We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Vivakor Inc | NASDAQ:VIVK | NASDAQ | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| -0.10 | -7.63% | 1.21 | 1.13 | 1.65 | 1.35 | 1.21 | 1.21 | 5,304 | 18:47:08 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

(Exact name of registrant as specified in its charter)

|

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(IRS Employer Identification No.) |

(Address of principal executive offices)

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K or this Report contains forward-looking statements. Any and all statements contained in this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report may include, without limitation, statements regarding the plans and objectives of management for future operations.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances, including the closing of the Membership Interest Purchase Agreement disclosed below, and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise, except as required by law.

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

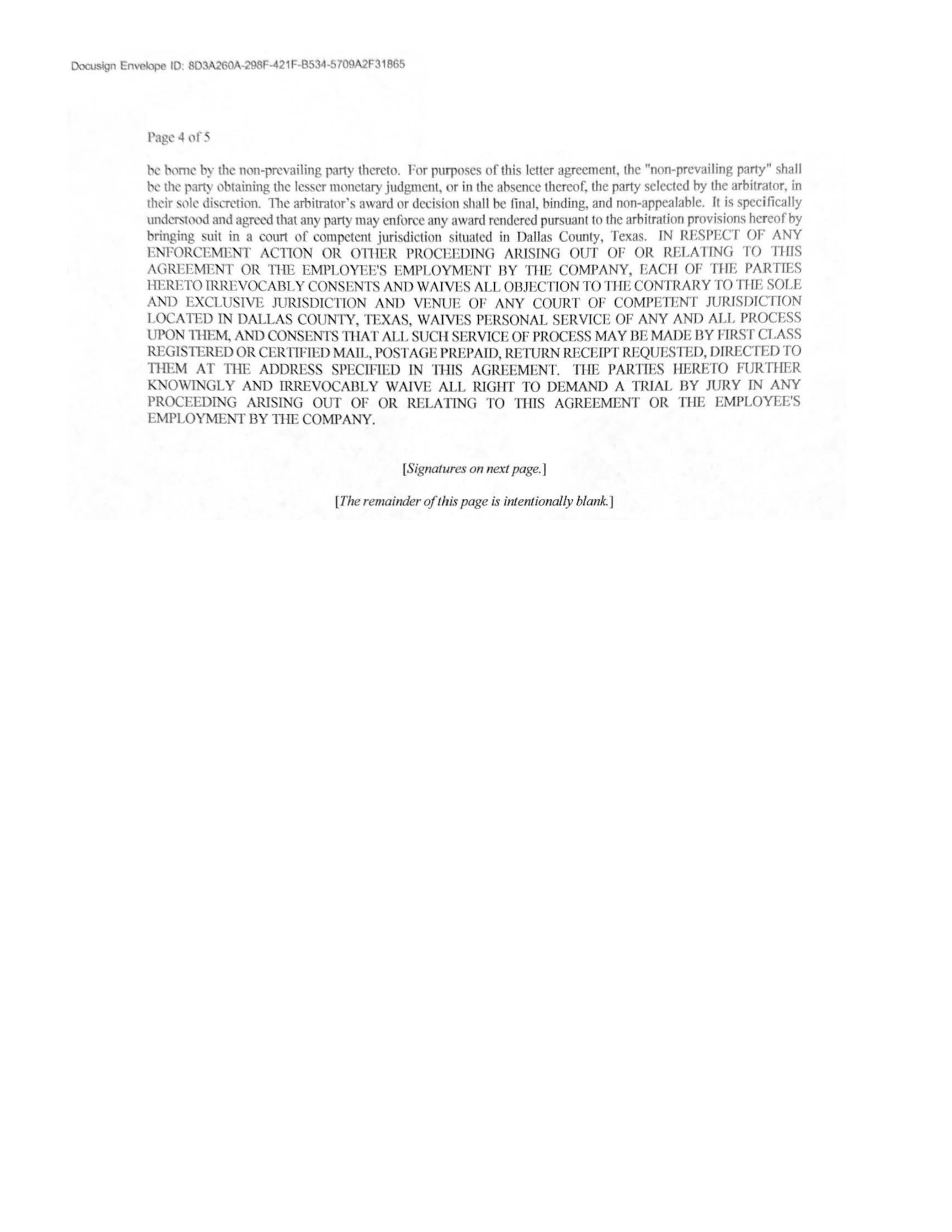

Employment Agreement

On August 22, 2024, we entered into a new executive employment agreement with our Vice President, Marketing. Pursuant to the new employment agreement, our Vice President, Marketing will receive $200,000 annually (the “Base Salary”), which after the first annual anniversary the Base Salary may increase to $350,000 contingent upon the Company achieving net profitability of $500,000 of all commodity trades by the Vice President, Marketing. In addition, the employment agreement provides for annual incentive cash and equity compensation of up to $440,000 based on certain performance goals as further set forth therein. As an inducement to enter into the executive employment agreement, the Vice President, Marketing is entitled to receive a one-time signing grant of Company common stock equivalent in value to $150,000, which are priced per share based on the closing price on the day of such grant (calculated to be 71,090 shares based on the effective date of the executive employment agreement). The signing bonus has not been issued and is due not later than thirty (30) calendar days after we file an amended Registration Statement on Form S-8 with the Securities and Exchange Commission registering shares under a Long Term Incentive Plan (“LTIP”), and the shares will only vest as set forth in the LTIP.

Item 1.01 of this Current Report on Form 8-K contains only a brief description of the material terms of, and does not purport to be a complete description of, the rights and obligations of the parties to the agreements in connection with the employment agreement, and such description is qualified in its entirety by reference to the full text of the employment agreement and its exhibits, which is attached hereto as Exhibit 10.1.

1

ITEM 3.02 UNREGISTERED SALES OF EQUITY SECURITIES.

On September 9, 2024, Aldali Int’l for Gen. Trading & Cont. Co. (DIC) exercised a Non-Qualified Stock Option held by them utilizing $1,179,000 owed to them by us under a promissory note as the exercise price and acquired 1,000,000 shares of our common stock that were held in reserve by our transfer agent under an irrevocable instruction letter. The stock certificate representing the shares contained a standard Rule 144 restrictive legend. The issuances of the foregoing securities was exempt from registration pursuant to Section 4(a)(2) of the Securities Act promulgated thereunder as the holder is a sophisticated investor and familiar with the Company’s operations. We are currently analyzing the exercise of the stock option and related issuance of the shares to ensure they complied with the terms of our agreement with DIC.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

| (d) | Exhibits |

| Exhibit No. | Title | |

| 10.1 | Form of Employment Agreement for Vice President, Marketing | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL). |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| VIVAKOR, INC. | |||

| Dated: November 15, 2024 | By: | /s/ James H. Ballengee | |

| Name: | James H. Ballengee | ||

| Title: | Chairman, President & CEO | ||

3

Exhibit 10.1

Oorusign Enwlopa 10 803A260A-298F-421F·B534..S709A2F31865 I OR DMI I TRATION, LLC PAT KNAPP EVP. a.- Counool. & s..cr..y 5220 Spofng Valley RG.d, Sf<l � Dolin. TtlOIO 7� (p) (gOO) 815-«160 (o)�com August 7, 2024 Rc: Offer ofEmployme11t Thank you for your interest in joining Vivakor Administration, LLC, a Texas limited liability company (the “Company”). ubjcct to your satisfaction of tbe conditions below, we arc pleased to otTer you at-will employment in the po ilion of Vice with an estimated start date of Tuesday, September 3, 2024, which will be confirmed or modified by your supervisor at a later time. Your employment will be at will for all purposes. You will repon directly to James Ballengee, Chainnan, President, & CEO, or another individual designated by the Company at any time or from time to time. lltis is an exempt position. During your employment, you will perfonn duties and responsibilities that are reasonable and consistent with your position or as othervise may be assigned to you from lime to time in the Company’s discretion. You agree to devote your full business time, attention, and best effons to U1e performance of your duties and to the funherance of the Company’s interests. Your compensation package will include an annualized salary of $200,000.00 USD (the “Base Compensation”). In addition, you will be eligible for: The standard package of health, life, vision, dental, and retirement benefits applicable to employees of the Company. You will be eligible to accrue and use Paid Time Off (“PTO”), prorated for your start date, in accordance with Company policies. In addition, for the remainder of calendar year 2024, the Company will reimburse you for one-third ( 1/3) of your out-of-pocket cost of health insurance benefits paid by you pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA ’1 with relation to your prior employment. In the event you discontinue COBRA coverage, this offer ofreimbursement will expire. The Base Compensation may be increased at any time or from time to time by the Company. In addition, no later than sixty (60) days after the first annual anniversary of your stan date, Ule Base Compensation viii be ubjl’Ct to a one-time prospective increase to $350,000.00 USD annually, contingent upon you achieving a net profitability of $500,000.00 USD of all commodity trades successfully sourced and closed by you during the period from your tart date to the first annual anniversary thereof (the “Bo11us Thresho/£1’). For purposes of thi letter agreement and your employment, “netprofitability” shall mean the net value of the lolloving: (a) The cost of purchasing commodities; (b) The sale price of the commodities; (c) The cost of logistics services necessary or incidental the movement or trnn.sponation of the commodities, which may be provided by Vivakor, its Affiliates (a defined below), or third panic ; (d) The net value of all commodity derivative contn1cts up to a notional value l’QIIlll to commodity trJdl� sourced and closed by you; and

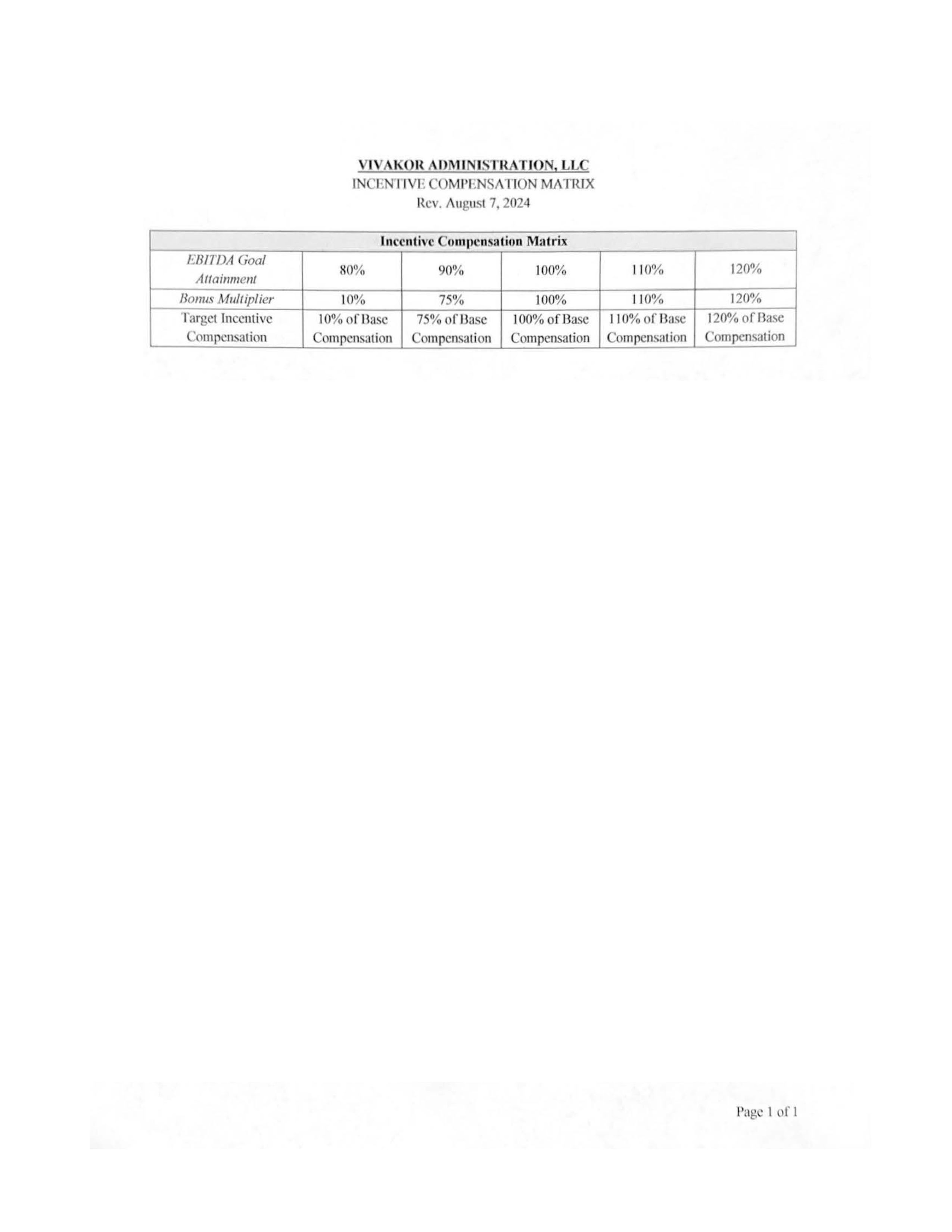

Dorusign Envelope 10. 803A260A-298F-421f:-B534.S709A2F318& Page 2 of5 (c) lnc co t of credit and working capital necessary or incidental to your commodity trading activities, including fcc and interCS1 for cash and letters of credit. provided, that the amount of working capital allocated IO your trades may be determined by Company in its commercially reasonable discretion. tcntl: ln addition to the foregoing, hall be eligible for bonus compensation in accordance with the following (f) Incentive Oonus. No later than thirty (30) calendar days aOcr the filing of an amended regi tration statement on Fom1 -8 (the “Registration Statement’) with the U.S. Securities and Exchange Commission by and forVivakor, Inc., a Nevada corporation (” Vivokor”), of the otTer and ale of shares orVivakor’s common stock (the “Shores”), which Shares may be issued from time to time in accordance witi1 ti1e tenus of a Long Tenn Jnccntive Plan ofVivakor (as amended and adopted from time to time, tl1e “Plan”), restricted Shares equal in value to One Hundred Fifty l11ousand and No/IOOs U..Dollars ($150,000.00), as defmed below, shaJI be paid to the you as an incentive equity grant to enter into this letter agreement (collectively, the “Signing Bonus’’) pursuant to U1e Plan, less applicable governmental witilholdings.TI1e Shares to be granted hereunder shall be initially unvCS1cd and shall vest only at such times and in such percentages as are set forth in the Plan. All of the Signing Bonus will be priced per share and issued in accordance with and subject to the Plan, applicable law, and the rules and regulations or The Nasdaq Capital Market, and, in the event that any the hares cannot be issued because compliance with such requirements has not been met, the obligation to issue Shares will be accrued untiJ such time as such compliance requirements have been atistied. Annual Incentive (i) You shall be eligible for an annual incentive bonus (tile “Incentive Bonus”) equal to the then-current Base Compensation multiplied by the Bonus Multiplier corresponding to the EBITOA Goal Attainment set forth on the Incentive Compensation Matrix enclosed herewith, as may be amended subject to subsection below (as amended, the “Incentive Compensation Matrix”), for a total annual Incentive Bonus. The Incentive Bonus shall be remitted twice, once in cash and once in Shares, which Shares shall be initially unvested and shall vest only at such Limes and in such percentages as are set forth in the Plan. The Incentive Bonus shall be paid to you no later than the last business day of March or the year succeeding the year for which the Incentive Bonus is calculated, less applicable governmental withholdings. The portion of the Incentive Bonus paid in Shares will be priced per share and issued in accordance with and subject to the Plan, applicable Jaw, and the rules and regulations of TheNasdaq Capital Market, and, in the event that any the Shares cannot be issued because compliance wiUJ such requirements has not been met, the obligation to issue Shares will be accrued until such time as such compliance requirements have been satisfied. (ii) Notwithstanding anythiJ1g contained in this letter agreement to the contrary, Plan and the Incentive Compensation Matrix may be modified, amended, and replaced by the Company, in its sole discretion, at any time or from time 10 time, upon (A) the adoption, implementation, and/or amendment of a Plan and/or new Incentive Compensation Matrix, and (B) specific written reference and notice to you that the Plan and Ule Incentive Compensation Matrix forth in this letter agreement is being modified, amended, and replaced by such Plan and/or Incentive Compensation Matrix. Your employment is contingent upon (i) your acceptance of ti1i o!Tcr via ymtr ignmurc below, (ii) your signature to an acknowledgement that you have read and understood the most recent Employee llandbook or Ule Company (enclosed herewith), (iii) execution of the most recent Motor Vehicle Policy of the Company (enclosed

Oocus!QI’I Envclope 10 803A260A-298F-421 F-6534-6709A2F31865 Page 3 of5 hcl.>witlt), and (iv) your execution of the most recent Credit Card Policy of the Company (enclosed herewith), (v) vcrilication of your right to work in tltc United States, as demonstrated by your completion of the 1-9 form upon hire and your submi ion of acceptable doctmtcntation (as noted on the 1-9 form) verifying your identity and work authorization within three day of tarting employment. and (vi) your satisfactory completion of a pre-employment ba kground check. Although U1e nonual workweek is Monday through Friday, you may be required to work schedules other than the nonn. It should also be noted that work schedules may be altered or changed due to business necessities and the need of our customers. Flexibility i critical to the success of our business operations. You may be a ked to pcrfomt work for partners, members, subsidiaries, sister companies, entities under common OWttership or control with the Company, ancVor otlter affiliates of tltc Compruty (each, an “Affiliole”) in connection witlt your employment. You agree that your employment is solely witlt the Company, and you knowingly and irrevocably agree not to maintain or cause to be maintained any dispute, controversy or claim relating to your employment or tltis letter agreement against any Affiliate entity of the Company. By igning below, you confinn that you have infomted the Company about all agreements tltat you have entered into with former employcr(s) that may in any way afTcct your perfonnancc of job duties for the Company and that you have provided to the Company all pertinent information regarding any such agreements. You further conftrm you will comply with any uch agrcentents witlt former employers. You agree to keep confidential all trade secrets and proprietary information relating to the Company, and Affiliates, learned in the course of your employment witlt tltc Company. You irrevocably agree that information about the Compruty’s customers, operations, practices, policies finances, ru1d strategies is proprietary infonnation of Ute Company that you may not disclose witltout written auU1orization from an executive of Ute Company. In the event you arc compelled to disclose such confidential infonnation by any governmental authority, you agree to promptly notify the Comp311y and work with tlle Company in good faitlt to limit Ute disclosure of such information. By signing below, you also confinn that you will not remove or take any documents or proprietary data or materials of any kind, electronic or otherwise, with you from your current or fonner employer(s) to the Company without writlen authorization from your current or former employer(s). You also confinn that you will not use or disclose any con.l:idential information of your former employer(s) during the course and scope of your employment wiUt the Company. lf you have any questions about the ownership of particular documents or other information, discuss such questions with your former employer before removing or copying the documents or information. Any dispute, controversy or clain1 arising out of or relating in any way to your employment or Utis letter agreement, including without limitation any dispute concerning the construction, validity, interpretation, enforceability or breach of tllis letter agreement or any tenn or condition of your employment, shall be exclusively resolved by confidential, binding arbitration upon our or your submission of Ute dispute to arbitration; provided, however, that should applicable law limit or abrogate this agreement to arbitrate, tlten the parties may bring suit in court as set fortll in the last two sentences of tltis paragraph. The demand for arbitration shall be made witltin a reasonable time after Ute claint, dispute or otller matter in question has arisen, and in no event hall it be made more Ulan one (I) year from when the aggrieved party hereto knew or should have known of tlte controversy, claim, dispute or breach. This agreement to arbitrate shall be specifical.ly enforceable. A party hereto may apply to any court with jurisdiction for interim or conservatory relict: including without limitation a proceeding to compel arbitration. The arbitration shall be conducted by one (I) arbitrator to be selected by tlle Company. Any party hereto may initiate arbitration by serving written notice upon tlte other party and filing a demrutd for arbitration with the American Arbitration Association. The arbitration shall be conducted in accordance with Ute then-existing Labor Arbitration Rules of the American Arbitration Association, but only to Ute extent such Labor Arbitration Rules of the Americ3Jl Arbitration Association do not conflict witlt tltis letter agreement, and shall be held and conducted in Dallas Cmmty, Texas. Except as may be required by law, neither Party nor its representatives may disclose the exi tence, content, or r�ults of any arbitration hereunder without Ute prior written consent of tl1e other party hereto. The arbitrator hall have no authority to award punitive, consequential, special, expectation, or indirect damages. The arbitrator shall not be entitled to issue injunctive or otl1cr equitable relief. TI1c arbitrator hall not be entitled to award any pre- or po t judgment interest. ’01e cost of the arbitration proceeding, as applicable (including, without limitation, rea ouable attorneys’ fees 3Jld costs, expert fees, arbitrator fees, and related costs and expenses), shall be home by the non prevailing party thereto. The cost of any proceeding in court to confinn or to vacate any arbitration award shall also

Docuslgn Envelope 10. 803A260A-298F--421F-8534-5709A2F31865 Pas� 4 (lf5 be me by the non-prevailing party thereto. f-or purposes of this letter agreement. the “non-prevailing par1y” shall be tl1c party obtaining the le er monetary judgment, or in the absence thereof, tl1e party selected by the arbitrator, in thdr. ole di crction. 1l1c arbitrator’s award or deci ion hall be final, binding, and non-appealable. It i� specifically undcn.‘tood and agreed that any party may enforce any award rendered pursuant to tlle arbitration provisions hereof by bringing suit in a court of competent juri diction situated in Dallas County, Texas. IN RESPECT OF IINY E OR ACTIO OR OTilER PROCEEDING !IIUSING Olff Of- OR RELATING TO TIIIS IIGREEME OR TilE EMPLOYEE’S EMPLOYMENT 13Y TilE COMPANY, EACH OF ·nm PARTIES HERETO IRREVOCABLY CON ENTS AND W!liVES ALL OBJECTION TO TILE CONTRARY TO TI IE SOLE AND CL IVE JURI DICTION AND VENUE OF !INY COURT OF COMPETENT JURISDJCDON LOCATED IN DALLA COUNTY, TEXA , WAIVES PERSONAL SERVICE OF ANY AND !ILL PROCESS UP0 THEM. AND CON ENTS Tll!lTALL SUCII SERVICE Of PROCESS MAY BE MIDE 13Y FIRST CLASS REGI TERED OR CERTIFIED MAlL, PO TAGE PREPAID, RETURN RECEIPT REQUESTED, DIRECTED TO TI-IEM AT TI-ffi ADORES PECIFlED IN ‘D{l AGREEMENT. nffi PARTIES llERETO FURTHER OWINGLY AND IRREVOCABLY WAIVE ALL RlGI-IT TO DEMAND A TIUAL BY JURY IN ANY PROCEEDING ARI ING Olff OF OR REL!ITlNG TO ·nUS AGREEMENT OR TIlE EMPLOYEE’S EMPLOYMENT BY THE COMPANY. [Signatures on next page.] [The remainder ofthis page is intentionally blank.]

� Em’Clape 10 803A260A-298F-421F-B534..S709A2F31865 P:�gc ‘i of5 Pll!aSC acknowledge your acceptance of thi!> offer hy signing and delivering this leuer back to me ac; soon as Jl<1S,iblc. You may email a igned copy to me. lltis offer is open for you to accept umll friday, Augu�t 16, 2024 a1 4:00p.m., Dallas, Tc.xa local time, at which time il will be deemed to be withdrawn. All terms and condition of this otTer arc confidential. hould you have qucstlotL�, please contact me at any time. I look forward to working with you and anticipate tltat you will provide significant contributions to t11e Company. Regards, VIVAKOR ADMINISTRATJON, LLC Name: Pat Title: EVP, General Counsel, & Secretary Eo: Employee Handbook Vehicle Policy Credit Card Policy Incentive Compensation Matrix CC: AJ I accept Vivakor Administration, LLC’s offer of employment as presented in tl1is correspondence. I understand and agree that my employment wit1t the Company is entered into voluntarily and l11at I may resign at any time. imilarly, my employment m�y be tenninated for any reason and at any time without previous notice. Signature:

IVAKOR LLC IN EN’IIVE COMI’EN AliON MATR£X Rev. AugtL’it 7, 2024 ElJITDA Goal Altainment /Jonus Multiplier Targct1nccntivc Compensation Incentive Compensation Matrix 80% 90% 100% 10% 75% 100% tO% ornasc 75%ofDa e 100% of Base Compensation Compensation Compensation 110% 120% 110% 120% IIO%of0asc 120%ofDase Compensation Compensation Page I of I

Cover |

Aug. 22, 2024 |

|---|---|

| Cover [Abstract] | |

| Document Type | 8-K |

| Amendment Flag | false |

| Document Period End Date | Aug. 22, 2024 |

| Entity File Number | 001-41286 |

| Entity Registrant Name | VIVAKOR, INC. |

| Entity Central Index Key | 0001450704 |

| Entity Tax Identification Number | 26-2178141 |

| Entity Incorporation, State or Country Code | NV |

| Entity Address, Address Line One | 5220 Spring Valley Road |

| Entity Address, Address Line Two | Suite 500 |

| Entity Address, City or Town | Dallas |

| Entity Address, State or Province | TX |

| Entity Address, Postal Zip Code | 75254 |

| City Area Code | (949) |

| Local Phone Number | 281-2606 |

| Written Communications | false |

| Soliciting Material | false |

| Pre-commencement Tender Offer | false |

| Pre-commencement Issuer Tender Offer | false |

| Title of 12(b) Security | Common Stock |

| Trading Symbol | VIVK |

| Security Exchange Name | NASDAQ |

| Entity Emerging Growth Company | true |

| Elected Not To Use the Extended Transition Period | false |

1 Year Vivakor Chart |

1 Month Vivakor Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions