We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| VS Media Holdings Ltd | NASDAQ:VSME | NASDAQ | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 1.12 | 1.09 | 1.40 | 0 | 09:16:59 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023.

Commission File Number: 001-41817

VS MEDIA HOLDINGS LIMITED

(Translation of registrant’s name into English)

Ms. Nga Fan Wong, Chief Executive Officer

6/F, KOHO,

75 Hung To Road,

Kwun Tong, Hong Kong

+852 2865 9992

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

VS MEDIA HOLDINGS LIMITED

AND SUBSIDIARIES

Announces Unaudited Financial Results For the Six Months Ended June 30, 2023

PRELIMINARY NOTE

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our audited consolidated financial statements and related notes that appear in Amendment No. 1 to Form F-1 filed to the SEC on August 21, 2023. In addition to historical consolidated financial information, the following discussion contains forward-looking statements that reflect our plans, estimates, and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below and elsewhere in this report. All amounts included herein with respect to the six months ended June 30, 2023 and 2022 (“Interim Financial Statements”) are derived from our unaudited condensed consolidated financial statements for the six months ended June 30, 2023 and 2022 included elsewhere in this report. These Interim Financial Statements have been prepared in accordance with U.S. Generally Accepted Accounting Principles, or US GAAP.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Results of Operations

Six months ended June 30, 2023 vs six months ended June 30, 2022

| Six months ended June 30, | ||||||||||||||||

| 2023 | 2022 | Variance | ||||||||||||||

| (US$ in thousands) | $ | % | ||||||||||||||

| Revenues, net | $ | 3,527 | $ | 4,326 | (799 | ) | (18.47 | ) | ||||||||

| Cost of revenues | (2,769 | ) | (3,174 | ) | (405 | ) | (12.76 | ) | ||||||||

| Gross profit | 758 | 1,152 | (394 | ) | (34.20 | ) | ||||||||||

| Marketing expenses | (85 | ) | (5 | ) | 80 | 1,600.00 | ||||||||||

| General and administrative expenses | (2,860 | ) | (945 | ) | 1,915 | 202.65 | ||||||||||

| Total operating expenses | (2,945 | ) | (950 | ) | 1,995 | 210.00 | ||||||||||

| Operating (loss) income | (2,187 | ) | 202 | (2,389 | ) | (1,182.67 | ) | |||||||||

| Other income (expense) | ||||||||||||||||

| Other income | 16 | 18 | (2 | ) | (11.11 | ) | ||||||||||

| Interest expense | (148 | ) | (94 | ) | 54 | 57.45 | ||||||||||

| Total other expense, net | (132 | ) | (76 | ) | 56 | 73.68 | ||||||||||

| (Loss) income before taxes | (2,319 | ) | 126 | (2,445 | ) | (1,940.48 | ) | |||||||||

| Provision for income taxes | - | - | - | - | ||||||||||||

| (Loss) income from continuing operations | (2,319 | ) | 126 | (2,445 | ) | (1,940.48 | ) | |||||||||

| Discontinued operations: | ||||||||||||||||

| Loss from discontinued operations | - | (8 | ) | (8 | ) | (100.00 | ) | |||||||||

| Gain on disposal | - | 5,089 | (5,089 | ) | (100.00 | ) | ||||||||||

| Net (loss) income | $ | (2,319 | ) | $ | 5,207 | (7,526 | ) | (144.54 | ) | |||||||

| 2 |

Revenues

We primarily generate our revenue by providing marketing services to brands and social media platforms and by selling products to our creators and customers. We recognize all our revenue on a gross basis, comprising (i) Marketing Services—service fees from brands and advertising revenue from social media platforms, which are essentially the exact amount brands and social media platforms pay us; and (ii) Social Commerce—product sales to creators and customers. Marketing Services are further subdivided into Campaign-Based Marketing Services, Optimization-Based Marketing Services and Marketing Services from Social Media Platforms.

We use revenue to assess our business growth, evaluate our market share, review our scale of operations, measure our performance, identify trends affecting our business, establish our budgets, measure the effectiveness of sales and marketing and determine our operational efficiencies.

| Six months ended June 30 | Variance | |||||||||||||||||||||||

| 2023 | 2022 | $ | % | |||||||||||||||||||||

| US$’000 | % | US’000 | % | |||||||||||||||||||||

| Campaign-Based Marketing Services | $ | 1,780 | 50.47 | $ | 1,627 | 37.61 | 153 | 9.40 | ||||||||||||||||

| Optimization-Based Marketing Services | 1,338 | 37.93 | 2,000 | 46.23 | (662 | ) | (33.10 | ) | ||||||||||||||||

| Social Media Platforms Marketing Services | 409 | 11.60 | 443 | 10.24 | (34 | ) | (7.67 | ) | ||||||||||||||||

| Social Commerce | - | - | 256 | 5.92 | (256 | ) | (100.00 | ) | ||||||||||||||||

| TOTAL | $ | 3,527 | 100.00 | $ | 4,326 | 100.00 | (799 | ) | (18.47 | ) | ||||||||||||||

During the six months ended June 30, 2023, we and our subsidiaries recorded revenue of approximately $3.5 million, representing a decrease of $0.8 million or 18.47% from revenue of approximately $4.3 million for the six months ended June 30, 2022. The decrease in revenue was mainly attributable to decreased revenue from our Optimization-Based Marketing Services and Social Commerce businesses. The decrease was mainly due to the weaken market sentiment, the decrease in overall spending by major Optimization-Based Marketing Services clients in Hong Kong and our strategy to temporarily close our Social Commerce business due to its low profit margin and high demand of cashflow.

Revenue derived from Campaign-Based Marketing Services was approximately $1.8 million for the six months ended June 30, 2023, as compared with approximately $1.6 million for the six months ended June 30, 2022, representing an increase of $0.2 million or 9.40%. The increase was mainly due to our strategy of focusing our efforts on growing several major clients to increase their overall spending.

Revenue derived from Optimization-Based Marketing Services was approximately $1.3 million for the six months ended June 30, 2023, as compared with approximately $2.0 million for the six months ended June 30, 2022, representing a decrease of $0.7 million or 33.10%. The decrease was mainly due to the weaken market sentiment, the decrease in overall spending by major Optimization-Based Marketing Services clients in Hong Kong.

Revenue derived from Social Media Platforms Marketing Services was approximately $0.41 million for the six months ended June 30, 2023, as compared with approximately $0.44 million for the six months ended June 30, 2022, representing a decrease of $0.03 million or 7.67%.

Revenue derived from our Social Commerce segment was $0 for the six months ended June 30, 2023, as compared with approximately $0.3 million for the six months ended June 30, 2022, representing a decrease of $0.3 million or 100.00%. The decrease was mainly due to our strategy to temporarily close the low margin businesses to focus on other more profitable businesses.

| 3 |

We carried out our business through our indirect wholly-owned HK SAR subsidiaries, VS Media HK, and Grace Creation, and our indirect wholly-owned Taiwan subsidiary, VS Media TW. The analysis of revenues by category of activity and geographical market for the six months ended June 30, 2023 and 2022 are summarized as below:

| Six months ended June 30, 2023 | Total | |||||||||||||||||||||||

| HK SAR | Taiwan | $ | % | |||||||||||||||||||||

| US$’000 | % | US’000 | % | |||||||||||||||||||||

| Campaign-Based Marketing Services | $ | 780 | 32.82 | $ | 1,000 | 86.96 | 1,780 | 50.47 | ||||||||||||||||

| Optimization-Based Marketing Services | 1,331 | 55.99 | 7 | 0.61 | 1,338 | 37.94 | ||||||||||||||||||

| Social Media Platforms Marketing Services | 266 | 11.19 | 143 | 12.43 | 409 | 11.60 | ||||||||||||||||||

| Social Commerce | - | - | - | - | - | - | ||||||||||||||||||

| TOTAL | $ | 2,377 | 100.00 | $ | 1,150 | 100.00 | 3,527 | 100.00 | ||||||||||||||||

| Six months ended June 30, 2022 | Total | |||||||||||||||||||||||

| HK SAR | Taiwan | $ | % | |||||||||||||||||||||

| US$’000 | % | US’000 | % | |||||||||||||||||||||

| Campaign-Based Marketing Services | $ | 339 | 11.86 | $ | 1,288 | 87.74 | 1,627 | 37.61 | ||||||||||||||||

| Optimization-Based Marketing Services | 2,000 | 69.98 | - | - | 2,000 | 46.23 | ||||||||||||||||||

| Social Media Platforms Marketing Services | 263 | 9.20 | 180 | 12.26 | 443 | 10.24 | ||||||||||||||||||

| Social Commerce | 256 | 8.96 | - | - | 256 | 5.92 | ||||||||||||||||||

| TOTAL | $ | 2,858 | 100.00 | $ | 1,468 | 100.00 | 4,326 | 100.00 | ||||||||||||||||

We operate in HK SAR and Taiwan. In HK SAR, the overall revenue generated for the six months ended June 30, 2023 decreased by 16.83% as compared to the same period in 2022. In Taiwan, the overall revenue generated for the six months ended June 30, 2023 decreased by 21.66% as compared to the same period in 2022. The decrease in both regions was primarily due to our strategy to temporarily close the low margin businesses to focus on profitability.

Campaign-Based Marketing Services was the biggest category in Taiwan as they contributed 86.96% and 87.74% of total revenues generated in Taiwan for the six months ended June 30, 2023 and 2022, respectively.

Optimization-Based Marketing Services was the biggest category in HK SAR as they contributed 55.99% and 69.98% of total revenues generated in HK SAR for the six months ended June 30, 2023 and 2022, respectively.

Cost of Revenues

| Six months ended June 30 | Variance | |||||||||||||||||||||||

| 2023 | 2022 | $ | % | |||||||||||||||||||||

| US$’000 | % | US’000 | % | |||||||||||||||||||||

| Campaign-Based Marketing Services | $ | 1,153 | 41.64 | $ | 1,042 | 32.83 | 111 | 10.65 | ||||||||||||||||

| Optimization-Based Marketing Services | 1,285 | 46.41 | 1,518 | 47.83 | (233 | ) | (15.35 | ) | ||||||||||||||||

| Social Media Platforms Marketing Services | 331 | 11.95 | 371 | 11.69 | (40 | ) | (10.78 | ) | ||||||||||||||||

| Social Commerce | - | - | 243 | 7.65 | (243 | ) | (100.00 | ) | ||||||||||||||||

| TOTAL | $ | 2,769 | 100.00 | $ | 3,174 | 100.00 | (405 | ) | (12.76 | ) | ||||||||||||||

Cost of revenues for the six months ended June 30, 2023 decreased to approximately $2.8 million compared with approximately $3.2 million for the same period in 2022, a decrease of $0.4 million or 12.76%. The decrease was mainly because of our strategy in terminating low margin businesses to focus on profitability.

Cost of revenues from Campaign-Based Marketing Services was approximately $1.2 million for the six months ended June 30, 2023, compared with approximately $1.0 million for the same period in 2022, representing an increase of $0.1 million or 10.65%. The increase was mainly associated with the growth of our Campaign-Based Marketing Services business during the first half fiscal year of 2023.

Cost of revenues from Optimization-Based marketing services was approximately $1.3 million for the six months ended June 30, 2023, compared with approximately $1.5 million for the same period in 2022, representing a decrease of $0.2 million or 15.35%. The decrease was directly associated with the decrease in revenue from Optimization-Based Marketing Service business.

| 4 |

Cost of revenues from Social Media Platforms Marketing Services was approximately $0.3 million for the six months ended June 30, 2023, compared with approximately $0.4 million for the same period in 2022, representing a decrease of $0.04 million or 10.78%. The decrease was in line with the decrease in revenue from Social Media Platforms Marketing Services.

Cost of revenues from Social Commerce was approximately $0 for the six months ended June 30, 2023, compared with approximately $0.2 million for the same period in 2022, representing a decrease of $0.2 million or 100.00%. The decrease was in line with the decrease in revenue from Social Commerce business.

Gross Profit

| Six months ended June 30 | Variance | |||||||||||||||||||||||

| 2023 | 2022 | $ | % | |||||||||||||||||||||

| US$’000 | GP % | US’000 | GP % | |||||||||||||||||||||

| Campaign-Based Marketing Services | $ | 627 | 35.22 | $ | 585 | 35.96 | 42 | 7.18 | ||||||||||||||||

| Optimization-Based Marketing Services | 53 | 3.96 | 482 | 24.10 | (429 | ) | (89.00 | ) | ||||||||||||||||

| Social Media Platforms Marketing Services | 78 | 19.07 | 72 | 16.25 | 6 | 8.33 | ||||||||||||||||||

| Social Commerce | - | - | 13 | 5.08 | (13 | ) | (100.00 | ) | ||||||||||||||||

| TOTAL | $ | 758 | 21.49 | $ | 1,152 | 26.63 | (394 | ) | (34.20 | ) | ||||||||||||||

Gross profit was $0.8 million for the six months ended June 30, 2023, as compared to $1.2 million for the same period in 2022, a decrease of $0.4 million or 34.20%. The overall decrease in gross profit margin from 26.63% for the six months ended June 30, 2022 to 21.49% for the six months ended June 30, 2023 was due to low gross profit margins in our Optimization-Based Marketing Service business and termination of our Social Commerce business during the six months ended June 30, 2023.

Other Income (Expenses)

| Six months ended June 30, | Variance | |||||||||||||||

| 2023 | 2022 | $ | % | |||||||||||||

| US$’000 | US$’000 | |||||||||||||||

| Sundry income | 16 | 18 | (2 | ) | (11.11 | ) | ||||||||||

| Interest expenses | (148 | ) | (94 | ) | 54 | 57.45 | ||||||||||

| Total | (132 | ) | (76 | ) | 56 | 73.68 | ||||||||||

Interest expense primarily was paid on loans we obtained from banks, financial institutions and shareholders. Interest expense increased by $0.05 million, or 57.45%, from $0.1 million for the comparable period of 2022 to $0.15 million for the six months ended June 30, 2023, which was mainly attributable to an increase of $0.2 million in average outstanding borrowings from third parties.

Operating Expenses

| Six months ended June 30, | Variance | |||||||||||||||

| 2023 | 2022 | $ | % | |||||||||||||

| US$’000 | US$’000 | |||||||||||||||

| Marketing expenses | 85 | 5 | 80 | 1,600.00 | ||||||||||||

| General and administrative expenses | 2,860 | 945 | 1,915 | 202.65 | ||||||||||||

| Total | 2,945 | 950 | 1,995 | 210.00 | ||||||||||||

Marketing expenses for the six months ended June 30, 2023 were $0.09 million compared with $0.005 million for the comparable period of 2022, representing an increase of $0.08 million or 1,600.00%. Such increase was mainly attributable to the marketing and media communication services we purchased for a period of two years from July 2022 to June 2024.

| 5 |

Our general and administrative expenses primarily consist of payroll and welfare expenses incurred by the administration as well as management and operating lease expenses for office rentals, depreciation and amortization expenses, travel and entertainment expenses, consulting and professional service fees, and provision for expected credit loss. General and administrative expenses increased by $1.9 million or 202.65%, from $0.9 million for the six months ended June 30, 2022 to $2.9 million for the six months ended June 30, 2023. The increase was primarily due to an increase in legal and professional fees incurred for our initial public offering and listing and compliance costs as a listed company.

Net (Loss) Income

As a result of the foregoing, we reported a net loss of $2.3 million for the six months ended June 30, 2023, as compared with a net income of $5.2 million for the comparable period of 2022. The decrease was mainly attributable from the decrease in revenues, increase in general and administrative expenses as mentioned above and no gain on disposal of subsidiaries incurred during the six months ended June 30, 2023.

Capital Structure and Liquidity

Total assets amounted to $7.7 million as of June 30, 2023, compared with $7.6 million as of December 31, 2022, representing a 1.68% increase. Current assets amounted to $7.4 million as of June 30, 2023, compared with $7.3 million as of December 31, 2022. Current liabilities were $7.7 million as of June 30, 2023, compared with $5.3 million as of December 31, 2022.

The current ratio as of June 30, 2023 was 0.97, compared with 1.37 as of December 31, 2022. The current ratio represents current assets divided by current liabilities and is a liquidity ratio used to measure a company’s ability to pay short-term obligations or those liabilities that are due within one year.

| Variance | ||||||||||||||||

June 30, 2023 | December 31, 2022 | $ | % | |||||||||||||

| US$’000 | US$’000 | |||||||||||||||

| Current Assets | 7,436 | 7,291 | 145 | 1.99 | ||||||||||||

| Current Liabilities | (7,654 | ) | (5,307 | ) | 2,347 | 44.22 | ||||||||||

| Working Capital (Deficit) | (218 | ) | 1,984 | (2,202 | ) | (110.99 | ) | |||||||||

As of June 30, 2023, our working capital deficit was $0.2 million as compared to working capital of $2.0 million as of December 31, 2022. Our working capital needs are influenced by the size of our operations, the volume, dollar value, and performance of our sales contracts, and the timing for collecting accounts receivable and media deposits and repayment of accounts payable.

On January 12, 2023, we obtained a 9-month loan with a principal amount of $255,754 and carrying an interest rate of 32.5% per annum from JS Alternatives JV Fund, an independent third party. These funds were made available for our working capital. To date, we have financed our operations primarily through cash flow from operations, loans from third parties, issuance of shares in private placements, and bank financing. We plan to support our future operations from new funding raised from private placement or public offering, cash generated from our operations and cash on hand.

We believe that our current cash and cash equivalents, together with the borrowing capacity under our revolving credit facilities and term loan facility since 2022 and the proceeds from our initial public offering will be sufficient to meet our anticipated working capital requirements and capital expenditures for the next 12 months. We may, however, need additional capital in the future to fund our continued operations. If we determine that our cash requirements exceed our available financial resources, we may seek to issue equity or debt securities or obtain credit facilities. The issuance and sale of additional equity would result in further dilution to our shareholders. The incurrence of indebtedness would result in increased fixed obligations and could result in operating and financial covenants that might restrict our operations. We cannot assure you that financing will be available in amounts or on terms acceptable to us.

| 6 |

Cash Flows

The following table summarizes our cash flow data for the periods presented:

| Six months ended June 30, | ||||||||

| 2023 | 2022 | |||||||

| US$’000 | US$’000 | |||||||

| Net cash provided by (used in) | ||||||||

| Operating activities – continuing operations | (388 | ) | (2,204 | ) | ||||

| Operating activities – discontinued operations | - | (221 | ) | |||||

| Investing activities | (3 | ) | 2,174 | |||||

| Financing activities | (68 | ) | (257 | ) | ||||

| Net decrease in cash and cash equivalents | (459 | ) | (508 | ) | ||||

| Effect of foreign currency translation | 236 | 501 | ||||||

| Cash and cash equivalents, beginning of period | 820 | 785 | ||||||

| Cash and cash equivalents, end of period | 597 | 778 | ||||||

Operating Activities

Net cash used in operating activities was $0.4 million and $2.4 million for the six months ended June 30, 2023 and 2022, respectively.

Net cash used in operating activities for the six months ended June 30, 2023 was primarily the result of the net loss of $2.3 million, an increase in deposits, prepayments, and others receivable of $0.2 million and a decrease in accounts payable of $0.06 million. These amounts were partially offset by a decrease in accounts receivable of $0.3 million, an increase in receipt in advance of $0.2 million, accruals and other payables of $1.7 million, non-cash adjustments consisting of depreciation on plant and equipment of $0.07 million and amortization of intangible assets of $0.1 million.

Net cash used in operating activities for the six months ended June 30, 2022 was primarily the result of the net income from continuing operations of $0.1 million, net loss from discontinued operations of $0.008 million, increase in deposits, prepayment, and other receivables of $2.7 million, decrease in accounts payable of $0.3 million and decrease in operating lease liabilities of $0.03 million. These amounts were partially offset by a decrease in accounts receivable of $0.6 million, an increase in receipt in advance of $0.06 million, accruals and other payables of $0.09 million, non-cash adjustments consisting of depreciation on plant and equipment of US$0.004 million, amortization of intangible assets of $0.01 million and non-cash lease expense of $0.03 million.

We do not believe we have a material collection risk under our business model that will have a negative impact on collectability. Our business has continued to grow and the demand for our services has been increasing. We believe that the outstanding balance of accounts receivable will be collected within the credit terms.

Investing Activities

Net cash used in investing activities amounted to $0.003 million for the six months ended June 30, 2023, representing the purchase of plant and equipment.

Net cash provided by investing activities amounted to $2.2 million for the six months ended June 30, 2022, representing proceeds from the disposal of subsidiaries.

| 7 |

Financing Activities

Net cash used in financing activities for the six months ended June 30, 2023 of $0.07 million was primarily due to proceeds from other borrowings of $0.3 million, offset by repayments of short-term bank loans of $0.03 million and advances to related parties of $0.3 million, respectively.

Net cash used in financing activities for the six months ended June 30, 2022 of $0.3 million was primarily due to proceeds from short-term bank loans, other borrowings, and a loan from a shareholder of $0.4 million, $0.6 million, and $0.04 million respectively, offset by repayments of promissory notes payable of $1.0 million and advances to related parties of $0.3 million, respectively.

Contractual Obligations

As of June 30, 2023 and December 31, 2022, our contractual obligation to repay outstanding debt and loans from related parties totaled $1,261,169 and $1,231,327, respectively.

We lease offices through operating leases in accordance with ASC Topic 842. As of June 30, 2023 and December 31, 2022, our future lease payments totaled $99,232 and 100,589, respectively.

OFF-BALANCE-SHEET ARRANGEMENTS

We have not entered into any derivative contracts that are indexed to our shares and classified as shareholders’ equity or that are not reflected in our consolidated financial statements. Furthermore, we do not have any retained or contingent interest in assets transferred to an unconsolidated entity that serves as credit, liquidity, or market risk support to such entity. We do not have any variable interest in any unconsolidated entity that provides financing, liquidity, market risk or credit support or that engages in leasing, hedging, or research and development services with us.

INFLATION

Inflation does not materially affect our business or the results of our operations.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Our discussion and analysis of our financial condition and results of operations are based upon our unaudited condensed consolidated financial statements. These financial statements are prepared in accordance with U.S. GAAP, which requires the Company to make estimates and assumptions that affect the reported amounts of our assets and liabilities and revenues and expenses, to disclose contingent assets and liabilities on the dates of the unaudited condensed consolidated financial statements, and to disclose the reported amounts of revenues and expenses incurred during the financial reporting periods. The most significant estimates and assumptions include the valuation of accounts receivable, useful lives of plant and equipment and intangible assets, recoverability of long-lived assets, provisions necessary for contingent liabilities, and revenue recognition. We continue to evaluate these estimates and to make assumptions that we believe are reasonable under the circumstances. We rely on these evaluations as the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Since the use of estimates is an integral component of the financial reporting process, actual results could differ from those estimates as a result of changes in our estimates. Some of our accounting policies require higher degrees of judgment than others in their application. We believe critical accounting policies as disclosed in this prospectus reflect the more significant judgments and estimates used in preparing our unaudited condensed consolidated financial statements.

The following critical accounting policies were used in preparing our unaudited condensed consolidated financial statements:

Basis of presentation

The accompanying unaudited condensed consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and applicable rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”), regarding financial reporting, and include all normal and recurring adjustments that management of the Company considers necessary for a fair presentation of its financial position and operation results.

| 8 |

Principles of consolidation

The accompanying audited consolidated financial statements reflect the activities of the Company, and each of the following entities:

| Place of | Attributable equity | Registered | ||||||||

| Name of company | incorporation | equity interest % | capital | |||||||

| VS MEDIA Holdings Limited | BVI | 100 | $ | 20 | ||||||

| VSM Holdings Limited | BVI | 100 | $ | 1,774 | ||||||

| VS MEDIA PTE. LTD. | Singapore | 100 | $ | 1 | ||||||

| VS Media Co Limited | BVI | 100 | $ | 1,000 | ||||||

| VS Media Limited | HK SAR | 100 | $ | - | * | |||||

| GRACE CREATION LIMITED | HK SAR | 100 | $ | - | * | |||||

| VS MEDIA LIMITED | Taiwan | 100 | $ | 198,288 | ||||||

*Less than $1

Management has eliminated all significant inter-company balances and transactions in preparing the accompanying unaudited condensed consolidated financial statements.

Use of estimates

The preparation of the unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the audited consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. Management makes these estimates using the best information available when the calculations are made; however, actual results could differ materially from those estimates.

Cash and cash equivalents

The Company considers cash, bank deposit and all highly liquid investments with original maturities of three months or less when purchased to be cash and cash equivalents. Cash consists primarily of cash in accounts held at a financial institution.

Deposits and prepayments

The Company makes a deposit payment to suppliers for the procurement of products and services. Upon physical receipt and inspection of products or provision of services from suppliers, the applicable amount is recognized from deposits and prepayments to cost of revenues.

Plant and equipment, net

Plant and equipment are carried at cost less accumulated depreciation. Depreciation is provided over their estimated useful lives, using the straight-line method. The Company typically applies a salvage value of 0%. The estimated useful lives of the plan and equipment are as follows:

| Leasehold improvements | the lesser of useful life or term of lease | |

| Furniture and fixtures | 3-5 years | |

| Equipment | 3-5 years |

The cost and related accumulated depreciation of assets sold or otherwise retired are eliminated from the accounts, and any gain or loss are included in the Company’s results of operations. The costs of maintenance and repairs are recognized as incurred; significant renewals and betterments are capitalized.

| 9 |

Intangible assets, net

Intangible assets are carried at cost less accumulated amortization. Amortization is provided over their useful lives, using the straight-line method. The estimated useful lives of the intangible assets are as follows:

| Software platform | 5 years |

Accounting for the impairment of long-lived assets

The Company annually reviews its long-lived assets for impairment or whenever events or changes in circumstances indicate that the carrying amount of assets may not be recoverable. Impairment may become obsolete from a difference in the industry, introduction of new technologies, or if the Company has inadequate working capital to utilize the long-lived assets to generate adequate profits. Impairment is present if the carrying amount of an asset is less than its expected future undiscounted cash flows.

If an asset is considered impaired, a loss is recognized based on the amount by which the carrying amount exceeds the fair market value of the asset. Assets to be disposed of are reported lower the carrying amount or fair value fewer costs to selling.

Lease

Effective January 1, 2019, the Company adopted ASU 2016-02, “Leases” (Topic 842), and elected the practical expedients that do not require us to reassess: (1) whether any expired or existing contracts are, or contain, leases, (2) lease classification for any expired or existing leases and (3) initial direct costs for any expired or existing leases. For lease terms of twelve months or fewer, a lessee is permitted to make an accounting policy election not to recognize lease assets and liabilities. The Company also adopted the practical expedient that allows lessees to treat the lease and non-lease components of a lease as a single lease component.

Lease terms used to calculate the present value of lease payments generally do not include any options to extend, renew, or terminate the lease, as the Company does not have reasonable certainty at lease inception that these options will be exercised. The Company generally considers the economic life of its operating lease ROU assets to be comparable to the useful life of similar owned assets. The Company has elected the short-term lease exception, therefore operating lease ROU assets and liabilities do not include leases with a lease term of twelve months or less. Its leases generally do not provide a residual guarantee. The operating lease ROU asset also excludes lease incentives. Lease expense is recognized on a straight-line basis over the lease term.

Commitments and contingencies

From time to time, the Company is a party to various legal actions arising in the ordinary course of business. The majority of these claims and proceedings related to or arise from commercial disputes. The Company first determine whether a loss from a claim is probable, and if it is reasonable to estimate the potential loss. The Company accrues costs associated with these matters when they become probable, and the amount can be reasonably estimated. Legal costs incurred in connection with loss contingencies are expensed as incurred. Also, the Company disclose a range of possible losses, if a loss from a claim is probable but the amount of loss cannot be reasonably estimated, which is in line with the applicable requirements of Accounting Standard Codification 450. The Company’s management does not expect any liability from the disposition of such claims and litigation individually or in the aggregate would have a material adverse impact on the Company’s consolidated financial position, results of operations and cash flows.

Related parties

The Company adopted ASC 850, “Related Party Disclosures”, for the identification of related parties and disclosure of related party transactions.

Foreign currency translation

The accompanying audited consolidated financial statements are presented in United States dollar (“$”). The functional currency of the Company is Hong Kong dollar (“HK$”), New Taiwanese dollar (“NT$”) and Singaporean dollar (“SG$”). VS Media HK and Grace Creation’s assets and liabilities are translated into $ from Hong Kong dollar (“HK$”) at year-end exchange rates. VS Media TW and VS Media SG’s assets and liabilities are translated into $ from New Taiwanese dollar (“NT$”) and Singaporean dollar (“SG$”), respectively. Their revenues and expenses are translated at the respective average exchange rate during the period. Capital accounts are translated at their historical exchange rates when the capital transactions occurred.

| 10 |

Revenue recognition

The Company receives revenue from contracts with customers, which are accounted for in accordance with Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers (Topic 606) (“ASC 606”).

ASC Topic 606 provided the following overview of how revenue is recognized from the Company’s contracts with customers: The Company recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods or services.

Step 1: Identify the contract(s) with a customer.

Step 2: Identify the performance obligations in the contract.

Step 3: Determine the transaction price – The transaction price is the amount of consideration in a contract to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer.

Step 4: Allocate the transaction price to the performance obligations in the contract – Any entity typically allocates the transaction price to each performance obligation on the basis of the relative standalone selling prices of each distinct good or service promised in the contract.

Step 5: Recognize revenue when (or as) the entity satisfies a performance obligation – An entity recognizes revenue when (or as) it satisfies a performance obligation by transferring a promised good or service to a customer (which is when the customer obtains control of that good or service). The amount of revenue recognized is the amount allocated to the satisfied performance obligation. A performance obligation may be satisfied at a point in time (typically for promises to transfer goods to a customer) or over time (typically for promises to transfer service to a customer).

Generally, revenues are recognized when the Company has negotiated the terms of the transaction, which includes determining either the overall price, or price for each performance obligation in the form of a service or a product, the service or product has been delivered to the customer, no obligation is outstanding regarding that service or product, and the Company is reasonably assured that funds have been or will be collected from the customer.

A summary of each of the Company’s revenue streams under ASC Topic 606 is as follows:

Marketing services from clients

The Company offers clients a comprehensive suite of digital marketing services to grow their social media presence and reach their target audiences, particularly Gen Z and Millennials, to achieve marketing goals. Clients can leverage the Company’s experience in building content and fanbases with creators, their creators’ creativity, engagement, and trust among creators’ loyal fanbases to increase their brand awareness and sell products. The Company provides custom digital product offerings, including (i) advising on content strategy and budget and recommending specific creators; (ii) communicating with and managing selected creators; (iii) producing and engaging relevant content with creators to promote key messages for clients; (iv) uploading branded content on creators’ social media channels; (v) amplifying the reach of creators’ and clients’ content through precise media planning and buying via boosting marketing services on social media platforms, such as Google; and (vi) providing optimization services through data analysis and reporting.

| 11 |

For campaign-based marketing services, the performance obligation is a promise to place a branded content on certain social media platforms and is satisfied upon delivery of related services to clients. Such revenue is recognized at a point in time, for the amount the Company is entitled to receive, when the marketing services are provided. For optimization-based marketing services, the performance obligation is identified at the contract level as it represents a promise to deliver services under an agreed period. Each performance obligation is satisfied over time as clients receive and consume benefits when its services are performed. Such revenue is recognized over the scheduled period on the straight-line basis.

Digital marketing solutions may include third-party creators and websites, such as Google or Facebook, which can be included in a digital marketing social media campaign. The Company may contract directly with a third-party, however, the Company is responsible for delivering the campaign results to its clients with or without the third-party. The Company is responsible for any payments due to the third-party regardless of the campaign results and without regard to the status of payment from its clients. The Company has discretion in setting the price for its clients without input or approval from third parties. Accordingly, revenue is reported gross, as principal, as the performance obligation is delivered.

Marketing services from social media platforms

The company monetizes its contents by receiving the advertising revenue generated from its channel pages and posts on social media platforms, such as YouTube and Facebook. The Company recognizes revenue as performance obligations are satisfied as the creation of contents are published on the social media platforms. The advertisements are delivered primarily based on impressions of contents on social media platforms, hence the Company provided the advertising services by an on-going basis during the publication period and the outcome of the services can be received and consumed by the social media platform simultaneously. The Company pays certain third parties a percentage of advertising revenue for their service of the creation of contents. The Company controls the advertising service as the Company is primarily responsible for providing the service. Accordingly, revenue is recorded gross, as principal, and is recognized over the period in which the advertising is transmitted.

Social commerce from customers

The Company recognizes revenue from the sale of products at the point in time when control of the asset is transferred to the customer. In certain sales arrangements, although the Company did not bear inventory risk, the Company has separate agreements with its customers and suppliers. The Company has primary responsibility for products meeting customers’ specifications, instead of suppliers, and has discretion in establishing the price for the specified products that sold to customers without suppliers’ involvement. As a result, suppliers are neither party to the contractual arrangements with the Company’s customers, nor are the beneficiaries of the Company’s customer agreements. Accordingly, the Company has control over the products that are sold to customers before the products are transferred to the customers and hence revenue is reported gross, as principal, as the performance obligation is delivered.

For marketing services from clients and social media platforms, payments are usually received within 30 days upon completion of performance obligation. For social commerce from customers, customers need to make full payment before shipments.

Management does not believe that its contracts include a significant financing component because the period between delivery or the contracting services to the customers and the time of payment do not typically exceed one year.

Significant balance sheet accounts related to the revenue cycle are as follows:

Accounts receivable, net

Accounts receivable, net includes amounts billed under the contract terms. The amounts are stated at their net realizable value. The Company maintains an allowance for expected credit loss to provide for the estimated number of receivables that will not be collected. The Company considers several factors in its estimate of the allowance, including knowledge of a client’s financial condition, its historical collection experience, and other factors relevant to assessing the collectability of such receivables. Bad debts are written off against allowances.

| 12 |

Expected credit loss

ASU No. 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments requires entities to use a current lifetime expected credit loss methodology to measure impairments of certain financial assets. Using this methodology will result in earlier recognition of losses than under the current incurred loss approach, which requires waiting to recognize a loss until it is probable of having been incurred. There are other provisions within the standard that affect how impairments of other financial assets may be recorded and presented, and that expand disclosures. The Company adopted the new standard effective January 1, 2019, the first day of the Company’s fiscal year and applied to accounts receivable and other financial instruments. The adoption of this guidance did not materially impact the net earning and financial position and has no impact on the cash flows.

Income taxes

The Company recognizes deferred income tax assets or liabilities for expected future tax consequences of events recognized in the audited consolidated financial statements or tax returns. Under this method, deferred income tax assets or liabilities are determined based upon the difference between the audited consolidated financial statement and income tax bases of assets and liabilities using enacted tax rates expected to apply when the differences settle or become realized. Valuation allowances are provided when it is more likely than not that a deferred tax asset is not realizable or recoverable in the future.

The Company determines that the tax position is more likely than not to be sustained and records the largest amount of benefit that is more likely than not to be realized when the tax position is settled. the Company recognizes interest and penalties, if any, related to uncertain tax positions in income tax expense.

Comprehensive income (loss)

The Company presents comprehensive income (loss) in accordance with ASC Topic 220, Comprehensive Income. ASC Topic 220 states that all items that are required to be recognized under accounting standards as components of comprehensive income (loss) be reported in the consolidated financial statements. The components of comprehensive income (loss) were the net income for the years and the foreign currency translation adjustments.

Income (loss) per share

The Company computes income (loss) per share following ASC Topic 260, “Earnings per share.” Basic income (loss) per share is measured as the income/(loss) available to common shareholders divided by the weighted average common shares outstanding for the period. Diluted loss per share presents the dilutive effect on a per-share basis from the potential conversion of convertible securities or the exercise of options and or warrants; the dilutive impacts of potentially convertible securities are calculated using the as-if method; the potentially dilutive effect of options or warranties are computed using the treasury stock method. Potentially anti-dilutive securities (i.e., those that increase income per share or decrease loss per share) are excluded from diluted income/(loss) per share calculation.

Segment Reporting

ASC 280, “Segment Reporting”, establishes standards for reporting information about operating segments on a basis consistent with the Company’s internal organizational structure as well as information about geographical areas, business segments and major customers in financial statements for detailing the Company’s business segments. The Company uses the “management approach” in determining reportable operating segments. The management approach considers the internal organization and reporting used by the Company’s chief operating decision maker for making operating decisions and assessing performance as the source for determining the Company’s reportable segments. Management, including the chief operating decision maker, reviews operation results by the revenue of different products or services. Based on management’s assessment, the Company had two operating and reportable segments during the years presented as set out in Note 16 to the audited consolidated financial statements.

| 13 |

Financial instruments

The Company’s financial instruments, including cash and cash equivalents, accounts and other receivables, accounts and other payables, accrued liabilities, amounts due from (to) related parties, promissory notes payable and bank loans, have carrying amounts that approximate their fair values due to their short maturities. ASC Topic 820, “Fair Value Measurements and Disclosures” requires disclosing the fair value of financial instruments held by the Company. ASC Topic 825, “Financial Instruments” defines fair value and establishes a three-level valuation hierarchy for disclosures of fair value measurement that enhances disclosure requirements for fair value measures. The carrying amounts reported in the audited consolidated balance sheets for cash and cash equivalents, accounts and other receivables, accounts and other payables, accrued liabilities, amounts due from (to) related parties, promissory notes payable and bank loans each qualify as financial instruments and are a reasonable estimate of their fair values because of the short period between the origination of such instruments and their expected realization and their current market rate of interest. The three levels of valuation hierarchy are defined as follows:

| ● | Level 1 - inputs to the valuation methodology used quoted prices for identical assets or liabilities in active markets. | |

| ● | Level 2 - inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets and information that are observable for the asset or liability, either directly or indirectly, for substantially the financial instrument’s full term. | |

| ● | Level 3 - inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

The Company analyzes all financial instruments with features of both liabilities and equity under ASC 480, “Distinguishing Liabilities from Equity” and ASC 815.

Recent accounting pronouncements

The Company does not believe other recently issued but not yet effective accounting standards, if currently adopted, would have a material effect on the Company’s unaudited condensed consolidated balance sheets, statement of operations and comprehensive loss and statement of cash flows.

EXPOSURE TO FLUCTUATIONS IN EXCHANGE RATES AND RELATED HEDGES

Our exposure to foreign currencies mainly arises from trade receipts from overseas clients. To mitigate the potential impact of currency fluctuations, we closely monitor our foreign currency exposures and use suitable hedging instruments when necessary. No foreign currency hedge contract was entered during the six months ended June 30, 2023. As of June 30, 2023, we have no outstanding foreign currency hedge contracts.

INTEREST RATE RISK EXPOSURE

The Company is exposed to cash flow interest rate risk through the changes in interest rates related mainly to the Company’s variable-rates line of credit, short-term bank loans and bank balances. The Company currently does not have any interest rate hedging policy in relation to fair value interest rate risk and cash flow interest rate risk. The directors monitor the Company’s exposures on an ongoing basis and will consider hedging the interest rate should the need arises.

CONTINGENT LIABILITIES

We have no material contingent liabilities as of June 30, 2023.

| 14 |

VS MEDIA HOLDINGS LIMITED

Unaudited Condensed Consolidated Interim Financial Statements

For the Six Months ended June 30, 2023 and 2022

| 15 |

VS MEDIA HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Currency expressed in United States Dollars (“US$”), except for number of shares)

| June 30, 2023 | December 31, 2022 | |||||||

| (Audited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 597,016 | $ | 820,570 | ||||

| Accounts receivable, net | 1,635,665 | 1,917,732 | ||||||

| Deposits, prepayments and other receivables, net | 4,748,019 | 4,545,591 | ||||||

| Due from related parties | 455,092 | 7,254 | ||||||

| Total current assets | 7,435,792 | 7,291,147 | ||||||

| Non-current assets | ||||||||

| Plant and equipment, net | 22,249 | 27,123 | ||||||

| Intangible assets, net | 47,442 | 57,865 | ||||||

| Deposit paid for acquisition of intangible assets | 115,090 | 115,601 | ||||||

| Right-of-use assets, operating leases | 99,231 | 100,589 | ||||||

| Total non-current assets | 284,012 | 301,178 | ||||||

| TOTAL ASSETS | $ | 7,719,804 | $ | 7,592,325 | ||||

| LIABILITIES AND SHAREHOLDERS’ (DEFICIT) EQUITY | ||||||||

| Current liabilities | ||||||||

| Short-term bank loans | $ | 1,600,244 | $ | 1,628,048 | ||||

Other borrowings - current | 367,647 | - | ||||||

| Accounts payable | 973,487 | 1,036,790 | ||||||

| Due to related parties | 650,161 | 504,837 | ||||||

| Loan – related parties | 1,261,169 | 1,231,327 | ||||||

| Receipt in advance | 280,114 | 59,069 | ||||||

| Lease liabilities | 65,705 | 66,604 | ||||||

| Accruals and other payables | 2,455,444 | 779,840 | ||||||

| Total current liabilities | 7,653,971 | 5,306,515 | ||||||

| Non-current liabilities | ||||||||

| Other borrowings – non-current | 527,494 | 632,737 | ||||||

| Lease liabilities – non-current | 33,527 | 33,985 | ||||||

| Total non-current liabilities | 561,021 | 666,722 | ||||||

| TOTAL LIABILITIES | $ | 8,214,992 | $ | 5,973,237 | ||||

| Commitments and contingencies | - | - | ||||||

| Shareholders’ (deficit) equity | ||||||||

| Ordinary share, no par value; 20,000,000 shares issued and outstanding as of June 30, 2023 and December 31, 2022 | $ | 20 | $ | 20 | ||||

| Additional paid-in capital | 16,213,997 | 16,213,997 | ||||||

| Accumulated other comprehensive income | 223,601 | 18,781 | ||||||

| Accumulated deficit | (16,932,806 | ) | (14,613,710 | ) | ||||

| Total shareholders’ (deficit) equity | (495,188 | ) | 1,619,088 | |||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ (DEFICIT) EQUITY | $ | 7,719,804 | $ | 7,592,325 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 16 |

VS MEDIA HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME

(Currency expressed in United States Dollars (“US$”), except for number of shares)

| Six Months Ended June 30, | ||||||||

| 2023 | 2022 | |||||||

| Revenues, net | $ | 3,526,757 | $ | 4,325,921 | ||||

| Cost of revenues | (2,768,829 | ) | (3,173,390 | ) | ||||

| Gross profit | 757,928 | 1,152,531 | ||||||

| Marketing expenses | (85,043 | ) | (5,169 | ) | ||||

| General and administrative expenses | (2,859,903 | ) | (945,177 | ) | ||||

| Total operating expenses | (2,944,946 | ) | (950,346 | ) | ||||

| Operating (loss) income | (2,187,018 | ) | 202,185 | |||||

| Other income (expenses) | ||||||||

| Other income | 15,530 | 17,886 | ||||||

| Interest expense | (147,608 | ) | (94,068 | ) | ||||

| Total other expense, net | (132,078 | ) | (76,182 | ) | ||||

| (Loss) income before taxes | (2,319,096 | ) | 126,003 | |||||

| Provision for income taxes | - | - | ||||||

| (Loss) income from continuing operations | (2,319,096 | ) | 126,003 | |||||

| Discontinued operations: | ||||||||

| Loss from discontinued operations | - | (8,357 | ) | |||||

| Gain on disposal | - | 5,089,120 | ||||||

| Net (loss) income | $ | (2,319,096 | ) | $ | 5,206,766 | |||

| Other comprehensive (loss) income: | ||||||||

| Foreign currency translation adjustment | 204,820 | 507,138 | ||||||

| Total comprehensive (loss) income | $ | (2,114,276 | ) | $ | 5,713,904 | |||

| (Loss) income per share from continuing operations – Basic and diluted | $ | (0.12 | ) | $ | 0.01 | |||

| Income per share from discontinued operations – Basic and diluted | $ | - | $ | 0.25 | ||||

| (Loss) income per share – Basic and diluted | $ | (0.12 | ) | $ | 0.26 | |||

| Basic and diluted weighted average shares outstanding | 20,000,000 | 20,000,000 | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 17 |

VS MEDIA HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ (DEFICIT) EQUITY

(Currency expressed in United States Dollars (“US$”), except for number of shares)

| Six months ended June 30, 2023 | ||||||||||||||||||||||||

| Ordinary shares | Additional paid-in | Accumulated other comprehensive | Accumulated other comprehensive | Total stockholders’ | ||||||||||||||||||||

| Share | Amount | capital | income | deficit | deficit | |||||||||||||||||||

| Balance at January 1, 2023 | 20,000,000 | $ | 20 | $ | 16,213,997 | $ | 18,781 | $ | (14,613,710 | ) | $ | 1,619,088 | ||||||||||||

| Net loss for the period | - | - | - | - | (2,319,096 | ) | (2,319,096 | ) | ||||||||||||||||

| Foreign currency translation adjustment | - | - | - | 204,820 | - | 204,820 | ||||||||||||||||||

| Balance at June 30, 2023 | 20,000,000 | $ | 20 | $ | 16,213,997 | $ | 223,601 | $ | (16,932,806 | ) | $ | (495,188 | ) | |||||||||||

| Six months ended June 30, 2022 | ||||||||||||||||||||||||

| Ordinary shares | Additional paid-in | Accumulated other comprehensive | Accumulated other comprehensive | Total stockholders’ | ||||||||||||||||||||

| Share | Amount | capital | loss | deficit | equity | |||||||||||||||||||

| Balance at January 1, 2022 | 20,000,000 | $ | 20 | $ | 15,713,997 | $ | (572,513 | ) | $ | (18,138,910 | ) | $ | (2,997,406 | ) | ||||||||||

| Net income for the period | - | - | - | - | 5,206,766 | 5,206,766 | ||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | 507,138 | - | 507,138 | ||||||||||||||||||

| Balance at June 30, 2022 | 20,000,000 | $ | 20 | $ | 15,713,997 | $ | (65,375 | ) | $ | (12,932,144 | ) | $ | 2,716,498 | |||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 18 |

VS MEDIA HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Currency expressed in United States Dollars (“US$”))

| Six Months Ended June 30, | ||||||||

| 2023 | 2022 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| (Loss) income from continuing operations | $ | (2,319,096 | ) | $ | 126,003 | |||

| Loss from discontinued operations | - | (8,357 | ) | |||||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation on plant and equipment | 7,420 | 3,949 | ||||||

| Amortization of intangible assets | 10,147 | 10,159 | ||||||

| Non-cash lease expense | - | 34,366 | ||||||

| Change in operating assets and liabilities: | ||||||||

| Inventories | - | 9,184 | ||||||

| Accounts receivable | 282,067 | 568,715 | ||||||

| Deposits, prepayments and other receivables | (202,428 | ) | (2,709,103 | ) | ||||

| Receipt in advance | 221,045 | 55,336 | ||||||

| Accounts payable | (63,303 | ) | (346,024 | ) | ||||

| Accruals and other payables | 1,675,604 | 85,460 | ||||||

| Operating lease liabilities | - | (34,367 | ) | |||||

| Net cash used in operating activities – continuing operations | (388,544 | ) | (2,204,679 | ) | ||||

| Net cash used in operating activities – discontinued operations | - | (220,701 | ) | |||||

| Net cash used in operating activities | (388,544 | ) | (2,425,380 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Purchase of plant and equipment | (2,807 | ) | - | |||||

| Proceeds from disposal of subsidiaries | - | 2,174,025 | ||||||

| Net cash (used in) provided by investing activities | (2,807 | ) | 2,174,025 | |||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Proceeds from new short-term bank loans | - | 383,367 | ||||||

| Repayment of short-term bank loans | (27,804 | ) | - | |||||

| Proceeds from other borrowings | 262,404 | 626,166 | ||||||

| Promissory notes payable | - | (967,794 | ) | |||||

| Loan from a shareholder | - | 35,563 | ||||||

| Advances to related parties | (302,514 | ) | (334,136 | ) | ||||

| Net cash used in financing activities | (67,914 | ) | (256,834 | ) | ||||

| Net decrease in cash and cash equivalents | (459,265 | ) | (508,189 | ) | ||||

| Effect of foreign currency translation on cash and cash equivalents | 235,711 | 500,998 | ||||||

| Cash and cash equivalents, beginning of period | 820,570 | 785,589 | ||||||

| Cash and cash equivalents, end of period | $ | 597,016 | $ | 778,398 | ||||

| Supplementary cash flow information: | ||||||||

| Taxes paid | $ | - | $ | - | ||||

| Interest paid | $ | 147,608 | $ | 94,068 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 19 |

VS MEDIA HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(Currency expressed in United States Dollars (“US$”), except for number of shares)

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES

VS MEDIA Holdings Limited (“VSME” or the “Company”) was incorporated in the British Virgin Islands (“BVI”) on August 30, 2022 as an investment holding company. The Company conducts its primary operations through its indirectly wholly owned subsidiaries VS Media Limited (“VS Media HK”), GRACE CREATION LIMITED (“Grace Creation”) and VS MEDIA LIMITED (“VS Media TW”) which are incorporated and domiciled in Hong Kong SAR (“HK SAR”), HK SAR and Taiwan, respectively; VS Media HK, Grace Creation and VS Media TW operate a global network of digital creators who create and upload content to social media platforms such as YouTube, Facebook, Instagram, and TikTok.

The Company owns VSM Holdings Limited (“VSM”) an investment holding company that was incorporated in the BVI on March 23, 2015. The primary purpose of VSM is to hold VS Media Co Limited (“VS Media BVI”) and VS Media BVI is an investment holding company that was incorporated in the BVI on August 22, 2013. The primary purpose of VS Media BVI is to hold VS Media HK.

VS MEDIA PTE. LTD. (“VS Media SG”) was incorporated in Singapore on July 23, 2019 and is dormant.

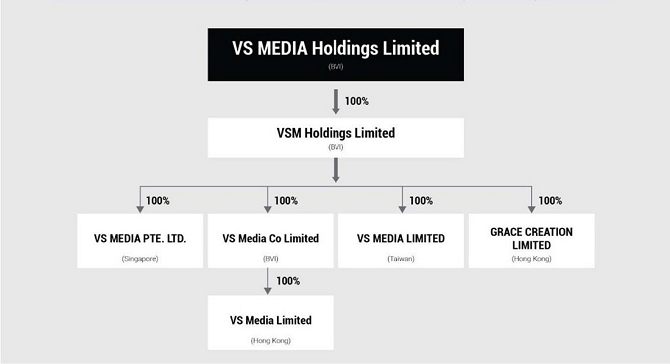

The following is an organization chart of the Company and its subsidiaries:

The registration statement for the Company’s Initial Public Offering (the “Offering”) was declared effective by the SEC on September 26, 2023. On October 2, 2023, the Company consummated the Offering of 2,000,000 Class A ordinary shares at a price to the public of $5.00 per share. The aggregate gross proceeds from the Offering amounted to $10,000,000, prior to deducting underwriting discounts, commissions and offering-related expenses.

GOING CONCERN

As of June 30, 2023, the Company had an accumulated deficit of $16,932,806 and incurred a net loss of $2,319,096 with a net cash used in operating activities of $388,544 for the six months ended June 30, 2023. These circumstances gave rise to substantial doubt that the Company would continue as a going concern subsequent to June 30, 2023. As of the date of this report, there still exists substantial doubt that the Company will continue as going concern. Management plans to focus its resources on more profitable projects. Additionally, the Company plans to raise capital via private placement or public offering in the event that the Company does not have adequate liquidity to meet its current obligations.

The accompanying unaudited consolidated financial statements have been prepared assuming the Company will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. These unaudited consolidated financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.

| 20 |

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation

The accompanying unaudited condensed consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and applicable rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”), regarding financial reporting, and include all normal and recurring adjustments that management of the Company considers necessary for a fair presentation of its financial position and operation results. The results of operations for the six months ended June 30, 2023 are not necessarily indicative of results to be expected for any other interim period or for the full year of 2023. Accordingly, these unaudited condensed consolidated financial statements should be read in conjunction with the Company’s audited consolidated financial statements and note thereto as of and for the years ended December 31, 2022 and 2021 on Form F-1/A.

Principles of consolidation

The accompanying unaudited condensed consolidated financial statements reflect the activities of the Company and each of the following subsidiaries:

| Name of company | Place of incorporation | Attributable equity interest % | Registered/ issued capital | |||||||

| VS MEDIA Holdings Limited | BVI | 100 | $ | 20 | ||||||

| VSM Holdings Limited | BVI | 100 | $ | 1,774 | ||||||

| VS MEDIA PTE. LTD. | Singapore | 100 | $ | 1 | ||||||

| VS Media Co Limited | BVI | 100 | $ | 1,000 | ||||||

| VS Media Limited | HK SAR | 100 | $ | - | * | |||||

| GRACE CREATION LIMITED | HK SAR | 100 | $ | - | * | |||||

| VS MEDIA LIMITED | Taiwan | 100 | $ | 198,288 | ||||||

*Less than $1

Management has eliminated all significant inter-company balances and transactions in preparing the accompanying unaudited condensed consolidated financial statements.

Use of estimates

The preparation of the unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the unaudited condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. Management makes these estimates using the best information available when the calculations are made; however, actual results could differ materially from those estimates.

Cash and cash equivalents

The Company considers cash, bank deposit and all highly liquid investments with original maturities of three months or less when purchased to be cash and cash equivalents. Cash consists primarily of cash in accounts held at a financial institution.

Deposits and prepayments

The Company makes a deposit payment to suppliers for the procurement of products and services. Upon physical receipt and inspection of products or provision of services from suppliers, the applicable amount is recognized from deposits and prepayments to cost of revenues.

Plant and equipment

Plant and equipment are carried at cost less accumulated depreciation. Depreciation is provided over their estimated useful lives, using the straight-line method. The Company typically applies a salvage value of 0%. The estimated useful lives of the plan and equipment are as follows:

| Leasehold improvements | the lesser of useful life or term of lease |

| Furniture and fixtures | 3-5 years |

| Equipment | 3-5 years |

The cost and related accumulated depreciation of assets sold or otherwise retired are eliminated from the accounts, and any gain or loss are included in the Company’s results of operations. The costs of maintenance and repairs are recognized as incurred; significant renewals and betterments are capitalized.

| 21 |

Intangible assets

Intangible assets are carried at cost less accumulated amortization. Amortization is provided over their useful lives, using the straight-line method. The estimated useful lives of the intangible assets are as follows:

| Software platform | 5 years |

Accounting for the impairment of long-lived assets

The Company annually reviews its long-lived assets for impairment or whenever events or changes in circumstances indicate that the carrying amount of assets may not be recoverable. Impairment may become obsolete from a difference in the industry, introduction of new technologies, or if the Company has inadequate working capital to utilize the long-lived assets to generate adequate profits. Impairment is present if the carrying amount of an asset is less than its expected future undiscounted cash flows.

If an asset is considered impaired, a loss is recognized based on the amount by which the carrying amount exceeds the fair market value of the asset. Assets to be disposed of are reported lower the carrying amount or fair value fewer costs to selling.

Lease

The Company adopted ASU 2016-02, “Leases” (Topic 842), and elected the practical expedients that do not require us to reassess: (1) whether any expired or existing contracts are, or contain, leases, (2) lease classification for any expired or existing leases and (3) initial direct costs for any expired or existing leases. For lease terms of twelve months or fewer, a lessee is permitted to make an accounting policy election not to recognize lease assets and liabilities. The Company also adopted the practical expedient that allows lessees to treat the lease and non-lease components of a lease as a single lease component.

Lease terms used to calculate the present value of lease payments generally do not include any options to extend, renew, or terminate the lease, as the Company does not have reasonable certainty at lease inception that these options will be exercised. The Company generally considers the economic life of its operating lease ROU assets to be comparable to the useful life of similar owned assets. The Company has elected the short-term lease exception, therefore operating lease ROU assets and liabilities do not include leases with a lease term of twelve months or less. Its leases generally do not provide a residual guarantee. The operating lease ROU asset also excludes lease incentives. Lease expense is recognized on a straight-line basis over the lease term.

As of June 30, 2023 and December 31, 2022, there were approximately $0.10 and $0.10 million right of use (“ROU”) assets and approximately $0.10 and $0.10 million and lease liabilities based on the present value of the future minimum rental payments of leases, respectively. The Company’s management believes that using an incremental borrowing rate of the Hong Kong Dollar Best Lending Rate (“BLR”) minus 2.25% (interest rate of short-term bank loans as mentioned in note 9) was the most indicative rate of the Company’s borrowing cost for the calculation of the present value of the lease payments; the rate used by the Company was 2.75%.

Commitments and contingencies

From time to time, the Company is a party to various legal actions arising in the ordinary course of business. The majority of these claims and proceedings related to or arise from commercial disputes. The Company first determine whether a loss from a claim is probable, and if it is reasonable to estimate the potential loss. The Company accrues costs associated with these matters when they become probable, and the amount can be reasonably estimated. Legal costs incurred in connection with loss contingencies are expensed as incurred. Also, the Company disclose a range of possible losses, if a loss from a claim is probable but the amount of loss cannot be reasonably estimated, which is in line with the applicable requirements of Accounting Standard Codification 450. The Company’s management does not expect any liability from the disposition of such claims and litigation individually or in the aggregate would have a material adverse impact on the Company’s unaudited condensed consolidated financial position, results of operations and cash flows.

Related parties

The Company adopted ASC 850, “Related Party Disclosures”, for the identification of related parties and disclosure of related party transactions.

Foreign currency translation

The accompanying unaudited condensed consolidated financial statements are presented in United States dollar (“$”). The functional currency of the Company is Hong Kong dollar (“HK$”), New Taiwanese dollar (“NT$”), Singaporean dollar (“SG$”). VSM, VS Media HK and Grace Creation’s assets and liabilities are translated into $ from HK$ at year-end exchange rates. VS Media TW and VS Media SG’s assets and liabilities are translated into $ from NT$ and SG$, respectively. Their revenues and expenses are translated at the respective average exchange rate during the period. Capital accounts are translated at their historical exchange rates when the capital transactions occurred.

| Six months ended June 30, | ||||||||

| 2023 | 2022 | |||||||

| Period-end $: HK$ exchange rate | 7.8200 | 7.8481 | ||||||

| Period average $: HK$ exchange rate | 7.8350 | 7.8254 | ||||||

| Period-end $: NT$ exchange rate | 31.0718 | 29.6029 | ||||||

| Period average $: NT$ exchange rate | 30.6095 | 28.7118 | ||||||

| Period-end $: SG$ exchange rate | 1.3545 | 1.3842 | ||||||

| Period average $: SG$ exchange rate | 1.3384 | 1.3648 | ||||||

| Period-end $: RMB exchange rate | N/A | 6.6952 | ||||||

| Period average $: RMB exchange rate | N/A | 6.4782 | ||||||

| 22 |

Revenue recognition

The Company receives revenue from contracts with customers, which are accounted for in accordance with Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers (Topic 606) (“ASC 606”).

ASC Topic 606 provided the following overview of how revenue is recognized from the Company’s contracts with customers: The Company recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods or services.

Step 1: Identify the contract(s) with a customer.

Step 2: Identify the performance obligations in the contract.

Step 3: Determine the transaction price – The transaction price is the amount of consideration in a contract to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer.

Step 4: Allocate the transaction price to the performance obligations in the contract – Any entity typically allocates the transaction price to each performance obligation on the basis of the relative standalone selling prices of each distinct good or service promised in the contract.

Step 5: Recognize revenue when (or as) the entity satisfies a performance obligation – An entity recognizes revenue when (or as) it satisfies a performance obligation by transferring a promised good or service to a customer (which is when the customer obtains control of that good or service). The amount of revenue recognized is the amount allocated to the satisfied performance obligation. A performance obligation may be satisfied at a point in time (typically for promises to transfer goods to a customer) or over time (typically for promises to transfer service to a customer).

Generally, revenues are recognized when the Company has negotiated the terms of the transaction, which includes determining either the overall price, or price for each performance obligation in the form of a service or a product, the service or product has been delivered to the customer, no obligation is outstanding regarding that service or product, and the Company is reasonably assured that funds have been or will be collected from the customer.

A summary of each of the Company’s revenue streams under ASC Topic 606 is as follows:

Marketing services from clients

The Company offers clients a comprehensive suite of digital marketing services to grow their social media presence and reach their target audiences, particularly Gen Z and Millennials, to achieve marketing goals. Clients can leverage the Company’s experience in building content and fanbases with creators, their creators’ creativity, engagement, and trust among creators’ loyal fanbases to increase their brand awareness and sell products. The Company provides custom digital product offerings, including (i) advising on content strategy and budget and recommending specific creators; (ii) communicating with and managing selected creators; (iii) producing and engaging relevant content with creators to promote key messages for clients; (iv) uploading branded content on creators’ social media channels; (v) amplifying the reach of creators’ and clients’ content through precise media planning and buying via boosting marketing services on social media platforms, such as Google; and (vi) providing optimization services through data analysis and reporting.

For campaign-based marketing services, the performance obligation is a promise to place a branded content on certain social media platforms and is satisfied upon delivery of related services to clients. Such revenue is recognized at a point in time, for the amount the Company is entitled to receive, when the marketing services are provided. For optimization-based marketing services, the performance obligation is identified at the contract level as it represents a promise to deliver services under an agreed period. Each performance obligation is satisfied over time as clients receive and consume benefits when its services are performed. Such revenue is recognized over the scheduled period on the straight-line basis.