We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Homeinns Hotel Grp. ADS, Each Representing Two Ordinary Shares (MM) | NASDAQ:HMIN | NASDAQ | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 35.71 | 0 | 01:00:00 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

RULE 13e-3 TRANSACTION STATEMENT

(Under Section 13(e) of the Securities Exchange Act of 1934)

HOMEINNS HOTEL GROUP

(Name of the Issuer)

Homeinns Hotel Group

BTG Hotels (Group) Co., Ltd.

BTG Hotels Group (HONGKONG) Holdings Co., Limited

BTG Hotels Group (CAYMAN) Holding Co., Ltd

Poly Victory Investments Limited

Ctrip Travel Information Technology (Shanghai) Co., Ltd.

Neil Nanpeng Shen

Smart Master International Limited

David Jian Sun

Peace Unity Investments Limited

Jason Xiangxin Zong

Wise Kingdom Group Limited

(Names of Persons Filing Statement)

Ordinary Shares, par value $0.005 per share

American Depositary Shares, each representing two Ordinary Shares

(Title of Class of Securities)

43742E1021

(CUSIP Number)

|

Homeinns Hotel Group No. 124 Caobao Road Xuhui District Shanghai 200235 People’s Republic of China Attention: Cathy Xiangrong Li (+86 21) 3337-3333 |

BTG Hotels (Group) Co., Ltd. BTG Hotels Group (HONGKONG) Holdings Co., Limited BTG Hotels Group (CAYMAN) Holding Co., Ltd 51 Fuxingmen Avenue Xicheng District, Beijing 100031 People’s Republic of China Attention: Rungang Zhang (+86-10) 6601-4466 |

|

Poly Victory Investments Limited c/o No. 10 Yabao Road Chaoyang District Beijing 100020 People’s Republic of China Attention: Yi Liu (+86-10) 8562-9988 |

Ctrip Travel Information Technology (Shanghai) Co., Ltd. c/o 968 Jin Zhong Road Shanghai 200335 People’s Republic of China Attention: Xiaofan Wang (+86-21) 3406-4880 |

|

Neil Nanpeng Shen Smart Master International Limited c/o Suite 3613, 36/F Two Pacific Place 88 Queensway Hong Kong (+852) 2501-8989 |

David Jian Sun Peace Unity Investments Limited c/o No. 124 Caobao Road Xuhui District, Shanghai 200235 People’s Republic of China (+86-21) 3337-3333 | |

|

Jason Xiangxin Zong c/o No. 124 Caobao Road Xuhui District, Shanghai 200235 People’s Republic of China (+86-21) 3337-3333 |

Wise Kingdom Group Limited c/o 968 Jin Zhong Road Shanghai 200335 People’s Republic of China Attention: Chung Lau (+86-21) 3406-4880 |

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

With copies to:

|

Kathryn King Sudol, Esq. Simpson Thacher & Bartlett 35th Floor, ICBC Tower 3 Garden Road, Central Hong Kong (+852) 2514-7600 |

Ke Geng, Esq. Nima Amini, Esq. O'Melveny & Myers LLP Yin Tai Centre, Office Tower, 37th Floor No. 2 Jianguomenwai Ave. Chao Yang District Beijing People’s Republic of China (+86 10) 6563-4261 |

Z. Julie Gao, Esq. Michael V. Gisser, Esq. Skadden, Arps, Slate, Meagher & Flom LLP c/o 42/F, Edinburgh Tower, The Landmark 15 Queen’s Road Central Hong Kong (+852) 3740-4700

|

This statement is filed in connection with (check the appropriate box):

| a | ¨ | The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14-C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

| b | ¨ | The filing of a registration statement under the Securities Act of 1933. |

| c | ¨ | A tender offer |

| d | x | None of the above |

Check the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies: ¨

Check the following box if the filing is a final amendment reporting the results of the transaction: ¨

Calculation of Filing Fee

| Transactional Valuation* | Amount of Filing Fee** | |

| US$1,192,692,889.03 | US$120,104.17 |

| * | Calculated solely for the purpose of determining the filing fee in accordance with Rule 0-11(b)(1) under the Securities Exchange Act of 1934, as amended. The filing fee is calculated based on the sum of (a) the aggregate cash payment for the proposed per share cash payment of US$17.90 for 63,913,855 issued and outstanding ordinary shares of the issuer (including shares represented by the American depositary shares) subject to the transaction, plus (b) the product of 1,384,558 ordinary shares issuable under all outstanding and unexercised options multiplied by US$4.62956 per share (which is the difference between US$17.90 per share merger consideration and the weighted average exercise price of US$13.27044 per share), plus (c) the product of 2,358,938 ordinary shares underlying the restricted share units multiplied by US$17.90 per share ((a), (b) and (c) together, the “Transaction Valuation”). |

| ** | The amount of the filing fee, calculated in accordance with Exchange Act Rule 0-11(b)(1) and the Securities and Exchange Commission Fee Rate Advisory #1 for Fiscal Year 2016, issued on August 27, 2015, was calculated by multiplying the Transaction Valuation by 0.00010070. |

| ¨ | Check box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting of the fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| Amount Previously Paid: | Filing Party: |

| Form or Registration No.: | Date Filed: |

| 1 | This CUSIP applies to the American Depositary Shares, evidenced by American Depositary Receipts, each representing two ordinary shares. |

TABLE OF CONTENTS

| Page | ||

| Item 1 | Summary Term Sheet | 3 |

| Item 2 | Subject Company Information | 3 |

| Item 3 | Identity and Background of Filing Person | 3 |

| Item 4 | Terms of the Transaction | 4 |

| Item 5 | Past Contracts, Transactions, Negotiations and Agreements | 4 |

| Item 6 | Purposes of the Transaction and Plans or Proposals | 5 |

| Item 7 | Purposes, Alternatives, Reasons and Effects | 6 |

| Item 8 | Fairness of the Transaction | 7 |

| Item 9 | Reports, Opinions, Appraisals and Negotiations | 8 |

| Item 10 | Source and Amounts of Funds or Other Consideration | 8 |

| Item 11 | Interest in Securities of the Subject Company | 9 |

| Item 12 | The Solicitation or Recommendation | 9 |

| Item 13 | Financial Statements | 10 |

| Item 14 | Persons/Assets, Retained, Employed, Compensated or Used | 10 |

| Item 15 | Additional Information | 10 |

| Item 16 | Exhibits | 11 |

INTRODUCTION

This Rule 13e-3 transaction statement on Schedule 13E-3, together with the exhibits hereto (this “Transaction Statement”), is being filed with the Securities and Exchange Commission (the “SEC”) pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), jointly by the following persons (each, a “Filing Person,” and collectively, the “Filing Persons”):

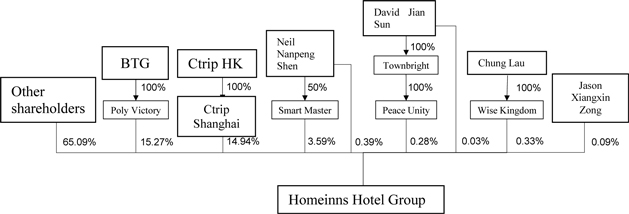

| (a) | Homeinns Hotel Group, an exempted company with limited liability incorporated under the laws of the Cayman Islands (the “Company”), the issuer of the ordinary shares, par value US$0.005 per share (each, a “Share”), including the Shares represented by the American depositary shares (“ADSs”), each representing two Shares, that is subject to the transaction pursuant to Rule 13e-3 under the Exchange Act; |

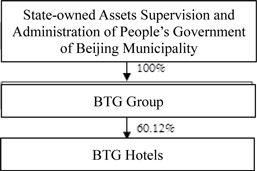

| (b) | BTG Hotels (Group) Co., Ltd., a joint stock company established and existing under the laws of the People’s Republic of China (the “PRC”) (“BTG Hotels” or “Parent”); |

| (c) | BTG Hotels Group (HONGKONG) Holdings Co., Limited, a company incorporated under the laws of the Hong Kong Special Administrative Region and a wholly owned subsidiary of BTG Hotels (“Holdco”); |

| (d) | BTG Hotels Group (CAYMAN) Holding Co., Ltd, an exempted company with limited liability incorporated under the laws of the Cayman Islands and a wholly owned subsidiary of Holdco (“Merger Sub”); |

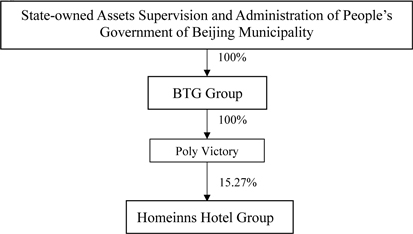

| (e) | Poly Victory Investments Limited, a company organized and existing under the laws of the British Virgin Islands (“Poly Victory”); |

| (f) | Ctrip Travel Information Technology (Shanghai) Co., Ltd., a limited liability company established and existing under the laws of the PRC (“Ctrip Shanghai”); |

| (g) | Neil Nanpeng Shen, co-founder, co-chairman of the board of directors, and an independent director of the Company (“Mr. Shen”); |

| (h) | Smart Master International Limited, a company organized and existing under the laws of the British Virgin Islands owned and controlled by Mr. Shen and his spouse (“Smart Master”); |

| (i) | Mr. David Jian Sun, the chief executive officer and a director of the Company (“Mr. Sun”); |

| (j) | Peace Unity Investments Limited, a company organized and existing under the laws of the British Virgin Islands indirectly owned and controlled by Mr. Sun (“Peace Unity”); |

| (k) | Jason Xiangxin Zong, the chief operating officer of the Company (“Mr. Zong”); and |

| (l) | Wise Kingdom Group Limited, a company organized and existing under the laws of the British Virgin Islands wholly owned and controlled by Chung Lau (“Ms. Lau”), the spouse of Mr. James Jianzhang Liang, co-founder and independent director of the Company (“Mr. Liang”) (“Wise Kingdom”, together with Poly Victory, Ctrip Shanghai, Mr. Shen, Smart Master, Mr. Sun, Peace Unity, and Mr. Zong, the “Rollover Shareholders”). |

On December 6, 2015, the Company entered into an agreement and plan of merger (the “Merger Agreement”) with Holdco, Merger Sub, and solely for the purposes of certain sections of the Merger Agreement, BTG Hotels, which included a plan of merger required to be filed with the Registrar of Companies of the Cayman Islands, substantially in the form attached as Annex A to the Merger Agreement (the “Plan of Merger”). The Merger Agreement provides for the merger of Merger Sub with and into the Company (the “Merger”), with the Company continuing as the surviving company after the Merger. At the effective time of the Merger (the “Effective Time”), the Company will be owned by Holdco and the Rollover Shareholders.

If the Merger is completed, each Share issued and outstanding immediately prior to the Effective Time, other than the Rollover Shares, the Excluded Shares, the Dissenting Shares and Shares represented by ADSs, each as described below, will be cancelled and cease to exist and will be converted into and exchanged for the right to receive US$17.90 per Share and each ADS issued and outstanding immediately prior to the Effective Time, other than ADSs representing the Rollover Shares or the Excluded Shares, will represent the right to surrender the ADS in exchange for US$35.80 per ADS (less cancellation fees of US$0.05 per ADS pursuant to the terms of the Deposit Agreement, dated as of October 31, 2006, among the Company, The Bank of New York Mellon, in its capacity as the ADS depositary (the “ADS Depositary”), and the holders and beneficial owners of ADSs issued thereunder (the “Deposit Agreement”)), in each case, in cash, without interest and net of any applicable withholding taxes. If the Merger is completed, the following Shares (including Shares represented by ADSs) will be cancelled and cease to exist at the Effective Time but will not be converted into the right to receive the consideration described in the immediately preceding sentence:

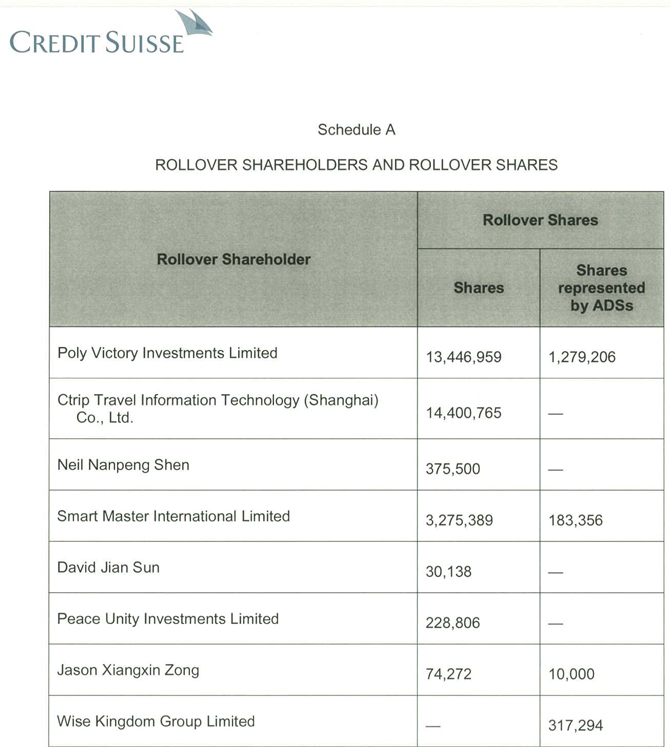

| (a) | each of 13,446,959 Shares and 1,279,206 Shares represented by ADSs held by Poly Victory, 14,400,765 Shares held by Ctrip Shanghai, 375,500 Shares held by Mr. Shen, 3,275,389 Shares and 183,356 Shares represented by ADSs held by Smart Master, 30,138 Shares held by Mr. Sun, 228,806 Shares held by Peace Unity, 74,272 Shares and 10,000 Shares represented by ADSs held by Mr. Zong, and 317,294 Shares represented by ADSs held by Wise Kingdom (collectively, the “Rollover Shares”), issued and outstanding immediately prior to the Effective Time will be converted into and become one validly issued, fully paid and non-assessable ordinary share, par value US$0.005 each, of the surviving company; |

| 1 |

| (b) | each of (i) the Shares held by the Company or any of its subsidiaries and (ii) the Shares (including ADSs representing such Shares) held by the ADS Depositary and reserved for issuance and allocation pursuant to the Company’s Amended and Restated 2006 Share Incentive Plan (the “Share Incentive Plan”) (collectively, the “Excluded Shares”), and ADSs representing the Excluded Shares, in each case, issued and outstanding immediately prior to the Effective Time, will be cancelled and cease to exist without payment of any consideration or distribution therefor; and |

| (c) | each of the Shares that are issued and outstanding immediately prior to the Effective Time and held by shareholders who have validly exercised and not effectively withdrawn or lost their right to dissent from the Merger in accordance with the Cayman Islands Companies Law (2013 Revision) (the “Cayman Islands Companies Law”) (collectively, the “Dissenting Shares”), will be cancelled and each holder thereof will be entitled to receive only the payment of the fair value of such Dissenting Shares held by them in accordance with the Cayman Islands Companies Law. |

In addition to the foregoing, at the Effective Time, (i) each option to purchase Shares granted under the Share Incentive Plan that is issued and outstanding immediately prior to the Effective Time and shall have become vested on or prior to the Effective Time will be cancelled and converted into the right to receive, as soon as practicable after the Effective Time, an amount equal to the product of (a) the total number of Shares issuable under such option immediately prior to the Effective Time multiplied by (b) the excess of US$17.90 over the exercise price payable per Share under such option, if any, in cash, without interest and net of any applicable withholding taxes, (ii) except as provided under the arrangement with respect to options held by certain directors, officers and employees of the Company described below, each option to purchase Shares granted under the Share Incentive Plan that is issued and outstanding immediately prior to the Effective Time and shall not have become vested on or prior to the Effective Time will be cancelled and converted into the right to receive a restricted cash award subject to the same vesting conditions and schedules applicable to such option, as soon as practicable after the Effective Time, in an amount equal to the product of (a) the total number of Shares issuable under such option immediately prior to the Effective Time multiplied by (b) the excess of US$17.90 over the exercise price payable per Share under such option, if any, in cash, without interest and net of any applicable withholding taxes, and (iii) except as provided under the arrangement with respect to restricted share units held by certain directors, officers and employees of the Company described below, each restricted share unit awarded under the Share Incentive Plan immediately prior to the Effective Time will be cancelled and converted into the right to receive a restricted cash award subject to the same vesting conditions and schedules applicable to such restricted share unit, as soon as practicable after the Effective Time, in an amount equal to the product of (a) US$17.90 and (b) the total number of Shares underlying such restricted share unit, without interest and net of any applicable withholding taxes. In the case that the exercise price per Share of any option is not lower than US$17.90, such option will be cancelled for no consideration. The restricted cash awards which (i) would vest within two (2) years after the Effective Time and are issued to certain directors, officers and employees of the Company who have executed and delivered to BTG Hotels and Holdco, prior to the closing of the Merger, a letter agreement relating to certain confidentiality, non-competition and employment undertakings (the “Selected Key Employees”), (ii) would vest within two (2) years after the Effective Time and are issued to Yi Liu, Mr. Shen, Min Bao, Mr. Liang and Yunxin Mei, a former director of the Company appointed by Poly Victory to the Board (collectively, the “Buyer Group Directors”), and (iii) are issued to the members of the Special Committee, in each case, will be fully vested and payable when issued, and the surviving company will pay all amounts owed under such restricted cash awards to the holders thereof as soon as practicable after closing of the Merger.

The Merger remains subject to the satisfaction or waiver of the closing conditions set forth in the Merger Agreement, including obtaining certain required regulatory approvals, the requisite approval of the shareholders of the Company, the requisite approval of BTG Hotels’ shareholders, as well as certain other customary closing conditions. The Merger Agreement, the Plan of Merger and the transactions contemplated by the Merger Agreement and the Plan of Merger (collectively, the “Transactions”), including the Merger, must be authorized and approved by (i) a special resolution (as defined in the Cayman Islands Companies Law), which requires an affirmative vote of shareholders representing at least two-thirds of the Shares present and voting in person or by proxy as a single class at the extraordinary general meeting of the Company’s shareholders, and (ii) so long as the Shares (excluding the Shares held by the Rollover Shareholders) present and voting in person or by proxy at the extraordinary general meeting of the Company’s shareholders exceed 50% of all of the issued and outstanding Shares of the Company as of the close of business on the record date established by the Company for such meeting, the affirmative vote of holders of Shares representing more than 50% of the Shares (excluding the Shares held by the Rollover Shareholders) present and voting in person or by proxy as a single class at such meeting.

The Company will make available to its shareholders a proxy statement (the “Proxy Statement,” a preliminary copy of which is attached as Exhibit (a)(1) to this Transaction Statement), relating to the extraordinary general meeting of the Company’s shareholders, at which the Company’s shareholders will consider and vote upon, among other proposals, a proposal to authorize and approve the Merger Agreement, the Plan of Merger and the Transactions, including the Merger. Copies of the Merger Agreement and the Plan of Merger are attached to the Proxy Statement as Annex A and Annex B, respectively, and are incorporated herein by reference. As of the date hereof, the Proxy Statement is in preliminary form and is subject to completion.

| 2 |

The cross-references below are being supplied pursuant to General Instruction G to Schedule 13E-3 and show the location in the Proxy Statement of the information required to be included in response to the items of Schedule 13E-3. Pursuant to General Instruction F to Schedule 13E-3, the information contained in the Proxy Statement, including all annexes thereto, is incorporated in its entirety herein by this reference, and the responses to each item in this Schedule 13E-3 are qualified in their entirety by the information contained in the Proxy Statement and the annexes thereto. Capitalized terms used but not defined in this Transaction Statement shall have the meanings given to them in the Proxy Statement.

All information contained in this Transaction Statement concerning each Filing Person has been supplied by such Filing Person and no Filing Person has produced any disclosure with respect to any other Filing Person.

| Item 1 | Summary Term Sheet |

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

| • | “Summary Term Sheet” |

| • | “Questions and Answers about the Extraordinary General Meeting and the Merger” |

| Item 2 | Subject Company Information |

| (a) | Name and Address. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

| • | “Summary Term Sheet—The Parties Involved in the Merger” |

| (b) | Securities. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “The Extraordinary General Meeting—Record Date; Shares and ADSs Entitled to Vote” |

| • | “The Extraordinary General Meeting— Procedures for Voting” |

| • | “Security Ownership of Certain Beneficial Owners and Management of the Company” |

| (c) | Trading Market and Price. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

| • | “Market Price of the Company’s ADSs, Dividends and Other Matters—Market Price of the ADSs” |

| (d) | Dividends. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

| • | “Market Price of the Company’s ADSs, Dividends and Other Matters—Dividend Policy” |

| (e) | Prior Public Offerings. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

| • | “Transactions in Shares and ADSs—Prior Public Offerings” |

| (f) | Prior Stock Purchases. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

| • | “Transactions in Shares and ADSs” |

| Item 3 | Identity and Background of Filing Person |

| (a) | Name and Address. Homeinns Hotel Group is the subject company. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—The Parties Involved in the Merger” |

| • | “Annex F—Directors and Executive Officers of Each Filing Person” |

| (b) | Business and Background of Entities. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—The Parties Involved in the Merger” |

| • | “Annex F—Directors and Executive Officers of Each Filing Person” |

| 3 |

| (c) | Business and Background of Natural Persons. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—The Parties Involved in the Merger” |

| • | “Annex F—Directors and Executive Officers of Each Filing Person” |

| Item 4 | Terms of the Transaction |

| (a)-(1) | Material Terms—Tender Offers. Not applicable. |

| (a)-(2) | Material Terms—Mergers or Similar Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet” |

| • | “Questions and Answers about the Extraordinary General Meeting and the Merger” |

| • | “Special Factors—Background of the Merger” |

| • | “Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board” |

| • | “Special Factors—Purposes of and Reasons for the Merger” |

| • | “Special Factors—Support Agreement” |

| • | “Special Factors—Interests of Certain Persons in the Merger” |

| • | “Special Factors—Material U.S. Federal Income Tax Consequences” |

| • | “The Extraordinary General Meeting” |

| • | “The Merger Agreement” |

| • | “Annex A—Agreement and Plan of Merger” |

| • | “Annex B—Plan of Merger” |

| (c) | Different Terms. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—Consortium Agreement” |

| • | “Special Factors—Interests of Certain Persons in the Merger” |

| • | “The Extraordinary General Meeting—Proposals to be Considered at the Extraordinary General Meeting” |

| • | “The Merger Agreement” |

| • | “Annex A—Agreement and Plan of Merger” |

| • | “Annex B—Plan of Merger” |

| (d) | Appraisal Rights. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Questions and Answers about the Extraordinary General Meeting and the Merger” |

| • | “Special Factors—Dissenters’ Rights” |

| • | “Dissenters’ Rights” |

| • | “Annex D—Cayman Islands Companies Law (2013 Revision)—Section 238” |

| (e) | Provisions for Unaffiliated Security Holders. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

| • | “Provisions for Unaffiliated Security Holders” |

| (f) | Eligibility for Listing or Trading. Not applicable. |

| Item 5 | Past Contracts, Transactions, Negotiations and Agreements |

| (a) | Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Special Factors—Interests of Certain Persons in the Merger” |

| • | “Special Factors—Related-Party Transactions” |

| • | “Transactions in Shares and ADSs” |

| 4 |

| (b) | Significant Corporate Events. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Special Factors—Background of the Merger” |

| • | “Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board” |

| • | “Special Factors—Purposes of and Reasons for the Merger” |

| • | “Special Factors—Interests of Certain Persons in the Merger” |

| • | “Special Factors—Related-Party Transactions—Share Exchange” |

| • | “The Merger Agreement” |

| • | “Annex A—Agreement and Plan of Merger” |

| • | “Annex B—Plan of Merger” |

| (c) | Negotiations or Contacts. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Special Factors—Background of the Merger” |

| • | “Special Factors—Interests of Certain Persons in the Merger” |

| • | “Special Factors—Related-Party Transactions—Share Exchange” |

| • | “The Merger Agreement” |

| • | “Annex A—Agreement and Plan” |

| • | “Annex B—Plan of Merger” |

| (e) | Agreements Involving the Subject Company’s Securities. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—Plans for the Company after the Merger” |

| • | “Summary Term Sheet—Financing of the Merger” |

| • | “Summary Term Sheet—Support Agreement” |

| • | “Summary Term Sheet—Consortium Agreement” |

| • | “Special Factors—Background of the Merger” |

| • | “Special Factors—Plans for the Company after the Merger” |

| • | “Special Factors—Financing of the Merger” |

| • | “Special Factors—Support Agreement” |

| • | “Special Factors—Consortium Agreement” |

| • | “Special Factors—Interests of Certain Persons in the Merger” |

| • | “Special Factors—Related-Party Transactions—Share Exchange” |

| • | “Special Factors—Voting by the Buyer Group at the Extraordinary General Meeting” |

| • | “The Merger Agreement” |

| • | “Transactions in Shares and ADSs” |

| • | “Annex A—Agreement and Plan of Merger” |

| • | “Annex B—Plan of Merger” |

| Item 6 | Purposes of the Transaction and Plans or Proposals |

| (b) | Use of Securities Acquired. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet” |

| • | “Questions and Answers about the Extraordinary General Meeting and the Merger” |

| 5 |

| • | “Special Factors—Purposes of and Reasons for the Merger” |

| • | “Special Factors—Effects of the Merger on the Company” |

| • | “Special Factors—Related-Party Transactions—Share Exchange” |

| • | “The Merger Agreement” |

| • | “Annex A—Agreement and Plan of Merger” |

| • | “Annex B—Plan of Merger” |

| (c)(1)-(8) | Plans. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—The Merger Agreement” |

| • | “Summary Term Sheet—Purposes and Effects of the Merger” |

| • | “Summary Term Sheet—Plans for the Company after the Merger” |

| • | “Summary Term Sheet—Financing of the Merger” |

| • | “Summary Term Sheet—Interests of the Company’s Executive Officers and Directors in the Merger” |

| • | “Special Factors—Background of the Merger” |

| • | “Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board” |

| • | “Special Factors—Purposes of and Reasons for the Merger” |

| • | “Special Factors—Effects of the Merger on the Company” |

| • | “Special Factors—Plans for the Company after the Merger” |

| • | “Special Factors—Financing of the Merger” |

| • | “Special Factors—Interests of Certain Persons in the Merger” |

| • | “Special Factors—Related-Party Transactions—Share Exchange” |

| • | “The Merger Agreement” |

| • | “Annex A—Agreement and Plan of Merger” |

| • | “Annex B—Plan of Merger” |

| Item 7 | Purposes, Alternatives, Reasons and Effects |

| (a) | Purposes. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—Purposes and Effects of the Merger” |

| • | “Summary Term Sheet—Plans for the Company after the Merger” |

| • | “Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board” |

| • | “Special Factors—Purposes of and Reasons for the Merger” |

| (b) | Alternatives. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Special Factors—Background of the Merger” |

| • | “Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board” |

| • | “Special Factors—Position of the Buyer Group as to the Fairness of the Merger” |

| • | “Special Factors—Purposes of and Reasons for the Merger” |

| • | “Special Factors—Alternatives to the Merger” |

| • | “Special Factors—Effects on the Company if the Merger Is Not Completed” |

| 6 |

| (c) | Reasons. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—Purposes and Effects of the Merger” |

| • | “Special Factors—Background of the Merger” |

| • | “Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board” |

| • | “Special Factors—Position of the Buyer Group as to the Fairness of the Merger” |

| • | “Special Factors—Purposes of and Reasons for the Merger” |

| • | “Special Factors—Effects of the Merger on the Company” |

| (d) | Effects. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—Purposes and Effects of the Merger” |

| • | “Special Factors—Background of the Merger” |

| • | “Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board” |

| • | “Special Factors—Effects of the Merger on the Company” |

| • | “Special Factors—Plans for the Company after the Merger” |

| • | “Special Factors—Effects on the Company if the Merger Is Not Completed” |

| • | “Special Factors—Interests of Certain Persons in the Merger” |

| • | “Special Factors—Material U.S. Federal Income Tax Consequences” |

| • | “Special Factors—Material PRC Income Tax Consequences” |

| • | “Special Factors—Material Cayman Islands Tax Consequences” |

| • | “The Merger Agreement” |

| • | “Annex A—Agreement and Plan of Merger” |

| • | “Annex B—Plan of Merger” |

| Item 8 | Fairness of the Transaction |

| (a)-(b) | Fairness; Factors Considered in Determining Fairness. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—Recommendations of the Special Committee and the Board” |

| • | “Summary Term Sheet—Position of the Buyer Group as to Fairness of the Merger” |

| • | “Summary Term Sheet—Opinions of the Special Committee’s Financial Advisor” |

| • | “Summary Term Sheet—Interests of the Company’s Executive Officers and Directors in the Merger” |

| • | “Special Factors—Background of the Merger” |

| • | “Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board” |

| • | “Special Factors—Position of the Buyer Group as to the Fairness of the Merger” |

| • | “Special Factors—Opinions of the Special Committee’s Financial Advisor” |

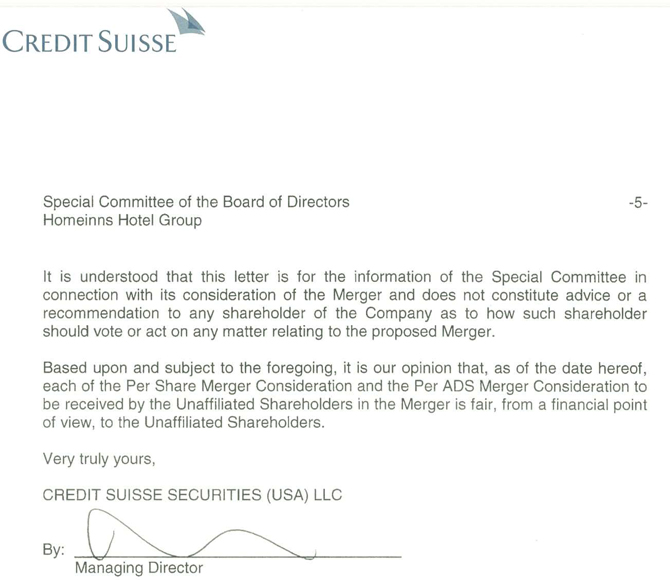

| • | “Special Factors—Interests of Certain Persons in the Merger” |

| • | “Annex C—Opinion of Credit Suisse Securities (USA) LLC, Financial Advisor to the Special Committee” |

| (c) | Approval of Security Holders. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—Shareholder Vote Required to Approve the Merger Agreement and the Plan of Merger” |

| • | “Questions and Answers about the Extraordinary General Meeting and the Merger” |

| • | “The Extraordinary General Meeting—Vote Required” |

| 7 |

| (d) | Unaffiliated Representative. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Special Factors—Background of the Merger” |

| • | “Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board” |

| • | “Special Factors—Opinions of the Special Committee’s Financial Advisor” |

| • | “Annex C—Opinion of Credit Suisse Securities (USA) LLC , Financial Advisor to the Special Committee” |

| (e) | Approval of Directors. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—Recommendations of the Special Committee and the Board” |

| • | “Questions and Answers about the Extraordinary General Meeting and the Merger” |

| • | “Special Factors—Background of the Merger” |

| • | “Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board” |

| (f) | Other Offers. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Special Factors—Background of the Merger” |

| • | “Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board” |

| Item 9 | Reports, Opinions, Appraisals and Negotiations |

| (a) | Report, Opinion or Appraisal. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—Opinions of the Special Committee’s Financial Advisor” |

| • | “Special Factors—Background of the Merger” |

| • | “Special Factors—Opinions of the Special Committee’s Financial Advisor” |

| • | “Special Factors—Valuation Report of the Financial Advisors for BTG Hotels” |

| • | “Annex C—Opinion of Credit Suisse Securities (USA) LLC , Financial Advisor to the Special Committee” |

| (b) | Preparer and Summary of the Report, Opinion or Appraisal. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Special Factors—Opinions of the Special Committee’s Financial Advisor” |

| • | “Special Factors—Valuation Report of the Financial Advisors for BTG Hotels” |

| • | “Annex C—Opinion of Credit Suisse Securities (USA) LLC , Financial Advisor to the Special Committee” |

| (c) | Availability of Documents. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

| • | “Where You Can Find More Information” |

The reports, opinions or appraisals referenced in this Item 9 will be made available for inspection and copying at the principal executive offices of the Company during its regular business hours by any interested holder of the Shares and ADSs or his, her or its representative who has been so designated in writing.

| Item 10 | Source and Amounts of Funds or Other Consideration |

| (a) | Source of Funds. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—Financing of the Merger” |

| • | “Special Factors—Financing of the Merger” |

| • | “The Merger Agreement” |

| 8 |

| • | “Annex A—Agreement and Plan of Merger” |

| • | “Annex B—Plan of Merger” |

| (b) | Conditions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—Financing of the Merger” |

| • | “Special Factors—Financing of the Merger” |

| (c) | Expenses. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

| • | “Summary Term Sheet—Fees and Expenses” |

| • | “Special Factors—Fees and Expenses” |

| (d) | Borrowed Funds. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

| • | “Summary Term Sheet—Financing of the Merger” |

| • | “Special Factors—Financing of the Merger” |

| • | “The Merger Agreement—Debt Financing” |

| Item 11 | Interest in Securities of the Subject Company |

| (a) | Securities Ownership. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—Interests of the Company’s Executive Officers and Directors in the Merger” |

| • | “Special Factors—Interests of Certain Persons in the Merger” |

| • | “Security Ownership of Certain Beneficial Owners and Management of the Company” |

| (b) | Securities Transactions. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

| • | “Transactions in Shares and ADSs” |

| Item 12 | The Solicitation or Recommendation |

| (d) | Intent to Tender or Vote in a Going-Private Transaction. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—Interests of the Company’s Executive Officers and Directors in the Merger” |

| • | “Summary Term Sheet—Support Agreement” |

| • | “Questions and Answers about the Extraordinary General Meeting and the Merger” |

| • | “Special Factors—Support Agreement” |

| • | “Special Factors—Voting by the Buyer Group at the Extraordinary General Meeting” |

| • | “The Extraordinary General Meeting—Vote Required” |

| • | “Security Ownership of Certain Beneficial Owners and Management of the Company” |

| (e) | Recommendations of Others. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—Recommendations of the Special Committee and the Board” |

| • | “Summary Term Sheet—Position of the Buyer Group as to Fairness of the Merger” |

| • | “Summary Term Sheet—Support Agreement” |

| • | “Special Factors—Reasons for the Merger and Recommendation of the Special Committee and the Board” |

| • | “Special Factors—Position of the Buyer Group as to the Fairness of the Merger” |

| 9 |

| • | “Special Factors—Support Agreement” |

| • | “The Extraordinary General Meeting—the Board’s Recommendation” |

| Item 13 | Financial Statements |

| (a) | Financial Information. The audited financial statements of the Company for the two years ended December 31, 2013 and 2014 are incorporated herein by reference to the Company’s annual report on Form 20-F for the year ended December 31, 2014, originally filed on April 24, 2015 (see page F-1 and following pages). |

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

| • | “Financial Information” |

| • | “Where You Can Find More Information” |

| (b) | Pro Forma Information. Not applicable. |

| Item 14 | Persons/Assets, Retained, Employed, Compensated or Used |

| (a) | Solicitation or Recommendations. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

| • | “The Extraordinary General Meeting—Solicitation of Proxies” |

| (b) | Employees and Corporate Assets. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| • | “Summary Term Sheet—The Parties Involved in the Merger” |

| • | “Special Factors—Interests of Certain Persons in the Merger” |

| • | “Annex F—Directors and Executive Officers of Each Filing Person” |

| Item 15 | Additional Information |

| (b) | Other Material Information. The information contained in the Proxy Statement, including all annexes thereto, is incorporated herein by reference. |

| 10 |

| Item 16 | Exhibits |

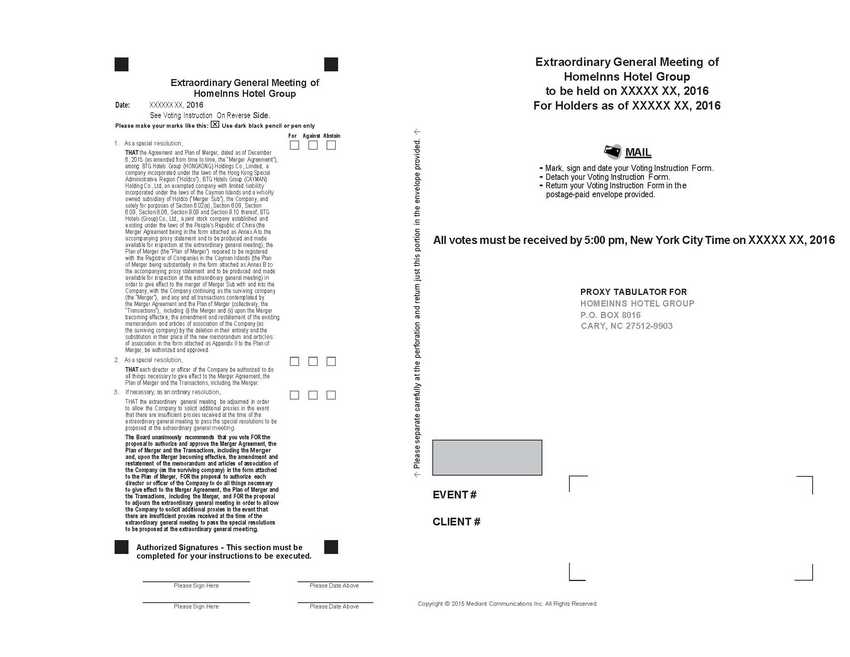

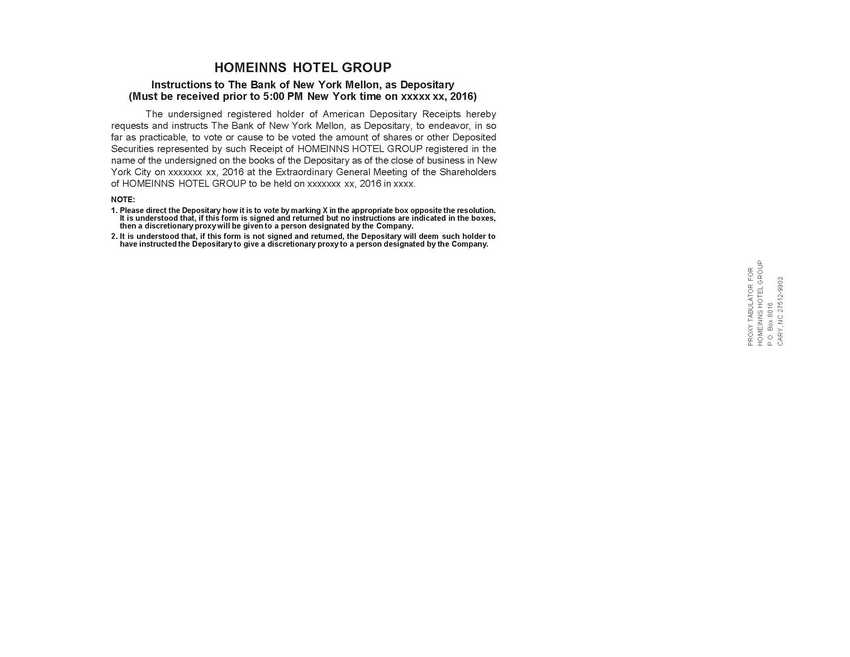

| (a)-(1) | Preliminary Proxy Statement of the Company, dated , 2016 (the “Proxy Statement”). | ||

| (a)-(2) | Notice of Extraordinary General Meeting of Shareholders of the Company, incorporated herein by reference to the Proxy Statement. | ||

| (a)-(3) | Form of Proxy Card, incorporated herein by reference to the Proxy Statement. | ||

| (a)-(4) | Form of ADS Voting Instruction Card, incorporated herein by reference to the Proxy Statement. | ||

| (a)-(5) | Press Release issued by the Company, dated December 7, 2015, incorporated herein by reference to Exhibit 99.1 to the Report on Form 6-K furnished by the Company to the SEC on December 7, 2015 (File No. 001-33082). | ||

| (b)-(1) | Debt Commitment Letter, dated December 6, 2015, among Industrial and Commercial Bank of China Limited, New York Branch, BTG Hotels and Holdco, incorporated herein by reference to Exhibit F to Amendment No. 1 to Schedule 13D filed by BTG Hotels, Holdco, Beijing Tourism Group Co., Ltd., Poly Victory, Ctrip.com International, Ltd., C-Travel International Limited, Ctrip.com (Hong Kong) Limited, Ctrip Shanghai, Mr. Shen, Smart Master, Mr. Liang, Ms. Lau, Wise Kingdom, Mr. Sun, Townbright Holdings Limited, Peace Unity and Mr. Zong with the SEC on December 7, 2015 (File No. 005-82520). | ||

| (c)-(1) | Opinion of Credit Suisse Securities (USA) LLC, dated December 5, 2015, incorporated herein by reference to Annex C to the Proxy Statement. | ||

| (c)-(2) | Discussion Materials prepared by Credit Suisse Securities (USA) LLC for discussion with the special committee of the board of directors of the Company, dated December 5, 2015. | ||

| (c)-(3) | English Translation of Valuation Report on Acquisition of Homeinns Hotel Group and Poly Victory Investments Limited by BTG Hotels prepared by Huatai United Securities Co., Ltd. and CITIC Securities Co., Ltd., dated December 23, 2015. | ||

| (d)-(1) | Agreement and Plan of Merger, dated December 6, 2015, among Holdco, Merger Sub, the Company and, solely for the purposes of Section 6.02(e), Section 6.08, Section 6.09, Section 8.06, Section 9.09 and Section 9.10 thereof, BTG Hotels, incorporated herein by reference to Annex A to the Proxy Statement. | ||

| (d)-(2) | English Translation of Agreement of Asset Purchase by Share Issue, dated December 6, 2015, among Beijing Tourism Group Co., Ltd., BTG Hotels, Ctrip Shanghai, Wise Kingdom, Mr. Shen, Smart Master, Mr. Sun, Peace Unity and Mr. Zong, incorporated herein by reference to Exhibit G to Amendment No. 1 to Schedule 13D filed by BTG Hotels, Holdco, Beijing Tourism Group Co., Ltd., Poly Victory, Ctrip.com International, Ltd., C-Travel International Limited, Ctrip.com (Hong Kong) Limited, Ctrip Shanghai, Mr. Shen, Smart Master, Mr. Liang, Ms. Lau, Wise Kingdom, Mr. Sun, Townbright Holdings Limited, Peace Unity and Mr. Zong with the SEC on December 7, 2015 (File No. 005-82520). | ||

| (d)-(3) | Support Agreement, dated December 6, 2015, among, BTG Hotels, Holdco, Poly Victory, Ctrip Shanghai, Mr. Shen, Smart Master, Mr. Sun, Peace Unity, Mr. Zong and Wise Kingdom, incorporated herein by reference to Exhibit H to Amendment No. 1 to Schedule 13D filed by BTG Hotels, Holdco, Beijing Tourism Group Co., Ltd., Poly Victory, Ctrip.com International, Ltd., C-Travel International Limited, Ctrip.com (Hong Kong) Limited, Ctrip Shanghai, Mr. Shen, Smart Master, Mr. Liang, Ms. Lau, Wise Kingdom, Mr. Sun, Townbright Holdings Limited, Peace Unity and Mr. Zong with the SEC on December 7, 2015 (File No. 005-82520). | ||

| (d)-(4) | Consortium Agreement, dated December 6, 2015, among BTG Hotels, Poly Victory, Ctrip.com International, Ltd., Mr. Shen, Mr. Liang and Mr. Sun, incorporated herein by reference to Exhibit I to Amendment No. 1 to Schedule 13D filed by BTG Hotels, Holdco, Beijing Tourism Group Co., Ltd., Poly Victory, Ctrip.com International, Ltd., C-Travel International Limited, Ctrip.com (Hong Kong) Limited, Ctrip Shanghai, Mr. Shen, Smart Master, Mr. Liang, Ms. Lau, Wise Kingdom, Mr. Sun, Townbright Holdings Limited, Peace Unity and Mr. Zong with the SEC on December 7, 2015 (File No. 005-82520). | ||

| (d)-(5) | English Translation of Performance Guarantee, dated December 4, 2015, issued by Industrial and Commercial Bank of China Limited, Beijing Central Business District Branch, in favor of Suzhou Hengchuang Software Co., Ltd. | ||

| (f)-(1) | Dissenters’ Rights, incorporated herein by reference to the section entitled “Dissenters’ Rights” in the Proxy Statement. | ||

| (f)-(2) | Section 238 of the Cayman Islands Companies Law (2013 Revision), incorporated herein by reference to Annex D to the Proxy Statement. | ||

| (g) | Not applicable. |

| 11 |

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: January 6, 2016

| Homeinns Hotel Group | ||

| By | /s/ Kenneth Gaw | |

| Name: | Kenneth Gaw | |

| Title: | Special Committee Member | |

| BTG Hotels (Group) Co., Ltd. | ||

| By | /s/ Rungang Zhang | |

| Name: | Rungang Zhang | |

| Title: | Chairman of Board of Directors | |

| BTG Hotels Group (HONGKONG) Holdings Co., Limited | ||

| By | /s/ Rungang Zhang | |

| Name: | Rungang Zhang | |

| Title: | Director | |

| BTG Hotels Group (CAYMAN) Holding Co., Ltd | ||

| By | /s/ Rungang Zhang | |

| Name: | Rungang Zhang | |

| Title: | Director | |

| Poly Victory Investments Limited | ||

| By | /s/ Yi Liu | |

| Name: | Yi Liu | |

| Title: | Director | |

| Ctrip Travel Information Technology (Shanghai) Co., Ltd. | ||

| By | /s/ Xiaofan Wang | |

| Name: | Xiaofan Wang | |

| Title: | Authorized Person | |

| Neil Nanpeng Shen | ||

| /s/ Neil Nanpeng Shen | ||

| Neil Nanpeng Shen | ||

| Smart Master International Limited | ||

| By | /s/ Neil Nanpeng Shen | |

| Name: | Neil Nanpeng Shen | |

| Title: | Director | |

| David Jian Sun | ||

| /s/ David Jian Sun | ||

| David Jian Sun | ||

| Peace Unity Investments Limited | ||

| By | /s/ David Jian Sun | |

| Name: | David Jian Sun | |

| Title: | Director | |

| Jason Xiangxin Zong | ||

| /s/ Jason Xiangxin Zong | ||

| Jason Xiangxin Zong | ||

| Wise Kingdom Group Limited | ||

| By | /s/ Chung Lau | |

| Name: | Chung Lau | |

| Title: | Director | |

EXHIBIT INDEX

| (a)-(1) | The Proxy Statement. | |

| (a)-(2) | Notice of Extraordinary General Meeting of Shareholders of the Company, incorporated herein by reference to the Proxy Statement. | |

| (a)-(3) | Form of Proxy Card, incorporated herein by reference to the Proxy Statement. | |

| (a)-(4) | Form of ADS Voting Instruction Card, incorporated herein by reference to the Proxy Statement. | |

| (a)-(5) | Press Release issued by the Company, dated December 7, 2015, incorporated herein by reference to Exhibit 99.1 to the Report on Form 6-K furnished by the Company to the SEC on December 7, 2015 (File No. 001-33082). | |

| (b)-(1) | Debt Commitment Letter, dated December 6, 2015, among Industrial and Commercial Bank of China Limited, New York Branch, BTG Hotels and Holdco, incorporated herein by reference to Exhibit F to Amendment No. 1 to Schedule 13D filed by BTG Hotels, Holdco, Beijing Tourism Group Co., Ltd., Poly Victory, Ctrip.com International, Ltd., C-Travel International Limited, Ctrip.com (Hong Kong) Limited, Ctrip Shanghai, Mr. Shen, Smart Master, Mr. Liang, Ms. Lau, Wise Kingdom, Mr. Sun, Townbright Holdings Limited, Peace Unity and Mr. Zong with the SEC on December 7, 2015 (File No. 005-82520). | |

| (c)-(1) | Opinion of Credit Suisse Securities (USA) LLC, dated December 5, 2015, incorporated herein by reference to Annex C to the Proxy Statement. | |

| (c)-(2) | Discussion Materials prepared by Credit Suisse Securities (USA) LLC for discussion with the special committee of the board of directors of the Company, dated December 5, 2015. | |

| (c)-(3) | English Translation of Valuation Report on Acquisition of Homeinns Hotel Group and Poly Victory Investments Limited by BTG Hotels prepared by Huatai United Securities Co., Ltd. and CITIC Securities Co., Ltd., dated December 23, 2015. | |

| (d)-(1) | Agreement and Plan of Merger, dated December 6, 2015, among Holdco, Merger Sub, the Company and, solely for the purposes of Section 6.02(e), Section 6.08, Section 6.09, Section 8.06, Section 9.09 and Section 9.10 thereof, BTG Hotels, incorporated herein by reference to Annex A to the Proxy Statement. | |

| (d)-(2) | English Translation of Agreement of Asset Purchase by Share Issue, dated December 6, 2015, among Beijing Tourism Group Co., Ltd., BTG Hotels, Ctrip Shanghai, Wise Kingdom, Mr. Shen, Smart Master, Mr. Sun, Peace Unity and Mr. Zong, incorporated herein by reference to Exhibit G to Amendment No. 1 to Schedule 13D filed by BTG Hotels, Holdco, Beijing Tourism Group Co., Ltd., Poly Victory, Ctrip.com International, Ltd., C-Travel International Limited, Ctrip.com (Hong Kong) Limited, Ctrip Shanghai, Mr. Shen, Smart Master, Mr. Liang, Ms. Lau, Wise Kingdom, Mr. Sun, Townbright Holdings Limited, Peace Unity and Mr. Zong with the SEC on December 7, 2015 (File No. 005-82520). | |

| (d)-(3) | Support Agreement, dated December 6, 2015, among, BTG Hotels, Holdco, Poly Victory, Ctrip Shanghai, Mr. Shen, Smart Master, Mr. Sun, Peace Unity, Mr. Zong and Wise Kingdom, incorporated herein by reference to Exhibit H to Amendment No. 1 to Schedule 13D filed by BTG Hotels, Holdco, Beijing Tourism Group Co., Ltd., Poly Victory, Ctrip.com International, Ltd., C-Travel International Limited, Ctrip.com (Hong Kong) Limited, Ctrip Shanghai, Mr. Shen, Smart Master, Mr. Liang, Ms. Lau, Wise Kingdom, Mr. Sun, Townbright Holdings Limited, Peace Unity and Mr. Zong with the SEC on December 7, 2015 (File No. 005-82520). | |

| (d)-(4) | Consortium Agreement, dated December 6, 2015, among BTG Hotels, Poly Victory, Ctrip.com International, Ltd., Mr. Shen, Mr. Liang and Mr. Sun, incorporated herein by reference to Exhibit I to Amendment No. 1 to Schedule 13D filed by BTG Hotels, Holdco, Beijing Tourism Group Co., Ltd., Poly Victory, Ctrip.com International, Ltd., C-Travel International Limited, Ctrip.com (Hong Kong) Limited, Ctrip Shanghai, Mr. Shen, Smart Master, Mr. Liang, Ms. Lau, Wise Kingdom, Mr. Sun, Townbright Holdings Limited, Peace Unity and Mr. Zong with the SEC on December 7, 2015 (File No. 005-82520). | |

| (d)-(5) | English Translation of Performance Guarantee, dated December 4, 2015, issued by Industrial and Commercial Bank of China Limited, Beijing Central Business District Branch, in favor of Suzhou Hengchuang Software Co., Ltd. | |

| (f)-(1) | Dissenters’ Rights, incorporated herein by reference to the section entitled “Dissenters’ Rights” in the Proxy Statement. | |

| (f)-(2) | Section 238 of the Cayman Islands Companies Law (2013 Revision), incorporated herein by reference to Annex D to the Proxy Statement. | |

| (g) | Not applicable. |

PRELIMINARY PROXY STATEMENT OF THE COMPANY

Exhibit (a)-(1)

, 2016

Shareholders of Homeinns Hotel Group

Re: Notice of Extraordinary General Meeting of Shareholders

Dear Shareholder:

You are cordially invited to attend an extraordinary general meeting of shareholders of Homeinns Hotel Group, an exempted company with limited liability incorporated under the laws of the Cayman Islands (the “Company”), to be held on , 2016 at a.m. ([local] time). The meeting will be held at . The accompanying notice of the extraordinary general meeting and proxy statement provide information regarding the matters to be acted on at the extraordinary general meeting, including at any adjournment or postponement thereof.

The Company entered into the Agreement and Plan of Merger (the “Merger Agreement”), dated as of December 6, 2015, with BTG Hotels Group (HONGKONG) Holdings Co., Limited (“Holdco”), a wholly owned subsidiary of BTG Hotels (Group) Co., Ltd., a PRC joint stock company that is listed on the Shanghai Stock Exchange and principally engaged in the management of hotels and tourism destinations (“BTG Hotels” or “Parent”), BTG Hotels Group (CAYMAN) Holding Co., Ltd (“Merger Sub”), a wholly owned subsidiary of Holdco, and solely for the purposes of certain sections thereof, BTG Hotels. Pursuant to the Merger Agreement, Merger Sub will be merged with and into the Company (the “Merger”), with the Company continuing as the surviving company (the “surviving company”). The purpose of the extraordinary general meeting is for you and the other shareholders of the Company to consider and vote upon, among other proposals, a proposal to authorize and approve the Merger Agreement, the plan of merger required to be filed with the Registrar of Companies of the Cayman Islands (the “Cayman Registrar”) in connection with the Merger (the “Plan of Merger”), and the transactions contemplated by the Merger Agreement and the Plan of Merger (collectively, the “Transactions”), including the Merger. Copies of the Merger Agreement and the Plan of Merger are attached as Annex A and Annex B, respectively, to the accompanying proxy statement.

Merger Sub and Holdco were formed solely for the purpose of the Merger. BTG Hotels is the sole shareholder of Holdco. If the Merger is completed, the Company will continue its operations as a privately held company and will be beneficially owned by Holdco and Poly Victory Investments Limited, a company organized and existing under the laws of the British Virgin Islands (“Poly Victory”), Ctrip Travel Information Technology (Shanghai) Co., Ltd., a limited liability company established and existing under the laws of the People’s Republic of China (the “PRC”) (“Ctrip Shanghai”), Neil Nanpeng Shen, co-founder, co-chairman of the board of directors, and an independent director of the Company (“Mr. Shen”), Smart Master International Limited, a company organized and existing under the laws of the British Virgin Islands owned and controlled by Mr. Shen and his spouse (“Smart Master”), Mr. David Jian Sun, the chief executive officer and a director of the Company (“Mr. Sun”), Peace Unity Investments Limited, a company organized and existing under the laws of the British Virgin Islands indirectly owned and controlled by Mr. Sun (“Peace Unity”), Jason Xiangxin Zong, the chief operating officer of the Company (“Mr. Zong”), and Wise Kingdom Group Limited, a company organized and existing under the laws of the British Virgin Islands wholly owned and controlled by Ms. Chung Lau (“Ms. Lau”), the spouse of Mr. James Jianzhang Liang, co-founder and independent director of the Company (“Mr. Liang”) (“Wise Kingdom”, together with Poly Victory, Ctrip Shanghai, Mr. Shen, Smart Master, Mr. Sun, Peace Unity, and Mr. Zong, the “Rollover Shareholders”). As of the date of the accompanying proxy statement, the Rollover Shareholders collectively beneficially own approximately 34.5% of the Company’s issued and outstanding ordinary shares, par value US$0.005 per share (each, a “Share”)(excluding, for purposes of this calculation, Shares issuable to the Rollover Shareholders upon the exercise of options of the Company). As the result of the Merger, the Company’s American depositary shares (“ADSs”), each representing two Shares, will no longer be listed on the NASDAQ Global Market (“NASDAQ”) and the American depositary shares program (“ADS program”) for the Shares will terminate.

| i |

If the Merger is completed, each Share issued and outstanding immediately prior to the effective time of the Merger (the “Effective Time”), other than the Rollover Shares, the Excluded Shares, the Dissenting Shares and Shares represented by ADSs, each as described below, will be cancelled and cease to exist and will be converted into and exchanged for the right to receive US$17.90 per Share and each ADS issued and outstanding immediately prior to the Effective Time, other than ADSs representing the Rollover Shares or the Excluded Shares, will represent the right to surrender the ADS in exchange for US$35.80 per ADS (less cancellation fees of US$0.05 per ADS pursuant to the terms of the Deposit Agreement, dated as of October 31, 2006, among the Company, The Bank of New York Mellon, in its capacity as the ADS depositary (the “ADS Depositary”), and the holders and beneficial owners of ADSs issued thereunder (the “Deposit Agreement”)), in each case, in cash, without interest and net of any applicable withholding taxes. If the Merger is completed, the following Shares (including Shares represented by ADSs) will be cancelled and cease to exist at the Effective Time but will not be converted into the right to receive the consideration described in the immediately preceding sentence:

(a) each of 13,446,959 Shares and 1,279,206 Shares represented by ADSs held by Poly Victory, 14,400,765 Shares held by Ctrip Shanghai, 375,500 Shares held by Mr. Shen, 3,275,389 Shares and 183,356 Shares represented by ADSs held by Smart Master, 30,138 Shares held by Mr. Sun, 228,806 Shares held by Peace Unity, 74,272 Shares and 10,000 Shares represented by ADSs held by Mr. Zong, and 317,294 Shares represented by ADSs held by Wise Kingdom (collectively, the “Rollover Shares”), issued and outstanding immediately prior to the Effective Time will be converted into and become one validly issued, fully paid and non-assessable ordinary share, par value US$0.005 each, of the surviving company;

(b) each of (i) the Shares held by the Company or any of its subsidiaries and (ii) the Shares (including ADSs representing such Shares) held by the ADS Depositary and reserved for issuance and allocation pursuant to the Company’s Amended and Restated 2006 Share Incentive Plan (the “Share Incentive Plan”) (collectively, the “Excluded Shares”), and ADSs representing the Excluded Shares, in each case, issued and outstanding immediately prior to the Effective Time, will be cancelled and cease to exist without payment of any consideration or distribution therefor; and

(c) each of the Shares that are issued and outstanding immediately prior to the Effective Time and held by shareholders who have validly exercised and not effectively withdrawn or lost their right to dissent from the Merger in accordance with the Cayman Islands Companies Law (2013 Revision) (the “Cayman Islands Companies Law”) (collectively, the “Dissenting Shares”), will be cancelled and each holder thereof will be entitled to receive only the payment of the fair value of such Dissenting Shares held by them in accordance with the Cayman Islands Companies Law.

In addition to the foregoing, at the Effective Time, (i) each option to purchase Shares granted under the Share Incentive Plan that is issued and outstanding immediately prior to the Effective Time and shall have become vested on or prior to the Effective Time will be cancelled and converted into the right to receive, as soon as practicable after the Effective Time, an amount equal to the product of (a) the total number of Shares issuable under such option immediately prior to the Effective Time multiplied by (b) the excess of US$17.90 over the exercise price payable per Share under such option, if any, in cash, without interest and net of any applicable withholding taxes, (ii) except as provided under the arrangement with respect to options held by certain directors, officers and employees of the Company described below, each option to purchase Shares granted under the Share Incentive Plan that is issued and outstanding immediately prior to the Effective Time and shall not have become vested on or prior to the Effective Time will be cancelled and converted into the right to receive a restricted cash award subject to the same vesting conditions and schedules applicable to such option, as soon as practicable after the Effective Time, in an amount equal to the product of (a) the total number of Shares issuable under such option immediately prior to the Effective Time multiplied by (b) the excess of US$17.90 over the exercise price payable per Share under such option, if any, in cash, without interest and net of any applicable withholding taxes, and (iii) except as provided under the arrangement with respect to restricted share units held by certain directors, officers and employees of the Company described below, each restricted share unit awarded under the Share Incentive Plan immediately prior to the Effective Time will be cancelled and converted into the right to receive a restricted cash award subject to the same vesting conditions and schedules applicable to such restricted share unit, as soon as practicable after the Effective Time, in an amount equal to the product of (a) US$17.90 and (b) the total number of Shares underlying such restricted share unit, without interest and net of any applicable withholding taxes. In the case that the exercise price per Share of any option is not lower than US$17.90, such option will be cancelled for no consideration. The restricted cash awards which (i) would vest within two (2) years after the Effective Time and are issued to certain directors, officers and employees of the Company who have executed and delivered to BTG Hotels and Holdco, prior to the closing of the Merger, a letter agreement relating to certain confidentiality, non-competition and employment undertakings (the “Selected Key Employees”), (ii) would vest within two (2) years after the Effective Time and are issued to Yi Liu, Mr. Shen, Min Bao, Mr. Liang and Yunxin Mei, a former director of the Company appointed by Poly Victory to the Board (collectively, the “Buyer Group Directors”), and (iii) are issued to the members of the Special Committee, in each case, will be fully vested and payable when issued, and the surviving company will pay all amounts owed under such restricted cash awards to the holders thereof as soon as practicable after closing of the Merger.

A special committee (the “Special Committee”) of the board of directors of the Company (the “Board”), composed solely of directors who are unaffiliated with Parent, Holdco, Merger Sub, any of the Rollover Shareholders or any member of the management of the Company, reviewed and considered the terms and conditions of the Merger Agreement, the Plan of Merger and the Transactions, including the Merger. The Special Committee, after consultation with its financial advisor and legal counsel and due consideration, unanimously (a) determined that the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, on the terms and subject to the conditions set forth in the Merger Agreement, are fair to and in the best interest of the Company and its shareholders (other than the Rollover Shareholders) (such shareholders other than the Rollover Shareholders are referred to herein as the “Unaffiliated Security Holders”), (b) declared it advisable for the Company to enter into the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, and (c) recommended that the Board authorize and approve the Merger Agreement, the Plan of Merger and the Transactions, including the Merger.

| ii |

At a meeting on December 5, 2015, the Board, acting upon the unanimous recommendation of the Special Committee and after each director duly disclosed his interests in the Transactions, including the Merger, as required by the memorandum and articles of association of the Company as amended to date and the Cayman Islands Companies Law, unanimously (a) determined that the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, on the terms and subject to the conditions set forth in the Merger Agreement, are fair to, and in the best interests of, the Company and its shareholders (other than the Rollover Shareholders) and declared it advisable for the Company to enter into the Transactions, including the Merger, (b) authorized and approved the execution, delivery and performance of the Merger Agreement, the Plan of Merger and the consummation of the Transactions, including the Merger, (c) directed that the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, be submitted to the shareholders of the Company for authorization and approval, and (d) subject to the terms of the Merger Agreement, resolved to recommend the approval of the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, to the shareholders of the Company.

The Board unanimously recommends that you vote FOR the proposal to authorize and approve the Merger Agreement, the Plan of Merger and the Transactions, including the Merger and, upon the Merger becoming effective, the amendment and restatement of the memorandum and articles of association of the Company (as the surviving company) in the form attached to the Plan of Merger, FOR the proposal to authorize each director or officer of the Company to do all things necessary to give effect to the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, and FOR the proposal to adjourn the extraordinary general meeting in order to allow the Company to solicit additional proxies in the event that there are insufficient proxies received at the time of the extraordinary general meeting to pass the special resolutions to be proposed at the extraordinary general meeting.

In considering the recommendation of the Special Committee and the Board, you should be aware that some of the Company’s directors and executive officers have interests in the Merger that are different from, and/or in addition to, the interests of the Company’s shareholders generally. The Special Committee and the Board were aware of these potential conflicts of interest and considered them, among other matters, in reaching their decisions and recommendations with respect to the Merger Agreement and related matters. As of the date of the accompanying proxy statement, the Rollover Shareholders collectively beneficially own approximately 34.5% of the Company’s issued and outstanding Shares (excluding, for purposes of this calculation, Shares issuable to the Rollover Shareholders upon the exercise of options of the Company). Pursuant to the terms of a support agreement (the “Support Agreement”), dated December 6, 2015, among BTG Hotels, Holdco and the Rollover Shareholders, each Rollover Shareholder agrees (i) to vote any and all of their Shares in favor of the authorization and approval of the Merger Agreement, the Plan of Merger and the transaction contemplated by the Merger Agreement, including the Merger, and to appoint BTG Hotels or any person designated by BTG Hotels as proxy and attorney-in-fact to vote their Shares; (ii) to receive no cash consideration with respect to the Rollover Shares; and (iii) that all of the Rollover Shares will be converted into ordinary shares of the surviving company at the Effective Time, in each case, upon the terms and subject to the conditions of the Support Agreement. In addition, the Special Committee and the Board were aware that certain directors and officers of the Company hold the Rollover Shares, which, pursuant to the terms of an agreement of asset purchase by share issue, dated December 6, 2015, among BTG Hotels, BTG and the Rollover Shareholders (other than Poly Victory), will be exchanged for a certain number of common shares of BTG Hotels at the completion of the share exchange transaction contemplated by such agreement and have entered into certain other transactions with the members of the Buyer Group or their affiliates.

The accompanying proxy statement provides detailed information about the Merger and the extraordinary general meeting. We encourage you to read the entire document and all of the attachments and other documents referred to or incorporated by reference herein carefully. You may also obtain more information about the Company from documents the Company has filed with the United States Securities and Exchange Commission (the “SEC”), which are available for free at the SEC’s website www.sec.gov.

Regardless of the number of Shares that you own, your vote is very important. The Merger cannot be completed unless the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, are authorized and approved by (i) a special resolution (as defined in the Cayman Islands Companies Law), which requires an affirmative vote of shareholders representing at least two-thirds of the Shares present and voting in person or by proxy as a single class at the extraordinary general meeting of the Company’s shareholders, and (ii) so long as the Shares (excluding the Shares held by the Rollover Shareholders) present and voting in person or by proxy at the extraordinary general meeting of the Company’s shareholders exceed 50% of all of the issued and outstanding Shares of the Company as of the close of business on the Share Record Date, the affirmative vote of holders of Shares representing more than 50% of the Shares (excluding the Shares held by the Rollover Shareholders) present and voting in person or by proxy as a single class at such meeting (the “Majority of Minority Vote Requirement”).

| iii |

Assuming the Rollover Shareholders comply with their voting undertakings under the Support Agreement, based on the number of Shares expected to be issued and outstanding and entitled to vote as of the close of business in the Cayman Islands on , 2016, the record date for voting Shares at the extraordinary general meeting (the “Share Record Date”), in order for the proposal to be authorized and approved:

| (a) | assuming all issued and outstanding Shares expected to be issued and outstanding and entitled to vote at the meeting are present in person or by proxy and voting at the meeting, at least Shares other than the Shares held by the Rollover Shareholders must be voted in favor of the special resolutions to be proposed at the extraordinary general meeting, including the special resolution to approve the Merger Agreement, the Plan of Merger and the Transactions, including the Merger; and |

| (b) | in order to satisfy the Majority of Minority Vote Requirement, assuming all issued and outstanding Shares expected to be issued and outstanding and entitled to vote at the meeting are present in person or by proxy and voting at the meeting, at least Shares held by the Company’s shareholders other than the Rollover Shareholders must be voted in favor of the proposal to authorize and approve the Merger Agreement, the Plan of Merger and the Transactions, including the Merger. |

Voting at the extraordinary general meeting will take place by poll voting, as the chairman of the Board has undertaken to demand poll voting at the meeting. Whether or not you plan to attend the extraordinary general meeting, please complete the accompanying proxy card, in accordance with the instructions set forth on the proxy card, as promptly as possible. The deadline to lodge your proxy card is , 2016 at a.m. ([local] time). Each shareholder has one vote for each Share held as of the close of business in the Cayman Islands on the Share Record Date.

Completing the proxy card in accordance with the instructions set forth on the proxy card will not deprive you of your right to attend the extraordinary general meeting and vote your Shares in person. Please note, however, that if your Shares are held of record by a broker, bank or other nominee and you wish to vote at the extraordinary general meeting in person, you must obtain from the record holder a proxy issued in your name. If you submit a signed proxy card without indicating how you wish to vote, the Shares represented by your proxy card will be voted FOR the proposal to authorize and approve the Merger Agreement, the Plan of Merger and the Transactions, including the Merger and, upon the Merger becoming effective, the amendment and restatement of the memorandum and articles of association of the Company (as the surviving company) in the form attached to the Plan of Merger, FOR the proposal to authorize each director or officer of the Company to do all things necessary to give effect to the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, and FOR the proposal to adjourn the extraordinary general meeting in order to allow the Company to solicit additional proxies in the event that there are insufficient proxies received at the time of the extraordinary general meeting to pass the special resolutions to be proposed at the extraordinary general meeting.

As the record holder of the Shares represented by ADSs, the ADS Depositary will endeavor to vote (or will endeavor to cause the vote of) the Shares it holds on deposit at the extraordinary general meeting in accordance with the voting instructions timely received from holders of ADSs at the close of business in New York City on , 2016 (the “ADS Record Date”). The ADS Depositary must receive such instructions no later than 5:00 p.m. (New York City time) on , 2016. The ADS Depositary has advised us that, pursuant to Section 4.7 of the Deposit Agreement, it will not vote or attempt to exercise the right to vote any Shares other than in accordance with signed voting instructions from the relevant ADS holder and, accordingly, Shares represented by ADSs for which no timely voting instructions are received by the ADS Depositary will not be voted. Notwithstanding the foregoing, pursuant to the Deposit Agreement, if the ADS Depositary timely receives voting instructions from a holder of ADSs that fails to specify the manner in which the ADS Depositary is to vote the Shares represented by such ADSs, the ADS Depositary will deem such holder to have instructed the ADS Depositary to vote in favor of the items set forth in the voting instructions. If you hold your ADSs in a brokerage, bank or other nominee account, you must rely on the procedures of the broker, bank or other nominee through which you hold your ADSs if you wish to vote.