We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| MMTec Inc | NASDAQ:MTC | NASDAQ | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| -0.01 | -0.87% | 1.14 | 1.14 | 1.15 | 1.165 | 1.14 | 1.15 | 12,241 | 14:42:08 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K/A

(Amendment No. 2)

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission File Number: 001-38766

MMTEC, INC.

(Translation of registrant’s name into English)

c/o MM Future Technology Limited

Room 2302, 23rd Floor

FWD Financial Center

308 Des Voeux Road Central

Sheung Wan, Hong Kong

Tel: + 852 36908356

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-________.

Completion of Acquisition or Disposition of Assets.

On June 7, 2023, MMTec, Inc., a British Virgin Islands company (“MMTec” or the “Company”), completed its previously announced acquisition of Alpha Mind Technology Limited, a British Virgin Islands company (“Alpha Mind”), pursuant to an Equity Acquisition Agreement dated May 16, 2023 between MMtec, Alfa Crest Investment Limited, a British Virgin Islands company (“Alfa Crest”), CapitoLabs Limited, a British Virgin Islands company (“CapitoLabs”, and together with Alfa Crest, the “Sellers”) and Alpha Mind.

On June 8, 2023, MMtec filed a Current Report on Form 6-K (the “Prior Report”) with the Securities and Exchange Commission to report the completion of the acquisition and other related matters. On August 29, 2023, MMTec filed Amendment No. 1 to the Prior Report, which provided the audited financial statements of Alpha Mind as of and for the years ended December 31, 2022 and 2021, and pro forma financial information as of and for the year ended December 31, 2022. MMTec is filing this Amendment No. 2 to the Prior Report to provide the audited financial statements of Alpha Mind as of May 31, 2023 and for the five months ended May 31, 2023, and the accompanying notes thereto and the related Independent Auditor’s Report, which are filed as Exhibit 99.1 and incorporated herein by reference.

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| MMTEC, INC. | |||

| By: | /s/ Min Kong | ||

| Name: | Min Kong | ||

| Title: | Chief Financial Officer | ||

| Date: January 25, 2024 | |||

2

Exhibit 23.1

|

Assentsure PAC |

| UEN – 201816648N | |

| 180B Bencoolen Street #03-01 | |

| The Bencoolen Singapore 189648 | |

| http://www.assentsure.com.sg |

Consent of Independent Registered Public Accounting Firm

We hereby consent to the incorporation of our report dated January 25, 2024 on Form 6-K/A of MMtec Inc, under the Securities Act of 1934 with respect to the consolidated balance sheet of Alpha Mind Technology Limited as of May 31, 2023, and the related consolidated statements of operations and comprehensive income, changes in equity, and cash flows, for the period from January 1, 2023 to May 31, 2023 and the related notes.

/s/ Assentsure PAC

Singapore

January 25, 2024

Exhibit 23.2

Consent of Independent Registered Public Accounting Firm

We hereby consent to the incorporation of our report dated August 29, 2023 in the Report of MMTEC, INC. on the Amendment No.2 to the Registration Statement Form 6-K, with respect to the consolidated balance sheets of Alpha Mind Technology Limited, its subsidiaries, and variable interest entities (collectively the “Company”) as of December 31, 2022, and the related consolidated statements of income (loss) and comprehensive income (loss), shareholders’ equity, and cash flows for the year ended December 31, 2022, and the related notes included herein.

| /s/ WWC, P.C. | |

| San Mateo, California | WWC, P.C. |

| January 25, 2024 | Certified Public Accountants |

| PCAOB ID: 1171 |

Exhibit 99.1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the shareholders and the board of directors of MMTEC, INC.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheet of Alpha Mind Technology Limited (the “Company”) as of May 31, 2023, the related consolidated statements of operations and comprehensive income, changes in equity, and cash flows, for the period from January 1, 2023 to May 31, 2023, and the related notes (collectively referred to as the “Financial Statements”). In our opinion, the Financial Statements present fairly, in all material respects, the consolidated financial position of the Company as of May 31, 2023, and the consolidated results of its operations and its cash flows for the period from January 1, 2023 to May 31, 2023, in conformity with accounting principles generally accepted in the United States.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (the “PCAOB”) and are required to be independent with respect to the Company in accordance with the United States federal securities laws. and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

| /s/ Assentsure PAC | |

| Singapore | |

| January 25, 2024 | |

| PCAOB ID Number 6783 |

1

ALPHA MIND TECHNOLOGY LIMITED AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| As of | ||||||||

| May

31, 2023 | December 31, 2022 | |||||||

| US$ | US$ | |||||||

| CURRENT ASSETS: | ||||||||

| Cash and cash equivalents | $ | 916,840 | $ | 341,743 | ||||

| Accounts receivable, net | 1,963,755 | 2,892,960 | ||||||

| Prepayments | 999,253 | 1,412,266 | ||||||

| Other receivables, net | 32,009 | 31,227 | ||||||

| Due from related parties | 46,174 | 20,784 | ||||||

| Short-term investment | 271,381 | 273,182 | ||||||

| Other current assets | 62,254 | 100,558 | ||||||

| Total Current Assets | 4,291,666 | 5,072,720 | ||||||

| NON-CURRENT ASSETS: | ||||||||

| Restricted cash- Non-current | 706,005 | 717,916 | ||||||

| Property and equipment, net | 58,601 | 68,541 | ||||||

| Operating lease right-of-use assets | 57,798 | — | ||||||

| Deferred tax assets | 72,228 | 25,360 | ||||||

| Total Non-current Assets | 894,632 | 811,817 | ||||||

| Total Assets | $ | 5,186,298 | $ | 5,884,537 | ||||

| CURRENT LIABILITIES: | ||||||||

| Accounts payable | $ | 1,405,135 | $ | 2,496,587 | ||||

| Salary payable | 42,763 | 65,709 | ||||||

| Other payables | 771,676 | 780,247 | ||||||

| Due to related parties | 40,494 | 16,723 | ||||||

| Taxes payable | 43,833 | 154,585 | ||||||

| Advance from customer | 93 | 5,306 | ||||||

| Operating lease liabilities - Current | 33,170 | — | ||||||

| Total Current Liabilities | 2,337,164 | 3,519,157 | ||||||

| NON-CURRENT LIABILITIES: | ||||||||

| Operating lease liabilities - Non-current | 14,831 | — | ||||||

| Total Non-current Liabilities | 14,831 | — | ||||||

| Total Liabilities | 2,351,995 | 3,519,157 | ||||||

| SHAREHOLDERS’ EQUITY: | ||||||||

| Common shares (par value $1.00 per share; 50,000 shares authorized as of April 17, 2023) | 50,000 | 50,000 | ||||||

| Subscription receivable | (50,000 | ) | (50,000 | ) | ||||

| Additional paid-in capital | 8,649,321 | 8,649,321 | ||||||

| Accumulated deficit | (5,112,005 | ) | (5,636,318 | ) | ||||

| Accumulated other comprehensive loss | (703,013 | ) | (647,623 | ) | ||||

| Total Shareholders’ Equity | 2,834,303 | 2,365,380 | ||||||

| Total Liabilities and Shareholders’ Equity | $ | 5,186,298 | $ | 5,884,537 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

2

ALPHA MIND TECHNOLOGY LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

| For the Five Months Ended | ||||||||

| May

31, 2023 | May

31, 2022 | |||||||

| US$ | US$ | |||||||

| REVENUE | $ | 16,415,780 | $ | 17,470,353 | ||||

| COST OF REVENUE | (15,350,247 | ) | (16,258,326 | ) | ||||

| GROSS PROFIT | 1,065,533 | 1,212,027 | ||||||

| OPERATING EXPENSES: | ||||||||

| Selling and marketing | (531,072 | ) | (430,488 | ) | ||||

| General and administrative | ||||||||

| Payroll and related benefits | (322,096 | ) | (352,441 | ) | ||||

| Other general and administrative | (134,075 | ) | (385,668 | ) | ||||

| Total Operating Expenses | (987,243 | ) | (1,168,597 | ) | ||||

| INCOME FROM OPERATIONS | 78,290 | 43,430 | ||||||

| OTHER INCOME (EXPENSE): | ||||||||

| Interest income | 784 | 389 | ||||||

| Interest expense | (2,376 | ) | (5,790 | ) | ||||

| Other income, net | 401,778 | 192,125 | ||||||

| Total Other income, net | 400,186 | 186,724 | ||||||

| INCOME BEFORE INCOME TAXES | 478,476 | 230,154 | ||||||

| INCOME TAXES | 45,837 | 12,404 | ||||||

| NET INCOME | $ | 524,313 | $ | 242,558 | ||||

| OTHER COMPREHENSIVE LOSS | ||||||||

| Foreign currency translation adjustments | (55,390 | ) | (141,864 | ) | ||||

| COMPREHENSIVE INCOME | $ | 468,923 | $ | 100,694 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

3

ALPHA MIND TECHNOLOGY LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

| Common Shares | Additional | Accumulated Other | Total | |||||||||||||||||||||||||

| Number of Shares | Amount | Subscription Receivable | Paid-in Capital | Accumulated Deficit | Comprehensive Loss | Shareholders’ Equity | ||||||||||||||||||||||

| US$ | US$ | US$ | US$ | US$ | US$ | |||||||||||||||||||||||

| Balance, January 1, 2022 | 50,000 | $ | 50,000 | $ | (50,000 | ) | $ | 8,205,976 | $ | (5,110,749 | ) | $ | (409,803 | ) | $ | 2,685,424 | ||||||||||||

| Net income for the five months ended May 31, 2022 | - | - | - | - | 242,558 | - | 242,558 | |||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | - | (141,864 | ) | (141,864 | ) | |||||||||||||||||||

| Balance, May 31, 2022 | 50,000 | $ | 50,000 | $ | (50,000 | ) | $ | 8,205,976 | $ | (4,868,191 | ) | $ | (551,667 | ) | $ | 2,786,118 | ||||||||||||

| Common Shares | Additional | Accumulated Other | Total | |||||||||||||||||||||||||

| Number of Shares | Amount | Subscription Receivable | Paid-in Capital | Accumulated Deficit | Comprehensive Loss | Shareholders’ Equity | ||||||||||||||||||||||

| US$ | US$ | US$ | US$ | US$ | US$ | |||||||||||||||||||||||

| Balance, January 1, 2023 | 50,000 | $ | 50,000 | $ | (50,000 | ) | $ | 8,649,321 | $ | (5,636,318 | ) | $ | (647,623 | ) | $ | 2,365,380 | ||||||||||||

| Net income for the five months ended May 31, 2023 | - | - | - | - | 524,313 | - | 524,313 | |||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | - | (55,390 | ) | (55,390 | ) | |||||||||||||||||||

| Balance, May 31, 2023 | 50,000 | $ | 50,000 | $ | (50,000 | ) | $ | 8,649,321 | $ | (5,112,005 | ) | $ | (703,013 | ) | $ | 2,834,303 | ||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

ALPHA MIND TECHNOLOGY LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

| For the Five Months Ended | ||||||||

| May 31, | ||||||||

| 2023 | 2022 | |||||||

| US$ | US$ | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net income | $ | 524,313 | $ | 242,558 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation expense | 9,056 | 9,259 | ||||||

| Allowance for bad debts | 1,584 | 86,822 | ||||||

| Deferred taxes expense | (48,648 | ) | (23,316 | ) | ||||

| Noncash other expense | 34,004 | - | ||||||

| Gain on short-term investment | (2,810 | ) | (4,620 | ) | ||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 904,955 | 1,117,970 | ||||||

| Advance to suppliers | 400,781 | 216,570 | ||||||

| Due from related parties | (25,390 | ) | (14,597 | ) | ||||

| Prepaid expenses and other current assets | 35,267 | 37,860 | ||||||

| Operating lease right-of-use assets | (93,464 | ) | - | |||||

| Accounts payable | (1,080,160 | ) | (1,564,239 | ) | ||||

| Salary payable | (22,484 | ) | (21,403 | ) | ||||

| Lease liabilities | 47,859 | - | ||||||

| Accrued liabilities and other payables | (111,540 | ) | 48,606 | |||||

| Net cash provided by operating activities | 573,323 | 131,470 | ||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchase of short-term investment | - | (124,293 | ) | |||||

| Cash used in investing activities | - | (124,293 | ) | |||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Cash borrowed from related parties | 23,771 | - | ||||||

| Repayments to related parties | - | (38,720 | ) | |||||

| Cash provided by (used in) financing activities | 23,771 | (38,720 | ) | |||||

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS AND RESTRICTED CASH | 597,094 | (31,543 | ) | |||||

| Effect of exchange rate changes on cash | (33,908 | ) | (54,404 | ) | ||||

| CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF YEAR | 1,059,659 | 1,296,256 | ||||||

| CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AT END OF YEAR | $ | 1,622,845 | $ | 1,210,309 | ||||

| RECONCILIATION OF CASH, CASH EQUIVALENTS AND RESTRICTED CASH | ||||||||

| Cash and cash equivalents at beginning of year | $ | 341,743 | $ | 512,028 | ||||

| Restricted cash at beginning of year | 717,916 | 784,228 | ||||||

| Total cash, cash equivalents and restricted cash at beginning of year | $ | 1,059,659 | $ | 1,296,256 | ||||

| Cash and cash equivalents at end of year | $ | 916,840 | $ | 459,637 | ||||

| Restricted cash at end of year | 706,005 | 750,672 | ||||||

| Total cash, cash equivalents and restricted cash at end of year | $ | 1,622,845 | $ | 1,210,309 | ||||

| SUPPLEMENTAL CASH FLOW INFORMATION: | ||||||||

| Cash paid for income tax | $ | (2,810 | ) | $ | (1,659 | ) | ||

| Cash paid for interest | $ | (2,376 | ) | $ | (5,790 | ) | ||

The accompanying notes are an integral part of these consolidated financial statements.

5

NOTE 1 – ORGANIZATION AND NATURE OF OPERATIONS

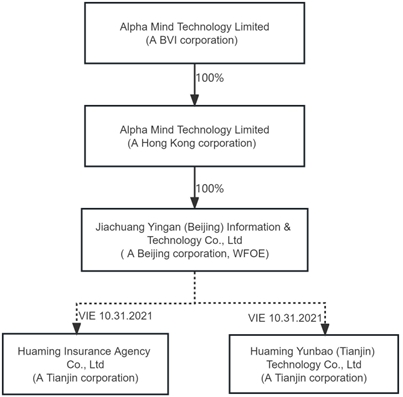

Alpha Mind Technology Limited (“Alpha Mind BVI” or the “Group”) is a holding company incorporated on April 17, 2023, under the laws of British Virgin Islands (the “BVI”). The Group has no substantive operations other than holding all of the outstanding capital shares of Alpha Mind Technology Limited (“Alpha Mind HK”), which is also a holding company incorporated in Hong Kong, China on October 19, 2021. All of the issued shares of Alpha Mind HK were transferred to Alpha Mind BVI on April 19, 2023. As a result, Alpha Mind BVI completed the acquisition of Alpha Mind HK. As this acquisition was a transaction under common control, the financial statements of the Group retroactively reflect the accounts for the periods prior to the acquisition.

The Group operates as an agency to sell insurance products in the People’s Republic of China (“PRC” or “China”), through variable interest entities (“VIE”), Huaming Insurance Agency Co., Ltd (“Huaming Insurance”), which was established on March 7, 2014, and Huaming Yunbao (Tianjin) Technology Co., Ltd (“Huaming Yunbao”), which was established on May 8, 2015.

On April 13, 2022, Alpha Mind HK became the sole shareholder of Jiachuang Yingan (Beijing) Information & Technology Inc. (“Jiachuang Yingan” or the “WFOE”), a Beijing, China company incorporated on August 2, 2019. Jiachuang Yingan entered into a series of contractual arrangements, or VIE agreements with Huaming Insurance, Huaming Yunbao, and the equity holders of Huaming Insurance and Huaming Yunbao, through which the Group obtained control and became the primary beneficiary of Huaming Insurance and Huaming Yunbao. As a result, Huaming Insurance and Huaming Yunbao became the Group’s VIE.

The structure of the Group as follows:

Contractual Arrangements

The Group, through the WFOE, has the following contractual arrangements with the VIE and its shareholders that enable the Group to (1) direct the activities that most significantly affect the economic performance of the VIE, and (2) receive the economic benefits of the VIE that could be significant to the VIE. Accordingly, the WFOE was considered the primary beneficiary of the VIE and had consolidated the VIE’s financial results of operations, assets and liabilities in the Group’s consolidated financial statements.

6

The significant terms of the Contractual Arrangements are as follows:

Exclusive Business Cooperation Agreement

Pursuant to the exclusive business cooperation agreement between the WFOE, Huaming Insurance and Huaming Yunbao, the WFOE has the exclusive right to provide Huaming Insurance and Huaming Yunbao with technical support services, consulting services and other services requested by Huaming Insurance and Huaming Yunbao from time to time, to the extent permitted under PRC law. In exchange, the WFOE is entitled to a service fee that is equal to all of the consolidated net income of each of Huaming Insurance and Huaming Yunbao. The service fee may be adjusted by the WFOE based on the actual scope of services rendered by the WFOE and the operational needs and expanding demands of Huaming Insurance and Huaming Yunbao. Pursuant to the exclusive business cooperation agreement, the service fees may be adjusted based on the actual scope of services rendered by the WFOE and the operational needs of Huaming Insurance and Huaming Yunbao.

The exclusive business cooperation agreement will remain in effect unless terminated in writing by Jiachuang Yingan, or in accordance with the following provision of the agreement:

During the term of the exclusive business cooperation agreement, the WFOE and Huaming Insurance and Huaming Yunbao shall renew the operation term prior to the expiration thereof so as to enable the exclusive business cooperation agreement to remain effective. The exclusive business cooperation agreement shall be terminated upon the expiration of the operation term of either the WFOE or Huaming Insurance and Huaming Yunbao if the application for renewal of the operation term is not approved by relevant government authorities. If an application for renewal of the operation term is not approved, according to the PRC Company Law, the expiration of the operation term may lead to the dissolution and cancellation of such PRC company.

Exclusive Option Agreement

Pursuant to the exclusive option agreement among the WFOE, Huaming Insurance and Huaming Yunbao, and the shareholders who collectively owned all of Huaming Insurance and Huaming Yunbao, such shareholders jointly and severally granted the WFOE an option to purchase their equity interests in Huaming Insurance and Huaming Yunbao. The purchase price upon exercise of the option will be the lowest price then permitted under applicable PRC laws. The WFOE or its designated person may exercise such option at any time to purchase all or part of the equity interests in Huaming Insurance and Huaming Yunbao until it has acquired all equity interests of Huaming Insurance and Huaming Yunbao, which is irrevocable during the term of the agreement.

The exclusive option agreement remains in effect until all equity interest held by shareholders in Huaming Insurance and Huaming Yunbao have been transferred or assigned to Jiachuang Yingan WFOE and/or any other person designated by the Jiachuang Yingan WFOE in accordance with such agreement.

Equity Interest Pledge Agreements

Pursuant to the equity interest pledge agreements, among the WFOE, Huaming Insurance, Huaming Yunbao, and the shareholders who collectively owned all of Huaming Insurance and Huaming Yunbao, such shareholders pledged all of the equity interests in Huaming Insurance and Huaming Yunbao to the WFOE as collateral to secure the obligations of Huaming Insurance and Huaming Yunbao under the exclusive business cooperation agreement and exclusive option agreements. These shareholders are prohibited from transferring the pledged equity interests without the prior consent of the WFOE unless transferring the equity interests to the WFOE or its designated person in accordance with the exclusive option agreements.

The equity interest pledge agreements will remain in effect until all of the obligations to the WFOE have been fulfilled completely by Huaming Insurance and Huaming Yunbao.

7

Shareholders’ Powers of Attorney (“POAs”)

Pursuant to the POAs, the shareholders of Huaming Insurance and Huaming Yunbao have given the WFOE an irrevocable proxy to act on their behalf on all matters pertaining to Huaming Insurance and Huaming Yunbao, and to exercise all of their rights as shareholders of Huaming Insurance and Huaming Yunbao, including the right to (i) attend shareholders meeting(s); (ii) exercise voting rights and all of the other rights including but not limited to the sale or transfer or pledge or disposition of their shares held in part or in whole; (iii) designate and appoint on behalf of the shareholders the legal representative, the directors, supervisors, the chief executive officer and other senior management members of Huaming Insurance and Huaming Yunbao; and (iv) to sign transfer documents and any other documents in relation to the fulfillment of the obligations under the exclusive option agreements and the equity interest pledge agreements. The POAs remain in effect while the shareholders of Huaming Insurance and Huaming Yunbao hold the equity interests in Huaming Insurance and Huaming Yunbao.

Spousal Consent Letters

Pursuant to the spousal consent letters, the spouses of the shareholders of Huaming Insurance and Huaming Yunbao commit that they have no right to make any assertions in connection with the equity interests of Huaming Insurance and Huaming Yunbao, which are held by the shareholders. In the event that the spouses obtain any equity interests of Huaming Insurance and Huaming Yunbao, which are held by the shareholders, for any reasons, the spouses of the shareholders shall be bound by the exclusive option agreement, the equity interest pledge agreement, the relevant POA, and the exclusive business cooperation agreement, and will comply with the obligations thereunder as a shareholder of Huaming Insurance and Huaming Yunbao. The spousal consent letters are irrevocable, and shall not be withdrawn without the consent of the WFOE.

Based on the foregoing contractual arrangements, which grant the WFOE effective control of Huaming Insurance and Huaming Yunbao and enable the WFOE to receive all of their expected residual returns, the Group accounts for Huaming Insurance and Huaming Yunbao as a VIE. Accordingly, the Group consolidates the accounts of Huaming Insurance and Huaming Yunbao for the periods presented herein, in accordance with Item 3A-02 of Regulation S-X promulgated by the Securities Exchange Commission (“SEC”), and Accounting Standards Codification (“ASC”) 810-10, Consolidation.

NOTE 2 – BASIS OF PRESENTATION

The accompanying consolidated financial statements and related notes have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and with the rules and regulations of the SEC for financial information, and include all normal and recurring adjustments that management of the Group considers necessary for a fair presentation of its financial position and operational results.

The consolidated financial statements include the financial statements of the Group and its subsidiaries, which include the wholly-owned foreign enterprise and VIE, over which the Group exercises control and, when applicable, entities for which the Group has a controlling financial interest or is the primary beneficiary for accounting purposes. The WFOE is deemed to have a controlling financial interest and be the primary beneficiary for accounting purposes of Huaming Insurance and Huaming Yunbao because it has both of the following characteristics: (1) the power to direct activities at Huaming Insurance and Huaming Yunbao that most significantly impact such entity’s economic performance, and (2) the right to receive benefits from Huaming Insurance and Huaming Yunbao that could potentially be significant to such entity. All transactions and balances among the Group and its subsidiaries have been eliminated upon consolidation.

The Group adopted a fiscal year end of December 31st.

8

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates and Assumptions

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that effect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

Significant estimates and assumptions reflected in the Group’s financial position as of May 31, 2023, and results of operation and cash flows for the five months that ended May 31, 2023, and 2022 include, but not are not limited to, the allowance for doubtful accounts, the useful life of property and equipment, and assumptions used in assessing impairment of long-lived assets, revenue recognition, deferred tax assets and the associated valuation allowance. Management bases the estimates on historical experience and various other assumptions that are believed to be reasonable, the results of which form the basis for making judgments about the carrying values of assets and liabilities. Actual results could materially differ from those estimates.

Foreign Currency Translation

The reporting currency of the Group is the U.S. dollar (“USD”). The functional currency of Jiachuang Yingan (Beijing) Information & Technology Co., Ltd, Huaming Insurance Agency Co., Ltd and Huaming Yunbao (Tianjin) Technology Co., Ltd is the Renminbi (“RMB”). The functional currency of Alpha Mind Technology Limited (HK) is the Hong Kong dollar (“HKD”). The financial statements of the Group’s subsidiaries whose functional currency is the RMB and HKD are translated to USD using period end rates of exchange for assets and liabilities, average rates of exchange for revenue and expenses and cash flows, and historical exchange rates for equity. As a result, amounts relating to assets and liabilities reported on the statements of cash flows may not necessarily align with the changes in the corresponding balances on the balance sheets. Translation adjustments resulting from the process of translating the local currency financial statements into USD are included in determining comprehensive income/loss.

All of the Group’s revenue and expense transactions are transacted in its functional currency. The Group does not enter into any material transaction in foreign currencies. Transaction gains or losses have not had, and are not expected to have, a material effect on the results of operations of the Group.

The consolidated balance sheet amounts, with the exception of equity, at May 31, 2023, and December 31, 2022, were translated at RMB 7.0821 to $1.00 and at RMB 6.9646 to $1.00, respectively. Equity accounts were stated at their historical rates. The average translation rates applied to consolidated statements of income and cash flows for the five months ended May 31, 2023 and 2022 were RMB 6.8842 and RMB 6.7261 to $1.00, respectively.

Cash and Cash Equivalents

The Group considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. Cash and cash equivalents are comprised primarily of bank accounts. At May 31, 2023, and December 31, 2022, cash and cash equivalents balances held in China amounted to $916,840 and $341,743, respectively.

9

Restricted Cash

The Group, as an insurance agency, is required to reserve 10% of its registered capital in cash held in an escrow bank account pursuant to the China Banking and Insurance Regulatory Commission (“CBIRC”) rules and regulations, in order to protect insurance premium appropriation by insurance agency which is restricted as to withdrawal for other than current operations. Thus, the Group classified the balance for guarantee deposit as a non-current asset. As of May 31, 2023 and December 31, 2022, the non-current restricted cash amounted to $706,005 and $717,916, respectively.

Concentrations of Credit Risk

The Group has operations carried out in China. Accordingly, the Group’s business, financial condition and results of operations may be influenced by the political, economic and legal environment in China, and by the general state of China’s economy. The Group’s operations in China are subject to specific considerations and significant risks not typically associated with companies in North America. The Group’s results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

Accounts Receivable, Net

Accounts receivable represents insurance agency service fees or commission receivables on insurance products sold from insurance companies stated at net realizable values. The Group reviews its accounts receivable on a periodic basis to determine if the bad debt allowance is adequate, and adjusts the allowance when necessary.

In establishing the allowance for doubtful accounts, management considers historical collection experience, aging of the receivables, the economic environment, industry trend analysis, and the credit history and financial conditions of the customers. Accounts are written off after exhaustive efforts at collection.

As of May 31, 2023. and December 31, 2022, allowance for doubtful accounts were $39,264 and $38,360 respectively.

Other Receivables, Net

Other receivables primarily include advances to employees and other deposits. Management regularly reviews the aging of receivables and changes in payment trends and records allowances when management believes collection of amounts due are at risk. Accounts considered uncollectable are written off against allowances after exhaustive collection efforts are made.

As of May 31, 2023, and December 31, 2022, allowances for doubtful accounts were $601,238 and $611,382, respectively.

Prepayments

Prepayments are advances to suppliers for future service renderings. As of May 31, 2023, and December 31, 2022, prepayments amounted to $999,253 and $1,412,266, respectively. For any advances to suppliers determined by management not to be in receipts or refundable, the Group will recognize an allowance account to reserve such balances. Management reviews its advances to suppliers on a regular basis to determine if the allowance is adequate, and adjusts the allowance when necessary. Delinquent account balances are written off against allowance for doubtful accounts after management has determined that the likelihood of collection is not probable. Management continues to evaluate the reasonableness of the valuation allowance policy and updates it if necessary. As of May 31, 2023, and December 31, 2022, no allowance for the doubtful accounts were deemed necessary.

10

Property and Equipment, Net

Property and equipment are stated at cost, less accumulated depreciation, and depreciated on a straight-line basis over the estimated useful lives of the assets. Cost represents the purchase price of the asset and other costs incurred to bring the asset into its existing use. The costs of repairs and maintenance are expensed as incurred; major replacements and improvements are capitalized. When assets are retired or disposed of, the cost and accumulated depreciation are removed from the accounts, and any resulting gains or losses are included in income/loss in the year of disposition. Estimated useful lives are as follows:

| Estimated Useful Life | ||

| Automobile | 5 Years |

Impairment of Long-lived Assets

In accordance with ASC Topic 360, the Group reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable, or at least annually. The Group recognizes an impairment loss when the sum of expected undiscounted future cash flows is less than the carrying amount of the asset. The amount of impairment is measured as the difference between the asset’s estimated fair value and its book value. The Group did not record any impairment charge for the five months ended May 31, 2023 and 2022.

Value Added Tax

Pursuant to the PRC tax legislation, general taxpayers normally apply value-added-tax (VAT) of 6% in the modern service industries on a nationwide basis. The Group is subject to VAT of 6% for providing insurance agency service as a general taxpayer, while the branch office in Liaoning Yixian was subject to 3% VAT as a small taxpayer until September 2022, and then was treated as a general taxpayer beginning in October 2022. Entities that are VAT general taxpayers are allowed to offset qualified input VAT paid to suppliers against their output VAT liabilities. Net VAT balance between input VAT and output VAT is recorded in tax payable. The amount of VAT liability is determined by applying the applicable tax rate to the invoiced amount. The Group reports revenue net of PRC’s VAT for all the periods presented on the statements of operations and comprehensive income (loss).

11

Revenue Recognition

The Group recognizes revenue under Accounting Standards Codification (“ASC”) Topic 606, Revenue from Contracts with Customers (“ASC 606”). The core principle of the revenue standard is that a company should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the Group expects to be entitled in exchange for those goods or services. The following five steps are applied to achieve that core principle:

| ● | Step 1: Identify the contract with the customer |

| ● | Step 2: Identify the performance obligations in the contract |

| ● | Step 3: Determine the transaction price |

| ● | Step 4: Allocate the transaction price to the performance obligations in the contract |

| ● | Step 5: Recognize revenue when the company satisfies a performance obligation |

The Group generates revenue primarily from its insurance agency services. According to the agency service contracts made by and between the Group and insurance carriers, the Group is authorized to sell insurance products provided by insurance carriers to the insureds as an insurance agent, and collects commission from the respective insurance carriers as revenue.

The commission charged is determined by the terms agreed in the agency service contract, typically a percentage of insurance premium. The performance obligation is considered met and revenue is recognized when the insurance agency services are rendered and completed at the time an insurance policy becomes effective and the premium is collected from the insured.

The necessary data to reasonably determine the revenue amount is controlled by the insurance carriers, and the bill statement is confirmed with the Group on a monthly basis. The Group has met all the criteria of revenue recognition when the premiums are collected by the respective insurance carriers and not before, because collectability is not ensured until receipt of the premium. Therefore, the Group does not accrue any commissions prior to the receipt of the related premiums of insurance carriers, due to the specific practice in the industry.

The Group recorded insurance agency commission revenue in the amount of $16,415,780 and $17,470,353 for the five months ended May 31, 2023 and 2022, respectively.

Costs of Revenue

Costs of revenue consists primarily of commissions paid to distribution channels. The Group generally recognizes commissions as costs of revenues when incurred. For the five months ended May 31, 2023 and 2022, the costs of revenue amounted to $15,350,247 and $16,258,326 respectively.

12

Selling and Marketing

Selling expenses mainly consisted of advertising and marketing expenses. For the five months ended May 31, 2023 and 2022, the selling expenses amounted to $531,072 and $430,488 respectively.

Operating Leases

The Group adopted FASB Accounting Standards Codification, Topic 842, Leases (“ASC 842”) using the modified retrospective approach, electing the practical expedient that allows the Group not to restate prior to the adoption of the standard on January 1, 2019.

The Group determines if an arrangement is a lease at inception under FASB ASC Topic 842, Right of Use Assets (“ROU”) and lease liabilities are recognized at commencement date based on the present value of remaining lease payments over the lease term. For this purpose, the Group considers only payments that are fixed and determinable at the time of commencement. As most of its leases do not provide an implicit rate, the Group uses its incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. The Group’s incremental borrowing rate is a hypothetical rate based on its understanding of what its credit rating would be. The ROUs include adjustments for prepayments and accrued lease payments. The ROUs also include any lease payments made prior to commencement and is recorded net of any lease incentives received. The Group’s lease terms may include options to extend or terminate the lease when it is reasonably certain that it will exercise such options.

ROUs are reviewed for impairment when indicators of impairment are present. ROUs from operating and finance leases are subject to the impairment guidance in ASC 360, Property, Plant, and Equipment, as ROUs are long-lived nonfinancial assets.

ROUs are tested for impairment individually or as part of an asset group if the cash flows related to the ROU are not independent from the cash flows of other assets and liabilities. An asset group is the unit of accounting for long-lived assets to be held and used, which represents the lowest level for which identifiable cash flows are largely independent of the cash flows of other groups of assets and liabilities. The Group recognized no impairment of ROUs as of May 31, 2023, and December 31, 2022. Operating leases are included in operating lease ROU and operating lease liabilities (current and non-current), on the consolidated balance sheets.

Employee Benefits

The Group makes mandatory contributions to the PRC government’s health, retirement benefit and unemployment funds in accordance with the relevant Chinese social security laws. The costs of these payments are charged to the same accounts as the related salary costs in the same period as the related salary costs incurred. Employee benefit costs totaled $322,096 and $352,441 for the five months ended May 31, 2023 and 2022, respectively.

13

Income Taxes

The Group accounts for income taxes using the asset/liability method prescribed by ASC 740, “Income Taxes.” Under this method, deferred tax assets and liabilities are determined based on the difference between the financial reporting and tax bases of assets and liabilities using enacted tax rates that will be in effect in the period in which the differences are expected to reverse. The Group records a valuation allowance to offset deferred tax assets if, based on the weight of available evidence, it is more-likely-than-not that some portion, or all, of the deferred tax assets will not be realized. The effect on deferred taxes of a change in tax rates is recognized as income or loss in the period that includes the enactment date.

The Group follows the accounting guidance for uncertainty in income taxes using the provisions of ASC 740 “Income Taxes”. Using that guidance, tax positions initially need to be recognized in the financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. As of May 31, 2023, and December 31, 2022, the Group had no significant uncertain tax positions that qualify for either recognition or disclosure in the financial statements. As of May 31, 2023, income tax returns for the tax years ended December 31, 2018 through December 31, 2022, remain open for statutory examination by PRC tax authorities. The Group recognizes interest and penalties related to significant uncertain income tax positions in other expense. No such interest and penalties were incurred for the five months ended May 31, 2023 and 2022.

Comprehensive Income

Comprehensive income is comprised of net income and all changes to the statements of equity, except those due to investments by shareholders, changes in paid-in capital and distributions to shareholders. For the Group, comprehensive income for the five months ended May 31, 2023 and 2022 consisted of net income and unrealized (loss) gain from foreign currency translation adjustment.

Fair Value of Financial Instruments and Fair Value Measurements

The Group adopted the guidance of ASC 820 for fair value measurements which clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

| ● | Level 1: Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date. |

| ● | Level 2: Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other than quoted prices that are observable, and inputs derived from or corroborated by observable market data. |

| ● | Level 3: Inputs are unobservable inputs which reflect the reporting entity’s own assumptions on what the market participants would use in pricing the asset or liability based on the best available information. |

14

The carrying amounts reported in the balance sheets for cash and cash equivalents, accounts receivable, prepaid expenses and other current assets, taxes payable, accrued liabilities and other payables, short-term investment and due from (to) related parties, approximate their fair market value based on the short-term maturity of these instruments.

Commitments and Contingencies

In the normal course of business, the Group is subject to contingencies, such as legal proceedings and claims arising out of its business, that cover a wide range of matters. Liabilities for such contingencies are recorded when it is probable that a liability has been incurred and the amount of the assessment can be reasonably estimated.

Segment Reporting

ASC 280 “Segment Reporting” establishes standards for reporting information on operating segments in interim and annual financial statements. Operating segments are defined as the components of an enterprise about which separate financial information is available that is evaluated regularly by the chief operating decision maker in deciding how to allocate resources and in assessing performance. Our chief operating decision makers direct the allocation of resources to operating segments based on the profitability, cash flows, and growth opportunities of each respective segment.

The Group manages its business as a single operating segment engaged in the provision of insurance agent services in the PRC. Substantially all of its revenues are derived in the PRC. All long-lived assets are located in the PRC.

Related Parties

Parties are considered to be related to the Group if the parties, directly or indirectly, through one or more intermediaries, control, are controlled by, or are under common control with the Group. Related parties also include principal owners of the Group, its management, members of the immediate families of principal owners of the Group and its management and other parties with which the Group may deal with if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. The Group discloses all significant related party transactions.

15

NOTE 4 – ACCOUNTS RECEIVABLE, NET

Accounts receivable, net consist of the following:

| May 31, 2023 | December 31, 2022 | |||||||

| Accounts receivable | $ | 2,003,019 | $ | 2,931,320 | ||||

| Less: Allowance for doubtful accounts | (39,264 | ) | (38,360 | ) | ||||

| Total accounts receivable, net | $ | 1,963,755 | $ | 2,892,960 | ||||

Movements of allowance for doubtful accounts are as follows:

| May 31, 2023 | December 31, 2022 | |||||||

| Beginning balance | $ | 38,360 | $ | 14,054 | ||||

| Addition | 456 | 26,399 | ||||||

| Exchange rate effect | 448 | (2,093 | ) | |||||

| Ending balance | $ | 39,264 | $ | 38,360 | ||||

NOTE 5 – PREPAYMENTS

Prepayments consist of the following:

| May 31, 2023 | December 31, 2022 | |||||||

| Advances to suppliers | $ | 996,221 | $ | 1,411,026 | ||||

| Prepaid expenses | 3,032 | 1,240 | ||||||

| Total | $ | 999,253 | $ | 1,412,266 | ||||

NOTE 6 – SHORT-TERM INVESTMENT

Short-term investments are investments in wealth management product with underlying bonds offered by private entities and other equity products. The investments can be redeemed upon one workday’s notice and their carrying values approximate their fair values. The gain (loss) from sale of any investments and fair value change are recognized in the statements of income and comprehensive income.

As of May 31, 2023, and December 31, 2022, the ending balance of short-term investments were $271,381 and $273,182 respectively.

16

NOTE 7 – PROPERTY AND EQUIPMENT, NET

Property and equipment consisted of the following at May 31, 2023 and December 31, 2022:

| May 31, 2023 | December 31, 2022 | |||||||

| Automobile | $ | 111,199 | $ | 113,075 | ||||

| Less: Accumulated depreciation | (52,598 | ) | (44,534 | ) | ||||

| Property and equipment, net | $ | 58,601 | $ | 68,541 | ||||

For the five months ended May 31, 2023 and 2022, depreciation expenses amounted to $9,056 and $9,259, respectively, all of which were included in operating expenses.

NOTE 8 – OTHER PAYABLES

| May 31, 2023 | December 31, 2022 | |||||||

| Borrowing from other parties | $ | 656,273 | $ | 635,102 | ||||

| Accrued expense | 24,042 | 3,010 | ||||||

| Others | 91,361 | 142,135 | ||||||

| Total | $ | 771,676 | $ | 780,247 | ||||

As of May 31, 2023, the balance of borrowing from other parties primarily presented:

| (1) | In 2019, the Group borrowed $845,218 from another party for working capital needs and repaid $308,903 to such party in the following years. The borrowing is short-term in nature, non-interest bearing, unsecured and repayable on demand. |

| (2) | In September 2022, the Group entered into a loan of $38,035 for purchasing a vehicle. The annual interest rate was 7.51%. As of May 31, 2023, the outstanding principal is $31,708. |

| (3) | In November 2021 and January 2022, the Group borrowed $22,592 and $65,658 respectively from other party for working capital needs and repaid $88,250 to such party on September 2023. The borrowing is short-term in nature, non-interest bearing, unsecured and repayable on demand. |

17

NOTE 9 – RELATED PARTY BALANCES AND TRANSACTIONS

Due from related parties

At May 31, 2023 and December 31, 2022, due from related party consisted of the following:

| Name of related parties | Relationship | May 31, 2023 | December 31, 2022 | |||||||

| Yangwei Cui | A Key Management Personnel | $ | 45,205 | $ | 19,799 | |||||

| Shumei Wang | A Key Management Personnel | 62 | 63 | |||||||

| Xin Wang | A Key Management Personnel | 907 | 922 | |||||||

| Total | $ | 46,174 | $ | 20,784 | ||||||

The balance due from related parties is interest free, unsecured and repayable on demand. Management believes that the related party receivable is fully collectable. Therefore, no allowance for doubtful accounts is deemed to be required on its due from related party at May 31, 2023, and December 31, 2022. The Group, historically, has not experienced an uncollectible receivable from the related party.

Due to related parties

| Name of related parties | Relationship | May 31, 2023 | December 31, 2022 | |||||||

| Jian Guo | Chairman of the Board of Directors | $ | 28 | $ | — | |||||

| Xiaodan Chen | A Key Management Personnel | 10,166 | 5,743 | |||||||

| Jianlong Zhao | A Key Management Personnel | 1,185 | 1,205 | |||||||

| Wei Meng | A Key Management Personnel | 4,450 | 4,525 | |||||||

| Guixin Ye | A Key Management Personnel | 11,270 | 4,551 | |||||||

| Xin Wang | A Key Management Personnel | 687 | 699 | |||||||

| Gujia (Beijing) Technology Co., Ltd. | An entity controlled by certain shareholders of the Group | 12,708 | — | |||||||

| Total | $ | 40,494 | $ | 16,723 | ||||||

The balance of due to related parties represents expenses paid by these related parties on behalf of the Group. The related parties’ payable is short-term in nature, interest free, unsecured and repayable on demand.

18

NOTE 10 – INCOME TAXES

BVI

Under the current laws of BVI, Alpha Mind BVI is not subject to tax on income or capital gain. In addition, payments of dividends by the Group to their shareholders are not subject to withholding tax in the BVI.

Hong Kong

Alpha Mind HK is incorporated in Hong Kong, China and is subject to 16.5% income tax on their taxable income generated from operations in Hong Kong. The first HK$2 million of profits arising in or derived from Hong Kong are taxed at 8.25% and any assessable profits over HK$2 million are taxed at 16.5%. Alpha Mind HK had no operations for the year ended December 31, 2022. Therefore, there was no provision for income taxes in the year ended December 31, 2022.

PRC

Jiachuang Yingan, Huaming Insurance and Huaming Yunbao are subject to PRC Enterprise Income Tax (“EIT”) on the taxable income in accordance with the relevant PRC income tax laws. The EIT rate for companies operating in the PRC is 25%.

On March 16, 2007, the National People’s Congress enacted a new enterprise income tax law, which took effect on January 1, 2008. The law applies a uniform 25% enterprise income tax rate to both foreign invested enterprises and domestic enterprises. In the five months ended May 31, 2023 and May 31, 2022, Jiachuang Yingan did not generate any taxable income. Therefore, there was no provision for income taxes in the five months ended May 31, 2023 and 2022.

The components of the provision for income taxes for the five months ended May 31, 2023 and 2022 consisted of the following:

| May 31, 2023 | May 31, 2022 | |||||||

| Current tax expense | $ | 2,810 | $ | 10,912 | ||||

| Deferred tax credit | (48,647 | ) | (23,316 | ) | ||||

| Total income tax expense | (45,837 | ) | (12,404 | ) | ||||

Reconciliation of the Differences Between Statutory Tax Rate and the Effective Tax Rate

The following table reconciles China statutory rates to the Group’s effective tax rate:

| May 31, 2023 | May 31, 2022 | |||||||

| China statutory income tax rate | 25 | % | 25 | % | ||||

| Change in valuation allowance | (15 | )% | (20 | )% | ||||

| Effective tax rate | 10 | % | 5 | % | ||||

The Group’s approximate net deferred tax assets as of May 31, 2023, and December 31, 2022 attributable to tax filings in the PRC are as follows:

| Deferred Tax Assets | May 31, 2023 | December 31, 2022 | ||||||

| Allowance for doubtful account | $ | 72,228 | $ | 25,360 | ||||

| Net deferred tax assets | $ | 72,228 | $ | 25,360 | ||||

The Group provided a valuation allowance equal to the deferred income tax assets related to net operating loss carryforward for the year ended December 31, 2022, because it was not known whether future taxable income will be sufficient to utilize the loss carryforward. The potential tax benefit arising from the loss carryforward will begin to expire in 2026.

As of May 31, 2023 and December 31, 2022, the Group had no significant uncertain tax positions that qualify for either recognition or disclosure in the financial statements.

19

The uncertain tax positions are related to tax years that remain subject to examination by the relevant tax authorities. Based on the outcome of any future examinations, or as a result of the expiration of statute of limitations for specific jurisdictions, it is reasonably possible that the related unrecognized tax benefits for tax positions taken regarding previously filed tax returns, might materially change from those recorded as liabilities for uncertain tax positions in the Group’s consolidated financial statements as of December 31, 2022 and 2021. In addition, the outcome of these examinations may impact the valuation of certain deferred tax assets (such as net operating losses) in future periods. The Group’s policy is to recognize interest and penalties accrued on any unrecognized tax benefits, if any, as a component of other expense. The Group does not anticipate any significant increases or decreases to its liability for unrecognized tax benefits within the next twelve months.

Accounting for Uncertainty in Income Taxes

The tax authority of the PRC government conducts periodic and ad hoc tax filing reviews on business enterprises operating in the PRC after those enterprises complete their relevant tax filings. Therefore, the Group’s PRC entities’ tax filings results are subject to change. It is therefore uncertain as to whether the PRC tax authority may take different views about the Group’s PRC entities’ tax filings, which may lead to additional tax liabilities.

ASC 740 requires recognition and measurement of uncertain income tax positions using a “more-likely-than-not” approach. The management evaluated the Group’s tax positions and concluded that no provision for uncertainty in income taxes was necessary as of May 31, 2023, and December 31, 2022.

NOTE 11 – SHAREHOLDERS’ EQUITY

Alpha Mind BVI was established under the laws of the BVI on April 17, 2023. The Group is authorized to issue a maximum of 50,000 shares of US $1.00 par value each of a single class and series.

NOTE 12 – COMMITMENTS AND CONTINGENCIES

Operating Lease Commitment

The Group leases office space under non-cancelable operating lease agreements, which end on various dates in 2024 and 2025. As of May 31, 2023, The Group’s operating leases had a weighted average remaining lease term of 1.51 years and a weighted average discount rate of 3.45%. Future lease payments under operating leases as of May 31, 2023, were as follows:

| May 31, 2023 | ||||

| 2023 | $ | 22,532 | ||

| 2024 | $ | 36,042 | ||

| 2025 | $ | 1,506 | ||

| Total future lease payments | $ | 60,080 | ||

| Less imputed interest | $ | (12,079 | ) | |

| Total lease liabilities | $ | 48,001 | ||

| Less: current portion | $ | (33,170 | ) | |

| Operating lease liability, non-current | $ | 14,831 | ||

20

Contingencies

From time to time, the Group may be subject to certain legal proceedings, claims and disputes that arise in the ordinary course of business. Although the outcomes of these legal proceedings cannot be predicted, the Group does not believe these actions, in the aggregate, will have a material adverse impact on its financial position, results of operations or liquidity.

Contingent Assets

As of May 31, 2023, The Group was involved in two pending lawsuits:

1) In June 2022, Huaming Insurance, a subsidiary of the Group, lodged a claim for $162,381 (RMB 1.15 million) against Gualong Cui (the “Borrower”). Borrower was confirmed deceased on May 31, 2022. Subsequently, the Group initiated legal proceedings against the Borrower’s successor to settle the outstanding loan within the scope of the inherited property. On August 28, 2023, a decision was reached in connection with this lawsuit. The successor of the Borrower was required to make total a payment of $151,826 (RMB 1.08 million), covering both the principal and the loss of interest.

2) In June 2023, Huaming Insurance, a subsidiary of the Group, lodged a claim against a supplier (Shanghai Niuling Internet Technology Co., Ltd.) for service fee refund. The matter is currently being considered by the local courts, and the Group believes that it is impractical to estimate the potential effects of this claim.

Variable Interest Entity Structure

In the opinion of the management, (i) the corporate structure of the Group is in compliance with existing PRC laws and regulations; (ii) the VIE Agreements are valid and binding, and do not result in any violation of PRC laws or regulations currently in effect; and (iii) the business operations of WFOE, VIE and VIE’s subsidiaries are in compliance with existing PRC laws and regulations in all material respects.

However, there are substantial uncertainties regarding the interpretation and application of current and future PRC laws and regulations. Accordingly, the Group cannot be assured that PRC regulatory authorities will not ultimately take a contrary view to the foregoing opinion of its management. If the current corporate structure of the Group or the VIE Agreements are found to be in violation of any existing or future PRC laws and regulations, the Group may be required to restructure its corporate structure and operations in the PRC to comply with changing and new PRC laws and regulations. In the opinion of management, the likelihood of loss in respect of the Group’s current corporate structure or the VIE Agreements is remote based on current facts and circumstances.

NOTE 13 – SUBSEQUENT EVENTS

The Group has evaluated subsequent events through the date the consolidated financial statements are issued and concluded that no subsequent events have occurred that would require recognition or disclosure in these consolidated financial statements.

21

1 Year MMTec Chart |

1 Month MMTec Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions