We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Salisbury Bancorp Inc | NASDAQ:SAL | NASDAQ | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 27.88 | 0.0001 | 30.26 | 0 | 00:00:00 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM

________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of (Date of earliest event reported)

________________________

(Exact name of registrant as specified in its charter)

________________________

|

(State of other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

(Address of principal executive offices) |

|

(Zip Code)

| |||

| Registrant’s telephone number, including area code: ( |

|||||

(Former name or former address, if changed since last report) ________________________ |

|||||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. | Entry into a Material Definitive Agreement. |

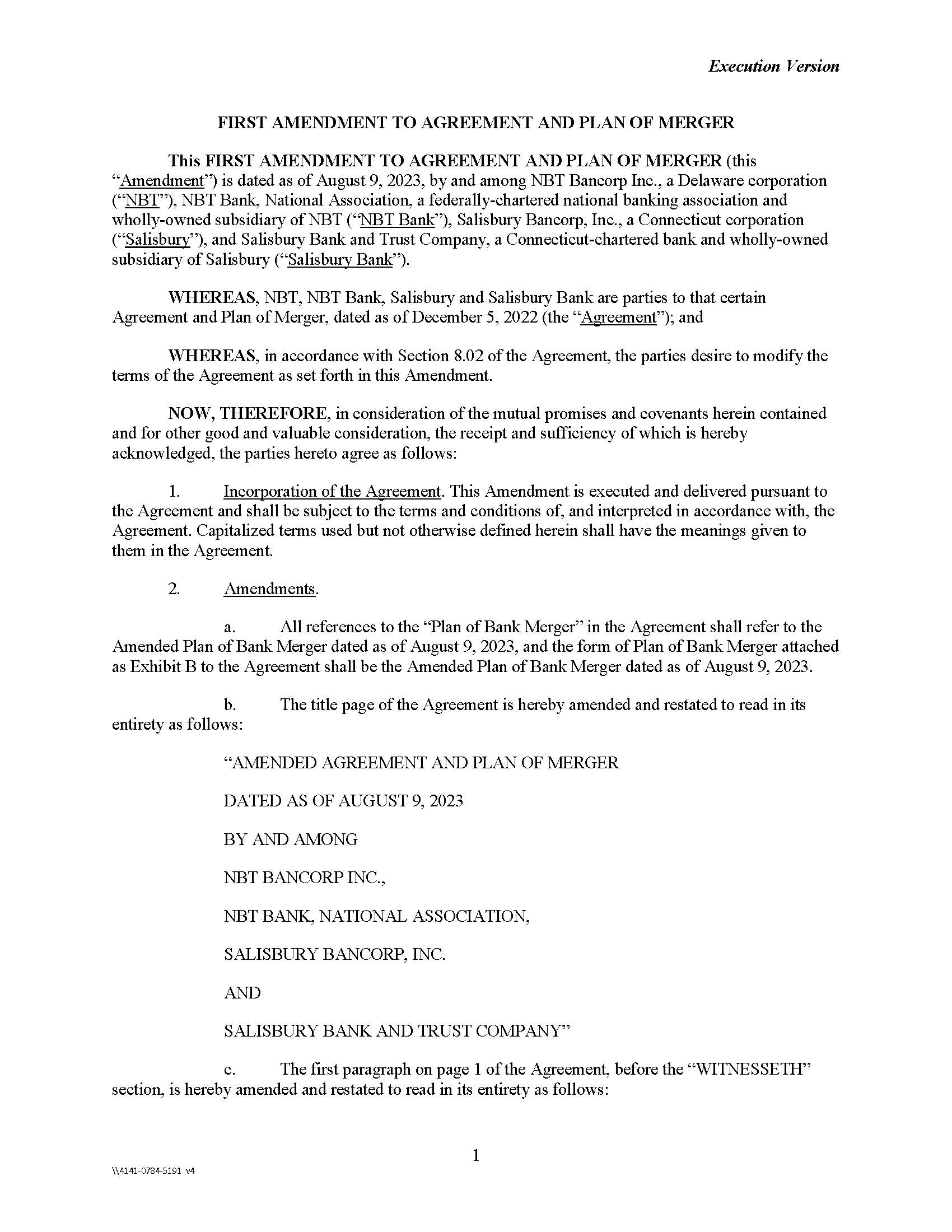

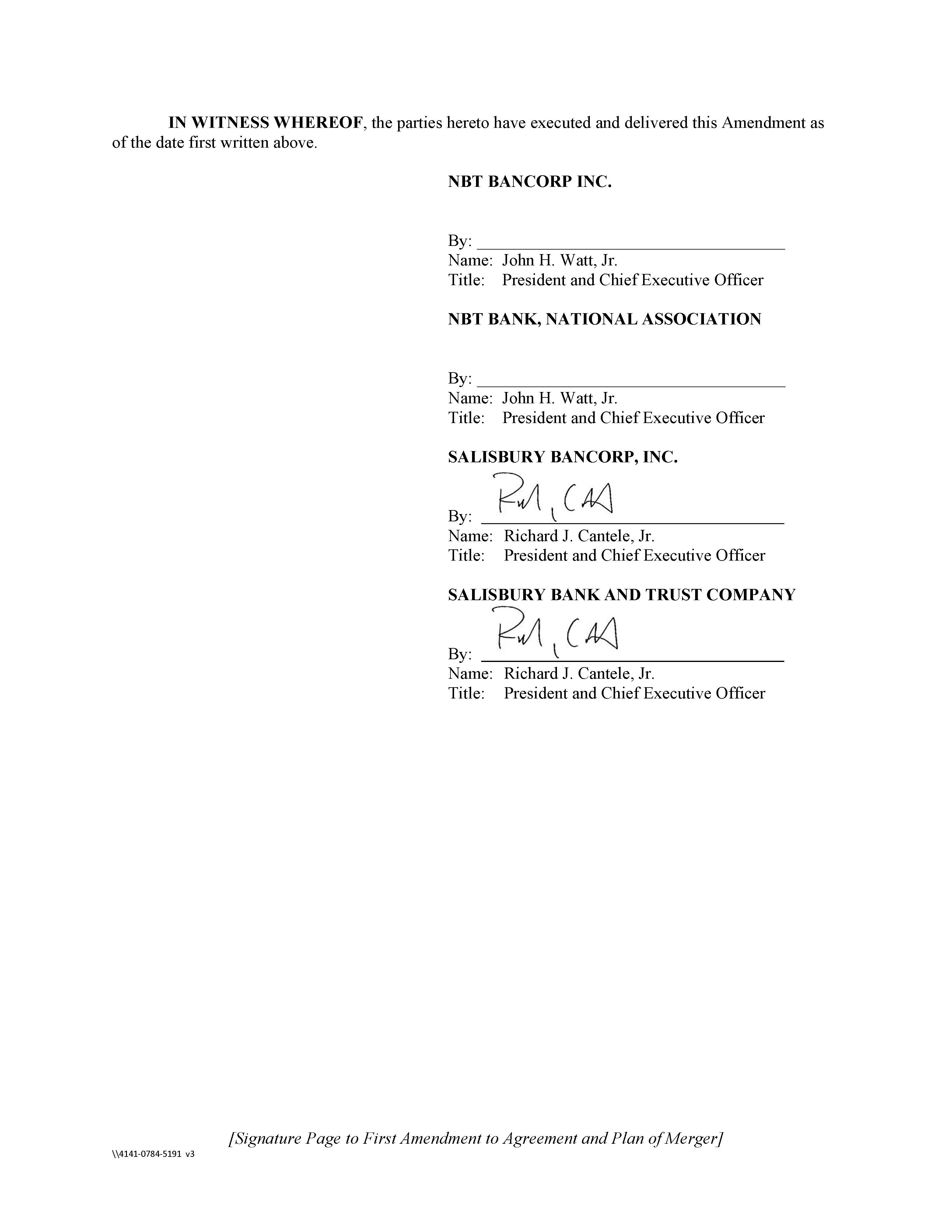

As previously disclosed, on December 5, 2022, Salisbury Bancorp, Inc. (“Salisbury”) and Salisbury Bank and Trust Company, Salisbury’s subsidiary bank (“Salisbury Bank”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with NBT Bancorp Inc. (“NBT”) and NBT Bank, National Association, NBT’s subsidiary bank (“NBT Bank”). The Merger Agreement provided for the acquisition of Salisbury by NBT through the merger of Salisbury with and into NBT, with NBT being the surviving entity, and the merger of Salisbury Bank with and into NBT Bank, with NBT Bank being the surviving entity. The Merger Agreement is filed as Exhibit 2.1 to the Current Report on Form 8-K filed by Salisbury with the Securities and Exchange Commission on December 5, 2022.

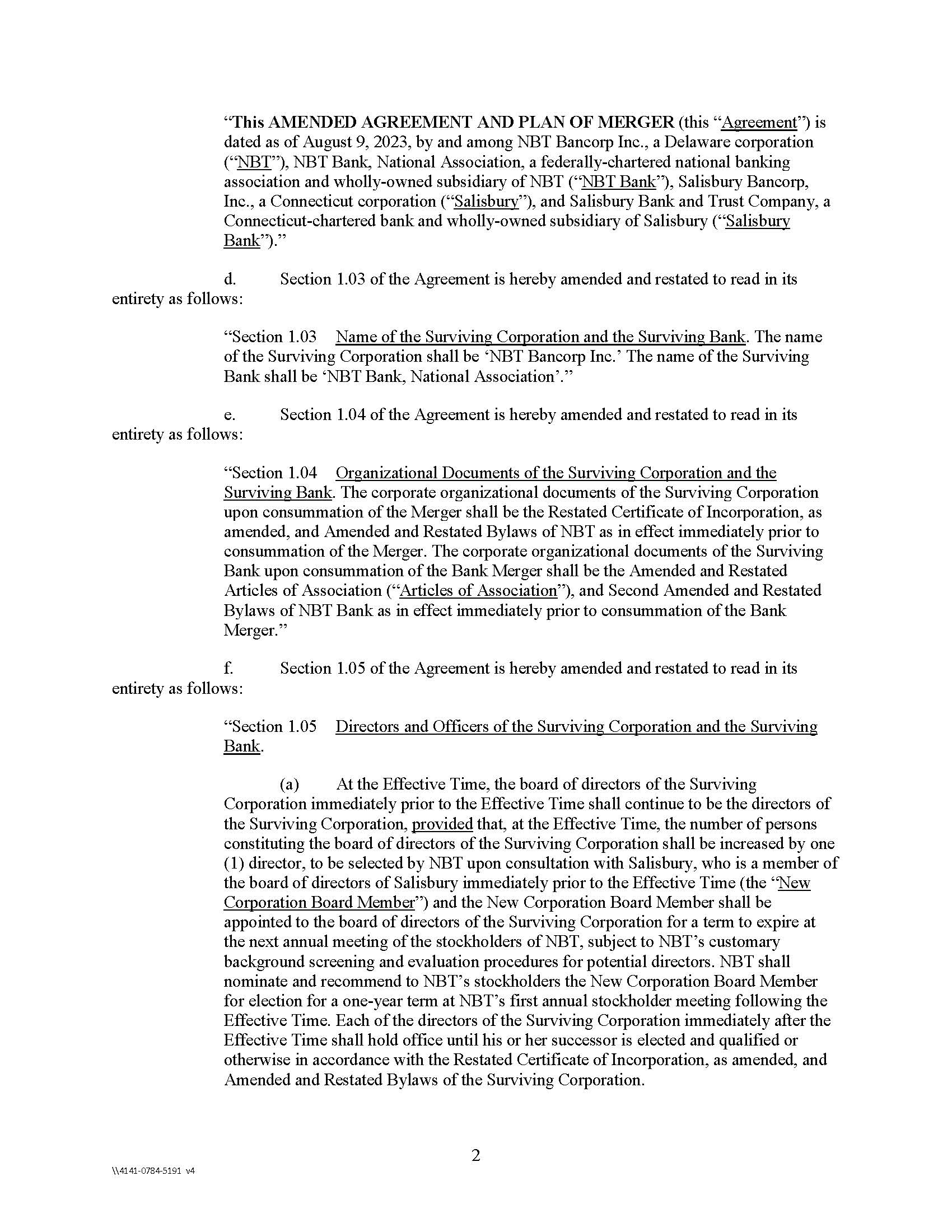

On August 9, 2023, Salisbury, Salisbury Bank, NBT and NBT Bank entered into a First Amendment to Agreement and Plan of Merger (the “Merger Agreement Amendment”) in accordance with Section 8.02 of the Merger Agreement to, among other matters, (i) correct certain typographical errors in the Merger Agreement, (ii) clarify that references to “charter and bylaws” of NBT and NBT Bank in the Merger Agreement refer to the Restated Certificate of Incorporation, as amended, and Amended and Restated Bylaws of NBT and the Articles of Association and Amended and Restated Bylaws of NBT Bank, respectively, and (iii) clarify that the New Bank Board Member (as defined in the Merger Agreement) shall be appointed to the board of directors of NBT Bank by the board of directors of NBT Bank in accordance with the Articles of Association and Amended and Restated Bylaws of NBT Bank.

The foregoing summary of the Merger Agreement Amendment does not purport to be a complete description and is qualified in its entirety by the full text of the Merger Agreement Amendment, which is attached hereto as Exhibit 2.2 and is incorporated herein by reference.

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

On August 11, 2023 (the “Closing Date”), NBT completed its acquisition of Salisbury pursuant to the Merger Agreement. Under the terms of the Merger Agreement, (i) Salisbury merged with and into NBT, with NBT being the surviving entity, and (ii) Salisbury Bank merged with and into NBT Bank, with NBT Bank being the surviving entity (the “Merger”).

Subject to the terms and conditions of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each share of Salisbury common stock was converted into the right to receive 0.7450 shares of NBT common stock, with cash payable in lieu of any fractional shares.

A copy of Salisbury’s press release dated August 14, 2023, announcing the completion of the Merger, is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The foregoing description of the Merger and the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, which is attached as Exhibit 2.1 to the Current Report on Form 8-K filed by Salisbury with the Securities and Exchange Commission on December 5, 2022, and is incorporated by reference herein.

| Item 3.01 | Notice of Delisting. |

On the Closing Date, Salisbury notified NASDAQ that a certificate of merger had been filed with the Secretary of State of the State of Delaware and the Secretary of State of the State of Connecticut and requested that NASDAQ (i) suspend trading of Salisbury Common Stock prior to the opening of trading on August 14, 2023, (ii) withdraw Salisbury Common Stock from listing on NASDAQ prior to the opening of trading on August 14, 2023 and (iii) file with the Securities and Exchange Commission (the “SEC”) notification on Form 25 of delisting of Salisbury common stock and of deregistration under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As a result, Salisbury common stock will no longer be listed on NASDAQ.

NBT, as successor to Salisbury, intends to file with the SEC a certification on Form 15 requesting the termination of registration of Salisbury common stock under Section 12(g) of the Exchange Act and the suspension of reporting obligations under Sections 13 and 15(d) of the Exchange Act.

The information set forth in Item 1.01 and Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.01.

| Item 3.03 | Material Modification to Rights of Security Holders. |

At the Effective Time, each holder of a certificate or book-entry share representing any shares of Salisbury common stock ceased to have any rights with respect thereto, except the right to receive the consideration as described above and subject to the terms and conditions set forth in the Merger Agreement.

The information set forth in Item 1.01, Item 2.01, Item 3.01, Item 5.01, Item 5.02 and Item 5.03 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

| Item 5.01 | Changes in Control of Registrant. |

On August 11, 2023, Salisbury was merged with and into NBT pursuant to the Merger Agreement, with NBT as the surviving corporation in the Merger.

The information set forth in Item 1.01, Item 2.01, Item 3.01, Item 3.03, Item 5.02 and Item 5.03 of this Current Report on Form 8-K is incorporated by reference into this Item 5.01.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

At the Effective Time, in accordance with the terms of the Merger Agreement, Salisbury’s directors and executive officers ceased serving in such capacities.

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

As a result of the Merger, at the Effective Time, Salisbury ceased to exist, and the Certificate of Incorporation and the Bylaws of Salisbury ceased to be in effect by operation of law.

The information set forth in Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.03.

| Item 8.01 | Other Events. |

On August 14, 2023, Salisbury issued a press release announcing the completion of the Merger. A copy of the press release is incorporated herein by reference as Exhibit 99.1.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

* Schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. NBT Bancorp Inc. agrees to furnish supplementally to the SEC a copy of any omitted schedule or exhibit upon request by the SEC.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| SALISBURY BANCORP, INC. | ||||||

| August 14, 2023 | ||||||

| By: |

/s/ Richard J. Cantele, Jr. | |||||

|

Richard J. Cantele, Jr. President and Chief Executive Officer | ||||||

Exhibit 2.2

Exhibit 99.1

NEWS RELEASE

Contact:

Rick Cantele, President and Chief Executive Officer

Salisbury Bancorp, Inc.

5 Bissell Street

Lakeville, CT 06039

860.435.9801

rcantele@salisburybank.com

FOR IMMEDIATE RELEASE

Salisbury banCORP, INC. COMPLETES MERGER WITH NBT BANCORP INC.

Lakeville, Connecticut, August 14, 2023 / GlobeNewswire…Salisbury Bancorp, Inc. (“Salisbury”), (NASDAQ Capital Market: “SAL”), the holding company for Salisbury Bank and Trust Company (“Salisbury Bank”), announced that it completed its merger with and into NBT Bancorp Inc. (“NBT”) (NASDAQ: NBTB) (the “Merger”) on August 11, 2023.

Salisbury’s President and Chief Executive Officer, Richard J. Cantele, Jr., stated, “We are excited about the consummation of our strategic merger with NBT. We believe Salisbury shareholders will benefit from the additional scale and expanded suite of products and services offered by NBT. I am extremely proud of the employees of Salisbury Bank who have worked diligently over the years to provide outstanding service to our customers and to give back to our communities. I am also grateful to our many customers for allowing us to partner and grow with them. I am confident that our customers will experience the same level of service from NBT.”

Background

Salisbury Bancorp, Inc. is the parent company of Salisbury Bank and Trust Company, a Connecticut chartered commercial bank serving the communities of northwestern Connecticut and proximate communities in New York and Massachusetts, since 1848, through full service branches in Canaan, Lakeville, Salisbury and Sharon, Connecticut; Great Barrington, South Egremont and Sheffield, Massachusetts; and Dover Plains, Fishkill, Millerton, Newburgh, New Paltz, and Poughkeepsie, New York.

Forward Looking Statements

This communication contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements about Salisbury and their industry involve substantial risks and uncertainties. Statements other than statements of current or historical fact, including statements regarding Salisbury’s future financial condition, results of operations, business plans, liquidity, cash flows, projected costs, and the impact of any laws or regulations applicable to Salisbury, are forward-looking statements. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “may,” “will,” “should” and other similar expressions are intended to identify these forward-looking statements. Such statements are subject to factors that could cause actual results to differ materially from anticipated results.

Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements include, but are not limited to the following: (1) the businesses of NBT and Salisbury may not be combined successfully, or such combination may take longer to accomplish than expected; (2) the cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) the possibility that NBT may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all or to successfully integrate Salisbury’s operations and those of NBT; (5) such integration may be more difficult, time consuming or costly than expected; (6) revenues following the proposed transaction may be lower than expected; (7) NBT’s success in executing its business plan and strategy and managing the risks involved in the foregoing; (8) the dilution caused by NBT’s issuance of additional shares of its capital stock in connection with the proposed transaction; (9) changes in general economic conditions, including changes in market interest rates and changes in monetary and fiscal policies of the federal government; (10) legislative and regulatory changes; and (11) uncertainty as to the extent of the duration, scope, and impacts of the COVID-19 pandemic on NBT. Further information about these and other relevant risks and uncertainties may be found in Salisbury’s and NBT’s respective Annual Reports on Form 10-K for the fiscal year ended December 31, 2022 and in subsequent filings with the SEC.

Forward-looking statements speak only as of the date they are made. Salisbury does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. You are cautioned not to place undue reliance on these forward-looking statements.

Cover |

Aug. 11, 2023 |

|---|---|

| Cover [Abstract] | |

| Document Type | 8-K |

| Amendment Flag | false |

| Document Period End Date | Aug. 11, 2023 |

| Current Fiscal Year End Date | --12-31 |

| Entity File Number | 001-14854 |

| Entity Registrant Name | SALISBURY BANCORP, INC. |

| Entity Central Index Key | 0001060219 |

| Entity Tax Identification Number | 06-1514263 |

| Entity Incorporation, State or Country Code | CT |

| Entity Address, Address Line One | 5 Bissell Street |

| Entity Address, City or Town | Lakeville |

| Entity Address, State or Province | CT |

| Entity Address, Postal Zip Code | 06039 |

| City Area Code | 860 |

| Local Phone Number | 435-9801 |

| Written Communications | false |

| Soliciting Material | false |

| Pre-commencement Tender Offer | false |

| Pre-commencement Issuer Tender Offer | false |

| Title of 12(b) Security | Common Stock, $0.10 par value per share |

| Trading Symbol | SAL |

| Security Exchange Name | NASDAQ |

| Entity Emerging Growth Company | false |

1 Year Salisbury Bancorp Chart |

1 Month Salisbury Bancorp Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions