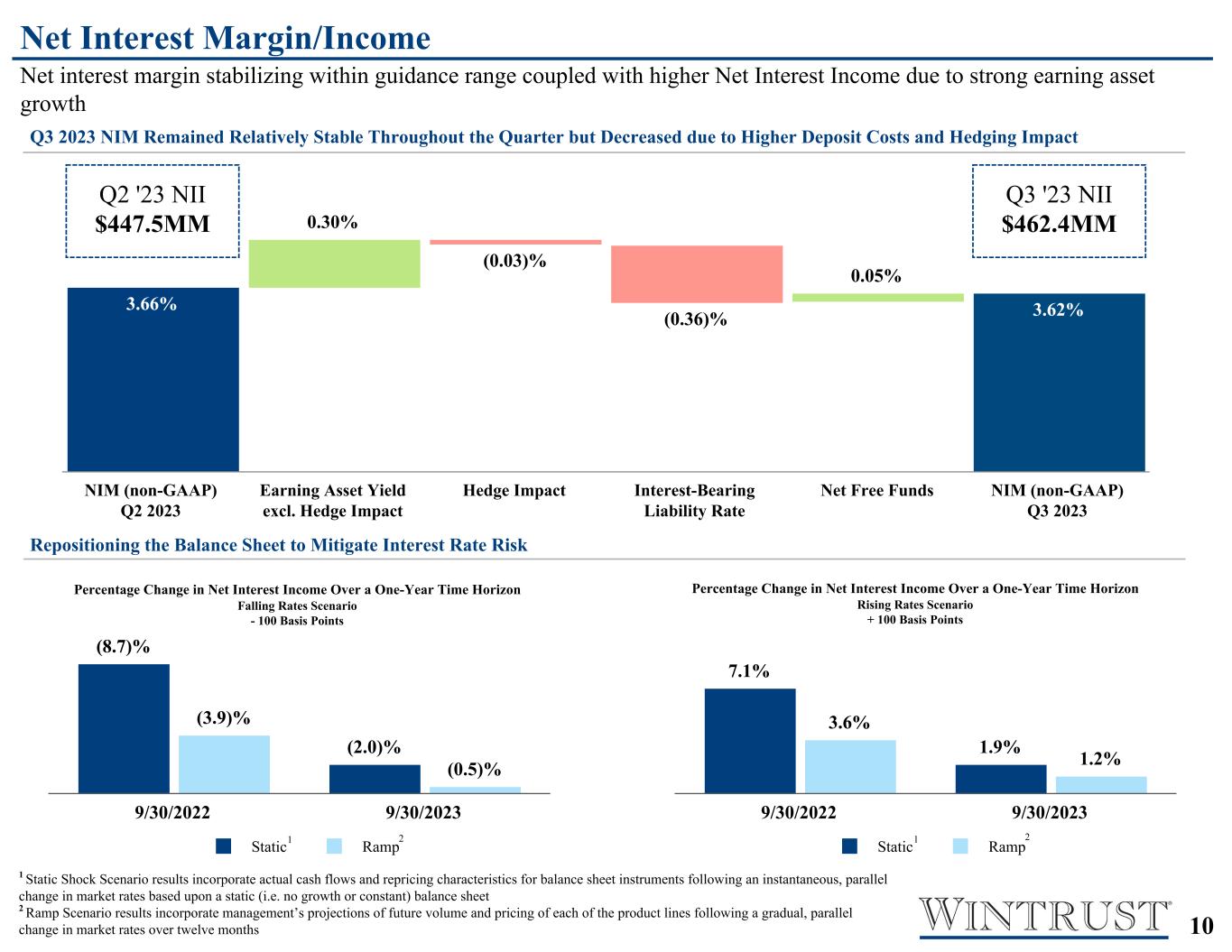

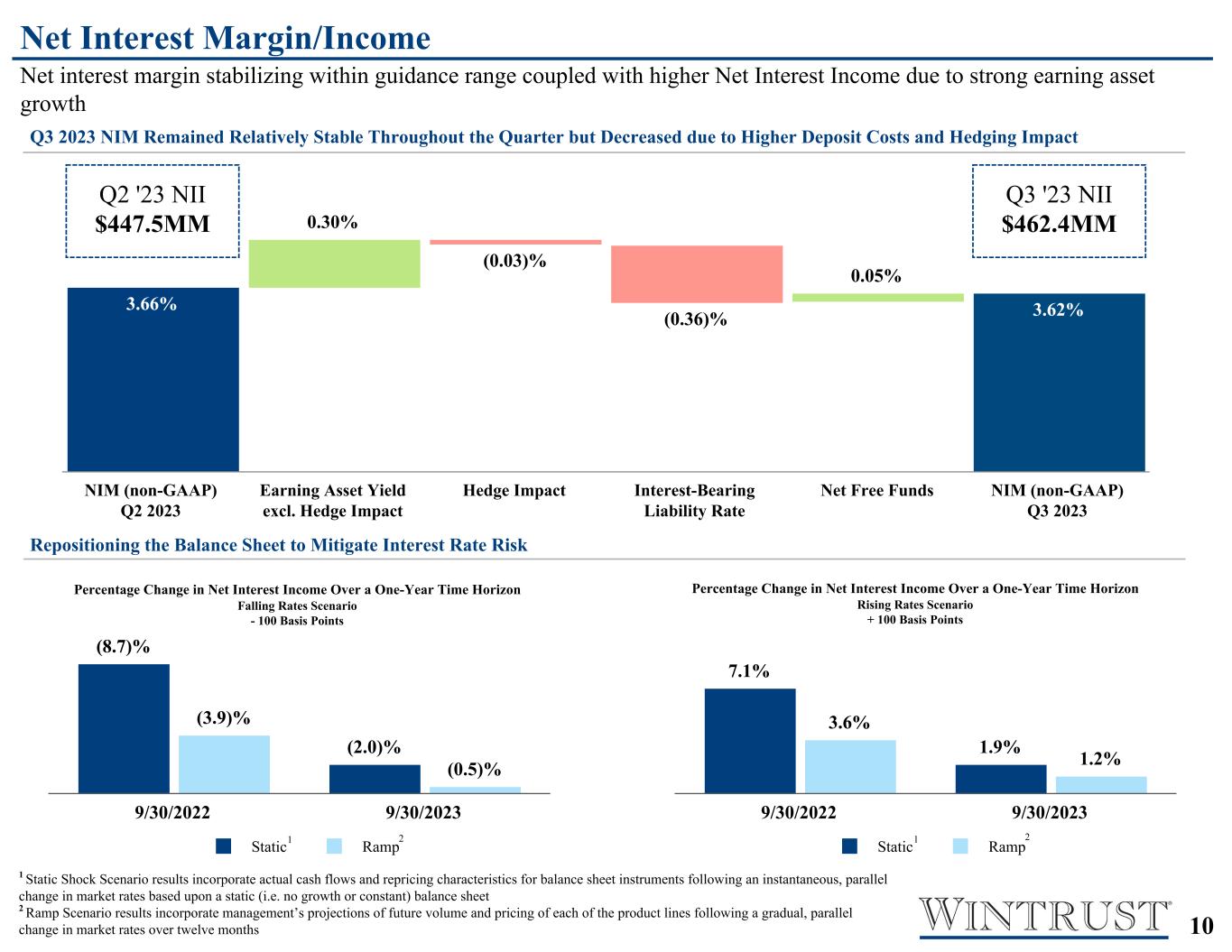

•Record quarterly net interest income of $462.4 million, increasing approximately $14.8 million primarily due to strong growth in earning assets.

◦Net interest margin decreased four basis points to 3.60% (3.62% on a fully taxable-equivalent basis, non-GAAP) during the third quarter of 2023 primarily due to the negative impact of hedging activities.

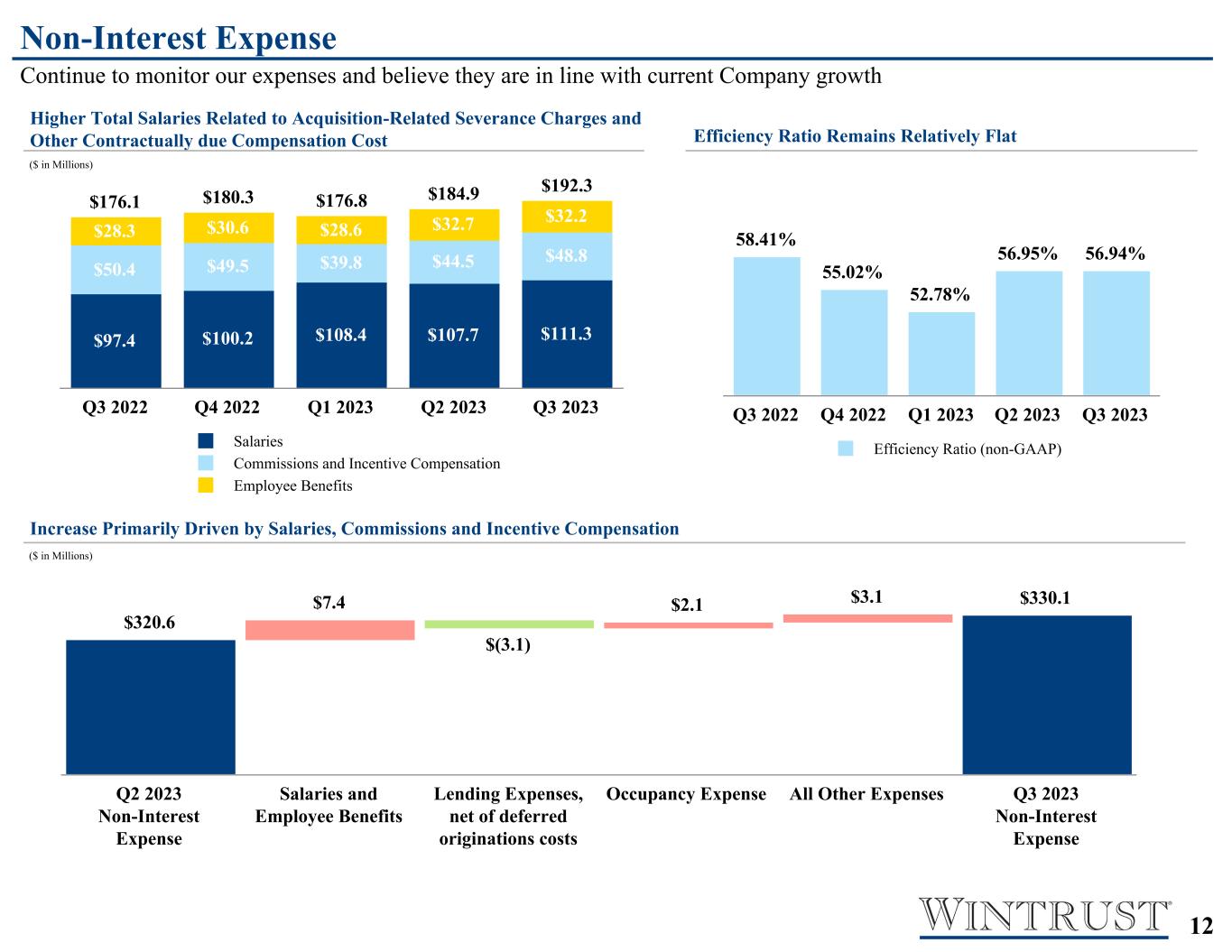

•Non-interest expense was negatively impacted by:

◦Occupancy costs of approximately $2.9 million from the impairment of two Company-owned buildings that are no longer being used.

◦Data processing costs of approximately $1.5 million from the termination of a duplicate service contract related to the acquisition of a wealth management business in 2023.

◦Other salary costs of approximately $1.6 million related to acquisition-related severance charges and other contractually due compensation costs.

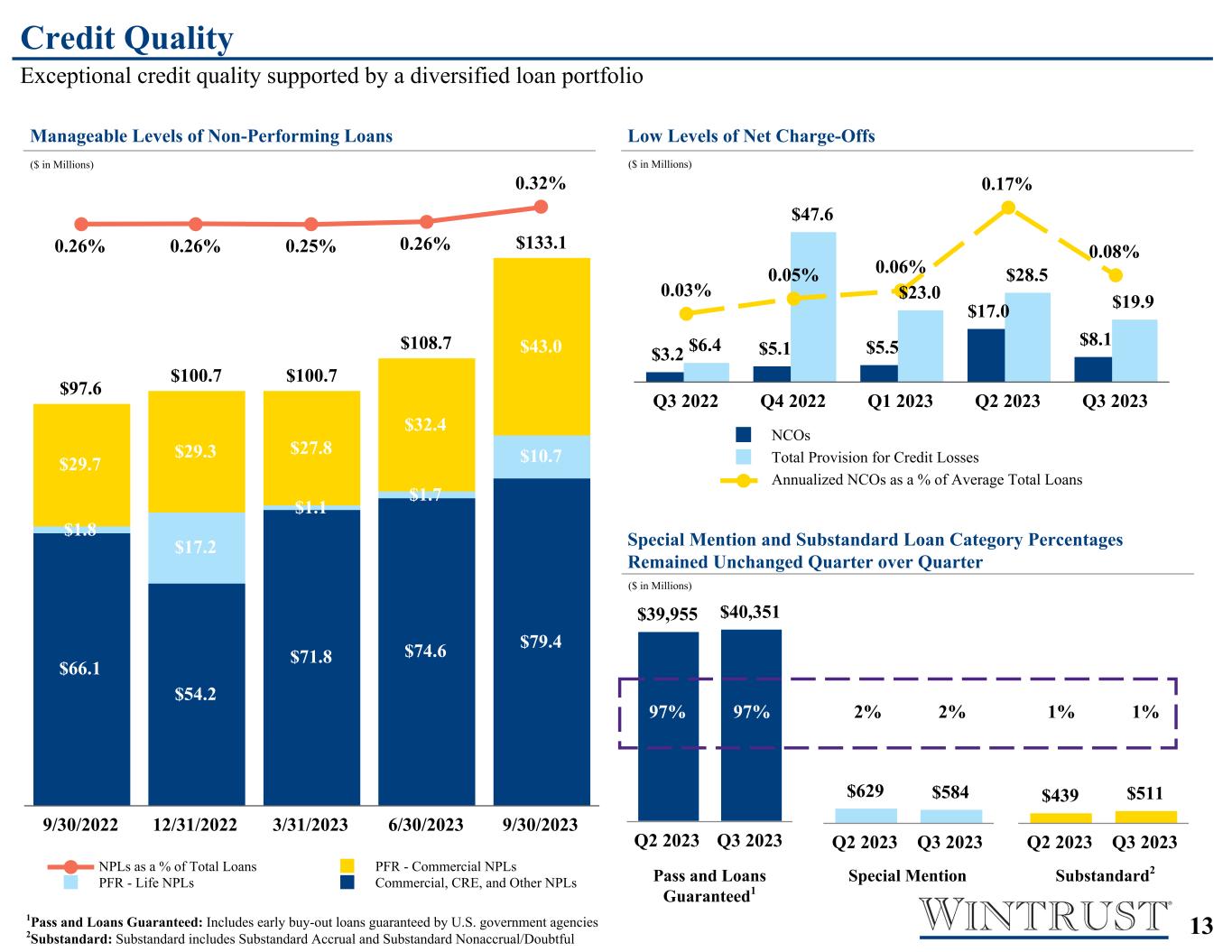

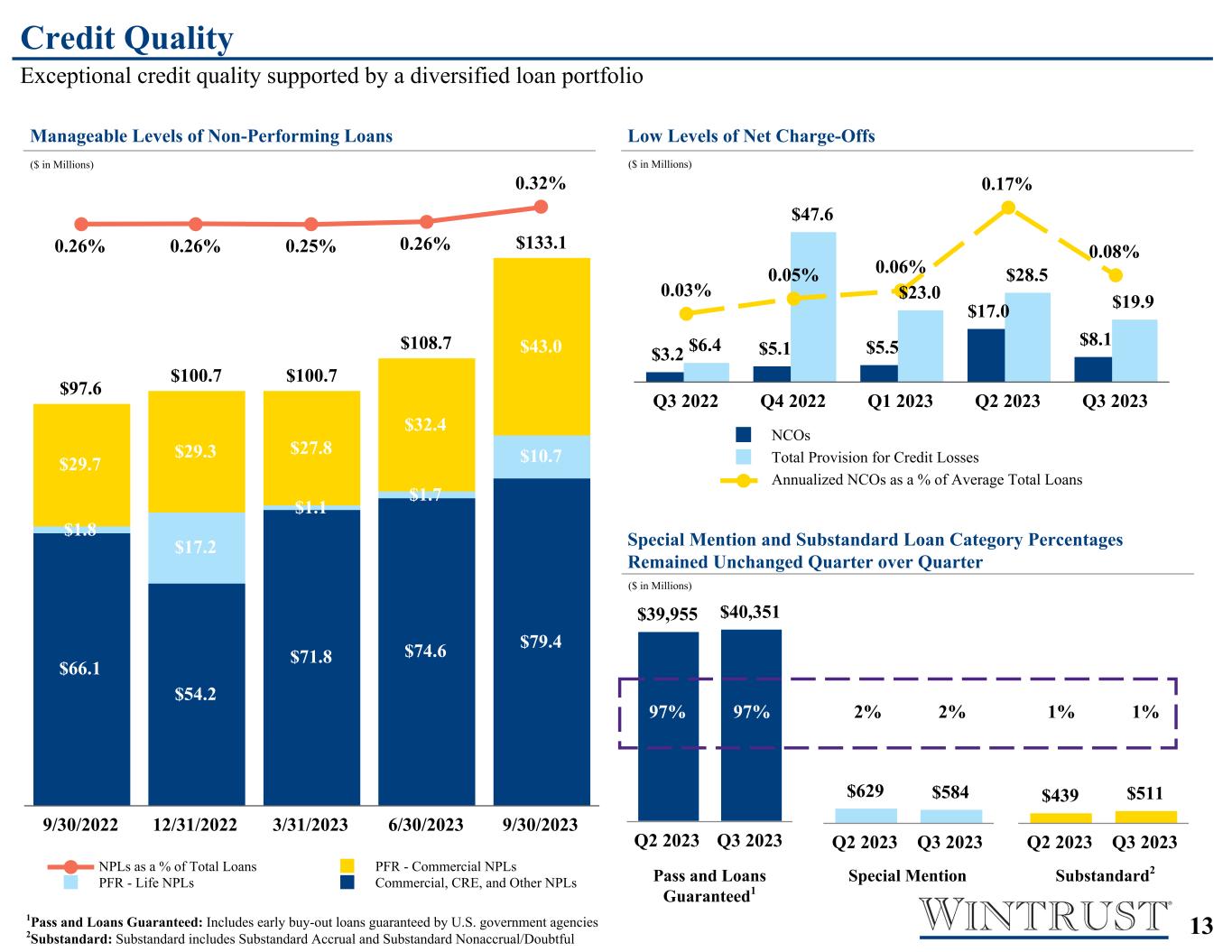

•Provision for credit losses totaled $19.9 million in the third quarter of 2023 as compared to a provision for credit losses of $28.5 million in the second quarter of 2023.

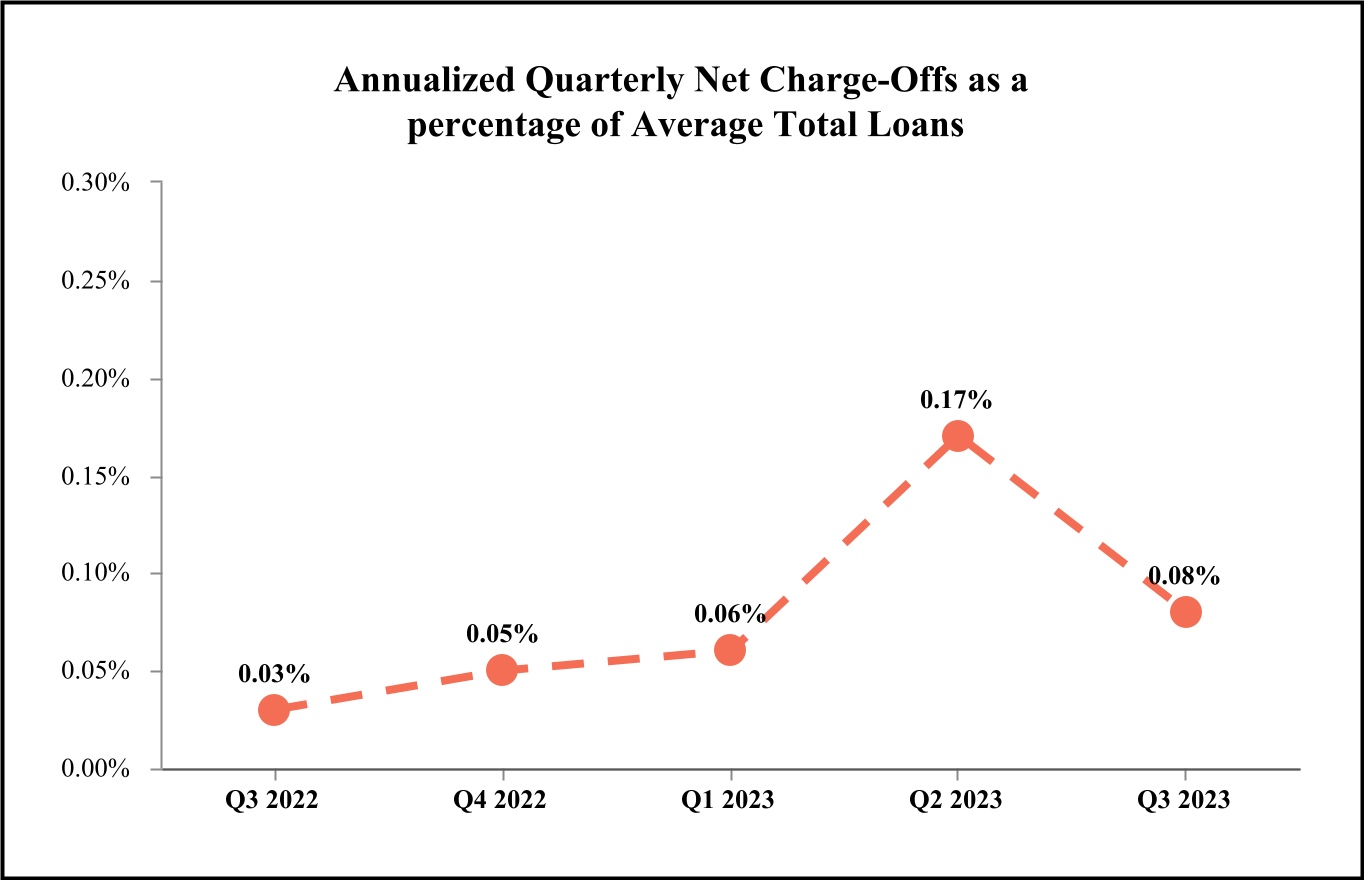

•Net charge-offs totaled $8.1 million or eight basis points of average total loans on an annualized basis in the third quarter of 2023 as compared to $17.0 million or 17 basis points of average total loans on an annualized basis in the second quarter of 2023.

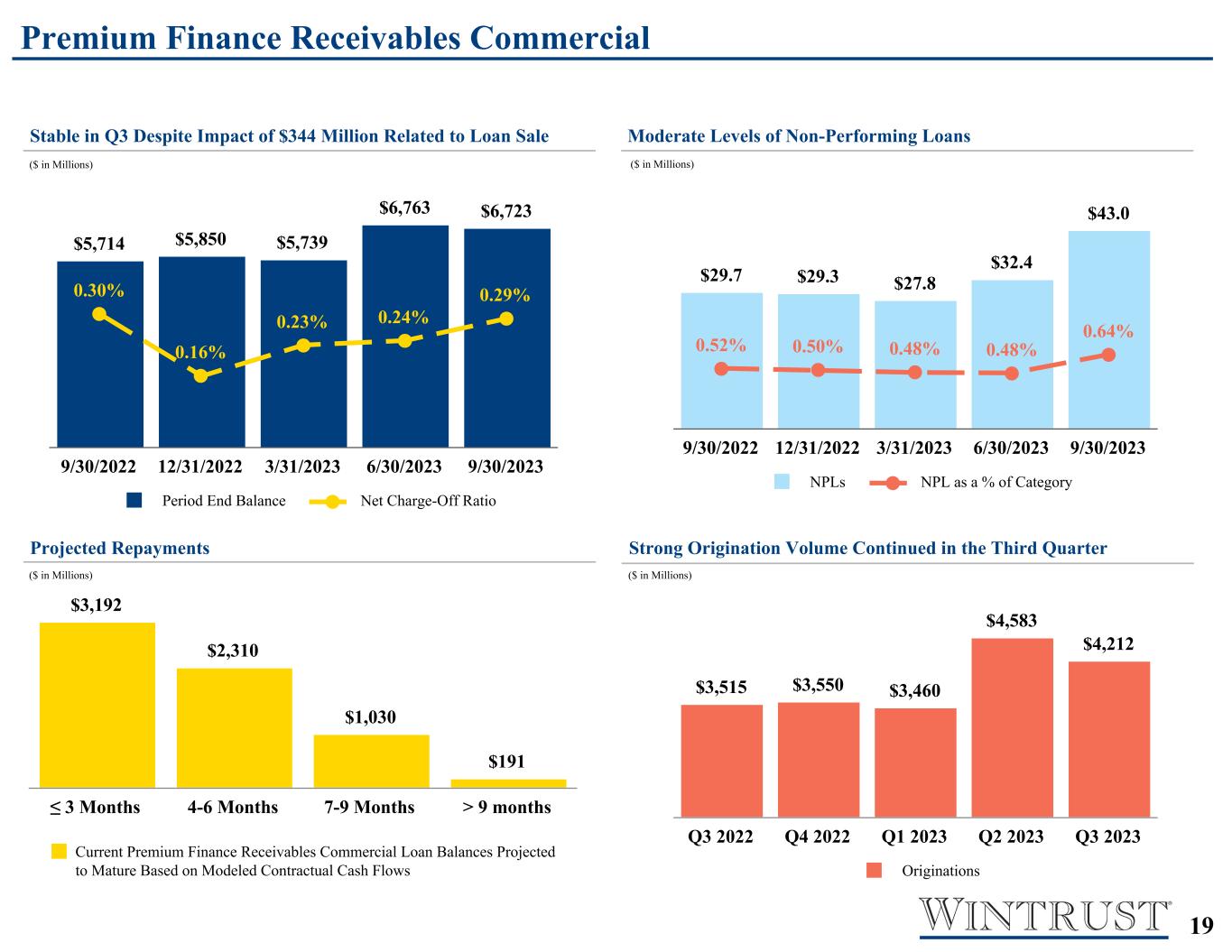

Mr. Crane commented, “By leveraging our customer relationships, market positioning, diversified products and competitive rates, we continued to generate significant deposit growth, increasing deposits approximately $1 billion, or 9% on an annualized basis, in the third quarter of 2023. Growth in retail deposits helped reduce our level of brokered deposits by approximately $392 million during the third quarter of 2023. In addition, deposit growth helped fund approximately $423 million of loan growth during the quarter. This strong loan growth was achieved despite the impact of a loan sale transaction within our property and casualty insurance premium finance receivables portfolio that reduced period-end balances at the end of the third quarter by approximately $344 million. Loan growth came primarily from draws on existing commercial real estate loan facilities as well as growth in our commercial portfolio. Additionally, despite the loan sale transaction noted above, our property and casualty insurance premium finance receivables portfolio ended the quarter relatively unchanged. We remain prudent in our review of credit prospects ensuring our loan growth stays within our conservative credit standards.”

Mr. Crane noted, “We grew our net interest income during the third quarter of 2023 by approximately $14.8 million primarily due to an increase in average earning assets of approximately $1.6 billion. Our net interest margin decreased four basis points during the third quarter, however, three basis points of the decline was due to the impact of our interest rate hedging strategies, which are designed to protect our net interest income if interest rates decline. Deposit pricing pressures moderated in the third quarter of 2023 and we expect that to continue into the fourth quarter. Assuming a similar interest rate environment, we believe our net interest margin will be relatively stable for the remainder of 2023 and entering 2024. The combination of balance sheet growth and a stable net interest margin is expected to continue to grow our net interest income.”

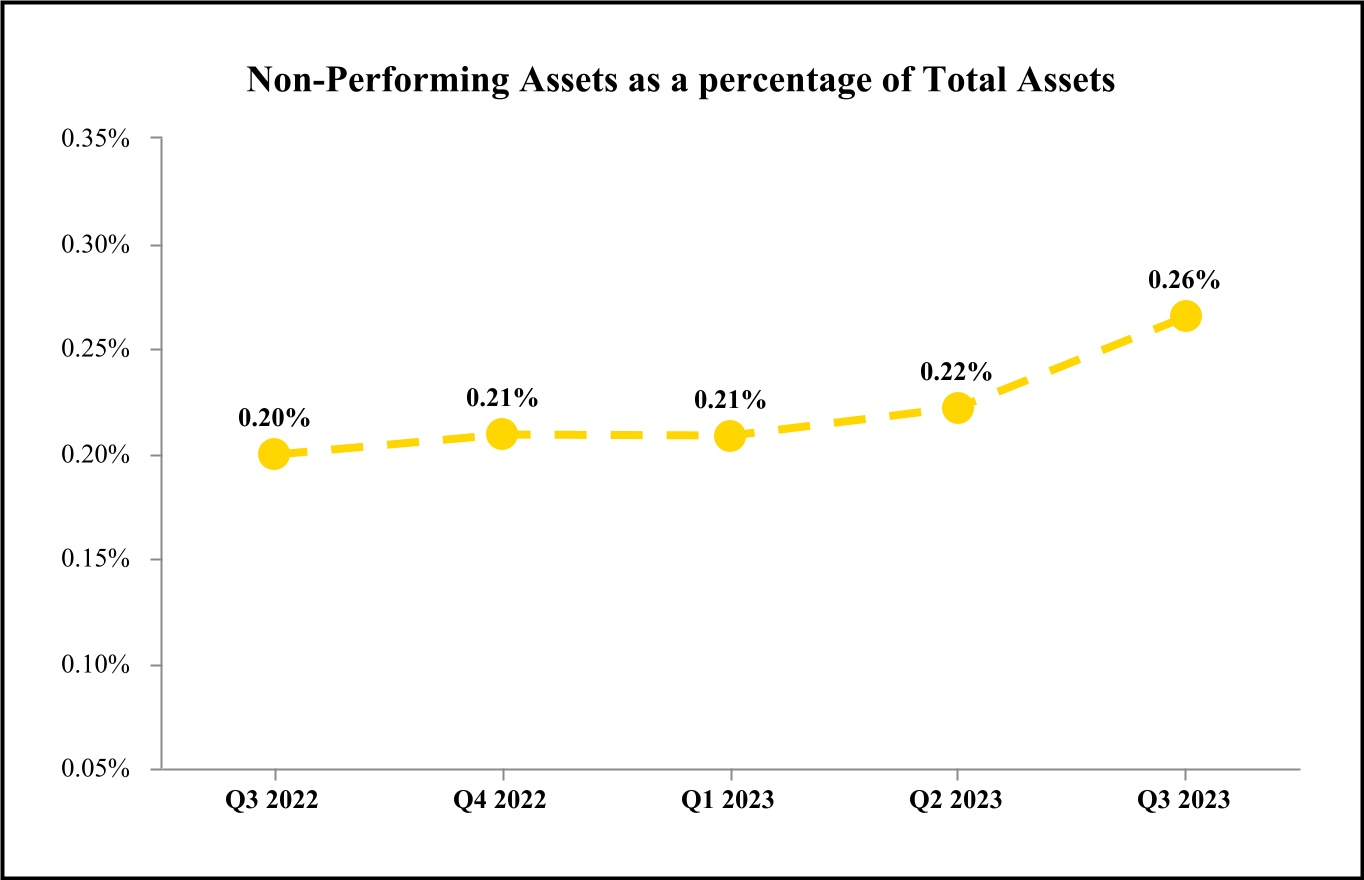

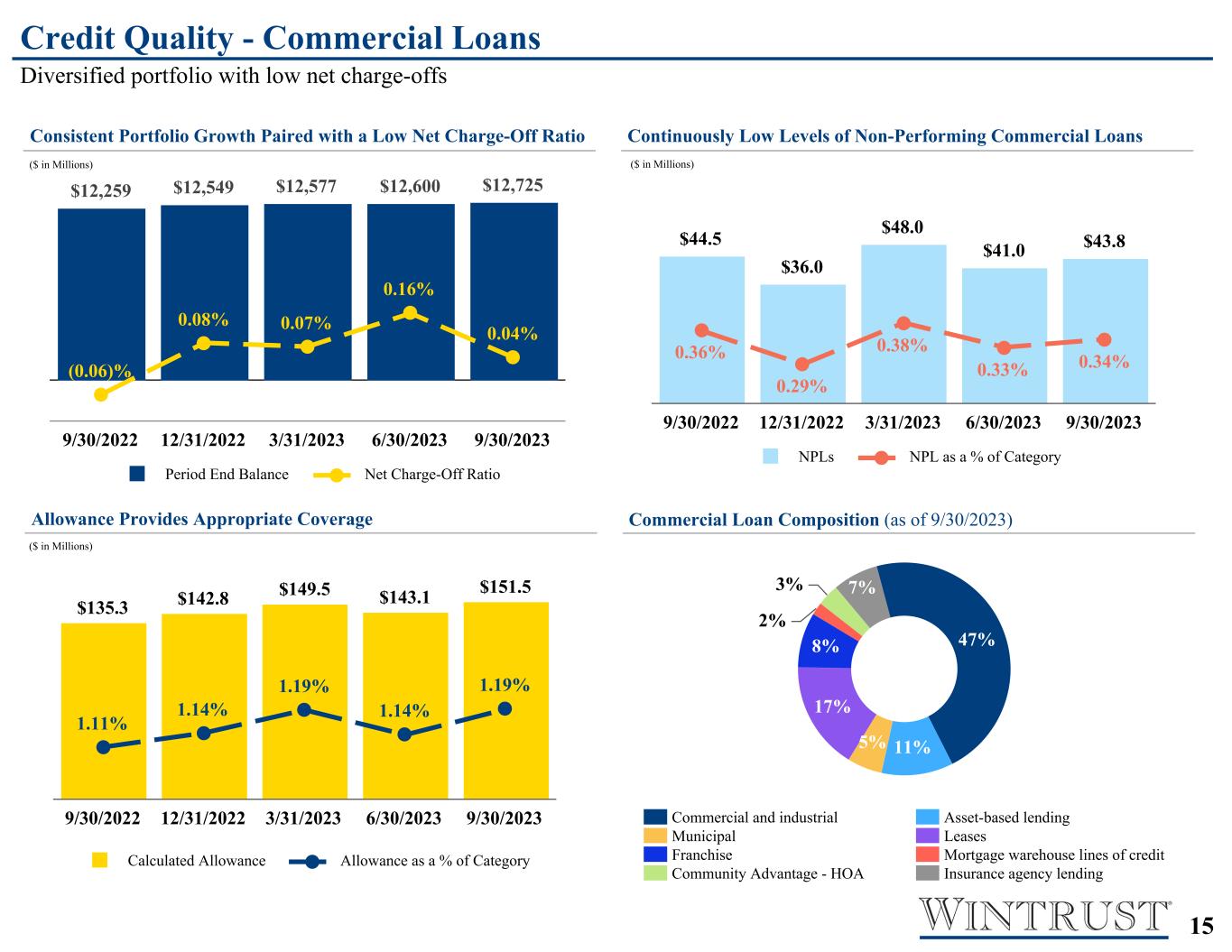

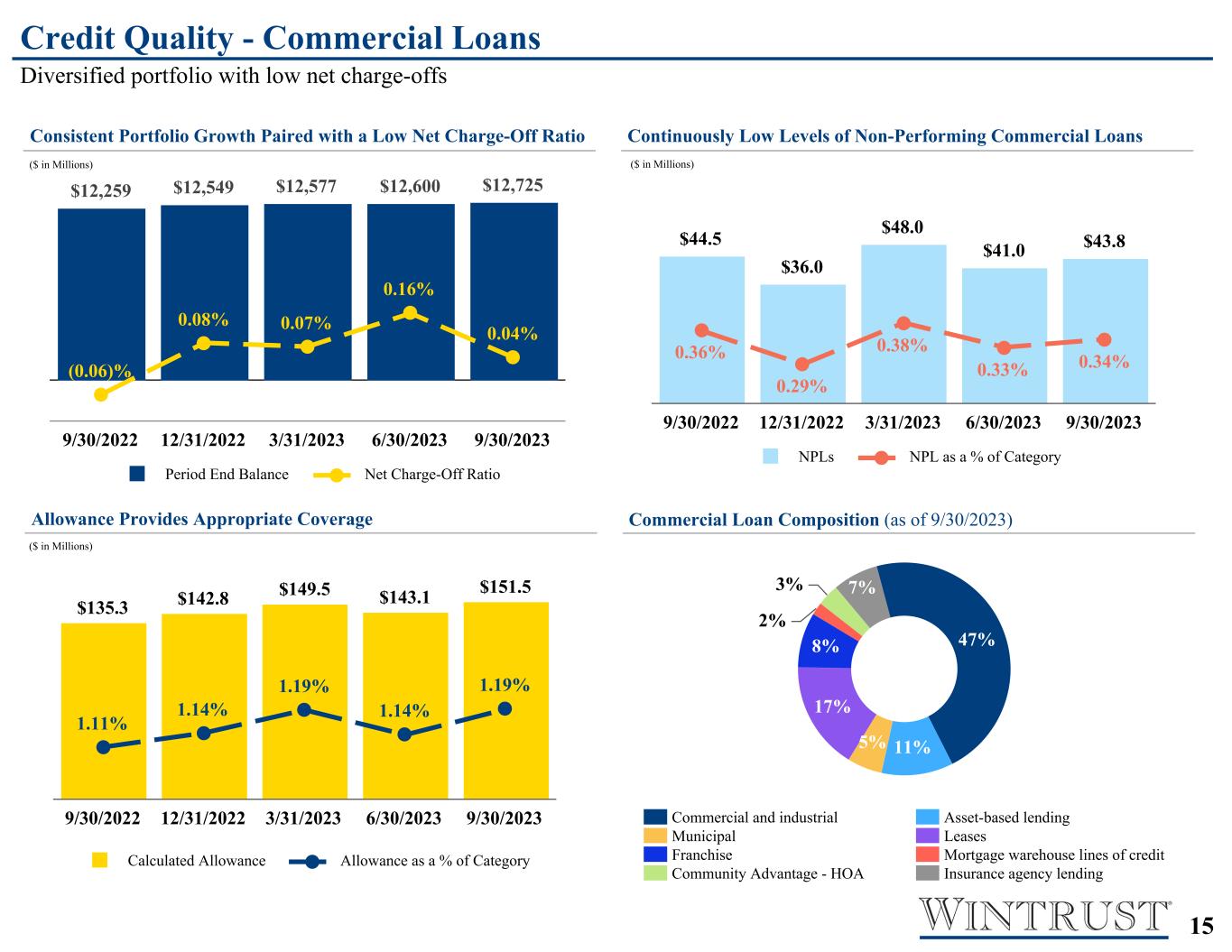

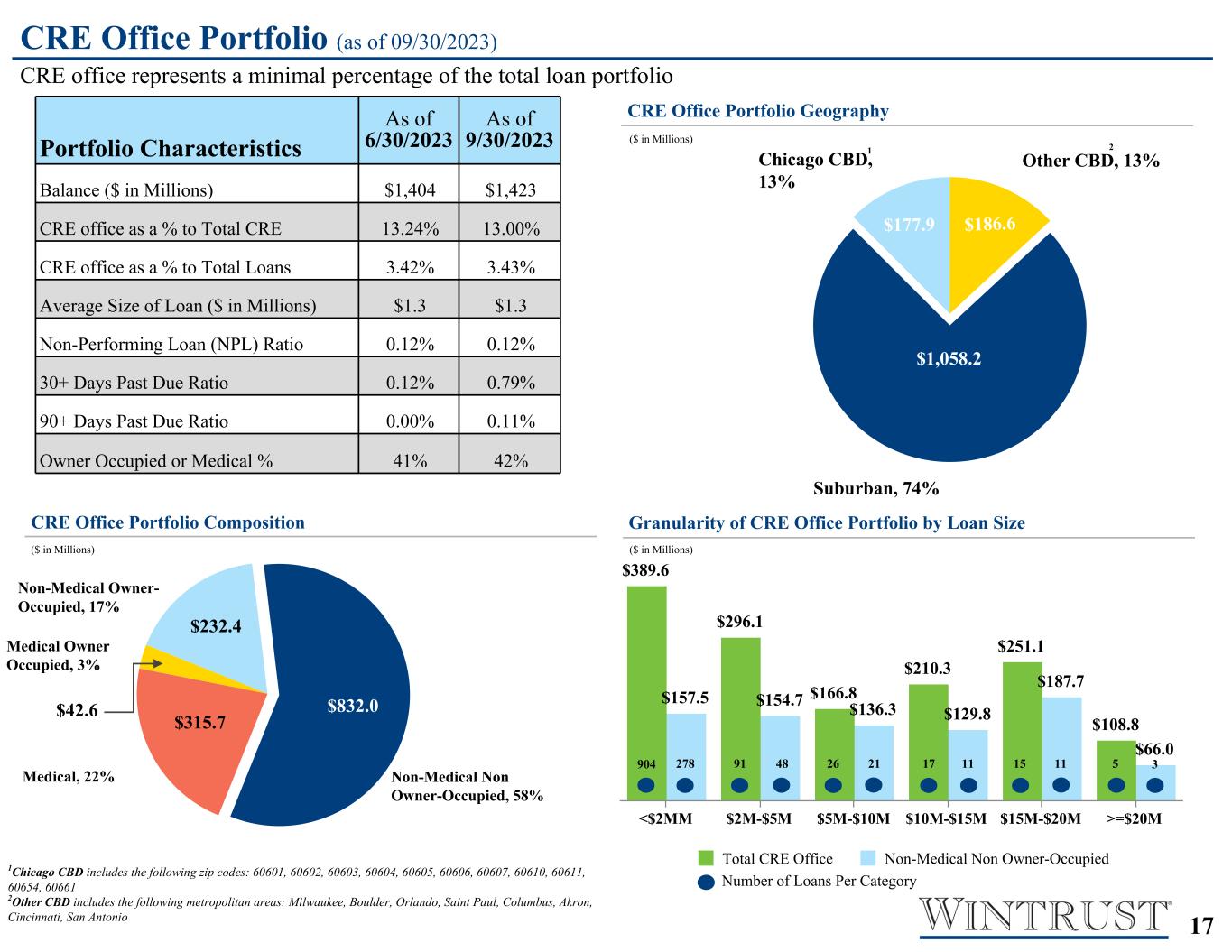

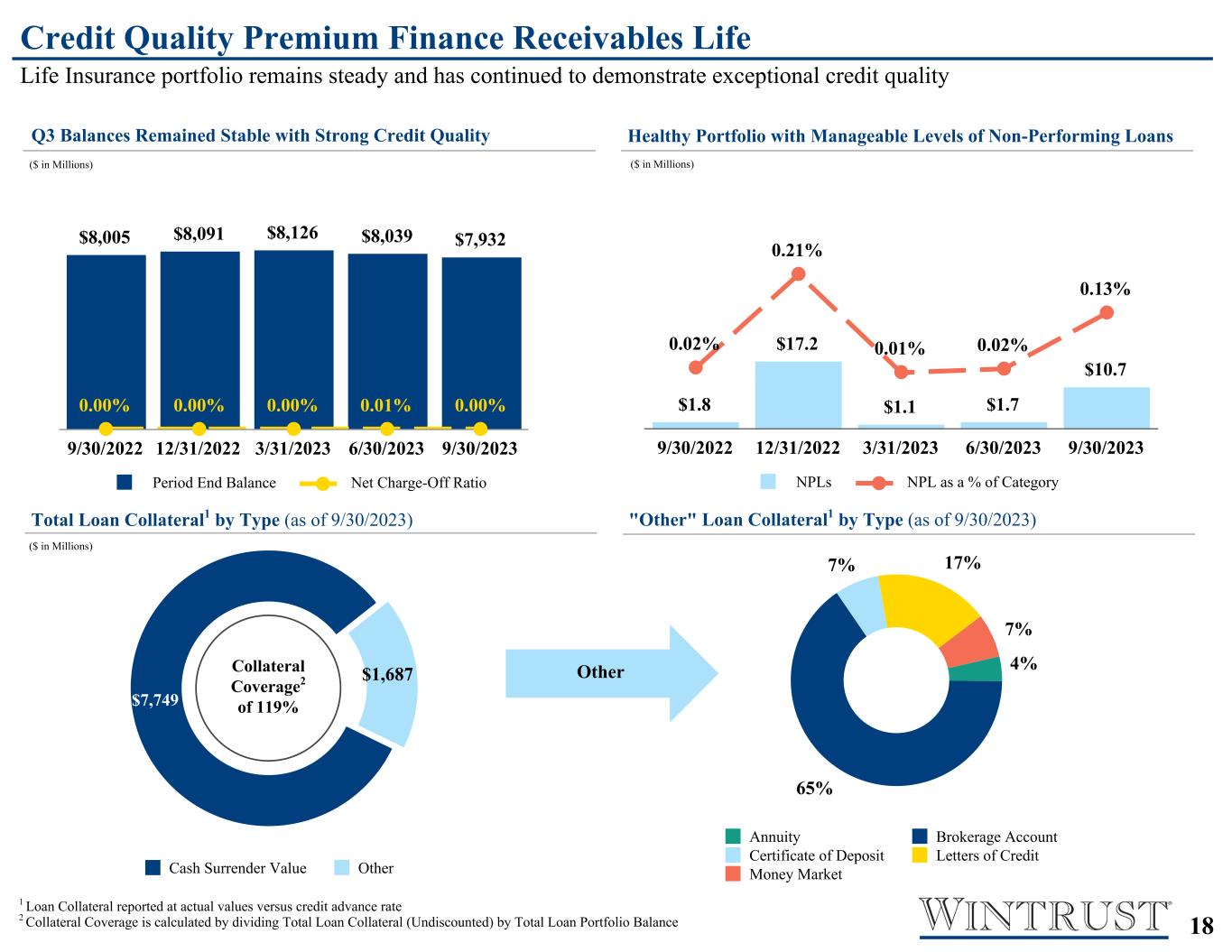

Commenting on credit quality, Mr. Crane stated, “Credit metrics remained strong and at historically low levels. Net charge-offs totaled $8.1 million or eight basis points of average total loans on an annualized basis in the third quarter of 2023 as compared to $17.0 million or 17 basis points of average total loans on an annualized basis in the second quarter of 2023. Non-performing loans totaled $133.1 million, or 0.32% of total loans, at the end of the third quarter of 2023 compared to $108.7 million, or 0.26% of total loans, at the end of the second quarter of 2023. Of the $24.4 million increase in non-performing loans in the third quarter of 2023, $19.6 million is related to the premium finance receivables portfolios in which we ultimately expect minimal losses. The allowance for credit losses on our core loan portfolio as of September 30, 2023 was approximately 1.51% of the outstanding balance (see Table 12 for additional information). We believe that the Company’s reserves remain appropriate and we remain diligent in our review of credit.”

Mr. Crane concluded, “I am very pleased with our results for the third quarter of 2023. Net income for the quarter was the second highest in our history, behind only the net income reported in the first quarter of 2023. Total loans as of September 30, 2023 were $739 million higher than average total loans in the third quarter of 2023, which is expected to help continue our momentum into the fourth quarter. We continue to win business and expand our franchise, keeping us well-positioned in the markets we serve. This will help grow our deposit and loan relationships, which should generate higher net revenues and earnings in the coming quarters. As a result, our capital ratios will benefit from the increased earnings.”

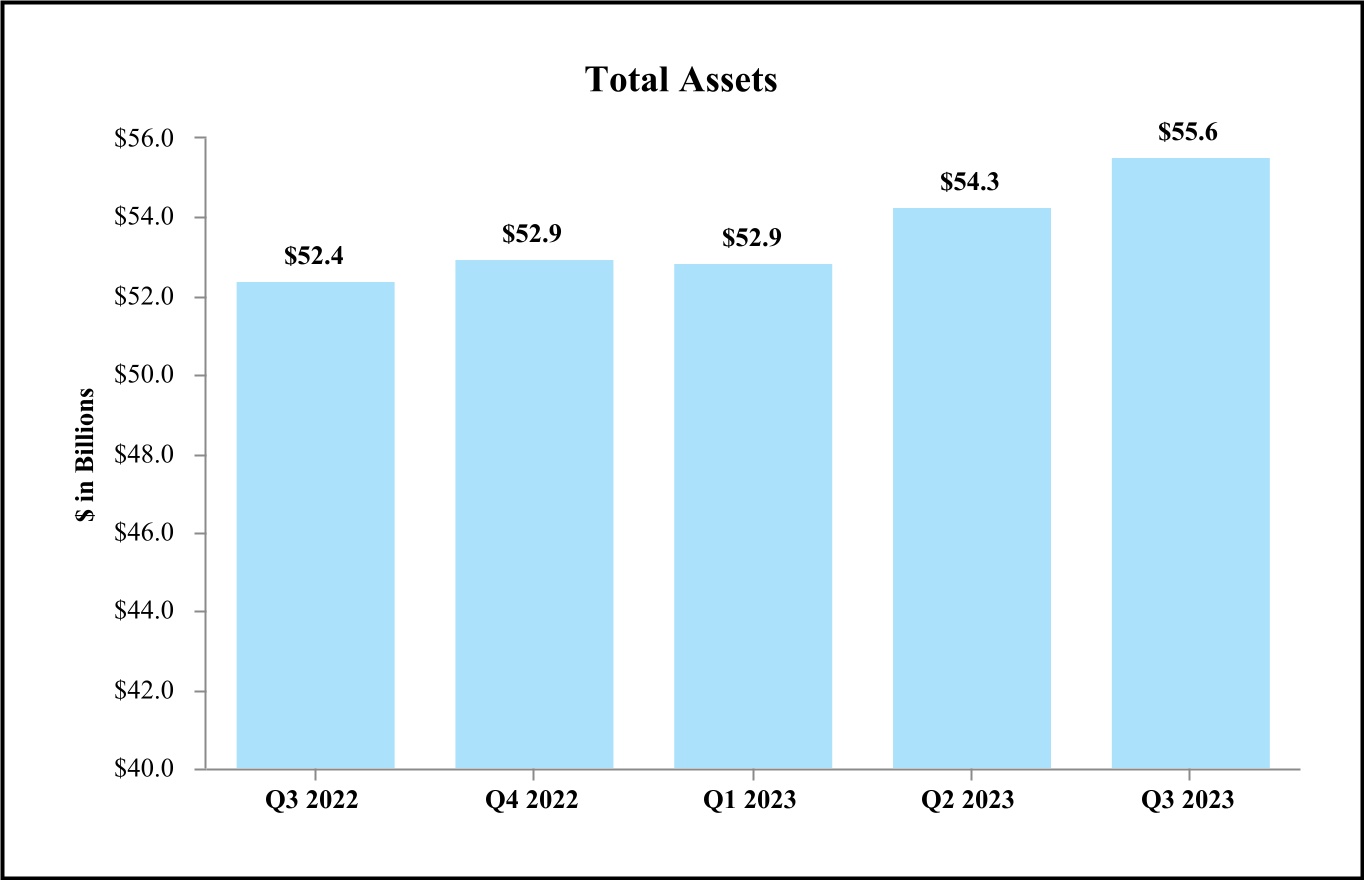

The graphs below illustrate certain financial highlights of the third quarter of 2023 as well as historical financial performance. See “Supplemental Non-GAAP Financial Measures/Ratios” at Table 17 for additional information with respect to non-GAAP financial measures/ratios, including the reconciliations to the corresponding GAAP financial measures/ratios.

SUMMARY OF RESULTS:

BALANCE SHEET

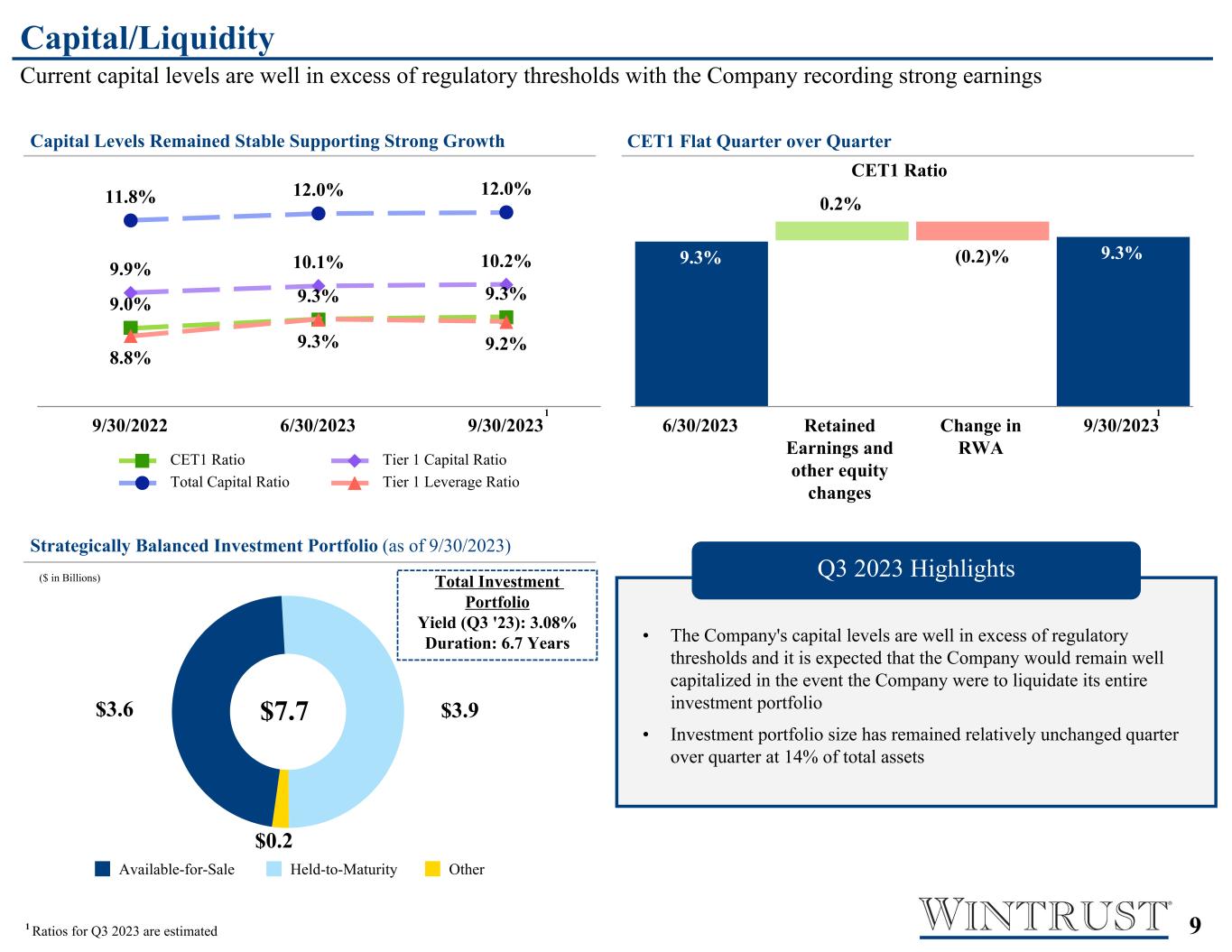

Total assets increased $1.3 billion in the third quarter of 2023 as compared to the second quarter of 2023. Total loans increased by $422.6 million as compared to the second quarter of 2023. The increase in loans was primarily the result of draws on existing commercial real estate loan facilities as well as growth in the commercial portfolio. Additionally, despite a loan sale transaction that reduced outstanding balances at the end of the third quarter of 2023 by $344 million, the property and casualty insurance premium finance receivables portfolio ended the quarter relatively unchanged. In the third quarter of 2023, the Company purchased securities, resulting in a $480.7 million increase in investment securities.

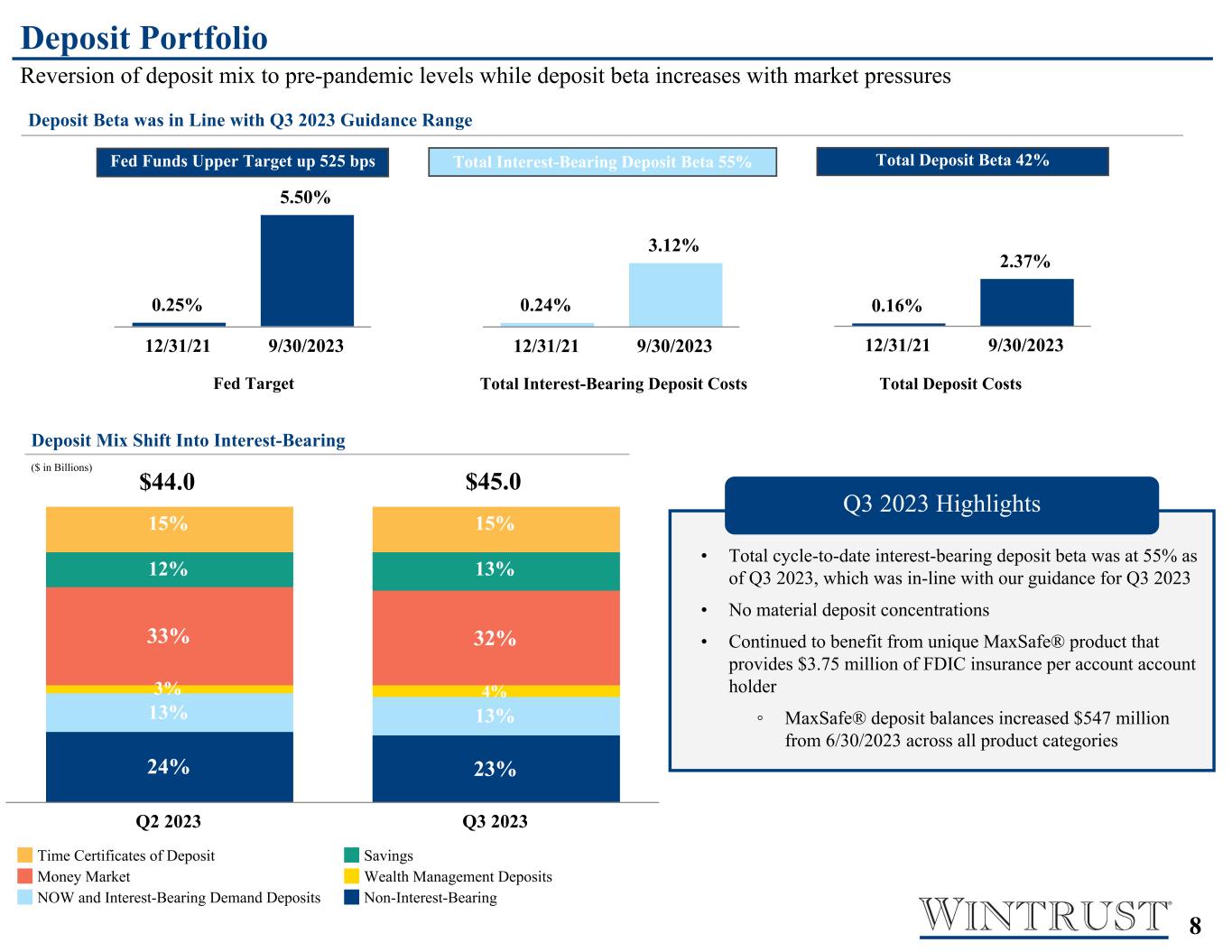

Total liabilities increased by $1.3 billion in the third quarter of 2023 as compared to the second quarter of 2023 primarily due to a $1.0 billion increase in total deposits. Non-interest bearing deposits as a percentage of total deposits was 23% at September 30, 2023 compared to 24% at June 30, 2023 as deposit growth came primarily from interest bearing deposit categories. Net outflows from non-interest bearing deposits stabilized during the third quarter of 2023 as average non-interest bearing deposits during the third quarter of 2023 essentially equaled the amount at the end of the second quarter of 2023 at $10.6 billion.

For more information regarding changes in the Company’s balance sheet, see Consolidated Statements of Condition and Table 1 through Table 3 in this report.

NET INTEREST INCOME

For the third quarter of 2023, net interest income totaled $462.4 million, an increase of $14.8 million as compared to the second quarter of 2023. The $14.8 million increase in net interest income in the third quarter of 2023 compared to the second quarter of 2023 was primarily due to a $1.6 billion increase in average earning assets and one additional day in the quarter.

Net interest margin was 3.60% (3.62% on a fully taxable-equivalent basis, non-GAAP) during the third quarter of 2023 compared to 3.64% (3.66% on a fully taxable-equivalent basis, non-GAAP) during the second quarter of 2023. The net interest margin decrease as compared to the second quarter of 2023 was primarily due to the negative impact of hedging activities as well as a 36 basis point increase in the rate paid on interest-bearing liabilities. This decrease was partially offset by a 27 basis point increase in yield on earning assets and a five basis point increase in the net free funds contribution. The 36 basis point increase on the rate paid on interest-bearing liabilities in the third quarter of 2023 as compared to the second quarter of 2023 was primarily due to a 41 basis point increase in the rate paid on interest-bearing deposits primarily related to the increasing rate environment. The 27 basis point increase in the yield on earning assets in the third quarter of 2023 as compared to the second quarter of 2023 was primarily due to a 28 basis point expansion on loan yields and 41 basis point increase in liquidity management asset yield.

For more information regarding net interest income, see Table 4 through Table 8 in this report.

ASSET QUALITY

The allowance for credit losses totaled $399.5 million as of September 30, 2023, an increase of $11.7 million as compared to $387.8 million as of June 30, 2023. A provision for credit losses totaling $19.9 million was recorded for the third quarter of 2023 as compared to $28.5 million recorded in the second quarter of 2023. For more information regarding the allowance for credit losses and provision for credit losses, see Table 11 in this report.

Management believes the allowance for credit losses is appropriate to account for expected credit losses. The Current Expected Credit Losses (“CECL”) accounting standard requires the Company to estimate expected credit losses over the life of the Company’s financial assets as of the reporting date. There can be no assurances, however, that future losses will not significantly exceed the amounts provided for, thereby affecting future results of operations. A summary of the allowance for credit losses calculated for the loan components in each portfolio as of September 30, 2023, June 30, 2023, and March 31, 2023 is shown on Table 12 of this report.

Net charge-offs totaled $8.1 million in the third quarter of 2023, as compared to $17.0 million of net charge-offs in the second quarter of 2023. The decrease in net charge-offs during the third quarter of 2023 was primarily the result of the sale to external parties of certain credits within the commercial real estate portfolio during the second quarter of 2023, which resulted in approximately $8.0 million in charge-offs. Net charge-offs as a percentage of average total loans were eight basis points in the third quarter of 2023 on an annualized basis compared to 17 basis points on an annualized basis in the second quarter of 2023. For more information regarding net charge-offs, see Table 10 in this report.

The Company’s delinquency rates remain low and manageable. For more information regarding past due loans, see Table 13 in this report.

Non-performing assets totaled $147.2 million and comprised 0.26% of total assets as of September 30, 2023, as compared to $120.3 million as of June 30, 2023. Non-performing loans totaled $133.1 million, or 0.32% of total loans, at September 30, 2023. The increase in the third quarter was primarily due to an increase in loans 90 days or more past due but still fully collateralized within the life insurance premium finance receivables portfolio, and certain credits within the property and casualty insurance premium finance receivables portfolio becoming nonaccrual. For more information regarding non-performing assets, see Table 14 in this report.

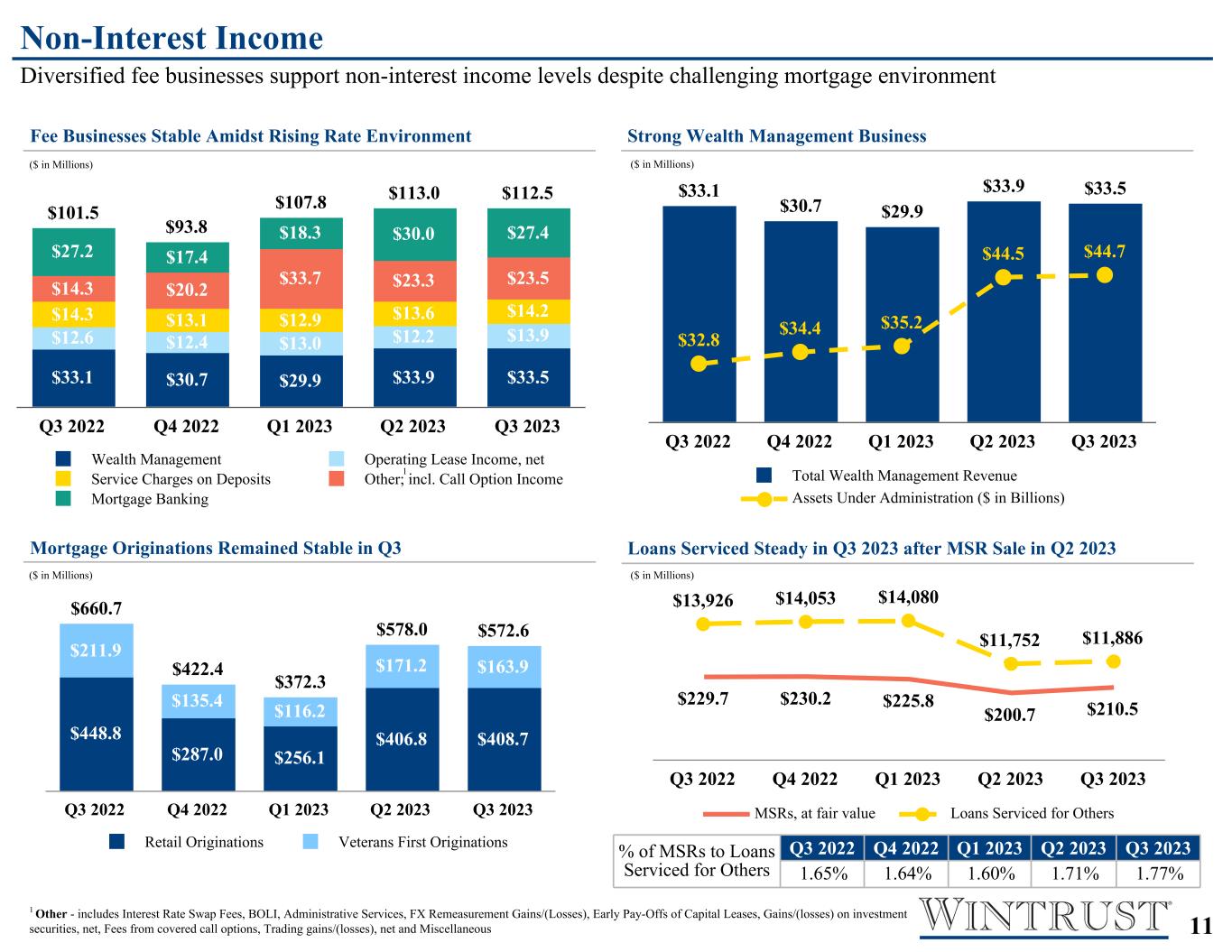

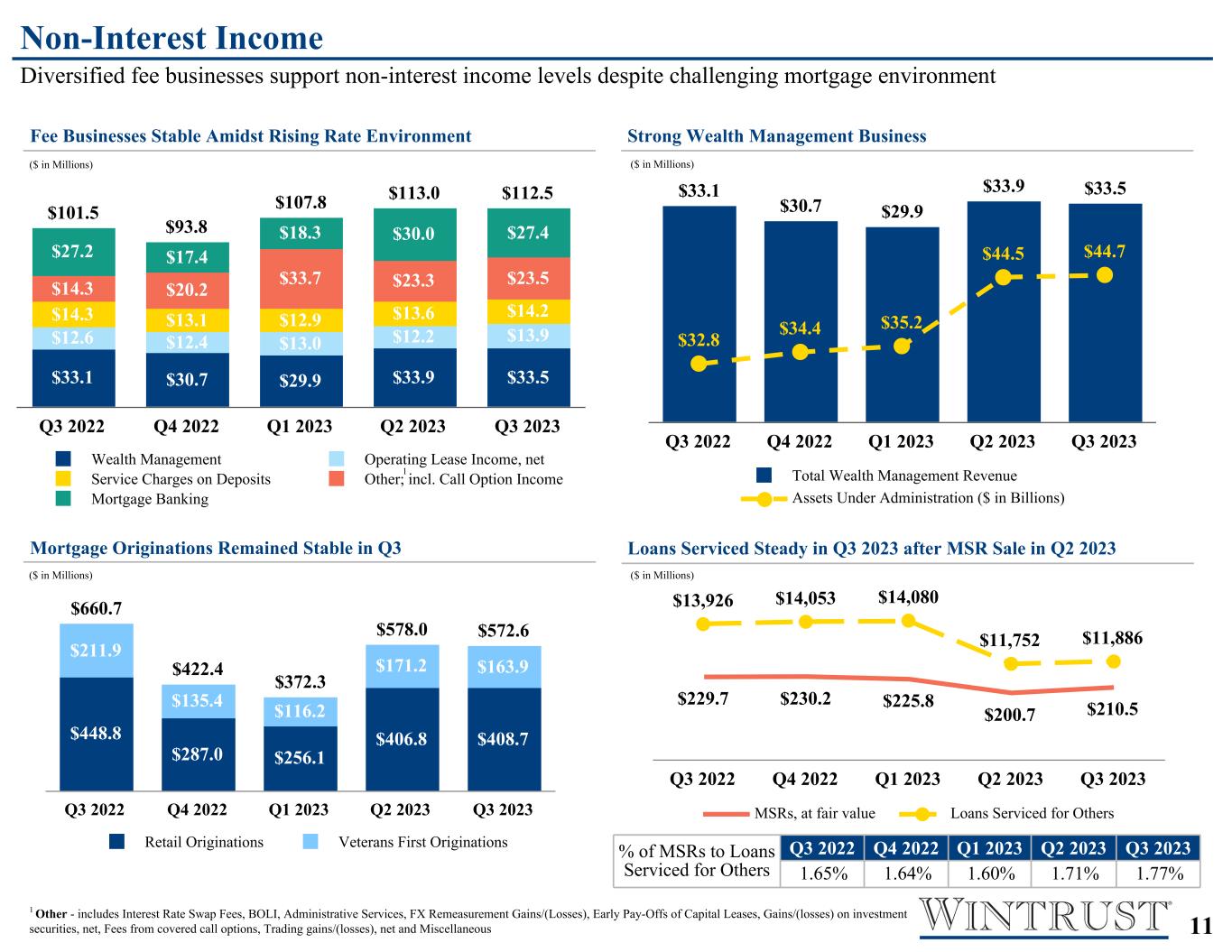

NON-INTEREST INCOME

Wealth management revenue was relatively stable in the third quarter of 2023 as compared to the second quarter of 2023. Wealth management revenue is comprised of the trust and asset management revenue of The Chicago Trust Company and Great Lakes Advisors, the brokerage commissions, managed money fees and insurance product commissions at Wintrust Investments and fees from tax-deferred like-kind exchange services provided by the Chicago Deferred Exchange Company.

Mortgage banking revenue decreased by $2.6 million in the third quarter of 2023 as compared to the second quarter of 2023 primarily due to an unfavorable valuation related change in the Company’s held-for-sale portfolio of early buy-out exercised loans guaranteed by U.S. government agencies which are held at fair value. This was partially offset by increased production revenue and a more favorable adjustments to the fair value of mortgage servicing rights compared to the second quarter of 2023. The Company monitors the relationship of these assets and seeks to minimize the earnings impact of fair value changes.

The Company recognized $2.4 million in net losses on investment securities in the third quarter of 2023 as compared to nominal gains in the second quarter of 2023.

Fees from covered call options increased by $1.6 million in the third quarter of 2023 as compared to the second quarter of 2023. The Company has typically written call options with terms of less than three months against certain U.S. Treasury and agency securities held in its portfolio for liquidity and other purposes. Management has entered into these transactions with the goal of economically hedging security positions and enhancing its overall return on its investment portfolio. These option transactions are designed to mitigate overall interest rate risk and do not qualify as hedges pursuant to accounting guidance.

For more information regarding non-interest income, see Table 15 in this report.

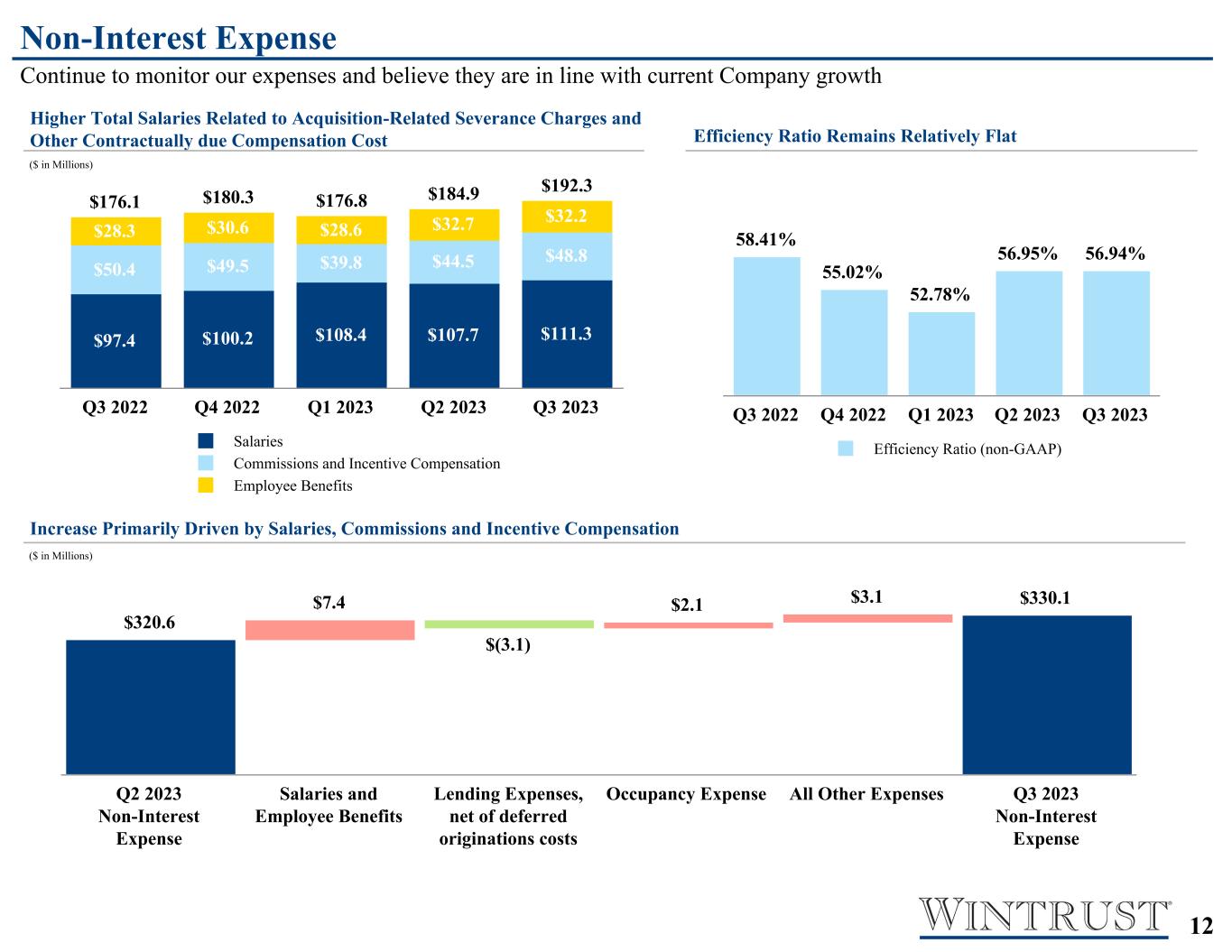

NON-INTEREST EXPENSE

Salaries and employee benefits expense increased by $7.4 million in the third quarter of 2023 as compared to the second quarter of 2023. The $7.4 million increase is primarily related to higher salary expense and incentive compensation expense due to elevated bonus accruals in the third quarter of 2023 as well as other salary costs of approximately $1.6 million related to acquisition-related severance charges and other contractually due compensation costs.

Operating lease equipment cost increased $2.2 million in the third quarter of 2023 as compared to the second quarter of 2023 primarily due to the impairment of certain assets during the period.

Occupancy expenses increased $2.1 million in the third quarter of 2023 as compared to the second quarter of 2023 primarily due to the impairment of two Company-owned buildings that are no longer being used.

Data processing expense increased $1.0 million in the third quarter of 2023 as compared to the second quarter of 2023 primarily due to the termination of a duplicate service contract related to the acquisition of a wealth management business in 2023.

Lending expenses, net of deferred origination costs, decreased by $3.1 million as compared to the second quarter of 2023 primarily due to higher loan originations in the second quarter of 2023.

Miscellaneous expense in the third quarter of 2023 decreased by $1.0 million as compared to the second quarter of 2023. Miscellaneous expense includes ATM expenses, correspondent bank charges, directors’ fees, telephone, postage, corporate insurance, dues and subscriptions, problem loan expenses and other miscellaneous operational losses and costs.

For more information regarding non-interest expense, see Table 16 in this report.

INCOME TAXES

The Company recorded income tax expense of $60.7 million in the third quarter of 2023 compared to $56.7 million in the second quarter of 2023. The effective tax rates were 26.98% in the third quarter of 2023 compared to 26.81% in the second quarter of 2023.

BUSINESS UNIT SUMMARY

Community Banking

Through its community banking unit, the Company provides banking and financial services primarily to individuals, small to mid-sized businesses, local governmental units and institutional clients residing primarily in the local areas the Company services. In the third quarter of 2023, this unit expanded its commercial, commercial real estate and residential real estate loan portfolios and grew retail deposits.

Mortgage banking revenue was $27.4 million for the third quarter of 2023, a decrease of $2.6 million as compared to the second quarter of 2023, primarily due to an unfavorable valuation related change in the Company’s held-for-sale portfolio of early buy-out exercised loans guaranteed by U.S. government agencies which are held at fair value. Service charges on deposit accounts totaled $14.2 million in the third quarter of 2023, an increase of $609,000 as compared to the second quarter of 2023, primarily due to higher fees associated with commercial account activity. The Company’s gross commercial and commercial real estate loan pipelines remained solid as of September 30, 2023 indicating momentum for expected continued loan growth in the fourth quarter of 2023.

Specialty Finance

Through its specialty finance unit, the Company offers financing of insurance premiums for businesses and individuals, equipment financing through structured loans and lease products to customers in a variety of industries, accounts receivable financing and value-added, out-sourced administrative services and other services. Originations within the insurance premium financing receivables portfolio were $4.6 billion during the third quarter of 2023 and average balances increased by $444.0 million as compared to the second quarter of 2023. The Company’s leasing portfolio balance increased in the third quarter of 2023, with its portfolio of assets, including capital leases, loans and equipment on operating leases, totaling $3.3 billion as of September 30, 2023 as compared to $3.1 billion as of June 30, 2023. Revenues from the Company’s out-sourced administrative services business were $1.3 million in the third quarter of 2023, an increase of $17,000 from the second quarter of 2023.

Wealth Management

Through four separate subsidiaries within its wealth management unit, the Company offers a full range of wealth management services, including trust and investment services, tax-deferred like-kind exchange services, asset management, securities brokerage services and 401(k) and retirement plan services. Wealth management revenue totaled $33.5 million in the third quarter of 2023, which was relatively stable compared to the second quarter of 2023. At September 30, 2023, the Company’s wealth management subsidiaries had approximately $44.7 billion of assets under administration, which included $8.3 billion of assets owned by the Company and its subsidiary banks, representing an increase from the $44.5 billion of assets under administration at June 30, 2023.

ITEM IMPACTING COMPARATIVE FINANCIAL RESULTS

Business Combination

On April 3, 2023, the Company completed its acquisition of Rothschild & Co Asset Management US Inc. and Rothschild & Co Risk Based Investments LLC from Rothschild & Co North America Inc. As the transaction was determined to be a business combination, the Company recorded goodwill of approximately $2.6 million on the purchase.

WINTRUST FINANCIAL CORPORATION

Key Operating Measures

Wintrust’s key operating measures and growth rates for the third quarter of 2023, as compared to the second quarter of 2023 (sequential quarter) and third quarter of 2022 (linked quarter), are shown in the table below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | % or (1) basis point (bp) change from 2nd Quarter 2023 | | % or

basis point (bp) change from

3rd Quarter

2022 |

| | Three Months Ended | |

| (Dollars in thousands, except per share data) | | Sep 30, 2023 | | Jun 30, 2023 | | Sep 30, 2022 | |

| Net income | | $ | 164,198 | | | $ | 154,750 | | | $ | 142,961 | | 6 | | % | | 15 | | % |

Pre-tax income, excluding provision for credit losses (non-GAAP) (2) | | 244,781 | | | 239,944 | | | 206,461 | | 2 | | | | 19 | | |

| | | | | | | | | | | |

| Net income per common share – Diluted | | 2.53 | | | 2.38 | | | 2.21 | | 6 | | | | 14 | | |

| Cash dividends declared per common share | | 0.40 | | | 0.40 | | | 0.34 | | — | | | | 18 | | |

Net revenue (3) | | 574,836 | | | 560,567 | | | 502,930 | | 3 | | | | 14 | | |

| Net interest income | | 462,358 | | | 447,537 | | | 401,448 | | 3 | | | | 15 | | |

| Net interest margin | | 3.60 | % | | 3.64 | % | | 3.34 | % | (4) | | bps | | 26 | | bps |

Net interest margin – fully taxable-equivalent (non-GAAP) (2) | | 3.62 | | | 3.66 | | | 3.35 | | (4) | | | | 27 | | |

Net overhead ratio (4) | | 1.59 | | | 1.58 | | | 1.53 | | 1 | | | | 6 | | |

| | | | | | | | | | | |

| Return on average assets | | 1.20 | | | 1.18 | | | 1.12 | | 2 | | | | 8 | | |

| Return on average common equity | | 13.35 | | | 12.79 | | | 12.31 | | 56 | | | | 104 | | |

Return on average tangible common equity (non-GAAP) (2) | | 15.73 | | | 15.12 | | | 14.68 | | 61 | | | | 105 | | |

| At end of period | | | | | | | | | | | |

| Total assets | | $ | 55,555,246 | | $ | 54,286,176 | | $ | 52,382,939 | 9 | | % | | 6 | | % |

Total loans (5) | | 41,446,032 | | 41,023,408 | | 38,167,613 | 4 | | | | 9 | | |

| | | | | | | | | | | |

| Total deposits | | 44,992,686 | | 44,038,707 | | 42,797,191 | 9 | | | | 5 | | |

| Total shareholders’ equity | | 5,015,613 | | 5,041,912 | | 4,637,980 | (2) | | | | 8 | | |

(1)Period-end balance sheet percentage changes are annualized.

(2)See Table 17: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

(3)Net revenue is net interest income plus non-interest income.

(4)The net overhead ratio is calculated by netting total non-interest expense and total non-interest income, annualizing this amount, and dividing by that period’s average total assets. A lower ratio indicates a higher degree of efficiency.

(5)Excludes mortgage loans held-for-sale.

Certain returns, yields, performance ratios, or quarterly growth rates are “annualized” in this presentation to represent an annual time period. This is done for analytical purposes to better discern, for decision-making purposes, underlying performance trends when compared to full-year or year-over-year amounts. For example, a 5% growth rate for a quarter would represent an annualized 20% growth rate. Additional supplemental financial information showing quarterly trends can be found on the Company’s website at www.wintrust.com by choosing “Financial Reports” under the “Investor Relations” heading, and then choosing “Financial Highlights.”

WINTRUST FINANCIAL CORPORATION

Selected Financial Highlights | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | Nine Months Ended |

| (Dollars in thousands, except per share data) | | Sep 30, 2023 | | Jun 30, 2023 | | Mar 31, 2023 | | Dec 31, 2022 | | Sep 30, 2022 | Sep 30, 2023 | | Sep 30, 2022 |

| Selected Financial Condition Data (at end of period): | | | |

| Total assets | | $ | 55,555,246 | | $ | 54,286,176 | | $ | 52,873,511 | | $ | 52,949,649 | | $ | 52,382,939 | | | |

Total loans (1) | | 41,446,032 | | 41,023,408 | | 39,565,471 | | 39,196,485 | | 38,167,613 | | | |

| Total deposits | | 44,992,686 | | 44,038,707 | | 42,718,211 | | 42,902,544 | | 42,797,191 | | | |

| | | | | | | | | | | | | |

| Total shareholders’ equity | | 5,015,613 | | 5,041,912 | | 5,015,506 | | 4,796,838 | | 4,637,980 | | | |

| Selected Statements of Income Data: | | | |

| Net interest income | | $ | 462,358 | | | $ | 447,537 | | | $ | 457,995 | | | $ | 456,816 | | | $ | 401,448 | | $ | 1,367,890 | | | $ | 1,038,546 | |

Net revenue (2) | | 574,836 | | | 560,567 | | | 565,764 | | | 550,655 | | | 502,930 | | 1,701,167 | | | 1,405,760 | |

| Net income | | 164,198 | | | 154,750 | | | 180,198 | | | 144,817 | | | 142,961 | | 499,146 | | | 364,865 | |

Pre-tax income, excluding provision for credit losses (non-GAAP) (3) | | 244,781 | | | 239,944 | | | 266,595 | | | 242,819 | | | 206,461 | | 751,320 | | | 536,325 | |

| | | | | | | | | | | | | |

| Net income per common share – Basic | | 2.57 | | | 2.41 | | | 2.84 | | | 2.27 | | | 2.24 | | 7.82 | | | 5.86 | |

| Net income per common share – Diluted | | 2.53 | | | 2.38 | | | 2.80 | | | 2.23 | | | 2.21 | | 7.71 | | | 5.78 | |

| Cash dividends declared per common share | | 0.40 | | | 0.40 | | | 0.40 | | | 0.34 | | | 0.34 | | 1.20 | | | 1.02 | |

| Selected Financial Ratios and Other Data: | | | |

| Performance Ratios: | | | |

| Net interest margin | | 3.60 | % | | 3.64 | % | | 3.81 | % | | 3.71 | % | | 3.34 | % | 3.68 | % | | 2.96 | % |

Net interest margin – fully taxable-equivalent (non-GAAP) (3) | | 3.62 | | | 3.66 | | | 3.83 | | | 3.73 | | | 3.35 | | 3.70 | | | 2.97 | |

| Non-interest income to average assets | | 0.82 | | | 0.86 | | | 0.84 | | | 0.71 | | | 0.79 | | 0.84 | | | 0.98 | |

| Non-interest expense to average assets | | 2.41 | | | 2.44 | | | 2.33 | | | 2.34 | | | 2.32 | | 2.39 | | | 2.33 | |

Net overhead ratio (4) | | 1.59 | | | 1.58 | | | 1.49 | | | 1.63 | | | 1.53 | | 1.55 | | | 1.35 | |

| | | | | | | | | | | | | |

| Return on average assets | | 1.20 | | | 1.18 | | | 1.40 | | | 1.10 | | | 1.12 | | 1.26 | | | 0.98 | |

| Return on average common equity | | 13.35 | | | 12.79 | | | 15.67 | | | 12.72 | | | 12.31 | | 13.91 | | | 10.96 | |

Return on average tangible common equity (non-GAAP) (3) | | 15.73 | | | 15.12 | | | 18.55 | | | 15.21 | | | 14.68 | | 16.43 | | | 13.21 | |

| Average total assets | | $ | 54,381,981 | | $ | 52,601,953 | | $ | 52,075,318 | | $ | 52,087,618 | | $ | 50,722,694 | $ | 53,028,199 | | $ | 49,863,793 |

| Average total shareholders’ equity | | 5,083,883 | | 5,044,718 | | 4,895,271 | | 4,710,856 | | 4,795,387 | 5,008,648 | | | 4,608,399 | |

| Average loans to average deposits ratio | | 92.4 | % | | 94.3 | % | | 93.0 | % | | 90.5 | % | | 88.8 | % | 93.2 | % | | 86.5 | % |

| Period-end loans to deposits ratio | | 92.1 | | | 93.2 | | | 92.6 | | | 91.4 | | | 89.2 | | | | |

| Common Share Data at end of period: | | | |

| Market price per common share | | $ | 75.50 | | | $ | 72.62 | | | $ | 72.95 | | | $ | 84.52 | | | $ | 81.55 | | | | |

| Book value per common share | | 75.19 | | | 75.65 | | | 75.24 | | | 72.12 | | | 69.56 | | | | |

Tangible book value per common share (non-GAAP) (3) | | 64.07 | | | 64.50 | | | 64.22 | | | 61.00 | | | 58.42 | | | | |

| Common shares outstanding | | 61,222,058 | | 61,197,676 | | 61,176,415 | | 60,794,008 | | 60,743,335 | | | |

| Other Data at end of period: | | | |

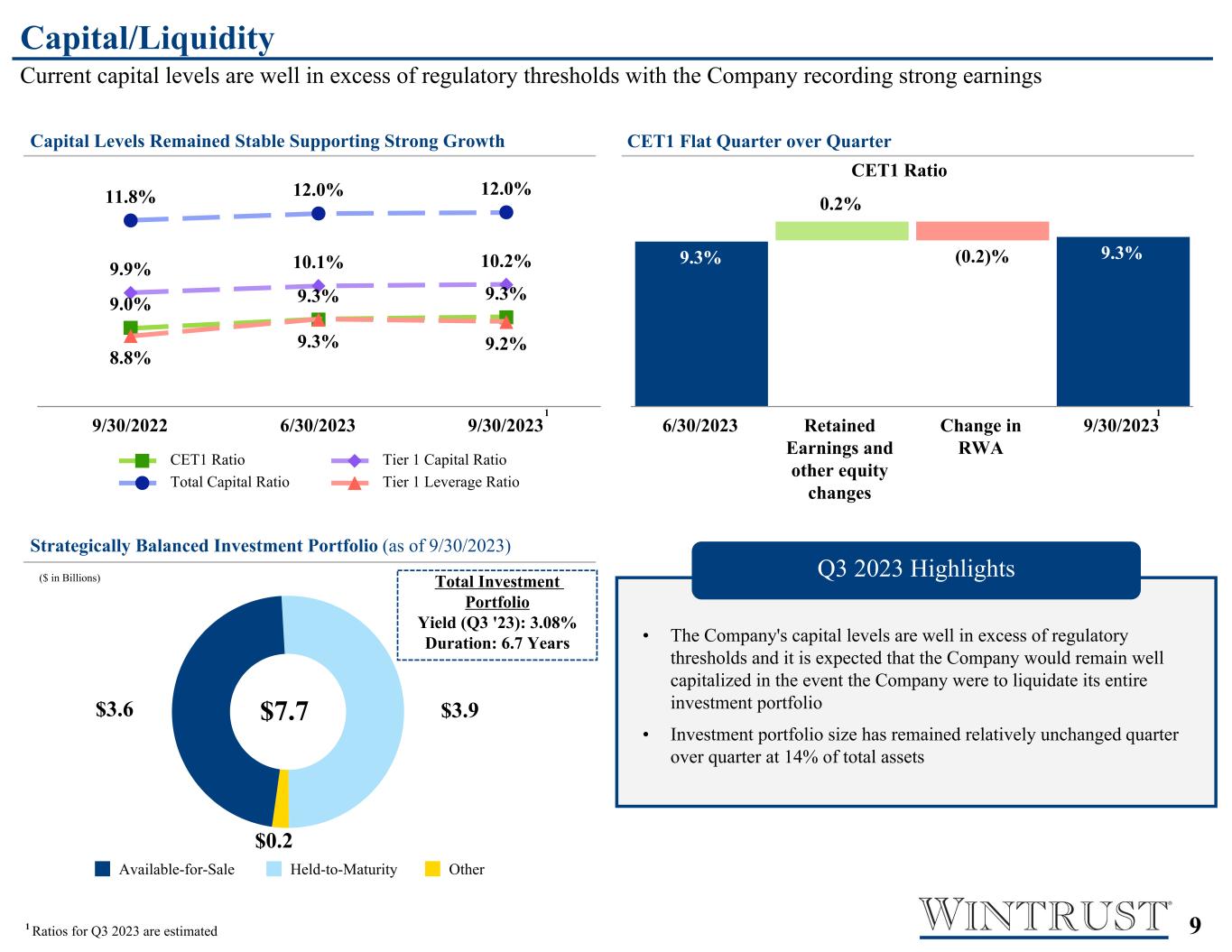

Tier 1 leverage ratio (5) | | 9.2 | % | | 9.3 | % | | 9.1 | % | | 8.8 | % | | 8.8 | % | | | |

| Risk-based capital ratios: | | | | | | | | | | | | | |

Tier 1 capital ratio (5) | | 10.2 | | | 10.1 | | | 10.1 | | | 10.0 | | | 9.9 | | | | |

Common equity tier 1 capital ratio (5) | | 9.3 | | | 9.3 | | | 9.2 | | | 9.1 | | | 9.0 | | | | |

Total capital ratio (5) | | 12.0 | | | 12.0 | | | 12.1 | | | 11.9 | | | 11.8 | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Allowance for credit losses (6) | | $ | 399,531 | | | $ | 387,786 | | | $ | 376,261 | | | $ | 357,936 | | | $ | 315,338 | | | | |

| | | | | | | | | | | | | |

| Allowance for loan and unfunded lending-related commitment losses to total loans | | 0.96 | % | | 0.94 | % | | 0.95 | % | | 0.91 | % | | 0.83 | % | | | |

| | | | | | | | | | | | | |

| Number of: | | | | | | | | | | | | | |

| Bank subsidiaries | | 15 | | | 15 | | | 15 | | | 15 | | | 15 | | | | |

| Banking offices | | 174 | | | 175 | | | 174 | | | 174 | | | 174 | | | | |

(1)Excludes mortgage loans held-for-sale.

(2)Net revenue is net interest income plus non-interest income.

(3)See Table 17: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

(4)The net overhead ratio is calculated by netting total non-interest expense and total non-interest income, annualizing this amount, and dividing by that period’s average total assets. A lower ratio indicates a higher degree of efficiency.

(5)Capital ratios for current quarter-end are estimated.

(6)The allowance for credit losses includes the allowance for loan losses, the allowance for unfunded lending-related commitments and the allowance for held-to-maturity securities losses.

WINTRUST FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CONDITION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (Unaudited) | | (Unaudited) | | (Unaudited) | | | | (Unaudited) |

| | Sep 30, | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, |

| (In thousands) | | 2023 | | 2023 | | 2023 | | 2022 | | 2022 |

| Assets | | | | | | | | | | |

| Cash and due from banks | | $ | 418,088 | | | $ | 513,858 | | | $ | 445,928 | | | $ | 490,908 | | | $ | 489,590 | |

| Federal funds sold and securities purchased under resale agreements | | 60 | | | 59 | | | 58 | | | 58 | | | 57 | |

| Interest-bearing deposits with banks | | 2,448,570 | | | 2,163,708 | | | 1,563,578 | | | 1,988,719 | | | 3,968,605 | |

| Available-for-sale securities, at fair value | | 3,611,835 | | | 3,492,481 | | | 3,259,845 | | | 3,243,017 | | | 2,923,653 | |

| Held-to-maturity securities, at amortized cost | | 3,909,150 | | | 3,564,473 | | | 3,606,391 | | | 3,640,567 | | | 3,389,842 | |

| Trading account securities | | 1,663 | | | 3,027 | | | 102 | | | 1,127 | | | 179 | |

| Equity securities with readily determinable fair value | | 134,310 | | | 116,275 | | | 111,943 | | | 110,365 | | | 114,012 | |

| Federal Home Loan Bank and Federal Reserve Bank stock | | 204,040 | | | 195,117 | | | 244,957 | | | 224,759 | | | 178,156 | |

| Brokerage customer receivables | | 14,042 | | | 15,722 | | | 16,042 | | | 16,387 | | | 20,327 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Mortgage loans held-for-sale, at fair value | | 304,808 | | | 338,728 | | | 302,493 | | | 299,935 | | | 376,160 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Loans, net of unearned income | | 41,446,032 | | | 41,023,408 | | | 39,565,471 | | | 39,196,485 | | | 38,167,613 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Allowance for loan losses | | (315,039) | | | (302,499) | | | (287,972) | | | (270,173) | | | (246,110) | |

| Net loans | | 41,130,993 | | | 40,720,909 | | | 39,277,499 | | | 38,926,312 | | | 37,921,503 | |

| Premises, software and equipment, net | | 747,501 | | | 749,393 | | | 760,283 | | | 764,798 | | | 763,029 | |

| Lease investments, net | | 275,152 | | | 274,351 | | | 256,301 | | | 253,928 | | | 244,822 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Accrued interest receivable and other assets | | 1,674,681 | | | 1,455,748 | | | 1,413,795 | | | 1,391,342 | | | 1,316,305 | |

| Trade date securities receivable | | — | | | — | | | 939,758 | | | 921,717 | | | — | |

| | | | | | | | | | |

| Goodwill | | 656,109 | | | 656,674 | | | 653,587 | | | 653,524 | | | 653,079 | |

| Other acquisition-related intangible assets | | 24,244 | | | 25,653 | | | 20,951 | | | 22,186 | | | 23,620 | |

| Total assets | | $ | 55,555,246 | | | $ | 54,286,176 | | | $ | 52,873,511 | | | $ | 52,949,649 | | | $ | 52,382,939 | |

| Liabilities and Shareholders’ Equity | | | | | | | | | | |

| Deposits: | | | | | | | | | | |

| Non-interest-bearing | | $ | 10,347,006 | | | $ | 10,604,915 | | | $ | 11,236,083 | | | $ | 12,668,160 | | | $ | 13,529,277 | |

| Interest-bearing | | 34,645,680 | | | 33,433,792 | | | 31,482,128 | | | 30,234,384 | | | 29,267,914 | |

| Total deposits | | 44,992,686 | | | 44,038,707 | | | 42,718,211 | | | 42,902,544 | | | 42,797,191 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Federal Home Loan Bank advances | | 2,326,071 | | | 2,026,071 | | | 2,316,071 | | | 2,316,071 | | | 2,316,071 | |

| | | | | | | | | | |

| Other borrowings | | 643,999 | | | 665,219 | | | 583,548 | | | 596,614 | | | 447,215 | |

| | | | | | | | | | |

| Subordinated notes | | 437,731 | | | 437,628 | | | 437,493 | | | 437,392 | | | 437,260 | |

| Junior subordinated debentures | | 253,566 | | | 253,566 | | | 253,566 | | | 253,566 | | | 253,566 | |

| | | | | | | | | | |

| Accrued interest payable and other liabilities | | 1,885,580 | | | 1,823,073 | | | 1,549,116 | | | 1,646,624 | | | 1,493,656 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total liabilities | | 50,539,633 | | | 49,244,264 | | | 47,858,005 | | | 48,152,811 | | | 47,744,959 | |

| Shareholders’ Equity: | | | | | | | | | | |

| Preferred stock | | 412,500 | | | 412,500 | | | 412,500 | | | 412,500 | | | 412,500 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Common stock | | 61,244 | | | 61,219 | | | 61,198 | | | 60,797 | | | 60,743 | |

| Surplus | | 1,933,226 | | | 1,923,623 | | | 1,913,947 | | | 1,902,474 | | | 1,891,621 | |

| Treasury stock | | (1,966) | | | (1,966) | | | (1,966) | | | (304) | | | — | |

| Retained earnings | | 3,253,332 | | | 3,120,626 | | | 2,997,263 | | | 2,849,007 | | | 2,731,844 | |

| Accumulated other comprehensive loss | | (642,723) | | | (474,090) | | | (367,436) | | | (427,636) | | | (458,728) | |

| Total shareholders’ equity | | 5,015,613 | | | 5,041,912 | | | 5,015,506 | | | 4,796,838 | | | 4,637,980 | |

| Total liabilities and shareholders’ equity | | $ | 55,555,246 | | | $ | 54,286,176 | | | $ | 52,873,511 | | | $ | 52,949,649 | | | $ | 52,382,939 | |

WINTRUST FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Nine Months Ended |

| (Dollars in thousands, except per share data) | Sep 30,

2023 | | Jun 30,

2023 | | Mar 31,

2023 | | Dec 31,

2022 | | Sep 30,

2022 | Sep 30, 2023 | | Sep 30, 2022 |

| Interest income | | | | | | | | | | | | |

| Interest and fees on loans | $ | 666,260 | | | $ | 621,057 | | | $ | 558,692 | | | $ | 498,838 | | | $ | 402,689 | | $ | 1,846,009 | | | $ | 1,008,888 | |

| Mortgage loans held-for-sale | 4,767 | | | 4,178 | | | 3,528 | | | 3,997 | | | 5,371 | | 12,473 | | | 17,198 | |

| Interest-bearing deposits with banks | 26,866 | | | 16,882 | | | 13,468 | | | 20,349 | | | 15,621 | | 57,216 | | | 23,098 | |

| Federal funds sold and securities purchased under resale agreements | 1,157 | | | 1 | | | 70 | | | 1,263 | | | 1,845 | | 1,228 | | | 3,640 | |

| Investment securities | 59,164 | | | 51,243 | | | 59,943 | | | 53,092 | | | 38,569 | | 170,350 | | | 107,508 | |

| Trading account securities | 6 | | | 6 | | | 14 | | | 6 | | | 7 | | 26 | | | 16 | |

| Federal Home Loan Bank and Federal Reserve Bank stock | 3,896 | | | 3,544 | | | 3,680 | | | 2,918 | | | 2,109 | | 11,120 | | | 5,704 | |

| Brokerage customer receivables | 284 | | | 265 | | | 295 | | | 282 | | | 267 | | 844 | | | 646 | |

| Total interest income | 762,400 | | | 697,176 | | | 639,690 | | | 580,745 | | | 466,478 | | 2,099,266 | | | 1,166,698 | |

| Interest expense | | | | | | | | | | | | |

| Interest on deposits | 262,783 | | | 213,495 | | | 144,802 | | | 95,447 | | | 45,916 | | 621,080 | | | 79,755 | |

| Interest on Federal Home Loan Bank advances | 17,436 | | | 17,399 | | | 19,135 | | | 13,823 | | | 6,812 | | 53,970 | | | 16,506 | |

| Interest on other borrowings | 9,384 | | | 8,485 | | | 7,854 | | | 5,313 | | | 4,008 | | 25,723 | | | 8,981 | |

| Interest on subordinated notes | 5,491 | | | 5,523 | | | 5,488 | | | 5,520 | | | 5,485 | | 16,502 | | | 16,484 | |

| Interest on junior subordinated debentures | 4,948 | | | 4,737 | | | 4,416 | | | 3,826 | | | 2,809 | | 14,101 | | | 6,426 | |

| Total interest expense | 300,042 | | | 249,639 | | | 181,695 | | | 123,929 | | | 65,030 | | 731,376 | | | 128,152 | |

| Net interest income | 462,358 | | | 447,537 | | | 457,995 | | | 456,816 | | | 401,448 | | 1,367,890 | | | 1,038,546 | |

| Provision for credit losses | 19,923 | | | 28,514 | | | 23,045 | | | 47,646 | | | 6,420 | | 71,482 | | | 30,943 | |

| Net interest income after provision for credit losses | 442,435 | | | 419,023 | | | 434,950 | | | 409,170 | | | 395,028 | | 1,296,408 | | | 1,007,603 | |

| Non-interest income | | | | | | | | | | | | |

| Wealth management | 33,529 | | | 33,858 | | | 29,945 | | | 30,727 | | | 33,124 | | 97,332 | | | 95,887 | |

| Mortgage banking | 27,395 | | | 29,981 | | | 18,264 | | | 17,407 | | | 27,221 | | 75,640 | | | 137,766 | |

| Service charges on deposit accounts | 14,217 | | | 13,608 | | | 12,903 | | | 13,054 | | | 14,349 | | 40,728 | | | 45,520 | |

| Losses (gains) on investment securities, net | (2,357) | | | 0 | | | 1,398 | | | (6,745) | | | (3,103) | | (959) | | | (13,682) | |

| Fees from covered call options | 4,215 | | | 2,578 | | | 10,391 | | | 7,956 | | | 1,366 | | 17,184 | | | 6,177 | |

| Trading gains (losses), net | 728 | | | 106 | | | 813 | | | (306) | | | (7) | | 1,647 | | | 4,058 | |

| Operating lease income, net | 13,863 | | | 12,227 | | | 13,046 | | | 12,384 | | | 12,644 | | 39,136 | | | 43,126 | |

| Other | 20,888 | | | 20,672 | | | 21,009 | | | 19,362 | | | 15,888 | | 62,569 | | | 48,362 | |

| Total non-interest income | 112,478 | | | 113,030 | | | 107,769 | | | 93,839 | | | 101,482 | | 333,277 | | | 367,214 | |

| Non-interest expense | | | | | | | | | | | | |

| Salaries and employee benefits | 192,338 | | | 184,923 | | | 176,781 | | | 180,331 | | | 176,095 | | 554,042 | | | 515,776 | |

| Software and equipment | 25,951 | | | 26,205 | | | 24,697 | | | 24,699 | | | 24,126 | | 76,853 | | | 71,186 | |

| Operating lease equipment | 12,020 | | | 9,816 | | | 9,833 | | | 10,078 | | | 9,448 | | 31,669 | | | 27,930 | |

| Occupancy, net | 21,304 | | | 19,176 | | | 18,486 | | | 17,763 | | | 17,727 | | 58,966 | | | 53,202 | |

| Data processing | 10,773 | | | 9,726 | | | 9,409 | | | 7,927 | | | 7,767 | | 29,908 | | | 23,282 | |

| Advertising and marketing | 18,169 | | | 17,794 | | | 11,946 | | | 14,279 | | | 16,600 | | 47,909 | | | 45,139 | |

| Professional fees | 8,887 | | | 8,940 | | | 8,163 | | | 9,267 | | | 7,544 | | 25,990 | | | 23,821 | |

| Amortization of other acquisition-related intangible assets | 1,408 | | | 1,499 | | | 1,235 | | | 1,436 | | | 1,492 | | 4,142 | | | 4,680 | |

| FDIC insurance | 9,748 | | | 9,008 | | | 8,669 | | | 6,775 | | | 7,186 | | 27,425 | | | 21,864 | |

| OREO expenses, net | 120 | | | 118 | | | (207) | | | 369 | | | 229 | | 31 | | | (509) | |

| Other | 29,337 | | | 33,418 | | | 30,157 | | | 34,912 | | | 28,255 | | 92,912 | | | 83,064 | |

| Total non-interest expense | 330,055 | | | 320,623 | | | 299,169 | | | 307,836 | | | 296,469 | | 949,847 | | | 869,435 | |

| Income before taxes | 224,858 | | | 211,430 | | | 243,550 | | | 195,173 | | | 200,041 | | 679,838 | | | 505,382 | |

| Income tax expense | 60,660 | | | 56,680 | | | 63,352 | | | 50,356 | | | 57,080 | | 180,692 | | | 140,517 | |

| Net income | $ | 164,198 | | | $ | 154,750 | | | $ | 180,198 | | | $ | 144,817 | | | $ | 142,961 | | $ | 499,146 | | | $ | 364,865 | |

| Preferred stock dividends | 6,991 | | | 6,991 | | | 6,991 | | | 6,991 | | | 6,991 | | 20,973 | | | 20,973 | |

| Net income applicable to common shares | $ | 157,207 | | | $ | 147,759 | | | $ | 173,207 | | | $ | 137,826 | | | $ | 135,970 | | $ | 478,173 | | | $ | 343,892 | |

| Net income per common share - Basic | $ | 2.57 | | | $ | 2.41 | | | $ | 2.84 | | | $ | 2.27 | | | $ | 2.24 | | $ | 7.82 | | | $ | 5.86 | |

| Net income per common share - Diluted | $ | 2.53 | | | $ | 2.38 | | | $ | 2.80 | | | $ | 2.23 | | | $ | 2.21 | | $ | 7.71 | | | $ | 5.78 | |

| Cash dividends declared per common share | $ | 0.40 | | | $ | 0.40 | | | $ | 0.40 | | | $ | 0.34 | | | $ | 0.34 | | $ | 1.20 | | | $ | 1.02 | |

| Weighted average common shares outstanding | 61,213 | | 61,192 | | 60,950 | | 60,769 | | 60,738 | 61,119 | | 58,679 |

| Dilutive potential common shares | 964 | | | 902 | | | 873 | | | 1,096 | | | 837 | | 888 | | | 814 | |

| Average common shares and dilutive common shares | 62,177 | | | 62,094 | | | 61,823 | | | 61,865 | | | 61,575 | | 62,007 | | | 59,493 | |

TABLE 1: LOAN PORTFOLIO MIX AND GROWTH RATES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | % Growth From (1) |

| (Dollars in thousands) | Sep 30, 2023 | | Jun 30, 2023 | | Mar 31, 2023 | | Dec 31,

2022 | | Sep 30, 2022 | Dec 31, 2022 (2) | | Sep 30, 2022 |

| Balance: | | | | | | | | | | | | |

| Mortgage loans held-for-sale, excluding early buy-out exercised loans guaranteed by U.S. government agencies | $ | 190,511 | | | $ | 235,570 | | | $ | 155,687 | | | $ | 156,297 | | | $ | 216,062 | | 29 | % | | (12) | % |

| Mortgage loans held-for-sale, early buy-out exercised loans guaranteed by U.S. government agencies | 114,297 | | | 103,158 | | | 146,806 | | | 143,638 | | | 160,098 | | (27) | | | (29) | |

| Total mortgage loans held-for-sale | $ | 304,808 | | | $ | 338,728 | | | $ | 302,493 | | | $ | 299,935 | | | $ | 376,160 | | 1 | % | | (19) | % |

| | | | | | | | | | | | |

| Core loans: | | | | | | | | | | | | |

| Commercial | | | | | | | | | | | | |

| Commercial and industrial | $ | 5,894,732 | | | $ | 5,737,633 | | | $ | 5,855,035 | | | $ | 5,852,166 | | | $ | 5,818,959 | | 1 | % | | 1 | % |

| Asset-based lending | 1,396,591 | | | 1,465,848 | | | 1,482,071 | | | 1,473,344 | | | 1,545,038 | | (7) | | | (10) | |

| Municipal | 676,915 | | | 653,117 | | | 655,301 | | | 668,235 | | | 608,234 | | 2 | | | 11 | |

| Leases | 2,109,628 | | | 1,925,767 | | | 1,904,137 | | | 1,840,928 | | | 1,582,359 | | 20 | | | 33 | |

| PPP loans | 13,744 | | | 15,337 | | | 17,195 | | | 28,923 | | | 43,658 | | (70) | | | (69) | |

| Commercial real estate | | | | | | | | | | | | |

| Residential construction | 51,550 | | | 51,689 | | | 69,998 | | | 76,877 | | | 66,957 | | (44) | | | (23) | |

| Commercial construction | 1,547,322 | | | 1,409,751 | | | 1,234,762 | | | 1,102,098 | | | 1,176,407 | | 54 | | | 32 | |

| Land | 294,901 | | | 298,996 | | | 292,293 | | | 307,955 | | | 282,147 | | (6) | | | 5 | |

| Office | 1,422,748 | | | 1,404,422 | | | 1,392,040 | | | 1,337,176 | | | 1,269,729 | | 9 | | | 12 | |

| Industrial | 2,057,957 | | | 2,002,740 | | | 1,858,088 | | | 1,836,276 | | | 1,777,658 | | 16 | | | 16 | |

| Retail | 1,341,451 | | | 1,304,083 | | | 1,309,680 | | | 1,304,444 | | | 1,331,316 | | 4 | | | 1 | |

| Multi-family | 2,710,829 | | | 2,696,478 | | | 2,635,411 | | | 2,560,709 | | | 2,305,433 | | 8 | | | 18 | |

| Mixed use and other | 1,519,422 | | | 1,440,652 | | | 1,446,806 | | | 1,425,412 | | | 1,368,537 | | 9 | | | 11 | |

| Home equity | 343,258 | | | 336,974 | | | 337,016 | | | 332,698 | | | 328,822 | | 4 | | | 4 | |

| Residential real estate | | | | | | | | | | | | |

| Residential real estate loans for investment | 2,538,630 | | | 2,455,392 | | | 2,309,393 | | | 2,207,595 | | | 2,086,795 | | 20 | | | 22 | |

| Residential mortgage loans, early buy-out eligible loans guaranteed by U.S. government agencies | 97,911 | | | 117,024 | | | 119,301 | | | 80,701 | | | 57,161 | | 29 | | | 71 | |

| Residential mortgage loans, early buy-out exercised loans guaranteed by U.S. government agencies | 71,062 | | | 70,824 | | | 76,851 | | | 84,087 | | | 91,503 | | (21) | | | (22) | |

| Total core loans | $ | 24,088,651 | | | $ | 23,386,727 | | | $ | 22,995,378 | | | $ | 22,519,624 | | | $ | 21,740,713 | | 9 | % | | 11 | % |

| | | | | | | | | | | | |

| Niche loans: | | | | | | | | | | | | |

| Commercial | | | | | | | | | | | | |

| Franchise | $ | 1,074,162 | | | $ | 1,091,164 | | | $ | 1,131,913 | | | $ | 1,169,623 | | | $ | 1,118,478 | | (11) | % | | (4) | % |

| Mortgage warehouse lines of credit | 245,450 | | | 381,043 | | | 235,684 | | | 237,392 | | | 297,374 | | 5 | | | (17) | |

| Community Advantage - homeowners association | 424,054 | | | 405,042 | | | 389,922 | | | 380,875 | | | 365,967 | | 15 | | | 16 | |

| Insurance agency lending | 890,197 | | | 925,520 | | | 905,727 | | | 897,678 | | | 879,183 | | (1) | | | 1 | |

| Premium Finance receivables | | | | | | | | | | | | |

| U.S. property & casualty insurance | 5,815,346 | | | 5,900,228 | | | 5,043,486 | | | 5,103,820 | | | 4,983,795 | | 19 | | | 17 | |

| Canada property & casualty insurance | 907,401 | | | 862,470 | | | 695,394 | | | 745,639 | | | 729,545 | | 29 | | | 24 | |

| Life insurance | 7,931,808 | | | 8,039,273 | | | 8,125,802 | | | 8,090,998 | | | 8,004,856 | | (3) | | | (1) | |

| Consumer and other | 68,963 | | | 31,941 | | | 42,165 | | | 50,836 | | | 47,702 | | 48 | | | 45 | |

| Total niche loans | $ | 17,357,381 | | | $ | 17,636,681 | | | $ | 16,570,093 | | | $ | 16,676,861 | | | $ | 16,426,900 | | 5 | % | | 6 | % |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total loans, net of unearned income | $ | 41,446,032 | | | $ | 41,023,408 | | | $ | 39,565,471 | | | $ | 39,196,485 | | | $ | 38,167,613 | | 8 | % | | 9 | % |

(1)NM - Not meaningful.

(2)Annualized.

TABLE 2: DEPOSIT PORTFOLIO MIX AND GROWTH RATES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | % Growth From |

| (Dollars in thousands) | Sep 30,

2023 | | Jun 30,

2023 | | Mar 31,

2023 | | Dec 31,

2022 | | Sep 30,

2022 | Jun 30,

2023 (1) | | Sep 30, 2022 |

| Balance: | | | | | | | | | | | | |

| Non-interest-bearing | $ | 10,347,006 | | $ | 10,604,915 | | $ | 11,236,083 | | $ | 12,668,160 | | $ | 13,529,277 | (10) | % | | (24) | % |

| NOW and interest-bearing demand deposits | 6,006,114 | | 5,814,836 | | 5,576,558 | | 5,591,986 | | 5,676,122 | 13 | | | 6 | |

Wealth management deposits (2) | 1,788,099 | | 1,417,984 | | 1,809,933 | | 2,463,833 | | 2,988,195 | 104 | | | (40) | |

| Money market | 14,478,504 | | 14,523,124 | | 13,552,277 | | 12,886,795 | | 12,538,489 | (1) | | | 15 | |

| Savings | 5,584,294 | | 5,321,578 | | 5,192,108 | | 4,556,635 | | 3,988,790 | 20 | | | 40 | |

| Time certificates of deposit | 6,788,669 | | 6,356,270 | | 5,351,252 | | 4,735,135 | | 4,076,318 | 27 | | | 67 | |

| Total deposits | $ | 44,992,686 | | $ | 44,038,707 | | $ | 42,718,211 | | $ | 42,902,544 | | $ | 42,797,191 | 9 | % | | 5 | % |

| Mix: | | | | | | | | | | | | |

| Non-interest-bearing | 23 | % | | 24 | % | | 26 | % | | 30 | % | | 32 | % | | | |

| NOW and interest-bearing demand deposits | 13 | | | 13 | | | 13 | | | 13 | | | 13 | | | | |

Wealth management deposits (2) | 4 | | | 3 | | | 4 | | | 5 | | | 7 | | | | |

| Money market | 32 | | | 33 | | | 32 | | | 30 | | | 29 | | | | |

| Savings | 13 | | | 12 | | | 12 | | | 11 | | | 9 | | | | |

| Time certificates of deposit | 15 | | | 15 | | | 13 | | | 11 | | | 10 | | | | |

| Total deposits | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | | |

(1)Annualized.

(2)Represents deposit balances of the Company’s subsidiary banks from brokerage customers of Wintrust Investments, Chicago Deferred Exchange Company, LLC (“CDEC”), trust and asset management customers of the Company.

TABLE 3: TIME CERTIFICATES OF DEPOSIT MATURITY/RE-PRICING ANALYSIS

As of September 30, 2023

| | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | | | | | | | | | Total Time

Certificates of

Deposit | | Weighted-Average

Rate of Maturing

Time Certificates

of Deposit |

| 1-3 months | | | | | | | | | $ | 987,384 | | | 3.36 | % |

| 4-6 months | | | | | | | | | 1,674,674 | | | 3.47 | |

| 7-9 months | | | | | | | | | 1,984,259 | | | 4.51 | |

| 10-12 months | | | | | | | | | 1,382,970 | | | 4.54 | |

| 13-18 months | | | | | | | | | 566,457 | | | 3.28 | |

| 19-24 months | | | | | | | | | 117,916 | | | 2.54 | |

| 24+ months | | | | | | | | | 75,009 | | | 1.62 | |

| Total | | | | | | | | | $ | 6,788,669 | | | 3.92 | % |

TABLE 4: QUARTERLY AVERAGE BALANCES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Balance for three months ended, |

| | | Sep 30, | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, |

| (In thousands) | | 2023 | | 2023 | | 2023 | | 2022 | | 2022 |

Interest-bearing deposits with banks, securities purchased under resale agreements and cash equivalents (1) | | $ | 2,053,568 | | | $ | 1,454,057 | | | $ | 1,235,748 | | | $ | 2,449,889 | | | $ | 3,039,907 | |

Investment securities (2) | | 7,706,285 | | | 7,252,582 | | | 7,956,722 | | | 7,310,383 | | | 6,655,215 | |

| FHLB and FRB stock | | 201,252 | | | 223,813 | | | 233,615 | | | 185,290 | | | 142,304 | |

| | | | | | | | | | |

Liquidity management assets (3) | | 9,961,105 | | | 8,930,452 | | | 9,426,085 | | | 9,945,562 | | | 9,837,426 | |

Other earning assets (3)(4) | | 17,879 | | | 17,401 | | | 18,445 | | | 18,585 | | | 21,805 | |

| Mortgage loans held-for-sale | | 319,099 | | | 307,683 | | | 270,966 | | | 308,639 | | | 455,342 | |

Loans, net of unearned income (3)(5) | | 40,707,042 | | | 40,106,393 | | | 39,093,368 | | | 38,566,871 | | | 37,431,126 | |

| | | | | | | | | | |

| | | | | | | | | | |

Total earning assets (3) | | 51,005,125 | | | 49,361,929 | | | 48,808,864 | | | 48,839,657 | | | 47,745,699 | |

| Allowance for loan and investment security losses | | (319,491) | | | (302,627) | | | (282,704) | | | (252,827) | | | (260,270) | |

| Cash and due from banks | | 459,819 | | | 481,510 | | | 488,457 | | | 475,691 | | | 458,263 | |

| Other assets | | 3,236,528 | | | 3,061,141 | | | 3,060,701 | | | 3,025,097 | | | 2,779,002 | |

Total assets | | $ | 54,381,981 | | | $ | 52,601,953 | | | $ | 52,075,318 | | | $ | 52,087,618 | | | $ | 50,722,694 | |

| | | | | | | | | | |

| NOW and interest-bearing demand deposits | | $ | 5,815,155 | | | $ | 5,540,597 | | | $ | 5,271,740 | | | $ | 5,598,291 | | | $ | 5,789,368 | |

| Wealth management deposits | | 1,512,765 | | | 1,545,626 | | | 2,167,081 | | | 2,883,247 | | | 3,078,764 | |

| Money market accounts | | 14,155,446 | | | 13,735,924 | | | 12,533,468 | | | 12,319,842 | | | 12,037,412 | |

| Savings accounts | | 5,472,535 | | | 5,206,609 | | | 4,830,322 | | | 4,403,113 | | | 3,862,579 | |

| Time deposits | | 6,495,906 | | | 5,603,024 | | | 5,041,638 | | | 4,023,232 | | | 3,675,930 | |

| Interest-bearing deposits | | 33,451,807 | | | 31,631,780 | | | 29,844,249 | | | 29,227,725 | | | 28,444,053 | |

| Federal Home Loan Bank advances | | 2,241,292 | | | 2,227,106 | | | 2,474,882 | | | 2,088,201 | | | 1,403,573 | |

| Other borrowings | | 657,454 | | | 625,757 | | | 602,937 | | | 480,553 | | | 478,909 | |

| Subordinated notes | | 437,658 | | | 437,545 | | | 437,422 | | | 437,312 | | | 437,191 | |

| Junior subordinated debentures | | 253,566 | | | 253,566 | | | 253,566 | | | 253,566 | | | 253,566 | |

Total interest-bearing liabilities | | 37,041,777 | | | 35,175,754 | | | 33,613,056 | | | 32,487,357 | | | 31,017,292 | |

| Non-interest-bearing deposits | | 10,612,009 | | | 10,908,022 | | | 12,171,631 | | | 13,404,036 | | | 13,731,219 | |

| Other liabilities | | 1,644,312 | | | 1,473,459 | | | 1,395,360 | | | 1,485,369 | | | 1,178,796 | |

| Equity | | 5,083,883 | | | 5,044,718 | | | 4,895,271 | | | 4,710,856 | | | 4,795,387 | |

Total liabilities and shareholders’ equity | | $ | 54,381,981 | | | $ | 52,601,953 | | | $ | 52,075,318 | | | $ | 52,087,618 | | | $ | 50,722,694 | |

| | | | | | | | | | |

Net free funds/contribution (6) | | $ | 13,963,348 | | | $ | 14,186,175 | | | $ | 15,195,808 | | | $ | 16,352,300 | | | $ | 16,728,407 | |

(1)Includes interest-bearing deposits from banks and securities purchased under resale agreements with original maturities of greater than three months. Cash equivalents include federal funds sold and securities purchased under resale agreements with original maturities of three months or less.

(2)Investment securities includes investment securities classified as available-for-sale and held-to-maturity, and equity securities with readily determinable fair values. Equity securities without readily determinable fair values are included within other assets.

(3)See Table 17: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

(4)Other earning assets include brokerage customer receivables and trading account securities.

(5)Loans, net of unearned income, include non-accrual loans.

(6)Net free funds are the difference between total average earning assets and total average interest-bearing liabilities. The estimated contribution to net interest margin from net free funds is calculated using the rate paid for total interest-bearing liabilities.

TABLE 5: QUARTERLY NET INTEREST INCOME

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net Interest Income for three months ended, |

| | | Sep 30, | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, |

| (In thousands) | | 2023 | | 2023 | | 2023 | | 2022 | | 2022 |

| Interest income: | | | | | | | | | | |

| Interest-bearing deposits with banks, securities purchased under resale agreements and cash equivalents | | $ | 28,022 | | | $ | 16,882 | | | $ | 13,538 | | | $ | 21,612 | | | $ | 17,466 | |

| Investment securities | | 59,737 | | | 51,795 | | | 60,494 | | | 53,630 | | | 39,071 | |

| FHLB and FRB stock | | 3,896 | | | 3,544 | | | 3,680 | | | 2,918 | | | 2,109 | |

| | | | | | | | | | |

Liquidity management assets (1) | | 91,655 | | | 72,221 | | | 77,712 | | | 78,160 | | | 58,646 | |

Other earning assets (1) | | 291 | | | 272 | | | 313 | | | 289 | | | 275 | |

| Mortgage loans held-for-sale | | 4,767 | | | 4,178 | | | 3,528 | | | 3,997 | | | 5,371 | |

Loans, net of unearned income (1) | | 668,183 | | | 622,939 | | | 560,564 | | | 500,432 | | | 403,719 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total interest income | | $ | 764,896 | | | $ | 699,610 | | | $ | 642,117 | | | $ | 582,878 | | | $ | 468,011 | |

| | | | | | | | | | |

| Interest expense: | | | | | | | | | | |

| NOW and interest-bearing demand deposits | | $ | 36,001 | | | $ | 29,178 | | | $ | 18,772 | | | $ | 14,982 | | | $ | 8,041 | |

| Wealth management deposits | | 9,350 | | | 9,097 | | | 12,258 | | | 14,079 | | | 11,068 | |

| Money market accounts | | 124,742 | | | 106,630 | | | 68,276 | | | 45,468 | | | 18,916 | |

| Savings accounts | | 31,784 | | | 25,603 | | | 15,816 | | | 8,421 | | | 2,130 | |

| Time deposits | | 60,906 | | | 42,987 | | | 29,680 | | | 12,497 | | | 5,761 | |

| Interest-bearing deposits | | 262,783 | | | 213,495 | | | 144,802 | | | 95,447 | | | 45,916 | |

| Federal Home Loan Bank advances | | 17,436 | | | 17,399 | | | 19,135 | | | 13,823 | | | 6,812 | |

| Other borrowings | | 9,384 | | | 8,485 | | | 7,854 | | | 5,313 | | | 4,008 | |

| Subordinated notes | | 5,491 | | | 5,523 | | | 5,488 | | | 5,520 | | | 5,485 | |

| Junior subordinated debentures | | 4,948 | | | 4,737 | | | 4,416 | | | 3,826 | | | 2,809 | |

| Total interest expense | | $ | 300,042 | | | $ | 249,639 | | | $ | 181,695 | | | $ | 123,929 | | | $ | 65,030 | |

| | | | | | | | | | |

| Less: Fully taxable-equivalent adjustment | | (2,496) | | | (2,434) | | | (2,427) | | | (2,133) | | | (1,533) | |

Net interest income (GAAP) (2) | | 462,358 | | | 447,537 | | | 457,995 | | | 456,816 | | | 401,448 | |

| Fully taxable-equivalent adjustment | | 2,496 | | | 2,434 | | | 2,427 | | | 2,133 | | | 1,533 | |

Net interest income, fully taxable-equivalent (non-GAAP) (2) | | $ | 464,854 | | | $ | 449,971 | | | $ | 460,422 | | | $ | 458,949 | | | $ | 402,981 | |

(1)Interest income on tax-advantaged loans, trading securities and investment securities reflects a taxable-equivalent adjustment based on the marginal federal corporate tax rate in effect as of the applicable period.

(2)See Table 17: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

TABLE 6: QUARTERLY NET INTEREST MARGIN

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net Interest Margin for three months ended, |

| | Sep 30, 2023 | | Jun 30, 2023 | | Mar 31,

2023 | | Dec 31, 2022 | | Sep 30,

2022 |

| Yield earned on: | | | | | | | | | | |

| Interest-bearing deposits with banks, securities purchased under resale agreements and cash equivalents | | 5.41 | % | | 4.66 | % | | 4.44 | % | | 3.50 | % | | 2.28 | % |

| Investment securities | | 3.08 | | | 2.86 | | | 3.08 | | | 2.91 | | | 2.33 | |

| FHLB and FRB stock | | 7.68 | | | 6.35 | | | 6.39 | | | 6.25 | | | 5.88 | |

| | | | | | | | | | |

| Liquidity management assets | | 3.65 | | | 3.24 | | | 3.34 | | | 3.12 | | | 2.37 | |

| Other earning assets | | 6.47 | | | 6.27 | | | 6.87 | | | 6.17 | | | 5.01 | |

| Mortgage loans held-for-sale | | 5.93 | | | 5.45 | | | 5.28 | | | 5.14 | | | 4.68 | |

| Loans, net of unearned income | | 6.51 | | | 6.23 | | | 5.82 | | | 5.15 | | | 4.28 | |

| | | | | | | | | | |

| Total earning assets | | 5.95 | % | | 5.68 | % | | 5.34 | % | | 4.73 | % | | 3.89 | % |

| | | | | | | | | | |

| Rate paid on: | | | | | | | | | | |

| NOW and interest-bearing demand deposits | | 2.46 | % | | 2.11 | % | | 1.44 | % | | 1.06 | % | | 0.55 | % |

| Wealth management deposits | | 2.45 | | | 2.36 | | | 2.29 | | | 1.94 | | | 1.43 | |

| Money market accounts | | 3.50 | | | 3.11 | | | 2.21 | | | 1.46 | | | 0.62 | |

| Savings accounts | | 2.30 | | | 1.97 | | | 1.33 | | | 0.76 | | | 0.22 | |

| Time deposits | | 3.72 | | | 3.08 | | | 2.39 | | | 1.23 | | | 0.62 | |

| Interest-bearing deposits | | 3.12 | | | 2.71 | | | 1.97 | | | 1.30 | | | 0.64 | |

| Federal Home Loan Bank advances | | 3.09 | | | 3.13 | | | 3.14 | | | 2.63 | | | 1.93 | |

| Other borrowings | | 5.66 | | | 5.44 | | | 5.28 | | | 4.39 | | | 3.32 | |

| Subordinated notes | | 4.98 | | | 5.06 | | | 5.02 | | | 5.05 | | | 5.02 | |

| Junior subordinated debentures | | 7.74 | | | 7.49 | | | 6.97 | | | 5.90 | | | 4.33 | |

| Total interest-bearing liabilities | | 3.21 | % | | 2.85 | % | | 2.19 | % | | 1.51 | % | | 0.83 | % |

| | | | | | | | | | |

Interest rate spread (1)(2) | | 2.74 | % | | 2.83 | % | | 3.15 | % | | 3.22 | % | | 3.06 | % |

| Less: Fully taxable-equivalent adjustment | | (0.02) | | | (0.02) | | | (0.02) | | | (0.02) | | | (0.01) | |

Net free funds/contribution (3) | | 0.88 | | | 0.83 | | | 0.68 | | | 0.51 | | | 0.29 | |

Net interest margin (GAAP) (2) | | 3.60 | % | | 3.64 | % | | 3.81 | % | | 3.71 | % | | 3.34 | % |

| Fully taxable-equivalent adjustment | | 0.02 | | | 0.02 | | | 0.02 | | | 0.02 | | | 0.01 | |

Net interest margin, fully taxable-equivalent (non-GAAP) (2) | | 3.62 | % | | 3.66 | % | | 3.83 | % | | 3.73 | % | | 3.35 | % |

(1)Interest rate spread is the difference between the yield earned on earning assets and the rate paid on interest-bearing liabilities.

(2)See Table 17: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

(3)Net free funds are the difference between total average earning assets and total average interest-bearing liabilities. The estimated contribution to net interest margin from net free funds is calculated using the rate paid for total interest-bearing liabilities.

TABLE 7: YEAR-TO-DATE AVERAGE BALANCES, AND NET INTEREST INCOME AND MARGIN

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Average Balance for nine months ended, | Interest for nine months ended, | Yield/Rate for nine months ended, |

| (Dollars in thousands) | Sep 30, 2023 | | Sep 30,

2022 | Sep 30, 2023 | | Sep 30, 2022 | Sep 30, 2023 | | Sep 30, 2022 |

Interest-bearing deposits with banks, securities purchased under resale agreements and cash equivalents (1) | $ | 1,584,120 | | | $ | 3,617,498 | | $ | 58,443 | | | $ | 26,738 | | 4.93 | % | | 0.99 | % |

Investment securities (2) | 7,637,612 | | | 6,542,077 | | 172,025 | | | 108,947 | | 3.01 | | | 2.23 | |

| FHLB and FRB stock | 219,442 | | | 138,405 | | 11,120 | | | 5,704 | | 6.77 | | | 5.51 | |

| | | | | | | | | |

Liquidity management assets (3)(4) | $ | 9,441,174 | | | $ | 10,297,980 | | $ | 241,588 | | | $ | 141,389 | | 3.42 | % | | 1.84 | % |

Other earning assets (3)(4)(5) | 17,906 | | | 23,673 | | 876 | | | 666 | | 6.54 | | | 3.76 | |

| Mortgage loans held-for-sale | 299,426 | | | 559,258 | | 12,473 | | | 17,198 | | 5.57 | | | 4.11 | |

Loans, net of unearned income (3)(4)(6) | 39,974,840 | | | 36,050,185 | | 1,851,686 | | | 1,010,913 | | 6.19 | | | 3.75 | |

| | | | | | | | | |

| | | | | | | | | |

Total earning assets (4) | $ | 49,733,346 | | | $ | 46,931,096 | | $ | 2,106,623 | | | $ | 1,170,166 | | 5.66 | % | | 3.33 | % |

| Allowance for loan and investment security losses | (301,742) | | | (257,992) | | | | | | | |

| Cash and due from banks | 476,490 | | | 472,127 | | | | | | | |

| Other assets | 3,120,105 | | | 2,718,562 | | | | | | | |

Total assets | $ | 53,028,199 | | | $ | 49,863,793 | | | | | | | |

| | | | | | | | | |

| NOW and interest-bearing demand deposits | $ | 5,544,488 | | | $ | 5,273,115 | | $ | 83,949 | | | $ | 12,584 | | 2.02 | % | | 0.32 | % |

| Wealth management deposits | 1,739,427 | | | 2,808,709 | | 30,705 | | | 15,671 | | 2.36 | | | 0.75 | |

| Money market accounts | 13,480,887 | | | 12,232,024 | | 299,649 | | | 35,123 | | 2.97 | | | 0.38 | |

| Savings accounts | 5,172,174 | | | 3,883,092 | | 73,203 | | | 2,813 | | 1.89 | | | 0.10 | |

| Time deposits | 5,718,850 | | | 3,741,014 | | 133,574 | | | 13,564 | | 3.12 | | | 0.48 | |

| Interest-bearing deposits | $ | 31,655,826 | | | $ | 27,937,954 | | $ | 621,080 | | | $ | 79,755 | | 2.62 | % | | 0.38 | % |

| Federal Home Loan Bank advances | 2,313,571 | | | 1,281,273 | | 53,970 | | | 16,506 | | 3.12 | | | 1.72 | |

| Other borrowings | 628,915 | | | 487,595 | | 25,723 | | | 8,981 | | 5.47 | | | 2.46 | |

| Subordinated notes | 437,543 | | | 437,081 | | 16,502 | | | 16,484 | | 5.04 | | | 5.03 | |

| Junior subordinated debentures | 253,566 | | | 253,566 | | 14,101 | | | 6,426 | | 7.44 | | | 3.34 | |

Total interest-bearing liabilities | $ | 35,289,421 | | | $ | 30,397,469 | | $ | 731,376 | | | $ | 128,152 | | 2.77 | % | | 0.56 | % |

| Non-interest-bearing deposits | 11,224,841 | | | 13,756,793 | | | | | | | |

| Other liabilities | 1,505,289 | | | 1,101,132 | | | | | | | |

| Equity | 5,008,648 | | | 4,608,399 | | | | | | | |

Total liabilities and shareholders’ equity | $ | 53,028,199 | | | $ | 49,863,793 | | | | | | | |

Interest rate spread (4)(7) | | | | | | | 2.89 | % | | 2.77 | % |

| Less: Fully taxable-equivalent adjustment | | | | (7,357) | | | (3,468) | | (0.02) | | | (0.01) | |

Net free funds/contribution (8) | $ | 14,443,925 | | | $ | 16,533,627 | | | | | 0.81 | | | 0.20 | |

Net interest income/margin (GAAP) (4) | | | | $ | 1,367,890 | | | $ | 1,038,546 | | 3.68 | % | | 2.96 | % |

| Fully taxable-equivalent adjustment | | | | 7,357 | | | 3,468 | 0.02 | | | 0.01 | |

Net interest income/margin, fully taxable-equivalent (non-GAAP) (4) | | | | $ | 1,375,247 | | | $ | 1,042,014 | | 3.70 | % | | 2.97 | % |

(1)Includes interest-bearing deposits from banks and securities purchased under resale agreements with original maturities of greater than three months. Cash equivalents include federal funds sold and securities purchased under resale agreements with original maturities of three months or less.

(2)Investment securities includes investment securities classified as available-for-sale and held-to-maturity, and equity securities with readily determinable fair values. Equity securities without readily determinable fair values are included within other assets.

(3)Interest income on tax-advantaged loans, trading securities and investment securities reflects a taxable-equivalent adjustment based on the marginal federal corporate tax rate in effect as of the applicable period.

(4)See Table 17: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

(5)Other earning assets include brokerage customer receivables and trading account securities.

(6)Loans, net of unearned income, include non-accrual loans.

(7)Interest rate spread is the difference between the yield earned on earning assets and the rate paid on interest-bearing liabilities.

(8)Net free funds are the difference between total average earning assets and total average interest-bearing liabilities. The estimated contribution to net interest margin from net free funds is calculated using the rate paid for total interest-bearing liabilities.

TABLE 8: INTEREST RATE SENSITIVITY

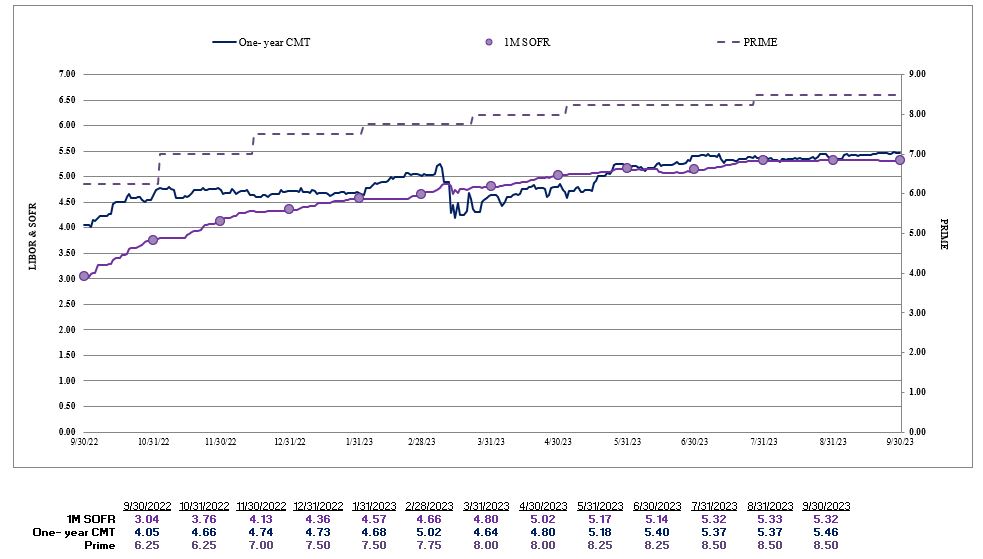

As an ongoing part of its financial strategy, the Company attempts to manage the impact of fluctuations in market interest rates on net interest income. Management measures its exposure to changes in interest rates by modeling many different interest rate scenarios.

The following interest rate scenarios display the percentage change in net interest income over a one-year time horizon assuming increases and decreases of 100 and 200 basis points. The Static Shock Scenario results incorporate actual cash flows and repricing characteristics for balance sheet instruments following an instantaneous, parallel change in market rates based upon a static (i.e. no growth or constant) balance sheet. Conversely, the Ramp Scenario results incorporate management’s projections of future volume and pricing of each of the product lines following a gradual, parallel change in market rates over twelve months. Actual results may differ from these simulated results due to timing, magnitude, and frequency of interest rate changes as well as changes in market conditions and management strategies. The interest rate sensitivity for both the Static Shock and Ramp Scenario is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Static Shock Scenario | | +200 Basis Points | | +100 Basis Points | | -100 Basis Points | | -200 Basis Points |

| Sep 30, 2023 | | 3.3 | % | | 1.9 | % | | (2.0) | % | | (5.2) | % |

| Jun 30, 2023 | | 5.7 | | | 2.9 | | | (2.9) | | | (7.9) | |

| Mar 31, 2023 | | 4.2 | | | 2.4 | | | (2.4) | | | (7.3) | |

| Dec 31, 2022 | | 7.2 | | | 3.8 | | | (5.0) | | | (12.1) | |

| Sep 30, 2022 | | 12.9 | | | 7.1 | | | (8.7) | | | (18.9) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Ramp Scenario | +200 Basis Points | | +100 Basis Points | | -100 Basis Points | | -200 Basis Points |

| Sep 30, 2023 | 1.7 | % | | 1.2 | % | | (0.5) | % | | (2.4) | % |

| Jun 30, 2023 | 2.9 | | | 1.8 | | | (0.9) | | | (3.4) | |

| Mar 31, 2023 | 3.0 | | | 1.7 | | | (1.3) | | | (3.4) | |

| Dec 31, 2022 | 5.6 | | | 3.0 | | | (2.9) | | | (6.8) | |

| Sep 30, 2022 | 6.5 | | | 3.6 | | | (3.9) | | | (8.6) | |

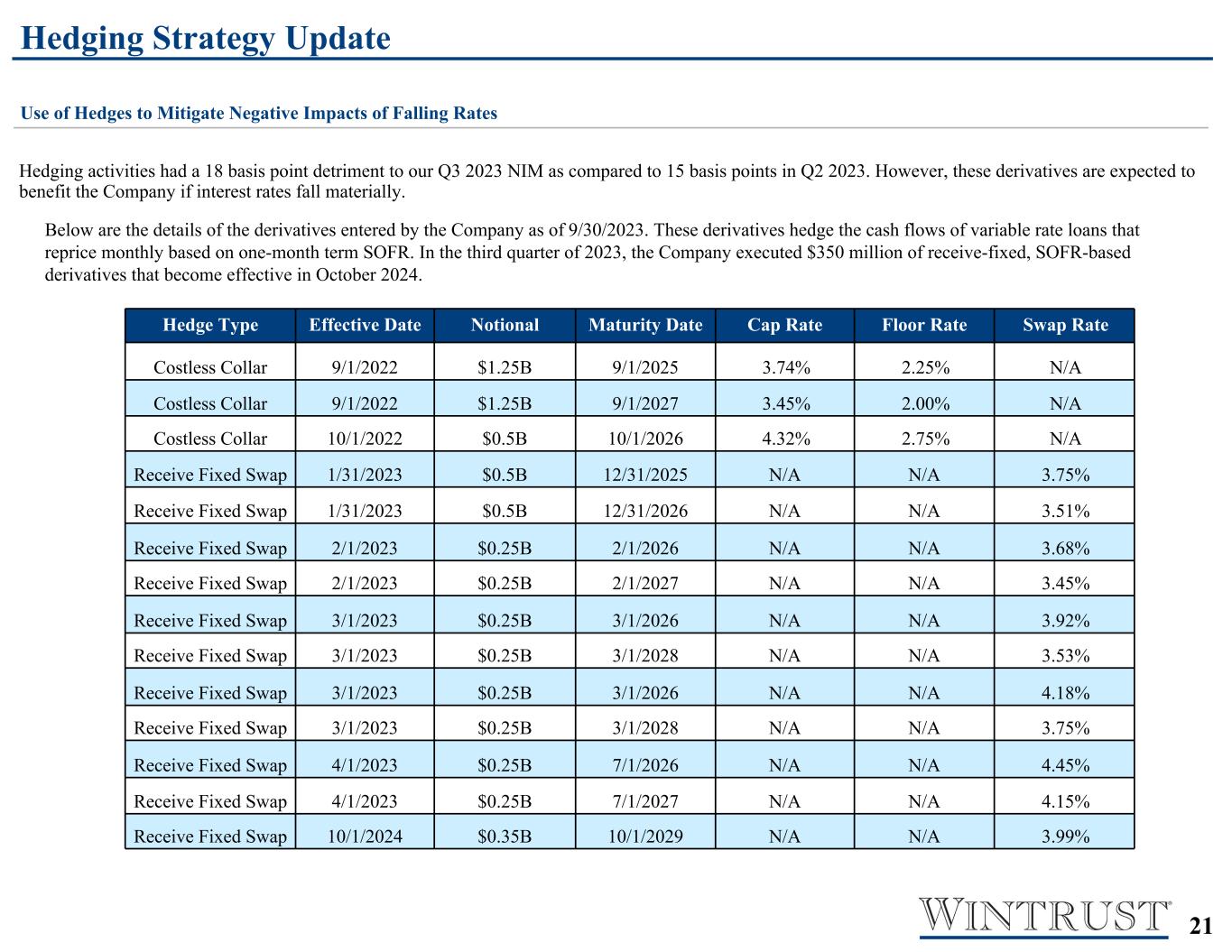

As shown above, the magnitude of potential changes in net interest income in various interest rate scenarios has continued to diminish. Given the recent unprecedented rise in interest rates, the Company has made a conscious effort to reposition its exposure to changing interest rates given the uncertainty of the future interest rate environment. To this end, management has executed various derivative instruments including collars and receive fixed swaps to hedge variable rate loan exposures and originated a higher percentage of its loan originations in longer term fixed rate loans. The Company will continue to monitor current and projected interest rates and expects to execute additional derivatives to mitigate potential fluctuations in the net interest margin in future years.

TABLE 9: MATURITIES AND SENSITIVITIES TO CHANGES IN INTEREST RATES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans repricing or contractual maturity period |

| As of September 30, 2023 | One year or

less | | From one to

five years | | From five to fifteen years | | After fifteen years | | Total |

| (In thousands) | | | | |

| Commercial | | | | | | | | | |

| Fixed rate | $ | 532,313 | | | $ | 2,805,566 | | | $ | 1,740,199 | | | $ | 19,102 | | | $ | 5,097,180 | |

| | | | | | | | | |

| Variable rate | 7,626,902 | | | 1,391 | | | — | | | — | | | 7,628,293 | |

| Total commercial | $ | 8,159,215 | | | $ | 2,806,957 | | | $ | 1,740,199 | | | $ | 19,102 | | | $ | 12,725,473 | |

| Commercial real estate | | | | | | | | | |

| Fixed rate | 637,462 | | | 2,891,879 | | | 546,918 | | | 48,296 | | | 4,124,555 | |

| Variable rate | 6,813,010 | | | 7,872 | | | 743 | | | — | | | 6,821,625 | |

| Total commercial real estate | $ | 7,450,472 | | | $ | 2,899,751 | | | $ | 547,661 | | | $ | 48,296 | | | $ | 10,946,180 | |

| Home equity | | | | | | | | | |

| Fixed rate | 10,785 | | | 2,398 | | | — | | | 29 | | | 13,212 | |

| Variable rate | 330,046 | | | — | | | — | | | — | | | 330,046 | |

| Total home equity | $ | 340,831 | | | $ | 2,398 | | | $ | — | | | $ | 29 | | | $ | 343,258 | |

| Residential real estate | | | | | | | | | |

| Fixed rate | 16,676 | | | 3,817 | | | 30,733 | | | 1,063,669 | | | 1,114,895 | |

| Variable rate | 74,016 | | | 268,720 | | | 1,249,972 | | | — | | | 1,592,708 | |

| Total residential real estate | $ | 90,692 | | | $ | 272,537 | | | $ | 1,280,705 | | | $ | 1,063,669 | | | $ | 2,707,603 | |

| Premium finance receivables - property & casualty | | | | | | | | | |

| Fixed rate | 6,612,136 | | | 110,611 | | | — | | | — | | | 6,722,747 | |

| Variable rate | — | | | — | | | — | | | — | | | — | |

| Total premium finance receivables - property & casualty | $ | 6,612,136 | | | $ | 110,611 | | | $ | — | | | $ | — | | | $ | 6,722,747 | |

| Premium finance receivables - life insurance | | | | | | | | | |

| Fixed rate | 137,889 | | | 594,399 | | | 3,978 | | | — | | | 736,266 | |

| Variable rate | 7,195,542 | | | — | | | — | | | — | | | 7,195,542 | |