We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| LendingTree Inc | NASDAQ:TREE | NASDAQ | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 49.41 | 46.98 | 51.50 | 10 | 09:03:46 |

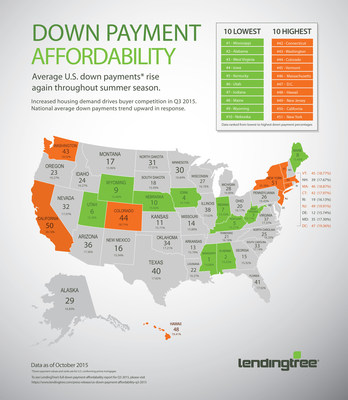

CHARLOTTE, N.C., Nov. 18, 2015 /PRNewswire/ -- According to the latest national down payment report released today by LendingTree®, a leading online loan marketplace, average down payment percentages for conventional 30-year fixed rate purchase mortgage offers rose slightly in the third quarter to an average of 17.63 percent, up slightly from 17.34 percent in the prior quarter and 16.29 percent in Q3 2014. The average down payment amount also rose quarter-over-quarter to $48,924, a sizeable increase from the previous quarter's average of $44,204. The average down payment for all purchase mortgages, including FHA, VA, non-prime, and jumbo mortgages in the second quarter was $49,127 or 15.41 percent.

"During the third quarter, the housing market thrived in certain markets as consumer demand outweighed supply," said Doug Lebda, founder and CEO of LendingTree. "In competitive housing markets, homebuyers will often bolster their buying credentials by offering a larger down payment. Not only could this improve a buyer's chances of securing the home, but could also help avoid delays in closing, create built-in equity and generate lower monthly payments. For potential buyers who are eyeing the market today, rates are beginning to trend upwards as we inch closer to the new year and a potential Fed rate hike."

The average down payment on an FHA mortgage in the second quarter was 7.99 percent, or $15,391, representing a slight increase from Q2 2015. The average down payment on a jumbo mortgage was 23.98 percent, or $170,185.

An infographic released by LendingTree ranks each state according to the conventional average down payment percentages offered to LendingTree customers from lowest to highest. The ten states with the lowest average down payment percentage for a 30-year fixed rate conventional loan are:

|

Rank |

State |

Quarterly Rank +/- |

Down Payment % |

Offered - Loan |

Offered - Down |

|

1 |

MS |

1 |

14.88% |

$190,133.13 |

$24,991.21 |

|

2 |

AL |

4 |

15.02% |

$192,115.66 |

$32,279.25 |

|

3 |

WV |

6 |

15.11% |

$183,564.93 |

$32,562.50 |

|

4 |

IA |

-1 |

15.19% |

$182,511.28 |

$30,975.24 |

|

5 |

KY |

3 |

15.21% |

$169,449.46 |

$31,801.08 |

|

6 |

UT |

11 |

15.28% |

$230,113.71 |

$37,173.84 |

|

7 |

IN |

-3 |

15.33% |

$172,793.06 |

$27,896.22 |

|

8 |

ME |

-3 |

15.43% |

$194,340.14 |

$37,556.97 |

|

9 |

WY |

10 |

15.46% |

$215,955.98 |

$37,644.52 |

|

10 |

NE |

19 |

15.66% |

$181,579.49 |

$30,509.04 |

The ten states with the highest down payment percentage for a 30-year fixed rate conventional loan are:

|

Rank |

State |

Quarterly |

Down |

Offered - Loan |

Offered - Down |

|

42 |

CT |

3 |

17.97% |

$235,755.59 |

$48,827.18 |

|

43 |

WA |

-5 |

18.02% |

$256,922.50 |

$61,995.68 |

|

44 |

CO |

-4 |

18.71% |

$241,437.13 |

$55,578.62 |

|

45 |

VT |

-6 |

18.77% |

$192,189.95 |

$44,050.25 |

|

46 |

MA |

0 |

18.87% |

$256,231.93 |

$54,516.47 |

|

47 |

DC |

4 |

19.36% |

$316,584.02 |

$101,291.67 |

|

48 |

HI |

-1 |

19.41% |

$307,571.43 |

$62,684.13 |

|

49 |

NJ |

1 |

19.91% |

$261,826.43 |

$65,616.73 |

|

50 |

CA |

-1 |

20.18% |

$301,613.85 |

$80,668.41 |

|

51 |

NY |

-3 |

20.38% |

$248,031.57 |

$86,838.03 |

To view the original release along with the associated high-resolution infographic, please visit the LendingTree Press Room.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation's leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 55 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 350 lenders offering home loans, personal loans, credit cards, student loans, personal loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

MEDIA CONTACT:

Megan Greuling

Megan.Greuling@LendingTree.com

704-943-8208

Photo - http://photos.prnewswire.com/prnh/20151118/289026

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/average-down-payments-rise-as-housing-demand-and-buyer-competition-increase-300181410.html

SOURCE LendingTree

Copyright 2015 PR Newswire

1 Year LendingTree Chart |

1 Month LendingTree Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions