We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Tingo Group Inc | NASDAQ:TIO | NASDAQ | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 0.69 | 0.7245 | 0.25 | 0 | 00:00:00 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported):

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

Registrant’s telephone

number, including area code: (

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol | Name of exchange on which registered | ||

| The |

Item 2.02 Results of Operations and Financial Condition.

On November 14, 2023, Tingo Group, Inc. (the “Company”), issued a press release (the “Press Release”) announcing its financial results and operational highlights for the third quarter ended September 30, 2023, and other financial information.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing

On November 13, 2023, the Company was notified (the “Notification Letter”) by the Nasdaq Listing Qualifications (“Nasdaq”) that it is not in compliance with the minimum bid price requirements set forth in Nasdaq Listing Rule 5550(a)(2) for continued listing on The Nasdaq Capital Market. Nasdaq Listing Rule 5550(a)(2) requires listed securities to maintain a minimum bid price of $1.00 per share, and Nasdaq Listing Rule 5810(c)(3)(A) provides that a failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business days. Based on the closing bid price of the Company’s common stock for the 30 consecutive business days prior to the date of the Notification Letter, the Company no longer meets the minimum bid price requirement. The Notification Letter has no immediate effect on the listing or trading of the Company’s common stock on the Nasdaq Capital Market and, at this time, the common stock will continue to trade on the Nasdaq Capital Market under the symbol “TIO”.

The Notification Letter provides that the Company has 180 calendar days, or until May 13, 2024, to regain compliance with Nasdaq Listing Rule 5550(a)(2). To regain compliance, the bid price of the Company’s common stock must have a closing bid price of at least $1.00 per share for a minimum of 10 consecutive business days. In the event the Company does not regain compliance by May 13, 2024, the Company may then be eligible for additional 180 days if it meets the continued listing requirement for market value of publicly held shares and all other initial listing standards for The Nasdaq Capital Market, with the exception of the bid price requirement, and will need to provide written notice of its intention to cure the deficiency during the second compliance period. If the Company does not qualify for the second compliance period or fails to regain compliance during the second compliance period, then Nasdaq will notify the Company of its determination to delist the Company’s common stock, at which point the Company will have an opportunity to appeal the delisting determination to a Hearings Panel.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 11, 2023, Amir Ayalon notified the Company of his decision to resign as the Company’s Chief Financial Officer, effective immediately, for personal reasons. In connection with the resignation of Mr. Ayalon, Kenneth Denos and Dozy Mmobuosi, the Company’s interim co-Chief Executive Officers were appointed as the Company’s interim co-Principal Financial and Accounting Officers, effective November 13, 2023.

Item 7.01 Regulation FD Disclosure.

On November 14, 2023, the Company posted to its website a presentation (the “Presentation”) containing its financial results for the three and nine months ended September 30, 2023. The Company also held an investor conference call discussing the financial results for the three and nine months ended September 30, 2023.

The full text of the Press Release and the Presentation are furnished as Exhibits 99.1 and 99.2 to this Current Report on Form 8-K and are incorporated herein by reference.

In accordance with the General Instruction B.2 of Form 8-K the information furnished pursuant to this Item in this Current Report on Form 8-K (including Exhibits 99.1 and 99.2) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

1

Item 8.01 Other Information.

On November 13, 2023, the Securities and Exchange Commission announced the temporary suspension, pursuant to Section 12(k) of the Securities Exchange of 1934, of trading in the securities of the Company. The temporary suspension will expire at 11:59 p.m. (Eastern Standard Time) on November 28, 2023.

According to the order, the Securities and Exchange Commission temporarily suspended trading in the Company’s securities because of questions and concerns regarding the adequacy and accuracy of publicly available information in the marketplace concerning the Company, including (1) press releases, periodic filings with the Securities and Exchange Commission—including Forms 10-K, 10-Q, and 8-K—and other publicly disseminated statements, since at least May 10, 2022, about the financial statements and business operations of its then merger acquisition target and current wholly-owned subsidiary, Tingo Mobile Ltd.; and (2) press releases, periodic filings with the Securities and Exchange Commission—including Forms 10-K, 10-Q, and 8-K—and other publicly disseminated statements, since at least February 9, 2023, about the financial statements and business operations of its wholly-owned subsidiary, Tingo Foods PLC.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Press release, dated November 14, 2023 | |

| 99.2 | Presentation dated November 14, 2023 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 15, 2023 | TINGO GROUP, INC. | ||

| By: | /s/ Dozy Mmobuosi | ||

| Name: | Dozy Mmobuosi | ||

| Title: | Interim Co-CEO | ||

3

Exhibit 99.1

Tingo Group, Inc. Reports Third Quarter 2023 Financial Results

Net Revenues for the 9 Months Ended September 30, 2023 Amounted to $2.41 Billion

Operating Profit for the 9 Months Ended September 30, 2023 Amounted to $492.5 Million

Lease of 6 Million New Phones and Corresponding Customer Onboarding to Nwassa Platform Scheduled to Commence from December 2023

International Expansion Gaining Pace with Pilot Program Launch in Malawi and MOU Signed with Government of Pakistan for Nationwide Rollout

Management to Host Conference Call Today at 8:00 a.m. Eastern Time

MONTVALE, NJ – November 14, 2023 – Tingo Group, Inc. (NASDAQ: TIO) (“Tingo” or the “Company”), a profitable multi-national fintech, agri-fintech, food processing and commodity trading company, today announced its financial results for the quarter ended September 30, 2023.

Highlights & Recent Developments

Financial Results

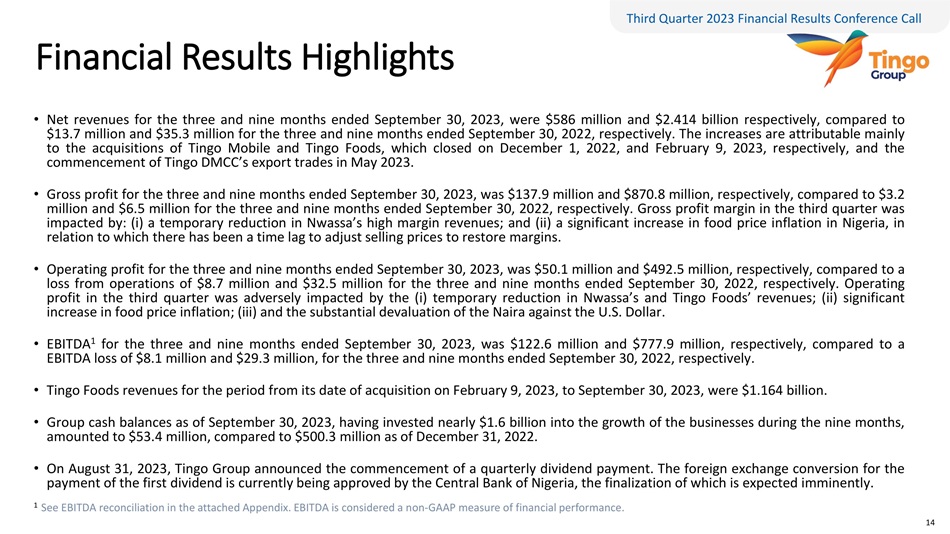

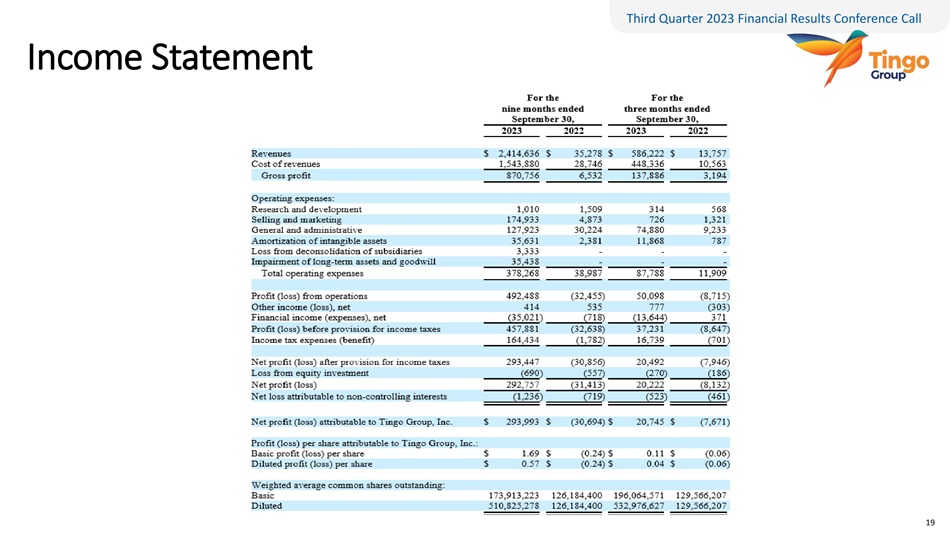

| ● | Net revenues for the three and nine months ended September 30, 2023, were $586.2 million and $2.414 billion respectively, compared to $13.7 million and $35.3 million for the three and nine months ended September 30, 2022, respectively. |

The net revenues for the three months ended September 30, 2023, represented a decrease of $391.0 million compared to the three months ended June 30, 2023, which was attributable to several factors. The Company’s net revenues were materially affected by the significant devaluation of Nigeria’s currency, which ensued following the Nigerian Government’s lifting of certain foreign exchange restrictions on June 14, 2023. While there was some impact on net revenues for the second quarter, the impact was significantly greater in the third quarter due to the fact the devaluation covered the entire quarter. The exchange rate moved from Naira 462.88 / $1.00 on June 13, 2023, to Naira 768.76 / $1.00 on September 30, 2023, which led to a decrease of 39.43% in the U.S. Dollar reported revenues of both Tingo Mobile and Tingo Foods for the third quarter, compared to the level that would have been recorded if calculated at the June 13, 2023 pre-devaluation exchange rate.

The businesses of Tingo Mobile and Tingo Foods, and their respective revenues, were temporarily adversely affected during the second quarter of 2023 by the economic disruption following Nigeria’s government elections and subsequent change of presidential administrations. These businesses were then affected further, and to an even greater degree, by the adverse publicity and loss of customer confidence created by the short seller report against the Company on June 6, 2023. The business of Tingo DMCC was also temporarily negatively impacted by the adverse publicity, and resultant loss of customer confidence, which resulted in a delay in several export orders.

1

| ● | Gross profit for the three and nine months ended September 30, 2023, was $137.9 million and $870.8 million, respectively, compared to $3.2 million and $6.5 million for the three and nine months ended September 30, 2022, respectively. |

The gross profit for the three months ended September 30, 2023, represented a decrease of $208.1 million compared to the three months ended June 30, 2023. The reduction in the gross profit and gross profit margin for the third quarter was attributable to the impact on revenues of the material change in the exchange rate of Nigeria’s currency against the U.S. dollar and the temporary loss of customer confidence created by the short seller report against the Company, combined with the impact on cost of sales in the Food Processing segment and Export and Commodity Trading segment of the high level of food price inflation in Nigeria, where it has taken time for the businesses to adjust their selling prices accordingly and restore profit margins.

| ● | Operating profit for the three and nine months ended September 30, 2023, was $50.1 million and $492.5 million, respectively, compared to a loss from operations of $8.7 million and $32.5 million for the three and nine months ended September 30, 2022, respectively. |

| ● | Net profit for the three and nine months ended September 30, 2023, was $20.7 million and $293.9 million respectively, compared to a net loss $7.7 million and $30.7 million for the three and nine months ended September 30, 2022, respectively. |

| ● | Net profit per share attributable to Tingo Group for the nine months ended September 30, 2023, of $1.69 based on the weighted average shares outstanding on September 30, 2023, and $0.57 per share on a fully diluted basis. |

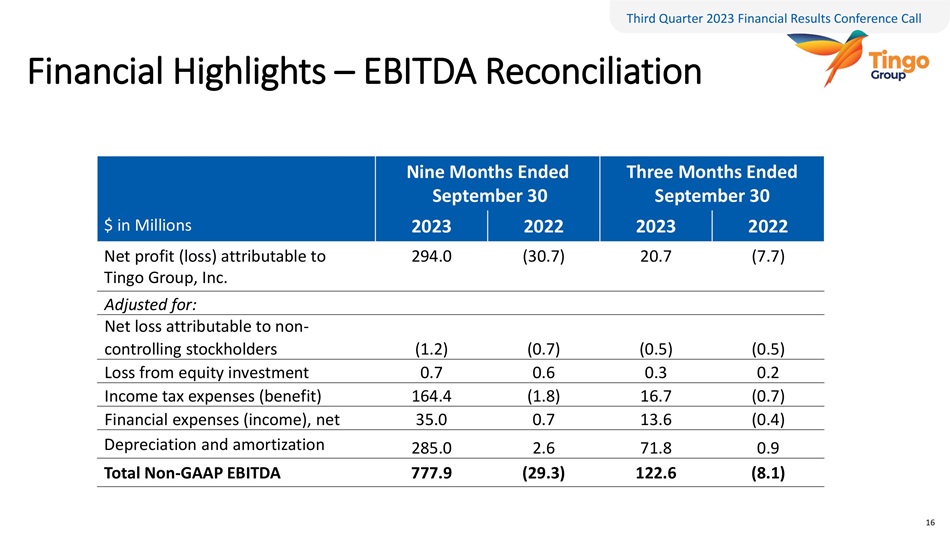

| ● | EBITDA1 for the three and nine months ended September 30, 2023, was $122.6 million and $777.9 million, respectively, compared to an EBITDA loss of $8.1 million and $29.3 million, for the three and nine months ended September 30, 2022, respectively. |

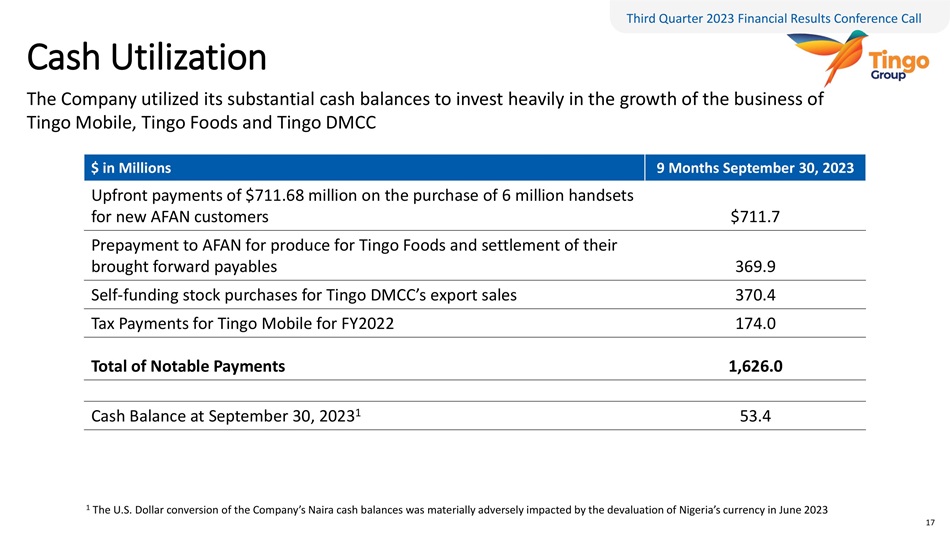

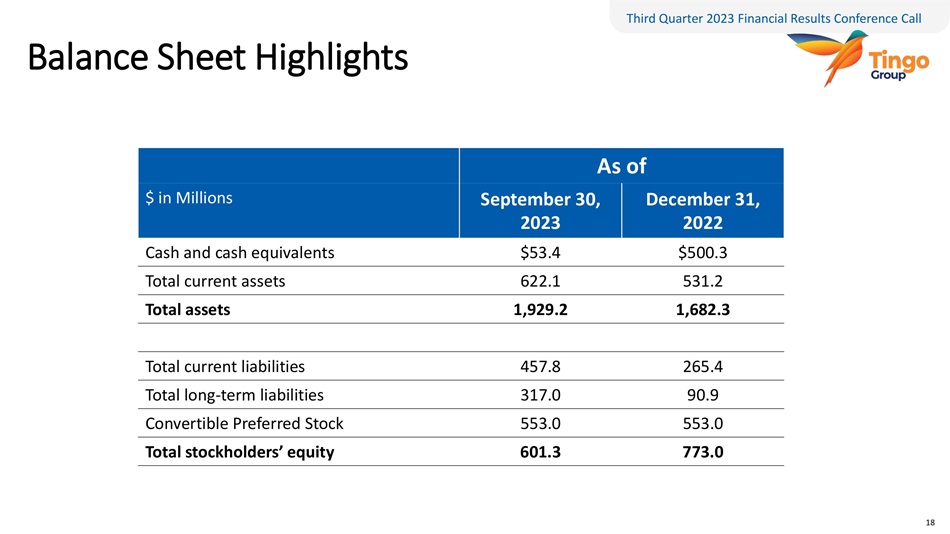

| ● | Tingo Group invested heavily in the growth of Tingo Mobile, Tingo Foods and Tingo DMCC during the nine months, including: (i) making an upfront payment of $711.6 million on the purchase of 6 million handsets for new AFAN customers, which are scheduled to commence generating revenue from December 2023; (ii) prepaying AFAN for produce for Tingo Foods and settling their brought forward payables, resulting in a total net outlay of $369.9 million; and (iii) self-funding stock purchases of $370.4 million for Tingo DMCCs export sales, the majority of the revenues for which are scheduled to be received during the fourth quarter. In addition, tax payments totaling $174.0 million were made for Tingo Mobile on its taxable earnings for fiscal year 2022, and the Company also incurred a substantial foreign exchange loss. As a result, the balance of cash and cash equivalents on September 30, 2023, stood at $53.4 million, compared to $500.3 million on December 31, 2022. |

| 1 | EBITDA (Earnings Before Interest Tax Depreciation and Amortization) is considered a non-GAAP measure of financial performance). See reconciliation of EBITDA to Operating Profit in the summarized financial results below. |

Operational Milestones

| ● | AFAN adopted Nwassa marketplace on an exclusive basis for all its members. AFAN is supporting this initiative with a nationwide marketing campaign to promote Nwassa as AFAN’s recommended method for farmers to use to purchase farming inputs; sell agricultural produce; and purchase of a range of value-added services. |

2

| ● | Purchased 6 million smartphone handsets to supply to new AFAN customers, which are expected to generate leasing revenue and Nwassa transaction revenue from December 2023. |

| ● | Commenced the first harvest of the 3,000 hectares of new farming land that Tingo Mobile financed the cultivation of in June 2023. Following the successful proof of model, Tingo Mobile and AFAN plan to significantly expand the program to cultivate much larger areas of land in 2024. |

| ● | Tingo Foods completed the development of its first Tingo branded food and beverage products, in what is planned to be an extensive range for the African market. Such products are scheduled for launch during the early part of next year. |

| ● | The joint venture construction partner for the new state-of-the-art processing facility in Delta State remains on track for Phase 1 of the facility to commence operations by the middle of 2024. |

| ● | Resumed development of Tingo DMCC commodity trading and export business outside of continental Africa, with the aim of commencing significant dollarization of the business by end of fourth quarter and the full dollarization of the Company’s earnings by end of 2024. |

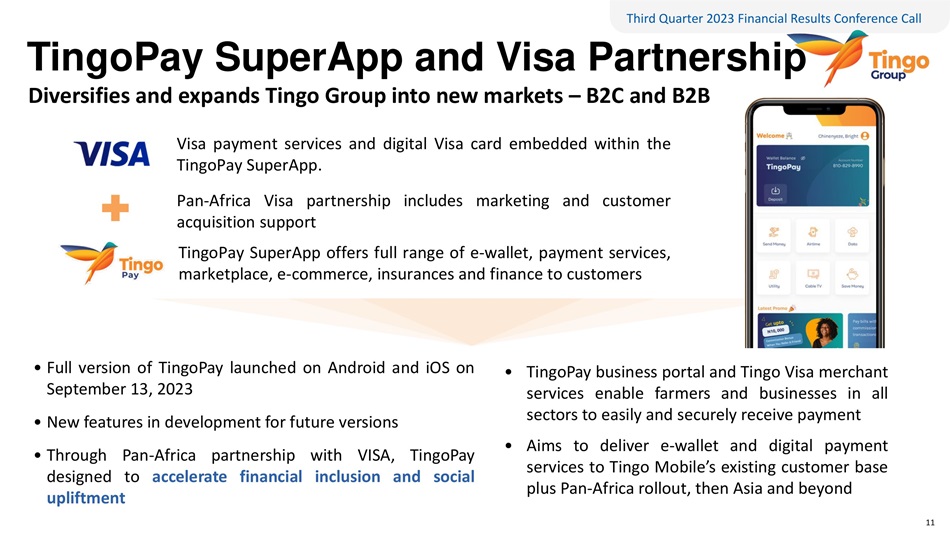

| ● | Launched full version of TingoPay on Android and iOS, having completed beta testing. New version includes an expanded range of features, including retail voucher cards and new bill payment functions, building on original features and TingoPay’s partnership with Visa. |

| ● | Opened new Africa headquarters in the financial sector of Victoria Island, Lagos. The new three-story 60,000 square foot headquarters building has capacity to accommodate a workforce of up to 500 in addition to the 100 employees that can be accommodated at the Company’s former headquarters on Lagos Island. |

| ● | Signed a Memorandum of Understanding with the Khyber Pakhtunkhwa Information Technology Board to launch and roll out the Company’s business and service offerings into Pakistan, the fifth most populous country and one of the largest agricultural commodity producers in the world. |

| ● | On August 30, 2023, completed a detailed investigation into allegations made by a Short Seller against the Company, disproving all such allegations. The investigation involved independent counsel investigating certain of the allegations at the direction of the independent directors, as well as the company engaging a Top 10 U.S. Law Firm as outside counsel to undertake its own investigation; along with the Nigerian offices of a separate global and Top 10 U.S. Law Firm to undertake investigative work in Nigeria. |

| ● | On August 31, 2023, announced the commencement of a quarterly dividend. The foreign exchange conversion for the payment of the first dividend, which is in the amount of $20 million, is currently being approved by the Central Bank of Nigeria, the finalization of which is expected soon. We intend to increase the amount of the quarterly dividend as we grow our earnings and cash balances. |

Dozy Mmobuosi, Co-Chief Executive Officer of Tingo Group and Founder of Tingo Mobile and Tingo Foods, commented, “After a challenging third quarter, where we suffered from the impact of several externally generated factors, I am very pleased with the strong recovery we are seeing in the fourth quarter, which I am confident will see us return to growth.

“The deepening of our relationship with AFAN, as the umbrella organization for Nigeria’s farmers and agricultural sector, has been a particularly important catalyst in our recovery, as we work with them, together with the cooperatives and several other parties to restore customer confidence following the negative press we received over the summer period in relation to the short seller attack. The adoption of Nwassa as AFAN’s exclusive agricultural marketplace platform, together with AFAN’s commencement to lease and distribute 6 million new smartphones from December, are expected to ensure that Tingo Mobile delivers a strong end to the year.

3

“Tingo Foods has already seen a particularly strong recovery, aided by the commencement of the wet-season harvest, including the harvest of the new farming land that we financed the cultivation and farming inputs for in June 2023. We have also been able to adjust Tingo Food’s selling prices to account for the significant increase in food price inflation experienced in the summer, thereby restoring our gross profit margins. The higher Tingo Foods selling prices are also expected to outweigh the impact of devaluation of the Naira. In addition, we are working towards launching our first Tingo branded food and beverage products by the end of the year, which will see a significant expansion of our product range, as well as a major step towards making Tingo a household name in Africa.

“Tingo DMCC experienced the delay and cancellation of business during the third quarter as new customers located outside of Africa, decided to wait for the completion of the investigation into the short seller allegations before proceeding with their orders. Since the completion of the investigation on August 30, 2023, and the publicly announced confirmation that all the short seller’s allegations against the Company had been disproved, Tingo DMCC has been able to resume the further development of its export and commodity trading business, including with its geographical expansion. The expansion of Tingo DMCC’s business outside of Africa, is expected to lead to the significant dollarization of the business before year end.

“I am aware that many of our stockholders are interested to know the status of the payment of the Company’s first dividend. I can confirm that we are working with our bankers in Nigeria and the Central Bank of Nigeria to obtain the foreign currency exchange approval on our first dividend payment of $20 million. While this has taken significantly longer than originally anticipate, which is due to well publicized external factors, we expect to receive the approval very soon, at which point we will formally declare the dividend and set the record date.”

Kenneth Denos, Co-Chief Executive Officer of Tingo Group, added: “We are proud of our progress and achievements for the third quarter and the nine months ended September 30, 2023. Despite some major headwinds that caused a decrease in customer activity during the quarter, we were able to regroup and continue on the path to growing and developing our businesses.

“The deepening of our partnership with AFAN to increase our customer base in Nigeria, the deployment of millions of smartphones to more of AFAN’s members by the end of this year, as well as the recent announcement of our endeavours in Pakistan, are strong indicators of the enormous potential we have to both increase our presence in those markets in which we already operate, as well as expand into new markets with incredible growth potential. We look forward to realizing these opportunities for the Company and our shareholders in the near future.”

Nine Months Ended September 30, 2023 Financial Review

| ● | Net revenues for the nine months ended September 30, 2023, were $2,414.6 million, compared to $35.3 million for the nine months ended September 30, 2022, an increase of 6,745%. The increase is mainly attributable to the addition of the Tingo Mobile and Tingo Foods acquisitions completed on December 1, 2022, and February 9, 2023, respectively, and the commencement of export trades through Tingo DMCC in May 2023. |

4

| ● | Gross profit for the nine months ended September 30, 2023, was $870.8 million, or 36% of revenues, compared to $6.5 million, or 19% of revenues, for the nine months ended September 30, 2022. |

| ● | Selling and marketing expenses for the nine months ended September 30, 2023, were $174.9 million as compared to $4.9 million for the nine months ended September 30, 2022. The increase was due to an increase in marketing expenses from the inclusion of sales and marketing expenses for Tingo Foods and Tingo Mobile, which was offset in part by a decrease in marketing expenses for the stock trading businesses. |

| ● | General and administrative expenses for the nine months ended September 30, 2023, were $127.9 million compared to $30.2 million for the nine months ended September 30, 2022, mainly attributed to the addition of costs from Tingo Mobile and Tingo Foods, and an increase in share-based payments totalling $40.7 million and share issuance from litigation in total amount of $16.5 million. |

| ● | Operating profit for the nine months ended September 30, 2023, was $492.5 million versus an operating loss of $32.5 million for the nine months ended September 30, 2022. The increase in profit from operations is mainly attributed to the acquisitions of Tingo Mobile and Tingo Foods and the commencement of export trades through Tingo DMCC, as explained above. |

| ● | Net income attributable to Tingo Group for the nine months ended September 30, 2023, was $293.9 million compared to a net loss of $30.7 million for the nine months ended September 30, 2022, primarily as a result of the acquisitions of Tingo Mobile and Tingo Foods, and the commencement of export trades through Tingo DMCC in May 2023. |

| ● | Consolidated EBITDA1 for the for the nine months ended September 30, 2023, was $777.9 million compared to Consolidated EBITDA1 Loss of $29.3 million for the nine months ended September 30, 2022. |

Third Quarter 2023 Results Conference Call

A presentation will accompany the conference call, which can be viewed during the webcast or accessed via the investor relations section of the Company’s website here.

The conference call will be followed by a question-and-answer period. Questions will be accepted leading up to the call and can be submitted via email to TIO@mzgroup.us.

To access the call, please use the following information:

| Date: | Tuesday November 14, 2023 |

| Time: | 8:00 a.m. Eastern Time (5:00 a.m. Pacific Time) |

| Dial-in: | 1-844-826-3035 |

| International Dial-in: | 1-412-317-5195 |

| Conference Code: | 10184362 |

| Webcast: | https://viavid.webcasts.com/starthere.jsp?ei=1639550&tp_key=34a5261e17 |

A telephone replay will be available approximately three hours after the call and will run through January 14, 2023, by dialing 1-844-512-2921 from the U.S., or 1-412-317-6671 from international locations, and entering replay pin number: 10184362. The replay can also be viewed through the webcast link above and the presentation utilized during the call will be available in the company’s investor relations section here.

5

About Tingo Group

Tingo Group, Inc. (Nasdaq: TIO) is a global Fintech, Agri-Fintech, food processing and commodity trading group of companies with operations in Africa, Southeast Asia and the Middle East. Tingo Group’s wholly owned subsidiary, Tingo Mobile, is a leading Agri-Fintech company operating in Africa, with a comprehensive portfolio of innovative products, including a ‘device as a service’ smartphone and a value-added service platform, the cornerstone of which is the Nwassa ‘seed-to-sale’ marketplace platform, as well as insurance, micro-finance, and mobile phone and data top-up. Tingo Group’s other Tingo business verticals include: TingoPay, a SuperApp in partnership with Visa, offering a wide range of B2C and B2B services including payment services, an e-wallet, foreign exchange and merchant services; Tingo Foods, a food processing business that processes raw foods into finished products such as rice, groundnut oil, nut products, wheat, millet and maize; and Tingo DMCC, a commodity trading platform and agricultural commodities export business based out of the Dubai Multi Commodities Center. In addition to its Tingo business verticals, Tingo Group also holds and operates an insurance brokerage platform business in China; and Magpie Securities, a regulated finance services Fintech business operating out of Hong Kong and Singapore, which, as relatively small businesses within the Company, are currently in the process of being reviewed and re-positioned. For more information visit tingogroup.com.

Disclaimer

This press release contains “forward-looking statements.” Forward-looking statements include, but are not limited to, statements regarding Tingo or its management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential”, “scheduled” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions and are subject to various known and unknown risks and uncertainties, many of which are beyond the company’s control, and cannot be predicted or quantified and consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made with the SEC by the Company and include, but are not limited to, statements about our products, including our newly acquired products, customers, regulatory approvals, the potential utility of and market for our products and services, our ability to implement our business strategy and anticipated business and operations, future financial and operational performance, our anticipated future growth strategy, including the Merger, or the acquisition of other companies or technologies, capital requirements, intellectual property, suppliers, joint venture partners, future financial and operating results, plans, objectives, expectations and intentions, revenues, costs and expenses, interest rates, outcome of contingencies, business strategies, regulatory filings and requirements, the estimated potential size of markets, capital requirements, the terms of any capital financing agreements the results of the independent review, the risk of restatement of the Company’s previously reported financial statements or the material weaknesses in internal control over financial reporting, costs relating to the independent review, which are likely to be material, the outcome of any legal proceedings that have been and may be instituted against the Company, including as may result from the independent review, the ability to meet stock exchange continued listing standards and other statements that are not historical facts. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the Securities and Exchange Commission (SEC), including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors and security holders are urged to read these documents free of charge on the SEC’s web site at http://www.sec.gov. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events or otherwise.

Investor Relations Contact

949-491-8235

TIO@mzgroup.us

www.mzgroup.us

6

TINGO GROUP, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(USD In Thousands, Except Share and Par Value Data)

| September 30, 2023 | December 31, 2022 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 53,418 | $ | 500,316 | ||||

| Trade accounts receivable, net | 359,185 | 11,541 | ||||||

| Inventories | 143 | - | ||||||

| Related party receivables | 8,953 | 13,491 | ||||||

| Other current assets | 200,405 | 5,828 | ||||||

| Total current assets | 622,104 | 531,176 | ||||||

| Property and equipment, net | 811,287 | 855,125 | ||||||

| Intangible assets, net | 280,935 | 185,407 | ||||||

| Goodwill | 211,849 | 101,247 | ||||||

| Right of use assets under operating lease | 1,132 | 2,260 | ||||||

| Long-term deposit and other non-current assets | 438 | 514 | ||||||

| Deferred tax assets | - | 3,661 | ||||||

| Restricted cash escrow | 1,371 | 2,233 | ||||||

| Micronet Ltd. equity method investment | 45 | 735 | ||||||

| Total long-term assets | 1,307,057 | 1,151,182 | ||||||

| Total assets | $ | 1,929,161 | $ | 1,682,358 | ||||

7

TINGO GROUP, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(USD In Thousands, Except Share and Par Value Data)

| September 30, 2023 | December 31, 2022 | |||||||

| LIABILITIES, TEMPORARY EQUITY AND EQUITY | ||||||||

| Short-term loan | $ | 164 | $ | 460 | ||||

| Trade accounts payable | 262,530 | 11,092 | ||||||

| Deposit held on behalf of clients | 498 | 2,528 | ||||||

| Related party payables | 57,682 | 57,506 | ||||||

| Current operating lease liability | 690 | 1,215 | ||||||

| Other current liabilities | 136,229 | 192,594 | ||||||

| Total current liabilities | 457,793 | 265,395 | ||||||

| Long-term loan | - | 377 | ||||||

| Long-term operating lease liability | 382 | 905 | ||||||

| Promissory note | 210,483 | - | ||||||

| Deferred tax liabilities | 105,460 | 89,597 | ||||||

| Other long-term liability | 640 | - | ||||||

| Accrued severance pay | 46 | 50 | ||||||

| Total long-term liabilities | 317,011 | 90,929 | ||||||

| Commitment and Contingencies (Note 11) | - | - | ||||||

| Temporary equity | ||||||||

| Series B preferred stock subject to redemption: $0.001 par value, 33,687.21 shares authorized and 0 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively. | 553,035 | 553,035 | ||||||

| Stockholders’ Equity: | ||||||||

| Series A preferred stock: $0.001 par value, 2,604.28 shares authorized and 0 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | - | 3 | ||||||

| Common stock: $0.001 par value, 750,000,000 shares authorized, 236,270,476 and 157,599,882 shares issued and outstanding as of September 30, 2023, and December 31, 2022, respectively | 236 | 158 | ||||||

| Additional paid-in capital | 949,192 | 889,579 | ||||||

| Accumulated other comprehensive income (loss) | (518,948 | ) | 4,367 | |||||

| Accumulated earnings (deficit) | 170,530 | (123,463 | ) | |||||

| Tingo Group, Inc. stockholders’ equity | 601,010 | 770,644 | ||||||

| Non-controlling interest | 312 | 2,355 | ||||||

| Total stockholders’ equity | 601,322 | 772,999 | ||||||

| Total liabilities, temporary equity and stockholders’ equity | $ | 1,929,161 | $ | 1,682,358 | ||||

8

TINGO GROUP, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(USD In Thousands, Except Share and Earnings Per Share Data)

| For the nine months ended September 30, | For the three months ended September 30, | ||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||

| Revenues | $ | 2,414,636 | $ | 35,278 | $ | 586,222 | $ | 13,757 | |||||||||

| Cost of revenues | 1,543,880 | 28,746 | 448,336 | 10,563 | |||||||||||||

| Gross profit | 870,756 | 6,532 | 137,886 | 3,194 | |||||||||||||

| Operating expenses: | |||||||||||||||||

| Research and development | 1,010 | 1,509 | 314 | 568 | |||||||||||||

| Selling and marketing | 174,933 | 4,873 | 726 | 1,321 | |||||||||||||

| General and administrative | 127,923 | 30,224 | 74,880 | 9,233 | |||||||||||||

| Amortization of intangible assets | 35,631 | 2,381 | 11,868 | 787 | |||||||||||||

| Loss from deconsolidation of subsidiaries | 3,333 | - | - | - | |||||||||||||

| Impairment of long-term assets and goodwill | 35,438 | - | - | - | |||||||||||||

| Total operating expenses | 378,268 | 38,987 | 87,788 | 11,909 | |||||||||||||

| Profit (loss) from operations | 492,488 | (32,455 | ) | 50,098 | (8,715 | ) | |||||||||||

| Other income (loss), net | 414 | 535 | 777 | (303 | ) | ||||||||||||

| Financial income (expenses), net | (35,021 | ) | (718 | ) | (13,644 | ) | 371 | ||||||||||

| Profit (loss) before provision for income taxes | 457,881 | (32,638 | ) | 37,231 | (8,647 | ) | |||||||||||

| Income tax expenses (benefit) | 164,434 | (1,782 | ) | 16,739 | (701 | ) | |||||||||||

| Net profit (loss) after provision for income taxes | 293,447 | (30,856 | ) | 20,492 | (7,946 | ) | |||||||||||

| Loss from equity investment | (690 | ) | (557 | ) | (270 | ) | (186 | ) | |||||||||

| Net profit (loss) | 292,757 | (31,413 | ) | 20,222 | (8,132 | ) | |||||||||||

| Net loss attributable to non-controlling interests | (1,236 | ) | (719 | ) | (523 | ) | (461 | ) | |||||||||

| Net profit (loss) attributable to Tingo Group, Inc. | $ | 293,993 | $ | (30,694 | ) | $ | 20,745 | $ | (7,671 | ) | |||||||

| Profit (loss) per share attributable to Tingo Group, Inc.: | |||||||||||||||||

| Basic profit (loss) per share | $ | 1.69 | $ | (0.24 | ) | $ | 0.11 | $ | (0.06 | ) | |||||||

| Diluted profit (loss) per share | $ | 0.57 | $ | (0.24 | ) | $ | 0.04 | $ | (0.06 | ) | |||||||

| Weighted average common shares outstanding: | |||||||||||||||||

| Basic | 173,913,223 | 126,184,400 | 196,064,571 | 129,566,207 | |||||||||||||

| Diluted | 510,825,278 | 126,184,400 | 532,976,627 | 129,566,207 | |||||||||||||

Non-GAAP Financial Measures

In addition to providing financial measurements based on generally accepted accounting principles in the U.S., or GAAP, we provide additional financial metrics that are not prepared in accordance with GAAP, or non-GAAP financial measures. Management uses non-GAAP financial measures, in addition to GAAP financial measures, to understand and compare operating results across accounting periods, for financial and operational decision making, for planning and forecasting purposes and to evaluate our financial performance.

9

Management believes that EBITDA reflects our ongoing business in a manner that allows for meaningful comparisons and analysis of trends in our business, as they exclude expenses and gains that are not reflective of our ongoing operating results. Management also believes that EBITDA is a key measure used by our management team to evaluate our operating performance, generate future operating plans and make strategic decisions. The Company believes EBITDA is useful to investors for the purposes of comparing our results period-to-period and alongside peers and understanding and evaluating our operating results in the same manner as our management team and board of directors.

These supplemental measures should not be considered superior to, as a substitute for or as an alternative to, and should be considered in conjunction with, the GAAP financial measures presented. In addition, since these non-GAAP measures are not determined in accordance with GAAP, they are susceptible to varying calculations and may not be comparable to other similarly titled non-GAAP measures of other companies.

EBITDA does not replace the presentation of our GAAP financial results and should only be used as a supplement to, not as a substitute for, our financial results presented in accordance with GAAP.

EBITDA is defined as net income from continuing operations calculated in accordance with GAAP, less net income attributable to non-controlling interests, plus the sum of income tax expense, interest expense, net, depreciation and amortization (“EBITDA”).

The following is a reconciliation of net profit (loss), the most directly comparable GAAP financial measure, to EBITDA (a non-GAAP financial measure) for each of the periods indicated.

| For the three months ended September 30, | ||||||||

| Dollars in Thousands | 2023 | 2022 | ||||||

| Net profit (loss) attributable to Tingo Group, Inc. | $ | 20,745 | $ | (7,671 | ) | |||

| Adjusted for: | ||||||||

| Net loss attributable to non-controlling stockholders | (523 | ) | (461 | ) | ||||

| Loss from equity investment | 270 | 186 | ||||||

| Income tax expenses (benefit) | 16,739 | (701 | ) | |||||

| Financial income (expenses),net | 13,644 | (371 | ) | |||||

| Depreciation and amortization | 71,755 | 872 | ||||||

| Total EBITDA attributable to Tingo Group, Inc. | $ | 122,630 | $ | (8,146 | ) | |||

| For the nine months ended September 30, | ||||||||

| Dollars in Thousands | 2023 | 2022 | ||||||

| Net profit (loss) attributable to Tingo Group, Inc. | $ | 293,993 | $ | (30,694 | ) | |||

| Adjusted for: | ||||||||

| Net loss attributable to non-controlling stockholders | (1,236 | ) | (719 | ) | ||||

| Loss from equity investment | 690 | 557 | ||||||

| Income tax expenses (benefit) | 164,434 | (1,782 | ) | |||||

| Financial expenses, net | 35,021 | 718 | ||||||

| Depreciation and amortization | 285,012 | 2,581 | ||||||

| Total EBITDA attributable to Tingo Group, Inc. | $ | 777,914 | $ | (29,339 | ) | |||

10

Exhibit 99.2

A Diverse Fintech & Agri - Fintech Group Making a Difference Delivering Financial Inclusion and Food Security August 10, 2023 NASDAQ: TIO Q3 2023 Financial Results Conference Call

2 Third Quarter 2023 Financial Results Conference Call Forward Looking Statements Cautionary Note Regarding Forward - Looking Statements Certain statements made herein contain, and certain oral statements made by representatives of Tingo Group, Inc . (“Tingo Group”) and its affiliates, from time to time may contain, “forward - looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 . Tingo Group and its subsidiaries actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward - looking statements as guarantees or predictions of future events . Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “might” and “continues,” and similar expressions are intended to identify such forward - looking statements . These forward - looking statements include, without limitation, Tingo Group’s expectations with respect to future performance . The statements contained in this presentation that are not purely historical are forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These statements are based on the beliefs and assumptions of our management based on information currently available to management . Such forward - looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward - looking statements . Most of these factors are outside of the control of Tingo Group and are difficult to predict . Factors that may cause such differences include but are not limited to : ( 1 ) the inability to obtain or maintain the listing of Tingo Group’s common stock on Nasdaq ; ( 2 ) the risk that the integration of the businesses of Tingo Mobile Limited (“Tingo Mobile”), Tingo Group and their affiliated companies with the historical business of Tingo Group disrupts the current plans and operations of Tingo Group ; ( 3 ) the ability to recognize the anticipated benefits of the acquisitions of Tingo Mobile, Tingo Foods Plc (“Tingo Foods”) and their affiliated companies, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth economically and hire and retain key employees ; ( 4 ) changes in applicable laws or regulations ; ( 5 ) the possibility that Tingo Group may be adversely affected by other economic, business, and/or competitive factors ; and ( 6 ) the ability of Tingo Foods to recognize benefits associated with its partnership with Evtec Energy PLC, and other risks and uncertainties identified in the Tingo Group annual report on Form 10 - K for the year ended December 31 , 2022 , filed with the Securities and Exchange Commission (“SEC”) on March 31 , 2023 , including those under “Risk Factors” therein, and in other filings with the SEC made by Tingo Group . The foregoing list of factors is not exclusive . Readers are referred to the most recent reports filed with the SEC by Tingo Group . Furthermore, such forward - looking statements speak only as of the date of this report . Except as required by law, we undertake no obligation to update any forward - looking statements to reflect events or circumstances after the date of such statements . This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any of our securities, nor shall there be any offer or sale of our securities in any jurisdiction in which such solicitation or sale would be unlawful prior to registration or qualification of our securities under the laws of any such jurisdiction . This presentation contains a discussion of EBITDA, a non - GAAP measure . This measure as calculated by Tingo Group and as presented in this document may differ materially from similarly titled measures reported by other companies due to differences in the way these measures are calculated . Non - GAAP measures have important limitations as analytical tools and should not be considered in isolation from, or as a substitute for an analysis of, Tingo Group’s operating results as reported under U . S . GAAP . A reconciliation of non - GAAP measures to GAAP financial measures is included elsewhere in this presentation .

3 Third Quarter 2023 Financial Results Conference Call Agenda • Introduction and Recent Developments • Product Timelines, Updates and Partnerships • Financial Results • Closing Summary and Q&A Dozy Mmobuosi Kenneth Denos Tingo Mobile & Tingo Foods Founder and Group Co CEO Group Co CEO • Founded Tingo Mobile Limited • Founded Tingo Foods PLC • Launched Nigeria’s 1st SMS Banking Solution • Co - sponsor for Africa Acquisition Corp Inc. • CEO, Outsize Capital • Director & Officer, Equus Total Return • Founder Acadia Law Group • CEO of MCC Global

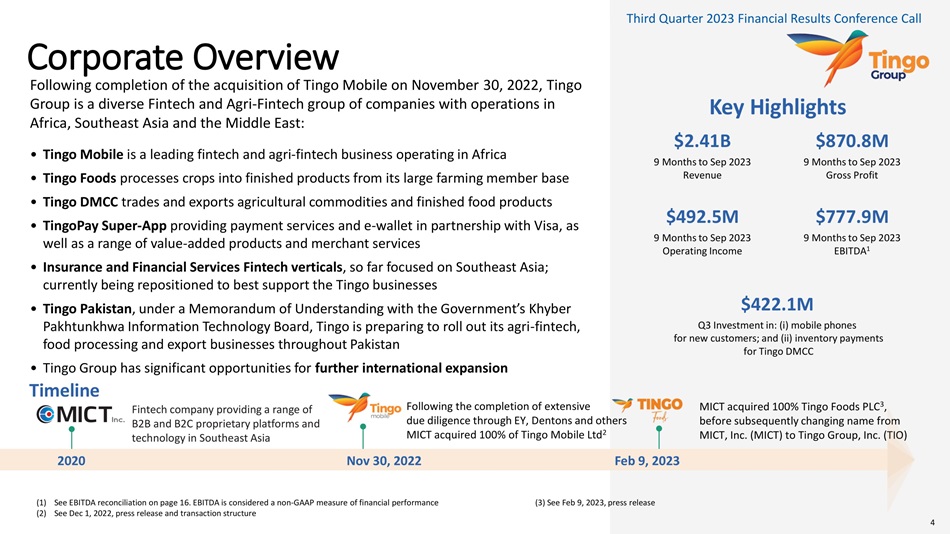

4 Third Quarter 2023 Financial Results Conference Call Corporate Overview MICT acquired 100% Tingo Foods PLC 3 , before subsequently changing name from MICT, Inc. (MICT) to Tingo Group, Inc. (TIO) Timeline (1) See EBITDA reconciliation on page 16. EBITDA i s considered a non - GAAP measure of financial performance (3) See Feb 9, 2023, press release (2) See Dec 1, 2022, press release and transaction structure Feb 9, 2023 Nov 30, 2022 2020 Fintech company providing a range of B2B and B2C proprietary platforms and technology in Southeast Asia Following completion of the acquisition of Tingo Mobile on November 30, 2022, Tingo Group is a diverse Fintech and Agri - Fintech group of companies with operations in Africa, Southeast Asia and the Middle East: • Tingo Mobile is a leading fintech and agri - fintech business operating in Africa • Tingo Foods processes crops into finished products from its large farming member base • Tingo DMCC trades and exports agricultural commodities and finished food products • TingoPay Super - App providing payment services and e - wallet in partnership with Visa, as well as a range of value - added products and merchant services • Insurance and Financial Services Fintech verticals , so far focused on Southeast Asia; currently being repositioned to best support the Tingo businesses • Tingo Pakistan , under a Memorandum of Understanding with the Government’s Khyber Pakhtunkhwa Information Technology Board, Tingo is preparing to roll out its agri - fintech, food processing and export businesses throughout Pakistan • Tingo Group has significant opportunities for further international expansion Key Highlights $870.8M $2.41B 9 Months to Sep 2023 Gross Profit 9 Months to Sep 2023 Revenue $777.9M $492.5M 9 Months to Sep 2023 EBITDA 1 9 Months to Sep 2023 Operating Income $422.1M Q3 Investment in: (i) mobile phones for new customers; and (ii) inventory payments for Tingo DMCC 4 Following the completion of extensive due diligence through EY, Dentons and others MICT acquired 100% of Tingo Mobile Ltd 2 Third Quarter 2023 Financial Results Conference Call

5 Third Quarter 2023 Financial Results Conference Call Our Mission Make a difference improving global food supply and tackling the world’s food security crisis; by delivering farmer empowerment, improved crop yields, reduced spoilage and better access to markets. Agri - Fintech Mission Group Mission Foster digital and financial inclusion through technology platforms to drive social and economic upliftment 5 Agri - Fintech Mission For Africa and Pakistan Support farmers to achieve sustainable food self - sufficiency, bringing an end to food insecurity and poverty in Africa and Pakistan Third Quarter 2023 Financial Results Conference Call

6 Third Quarter 2023 Financial Results Conference Call Acquisition & Recent Developments • November 30 , 2022 – Completed the acquisition of 100 % of Tingo Mobile, following the completion of extensive due diligence by world class advisors : including Big 4 accounting firm, No . 1 U . S . law firm in Africa, and others • Fourth Quarter of 2022 – Commenced geographical expansion of Tingo Mobile to Ghana, Malawi/East Africa and Dubai/ Middle East • December 2022 – Launched Tingo DMCC commodities trading platform & export business • December 2022 – Launched beta version of TingoPay Super App and Visa Partnership, to field - test and further develop • February 2023 – Completed acquisition of Tingo Foods and commenced to build largest food processing facility in Africa • April 25 , 2023 – Entered agreement with Prime Commodity Exchange (PCX) and All Farmers Association of Nigeria (AFAN), securing considerable produce supply, nationwide warehousing facilities and enhanced commodity trading opportunities • May 30 , 2023 – Commenced commodity export trades through Tingo DMCC, with the aim of fully dollarizing the Company’s group earnings • August 31 , 2023 – Announced commencement of quarterly dividends • October 24 , 2023 – Entered MoU with Pakistan Government to roll out Tingo’s businesses throughout the country

7 Third Quarter 2023 Financial Results Conference Call Agri Fintech Growth Strategy Replicating our Proven Model - Tingo Mobile and NWASSA Marketplace ~30.0M 6.0M >12.5M Expected number of Tingo Mobile customers within next 6 months Mobile Phones Ordered for distribution to new customers in Q4 2023 Tingo Mobile active customers at Sep 30, 2023 NWASSA • October 2022 – Signed All Farmers Association of Nigeria (AFAN) trade partnership – with commitment to triple farmer numbers from 9 . 3 M to ~ 30 . 0 M • November 2022 – Expanded into Ghana, signing Kingdom of Ashanti trade partnership with commitment to enroll a minimum of 2 . 0 M new farmers and a target of 4 . 0 M • December 2022 – Expanded into Malawi as a base to expand into East Africa • Tingo Foods and Tingo DMCC aim to significantly increase offtake and demand for produce from Tingo Mobile farmers, reduce post harvest losses and deliver fair pricing • April 2023 - Signed agreement with Prime Commodity Exchange (PCX) and AFAN, securing nationwide warehousing facilities for produce, increasing offtake capabilities • October 2023 – Entered into MoU with Pakistan Government for countrywide rollout • Progressing testing on forthcoming Nwassa web platform and App to complement existing USSD GSM transaction platform

8 Third Quarter 2023 Financial Results Conference Call Tingo Foods – Food Processing Business Constructing what is believed to be the largest food processing facility in Africa A key part of the Tingo Group eco - system from Seed to Sale Creating significant demand and offtake for Tingo Mobile’s Farmers + Creating significant supply for Tingo’s commodity trading and export business Partnership with Evtec Energy and their associated entities to build $ 150 M 110 MW Solar Plant, aims to achieve net zero carbon emissions and reduced energy costs . • Generated more than $ 1 . 16 billion of revenue between date of acquisition on February 9 , 2023 , and September 30 , 2023 • Delivered gross profit of $ 427 . 1 million in the first eight months since acquisition • Continually developing new products and expanding product range • Constructing largest food processing plant in Africa, with state - of - the - art $ 1 . 6 billion food processing facility in Delta State of Nigeria • Phase 1 of new food processing facility on track and scheduled to open mid - 2024 • Rollout of food processing businesses in Malawi and Pakistan expected H 1 2024 • Farmers and agricultural sector in each country to benefit from substantial expansion of domestic processing capabilities – increasing crop demand, reducing post - harvest losses, delivering better prices to farmers and generating financial upliftment Rendered CAD Designs of Tingo Foods Processing Facility

9 Third Quarter 2023 Financial Results Conference Call Tingo DMCC - Agri Commodity Platform In Partnership with the Dubai Multi Commodities Centre (DMCC) A global commodity platform and export business – completing the seed to sale eco - system • Commenced first exports transactions on May 30 , 2023 , delivering $ 668 million of revenues in five months to September 30 , 2023 • Exclusive agreement with Prime Commodity Exchange (PCX) and All Farmers Association of Nigeria (AFAN), secures considerable produce supply, nationwide warehousing facilities and enhanced commodity trading opportunities • Export business expected to dollarize Company’s group earnings, and at the same time give Tingo Mobile’s farmers and Tingo Foods direct access to international markets • Tingo DMMC on track to facilitate global export of agricultural commodities, including : Crops from Tingo Mobile’s farmers - such as wheat, millet, paddy rice, cassava, ginger, cashew nuts, cocoa and cotton Finished food and beverage products from Tingo Foods – such as milled rice, noodles, pasta, cooking oils, coffee, tea and chocolate • Has access to multi - billion dollars per annum of produce for export, through the c . 60 M farmers of Nigeria, to be followed by Ghana, Malawi, Pakistan and other territories

10 Third Quarter 2023 Financial Results Conference Call Prime Commodity Exchange & AFAN Produce Supply, Warehousing and Commodity Exchange Agreement • E xclusive use of AFAN’s existing network of 2 , 322 warehouses for a minimum term of 30 years • Right of first refusal to purchase or trade all produce stored in AFAN’s warehouses - to use primarily to serve the Tingo Foods and Tingo DMCC • PCX e - Warehouse Receipt System in all warehouses, enabling crops and other produce to be commoditized and traded by Tingo from delivery date • Priority position on PCX commodity trading platform, enabling Tingo DMCC to trade produce and commodities on spot, futures and derivative basis • AFAN, the umbrella body for Nigeria’s farming sector, has committed to coordinate its members to utilize the Partnership’s warehouses for produce • The Partnership has committed to a targeted increase in the number of warehouses to 80 , 000 in the next two years • Tingo Mobile has the right to sublet the warehouse space to pre - approved third parties, such as e - commerce businesses and wholesale businesses • Expected to add considerable value to Tingo DMCC, Tingo Foods and the whole Tingo Ecosystem

11 Third Quarter 2023 Financial Results Conference Call TingoPay SuperApp and Visa Partnership • Full version of TingoPay launched on Android and iOS on September 13 , 2023 • New features in development for future versions • Through Pan - Africa partnership with VISA, TingoPay designed to accelerate financial inclusion and social upliftment Visa payment services and digital Visa card embedded within the TingoPay SuperApp . Pan - Africa Visa partnership includes marketing and customer acquisition support TingoPay SuperApp offers full range of e - wallet, payment services, marketplace, e - commerce, insurances and finance to customers • TingoPay business portal and Tingo Visa merchant services enable farmers and businesses in all sectors to easily and securely receive payment • Aims to deliver e - wallet and digital payment services to Tingo Mobile’s existing customer base plus Pan - Africa rollout, then Asia and beyond Diversifies and expands Tingo Group into new markets – B2C and B2B

12 Third Quarter 2023 Financial Results Conference Call Financial & Digital Inclusion Increase Food Supply and Reduce Post Harvest Losses Social Upliftment Ecosystem Mobile Handsets with Embedded Software & Platforms Marketplace for inputs and produce Valued - Added Services and Payment Services Processing of produce into finished food products Wholesale and Export of Foods and Commodity Trading

13 Third Quarter 2023 Financial Results Conference Call Environmental, Social & Governance • Fostering digital and financial inclusion through technology platforms – driving the social and economic upliftment of customers • Meaningfully improving global food supply and tackling the world’s food security crisis by e mpowering the farmer - increasing crop yields ; reducing post harvest losses ; improving access to markets, and ; delivering fairer prices • Delivering significant environmental benefits – reducing crop wastage ; improving farming and food production efficiency ; promoting sustainable farming techniques ; reducing freight miles • Adopting a mature ESG framework underpinned and guided by the United Nations’ Sustainable Development Goals 13 Third Quarter 2023 Financial Results Conference Call

14 Third Quarter 2023 Financial Results Conference Call Financial Results Highlights • Net revenues for the three and nine months ended September 30 , 2023 , were $ 586 million and $ 2 . 414 billion respectively, compared to $ 13 . 7 million and $ 35 . 3 million for the three and nine months ended September 30 , 2022 , respectively . The increases are attributable mainly to the acquisitions of Tingo Mobile and Tingo Foods, which closed on December 1 , 2022 , and February 9 , 2023 , respectively , and the commencement of Tingo DMCC’s export trades in May 2023 . • Gross profit for the three and nine months ended September 30 , 2023 , was $ 137 . 9 million and $ 870 . 8 million, respectively, compared to $ 3 . 2 million and $ 6 . 5 million for the three and nine months ended September 30 , 2022 , respectively . Gross profit margin in the third quarter was impacted by : (i) a temporary reduction in Nwassa’s high margin revenues ; and (ii) a significant increase in food price inflation in Nigeria, in relation to which there has been a time lag to adjust selling prices to restore margins . • Operating profit for the three and nine months ended September 30 , 2023 , was $ 50 . 1 million and $ 492 . 5 million, respectively, compared to a loss from operations of $ 8 . 7 million and $ 32 . 5 million for the three and nine months ended September 30 , 2022 , respectively . Operating profit in the third quarter was adversely impacted by the (i) temporary reduction in Nwassa’s and Tingo Foods’ revenues ; (ii) significant increase in food price inflation ; (iii) and the substantial devaluation of the Naira against the U . S . Dollar . • EBITDA 1 for the three and nine months ended September 30 , 2023 , was $ 122 . 6 million and $ 777 . 9 million, respectively, compared to a EBITDA loss of $ 8 . 1 million and $ 29 . 3 million, for the three and nine months ended September 30 , 2022 , respectively . • Tingo Foods revenues for the period from its date of acquisition on February 9 , 2023 , to September 30 , 2023 , were $ 1 . 164 billion . • Group cash balances as of September 30 , 2023 , having invested nearly $ 1 . 6 billion into the growth of the businesses during the nine months, amounted to $ 53 . 4 million, compared to $ 500 . 3 million as of December 31 , 2022 . • On August 31 , 2023 , Tingo Group announced the commencement of a quarterly dividend payment . The foreign exchange conversion for the payment of the first dividend is currently being approved by the Central Bank of Nigeria, the finalization of which is expected imminently . 1 See EBITDA reconciliation in the attached Appendix . EBITDA i s considered a non - GAAP measure of financial performance .

15 Third Quarter 2023 Financial Results Conference Call Financial Highlights Income Statement 1 See EBITDA reconciliation in the attached Appendix . EBITDA i s considered a non - GAAP measure of financial performance . Three Months Ended September 30, Nine Months Ended September 30, 2022 2023 2022 2023 $ in Millions 13.7 $586 $35.3 $2,414.6 Revenue 3.2 137.9 6.5 870.8 Gross Profit (8.7) 50.1 (32.5) 492.5 Operating Income / (Loss) (8.1) 122.6 (29.3) 777.9 EBITDA 1 (8.6) 37.2 (32.6) 457.9 Net Income / (Loss) Before Tax (7.7) 20.7 (30.7) 294.0 Net Income / (Loss) On August 31 , 2023 , the Company announced the commencement of quarterly dividends . The foreign exchange conversion for the payment of the first dividend is currently being approved by the Central Bank of Nigeria, the finalization of which is expected imminently .

16 Third Quarter 2023 Financial Results Conference Call Financial Highlights – EBITDA Reconciliation Three Months Ended September 30 Nine Months Ended September 30 2022 2023 2022 2023 $ in Millions (7.7) 20.7 (30.7) 294.0 Net profit (loss) attributable to Tingo Group, Inc. Adjusted for: (0.5) (0.5) (0.7) (1.2) Net loss attributable to non - controlling stockholders 0.2 0.3 0.6 0.7 Loss from equity investment (0.7) 16.7 (1.8) 164.4 Income tax expenses (benefit) (0.4) 13.6 0.7 35.0 Financial expenses (income), net 0.9 71.8 2.6 285.0 Depreciation and amortization (8.1) 122.6 (29.3) 777.9 Total Non - GAAP EBITDA

17 Third Quarter 2023 Financial Results Conference Call Cash Utilization The Company utilized its substantial cash balances to invest heavily in the growth of the business of Tingo Mobile, Tingo Foods and Tingo DMCC 9 Months September 30, 2023 $ in Millions $711.7 Upfront payments of $711.68 million on the purchase of 6 million handsets for new AFAN customers 369.9 Prepayment to AFAN for produce for Tingo Foods and settlement of their brought forward payables 370.4 Self - funding stock purchases for Tingo DMCC’s export sales 174.0 Tax Payments for Tingo Mobile for FY2022 1,626.0 Total of Notable Payments 53.4 Cash Balance at September 30, 2023 1 1 The U . S . Dollar conversion of the Company’s Naira cash balances was materially adversely impacted by the devaluation of Nigeria’s currency in June 2023

18 Third Quarter 2023 Financial Results Conference Call Balance Sheet Highlights As of December 31, 2022 September 30, 2023 $ in Millions $500.3 $53.4 Cash and cash equivalents 531.2 622.1 Total current assets 1,682.3 1,929.2 Total assets 265.4 457.8 Total current liabilities 90.9 317.0 Total long - term liabilities 553.0 553.0 Convertible Preferred Stock 773.0 601.3 Total stockholders’ equity

19 Third Quarter 2023 Financial Results Conference Call Income Statement

20 Third Quarter 2023 Financial Results Conference Call Uniquely Positioned • Nasdaq - listed profitable company (In 9 Months to Sep 2023 , generated revenues of $ 2 . 41 B and EBITDA 1 of $ 777 . 9 M) • Strong balance sheet and cash generation from operations • Commitment to pay dividends – awaiting Central Bank of Nigeria approval • Full Agri and Food Ecosystem from Seed to Sale • Vast potential for food processing and export businesses • Increasing world food supply ; addressing food shortage and food security crises ; a benefactor of food price inflation • Visa x Tingo partnership and TingoPay SuperApp introduces Tingo into new B 2 C and B 2 B markets • Proven proprietary fintech platforms, replicable in new geographical markets and new sectors • Significant opportunity in Pakistan and Rest of Asia • Prodigious addressable global market • Significant ESG impact 20 1 See EBITDA reconciliation at Page 16 . EBITDA i s considered a non - GAAP measure of financial performance . Third Quarter 2023 Financial Results Conference Call

www.tingogroup.com Company 201 - 225 - 0190 info@tingogroup.com Investor Relations Chris Tyson/Larry Holub 949 - 491 - 8235 TIO@mzgroup.us A Global Fintech & Agri - Fintech Group Making a Difference Delivering Financial Inclusion and Food Security NASDAQ: TIO Q&A

Cover |

Nov. 11, 2023 |

|---|---|

| Cover [Abstract] | |

| Document Type | 8-K |

| Amendment Flag | false |

| Document Period End Date | Nov. 11, 2023 |

| Entity File Number | 001-35850 |

| Entity Registrant Name | Tingo Group, Inc. |

| Entity Central Index Key | 0000854800 |

| Entity Tax Identification Number | 27-0016420 |

| Entity Incorporation, State or Country Code | DE |

| Entity Address, Address Line One | 28 West Grand Avenue |

| Entity Address, Address Line Two | Suite 3 |

| Entity Address, City or Town | Montvale |

| Entity Address, State or Province | NJ |

| Entity Address, Postal Zip Code | 07645 |

| City Area Code | 201 |

| Local Phone Number | 225-0190 |

| Written Communications | false |

| Soliciting Material | false |

| Pre-commencement Tender Offer | false |

| Pre-commencement Issuer Tender Offer | false |

| Title of 12(b) Security | Common Stock, par value $0.001 per share |

| Trading Symbol | TIO |

| Security Exchange Name | NASDAQ |

| Entity Emerging Growth Company | false |

1 Year Tingo Chart |

1 Month Tingo Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions