We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Theravance Biopharma Inc | NASDAQ:TBPH | NASDAQ | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| -0.14 | -1.44% | 9.59 | 8.84 | 10.33 | 9.83 | 9.56 | 9.65 | 310,234 | 05:00:02 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

Current Report Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported):

(Exact Name of Registrant as Specified in its Charter)

| (State or Other Jurisdiction of | (Commission File Number) | (I.R.S. Employer Identification | ||

| Incorporation) | Number) |

(

(Addresses, including zip code, and telephone numbers, including area code, of principal executive offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered | ||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On November 12, 2024, Theravance Biopharma, Inc. (the “Company”) issued a press release and is holding a conference call regarding its financial results for the quarter ended September 30, 2024 and a business update. A copy of the press release is furnished as Exhibit 99.1 to this Current Report and a copy of materials that will accompany the call is furnished as Exhibit 99.2 to this Current Report.

The information in Item 2.02 and in Item 9.01 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Securities Exchange Act of 1934”), or otherwise subject to the liabilities of that Section, nor shall it be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| 99.1 | Press Release dated November 12, 2024 | |

| 99.2 | Slide deck entitled Third Quarter 2024 Financial Results and Business Update | |

| 104 | Cover Page Interactive Data File (cover page XBRL tags embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| THERAVANCE BIOPHARMA, INC. | ||

| Date: November 12, 2024 | By: | /s/ Aziz Sawaf |

| Aziz Sawaf | ||

| Senior Vice President and Chief Financial Officer | ||

Exhibit 99.1

Theravance Biopharma, Inc. Reports Third

Quarter 2024

Financial Results and Announces Initiatives to Unlock Shareholder Value

| · | Third quarter results highlight strong operational performance across key value drivers: |

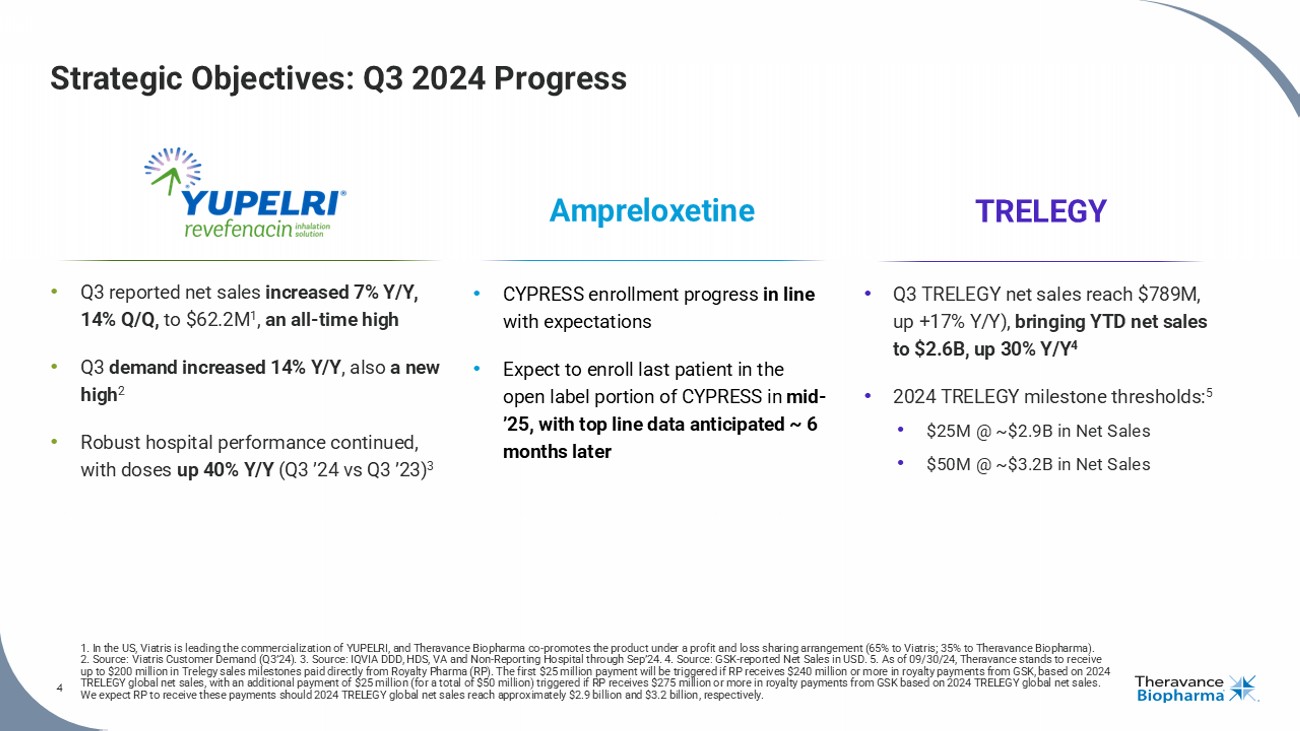

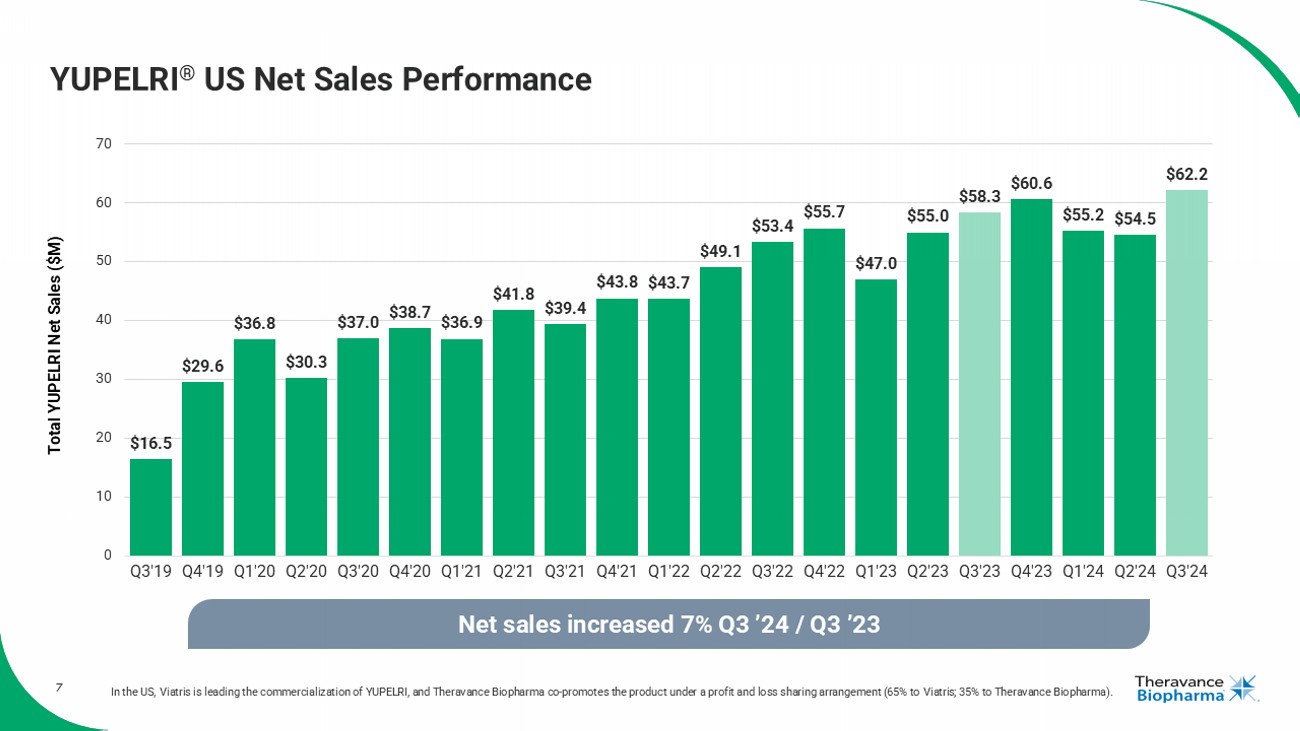

| o | YUPELRI® (revefenacin) net sales of $62.2 million, recognized by Viatris, an all-time high, increased 7% versus Q3 2023 and 14% versus Q2 20241 |

| o | CYPRESS enrollment in-line with expectations, with timelines on track |

| o | TRELEGY net sales increased 17%, to $789 million, as reported by GSK: |

| § | Q4 sales of at least ~$260 million needed to earn $25 million milestone2 |

| § | Q4 sales of at least ~$610 million needed to earn $50 million milestone2 |

| · | Board of Directors announces initiatives to unlock shareholder value and enhance corporate governance |

DUBLIN, IRELAND – NOV. 12, 2024 – Theravance Biopharma, Inc. (“Theravance Biopharma” or the “Company”) (NASDAQ: TBPH) today reported financial and operational results for the third quarter of 2024 and announced the formation of a Strategic Review Committee to assess alternatives to unlock shareholder value.

Reflecting on the quarter’s operational performance, Rick Winningham, Theravance Biopharma CEO commented, “Through our collaboration with Viatris, we achieved a strong quarter for YUPELRI demand and made progress on recent mix-related pricing headwinds, therein driving quarterly net sales to an all-time high. We believe we are well positioned to build on recent momentum and achieve continued YUPELRI growth, while continuing to pay careful attention to our cost structure.” He continued, “In addition, we are pleased with the progress we made in CYPRESS this quarter and reaffirm our development timelines with a goal of making this important therapy available to patients.”

Third Quarter Recent Highlights

YUPELRI® (revefenacin) inhalation solution, the first and only once-daily, nebulized LAMA (long- acting muscarinic antagonist) bronchodilator approved in the US for the maintenance treatment of patients with chronic obstructive pulmonary disease (COPD):

| · | Realized total net sales of $62.2 million for the quarter, representing 7% growth compared with Q3 2023 and 14% sequential growth compared with Q2 2024.1 |

| · | Demand up 14%, (Q3 2024 vs Q3 2023) exceeding expectations and year-to-date trends.3 |

1 In the US, Viatris is leading the commercialization of YUPELRI, and the Company co-promotes the product under a profit and loss sharing arrangement (65% to Viatris; 35% to the Company).

2 The first payment of $25 million will be triggered if Royalty Pharma (RP) receives $240 million or more in royalty payments from GSK based on 2024 TRELEGY global net sales, which we expect would occur should TRELEGY global net sales reach approximately $2.9 billion. A second payment of $25 million (for a total of $50 million) will be triggered if RP receives $275 million or more in royalty payments from GSK, which we expect would occur should 2024 TRELEGY global net sales exceed approximately $3.2 billion.

3 Source: Viatris Customer Demand (Q3’24).

Page 1 of 11

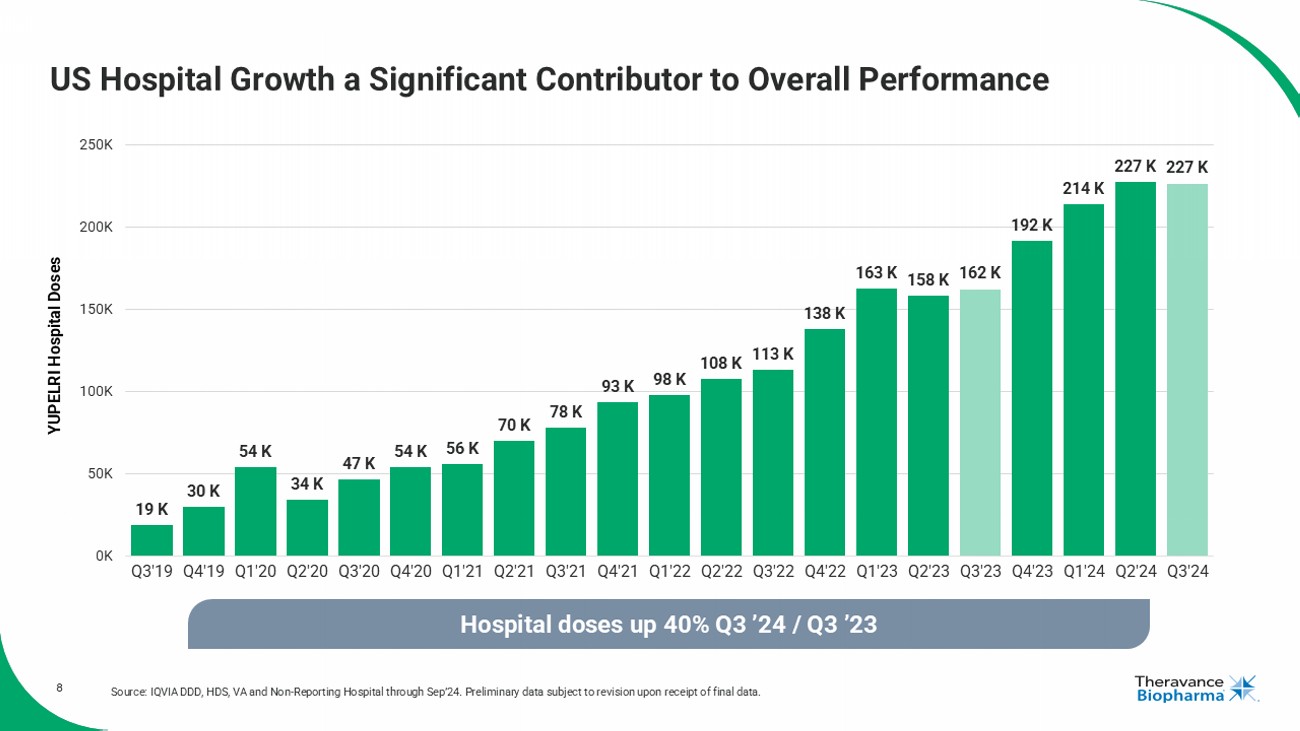

| · | Hospital doses sold increased by 40% (Q3 2024 vs Q3 2023).4 |

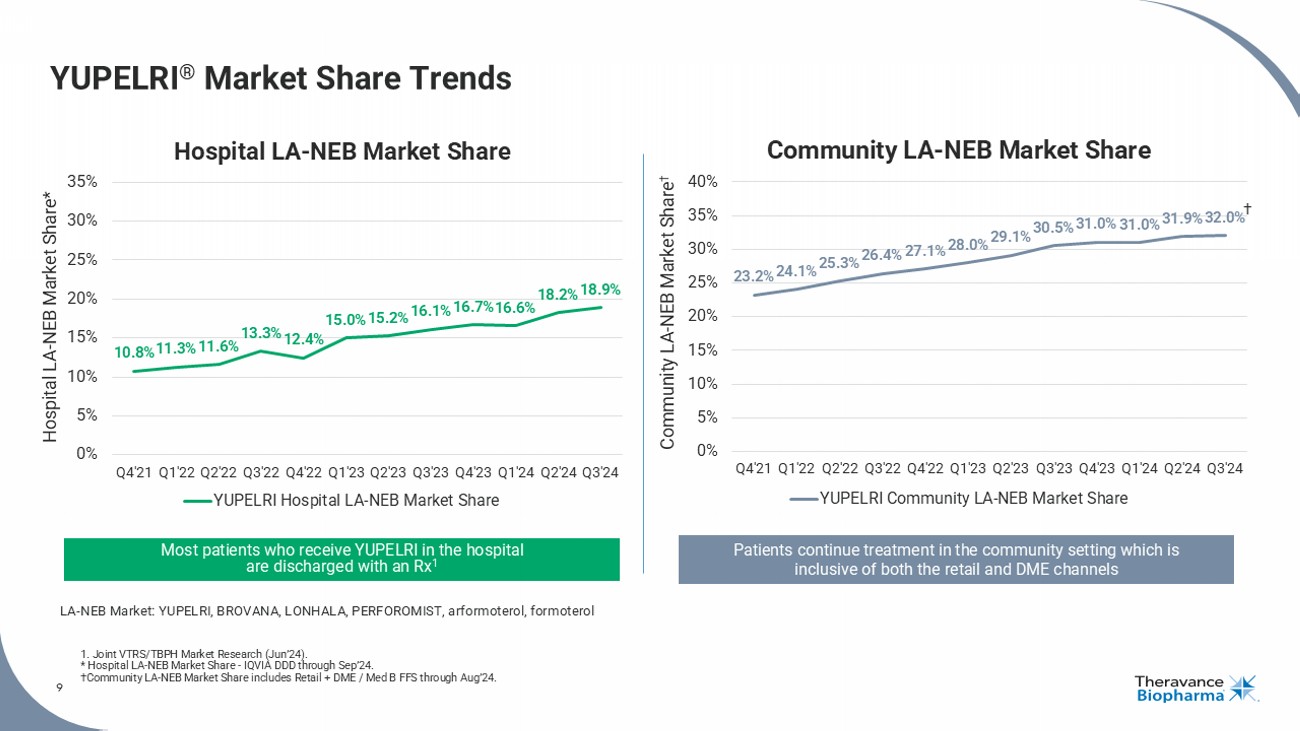

| · | Continued to achieve all-time market share highs within the long-acting nebulized segment of the COPD market, with hospital share approaching 19% and community share reaching 32%, respectively.5 |

| · | In October, published YUPELRI FEV1 AUC6 analysis of registrational Phase 3 Studies 0126 and 0127, demonstrating a substantial peak response and confirming the significant and sustained improvements in lung function compared with placebo over 24 hours.7 |

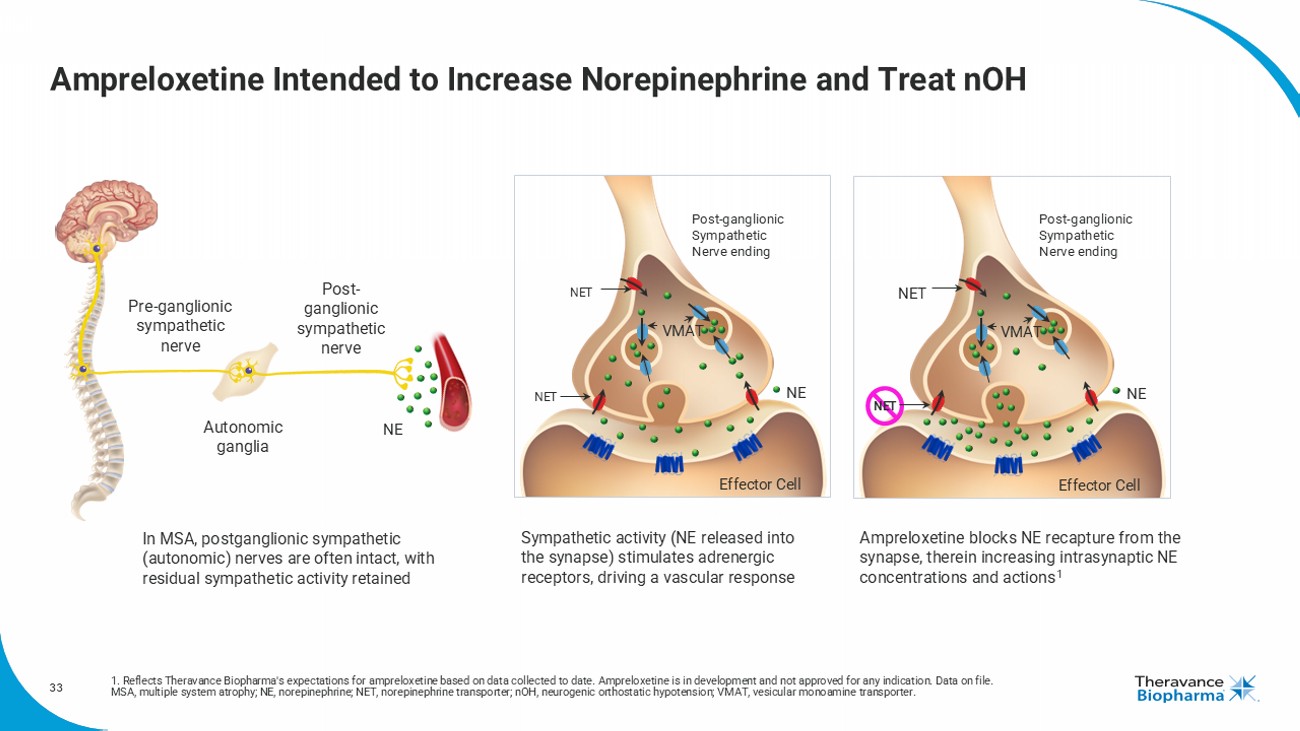

Ampreloxetine, an investigational, once-daily norepinephrine reuptake inhibitor in development for the treatment of symptomatic neurogenic orthostatic hypotension (nOH) in patients with multiple system atrophy (MSA):

| · | CYPRESS open-label enrollment still targeted for completion in mid-2025, with data anticipated to be available approximately six months later. |

| · | In September, presented data on the long-term safety of ampreloxetine in nOH at the 2024 International Congress of Parkinson’s Disease and Movement Disorders®. |

| o | Data indicate ampreloxetine was generally well tolerated with a low incidence of treatment-emergent adverse events and study withdrawals over approximately 9 months of exposure to ampreloxetine. |

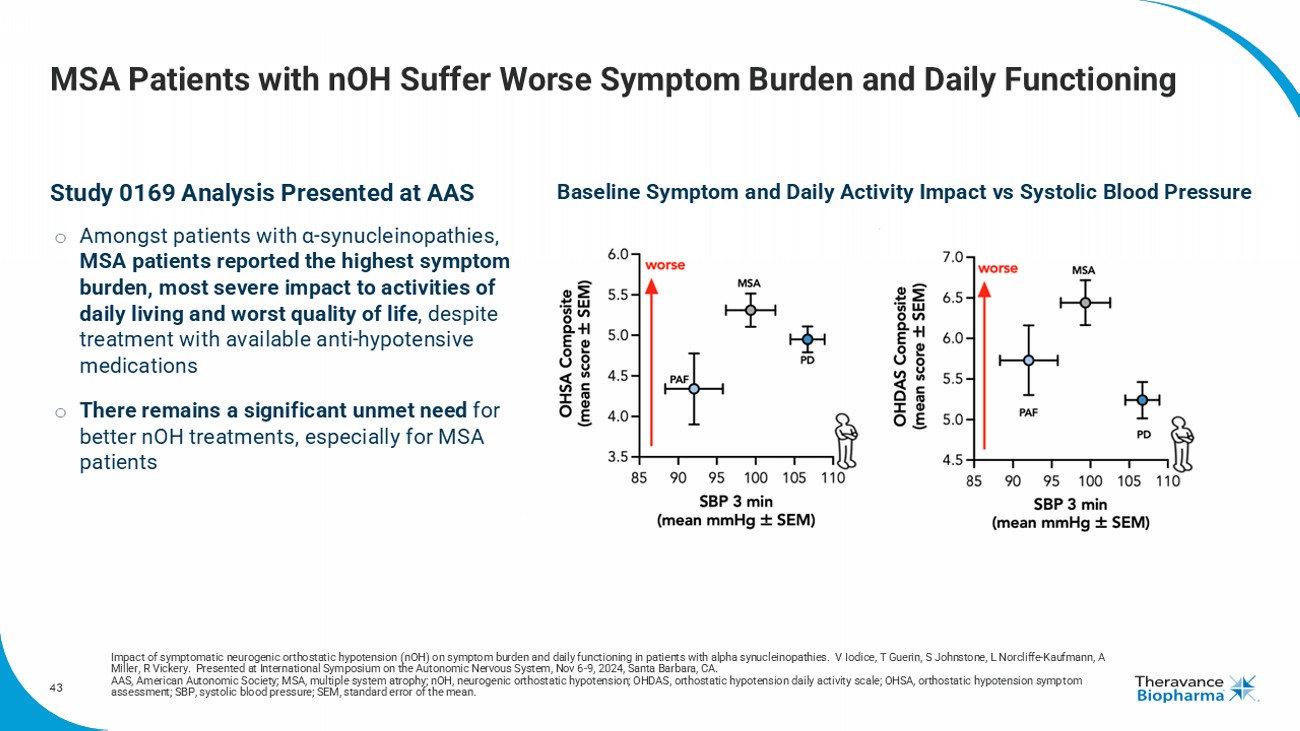

| · | In November, presented data from Study 0169 at the 2024 American Autonomic Society meeting highlighting the significant burden of symptomatic nOH and the high unmet needs in patients with MSA. |

| o | MSA patients experienced higher baseline symptom burden, and reduced activities of daily living and quality of life, despite treatment with available pressor agents. |

TRELEGY Update:

| · | GSK posted third quarter 2024 global net sales of approximately $789 million (up 17% from $675 million reported in the third quarter of 2023), bringing year-to-date TRELEGY global net sales to approximately $2.6 billion (up 30% from the same period in 2023). |

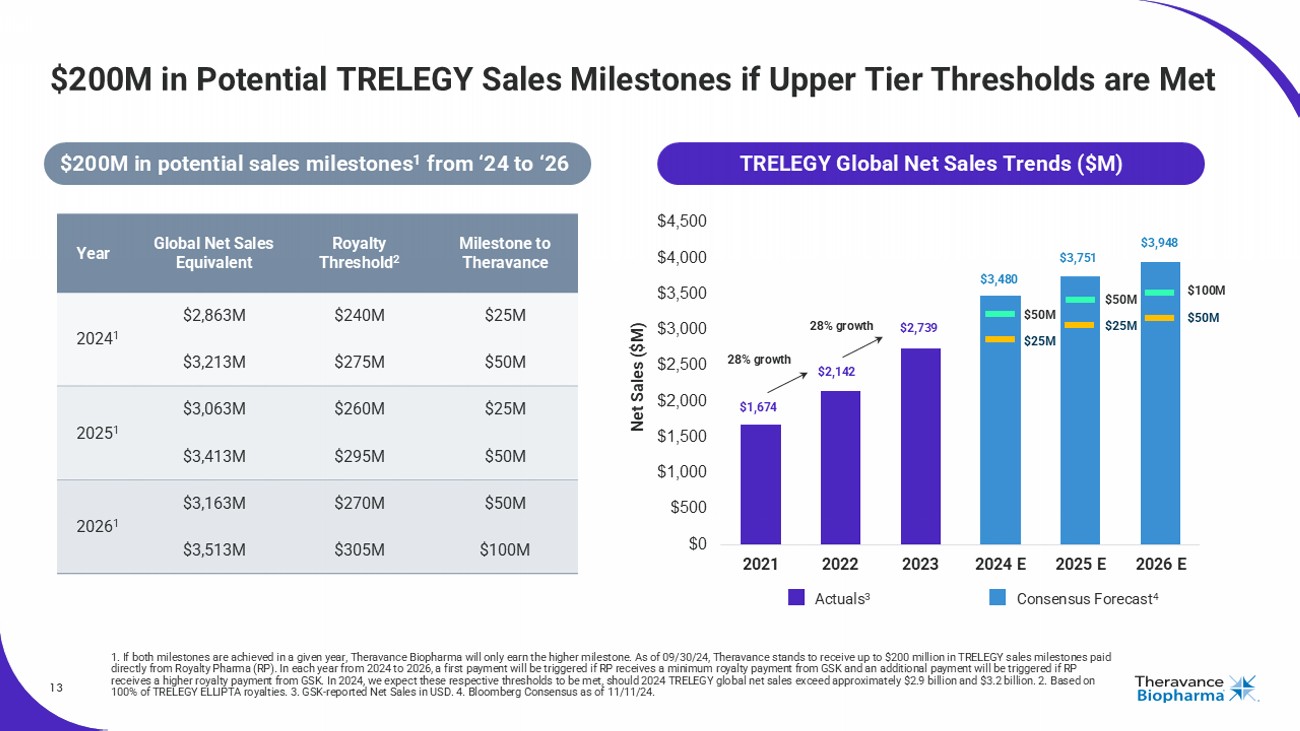

| · | Based on 2024 through 2026 performance, Theravance Biopharma is eligible to receive a total of up to $200 million in milestone payments from Royalty Pharma (RP), should RP receive royalties from GSK exceeding certain thresholds tied to TRELEGY global net sales. |

| o | Theravance estimates that the first milestone payment of $25 million will be achieved if TRELEGY global net sales exceed approximately $2.9 billion in 2024 (requiring fourth quarter 2024 sales reach at least ~$260 million).2 |

| o | Theravance estimates that a second $25 million milestone payment (for a total of $50 million) will be achieved if TRELEGY global net sales exceed approximately $3.2 billion in 2024 (requiring fourth quarter 2024 sales reach at least ~$610 million).2 |

4 Source: IQVIA DDD, HDS, VA and Non-Reporting Hospital through Sep ’24.

5 Hospital LA-NEB Market Share - IQVIA DDD through Sep ’24. Community LA-NEB Market Share includes Retail + DME / Med B FFS through Jul ’24.

6 Area under the forced expiratory volume in 1 second vs time curve.

7 LeMaster, W. B., Witenko, C. J., Lacy, M. K., Olmsted, A. W., Moran, E. J., & Mahler, D. A. (2024). Revefenacin Area Under the Curve Spirometry in Patients with Moderate to Very Severe COPD. International Journal of Chronic Obstructive Pulmonary Disease, 19, 2299–2308. https://doi.org/10.2147/COPD.S483176

Page 2 of 11

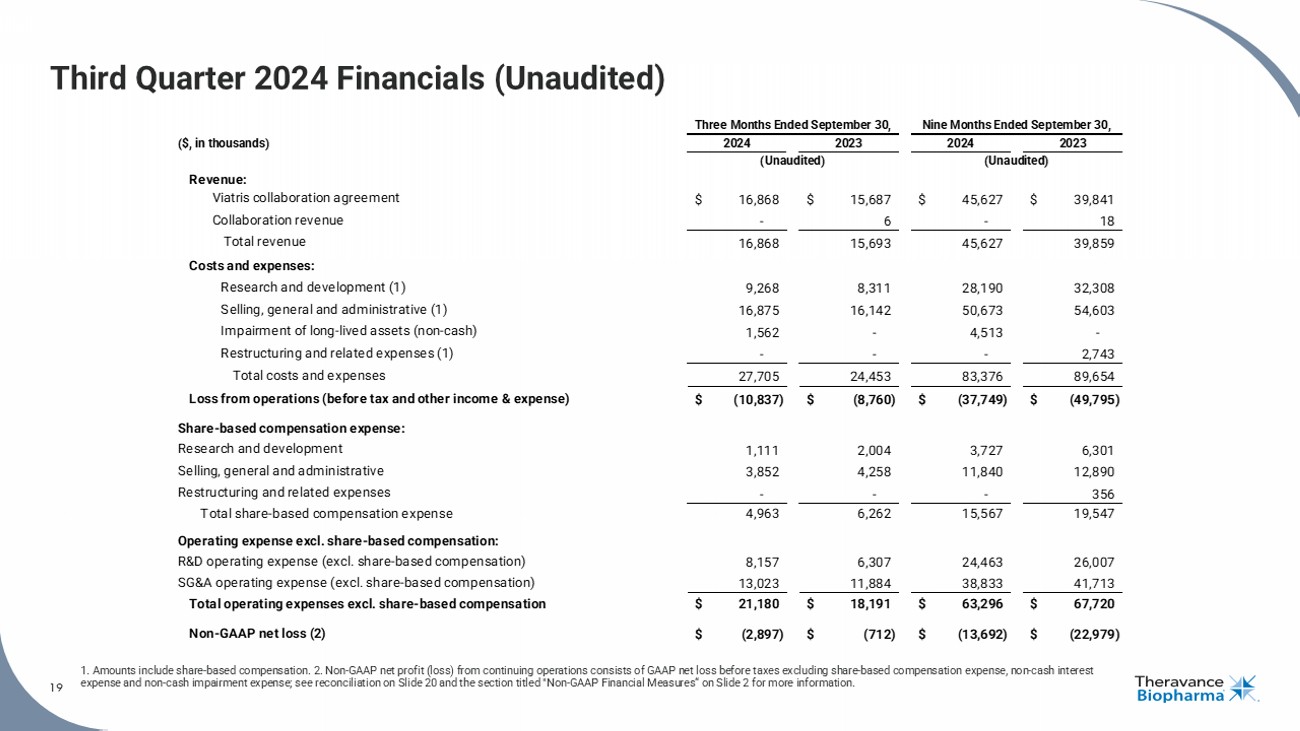

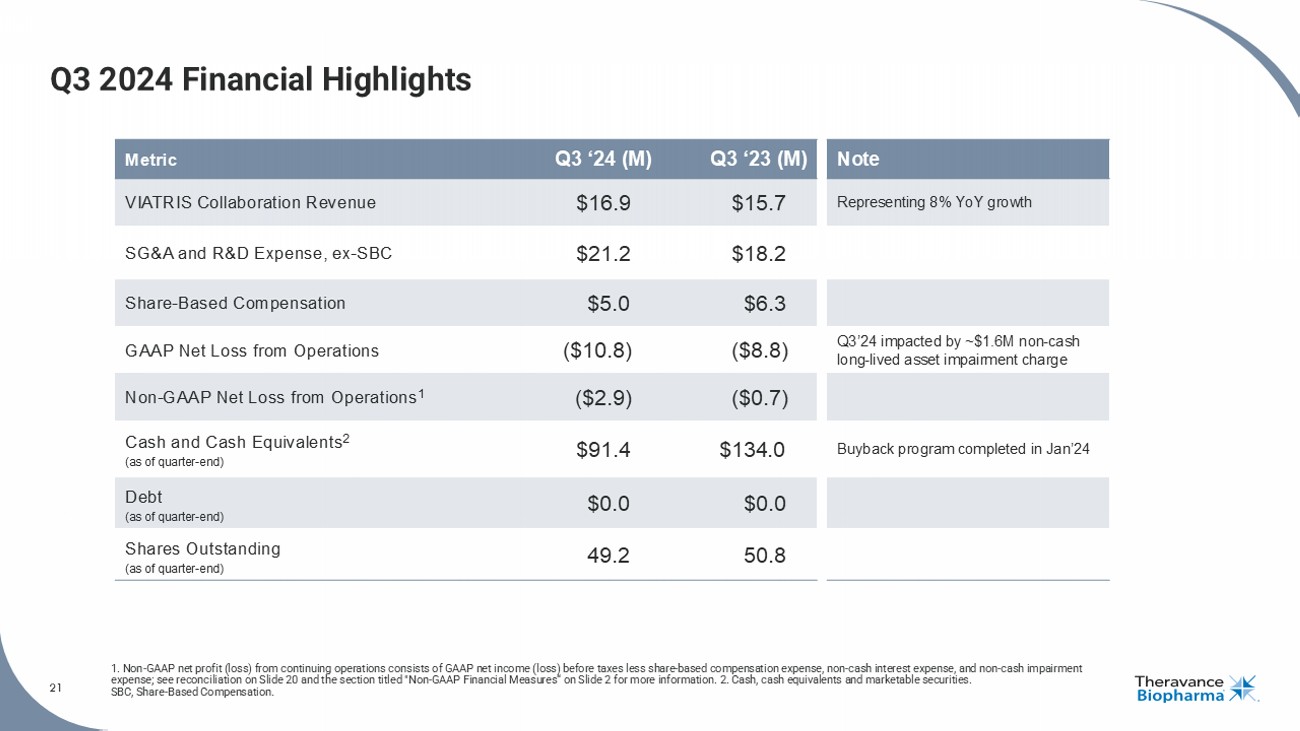

Third Quarter Financial Results

| · | Revenue: Total revenue for the third quarter of 2024 was $16.9 million, consisting entirely of Viatris collaboration revenue. Viatris collaboration revenue increased by $1.2 million, or 8%, in the third quarter compared to the same period in 2023, and by 18% sequentially compared to Q2 2024. The Viatris collaboration revenue represents amounts receivable from Viatris and comprises the Company’s 35% share of net sales of YUPELRI, as well as its proportionate amount of the total shared commercial costs incurred by the two companies. The non-shared YUPELRI costs incurred by Theravance Biopharma are recorded within operating expenses. While Viatris records the total net sales of YUPELRI within its financial statements, Theravance Biopharma’s implied 35% share of net sales of YUPELRI for the third quarter of 2024 was $21.8 million which represented a 7% increase compared to the same period in 2023. |

| · | Research and Development (R&D) Expenses: R&D expenses for the third quarter of 2024 were $9.3 million, compared to $8.3 million in the same period in 2023. Third quarter R&D expenses included total non-cash share-based compensation of $1.1 million. |

| · | Selling, General and Administrative (SG&A) Expenses: SG&A expenses for the third quarter of 2024 were $16.9 million, compared to $16.1 million in the same period in 2023. Third quarter SG&A expenses included total non-cash share-based compensation of $3.9 million. |

| · | Non-Cash Impairment of Long-Lived Assets: The Company incurred a non-cash impairment charge of $1.6 million on its long-lived assets (consisting primarily of its operating leases) in the third quarter of 2024. This impairment charge includes a full write-off of its excess R&D lab space operating lease. |

| · | Share-Based Compensation: Share-based compensation expenses for the third quarter of 2024 was $5.0 million, compared to $6.3 million in the same period in 2023. Share-based compensation expenses consisted of $1.1 million for R&D and $3.9 million for SG&A in the third quarter of 2024, compared to $2.0 million and $4.3 million, respectively, in the same period in 2023. |

Page 3 of 11

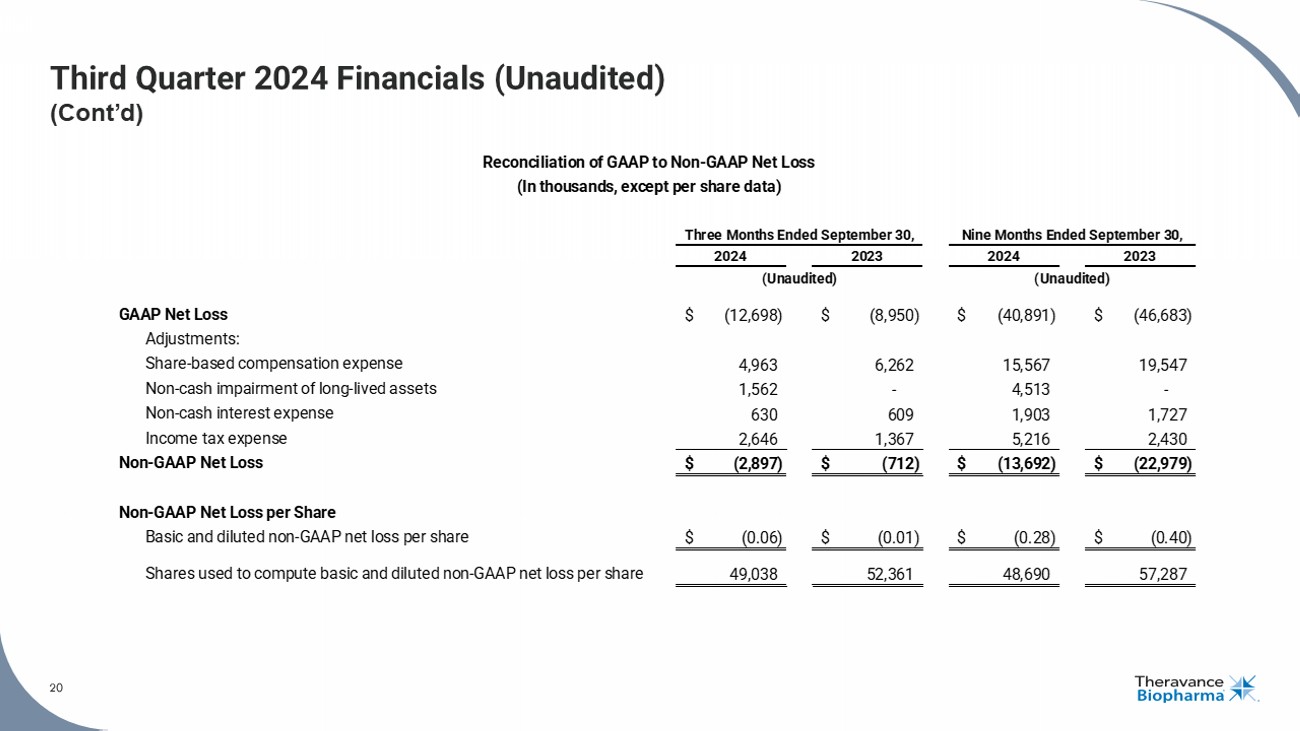

| · | Net Loss and Non-GAAP Net Loss from Operations8: Net loss was $12.7 million in the third quarter of 2024 compared to $9.0 million in the same period in 2023. The net loss in the third quarter of 2024 was impacted by the $1.6 million non-cash impairment charge on the Company’s long-lived assets. Non-GAAP net loss from operations was $2.9 million in the third quarter 2024 compared to a non-GAAP net loss from operations of $0.7 million in the same period in 2023. See the section titled "Non-GAAP Financial Measures" for more information. |

| · | Cash Position: Cash, cash equivalents and marketable securities totaled $91.4 million as of September 30, 2024. |

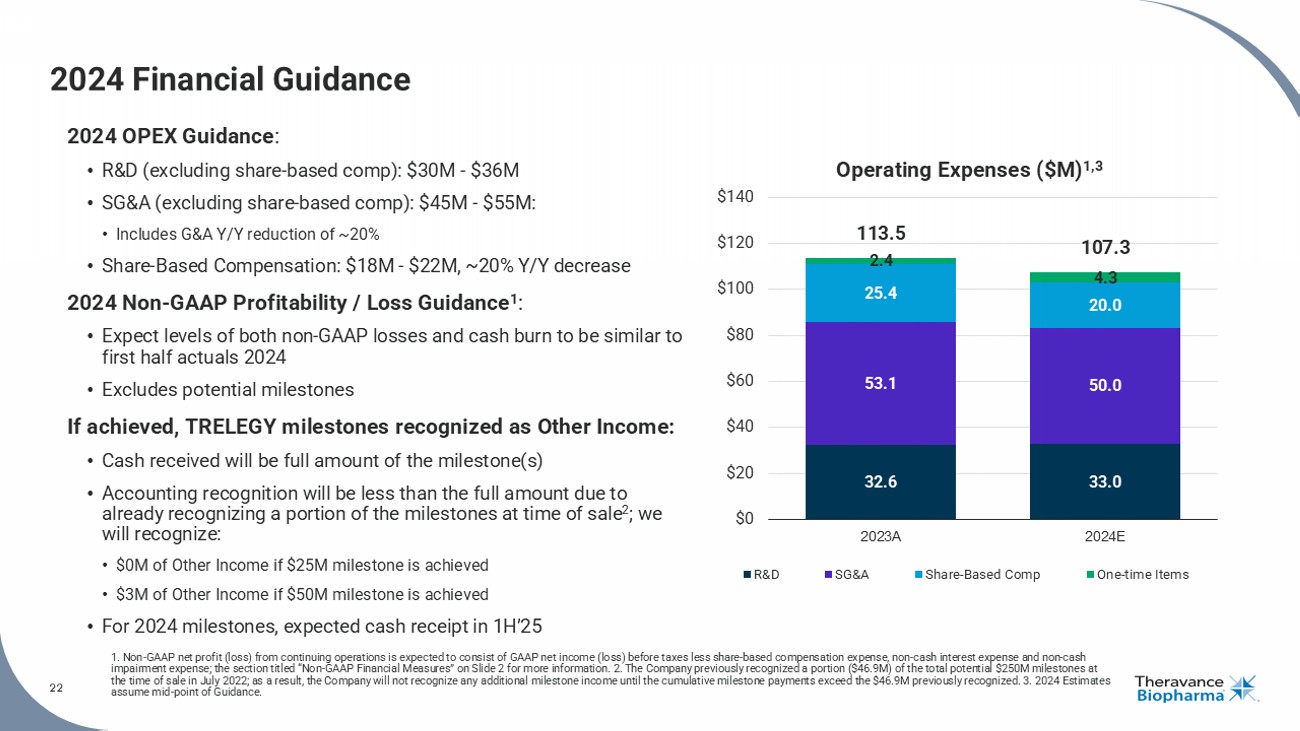

2024 Financial Guidance

| · | Operating Expenses (excluding share-based compensation): The Company continues to expect full year 2024 R&D expenses of $30 million to $36 million and SG&A expenses of $45 million to $55 million, in each case excluding share-based compensation. |

| · | Share-Based Compensation: The Company continues to expect full year share-based compensation expenses of $18 million to $22 million. |

| · | Non-GAAP Net Profit / Loss: The Company expects levels of both non-GAAP losses and cash burn in the second half to be similar to first half actuals 2024. |

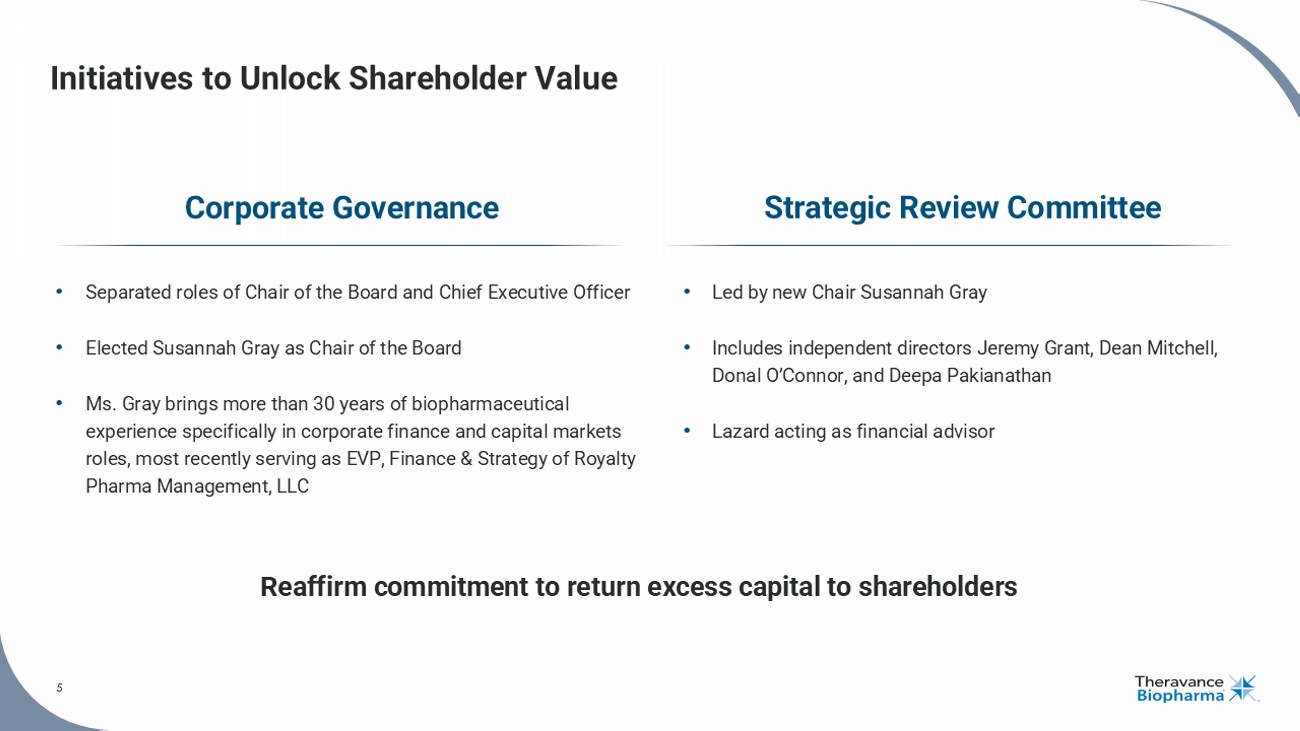

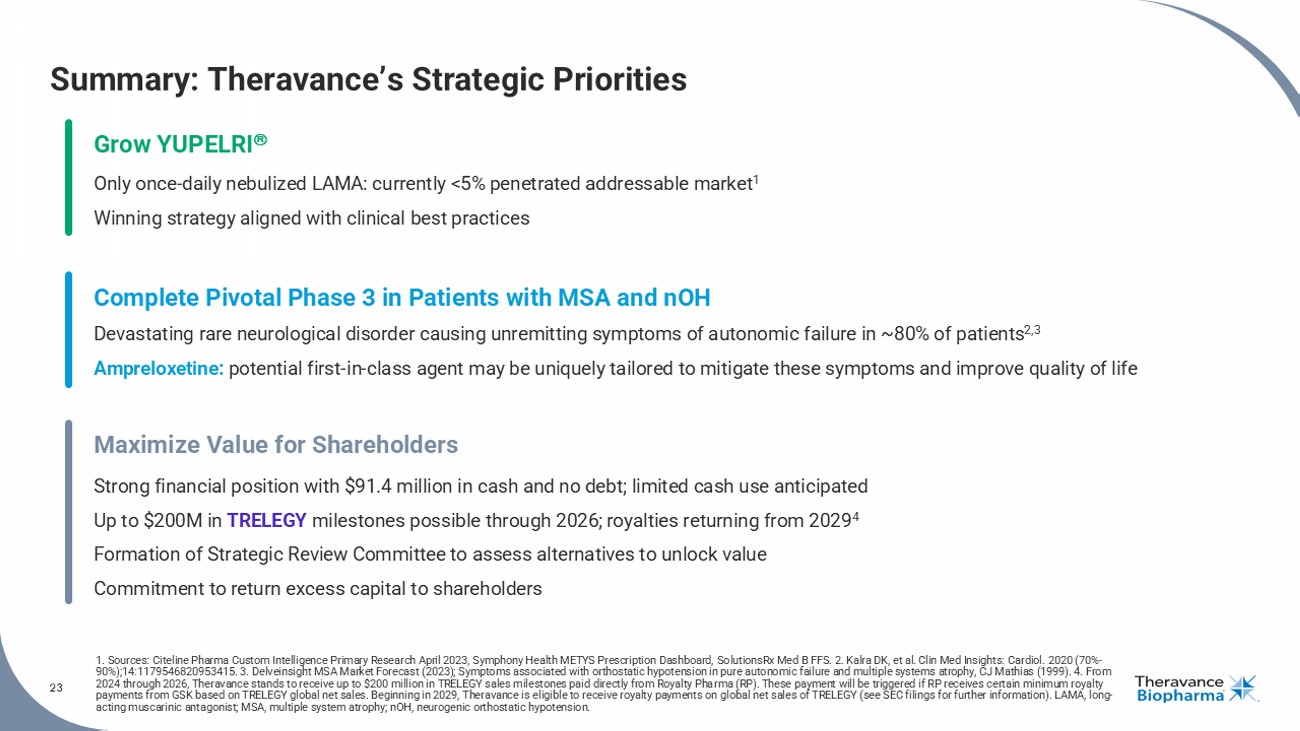

Formation of Strategic Review Committee & Enhanced Corporate Governance

The Board of Directors has formed a Strategic Review Committee (the “Committee”) composed entirely of independent directors to assess all strategic alternatives available to the Company, including those related to YUPELRI, ampreloxetine and TRELEGY, with the objective of unlocking shareholder value. The Committee is chaired by Susannah Gray and includes Jeremy Grant, Dean Mitchell, Donal O’Connor, and Deepa Pakianathan. Lazard will be acting as financial advisor to assist in this review process.

There can be no assurance that the Company’s strategic review process will result in any transaction. Theravance Biopharma has not set a timetable for completion of this process, and it does not intend to disclose further developments unless and until it determines that such disclosure is appropriate or necessary.

Additionally, as part of its ongoing review of its corporate governance policies, the Company announced today that it has separated the roles of Chair of the Board and Chief Executive Officer. The Company believes that the separation of these roles will allow management to sharpen its focus on operational goals, including growing YUPELRI and completing the CYPRESS study. The Board of Directors elected Susannah Gray as Chair of the Board of the Company, while Rick Winningham will continue as a member of the Board of Directors and Chief Executive Officer.

8 Non-GAAP profit (loss) consists of GAAP net income (loss) before taxes less share-based compensation expense, non-cash interest expense, and non-cash impairment expense. See the section titled "Non-GAAP Financial Measures" for more information.

Page 4 of 11

Settlement Agreement

On September 18, 2024, certain subsidiaries of Theravance Biopharma and Viatris, entered into a settlement agreement (the “Settlement Agreement”) with Qilu Pharmaceutical Co., Ltd. and Qilu Pharma Inc. (together Qilu) relating to Theravance Biopharma’s and Viatris’ YUPELRI® (revefenacin) inhalation solution. The Settlement Agreement resolves ongoing patent litigation brought by Theravance Biopharma and Viatris against Qilu pursuant to the Hatch-Waxman Act based on Qilu’s filing of an abbreviated new drug application (ANDA) seeking approval to market a generic version of YUPELRI® (revefenacin) inhalation solution prior to expiration of certain Orange Book listed patents.

Under the Settlement Agreement, Theravance and Viatris granted Qilu a royalty-free, non-exclusive, non-sublicensable, non-transferable license to manufacture and market Qilu’s generic version of YUPELRI® (revefenacin) inhalation solution in the United States on or after the Licensed Launch Date of April 23, 2039, subject to certain exceptions as is customary in these types of agreements. As required by law, the settlement is subject to review by the U.S. Department of Justice and the Federal Trade Commission. The patent litigation previously disclosed by the Company remains pending against three other ANDA filers.

Conference Call and Live Webcast Today at 5:00 pm EST

Theravance Biopharma will hold a conference call and live webcast accompanied by slides today at 5:00 pm EST / 2:00 pm PST / 10:00 pm GMT. To participate in the live call by telephone, please register here. Those interested in listening to the conference call live via the internet may do so by visiting Theravance Biopharma’s website at www.theravance.com, under the Investors section, Events and Presentations.

A replay of the webcast will be available on Theravance Biopharma’s website for 30 days through December 12, 2024.

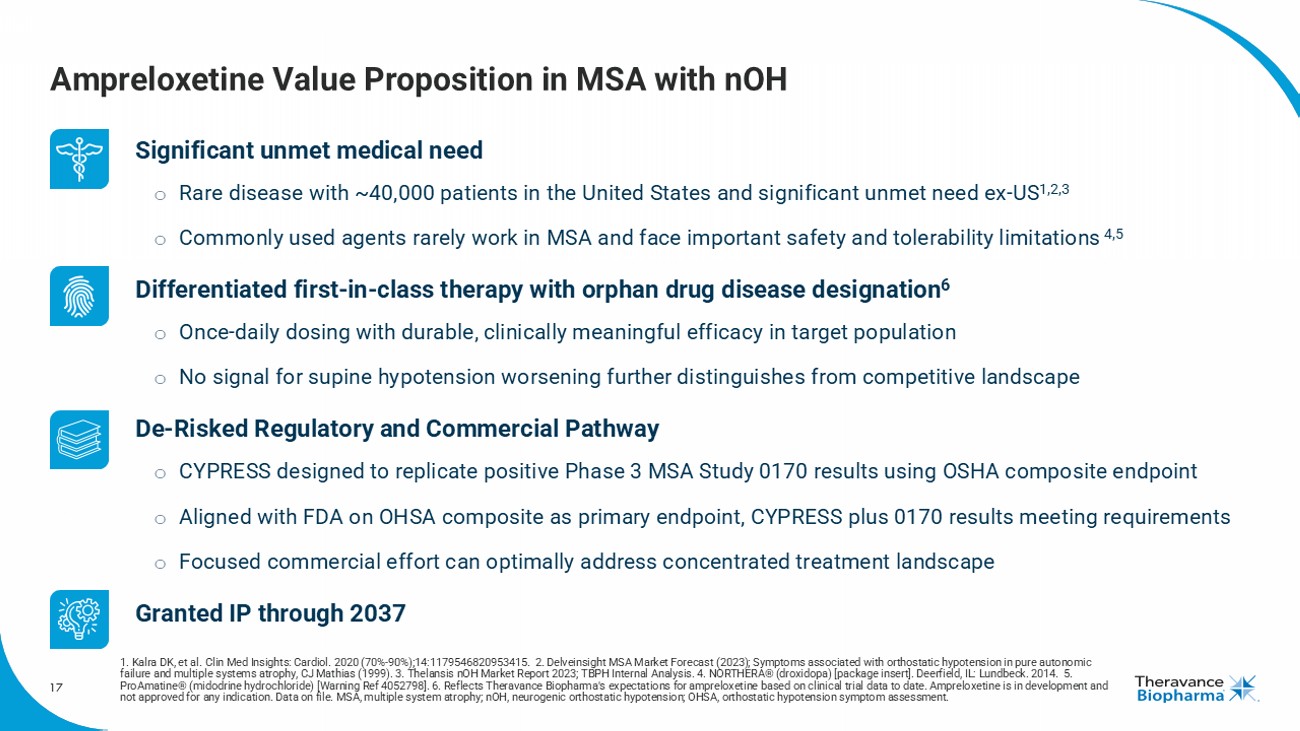

About Ampreloxetine

Ampreloxetine, an investigational, once-daily norepinephrine reuptake inhibitor in development for the treatment of symptomatic neurogenic orthostatic hypotension (nOH) in patients with multiple system atrophy (MSA). The unique benefits of ampreloxetine treatment reported in MSA patients from Study 0170 included an increase in norepinephrine levels, a favorable impact on blood pressure, clinically meaningful and durable symptom improvement, and no signal for supine hypertension. In the US, the Company has been granted an Orphan Drug Designation for ampreloxetine for the treatment of symptomatic nOH in patients with MSA and, if results from the ongoing Phase 3 CYPRESS study are supportive, plans to file an NDA for full approval in this indication.

Page 5 of 11

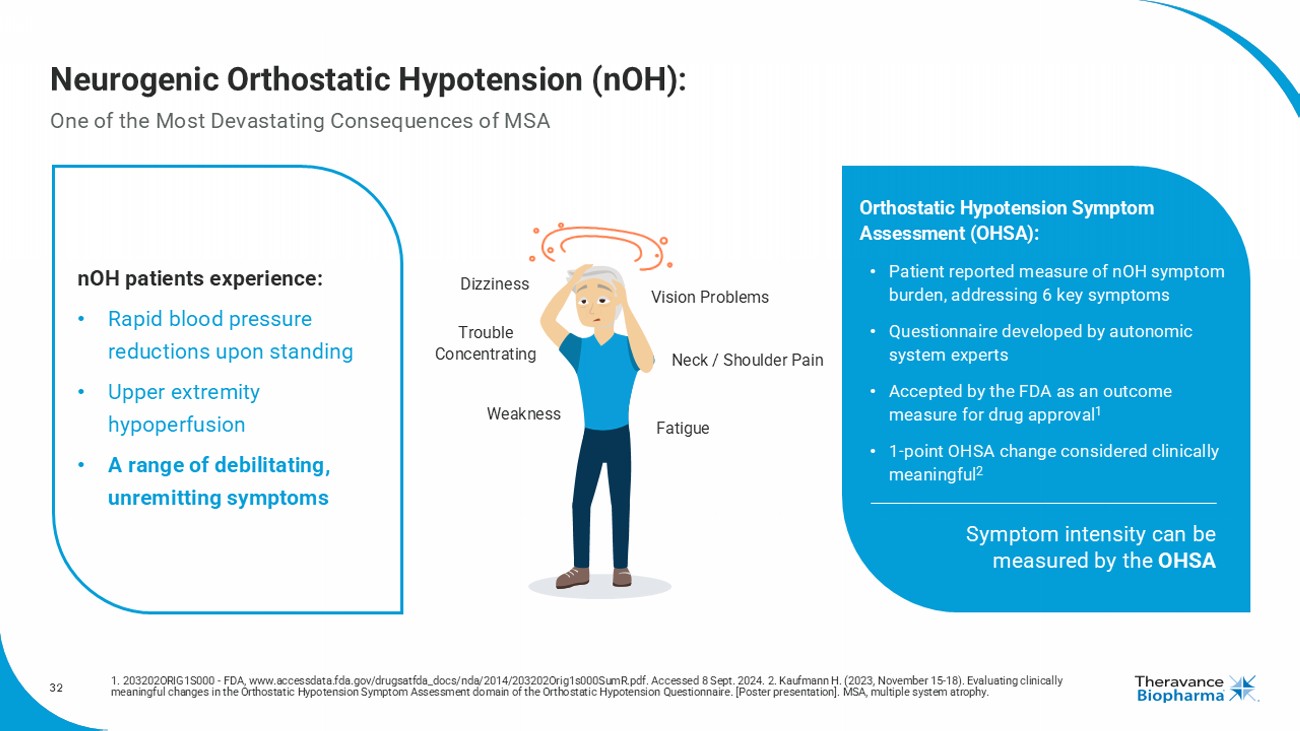

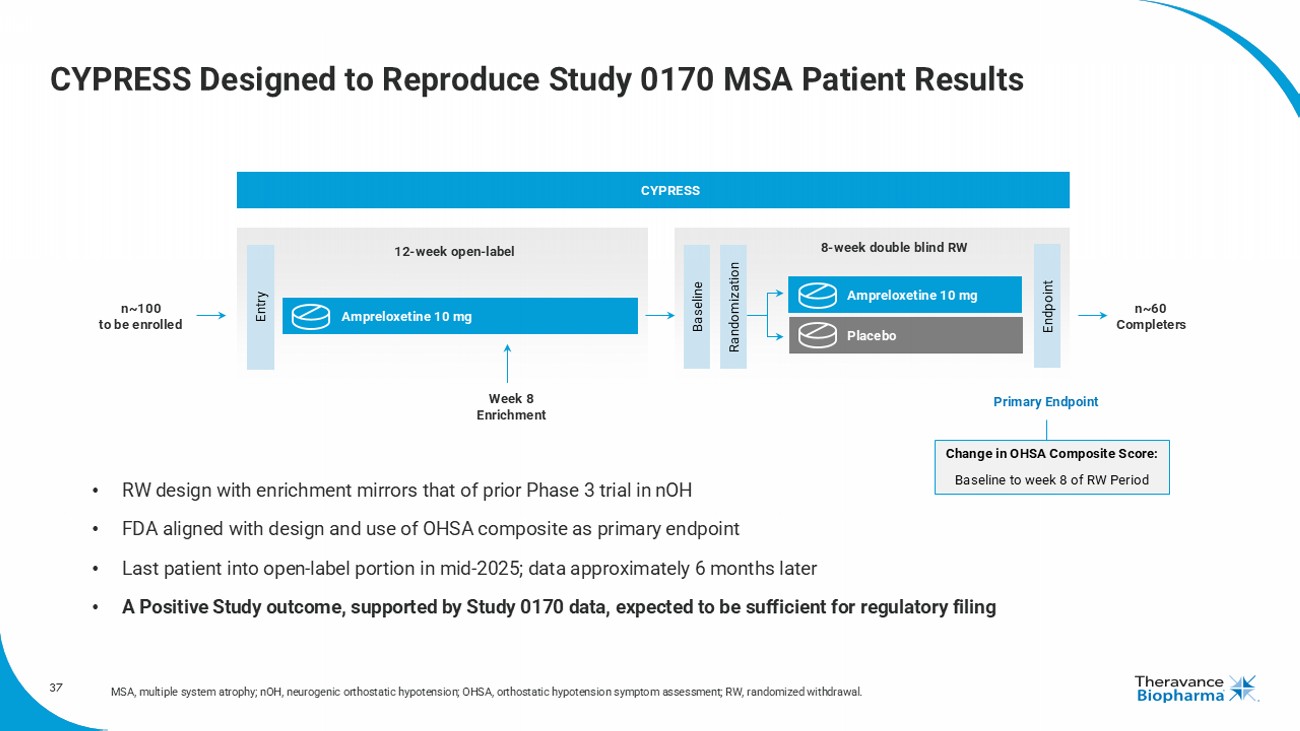

About CYPRESS (Study 0197), a Phase 3 Study

Study 0197 (NCT05696717) is currently enrolling. This is a registrational Phase 3, multi-center, randomized withdrawal study to evaluate the efficacy and durability of ampreloxetine in participants with MSA and symptomatic nOH after 20 weeks of treatment; the primary endpoint of the study is change in the Orthostatic Hypotension Symptom Assessment (OHSA) composite score. The Study includes four periods: screening, open label (12-week period, participants will receive a single daily 10 mg dose of ampreloxetine), randomized withdrawal (eight-week period, double-blind, placebo-controlled, participants will receive a single daily 10 mg dose of placebo or ampreloxetine), and a long-term treatment extension. Secondary outcome measures include change from baseline in Orthostatic Hypotension Daily Activity Scale (OHDAS) item 1 (activities that require standing for a short time) and item 3 (activities that require walking for a short time).

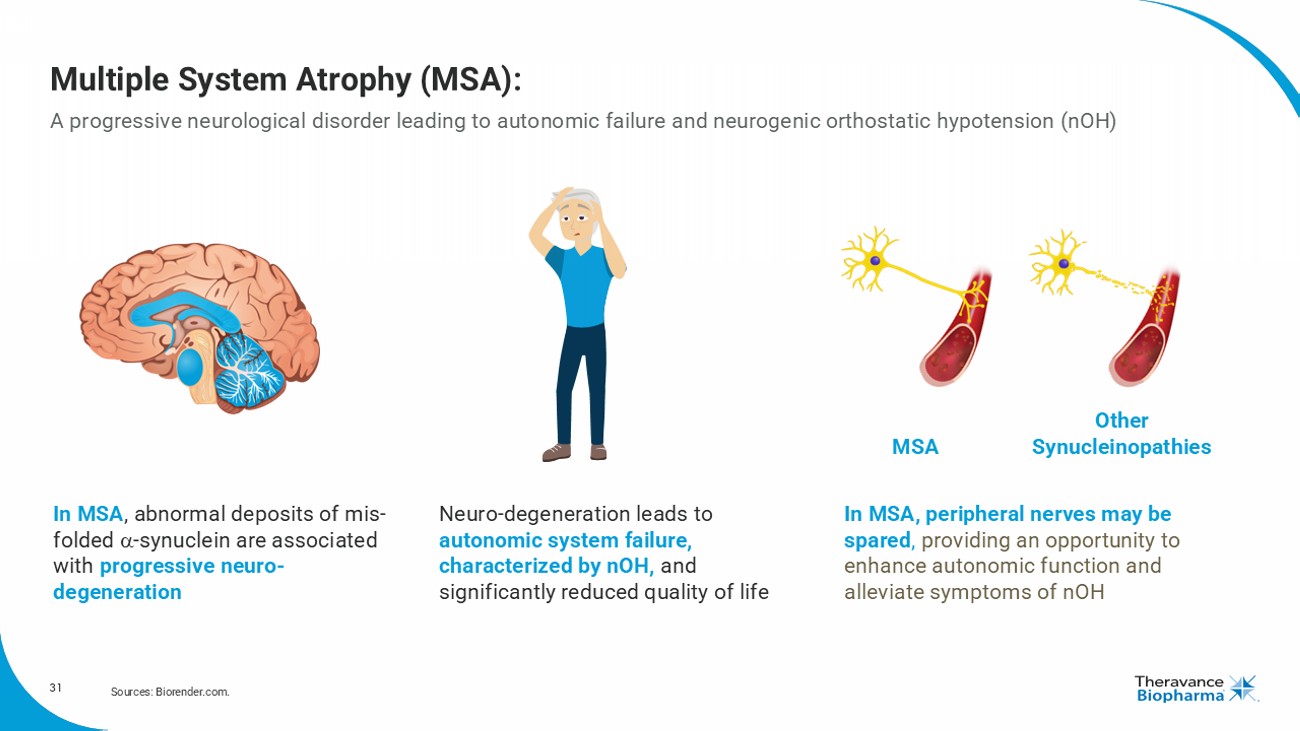

About Multiple System Atrophy (MSA) and Symptomatic Neurogenic Orthostatic Hypotension (nOH)

MSA is a progressive brain disorder that affects movement and balance and disrupts the function of the autonomic nervous system. The autonomic nervous system controls body functions that are mostly involuntary. One of the most frequent autonomic symptoms associated with MSA is a sudden drop in blood pressure upon standing (nOH).9 There are approximately 50,000 MSA patients in the US10 and 70-90% of MSA patients experience nOH symptoms.11 Despite available therapies, many MSA patients remain symptomatic with nOH.

Neurogenic orthostatic hypotension (nOH) is a rare disorder defined as a fall in systolic blood pressure of ≥20 mm Hg or diastolic blood pressure of >10 mm Hg, within 3 minutes of standing. Severely affected patients are unable to stand for more than a few seconds because of their decrease in blood pressure, leading to cerebral hypoperfusion and syncope. A debilitating condition, nOH results in a range of symptoms including dizziness, lightheadedness, fainting, fatigue, blurry vision, weakness, trouble concentrating, and head and neck pain.

9 https://medlineplus.gov/genetics/condition/multiple-system-atrophy/

10 UCSD Neurological Institute (25K-75K, with ~10K new cases per year); NIH National Institute of Neurological Disorders and Stroke (15K-50K).

11 Delveinsight MSA Market Forecast (2023); Symptoms associated with orthostatic hypotension in pure autonomic failure and multiple systems atrophy, CJ Mathias (1999).

Page 6 of 11

About Theravance Biopharma

Theravance Biopharma, Inc.’s focus is to deliver Medicines that Make a Difference® in people’s lives. In pursuit of its purpose, Theravance Biopharma leverages decades of expertise, which has led to the development of FDA-approved YUPELRI® (revefenacin) inhalation solution indicated for the maintenance treatment of patients with chronic obstructive pulmonary disease (COPD). Ampreloxetine, its late-stage investigational once-daily norepinephrine reuptake inhibitor in development for symptomatic neurogenic orthostatic hypotension (nOH) in patients with Multiple System Atrophy (MSA), has the potential to be a first in class therapy effective in treating a constellation of cardinal symptoms in MSA patients. The Company is committed to creating/driving shareholder value.

For more information, please visit www.theravance.com.

THERAVANCE BIOPHARMA®, THERAVANCE® and the Cross/Star logo are registered trademarks of the Theravance Biopharma group of companies (in the U.S. and certain other countries).

YUPELRI® is a registered trademark of Mylan Specialty L.P., a Viatris company. Trademarks, trade names or service marks of other companies appearing in this press release are the property of their respective owners.

Forward-Looking Statements

This press release and the conference call will contain certain "forward-looking" statements as that term is defined in the Private Securities Litigation Reform Act of 1995 regarding, among other things, statements relating to goals, plans, objectives, expectations and future events. Theravance Biopharma intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Examples of such statements include statements relating to: the Company’s expectations regarding its future profitability, expenses and uses of cash, the Company’s goals, designs, strategies, plans and objectives, future growth of YUPELRI sales, future royalty payments, the ability to provide value to shareholders, the Company’s regulatory strategies and timing of clinical studies, possible safety, efficacy or differentiation of our investigational therapy, the status of patent infringement litigation initiated by the Company and its partner against certain generic companies in federal district courts; contingent payments due to the Company from the sale of the Company’s TRELEGY ELLIPTA royalty interests to Royalty Pharma, and expectations around the use of OHSA scores as endpoints for clinical trials. These statements are based on the current estimates and assumptions of the management of Theravance Biopharma as of the date of this press release and the conference call and are subject to risks, uncertainties, changes in circumstances, assumptions and other factors that may cause the actual results of Theravance Biopharma to be materially different from those reflected in the forward-looking statements. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include, among others, risks related to: factors that could increase the Company’s cash requirements or expenses beyond its expectations and any factors that could adversely affect its profitability, whether the milestone thresholds can be achieved, delays or difficulties in commencing, enrolling or completing clinical studies, the potential that results from clinical or non-clinical studies indicate the Company’s product candidates or product are unsafe, ineffective or not differentiated, risks of decisions from regulatory authorities that are unfavorable to the Company, dependence on third parties to conduct clinical studies, delays or failure to achieve and maintain regulatory approvals for product candidates, risks of collaborating with or relying on third parties to discover, develop, manufacture and commercialize products, and risks associated with establishing and maintaining sales, marketing and distribution capabilities with appropriate technical expertise and supporting infrastructure, the ability of the Company to protect and to enforce its intellectual property rights, volatility and fluctuations in the trading price and volume of the Company’s shares, and general economic and market conditions. Other risks affecting Theravance Biopharma are in the Company's Form 10-Q filed with the SEC on August 8, 2024, and other periodic reports filed with the SEC. In addition to the risks described above and in Theravance Biopharma’s filings with the SEC, other unknown or unpredictable factors also could affect Theravance Biopharma’s results. No forward-looking statements can be guaranteed, and actual results may differ materially from such statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Theravance Biopharma assumes no obligation to update its forward-looking statements on account of new information, future events or otherwise, except as required by law.

Page 7 of 11

Non-GAAP Financial Measures

Theravance Biopharma provides a non-GAAP profitability target and a non-GAAP metric in this press release. Theravance Biopharma believes that the non-GAAP profitability target and non-GAAP net profit (loss) from operations provide meaningful information to assist investors in assessing prospects for future performance and actual performance as they provide better metrics for analyzing the performance of its business by excluding items that may not be indicative of core operating results and the Company's cash position. Because non-GAAP financial targets and metrics, such as non-GAAP profitability and non-GAAP net loss from continuing operations, are not standardized, it may not be possible to compare these measures with other companies' non-GAAP targets or measures having the same or a similar name. Thus, Theravance Biopharma's non-GAAP measures should be considered in addition to, not as a substitute for, or in isolation from, the Company's actual GAAP results and other targets.

Please see the appendix attached to this press release for a reconciliation of non-GAAP net profit (loss) from operations to its corresponding measure, net profit (loss) from operations. A reconciliation of non-GAAP net profit (loss) from operations to its corresponding GAAP measure is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses and other factors in the future.

Contact:

investor.relations@theravance.com

650-808-4045

Page 8 of 11

THERAVANCE BIOPHARMA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

| September 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| (Unaudited) | (1) | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents and short-term marketable securities | $ | 91,361 | $ | 102,426 | ||||

| Receivables from collaborative arrangements | 16,845 | 17,474 | ||||||

| Prepaid clinical and development services | 597 | 2,038 | ||||||

| Other prepaid and current assets | 7,677 | 11,603 | ||||||

| Total current assets | 116,480 | 133,541 | ||||||

| Property and equipment, net | 7,788 | 9,068 | ||||||

| Operating lease assets | 29,334 | 36,287 | ||||||

| Future contingent milestone and royalty assets | 194,200 | 194,200 | ||||||

| Restricted cash | 836 | 836 | ||||||

| Other assets | 7,467 | 8,067 | ||||||

| Total assets | $ | 356,105 | $ | 381,999 | ||||

| Liabilities and Shareholders' Equity | ||||||||

| Current liabilities | $ | 23,435 | $ | 24,767 | ||||

| Long-term operating lease liabilities | 40,785 | 45,236 | ||||||

| Future royalty payment contingency | 29,691 | 27,788 | ||||||

| Unrecognized tax benefits | 71,563 | 65,294 | ||||||

| Other long-term liabilities | 4,977 | 5,919 | ||||||

| Shareholders' equity | 185,654 | 212,995 | ||||||

| Total liabilities and shareholders’ equity | $ | 356,105 | $ | 381,999 | ||||

| (1) | The condensed consolidated balance sheet as of December 31, 2023 has been derived from the audited consolidated financial statements included in the Company's Annual Report on Form 10-K for the year ended December 31, 2023. |

Page 9 of 11

THERAVANCE BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Revenue: | ||||||||||||||||

| Viatris collaboration agreement (1) | $ | 16,868 | $ | 15,687 | $ | 45,627 | $ | 39,841 | ||||||||

| Collaboration revenue | - | 6 | - | 18 | ||||||||||||

| Total revenue | 16,868 | 15,693 | 45,627 | 39,859 | ||||||||||||

| Costs and expenses: | ||||||||||||||||

| Research and development (2) | 9,268 | 8,311 | 28,190 | 32,308 | ||||||||||||

| Selling, general and administrative (2) | 16,875 | 16,142 | 50,673 | 54,603 | ||||||||||||

| Impairment of long-lived assets (non-cash) | 1,562 | - | 4,513 | - | ||||||||||||

| Restructuring and related expenses (2) | - | - | - | 2,743 | ||||||||||||

| Total costs and expenses | 27,705 | 24,453 | 83,376 | 89,654 | ||||||||||||

| Loss from operations | (10,837 | ) | (8,760 | ) | (37,749 | ) | (49,795 | ) | ||||||||

| Interest expense (non-cash) | (630 | ) | (609 | ) | (1,903 | ) | (1,727 | ) | ||||||||

| Interest income and other income (expense), net | 1,415 | 1,786 | 3,977 | 7,269 | ||||||||||||

| Loss before income taxes | (10,052 | ) | (7,583 | ) | (35,675 | ) | (44,253 | ) | ||||||||

| Provision for income tax expense | (2,646 | ) | (1,367 | ) | (5,216 | ) | (2,430 | ) | ||||||||

| Net loss | $ | (12,698 | ) | $ | (8,950 | ) | $ | (40,891 | ) | $ | (46,683 | ) | ||||

| Net loss per share: | ||||||||||||||||

| Basic and diluted net loss per share | $ | (0.26 | ) | $ | (0.17 | ) | $ | (0.84 | ) | $ | (0.81 | ) | ||||

| Shares used to compute basic and diluted net loss per share | 49,038 | 52,361 | 48,690 | 57,287 | ||||||||||||

| Non-GAAP net loss | $ | (2,897 | ) | $ | (712 | ) | $ | (13,692 | ) | $ | (22,979 | ) | ||||

| (1) | While Viatris, Inc. records the total YUPELRI net sales, the Company is entitled to a 35% share of the net profit (loss) pursuant to a co-promotion agreement with Viatris as presented below: |

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| (In thousands) | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| YUPELRI net sales (100% recorded by Viatris) | $ | 62,189 | $ | 58,325 | $ | 171,945 | $ | 160,318 | ||||||||

| YUPELRI net sales (Theravance Biopharma implied 35%) | 21,766 | 20,414 | 60,181 | 56,111 | ||||||||||||

| (2) | Amounts include share-based compensation expense as follows: |

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| (In thousands) | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Research and development | $ | 1,111 | $ | 2,004 | $ | 3,727 | $ | 6,301 | ||||||||

| Selling, general and administrative | 3,852 | 4,258 | 11,840 | 12,890 | ||||||||||||

| Restructuring and related expenses | - | - | - | 356 | ||||||||||||

| Total share-based compensation expense | $ | 4,963 | $ | 6,262 | $ | 15,567 | $ | 19,547 | ||||||||

Page 10 of 11

THERAVANCE BIOPHARMA, INC.

Reconciliation of GAAP to Non-GAAP Net Loss

(In thousands)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| GAAP net loss | $ | (12,698 | ) | $ | (8,950 | ) | $ | (40,891 | ) | $ | (46,683 | ) | ||||

| Adjustments: | ||||||||||||||||

| Share-based compensation expense | 4,963 | 6,262 | 15,567 | 19,547 | ||||||||||||

| Non-cash impairment of long-lived assets | 1,562 | - | 4,513 | - | ||||||||||||

| Non-cash interest expense | 630 | 609 | 1,903 | 1,727 | ||||||||||||

| Income tax expense | 2,646 | 1,367 | 5,216 | 2,430 | ||||||||||||

| Non-GAAP net loss | $ | (2,897 | ) | $ | (712 | ) | $ | (13,692 | ) | $ | (22,979 | ) | ||||

Page 11 of 11

Exhibit 99.2

THERAVANCE BIOPHARMA ® , THERAVANCE ® , the Cross/Star logo and MEDICINES THAT MAKE A DIFFERENCE ® are registered trademarks of the Theravance Biopharma group of companies (in the U.S. and certain other countries). All third - party trademarks used herein are the property of their respective owners. © 2024 Theravance Biopharma. All rights reserved. Theravance Biopharma Third Quarter 2024 Financial Results and Business Update November 12, 2024

2 Forward Looking Statements This presentation contains certain "forward - looking" statements as that term is defined in the Private Securities Litigation Reform Act of 1995 regarding, among other things, statements relating to goals, plans, objectives, expectations and future events . Theravance Biopharma, Inc . (the “Company”) intends such forward - looking statements to be covered by the safe harbor provisions for forward - looking statements contained in Section 21 E of the Securities Exchange Act of 1934 , as amended, and the Private Securities Litigation Reform Act of 1995 . Examples of such statements include statements relating to : the Company’s expectations regarding its future profitability, expenses and uses of cash, the Company’s goals, designs, strategies, plans and objectives, future growth of YUPELRI sales, future royalty payments, the ability to provide value to shareholders, the Company’s regulatory strategies and timing of clinical studies, possible safety, efficacy or differentiation of our investigational therapy, the status of patent infringement litigation initiated by the Company and its partner against certain generic companies in federal district courts ; contingent payments due to the Company from the sale of the Company’s TRELEGY ELLIPTA royalty interests to Royalty Pharma, and expectations around the use of OHSA scores as endpoints for clinical trials . These statements are based on the current estimates and assumptions of the management of Theravance Biopharma as of the date of this press release and the conference call and are subject to risks, uncertainties, changes in circumstances, assumptions and other factors that may cause the actual results of Theravance Biopharma to be materially different from those reflected in the forward - looking statements . Important factors that could cause actual results to differ materially from those indicated by such forward - looking statements include, among others, risks related to : factors that could increase the Company’s cash requirements or expenses beyond its expectations and any factors that could adversely affect its profitability, whether the milestone thresholds can be achieved, delays or difficulties in commencing, enrolling or completing clinical studies, the potential that results from clinical or non - clinical studies indicate the Company’s product candidates or product are unsafe, ineffective or not differentiated, risks of decisions from regulatory authorities that are unfavorable to the Company, dependence on third parties to conduct clinical studies, delays or failure to achieve and maintain regulatory approvals for product candidates, risks of collaborating with or relying on third parties to discover, develop, manufacture and commercialize products, and risks associated with establishing and maintaining sales, marketing and distribution capabilities with appropriate technical expertise and supporting infrastructure, the ability of the Company to protect and to enforce its intellectual property rights, volatility and fluctuations in the trading price and volume of the Company’s shares, and general economic and market conditions . Other risks affecting the Company are in the Company’s Form 10 - Q filed with the SEC on August 8 , 2024 , and other periodic reports filed with the SEC . In addition to the risks described above and in Theravance Biopharma's filings with the SEC, other unknown or unpredictable factors also could affect Theravance Biopharma’s results . No forward - looking statements can be guaranteed, and actual results may differ materially from such statements . Given these uncertainties, you should not place undue reliance on these forward - looking statements . Theravance Biopharma assumes no obligation to update its forward - looking statements on account of new information, future events or otherwise, except as required by law . Non - GAAP Financial Measures Theravance Biopharma provides a non - GAAP profitability target and a non - GAAP metric in this press release . Theravance Biopharma believes that the non - GAAP profitability target and non - GAAP net profit (loss) from continuing operations provide meaningful information to assist investors in assessing prospects for future performance and actual performance as they provide better metrics for analyzing the performance of its business by excluding items that may not be indicative of core operating results and the Company's cash position . Because non - GAAP financial targets and metrics, such as non - GAAP profitability and non - GAAP net loss from continuing operations, are not standardized, it may not be possible to compare these measures with other companies' non - GAAP targets or measures having the same or a similar name . Thus, Theravance Biopharma's non - GAAP measures should be considered in addition to, not as a substitute for, or in isolation from, the Company's actual GAAP results and other targets . Please see the appendix attached to this presentation for a reconciliation of non - GAAP net profit (loss) from continuing operations to its corresponding measure, net profit (loss) from continuing operations . A reconciliation of non - GAAP net profit (loss) from continuing operations to its corresponding GAAP measure is not available on a forward - looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses and other factors in the future .

3 Agenda Welcome / Opening Remarks Rick Winningham : Chief Executive Officer YUPELRI ® / Commercial Update Rhonda Farnum: Senior Vice President, Chief Business Officer Ampreloxetine Update Dr. Áine Miller: Senior Vice President, Development Financial Update Closing Remarks / Q&A Aziz Sawaf: Senior Vice President, Chief Financial Officer Rick Winningham / Team TRELEGY ELLIPTA Update Aziz Sawaf: Senior Vice President, Chief Financial Officer

4 Strategic Objectives: Q3 2024 Progress 1. In the US, Viatris is leading the commercialization of YUPELRI, and Theravance Biopharma co - promotes the product under a profit and loss sharing a rrangement (65% to Viatris ; 35% to Theravance Biopharma). 2. Source: Viatris Customer Demand (Q3’24) . 3 . Source: IQVIA DDD, HDS, VA and Non - Reporting Hospital through Sep’24. 4. Source: GSK - reported Net Sales in USD. 5. As of 09/30/24, Theravance stands to receive up to $200 million in Trelegy sales milestones paid directly from Royalty Pharma (RP). The first $25 million payment will be triggered if RP receives $240 mi llion or more in royalty payments from GSK, based on 2024 TRELEGY global net sales, with an additional payment of $25 million (for a total of $50 million) triggered if RP receives $27 5 m illion or more in royalty payments from GSK based on 2024 TRELEGY global net sales. We expect RP to receive these payments should 2024 TRELEGY global net sales reach approximately $2.9 billion and $3.2 billion , r espectively. 4 • Q3 reported net sales increased 7% Y/Y, 14% Q/Q, to $62.2M 1 , an all - time high • Q3 demand increased 14% Y/Y , also a new high 2 • Robust h ospital performance continued, with doses up 40% Y/Y (Q3 ’24 vs Q3 ’23) 3 • CYPRESS enrollment progress in line with expectations • Expect to enroll last patient in the open label portion of CYPRESS in mid - ’25, with top line data anticipated ~ 6 months later Ampreloxetine TRELEGY • Q3 TRELEGY net s ales reach $789M, up +17% Y/Y), bringing YTD net sales to $ 2.6B, up 30% Y/Y 4 • 2024 TRELEGY m ilestone thresholds: 5 • $25M @ ~$2.9B in Net Sales • $50M @ ~$3.2B in Net Sales

5 Initiatives to Unlock Shareholder Value 5 • Separated roles of Chair of the Board and Chief Executive Officer • Elected Susannah Gray as Chair of the Board • Ms. Gray brings more than 30 years of biopharmaceutical experience specifically in corporate finance and capital markets roles, most recently serving as EVP, Finance & Strategy of Royalty Pharma Management, LLC Corporate Governance • Led by new Chair Susannah Gray • Includes independent directors Jeremy Grant, Dean Mitchell, Donal O’Connor, and Deepa Pakianathan • Lazard acting as financial advisor Strategic Review Committee Reaffirm commitment to return excess capital to shareholders

The Only Once - Daily, Nebulized LAMA Maintenance Medicine for COPD Co - promotion agreement with VIATRIS TM (35% / 65% Profit Share) Rhonda Farnum Senior Vice President, Chief Business Officer COPD, chronic obstructive pulmonary disease; LAMA, long - acting muscarinic antagonist

7 YUPELRI ® US Net Sales Performance In the US, Viatris is leading the commercialization of YUPELRI, and Theravance Biopharma co - promotes the product under a profit and loss sharing arrangement (65% to Viatris ; 35% to Theravance Biopharma). $16.5 $29.6 $36.8 $30.3 $37.0 $38.7 $36.9 $41.8 $39.4 $43.8 $43.7 $49.1 $53.4 $55.7 $47.0 $55.0 $58.3 $60.6 $55.2 $54.5 $62.2 0 10 20 30 40 50 60 70 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Net sales increased 7% Q3 ’24 / Q3 ’23 Total YUPELRI Net Sales ($M)

8 US Hospital Growth a Significant Contributor to Overall Performance Source: IQVIA DDD, HDS, VA and Non - Reporting Hospital through Sep’24. Preliminary data subject to revision upon receipt of final data. 19 K 30 K 54 K 34 K 47 K 54 K 56 K 70 K 78 K 93 K 98 K 108 K 113 K 138 K 163 K 158 K 162 K 192 K 214 K 227 K 227 K 0K 50K 100K 150K 200K 250K Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 YUPELRI Hospital Doses Hospital doses up 40 % Q3 ’24 / Q3 ’23

9 YUPELRI ® Market Share Trends 1. Joint VTRS/TBPH Market Research (Jun’24). * Hospital LA - NEB Market Share - IQVIA DDD through Sep’24. †Community LA - NEB Market Share includes Retail + DME / Med B FFS through Aug’24. 9 10.8% 11.3% 11.6% 13.3% 12.4% 15.0% 15.2% 16.1% 16.7% 16.6% 18.2% 18.9% 0% 5% 10% 15% 20% 25% 30% 35% Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Hospital LA - NEB Market Share* YUPELRI Hospital LA-NEB Market Share Patients continue treatment in the community setting which is inclusive of both the retail and DME channels 23.2% 24.1% 25.3% 26.4% 27.1% 28.0% 29.1% 30.5% 31.0% 31.0% 31.9% 32.0% 0% 5% 10% 15% 20% 25% 30% 35% 40% Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Community LA - NEB Market Share † YUPELRI Community LA-NEB Market Share Most patients who receive YUPELRI in the hospital are discharged with an Rx 1 LA - NEB Market: YUPELRI, BROVANA, LONHALA, PERFOROMIST, arformoterol, formoterol Hospital LA - NEB Market Share Community LA - NEB Market Share †

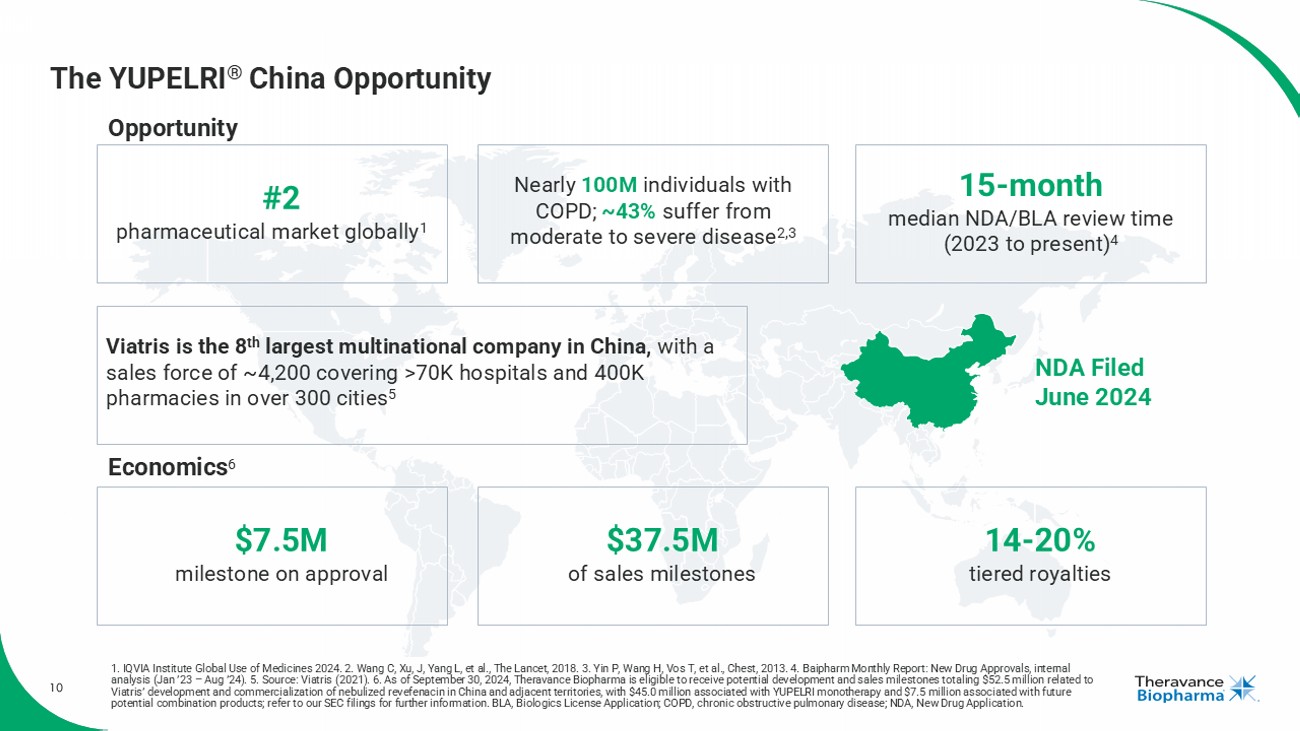

10 The YUPELRI ® China Opportunity NDA Filed June 2024 Viatris is the 8 th largest multinational company in China, with a sales force of ~4,200 covering >70K hospitals and 400K pharmacies in over 300 cities 5 #2 pharmaceutical market globally 1 Nearly 100M individuals with COPD; ~43% suffer from moderate to severe disease 2,3 15 - month median NDA/BLA review time (2023 to present) 4 Economics 6 $7.5M milestone on approval $37.5M of sales milestones 14 - 20% tiered royalties Opportunity 1. IQVIA Institute Global Use of Medicines 2024. 2. Wang C, Xu, J, Yang L, et al., The Lancet, 2018. 3. Yin P, Wang H, Vos T, et al., Chest, 2013. 4. Baipharm Monthly Report: New Drug Approvals, internal analysis (Jan ’23 – Aug ’24). 5. Source: Viatris (2021). 6. As of September 30, 2024, Theravance Biopharma is eligible to receive potential development and sales milestones tot aling $52.5 million related to Viatris ’ development and commercialization of nebulized revefenacin in China and adjacent territories, with $45.0 million associated with YUPELRI monotherapy and $7.5 million associated with fu tu re potential combination products; refer to our SEC filings for further information. BLA, Biologics License Application; COPD, c hro nic obstructive pulmonary disease; NDA, New Drug Application.

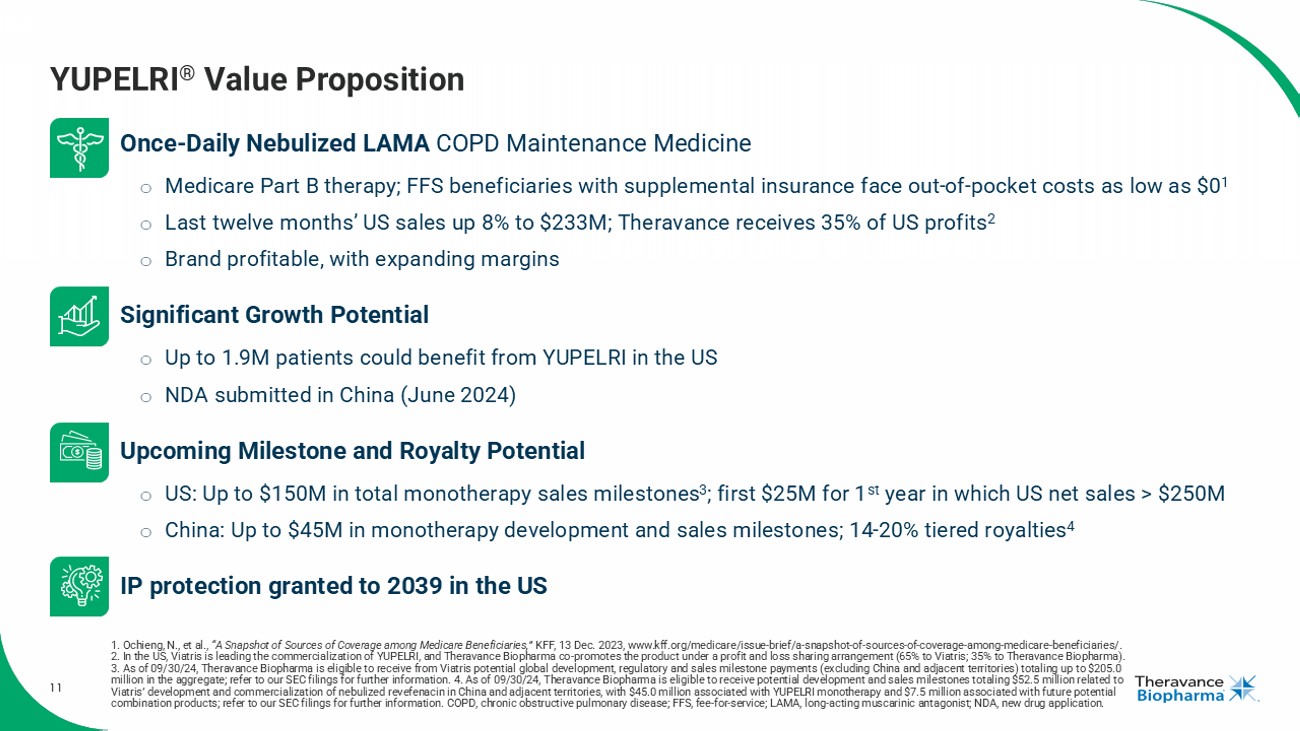

11 Once - Daily Nebulized LAMA COPD Maintenance Medicine o Medicare Part B therapy; FFS beneficiaries with supplemental insurance face out - of - pocket costs as low as $0 1 o Last twelve months’ US sales up 8% to $233M; Theravance receives 35% of US profits 2 o Brand profitable, with expanding margins Significant Growth Potential o Up to 1.9M patients could benefit from YUPELRI in the US o NDA submitted in China (June 2024) Upcoming Milestone and Royalty Potential o US: Up to $150M in total monotherapy sales milestones 3 ; first $25M for 1 st year in which US net sales > $250M o China: Up to $45M in monotherapy development and sales milestones; 14 - 20% tiered royalties 4 IP protection granted to 2039 in the US YUPELRI ® Value Proposition 1. Ochieng, N., et al., “A Snapshot of Sources of Coverage among Medicare Beneficiaries,” KFF, 13 Dec. 2023, www.kff.org/medicare/issue - brief/a - snapshot - of - sources - of - coverage - among - medicare - beneficiaries/. 2. In the US, Viatris is leading the commercialization of YUPELRI, and Theravance Biopharma co - promotes the product under a profit and loss sharing a rrangement (65% to Viatris ; 35% to Theravance Biopharma). 3. As of 09/30/24, Theravance Biopharma is eligible to receive from Viatris potential global development, regulatory and sales milestone payments (excluding China and adjacent territories) totaling up to $205.0 million in the aggregate; refer to our SEC filings for further information. 4. As of 09/30/24, Theravance Biopharma is eligib le to receive potential development and sales milestones totaling $52.5 million related to Viatris ’ development and commercialization of nebulized revefenacin in China and adjacent territories, with $45.0 million associated with YUPELRI monotherapy and $7.5 million associated with fu tu re potential combination products; refer to our SEC filings for further information . COPD, chronic obstructive pulmonary disease; FFS, fee - for - service; LAMA, long - acting muscarinic antagonist; NDA, new drug application .

The First And Only Once - Daily Triple Therapy In a Single Inhaler For Adult Patients With COPD Or Asthma Milestone and royalty agreement with Royalty Pharma Aziz Sawaf Senior Vice President, Chief Financial Officer GSK’s TRELEGY COPD, chronic obstructive pulmonary disease

13 $200M in Potential TRELEGY Sales Milestones if Upper Tier Thresholds are Met 1. If both milestones are achieved in a given year, Theravance Biopharma will only earn the higher milestone. As of 09/30/24, Th eravance stands to receive up to $200 million in TRELEGY sales milestones paid directly from Royalty Pharma (RP). In each year from 2024 to 2026, a first payment will be triggered if RP receives a minimum ro yalty payment from GSK and an additional payment will be triggered if RP receives a higher royalty payment from GSK. In 2024, we expect these respective thresholds to be met, should 2024 TRELEGY glo bal net sales exceed approximately $2.9 billion and $3.2 billion. 2. Based on 100% of TRELEGY ELLIPTA royalties. 3. GSK - reported Net Sales in USD. 4. Bloomberg Consensus as of 11/11/24. $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 2021 2022 2023 2024 E 2025 E 2026 E Consensus Forecast 4 Actuals 3 Net Sales ($M) $50M $25M $50M $25M $100M $50M $1,674 $2,142 $2,739 $3,480 $3,751 $3,948 28% growth 28% growth Milestone to Theravance Royalty Threshold 2 Global Net Sales Equivalent Year $25M $240M $2,863M 2024 1 $50M $275M $3,213M $25M $260M $3,063M 2025 1 $50M $295M $3,413M $50M $270M $3,163M 2026 1 $100M $305M $3,513M TRELEGY Global Net Sales Trends ($M) $200M in potential sales milestones 1 from ‘24 to ‘26

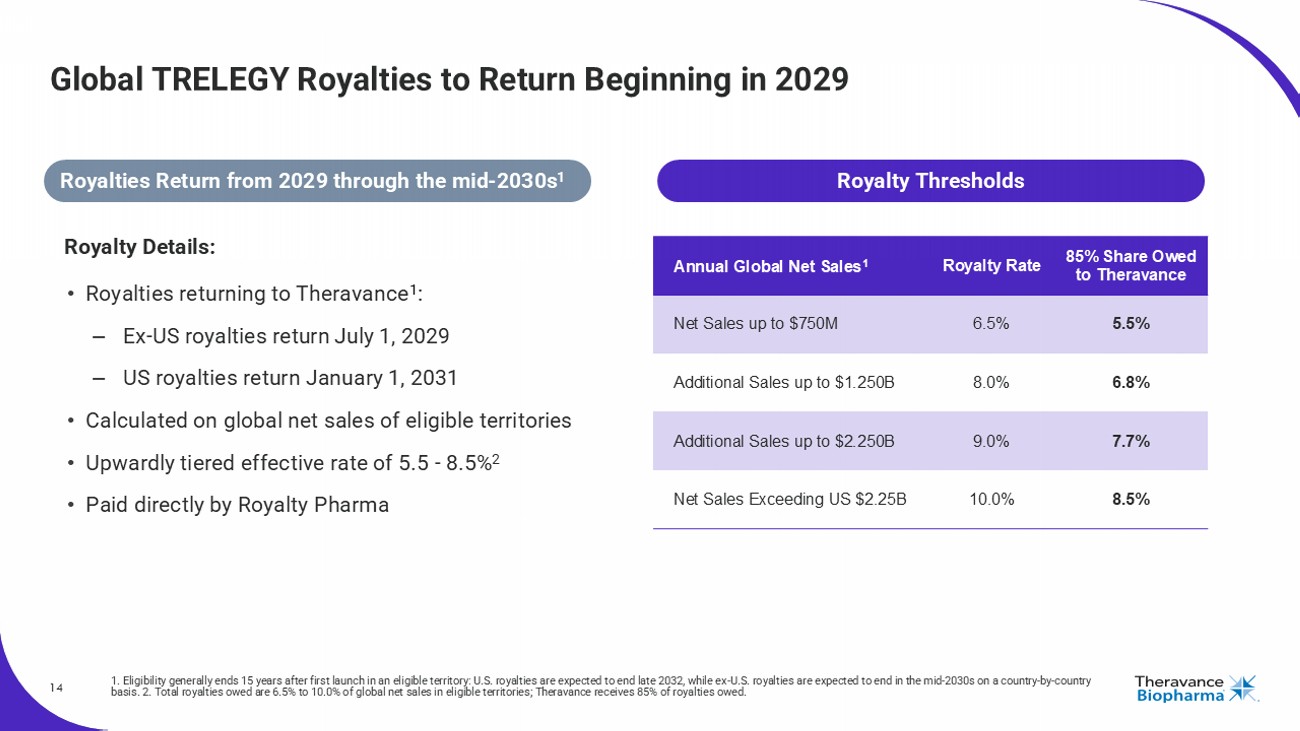

14 Global TRELEGY Royalties to Return Beginning in 2029 1. Eligibility generally ends 15 years after first launch in an eligible territory: U.S. royalties are expected to end late 2 032 , while ex - U.S. royalties are expected to end in the mid - 2030s on a country - by - country basis. 2. Total royalties owed are 6.5% to 10.0% of global net sales in eligible territories; Theravance receives 85% of roya lti es owed. Royalty Details: • Royalties returning to Theravance 1 : – Ex - US royalties return July 1, ್ 2029 – US royalties return Jan uary 1, ್ 2031 • Calculated on global net sales of eligible territories • Upwardly tiered effective rate of 5.5 - 8.5% 2 • Paid directly by Royalty Pharma 85% Share Owed to Theravance Royalty Rate Annual Global Net Sales 1 5.5% 6.5% Net Sales up to $750M 6.8% 8.0% Additional Sales up to $1.250B 7.7% 9.0% Additional Sales up to $2.250B 8.5% 10.0% Net Sales Exceeding US $2.25B Royalty Thresholds Royalties Return from 2029 through the mid - 2030s 1

The first once - daily, selective norepinephrine reuptake inhibitor in development to treat symptomatic nOH in MSA Dr. Áine Miller Senior Vice President, Development MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension AMPRELOXETINE

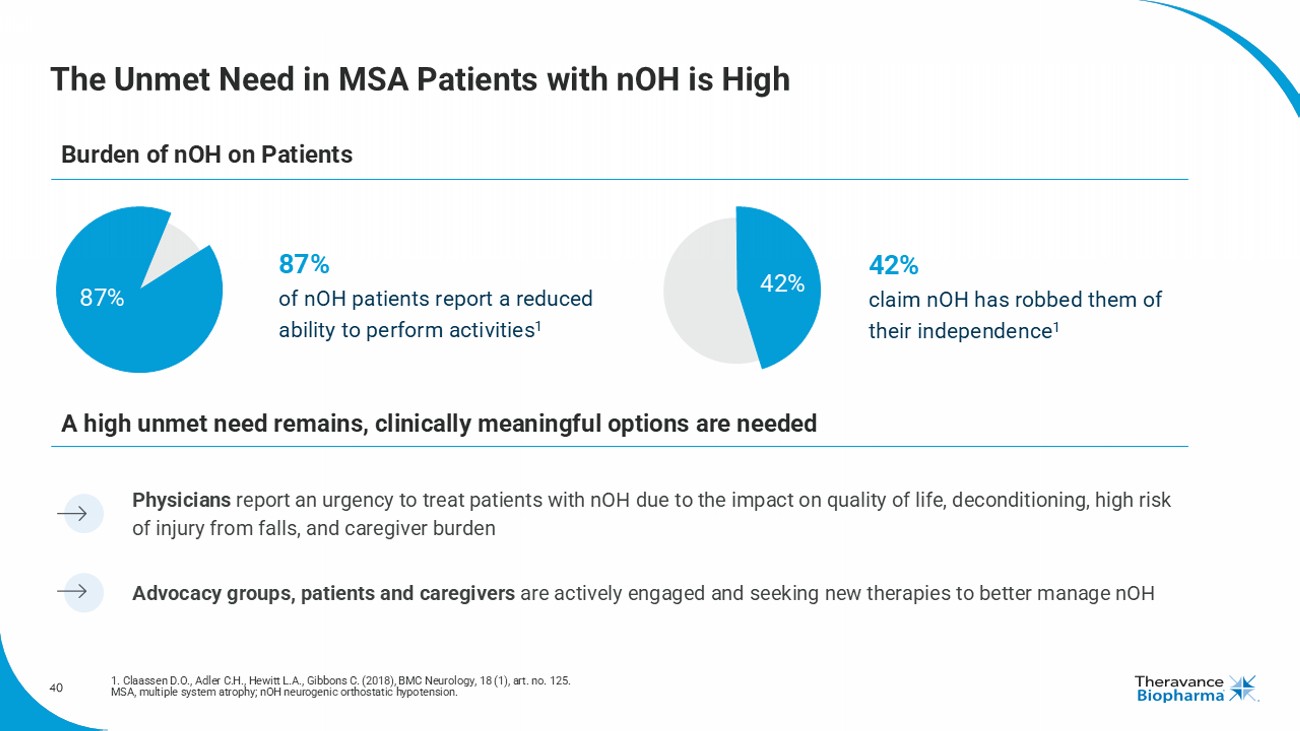

16 Ampreloxetine Update CYPRESS Study: o Significant progress activating remaining key Academic Centers / Centers of Excellence o Enrollment consistent with projections, with development timelines on track 1. Long - term safety of ampreloxetine in patients with symptomatic neurogenic orthostatic hypotension. R Freeman, I Biaggioni, R Vickery, L Norcliffe - Kaufmann, T Gu erin, M Bryarly , V Iodice , M Rudzińska - Bar, M Boczarska - Jedynak , C Oehlwein , C Shibao , H Kaufmann. Presented at International Congress of Parkinson’s Disease and Movement Disorders, Sept 26 - Oct1, 2024, Philadelph ia, PA. 2. Impact of symptomatic neurogenic orthostatic hypotension ( nOH ) on symptom burden and daily functioning in patients with alpha synucleinopathies . V Iodice , T Guerin, S Johnstone, L Norcliffe - Kaufmann, A Miller, R Vickery. Presented at International Symposium on the Autonomic Nervous System, Nov 6 - 9, 2024, Santa Barbara, CA. MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension. Scientific Presentations: o Long - term data from Study 0170 open label extension (OAK) presented at the International Congress of Parkinson’s Disease and Movement Disorders meeting in September support safety and tolerability profile of ampreloxetine 1 o At the 2024 American Autonomic Society meeting, presented analysis of Study 0169 (SEQUOIA) in primary autonomic failure, highlighting the symptomatic burden of nOH in these patients and the greater unmet need in patients with MSA 2

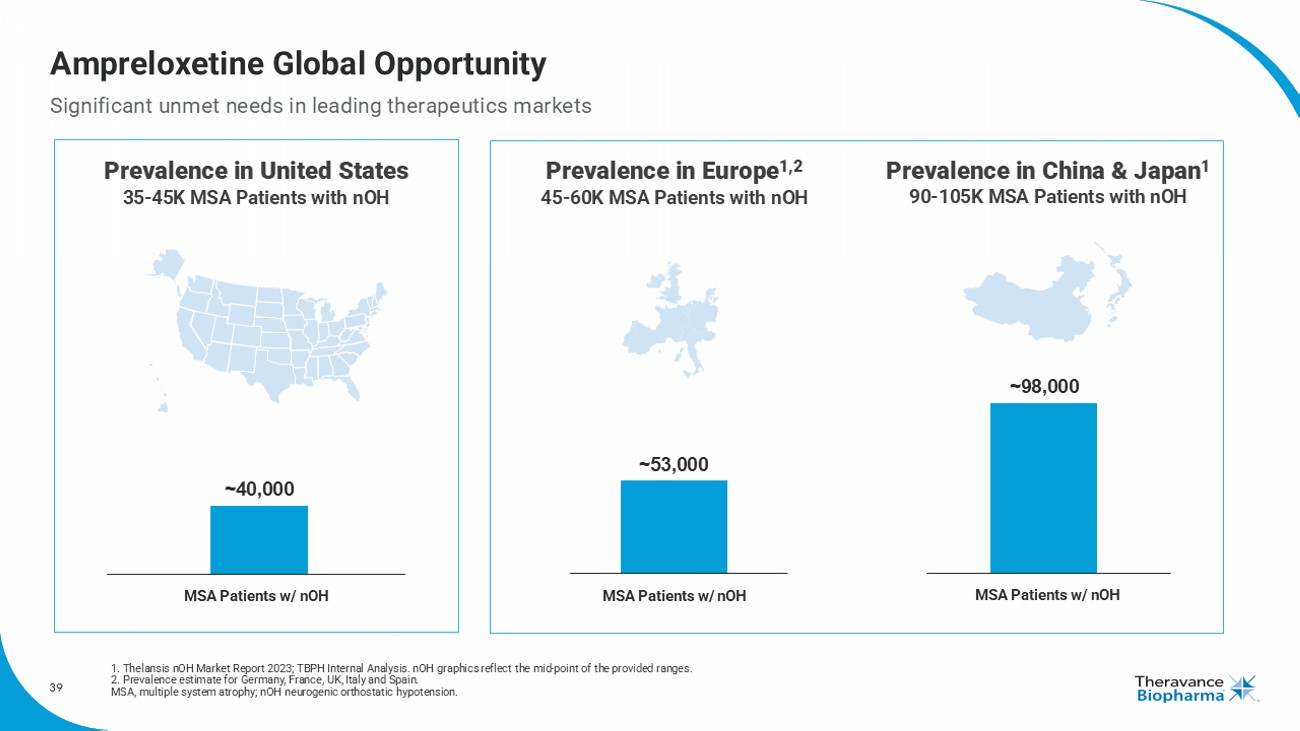

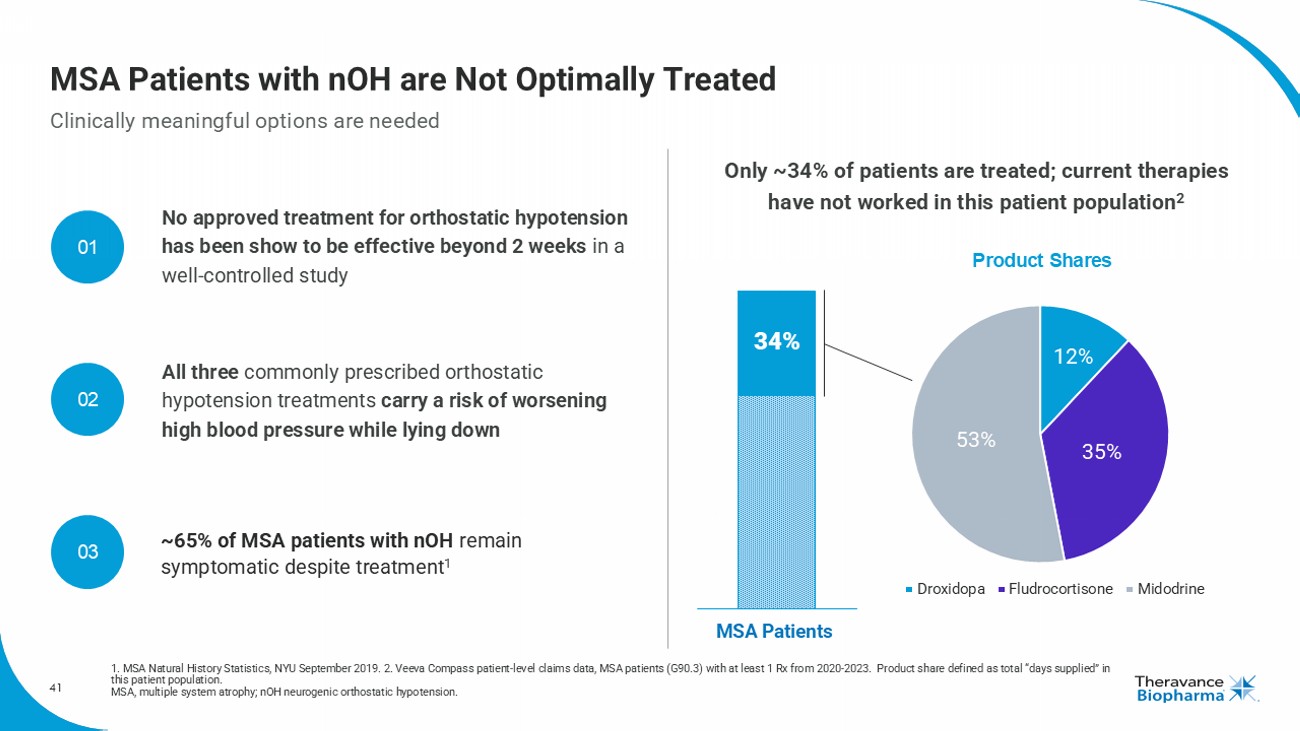

17 Ampreloxetine Value Proposition in MSA with nOH Significant unmet medical need o Rare disease with ~40,000 patients in the United States and significant unmet need ex - US 1,2,3 o Commonly used agents rarely work in MSA and face important safety and tolerability limitations 4,5 Differentiated first - in - class therapy with orphan drug disease designation 6 o Once - daily dosing with durable, clinically meaningful efficacy in target population o No signal for supine hypotension worsening further distinguishes from competitive landscape De - Risked Regulatory and Commercial Pathway o CYPRESS designed to replicate positive Phase 3 MSA Study 0170 results using OSHA composite endpoint o Aligned with FDA on OHSA composite as primary endpoint, CYPRESS plus 0170 results meeting requirements o Focused commercial effort can optimally address concentrated treatment landscape Granted IP through 2037 1. Kalra DK, et al. Clin Med Insights: Cardiol . 2020 (70% - 90%);14:1179546820953415. 2. Delveinsight MSA Market Forecast (2023); Symptoms associated with orthostatic hypotension in pure autonomic failure and multiple systems atrophy, CJ Mathias (1999). 3. Thelansis nOH Market Report 2023; TBPH Internal Analysis. 4. NORTHERA® (droxidopa) [package insert]. Deerfield, IL: Lundbeck. 2014. 5. ProAmatine ® (midodrine hydrochloride) [Warning Ref 4052798]. 6. Reflects Theravance Biopharma's expectations for ampreloxetine based on clinical trial data to date. Ampreloxetine is in development and not approved for any indication. Data on file. MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension; OHSA, orthostatic hypotension symptom assessment.

Financial Update Aziz Sawaf Senior Vice President, Chief Financial Officer

19 Third Quarter 2024 Financials (Unaudited) 1. Amounts include share - based compensation. 2. Non - GAAP net profit (loss) from continuing operations consists of GAAP net loss before taxes excluding share - based compensation expense, non - cash interest expense and non - cash impairment expense; see reconciliation on Slide 20 and the section titled "Non - GAAP Financial Measures“ on Slide 2 for more information. 19 ($, in thousands) Revenue: Viatris collaboration agreement $ 16,868 $ 15,687 $ 45,627 $ 39,841 Collaboration revenue - 6 - 18 Total revenue 16,868 15,693 45,627 39,859 Costs and expenses: Research and development (1) 9,268 8,311 28,190 32,308 Selling, general and administrative (1) 16,875 16,142 50,673 54,603 Impairment of long-lived assets (non-cash) 1,562 - 4,513 - Restructuring and related expenses (1) - - - 2,743 Total costs and expenses 27,705 24,453 83,376 89,654 Loss from operations (before tax and other income & expense) $ (10,837) $ (8,760) $ (37,749) $ (49,795) Share-based compensation expense: Research and development 1,111 2,004 3,727 6,301 Selling, general and administrative 3,852 4,258 11,840 12,890 Restructuring and related expenses - - - 356 Total share-based compensation expense 4,963 6,262 15,567 19,547 Operating expense excl. share-based compensation: R&D operating expense (excl. share-based compensation) 8,157 6,307 24,463 26,007 SG&A operating expense (excl. share-based compensation) 13,023 11,884 38,833 41,713 Total operating expenses excl. share-based compensation $ 21,180 $ 18,191 $ 63,296 $ 67,720 Non-GAAP net loss (2) $ (2,897) $ (712) $ (13,692) $ (22,979) Three Months Ended September 30, 2024 2023 (Unaudited) Nine Months Ended September 30, 2024 2023 (Unaudited)

20 Third Quarter 2024 Financials (Unaudited) (Cont’d) 20 See the section titled "Non - GAAP Financial Measures" on Slide 2 for more information. GAAP Net Loss $ (12,698) $ (8,950) $ (40,891) $ (46,683) Adjustments: Share-based compensation expense 4,963 6,262 15,567 19,547 Non-cash impairment of long-lived assets 1,562 - 4,513 - Non-cash interest expense 630 609 1,903 1,727 Income tax expense 2,646 1,367 5,216 2,430 Non-GAAP Net Loss $ (2,897) $ (712) $ (13,692) $ (22,979) Non-GAAP Net Loss per Share Basic and diluted non-GAAP net loss per share $ (0.06) $ (0.01) $ (0.28) $ (0.40) Shares used to compute basic and diluted non-GAAP net loss per share 49,038 52,361 48,690 57,287 (Unaudited) Reconciliation of GAAP to Non-GAAP Net Loss (In thousands, except per share data) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 (Unaudited)

21 Q3 2024 Financial Highlights 1. Non - GAAP net profit (loss) from continuing operations consists of GAAP net income (loss) before taxes less share - based compen sation expense, non - cash interest expense, and non - cash impairment expense; see reconciliation on Slide 20 and the section titled "Non - GAAP Financial Measures“ on Slide 2 for more information. 2. Cash, cash equivalents and marketable s ecurities. SBC, Share - Based Compensation. Note Q3 ‘23 (M) Q3 ‘24 (M) Metric Representing 8% YoY growth $15.7 $16.9 VIATRIS Collaboration Revenue $18.2 $21.2 SG&A and R&D Expense, ex - SBC $6.3 $5.0 Share - Based Compensation Q3’24 impacted by ~$1.6M non - cash long - lived asset impairment charge ($8.8) ($10.8) GAAP Net Loss from Operations ($0.7) ($2.9) Non - GAAP Net Loss from Operations 1 Buyback program completed in Jan’24 $134.0 $91.4 Cash and Cash Equivalents 2 (as of quarter - end) $0.0 $0.0 Debt (as of quarter - end) 50.8 49.2 Shares Outstanding (as of quarter - end)

22 2024 Financial Guidance 1. Non - GAAP net profit (loss) from continuing operations is expected to consist of GAAP net income (loss) before taxes less shar e - based compensation expense, non - cash interest expense and non - cash impairment expense; the section titled “Non - GAAP Financial Measures” on Slide 2 for more information. 2. The Company previously recognized a portion ($46.9M) of the total potential $250M milestones at the time of sale in July 2022; as a result, the Company will not recognize any additional milestone income until the cumulati ve milestone payments exceed the $46.9M previously recognized. 3. 2024 Estimates assume mid - point of Guidance. 2024 OPEX Guidance : • R&D (excluding share - based comp): $30M - $36M • SG&A (excluding share - based comp): $45M - $55M: • Includes G&A Y/Y reduction of ~20% • Share - Based Compensation: $18M - $22M, ~20% Y/Y decrease 2024 Non - GAAP Profitability / Loss Guidance 1 : • Expect levels of both non - GAAP losses and cash burn to be similar to first half actuals 2024 • Excludes potential milestones If achieved, TRELEGY milestones recognized as Other Income: • Cash received will be full amount of the milestone(s) • Accounting recognition will be less than the full amount due to already recognizing a portion of the milestones at time of sale 2 ; we will recognize: • $0M of Other Income if $25M milestone is achieved • $3M of Other Income if $50M milestone is achieved • For 2024 milestones, expected cash receipt in 1H’25 32.6 33.0 53.1 50.0 25.4 20.0 2.4 4.3 113.5 107.3 $0 $20 $40 $60 $80 $100 $120 $140 2023A 2024E R&D SG&A Share-Based Comp One-time Items Operating Expenses ($M) 1,3

23 Maximize Value for Shareholders Complete Pivotal Phase 3 in Patients with MSA and nOH Devastating rare neurological disorder causing unremitting symptoms of autonomic failure in ~80% of patients 2,3 Ampreloxetine : p otential first - in - class agent may be uniquely tailored to mitigate these symptoms and improve quality of life Strong financial position with $91.4 million in cash and no debt; limited cash use anticipated Up to $200M in TRELEGY milestones possible through 2026 ; royaltie s returning from 2029 4 F ormation of Strategic Review Committee to assess alternatives to unlock value Commitment to return excess capital to shareholders Summary: Theravance’s Strategic Priorities 1. Sources: Citeline Pharma Custom Intelligence Primary Research April 2023, Symphony Health METYS Prescription Dashboard, SolutionsRx Med B FFS. 2. Kalra DK, et al. Clin Med Insights: Cardiol . 2020 (70% - 90%);14:1179546820953415. 3. Delveinsight MSA Market Forecast (2023); Symptoms associated with orthostatic hypotension in pure autonomic failure and multiple systems a tr ophy, CJ Mathias (1999). 4. From 2024 through 2026, Theravance stands to receive up to $200 million in TRELEGY sales milestones paid directly from Royalty Pha rma (RP). These payment will be triggered if RP receives certain minimum royalty payments from GSK based on TRELEGY global net sales. Beginning in 2029, Theravance is eligible to receive royalty payments on gl obal net sales of TRELEGY (see SEC filings for further information). LAMA, long - acting muscarinic antagonist; MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension. Grow YUPELRI Only once - daily nebulized LAMA: currently <5% penetrated addressable market 1 Winning strategy aligned with clinical best practices

Rick Winningham Chief Executive Officer Aziz Sawaf, CFA Senior Vice President, Chief Financial Officer Rhonda Farnum Senior Vice President, Chief Business Officer Áine Miller Senior Vice President, Development Q&A Session

25 YUPELRI ® (revefenacin) Inhalation Solution YUPELRI ® inhalation solution is indicated for the maintenance treatment of patients with chronic obstructive pulmonary disease (COPD) . Important Safety Information (US) YUPELRI is contraindicated in patients with hypersensitivity to revefenacin or any component of this product . YUPELRI should not be initiated in patients during acutely deteriorating or potentially life - threatening episodes of COPD, or for the relief of acute symptoms, i . e . , as rescue therapy for the treatment of acute episodes of bronchospasm . Acute symptoms should be treated with an inhaled short - acting beta 2 - agonist . As with other inhaled medicines, YUPELRI can produce paradoxical bronchospasm that may be life - threatening . If paradoxical bronchospasm occurs following dosing with YUPELRI, it should be treated immediately with an inhaled, short - acting bronchodilator . YUPELRI should be discontinued immediately and alternative therapy should be instituted . YUPELRI should be used with caution in patients with narrow - angle glaucoma . Patients should be instructed to immediately consult their healthcare provider if they develop any signs and symptoms of acute narrow - angle glaucoma, including eye pain or discomfort, blurred vision, visual halos or colored images in association with red eyes from conjunctival congestion and corneal edema . Worsening of urinary retention may occur . Use with caution in patients with prostatic hyperplasia or bladder - neck obstruction and instruct patients to contact a healthcare provider immediately if symptoms occur . Immediate hypersensitivity reactions may occur after administration of YUPELRI . If a reaction occurs, YUPELRI should be stopped at once and alternative treatments considered . The most common adverse reactions occurring in clinical trials at an incidence greater than or equal to 2 % in the YUPELRI group, and higher than placebo, included cough, nasopharyngitis, upper respiratory infection, headache and back pain . Coadministration of anticholinergic medicines or OATP 1 B 1 and OATP 1 B 3 inhibitors with YUPELRI is not recommended . YUPELRI is not recommended in patients with any degree of hepatic impairment . OATP, organic anion transporting polypeptide. 25

26 About YUPELRI ® ( revefenacin ) Inhalation Solution YUPELRI ® ( revefenacin ) inhalation solution is a once - daily nebulized LAMA approved for the maintenance treatment of COPD in the US . Market research by Theravance Biopharma indicates approximately 9 % of the treated COPD patients in the US use nebulizers for ongoing maintenance therapy . 1 LAMAs are a cornerstone of maintenance therapy for COPD and YUPELRI ® is positioned as the first once - daily single - agent bronchodilator product for COPD patients who require, or prefer, nebulized therapy . YUPELRI ® ’s stability in both metered dose inhaler and dry powder device formulations suggest that this LAMA could also serve as a foundation for novel handheld combination products . 1. TBPH market research (N=160 physicians); refers to US COPD patients. COPD, chronic obstructive pulmonary disease; LAMA, long - acting muscarinic antagonist. 26

Appendix I: YUPELRI

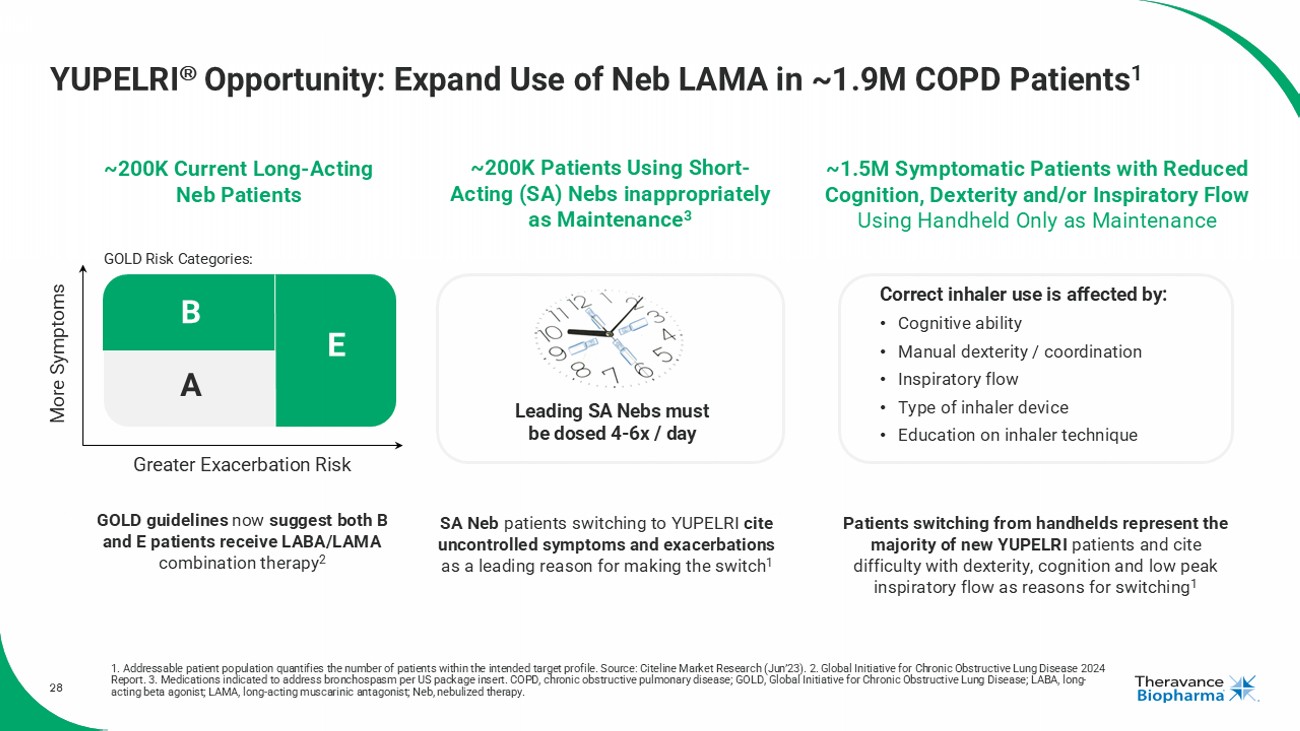

28 YUPELRI Opportunity: Expand Use of Neb LAMA in ~1.9M COPD Patients 1 1. Addressable patient population quantifies the number of patients within the intended target profile. Source: Citeline Mark et Research (Jun’23). 2. Global Initiative for Chronic Obstructive Lung Disease 2024 Report. 3. Medications indicated to address bronchospasm per US package insert. COPD, chronic obstructive pulmonary disease; GOL D, Global Initiative for Chronic Obstructive Lung Disease; LABA, long - acting beta agonist; LAMA, long - acting muscarinic antagonist; Neb, nebulized therapy. ~200K Current Long - Acting Neb Patients ~200K Patients Using Short - Acting (SA) Nebs inappropriately as Maintenance 3 ~1.5M Symptomatic Patients with Reduced Cognition, Dexterity and/or Inspiratory Flow Using Handheld Only as Maintenance GOLD guidelines now suggest both B and E patients receive LABA/LAMA combination therapy 2 More Symptoms Greater Exacerbation Risk A B E SA Neb patients switching to YUPELRI cite uncontrolled symptoms and exacerbations as a leading reason for making the switch 1 Patients switching from handhelds represent the majority of new YUPELRI patients and cite difficulty with dexterity, cognition and low peak inspiratory flow as reasons for switching 1 Leading SA Nebs must be dosed 4 - 6x / day GOLD Risk Categories: Correct inhaler use is affected by: • Cognitive ability • Manual dexterity / coordination • Inspiratory flow • Type of inhaler device • Education on inhaler technique

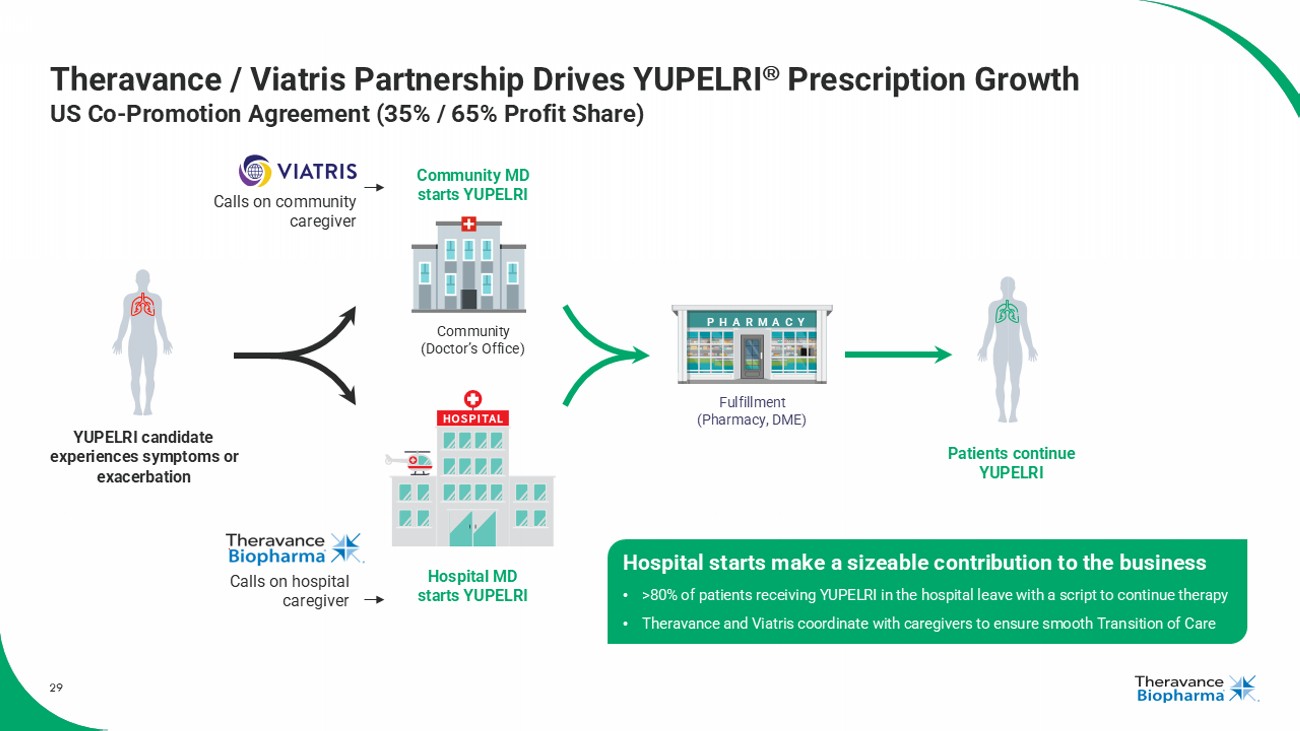

29 Theravance / Viatris Partnership Drives YUPELRI Prescription Growth US Co - Promotion Agreement (35% / 65% Profit Share) Community (Doctor’s Office) Hospital MD starts YUPELRI Community MD starts YUPELRI Hospital starts make a sizeable contribution to the business • >80% of patients receiving YUPELRI in the hospital leave with a script to continue therapy • Theravance and Viatris coordinate with caregivers to ensure smooth Transition of Care Patients continue YUPELRI YUPELRI candidate experiences symptoms or exacerbation Fulfillment (Pharmacy, DME) PHARMACY Calls on community caregiver Calls on hospital caregiver

Appendix II: ampreloxetine

31 Multiple System Atrophy (MSA): A progressive neurological disorder leading to autonomic failure and neurogenic orthostatic hypotension ( nOH ) Sources: Biorender.com. In MSA , abnormal deposits of mis - folded - synuclein are associated with progressive neuro - degeneration Neuro - degeneration leads to autonomic system failure, characterized by nOH , and significantly reduced quality of life In MSA, peripheral nerves may be spared , providing an opportunity to enhance autonomic function and alleviate symptoms of nOH MSA Other Synucleinopathies

32 Neurogenic Orthostatic Hypotension ( nOH ): One of the Most Devastating Consequences of MSA 1. 203202ORIG1S000 - FDA, www.accessdata.fda.gov/drugsatfda_docs/nda/2014/203202Orig1s000SumR.pdf. Accessed 8 Sept. 2024. 2. Kau fmann H. (2023, November 15 - 18). Evaluating clinically meaningful changes in the Orthostatic Hypotension Symptom Assessment domain of the Orthostatic Hypotension Questionnaire. [Po ste r presentation]. MSA, multiple system atrophy. nOH patients experience: • R apid blood pressure reductions upon standing • U pper extremity hypoperfusion • A range of debilitating, unremitting symptoms Orthostatic Hypotension Symptom Assessment (OHSA): • Patient reported measure of nOH symptom burden, addressing 6 key symptoms • Questionnaire developed by autonomic system experts • Accepted by the FDA as an outcome measure for drug approval 1 • 1 - point OHSA change considered clinically meaningful 2 Symptom intensity can be measured by the OHSA Dizziness Vision Problems Trouble Concentrating Neck / Shoulder Pain Weakness Fatigue

33 Ampreloxetine Intended to Increase Norepinephrine and Treat nOH Post - ganglionic sympathetic nerve Pre - ganglionic sympathetic nerve Autonomic ganglia NE Post - ganglionic Sympathetic Nerve ending NET NE VMAT Effector Cell NET Sympathetic activity ( NE released into the synapse) stimulates adrenergic receptors, driving a vascular response In MSA, postganglionic sympathetic (autonomic) nerves are often intact, with residual sympathetic activity retained Ampreloxetine blocks NE recapture from the synapse, therein increasing intrasynaptic NE concentrations and actions 1 Post - ganglionic Sympathetic Nerve ending NET NE VMAT Effector Cell NET 1. Reflects Theravance Biopharma's expectations for ampreloxetine based on data collected to date. Ampreloxetine is in development and not approved for any indication. Data on file. MSA, multiple system atrophy; NE, norepinephrine; NET, norepinephrine transporter; nOH , neurogenic orthostatic hypotension; VMAT, vesicular monoamine transporter.

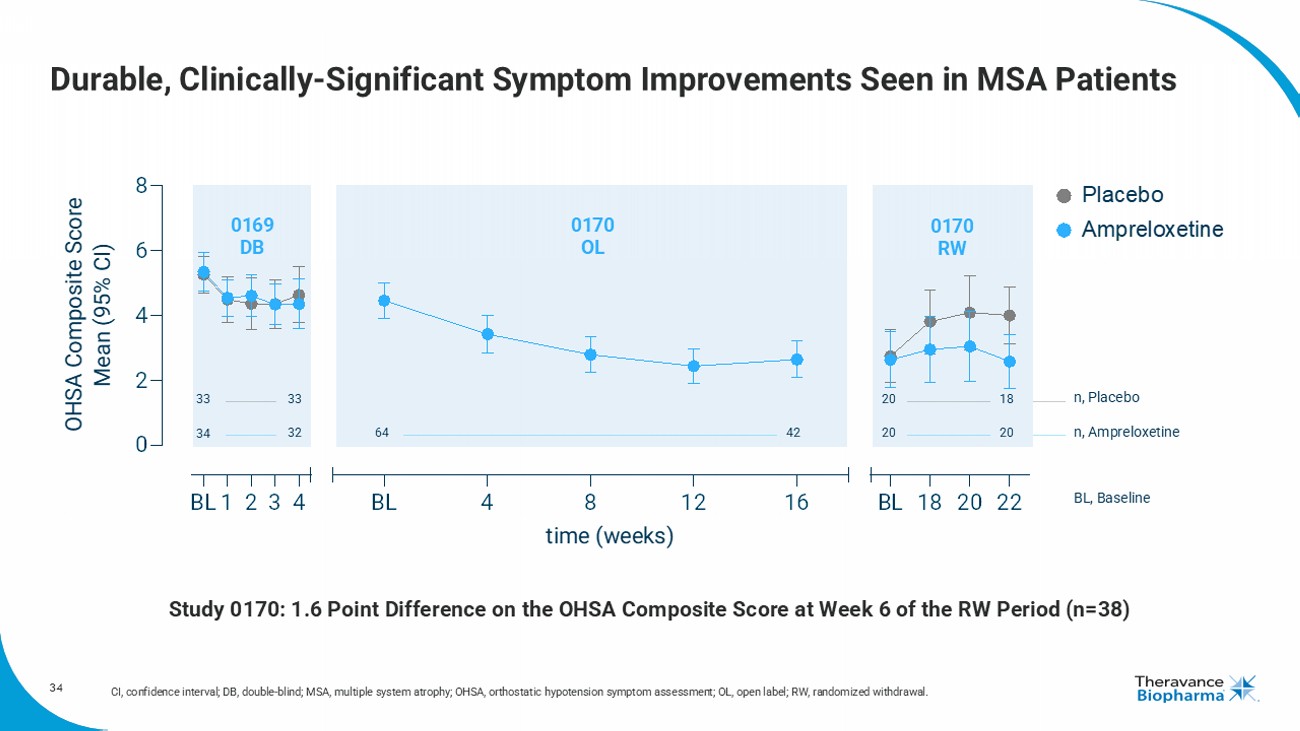

34 Durable, Clinically - Significant Symptom Improvements Seen in MSA Patients CI, confidence interval; DB, double - blind; MSA, multiple system atrophy; OHSA, orthostatic hypotension symptom assessment; OL, o pen label; RW, randomized withdrawal. BL1 2 3 4 0 2 4 6 8 BL 4 8 12 16 BL 18 20 22 time (weeks) OHSA Composite Score Mean (95% CI) Placebo Ampreloxetine 33 33 20 18 34 32 20 20 64 42 n, Placebo n, Ampreloxetine BL, Baseline 0169 DB 0170 OL 0170 RW Study 0170: 1.6 Poin t Difference on the OHSA Composite Score at Week 6 of the RW Period (n=38)

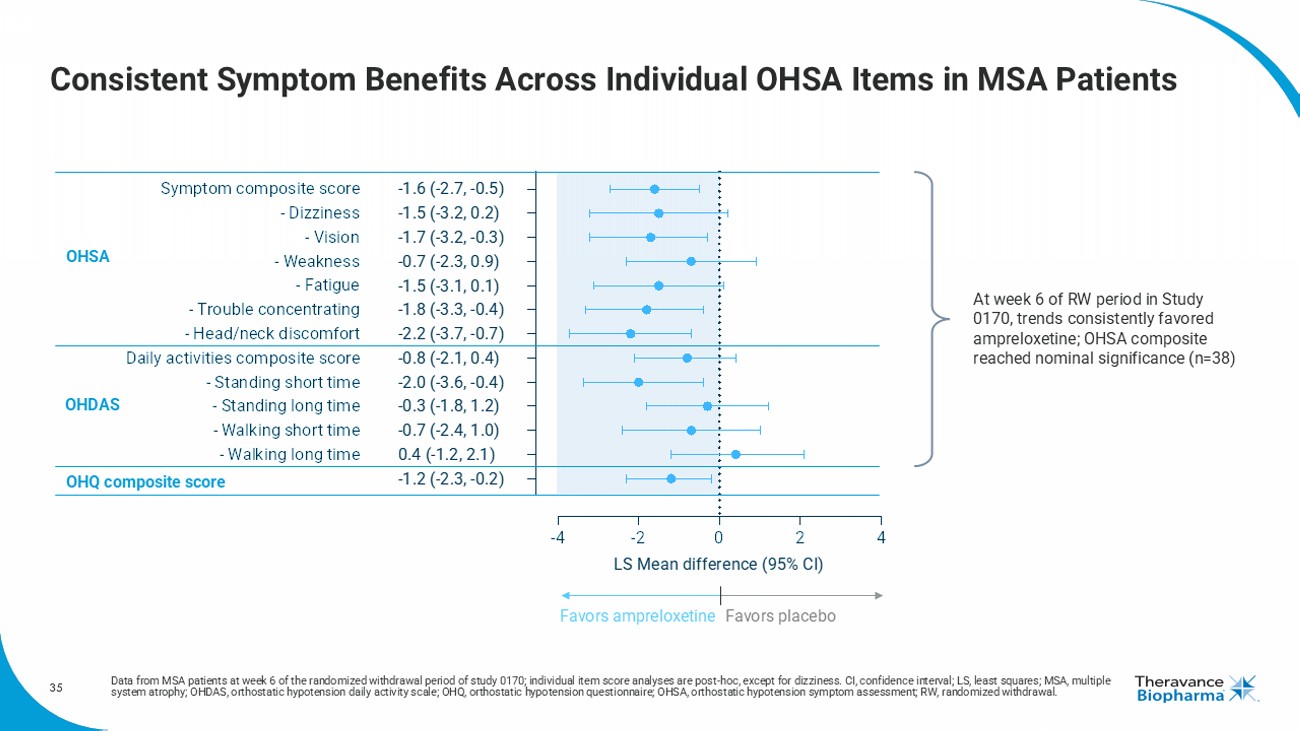

35 Consistent Symptom Benefits Across Individual OHSA Items in MSA Patients Data from MSA patients at week 6 of the randomized withdrawal period of study 0170; individual item score analyses are post - hoc, except for dizziness. CI, confidence interval; LS, least squares; MSA, multiple system atrophy; OHDAS, orthostatic hypotension daily activity scale; OHQ, orthostatic hypotension questionnaire; OHSA, orthos tat ic hypotension symptom assessment; RW, randomized withdrawal. -4 -2 0 2 4 OHQ composite score - Walking long time - Walking short time - Standing long time - Standing short time Daily activities composite score - Head/neck discomfort - Trouble concentrating - Fatigue - Weakness - Vision - Dizziness Symptom composite score LS Mean difference (95% CI) -1.6 (-2.7, -0.5) -1.5 (-3.2, 0.2) -1.7 (-3.2, -0.3) -0.7 (-2.3, 0.9) -1.5 (-3.1, 0.1) -1.8 (-3.3, -0.4) -2.2 (-3.7, -0.7) -0.8 (-2.1, 0.4) -2.0 (-3.6, -0.4) -0.3 (-1.8, 1.2) -0.7 (-2.4, 1.0) 0.4 (-1.2, 2.1) -1.2 (-2.3, -0.2) OHSA OHDAS Favors ampreloxetine Favors placebo OHQ composite score At week 6 of RW period in Study 0170, trends consistently favored ampreloxetine ; OHSA composite reached nominal significance (n=38)

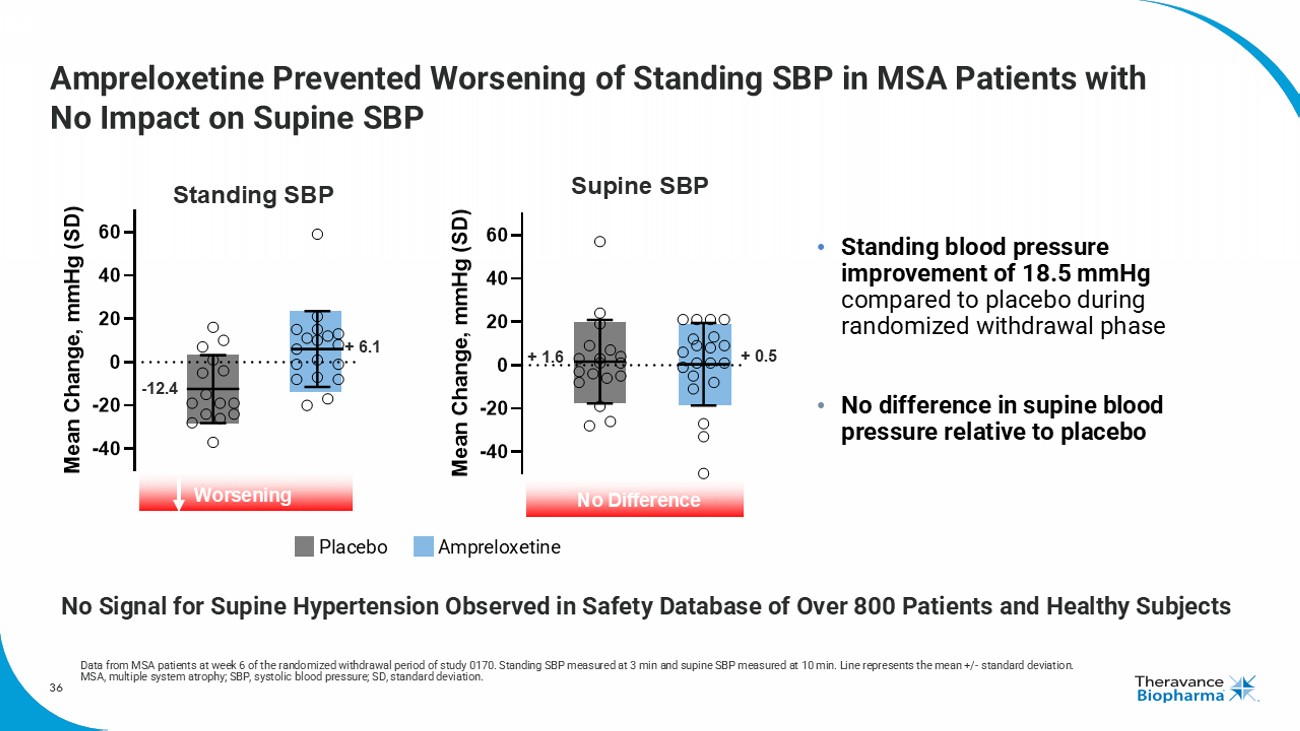

36 -40 -20 0 20 40 60 M e a n C h a n g e , m m H g ( S D ) Supine SBP No Difference + 1.6 + 0.5 Ampreloxetine Prevented Worsening of Standing SBP in MSA Patients with No Impact on Supine SBP • Standing blood pressure improvement of 18.5 mmHg compared to placebo during randomized withdrawal phase • No difference in supine blood pressure relative to placebo Data from MSA patients at week 6 of the randomized withdrawal period of study 0170. Standing SBP measured at 3 min and supine SB P measured at 10 min. Line represents the mean +/ - standard deviation. MSA, multiple system atrophy; SBP, systolic blood pressure; SD, standard deviation. Placebo Ampreloxetine - 12.4 + 6.1 Standing SBP Worsening No Signal for Supine Hypertension Observed in Safety Database of Over 800 Patients and Healthy Subjects -40 -20 0 20 40 60 M e a n C h a n g e , m m H g ( S D )

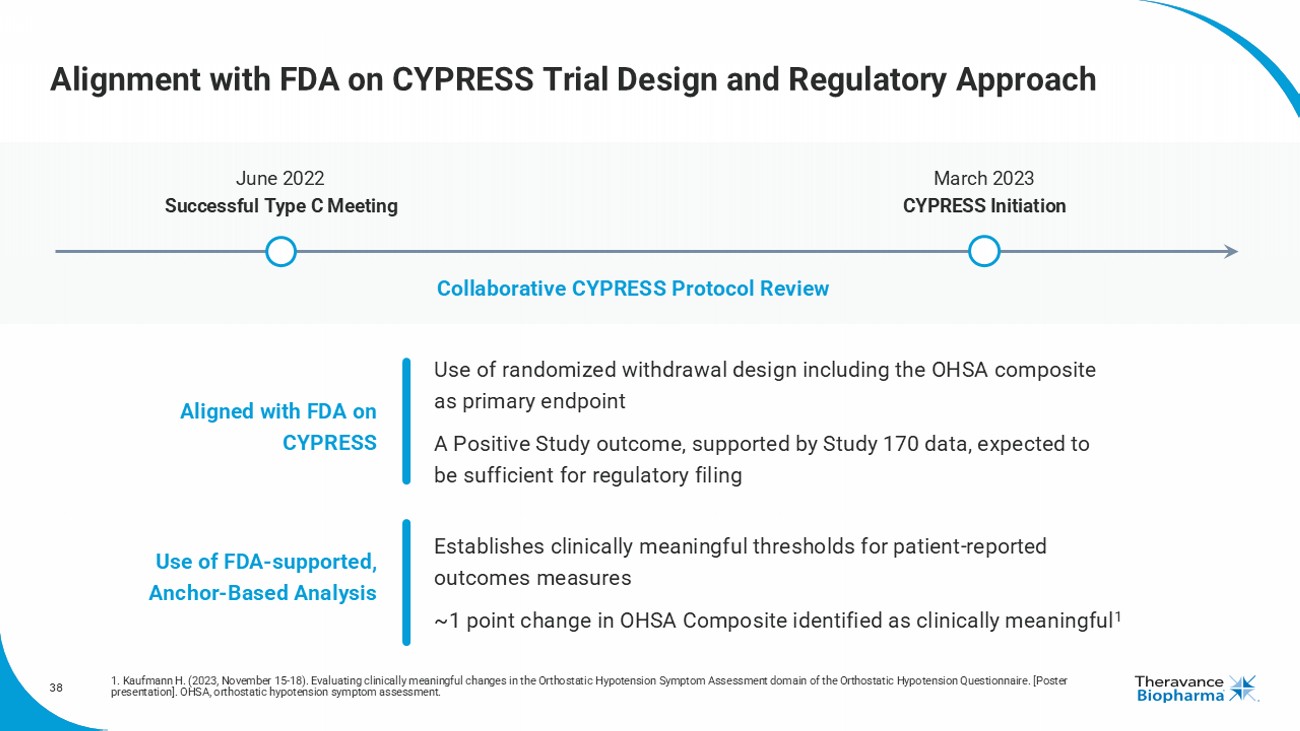

37 CYPRESS Designed to Reproduce Study 0170 MSA Patient Results MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension; OHSA, orthostatic hypotension symptom assessment; RW, randomized withdrawal. Entry Endpoint 8 - week double blind RW 12 - week open - label Baseline Randomization Ampreloxetine 10 mg Ampreloxetine 10 mg Placebo Week 8 Enrichment n~100 to be enrolled n~60 Completers CYPRESS Change in OHSA Composite Score: Baseline to week 8 of RW Period • RW design with enrichment mirrors that of prior Phase 3 trial in nOH • FDA aligned with design and use of OHSA composite as primary endpoint • Last patient into open - label portion in mid - 2025; data approximately 6 months later • A P ositive Study outcome, supported by Study 0170 data, expected to be sufficient for regulatory filing Primary Endpoint

38 Alignment with FDA on CYPRESS Trial Design and Regulatory Approach 1. Kaufmann H. (2023, November 15 - 18). Evaluating clinically meaningful changes in the Orthostatic Hypotension Symptom Assessmen t domain of the Orthostatic Hypotension Questionnaire. [Poster presentation]. OHSA, orthostatic hypotension symptom assessment. Aligned with FDA on CYPRESS Use of FDA - supported, Anchor - Based Analysis June 2022 Successful Type C Meeting March 2023 CYPRESS Initiation Collaborative CYPRESS Protocol Review Use of r andomized withdrawal design including the OHSA composite as primary endpoint A Positive Study outcome, supported by Study 170 data, expected to be sufficient for regulatory filing Establishes clinically meaningful thresholds for patient - reported outcomes measures ~1 point change in OHSA Composite identified as clinically meaningful 1

39 Prevalence in Europe 1,2 45 - 60K MSA Patients with nOH Prevalence in China & Japan 1 90 - 105K MSA Patients with nOH Ampreloxetine Global Opportunity Significant unmet needs in leading therapeutics markets 1. Thelansis nOH Market Report 2023; TBPH Internal Analysis. nOH graphics reflect the mid - point of the provided ranges . 2. Prevalence estimate for Germany , France , UK, Italy and Spain . MSA, multiple system atrophy ; nOH neurogenic orthostatic hypotension . ~ 40,000 ~ 53,000 ~ 98,000 MSA Patients w/ nOH MSA Patients w/ nOH Prevalence in United States 3 5 - 45K MSA Patients with nOH ~ 53,000 ~ 98,000 MSA Patients w/ nOH

40 The Unmet Need in MSA Patients with nOH is High 1. Claassen D.O., Adler C.H., Hewitt L.A., Gibbons C. (2018), BMC Neurology, 18 (1), art. no. 125. MSA, multiple system atrophy; nOH neurogenic orthostatic hypotension. Advocacy groups, patients and caregivers are actively engaged and seeking new therapies to better manage nOH Physicians report an urgency to treat patients with nOH due to the impact on quality of life, deconditioning, high risk of injury from falls, and caregiver burden Burden of nOH on Patients A high unmet need remains, clinically meaningful options are needed 87% 87% of nOH patients report a reduced ability to perform activities 1 42 % 42 % claim nOH has robbed them of their independence 1

41 MSA Patients with nOH are Not Optimally Treated Clinically meaningful options are needed 1. MSA Natural History Statistics, NYU September 2019. 2. Veeva Compass patient - level claims data, MSA patients (G90.3) with at least 1 Rx from 2020 - 2023. Product share defined as total “days supplied” in this patient population. MSA, multiple system atrophy; nOH neurogenic orthostatic hypotension. Only ~34% of patients are treated; current therapies have not worked in this patient population 2 MSA Patients 34% All three commonly prescribed orthostatic hypotension treatments carry a risk of worsening high blood pressure while lying down No approved treatment for orthostatic hypotension has been show to be effective beyond 2 weeks in a well - controlled study ~ 65 % of MSA patients with nOH remain symptomatic despite treatment 1 12% 35% 53% Droxidopa Fludrocortisone Midodrine Product Shares 01 02 03

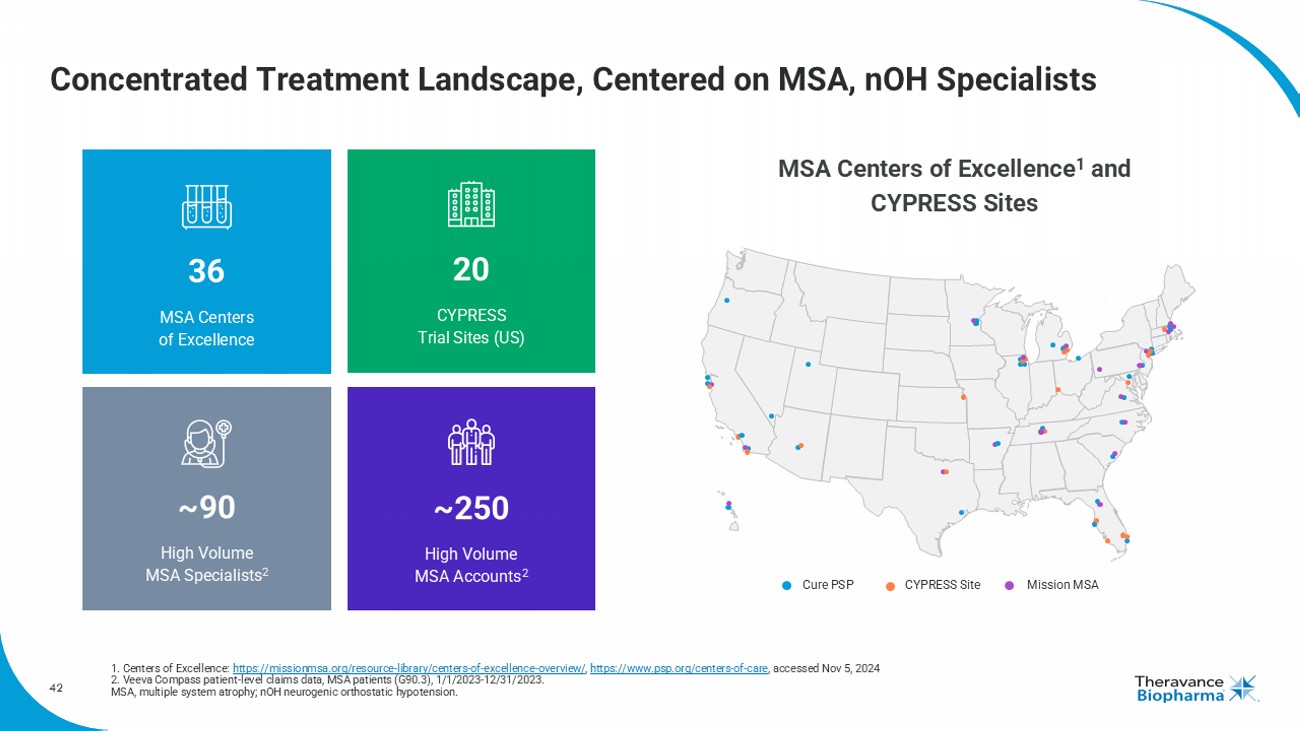

42 Concentrated Treatment Landscape, Centered on MSA, nOH Specialists 1. Centers of Excellence: https://missionmsa.org/resource - library/centers - of - excellence - overview/ , https://www.psp.org/centers - of - care , accessed Nov 5, 2024 2. Veeva Compass patient - level claims data, MSA patients (G90.3), 1/1/2023 - 12/31/2023. MSA, multiple system atrophy; nOH neurogenic orthostatic hypotension. 36 MSA Centers of Excellence 20 CYPRESS Trial Sites (US) ~250 High Volume MSA Accounts 2 ~90 High Volume MSA Specialists 2 MSA Centers of Excellence 1 and CYPRESS Sites 42 Cure PSP CYPRESS Site Mission MSA

43 MSA Patients with nOH Suffer Worse Symptom Burden and Daily Functioning Impact of symptomatic neurogenic orthostatic hypotension ( nOH ) on symptom burden and daily functioning in patients with alpha synucleinopathies . V Iodice , T Guerin, S Johnstone, L Norcliffe - Kaufmann, A Miller, R Vickery. Presented at International Symposium on the Autonomic Nervous System, Nov 6 - 9, 2024, Santa Barbara, CA. AAS, American Autonomic Society; MSA, multiple system atrophy; nOH , neurogenic orthostatic hypotension; OHDAS, orthostatic hypotension daily activity scale; OHSA, orthostatic hypotension symp tom assessment; SBP, systolic blood pressure; SEM, standard error of the mean. Study 0169 Analysis Presented at AAS o Amongst patients with α - synucleinopathies , MSA patients reported the highest symptom burden, most severe impact to activities of daily living and worst quality of life , despite treatment with available anti - hypotensive medications o There remains a significant unmet need for better nOH treatments, especially for MSA patients Baseline Symptom and Daily Activity Impact vs Systolic Blood Pressure

Appendix III: Corporate / Other

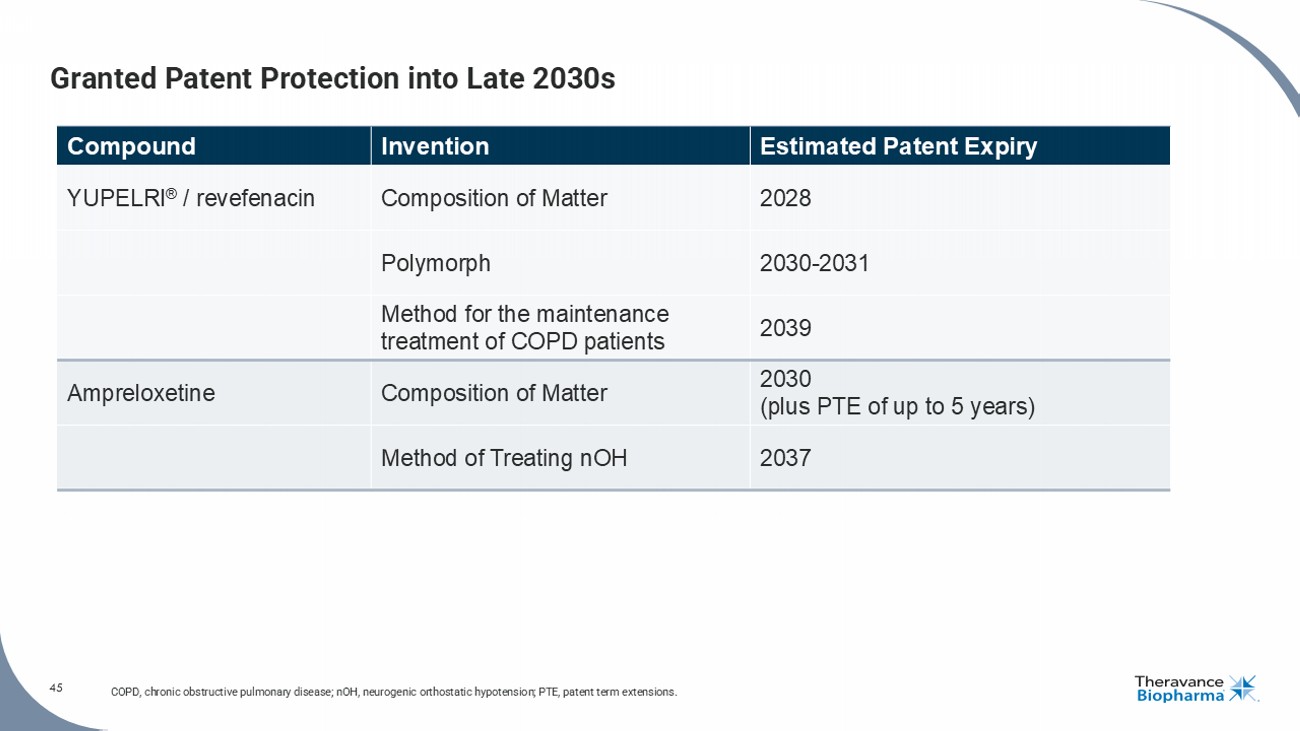

45 Granted Patent Protection into Late 2030s COPD, chronic obstructive pulmonary disease; nOH , neurogenic orthostatic hypotension; PTE, patent term extensions. Estimated Patent Expiry Invention Compound 2028 Composition of Matter YUPELRI ® / revefenacin 2030 - 2031 Polymorph 2039 Method for the maintenance treatment of COPD patients 2030 (plus PTE of up to 5 years) Composition of Matter Ampreloxetine 2037 Method of Treating nOH

Cover |

Nov. 12, 2024 |

|---|---|

| Cover [Abstract] | |

| Document Type | 8-K |

| Amendment Flag | false |

| Document Period End Date | Nov. 12, 2024 |

| Entity File Number | 001-36033 |

| Entity Registrant Name | THERAVANCE BIOPHARMA, INC. |

| Entity Central Index Key | 0001583107 |

| Entity Tax Identification Number | 98-1226628 |

| Entity Incorporation, State or Country Code | E9 |

| Entity Address, Address Line One | C/O Theravance Biopharma US, Inc. |

| Entity Address, Address Line Two | 901 Gateway Boulevard |

| Entity Address, City or Town | South San Francisco |

| Entity Address, Country | CA |

| Entity Address, Postal Zip Code | 94080 |

| City Area Code | 650 |

| Local Phone Number | 808-6000 |

| Written Communications | false |

| Soliciting Material | false |

| Pre-commencement Tender Offer | false |

| Pre-commencement Issuer Tender Offer | false |

| Title of 12(b) Security | Ordinary Share $0.00001 Par Value |

| Trading Symbol | TBPH |

| Security Exchange Name | NASDAQ |

| Entity Emerging Growth Company | false |

1 Year Theravance Biopharma Chart |

1 Month Theravance Biopharma Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com